| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the November 2018 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

Transaction count is an inferior measure

By Nic Carter

Posted November 10, 2018

It is popular to measure Bitcoin by looking at its daily transaction count or ‘tps’ — transactions per second. New blockchains often advertise tps rates in the millions or billions and sneer at Bitcoin’s measly 3 - 4 tps rate (it fluctuates between 200,000 and 350,000 transactions per day).

But this is an incomplete picture. There are at least three important variables to consider when holistically appraising a value transfer system, and the transaction rate is just one of them:

- Transaction capacity (tps)

- Typical transaction characteristics (transaction size)

- Settlement assurances

Together, transaction rate and average transaction size give you the economic throughput of the system; a measure of its financial bandwidth per unit of time. The settlement assurances tell you what sort of a system it is. How certain are you that you won’t face a chargeback or be defrauded? Does your transaction settle immediately, like physical cash? Or is there a 90-day chargeback period prior to settlement, as with most credit cards?

Even though Bitcoin is virtual, it is closer to a physical settlements system than a deferred-settlement system like credit cards. Bitcoins are virtual bearer instruments: if you possess the private key which unlocks an unspent output, you are the owner of those coins and entitled to do with them whatever you like. That asset is no one’s liability. In this respect, it more closely resembles physical cash or a commodity like gold. There is no recourse if you lose your coins or send them to the wrong address. Of course, recourse has its advantages in certain contexts; and the overhead for dealing with reversed transactions and fraud is exactly why credit fees exist. The costs of credit fraud and the remediation infrastructure are passed on to end users in the form of merchant fees. That’s why you can’t typically do a credit transaction for less than a dollar or two.

So how do you consistently compare dissimilar value-transfer systems like Bitcoin, Paypal, Visa, SWIFT, and physical cash? I’d recommend broadening your focus beyond simple transaction count. That’s only one component of economic throughput.

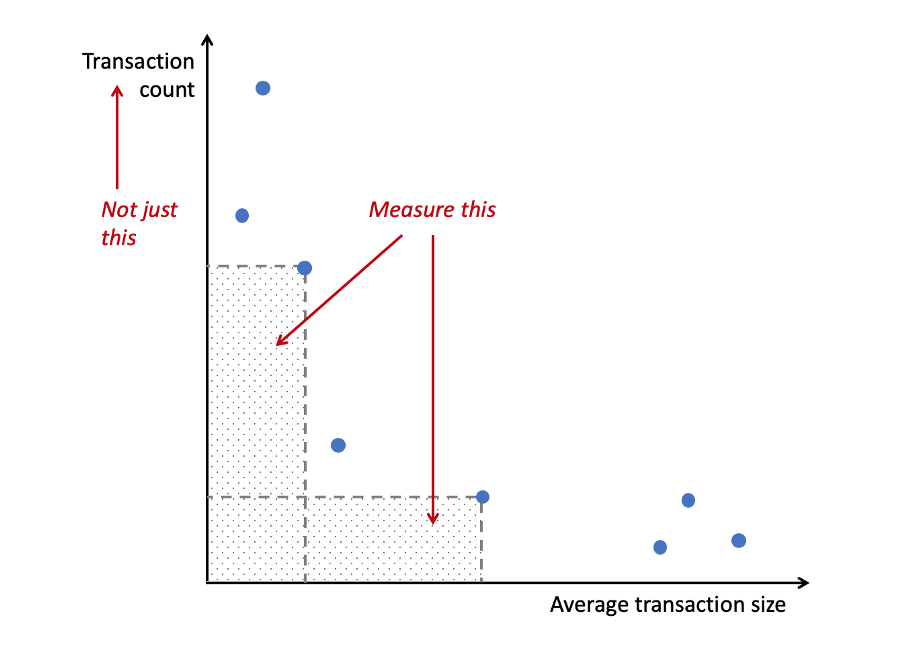

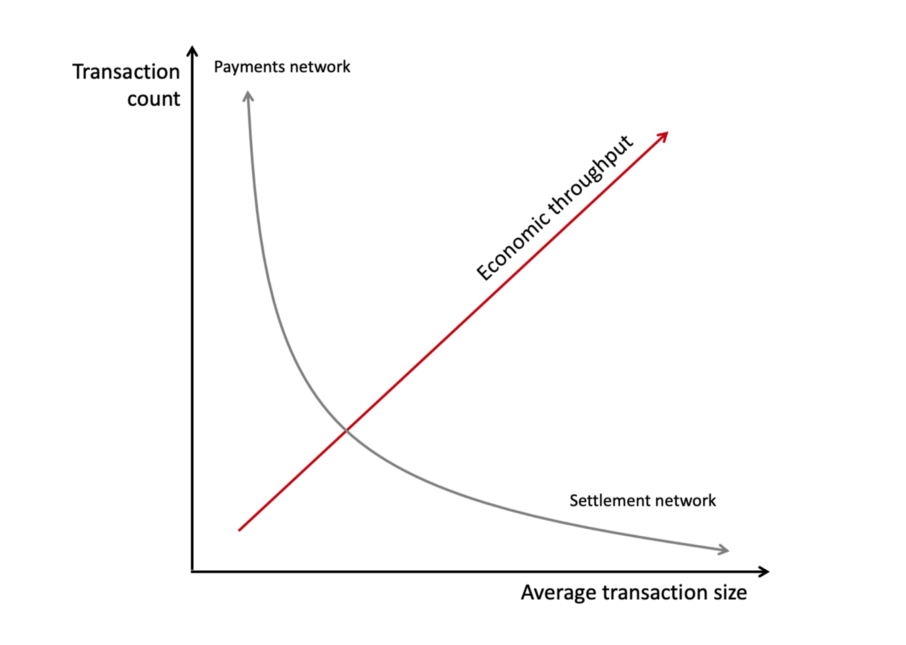

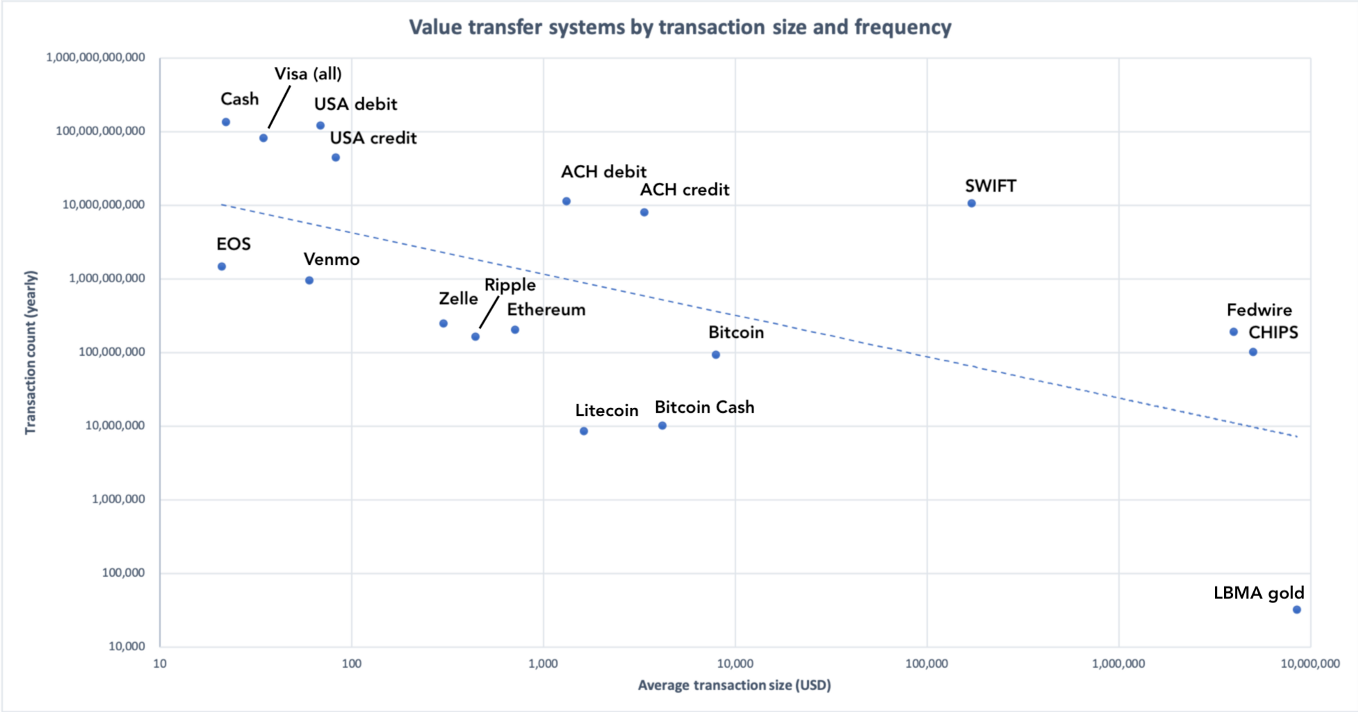

The chart below shows an idealized comparison of various value transfer systems along the axes of transaction count and typical transaction size. To simplify, payment networks consist of many small transactions, whereas settlement networks will exhibit fewer, but larger transactions (in dollar terms).

What we should really be interested in is the area under each point: that’s average transaction size * the number of transactions, which gives us the value flowing through the system per unit of time.

To further simplify, what you find if you aggregate data from a variety of networks is that they tend to cluster at one end or the other.

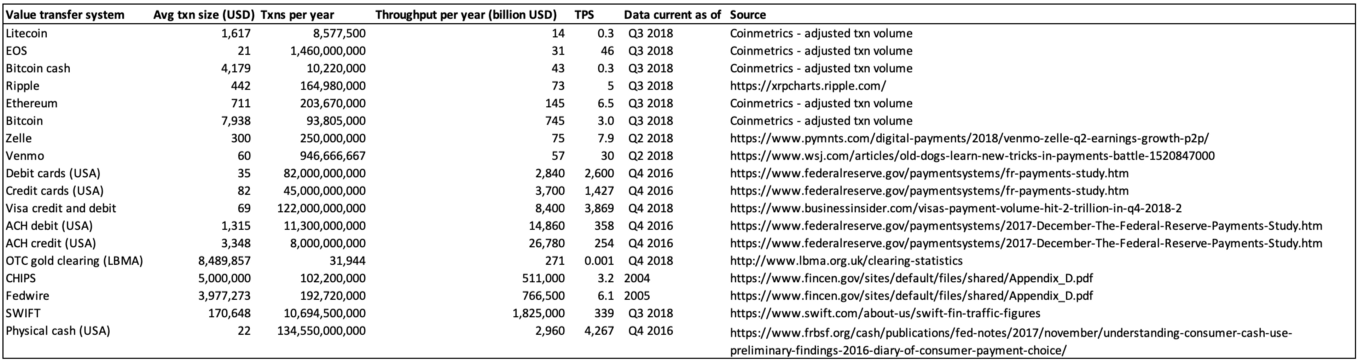

I’m oversimplifying of course, but you get the idea. Let’s plug some real numbers into the idealized model. I went ahead and found data for physical cash transactions, credit/debit transactions, mobile p2p payments, various popular cryptocurrencies, gold settlements, and various settlement and financial infrastructure systems (ACH, Fedwire, CHIPS, SWIFT).

The real numbers chart looks like an even more exaggerated version of the L in my toy model, because the systems vary on many orders of magnitude along the two axes.

Sources in appendix

Sources in appendix

On the top left, you have physical cash and Visa credit/debit transactions, which have extremely high volume and smallish per-transaction sizes. On the bottom right, you have the massive settlement networks, with the gold settlements on the London market taking the crown for per-transaction size. One caveat: SWIFT is a messaging service, so value does not really flow through the system. The numbers listed for SWIFT are mostly academic in nature.

Let’s take the log view so we can cram everything in there.

Blue dotted line represents the exponential best fit

Blue dotted line represents the exponential best fit

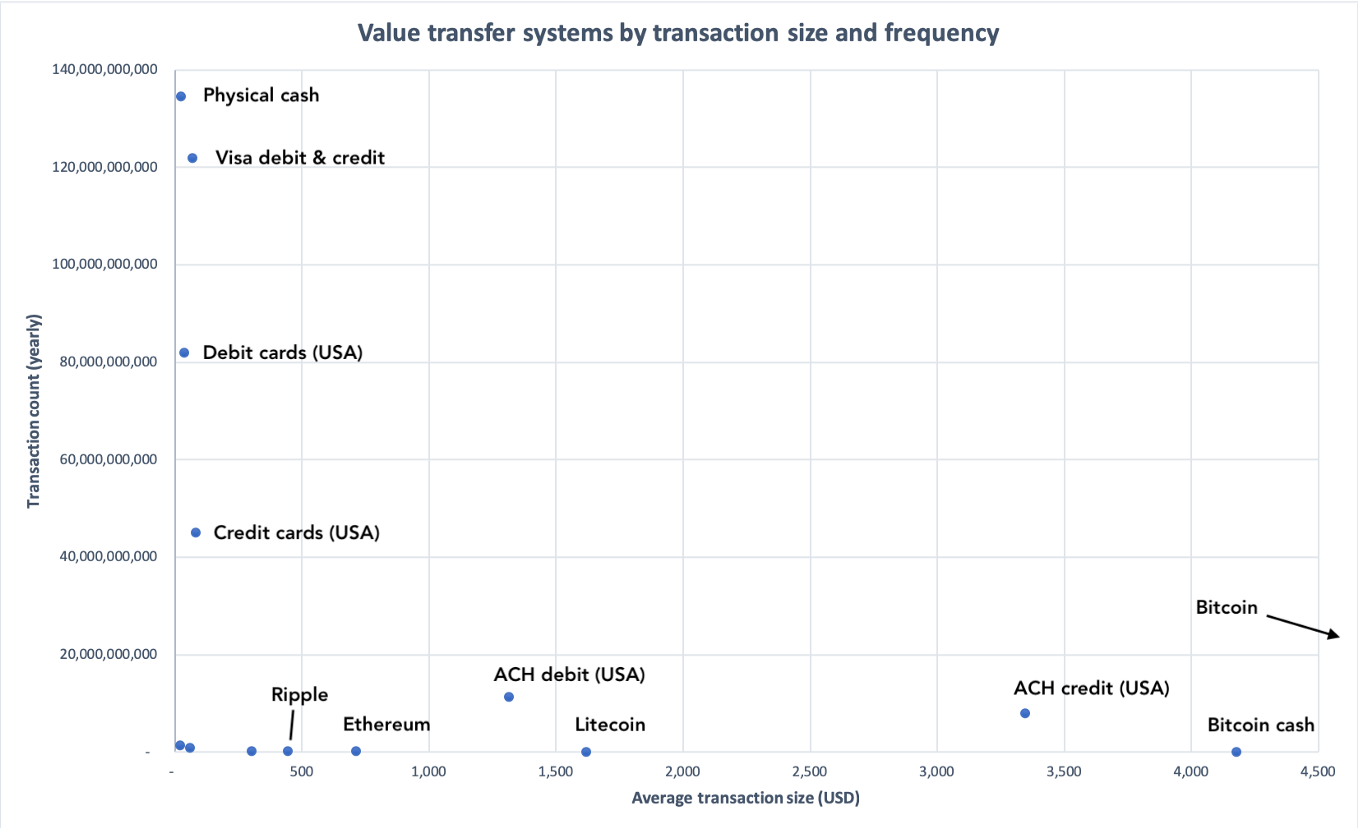

This is the most comprehensive view. It demonstrates clearly that you have settlement-like networks towards the bottom right, and payment-like networks on the top left. Bitcoin is edging closer and closer to the bottom right, as base-layer transactions encode progressively more value. Let’s exclude the megalarge settlement networks and focus on the payments networks.

Chart truncated to show a subset of the data

Chart truncated to show a subset of the data

As you can tell, most cryptocurrencies can barely lift themselves off the X axis — they don’t have the throughput, or crucially, the adoption, to work as mainstream payments networks.

So what is Bitcoin for, anyway?

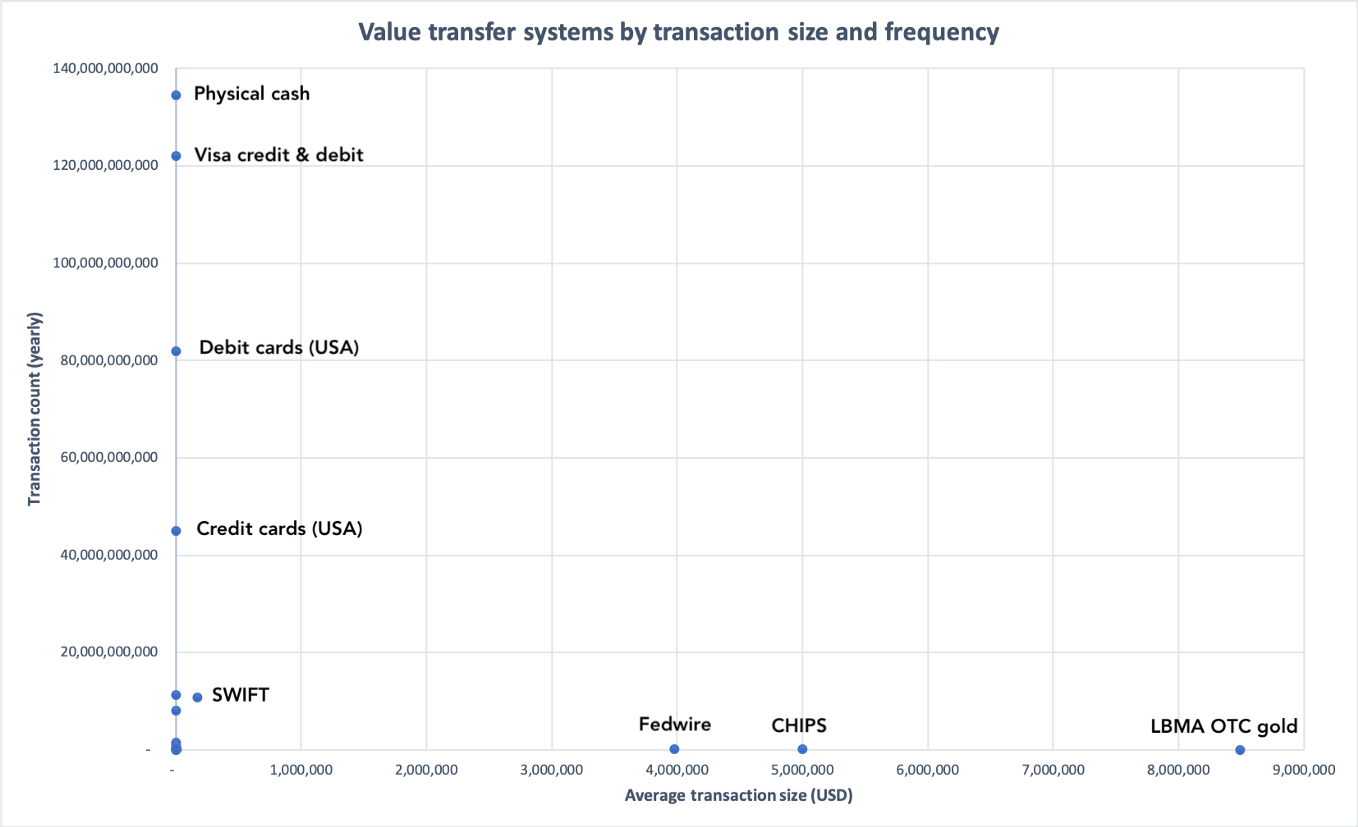

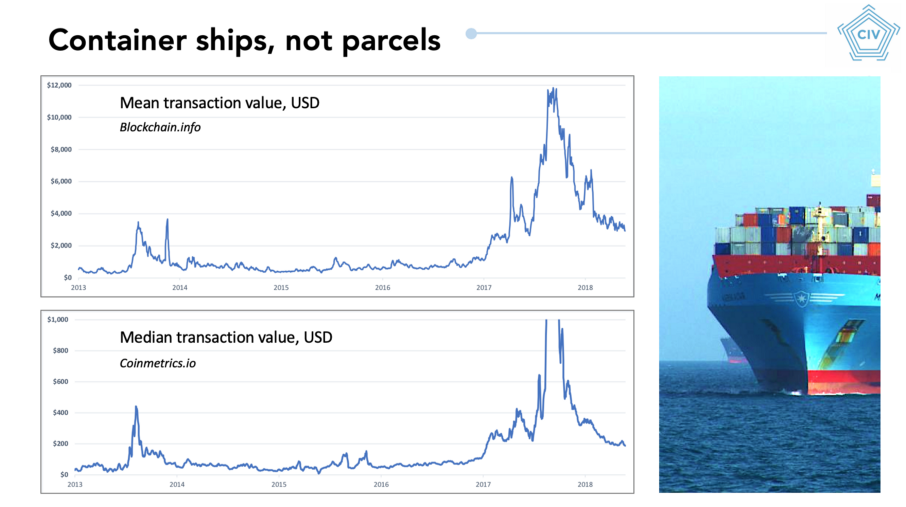

As shown on the chart, Bitcoin transactions tend to be quite large. It’s hard to know the precise number, but your average transaction will be in the thousands of dollars, possibly tens of thousands. Your median transaction is well over $100.

Slide from ‘Bitcoin as a novel economic system,’ my presentation at Baltic Honeybadger 2018

Slide from ‘Bitcoin as a novel economic system,’ my presentation at Baltic Honeybadger 2018

Large transactions are partly out of necessity: exchanges will often batch together many cashouts to investors into a single transaction, to reduce the per-payment overhead, which increases transaction size; and fees in the single-digit dollars mean that only larger transactions are worth it from a fees perspective.

More saliently, though, the strong assurances of global final settlement that Bitcoin provides are simply not required for low-value transactions. Typical usage of the system tends to be scaled to the assurances that the system provides . You don’t drive an armored personnel carrier down the street to get a packet of cigarettes — you don’t need those security guarantees. You don’t wear body armor when you walk to work. You don’t put your petty cash in a safe and handcuff it to yourself when you buy groceries.

What critics miss when they fixate on TPS is the simple fact that the users of these systems tend to have a good idea of what they want from them. Low-stakes, small value transfers with some reversibility guarantees work just fine on Venmo, Paypal, or Visa. Yes — these don’t work for the unbanked, but then again virtually no financial infrastructure does. This stuff takes a long time to build, as does the trust in the system.

What a low bandwidth-in-bytes but high bandwidth-in-dollars system like Bitcoin works for is large, inter-jurisdictional, money-for-enemies transactions where mutual trust is lacking and rapid settlement is desired. If mutual trust is present, or deferred settlement is acceptable, or the payment size is very small, base-layer-bitcoin is not the system for you! Vanilla Bitcoin is useful for a tiny fraction of all of the payments or value transfers that happen on a given day. And that’s fine!

Bitcoin lives on the bottom right size of the size/frequency chart. Those 3 or 4 transactions which happen per second on Bitcoin are exactly what its users are after. That very particular, idiosyncratic use case doesn’t really overlap with systems like Visa, Paypal, Alipay, or Venmo. They aren’t teleologically comparable: they aren’t trying to do the same thing.

Is it fair to compare them? Yes, but only if you are mindful of the tradeoffs made by each system.

“Why can’t fruit be compared” — Lil Dicky

Additionally, Bitcoin’s near-immediate physical settlement opens up a large design space allowing developers to add cheaper, more convenient payments networks with deferred settlement. This is Lightning and other second-layer solutions: cheap, near-instantaneous transfers which periodically settle to the base layer. The truth is that not all transactions merit final settlement within minute of occurring; for these petty cash situations you are better off using a higher layer. Bitcoin — and increasingly, Ethereum too — is developing precisely with this in mind.

So, in short, value transfer systems vary along at least three major axes, not just one. The response to “Our system does 500,000 TPS” is “at what cost?” Are you deferring settlement? Do you have a single validator? Do you require that transactors be part of the US-controlled financial system?

In my view, economic throughput — the dollar equivalent value flowing through the system per unit of time — is a far more comprehensive view of the system than the simple message-send-rate (TPS). Measure the area under the point, not just the Y value. From that more holistic perspective, Bitcoin is a single order of magnitude away from Visa.

Appendix

For data collection, recency was sought. Data for major cryptocurrencies comes from coinmetrics.io. Both adjusted transaction volume and transaction count were smoothed on a trailing 30-day basis and annualized. Raw or nominal transaction volumes for cryptocurrencies are noisy and bias the figures upwards, and so Coinmetrics performs transparent adjustments and de-noising to render the figures more conservative.

Data for legacy financial systems is found in 10K reports, news articles, and academic studies and annualized. Figures for CHIPS and Fedwire are somewhat out of date and hence should be interpreted as rough order of magnitude estimates. SWIFT data is taken from the most recent quarter and annualized but does not imply settlement volume but rather financial messaging.

Building a fundamental piece of technology that will bring Bitcoin to the next billion users? Reach out: castleisland.vc .

How Does Distributed Consensus Work?

##An overview of key breakthroughs in blockchain technology — and why Nakamoto Consensus is such a big deal

By Preethi Kasireddy

Posted November 13, 2018

Distributed systems can be difficult to understand, mainly because the knowledge surrounding them is distributed. But don’t worry, I’m well aware of the irony. While teaching myself distributed computing, I fell flat on my face many times. Now, after many trials and tribulations, I’m finally ready to explain the basics of distributed systems to you.

Blockchains have forced engineers and scientists to re-examine and question firmly entrenched paradigms in distributed computing.

I also want to discuss the profound effect that blockchain technology has had on the field. Blockchains have forced engineers and scientists to re-examine and question firmly entrenched paradigms in distributed computing. Perhaps no other technology has catalyzed progress faster in this area of study than blockchain.

Distributed systems are by no means new. Scientists and engineers have spent decades researching the subject. But what does blockchain have to do with them? Well, all the contributions that blockchain has made wouldn’t have been possible if distributed systems hadn’t existed first.

Essentially, a blockchain is a new type of distributed system. It started with the advent of Bitcoin and has since made a lasting impact in the field of distributed computing. So, if you want to really know how blockchains work, a great grasp of the principles of distributed systems is essential.

Unfortunately, much of the literature on distributed computing is either difficult to comprehend or dispersed across way too many academic papers. To make matters more complex, there are hundreds of architectures, all of which serve different needs. Boiling this down into a simple-to-understand framework is quite difficult.

Because the field is vast, I had to carefully choose what I could cover. I also had to make generalizations to mask some of the complexity. Please note, my goal is not to make you an expert in the field. Instead, I want to give you enough knowledge to jump-start your journey into distributed systems and consensus.

After reading this post, you’ll walk away with a stronger grasp of:

- What a distributed system is,

- The properties of a distributed system,

- What it means to have consensus in a distributed system,

- An understanding of foundational consensus algorithms (e.g. DLS and PBFT), and

- Why Nakamoto Consensus is a big deal.

I hope you’re ready to learn, because class is now in session.

What Is a Distributed System?

A distributed system involves a set of distinct processes (e.g., computers) passing messages to one another and coordinating to accomplish a common objective (i.e., solving a computational problem).

A distributed system is a group of computers working together to achieve a unified goal.

Simply put, a distributed system is a group of computers working together to achieve a unified goal. And although the processes are separate, the system appears as a single computer to end-user(s).

As I mentioned, there are hundreds of architectures for a distributed system. For example, a single computer can also be viewed as a distributed system: the central control unit, memory units, and input-output channels are separate processes collaborating to complete an objective.

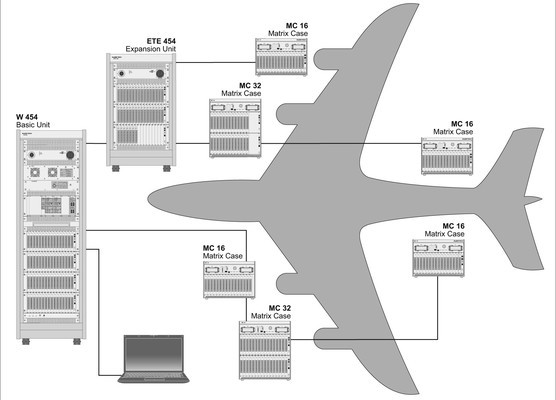

In the case of an airplane, these discrete units work together to get you from Point A to Point B:

Source: https://www.weetech.de/en/news-info/tester-abc/distributed-system-1/

Source: https://www.weetech.de/en/news-info/tester-abc/distributed-system-1/

In this post, we’ll focus on distributed systems in which processes are spatially-separated computers.

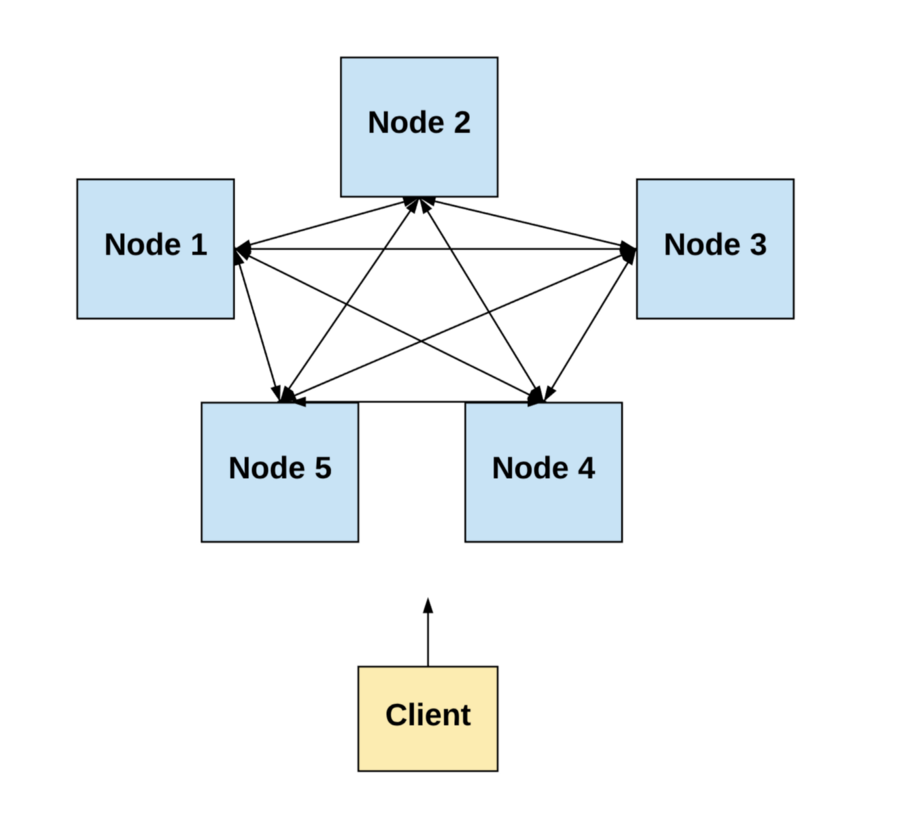

Diagram by author.

Diagram by author.

Note: I may use the terms “node,” “peer,” “computer,” or “component” interchangeably with “process.” They all mean the same thing for the purposes of this post. Similarly, I may use the term “network” interchangeably with “system.”

Properties of a Distributed System

Every distributed system has a specific set of characteristics. These include:

A) Concurrency

The processes in the system operate concurrently, meaning multiple events occur simultaneously. In other words, each computer in the network executes events independently at the same time as other computers in the network.

This requires coordination.

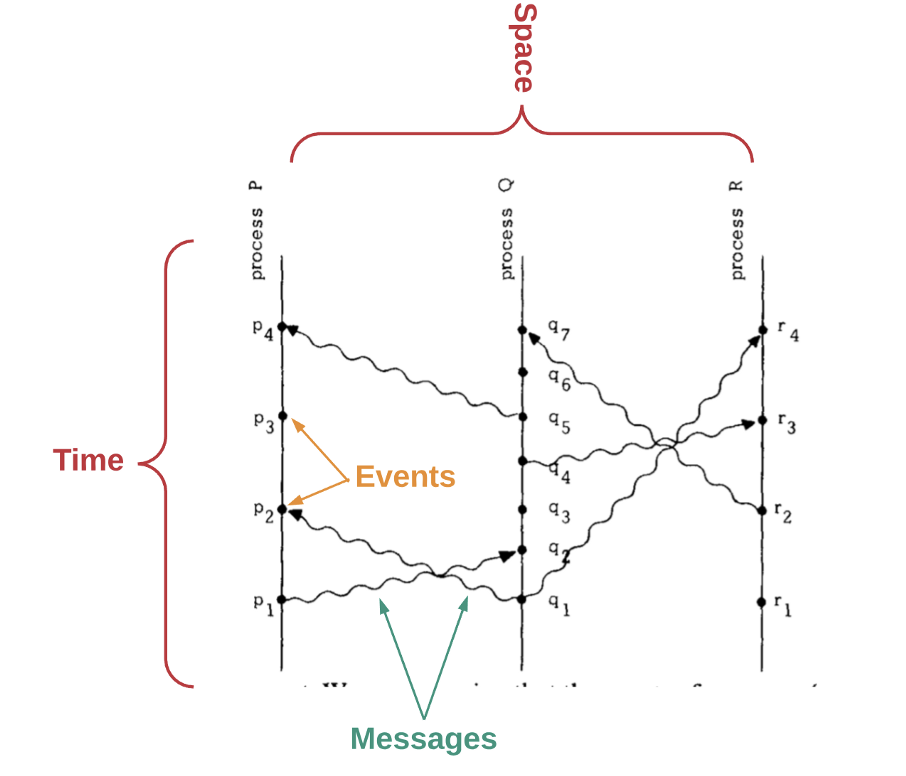

Lamport, L (1978). Time, Clocks and Ordering of Events in a Distributed System

Lamport, L (1978). Time, Clocks and Ordering of Events in a Distributed System

B) Lack of a global clock

For a distributed system to work, we need a way to determine the order of events. However, in a set of computers operating concurrently, it is sometimes impossible to say that one of two events occurred first, as computers are spatially separated. In other words, there is no single global clock that determines the sequence of events happening across all computers in the network.

In the paper “Time, Clocks and Ordering of Events in a Distributed System,” Leslie Lamport shows how we can deduce whether one event happens before another by remembering the following factors:

- Messages are sent before they are received.

- Each computer has a sequence of events.

By determining which event happens before another, we can get a partial ordering of events in the system. Lamport’s paper describes an algorithm which requires each computer to hear from every other computer in the system. In this way, events can be totally ordered based on this partial ordering.

However, if we base the order entirely upon events heard by each individual computer, we can run into situations where this order differs from what a user external to the system perceives. Thus, the paper shows that the algorithm can still allow for anomalous behavior.

Finally, Lamport discusses how such anomalies can be prevented by using properly synchronized physical clocks.

But wait — there’s a huge caveat: coordinating otherwise independent clocks is a very complex computer science problem. Even if you initially set a bunch of clocks accurately, the clocks will begin to differ after some amount of time. This is due to “clock drift,” a phenomenon in which clocks count time at slightly different rates.

Essentially, Lamport’s paper demonstrates that time and order of events are fundamental obstacles in a system of distributed computers that are spatially separated.

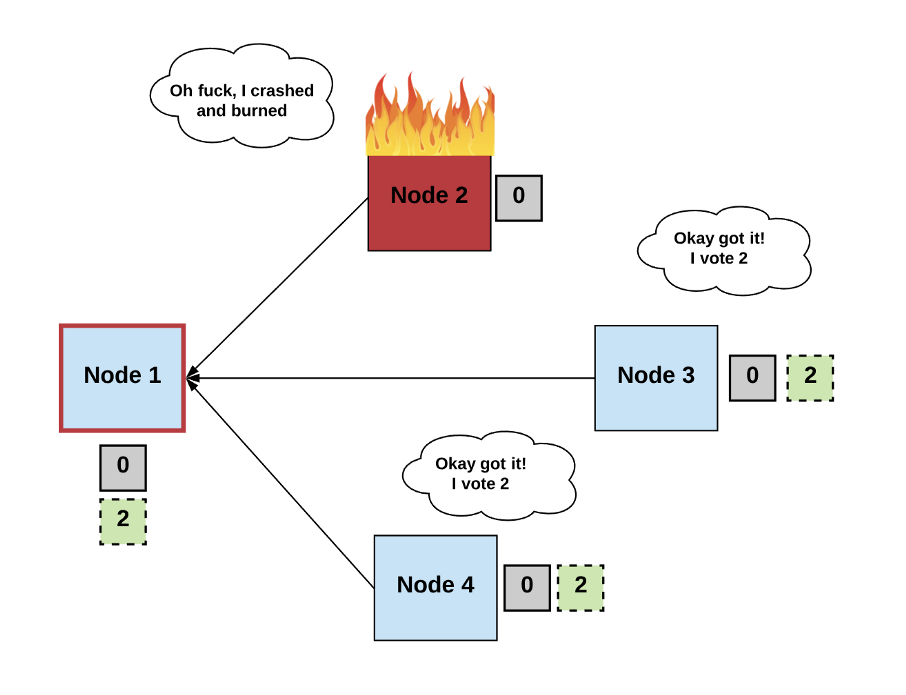

C) Independent failure of components

A critical aspect of understanding distributed systems is acknowledging that components in a distributed system are faulty. This is why it’s called “fault-tolerant distributed computing.”

It’s impossible to have a system free of faults. Real systems are subject to a number of possible flaws or defects, whether that’s a process crashing; messages being lost, distorted, or duplicated; a network partition delaying or dropping messages; or even a process going completely haywire and sending messages according to some malevolent plan.

It’s impossible to have a system free of faults.

These failures can be broadly classified into three categories:

- Crash-fail: The component stops working without warning (e.g., the computer crashes).

- Omission: The component sends a message but it is not received by the other nodes (e.g., the message was dropped).

- Byzantine: The component behaves arbitrarily. This type of fault is irrelevant in controlled environments (e.g., Google or Amazon data centers) where there is presumably no malicious behavior. Instead, these faults occur in what’s known as an “adversarial context.” Basically, when a decentralized set of independent actors serve as nodes in the network, these actors may choose to act in a “Byzantine” manner. This means they maliciously choose to alter, block, or not send messages at all.

With this in mind, the aim is to design protocols that allow a system with faulty components to still achieve the common goal and provide a useful service.

Given that every system has faults, a core consideration we must make when building a distributed system is whether it can survive even when its parts deviate from normal behavior, whether that’s due to non-malicious behaviors (i.e., crash-fail or omission faults) or malicious behavior (i.e., Byzantine faults).

Broadly speaking, there are two types of models to consider when making a distributed system:

1) Simple fault-tolerance

In a simple fault-tolerant system, we assume that all parts of the system do one of two things: they either follow the protocol exactly or they fail. This type of system should definitely be able to handle nodes going offline or failing. But it doesn’t have to worry about nodes exhibiting arbitrary or malicious behavior.

2A) Byzantine fault-tolerance

A simple fault-tolerant system is not very useful in an uncontrolled environment. In a decentralized system that has nodes controlled by independent actors communicating on the open, permissionless internet, we also need to design for nodes that choose to be malicious or “Byzantine.” Therefore, in a Byzantine fault-tolerant system, we assume nodes can fail or be malicious.

2B) BAR fault-tolerance

Despite the fact that most real systems are designed to withstand Byzantine failures, some experts argue that these designs are too general and don’t take into account “rational” failures, wherein nodes can deviate if it is in their self-interest to do so. In other words, nodes can be both honest and dishonest, depending on incentives. If the incentives are high enough, then even the majority of nodes might act dishonestly.

More formally, this is defined as the BAR model — one that specifies for both Byzantine and rational failures. The BAR model assumes three types of actors:

- Byzantine:Byzantine nodes are malicious and trying to screw you.

- Altruistic:Honest nodes always follow the protocol.

- Rational:Rational nodes only follow the protocol if it suits them.

D) Message passing

As I noted earlier, computers in a distributed system communicate and coordinate by “message passing” between one or more other computers. Messages can be passed using any messaging protocol, whether that’s HTTP, RPC, or a custom protocol built for the specific implementation. There are two types of message-passing environments:

1) Synchronous

In a synchronous system, it is assumed that messages will be delivered within some fixed, known amount of time.

Synchronous message passing is conceptually less complex because users have a guarantee: when they send a message, the receiving component will get it within a certain time frame. This allows users to model their protocol with a fixed upper bound of how long the message will take to reach its destination.

However, this type of environment is not very practical in a real-world distributed system where computers can crash or go offline and messages can be dropped, duplicated, delayed, or received out of order.

2) Asynchronous

In an asynchronous message-passing system, it is assumed that a network may delay messages infinitely, duplicate them, or deliver them out of order. In other words, there is no fixed upper bound on how long a message will take to be received.

What It Means to Have Consensus in a Distributed System

So far, we’ve learned about the following properties of a distributed system:

- Concurrency of processes

- Lack of a global clock

- Faulty processes

- Message passing

Next, we’ll focus on understanding what it means to achieve “consensus” in a distributed system. But first, it’s important to reiterate what we alluded to earlier: there are hundreds of hardware and software architectures used for distributed computing.

The most common form is called a replicated state machine.

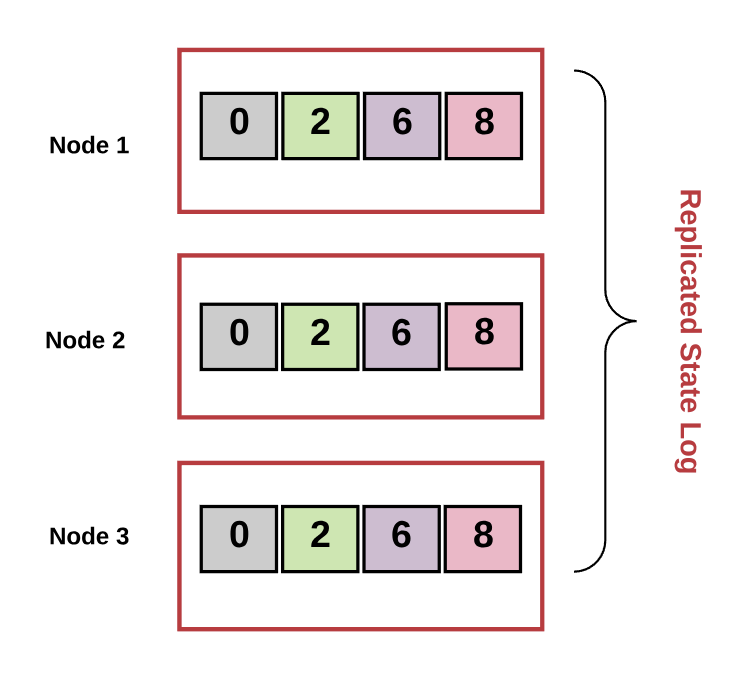

Replicated State Machine

A replicated state machine is a deterministic state machine that is replicated across many computers but functions as a single state machine. Any of these computers may be faulty, but the state machine will still function.

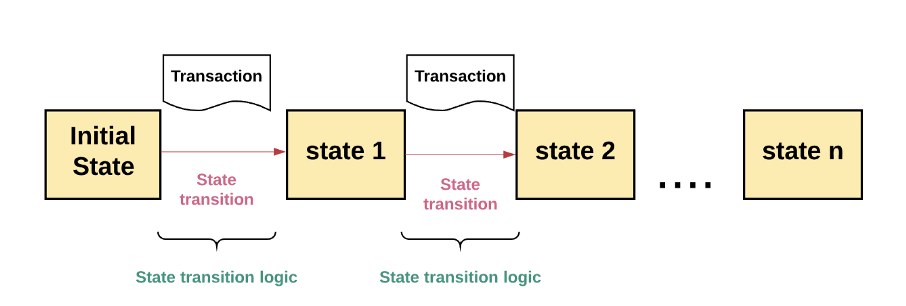

Diagram by author.

Diagram by author.

In a replicated state machine, if a transaction is valid, a set of inputs will cause the state of the system to transition to the next state. A transaction is an atomic operation on a database. This means the operations either complete in full or never complete at all. The set of transactions maintained in a replicated state machine is known as a “transaction log.”

The logic for transitioning from one valid state to the next is called the “state transition logic.”

Diagram by author.

Diagram by author.

In other words, a replicated state machine is a set of distributed computers that all start with the same initial value. For each state transition, each of the processes decides on the next value. Reaching “consensus” means that all the computers must collectively agree on the output of this value.

In turn, this maintains a consistent transaction log across every computer in the system (i.e., they “achieve a common goal”). The replicated state machine must continually accept new transactions into this log (i.e., “provide a useful service”). It must do so despite the fact that:

- Some of the computers are faulty.

- The network is not reliable and messages may fail to deliver, be delayed, or be out of order.

- There is no global clock to help determine the order of events.

And this, my friends, is the fundamental goal of any consensus algorithm.

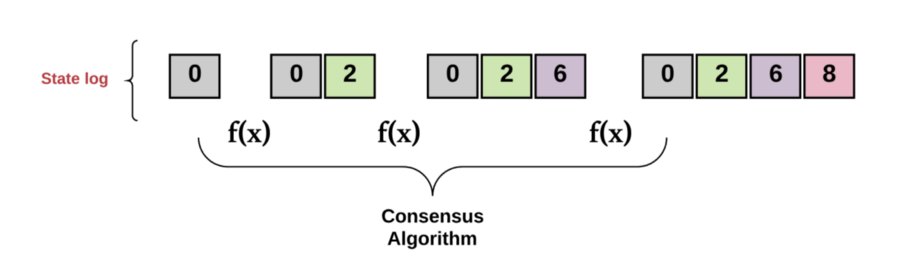

Diagram by author.

Diagram by author.

The Consensus Problem, Defined

An algorithm achieves consensus if it satisfies the following conditions:

- Agreement: All non-faulty nodes decide on the same output value.

- Termination: All non-faulty nodes eventually decide on some output value.

Note: Different algorithms have different variations of the conditions above. For example, some divide the Agreement property into Consistency and Totality . Some have a concept of Validity or Integrity or Efficiency . However, such nuances are beyond the scope of this post.

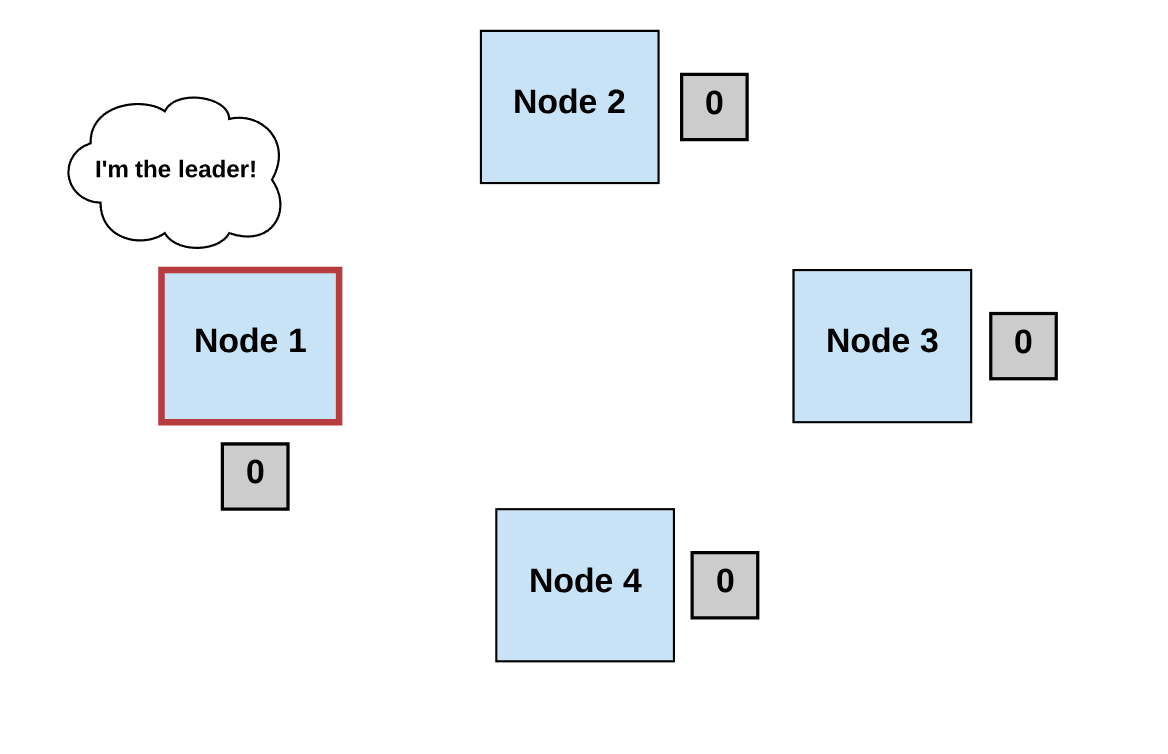

Broadly speaking, consensus algorithms typically assume three types of actors in a system:

- Proposers, often called leaders or coordinators.

- Acceptors, processes that listen to requests from proposers and respond with values.

- Learners, other processes in the system which learn the final values that are decided upon.

Generally, we can define a consensus algorithm by three steps:

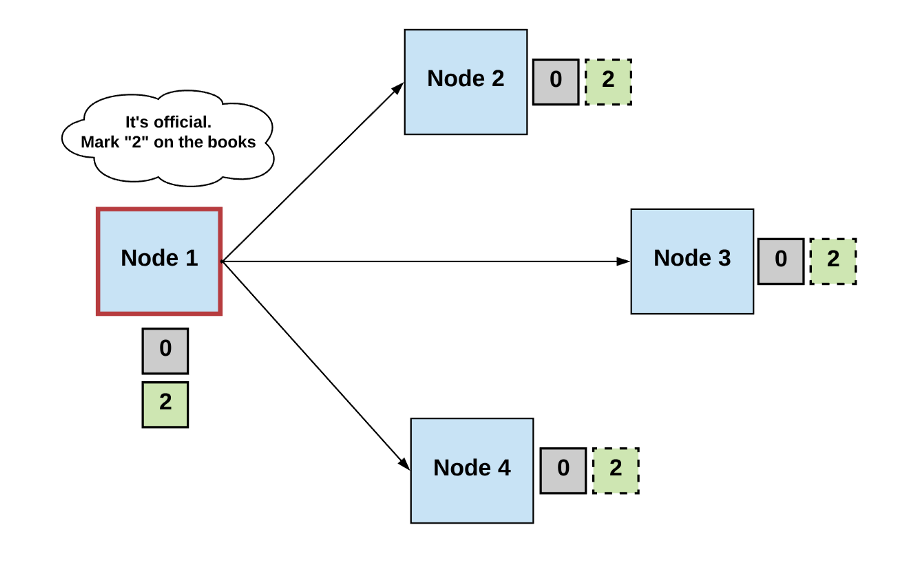

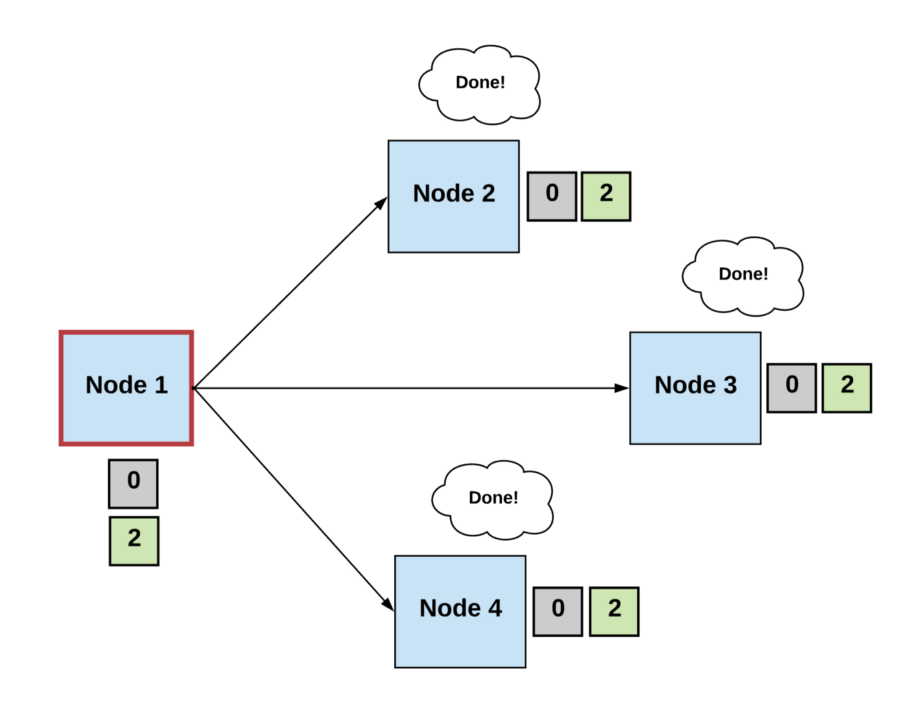

Step 1: Elect

- Processes elect a single process (i.e., a leader) to make decisions.

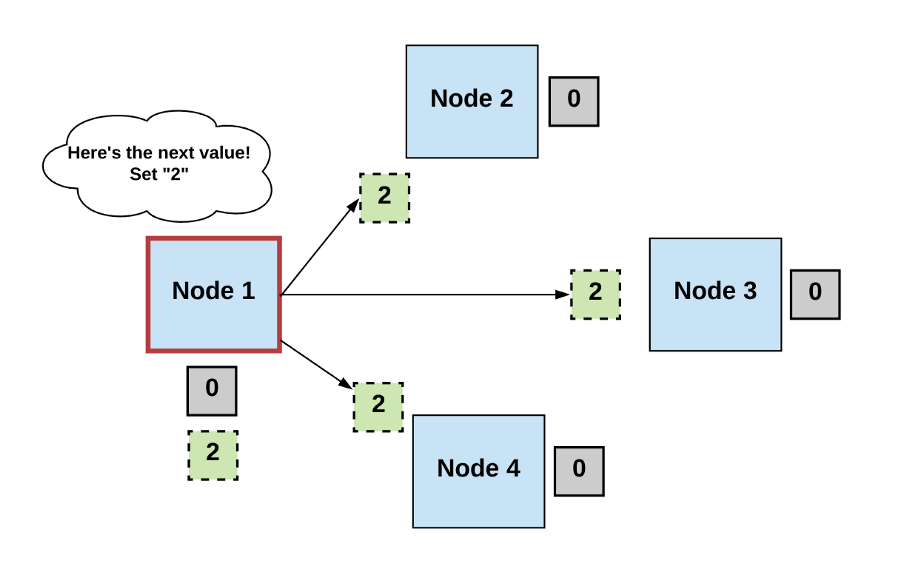

- The leader proposes the next valid output value.

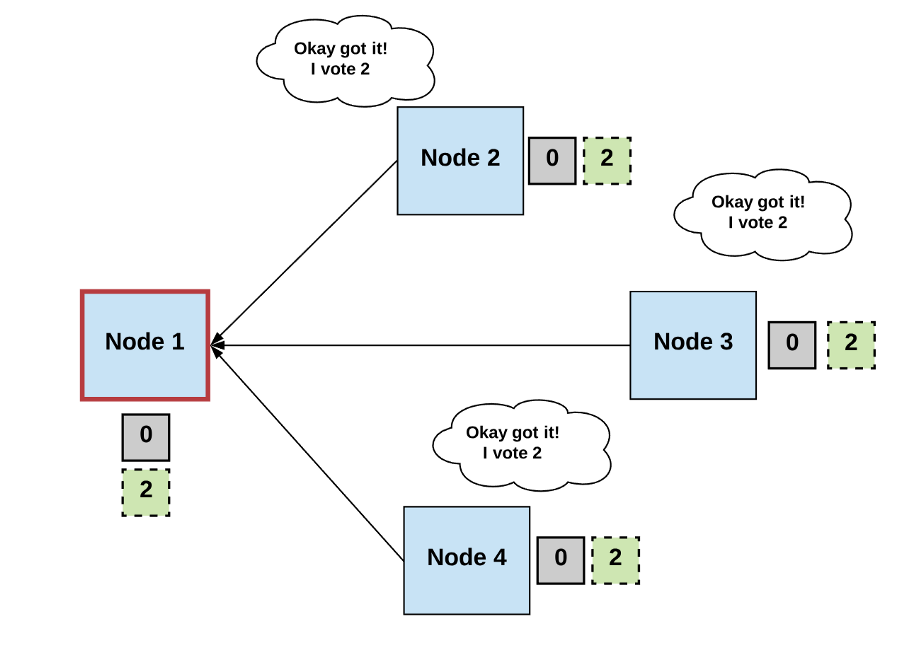

Step 2: Vote

- The non-faulty processes listen to the value being proposed by the leader, validate it, and propose it as the next valid value.

Step 3: Decide

- The non-faulty processes must come to a consensus on a single correct output value. If it receives a threshold number of identical votes which satisfy some criteria, then the processes will decide on that value.

- Otherwise, the steps start over.

Diagrams by author.

Diagrams by author.

It’s important to note that every consensus algorithm has different:

- Terminology (e.g., rounds, phases),

- Procedures for how votes are handled, and

- Criteria for how a final value is decided (e.g., validity conditions).

Nonetheless, if we can use this generic process to build an algorithm that guarantees the general conditions defined above, then we have a distributed system which is able to achieve consensus.

Simple enough, right?

FLP impossibility

… Not really. But you probably saw that coming!

Recall how we described the difference between a synchronous system and asynchronous system:

- In synchronous environments, messages are delivered within a fixed time frame

- In asynchronous environments, there’s no guarantee of a message being delivered.

This distinction is important.

Reaching consensus in a synchronous environment is possible because we can make assumptions about the maximum time it takes for messages to get delivered. Thus, in this type of system, we can allow the different nodes in the system to take turns proposing new transactions, poll for a majority vote, and skip any node if it doesn’t offer a proposal within the maximum time limit.

But, as noted earlier, assuming we are operating in synchronous environments is not practical outside of controlled environments where message latency is predictable, such as data centers which have synchronized atomic clocks.

In reality, most environments don’t allow us to make the synchronous assumption. So we must design for asynchronous environments.

If we cannot assume a maximum message delivery time in an asynchronous environment, then achieving termination is much harder, if not impossible. Remember, one of the conditions that must be met to achieve consensus is “termination,” which means every non-faulty node must decide on some output value.

This is formally known as the “FLP impossibility result.” How did it get this name? Well, I’m glad you asked!

Even a single faulty process makes it impossible to reach consensus among deterministic asynchronous processes.

In their 1985 paper “Impossibility of Distributed Consensus with One Faulty Process,” researchers Fischer, Lynch, and Paterson (aka FLP) show how even a single faulty process makes it impossible to reach consensus among deterministic asynchronous processes. Basically, because processes can fail at unpredictable times, it’s also possible for them to fail at the exact opportune time that prevents consensus from occurring.

Diagram by author.

Diagram by author.

This result was a huge bummer for the distributed computing space. Nonetheless, scientists continued to push forward to find ways to circumvent FLP impossibility.

At a high level, there are two ways to circumvent FLP impossibility:

- Use synchrony assumptions.

- Use non-determinism.

Let’s take a deep dive into each one right now.

Approach 1: Use Synchrony Assumptions

I know what you’re thinking: What the heck does this even mean?

Let’s revisit our impossibility result. Here’s another way to think about it: the FLP impossibility result essentially shows that, if we cannot make progress in a system, then we cannot reach consensus. In other words, if messages are asynchronously delivered, termination cannot be guaranteed. Recall that termination is a required condition that means every non-faulty node must eventually decide on some output value.

But how can we guarantee every non-faulty process will decide on a value if we don’t know when a message will be delivered due to asynchronous networks?

To be clear, the finding does not state that consensus is unreachable. Rather, due to asynchrony, consensus cannot be reached in a fixed time. Saying that consensus is “impossible” simply means that consensus is “not always possible.” It’s a subtle but crucial detail.

One way to circumvent this is to use timeouts. If no progress is being made on deciding the next value, we wait until a timeout, then start the steps all over again. As we’re about to see, this is what consensus algorithms like Paxos and Raft essentially did.

Paxos

Introduced in the 1990s, Paxos was the first real-world, practical, fault-tolerant consensus algorithm. It’s one of the first widely adopted consensus algorithms to be proven correct by Leslie Lamport and has been used by global internet companies like Google and Amazon to build distributed services.

Paxos works like this:

Phase 1: Prepare request

- The proposer chooses a new proposal version number (n) and sends a “prepare request” to the acceptors.

- If acceptors receive a prepare request (“prepare,” n) with n greater than that of any prepare request they had already responded to, the acceptors send out (“ack,” n, n’, v’) or (“ack,” n, ^ , ^).

- Acceptors respond with a promise not to accept any more proposals numbered less than n.

- Acceptors suggest the value (v) of the highest-number proposal that they have accepted, if any. Or else, they respond with ^.

Phase 2: Accept request

- If the proposer receives responses from a majority of the acceptors, then it can issue an accept request (“accept,” n, v) with number n and value v.

- n is the number that appeared in the prepare request.

- v is the value of the highest-numbered proposal among the responses.

- If the acceptor receives an accept request (“accept,” n, v), it accepts the proposal unless it has already responded to a prepare request with a number greater than n.

Phase 3: Learning phase

- Whenever an acceptor accepts a proposal, it responds to all learners (“accept,” n, v).

- Learners receive (“accept,” n, v) from a majority of acceptors, decide v, and send (“decide,” v) to all other learners.

- Learners receive (“decide,” v) and the decided v.

Source: https://www.myassignmenthelp.net/paxos-algorithm-assignment-help

Source: https://www.myassignmenthelp.net/paxos-algorithm-assignment-help

Phew! Confused yet? I know that was a quite a lot of information to digest.

But wait… There’s more!

As we now know, every distributed system has faults. In this algorithm, if a proposer failed (e.g., because there was an omission fault), then decisions could be delayed. Paxos dealt with this by starting with a new version number in Phase 1, even if previous attempts never ended.

I won’t go into details, but the process to get back to normal operations in such cases was quite complex since processes were expected to step in and drive the resolution process forward.

The main reason Paxos is so hard to understand is that many of its implementation details are left open to the reader’s interpretation: How do we know when a proposer is failing? Do we use synchronous clocks to set a timeout period for deciding when a proposer is failing and we need to move on to the next rank? 🤷

In favor of offering flexibility in implementation, several specifications in key areas are left open-ended. Things like leader election, failure detection, and log management are vaguely or completely undefined.

This design choice ended up becoming one of the biggest downsides of Paxos. It’s not only incredibly difficult to understand but difficult to implement as well. In turn, this made the field of distributed systems incredibly hard to navigate.

By now, you’re probably wondering where the synchrony assumption comes in.

In Paxos, although timeouts are not explicit in the algorithm, when it comes to the actual implementation, electing a new proposer after some timeout period is necessary to achieve termination. Otherwise, we couldn’t guarantee that acceptors would output the next value, and the system could come to a halt.

Raft

In 2013, Ongaro and Ousterhout published a new consensus algorithm for a replicated state machine called Raft, where the core goal was understandability (unlike Paxos).

One important new thing we learned from Raft is the concept of using a shared timeout to deal with termination. In Raft, if you crash and restart, you wait at least one timeout period before trying to get yourself declared a leader, and you are guaranteed to make progress.

But Wait… What about ‘Byzantine’ Environments?

While traditional consensus algorithms (such as Paxos and Raft) are able to thrive in asynchronous environments using some level of synchrony assumptions (i.e. timeouts), they are not Byzantine fault-tolerant. They are only crash fault-tolerant.

Crash-faults are easier to handle because we can model the process as either working or crashed — 0 or 1. The processes can’t act maliciously and lie. Therefore, in a crash fault-tolerant system, a distributed system can be built where a simple majority is enough to reach a consensus.

In an open and decentralized system (such as public blockchains), users have no control over the nodes in the network. Instead, each node makes decisions toward its individual goals, which may conflict with those of other nodes.

In a Byzantine system where nodes have different incentives and can lie, coordinate, or act arbitrarily, you cannot assume a simple majority is enough to reach consensus. Half or more of the supposedly honest nodes can coordinate with each other to lie.

For example, if an elected leader is Byzantine and maintains strong network connections to other nodes, it can compromise the system. Recall how we said we must model our system to either tolerate simple faults or Byzantine faults. Raft and Paxos are simple fault-tolerant but not Byzantine fault-tolerant. They are not designed to tolerate malicious behavior.

The ‘Byzantine General’s Problem’

Trying to build a reliable computer system that can handle processes that provide conflicting information is formally known as the “Byzantine General’s Problem.” A Byzantine fault-tolerant protocol should be able to achieve its common goal even against malicious behavior from nodes.

The paper “ Byzantine General’s Problem “ by Leslie Lamport, Robert Shostak, and Marshall Pease provided the first proof to solve the Byzantine General’s problem: it showed that a system with x Byzantine nodes must have at least 3x + 1 total nodes in order to reach consensus.

Here’s why:

If x nodes are faulty, then the system needs to operate correctly after coordinating with n minus x nodes (since x nodes might be faulty/Byzantine and not responding). However, we must prepare for the possibility that the x that doesn’t respond may not be faulty; it could be the x that does respond. If we want the number of non-faulty nodes to outnumber the number of faulty nodes, we need at least n minus x minus x > x. Hence, n > 3x + 1 is optimal.

However, the algorithms demonstrated in this paper are only designed to work in a synchronous environment. Bummer! It seems we can only get one or the other (Byzantine or Asynchronous) right. An environment that is both Byzantine and Asynchronous seems much harder to design for.

Why?

In short, building a consensus algorithm that can withstand both an asynchronous environment and a Byzantine one is… well, that would sort of be like making a miracle happen.

Algorithms like Paxos and Raft were well-known and widely used. But there was also a lot of academic work that focused more on solving the consensus problem in a Byzantine + asynchronous setting.

So buckle your seatbelts…

We’re going on a field trip…

To the land of…

Theoretical academic papers!

Okay, okay — I’m sorry for building that up. But you should be excited! Remember that whole “making a miracle” thing we discussed earlier? We’re going to take a look at two algorithms (DLS and PBFT) that brought us closer than ever before to breaking the Byzantine + asynchronous barrier.

The DLS Algorithm

The paper “Consensus in the Presence of Partial Synchrony” by Dwork, Lynch, and Stockmeyer (hence the name “DLS” algorithm) introduced a major advancement in Byzantine fault-tolerant consensus: it defined models for how to achieve consensus in “a partially synchronous system.”

As you may recall, in a synchronous system, there is a known fixed upper bound on the time required for a message to be sent from one processor to another. In an asynchronous system, no fixed upper bounds exist. Partial synchrony lies somewhere between those two extremes.

The paper explained two versions of the partial synchrony assumption:

- Assume that fixed bounds exist for how long messages take to get delivered. But they are not known a priori. The goal is to reach consensus regardless of the actual bounds.

- Assume the upper bounds for message delivery are known, but they’re only guaranteed to hold starting at some unknown time (also called “Global Standardization Time,” GST). The goal is to design a system that can reach consensus regardless of when this time occurs.

Here’s how the DLS algorithm works:

A series of rounds are divided into “trying” and “lock-release” phases.

- Each round has a proposer and begins with each of the processes communicating the value they believe is correct.

- The proposer “proposes” a value if at least N − xprocesses have communicated that value.

- When a process receives the proposed value from the proposer, it must lock on the value and then broadcast that information.

- If the proposer receives messages from x + 1 processes that they locked on some value, it commits that as the final value.

DLS was a major breakthrough because it created a new category of network assumptions to be made — namely, partial synchrony — and proved consensus was possible with this assumption. The other imperative takeaway from the DLS paper was separating the concerns for reaching consensus in a Byzantine and asynchronous setting into two buckets: safety and liveness.

Safety

This is another term for the “agreement” property we discussed earlier, where all non-faulty processes agree on the same output. If we can guarantee safety, we can guarantee that the system as a whole will stay in sync. We want all nodes to agree on the total order of the transaction log, despite failures and malicious actors. A violation of safety means that we end up with two or more valid transaction logs.

Liveness

This is another term for the “termination” property we discussed earlier, where every non-faulty node eventually decides on some output value. In a blockchain setting, “liveness” means the blockchain keeps growing by adding valid new blocks. Liveness is important because it’s the only way that the network can continue to be useful — otherwise, it will stall.

As we know from the FLP impossibility, consensus can’t be achieved in a completely asynchronous system. The DLS paper argued that making a partial synchrony assumption for achieving the liveness condition is enough to overcome FLP impossibility.

Thus, the paper proved that the algorithms don’t need to use any synchrony assumption to achieve the safety condition.

Pretty straightforward, right? Don’t worry if it’s not. Let’s dig a little deeper.

Remember that if nodes aren’t deciding on some output value, the system just halts. So, if we make some synchrony assumptions (i.e., timeouts) to guarantee termination and one of those fails, it makes sense that this would also bring the system to a stop.

But if we design an algorithm where we assume timeouts (to guarantee correctness), this carries the risk of leading to two valid transaction logs if the synchrony assumption fails.

Designing a distributed system is always about trade-offs.

This would be far more dangerous than the former option. There’s no point in having a useful service (i.e., liveness) if the service is corrupt (i.e., no safety). Basically, having two different blockchains is worse than having the entire blockchain come to a halt.

A distributed system is always about trade-offs. If you want to overcome a limitation (e.g., FLP impossibility), you must make a sacrifice somewhere else. In this case, separating the concerns into safety and liveness is brilliant. It lets us build a system that is safe in an asynchronous setting but still needs some form of timeouts to keep producing new values.

Despite everything that the DLS paper offered, DLS was never widely implemented or used in a real-world Byzantine setting. This is probably due to the fact that one of the core assumptions in the DLS algorithm was to use synchronous processor clocks in order to have a common notion of time. In reality, synchronous clocks are vulnerable to a number of attacks and wouldn’t fare well in a Byzantine fault-tolerant setting.

The PBFT Algorithm

Another Byzantine fault-tolerant algorithm, published in 1999 by Miguel Castro and Barbara Liskov, was called “Practical Byzantine Fault-Tolerance” (PBFT). It was deemed to be a more “practical” algorithm for systems that exhibit Byzantine behavior.

“Practical” in this sense meant it worked in asynchronous environments like the internet and had some optimizations that made it faster than previous consensus algorithms. The paper argued that previous algorithms, while shown to be “theoretically possible,” were either too slow to be used or assumed synchrony for safety.

And as we’ve explained, that can be quite dangerous in an asynchronous setting.

In a nutshell, the PBFT algorithm showed that it could provide safety and liveness assuming (n-1)/3nodes were faulty. As we previously discussed, that’s the minimum number of nodes we need to tolerate Byzantine faults. Therefore, the resiliency of the algorithm was optimal.

The algorithm provided safety regardless of how many nodes were faulty. In other words, it didn’t assume synchrony for safety. The algorithm did, however, rely on synchrony for liveness. At most, (n-1)/3 nodes could be faulty and the message delay did not grow faster than a certain time limit. Hence, PBFT circumvented FLP impossibility by using a synchrony assumption to guarantee liveness.

The algorithm moved through a succession of “views,” where each view had one “primary” node (i.e., a leader) and the rest were “backups.” Here’s a step-by-step walkthrough of how it worked:

- A new transaction happened on a client and was broadcast to the primary.

- The primary multicasted it to all the backups.

- The backups executed the transaction and sent a reply to the client.

- The client wanted x + 1 replies from backups with the same result. This was the final result, and the state transition happened.

If the leader was non-faulty, the protocol worked just fine. However, the process for detecting a bad primary and reelecting a new primary (known as a “view change”) was grossly inefficient. For instance, in order to reach consensus, PBFT required a quadratic number of message exchanges, meaning every computer had to communicate with every other computer in the network.

Note: Explaining the PBFT algorithm in full is a blog post all on its own! We’ll save that for another day ;).

While PBFT was an improvement over previous algorithms, it wasn’t practical enough to scale for real-world use cases (such as public blockchains) where there are large numbers of participants. But hey, at least it was much more specific when it came to things like failure detection and leader election (unlike Paxos).

It’s important to acknowledge PBFT for its contributions. It incorporated important revolutionary ideas that newer consensus protocols (especially in a post-blockchain world) would learn from and use.

For example, Tendermint is a new consensus algorithm that is heavily influenced by PBFT. In their “validation” phase, Tendermint uses two voting steps (like PBFT) to decide on the final value. The key difference with Tendermint’s algorithm is that it’s designed to be more practical.

For instance, Tendermint rotates a new leader every round. If the current round’s leader doesn’t respond within a set period of time, the leader is skipped and the algorithm simply moves to the next round with a new leader. This actually makes a lot more sense than using point-to-point connections every time there needs to be a view-change and a new leader elected.

Approach 2: Non-Determinism

As we’ve learned, most Byzantine fault-tolerant consensus protocols end up using some form of synchrony assumption to overcome FLP impossibility. However, there is another way to overcome FLP impossibility: non-determinism.

Enter: Nakamoto Consensus

As we just learned, in traditional consensus, f(x) is defined such that a proposer and a bunch of acceptors must all coordinate and communicate to decide on the next value.

Traditional consensus doesn’t scale well.

This is too complex because it requires knowing every node in the network and every node communicating with every other node (i.e., quadratic communication overhead). Simply put, it doesn’t scale well and doesn’t work in open, permissionless systems where anyone can join and leave the network at any time.

The brilliance of Nakamoto Consensus is making the above probabilistic. Instead of every node agreeing on a value, f(x) works such that all of the nodes agree on the probability of the value being correct.

Wait, what does that even mean?

Byzantine-fault tolerant

Rather than electing a leader and then coordinating with all nodes, consensus is decided based on which node can solve the computation puzzle the fastest. Each new block in the Bitcoin blockchain is added by the node that solves this puzzle the fastest. The network continues to build on this timestamped chain, and the canonical chain is the one with the most cumulative computation effort expended (i.e., cumulative difficulty).

The longest chain not only serves as proof of the sequence of blocks, but proof that it came from the largest pool of CPU power. Therefore, as long as a majority of CPU power is controlled by honest nodes, they’ll continue to generate the longest chain and outpace attackers.

Block rewards

Nakamoto Consensus works by assuming that nodes will expend computational efforts for the chance of deciding the next block. The brilliance of the algorithm is economically incentivizing nodes to repeatedly perform such computationally expensive puzzles for the chance of randomly winning a large reward (i.e., a block reward).

Sybil resistance

The proof of work required to solve this puzzle makes the protocol inherently Sybil-resistant. No need for PKI or any other fancy authentication schemes.

Peer-to-peer gossip

A major contribution of Nakamoto Consensus is the use of the gossip protocol. It’s more suitable for peer-to-peer settings where communication between non-faulty nodes can’t be assumed. Instead, we assume a node is only connected to a subset of other nodes. Then we use the peer-to-peer protocol where messages are being gossiped between nodes.

Not “technically” safe in asynchronous environments

In Nakamoto consensus, the safety guarantee is probabilistic — we’re growing the longest chain, and each new block lowers the probability of a malicious node trying to build another valid chain.

Therefore, Nakamoto Consensus does not technically guarantee safety in an asynchronous setting. Let’s take a second to understand why.

For a system to achieve the safety condition in an asynchronous setting, we should be able to maintain a consistent transaction log despite asynchronous network conditions. Another way to think about it is that a node can go offline at any time and then later come back online, and use the initial state of the blockchain to determine the latest correct state, regardless of network conditions. Any of the honest nodes can query for arbitrary states in the past, and a malicious node cannot provide fraudulent information that the honest nodes will think is truthful.

Nakamoto Consensus does not technically guarantee safety in an asynchronous setting.

In previous algorithms discussed in this post, this is possible because we are deterministically finalizing a value at every step. As long as we terminate on each value, we can know the past state. However, the reason Bitcoin is not “technically” asynchronously safe is that it is possible for there to be a network partition that lets an attacker with a sufficiently large hash power on one side of the partition to create an alternative chain faster than the honest chain on the other side of the partition — and on this alternative chain, he can try to change one of his own transactions to take back money he spent.

Admittedly, this would require the attacker to gain a lot of hashing power and spend a lot of money.

In essence, the Bitcoin blockchain’s immutability stems from the fact that a majority of miners don’t actually want to adopt an alternative chain. Why? Because it’s too difficult to coordinate enough hash power to get the network to adopt an alternative chain. Put another way, the probability of successfully creating an alternative chain is so low, it’s practically negligible.

Nakamoto vs. Traditional Consensus

For practical purposes, Nakamoto Consensus is Byzantine fault-tolerant. But it clearly doesn’t achieve consensus the way consensus researchers would traditionally assume. Therefore, it was initially seen as being completely out of the Byzantine fault-tolerant world.

By design, the Nakamoto Consensus makes it possible for any number of nodes to have open participation, and no one has to know the full set of participants. The importance of this breakthrough can’t be overstated. Thank you, Nakamoto.

Simpler than previous consensus algorithms, it eliminates the complexity of point-to-point connections, leader election, quadratic communication overhead, etc. You just launch the Bitcoin protocol software on any computer and start mining.

This makes it easily deployable in a real-world setting. It is truly the more “practical” cousin of PBFT.

Conclusion

And there you have it — the brief basics of distributed systems and consensus. It has been a long, winding journey of research, roadblocks, and ingenuity for distributed computing to get this far. I hope this post helps you understand the field at least a tiny it better.

Nakamoto Consensus is truly an innovation that has allowed a whole new wave of researchers, scientists, developers, and engineers to continue breaking new ground in consensus protocol research.

And there’s an entirely new family of protocols being developed that go beyond Nakamoto Consensus. Proof-of-Steak, anyone? ;) But I’ll save that for the next post — stay tuned!

Note: For the purposes of not turning this into a book, I skipped MANY important papers and algorithms. For example, Ben Orr’s Common Coin also used probabilistic approaches but was not optimally resilient. Other algorithms like Hash Cash also used PoW but for limiting email spam and denial-of-service attacks. And there are so many more traditional consensus protocols that I left out! I feel the above is good enough to help you get a great grasp on consensus in a traditional setting vs. Nakamoto. See ya in the next post!

Special thanks to Zaki Manian for putting up with all my questions on distributed consensus.

Exploring Liquid Sidechain

Joe Kendzicky

Posted November 15, 2018

Overview

In 2014, a group of notable Bitcoin developers published Enabling Blockchain Innovations with Pegged Sidechains. This whitepaper outlined a very high level framework on how sidechains might look, but lacked significant technical specifications with regard to implementation. Two years later, a group of Blockstream researchers released Strong Federations: An Interoperable Blockchain Solution to Centralized Third-Party Risks, describing how many of the aforementioned concepts could be implemented utilizing a semi-trusted Byzantine fault tolerant consensus mechanism referred to as strong federations. Strong federations fall somewhere between the extensive decentralization guarantees provided through Nakamoto style consensus, and the significant trust implications of centralized exchange services. In this article, we explore one of the first iterations of federated two-way pegs: Liquid, a settlement network primarily directed towards exchanges and other liquidity providers.

What do sidechains provide?

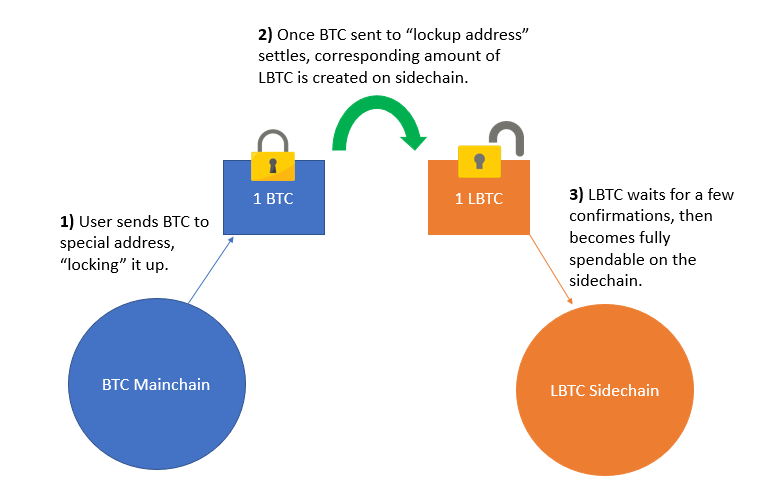

Sidechains allow us to take an asset that traditionally exists on a remote chain, and transfer it onto a different blockchain, without distorting the asset’s integrity. For example, imagine there were a way to move bitcoin onto the Ethereum network. Though it is impossible to actually move a BTC onto another chain, we could create a synthetic ETH token collateralized by real bitcoin on the mainchain. Anyone holding the ETH token could exchange it at any moment for real BTC, and thus the two assets would exhibit a 1:1 (or near 1:1) peg.

Having this capability opens the door to many different form of unique cross-chain interoperability features, such as executing smart contracts across different blockchains. Sidechains always involve a source and destination blockchain. A peg is established between the chains, meaning assets from the source are converted into entirely new ones on the destination, at a fixed ratio (usually 1:1). Since the destination sidechain is its own independent blockchain, destination tokens can be transferred freely among network users, just as they would inside of the source network. Users are free to reconvert their sidechain tokens back into mainchain ones at their full discretion. Usually these destination tokens provide beneficial features that the source chain cannot: privacy, Turing-completeness, fast settlement or low fees. In our scenario, Bitcoin serves as the source blockchain, with Liquid as the destination.

Functionaries

To begin, let’s first start off by defining two important figures within the Liquid ecosystem:

1) Watchmen- play an important role serving as gatekeepers, regulating the transition of assets between the source and destination blockchains.

2) Blocksigners- contribute to the creation of new blocks, similar to miners in proof-of-work systems and validators in proof-of-stake systems

Both of the above parties fall under the collective roof of functionaries. Functionaries are a privileged set of network actors who mechanically perform defined network operations. By privileged, we are referring to a fixed group of permissioned actors who have the capacity to fulfill these roles. Contrast this to open system like Bitcoin, where any network participant has the ability to contribute to the consensus process through open mining operations.

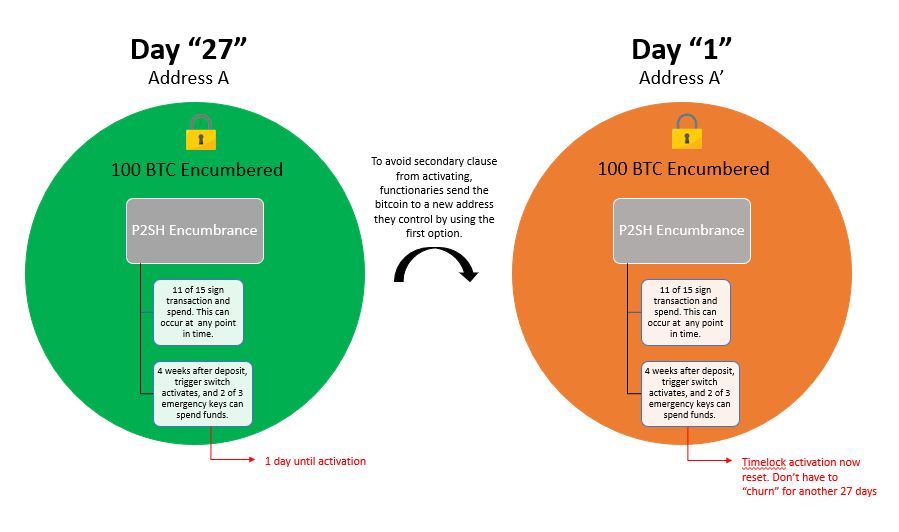

Entry into the sidechain is a process referred to as a “peg-in”, where Bitcoin users deposit BTC to a specially constructed address, called a pay-to-script-hash (P2SH). Traditional Bitcoin scripts usually just require the spender to produce a valid signature from a private key. This private key corresponds to the public key in which the funds are encumbered. P2SH requires the spender to produce a few more pieces of information outside of just a digital signature. The scripts required to spend the LBTC reads: <11 of 15 Multisig> OR <4-week timeout + 2-of-3 Multisig>. We will touch on this construct and its importance in later segments.

Once bitcoins are sent to the P2SH address, the depositing party loses sovereignty over them. A confirmation period ensues to guarantee settlement of the funds, preventing against the risk of a chain reorganization or double spend attack. Without sufficient confirmation that the pegged-in BTC has settled, an attacker might be granted LBTC prematurely on the Liquid sidechain, while their BTC manages to “escape” on the mainchain through a reorg or doublespend. Such an event would lead to a situation where LBTC and BTC no longer maintain a 1:1 pegged ratio, thereby granting the attacker free money.

Liquid requires 102 BTC confirmations for the transaction in order for the LBTC to become available. This seemingly ambiguous number exists for 2 reasons:

- 100 blocks as overkill to guarantee that a reorganization is probabilistically impractical. This is the same depth that the Bitcoin protocol requires miners to wait before being able to spend their coinbase rewards when they solve a new block. While 6 confirmations is usually considered sufficiently strong for a BTC transaction, there have been a few rare occasions of orphaned blocks extending much deeper (though this usually only happens during some obscure bug interval). For example, the March 12, 2013 fork extended 31 blocks, while the 2010 value overflow bug extended an orphan 53 blocks.

- 2 blocks to ensure every node agrees on the 100th block. Given our first principle, conflicting views could exist amongst the network nodes as to which block that 100th block is, were a chain split to happen after the 99th mined block. By extending depth an additional 2 blocks, we allow the blockchain some leeway time to re-converge if necessary.

It is important to understand that the BTC on the Bitcoin chain is not destroyed. Rather they remain “frozen” in the multisignature account until the corresponding LBTC are revoked off the destination chain, and proof has been illustrated that such action has taken place.

Examining LBTC Creation

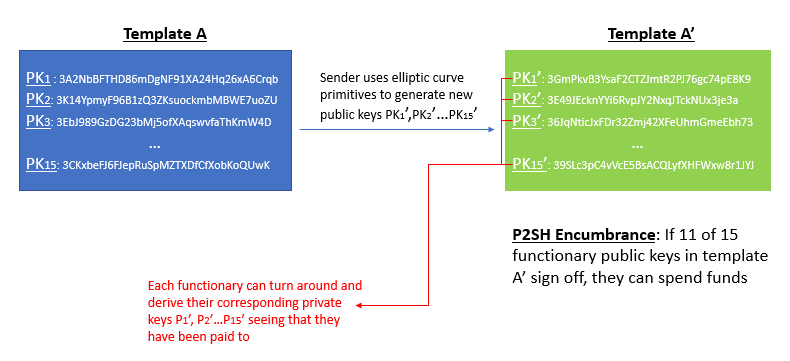

BIP 32 introduced a set of important features that allows for hierarchical wallet structures. Hierarchical frameworks are useful because they allow for deterministic construction of new public keys (and therefore unlimited new BTC addresses) without needing underlying exposure to the public key’s corresponding private key. This is a great feature for online merchants wanting to incorporate Bitcoin payments at point of sale. They can upload something called the master private key into their web server, and compute sub-domains of new bitcoin addresses directly from this master public key. Previously, they would have had to either expose their private key onto the server in order to derive new addresses (dangerous) or generate a bunch of new private/pub key pairs offline, then manually import the addresses over to the server (inefficient).

We can think about the construction of new LBTC in a somewhat similar fashion, though some technical differences remain. Essentially what the user is doing during a Liquid peg-in transaction is performing some cryptographic tricks to derive a new public key (call this A’) directly from each functionary’s existing public key (call this A), in a similar way that BIP 32 allows one to derive a child public key from a parent public key without needing involvement from the corresponding private keys. The user then sends their BTC to a special P2SH address that references all these new A’ addresses. This P2SH transaction reads very analogously to a multisignature clause. It says “if 11 functionaries (out of the 15 possible) prove ownership of the A’ public keys outlined in this template, by collectively signing off with their corresponding a’ private keys, they can unlock and spend the funds.”

After issuing the Bitcoin P2SH transaction, the user needs to actually let the functionaries know that the transaction occurred. Up to this point, the functionaries still have no idea that they’ve been paid; everything has been done on the user end. The user now needs to turns around and hand this new template of A’ to the functionaries, so that they can reverse engineer the corresponding a’ and gain access to the locked up BTC.

The way the user goes about doing this is by creating a LBTC transaction from scratch. The inputs to this transaction will look a bit funky, because they reference no previous LBTC output (think coinbase transactions when miners mine a new BTC block). Instead, the LBTC transaction embeds the original BTC transfer as its input, illustrating proof that the user previously surrendered their BTC rights into the hands of the watchmen. Seeing that they’ve been paid via the A’ public keys and the 102-block confirmation period has passed, these functionaries can reverse engineer back to its corresponding private keys a’ and assume control over those funds. With all the boxes now checked, the functionaries will validate the peg-in LBTC transaction by including it into a Liquid block.

Once the new LBTC are unlocked onto the Liquid sidechain, users are free to engage in transactional behavior at their full discretion. Very similar to the traditional Bitcoin blockchain, LBTC are governed by the underlying private keys of their owners, are immutable digital assets, and publicly auditable through a distributed ledger. LBTC also possess certain characteristic advantages over the tradition BTC network. Examples include resistance to reorganizations, 1-minute block times, deterministic block intervals (instead of dynamic block production), and ring confidential transactions.

When users are ready to convert their LBTC back into BTC, they engage in the “peg-out” process. This involves transferring their LBTC to a Liquid address where they wait for 2 block confirmations. Because there is no threat of reorganizations occuring on the Liquid network, we don’t have to wait the meticulous 100-block period as we did during the peg-in process. After 2 Liquid blocks have ensued, watchmen sign off the 11 of 15 transaction on the Bitcoin mainchain, transferring money to the entitled owner, and subsequently destroying the LBTC in the process.

Peg-Out Transactions

When funds are ready to be transferred out of the Liquid sidechain and back into the Bitcoin network, the LBTC needs to be destroyed and the corresponding BTC released from multisig via the Watchmen efforts. In an effort to preserve privacy and mitigate security risks, functionaries control a Peg-out Authorization Key list that ensures outgoing BTC transactions are sent to a bitcoin address controlled by an authorized party. However, this creates an unfortunate situation where any user needing to redeem their LBTC to BTC must do so through an exchange or partner with a block signer. Essentially what we have happening is the user sends LBTC to a burn-style address, then waits 2 confirmations for that LBTC transaction to settle. The exchange sees the transaction as confirmed, pays out the user from their own hot wallet, and is subsequently “reimbursed” by receiving the BTC from the functionary multisig.

The intention of this strategy is aimed to reduce the risk of theft on the sidechain, which would consequently lead to theft on the mainchain. Peg-out addresses which the Watchmen pay out to are air-gapped cold addresses maintained by the exchanges. These addresses are constructed in a way that make it incredibly difficult to compromise the underlying private key.

Emergency Recovery Process

Remember how we earlier touched on the <11 of 15 Multisig> OR <4-week timeout + 2-of-3 Multisig>_P2SH that keeps our Bitcoin locked up? The < _4-week + 2-of-3 Multisig> clause serves as an emergency recovery component in a situation where ⅓ of the network goes offline or begins engaging in nefarious behavior. If such an event were to take place, the network would stall out and fail to produce additional blocks, but the Bitcoin on the mainchain would be stuck in escrow if the 11 of 15 component is not capable of being overcome. So, we introduce a second clause that consists of a completely different set of 3 emergency keys which can be used if (and only if) the network sits idle for 4 weeks, and we only need 2 of those 3 signers to sign off and move funds out. These keys are controlled by a totally different set of functionaries (undisclosed who these participants are for security reasons, but presumed to be geographically distributed attorneys) and can only be utilized after the 4 week lapse. Because of this, functionaries need to “churn” the locked BTC on the 27th day by sending it to to a new peg-in address they control, as a way to reset the timelock. Otherwise, 2 of the 3 emergency component would go into effect, and functionaries could then collude and steal user deposits.

Consensus Algorithm

In Bitcoin, miners bundle transactions into aggregated units called candidate blocks, with each candidate displaying a unique header. These miners subsequently perform redundant SHA-256 hashing on such headers, tweaking the nonce field element after each iterative hash, until someone in the group arbitrarily produces a digest below a predefined target. The winning party broadcasts their solution to the rest of the network, who can validate its authenticity. If the rest of the network is satisfied by the proof, they simultaneously adopt the winning party’s candidate block as the “official” ledger state.

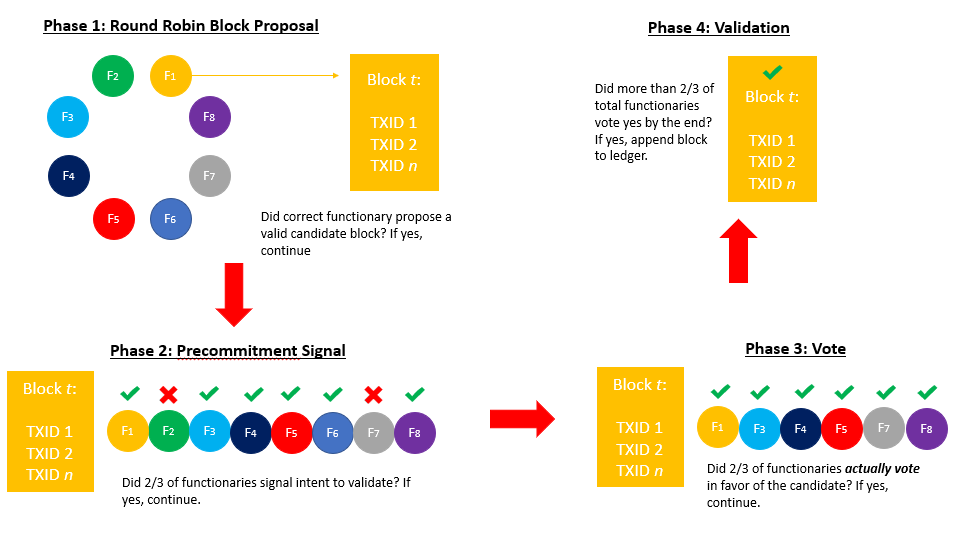

Liquid does not depend on a dynamic hashing contest to reach network consensus. Rather, it involves a Byzantine fault tolerant, round-robin multisignature scheme amongst a privileged group of blocksigners (the second group of functionaries we touched on earlier). These blocksigners inherit a role similar to miners in PoW, or validators in PoS; their job is to contribute to forward propagation of the network by creating new blocks, and thereby validate transactions. By limiting the number of candidates capable of contributing to consensus rather than remaining an open consortium, the network is able to achieve universal consensus with lower latency, faster block intervals, and lower computational burdens. In many respects, the consensus algorithm replicates features found in the Ripple RCPA protocol, described here. The system involves a round-robin style where blocksigners rotate turns proposing candidate blocks. After the blocksigner issues a candidate, their peers signal intent to validate the block through a precommitment scheme. At the conclusion of the precommitment round, if 2/3 or more of the group has signaled favorably, each member proceeds by actually signing the k of n block with their key. If the number of signees is greater than 2/3 then the block is accepted by the network and written to ledger. Note that the number of blocksigners who commit to sign and those who actually end up signing may be slightly different. For example, if someone loses connection midway through the process. The system rotates to a different block signer who proposes a new candidate block, and the process repeats.

A compelling feature of the Liquid BFT is that a reorganization after two block’s depth is impossible (assuming no malice or bugs). If a candidate block fails to reach its designated threshold, or the selected functionary for that 1-min time frame fails to perform their duty, no block for that interval is produced. Those transactions then carry over into the next candidate round. Users are not at risk of the network forking into two conflicting chains. The tradeoff to this scenario is that the network has the potential to stall out if blocksigners continually fail to reach the designated threshold required to append a new block.

Privacy

Liquid offers privacy features to users by embedding Ring Confidential Transactions directly into the protocol. Ring CT shields important metadata such as the transactional output values along with the destination/recipient addresses. Similar to Zcash, Liquid users have the ability to broadcast transactions on a transparent or confidential basis. However, the protocol automatically issues transactions on an opaque basis by default; users must manually configure transactions if they want the metadata to be publicly exposed. When dealing with CT’s, only the participants that have access to the what is known as the blinding key are capable of viewing such information. This key is limited to the sender and recipient of the transaction, but can be passed along to other parties as they like.

The benefit to such a system is that it allows network participants selective disclosure. Selective disclosure gives network participants the ability to preserve the integrity of information that may be sensitive to their business or trading operations, while simultaneously offering the ease and flexibility of sharing this data in a frictionless manner with authorized parties (business partners, auditors, government officials etc). A great example of where CT might prove beneficial is for traders who are looking to place large orders. Since the Bitcoin blockchain is available for public audit, external actors can witness the movement of large funds to an exchange and front run, driving up the order book and forcing the trader to incur slippage.

Challenges

While there are many positive implications of LBTC, it also comes with its share of tradeoffs, especially for node operators. Some of the biggest performance limitations include:

- 1MB block size (relatively low)

- 10x CPU requirements over BTC

- 10x bandwidth requirements over BTC

- 10x transaction sizes compared to BTC due to CT features. However, drastic improvements are on the horizon with the implementation of bulletproofs (see XMR)

- UTXO sets could grow exponentially larger

- Synchronization and new node bootstrapping could get significantly more difficult and computationally expensive

- Higher trust implications (discussed in later segments)

Issued Assets

Another interesting feature Liquid provisions are Issued Assets. Issued Assets are analog to the ERC-20 standard commonly found on the Ethereum network, and are uniquely native to the Liquid sidechain. Any sidechain participant has the ability to issue and transfer their own Issued Asset with other users inside the Liquid ecosystem. The provisioners can elect for supply to remain permanently fixed, or maintain discretionary autonomy over its future inflation schedule. This is accomplished through a feature called the reissuance token, which subsequently can be constructed using a multisignature scheme and dispersed among numerous parties. Different scenarios where these assets may come into play is if an issuer wants to distribute some form of tokenized security across a highly liquid and interconnected network: gold storage tokens, fiat backed tokens, shares in a company, collectables, ETF-related products etc.

Risk Mitigation

If not already obvious, some attack vectors lay present. Functionaries are not only required to communicate with one another, but sometimes depend on these communication broadcasts in order to determine how they themselves should act in specific situations.For example, during the precommitment of the consensus algorithm, if a blocksigner themselves signals “Yes” for a specific candidate block, but sees that not enough signers signaled accordingly to meet the X target, they will sit out during the actual signing phase. If an attacker is capable of infiltrating more than 1/3 of the blocksigners, they could force a network stall out simply by refusing to vote, and preventing the require 2/3 consensus to be achieved in order to create a block. If they are capable of corrupting 2/3 of the blocksigners, they could validate nefarious blocks.

To prevent against such threats, when new functionaries join the network, Blockstream provides these agents with proprietary hardware to conduct network operations. This hardware consists of two components: a server with precompiled software to perform network operations, and a “offline” hardware module to store functionary keys. These hardware boxes are designed in a way that purposely limits their vulnerabilities to network stack exploits which could compromise the consensus process. Each functionary server is presumably stored in a secure, anonymous location, and only communicates to other functionary servers via Tor. Tor connections provide security by obfuscating the server’s IP address, reducing the risk of physical theft or tampering while simultaneously hedging against potential DDOS attacks on the server. RCP calls are severely restricted and the hardware is specifically configured to only allow incoming SSH connections when a button on the box is pressed. Meaning to make any software or network alterations, you need to be in physical location of the hardware, severely limiting attack vectors.

The most obvious threat to the Federation is the group of functionaries themselves. At the end of the day, users transacting across the Liquid network are forced to trust the functionaries. If more than ⅔ of the functionaries collude, they have the ability to steal user funds. However, given the game-theoretic incentive models at play, the probability of this happening seems relatively low. First and most obvious, these functionaries are not anonymous parties but publicly recognized institutions that operate in jurisdictions where laws exist. The probability of a set of functionaries openly colluding to steal user funds without being subject to legal recourse are slim to none. Second, with regards to covert collusion (playing it off as a hack), exchanges would naturally be disincentivized to steal from their customers, thereby driving away core business revenues (exchange fees), unless the payoff from the attack outweighed the cost of collusion plus opportunity cost of capital relinquished from future business revenues. Consider also the fact that the cost of collusion grows logarithmically with respect to number of total parties colluding. Unless the Liquid network grows to a considerable value, it is highly improbable scenario this happens, given how much money these businesses are making on trading fees.

Workflows

Liquid’s audience will primarily cater towards exchanges, market makers and other large liquidity providers, along with their users. While Issued Assets might offer compelling opportunities for asset issuance, the scripting capabilities offered by other blockchain systems and higher levels of throughput make it a highly competitive and saturated market. Traders on the other hand are in fervent demand for quicker asset settlement, illustrated through the radical price discrepancies that exist across premier exchanges. Being able to move significant volume across platforms will reduce friction and costs for traders and liquidity providers alike, while simultaneously improving overall market efficiency by reducing spreads between exchange indexes.

Conclusion

While not the most bleeding edge implementation of sidechain technology, Liquid addresses a legitimate and current need in the cryptoasset ecosystem by allowing traders and exchanges to provision liquidity and settle transactions in short order. Benefits include embedded privacy through confidential transactions, higher throughput, faster settlements times, and ability to issue custom assets. Drawbacks include increased computational costs to node operators, higher degrees of trust than Nakamoto consensus, and counterparty risk of stolen or irrecoverable funds. If successful, Liquid validates the sidechain model, and opens the Bitcoin blockchain for increased functionality in further implementations. This no doubt comes with certain risks, but is a development challenge worth pursuing given the non-coercive nature of this technology.

Many thanks to Allen Piscitello from Blockstream , Pietro Moran and Hasu for their contributions to this piece!

Cryptic History: The Cypherpunks

William Smith

November 19, 2018

“[T]he question at once arises whether it would not be equally desirable to do away altogether with the monopoly of government supplying money and to allow private enterprise to supply the public with other media of exchange it may prefer” F.A. Hayek

The sixteen square inches of inked fabric constituting a federal reserve note represents power, not value. It wasn’t always this way. Money proper, as evolved through the intertwining processes of exchange, holds value because of what it represents: all other goods. The Regression Theorem, developed by early 20th century economist Friedrich Wieser and his student Ludwig von Mises, demonstrates this process. Money, when examined historically, derives its value from comparisons to commodity goods. Money is intimately connected to barter. But government has usurped this role, replacing commodity value for the value of violence.

Money is a government service, a service facilitated by graft and perpetuated by surveillance.

First, inflation is theft. When the government artificially increases the supply of money the purchasing power of all money decreases across the board. Real wealth and savings evaporate. Since the creation of the Federal Reserve in 1913, the U.S. Dollar has lost 95 percent of its value. That’s generational wealth simply stolen.