Bitcoin’s Gravity

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Bitcoin’s Gravity

How idea-value feedback loops are pulling people in

By Gigi

Posted May 1, 2019

Bitcoin is different things to different people. Whatever it might be to you, it is undoubtedly an opinionated and polarizing phenomenon. There are certain ideas embedded in the essence of Bitcoin, and you might be intrigued by some or all of them.

The invention of Bitcoin, and its underlying blockchain, which is so widely misunderstood, spawned many projects, networks, and communities. Some of these networks are in direct competition, which has resulted in endless conflicts and lots of debate. The root of these conflicts is ideological in nature: disagreement about how the world is and how it should be — a disagreement about ideas.

The following is an attempt to explain some of the reasons behind this polarization, explore the underlying dynamics in more detail, and illustrate why an increasing number of people seem to be gravitating towards Bitcoin.

“There are some oddities in the perspective with which we see the world. The fact that we live at the bottom of a deep gravity well, on the surface of a gas covered planet going around a nuclear fireball 90 million miles away and think this to be normal is obviously some indication of how skewed our perspective tends to be, but we have done various things over intellectual history to slowly correct some of our misapprehensions.”Douglas Adams

Agreeing on a Set of Ideas

The goal of the Bitcoin network is to reach consensus, a general agreement on the state of the system. Bitcoin’s breakthrough innovation was utilizing unforgeable costliness to reach global consensus without relying on a central authority.

Bitcoin can be understood as a game that anyone can join. Like all games, it can only be played if it has rules, certain ideas which are internally consistent. Otherwise, it wouldn’t be a game; it would be chaos.

“Before any game can be played, the rules have to be established; before the game can be altered, the rules have to be made manifest. […] All those who know the rules, and accept them, can play the game — without fighting over the rules of the game. This makes for peace, stability, and potential prosperity — a good game. The good, however, is the enemy of the better; a more compelling game might always exist.”Maps of Meaning Bitcoin’s consensus rules are just that: a set of ideas, codified into validation rules, acted out by nodes on the network. Changing this core set of ideas is akin to changing what Bitcoin is, and the decentralized nature of the network makes changing them extremely difficult. There is no central authority to dictate changes, making unanimous adoption of a new set of ideas virtually impossible. Anyone who changes the rules, even if he thinks such a change is for the better, will start to play a different game, with only those who join him.

As Bitcoin’s creator famously said: the nature of Bitcoin is such that once the first version was released, the core design was set in stone for the rest of its lifetime.

Undoubtedly, Satoshi had certain ideas in mind when he created Bitcoin. Many of these ideas are articulated in his writing, and even in the genesis block. Most importantly, however, his core ideas are codified in Bitcoin’s consensus rules:

- fixed supply

- no central point of failure

- no possibility of confiscation or censorship

- everything can be validated by everyone at all times

This set of ideas is embedded in the rules of the network, and you have to adopt them to participate. In essence, a network like Bitcoin encodes a social contract in its software: ideas which are shared by everyone on the network.

Spreading ideas

All great things start small, and Bitcoin was no exception. In the beginning, it was one node, one piece of software, one person, one set of ideas. On 31 October 2008, the Bitcoin whitepaper was published. Two months later, on 3 January 2009, the genesis block was mined.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”Bitcoin’s Genesis Block It took only two days until a second person was intrigued enough to join the network. Hal Finney ran the software, connected to Satoshi’s node, and the Bitcoin network was born. Soon, other people picked up on the idea, ran the software, and set up their nodes to join the network. The rest, as they say, is history.

The Bitcoin network is a complex piece of machinery. The constituents of the network — part technology, part biology — make it inherently difficult to describe and understand. While the following doesn’t claim to be a complete description of the system by any means, I think it’s helpful to focus on some constituents in more detail. In particular, I want to focus on the following four: ideas, people, code, and nodes.

Bitcoin’s ingredients: two parts software, two parts hardware.

Bitcoin’s ingredients: two parts software, two parts hardware.

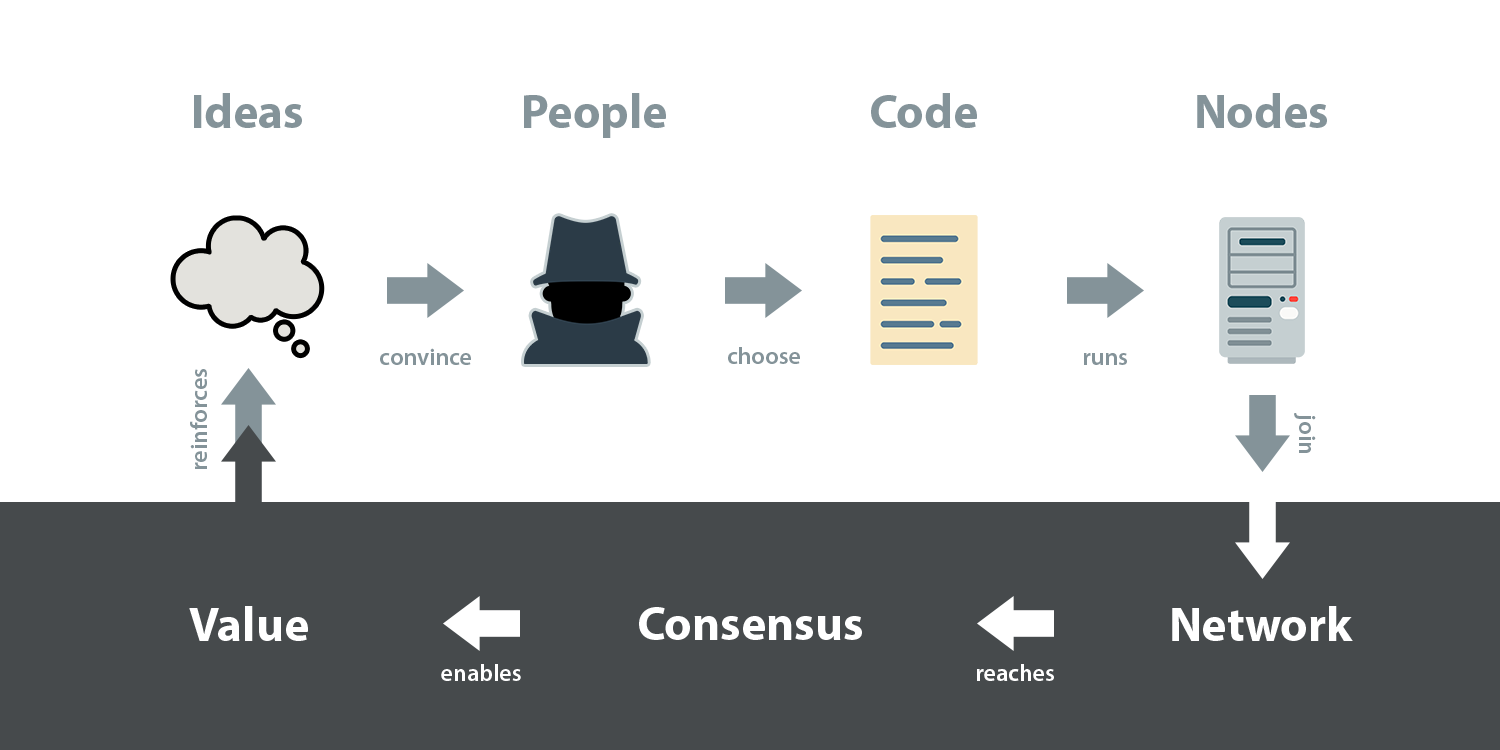

On the physical layer, the network is made up of interconnecting nodes. Bitcoin’s consensus rules are embodied in its software, i.e. the code which is running on its nodes. Ultimately, people are choosing which software to run, a decision which is shaped by the set of ideas they hold.

The possibility of running self-sovereign nodes is part of the reason why Bitcoin’s consensus rules are so hard to change. As mentioned above, there is no central authority, no entity to trust. Changes have to be adopted voluntarily by everyone. People are free to run any version of the software, be it out of conviction, laziness, or contempt.

Bitcoin is a system “based on cryptographic proof instead of trust,” to quote the whitepaper. The implication is that you are the authority and you have to verify everything for yourself from scratch. Out of this, consensus emerges.

“Freedom brings men rudely and directly face to face with their own personal responsibility for their own free actions.”Frank Meyer, In Defense of Freedom As soon as consensus is reached on the network, value comes into play. That bitcoins — or any monies, for that matter — have value, is in itself an idea that people need to be convinced of.

For Bitcoin, this process took almost 500 days. When the network was in its infancy, bitcoins weren’t worth anything. They were mined and sent back and forth between curious cypherpunks. However, the moment Laszlo exchanged 10,000 BTC for two pizzas, Bitcoin went from zero to one. In an instant, the network became valuable in a tangible way.

Ever since this moment, the following idea-value feedback loop is at play:

- Bitcoin’s set of ideas— its value proposition — is attracting people.

- Those people freely choose which code to run.

- The selected code runs on individual nodes, dictating their behavior.

- Nodes join the network, connecting to peers who share their ideas.

- The network reaches consensus, enabling agreement on who owns what.

- The value, in turn, is based on the set of ideas enforced by consensus rules: the embodiment of its value proposition.

Idea-value feedback loop.

Idea-value feedback loop.

This idea-value feedback loop, the re-enforcement of ideas through value creation, is the mechanism behind Bitcoin’s gravity. Everything in this cycle influences everything else — whether it is software, hardware, or wetware. This loop is what ultimately captures people, and since Bitcoin’s core set of ideas is virtually fixed, it has some surprising effects on the sets of ideas held by people.

Bitcoin’s Gravity Well

As we have seen above, Bitcoin is an opinionated piece of software, creating an opinionated network. The result of an opinionated network is that it attracts opinionated people.

Arguably, most early adopters of Bitcoin shared its core set of ideas. As Dan Held points out in Planting Bitcoin, Satoshi carefully chose the initial group of people: cryptographers and cypherpunks, who understood the technical components Bitcoin is made of.

There are many paths which might bring you close to Bitcoin’s gravitational pull: you might have an interest in cryptography, information security, or financial technologies. You may hold certain political or economic beliefs. You might be a gold bug, free speech advocate, or a speculator. You may need to use Bitcoin out of necessity. Whatever the reasons for your initial contact with Bitcoin, there is a certain probability that you are pulled in. Satoshi alluded to this multi-dimensional attractiveness in one of his emails to the cryptography mailing list.

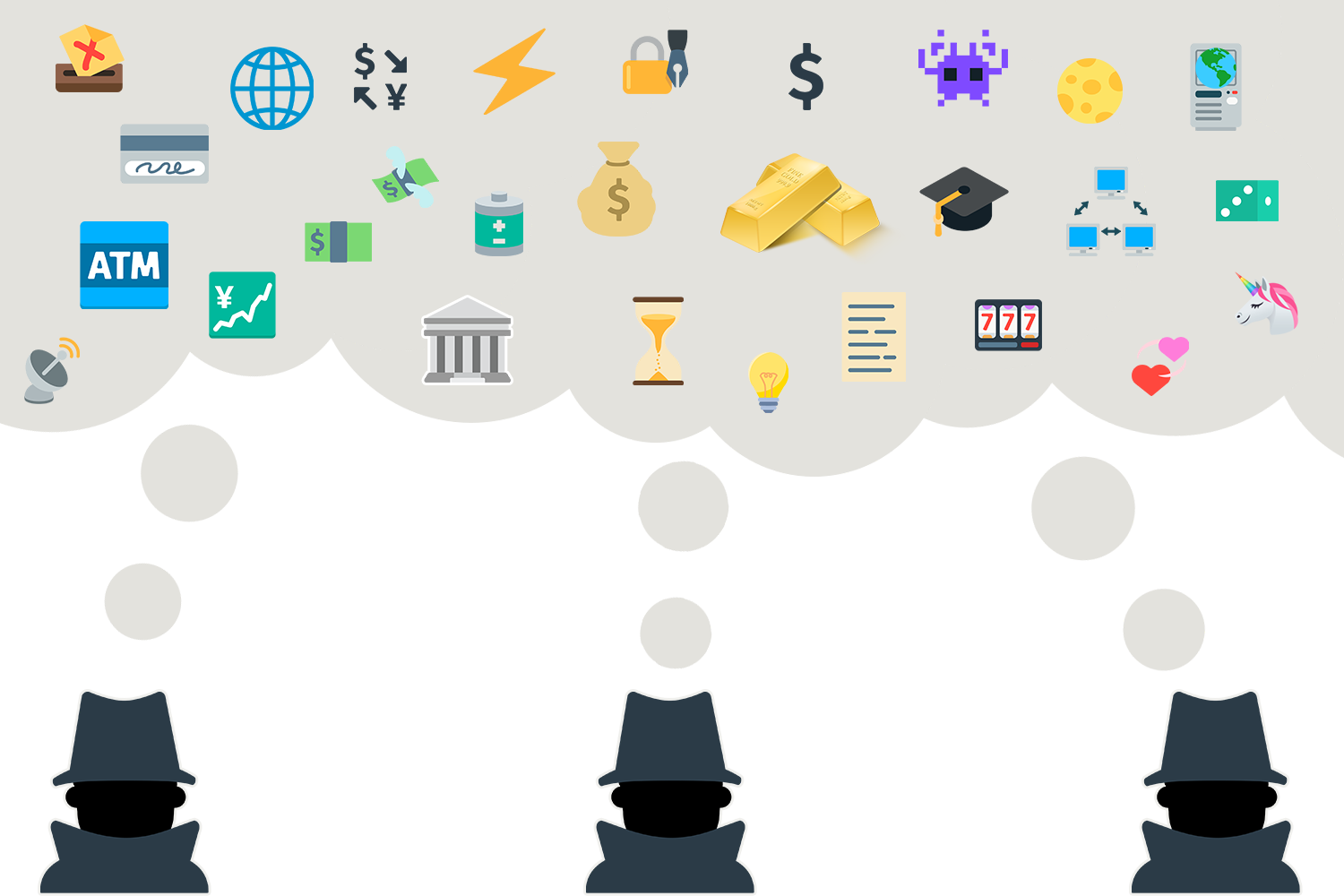

“It’s very attractive to the libertarian viewpoint if we can explain it properly. I’m better with code than with words though.”Satoshi Nakamoto One way to illustrate this is by visualizing a landscape of ideas. Since the number of all possible ideas is basically infinite, we will have to focus on a small subset. And since we are talking about Bitcoin, we will focus on the small universe of ideas spawned by asking the question of what Bitcoin is.

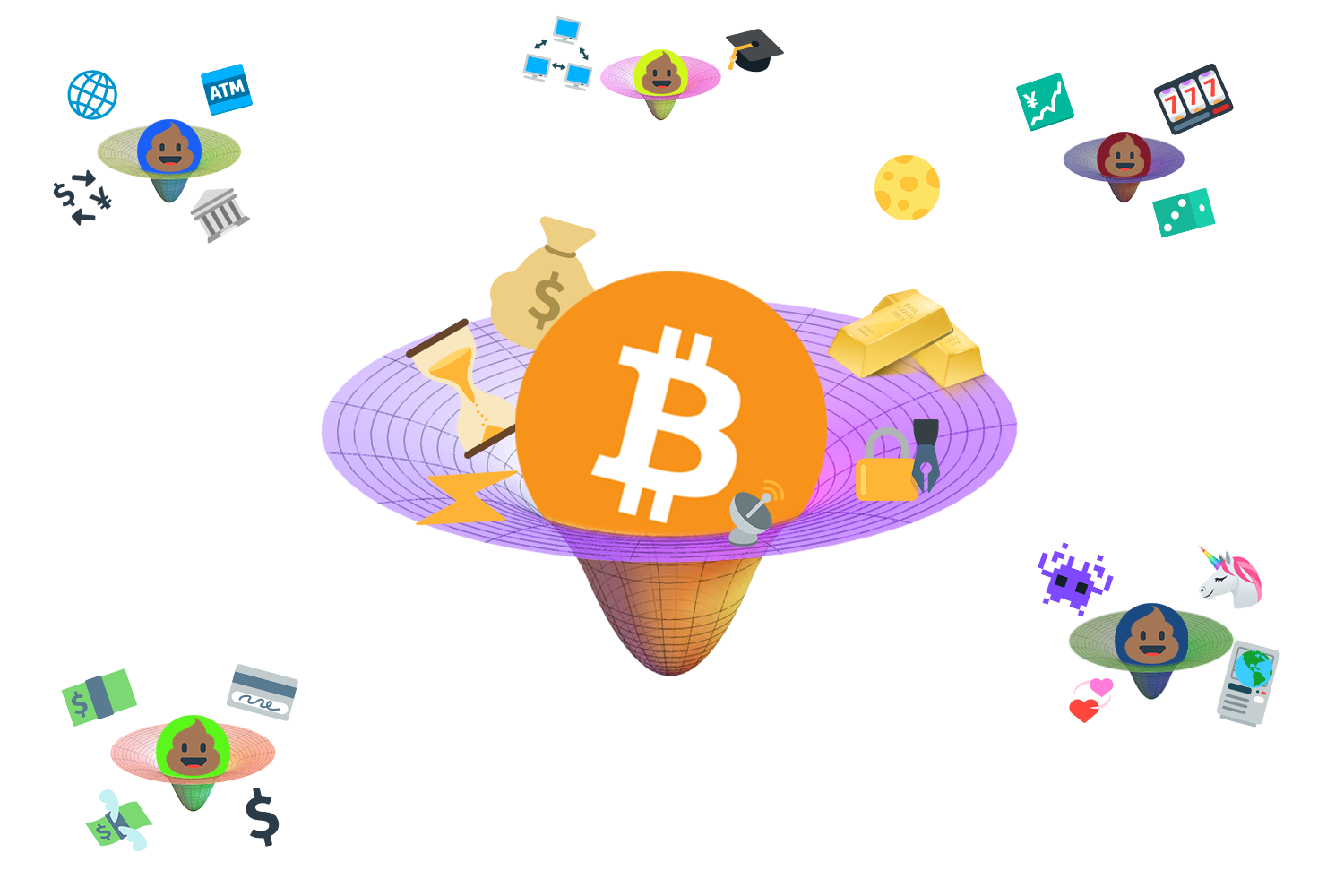

What is Bitcoin?

What is Bitcoin?

Ask three strangers what Bitcoin is, and you will probably get three very different answers. Any answer is necessarily shaped by past experience, political and economic beliefs, and an individual understanding of the world. Your personal set of ideas, your world view, defines where you are on the landscape of ideas.

The landscape has sets of ideas which clump together: narratives, which help to explain what Bitcoin is. One person might think of Bitcoin primarily as digital gold, focusing on the store of value aspect of Bitcoin. Another person might think of Bitcoin as a payment system, focusing on the medium of exchange aspect of Bitcoin. Yet another person might think of Bitcoin as a way to automate more complex social constructs, focusing on automation of contracts and similar ideas.

“Nobody can know everything. The complexity of society is irreducible. We cling to mental models that satisfy our thirst for understanding a given phenomenon, and stick to groups who identify with similar narratives.” Dan Held These narratives, these sets of ideas, describe both what Bitcoin actually is — at least in part — and what people think it is. These narratives will necessarily evolve over time as our understanding of the system and the system itself evolves. Neither ideas, nor people, nor Bitcoin, nor the world at large are static things. Our visions of Bitcoin have changed, and will continue to do so in the future.

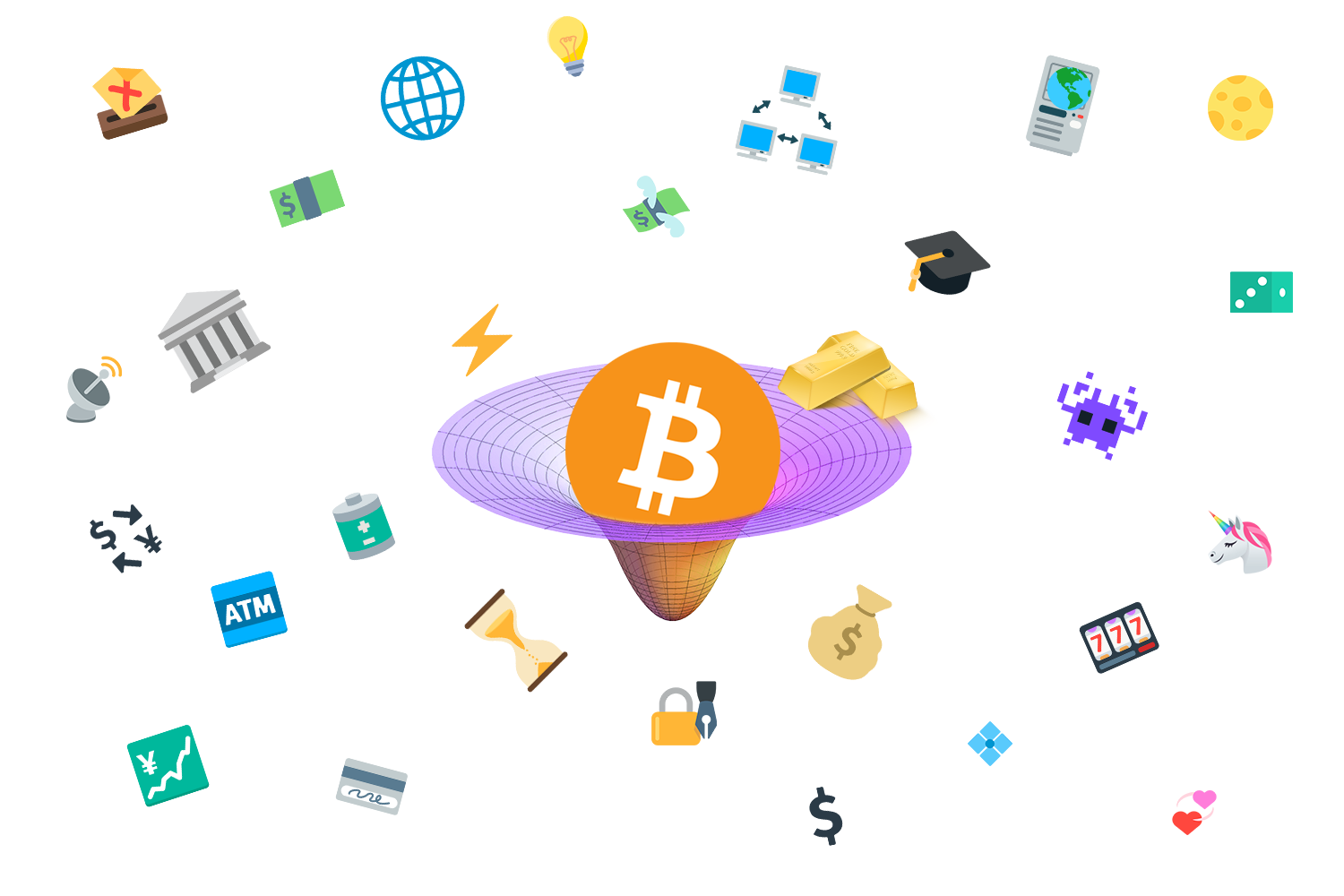

Whatever Bitcoin is, it acts as a gravity well in this universe of ideas. If your set of ideas overlaps with those embodied by Bitcoin, you are close to its gravity well and captured easily. If your set of ideas is opposed to Bitcoin’s, you are far away from its gravitational pull and remain unattracted.

What is Bitcoin?

What is Bitcoin?

Consequently, Bitcoin is attracting opinionated people who share certain ideas and ideals. “Birds of a feather flock together,” as the saying goes. In this case, many nerd-birds and cypherpunks flocked around Bitcoin early. Not particularly surprising.

What is surprising, however, is the side-effect of an opinionated network: it influences people. Since the set of ideas embodied by Bitcoin is fixed, it is the set of ideas held by people which has to align — not vice-versa. The last ten years have shown that Bitcoin is very effective in changing minds. So far, no single mind was particularly effective in changing it.

“So the universe is not quite as you thought it was. You’d better rearrange your beliefs, then. Because you certainly can’t rearrange the universe.” —Isaac Asimov To repeat an old TFTC trope: Bitcoin will change us more than we will change it, as I have learned myself.

Attraction and Repulsion

But what if your set of ideas does not overlap with Bitcoin’s? What if you wish to change Bitcoin’s set of ideas, not convinced of the futility of this endeavor? What if you are downright repulsed by some of its ideas?

“The miracle of physics that I’m talking about here is something that was actually known since the time of Einstein’s general relativity; that gravity is not always attractive. Gravity can act repulsively.”Alan Guth If you are truly repulsed by Bitcoin’s ideas, you might end up drifting away into space, joining the interstellar void where nocoiners float around.

If you want to change Bitcoin’s ideas in a fundamental way, you might end up creating another gravity well. This is easily possible because of Bitcoin’s openness. Its open source code, permissionless network structure, and lack of formal organization of any kind allows anyone to copy, modify, and run the code without asking for permission.

As outlined above, changing the core rules of Bitcoin results in a new game — different from the game everyone else is playing. To not play alone, you would have to convince other people to play with you. If you want to have the same number of people to play with, you will have to convince everyone on the network that your set of ideas is better than the one held by everyone else. And since this is mostly a financial game, strong network effects are very beneficial; it is in your best interest to convince everyone.

Failing to do so will create a competing system; either by creating a new network or by splitting off from the existing Bitcoin network. Since all new projects are inspired by Bitcoin, the set of ideas necessarily overlaps; sometimes almost exactly.

“Tracking narratives is a good way to help people understand that there are, in fact, a menu of beliefs competing for their affiliation; […] Trying to identify where one narrative ends and another begins is a challenging task, as ideas tend to have permeable borders.”Nathaniel Whittemore Since creating new gravity wells is (a) possible and (b) relatively easy to do (copy Bitcoin’s code, change a few parameters, launch the new network with a couple of friends) there was an explosion of alternative coins in the last few years. While most of these altcoins are outright scams, some try to find a niche, attracting people who share its new or modified set of ideas.

Different ideas are captured by different gravity wells.

Different ideas are captured by different gravity wells.

Being sucked into one of these gravity wells — and thus into an idea-value feedback loop — is the reason for much of the toxicity we see in Bitcoin and elsewhere. The direct link between holding beliefs (ideas) and holding assets (value) is a multiplying factor which can result in ever deeper entrenchment.

“Everyone knows nowadays that people “have complexes.” What is not so well known, though far more important theoretically, is that complexes can have us.”Carl Jung One could argue, as Carl Jung did in relationship to complexes, that blockchains have people. At the root of every gravity well is a set of ideas and a group of people which are had by them.

Once captured, a difference in technicalities can easily become a difference in ideologies — and vice versa. Giving up on ideas is difficult in any case, but if your net worth is intractably linked these ideas it becomes ever more difficult.

Orbits and Collisions

The formation of any gravity well isn’t exactly a smooth ride. Just like stellar and planetary formation is violent at times — suns swallowing planets, planets bumping into each other, and moons being smashed to pieces — the formation of Bitcoin’s gravity well had some violent events too.

I plan to explore some of these events in the future, but for now, let’s just acknowledge that there are other projects orbiting Bitcoin and that there have been collisions in the past.

An artist’s impression of Bitcoin and its satellites. Source: KQED Science

An artist’s impression of Bitcoin and its satellites. Source: KQED Science

Whether all other projects will be swallowed by Bitcoin or die on their own, or whether some will find stable orbits, is yet to be seen. What can be observed today, however, is that most networks are competitive. To quote Eric Hoffer: “the gain of one in adherents is the loss of all the others.”

What can also be observed, since it has happened multiple times over the last couple of years, is that projects which fail to deliver on their value proposition are quickly losing most of their adherents and also their value — the former due to disillusion, the latter due to market forces. Value, and speculation on future value, is an integral part of the idea-value feedback loop. If ideas don’t materialize or fail, real (and speculative) value is lost, which is effectively killing those ideas and the networks which embody them.

However, as long as people hold different sets of ideas, and as long as a project in Bitcoin’s orbit embodies this set of ideas, people will flock to it. Whether those ideas have merit will be decided by time, the open market, and ultimately, reality. Horrible ideas don’t work at all, bad ideas not for long, and solutions which aren’t substantially better than the status quo won’t thrive in a free market.

The best ideas, however, might be discovered by the biggest networks and will be assimilated, if assimilation is possible. If Bitcoin can eat it, it will eat it.

Feeding on Ideas

As mentioned above, Bitcoin’s core set of ideas is fixed from day one. However, this doesn’t imply that Bitcoin can’t be improved. It can and should be improved, but it has to be improved in ways that don’t destroy the essence of Bitcoin. Such improvements are happening all the time, which is why we can send payments to script hashes, have segregated witness, and can pay small amounts quickly and cheaply on the lightning network.

The technicalities of improving Bitcoin — and the important difference between a soft and a hard fork — are well worth exploring, but are beyond the scope of this article. Without going into more details in regards to the nature of these improvements, Bitcoin undoubtedly is improving, and thus its feature set is changing and expanding.

In terms of gravitational pull, this means that Bitcoin is gaining mass. The set of ideas which describes Bitcoin is expanding along with its feature set, potentially capturing more people and swallowing competing projects and ideas in the process.

The idea of cheap payments, for example, has re-emerged thanks to payment channels on the lightning network. While still in its early stages, other projects built on this idea will lose their merit if the lightning network is successful on a large scale.

Privacy is another idea which is at the root of several competing projects. If future privacy enhancements in Bitcoin prove to be successful (Schnorr signatures, lightning, whirlpool, wallets supporting CoinJoins), these projects might be swallowed by Bitcoin as well.

“And the earth opened her mouth, and swallowed them up, and their houses, and all the men that appertained unto Korah, and all their goods. They, and all that appertained to them, went down alive into the pit, and the earth closed upon them: and they perished from among the congregation.”Book of Numbers I’m not saying that all other projects will perish, necessarily. But networks thrive because of network effects: the winner takes most, if not all.

The Value of Conviction

Whenever people are debating ideas, tribalism is the norm, not the exception. Whether it is politics, sports, iPhone vs Android, or pineapple on pizza, people identify with the camp that is closest to their ideas and ideals.

While the validity of ideas are sometimes hard to measure, either because their consequences are very indirect (politics) or subjective and not truly consequential in the grand scheme of things (pineapple on pizza), networks like Bitcoin come with a direct measurement: value.

While this value can be distorted by both manipulation and speculation, it is a reliable and (almost) direct indicator of both conviction and validity of ideas. If more people are convinced by a network’s set of ideas, more people will hold its native token as an asset. And the more those ideas align with reality, the more real-world value is generated by the network, convincing more people and deepening the convictions of those already convinced.

Bitcoin has the largest gravity for a reason: it works since day one, solves real problems for real people, generating real value. It works because its set of ideas aligns most closely with reality. It is valuable because people believe in its value proposition, and with good reason: Bitcoin is the largest, most secure, most robust network for permissionless and digital value transfer to date. And it is growing.

Whether you are already convinced by Bitcoin’s ideas or are diametrically opposed to them, Bitcoin will continue to not care. Its gravitational pull will continue to increase, swallowing ideas, people, code, and nodes in the process.

Conclusion

We have seen that Bitcoin embodies a certain set of ideas in its consensus rules and overall architecture. Changing Bitcoin’s core set of ideas is virtually impossible, which is why its core design is “set in stone” since day one.

The idea-value feedback loop is what creates Bitcoin’s gravity. People coming close to this feedback loop have a certain probability of being captured, which forces them to align their own set of ideas with Bitcoin’s or “fork off.”

Understanding that any unchanging system will change its participants is helpful in understanding both attraction to and repulsion by Bitcoin. Since changing the core set of ideas is not an option, new projects embodying new sets of ideas are launched, creating new gravity wells in the process.

A different idea-value feedback loop is the basis for each gravity well. Tribalism and loss-aversion help to explain some of the toxicity between competing projects and communities, since falling into any feedback loop will taint the world view of anyone captured by it.

“For one can fall victim to possession if one does not understand betimes why one is possessed. One should ask oneself for once: Why has this idea taken possession of me? What does that mean in regard to myself?”Carl Jung Both the world and Bitcoin are dynamic things, making any set of ideas we currently hold insufficient for a permanent, complete view of either. Bitcoin can and does change, even if its essence is virtually unchangeable. No matter our individual beliefs, we must not get too attached to any narrative, or to any set of ideas.

Bitcoin’s dominance is no accident. Its set of ideas managed to convince the largest group of people, generating the most value in turn. However, exploring other ideas can be a good and healthy thing, if pursued genuinely. Time and the free market will decide which ideas align with reality. Bad ideas will vanish, and good ideas will be absorbed.

In a world where people hold a combination of ideas and valuable assets, a feedback loop which links and reinforces both is a powerful force of attraction. Whether you just started to feel Bitcoin’s gentle pull or you’ve been a hodlonaut in close orbit, Bitcoin’s gravity will continue to increase. I am convinced of that idea, and I hope to have planted a seed of conviction in you as well.

Further Reading

- Unpacking Bitcoin’s Social Contract by Hasu

- We can’t all be friends: crypto and the psychology of mass movements by Tony Sheng

- Visions of Bitcoin - How major Bitcoin narratives changed over time by Hasu and Nic Carter

- The Many Faces of Bitcoin by Murad Mahmudov and Adam Taché

- Bitcoin: Past and Future by Murad Mahmudov and Adam Taché

- Crypto-incrementalism vs Crypto-anarchy by Tony Sheng

- Bitcoin Culture Wars by Brandon Quittem

- Schrödinger’s Securities by Nathaniel Whittemore

- Market Narratives Are Marketing by Nathaniel Whittemore

- Quantum Narratives by Dan Held

Acknowledgments

- Thanks to Hasu, whose incredible feedback helped to shape large parts of this article. His writing on Unpacking Bitcoin’s Social Contract was my inspiration for writing about Bitcoin’s gravity.

- Thanks to Nathaniel Whittemore for his writings on narratives and feedback on earlier drafts of this article.

- Thanks to Ben Prentice for proofreading the final draft.

- Graphics based on the fxemoji set cc-by Sabrina Smelko

- Dedicated to the bravest space cat of them all (* April 2017, † April 2019).