| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the April 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

- 9-25-2019 Additional content has been added to this journal.

- When the Price of Bitcoin Rises

- The Race to Acquire One Bitcoin

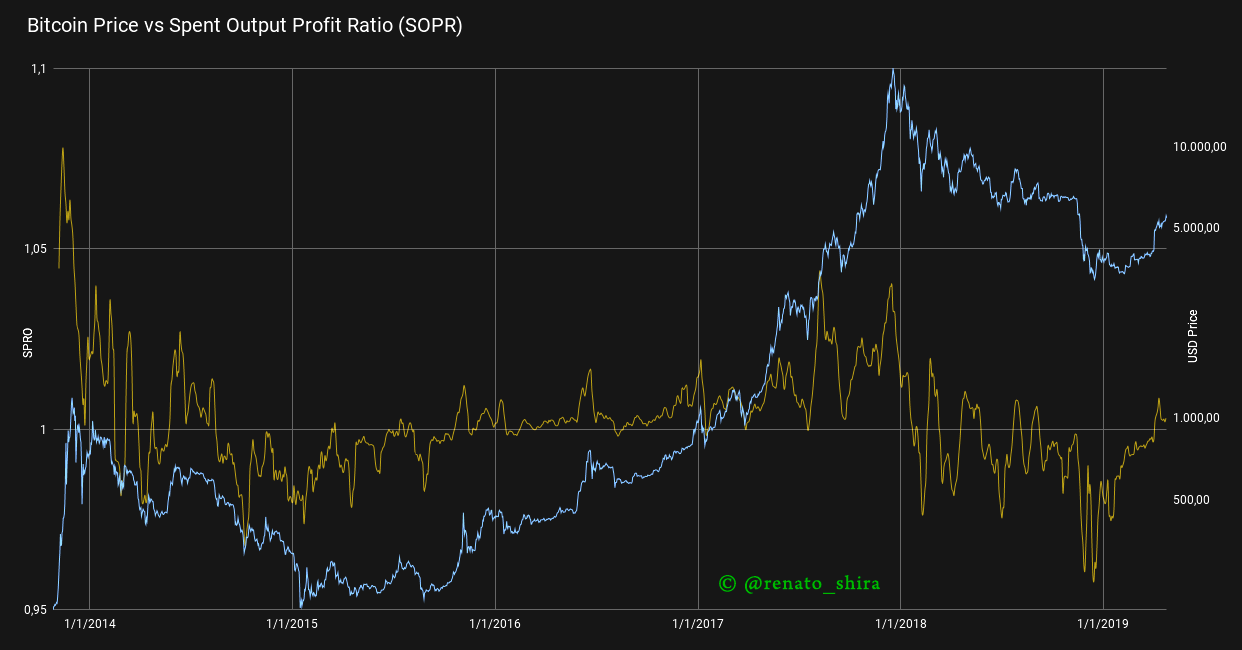

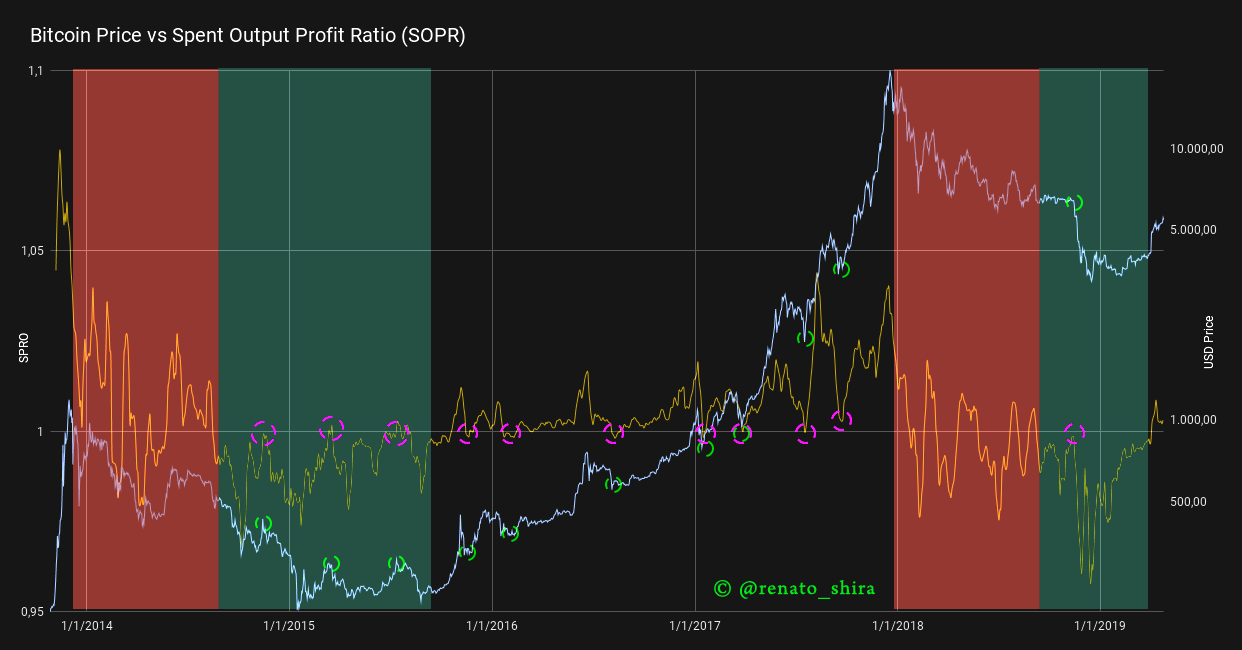

- 12-19-2019 Added: Introducing SOPR: spent outputs to predict bitcoin lows and tops

Bitcoin: An insurance policy against the largest monetary and fiscal policy experiment in human history

By Travis Kling

Posted April 1, 2019

Quick Take

- The world is in the midst of the largest monetary and fiscal policy experiment in human history

- That ‘experiment’ is now 10 years old and facing daunting challenges, because risk assets are now entirely reliant on cheap money

- Every fiat currency in history has completely failed in its ability to maintain purchasing power

- It would be naïve to think this ‘experiment’ is going to end without significant market stress. A bet on Bitcoin is opting out of this experiment

- Bitcoin is a better long term store of value than both fiat currency and gold

The following piece is a contributor essay from Travis Kling, the Chief Investment Officer of Ikigai Asset Management, a crypto asset hedge fund. Prior to founding Ikigai,Travis spent 10 years in traditional finance, most recently as a portfolio manager at Point72. Disclaimer: This is not investment advice.

More than a decade ago, on the back of the global financial crisis, the world began the largest monetary and fiscal policy experiment in human history: globally-coordinated quantitative easing while running massive deficits on top of increasingly untenable debt levels. That ‘experiment’ is now 10 years old and facing daunting challenges, because risk assets are now entirely reliant on cheap money.

In 2017 the Fed slowly began shrinking its bloated $4.5 trillion balance sheet and raising rates. By late 2018, this tightening put risk assets globally under significant stress. In late January, on the back of market stress and President Trump chastising the Fed on Twitter, the Fed capitulated. They made a complete U-turn from quantitative tightening and a hawkish stance to an openness to further easing and a decidedly dovish stance.

This dovish stance was confirmed by Chairman Jerome Powell on 60 Minutes on March 10 and solidified by the FOMC statement on March 21. On March 26 Stephen Moore, the President’s recent nominee for the Fed board, publicly lobbied for his nomination by stating he would demand a 50bps rate cut if appointed. The Fed, billed as an independent organization unaffected by the political machine of Washington, has unequivocally become politicized.

Over the last several months, commentary and actions from the ECB, BoJ, PBoC and RBA have echoed the Fed’s dovish capitulation. Global central banks have resoundingly taken their stand – rather than attempting to unwind the ‘experiment’, central banks and governments globally look likely to keep printing money at a breakneck pace.

To frame the current environment, the US dollar has only existed as a fiat currency for 48 years. In 1861, the U.S. treasury printed its first paper currency and for 110 years, those dollars could be redeemed for gold. When Nixon abolished the gold standard in 1971, the U.S. dollar became a fiat currency. Fiat currencies have been around since 11th century China and, without exception, every one has failed in its ability to maintain purchasing power.

As an alternative to this relentless devaluation, civilizations have been using gold to store value for ~ 5,000 years. Ten years ago, a new store of value emerged, based on computer science, cryptography and game theory. And after a tremendous price run-up in 2017 and subsequent crash in 2018, Bitcoin appears to have found a bottom. Over that time, Bitcoin has also been finding its identity – a non-sovereign, hard-capped supply, global, immutable, decentralized, digital store of value. It is Gold 2.0, and a compelling argument can be made that bitcoin is better at being gold than gold.

Similar to gold, much of bitcoin’s value is derived from its limited supply. Gold’s annual supply increase has historically been 1-2%, giving holders confidence that its purchasing power won’t be diluted. Bitcoin’s supply is the most predictable ever – there will only ever be 21 million. When compared to gold, Bitcoin more effectively satisfies the six characteristics of money: durable, divisible, portable, uniform, scarce and accepted. The world has a new, arguably better form of money.

Does the world need a new form of money? We have an interesting backdrop for a non-sovereign, hard-capped supply, digital form of money to gain mass adoption. The increasingly erratic U.S. president is yelling at an irresponsible central bank to act even more irresponsibly with its monetary policy, while running a $1 trillion deficit for the second year in a row. Bitcoin is a risk asset right now, but it is a risk asset with a specific set of investment characteristics. The more irresponsible monetary and fiscal policies are, the more attractive those characteristics become.

It would be naïve to think this ‘experiment’ is going to end without significant market stress. A bet on Bitcoin is opting out of this experiment. Whether it’s 1%, 5% or 25% of a portfolio, a bet on Bitcoin means there’s a chance this experiment could go very wrong, and portfolio protection from that downside scenario is warranted.

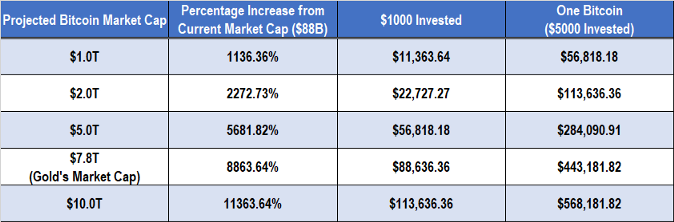

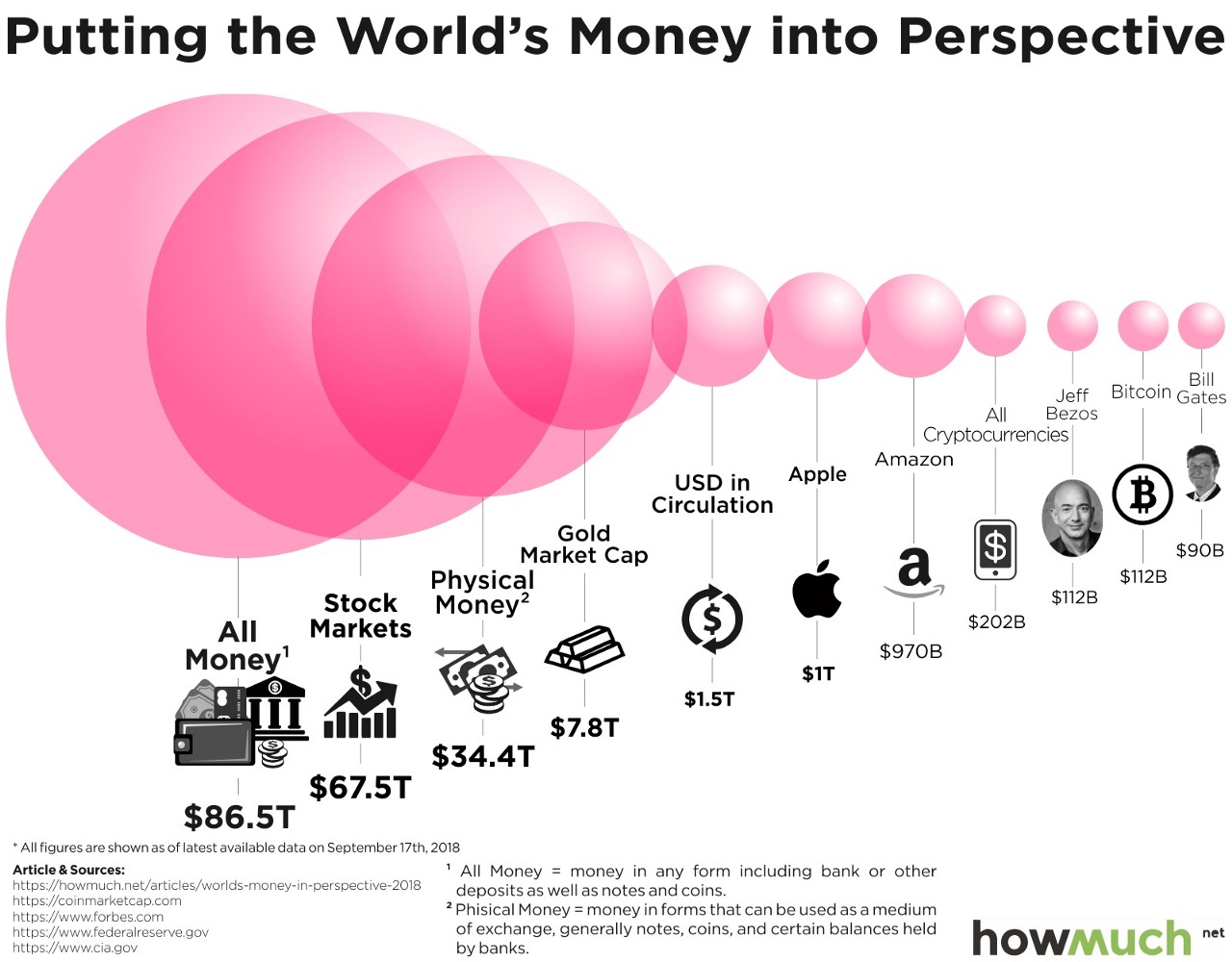

Bitcoin prices have been understandably volatile. It makes complete sense that the world is having a hard time understanding, and in turn valuing, Bitcoin. A new form of money doesn’t come around very often. It is in fact exceedingly rare for an entirely new and superior store of value to emerge. Ancient civilizations used seashells, salt, and heavy rocks for thousands of years to store value – each eventually failed to maintain purchasing power. Then gold was discovered, deemed superior, mass adopted and propelled to be the global monetary standard. Today global gold supplies are valued at $8 trillion. If the world decides Bitcoin is a superior store of value to gold, the price of Bitcoin will likely increase significantly from current levels. In the meantime, central banks and governments around the world are proving the profound need for a non-sovereign, hard-capped supply, global, immutable, decentralized, digital store of value.

Managing Bitcoin and Private Keys

By Thib

Posted April 1, 2019

Owning a bitcoin means controlling the underlying private key that secures it.** If lost, no recovery is possible. No third-party can help. It’s irrevocably gone.

Private keys must be kept secret and protected at all times. This is non-trivial for most users, with many severe financial losses in the past attesting to such unfortunate reality (here, there, over here and more there).

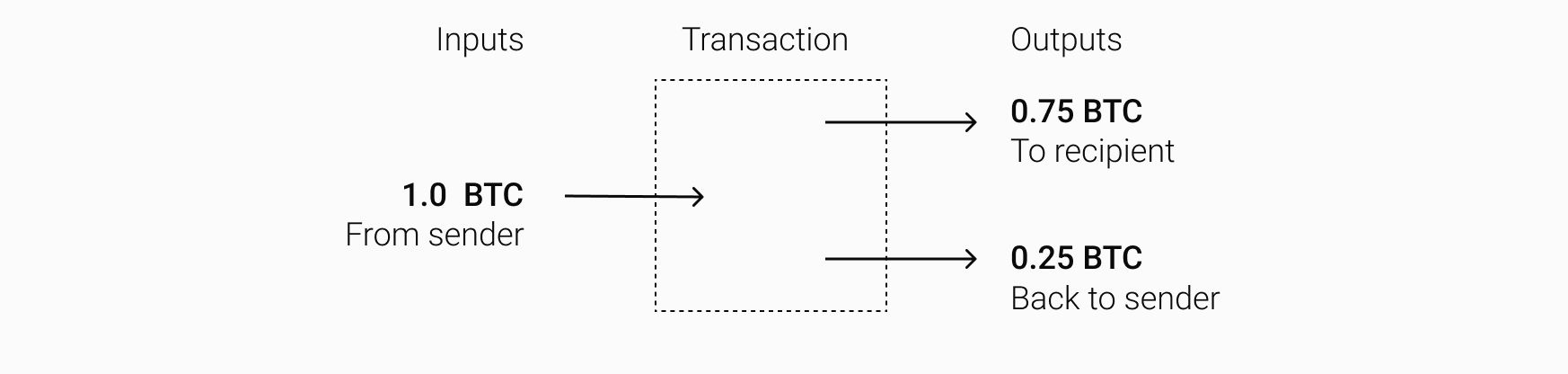

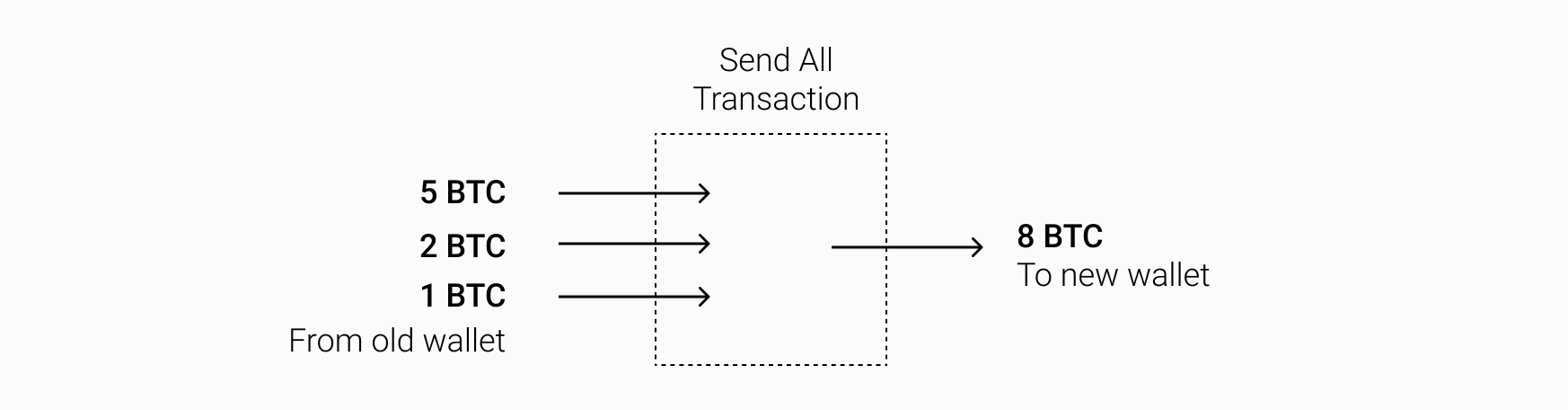

Private keys govern how bitcoins are spent (or moved between UTXOs, to be precise). Bitcoins are securely stored on a globally distributed ledger. The ledger is replicated and synced across anyone who wants access to it to verify how bitcoins are moved within the network. This is usually done by running a full node (more on that later). Private keys unlock bits of this ledger, called addresses (or UTXOs), where bitcoins are stored.

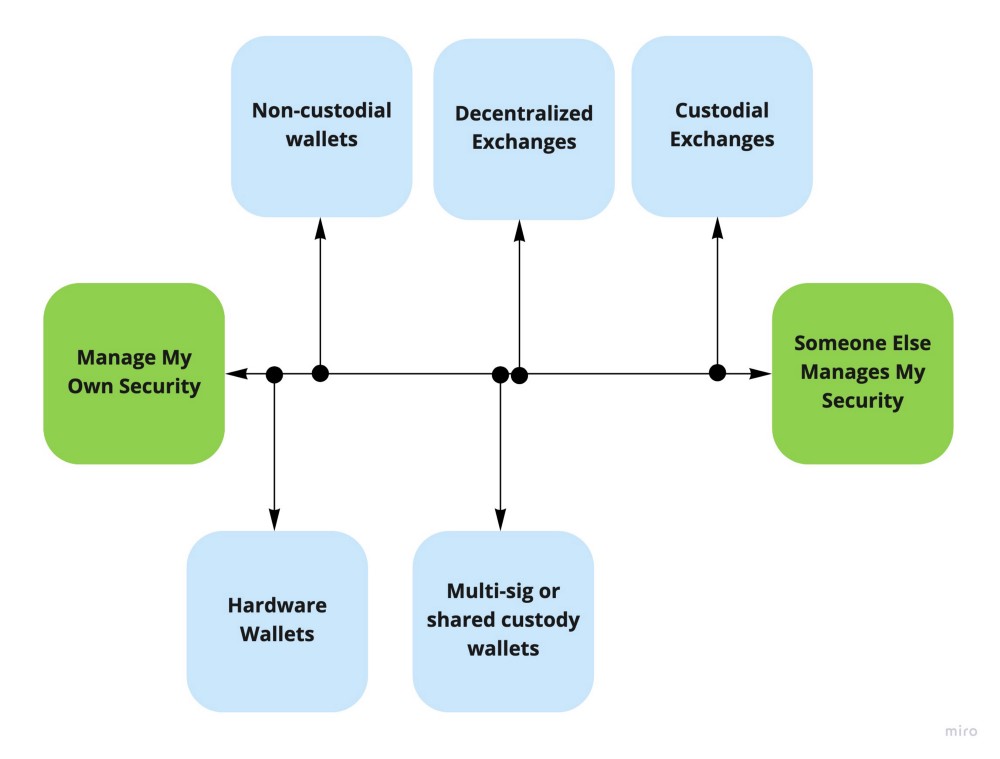

Managing private keys

A Bitcoin private key is a 256-bit data unit, often represented as an hexadecimal string, which can be understood as a digital bearer asset with intrinsic financial value. It is code with a price tag. Money is now pure software. Anyone in possession of a private key is deemed the rightful owner of the associated bitcoins.

From generation, to storage and utilization, private keys deserve delicate care and extreme caution for Bitcoin to be utilized securely as a global value communication protocol on the Internet.

Generating new Bitcoin private keys requires randomness to ensure no one can easily guess what it is. Once it is created, it must be stored securely, sometimes offline, to reduce the possibility of loss or theft. When used to approve or sign Bitcoin transactions, private keys must be cautiously managed to avoid introducing risks of loss. Secure backups may also be used with additional security to recover compromised or lost private keys.

This is an oversimplification of private key management, applied to Bitcoin.

Security issues are real

Exclusive control of private keys, echoing with rightful ownership, is primordial for bitcoin owners. But self-managing private keys brings an unusual responsibility that can be problematic to most people. Cutting trusted third parties, such as banks for credential recovery, requires full accountability over private key management. Not an easy feat for most.

In many countries, consumers are legally protected from any liability in traditional banking as most transactions are traceable and reversible. Bitcoin transactions while traceable are irreversible, leading to permanent losses with no legal recourse to authorities or financial protections.

Users who manage their own bitcoin private keys rely on setups that often require technical skills, an advanced dedication for security and a high risk tolerance as simple errors are still quite common.

Over the last decade, multiple improvements were released by individuals, open source projects and companies, making bitcoin private key management much easier and minimizing safety trade-offs, while ensuring users retain full control of their funds in the best cases.

Full control means bitcoin owners can be sovereign in how they manage their wealth, independently from trusted third-parties, which is essential for bitcoin’s long-term morphing from a value communication protocol on the Internet into a global peer-to-peer economic system.

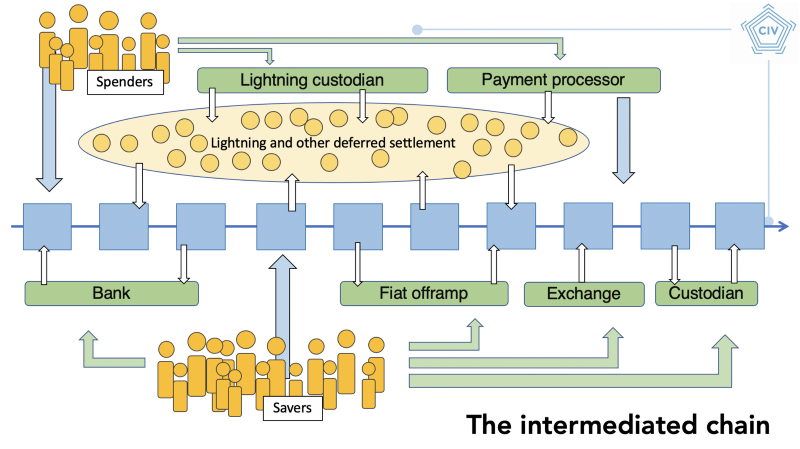

Custodial wallets

Today, most bitcoin owners still leave private keys on online custodial wallets such as exchanges after having acquired bitcoins, delegating full control of their private keys to trusted third parties.

There isn’t comprehensive data on the third-party custodied proportion but it is public knowledge that Coinbase, a popular cryptocurrency exchange, recently announced they possess 5% of bitcoin’s circulating supply under custody, drawing attention to the large portion of bitcoin holders giving away full control of their assets.

Exchange platforms make it ridiculously easy for people to acquire and store bitcoins, reducing the anxiety that comes with the self-custody responsibility. They are one of the most essential and valuable products to onboard new users. But simplicity is often mistakenly associated with security.

Multiple custodial exchanges have lost customers’ bitcoins in the past due to hacks, as they turn into honey pots for hackers or internal collusion jobs. User credentials have been stolen, 2-factor authentications have been spoofed and private keys were compromised with no recourse for affected users. Mt. Gox is the obvious illustration with 850,000 BTC lost, but there was also Coincheck with over $500M stolen, and most recently QuadrigaCX that lost $190M of customers’ funds. Lots of other cases (here, there or here) have happened, totalling hundreds of millions of customers’ funds that are gone forever.

Many web, mobile and desktop wallets also have full custodial control of their users’ bitcoins, which introduces similar risks as with exchanges. Aesthetically-pleasing user interfaces with highly usable experiences lure users into trusting them.

Often these products are developed by small teams of developers or early-stage companies with light governance, fragile security models and no credit history, making these counterparties highly risky to delegate full control of your funds.

Some custodial wallets may let users control a portion of their private keys but still force users to rely on trusted third-party full nodes to verify Bitcoin transactions. More on that later.

Non-custodial wallets

Self-custody of bitcoin private keys is therefore the most advisable alternative to eliminate reliance on unproven third parties. “Not your keys, not your bitcoins” is being thrown around over and over in the community but it often takes some time (rightfully so) to fully grasp why that concept truly matters.

Efforts in the Bitcoin community, such as the Proof Of Keys movement initiated by Trace Mayer, are attempts to make more people care about controlling their own keys to protect their bitcoins, asking bitcoin holders to withdraw their private keys from custodial exchanges into the non-custodial alternatives described below.

Bitcoin’s architecture design using public key cryptography allows users to be sovereign by self-managing their wealth in an effort to cut the overwhelming dependence on trusted financial institutions such as banks.

With that principle in mind, non-custodial wallets have been developed to help users safekeep bitcoins on their computers, mobile devices, specialized hardware and even paper.

Non-custodial desktop wallets can be “lightweight”, meaning they need to be connected to a full-node of the Bitcoin network to verify transactions.

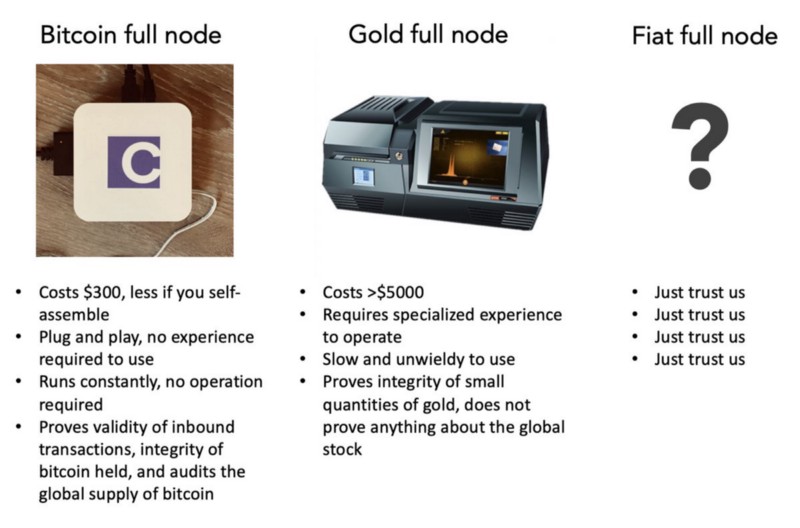

Full nodes are used in Bitcoin to transparently verify the transactions that are happening in the network, without trusting an intermediary to report information. All the Bitcoin transaction history since the network was born on the Internet on January 3rd, 2009 are stored and accessible in any active full node.

Using Simple Payment Verification (SPV), non-custodial desktop wallets ask full nodes to verify specific transactions, which diminish privacy if done with a trusted third-party full node, but is fine if it is user-owned. Using this method, bitcoin holders are truly sovereign in how they manage their private keys and verify that their transactions went through.

Lightweight desktop wallets include Electrum or Wasabi, which rely on their corporate servers to verify user transactions as trusted full nodes, reducing user privacy.

For lightweight desktop wallets that don’t rely on third-party full nodes, users need to set up and operate their own Bitcoin full node and have the patience to perform the initial block download from the genesis block to today, which may take several days or weeks depending on technical limitations such as bandwidth and processor speed.

This makes desktop wallets easier to use for regular users who may not have sufficient computer disk space to store the entire Bitcoin blockchain history directly on their computer, or enough network bandwidth to download the 215GB of transactions. Some companies such as Nodl, Casa and Samourai’s Dojo are making full node plug-and-play products to help onboard less tech-savvy users.

Other desktop clients have “full-verification nodes,” which requires users to download Bitcoin’s entire blockchain transaction history without requiring any external full node for verification.

Besides the technical specifications required for the computer to perform such operations (at least 500GB of disk space as Bitcoin’s blockchain is 215GB now and growing, with high network bandwidth and reasonable CPU), users need to have this wallet connected to the Internet constantly.

This is to prevent the in-app full node from disconnecting from the network and having to re-sync to download the latest blocks, which introduces delays until the full node is fully synced again to the tip of Bitcoin’s blockchain.

Full node desktop clients include Armory or Electrum. Unfortunately, hardware failure risk and Internet connectivity via Wi-Fi for desktop computers and laptops make users prone to a wide range of online security risks on desktop wallets.

Mobile

Similar to desktop clients, mobile wallets store private keys on user devices, which are connected to the Internet via Wi-Fi and cellular networks such as LTE. They are available on either Android, iOS or Windows Phone.

Bringing better usability, mobile wallets are by default “lightweight” wallets due to the hardware memory and bandwidth constraints tied to mobile devices. Mobile wallets also use SPV and either rely on trusted third-party servers providing transaction verification (which isn’t favorable) or connecting to user-owned full nodes.

As noted, SPV wallets can introduce privacy concerns for users when there is a trusted third-party full-node involved in providing transaction verification. For users operating their own personal full node, privacy concerns using SPV are diminished.

Mobile devices are reasonably more secure than desktop computers with data encryption but still face hardware failure risks, social engineering and physical losses. Strikingly, they are ubiquitous and can be useful in other multi-party configurations that we will cover later on.

Mobile wallets using trusted third-party full-node servers include Mycelium and Blockstream Green. Some rely on one core corporate server, which is the least favorable option for privacy and security, while other configurations randomly select verification servers from a trusted list, which reduces privacy concerns.

Other mobile wallets connecting to user-owned full nodes include BRD Wallet and Zap on iOS, Electrum Wallet with Samourai Wallet on Android. HODL Wallet is available on both iOS and Android and lets advanced users choose between connecting to their own full-node or using their third-party server.

Specialized hardware

Dedicated companies have developed specialized hardware products to make it safer and easier for owners to store their bitcoins independently of any trusted third parties, while reducing risks of traditional desktop and mobile wallets.

Hardware wallet providers such as Trezor, Ledger and Cold Card Wallet are the most popular manufacturers. Specialized hardware in the form of USB-like devices store private keys offline to reduce the potential attacks from hackers that users may face but require users to trust the hardware providers and their full-node APIs to verify transactions.

Specialization of hardware devices is an attempt to prevent physical extraction of private keys. Hardware wallets are either connected to desktop or mobile apps to execute operations in tandem with a trusted interface built-in on the device. Users need to have these specialized devices physically each time they want to move funds to and from their wallet, which is not the most convenient.

Even with added security features, multiple cases of losses and thefts occurred in the past due to people buying reused hardware wallets (always buy directly from verified manufacturers) or loosing the device with its recovery (here or here).

In case of physical loss or destruction, hardware wallets have backups that need to be stored separately to recover the private keys they contained.

Physical backups

Backups of private keys must be stored by users who are advised to write them down on a piece of paper. Backups, also called seed, recovery or mnemonic phrase, are the ultimate option for users to recover funds in case private keys get lost or compromised via a web, mobile, desktop or hardware wallet.

Storing backups is a responsibility that is outside the scope of hardware, web, mobile or desktop wallet providers. This introduces potential user errors and likely loss events if backups are lost or compromised. It is the ultimate recovery material. If lost or compromised, there are no recourse.

Backups must be stored offline to minimize risk exposure to theft and loss, which involves operational and physical security. Preventive measures must be considered to avoid physical theft of recovery material, which would lead to the compromise of the entirety of the associated private keys and funds.

Floods, fires, earthquakes and other catastrophic events may very well destroy the backups users are storing in their homes or workplaces. Companies such as Cryptosteel, Hodlinox or Billfodl are developing heat-resistant steel plates to prevent long-term degradation of backups.

Redundancy of backups across geographies is advisable, which introduces other risks and dependencies. Sharding, or splitting, backups into multiple sub-parts help reduce the likelihood of a malicious actor compromising the funds. Vault providers can help store redundant or partial copies of backups for maximum security but introduce third-parties.

Operational complexity and cognitive burden rise dramatically as a direct cost of extended security measures. Today this is the state-of-the-art for backups and recovery of bitcoins.

Open-source frameworks

Open-source software and procedures, such as Glacier, a protocol for high-security bitcoin storage have been released by the community in an attempt to create an industry standard. It is a highly-involved operational procedure, which require redundant, quarantined and special-purpose hardware.

Physical dice are used to generate true randomness that algorithms on computers aren’t capable of creating properly. Combined with purpose-limited offline computers, truly random private keys are generated, and stored on offline paper wallets.

This is a deep cold storage, which involves machines that have never been connected to the Internet and never will with one-time disposable hardware that gets burned after having generated private keys.

All these operations must happen in a faraday cage to nullify the exposure to potential radio-wave side attack channels. Not a procedure for your casual user securing his bitcoins. Minimum expense for that configuration is roughly $600 and takes 5-7 hours of initial set up.

Institutional custodians

With the rise of Bitcoin’s market cap in 2017, institutions have showed interest in the safekeeping of bitcoins with novel configurations. As fiduciaries, institutions are forbidden to self-custody bitcoins and are required to hold funds using dedicated third-party custodians that are regulated under the appropriate regulatory regimes, licenses and supervising entities.

With the segregation of duties between investing and custody, custodians have emerged as a quality interim solution to bring institutional liquidity in the market until regulations and technology mature sufficiently to have reliable non-custodial infrastructure deployed mass market.

Custodians often provide bespoke governance, internal controls, proof of reserves and insurance guarantees for fiduciaries with multi-party authorizations, where many signatories are registered to collectively approve transactions on bespoke governance rules.

Multiple companies are working towards getting a share of the market, with notable entities such as ICE’s Bakkt (still pre-launch), Fidelity Digital Assets, Anchorage, Xapo or KNØX.

Multi-signature

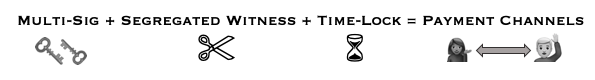

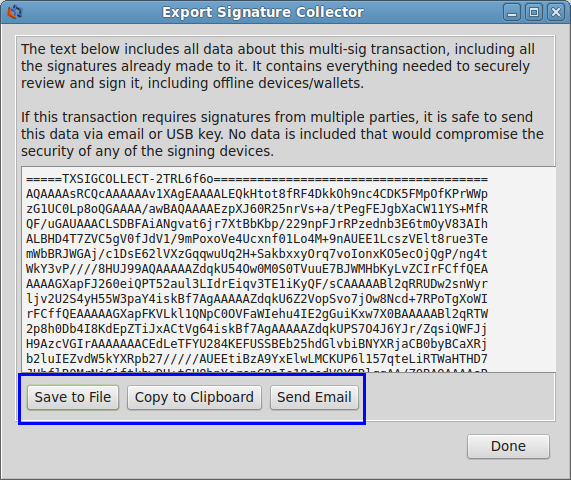

Multiple signing authorities can be required to execute Bitcoin transactions. Multi-signature is a built-in feature of Bitcoin’s P2SH (pay-to-script hash) at the base protocol layer that has been available since the early days. This design reduces single points of failure and enable bespoke transaction governance rules based on amounts, time locks and specific use cases.

Multi-signature schemes, where 2 authorizers out of 3 registered would be required to execute on a transaction, allow users to retain full control of their bitcoins, controlling 2 keys, while ensuring continuity in case of loss with other parties controlling the remaining key. The architecture of such system is non-trivial to design and implement securely while abstracting away the complexity from the end-user experience.

Companies such as Casa has recently released multi-signature wallets for users, letting consumers store keys across their devices, and a few with Casa creating a “seedless” configuration, where users can get their private keys recovered using other keys securely held by Casa in case of loss events. BlockstreamGreen has been updated recently with a new multi-signature mobile wallet for consumers using “2-of-2 multisig by default, with one key held on the device, and one key held on Blockstream’s servers.” BlockstreamGreen send pre-signed transactions to users, which only need the user signature to be treated as valid transactions. Muun is the another multi-signature mobile wallet for Bitcoin. “As a non custodial service, Muun helps users fulfill Bitcoin’s be-your-own-bank promise, and protect their funds from trusted third parties, attackers and human error […] transactions are protected with 2-of-2 multisig and theft detection. A personal key is stored in your phone. Muun holds a co-signing key.”

On the institutional side, Unchained Capital has recently announced their “collaborative custody” product, as “a superior approach to security that combines the control of self-custody with the benefits of a managed financial service. Ledger Vault was released in 2018 as a “multi-authorization cryptocurrency wallet management solution enabling financial institutions to safekeep their funds […] looking for convenience and streamlined operations with zero compromise on security.” Ciphrex, is an open-source, free to use multi-signature desktop wallet. “It supports the best security practices in the industry and is rated amongst the most secure wallets by bitcoin.org.” MuSig, was released by Blockstream earlier in 2019, as a new multi-signature standard to offer “provable security, even against colluding subsets of malicious signers, and [producing] signatures indistinguishable from ordinary single-signer Schnorr signatures.” Blockstream has proposed their code implementation to be deployed into Bitcoin development environments, which may happen later on should it pass community standards.

An ongoing quest…

Multiple developments are currently happening for bitcoin private key management in an effort to blend security with usability and user sovereignty. A peer-to-peer, country-agnostic and economic system built on Bitcoin deserves novel solutions to onboard the next millions of consumers and businesses without introducing reliance on trusted third parties.

It has only been 10 years since Bitcoin’s birth so the industry still deserves additional infrastructure development for Bitcoin private key management. Safekeeping private keys and utilizing public key cryptography has proven to be a non-trivial but ever-evolving endeavour.

Perhaps in 10 years, most Bitcoin hodlers will be able to securely manage their private keys without knowing how the system operates in the back-end, collectively storing a portion of the world’s growing Bitcoin wealth.

Owing a lot to Antoine, Ben, Allen who reviewed early draft versions of this writing, and specifically to Sun and Zane with whom we’re trying to make bitcoin private key management better for us three. Learning everyday from the best, who are helping us shape a better understanding of Bitcoin, for private key management, security, privacy, usability and so many other important things: @JackMallers @giacomozucco @francispouliot_ @LukeDashjr @lopp @starkness @valkenburgh @nic__carter @fernandoulrich @LarryBitcoin

The case for a small allocation to Bitcoin

By Wences Casares, CEO of Xapo

Posted April 11, 2019

Why most portfolios should allocate up to 1% to Bitcoin

Summary

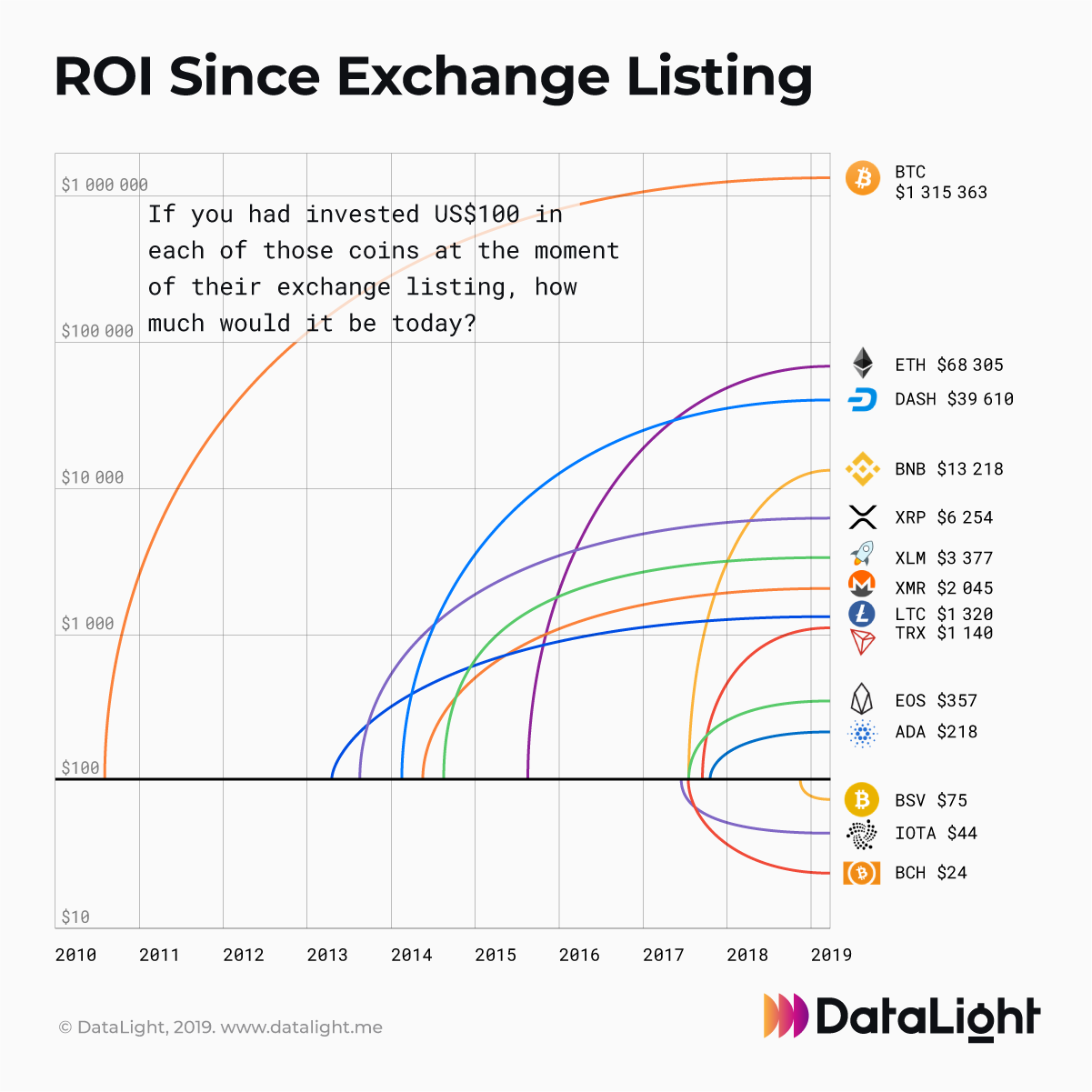

Bitcoin is a fascinating experiment but it is still just that: an experiment. As such it still has a chance of failing and becoming worthless. In my (subjective) opinion the chances of Bitcoin failing are at least 20%. But after 10 years of working well without interruption, with more than 60 million holders, adding more than 1 million new holders per month and moving more than $1 billion per day worldwide, it has a good chance of succeeding. In my (subjective) opinion those chances of succeeding are at least 50%. If Bitcoin does succeed, 1 Bitcoin may be worth more than $1 million in 7 to 10 years. That is 250 times what it is worth today (at the time of writing the price of Bitcoin is ~ $4,000).

I suggest that a $10 million portfolio should invest at most $100,000 in Bitcoin (up to 1% but not more as the risk of losing this investment is high). If Bitcoin fails, this portfolio will lose at most $100,000 or 1% of its value over 3 to 5 years, which most portfolios can bear. But if Bitcoin succeeds, in 7 to 10 years those $100,000 may be worth more than $25 million, more than twice the value of the entire initial portfolio.

In today’s world where every asset seems priced for perfection, it is hard, if not impossible, to find an asset that is so mispriced and where the possible outcomes are so asymmetrical. Bitcoin offers a unique opportunity for a non-material exposure to produce a material outcome.

It would be irresponsible to have an exposure to Bitcoin that one cannot afford to lose because the risk of losing the principal is very real. But it would be almost as irresponsible to not have any exposure at all.

What is interesting about the Bitcoin Blockchain?

Throughout this essay I refer to the “Bitcoin Blockchain” when I am referring to the Bitcoin platform as a whole, including the Bitcoin Blockchain and the Bitcoin currency. Many different systems for different use cases may one day run on top of the Bitcoin Blockchain. When I refer to “Bitcoin” I am referring to Bitcoin the currency, that can be bought, sold, sent, received, held, etc. You can think of the Bitcoin currency as the first system to run on top of the Bitcoin Blockchain.

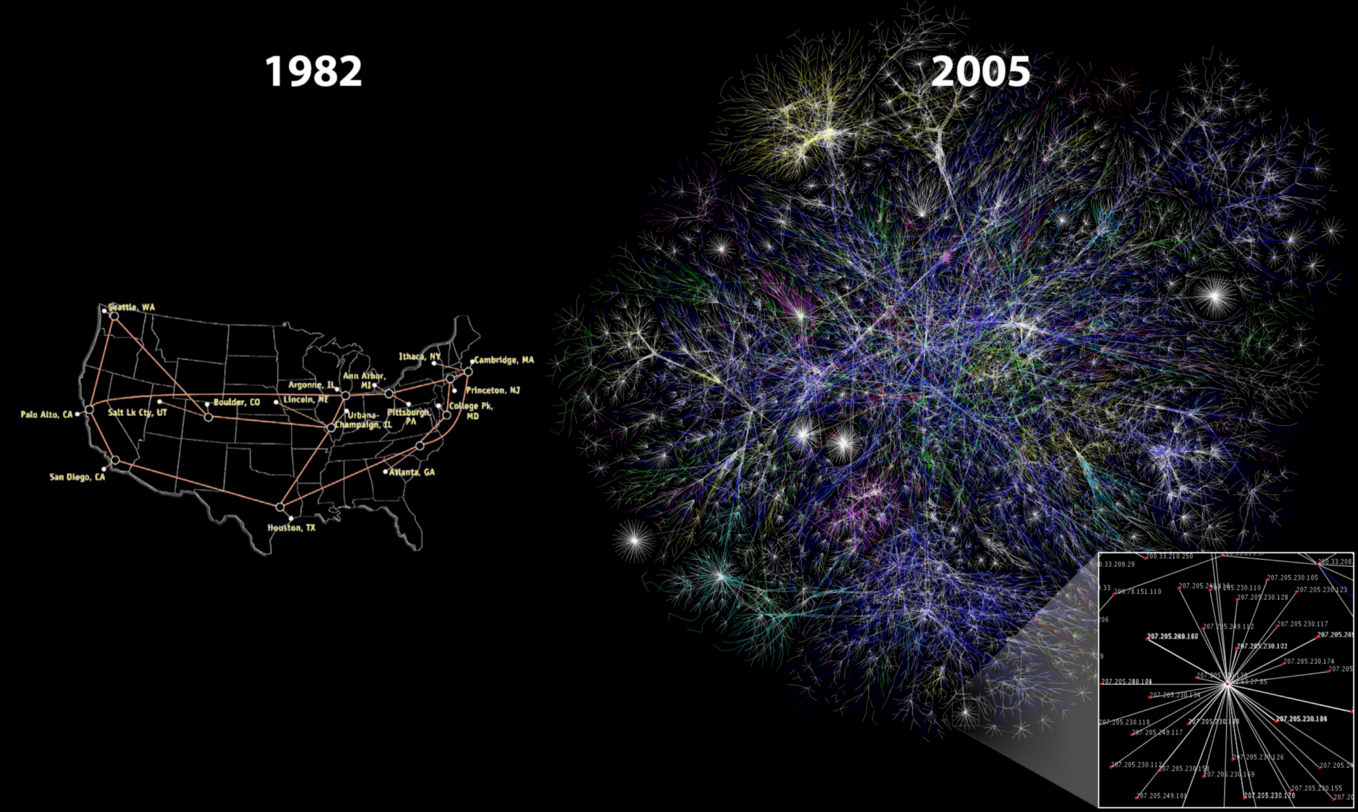

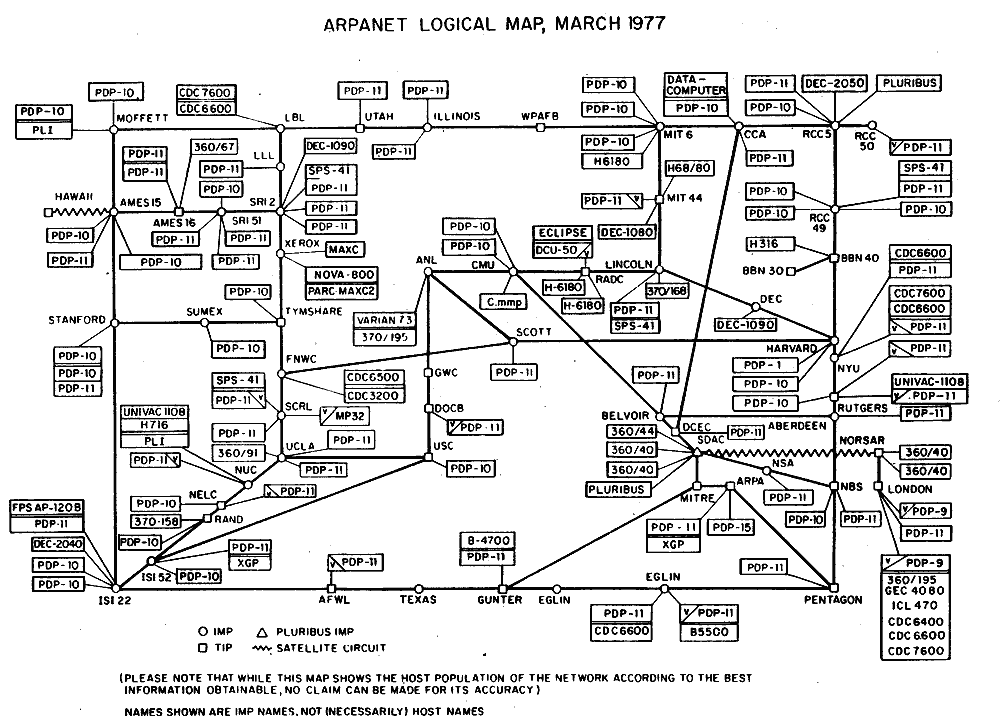

The current state of the Bitcoin Blockchain is similar to the state of the Internet in 1992. Back then the Internet was very nascent and experimental. Just like with the early days of the Internet there are many bold claims about how the Bitcoin Blockchain will revolutionize the world and solve so many problems. Many of these claims are exaggerated or wrong. Even though right now most of us feel like we do not fully understand the Bitcoin Blockchain, over time we will all does not get any value from having a sovereign platform can you be correct to assume that the Bitcoin Blockchain electricity consumption is an enormous waste.

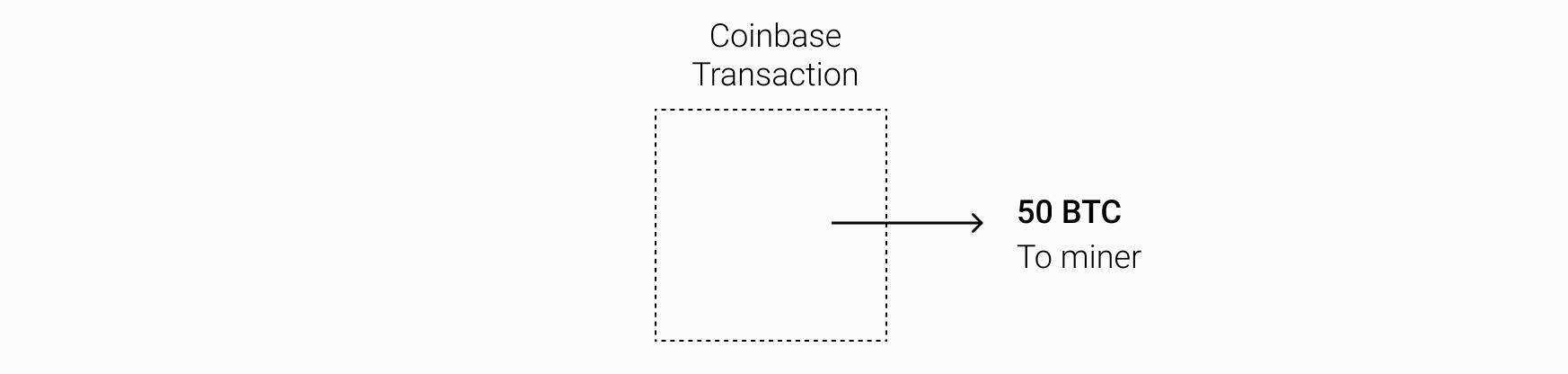

Bitcoin miners secure the Bitcoin Blockchain because they get paid in bitcoins to do so. The Bitcoin Blockchain is secured, to an important degree, by the bitcoins that the miners earn. If you were to remove the bitcoins, most miners would stop mining and, therefore, the Bitcoin Blockchain would not be very robust and not very sovereign. In corporate circles, especially in financial institutions, it has become fashionable to say “I am interested in the Blockchain but not in Bitcoin”, which is the same as saying “I am interested in the web but not interested in the Internet” (remember Intranets?), not understanding that the web could not exist without the Internet. The only innovation of the Blockchain is it’s sovereignty, the only sovereign Blockchain so far is the Bitcoin Blockchain and the fuel that keeps it sovereign is the Bitcoin currency. It is like a boa eating its own tail.

If a group of people wanted to take away the Bitcoin Blockchain sovereignty today they would not only need an extraordinary amount of capital and the capacity to develop specialized mining hardware in very large quantities, but they would also need access to the equivalent of the United States largest hydroelectric dam for an extended period of time. That would be hard to do but not impossible. Every day that goes by it gets even harder to “break” the Bitcoin Blockchain sovereignty. The Bitcoin Blockchain sovereignty has been attacked in the past (in fact, one of those attacks found me on the wrong side of history and that is how I painfully learned many of these lessons, but that’s another story…) and so far it has always survived intact. We can expect the Bitcoin Blockchain sovereignty to come under attack from more and more resourceful bad actors, coalitions of bad actors or even from nation states eventually. Only time will tell if Bitcoin is truly sovereign or not.

Where can a sovereign platform add value?

It is a lot easier to see where the Bitcoin Blockchain will NOT add any value. For any Blockchain to add value it has to be the ultimate arbiter of truth: nothing has to be able to contest it or change it. For any use case in which the Blockchain information can be contested or changed by a government, by a registrar of deeds, by a court, by the police, by the SEC or by any other authority it does not make sense to use a Blockchain. Claims that the Blockchain can solve property titles, securities settlement, supply chain management, the authenticity of works of art and many other similar cases are misplaced. It is true that the systems that we are using today in all of those cases are old, antiquated and inefficient. And it is true that all of those cases involve many stakeholders that use different data formats and transaction protocols that are often proprietary, but all of those problems would be better solved if those stakeholders agreed to use open standards and if they used better technology. Most often the word “Blockchain” is being waved frantically by consultants who want to scare their corporate customers into buying new technology projects, or by executives at those corporations who do not yet understand the Blockchain but understand that they may get the budget they want if they say their project is using “Blockchain”, or by entrepreneurs who think they are more likely to get the funding or press coverage they want if they add the word “Blockchain” to whatever they are doing.

So, where does a sovereign platform add value? As an example, an identity system may benefit from a sovereign platform. We would rather not keep all of our identity information (full name, social security #, date of birth, name of our parents, name of our spouses and kids, our address, passport information, payment information, etc.) on our phone which can be easily hacked, but we also do not want to give all that information to Google or Facebook or to our government. A sovereign system that no one can corrupt or control that will keep our information safe and will ask us every time someone wants a piece of our information may make sense. With this example we are simply trying to be creative and guess one possible use case, I am sure we will be surprised by creative and revolutionary entrepreneurs coming up with uses cases that take full advantage of a sovereign platform and that we cannot imagine right now.

But there is a use case that makes a lot of sense and, in fact, it is already working quite well. That is to use this sovereign platform to run a global system of value and settlement which is what Bitcoin, the currency, may become. Similar to what gold was for 2,000 years and similar to what the US dollar has been for the last 70 years. Bitcoin is potentially superior to gold and to the US dollar as a global non-political standard of value and settlement because there will never be more than 21 million bitcoins and because Bitcoin is open and uncensorable. There will never be more than 21 million bitcoins because it runs on a sovereign platform so no one can change or inflate that number. Additionally, Bitcoin is uncensorable because it runs on a sovereign platform so no one can change the transactions that already exist in the system and no one can keep the system from accepting new transactions. This allows for unprecedented economic freedom in the same way the internet allowed for unprecedented freedom of information. Gold has the advantage that it is tangible and many people (especially older ones, who tend to have more capital) strongly prefer something that they can touch. Gold also has in its favor that it has been around for over 2,000 years, and it may be impossible for Bitcoin to match that history and reputation. The dollar has the advantage that it is already easily understood and accepted globally and it is a platform with remarkable network effects. These qualities may be too much for Bitcoin to overcome. Or it may be that we collectively come to appreciate the advantages of a digital unit that cannot be inflated or censored. Only time will tell.

Bitcoin is not an asset. It does not produce earnings or dividends and it does not generate interest. And Bitcoin has no intrinsic value. Bitcoin is simply money and most forms of good money have no intrinsic value. Gold, the US dollar and national currencies do not have any intrinsic value either but because they have had a monetary value for a long time most people perceive them as being intrinsically valuable, which is a big advantage. The main hurdle Bitcoin has to clear to become successful is to develop a similar widespread social perception of value and achieving that is quite an ambitious goal.

What does a world in which Bitcoin succeeded look like?

If Bitcoin succeeds it will most likely not replace any national currency. It may be a supranational currency that exists on top of all national currencies. If Bitcoin succeeds it may be a global non-political standard of value and settlement.

The world already has a global non-political standard of measure in the meter, and a global non-political standard of weight in the kilo. Could you imagine a world in which we changed the length of the meter or the weight of the kilo regularly according to political considerations? Yet that is what we are doing with our standard of value. Today we use the US dollar as a global standard of value which is much better than nothing but quite imperfect: it has lost significant value since inception, it is hard to know how many dollars will be outstanding in the future and, increasingly, the ability or inability to use it as a platform depends on political considerations. The world would be much better off with a global non-political standard of value.

The same is true for a global non-political standard of settlement. Only banks can participate in most settlement networks (like SWIFT, Fedwire, ACH in the US, CHAPS in the UK, SEPA in Europe, Visa and Mastercard, etc). Individuals, corporations and governments can only access these settlement networks through banks. Using these settlement networks takes time

(sometimes days), the process is opaque and costly and, increasingly, the ability to use them is determined by political considerations. Imagine an open platform where any individual, corporation or government could settle with any other individual, corporation or government anywhere in the world, in real time and for free, 24/7 and 365 days of the year. This would do for money what the Internet did for information.

In a world in which Bitcoin succeeds all currencies may be quoted in satoshis (the smallest fraction of a Bitcoin). When your granddaughter asks what is the price of the New Zealand dollar she may receive an answer in satoshis: the New Zealand dollar is 72 satoshis today. And the price of the Turkish Lira? 21 satoshis today. The US dollar? 107 satoshis today. A barrel of oil? 5,600 satoshis today. Global GDP? 97,356,765 bitcoins. The GDP of Indonesia? 1,417,007 bitcoins. The reserves of the South African Reserve Bank? 53,230 bitcoins. You get the idea. Then all of these values would be easily comparable across time and across geographies.

When your granddaughter asks “Grandpa, how did you guys keep track of all these things when you did not have Bitcoin?” your answer will be “We used the US dollar”. Then she may ask

“Really? But isn’t that the currency of the United States?” after you say yes she may ask “And how did you keep track of the US dollar?” to which you will say “Well… mostly in Euros, sometimes in Yen, Swiss Francs or other currencies depending on what we were talking about”. She may think we were weird.

Why not another cryptocurrency instead of Bitcoin?

There are about 1,000 cryptocurrencies that have at least one transaction a day. So why Bitcoin and not any one of those other ones? Over 60 million people own Bitcoin and over 1 million people become new owners every month. The other 1,000 cryptocurrencies have less than 5 million owners combined, so Bitcoin will add more users in the next 5 months than those 1,000 cryptocurrencies added in their combined history. Bitcoin is moving over $1 billion a day which is also more than all the other cryptocurrencies combined.

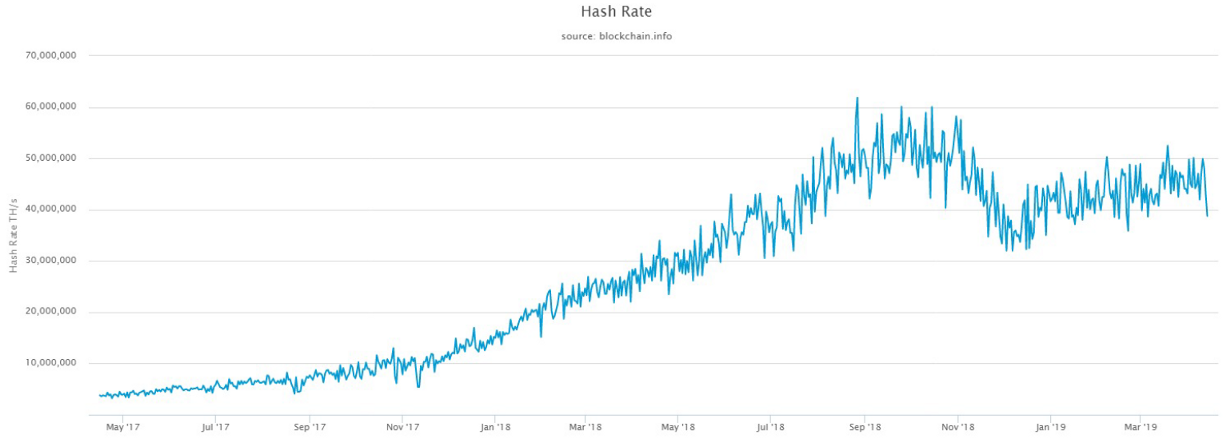

The most important metric of all, though, is how much can we trust these platforms or how sovereign they are. The measure of how sovereign these platforms are is the square of the computing power they have. If we use electricity consumption as a proxy of the computing power each of these platforms have, all of those 1,000 cryptocurrencies combined have less than 1% of the Bitcoin Blockchain processing (mining) power so none of them is (yet) really sovereign and in many cases their code is controlled by a person or a small group of people. New technologies may achieve sovereignty without relying on processing power and that may seriously challenge the Bitcoin Blockchain. But if those technologies do not get developed or it takes too long it may be difficult to unseat the Bitcoin Blockchain.

The Bitcoin Blockchain is a open protocol, not a company. The history of protocols is very different than the history of companies. In the history of companies there is a lot of change, disruption and churn (Microsoft-Apple, eBay-Amazon, Altavista-Google, MySpace-Facebook, etc.). However, the history of protocols is very different. Once a protocol gets established it almost never changes. For example, we are using IP (Internet Protocol, or just “the Internet” colloquially) for almost all transport of data (until the late 90s cisco routers used to route dozens of protocols, today they only route IP). We are using only one web protocol and only one email protocol. The email protocol, for example, is quite lousy. At the protocol level there is no way for me to know if you received my email, much less if you read it, there is no way for you to verify my identity when you receive my email, there is no way to handle spam and many, many other things that could be fixed at the protocol level. I am sure some people have already developed much better email protocols, but we never heard about them and most likely we never will: once a protocol gets established it becomes the only protocol for that use case and it is not possible to displace it with a better protocol. Right now it looks like the standard protocol for a sovereign platform will be the Bitcoin Blockchain.

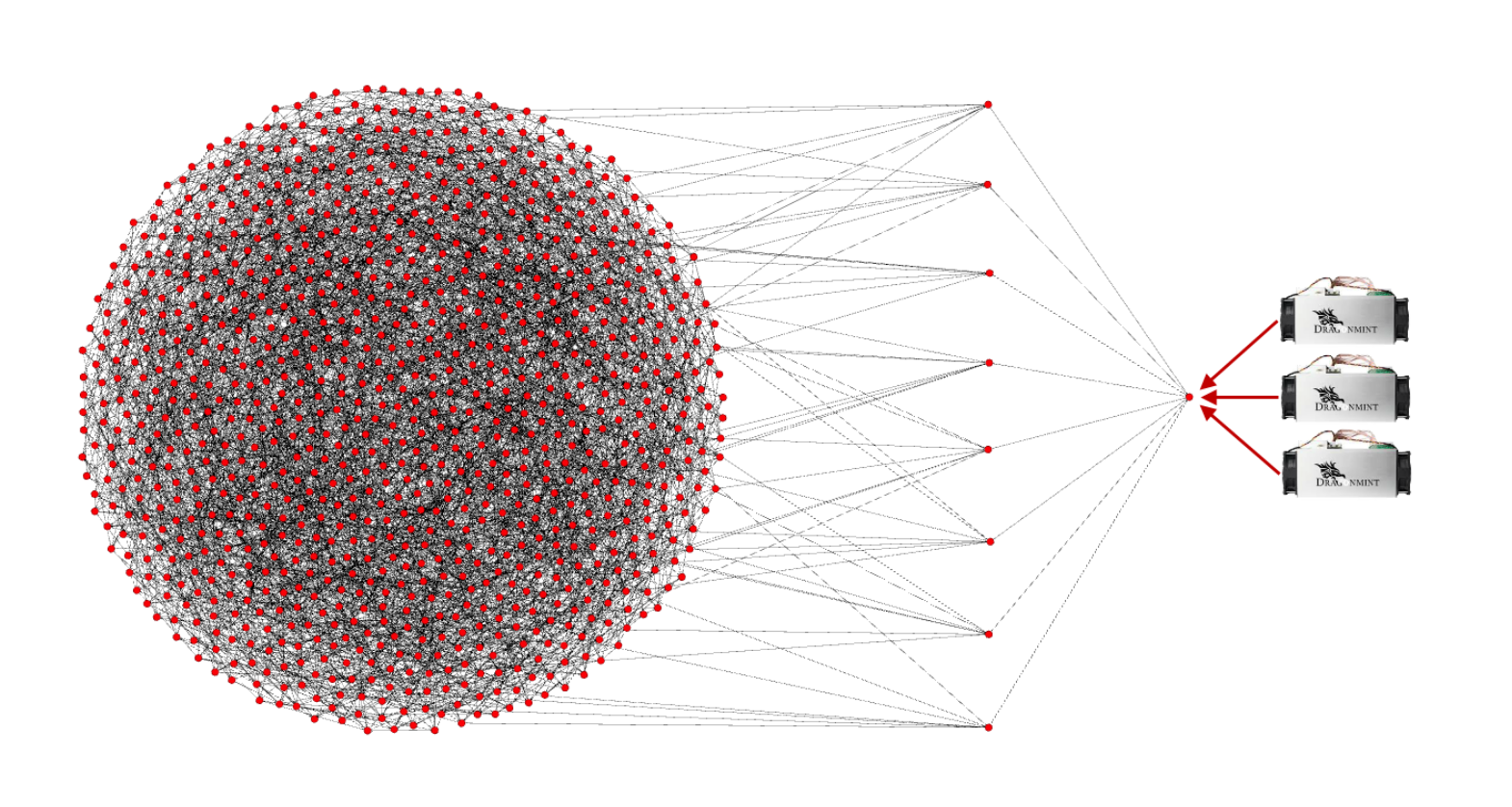

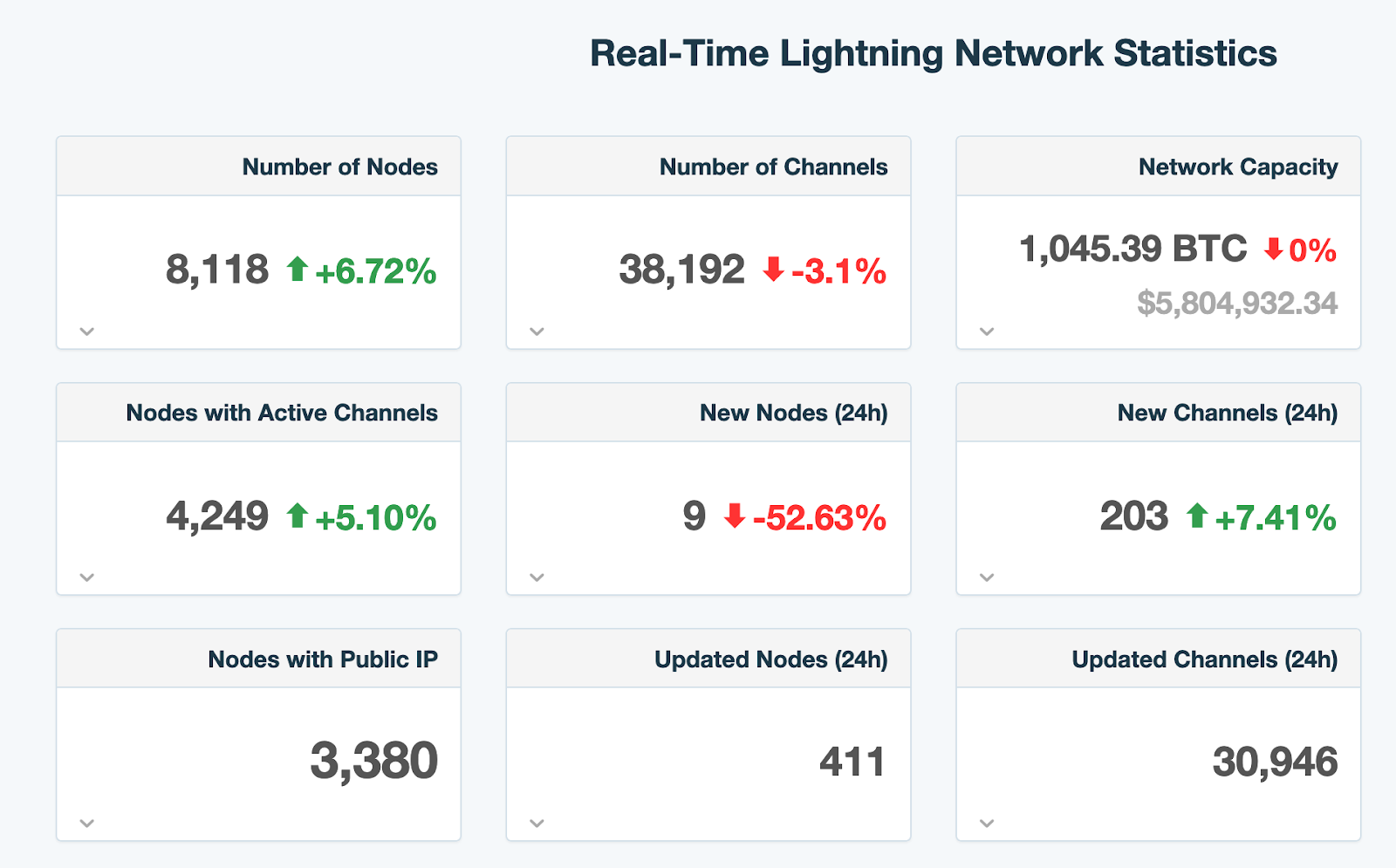

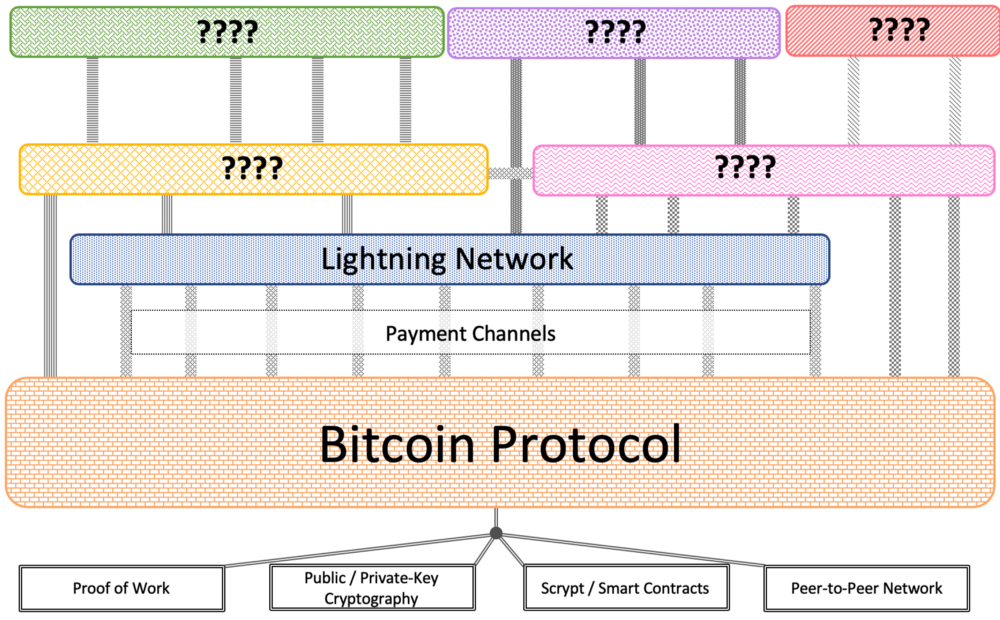

Many interesting technologies and applications that are being tested with other cryptocurrencies and other Blockchains and, if they are successful, they may be implemented on top of the Bitcoin Blockchain. It is not efficient to invest massive amounts of new hardware and electricity to replicate sovereignty when we already have a most solid and robust sovereign Bitcoin Blockchain. It is more efficient to simply build on top of it. For example, the Bitcoin Blockchain is limited in that it can only process approximately 3,000 transactions every 10 minutes, you have to wait 10 minutes for the transaction to be recorded in the Blockchain and up to 1 hour if you want to make sure it is irreversible. And you have to pay anywhere from 5 cents to 50 cents in transaction fees for the miners to process your transaction. The Lightning Network takes advantage of the robustness of the Bitcoin Blockchain and it works as a “Layer 2” solution on top of the Bitcoin Blockchain, enabling thousands of transactions per second of as little as 1 satoshi ($0.00004), for free and in real time. Similarly, other early examples of Layer 2 solutions that work on top of the Bitcoin Blockchain are RSK which enables the full functionality of Ethereum but on top of the much more robust Bitcoin Blockchain. Liquid is an open source wholesale settlement network developed by Blockstream that operates on top of the Bitcoin Blockchain. There are many more examples of technologies being developed to take advantage of the sovereignty and robustness of the Bitcoin Blockchain and enhance its capabilities by building on top of it.

How can Bitcoin fail?

Bitcoin can fail in many different ways. It could be taken over by a bad actor. It could be displaced by a better platform. It could be hacked. And Bitcoin can probably fail in many ways that we cannot imagine yet. Because Bitcoin does not have any intrinsic value, and because it’s value depends on a social consensus which is a sort of collective delusion, in my opinion, the most likely way in which Bitcoin could fail is a price panic. If we all decide at the same time that we think Bitcoin is worthless, then it will be worthless. It is a self-fulfilled prophecy. If the price of Bitcoin were to plummet to zero or near zero, even if the platform remained intact, its reputation would suffer immensely and it could take a generation to rebuild that credibility. This could happen if people buy amounts of Bitcoin they cannot afford to lose, for example if people invest their retirement funds or their kids’ college funds into Bitcoin, and as the price goes does down they are forced to sell, pushing the price further down and forcing others to sell. So, in my opinion, the biggest risk to Bitcoin is people investing amounts they cannot afford to lose.

Most of the capital invested in Bitcoin today seems to be capital that people can afford to lose. That is not because people are wise, or because the regulators have been very effective or that the industry has been prudent. The only reason why most people today do not have an amount of Bitcoin they cannot afford to lose is because of Bitcoin’s price volatility. Ironically Bitcoin’s price volatility is the best insurance against Bitcoin’s biggest risk. If Bitcoin ever begins to be perceived as a safe asset before it has matured and people begin to allocate capital they cannot afford to lose we should be concerned. This happens to some degree during every Bitcoin price rally but, fortunately, so far each rally has corrected without destroying Bitcoin, but one day that could not be the case.

After 10 years of Bitcoin working well without interruption more concerning than a complete failure is a scenario where Bitcoin does not fail but it becomes irrelevant. Something similar to what happened to the BitTorrent protocol, which still exists but is less and less relevant as the real revolution in digital file sharing and entertainment happened through Dropbox, Spotify, Netflix, and many others. Similarly, there is a chance that Bitcoin does not fail but that it never becomes mainstream, that is only used by a group of believers and fanatics but not much more beyond that. That could happen because financial institutions, governments, and regulators manage to keep Bitcoin separate and ostracized from the rest of the financial world, like a non-convertible currency, but it could also happen even if financial institutions, governments, and regulators keep going on their current path of enabling Bitcoin to be fully connected to the financial world. If Bitcoin never becomes mainstream bitcoins will still have a price but most likely lower than what it is today. In my (subjective) opinion the chance of this happening is 30%.

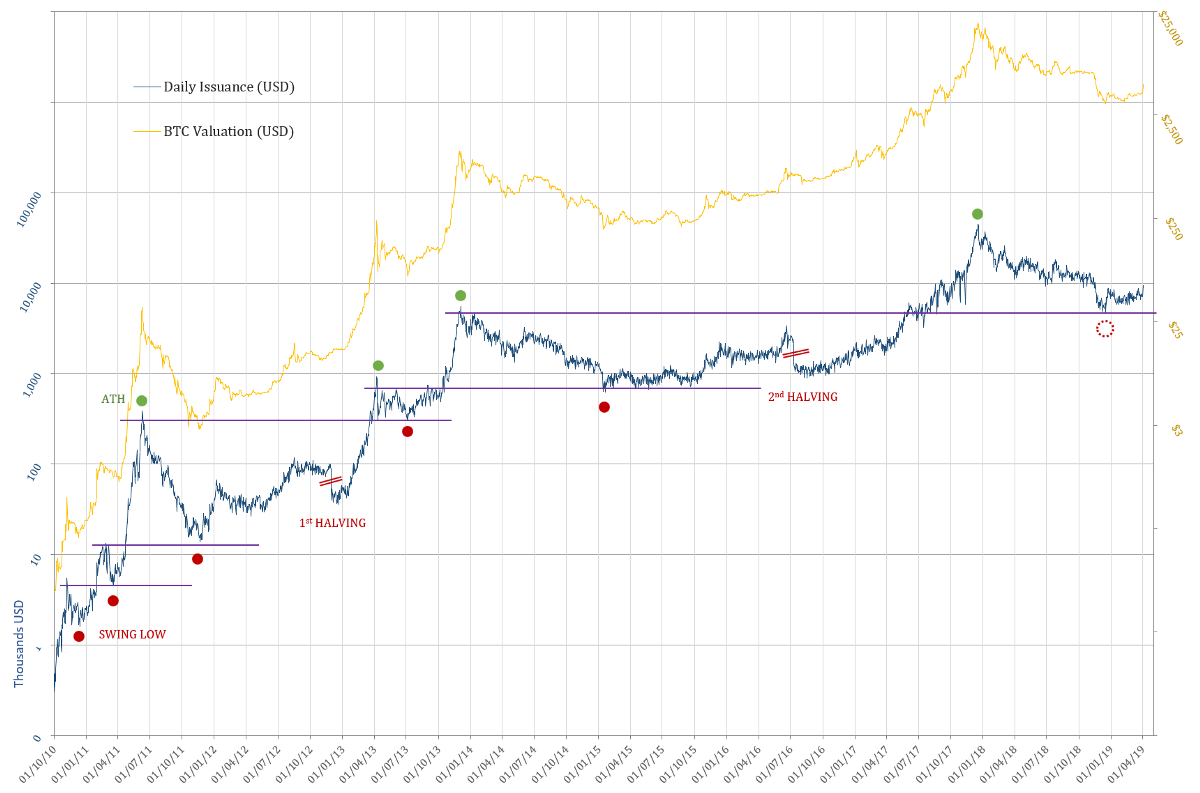

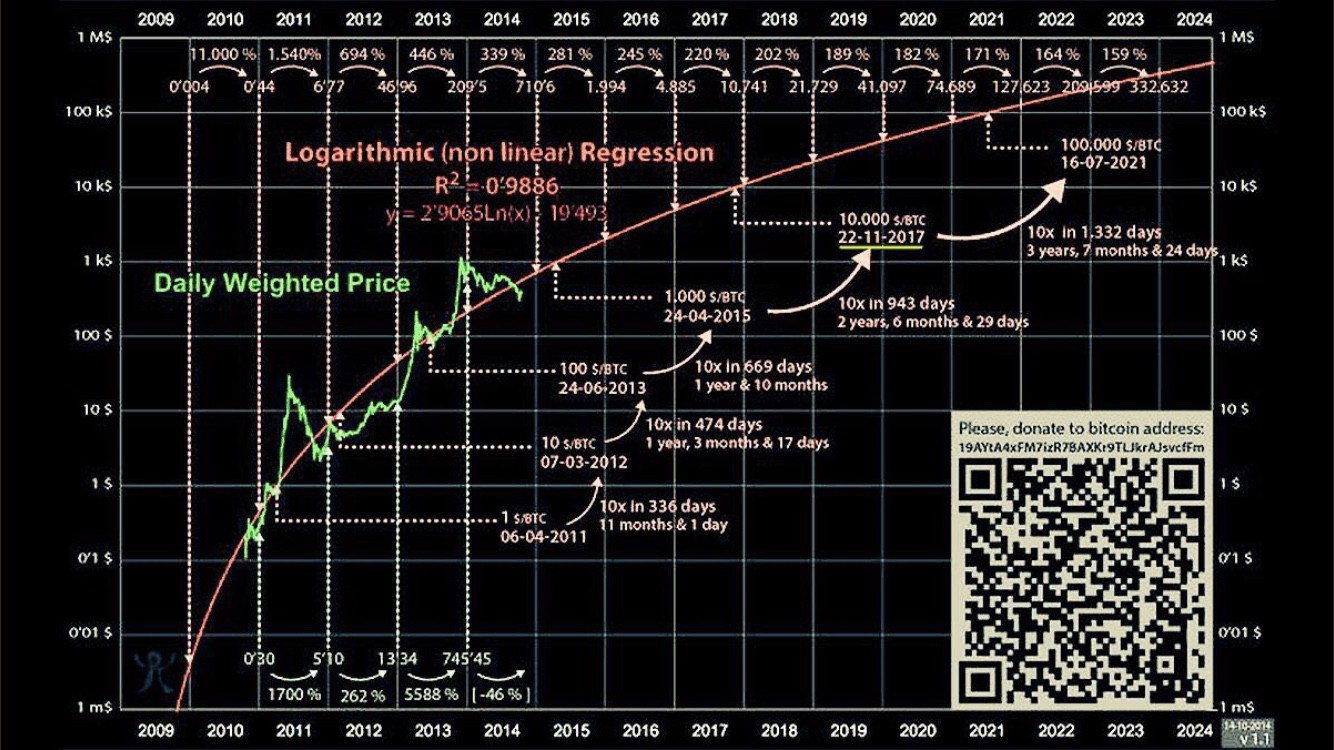

Bitcoin’s price action

Bitcoin launched in January 2009 but it did not have a price until July 2010 when it began to to change hands informally at $0.05 cents per bitcoin. In November 2010 Bitcoin had its first price rally that took the price to a peak of $0.39 cents to then “crash” to $0.19 cents. The price was at its peak of $0.39 cents only very briefly and the volume on prices near $0.39 cents was negligible, for most casual observers the rally simply took the price of Bitcoin from $0.05 cents to $0.19 cents, an increase of 280%, but most of the commentary at the time focused on the Bitcoin “crash” of over 50% from $0.39 to $0.19 cents. This exact same story has repeated itself 6 times in Bitcoin’s history so far. There have been 6 of these rallies in Bitcoin’s 10-year history and in between the rallies the price of Bitcoin has traded sideways or downward for months or years at a time. During most of Bitcoin’s 10-year history, the press has been commenting and worrying about Bitcoin’s latest “crash”. How can something that constantly crashes go from

$0.05 cents to $4,000 you ask? If you want something to go from $0.05 cents to $4,000 and fool everybody into believing that it is failing, do it with as much volatility as possible.

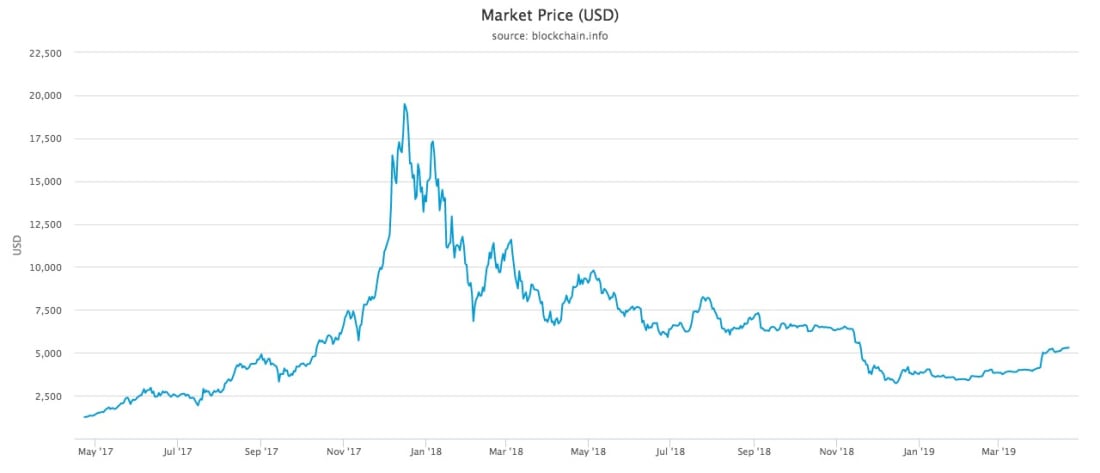

The second Bitcoin price rally happened in February 2011 and it took the price of Bitcoin over $1.00 for the first time to then “crash” to $0.68 cents. The third rally happened in August 2011 and it took the price of Bitcoin to $29 to then “crash” to $2. The fourth rally happened in April 2013 and it took the price to $230 to then “crash” to $66. The fifth rally happened in December 2013 and it took the price to $1,147 to then “crash” to $177. The 6th (and currently last) rally happened in December 2017 and it took the price of Bitcoin to $19,783 to then “crash” below $3,200 (and until this bear market is over we don’t know how low it may go).

The Bitcoin price rallies are the most important feature of how Bitcoin propagates, how people spread the word and how more people want to own it. It is a risky mechanism, so far it has worked well but it could lead to a disaster one day. The Bitcoin price rallies are Bitcoin’s best moments but they are also it most dangerous and vulnerable moments.

Every Bitcoin bear market is about working out the excesses of the rally. During the rally too many people buy too many bitcoins thinking that they will be able to sell them for a big gain very soon and that usually does not happen. Imagine a fruit tree that has some good fruit and some rotten fruit. The Bitcoin bear markets resembles a period in which the tree is shaken until all the rotten fruit has fallen to the ground. Every time the tree is shaken some rotten fruit falls to the ground. The Bitcoin tree is shaken by the price going down and by letting time pass by. The more the price goes down and the more time passes without another rally the more people give up their original expectations, they sell, they adjust their exposure and their expectations. Eventually, no matter how much you shake the tree there is no more fruit to fall to the ground and the market may be getting ready for another rally.

If Bitcoin succeeds it is likely that the price will do another 6 of these rallies over the next 7 to 10 years. Anyone who tells you that they know what the price of Bitcoin will be next week, much less next year is either ignorant or outright lying to you. It is not possible to know when the price will hit bottom or when the next rally will come and the penalty for trying to time the bottom or the top and getting it wrong can be much higher than the money you were trying to save. If you decide to buy Bitcoin simply decide what is the amount of money you can afford to lose (ideally less than 1% of your net worth), deploy it at market and at once and forget about it for 7 to 10 years. I have been giving this advice for 6 years and, by watching what people do with this advice, I can tell you that “Forget about it for 7 to 10 years” is the most difficult part of the simple recipe I am proposing. This lack of discipline destroys a lot more value than you would anticipate. The price volatility rattles people and makes them trade. If the price goes down a lot they want to buy more to reduce their average their cost, they buy more and now they have more than they can afford to lose so they care even more about the price volatility. Even worse: when the price goes up 10 times they decide to sell to rebalance because now Bitcoin represents too much of their net worth and it is too risky (it is hard to double your portfolio with a 1% exposure if you rebalance it every time it multiplies by 10). If you think this may happen to you, I suggest you invest in two buckets: keep one bucket that you will not trade for 7 to 10 years, and another bucket that you will trade as much as you want (but be responsible and be sure that both buckets combined add to an amount then you can afford to lose).

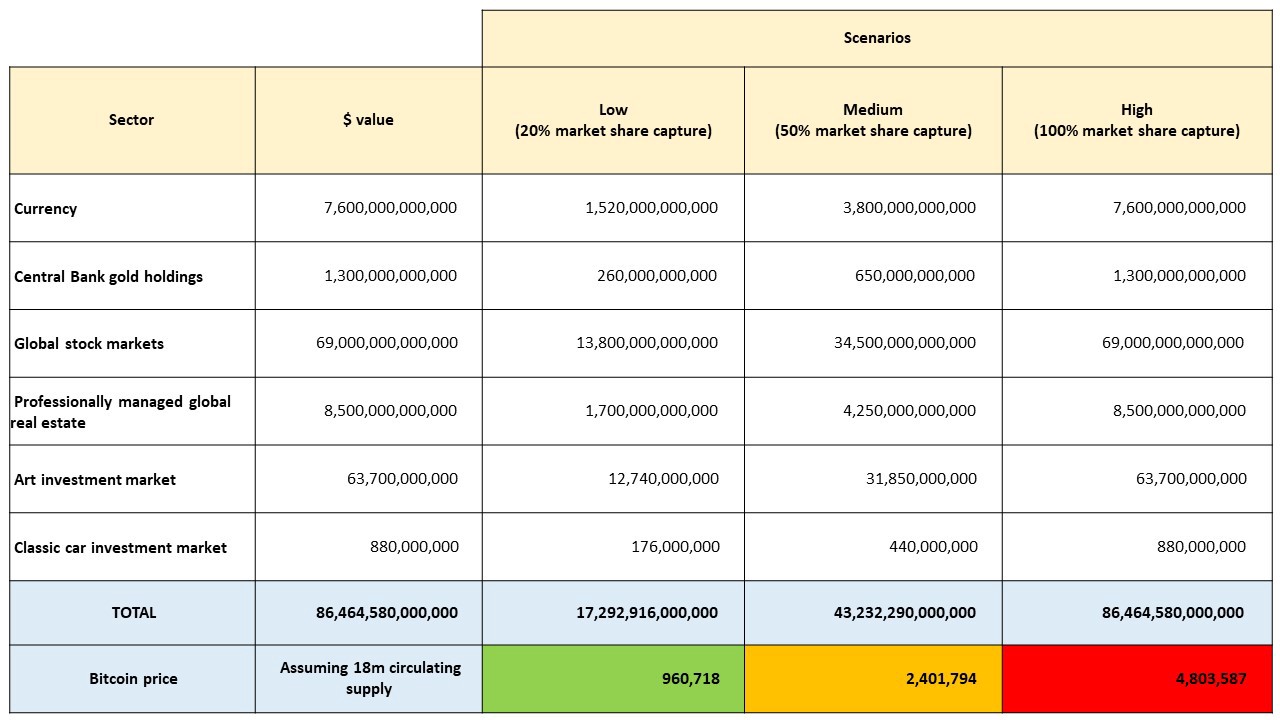

Why do I believe 1 Bitcoin may be worth $1 million in 7 to 10 years?

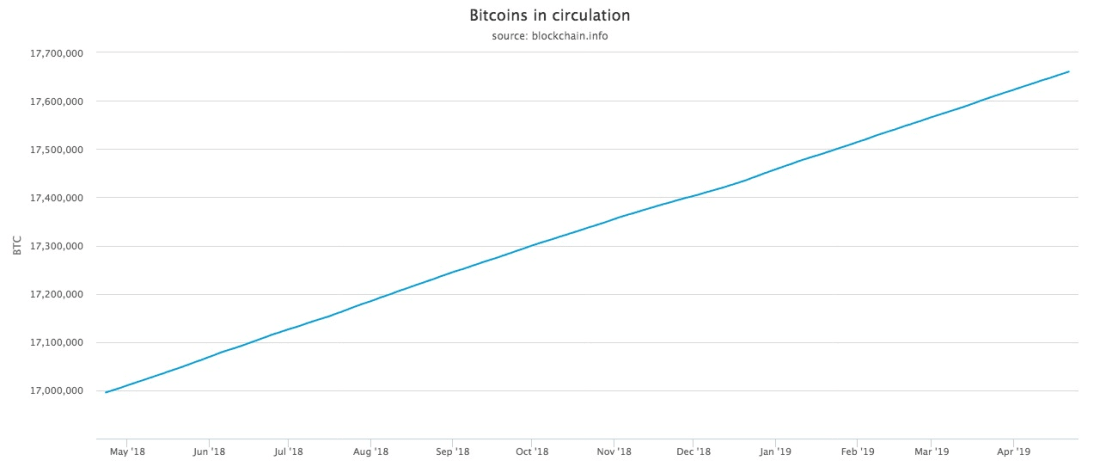

How much a Bitcoin may be worth if Bitcoin succeeds is pure speculation. Today Bitcoin is worth a total of ~ $70 billion (~ 17.5 million bitcoins in circulation x ~ $4,000 per Bitcoin). If Bitcoin ever becomes the world’s standard of value and settlement it may have to be worth more than gold and less than the world’s narrow supply of money. All the gold that was ever been mined is worth ~ $7 trillion the world’s narrow supply of money is ~ $40 trillion. If Bitcoin is ever worth as much as gold each Bitcoin would be worth ~ $300,000, and if Bitcoin is ever worth as much as the world’s narrow supply of money it would be worth ~ $2 million.

My preferred way of guessing how the price of Bitcoin may evolve is much more prosaic. I have noticed over time that the price of Bitcoin fluctuates around ~ $7,000 x how many people own bitcoins. So if that constant maintains and if 3 billion people ever own Bitcoin it would be worth ~ $21 trillion (~ $7,000 x 3 billion) or $1 million per Bitcoin.

In closing

This essay is focused on making the case for a small allocation to Bitcoin and, therefore, it focuses on the possible financial gain to be had if Bitcoin succeeds. But if Bitcoin does for Money what the Internet did for information the prospect of unprecedented economic freedom is much more exciting than any possible financial gain.

I grew up in Patagonia, Argentina, where my parents are sheep ranchers. Growing up I saw my family lose their entire savings three times: the first time because of an enormous devaluation, the second time because of hyperinflation and the last time because the government confiscated all bank deposits. It seemed like every time we were recovering, a new and different economic storm would wipe us out again. My memory of these events is not economic or financial but very emotional. I remember my parents fighting about money, I remember being scared, I remember everybody around us being scared and returning to desperate, almost animal like behavior. I also remember thinking how unfair it was that these crises hit the poor the hardest. People who had enough money to get some US dollars protected themselves that way, people who had even more money and could afford to buy a house or apartment protected themselves that way, and people who had even more money and could have a bank account abroad protected themselves that way. But the poor could not do any of those things and got hit the hardest. When I saw the emergence of the Internet I was young and idealistic and I sincerely thought the Internet was going to democratize money and fix money forever. But it has been 30 years since the Internet was created and it has fixed many problems but increasing economic freedom is not one of them. I was about to give up hope for the Internet to fix this problem when I ran into Bitcoin by accident. At first I was very cynical but the more I learned about it the more curious I became, after six months of studying and using Bitcoin I decided to dedicate the rest of my career, my capital and my reputation to help Bitcoin succeed. Nothing would make me prouder than to be able to tell my grandkids that I was part one of a very large community who helped Bitcoin succeed. And that because Bitcoin succeeded now billions of people can safely send, receive and store any form of money they want as easily as they can send or store a picture. So that what I saw happen to my parents and countless others can never happen again. Wences Casares is the CEO of Xapo, a Bitcoin wallet that helps individuals and institutions buy, sell and store Bitcoin. If you want to learn more about Bitcoin or if you are interested in buying Bitcoin do not hesitate to reach out to him at wences@xapo.com

Further reading:

➔ “Shelling Out: The Origins of Money” by Nick Szabo. Essential background on the nature of money.

➔ “An (Institutional) Investor’s Take on Cryptoassets” by John Pfeffer. Bitcoin analysis from an investor’s perspective

➔ “The Bitcoin Standard” by Saifedean Ammous. Non technical explanation of Bitcoin and what it may become.

➔ “Mastering Bitcoin” by Andreas Antonopoulos. Technical explanation of Bitcoin for non-technical people.

➔ “Programming Bitcoin” book by Jimmy Song. Technical explanation of Bitcoin for technical people and programming guide.

Crypto - Time to Take it at the Flood

By Rayne Steinberg

Posted April 4, 2019

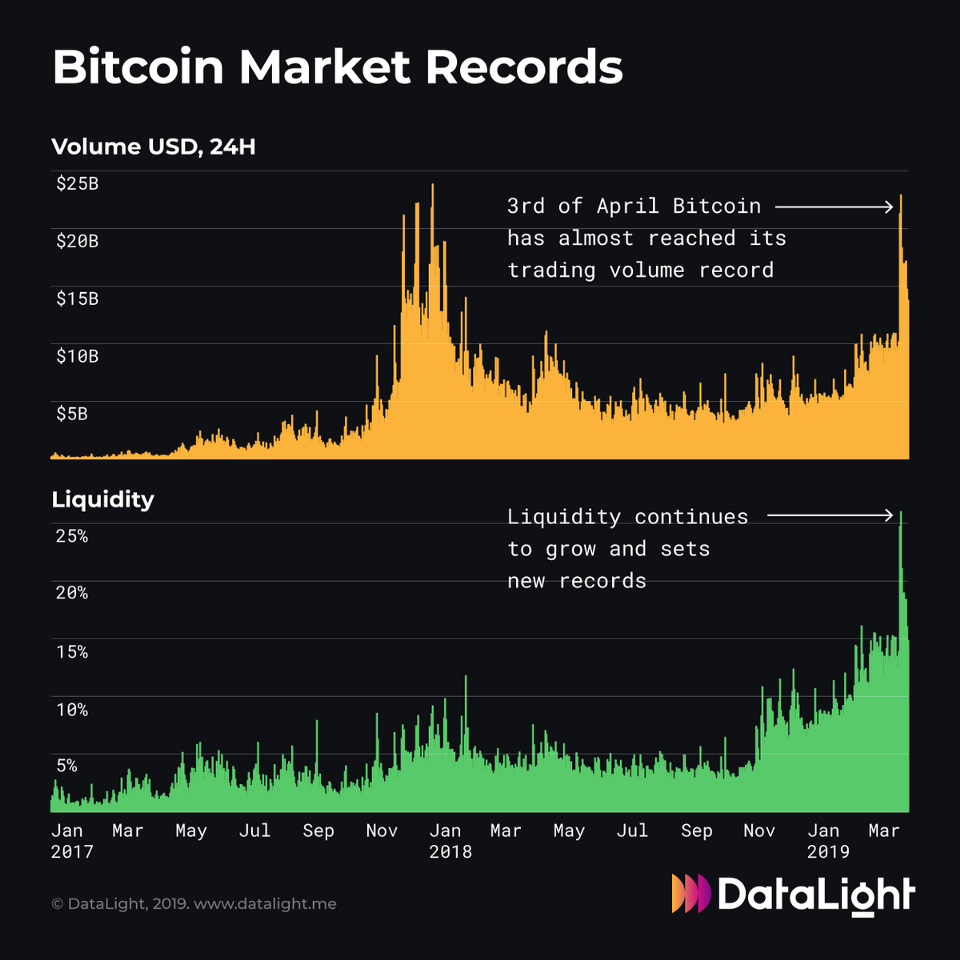

The recent collapse in crypto assets from their high in December of 2017 has caused many to question the viability of crypto and blockchain, generally, and Bitcoin specifically. The overall market cap of the crypto ecosystem peaked at around $800 billion in January of 2018 and recently set a low of $100 billion in December of 2018. This is an 87% decline from peak, and a catastrophic result for any asset class. But what should investors make of it? And how should one approach it from here?

First, we have to contextualize the performance of crypto as an asset class. For these discussions, I will use Bitcoin as a proxy for the broader crypto market as it has the only meaningful return set.

Bitcoin - What Is It?

Let’s look at the Bitcoin boom-bust cycle through the lens of previous historical experiences. In order to do that, we have to determine what crypto/blockchain/bitcoin is. Bitcoin has attributes that overlap many areas. It has some qualities that are akin to a financial instrument, and others that compete more with currencies. Also, it is a new and disruptive technology. Also, it is an idea that advances decentralization and is a potential remedy for a financial system that is losing trust.

Bitcoin - The Asset Bubble

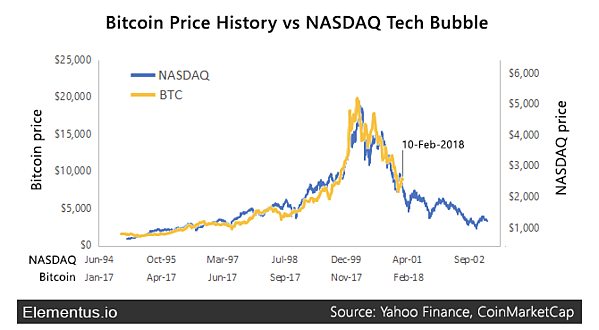

When we look at Bitcoin as an asset class, we can view the recent run-up and subsequent collapse in prices like any other financial bubble. Many have compared it to the technology stock bubble of the late 1990s. And the trends look remarkably similar:

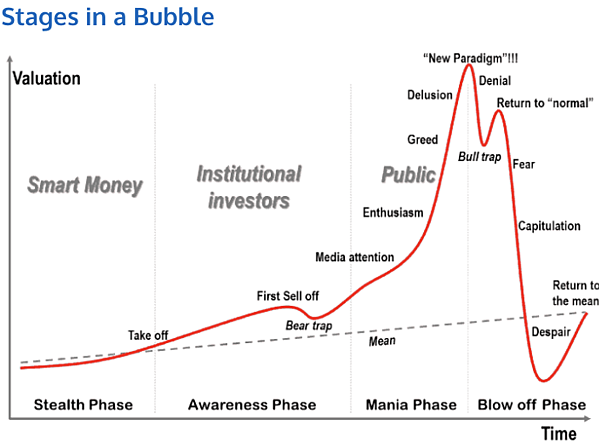

This is interesting but does not really tell us that much. There is a broad pattern that bubbles follow:

Source

Source

There have been many financial bubbles throughout history that have followed this pattern. If the recent volatility in Bitcoin was just a run of the mill asset bubble, we could dismiss it and move on. Bitcoin would have just now entered the end of the Blow Off Phase. But Bitcoin is more than just an asset class; it is a new and disruptive technology.

Bitcoin - The Disruptor

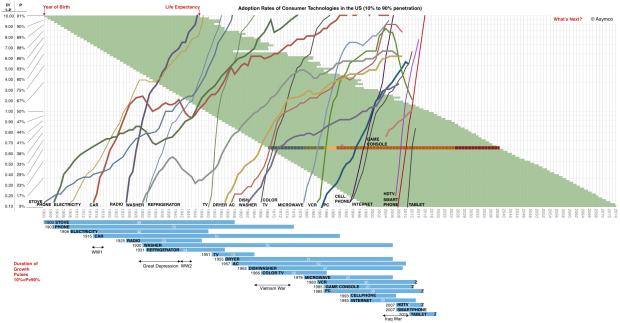

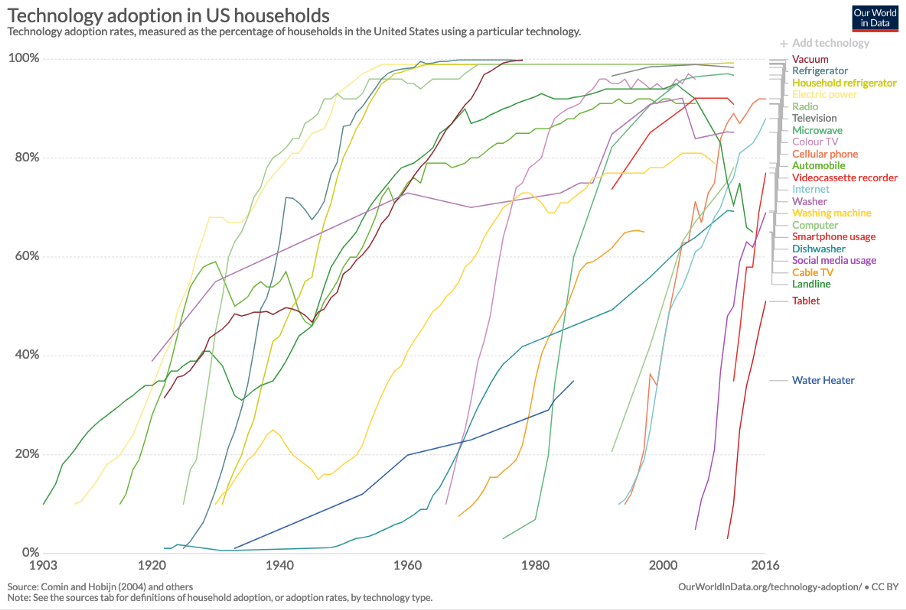

When we treat Bitcoin as a disruptive technology, there are many corollaries for us to consider. Asymco outlines the adoption cycle of all major innovations in the US from 1900 on:

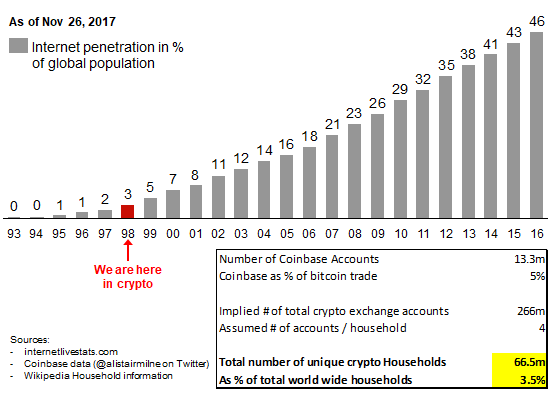

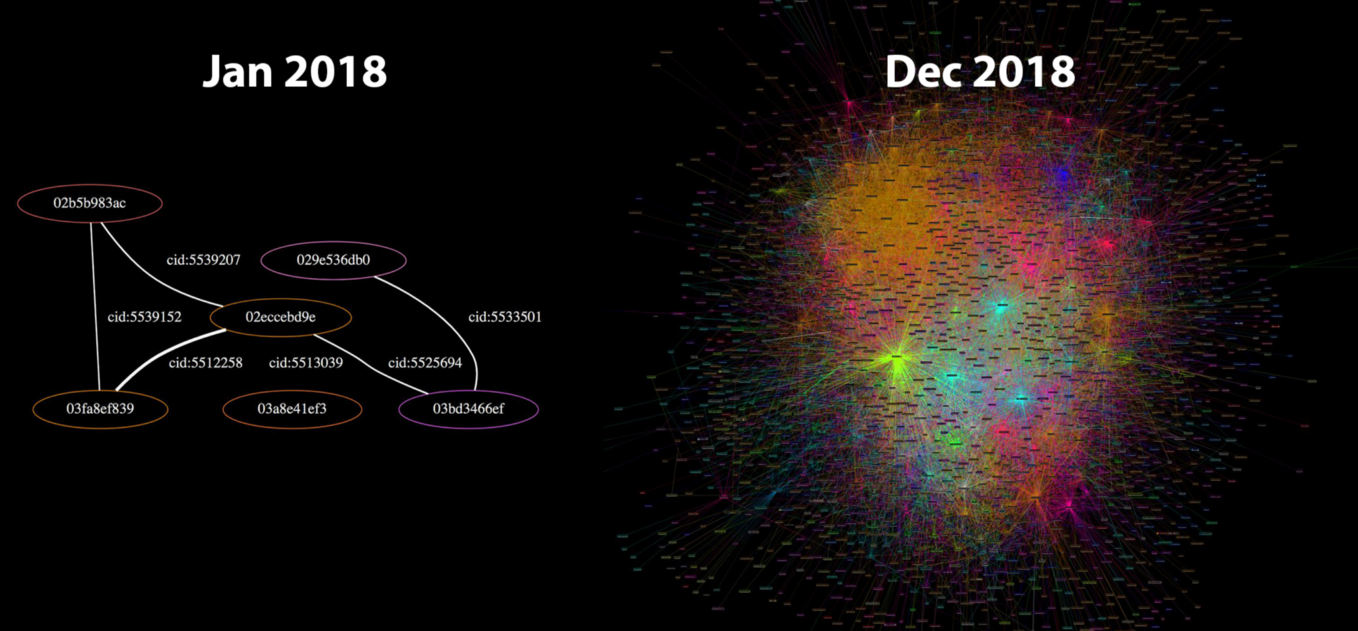

If blockchain is a revolutionary technology, it is important to know where it is in its life cycle. By most accounts, it is still, incredibly early innings. This comparison contextualizes it in relation to the internet and its rate of penetration:

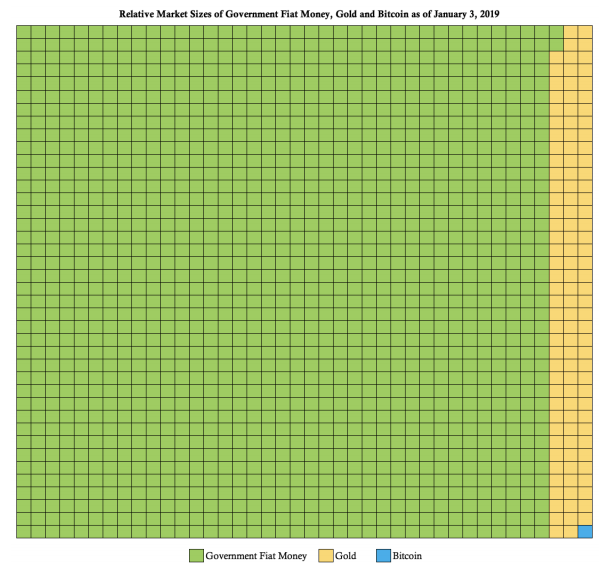

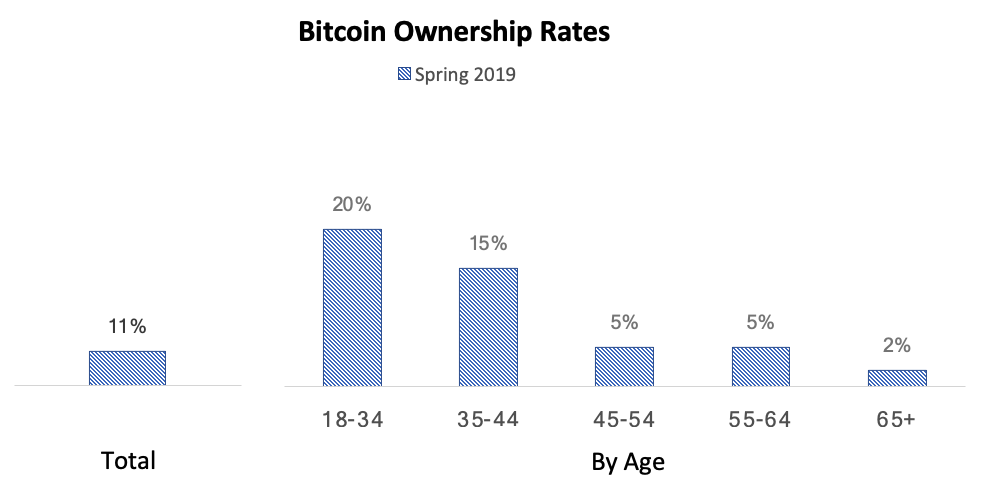

One can argue it is even earlier, as the above analysis is estimating user adoption where it mainly takes into account retail adoption. As Bitcoin is potentially a replacement for currency one could argue that the total market for Bitcoin is that of government fiat + gold. When looked at this way, Bitcoin is only 0.07% of that addressable market:

By any of these measures, Bitcoin is at the beginning of its adoption cycle, not the end. In addition to the technology, what is even more fundamental, is the animating idea behind it.

Bitcoin - The Idea

The idea of Bitcoin is more basic than its asset class and technology-like attributes. Robert Breedlove says Its “a momentous Innovation of the digital age. As such, it has many unique characteristics, properties and capabilities never before seen in a monetary technology:”

- Immutable Monetary Policy

- Digital Scarcity

- Absolute Scarcity

- Global Final Settlement System

- Self-Sovereign Network

- Stateless Money

- Revolutionary Social Contract Implementation

- Global Consensus

- Global Energy Buyer of Last Resort

- A New Form of Life

- Adaptive Security

- Adaptive Functionality

- Programmability

The revolutionary and society-changing nature of this idea is what makes it incredibly powerful and disruptive. This is the first technology that has the ability to halt, and perhaps reverse, our relentless drive towards centralization while still affording us of its benefits. And as an idea, it came into existence in response to the overreach of banks and governments during the financial crisis. The same policies that spawned it are being continued and amplified today. The idea of Bitcoin is much more similar to a sea-change in societal thinking, like the spread of a major religion or the reaction to one. And when thought of like that, it is incredibly early and it will take a long time for that idea to work its way around the globe.

What Do You Do?

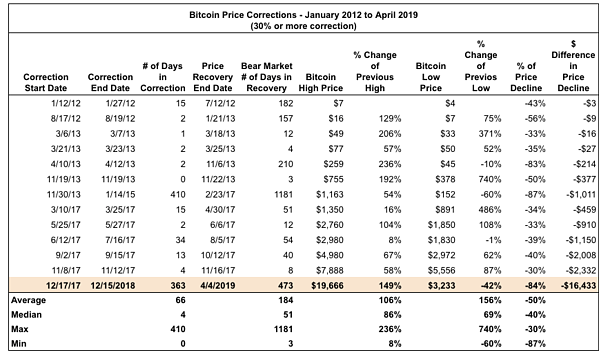

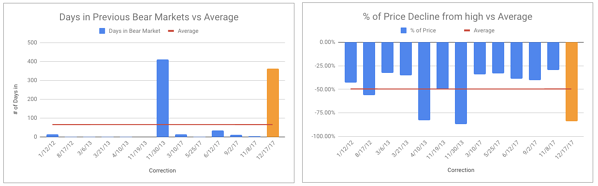

If the above is true, what does that mean in regards to the current price level of Bitcoin? Should we be buying or selling? Even if we agree with the thesis that this is a transformative technology and we are at the earliest stages, no one wants to suffer through more downside volatility than they have to. Let us contextualize this bear market as it relates to other Bitcoin downdrafts. I used Solomon Stavis piece From Bear to Bull, a Look into the Cycle of Bitcoin Prices as a place to start. From January of 2012, there have been 13 corrections of more than 30% in Bitcoin (including our current correction):

If we did put a bottom in on 12/15/2018 at $3,233, then this correction would have lasted 363 days with a max drawdown of 84%. This compares to an average length of 66 days for bear markets and an average 50% decline.

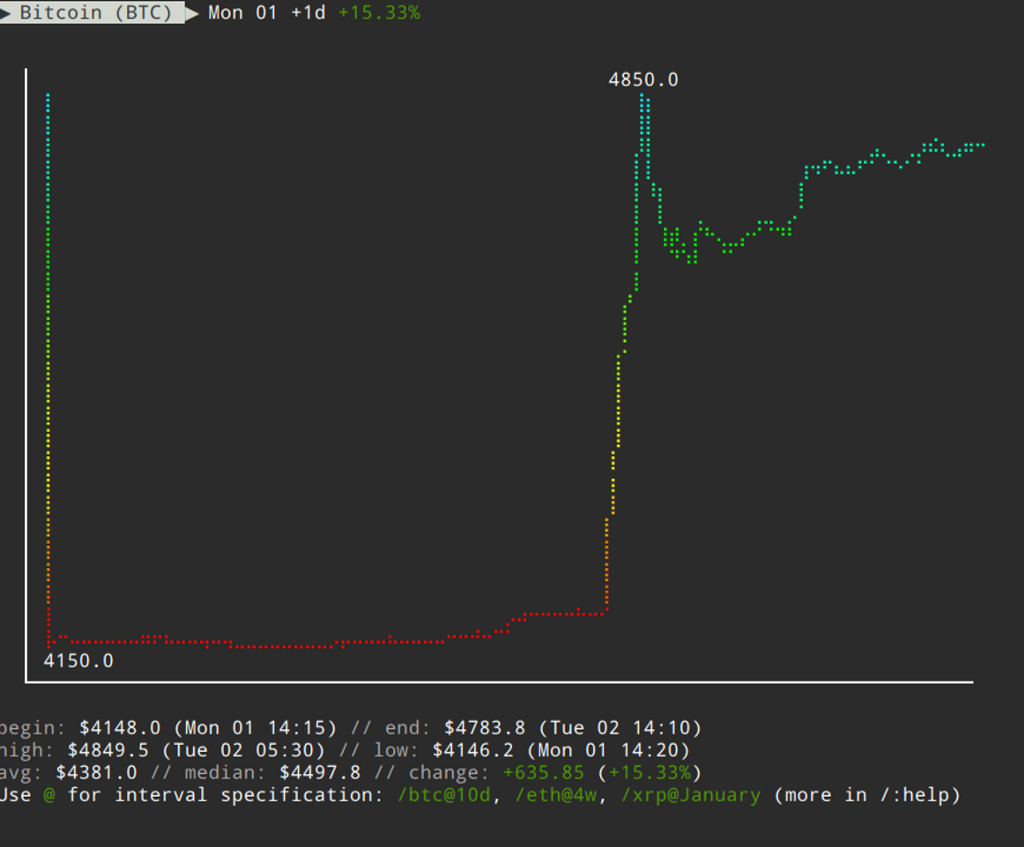

Source: Yahoo Finance, data as of 4/2/2019

Source: Yahoo Finance, data as of 4/2/2019

In both duration and severity, this correction is near the previous extremes.

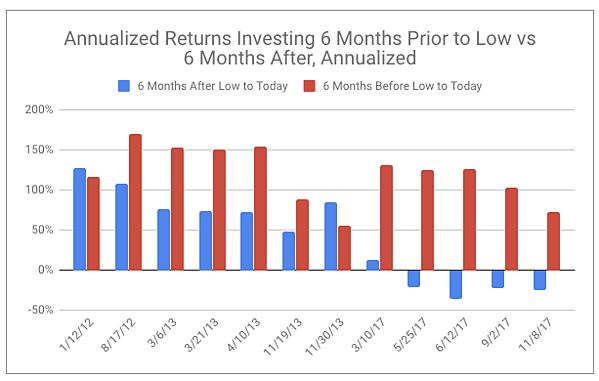

And what we are trying to determine is if this really is the bottom, or do we have more to drop? A better question is, is it better to be early or late. And by that I mean, if you feel you are near a bottom, would you prefer to invest before it bottomed or after? To add some color around this, I examined if you had invested 6 months before each of the previous lows, or if you waited until six months after.

Source: Yahoo

Finance, data as of 4/2/2019

Source: Yahoo

Finance, data as of 4/2/2019

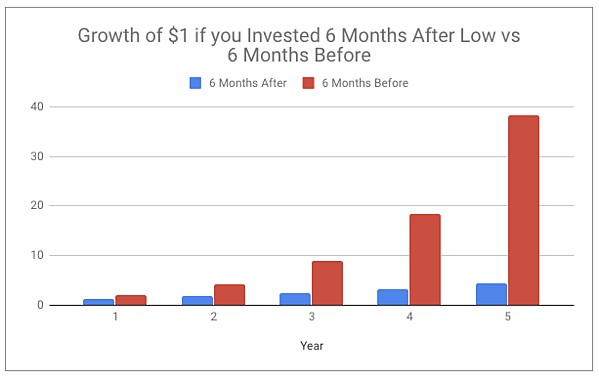

The average annualized return for the after low set is 41%, an unimaginable return in any other asset class. The average annual return for the before the low investment is, however, an eye-popping 120%. When you look at the growth of a dollar invested at these respective rates, over 5 years, late grows to $4, and early grows to $38.

Source: Yahoo Finance, data as of 4/2/2019

Source: Yahoo Finance, data as of 4/2/2019

In this case, the early bird really does get the worm.

While this analysis is rudimentary, and the time series is short, the data does suggest its better to be early than late. As of 4/2/2019, Bitcoin is up 54% from the low on 12/15/18. If you believe the overall thesis for Bitcoin specifically and the crypto and blockchain space generally, you may not get another opportunity to enter at such an opportune time.

If Shakespeare’s Brutus were transported to a pension’s investment committee meeting where they are considering making an allocation to crypto, his famous words of action might be the best advice they could get:

There is a tide in the affairs of men, Which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures.

Technological Teachings of Bitcoin

What I’ve Learned From Bitcoin: Part III

By Gigi

Posted April 2, 2019

This is part 3 of a 3 part series

- Part 1 Philosophical Teachings of Bitcoin

- Part 2 Economic Teachings of Bitcoin

- Part 3 Technological Teachings of Bitcoin

What is Bitcoin? The many answers to this question are as interesting as they are varied. Bitcoin is both a social and a monetary phenomenon, but it is also a technological one. The intersection of many disciplines is what makes Bitcoin endlessly fascinating. Like many others, I began to stumble down this strange rabbit hole a while ago. Even though this article is the last of this series, I am still stumbling down with no end in sight, and I invite you to stumble along with me.

This is the third chapter of a personal journey. Again, I am indebted to Arjun Balaji who asked the following on Twitter: “What have you learned from Bitcoin?” It is this question which has led me to write this series to outline some of the things I’ve learned.

- I: Philosophical Teachings of Bitcoin

- II: Economic Teachings of Bitcoin

- III: Technological Teachings of Bitcoin

Part one explored what I’ve learned from Bitcoin when seen through a philosophical lens: the interplay of immutability and change, copying and scarcity, Bitcoin’s origin story and identity, locality in a world of replication, money as free speech, and the limits of knowledge.

Part two discussed some of the economic teachings of Bitcoin: the concept of value, (sound) money and its history, inflation, and some aspects of “modern” banking like fractional reserve banking.

Part three will explore seven things I have learned from examining Bitcoin through the lens of technology. As in the previous parts, I will only be able to scratch the surface. Bitcoin is an expanding universe, evolving and improving every day. Whole books can be and have been written on small, specific parts of this cosmos. And just like in our own universe, the expansion seems to be accelerating.

Find lessons 1–7 here and lessons 8–14 here.

Lesson 15: Strength in numbers

Numbers are an essential part of our everyday life. Large numbers, however, aren’t something most of us are too familiar with. The largest numbers we might encounter in everyday life are in the range of millions, billions, or trillions. We might read about millions of people in poverty, billions of dollars spent on bank bailouts, and trillions of national debt. Even though it’s hard to make sense of these headlines, we are somewhat comfortable with the size of those numbers.

Although we might seem comfortable with billions and trillions, our intuition already starts to fail with numbers of this magnitude. Do you have an intuition how long you would have to wait for a million/billion/trillion seconds to pass? If you are anything like me, you are lost without actually crunching the numbers.

Let’s take a closer look at this example: the difference between each is an increase by three orders of magnitude: 10⁶, 10⁹, 10¹². Thinking about seconds is not very useful, so let’s translate this into something we can wrap our head around:

- 10⁶: One million seconds was 1½ weeks ago.

- 10⁹: One billion seconds was almost 32 years ago.

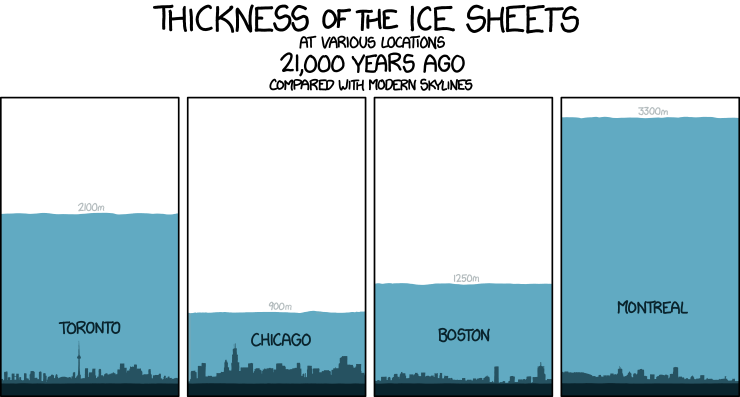

- 10¹²: One trillion seconds ago Manhattan was covered under a thick layer of ice.

About 1 trillion seconds ago. Source: xkcd #1125

About 1 trillion seconds ago. Source: xkcd #1125

As soon as we enter the beyond-astronomical realm of modern cryptography, our intuition fails catastrophically. Bitcoin is built around large numbers and the virtual impossibility of guessing them. These numbers are way, way larger than anything we might encounter in day-to-day life. Many orders of magnitude larger. Understanding how large these numbers truly are is essential to understanding Bitcoin as a whole.

Let’s take SHA-256, one of the hash functions used in Bitcoin, as a concrete example. It is only natural to think about 256 bits as “two hundred fifty-six,” which isn’t a large number at all. However, the number in SHA-256 is talking about orders of magnitude — something our brains are not well-equipped to deal with.

While bit length is a convenient metric, the true meaning of 256-bit security is lost in translation. Similar to the millions (10⁶) and billions (10⁹) above, the number in SHA-256 is about orders of magnitude (2²⁵⁶).

So, how strong is SHA-256, exactly?

“SHA-256 is very strong. It’s not like the incremental step from MD5 to SHA1. It can last several decades unless there’s some massive breakthrough attack.”

Let’s spell things out. 2²⁵⁶ equals the following number:

115 quattuorvigintillion 792 trevigintillion 89 duovigintillion 237 unvigintillion 316 vigintillion 195 novemdecillion 423 octodecillion 570 septendecillion 985 sexdecillion 8 quindecillion 687 quattuordecillion 907 tredecillion 853 duodecillion 269 undecillion 984 decillion 665 nonillion 640 octillion 564 septillion 39 sextillion 457 quintillion 584 quadrillion 7 trillion 913 billion 129 million 639 thousand 936.

That’s a lot of nonillions! Wrapping your head around this number is pretty much impossible. There is nothing in the physical universe to compare it to. It is far larger than the number of atoms in the observable universe. The human brain simply isn’t made to make sense of it.

One of the best visualizations of the true strength of SHA-256 is the following video by Grant Sanderson. Aptly named “How secure is 256 bit security?” it beautifully shows how large a 256-bit space is. Do yourself a favor and take the five minutes to watch it. As all other 3Blue1Brown videos it is not only fascinating but also exceptionally well made. Warning: You might fall down a math rabbit hole.

Answer: Pretty secure.

Bruce Schneier used the physical limits of computation to put this number into perspective: even if we could build an optimal computer, which would use any provided energy to flip bits perfectly, build a Dyson sphere around our sun, and let it run for 100 billion billion years, we would still only have a 25% chance to find a needle in a 256-bit haystack.

“These numbers have nothing to do with the technology of the devices; they are the maximums that thermodynamics will allow. And they strongly imply that brute-force attacks against 256-bit keys will be infeasible until computers are built from something other than matter and occupy something other than space.”

It is hard to overstate the profoundness of this. Strong cryptography inverts the power-balance of the physical world we are so used to. Unbreakable things do not exist in the real world. Apply enough force, and you will be able to open any door, box, or treasure chest.

Bitcoin’s treasure chest is very different. It is secured by strong cryptography, which does not give way to brute force. And as long as the underlying mathematical assumptions hold, brute force is all we have. Granted, there is also the option of a global $5 wrench attack. But torture won’t work for all bitcoin addresses, and the cryptographic walls of bitcoin will defeat brute force attacks. Even if you come at it with the force of a thousand suns. Literally.

This fact and its implications were poignantly summarized in the call to cryptographic arms: “ No amount of coercive force will ever solve a math problem.”

“It isn’t obvious that the world had to work this way. But somehow the universe smiles on encryption.”

Nobody yet knows for sure if the universe’s smile is genuine or not. It is possible that our assumption of mathematical asymmetries is wrong and we find that P actually equals NP, or we find surprisingly quick solutions to specific problems which we currently assume to be hard. If that should be the case, cryptography as we know it will cease to exist, and the implications would most likely change the world beyond recognition.

“Vires in Numeris” = “Strength in Numbers”

—epii

Vires in numeris is not only a catchy motto used by bitcoiners. The realization that there is an unfathomable strength to be found in numbers is a profound one. Understanding this, and the inversion of existing power balances which it enables changed my view of the world and the future which lies ahead of us.

One direct result of this is the fact that you don’t have to ask anyone for permission to participate in Bitcoin. There is no page to sign up, no company in charge, no government agency to send application forms to. Simply generate a large number and you are pretty much good to go. The central authority of account creation is mathematics. And God only knows who is in charge of that.

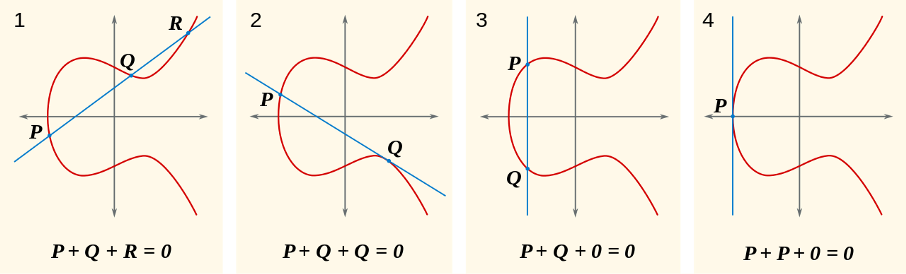

Elliptic curve examples (cc-by-sa Emmanuel Boutet)

Elliptic curve examples (cc-by-sa Emmanuel Boutet)

Bitcoin is built upon our best understanding of reality. While there are still many open problems in physics, computer science, and mathematics, we are pretty sure about some things. That there is an asymmetry between finding solutions and validating the correctness of these solutions is one such thing. That computation needs energy is another one. In other words: finding a needle in a haystack is harder than checking if the pointy thing in your hand is indeed a needle or not. And finding the needle takes work.

The vastness of Bitcoin’s address space is truly mind-boggling. The number of private keys even more so. It is fascinating how much of our modern world boils down to the improbability of finding a needle in an unfathomably large haystack. I am now more aware of this fact than ever.

Bitcoin taught me that there is strength in numbers.

Lesson 16: Reflections on “Don’t Trust, Verify”

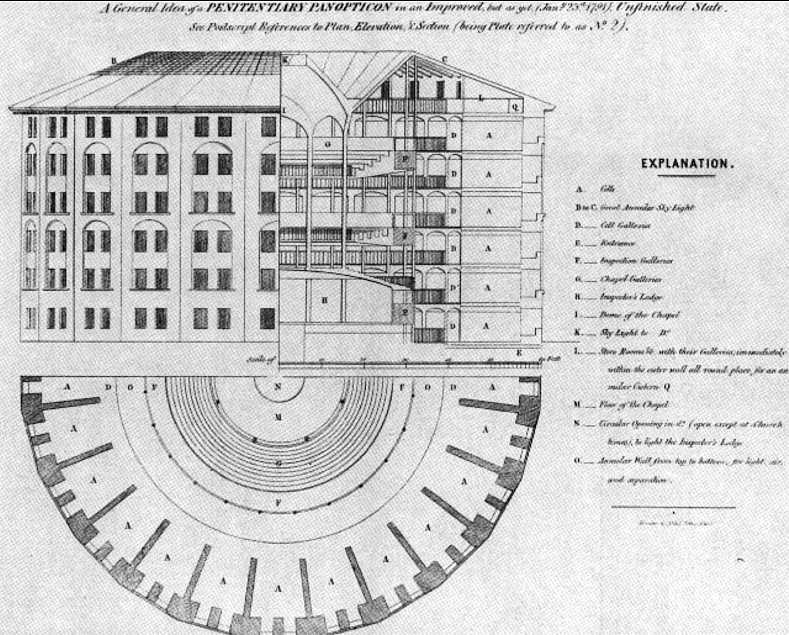

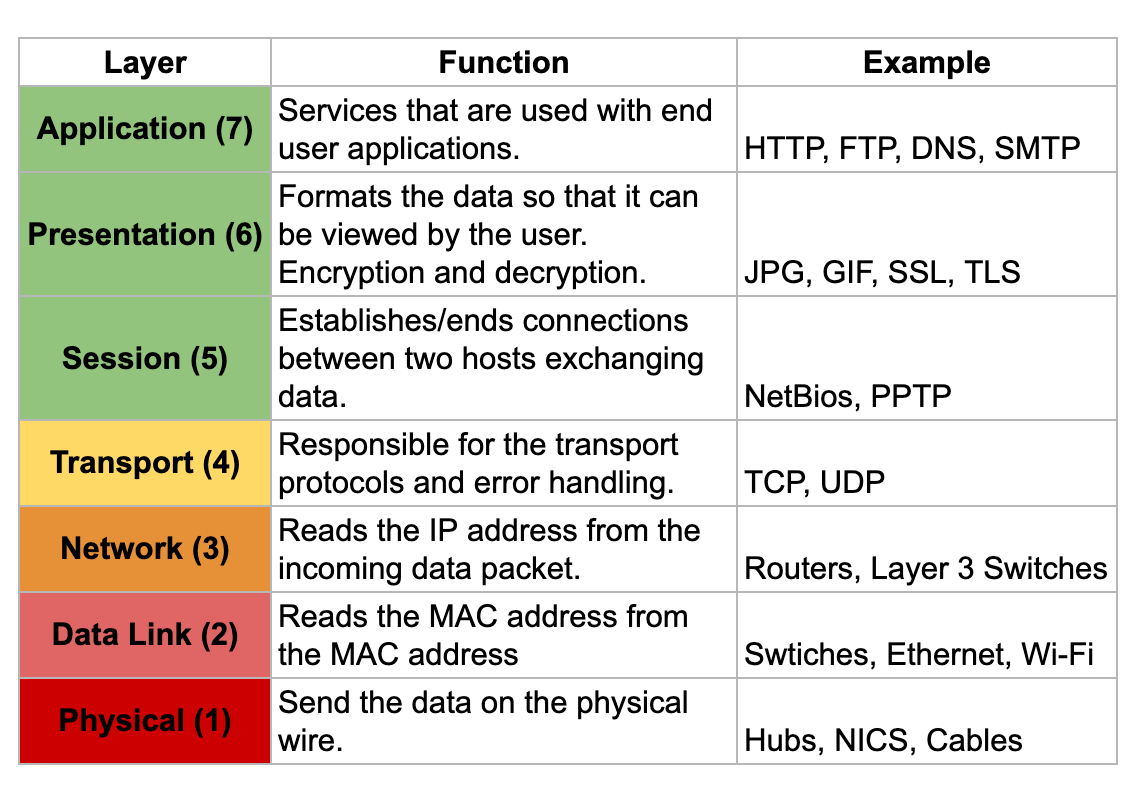

Bitcoin aims to replace, or at least provide an alternative to, conventional currency. Conventional currency is bound to a centralized authority, no matter if we are talking about legal tender like the US dollar or modern monopoly money like Fortnite’s V-Bucks. In both examples, you are bound to trust the central authority to issue, manage and circulate your money. Bitcoin unties this bound, and the main issue Bitcoin solves is the issue of trust.

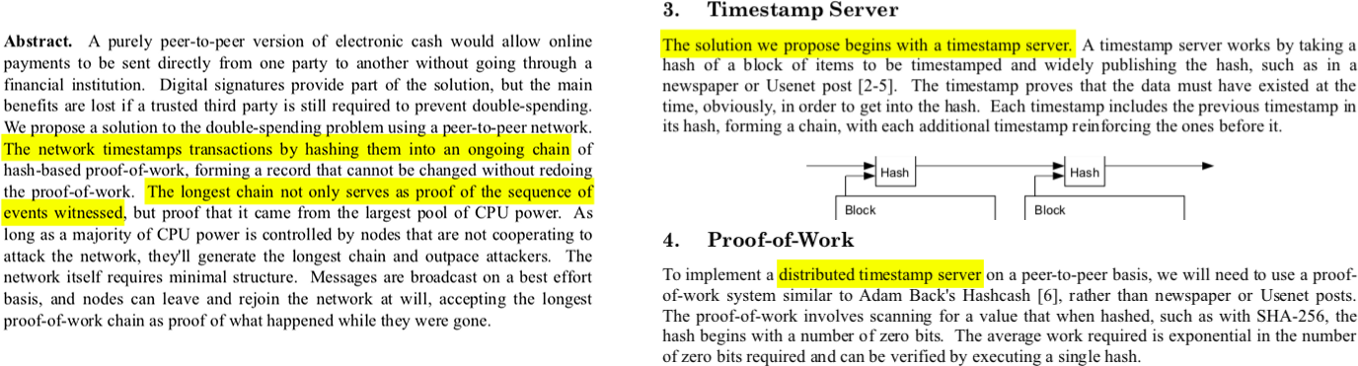

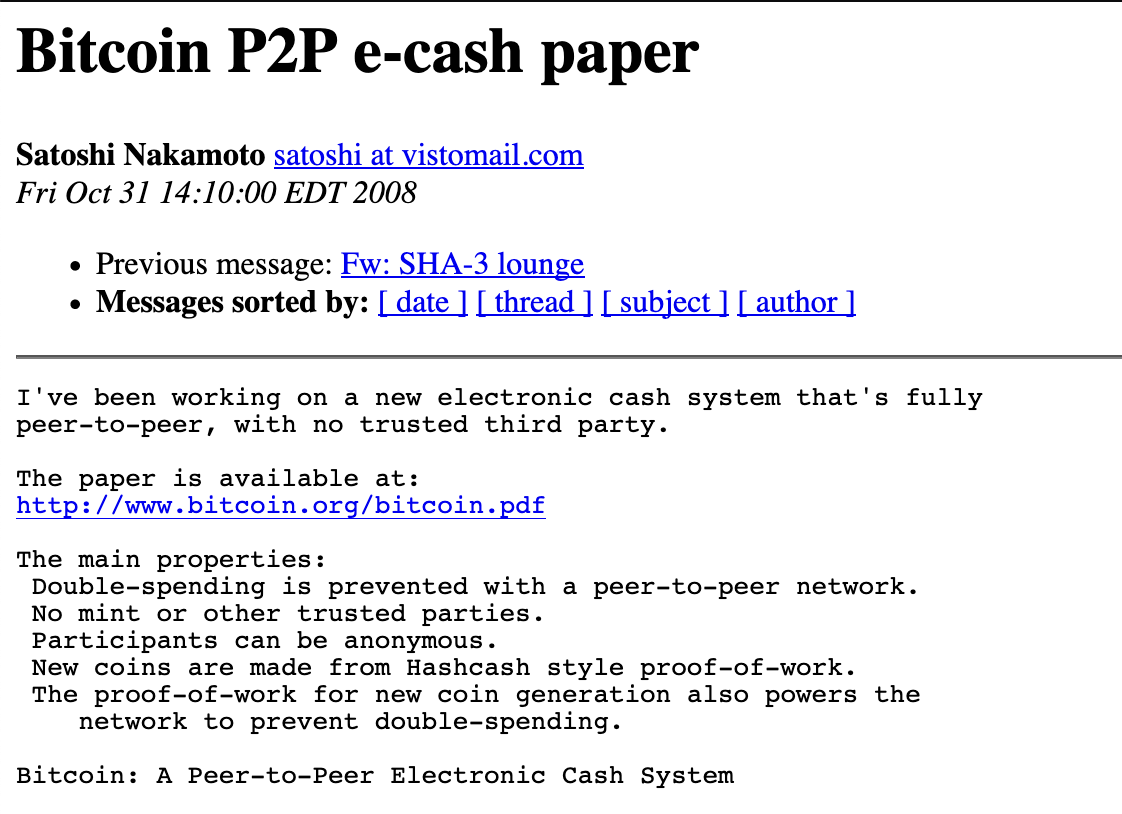

“The root problem with conventional currency is all the trust that’s required to make it work. […] What is needed is an electronic payment system based on cryptographic proof instead of trust” —Satoshi Nakamoto

Bitcoin solves the problem of trust by being completely decentralized, with no central server or trusted parties. Not even trusted third parties, but trusted parties, period. When there is no central authority, there simply is no-one to trust. Complete decentralization is the innovation. It is the root of Bitcoin’s resilience, the reason why it is still alive. Decentralization is also why we have mining, nodes, hardware wallets, and yes, the blockchain. The only thing you have to “trust” is that our understanding of mathematics and physics isn’t totally off and that the majority of miners act honestly (which they are incentivized to do).

While the regular world operates under the assumption of “trust, but verify,” Bitcoin operates under the assumption of “don’t trust, verify.”_Satoshi made the importance of removing trust very clear in both the introduction as well as the conclusion of the Bitcoin whitepaper.

“Conclusion: We have proposed a system for electronic transactions without relying on trust.” —Satoshi Nakamoto

Note that “without relying on trust” is used in a very specific context here. We are talking about trusted third parties, i.e. other entities which you trust to produce, hold, and process your money. It is assumed, for example, that you can trust your computer.

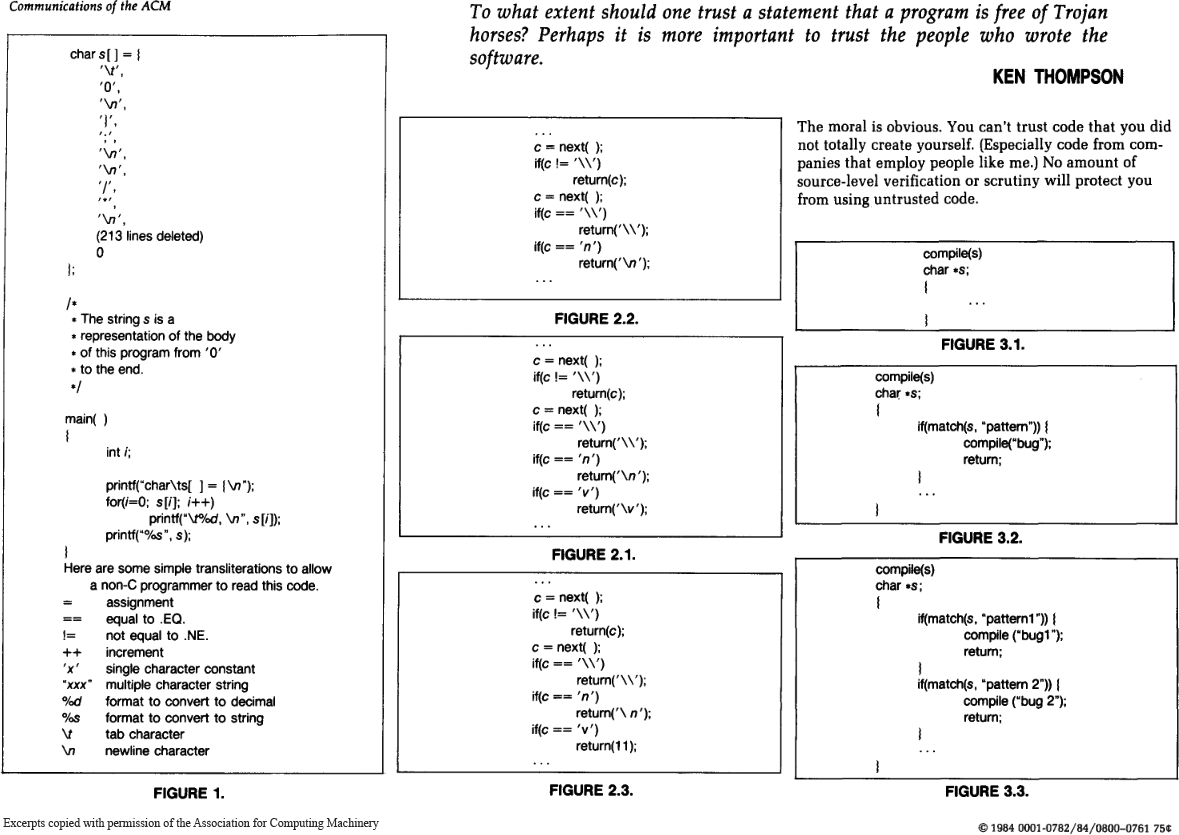

As Ken Thompson showed in his Turing Award lecture, trust is an extremely tricky thing in the computational world. When running a program, you have to trust all kinds of software (and hardware) which, in theory, could alter the program you are trying to run in a malicious way. As Thompson summarized in his Reflections on Trusting Trust: “The moral is obvious. You can’t trust code that you did not totally create yourself.”

Thompson demonstrated that even if you have access to the source code, your compiler — or any other program-handling program or hardware — could be compromised and detecting this backdoor would be very difficult. Thus, in practice, a truly trustless system does not exist. You would have to create all your software and all your hardware (assemblers, compilers, linkers, etc.) from scratch, without the aid of any external software or software-aided machinery.

“If you wish to make an apple pie from scratch, you must first invent the universe.” —Carl Sagan

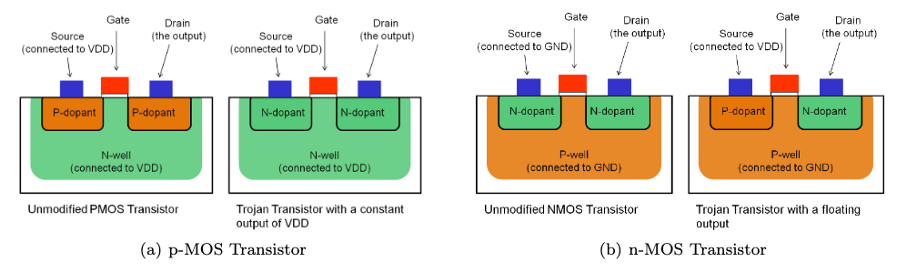

The Ken Thompson Hack is a particularly ingenious and hard-to-detect backdoor, so let’s take a quick look at a hard-to-detect backdoor which works without modifying any software. Researchers found a way to compromise security-critical hardware by altering the polarity of silicon impurities. Just by changing the physical properties of the stuff that computer chips are made of they were able to compromise a cryptographically secure random number generator. Since this change can’t be seen, the backdoor can’t be detected by optical inspection, which is one of the most important tamper-detection mechanism for chips like these.

Stealthy Dopant-Level Hardware Trojans by Becker, Regazzoni, Paar, Burleson

Stealthy Dopant-Level Hardware Trojans by Becker, Regazzoni, Paar, Burleson

Sounds scary? Well, even if you would be able to build everything from scratch, you would still have to trust the underlying mathematics. You would have to trust that secp256k1 is an elliptic curve without backdoors. Yes, malicious backdoors can be inserted in the mathematical foundations of cryptographic functions and arguably this has already happened at least once. There are good reasons to be paranoid, and the fact that everything from your hardware, to your software, to the elliptic curves used can have backdoors are some of them.

“Don’t trust. Verify.”