| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the March 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

Bitcoin Timestamp Security

Jameson Lopp

Posted March 3, 2019

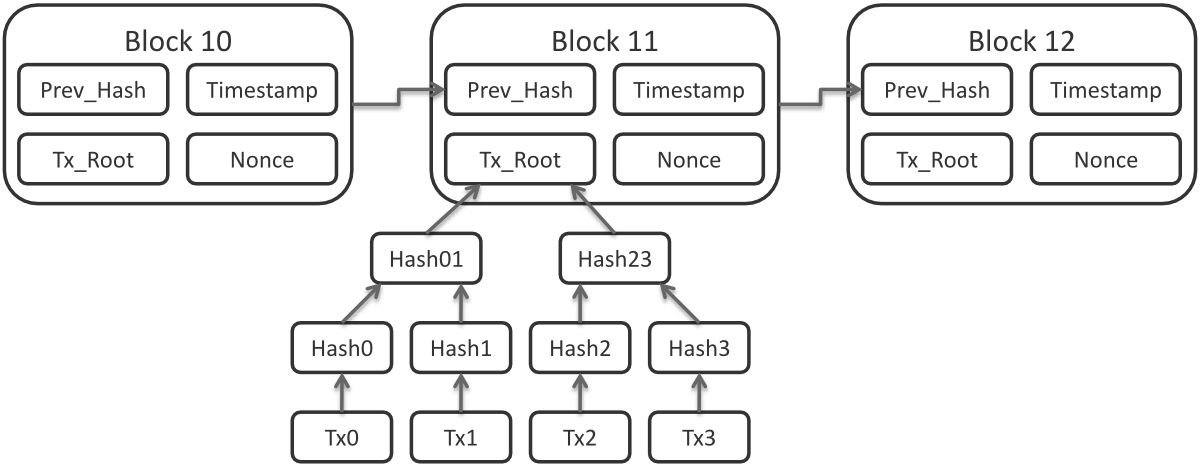

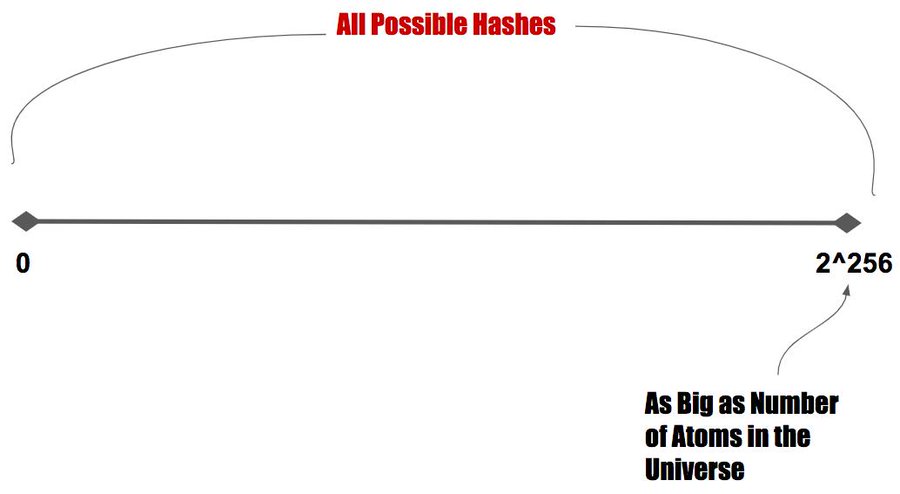

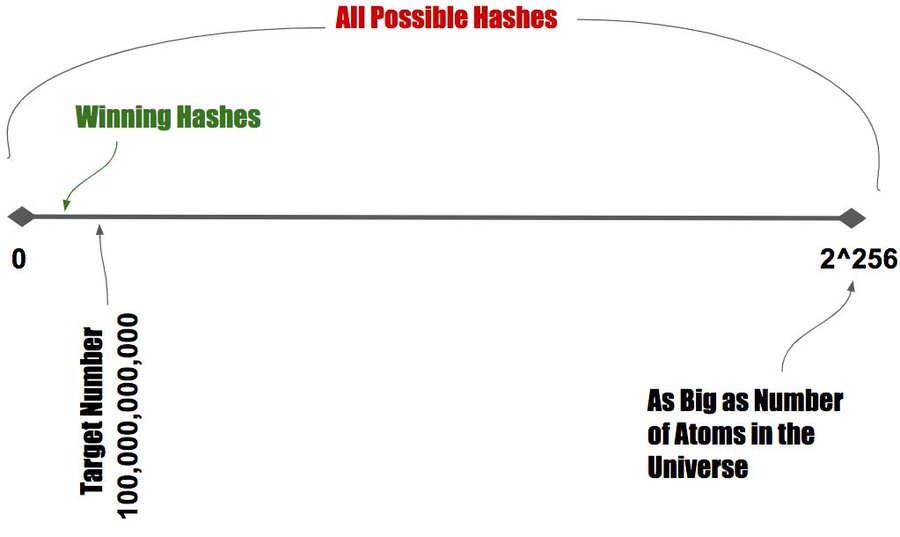

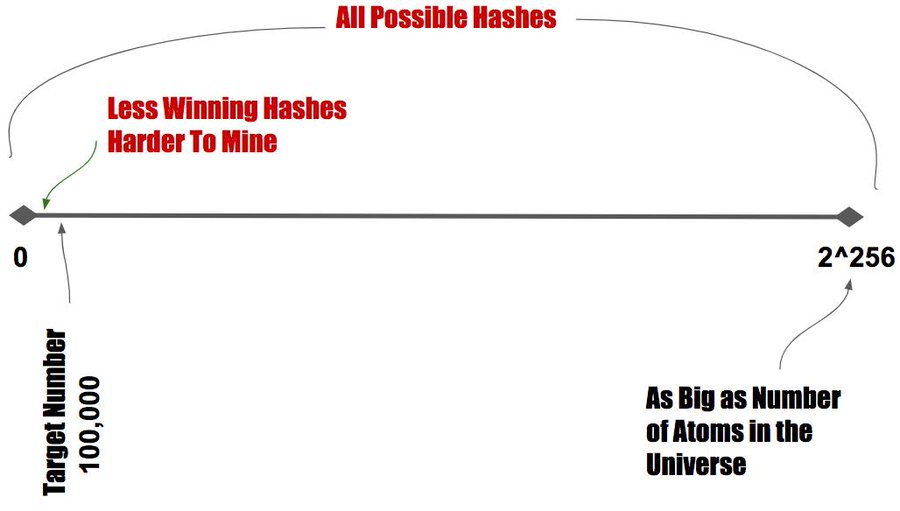

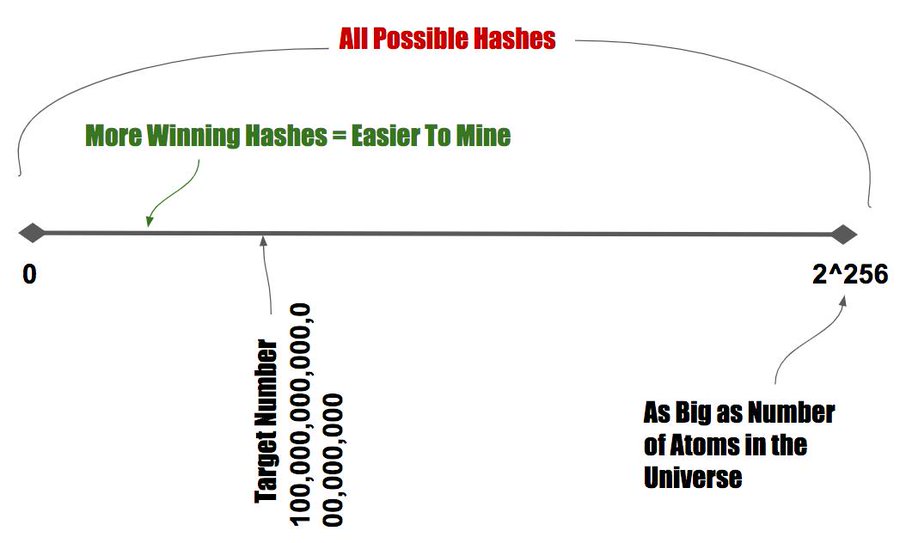

Bitcoin is often referred to as a secure timestamping service. We never had a global record of truth with trustworthy timestamps, so how did this come about? It’s generally due to Proof of Work being combined to a few simple rules by which miners must abide. The primary functions of miners are to:

- Take unordered unconfirmed transactions and put them in a specific order

- Bundle up the transactions into a valid container (block)

- Timestamp the block within an acceptable range of time

This final attribute is what enables Bitcoin to have a controlled release of the supply of bitcoins. Otherwise Bitcoin would suffer from rapid inflation whenever the hashrate increased. But it turns out that this attribute assigns quite a bit of utility to the Bitcoin protocol and also makes it possible for folks to use Bitcoin as a data anchor for other services. Because we have reasonably strong assurances that timestamps fall within a given range and we have mathematical assurance of the amount of energy required to rewrite the blockchain history, Bitcoin provides a sound anchor for timestamping of data. But how reliable is it?

Bitcoin’s Timestamp Flexibility

In order for the time field of a block header to be considered valid by nodes it must meet two criteria:

- Be less than 2 hours in the future from your computer’s current time

- Be greater than the median timestamp of the past 11 blocks

The first rule makes sense — we obviously don’t want anyone claiming to be from the future and it’s very easy for nodes to reject such claims because we’re all in general agreement about what time it currently is. There are a variety of ways that one can check the current time, though a very popular means of computers syncing their clocks is via the Network Time Protocol.

However, ensuring that the time isn’t too far before a sensible point is harder. This is because we can’t assume that a node is validating the block anywhere near the time it is initially created. Nodes need to be able to leave and rejoin the network for any reason or no reason. A node that was too far behind the tip of the chain would start rejecting historical blocks if they had to be created within a few hours of the current time.

“Nodes can leave and rejoin the network at will, accepting the proof-of-work chain as proof of what happened while they were gone.” — Satoshi Nakamoto, Bitcoin Whitepaper

Perhaps counterintuitively, there is no rule requiring that a block’s timestamp has to be after the timestamp of the previous block. If you think about it, such a rule could cause problems — if a miner created a block with a timestamp nearly 2 hours in the future, the next block would also have to be far in the future — it would be harder for other miners to self-correct the median time of the past 11 blocks.

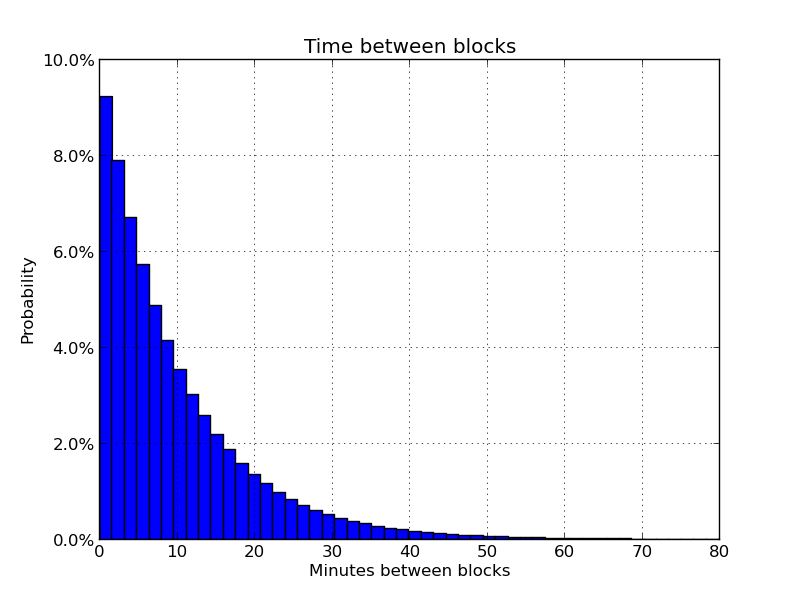

Also, recall that while blocks are expected to be produced about every 10 minutes, there is no real guarantee. Blocks could range from anywhere from several milliseconds to several hours apart. While the expected median time of the past 11 blocks should be 1 hour ago, it could be far more or far less.

Source: https://en.bitcoin.it/wiki/Confirmation

Source: https://en.bitcoin.it/wiki/Confirmation

Pushing the Window

If you think about how an adversary might try to expand the acceptable timestamp window, it’s pretty clear that no adversary will be able to push the timestamps to be more than 2 hours in the future, no matter how much hashpower they have. However, an attacker with sufficient hashpower could put some drag on the progression of “bitcoin time” by only minting blocks with timestamps that are barely valid — that are just one second after the median time of the past 11 blocks.

Are there incentives to do this? In the extreme case a “time warp attack” offers short term financial incentives that we’ll discuss later. It’s less clear what incentives may exist for only dragging the timestamps by a few hours here and there. Though considering that other protocols can be built on top of Bitcoin (such as Lightning Network) and can involve time locks, there could be other protocols in the future that can be gamed by slowing the progression of timestamps on the blockchain.

Hashpower Time Dragging

Since the earliest valid block time is based upon the median time of the past 11 blocks, an adversarial miner needs to generate a lot of blocks in order to induce any noticeable drag on the MTP.

Let’s assume a situation where all miners are roughly in sync via NTP but there is one adversarial miner who is trying to drag the median time of the past 11 blocks as much as possible.

One point is quite clear: it was a smart decision by Satoshi to use the median timestamp of the past 11 blocks rather than the average, as average would be more manipulable. Another way to think of “median time past” is that it basically means the timestamp of the 6th most recent block if all of the timestamps are in order. If they aren’t, the algorithm just re-orders them. As such, if you want to have a non-negligible effect on this value you need to have solved 6 of the past 11 blocks. In order to sustain such an attack you’d need 55% hashpower, at which point one of the main assumptions of Bitcoin’s thermodynamic security breaks down. But a miner with less hashpower could still achieve this on occasion if they have a streak of luck.

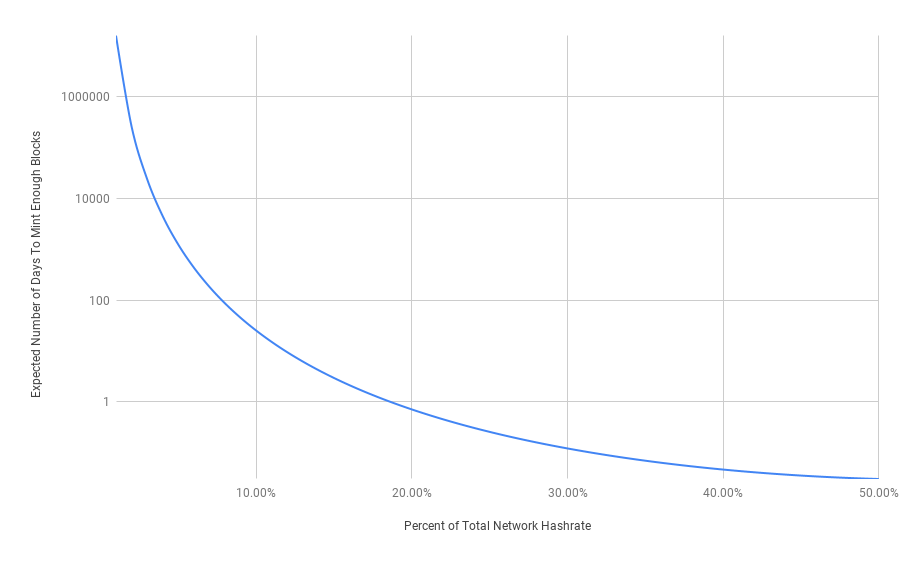

How hard is it to find 6 out of 11 blocks? Well, the chance that a given miner will solve the next block is basically the same as their percentage of the total network hashrate. Thus, if you only have 1% of the hashrate (which is still quite a lot) then your chance of minting 6 out of any 11 contiguous blocks = (0.01⁶0.99⁵)( 11!/(5!6!)) = about one in 2 billion. If you maintained 1% of the hashrate then the expected number of blocks that would need to occur before you found 6 out of 11 would be over 43,000 years.

A more generalized formula for the expected wait time to pull off a successful time drag attack would be:

(1 / (462 * (% hashrate⁶ * (1- % hashrate)⁵))) / 144 blocks/day = # days

As we can see, for attackers to conduct such an attack on any meaningful timescale then they’d need a decent size mining pool with at least 10% of the total network hashrate.

Maximum Drag

However, in order to induce the maximum drag on the MTP a miner would want to solve 6 blocks in a row. If their 6 of the past 11 blocks are not all in order, then time gaps created by other miners would force the adversarial miner to set the timestamps of their blocks more than one second after each other because the MTP for each block would jump forward significantly as honest miners place more accurate timestamps on their blocks.

How hard is it to solve 6 blocks in a row? If we once again assume a miner with 1% of the network hashrate then the chance of minting any given streak of 6 blocks in a row is 0.01⁶ = roughly one in a trillion. If you maintained 1% of the hashrate then the expected number of blocks that would need to occur before you found 6 in a row would be nearly 2 million years.

A more generalized version of the expected time to successful time drag attack formula would be:

(1 / % hashrate⁶ ) / 144 blocks/day = # days

This attack is even more difficult to pull off, requiring more like 20% or 30% of the network hashrate to occur in a reasonable timeframe. As you may imagine, this happens quite rarely and when it does, people notice. The last times it happened were in July 2014 by GHash, which had over 40% of the hashpower for a while and even touched 51% for a short time. It also happened 9 months earlier when BTC Guild had nearly half of the hashpower. If you have 50% of the hashpower then your chance of minting 6 blocks in a row is 0.5⁶ = one in 64. If you maintained 50% of the hashrate then you could expect to find 6 blocks in a row nearly every 12 hours.

It’s clear that it’s not possible to sustain a drag on Bitcoin’s Median Time Past on a long term time scale without majority hashpower, but you could drag it by as much as several hours for a short period (a block or so) with the right combination of luck and patience. If you assume that other miners are fairly accurate with their timestamps, then the median time past should be approximately 1 hour ago, though it could be several hours more due to the variability in blocks being found. If you manage to mint 6 blocks with timestamps of 1 hour ago plus 1 second, 2 seconds, 3 seconds, etc then at the 6th block the MTP would be approximately 2 hours ago. If we assume an extreme condition of 1 hour gaps between blocks, then the MTP would be 6 hours ago.

By allowing a reasonable amount of flexibility with block timestamps and then taking a median time of recent blocks, we end up with an algorithm that is pretty hard to game but is not so brittle as to adversely affect miners who are somewhat out of sync with the real time.

Let’s Do the Time Warp Again

What if an attacker did have more than 50% of the network hashpower and they wanted to slow the passage of Bitcoin time? They could do some pretty nasty stuff. Such an adversarial miner could prevent the timestamp from advancing by more than 1 second with each new block. If they did this for a long enough period of time and ended up creating blocks on the difficulty retarget intervals with timestamps that made it look like the previous 2016 blocks took far more than 2 weeks to create, they could game the retargeting logic to decrease the mining difficulty by up to 75% every 2016 blocks. Eventually with the difficulty low enough, they could mint as many blocks as they wanted in a given time period and thus receive more mining reward than expected. An optimized time warp attack could mine all the remaining bitcoin in 18.7 days. We’ve actually seen similar behavior occur on Bitcoin’s testnet3 due to a quirk in the difficulty retargeting and now testnet3 has minted 1,482,878 blocks in 8 years, about 350% of the expected emission.

Time warp attacks are nothing new. Such an attack was first performed against a coin called “Geist Geld” in 2011 and it was discussed as being a “variant of the 51% attack” on BitcoinTalk. Geist Geld was intended to test out the upper limits of block generation rate via very short block times, as well as the behavior of a cryptocurrency with (almost) stable generation rate and no upper limit or alteration to supply.

Whitecoin appears to have also suffered from a time warp attack that was conducted in 2014.

In 2018 Verge was hit by such an attack. And then 6 weeks later it was hit again!

In general, cryptocurrencies that have a minority of hashpower for a given style of hardware (ASICs or GPUs) are vulnerable to time warp attacks because they are inherently vulnerable to 51% attacks.

Interestingly, while time warping is often referred to as an attack because it results in unintended behavior of the system, some people have shown that it can be exploited for potentially desired uses. In 2015 Vitalik Buterin described a way to speed up blocks via a soft fork and thus increase on-chain capacity. In 2018 Bitcoin developer Mark Friedenbach made a proposal for leveraging this unintended behavior in order to add new functionality to Bitcoin. In his “Forward Blocks” proposal, Mark states that his method enables scaling up on-chain transaction volume to 3584X current levels, changing the proof-of-work algorithm in a backwards compatible way, sharding, a rebateable fee market for consensus fee detection, and smoothing out drops in miner subsidy along with prerequisite protocol pieces for confidential transactions, mimblewimble, unlinkable anonymous spends, and sidechains.

Such proposals are contentious, however, and would likely force anyone building systems reliant upon the timestamps in the Bitcoin block headers to look elsewhere for that data. It would also be fairly easy for such a change to be blocked, as Greg Maxwell stated on the Bitcoin developer mailing list:

It can be fixed with a soft-fork that

further constraints block timestamps,

and a couple of proposals have been

floated along these lines.

In Conclusion

Bitcoin’s timestamp security and the simple rules constraining the window of acceptable timestamps have withstood 10 years in an adversarial environment despite their known weaknesses. We know that a 51% cabal of miners could wreak havoc on the network, at least for a short time, but this has never happened — likely because the incentives are not aligned for miners to do so. Rational miners would not choose a short term gain in return for killing the long term golden goose.

Thanks to Jimmy Song and David A. Harding.

Bitcoin Has a Branding Problem — It’s Evolution, Not Revolution

For technologists and historians, it may well be a revolution; but for everyone else — it’s an evolution in personal finance.

By Ryan Radloff

Posted March 6, 2019

Before we get started I’ve broken this post out into two parts to address the point, so please bear with me regarding format.

Part 1 — I take a look at how our financial lives trend towards convenience (and as a result, dependence on intermediaries); and whether we should expect that to change anytime soon.

Part 2 — I look at the larger evolution of assets from physical to ‘digital’ over the last 35+ years; and where bitcoin fits in that trend.

Both parts are important to illustrate a critical point — for the end user, bitcoin doesn’t exist in a vacuum. It exists on a spectrum of evolution for consumers and the best thing we can do to drive adoption is acknowledge this nuance.

Langley, N., Garland, J., Morgan, F., LeRoy, M., Ryerson, F., Haley, J., Bolger, R., … Baum, L. F. (1939). _The wizard of Oz_. Hollywood, Calif.: Metro Goldwyn Mayer.

Langley, N., Garland, J., Morgan, F., LeRoy, M., Ryerson, F., Haley, J., Bolger, R., … Baum, L. F. (1939). _The wizard of Oz_. Hollywood, Calif.: Metro Goldwyn Mayer.

Part 1: Trending Towards Convenience (Dependence)

As an American residing in London, it takes me around two weeks from the moment I walk into a local bank branch to complete the arduous and highly manual process of verification (a.k.a. Know Your Customer) in order to become an account holder.

This system is so inefficient that it has birthed a new array of challenger banks (e.g. Revolut, Monzo and Starling Bank). These banks focus on eliminating the inefficiencies and friction of traditional banking, and claim to put us more in control of our finances than ever before.

This model and mission has driven rapid growth for the aforementioned companies, and altered our notion of what a bank looks and feels like.

Yet at the same time, it’s a model and mission which, to borrow from The Wizard of Oz, asks us to “ Pay no attention to that man behind the curtain…“

…and perhaps more than ever before, that is the paradox at play here.

Pay No Attention to That Man Behind the Curtain

While new Fintech banks/platforms provide the illusion of closer proximity to our finances, in many cases these platforms are nothing more than a re-engineered interface for the traditional financial system, with new branding.

For example, Yolt is really just a slick front-end for Dutch multinational bank ING; Wealthify, a brilliant UI owned by Aviva; Zelle — founded by Bank of America, Wells Fargo and JPMorgan Chase — backed by even more banks; and Nutmeg, the mobile choice for investment management, is substantially owned by Goldman Sachs.

Sure, with a few taps I can send £4 I owe you for that latte faster than ever before. But the net result (trade-off) of the rapid digitalisation of the financial system is a requisite increase in specialised financial intermediaries layered on top of each other, built to eliminate the ‘friction’ points of the legacy world.

And here lies the paradox:

While we’ve been hit with slogans like ‘ New Money’_as we venture deeper down the path of convenience banking, we’re really just interacting with a new facade of the legacy financial system.

With that context, it’s easy to understand why people are confused when a truly digital, fully bearer asset enters the picture — ’ New Money’ incarnate.

We don’t initially understand 1) how it’s different than what we already have and 2) why we should ever be concerned about what is going on behind the curtain of our new digital banks.

After all… we’re in control of our finances, not them — so who cares?!

To the second point, what most people don’t realise is the unfortunate reality that the existing system has ‘evolved’ into an incredibly complex web of financial intermediaries built on top of and around each other. All meant to distribute risk more evenly (yet rarely do), the actual result is an opaque fiefdom for risky (and unscrupulous) behaviour.

Look no further than some of these headlines from the last few years…

- HSBC to pay $1.9 billion U.S. fine in money-laundering case

- Watchdogs impose $3.4B fines in bank forex probe

- Deutsche Bank settles silver, gold price manipulation suits

- Banks face $1bn bill over fees-for-no-service scandal

- JPMorgan to pay more than $135 million for improper handling of American Depositary Receipts (ADRS)

- Wells Fargo is paying $575 million to states to settle fake account claims

This isn’t even to mention banks’ central role in the 2008 financial crisis, the lasting effects of which have been well documented and which no doubt impacted countless families in immense ways — my own included.

As Elaine Ou opined for Bloomberg:

“Financial institutions make people feel safe by hiding risk behind layers of complexity. Crypto brings risk front and centre and brags about it on the internet.”

And to the first point regarding how digital assets are different than what we already have… those outside of crypto-land have their PayPal app, their Venmo accounts and can easily send $4 internationally to a friend without using Bank of America or Barclays. Why do they need anything new, much less a revolution?

Revolution is a rallying cry for early adopters, and a historians’ view on what is actually evolution, in real-time.

Revolutions are inconvenient, messy and disruptive to the status quo, a default which we are unfortunately biased towards.

Revolutions often only happen as an absolute necessity, when ‘society’ has exhausted all other options and tensions have evolved to a breaking point.

So when outsiders (read: people we would like to eventually opt-in to this new system) hear the “revolution” declaration from bitcoiners, it simply doesn’t resonate. Humans are wired to seek confirmation of our own biases and be sceptical of new ideas that challenge or threaten our worldview.

The Evolution Amidst the Revolution

Challenger Fintech banks are winning hearts and minds by capitalising on the weaknesses of bigger, bulkier competitors. Legacy banks are now ‘evolving’ with their own facades meant to capture those same hearts and minds.

Consumers are loving the evolution toward convenience and ‘control.’

I would argue that Bitcoin is simply part of this larger migration away from our parents “brick and mortar” banks toward more nimble, digital financial services.

While Bitcoin is a revolution with respect to approach, infrastructure and (dis)intermediation; to the consumer, it will (and should) feel like it is part of the same evolution that they have been part of all along.

Although Bitcoin does indeed seek to revolutionise the financial industry by separating money and state, “revolution” doesn’t need to be the lede.

From most people’s perspective, we’ve gotten along just fine paying no attention to that ‘man behind the curtain.’ Why should we expect to change that behaviour en masse all of a sudden?

Part 2: Reframing Bitcoin in the Progression to Digital Finance

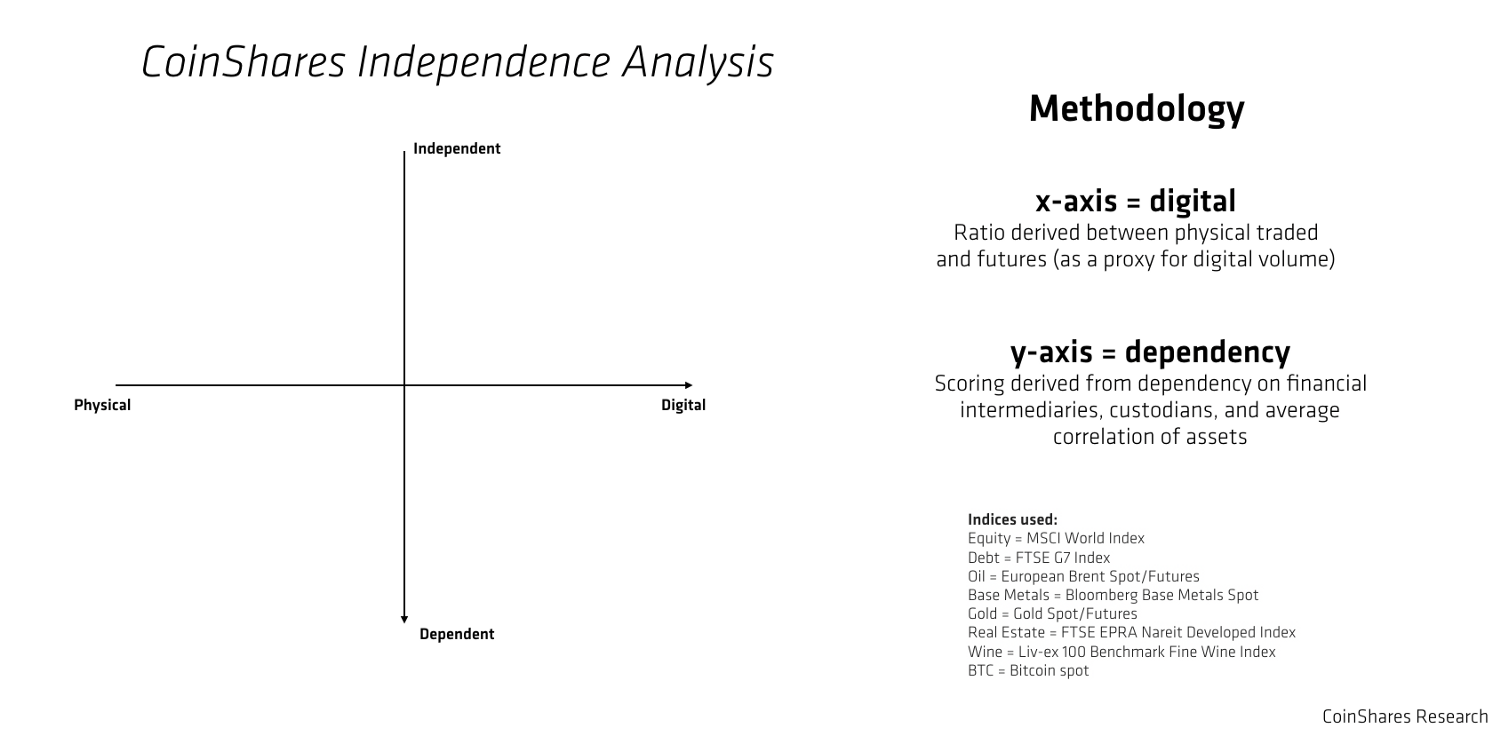

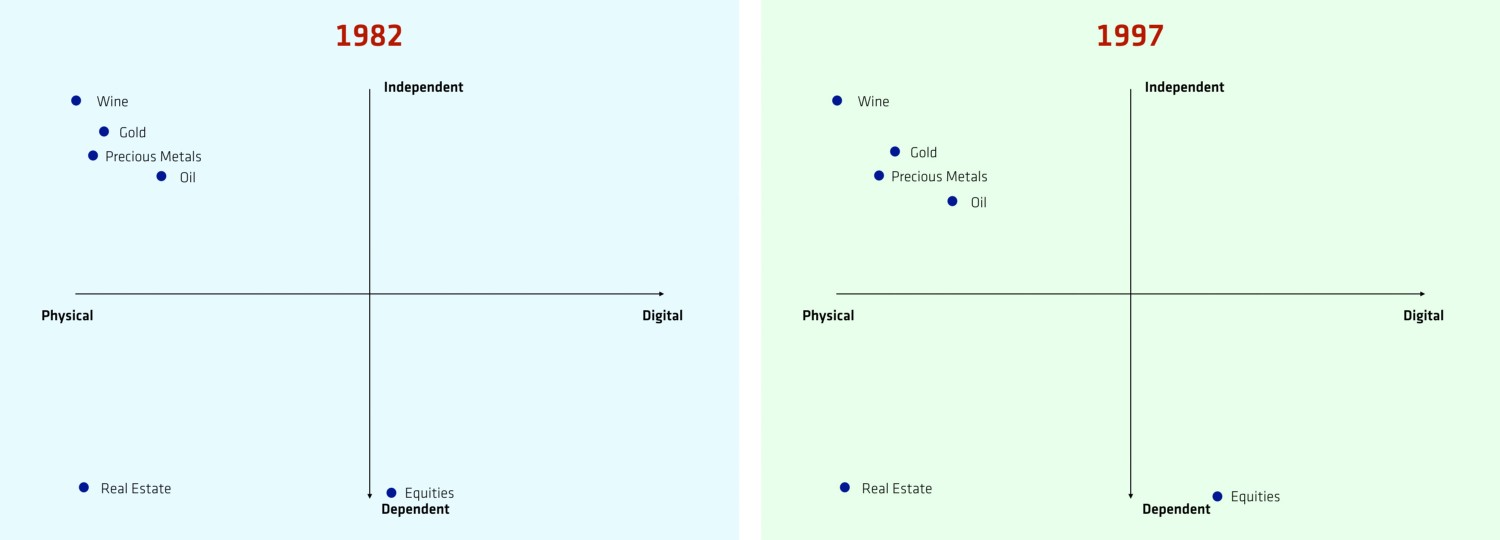

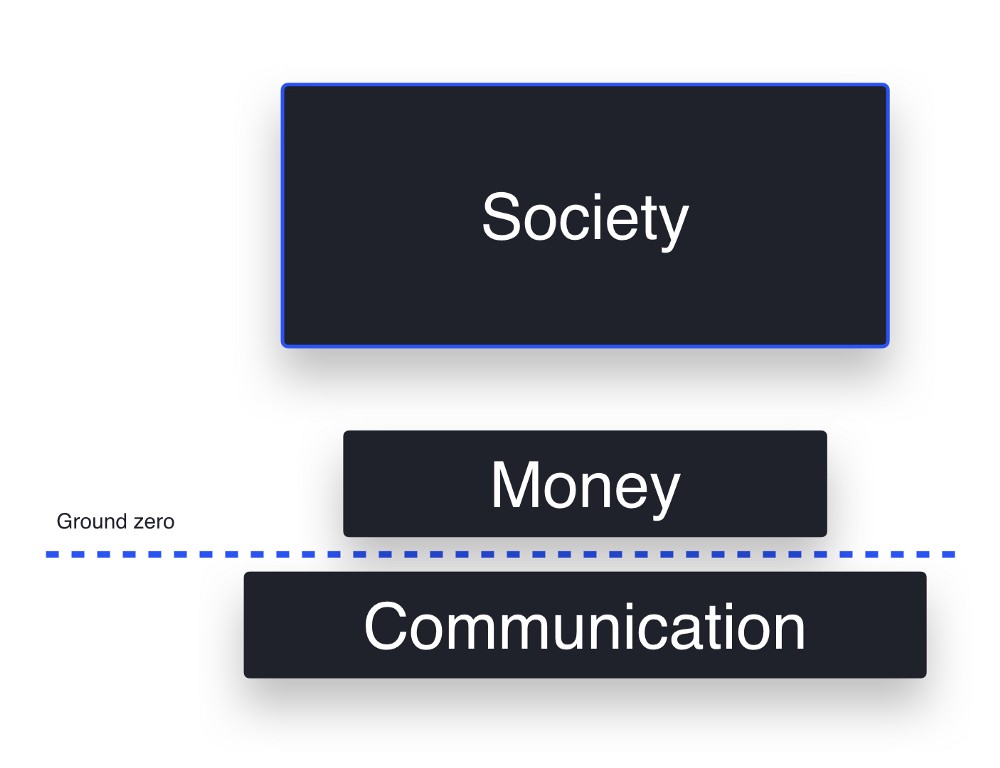

In an effort to track the larger progression towards digital finance (an evolution over 35+ years in the making), our research team at CoinShares developed a qualitative approach that plots the dependency of an asset on financial intermediaries against how digital an asset is (as defined below).

As I touched on in the previous section, we witnessed an explosion in the number of financial intermediaries as we’ve moved towards ‘convenience banking’. The truth, however, is that the number of intermediaries has been mushrooming for much longer, coinciding with a shift in preference towards digital proxies for financial assets.

For the purposes of this exercise, we defined “dependency” as an asset’s dependence on — or independence from — third-party intermediaries in order to buy, sell, and custody said asset. We’ve plotted this on the y-axis in the charts below.

On the X-axis, we plotted how “digital” an asset has become. This was measured by tracking the preference to interact with that asset in a non-physical, ‘proxied’ format (i.e. digital) — whether it be an ETF, option, future, etc. — rather than the underlying asset itself.

For both of these measures, we used quantitive data whenever available, and supplemented with qualitative observations when it was not. In these instances, we identified specific inflection points to warrant movement on the ‘dependency’ y-axis.

For example, fine wine is generally considered an illiquid asset. In 1982, it was tradable in rare circumstances when a buyer and seller were paired. Yet in 2000, Liv-ex launched to bring transparency and efficiency to fine wine trading via an electronic exchange. A few years later, they launched the Liv-ex 100 Fine Wine Index. Today, there are a number of structured investment vehicles (e.g. the Vinculum Wine Fund) that offer exposure to this asset class — beyond purchasing the wines themselves; but this also introduced new intermediaries to the process.

Across nearly all asset classes, as transactions shifted to the digital sphere, they required more intermediaries; and as a result, rendered assets ‘more dependent.’ The exceptions were equities and real estate, which involved a number of intermediaries even before this shift to digital.

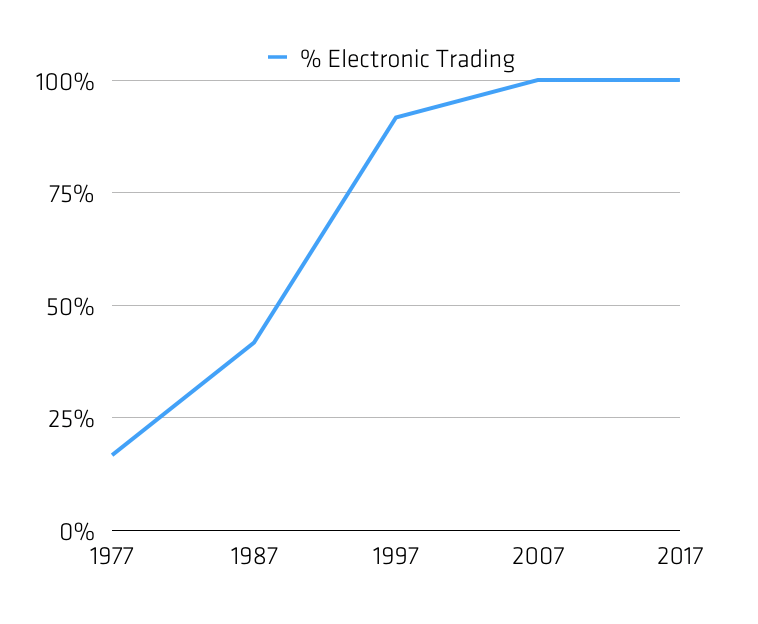

As a part of this mini-survey, we also looked at the shift in transaction volumes from physical trades to electronic ones. This became one of our proxies for the digitalisation of assets — the transition of exchange volumes from open outcry to electronic trades.

Open Outcry trading versus electronic — CoinShares Research

Open Outcry trading versus electronic — CoinShares Research

In a short amount of time, digitised, electronic trading accounted for more than 50% of all bids placed. By the early 2000s, open-outcry trading was effectively extinct.

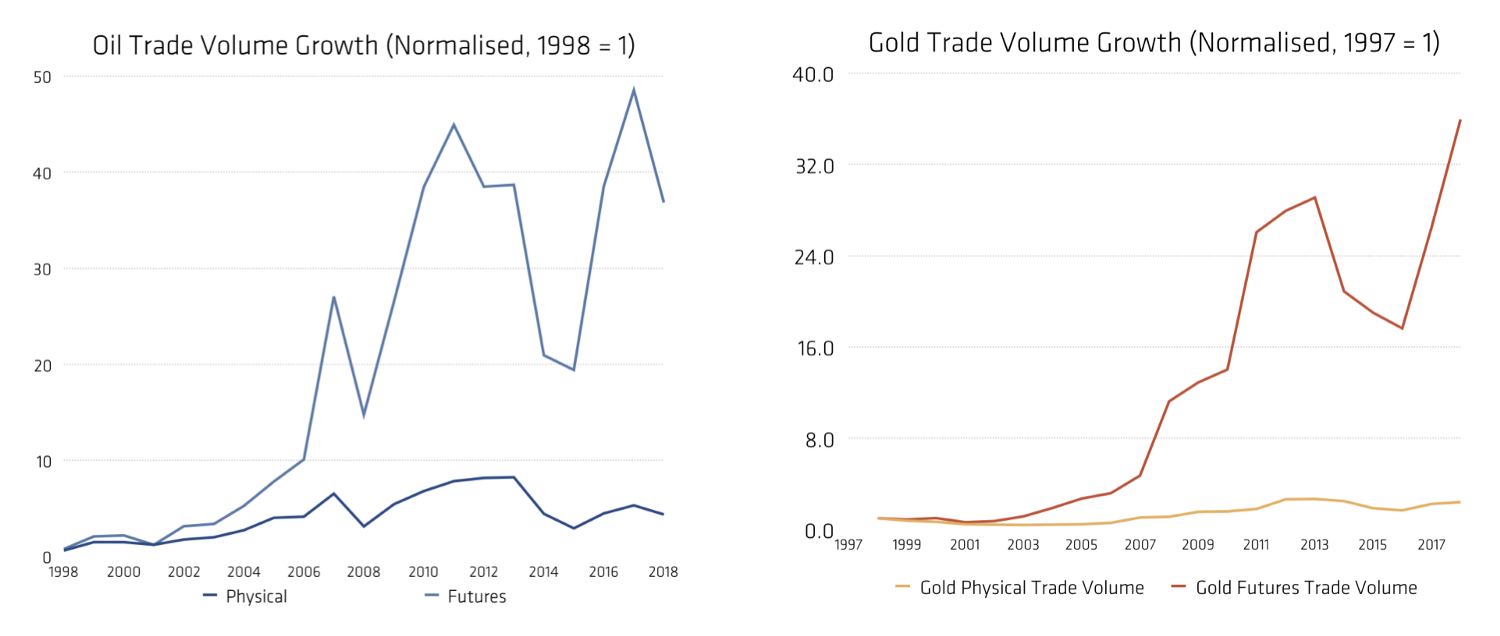

This same evolutionary phenomenon is particularly well illustrated by commodity trading, which saw a quick proliferation of interest in synthetic derivatives compared to the previously dominant physical volume. The below graphs show the relative growth in futures markets versus physical volumes for Gold and Oil.

Please note that while there are many Gold and Oil derivatives, we have used futures as a proxy to represent this digital shift. Had we included the market for Gold ETPs, this shift would be even harder to deny.

Please note that while there are many Gold and Oil derivatives, we have used futures as a proxy to represent this digital shift. Had we included the market for Gold ETPs, this shift would be even harder to deny.

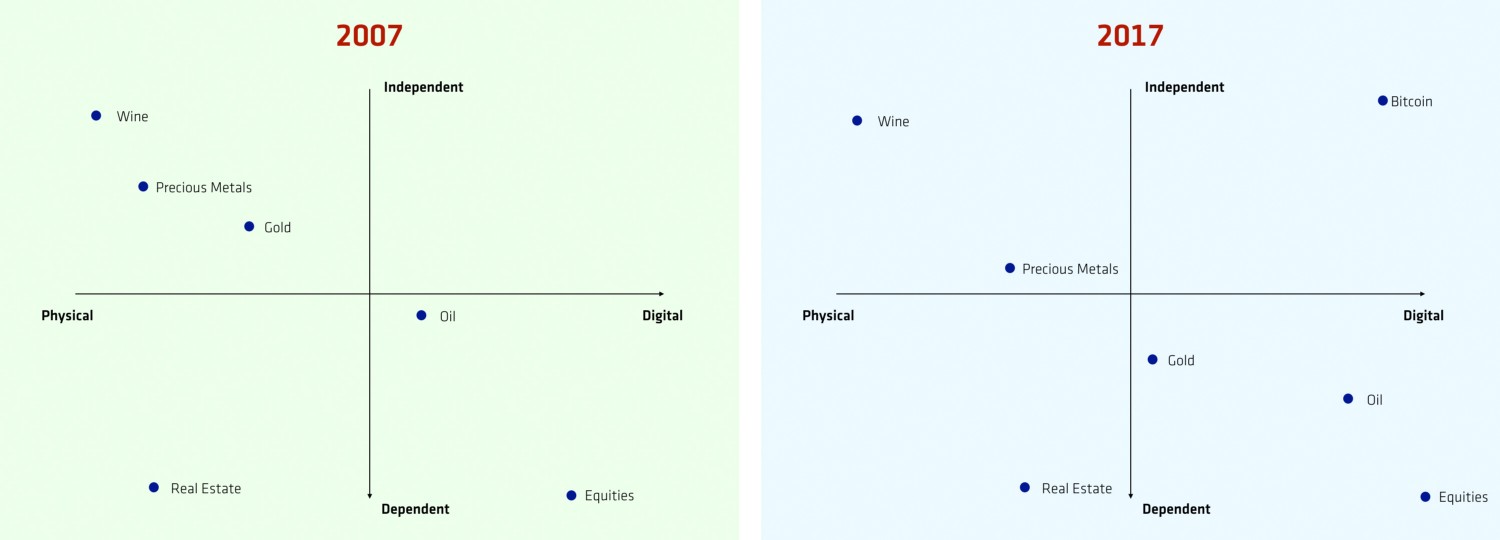

Having plotted dependency and digitalisation on these axes, the changes between years is interesting to track (shown below from 1982–2017):

Representational Figures. CoinShares Research.

Representational Figures. CoinShares Research.

Throughout each phase of this trend, it seems that one asset leads, or paves the way, and others follow. I expect bitcoin’s emergence as a new type of asset, which lives in the top right quadrant, to have a similar effect and pull other assets in this direction as well.

I believe it is likely this will occur within the ‘second layer’ infrastructure that is being built on top of the bitcoin blockchain. There is already technology being deployed which facilitates ‘tokenisation’ of real-world assets, in a format compliant with existing regulations — as my business partner Danny Masters has touched on.

In the meantime, however, this category represents a tiny fraction of global assets, and in any case has clear potential for substantial growth.

So why does this matter?

Until Bitcoin was introduced, we never had a functional way to operate independently from this web of financial intermediaries in the digital sphere; no way to hedge against financial intermediaries in the same way that we could with our physical offline portfolio (e.g. physical gold, fine art, wine).

Before Bitcoin, digital investments always required a trusted third-party for settlement, clearing, and custody.

Bitcoin’s ‘why’ is that it removes the need for intermediaries and provides an alternative choice to the system — not simply a spiffy facade.

That choice is an evolutionof a trend which dates back over 35+ years now.

If we want consumers to consider adoption, we need to start thinking about how this fits in the larger context — bitcoin does not exist in a vacuum.

One of the most important features of Bitcoin is that it gives users the choice to hold a completely digital bearer asset, and manage the keys for themselves to eliminate counter-party risk.

Don’t get me wrong — I still expect intermediaries, lots of them in fact.

The business I run on a daily basis acts as an intermediary, offering convenience and a familiar format (ETP) in exchange for control over the underlying assets the product track. Many exchanges offer a similar proposition, acting at least as a temporary custodian for customer funds.

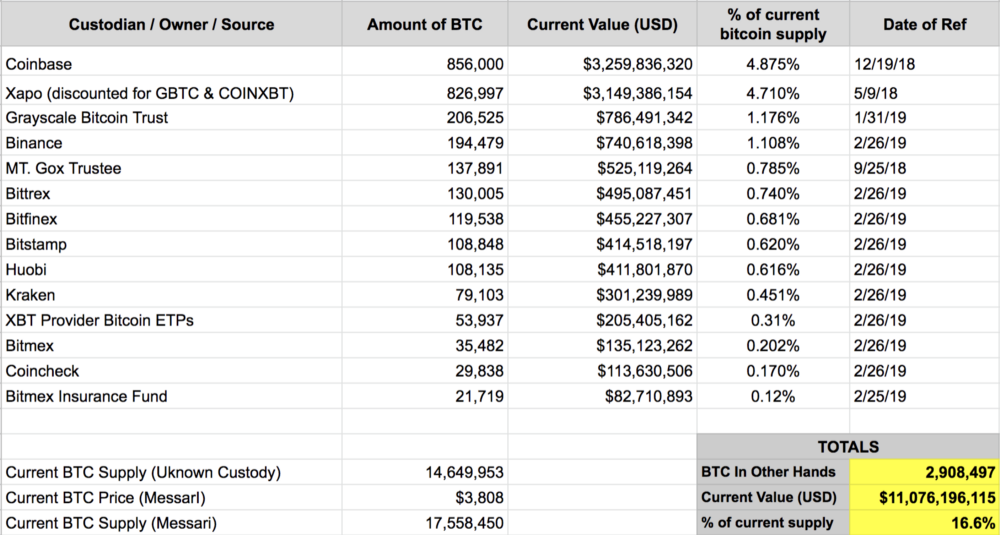

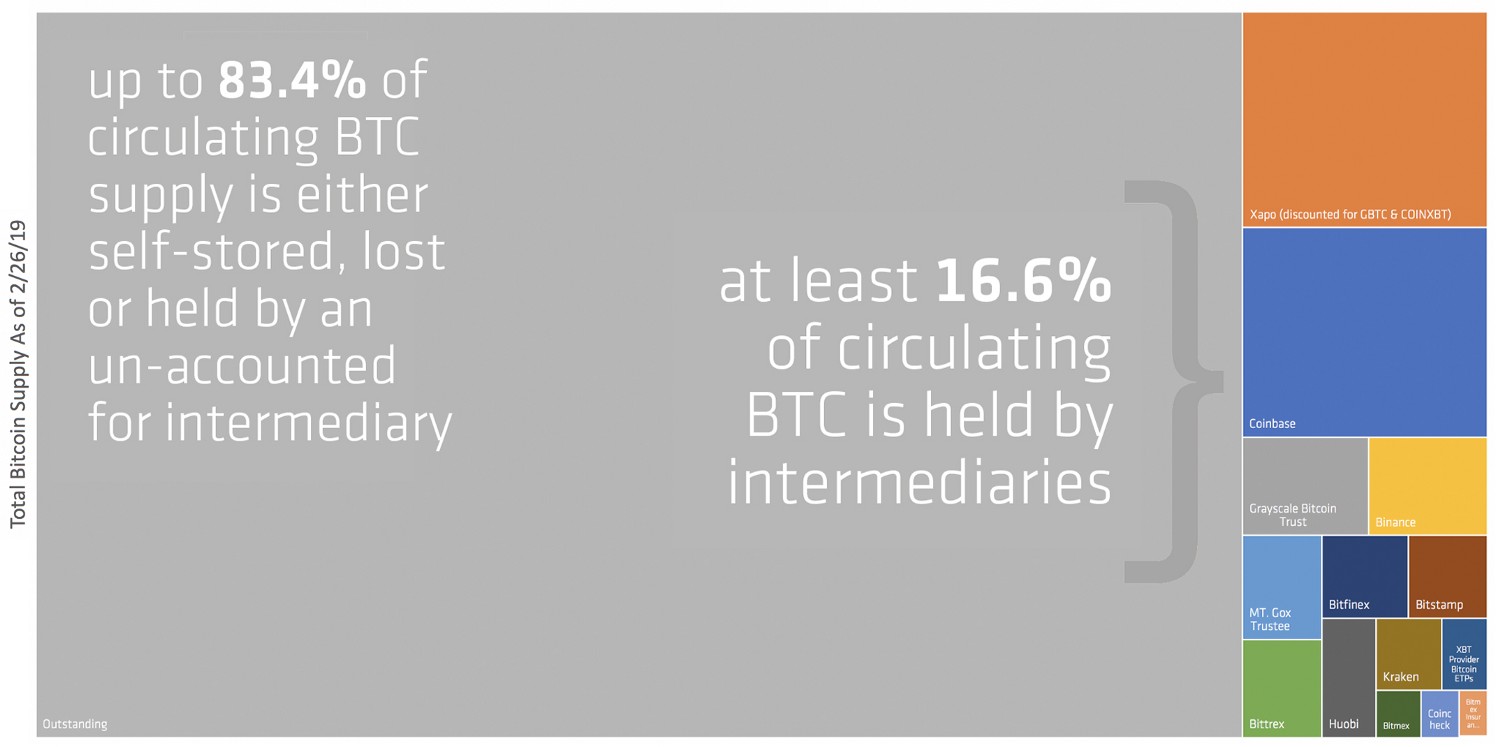

The above table is only in regard to bitcoin holdings, not other crypto assets. Please feel free to drop a note in the comments of any products we may have missed. You can also view our full data and sources here.

The above table is only in regard to bitcoin holdings, not other crypto assets. Please feel free to drop a note in the comments of any products we may have missed. You can also view our full data and sources here.

A quick scan of the publicly reported bitcoin being held by an entity that is not the ultimate beneficial owner shows that at least 17% of the currently circulating bitcoin supply is likely custodied by a third-party.

Coinshares Research

Coinshares Research

Third-parties offer convenience, alleviate the hassle of key management and custody, and can streamline compliance requirements. Third-parties are not inherently good or bad; they simply offer a service to which users have grown accustomed.

But what is different about Bitcoin and this new digital paradigm is that these users finally have a choice. They have an option to utilise the convenience of these intermediaries, and the security trade-offs (risks) are clear.

In other words, with Bitcoin the risks are right there in front of you, and each individual has the opportunity to choose how much of that risk to take.

This is a huge leap forward in the evolutionary progression of our digital financial lives, especially when we consider the web of complexity and blind trust that consumers are required to place in our current financial system.

Personally, I could not be more excited for what comes next. But I’ll conclude by asking a favour…

Right now, too much of Bitcoin’s “viva la revolución” mantra feels like this:

Do us all a favour — help Bitcoin, and please STOP SCREAMING ANARCHY AND REVOLUTION. We might just help the world evolve — and drive bitcoin adoption — in the process…

Much credit to many members of the CoinShares team for the contributions, edits and comments — getting this right is always a team effort.

Skeptic’s Guide to Bitcoin: Investing in Bitcoin

By Su Zhu & Hasu

Posted March 6, 2019

This is part 4 of a 4 part series. See additional articles below

- Part 1 Skeptic’s Guide to Bitcoin: An Honest Account of Fiat Money

- Part 2 Skeptic’s Guide to Bitcoin: Unpacking Bitcoin’s Social Contract

- Part 3 Skeptic’s Guide to Bitcoin: Bitcoin and the Promise of Independent Property Rights

- Part 4 Skeptic’s Guide to Bitcoin: Investing in Bitcoin

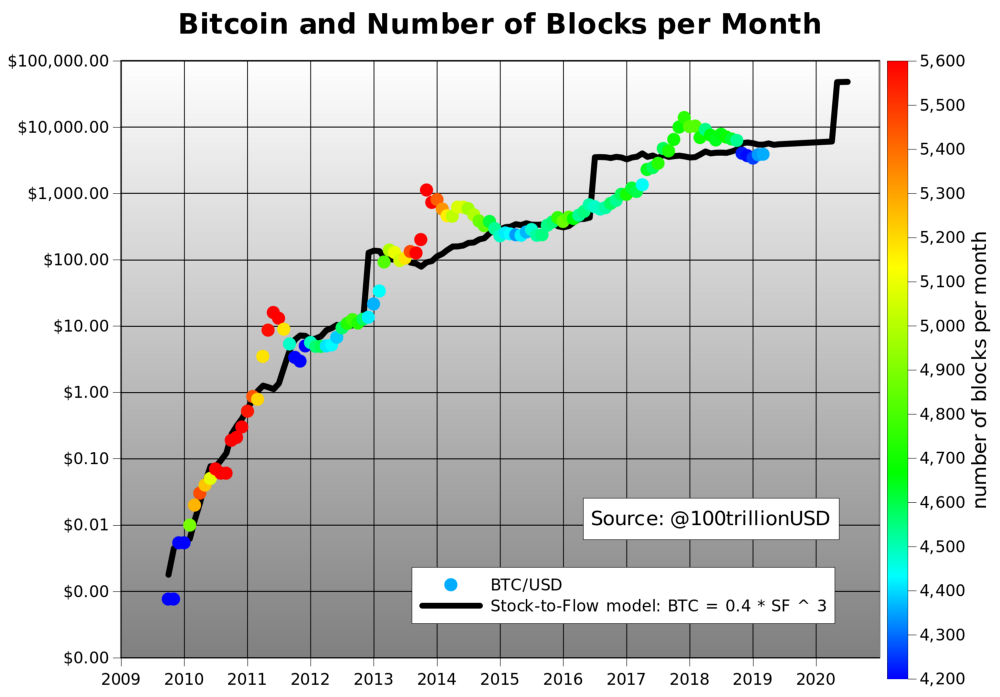

We don’t talk much about price in this blog, but we will make an exception today to show how to value bitcoin using a high-level approach. We’ll highlight three significant trends in the world and suggest how either one of them could lead to increased demand for neutral, private money in the future.

How to value Bitcoin

On a long enough timeframe, valuing bitcoin is straight-forward. The market finds a price based on available supply and demand. When more people want to buy bitcoin than sell it, the price goes up and vice versa. For most types of assets, a price increase entices producers to make more of it, pushing the price back down. Likewise, a price decrease leads to a decrease in supply, making the price go back up. As a result, most goods tend to be relatively price-stable near their cost of production.

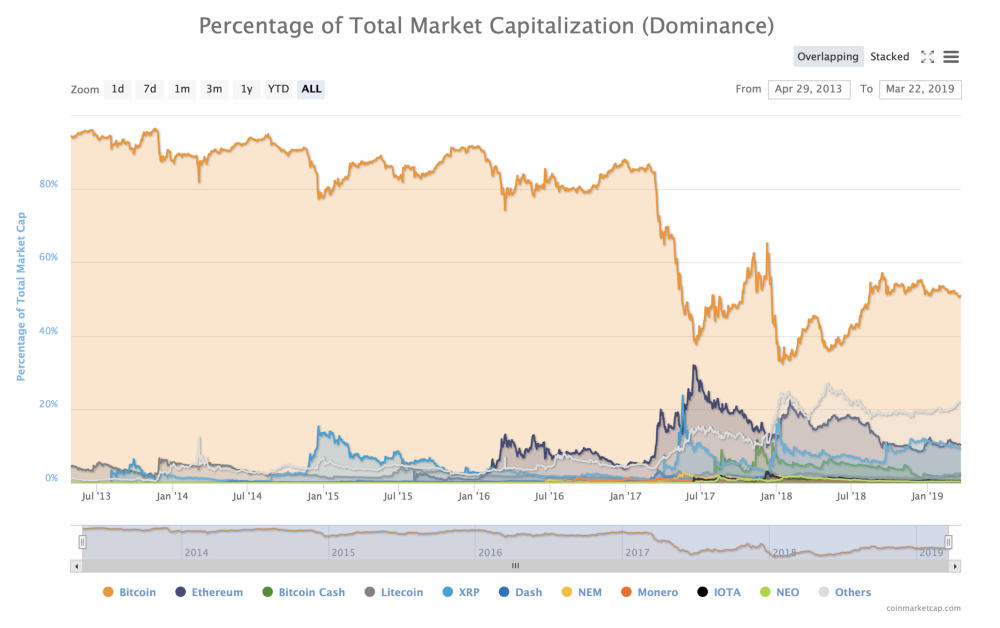

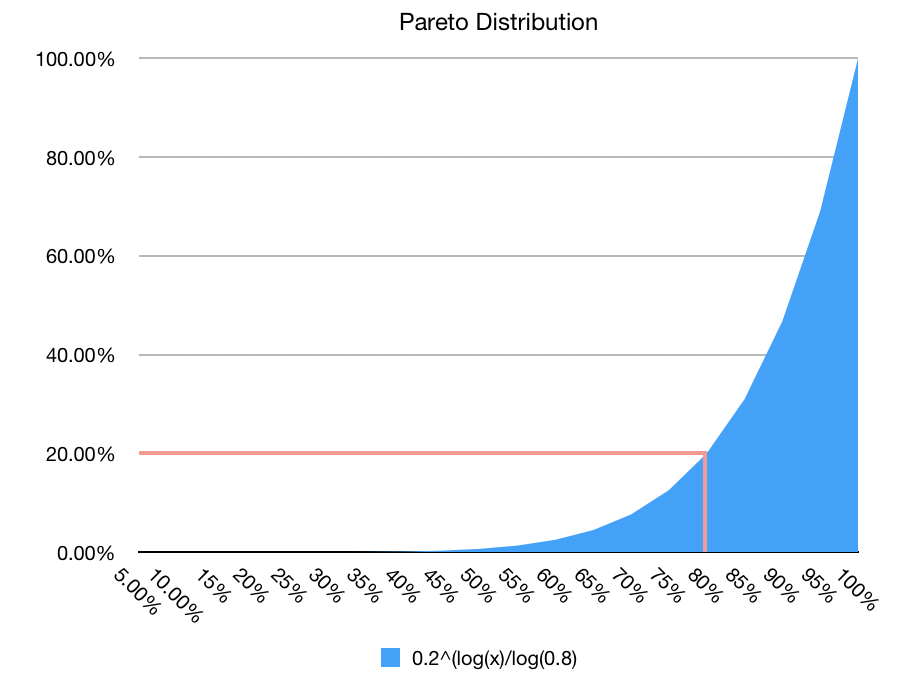

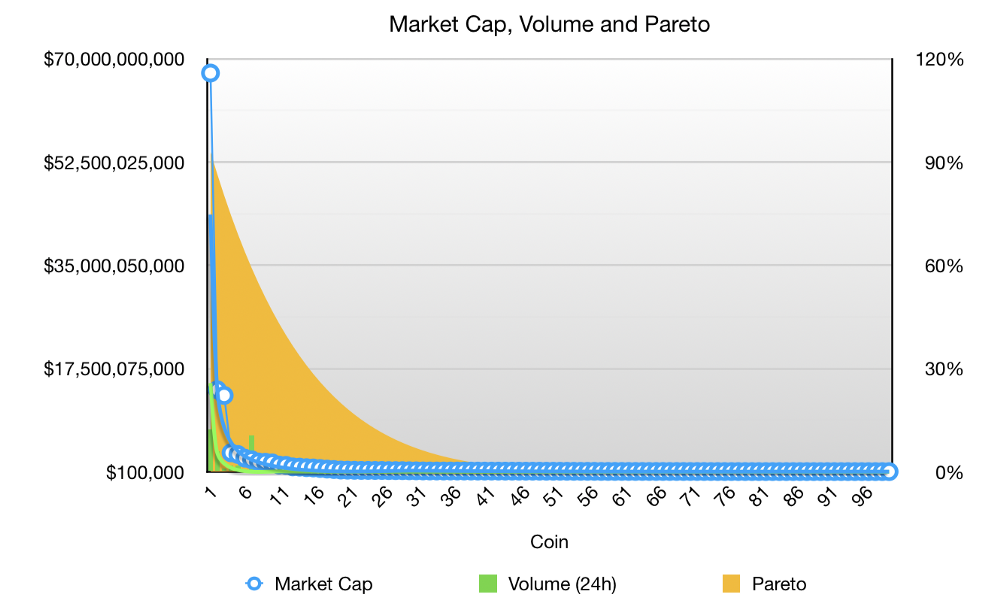

Bitcoin has a fixed supply. There will only ever be 21M units, and we always know how many of them exist. The market can still try to create “substitute goods” (other cryptocurrencies with similar properties) to increase the supply. We fully expect this to (continue to) happen, but money has immense “brand value” in the form of network effects, liquidity, and integration in existing financial infrastructure. Bitcoin’s supply isn’t entirely inelastic to changes in demand, but certainly less so than other assets, leaving upside to be captured by existing owners rather than producers.

The sum of all bitcoin multiplied with their price is called market capitalization. Comparing “market caps” of assets like fiat currency, real estate, stocks or commodities allows us to see how much value people store in them at any given time. Bitcoin’s market cap today is $80b, which is small compared to what we could see as potential target markets to disrupt:

- US dollar notes held abroad: around $1T, including over 75% of all $100 bills in existence (source)

- Global base money: $19.6T (source)

- Gold held for investment purposes: around $1.1T privately held (excluding jewelry) and $1.3T held by central banks (source)

Since the supply side of bitcoin (and substitute goods) is less responsive to changes in demand, we expect rising demand to manifest in a higher exchange price. We see three primary sources of such future demand.

Demand for digital cash

90% of all money today is virtual. It is created when someone takes a loan and henceforth lives on a bank ledger — until the debt is paid and the money destroyed or it is withdrawn as cash.

The growing trend away from physical cash to digital payments is understandable. Cash has the annoying property that you need to be in the same location to exchange it. Most of us are also paid digitally for the work we do, so to pay in cash one would have to constantly replenish it.

Countries that have abandoned the use of physical cash altogether are called “cashless”. It can happen without coercion, like in Sweden. In other countries like India, the government has demonetized larger denomination banknotes. In China, digital payments serve as a tool of social control and the backbone for a new social credit system.

Central banks around the world are enthralled by the idea of negative interest rates— the ultimate holy grail of monetary control. In a cashless society, they can directly tax people’s bank accounts to disincentivize saving and encourage “aggregate spending” in the form of consumption and investment.

Digital payments are highly efficient and convenient, but they are not “money” when it comes to the properties that our parents and their parents have been used to. It is a new form of money that makes very concrete tradeoffs. Digital payments receive their efficiency gains from including a trusted third party in every transaction that maintains a central ledger that it can much easier update when told to. This arrangement doesn’t come without drawbacks: The intermediary monitors all financial activity, can refuse transactions he disagrees with, or even confiscate funds altogether.

Cash, on the other hand, can be exchanged peer-to-peer between people. The transactions are permissionless, private and immediately final (no one can revert them after the fact.)

As our reliance on financial intermediaries grows, so does the importance of who controls them. Today, a small number of payment companies have a disproportionally large impact to define what speech is acceptable online and what businesses should be allowed to operate. Money is the lifeblood of the economy — someone who is cut off by payment processors loses his autonomy and almost any chance to run his business.

Every year, the world is moving closer towards going “cashless”. The reason, in our opinion, is that the benefits of digital payments are immediate and visible to the user, while the downsides are invisible until they matter. As a consequence, the global supply of physical cash will continue to drop. This drop, however, is not an accurate reflection of the demand to hold it. Governments, central banks, and large corporations have an incentive to push for a cashless society (though not all of them do), while cash has no coordinated, commercial interests backing it. Demand for cash is also underrepresented as long as financial intermediaries can be wholly trusted, which isn’t guaranteed to last forever. It seems unnecessary like fire insurance — until it burns.

Bitcoin is the first and only form of money that offers cashlike properties but can be stored and transferred digitally. When governments no longer provide physical cash, there could be a lot of excess demand for an asset with cashlike properties looking for a release valve — and bitcoin is in a unique position to offer that.

Demand for a global, neutral settlement network

Digital payments work for parties who have a middleman they can trust. Since WW2, the US has been this trusted middleman for most of the developed world. Lately, the US has shown they are willing to weaponize the financial system to command their political will (by pressuring SWIFT into cutting off Russia and Iran as part of their sanctions). It is not well received by their allies.

Additionally, political moods in many countries are turning towards isolationism, both in Europe (Brexit, revolts in France) as well as the US (trade war with China, threats to leave nuclear arms treaty with Russia). US-led soft power institutions like the WB, IMF, and WTO are gradually losing their influence. These were the main tools for projecting US power abroad, and their disenfranchisement will leave power vacuums and uncertainty in their wake. We believe the world is currently moving away from having one trusted protector and intermediary, to a multipolar world order.

As frictions between world powers increase, the willingness to trust financial infrastructure controlled by someone else will decrease. That creates demand for a financial network that is not controlled by one party but is politically neutral. Even online, censorship is on the rise. China’s internet is effectively cut off from the rest of the world, and Russia is planning to follow suit.

Bitcoin fulfills the conditions of being neutral and censorship-resistant. While in the past, controversial activity found a home in Bitcoin (like Silk Road and Wikileaks), the world could wake up to the benefits of censorship-resistance as a positive trait that is no longer “just for criminals.”

Demand for a hedge against failure of the existing system

Many people are worried about the overleveraged state of the world economy and our financial system. Both consumer and sovereign debt levels are at all-time highs relative to GDPs, while interest rates, especially in Europe and Japan, are still zero. When the economy slows down, there is little that central banks can do to ease the pain and kickstart the economy.

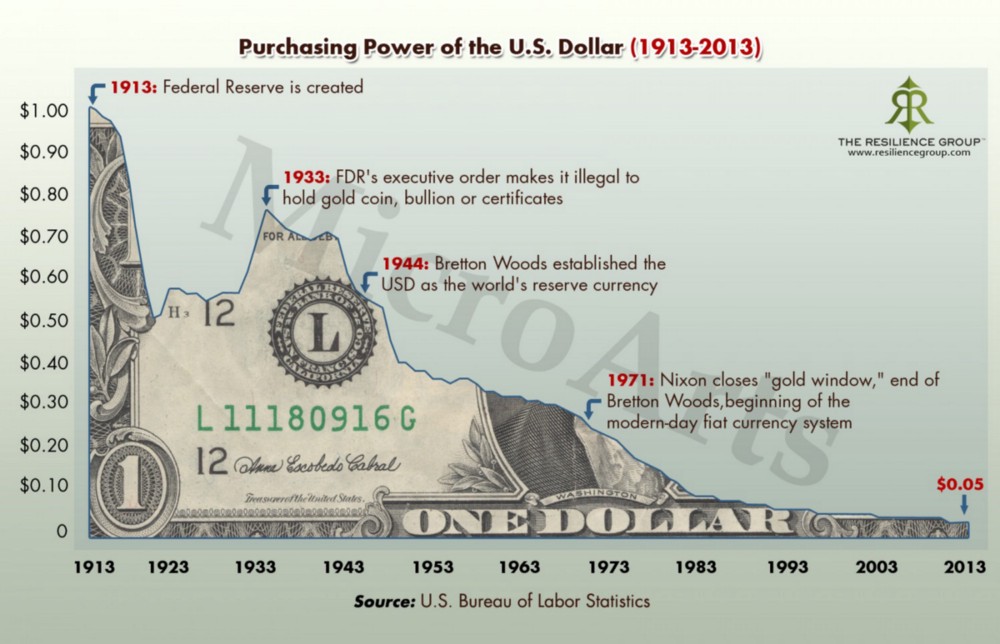

Further, a widespread shift in demographics has created a massive gap between future government liabilities and income from taxes. For example, the US government doesn’t “just” owe $20T in sovereign debt but ten times as much in domestic debt, in the forms of entitlements programs. Many believe that the only way to pay up is by throwing the US dollar under the bus and devalue it to meet at least nominal obligations.

Given, this is a doomsday scenario and not very fun to think about, but it’s a reality that any investor has to deal with today. Gold has traditionally been a trust anchor when investors flee out of fiat currency, but it is also highly co-opted by governments, hard to secure and repatriate — as some countries experience today. We believe that over a long enough timeframe bitcoin can become the gold of the internet-native generation and take its place as a hedge against government and central bank failures.

“Bitcoin as doomsday insurance” is a narrative that is picking up steam and that is now commonly cited even by skeptics such as Ken Rogoff as a primary use case of bitcoin. As more people are getting worried about systemic risk, demand for bitcoin as limited “insurance tickets” could rise accordingly.

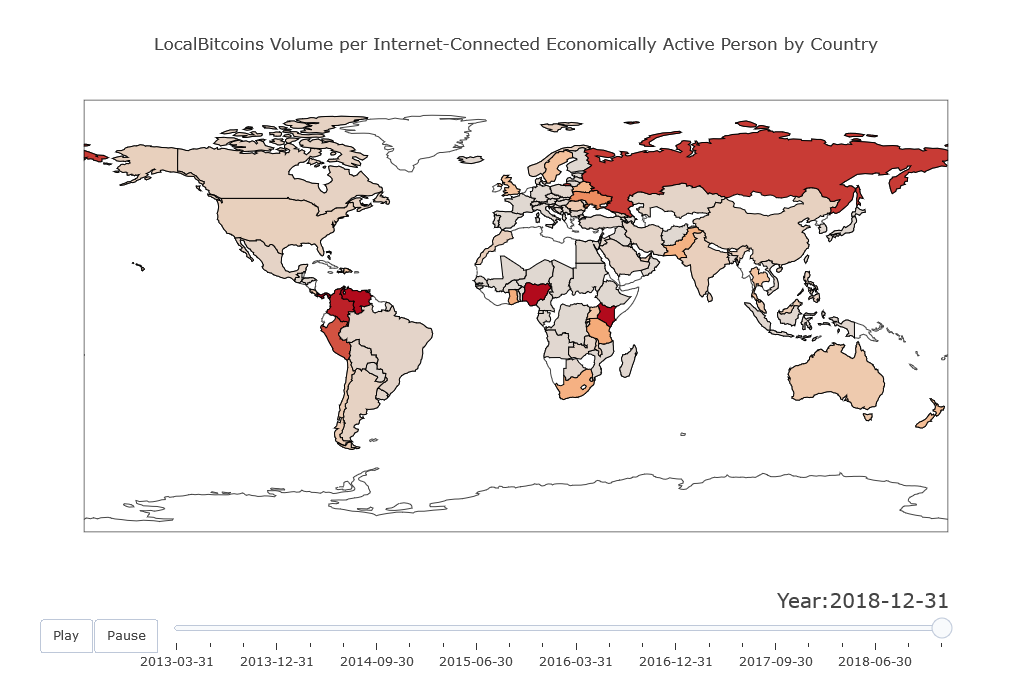

That bitcoin does, in fact, work as an exit ramp for weak local currencies can be seen in Venezuela and other South and Central American countries, where bitcoin is increasingly adopted “on the ground” as an alternative to the US dollar. A recent study about global data from the peer-to-peer exchange LocalBitcoins found that “ in the 4th quarter of 2018, as Bitcoin price and interest seemed to hit their doldrums, 23 countries on LBC had their best quarters ever. Almost all of these countries are in the developing world. “

The US dollar is still the most sought after black market currency, but bitcoin is better at some things that make it an attractive alternative for people in developing countries. It’s easier to protect against confiscation (for example using a brain wallet) and transfer digitally — especially across borders. Skeptics of bitcoin often miss the fact that currency competition is like running from a bear — you only have to outlast your slowest friend. Bitcoin, in its current immature form, competes with the weakest of fiat currencies, not with the US dollar, Euro or JPY, and does so despite its price volatility.

Is Bitcoin’s volatility a problem?

I’m often asked if bitcoin’s price volatility will prevent adoption. Bitcoin is volatile for two reasons. First, bitcoin’s supply is fixed and doesn’t react in changes to demand. Second, as a young currency, it is mainly used for speculation today. Its price is a function of deferred expectations of growth (and expectations of other people’s expectations, and so on), all of which get revised all the time. The best way to think about volatility is as a temporary transaction cost. As bitcoin’s market capitalization grows, less of its value will be from speculation (as there is less future growth to bet on) and more from fundamental usage. That will lower bitcoin’s volatility and make it cheaper to use.

While it can be seen as a chicken-egg problem initially — bitcoin needs adoption to become price-stable, but many forms of adoption require price-stability — using bitcoin has a different value to different people. Bitcoin’s success as money shouldn’t be judged by its ability to perform consumer payments. Instead, bitcoin is first adopted by those who can tolerate the costs because it helps them better than existing alternatives— or because there are no alternatives. With every additional group of people bitcoin serves, it becomes less volatile and cheaper to use, making it more attractive for use cases which are slightly more price-sensitive. A positive feedback loop! The fact that anyone uses bitcoin today, despite its volatility and complexity, is amazing to me and should be seen as a ringing endorsement by the market.

Summary

Bitcoin is a new financial network with a token (also called bitcoin but with a lowercase ‘b’) that is currently in its monetization phase. During this phase, its price is largely determined by expectations of future growth — making it expectedly volatile. Despite the cost and complexity, people use bitcoin on the ground today in developing countries and to make unstoppable transactions online. The more people use it, the less volatile it will become, encouraging further adoption.

Since bitcoin’s supply is fixed (and substitute goods hard to make), the price is largely a function of demand to hold it. We identified three major trends in the world that could lead to significant demand down the road. Demand, that bitcoin is well positioned to serve — often as the only competitor — and that could create significant upside for existing holders.

Acknowledgments: Thank you to Nic Carter for his excellent feedback. This content should not be relied upon as legal, business, investment or tax advice. You should consult your advisers as to legal, business, tax and other related matters concerning any investment. Furthermore, this content is not directed at nor intended for use by any investor or prospective investor, and may not under any circumstances be relied upon when making investment decisions.

Privacy and Cryptocurrency, Part I: How Private is Bitcoin?

Eric Wall

March 7, 2019

This is part 1 of a series

- Privacy and Cryptocurrency, Part I: How Private is Bitcoin?

- Future post will go here

Foreword

The Human Rights Foundation cares deeply about protecting our civil liberties and privacy in our increasingly digital age, especially in places where people live under authoritarian governments. Without a free press, without local watchdog organizations, and without effective ways to hold governments accountable, the 4 billion people who live under authoritarianism need our help, and technology is one way we can reach out. As we’ve seen with the evolution of encrypted messaging, virtual private networks, and free knowledge initiatives like the Tor Project, Wikipedia, and Signal, technology can be a liberation tool, if built with the right values in mind. But as we’ve seen with centralized platforms ranging from Facebook to WeChat, technology will also be a tool of surveillance and even social engineering.

Unless we take a stand now, and help make platforms and protocols with user privacy and decentralization in mind, mass surveillance and social credit may be the inevitable future. To help elevate this conversation, the Zcash Foundation has provided generous support for HRF to bring Eric Wall on as a Technology Privacy Fellow. Eric will be working with HRF for the next six months, writing five essays on privacy technology, with a special focus on cryptocurrency and how we can preserve privacy in the financial world. We look forward to sharing Eric’s work with you, and seeing it inspire fresh conversations with policymakers, philanthropists, investors, students, and the builders of our current and future technology infrastructure.

— Alex Gladstein Chief Strategy Officer Human Rights Foundation —-

Key points:

- If you’re an activist or a journalist, you may wonder how safe it is to use bitcoin to escape the prying eyes of a government or corporation

- Bitcoin is only semi-private; the protocol doesn’t know your real name but transactions can still be linked to you in a myriad of ways

- Blockchain analytics firms specialize in deanonymizing bitcoin activity and sell this data to corporations and law enforcement agencies

- A grasp of how the system works and use of tools such as Tor, coin control, CoinJoin transactions and avoiding address reuse can make a crucial difference in protecting your identity and transactions from being unmasked

- This article aims to give the reader a primer on Bitcoin privacy — later articles in the series will look at different wallets, compare different cryptocurrencies and survey exchange platforms in regions with restricted economic and political freedom

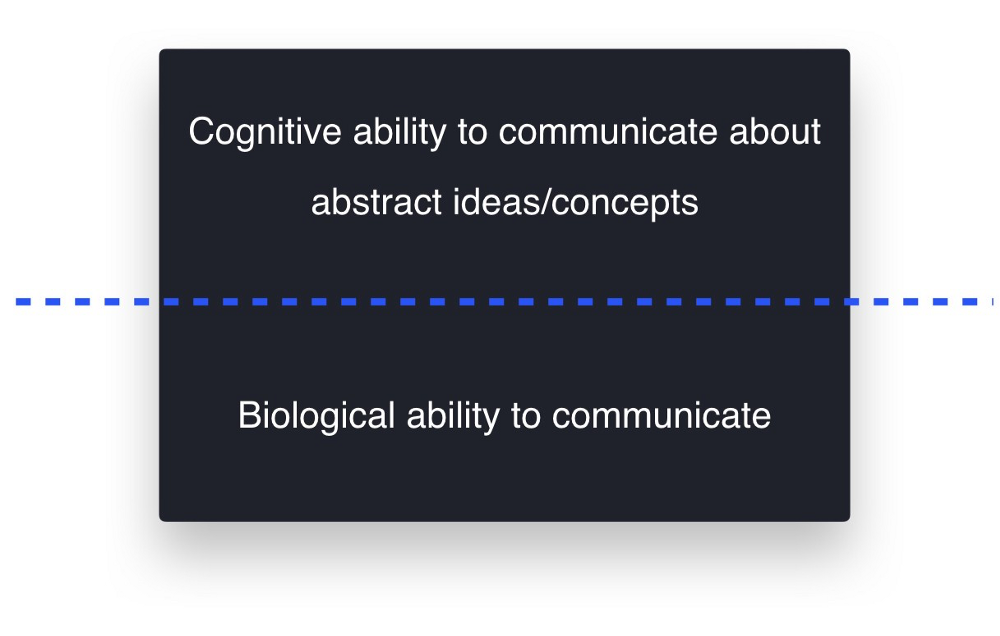

Why cryptocurrencies?

It’s clear from the onset when observing cryptocurrencies at a protocol level that they are inherently more privacy-oriented than traditional digital payment systems. At the base layer of these protocols, there is typically no mapping between users’ cryptographic key pairs and their real-world identities, yet they allow us to store and transfer wealth across the globe with an unprecedented degree of freedom.

The intention of the Human Rights Foundation is to examine these technologies and elucidate on their potential of bringing economic and political freedom to the individual. While there are many angles in the context of money that are within the scope of such an endeavor, we’ve chosen to focus on the topic of privacy foremost. In that pursuit it’s also clear that the degree to which cryptocurrencies enable privacy is not by any means trivial or binary — it varies greatly depending on the user’s particular choice of core and ancillary technologies and usage patterns, as well as the capabilities and sophistication of the attacker.

Regardless of that, we can observe that the adoption rate of cryptocurrencies — in particular, bitcoin — is increasing in countries where the economic freedom of the population is limited. While the liberating and democratic aspects of cryptocurrencies are apparent, especially the extent to which they enable censorship-resistant transaction networks and monetary policies impervious to various forms of government sabotage, none of these benefits are particularly helpful as long as authoritarian regimes can deanonymize and prosecute the users of these currencies at will.

Many thanks to Matt Ahlborg for lending us this visualization from his great piece “Nuanced Analysis of LocalBitcoins Data Suggests Bitcoin is Working as Satoshi Intended “ which explains the exact methods used to generate it.

Many thanks to Matt Ahlborg for lending us this visualization from his great piece “Nuanced Analysis of LocalBitcoins Data Suggests Bitcoin is Working as Satoshi Intended “ which explains the exact methods used to generate it.

The ambition of this initiative is to cut through the complexity of the cryptocurrency privacy subject by sourcing subject matter expertise from the industry. When we approach this subject, we recognize that we enter into a complex field, and as in any complex field, experts disagree. We will strive to strip this initiative from personal biases and condense opinions and research into simple practical guidelines.

The product of this research will be an article series of which this is the first piece.

A primer on Bitcoin privacy

Bitcoin is neither completely anonymous nor completely transparent. The Bitcoin privacy conundrum exists in a grey area where the unmasking of a user’s financial activity ultimately depends on the capabilities of the adversary and the sophistication of the user and their choice of tools. There is no perfect privacy solution for any activity on the Internet, and in many cases, privacy-conscious choices come with tradeoffs to both cost and ease-of-use where no one-size-fits-all solution exists. Moreover, privacy is never a static thing but evolves continuously and in response to the battle between those who build tools to protect privacy and those who build tools to destroy it.

The Bitcoin protocol itself evolves over time, which can lead to dramatic changes in its privacy properties. Changes to the core protocol are seldom simple choices between privacy and transparency alone, but more often come packed with changes to the security, scalability, and backward-compatibility of the software as well. Historically, the trend and ethos within the Bitcoin community has always favored privacy over transparency, but more conservatively so compared to other cryptocurrencies where privacy is the primary focus.

As a result, activists or journalists who are considering using bitcoin to escape the prying eyes of an authoritarian government or a corporation need to understand what type of traces they leave when they’re using it and whether the privacy nature of bitcoin is sufficient for their needs. However, achieving this understanding requires some amount of effort.

Tracing transactions

When you transact on the Bitcoin network you leave two types of traces. These can be categorized into “what’s on the blockchain” and “what’s not on the blockchain”. The information that is on the blockchain reveals no direct link between your identity and your transactions, but it does reveal information that can link your transactions to each other. What does link your identity to your transactions are the things in the second category: “what’s not on the blockchain”.

What’s not on the blockchain

When you transact on the Bitcoin network, you are sometimes sending or receiving money to/from some entity that knows who you are. That entity will then have outside-of-the-blockchain-knowledge that links your identity to a transaction.

When you combine this fact with the other fact that your transactions can be linked to each other, the result is that motivated entities can sometimes figure out how you’re using your bitcoins, how much you have and who you’ve been transacting with.

There are also countless ways you could be linked to a transaction even without having transacted with an entity that knows who you are, since Bitcoin transactions are typically sent in unencrypted packets over the Internet and the source IP address can be pinpointed through various means. Bitcoin transactions sent via full nodes such as Bitcoin Core require some triangulation or targeted traffic sniffing in order for the source IP address to be estimated, whereas other “light” wallets such as mobile wallets (Mycelium, Blockchain Wallet, Coinbase Wallet) will often broadcast transactions through company-run servers that can see your IP address directly and your full transaction history. The same is true for most hardware wallets (Ledger, Trezor) in their out-of-the-box setups.

Geolocation IP databases can often roughly approximate your physical location using your IP address. You can test it out yourself using this link, then enter the coordinates you get into an interface like Google Maps. More importantly, your IP address reveals your Internet Service Provider (ISP), which in turn knows the real-world identity of the owner of your IP address and often has a legal obligation to store this information for several months.

Even if you are using a public WiFi network to transmit your transactions, you could still accidentally associate your real identity with that IP address from the websites you visit and the background services your device connects to. Your Dropbox application will gladly connect to Dropbox’s company servers when you start your laptop which will associate that IP address with your Dropbox account in Dropbox’s server logs. The same thing will happen when you browse to a personal account on any website. Even if you don’t visit any personal web accounts, cookies stored on your laptop can reveal who you are to the website you browse to through your cookie’s association to your previous browsing history. Many websites allow third parties to track users like this for analytics purposes — Google alone is estimated to track users across 80% of the sites of the entire web.

Even if you clear your cookies, website operators can track you across their different sites as long as your browser fingerprint is unique and associate your IP address to your identity that way. And even if you have no services running and avoid browsing altogether, your device’s MAC address could get exposed to the network provider which could be linked to your identity using sophisticated methods. So, even if your IP address doesn’t lead back to you via an ISP record, you might still leave other traces that do when you’re using your personal devices.

The worst category for privacy is of course when using third-party services that implement know your customer (KYC) practices as your Bitcoin wallet, as these services will keep logs of all your transactions and your real-world identity.

You could also be linked to a Bitcoin address or transaction just by searching for it using web-based tools since there usually aren’t that many people other than you who are going to be looking up your transactions on the web for no good reason. Keep this in mind as we move to the next segment. Other data that isn’t on the blockchain but can easily be logged about your transaction is the approximate time it was broadcast to the network.

The current known best method to hide your source device and IP address when retrieving information about transactions or when transmitting transactions is to leverage Tor hidden services. Many wallets including Bitcoin Core will provide this as a configurable option while others have it built-in. The Tor browser can similarly be a useful tool for your web-based Bitcoin-related activity as it, in addition to hiding your IP address, clears cookies upon each exit, prevents third-party cookies and is immune to most browser fingerprinting techniques.

What’s on the blockchain

A simple way to begin understanding what type of information is revealed by the Bitcoin blockchain is to use a block explorer. For this exercise, we’ll use the open-source explorer blockstream.info.

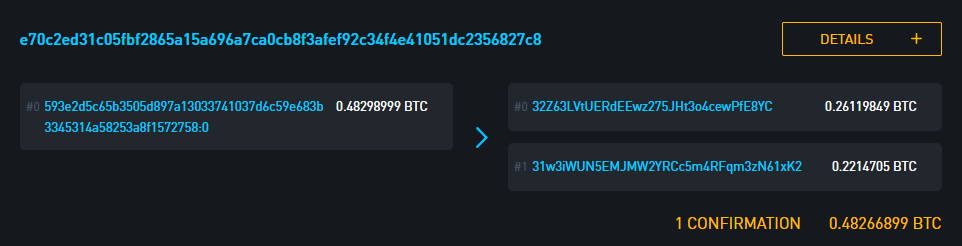

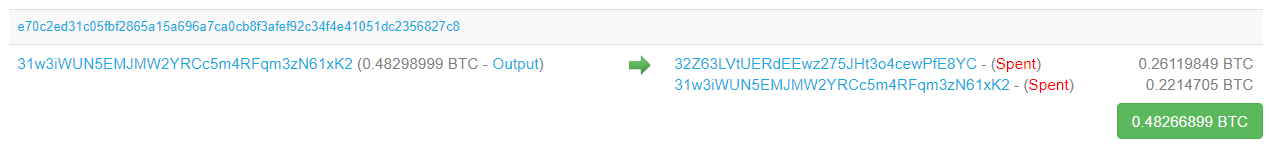

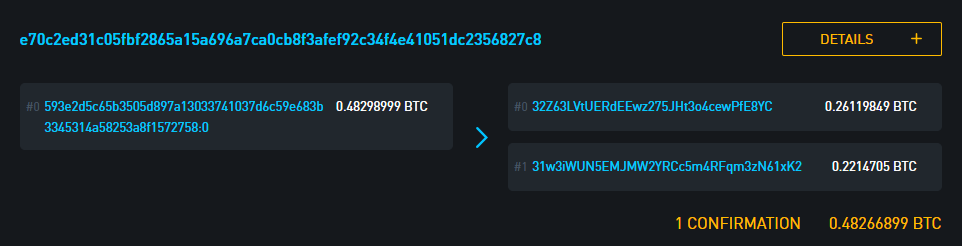

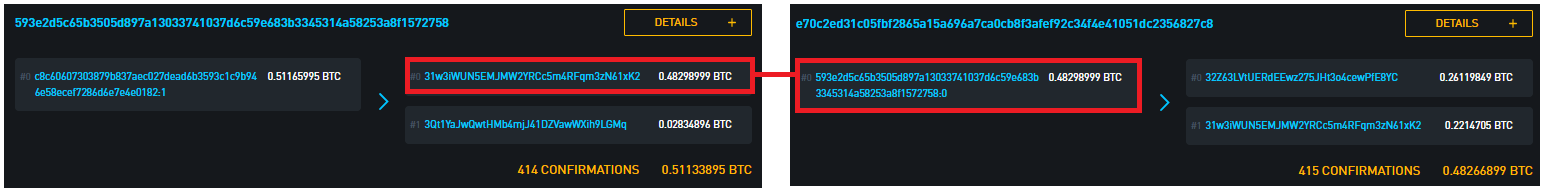

The most recent block at the time of writing (#563899) in the Bitcoin blockchain contains 2122 transactions. Let’s look at what a randomly chosen transaction reveals.

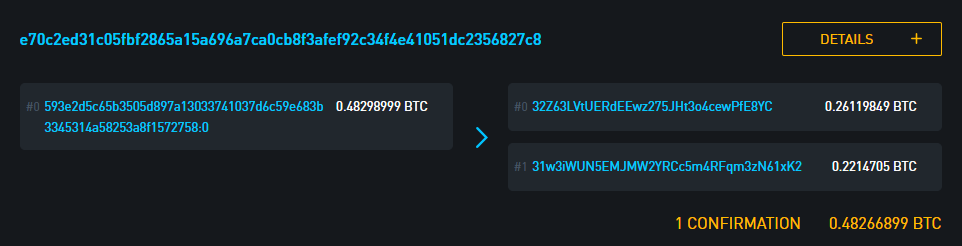

Transactions contain inputs and outputs and are identified by transaction IDs (seen at the top in the image above). If your Bitcoin wallet has sent a transaction, each transaction will be associated with one such identifier.

From a high-level view, what is revealed about this transaction is the following:

- The approximate time the transaction was mined (from the block header)

- The addresses bitcoins were sent to and the amounts sent (i.e. the “transaction outputs”)

- The source of the funds for the transaction (i.e. the inputs)

Let’s look at each of these items individually for the transaction shown above, e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8

Time

Transactions are not timestamped, but blocks are. Block timestamps are not necessarily precisely accurate, but assuming a majority of miners are reporting time honestly, all blocks are bound to be reasonably accurate within a few hours range. For the blocks mined by the honest miners, they’ll be precisely accurate. This doesn’t mean that the block timestamp is necessarily accurate within a few hours range to its transactions’ broadcast times however, since it can sometimes take a lot longer for a transaction to be included in a block. Some block explorers complement data this by displaying the time they first saw a transaction on the network to give a more accurate view of transactions’ broadcast times.

The approximate time when the transaction above was included in a block can be derived by looking at the block header (in our case it’s block #563899 with the timestamp 2019–02–20, 14:45 UTC).

The addresses bitcoins were sent to and the amounts sent

The receiving addresses in this transaction are:

1: 32Z63LVtUERdEEwz275JHt3o4cewPfE8YC 0.26119849 BTC

2: 31w3iWUN5EMJMW2YRCc5m4RFqm3zN61xK2 0.2214705 BTC

There is more to an address than what meets the eye. It’s easy to think of Bitcoin addresses as “hard-to-read email addresses but for bitcoins”, but an address isn’t always a simple pointer to a certain user’s cryptographic key-pair. What addresses are in reality, are cryptographic descriptors of the spending rules for the next time someone wants to move those bitcoins.

For example, if you send bitcoins to:

37k7toV1Nv4DfmQbmZ8KuZDQCYK9x5KpzP

the configuration of this address is such that you’re not sending bitcoins to an owner of a particular private key, but rather to a spending rule that releases the coins to anyone who can provide two different strings that have the same SHA-1 hash (this would mean that the SHA-1 hash function is broken, which it was in 2017— so don’t send anything to that address!). What’s good to note is that since many address formats used today are hashed when we send bitcoins to them, we t ypically can’t tell what those spending rules are until someone spends bitcoin from that address, as they need to reveal what was hashed in order to do so.

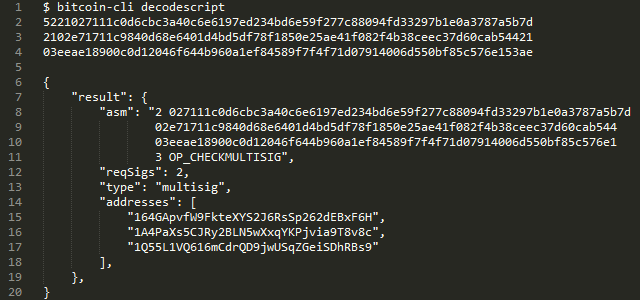

In our example transaction, the blockchain reveals that bitcoins have been spent from both addresses, so the spending rules for those addresses are known.

32Z63LVtUERdEEwz275JHt3o4cewPfE8YC

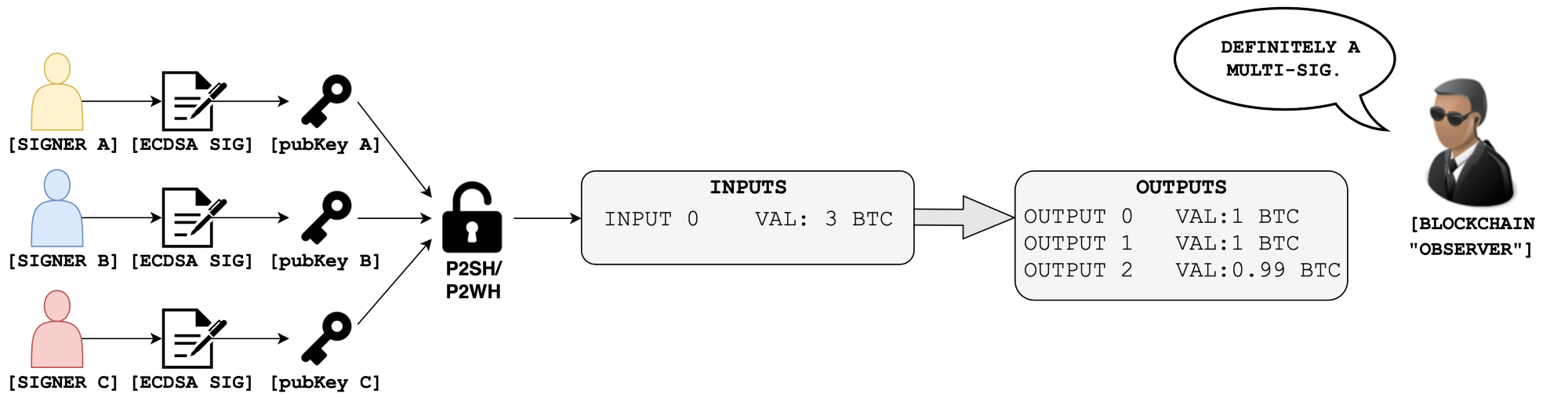

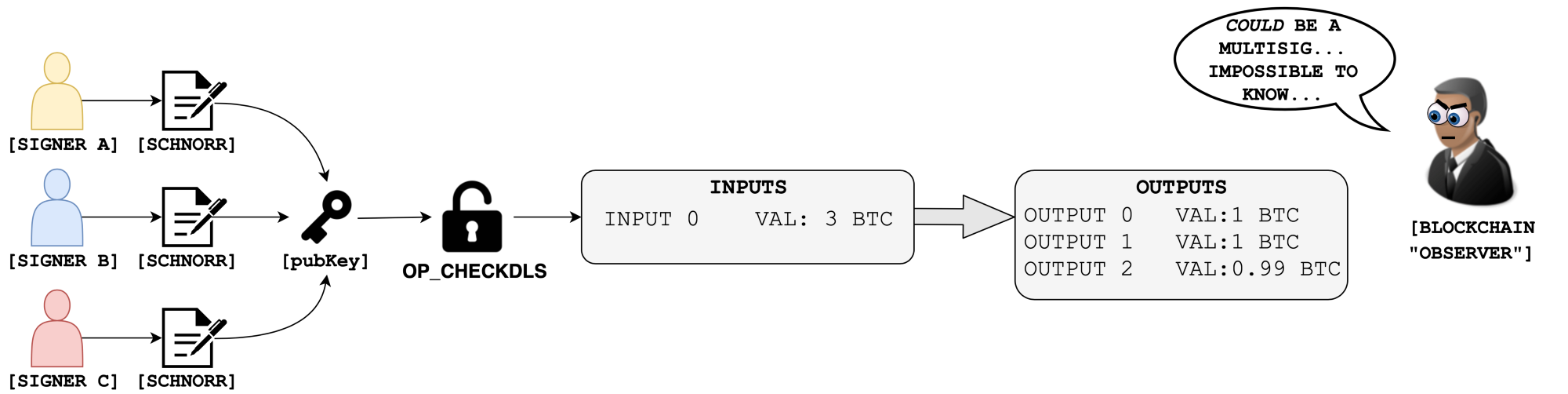

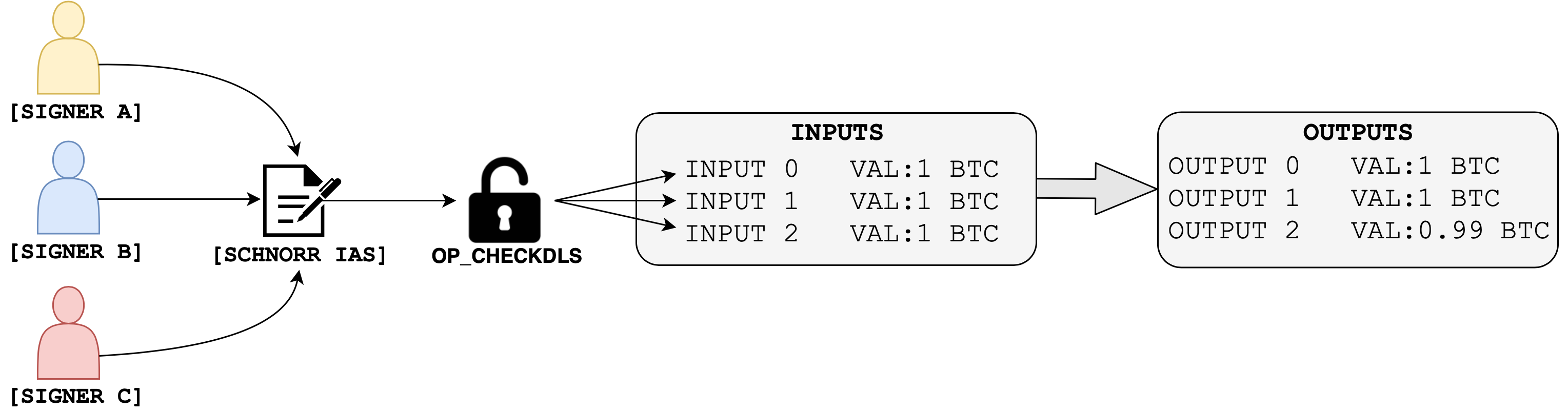

was revealed to be a 2-of-2 multisignature address when it was spent from in the transaction

f491dfe9867c36e85950116a90a6128060d6070866ad0f3598d70d146750162f

We’ll look at exactly how that information is revealed in the next section.

Similarly, it was revealed of

[31w3iWUN5EMJMW2YRCc5m4RFqm3zN61xK2](https://blockstream.info/address/31w3iWUN5EMJMW2YRCc5m4RFqm3zN61xK2)

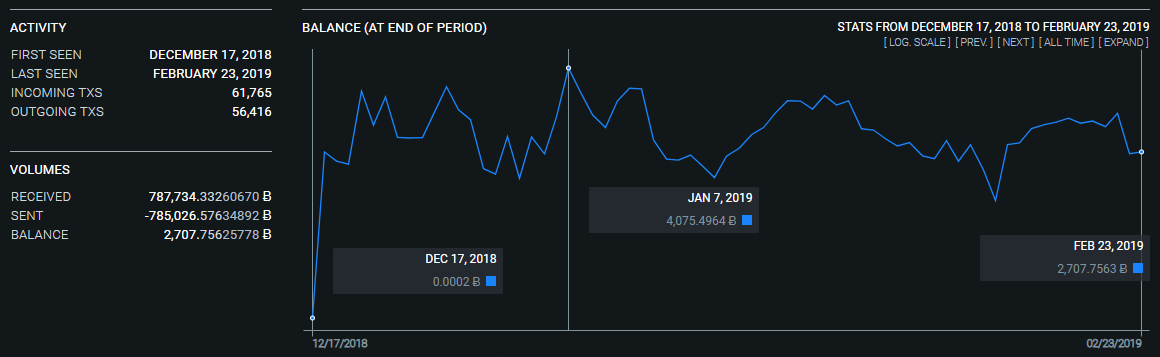

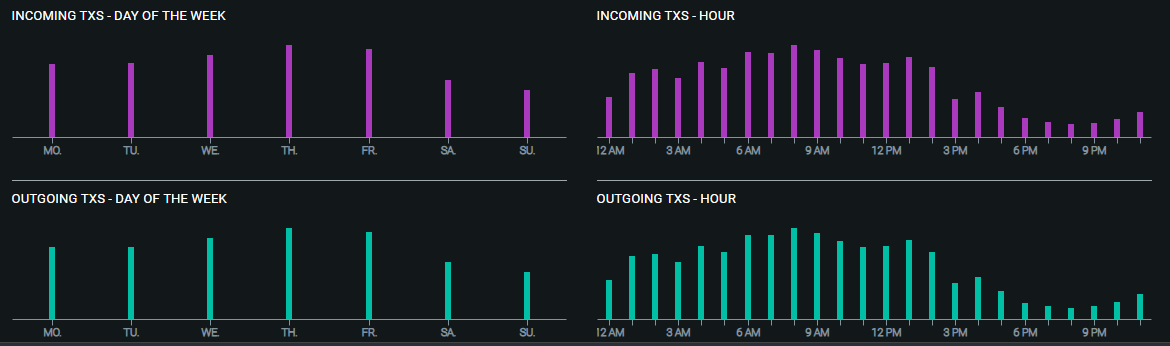

that it is a frequently used 2-of-3 multisignature address and at the time of writing holds roughly 2,700 bitcoin (US$10.6m). More advanced blockchain tools such as oxt.me will even plot the wallet balance over time and display with approximate accuracy which hours of the day it has seen the most activity.

Historical balance and activity relating to the address 31w3iWUN5EMJMW2YRCc5m4RFqm3zN61xK2 (oxt.me).

Historical balance and activity relating to the address 31w3iWUN5EMJMW2YRCc5m4RFqm3zN61xK2 (oxt.me).

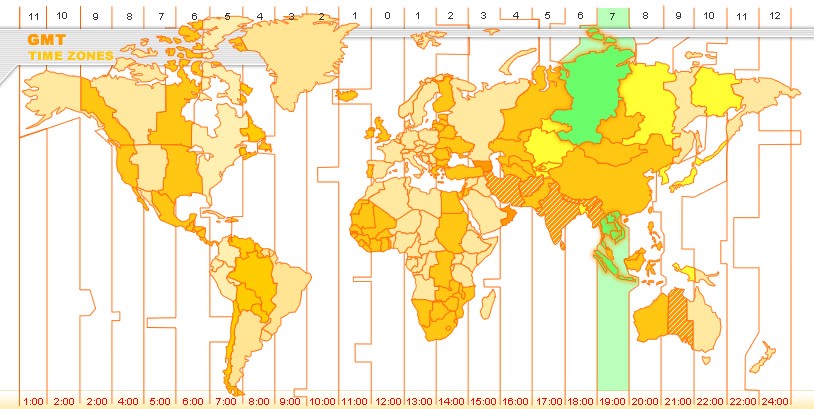

Seeing as 18:00-22:00 UTC are the hours with the least activity for this address, it wouldn’t be unreasonable to assume that these hours represent the night-times 01:00-05:00 or 02:00-06:00 in the region where the address is controlled. Given the hours of activity, the volumes and the multisignature setup of this address, one could guess that this address belongs to a cryptocurrency exchange in the GMT+7/8 time zones.

It’s considered good privacy hygiene to never reuse a Bitcoin address because it helps to break transaction linkage. That’s also a good idea for all users of P2SH addresses (all addresses starting with a “3” and 62-character addresses starting with “bc”) because by the time you reveal what the spending rules are for that address, you’ve already sent the bitcoins to a new, hashed address for which the spending rules are yet unknown.

Wallets known as HD wallets can generate many addresses but only require a single back-up seed in order to access the funds. These wallets will also automatically generate a fresh address for you every time you’ve received a transaction.

Now let’s look at the transaction again to see what else we can reveal about the sent coins.

Bitcoin transactions are regularly directed towards two addresses where one of the transaction outputs is the actual payment and the other is what is known as a “change output” going back to the sender. It’s similar to when you pay for a $3 item with a $5 bill, it creates two payments; one of $3 to the merchant and one with the change of $2 going back to the one paying.

Identifying a transaction output as a change output requires the use of heuristics .Examples of heuristics that can be used to discern a change output from the other payment are; the usage of round numbers (in the bitcoin amount or in the fiat currency value of the amount at the time of the transaction), the order of the outputs in the transaction body and so on. In our chosen transaction, it’s easy to detect the change output because it’s going back to the same address that was used to receive the bitcoins that were spent, as we’ll see below.

In principle, Bitcoin wallets behave somewhat differently from each other and leave different traces on the blockchain — similar to how browsers reveal pieces of information about themselves when they browse the web. Because of this, it is sometimes possible to identify certain transactions as originating from a certain kind of Bitcoin wallet application.

If your adversary knows which wallet application you’re using then that knowledge can contribute to mapping your identity to one of your transactions, which would weaken your privacy. Every little piece of information helps an adversary paint a picture of who you are and what you are doing.

The source of funds for the transaction

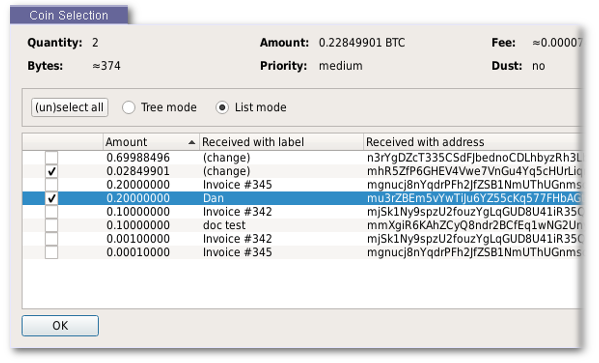

In Bitcoin transactions, the “source of funds” is always other “unspent” transactions, or to be precise, unspent transaction outputs (known as UTXOs). It’s good to keep in mind that what is seen in a block explorer is a combination of decoded raw blockchain data and derived data. One block explorer might choose to display the transaction like this:

From blockchain.com.

From blockchain.com.

Here the “source of funds” is displayed as an address. Blockstream’s explorer chooses to display it like this, where the source of funds is displayed as a transaction:

The reason why Blockstream’s explorer doesn’t show an address as the source of funds is that addresses aren’t technically a part of the inputs to a transaction and it isn’t always possible to infer the notion of an originating address (example). Moreover, since address reuse is discouraged, it’s good to break inherited mental models from traditional payment systems and not further cement the idea that money could or should be sent back to the recipient at the same address by showing addresses as senders.

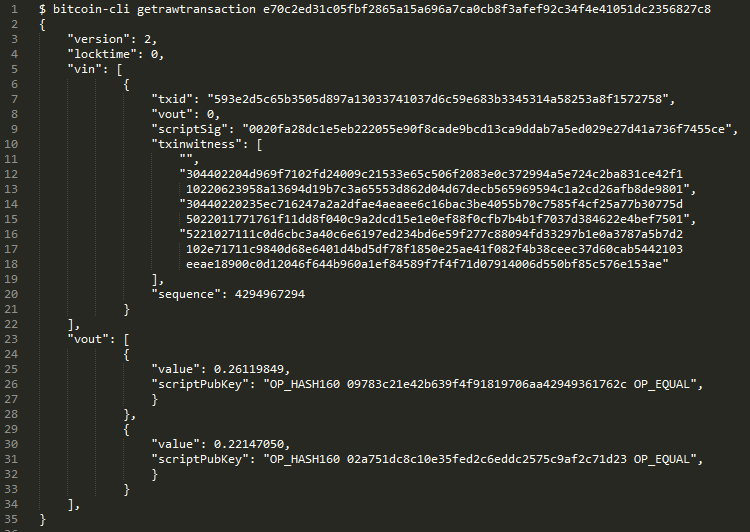

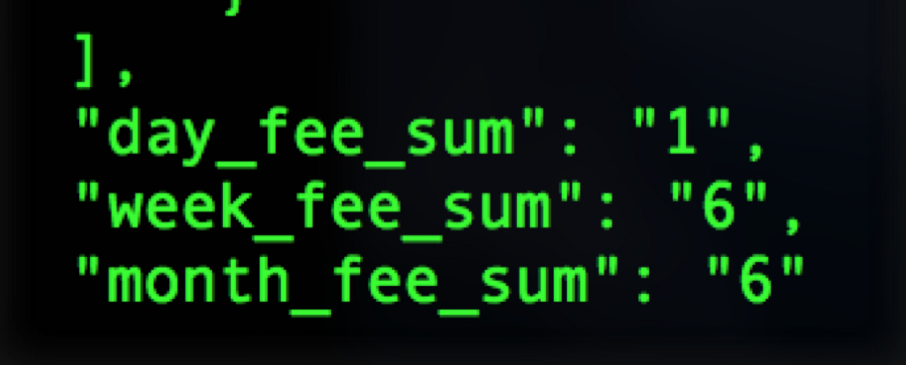

Let’s get more technical for a moment and look at the decoded raw data of the transaction, which you can fetch from your own local copy of the Bitcoin blockchain if you run a full node (or by using a trusted web-based interface). Here’s what it looks like:

e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8 decoded (manually trimmed).

e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8 decoded (manually trimmed).

The source of funds is described by the vin-array. It doesn’t refer to an address specifically. Instead, it refers to the output of a previous transaction;

593e2d5c65b3505d897a13033741037d6c59e683b3345314a58253a8f1572758

, where vout: 0 refers to that transaction’s first output (vout: 1 would mean its second output, and so on). This unspent transaction output (UTXO) is the source of funds.

To clarify what this means, the source of funds for a transaction is not an address, nor is it a transaction. The source of funds is a specific output of a specific previous transaction. Knowing this will help you protect your privacy when using bitcoin, as we’ll see in later sections.

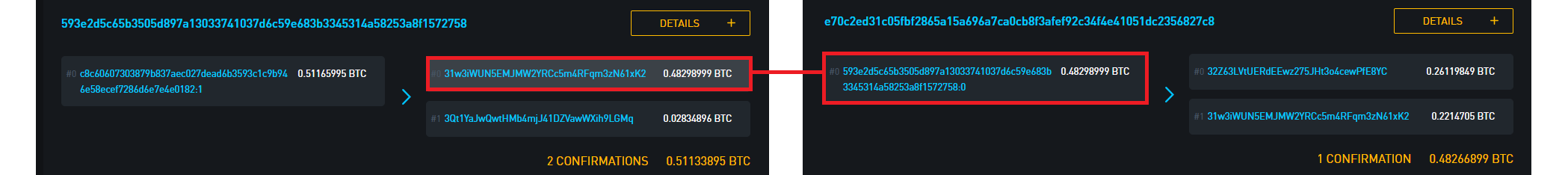

The source of funds for e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8.

The source of funds for e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8.

We can further decode parts of this transaction from the decoded raw data such as what’s in txinwitness to find out more about the source of funds. The last hexadecimal string in txinwitness reveals the 2-of-3 multisiginature script, which allowed us to deduce that it’s likely to be an exchange wallet.

The two other hexadecimal strings we saw in the txinwitness are just the signatures fulfilling this 2-of-3 multisignature condition.

Now that we’ve identified the source of funds, we can see in this example that it’s a 0.48298999 bitcoin output (~US$1850), even though the sent payment was just one of ~US$1000. This has an undesirable consequence: imagine a situation in which a friend pays you $10 but the transaction reveals that he’s the owner of a million dollars and has immediate access to send the full amount— obviously not very good for privacy. If you are worried about disclosing information about your bitcoin wealth when you are sending a payment to someone, you need to be aware of which inputs are used in your transactions (more on this below).

Combining the knowledge

Because transactions always need to provide the source of funds, transactions become linked together, producing what’s known as a transaction graph. If you pay a friend in bitcoin, not only will your friend see the inputs you used in the transaction, but you will also be able to see when your friend spends those coins and to which addresses the coins are sent.

Some addresses are known in the Bitcoin space, such as the Bitfinex cold wallet or the seized Silk Road coins. An address can become known because an entity — for example, a business or a charity — advertently exposes their deposit or donation addresses on their website, or inadvertently because a forum post or a law enforcement record publicly reveals the connection. Blockchain analytics firms will scrape the web regularly to find such information.

Other addresses become exposed via association through a technique called clustering.

Clustering

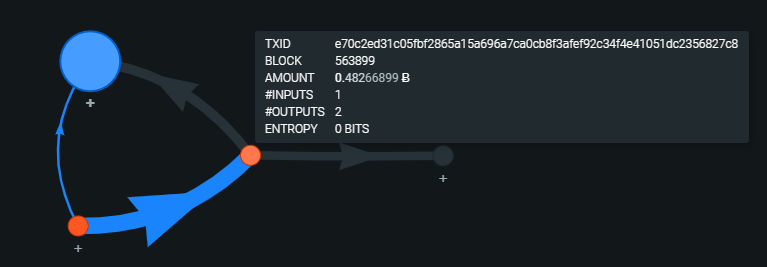

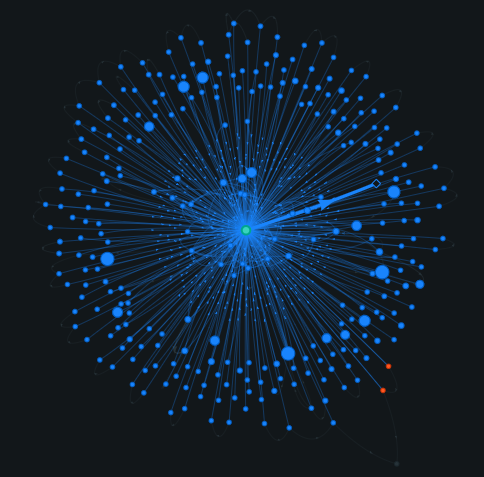

Let’s go back to our example transaction from the previous examples, e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8. Here, we can immediately see that both the source of funds of our transaction and our transaction (red dots) have been used to jointly fund a third transaction (big blue dot).

Transaction graph for e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8 (oxt.me).

Transaction graph for e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8 (oxt.me).

Particularly, it’s the second output of the funding transaction and the first output of our transaction that are involved in funding this transaction. They were previously sent to the addresses:

3Qt1YaJwQwtHMb4mjJ41DZVawWXih9LGMq

32Z63LVtUERdEEwz275JHt3o4cewPfE8YC

On the surface, these appear to be two separate addresses with just one innocuous-looking incoming and outgoing transaction each. But because their private keys have both been used to sign the big blue dot transaction, these addresses now all belong to the same cluster (along with 407 other addresses involved in the inputs to the transaction), which we can make assumptions about having the same owner. This heuristic has gone under a couple of different names in the past, the most recent one being the common-input-ownership-heuristic.

Transaction graph for “the big blue dot” transaction f491dfe9867c36e85950116a90a6128060d6070866ad0f3598d70d146750162f (oxt.me).

Transaction graph for “the big blue dot” transaction f491dfe9867c36e85950116a90a6128060d6070866ad0f3598d70d146750162f (oxt.me).

Blockchain analytics firms will use such heuristics to create giant clusters. The blockchain explorer WalletExplorer has pinned the two addresses to belong to a cluster of 162787 addresses in total. Analytics firms label such clusters with all identities (IP addresses, user accounts, organizations, real names) they’re able to pin to the cluster in order to map out the Bitcoin transaction ecosystem. They then sell access to these data sets to law enforcement agencies and other companies.

Many blockchain analytics firms receive information about transactions directly from their own customers, such as cryptocurrency exchanges. However, two of the largest analytics firms, Chainalysis and Elliptic, have stated that they do not trace back transactions to specific individuals in the data they receive, but only to the exchanges or other business entities (1, 2).

It only takes the deanonymization of one address in a cluster to deanonymize an entire cluster.

Breaking the heuristics

We’ve seen now that there are a multitude of ways your identity can be linked to a certain Bitcoin address or transaction and yet another multitude of ways your Bitcoin transactions can be linked to each other. When put together, these information leaks in combination can unmask our entire financial privacy.

Some Bitcoin users intentionally try to make this kind of analysis difficult by using tools and techniques to break the heuristics analytics companies employ. Some techniques decrease the effectiveness of the heuristics through distortive methods while others attempt to avoid the heuristics altogether. Bitcoin wallets can assist users by automating some of these techniques or make them available through a user interface.

Here’s a non-exhaustive list of some examples:

- Randomizing the order of outputs when creating transactions to decrease change output detection accuracy (example).

- Avoiding address reuse via HD wallets.

- A PayNymis a publicly sharable ID which allows you to receive payments at different unassociated addresses you control that only become known to you and the sender. The PayNym allows a new address to be derived for each payment without you having to manually present a new address each time, which is great if you want to conveniently receive, say, donations online using bitcoin.

- Coin selection/coin control — wallets can be designed to prioritize clustering fewer addresses together when possible by selecting inputs for transactions more carefully (example), or allow users to select inputs for transactions manually to avoid revealing ownership of certain coins (example).

Coin control in Bitcoin Core — user can manually choose the source of funds for a transaction.

Coin control in Bitcoin Core — user can manually choose the source of funds for a transaction.

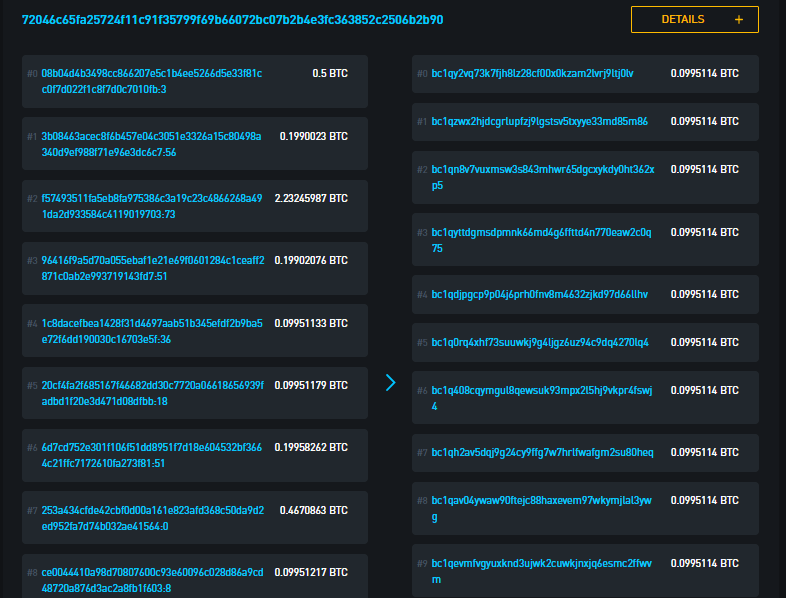

A more advanced example of a privacy-enhancement technique is CoinJointransactions. CoinJoins are a scheme which adds many inputs from many different users into a joint transaction before the transaction is broadcast.

In our example, we saw how the input of a transaction always references a specific output of a previous transaction, rather than the whole transaction:

The source of funds for e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8.

The source of funds for e70c2ed31c05fbf2865a15a696a7ca0cb8f3afef92c34f4e41051dc2356827c8.

But the inputs and the outputs within each individual transaction don’t reference each other in any way; transactions are valid as long as there’s enough bitcoin in the inputs to cover all the outputs.

A CoinJoin transaction (72046c65fa25724f11c91f35799f69b66072bc07b2b4e3fc363852c2506b2b90) created by the Wasabi Wallet.

A CoinJoin transaction (72046c65fa25724f11c91f35799f69b66072bc07b2b4e3fc363852c2506b2b90) created by the Wasabi Wallet.

Here, the outputs are chopped up into many equal-amount chunks, so you can’t be sure which input funds which payment. The result is that a payment can have a plethora of possible “source of funds” indiscernible from one another, as well as a plethora of possible destinations. This technically doesn’t hide the source of funds or the destination, but it mixes it so that it becomes difficult to prove what actually funded a particular payment and who’s bitcoins went where.

What’s also interesting about these kinds of transactions is that they complicate the idea of the common-input-ownership-heuristic. These inputs would all get flagged as belonging to the same owner, which in this transaction they aren’t. The images below show false clusters of independent payments as a result of CoinJoin transactions.

CoinJoin transactions created by the Wasabi Wallet. Transaction IDs from left to right: 72046c65fa25724f11c91f35799f69b66072bc07b2b4e3fc363852c2506b2b90, d7a428a8e3d69f236519cb999dbcb47b3b283548875371da567259be806e35ea, 20cf4fa2f685167f46682dd30c7720a06618656939fadbd1f20e3d471d08dfbb (oxt.me).

CoinJoin transactions created by the Wasabi Wallet. Transaction IDs from left to right: 72046c65fa25724f11c91f35799f69b66072bc07b2b4e3fc363852c2506b2b90, d7a428a8e3d69f236519cb999dbcb47b3b283548875371da567259be806e35ea, 20cf4fa2f685167f46682dd30c7720a06618656939fadbd1f20e3d471d08dfbb (oxt.me).

But because these transactions all have the odd look of equal-amount outputs, they’re rather easy to spot and can be eliminated from the clustering analytics tools. Equal-amount CoinJoin transactions are best understood as mixers to be used when one wishes to obfuscate the source of funds for a payment and the destination to which a payment is sent.

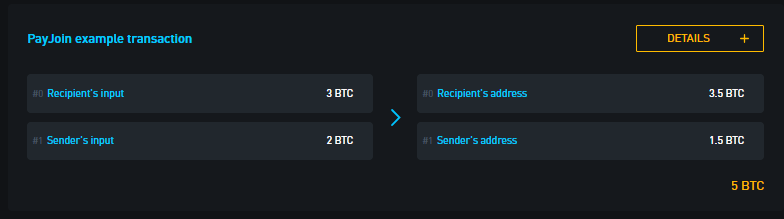

However, the same principle is used to create transactions that are indistinguishable from normal transactions in a recent invention called a PayJoin or Pay-to-EndPoint (P2EP). This emerging transaction type mixes inputs from the payer and the recipient and pays the recipient by shifting over the payment amount from the sender’s output and to the recipient’s output during a real payment for something.

A PayJoin transaction template where the sender pays 0.5 bitcoin to the recipient, mixing inputs with each other in the process.

A PayJoin transaction template where the sender pays 0.5 bitcoin to the recipient, mixing inputs with each other in the process.

This transaction doesn’t do a lot of mixing — but it does trigger the common-input-ownership heuristic erroneously. More importantly, it triggers the heuristic without leaving any clues for the analytics firms to not cluster the inputs together, which they would need to in order to avoid giving false positives. If the usage of PayJoins becomes widespread, the portion of false common-input-ownership positives could become so great that the heuristic itself becomes unreliable, which would be a massive setback for the blockchain analytics tools.

The Lightning Network

The Lightning Network is a beta technology that is being developed on top of the Bitcoin protocol to facilitate low-cost, instant payments. The Lightning Network is accessible to users of Lightning wallets. Lightning transactions differ from base-layer transactions in many ways which make them advantageous from a privacy perspective:

- Lightning transactions are not stored on a public ledger.

- Lightning transactions use onion routing which doesn’t disclose who the final recipient is to the rest of the network.

- Lightning transactions don’t mix inputs and can’t be clustered together.

The Lightning Network is a system of channels which require liquidity; the current set of merchants and users that accept Lightning payments today are a small subset of the total set of Bitcoin users in the system, and not all payments (especially larger ones) can propagate through the channel system, although that is expected to improve over time. This also means that while Lightning can provide improved privacy for the transactions in its channel system, those channels still need to be funded by regular Bitcoin transactions, which are subject to the privacy concerns in this post.

Another problem is that unlike base-layer Bitcoin payment recipients, recipients of Lightning payments are required to have a Lightning node running. Your node communicates with other Lightning nodes using TCP/IP. Whenever your node interacts with the network (sending, receiving or routing other payments) someone will learn about the existence of your node, its public key and its IP address. From your public key, it’s trivial to find out which channels are open between you and other nodes, and how many bitcoins you each have committed to those channels upon opening them. For private channels, the IP address is only revealed to the ones you have an open channel with, but for public channels, it’s revealed to the entire network and it’s even possible for someone to probe the channels’ current balances to figure out if you’re a target worth attacking.

When you run a Lightning node, you should assume that your channel balances are known and that they can be linked to your IP address. For this reason, running your Lightning node over Tor is a good option to protect your privacy.

The Lightning Network is currently under quite rapid development and many of its properties might be subject to change in the near future.

Protocol changes

There are several privacy-enhancing technologies that are in development for the base-layer Bitcoin protocol. Here are a few examples:

- Schnorr signatures — a signature scheme which, among other improvements, makes multisignature addresses indistinguishable from single-signature addresses

- Scriptless scripts — a method by which to use scripts without disclosing the actual spending rules

- Taproot — a technique with the potential of making transactions of all types of spending rules indistinguishable from each other

Conclusion

This article aims to give a primer to how privacy works in Bitcoin. The pseudonymous but transparent nature of the Bitcoin blockchain creates an environment where the privacy of the system ultimately hinges on the tools employed by the user and the spying entity. Users who take few precautions for protecting their privacy will most likely leak enough financial information in order for it to be dangerous, assuming that the spying entity is analyzing the blockchain.

The next step is to get acquainted with how different Bitcoin wallet applications can help with privacy, and what to expect when using them. This will be covered in the next article in this series. In later articles, we will look at different cryptocurrencies and survey available exchange platforms in regions with restricted economic and political freedom.

Further reading

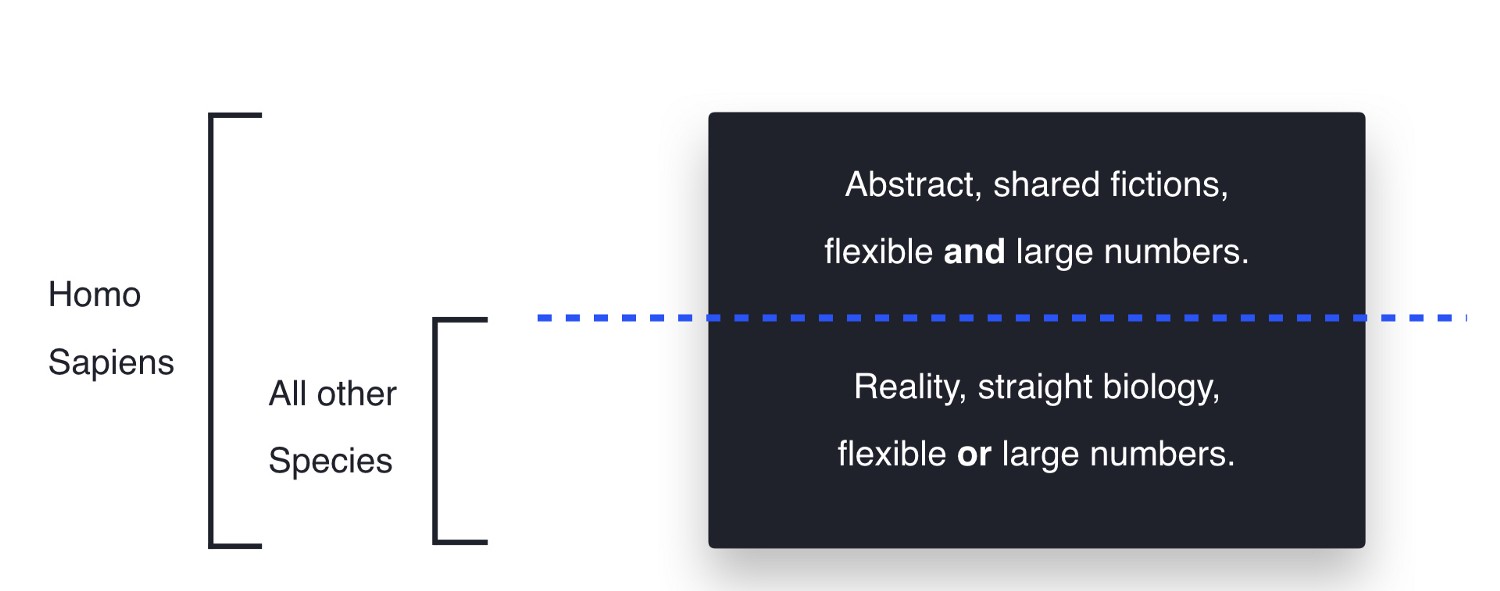

To completely understand what is going on under the hood of Bitcoin, Andreas Antonopoulos’ Mastering Bitcoin is an excellent resource which is translated into several languages.