| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the January 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

Cryptocurrency: The Canary in the Coal Mine

What Crypto Can Tell Us About Macro Markets in 2019

By Jill Carlson

Posted Jan 1, 2019

Over the last quarter, the market has rejected risk assets across the board in a sudden reversal of the year’s trend. The S&P 500 erased its 9% gain over a matter of weeks in October. The Nasdaq index retraced from an 18% gain to end the year down 5%.

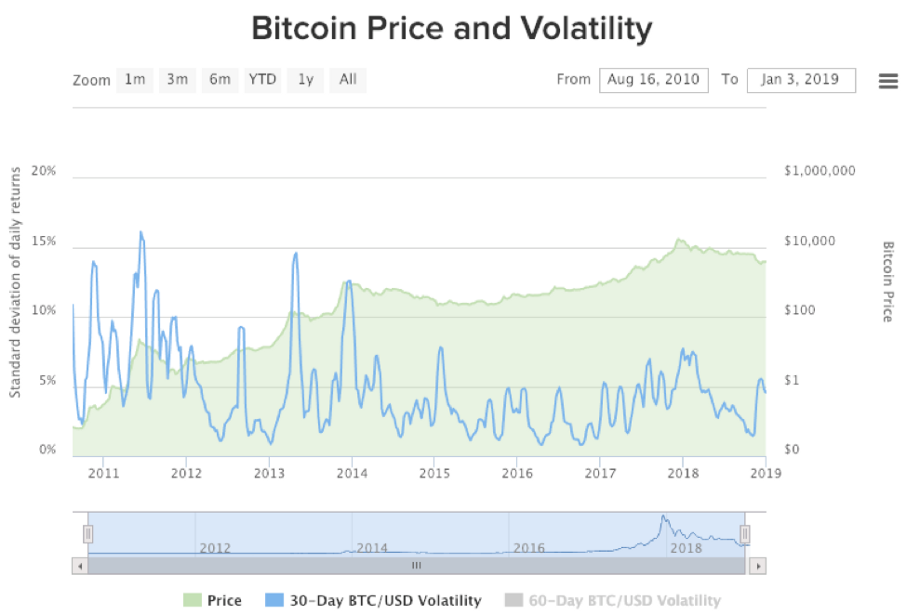

But no market has felt more pain recently than that of cryptocurrencies. The aggregate market cap of cryptocurrencies, which topped out at $830 billion last January, has since crumbled to $130 billion. Much of this unwind has occurred only in the last two months, with the crypto market as a whole getting marked down over 40% quarter-to-date.

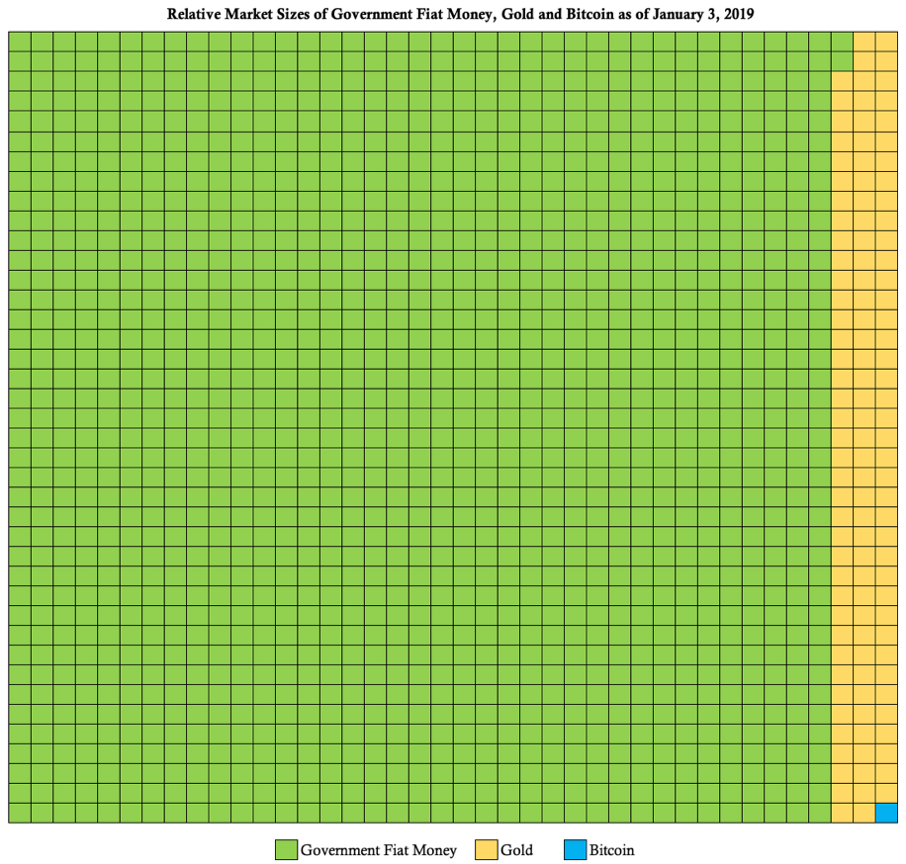

The cryptocurrency market is admittedly miniscule relative to other asset classes. Cryptocurrency (no matter how big the drawdown) is unlikely to have any impact on broader markets any time soon. Bitcoin has demonstrated no substantial correlation to any other asset, whether equities or gold. Nonetheless, what has been happening with this nascent asset class over the last year may reveal some important macro trends.

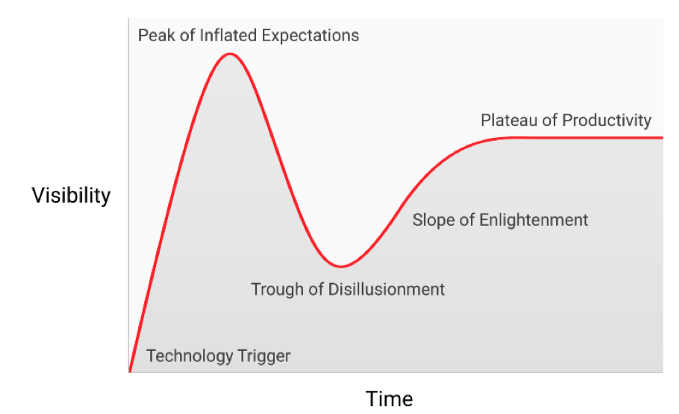

Two years ago, at the end of 2016, the cryptocurrency market stood at $15 billion in value. Trading volumes across all cryptocurrencies hovered in the double-digit millions. What led to the asymptotic spike in prices over the course of 2017? While it may be possible to point to certain headlines and technology developments as catalysts, most would probably dismiss the phenomenon as a speculative bubble. They may not be wrong in this characterization, but they may also miss the macro context in which all of this occurred.

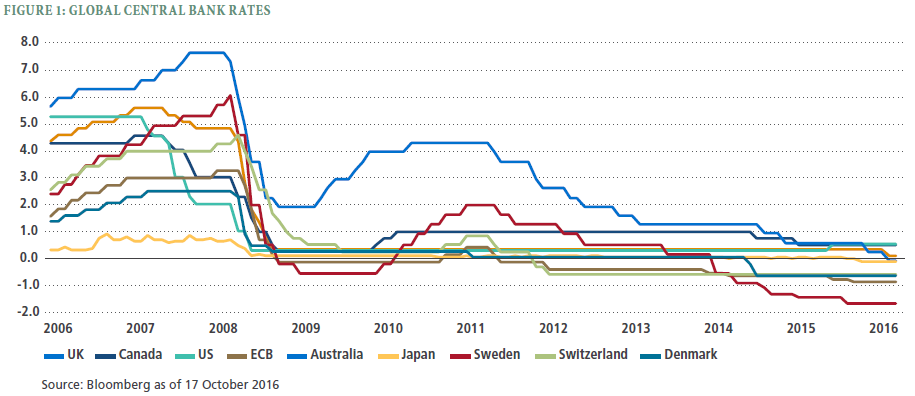

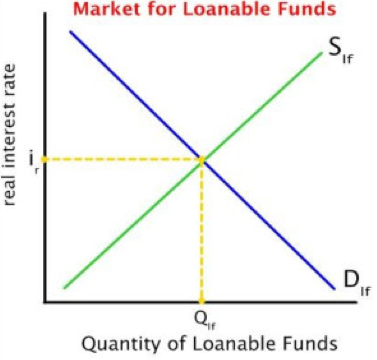

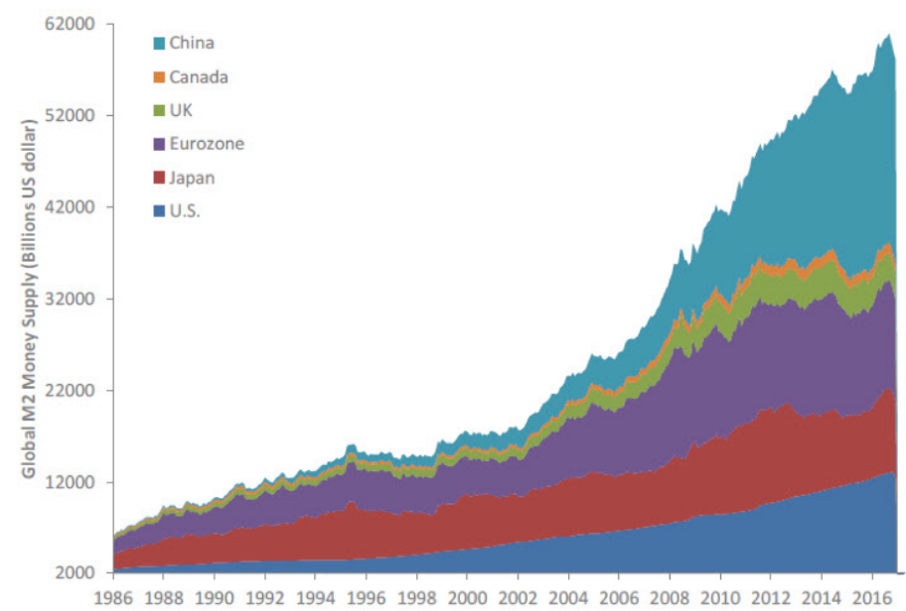

We have seen many search for yield trades play out over the last 8 years. With central banks around the world pumping liquidity into the economy, traditionally risky assets have seen their premiums sucked out of them. Emerging markets stocks, bonds, and currencies have benefited from this trend. High beta equities, most notably in the tech sector, have boomed with the FAANG stocks leading the way. This trend has also driven money further out along the risk spectrum into alternative asset classes, ranging from art to cars to venture capital.

With rates like these, who needs hedges? Image from Pimco’s 2016 Negative Interest Rate Report. https://global.pimco.com/en-gbl/resources/education/investing-in-a-negative-interest-rate-world

With rates like these, who needs hedges? Image from Pimco’s 2016 Negative Interest Rate Report. https://global.pimco.com/en-gbl/resources/education/investing-in-a-negative-interest-rate-world

The cryptocurrency boom of 2017 may have been the illogical conclusion of this global search for yield. It certainly followed this trend, starting as money poured into the relatively lower beta cryptocurrencies (like bitcoin and ethereum). Over time capital found its way into brand new assets as well, the products of initial coin offerings (ICOs) into which investors dumped an estimated $20 billion in the last year and a half, often with little in the way of investor rights or protections. Talk about “risk on”…

But the story has changed since then. If you bought bitcoin at the peak last December and sold today you would be realizing an 80+% loss. Many of bitcoin’s brethren, including many ICOs, have performed far worse with some cryptocurrencies getting marked down 95+% this year. The last major legs lower of this correction in October and November have coincided with the broader market sell off.

Perhaps cryptocurrency, the last mover on the way up, is the leading indicator of a broader market fall. If the cryptocurrency boom of 2017 was partly the result of the longest expansionary period the economy has seen in a century, perhaps the bursting crypto bubble of 2018 is the canary in the coal mine that the search for yield has run its course.

The recent downturn across asset classes has been blamed on a global growth slowdown, rising interest rates, and continued political uncertainty. Whether this plays out in 2019 remains to be seen, but if it does, it will manifest first as capital leaves what it perceives to be the riskiest assets.

Tweetstorm: Bitcoin’s 10 Year Anniversary

By Vijay Boyapati

Posted January 2, 2019

- 10 years ago today, in an unknown location, a mysterious figure whose identity is still unknown, tapped a key on his keyboard, spurring his CPU into action. In doing so, Satoshi reified his vision for a decentralized digital cash that he’d published 3 months earlier.

- The fan in his computer began spinning to keep the CPU, burning from the burden of work it had been given, from overheating. The CPU in Satoshi’s computer was searching for a special pattern, much like a digital needle in a haystack, that would secure #Bitcoin’s first block.

- Here is that needle:

1

0x000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

It is the hash of Bitcoin’s “Genesis Block”, which created the first 50 bitcoins ever to be mined (by a quirk of Bitcoin’s protocol these 50 bitcoins can never be spent).

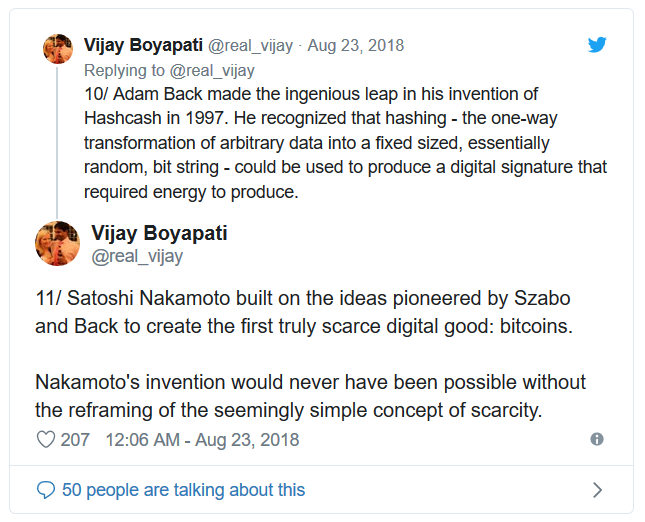

- With a brilliant leap of imagination, Satoshi had done what no one else had been able to do, and which many thought impossible. He had ingeniously incorporated @adam3us’s Hashcash design as a way of securing transactions on a network not controlled by anyone.

- By burning energy in search of digital needles-in-haystacks, Satoshi’s proof-of-work design allowed, for the first time ever, scarcity to be brought to the digital realm:

- Since the creation of Bitcoin’s genesis block on January 3rd, 2009 at 6:15pm (GMT), the Bitcoin network has seen the steady and remarkably reliable creation of blocks for a decade, allowing millions of people to store and transfer value without let or hindrance.

- While many are obsessed with making price predictions about #Bitcoin in 2019, one thing we can actually predict with high certainty is that Bitcoin blocks will continue to be created approximately every 10 minutes with remarkable reliability.

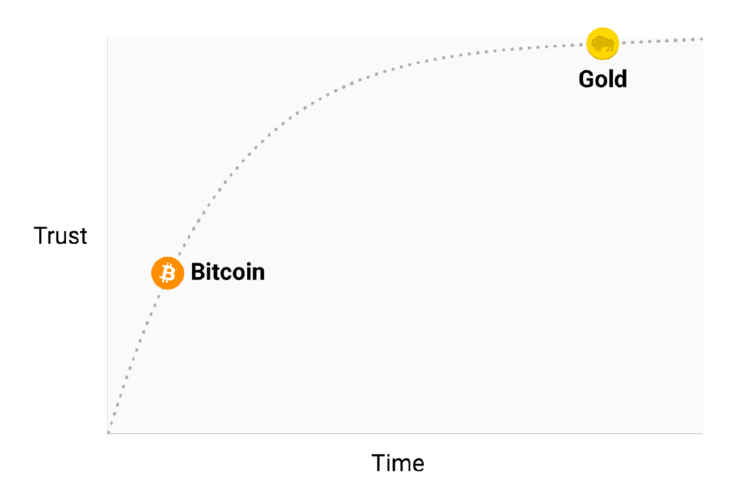

- As the Bitcoin network continues to function reliably well into the next decade, there will be near-universal confidence that it will be available forever, much as people believe the Internet is a permanent feature of the modern world.

- Slowly but inexorably the world’s population will come to recognize the benefit of opting out of the status quo monetary order and returning to a world of true individual financial sovereignty.

- 10 years hence we will look back at the now 20 year old Genesis Block and recognize its creation as the beginning of a new monetary epoch. With the tap of a key on his keyboard Satoshi set in motion a sequence of events that set our world financially free.

Addendum: If you’re interested in learning more about the genesis block I highly recommend the fantastic 2013 post by the brilliant @SDLerner .

Bitcoin: Two Parts Math, One Part Biology

By Hugo Nguyen

January 3, 2019

This is Part 5 of a 5 part series

- Part 1 - The Anatomy of Proof-of-Work

- Part 2 - Bitcoin, Chance and Randomness

- Part 3 - How Cryptography Redefines Private Property

- Part 4 - Bitcoin’s Incentive Scheme and the Rational Individual

- Part 5 - Bitcoin: Two Parts Math, One Part Biology

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Ten years ago today Satoshi Nakamoto immortalized these words by embedding them in Bitcoin’s very first block — the genesis block. They are a solemn reminder of the unfair and broken system we all live under, and likely the reason Satoshi created Bitcoin in the first place: to wrest control of money back from governments and central bankers [1].

The last 10 years has been nothing short of a miracle. The Bitcoin network has been up 24/7, boasting an impressive record of 99.98% uptime [2]. What is most amazing is that Bitcoin achieved this without anyone being in control.

Bitcoin is a unique invention because it uproots the very foundation of our society: it redefines money. Money, together with language, are considered the 2 most important tools we humans use to cooperate and build civilizations.

My personal journey into Bitcoin has also been extremely rewarding. Very few things are as intellectually stimulating as Bitcoin. Grokking Bitcoin means going down the rabbit hole that is finance, money, history, economics, computer science and biology. It means retracing the footsteps of giants such as Cardano, Pascal, Turing, Plato & Aristotle, Locke, Hume, Adam Smith, Nash, Kahneman & Tversky, Darwin, John Maynard Smith, Dawkins, Diffie, Hellman & Merkle, Szabo, to name a few. It means asking fundamental questions about the nature of the world we live in — much of which we often take for granted. Bitcoin sends you on an exhilarating and never-ending quest for truth.

Over the last several months I have written a series of articles — which I have called the Bitcoin Fundamentals series. My goal is to go down the rabbit hole as far as I could, to see what Bitcoin is really made of.

Writing these concepts down also forces me to articulate my thinking and helps my understanding of Bitcoin. I hope they will help others as well. The rest of this article will sum up what we have learned in the series.

Full index of the series:

- Part 1 - The Anatomy of Proof-of-Work

- Part 2 - Bitcoin, Chance and Randomness

- Part 3 - How Cryptography Redefines Private Property

- Part 4 - Bitcoin’s Incentive Scheme and the Rational Individual

- Part 5 - Bitcoin: Two Parts Math, One Part Biology

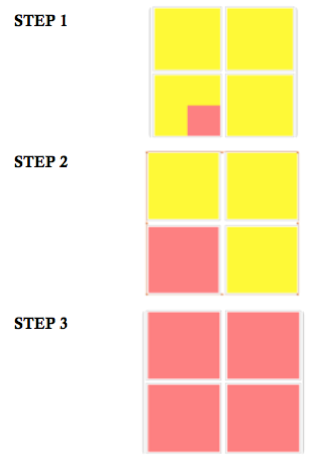

The three sublayers of Bitcoin

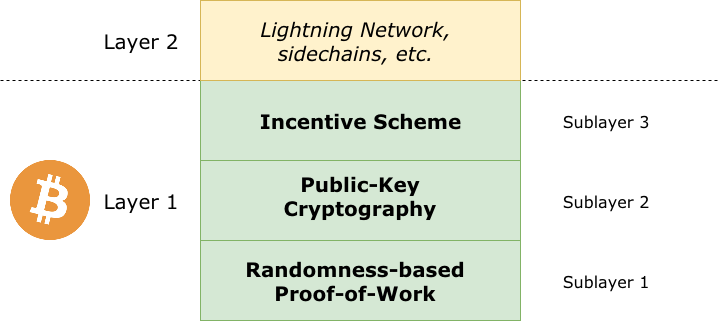

Bitcoin is composed of 3 fundamental building blocks:

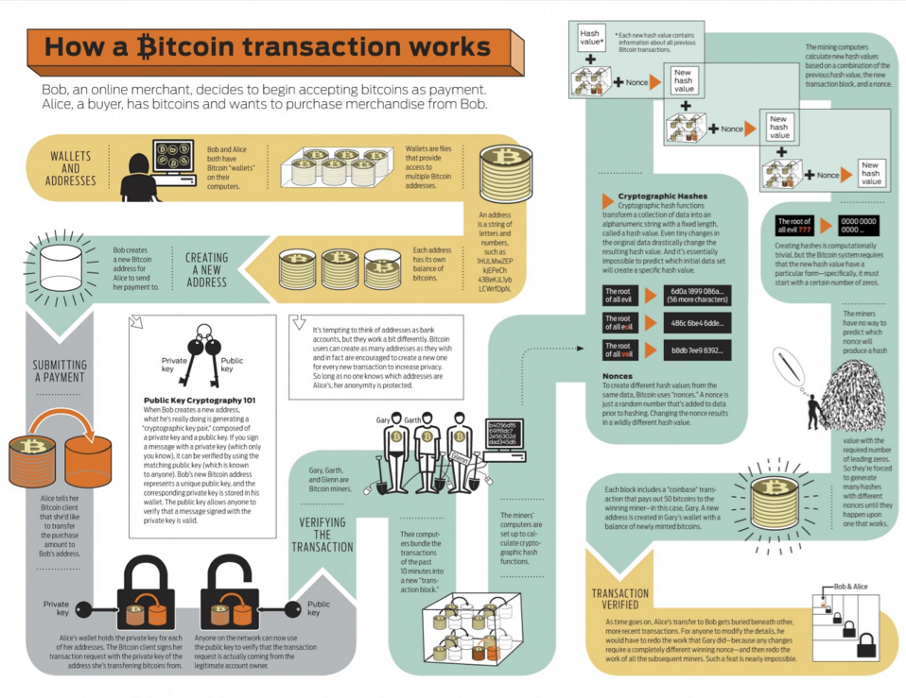

(i) Randomness-based Proof-of-Work

(ii) Public-key cryptography

(iii) Incentive scheme

If we consider Bitcoin as a base layer upon which further layers can be built upon (such as the Lightning Network, TumbleBit or sidechains), then these building blocks can be viewed as sublayers within the base layer.

The 3 sublayers of Bitcoin base protocol

The 3 sublayers of Bitcoin base protocol

There is an implicit hierarchy among these sublayers. That is:

Sublayer 1: Proof-of-Work (PoW) forms the first sublayer. PoW approximates energy burnt and is the bridge between the digital world and the physical world. PoW gives digital blocks — which are just strings of 1s and 0s — real-world significance. With PoW, the Bitcoin ledger becomes an unforgeable and costly asset, with real weight behind it.

Sublayer 2: Public-key cryptography (PKC) forms the second sublayer. If PoW enables a new digital asset, then PKC and specifically digital signatures “tokenize” that asset, chopping it into pieces. Individuals can then store these pieces privately and exchange them with each other.

Sublayer 3: Finally, Bitcoin’s incentive scheme forms the third sublayer, which sustains the system created by sublayers 1 and 2. Bitcoin is a dynamic network. It resembles a living organism whose heart beats roughly every 10 minutes. Bitcoin’s incentive scheme provides the engine for this heartbeat, and is built on the token natively generated by sublayer 2.

Sublayer 2 wouldn’t matter without sublayer 1. Sublayer 3 wouldn’t matter without sublayers 1 and 2.

These sublayers together form the three-legged stool that is the foundation of the entire Bitcoin ecosystem. [3][4]

Two Parts Math, One Part Biology

From the exploration in the series, we have also learned that under the hood:

- Randomness-based PoW is based on math

- Public-key cryptography is also based on math

- Incentive scheme is based on human behavior

It can be said then, that Bitcoin is two parts math, one part biology.

It’s worth noting that both randomness-based PoW and PKC rely on the same mathematical concept underneath, namely one-way function, but they form very distinct parts of the system. PoW creates the digital asset, while PKC tokenizes it.

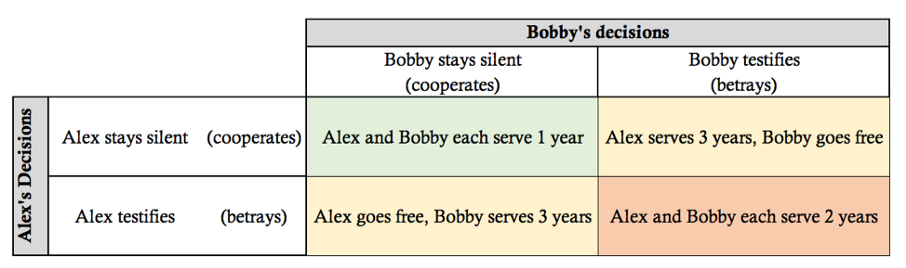

The third sublayer of Bitcoin, incentive scheme, is arguably Bitcoin’s weakest link. Unlike the first 2 sublayers, it relies on human behavior, which is less consistent and rigorous than mathematical principles. Human behavior exhibits bounded rationality, which is coded at the gene level, but imperfect. Humans are prone to miscalculations and occasional irrational behavior.

It remains to be seen whether Bitcoin’s incentive scheme would be strong enough to hold the network together for the long term.

Final Words

I would like to close out the series by saying that in no way does this constitute a complete understanding of Bitcoin. But I hope it will serve as a good starting point for someone who is new to Bitcoin. Some of the content in this series are my own personal opinions. The reader would do well to do his or her own research and form their own opinions. “Don’t trust, verify” works equally well in Bitcoin and in learning.

Acknowledgements

Special thanks to Nic Carter, Steve Lee, Jimmy Song, Hasu, Murad Mahmudov and Dan Held for their extremely valuable feedback in the writing of this series.

[1] The genesis message also doubled as proof that Satoshi did not unfairly premine before January 3rd, 2009.

[2] Bitcoin has experienced a dozen hours of “downtime”: a combined total of 77 blocks where the network accidentally split, from 2 incidents in 2010 and 2013. This record is as impressive if not better than that of AWS, Google Cloud and Microsoft Azure.

[3] The term “cryptocurrency” derives from the use of public-key cryptography (sublayer 2), which ironically captures only one of many crucial aspects of this technology.

[4] These are the high-level building blocks. In practice the high-level building blocks are implemented using even smaller blocks. This includes hardware devices, software components, and communication protocols such as TCP/IP — each one bringing their own unique set of challenges.

Thanks to Dan Held.

Planting Bitcoin - Season (2/4)

Central Banks and the 2008 Financial Crisis

By Dan Held

Posted January 6, 2019

This is part 2 of a 4 part series

- Part 1: Planting Bitcoin - Species

- Part 2: Planting Bitcoin - Season

- Part 3: Planting Bitcoin - Soil

- Part 4: Planting Bitcoin - Gardening

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” — Satoshi Nakamoto

Introduction

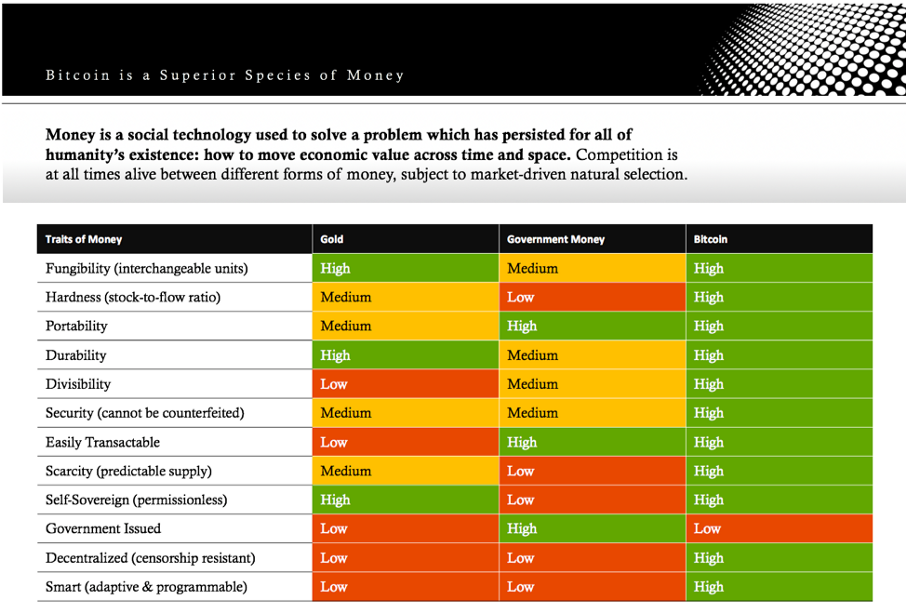

In my last article, “Species,” I covered why Satoshi’s design of Bitcoin’s genetic code made it the best species of money ever created.

Satoshi had begun crafting Bitcoin’s genetic code in 2007 but had waited for the right moment to plant the seed, the right moment in which the world would understand and embrace what he had created. In this article, I will dive into the moment in which Satoshi precisely chose to plant the Bitcoin seed.

Central Banks

From the founding of the Bank of England, central banks have been used as a means for states to fund their policies without risking the popular ire caused by direct taxation. When the capital provided by central banks is misallocated by either the state or in a market distorted by artificially low interest rates, an inevitable collapse occurs. The central bank is the root of these periodic market dislocations.

“I believe the root cause of every financial crisis, the root cause, is flawed government policies” — Henry Paulson (US Treasury Secretary during the 2008 financial crisis and former Goldman Sachs CEO)

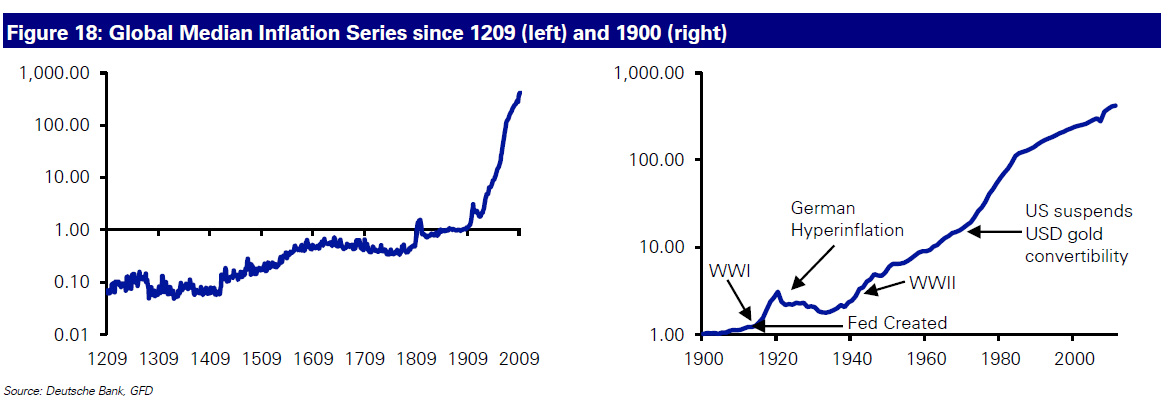

There hasn’t been a year of global deflation since 1933

There hasn’t been a year of global deflation since 1933

With the recent market dislocation, investors were bailed out. Unfortunately, you cannot subsidize irresponsibility and expect people to become more responsible. Prior to the 20th century, ordinary people could always flee to gold to save themselves from the effects of the failed, inflationist, policies of the central bank. This ended across much of the world in the 20th century as gold was outlawed. — Vijay Boyapati

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.” — Alan Greenspan (Former Chairman of the Federal Reserve)

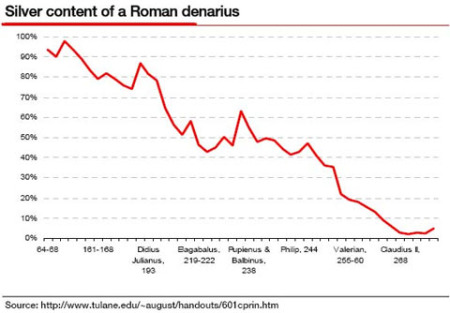

The standard Roman silver coin

The standard Roman silver coin

Early 2007

Satoshi Nakamoto, after years and years of research, starts coding up Bitcoin.

2008 Financial Crisis

“The problem had grown so big that the end was bound to be cataclysmic and have big social and political consequences” — Michael Lewis (Big Short)

January

Fed tries to stop the housing bust

The Federal Market Open Committee began lowering the fed funds rate (to 3.0%). There were 57 percent more foreclosures than 12 months earlier

February

Bush signs tax rebate as home sales continue to plummet

February 13: President Bush signed a tax rebate bill to help the struggling housing market. The bill increased limits for FHA loans and allowed Freddie Mac to repurchase jumbo loans.

March

Fed begins bailouts

March 14: The Federal Reserve held its first emergency weekend meeting in 30 years.

March 17: The Federal Reserve announced it would guarantee Bear Stearns’ bad loans.

March 18: The Federal Open Market Committee lowered the fed funds rate by 0.75 percent to 2.25 percent. It had halved the interest rate in six months. That same day, federal regulators agreed to let Fannie Mae and Freddie Mac take on another $200 billion in subprime mortgage debt.

April — June

The Fed buys more toxic bank debt

June 2: The Fed auctions totaled $1.2 trillion. In June, the Federal Reserve lent $225 billion through its Term Auction Facility.

July

IndyMac bank fails

July 11: The Office of Thrift Supervision closed IndyMac Bank. Los Angeles police warned angry IndyMac depositors to remain calm while they waited in line to withdraw funds from the failed bank.

July 23: Secretary Paulson made the Sunday talk show rounds. He explained the need for a bailout of Fannie Mae and Freddie Mac. The two agencies themselves held or guaranteed more than half of the $12 trillion of the nation’s mortgages.

August

August 18: Satoshi registers Bitcoin.org through anonymousspeech.com

September Global panic

September 7: Treasury nationalizes Fannie and Freddie and will run the two until they are strong enough to return to independent management. The Fannie and Freddie bailout initially cost taxpayers $187 billion.

September 15: Lehman Brothers files for chapter 11 bankruptcy, the largest bankruptcy filing in U.S. history with over $600B in assets. The bankruptcy triggered a one-day drop in the Dow Jones Industrial Average of 4.5%, the largest decline since the September 11, 2001 attacks. Later that day, Bank of America officially announced it would purchase struggling Merrill Lynch for $50 billion.

“It’s terrible. Death. Like a massive earthquake.’‘ — Kirsty McCluskey a Lehman trader in London

September 16: Fed buys AIG for $85 Billion. The company had insured trillions of dollars of mortgages throughout the world. If it had fallen, so would the global banking system. On that same day, the Reserve Primary Fund “broke the buck.” It didn’t have enough cash on hand to pay out all the redemptions that were occurring.

“I asked my wife to please go to the ATM and take as much cash as she could. When she asked why, I said it was because I didn’t know whether there was a chance that banks might not open.” — Mohamed El-Erian (One of the most powerful economists/leaders in finance)

September 17: Economy on the brink of collapse. Panic spreads. Investors withdrew a record $144.5 billion from their money market accounts. During a typical week, only about $7 billion is withdrawn. If it had continued, businesses couldn’t get money to fund their day-to-day operations. In just a few weeks, shippers wouldn’t have had the cash to deliver food to grocery stores.

October Bailouts

October 3: Bitcoin whitepaper PDF likely created (not the first time it was written, but the first time it was prepared for publishing)

The same day, the bank bailout bill allowed Treasury to buy shares of troubled banks. It was the fastest way to inject capital into the frozen financial system. Despite this, global stock markets continue to collapse.

“Just as our politics are falling apart, our portfolios are falling apart, too.” — Ben Hunt

October 7: The Federal Reserve agreed to issue short-term loans for businesses that couldn’t get them elsewhere, to the tune of $1.7 Trillion.

October 13: Treasury Secretary Hank Paulson sits down with 9 major bank CEOs. The total bailout package looks more like $2.25 trillion, well more than the original $700 billion available.

“September and October of 2008 was the worst financial crisis in global history, including the Great Depression” — Ben Bernanke

October 14: The governments of the EU, Japan, and the United States again took unprecedented coordinated action . The EU committed to spending $1.8 trillion to guarantee bank financing, buy shares to prevent banks from failing, and take any other steps needed to get banks to lend to each other again. This was after the UK committed $88 billion to purchase shares in failing banks and $438 billion to guarantee loans. In a show of solidarity, the Bank of Japan agreed to lend unlimited dollars .

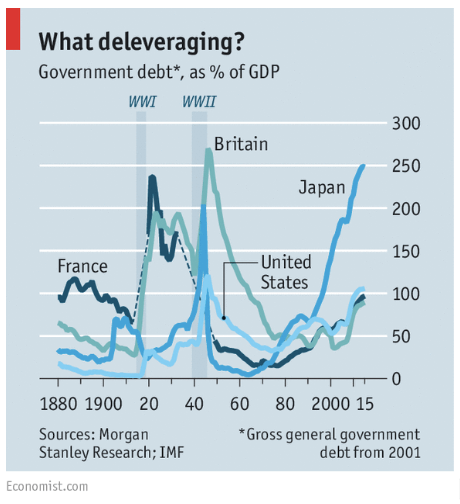

Debt/GDP ratios are at wartime highs. Central banks haven’t unwound their 2008 trade

Debt/GDP ratios are at wartime highs. Central banks haven’t unwound their 2008 trade

October 21 — Fed lends $540 Billion to bail out money market funds which are continuing to meet a barrage of redemptions.

“People feel like nothing in the country is working — the president, Congress, corporations.” (October 15, 2008) Reuters

October 31: Satoshi publishes the Bitcoin whitepaper

Walking on the street in a city Satoshi looks around and notices a businesswoman on her blackberry, hailing a cab. He passes a newspaper stand and sees Miley Cyrus’ (known as Hannah Montana) controversial photos in Vanity Fair, she’s 15.

George Bush’s approval rating is at a record low of 21%, Congress is at 10% — just above its all-time low. Lehman Brothers had just collapsed a month prior.

“Is now the time? Is the world ready?” Satoshi thought to himself. He had spent the last few years coding up Bitcoin then writing the whitepaper. He had patiently waited to release it to the world, but the moment had to be right… there was only one shot at this. “Is the whitepaper easy enough to read? I want to make sure this resonates with the cypherpunks, I’m hoping cash will be most understandable to the other members on the mailing list who have previously created e-currencies.”

“When the moment is ripe, a fanatic leader galvanizes the ripe population and pushes it to a point of no return. The leader translates the ideals published by the “men of words [cypherpunks]” into doctrines [whitepaper] promising sudden and spectacular change.” — Eric Hoffer, author of “ The True Believer ” (via Tony Sheng )

He returned to his home and reviewed the whitepaper for any glaring mistakes the 47th time, he couldn’t find any. He leaned back and stared at the wall. He realized this was the moment, it was time to plant the seed. He popped open his e-mail client, checked the draft e-mail to the cryptographer (cypherpunk) e-mailing list and pressed send. There was no going back.

“Indeed, Bitcoin rose like a phoenix from the ashes of the 2008 global financial catastrophe — a catastrophe that was precipitated by the policies of central banks like the Federal Reserve.” — Vijay Boyapati

With the 2008 financial crisis, trust had been lost in a world that ran on trust.

Bitcoin was launched in a time of absolute necessity, Satoshi planted the seed at precisely the right moment.

Planting Bitcoin - Gardening (4/4)

By Dan Held

Posted January 6, 2019

This is part 4 of a 4 part series

- Part 1: Planting Bitcoin - Species

- Part 2: Planting Bitcoin - Season

- Part 3: Planting Bitcoin - Soil

- Part 4: Planting Bitcoin - Gardening

Introduction

In my last article, “Soil,” I covered the Cypherpunks or the “Soil” in which he planted the Bitcoin seed giving it the best chance for survival.

Satoshi’s design of Bitcoin’s genetic code made it the best species of money ever created, he waited for exactly the right moment to plant the seed, and had planted it in the most fertile soil. Now it was time to nurture Bitcoin’s development.

Early Development

“The project needs to grow gradually so the software can be strengthened along the way.” — Satoshi Nakamoto

Satoshi chose to be anonymous, which fit the ethos of the Cypherpunks. People can project hopes and dreams on an anonymous individual, ensuring maximal narrative fit . That’s why a book is often better than the movie. His anonymity was a critical component of the founder story — dev worship is a dangerous thing for an open source project aiming for decentralization. Volunteers need to rely on trusting the objective reality of the code, rather than focusing on the merits of the project leader.

“It is high time for everyone involved in BTC to stop concerning themselves with the question of the identity of Nakamoto, and accept that it does not matter to the operation of the technology, in the same way that the identity of the inventor of the wheel no longer matters”- Saifedean Ammous

As a subtle jab to central banks, and as a nod to his admiration of the gold standard, he chose his birthday (on his p2p foundation website profile) as the date the US made gold ownership illegal through Executive Order 6102, April 5th. And he chose 1975 as his year of birth which is the year when the US citizens were allowed to own gold again.

“[with Bitcoin] we can win a major battle in the arms race and gain a new territory of freedom for several years.” — Satoshi Nakamoto

In his public statements, he usually focused on ordinary, mainstream, users, with his tone sometimes even excited in suggesting many ways bitcoin could be made more convenient or useful for commerce or other things. Satoshi was practical, which made interactions very easy and comfortable. He tended to avoid philosophical discussions and political arguments.

Additionally, Satoshi took steps to signal to the Cypherpunks, and future members, that Bitcoin wasn’t a scam. The conservative deescalation of his mining contributions, never spending any of his coins, nor using his influence for any purpose, shows that he wanted the world to make up their own mind about his project and judge it on its own terms. And unlike every other founder in history, Satoshi never cashed out.

“Bitcoin benefited from an extremely rare set of circumstances. Because it launched in a world where digital cash had no established value, they circulated freely. That can’t be recaptured today since everyone expects coins to have value. Not only was it fair, but it was historically unique in its fairness. The immaculate conception.” Nic Carter

Many of the early Cypherpunks became core developers in the Bitcoin protocol like Hal Finney and Adam Bach. The caliber of the early development team attracted talented (soon to be “core”) developers.

“Gifted people tend to want to work with other top people and work on something that matters, that they believe in. Motivation matters . Protocol design and coding is partly an artistic, aesthetic endeavour; people do their best work on a mission: uncensorable global internet money” — Adam Bach

The Gardener Leaves

Satoshi showed a great level of restraint and took a long-term perspective on issues, as when Satoshi resisted the calls for bitcoin to market itself as a funding mechanism for Wikileaks after PayPal famously froze its account. This, Satoshi argued, would only bring down legal and regulatory hammers that much faster. Satoshi recognized the need to carefully cultivate Bitcoin.

“I make this appeal to WikiLeaks not to try to use Bitcoin. Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change, and the heat you would bring would likely destroy us at this stage .” — Satoshi Nakamoto

The connection to Wikileaks at such an early stage, at the height of what could be called public resistance against the Iraq war, probably gave Bitcoin a very different dimension. So he did not mince his words nor hide his intention for leaving in what can be called the last public statement where he says the US government was headed towards Bitcoin.

“It would have been nice to get this attention in any other context. WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us .” — Satoshi Nakamoto

In April 2011, Gavin Andressen notified Satoshi that he was meeting with the CIA. Any further involvement might give away his identity which would endanger the long-term success of the project . Bitcoin now had enough support that he could walk away, and so he did.

“Satoshi left because he didn’t want its influence to affect the protocol development creating a single point of failure. The very idea of “Satoshi Vision” itself is against Satoshi’s vision for Bitcoin” — Frederico Tenga

Social Scalability

Satoshi was able to walk away because Bitcoin had trust minimization baked into the protocol. This is what made it socially scalable.

“Power and scale breed conflict and corruption, that the purest part of any revolution is the beginning.” — Dhruv Bansal

It is easy to start with good intentions, however as things scale that becomes harder and harder to maintain. Bitcoin was specially architected to be trust minimized . Satoshi set it up so that there is no one person or group whose power can be coveted, usurped, or broken.

“Bitcoin is a social breakthrough, not a technological one” — Alex Hardy

Bitcoin needed to be the universal language for money . You are communicating with strangers worldwide, which you neither know nor trust that agree you own an abstraction of value.

“Bitcoin is a distributed incentive structure we collectively engineer and freely opt-into. It’s political technology, the first of its kind. This leaderless-ness is one part of what gives Bitcoin — in particular, beyond other cryptocurrencies today — such robustness.” — Dhruv Bansal

HODLing, the Hero’s Journey

“In the beginning of a change the patriot is a scarce man, and brave, and hated and scorned. When his cause succeeds, the timid join him, for then it costs nothing to be a patriot.” — Mark Twain

Satoshi built Bitcoin for the believers in a new financial system, the HODLers, the revolutionaries. The ones who were disenfranchised with the existing financial system. The ones who would be attracted by the prospect of sudden and spectacular change in their life.

We must heed the call for a Hero’s Journey (the HODLer) that is rooted in HODL. It’s not just a meme, it is representative of foundational values upon which stronger cultural memes are eventually developed . This supports Bitcoin’s cultural foundation.

“Over and over again, the financial system was, in some narrow way, discredited….The rebellion by American youth against the money culture never happened.” — Big Short

The Hero at the beginning of their Journey has values that do not agree with the values that the Hero ends up with at Journey’s end. That is the entire point of undertaking the Journey, but is also what makes it so frightening. The Hero must let go of his/her former self in the pursuit of this transformed version of themselves. The Journey’s end is unknown, but what is known is that the Journey inspires the acquisition of new knowledge, the relinquishing of outdated paradigms and the abandoning of the familiar.The HODL Journey in Bitcoin sketches a map that becomes clearer with the acquisition of knowledge.

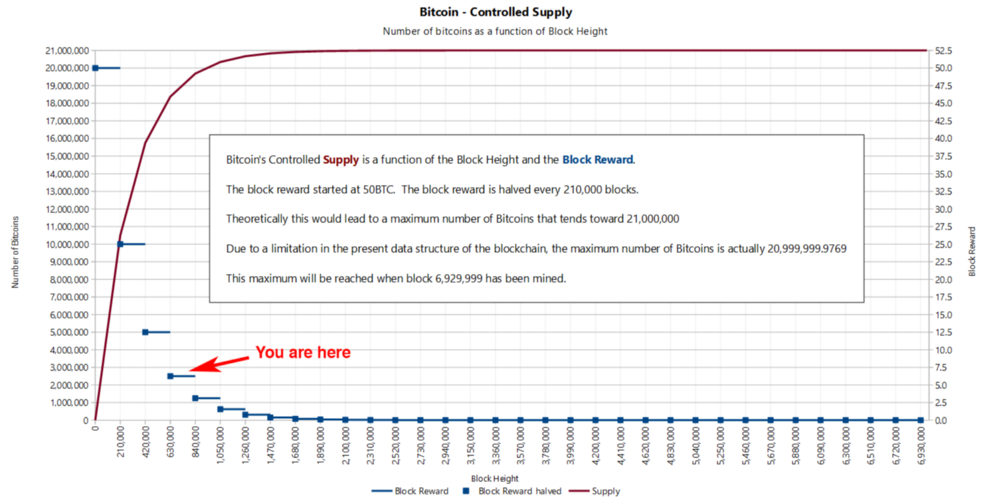

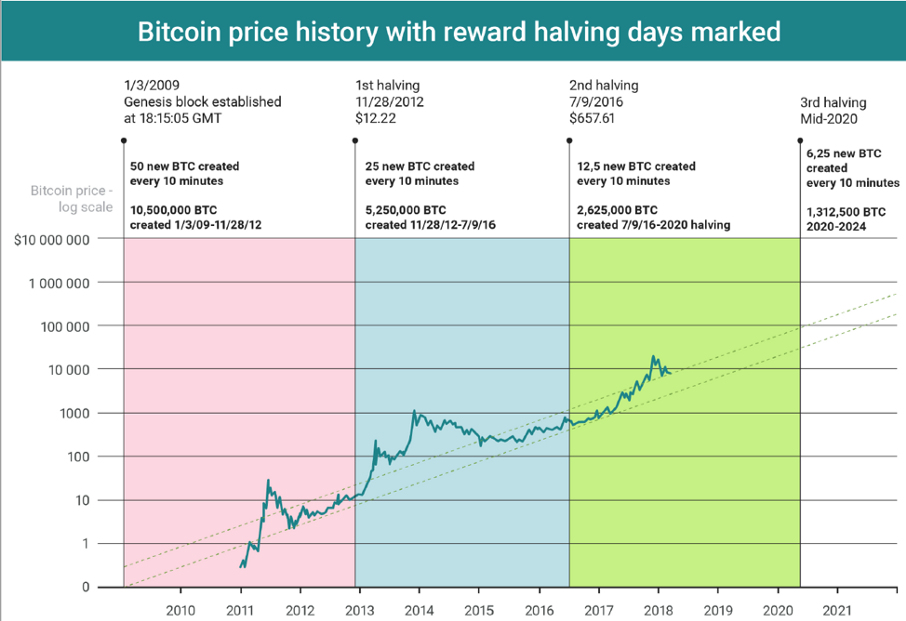

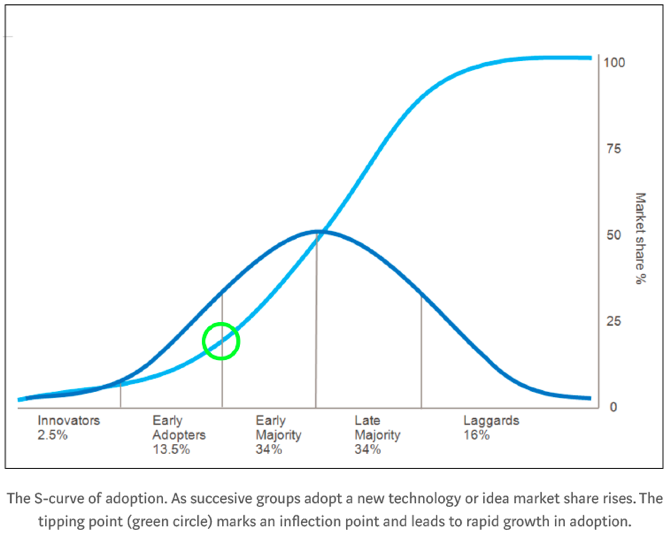

Satoshi needed to bootstrap the network with an incentive mechanism — the block reward which (a) controlled currency supply of Bitcoin and (b) created an incentive for people to participate in the network. Each cycle brings aboard a new set of true believers; a new set of HODLers . They, in their turn, become strong advocates for the adoption of Bitcoin as a store of value. Contagious Freedom. Vijay Boyapati

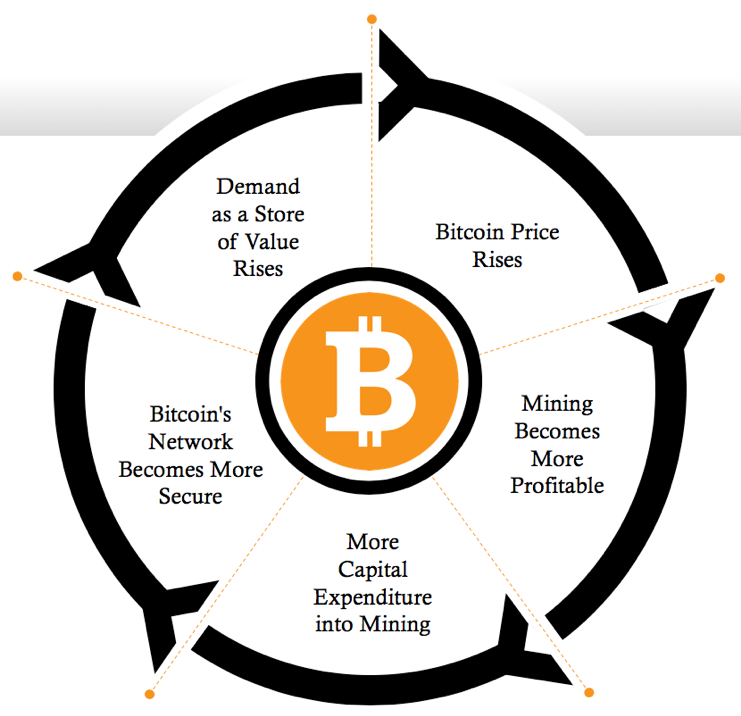

” Hodling bootstrapped Bitcoin into existence. Hodling increases value, which increases demand, hash rate, and network security, which, in turn, attracts new hodlers and devs. This self-reinforcing feedback loop drives Bitcoin’s network effects, security, and value.” — @TobiasAHuber

Satoshi had encoded in Bitcoin DNA a mechanism to incentivize the participants, through the shared belief in Bitcoin manifested via HODLing.

“In this sense, it’s more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes. As the number of users grows, the value per coin increases. I t has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.“ — Satoshi Nakamoto

Early HODLers believed in Bitcoin despite overwhelming negativity and false information (ex: labeled as a currency for money launderers and drug dealers, price fluctuations). HODLers had stronger risk appetite to weather the volatility of being a first mover. They’re practitioners of skin in the game.

In terms of the Hero’s Journey, “HODL!” is the mentor’s advice to the Hero in his Journey . Its roots are firmly based on the futility of trying to beat the market (Efficient Market Hypothesis and Hayekian Distributed information both dictate that the market can’t be systematically outperformed).

The increase in Bitcoin’s price has corresponding virality. And as it expands, HODLing becomes popular with people with a lower risk appetite, pulling in more and more network effect into the Bitcoin black hole — Dan McArdle

Via the Lindy Effect, the longer Bitcoin remains in existence the greater society’s confidence that it will continue to exist long into the future. It slowly seeps further into the psyche of those in charge.

“Protocols die when they run out of believers.” — Naval

The faith in a new financial system is what binds everything together. Bitcoin is not just a software project. It’s a method of coordination for a large group of people who face powerful adversaries. Bitcoin isn’t just a technological breakthrough, it’s also a social one.

“When people are ripe for a mass movement, they are usually ripe for any effective movement, and not solely with a particular doctrine or program. All mass movements are competitive, and the gain of one in adherents is the loss of all the others….A stable and sustainable ideology must be the foundation of all cryptocurrencies. No amount of cryptography, or consensus protocol development will help a cryptocurrency with an unstable and bankrupt ideology. Stable ideologies allow communities to thrive”. Kay Kurokawa

A simple example in religion is the Christian tenet that “there is one true god”. This belief strengthens the religion because it weakens membership in competing religions. Communities with unstable ideologies will eventually collapse.

“Unlike Bitcoin, nobody needs to explain why gold is valuable. Gold is simple. Bitcoin is complicated. So in the long run, the argument goes, Bitcoin can never replace gold… It’s true that the stories we tell matter, but those stories can change. Stories don’t win over everything. Eventually, raw utility supplants tradition. Bitcoin is a serious improvement over gold and starts to displace its role, the market will respond and re-price accordingly… To the digital native of the future, Bitcoin wallets will probably seem more natural than vaults full of useless metals painstakingly drilled out of the earth.” — Haseeb Qureshi

Money is a winner-take-all technology, driven by network effects. The crypto with the most HODLers, therefore, is the most demanded by consumers and will be the ultimate winner.

“Bitcoin is digital gold in the eyes of [HODLers]. To some extent this group already operates on a Bitcoin Standard: investments are evaluated on their ability to yield a return in Bitcoin.” Tuur Demeester

HODL forces us to extend our gaze beyond the present. It forces our present selves to contend with an alternate reality. HODL asks us to reconfigure our present set of preferences to permit the consideration of a future Bitcoin-based digital economy.

HODL is a noble basis for a Journey. Through the sacrifice of current consumption, HODLing is a net benefit for everyone as it increases every coin’s purchasing power.

“No Hero fights alone; All for one, one for all. Your call to HODL need not be the same as mine; indeed, they can be very different. Yet, in the end, they all redound to the benefit of each other.” — Prateek Goorha

Bitcoin promises an alternative for citizens across the world to keep their savings in a form of money that can neither be confiscated nor diluted. If Bitcoin grows much larger, it may force governments to become a voluntary organization. Through HODLing, we may finally be free.

“The secret to happiness is freedom; the secret to freedom is courage” — Thucydides

Those who opt-in to Bitcoin, are trading something abundant for something scarce, trading the past for the future, trading financial dependence for financial sovereignty.

Conclusion

Satoshi architected the perfect genetic code necessary to a new species of money, Bitcoin. He then waited for the precise moment to plant the new species, the 2008 Financial Crisis. At that moment, he distributed the whitepaper to the only group that cared — the Cypherpunks. And finally, he nurtured Bitcoin to a stage where it no longer needed him.

Many digital cash systems came and went over the years before Bitcoin and after Bitcoin . Most were just whitepapers, some wrote and developed code, some even built a community, but it will be extremely difficult to repeat the success of Bitcoin’s planting.

“Let the future tell the truth, and evaluate each one according to his work and accomplishments. The present is theirs; the future, for which I have really worked, is mine.” — Nikola Tesla

Planting Bitcoin — Soil (3/4)

By Dan Held

Posted January 6, 2019

This is part 3 of a 4 part series

- Part 1: Planting Bitcoin - Species

- Part 2: Planting Bitcoin - Season

- Part 3: Planting Bitcoin - Soil

- Part 4: Planting Bitcoin - Gardening

Introduction

In my last article, “Season,” I covered the precise moment in which Satoshi planted Bitcoin, the 2008 Financial Crisis. In this article, I cover the Cypherpunks or the “Soil” in which he planted the Bitcoin seed giving it the best chance for survival.

Cypherpunks

Sending the Bitcoin whitepaper to the cryptography mailing list on October 31, 2008 was the obvious choice. This was the right group to gather feedback from, the right channel to engage with. The list was predominately populated by the Cypherpunks * who were activists advocating widespread use of strong cryptography, as a route to social and political change.

“Cypherpunks” is a play on the word ‘cipher’ or ‘cypher’, for encryption; and cyberpunk a genre of sci-fi.

The group was originally comprised of Eric Hughes, Tim May, and John Gilmore. At first, the meetings were in-person meetings in the San Francisco Bay Area, but they decided to expand the group via the cryptographer mailing list which would allow them to reach other Cypherpunks. The mailing list was a place to exchange ideas freely through the use of encryption methods, such as PGP, to ensure complete privacy. The basic ideas behind this movement can be found in the Cypherpunk manifesto written by Eric Hughes in 1993. The key principle which underpins the manifesto is the importance of privacy and finality in transactions — PetriB

“Therefore, privacy in an open society requires anonymous transaction systems. Until now, cash has been the primary such system.” — A Cypherpunk’s Manifesto

We want the ability to ensure that others cannot use the information in the history of our transactions against us . For example: a purchase indicating that someone is wealthy, an embarrassing purchase, or one that would make you subject to spam or harassment. We do not want our financial purchase to haunt us further down the road. We want an endpoint beyond which we do not have to worry about further contingencies. In the world of payments, this is closely related to the concept of “finality“ — ideally we want to be able to state with certainty that at some point the payment has been made, the debt has been cleared, and the funds are secure. But recent developments have increased the ability for more powerful parties to clawback funds (via trusted third parties, legal funds, etc).

We hope that existing laws would provide protection against these difficulties. However, we can remove that moral hazard by not having to trust third parties or more powerful adversaries which can revert transactions solely based on their capabilities. This is what the Cypherpunks were fighting for with cryptography. They were the “Men of words,” or anti-establishment intellectuals that laid the foundation for individuals like Satoshi to come along.

“The words of anti-establishment intellectuals sow the seeds for revolution . They present ideas and sometimes discredit the establishment, paving the way for a charismatic leader to package their thinking into a movement .” — Tony Sheng

Elliot Alderson, the “Cypherpunk” in the fictional show “Mr. Robot.” He joins a group that aims to destroy all debt records by encrypting the financial data of the largest conglomerate in the world, E Corp.

Elliot Alderson, the “Cypherpunk” in the fictional show “Mr. Robot.” He joins a group that aims to destroy all debt records by encrypting the financial data of the largest conglomerate in the world, E Corp.

The first attempts at making an anonymous transacting system were made by Cypherpunks on that cryptographer mailing list, including:

- Adam Back, the inventor of hashcash, the proof-of-work (PoW) system used by several anti-spam systems. A similar PoW system is used in bitcoin

- Nick Szabo, designed a mechanism for a decentralized digital currency he called “bit gold.” Bit gold was never implemented, but has been called “a direct precursor to the Bitcoin architecture”

- Wei Dai, who published “b-money”, an “anonymous, distributed electronic cash system”

- Hal Finny, who created the first reusable proof of work system before Bitcoin (And in January 2009 he became Bitcoin network’s first transaction recipient). He was also a developer of the secure communication method known as Pretty Good Privacy (PGP)

- David Chaum, founded DigiCash (1989) as a form of centralized “electronic money” that deployed the same kinds of cryptographic protocols — public key cryptography — that support the nature of bitcoin transactions. It is often called “Chaumian eCash.”

Satoshi cites many of these Cypherpunks in the Bitcoin whitepaper and references their influence on Bitcoin’s development in public statements made post code launch.

“Bitcoin is an implementation of Wei Dai’s b-money proposal… and Nick Szabo’s Bitgold proposal” — Satoshi Nakamoto

In fact, Satoshi thought he was late to cryptocurrency! While the Cypherpunks had attempted many times to genetically code a species of money that would survive, none had been successful.

“A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s . I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.” — Satoshi Nakamoto

He had written the whitepaper to fit his target audience, the Cypherpunks. That’s why he uses the words “electronic cash”, “proof-of-work,” etc. which was previously used terminology in the other Cypherpunk whitepapers. He uses an ecommerce example to make it easier for everyone to comprehend. He’s crafting a narrative that will resonate with the Cypherpunks, to get them interested and involved. Bitcoin was the holy grail — it had solved the problem of finality and provided a small measure of privacy. The source code implementation was his product spec.

“The functional details are not covered in the paper, but the sourcecode is coming soon.” — Satoshi Nakamoto

The following things not described in the whitepaper, but are included in the source code: 21M hard cap, 10 minute blocks, 1 MB block caps. Those were incredibly important components of Bitcoin. The whitepaper was merely a teaser.

“If the Bitcoin Whitepaper is the Declaration of Independence, the Source Code is the Constitution“ — Pierre Rochard

In true Cypherpunk fashion, the publication of Satoshi’s whitepaper (October 2008) was quickly followed by code release in January 2009. The notion that good ideas need to be implemented, not just discussed, is very much part of the culture of the mailing list.

” Cypherpunks write code . We know that someone has to write software to defend privacy, and since we can’t get privacy unless we all do, we’re going to write it. We publish our code so that our fellow Cypherpunks may practice and play with it . Our code is free for all to use, worldwide… We know that software can’t be destroyed and that a widely dispersed system can’t be shut down .” — A Cypherpunk’s Manifesto

Importantly, Satoshi didn’t premine any Bitcoins. Satoshi gave the Cypherpunks a two month heads up before mining the Genesis block. To prove fairness, he included a proof of no premine timestamp in the Genesis Block of the Bitcoin blockchain. It carried a strong political message. What he was trying to accomplish was clear — they were building a new financial system. Bitcoin wasn’t merely digital cash, it was an alternative to banks.

” The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” — Genesis Block

Planting Bitcoin — Species (1/4)

Sound Money (sanum pecuniam)

By Dan Held

Posted January 6, 2019

This is part 1 of a 4 part series

- Part 1: Planting Bitcoin - Species

- Part 2: Planting Bitcoin - Season

- Part 3: Planting Bitcoin - Soil

- Part 4: Planting Bitcoin - Gardening

Foreword

I wrote this series, “Planting Bitcoin”, to paint the origin story of Bitcoin leading up to the 10 year anniversary (10/31/2018). I felt that this story hadn’t been told in a comprehensive and easy to read manner. I’d like to thank Jill Carlson for incepting this idea on the road trip back from Tahoe in early 2018.

Introduction

Bitcoin’s origin is akin to planting a tree. It wasn’t just Satoshi’s selection of the species (code), but the season (timing), soil (distribution), and gardening (community) that were essential to its success. It had to grow to be strong, mighty, and huge. It had to survive droughts, storms, and predators. Its deep roots had to support the weight of becoming a new world reserve currency.

What is Money

Money is most easily defined as the medium in which value is transferred. But Money is not just paper in your hand; or numbers in your bank account, Money represents something much more fundamental:

- Money is a primitive form of memory or record-keeping. It is the collective memory of who has the ability to allocate wealth.

- Money, which is the representation of the work required to acquire goods and services, can also be viewed as stored energy.

- Money is the central information utility of the world economy. As a medium of exchange, store of value, and unit of account, money is the critical vessel of information about the conditions of markets.

The main functions of money are Store of Value (SoV), Medium of Exchange (MoE), and Unit of Account (UoA). No money starts by providing all three functions, each new species of money follows a distinct evolutionary path that we will cover later. Let’s first start by identifying the newest species of money, Bitcoin.

Species

“These protocols can’t be described comprehensively as static objective things. They’re best thought of as live systems” — Ari Paul

Bitcoin is a new form of life, a new species of money called “cryptocurrency.” More importantly, it is “sound money,” or using proper taxonomy, “sanum pecuniam.” Sound money is defined as money that has a purchasing power determined by markets, independent of governments and political parties which is essential for individual freedom.

“I had to write all the code before I could convince myself that I could solve every problem, then I wrote the paper.” — Satoshi Nakamoto

The code of life is written into an organism at its inception. Satoshi carefully architected Bitcoin’s DNA, or genetic code, to be the best sound money ever created. We can think of Bitcoin’s genetic code as representing instructions that have been written to incentivize the organization and coordination of cellular function.

“I believe I’ve worked through all those little details over the last year and a half while coding it, and there were a lot of them”- Satoshi Nakamoto

Bitcoin’s genetic code:

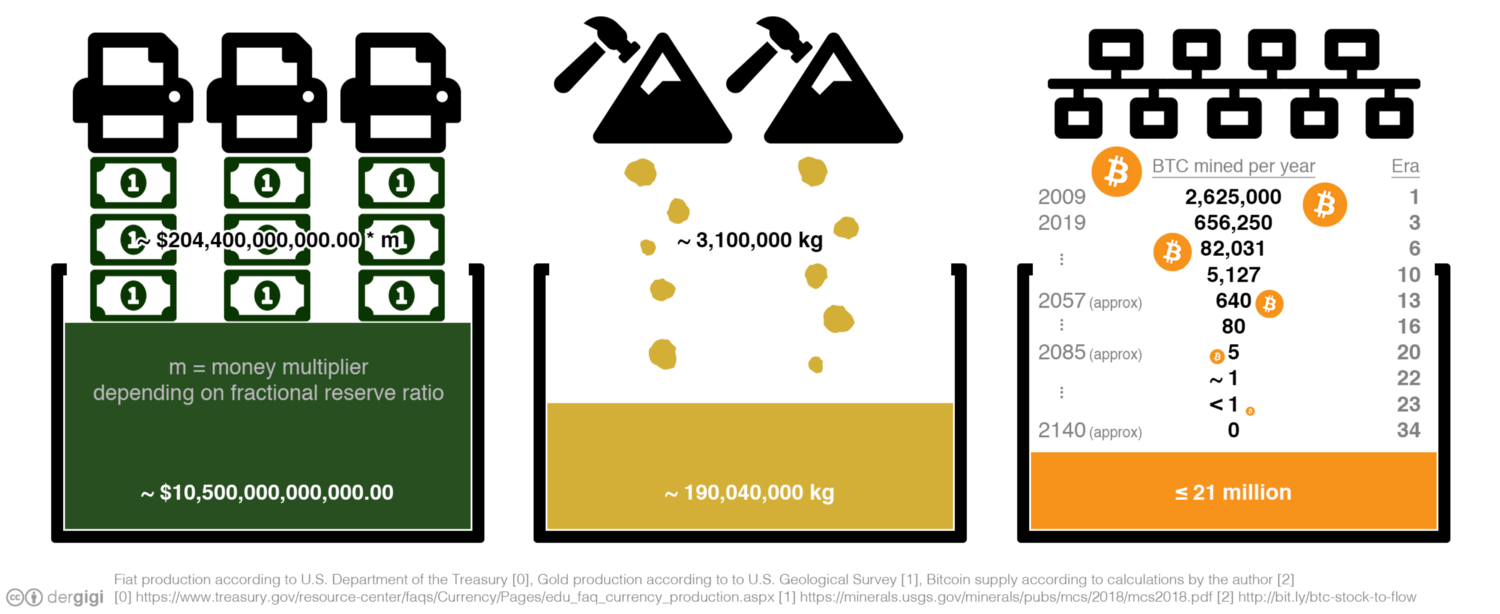

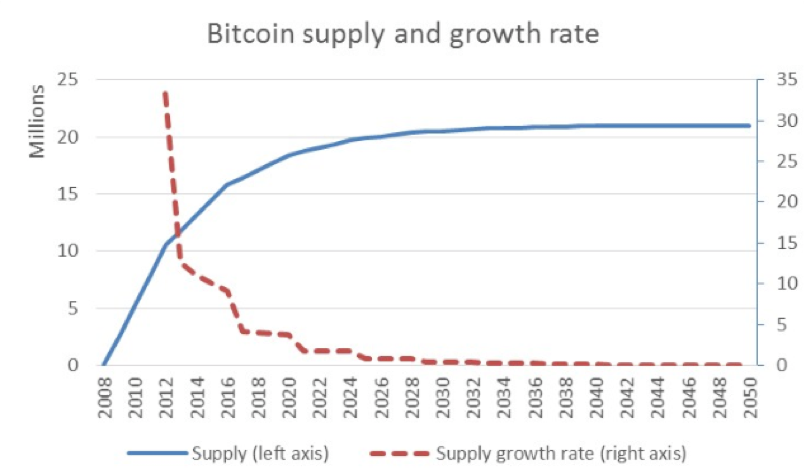

- Satoshi needed a way for the Bitcoin to spark itself into existence, so he coded in its DNA a fixed supply (21M Bitcoins). An increase in Bitcoin’s price inevitably leads to a corresponding increase in participants (users), security (mining), and developers. This becomes a self-reinforcing feedback loop.

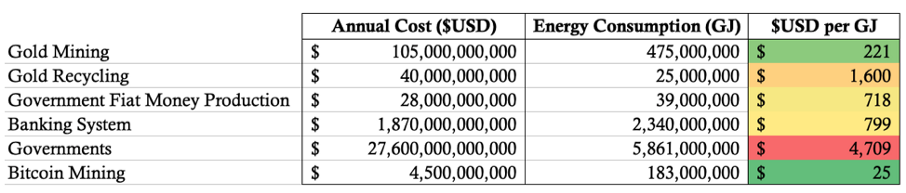

- Bitcoin’s mining function, Proof of Work (PoW) is both its metabolism and defense mechanism. Bitcoin eats energy to generate new coins and build digital walls to protect the network. PoW also makes Bitcoin anti-fragile, or in other words, as it grows larger, it becomes more resistant to attack.

- A new Bitcoin block is found every 10 minutes, this genetic code enables Bitcoin’s cells to effectively communicate and coordinate with each other despite enormous distances. It is the internal clock that sets the metabolic rate.

“It lives and breathes on the internet. It lives because it can pay people to keep it alive. It lives because it performs a useful service that people will pay it to perform. It lives because anyone, anywhere, can run a copy of its code. It lives because all the running copies are constantly talking to each other. It lives because it is radically transparent: anyone can see its code and see exactly what it does. It can’t be changed. It can’t be argued with. It can’t be tampered with. It can’t be corrupted. It can’t be stopped. It can’t even be interrupted. If nuclear war destroyed half of our planet, it would continue to live, uncorrupted.” — Ralph Merkle

Bitcoin’s genetic code manifests itself via traits (characteristics of an organism) that may or may not be visible.

Traits

In biology, a trait or character is a feature of an organism. According to Charles Darwin’s theory of evolution by natural selection, organisms that possess heritable traits that enable them to better adapt to their environment compared with other members of their species will be more likely to survive, reproduce, and pass more of their genes on to the next generation.

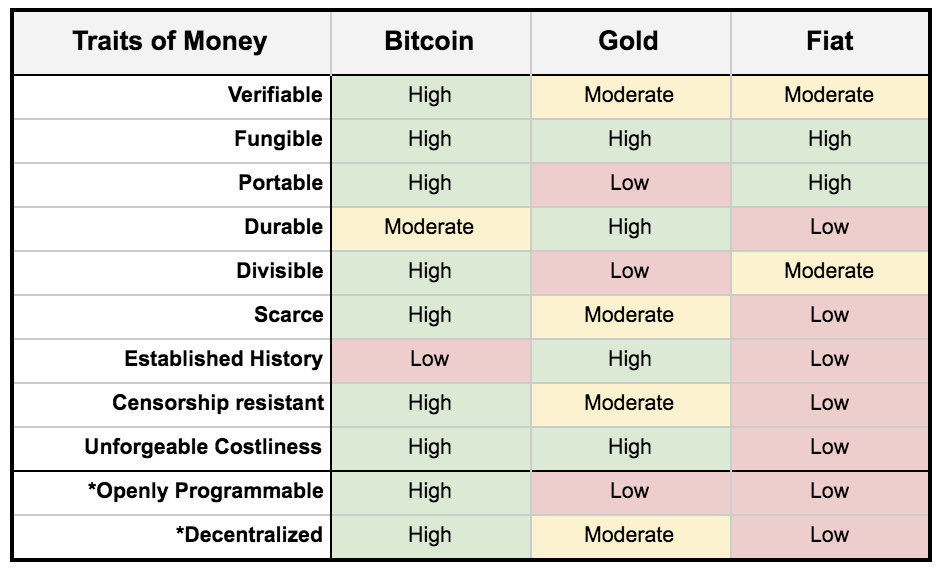

Money is no different. Money has traits that enable it to survive and thrive as a Store of Value (SoV), Medium of Exchange (MoE), and Unit of Account (UoA). Bitcoin is a new species that has vastly superior traits to its predecessors. Below we dive deeper into those traits between different species of money.

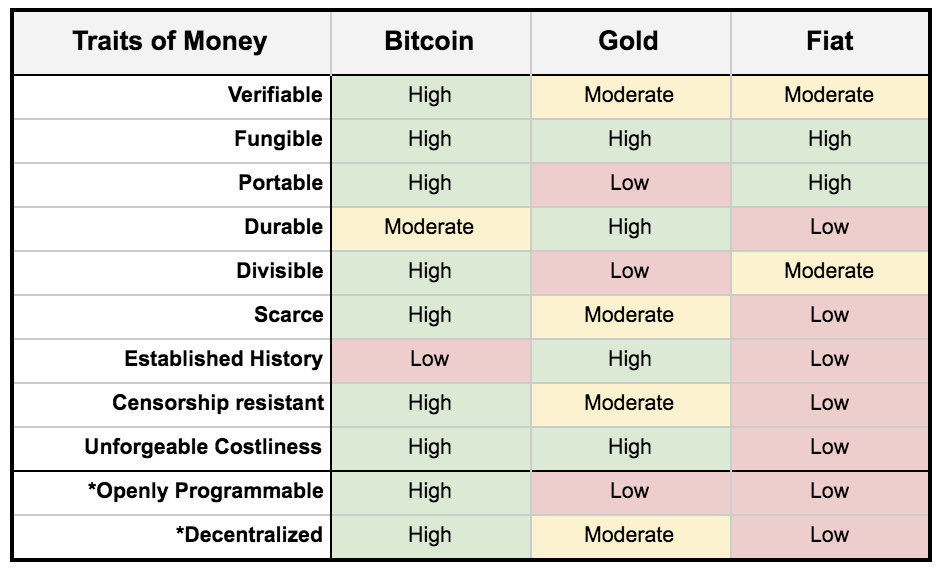

Bitcoin’s birth introduced two new traits, “Openly programmable” and “Decentralized”

Bitcoin’s birth introduced two new traits, “Openly programmable” and “Decentralized”

(The sections below, on the attributes that make for a sound money, are largely borrowed from Vijay Boyapati ’s article “ The Bullish Case for Bitcoin “)

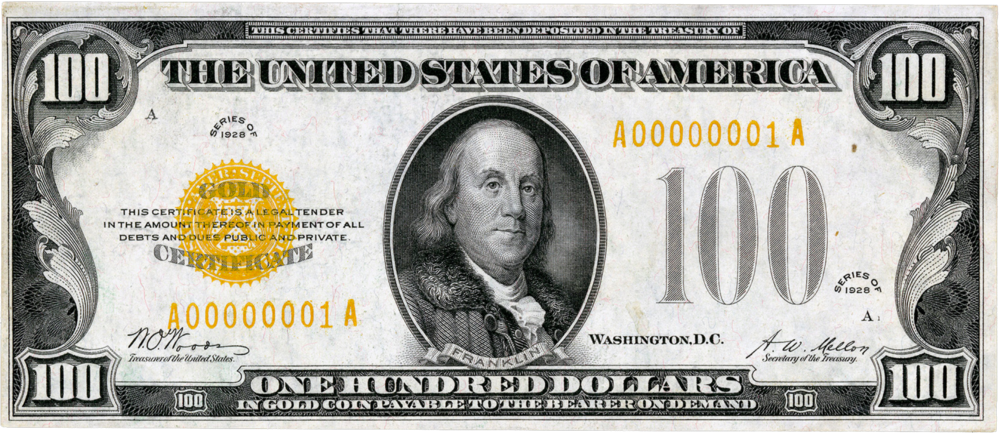

Verifiable

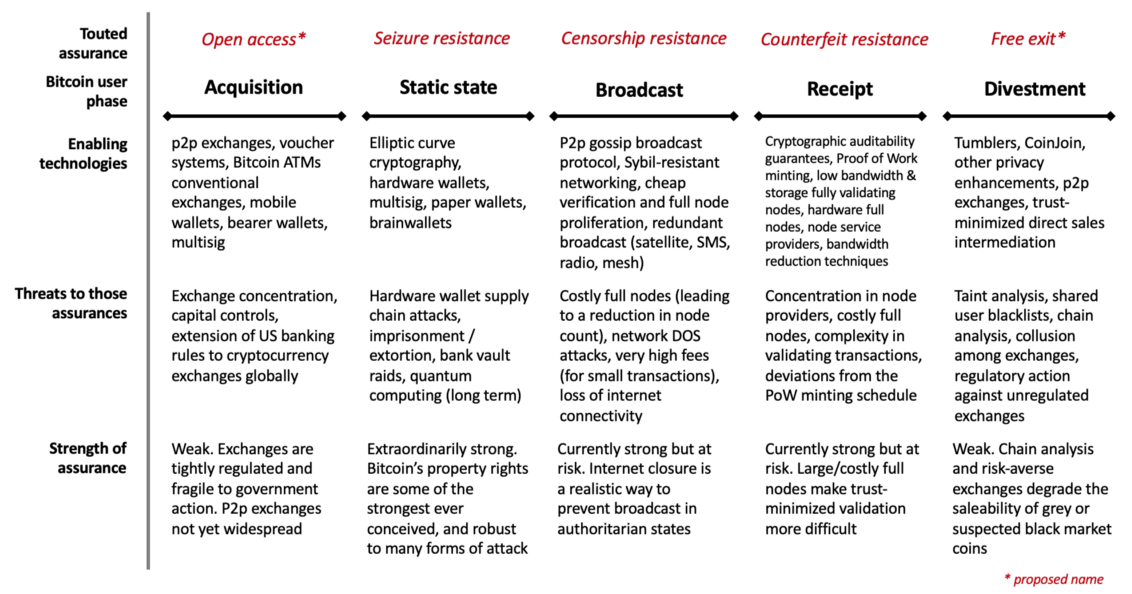

Fiat currencies and gold are fairly easy to verify for authenticity. However, despite providing features on their banknotes to prevent counterfeiting, nation-states and their citizens still face the potential to be duped by counterfeit bills. Gold is also not immune from being counterfeited. Sophisticated criminals have used gold-plated tungsten as a way of fooling gold investors into paying for false gold. Bitcoins, on the other hand, can be verified with absolute mathematical certainty.

Fungible

Gold provides the standard for fungibility. When melted down, an ounce of gold is nearly indistinguishable from any other ounce. Fiat currencies, on the other hand, are only as fungible as the issuing institutions allow them to be. While it may be the case that a fiat banknote is usually treated like any other by merchants accepting them, there are instances where large-denomination notes have been treated differently to small ones. For instance, India’s government, in an attempt to stamp out India’s untaxed gray market, completely demonetized their 500 and 1000 rupee banknotes. Bitcoins are fungible at the network level, meaning that every bitcoin, when transmitted, is treated the same on the Bitcoin network. However, because bitcoins are traceable on the blockchain, a particular bitcoin may become tainted by its use in illicit trade and merchants or exchanges may be compelled not to accept such tainted bitcoins. Despite this, there is no alternative pricing for “tainted Bitcoins” so it remains highly fungible.

Portable

Bitcoins are the most portable store of value ever used by man. A single USB stick can contain a billion dollars, easily carried anywhere, transmitted near instantly. Fiat currencies, being fundamentally digital, are also highly portable. However, governments can control the free flow of capital. Cash can be used to avoid capital controls, but then the risk of storage and cost of transportation become significant. Gold, being physical in form and incredibly dense, is by far the least portable. When bullion is transferred between a buyer and a seller it is typically only the title to the gold that is transferred, not the physical bullion itself (It cost Germany $9.1 million to repatriate their gold).

Durable

Gold is the king of durability — the vast majority of gold that has ever been mined or minted, including the gold of the Pharaohs, remains today and will for near eternity (it can only be destroyed through nuclear transmutation). While fiat currency exists both in physical and digital forms, we will only consider the durability of its digital form… the durability of the institution that issues them. Many fiat issuing governments have come and gone over the centuries, and their currencies disappeared with them. If history is a guide, it would be folly to consider fiat currencies durable in the long term — the US dollar and British Pound are relative anomalies in this regard. Bitcoins, having no issuing authority, may be considered durable so long as the network that secures them remains in place. Given that Bitcoin is still in its infancy, it is too early to draw strong conclusions about its durability. However, there are encouraging signs that the network displays a remarkable degree of “anti-fragility .”

Divisible

Bitcoins can be divided down to a hundred millionth of a bitcoin and transmitted at such infinitesimal amounts. Fiat currencies are typically divisible down to pocket change, which has little purchasing power, making fiat divisible enough in practice. Gold, while physically divisible, becomes difficult to use when divided into small enough quantities that it could be useful for lower-value day-to-day trade.

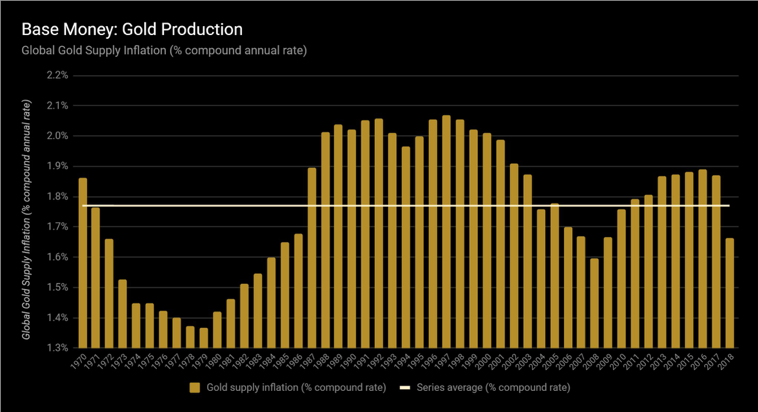

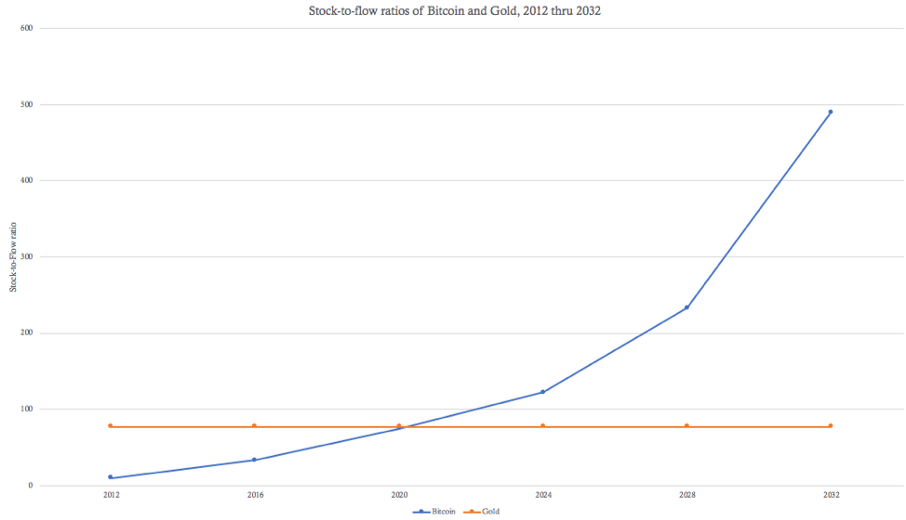

Scarce

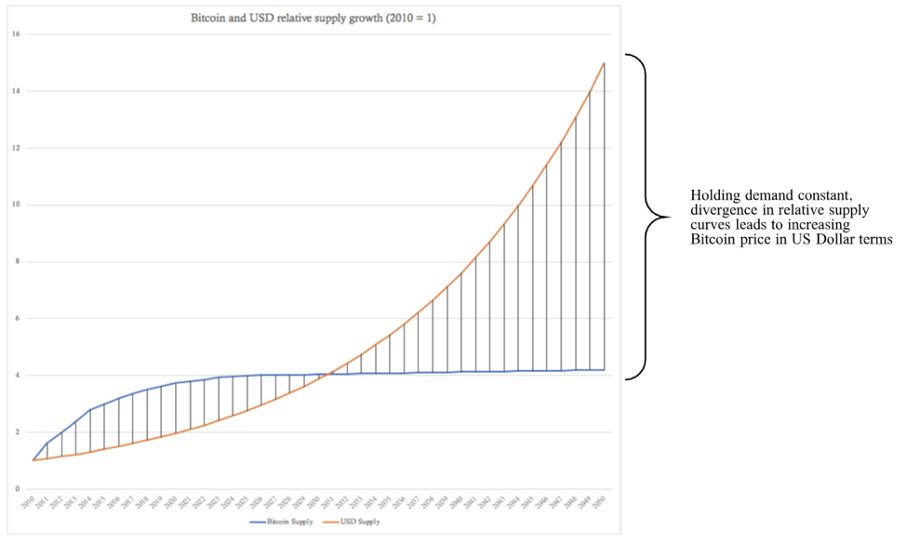

The attribute that most clearly distinguishes Bitcoin from fiat currencies and gold is its predetermined absolute scarcity: only 21 million bitcoins can ever be created (the number of units is arbitrary, as Bitcoins can be subdivided into 210 quadrillion satoshis). This gives the owner of bitcoins a known percentage of the total possible supply. Gold, while remaining quite scarce through history, is not immune to increases in supply. If it were ever the case that a new method of mining or acquiring gold became economic, the supply of gold could rise dramatically (ex: sea-floor or asteroid mining). Finally, fiat currencies, while only a relatively recent invention of history, have proven to be prone to constant increases in supply. Nation-states have shown a persistent proclivity to inflate their money supply to solve short-term political problems.

Established history

No monetary good has a history as long and storied as gold, which has been valued for as long as human civilization has existed. Coins minted in the distant days of antiquity still maintain significant value today . The same cannot be said of fiat currencies, which are a relatively recent anomaly of history. From their inception, fiat currencies have had a near-universal tendency toward eventual worthlessness. The use of inflation as an insidious means of invisibly taxing a citizenry has been a temptation that no states in history have been able to resist. Bitcoin, despite its short existence, has weathered enough trials in the market that there is a high likelihood it will not vanish as a valued asset any time soon. Furthermore, the Lindy effect suggests that the longer Bitcoin remains in existence the greater society’s confidence that it will continue to exist long into the future. The median age of a human is ~30 years old, which means Bitcoin has been around for nearly 33.3% of the average human life. If Bitcoin exists for 20 years, there will be near-universal confidence that it will be available forever, much as people believe the Internet is a permanent feature of the modern world.

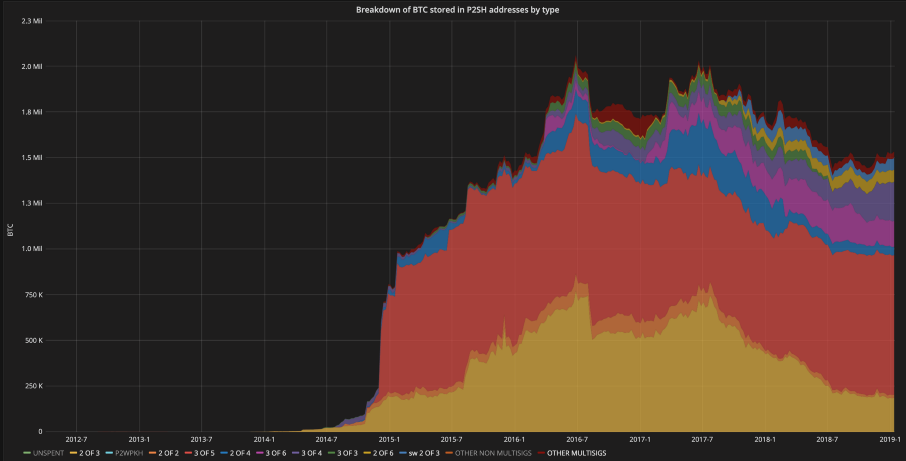

Censorship resistant

One of the most significant sources of early demand for bitcoins was their use in the illicit drug trade. Silk Road was a testament to this resistance. The key attribute that makes Bitcoin valuable for proscribed activities is that it is “permissionless” at the network level. When bitcoins are transmitted on the Bitcoin network, there is no human intervention deciding whether the transaction should be allowed. As a distributed peer-to-peer network, Bitcoin is, by its very nature, designed to be censorship-resistant. This is in stark contrast to the fiat banking system, where states regulate banks and the other gatekeepers of money transmission to report and prevent outlawed uses of monetary goods. A classic example of regulated money transmission is capital controls. A wealthy millionaire, for instance, may find it very hard to transfer their wealth to a new domicile if they wish to flee an oppressive regime (Russian assets in the UK being frozen). Although gold is not issued by states, its physical nature makes it difficult to transmit at distance, making it far more susceptible to state regulation than Bitcoin. India’s Gold Control Act is an example of such regulation. If your mission is to disrupt central banks, you need to have sovereign level censorship resistance.

“Bitcoin’s advantages lie not in its speed, convenience, or friendly user experience. Bitcoin’s value comes from it having an immutable monetary policy precisely because nobody can easily change it” — Saifedean Ammous

Unforgeable Costliness

Money that is costly to create. Due either to its original cost (gold mining) or the improbability of its history (art) — and that it is difficult to fake this costliness. Bitcoin’s PoW ensures the cost to mine a Bitcoin is near equivalent to how much it would cost to purchase one on an exchange. The unforgeable costliness pattern includes the following basic steps:

“(1) find or create a class of objects that is highly improbable, takes much effort to make, or both, and such that the measure of their costliness can be verified by other parties.

(2) use the objects to enable a protocol or institution to cross trust boundaries”

- Nick Szabo

Openly Programmable

Bitcoin is open-source; its design is public, it is usable by anyone/anywhere/anytime. Developers can freely program applications on top of the Bitcoin protocol without having to ask anyone for permission.

“It is dynamic, upgradable and extendable. It does not need throwing out and replacing with each new iteration, it will continuously improve.” — Neil Woodfine

Decentralized

In it’s simplest definition, decentralization means a lack of centralized control. Or the degree to which an entity within the system can resist coercion and still function as part of the system. Coercion doesn’t necessarily mean force, it means negative incentives to align with an authority. Decentralization is an important trait for money because any centralized control could threaten any one of the other traits (especially scarcity and censorship resistance)

Decentralization is also important because it enables greater social scalability . The challenge is that natural systems inherently evolve towards centralization (hierarchies). We see this emergent property in cryptocurrencies as well. Hierarchy is an emergent property of networks. When we consider more complex systems, we must contend with more complex relationships between the layers. Quantifying decentralization is an especially thorny issue.

Decentralization is such a misunderstood concept, because people apply it to a whole system, when really it needs to be applied to multiple layers within the system: The Protocol, The Politics and The Practical. — Sarah Lewis

Evolution

For a species of money to survive, it needs to be competitive on every attribute and be exceptionally better on a few of them. Attributes don’t sum, they multiply.

When Gold was first introduced, the bead makers (an example of a more primitive form of money) probably tried to convince the ignorant population that gold was no substitute for beads. But it turned out that gold had traits that were more advantageous. It did not matter what anyone thought. Gold was destined to be a more powerful currency than shells or beads.

The fact that gold has remained a valued commodity for thousands of years speaks to the importance of these specific traits. In fact, the combination of traits possessed by gold and other precious metals eventually provided the foundation for the next evolution in money, fiat currency. In money’s next evolution of species, fiat currency fulfilled several critical traits to an even greater degree than gold. Paper was more portable and could be more easily transacted. That is not to say it was entirely superior. In many cases, fiat currencies lacked durability, and as we will see, would eventually become less and less scarce (due to inflation) The critical flaw: its supply was controlled by kings and governments and increasingly used as a tool to wield power and control. Upon every new iteration of species, they each evolve in the following four stages (taken from “The Bullish Case for Bitcoin”):

- Collectible. In the very first stage of its evolution, money will be demanded solely based on its peculiar properties, usually becoming a whimsy of its possessor. Shells, beads and gold were all collectibles before later transitioning to the more familiar roles of money.

- Store of value: Once it is demanded by enough people for its peculiarities, money will be recognized as a means of keeping and storing value over time. As a good becomes more widely recognized as a suitable store of value, its purchasing power will rise as more people demand it for this purpose. The purchasing power of a store of value will eventually plateau when it is widely held and the influx of new people desiring it as a store of value dwindles.

- Medium of exchange: When money is fully established as a store of value, its purchasing power will stabilize. Having stabilized in purchasing power, the opportunity cost of using money to complete trades will diminish to a level where it is suitable for use as a medium of exchange.

- Unit of account. When money is widely used as a medium of exchange, goods will be priced in terms of it. I.e., the exchange ratio against money will be available for most goods.

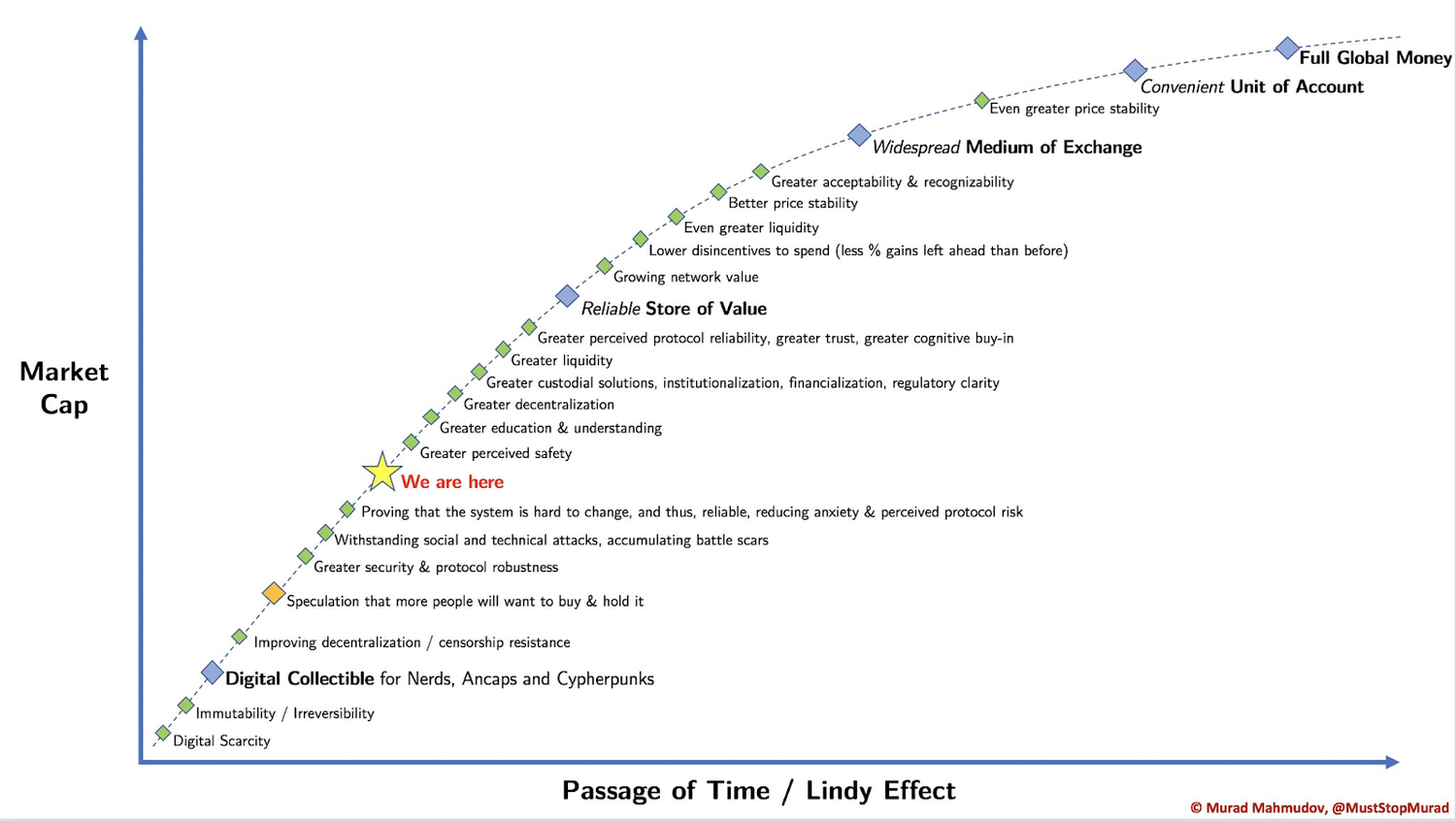

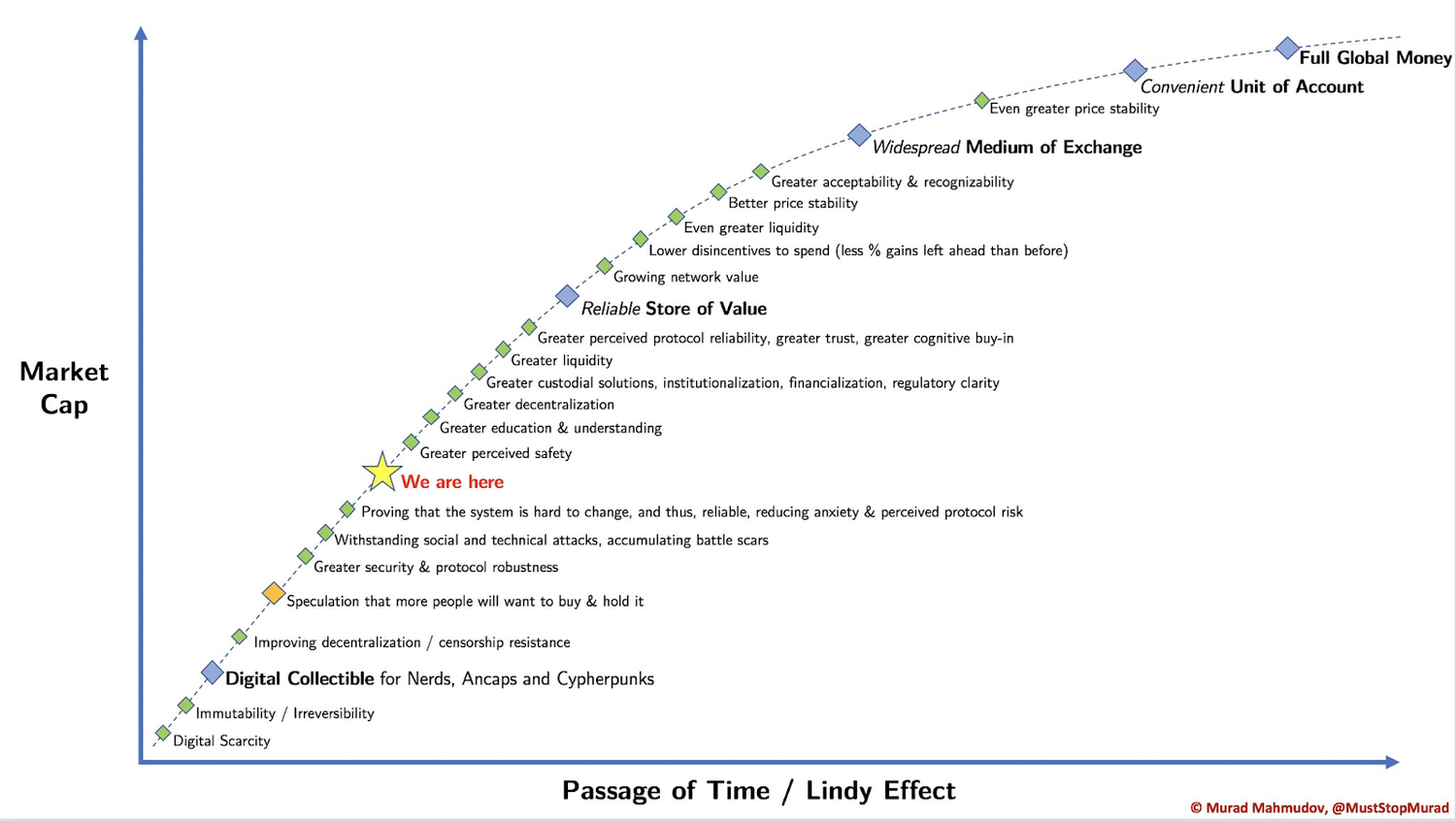

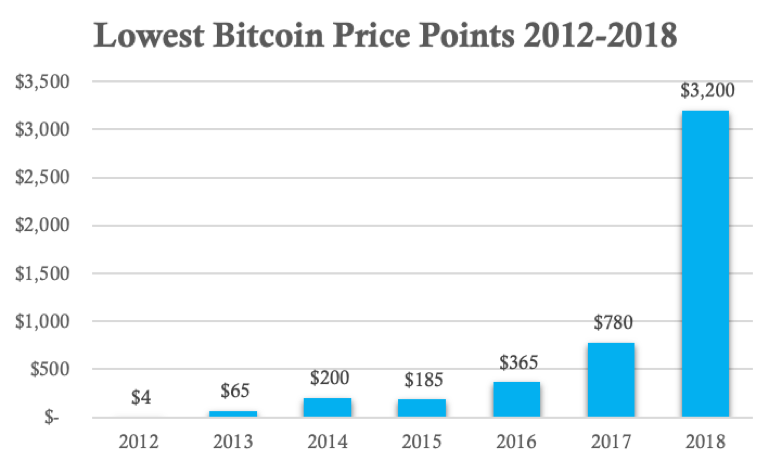

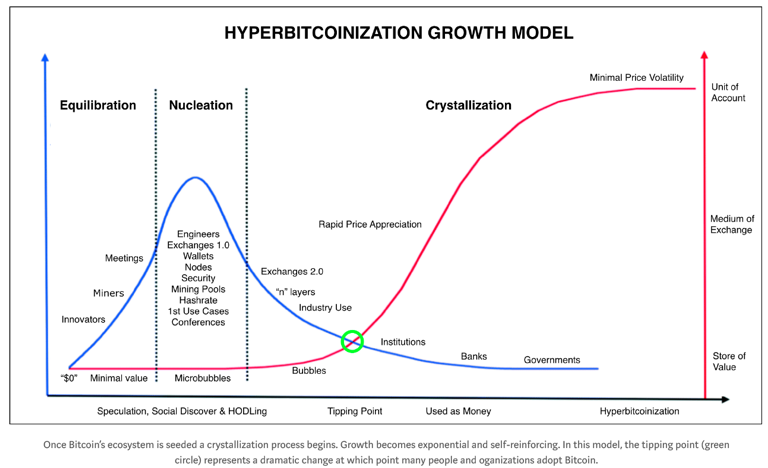

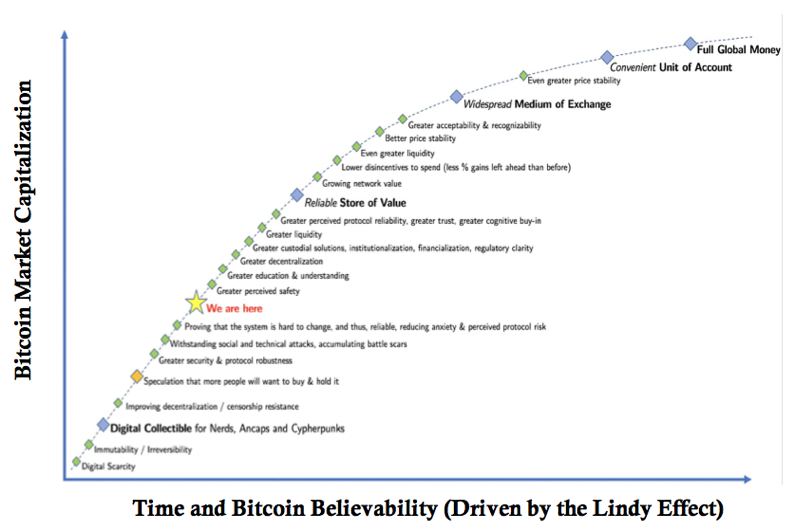

Bitcoin’s stage in the evolutionary process is shown below, provided by Murad Mahmudov

Bitcoin’s stage in the evolutionary process is shown below, provided by Murad Mahmudov

Bitcoin’s stage in the evolutionary process is shown below, provided by Murad Mahmudov

Survival and Extinction

Extinction can most simply be described as the failure of a species to compete in an environment to such at a degree that it eventually ceases to exist. The inability to compete itself may be the result of two primary causes; increased competition from superior species or a dramatic change in environment.

“Charles Darwin’s theory of natural selection originated to provide an evidence-based explanation of the past. We now leverage this theory to look forward and understand its implications on the future of currency. Given the ever-changing conditions of the future, will gold and fiat currencies continue to compete or go the way of the dinosaur?” — Ryan Walker “On the Origins of Money: Darwin and the Evolution of Cryptocurrency”

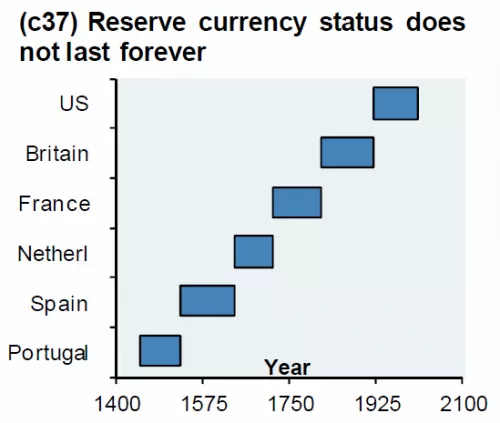

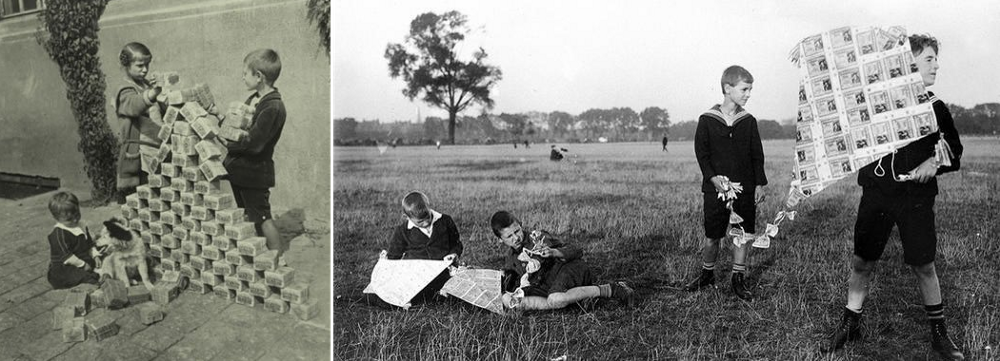

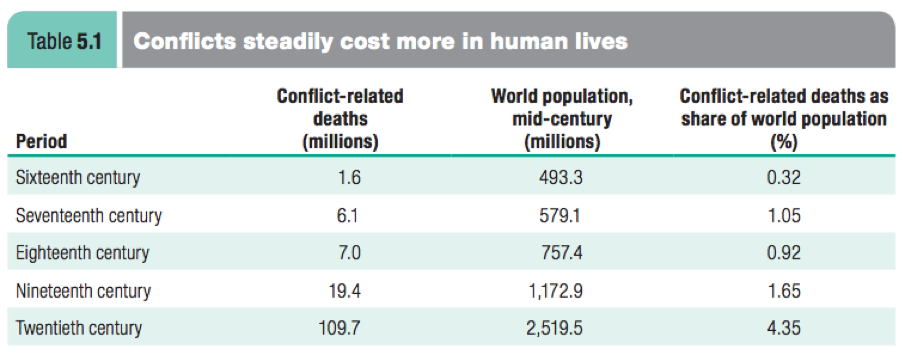

According to a study of 775 fiat currencies by DollarDaze.org the average life expectancy of a fiat currency is 27 years. The study also indicated the most common causes of any given currencies extinction are hyperinflation, monetary reform, war and independence. Looking towards the fittest of fiat currencies, those that become reserve currencies, we find that most last just under 100 years. (Note: US currency only starts from 1933 because USD was redeemable for gold prior to that)

JPM, Hong Kong Monetary Authority, December 2011

JPM, Hong Kong Monetary Authority, December 2011

With fiat currencies being so susceptible to failure, gold has long served as an alternative as it is more scarce and durable. In terms of scarcity, fiat currencies can be printed and inflated at the will of their authorities.

“While Bitcoin is a new invention of the digital age, the problems it purports to solve — namely, providing a form of money that is under the full command of its owner and likely to hold its value in the long run — are as old as human society itself” — Saifedean Ammous

The currencies are in a state of hyper-evolution as they continue to take on a varied array of distinctive traits that set them apart from one another within their own competitive ecosystem (fiat/crypto).

Equally as threatening to traditional forms of money, the conditions of the environment in which currencies compete is in a constant state of change. Undertones of growing distrust in centralized entities encourage populations to consider alternative stores of value.

Sovereignty, once a trait that was necessary for the survival of a currency, may now be falling out of favor. Centralized failures such as the US financial crisis of 2008 or hyper-inflated fiat currencies such as Zimbabwe dollars or Argentinian pesos compound these sentiments. The most profound of these conditions is the growing awareness throughout the world that decentralized trust is possible.

Instead of becoming anti-fragile, which is the property of growing stronger in a volatile and stressful environment, central banks have removed danger and mortality from failure, which causes competition to stagnate or degrade.

Sometimes stressors are so strong that they are fatal for a species of money. While this is devastating for the money itself, the population comprised of those that survive are fitter on average. This isn’t because any of the survivors grew stronger from the stress, but simply because the weaker monies were removed.

“We humans regularly underestimate high-impact, long-tail events . Careful consideration of long tail events is especially important in the design of a protocol that has the potential to become the backbone of the global economy” — Hugo Nguyen

It is interesting to imagine what Charles Darwin would make of the current state of money. History would have us believe that the existence and survival of any entity, be it plant, animal, corporation, or money is subject to the laws of natural selection.

With this understanding, it is hard to imagine Darwin contesting the opinion that Bitcoin possesses the necessary traits to become the dominant species of money.

Bitcoin has been perfectly honed for its environment through its exceptional genetic code and the manifestation of that code in the form of superior traits.

Bitcoin is the apex predator of money and is constantly evolving. None of the previous monetary life forms stand a chance.

Bitcoin: Winner Takes Most or Winner Takes All?

Exploring market share capture in cryptocurrencies

By Misir Mahmudov and Yassine Elmandjra

Posted January 7, 2019

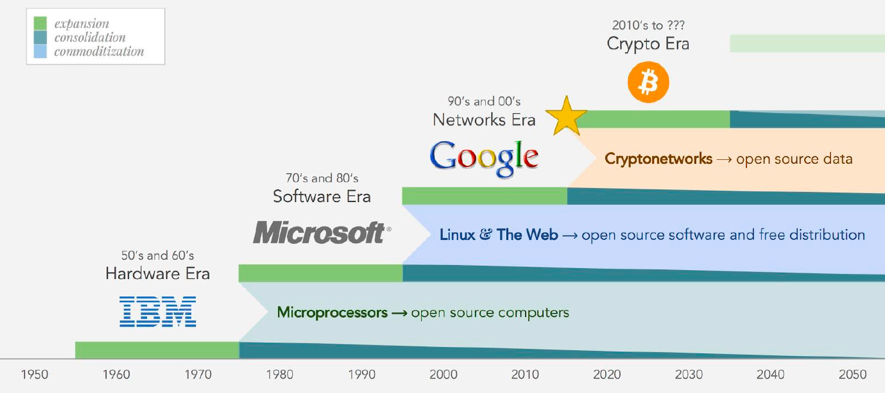

This series will explore how the winner-takes-all or winner-takes-most notion applies to the cryptocurrency market. In Part I, we will provide a high-level overview on the evolution of monetary systems up to the inception of cryptocurrencies, shedding light on the limitations of previous forms of money. In Part II, we will explain why the clear winner, likely Bitcoin, should capture most, if not all cryptocurrency market share. In Part III, we will apply this reasoning to the global economy and determine the extent to which the cryptocurrency market may capture a share of global base money.

Part I: The Quest for a Global Money

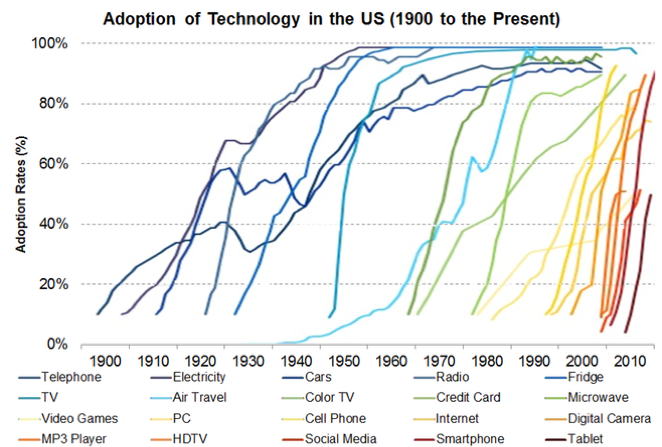

Before the rise of any universal monetary standards, barter was a common means of direct exchange. Subject to the problem of coincidence of wants, civilization came to understand the impracticability of barter. In an attempt to provide a solution to this impracticality, indirect exchange emerged and was made possible with intermediary goods such as seashells, glass beads, and cattle. Over time, modern technologies (like mass utilization of hydrocarbon fuel energy and importation) considerably advanced manufacturing and transportation, making the world increasingly connected. Exploration and intercontinental trade became more prevalent, and the standard traits of money evolved to accommodate a more global context. This ultimately undermined existing media of exchange, as the lack of absolute scarcity and low costs of production could not provide money guarantees and were exploited by increasingly advanced technologies. Specifically, outside groups learned how to easily reproduce region-specific forms of money. Unaware of the absolute abundance of their money, nations suffered severe wealth dilution. [1]

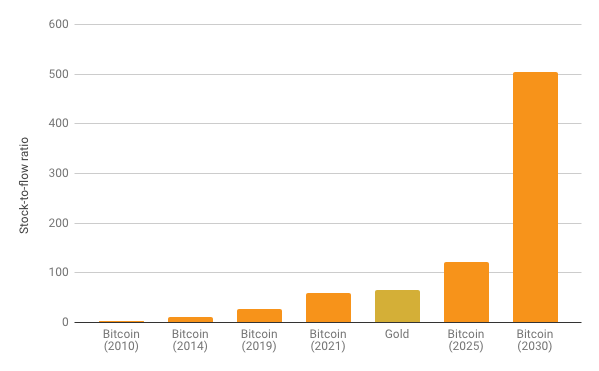

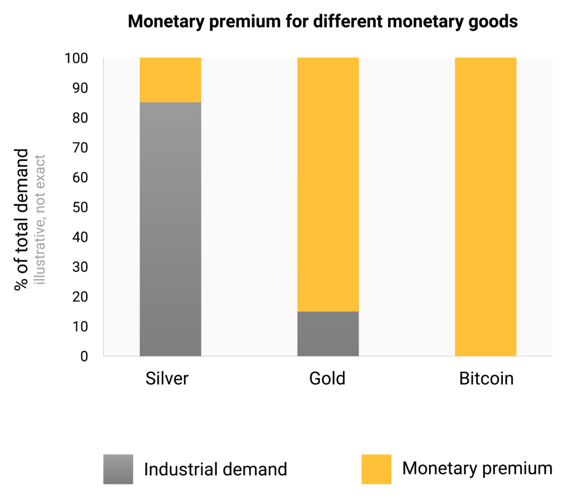

As the limitations in existing forms of money began to manifest, specific properties of monetary goods emerged that better fulfilled money’s store of value and medium of exchange functionalities, including scarcity, durability, portability, fungibility, verifiability, divisibility, and established history. Through a process of monetary natural selection, goods competed with each other based on these demanded attributes and in the 19th century, the world converged to gold as the global monetary standard.

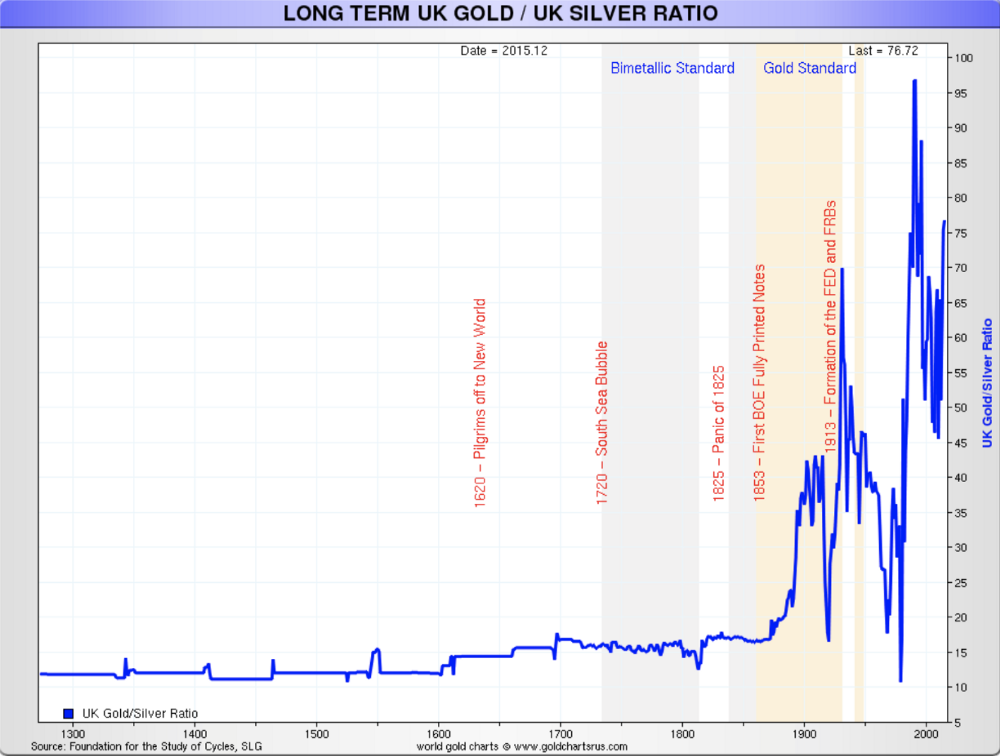

With the rise of gold, other forms of commodity money took form. Silver as a money was popularized because of the high costs associated with using gold in day-to-day trade. Silver’s lower value per unit weight relative to gold made it easier to use for smaller transactions. [2] For centuries, the gold to silver ratio remained between 12 and 15 and was recognized as the bimetallic standard. But this bimetallic standard ended up as nothing but a temporary phenomenon adopted to overcome insufficient technology. With the introduction of paper money backed by gold, which gave people the ability to trade any amount of value represented in gold terms, silver’s monetary role was subsequently reduced. The graph below shows how rapidly the gold to silver ratio soared after the popularization of paper money.

Gold / Silver Ratio https://www.goldbroker.com/news/gold-and-silver-correlation-988

Gold / Silver Ratio https://www.goldbroker.com/news/gold-and-silver-correlation-988

Through financialization, gold’s limitations to serve as a global money began to surface. In particular, gold’s physical nature and high value per unit weight made it vulnerable to centralization and its detrimental effects. With gold’s lack of portability and the high friction in using a scale to measure the amount of gold in every transaction, the state intervened to establish standardized units by minting (coining) gold coins. As citizens got acclimated with the conferred legitimacy and the infrastructure built around standardized units, the state felt comfortable engaging with what is known as ‘coin clipping’, a form of debasement whereby jurisdictions would reduce the content of gold in a coin and use the excess gold to finance expenditure at the cost of citizens.

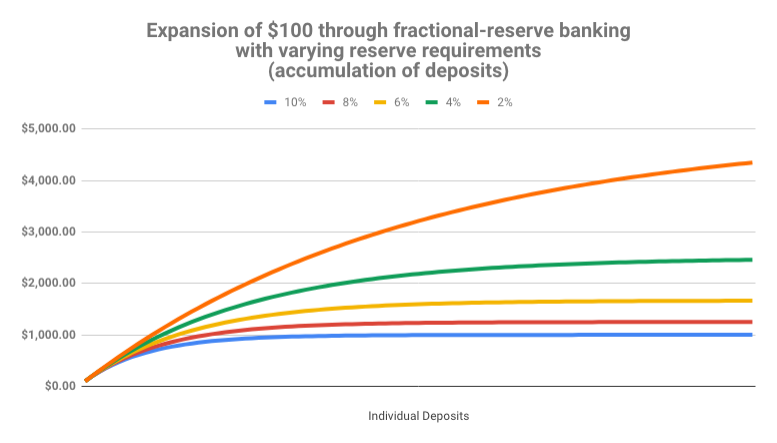

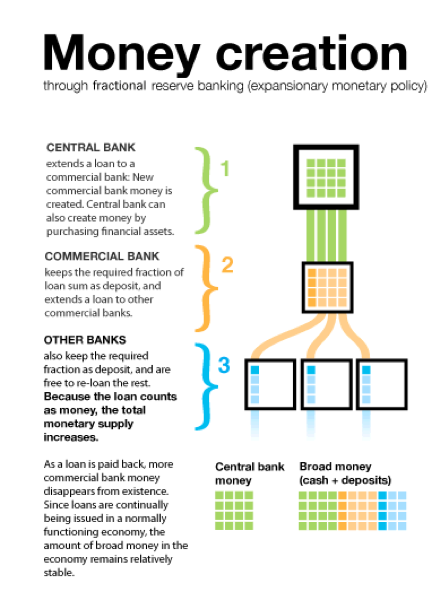

Later, goldsmiths, who provided services for custodying precious metals, introduced promissory notes (IOUs) that were redeemable for metals. These notes (paper money) eventually became commonly used in exchange. The goldsmiths understood that they could lend out more notes than gold they had stored in their vaults because people were unlikely to simultaneously redeem their gold reserves. This practice became known as fractional reserve banking. Goldsmiths, which later became banks, issued receipts in excess of the represented metal and generated massive profits as a result.

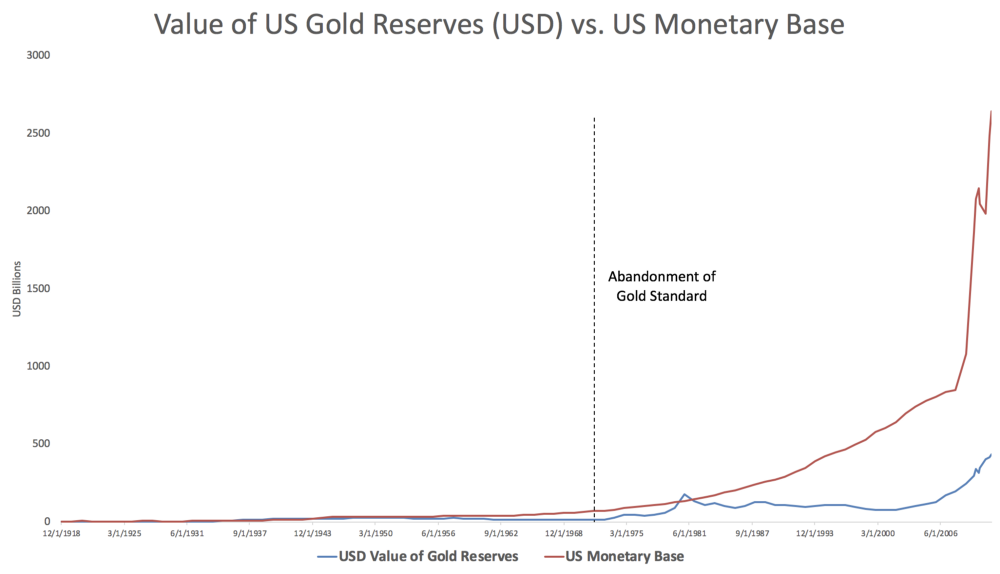

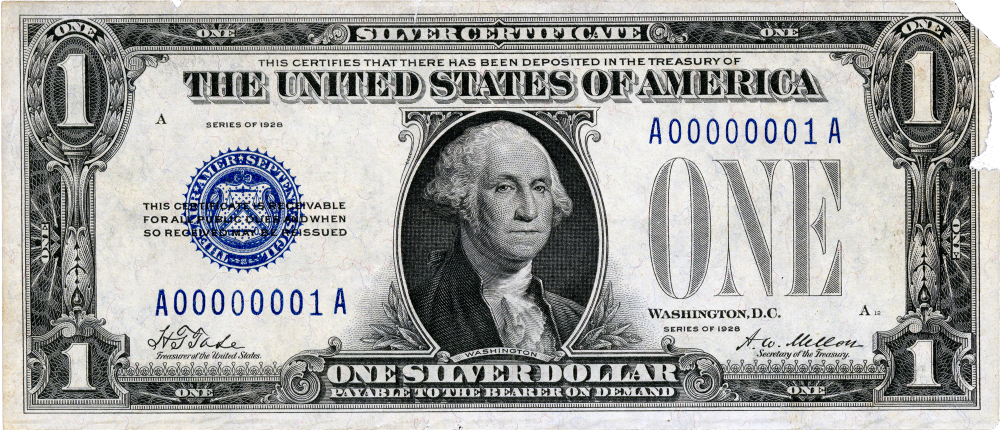

The 18th and the 19th centuries saw the formalization of the Gold Standard as the proliferation of banknotes and the less sound nature of silver made itself known. The Gold Standard was a monetary system whereby a country’s monetary supply was directly linked to the value of its gold reserves, putting a cap on a nation’s ability to inflate supply. By the 20th century, states began exploiting the limitations of gold and abusing the practice of fractional reserve banking, ultimately removing its viability as a global money. The US was able to centralize gold reserves, often forcefully confiscating gold from its citizens, [3] and began printing money in excess of their underlying reserves. Instead of attempting to redeem themselves, the US under Richard Nixon cancelled the convertibility of the dollar into gold and officially abandoned the Gold Standard in 1971. Ties between gold and paper money were in turn severed, marking the beginnings of fully unbacked fiat currencies. Below is a chart of the US monetary base expansion relative to the value of US gold reserves.

Currencies… Currencies Everywhere.

Today, there exists over 180 currencies across 195 countries. The reason for such an anomaly is simple: there is no free market for currencies. Currency markets have been restricted by governments in order to maintain financial control. There are numerous laws and institutions set up for the exact purpose of inhibiting a free market monetary system. This includes enforced borders, legal tender laws, capital controls, state decrees, seigniorage privileges, local control, local monopolies on violence, debt extinguishing laws, capital gains taxes, implicit bailout guarantees for banks, central banks and dozens of other artificial barriers. This type of legislation forces people around the world to keep using inferior currencies under the threat of direct or indirect violence or repercussions. The centralized nature of the financial system and flows allows governments and institutions to impose these restrictions and greatly limit people’s ability to express their true demand for superior, more competitive currencies. Fiat money’s soundness is now dependent on an authority’s ability to enforce legitimate monetary policy. People living in countries like Venezuela are unable to reliably store their wealth due to hyperinflation induced by irresponsible monetary policy and limited availability of more reliable currencies due to strict capital controls. In addition, as the only form of legal tender, citizens are obliged to pay taxes in and accept the inferior currency in exchange for goods and services. The more competitive currencies, like the dollar, that do make their way into countries like Venezuela, are sold at large premiums as the high demand is not met by the controlled supply. Until recently, citizens of countries like Venezuela had no way to opt out of this system and were forced to adopt easy money.

The government’s control of money has made it vulnerable to gross mismanagement. In an interview in 1984, Friedrich Hayek famously said: “I don’t believe we shall ever have a good money again before we take the thing out of the hands of government. We can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” And, in Free Market Monetary System , Friedrich Hayek notes that “ the monopoly of government of issuing money has not only deprived us of good money but has also deprived us of the only process by which we can find out what would be good money. We do not even quite know what exact qualities we want … because we have never been allowed to experiment with it. We have never been given a chance to find out what the best kind of money would be.”