Money, Bitcoin and Time: 2 of 3

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Money, Bitcoin and Time: 2 of 3

By Robert Breedlove

Posted January 26, 2019

This is part 2 of a 3 part series

The Simple Truth about Bitcoin: Bitcoin is the hardest form of money ever invented. It has successfully brought the advantages of physical cash money into the digital realm. Bitcoin is changing the way people organize themselves. The next chapter in the story of money is being written in a new language…

The Simple Truth about Bitcoin: Bitcoin is the hardest form of money ever invented. It has successfully brought the advantages of physical cash money into the digital realm. Bitcoin is changing the way people organize themselves. The next chapter in the story of money is being written in a new language…

Grasping Bitcoin [7]

Bitcoin seems easy to understand at first (it’s just magic internet money, right?), however truly grasping its significance is a formidable task. Once you think you have Bitcoin figured out, you’ll see it from another perspective and realize how little you actually knew. This pursuit of understanding Bitcoin is like a mountain climber that continually encounters false peaks, which fool him into thinking he has reached the summit, only to realize it is higher still.

It has been said that you can judge the quality and importance of an idea by the vehemence of its opposition. Bitcoin has been called many things — digital gold, tulip mania 2.0, financial revolution, the MySpace of cryptocurrencies, environmental disaster, rat poison squared, libertarian idealism, apex predator of monetary technologies, the biggest bubble in history, the model-T of cryptocurrencies, a superior species of money — but it turns out that, in context of the history and nature of money, Bitcoin appears to be a distinct evolutionary leap forward. Bitcoin is not an internet application like MySpace, it is an internet protocol. Bitcoin is not the model-T of cryptocurrencies, it is a more like a global freeway system. Bitcoin is not like any type of gold coin, Bitcoin is more like the element gold. Its integrity is protected by the inviolable laws of mathematics. Human nature is one of its core components. It is a new form of social institution. Bitcoin is a living system unto itself that adapts to environmental changes.

This may sound mind blowing at first. Most innovations of this magnitude sound this way in the beginning as we struggle to communicate using outdated terms and analogies that cannot possibly convey their importance. However, history shows us that ignoring innovation is a terrible strategy. In light of its inherent complexity and novelty, we will view Bitcoin from many different perspectives in an attempt to create a mosaic of understanding in the minds of our readers. First and foremost, Bitcoin is digital cash money .

Digital Cash Money [1]

As the global economy becomes increasingly digitized and interconnected, new technological realities are taking shape which will cause the market to naturally select for the most effective species of money native to this new digital terrain. Bitcoin is the first truly digital solution to the problem of money. It is the world’s first digital cash (in the original sense of the word cash discussed earlier) meaning that it is under the full control of its owner and can be used for final settlement in the same way as gold is today. Put another way, Bitcoin is digital cash money, a self-sovereign asset that contains within it all the trust factors and permissions necessary to transact with it. Bitcoin is not the liability of any counterparty, hence its nickname — digital gold.

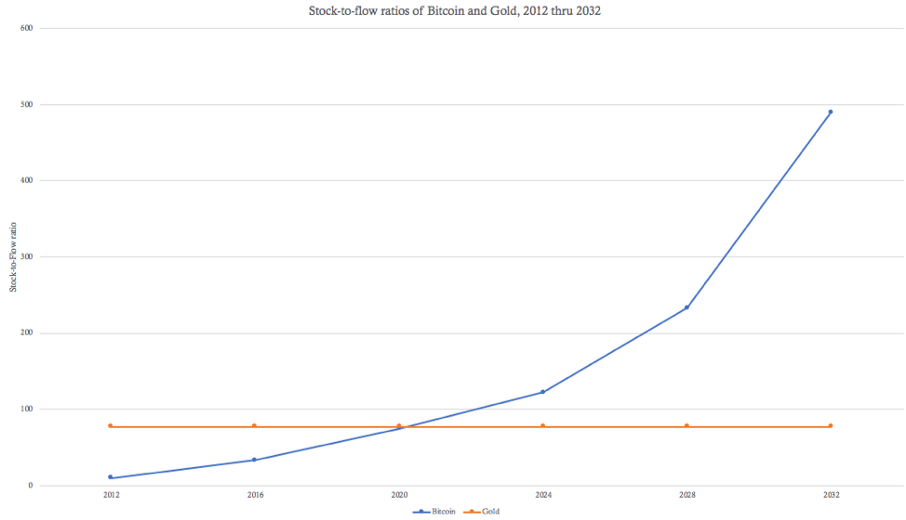

Like gold, Bitcoin is a supranational form of money, meaning that no government needs to decree its value or permit its use, nor can it be eliminated unilaterally by regulation. The hardness of Bitcoin is superior to all forms of money, including gold, and its stock-to-flow ratio will eventually reach infinity. As a digital asset, Bitcoin has unprecedented levels of salability across scales, space and time. It is resistant to confiscation, censorship, inflation and counterfeit. Meritoriously, Bitcoin’s value is attained entirely from the social consensus it earns by competing freely in the marketplace.

As one perspective of its monetary significance, Bitcoin can be understood as the successful fusion of the advantages associated with physical cash payments with the efficiencies and certainties enabled by digital technology. Cash payments have the advantage of being immediate, final and requiring no trust from either counterparty in each other nor any other intermediary. The drawback of cash payments was the need for parties to be present in the same space and time, which increases risks associated with physical custody, especially for larger transactions. As more business is conducted remotely, thanks to ever-advancing telecommunications technologies like the internet, physical cash transactions become increasingly impractical.

Since the inception of computers, the nature of all digital objects is that they were infinitely replicable. This meant that no digital object could be provably limited in quantity. For instance, when you “send” and email, you are actually sending a copy, as you still have the email in your sent folder. Before Bitcoin, there was no way to send a digital good that could not also be resent elsewhere at a later time. This presented an intractable issue for direct digital payments known as the double-spend problem . Without a trusted third-party intermediary to verify the payer was not double spending, digital payments were not possible. Using intermediated digital payments (like Venmo or PayPal) exposed parties to additional transaction costs, risk of censorship, fraud and transaction disputes.

The nature of digital objects also meant creating a digital cash was impossible, since its monetary units could be reproduced endlessly and would therefore suffer from unlimited inflation. Before Bitcoin, people had to rely on physical laws (rarity and chemistry, in the case of gold) or jurisdictional laws (government and central bank monopolies) to regulate money supplies. Innovatively, Bitcoin relies on mathematical laws to protect its monetary policy. Building on top of decades of innovative trial and error by other programmers and combining a wide range of proven technologies, Nakamoto successfully made Bitcoins the first digital objects that were verifiably scarce. As the world’s first instance of digital scarcity, Bitcoin was able to solve the double-spend problem and become the world’s first functional digital cash.

“That in order to make a person covet a thing, it is only necessary to make the thing difficult to attain.” - Mark Twain

In this way, Bitcoin would bring the desirous advantages of physical cash to the digital realm and combine them with an immutable monetary policy to inoculate its holders from all unexpected inflation. Drawing on lessons learned by other programmers during two decades of attempts at this innovative breakthrough, Nakamoto finally achieved digital cash money by combining four key technologies:

- Proof-of-Work — mathematical puzzles which require energy expenditure to be solved, solutions are rewarded with newly issued Bitcoin and user transaction fees, functions as the skin in the game necessary to keep Bitcoin’s distributed ledger truthful and maintain its monetary hardness

- Distributed peer-to-peer network — a record of Bitcoin’s entire transaction history is maintained by each network participant (known as a node) who mathematically verify each other’s work, making the entire system resistant to censorship and manipulation

- Hashing — a method of computer cryptography that transforms any stream of data into dataset of fixed size (known as a hash), this transformation is irreversible and is the foundation of trustless verification within the Bitcoin network

- Digital Signatures — a method of authentication that relies on a set of mathematically related elements called the private key, the public key and signatures — the private key (which must be kept secret) allows its holder to control the Bitcoin associated with it, meaning that the private key is a bearer instrument (holding Bitcoin is holding its private key, which makes it a self-sovereign monetary good like gold)

In the same way a monetary assessment of gold would not delve too deep into its chemical properties, this essay will not delve too deep into the technological properties of Bitcoin. We will instead focus on its monetary properties and its relevance in the story of money. However, some basic technical knowledge of Bitcoin is warranted to fully appreciate the importance of the innovation that is digital cash money.

Technological Properties [1]

Bitcoin is open-source software, meaning its source code can be inspected by anyone. This makes Bitcoin a language, its source code and transaction history are universally transparent and can even be printed onto paper (interestingly, this makes it protected under the First Amendment in the United States, more on this later). As an open-source software project, Bitcoin is supported by a global network of volunteer programmers. These programmers are self-interested in the sense that they are almost always Bitcoin owners as they are aligned with its purpose philosophically, and therefore stand to gain financially from its expanding network. Their work over the years has greatly enhanced the functionality of the Bitcoin network. However, these programmers are unable to change the rules of Bitcoin (as we will see when we discuss Bitcoin’s social contract).

To become a Bitcoin network member, known as a node, all that is necessary is to download and run the software on a computer. Once downloaded, the software will enable you to store Bitcoin and transact it with any other node in the world. Also, by becoming a node, the entire Bitcoin transaction history will be recorded on your machine and updated in perpetuity, just as it is on every other node in the world. This is the essence of Bitcoin’s decentralized architecture . The Bitcoin network, similar to the internet, lives everywhere and nowhere .

Owning a Bitcoin means owning the private key that can authorize it to be used in a transaction. The private key is purely informational, meaning that it is just a string of alphanumeric characters. This makes it a self-sovereign form of money, giving its holder the presumption of rightful ownership, which makes Bitcoin an instrument of final settlement (like gold). Bitcoin is the world’s first global, digital final settlement system.

Bitcoin is entirely reliant on verification, which allows its users to completely eliminate any need for trust. All Bitcoin transactions are recorded by every node on the network so that they all share one common ledger of balances and transactions (remarkably similar to the Rai Stone system used by the Yap Islanders). Transactions are grouped together approximately every ten minutes in what is known as a block . Each block is then added to the previous block of transactions, forming a chronological chain of inextricably linked blocks that stretches all the way back to the genesis block mined by Nakamoto himself exactly 10 years ago today. This is commonly called the Bitcoin blockchain . The blockchain is the common ledger of which each node maintains its own copy (commonly known as the distributed ledger). Each node verifies the accuracy of every other node’s transaction inputs and truth is established by consensus. In this way, the Bitcoin network relies 100% on verification and 0% on trust. This gives Bitcoin the unique property of trustlessness, meaning it is able to operate successfully without the need to trust any counterparty or intermediary whatsoever.

Blockchain, Energy and Mining [1,3,8,11]

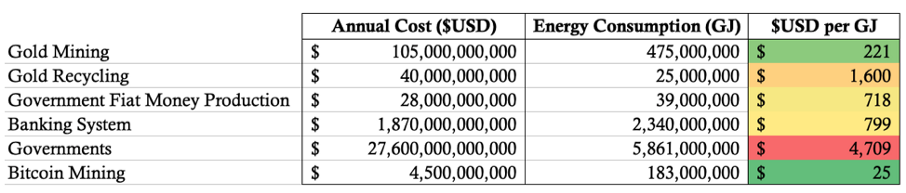

Economic incentives and disincentives are used to maintain truthful records in the blockchain, it what is an ingenious application of the skin in the game concept. Nodes compete to solve complex mathematical puzzles in a process called proof-of-work . Nodes are incentivized to perform this computing task because the first one to solve the proof-of-work is awarded a batch of newly issued Bitcoin and the transaction fees generated within the latest block of transactions — called the block reward . A block is sealed approximately every ten minutes, which triggers the opening of the next block and proof-of-work competition. Nodes expend processing power (in the form of electricity) to solve these complicated mathematical problems, although considerably less and much more efficiently than the systems that support gold and government money today:

Bitcoin mining is exceptionally energy efficient relative to other monetary systems and their institutions.

Bitcoin mining is exceptionally energy efficient relative to other monetary systems and their institutions.

Proof-of-work energy expenditure is the thermodynamic bridge from the physical to the digital world. It transmutes the fundamental commodity of the universe, energy, into digital gold. This energy expenditure is essential to the functioning of the Bitcoin network, as it disincentivizes node dishonesty. If a node attempted to include a fraudulent transaction in a block, other nodes would reject it and it would incur the cost of processing power without the prospect of earning the block reward. This process is commonly referred to as mining and the competing nodes are called miners (or mining nodes). Mining is a truly capitalistic voting mechanism where energy expended equals hashes, which are votes for the proof-of-work solution, generated. The name mining is an ode to the arduous process of mining of gold. As we have learned, the costs and risks related to the mining of this monetary metal is necessary for it to maintain its hardness (skin in the game). Similarly, mining using proof-of-work is the only known method of creating digital cash money.

Money, which is the representation of the work required to generate goods, can also be considered a form of stored energy. In the early 20th century, free market proponents like Henry Ford and Thomas Edison were interested in replacing gold or the US dollar with an energy money. Showing great prescience, they foresaw the day when the world may exhaust its non-renewable energy sources and be forced to switch to alternatives. Convicted in their free market beliefs, they shared this idea and assumed a great deal of reputational risk in the process, as their views ran contrary to the established economic order. The concept of energy money was popular due to its hard money characteristics, as energy is costly to produce. However, energy money was technologically well before its time, as energy could not be transmitted or stored easily using technologies of the day. In championing a novel idea with the greater good at heart, Ford and Edison were exhibiting soul in the game, or the exposure to downside risks on behalf of others. As Edison said in 1931:

“I’d put my money on the sun and solar energy. What a source of power! I hope we don’t have to wait until oil and coal run out before we tackle that.”

By using proof-of-work, which was originally invented as a measure to mitigate email spam, Bitcoin became the world’s first functional energy money. With physical monetary goods, we were required to build walls to safeguard our money. With the Bitcoin network, we are required to expend energy to preserve the sanctity of its ledger, secure its network and enforce the immutability of its money supply. Proof-of-work is essential for Bitcoin to function as hard, digital cash money and enables it to serve as the buyer of last resort for electricity worldwide. The Bitcoin network provides a perpetual economic incentive for everyone in the world to invent more efficient methods of harnessing energy. This global incentive will increase the rate of innovation in energy technologies. As Bitcoin expert Nic Carter puts it:

“The Bitcoin network is a global energy net that liberates stranded assets and makes new ones viable. Imagine a 3D topographic map of the world with cheap energy hotspots being lower and expensive energy being higher. I imagine Bitcoin mining being akin to a glass of water poured over the surface, settling in the nooks and crannies, and smoothing it out.”

As more nodes compete to solve the proof-of-work puzzle, the difficulty automatically increases so that new blocks are added on average once every ten minutes. This automatic algorithmic change is called the difficulty adjustment and is perhaps the most ingenious aspect of Bitcoin. It is the most reliable engineering solution for making and keeping money maximally hard and gives Bitcoin the unique ability to adapt its network security as it grows. As we have seen, when a form of money appreciates, people are immediately incentivized to increase its new supply flow, which reduces its stock-to-flow ratio and compromises its hardness. With Bitcoin, an increase in its price does not lead to the production of more Bitcoin beyond its transparent and predictable supply schedule. Instead, it simply leads to an increase in processing power committed by miners which in turn makes the network more secure and difficult to compromise. Like a vault that becomes harder to crack the more money that is stored within it, Bitcoin offers people an incredibly effective means of value storage.

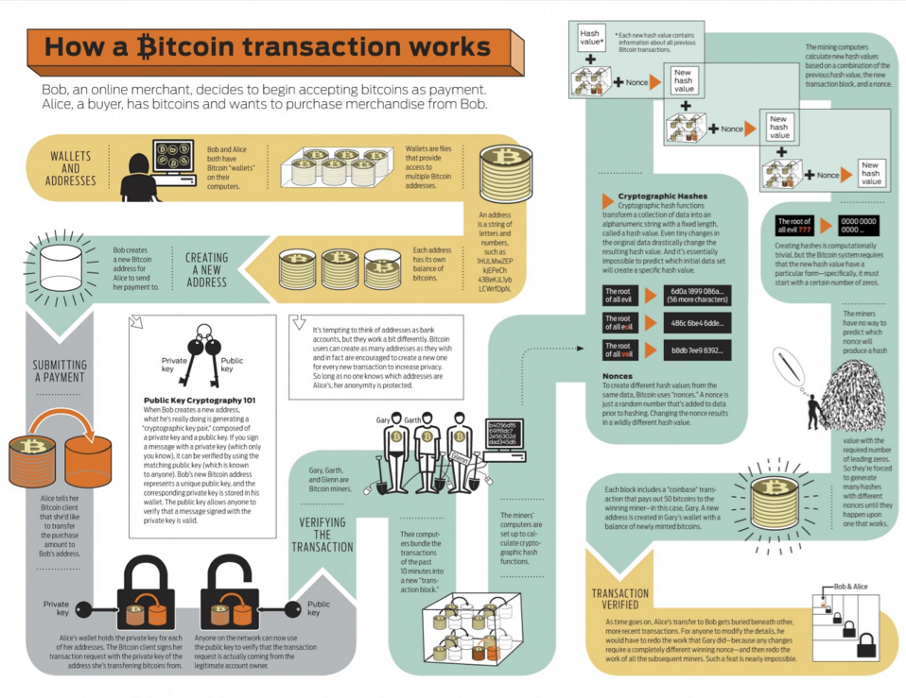

Next, we depict the entire process of a Bitcoin transaction:

How a bitcoin transaction works

How a bitcoin transaction works

The Internet of Value [9]

“The internet of value” is a popular moniker to describe Bitcoin. In reality, the Bitcoin protocol can be considered an integral and newly evolved layer of the commercial internet. In computer science, a protocol is a ruleset that governs the transmission of data. The internet as we know it is an integration of four successive layers of open-source protocols, called the Internet Protocol Suite, that maintain constant communication with one another:

- The Link Layer puts data packets on the wire

- The Internet Layer routes data packets across networks

- The Transport Layer persists communication across any given conversation

- The Application Layer delivers software files and applications

In this context, Bitcoin can be considered the fifth layer of the internet protocol suite:

- The Value Layer allocates scarce resources across networks

In the same way the internet is a set of open-source protocols for exchanging data, Bitcoin is an open-source protocol for exchanging value. It is trustless, as any machine can accept it from any other securely and at virtually zero cost. Bitcoin is also global and permissionless, meaning that any machine can speak its language and no central bank is required to authorize its use. This means that transactions on its network are essentially unstoppable as all trust factors and permissions necessary to transact with it are intrinsic to the act of holding a Bitcoin private key. Software protocol developments are being implemented that will make Bitcoin transactions even faster, cheaper, anonymous and capable of authentication. These can expand the utility of Bitcoin to enable the allocation of scarce network resources like computing power, verification of contracts or tracking identity and reputation.

Although Bitcoin is the fifth layer of the internet protocol suite, it is the base layer protocol for the value layer itself. This means that second and other higher order protocol layers may be built on top of it. A second layer protocol to Bitcoin, called the Lightning Network, is currently being implemented and is designed to sacrifice some degree of trustlessness to achieve higher transaction throughput, allowing Bitcoin to be used more effectively as a medium of exchange. The Lightning Network is an open-source protocol and functions by establishing trust channels among parties for faster, cheaper transactions that are then settled periodically to the Bitcoin blockchain. Higher order protocol development and integration is one of the many ways Bitcoin adapts to changes in its environment (more on this later).

In the same way that money is an emergent property of complex human interactions, Bitcoin is an emergent property of complex interactions occurring between people, machines and markets. Even if Nakamoto and Bitcoin never existed, it would still be necessary for us to invent the concept of cryptoassets to enable machines to exchange value to facilitate digital economies, use smart contracts and provide the substrate necessary for the ‘internet of things’ to come into existence. Not only is Bitcoin a prerequisite innovation to the digital economy, it is also the hardest monetary technology ever invented.

The Infinite Hardness of Bitcoin [1]

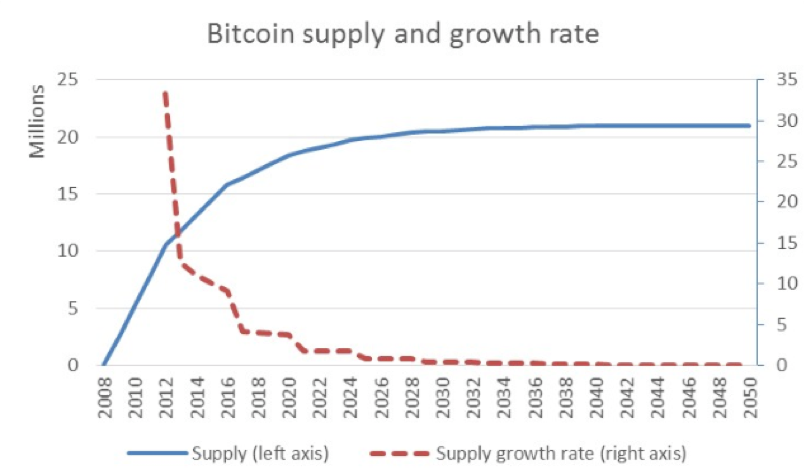

Bitcoin is the hardest form of money in existence. Its money supply is enforced mathematically and, like the other rules of Bitcoin, cannot be broken or changed. Only 21 million Bitcoins can and will ever exist:

The monetary policy of Bitcoin is set in (mathematical) stone.

The monetary policy of Bitcoin is set in (mathematical) stone.

This strictly limited supply makes it the first monetary technology exhibiting absolute scarcity . Unlike gold and other monetary metals, no matter how much demand for Bitcoin increases there will never be any units produced in excess of its fully transparent, predictable and unchangeable monetary policy.

Before Bitcoin, only time itself had achieved the property of absolute scarcity.

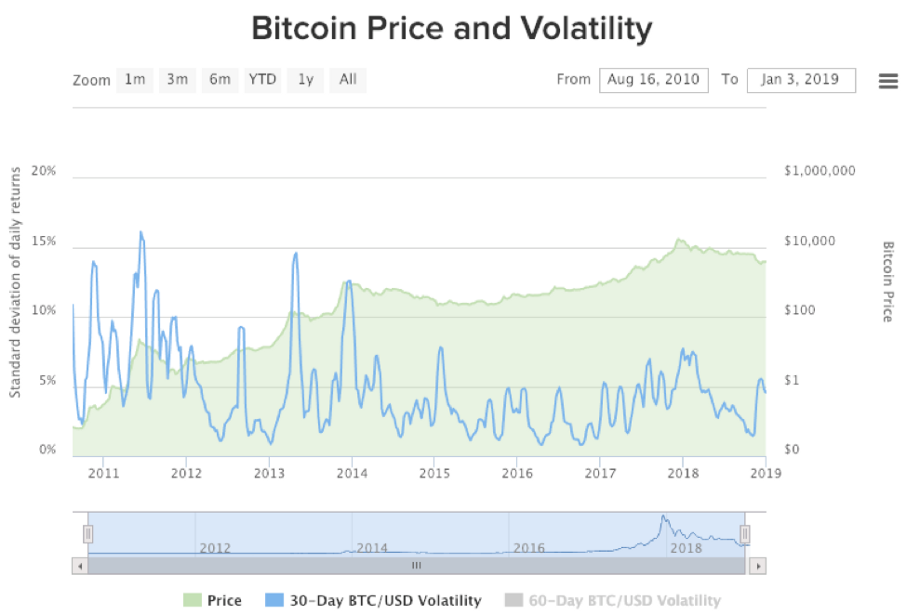

Since increased demand for Bitcoin cannot affect its supply, it can only be expressed in its price. Bitcoin has perfect price inelasticity of supply, meaning that it has zero supply-side response to increases in its price. Unlike gold and all other physical commodities, where an increase in demand will inevitably lead to larger supplies being produced over time, Bitcoin can only express an increase in demand by becoming more expensive (and a more secure network). A perfect price inelasticity of supply no doubt contributes to the notorious price volatility of Bitcoin it is exhibiting at the earliest stages of its growth we are witnessing today.

Absolute scarcity greatly exacerbates Bitcoin’s price volatility. As its network continues to grow, the value of Bitcoin as an unstoppable payments channel and uninflatable money is steadily increasing over time while its price is constantly attempting to find it, dramatically overshooting and undershooting along the way. With a totally inflexible supply schedule, as long as Bitcoin is growing quickly, its price will behave like that of a startup company stock undergoing meteoric growth. Should Bitcoin achieve sufficient market penetration that its growth slows down, it would stop attracting high-risk investment flows and become a stable monetary asset expected to appreciate slightly each year as demand increases due to productivity and population growth — like any mature hard money should. As expected, over the long-run we are already seeing a decrease in Bitcoin’s price volatility:

As expected, the price volatility of Bitcoin is gradually declining as its network value grows.

As expected, the price volatility of Bitcoin is gradually declining as its network value grows.

Bitcoin’s immutable monetary policy ensures that its supply will continue to grow at a decreasing rate and will reach its maximum of 21 million units sometime in the year 2140. To maintain salability across scales, Nakamoto designed each Bitcoin to be further divisible into 100 million units, which are now commonly called Satoshis in his honor. Once the last Bitcoin is mined, its stock-to-flow ratio will become infinite as its flow will completely and irreversibly cease. Beyond this point, miners will be compensated exclusively by transaction fees. Bitcoin’s decreasing growth rate means that the first 20 million coins will be mined by the year 2025, leaving the last 1 million to be mined over the subsequent 115 years:

Due to its decreasing supply growth rate, over 95% of all Bitcoins will be mined by the year 2025.

Due to its decreasing supply growth rate, over 95% of all Bitcoins will be mined by the year 2025.

This predictable, transparent and immutable supply schedule gives Bitcoin a significant advantage as it competes for the trust of the people to become a reliable store of value. Unlike government money or even gold, people know with absolute certainty that Bitcoin will never have its salability across time compromised by unexpected supply increases.

Bitcoin is uninflatable money in a world where wealth is continuously stolen via inflation.

As is the case with its other immutable laws, Bitcoin’s monetary policy is enforced by the inviolable laws of mathematics. Inevitably, Bitcoin will surpass gold around the year 2020 to become the hardest form of money in history:

As sure as 1+1=2, Bitcoin will soon surpass gold to become the hardest form of money in history.

As sure as 1+1=2, Bitcoin will soon surpass gold to become the hardest form of money in history.

By virtue of its natively digital nature, Bitcoin is (critically) highly resistant to centralization. As we have learned, it was the centralization of gold that led to government money backed by gold, which made gold more salable across scales and encouraged a gold standard to flourish throughout most of the world. However, as the temptation to expand money supplies seems to be irresistible for humans, governments soon took control of the banking sector, printed money in excess of its gold reserves, eventually severed their currencies peg to gold and thereby destroyed the hardness of government money completely.

Historically, people who adopted hard money systems flourished — such as the Romans under Caesar, The Byzantines under Constantine and the Europeans under the gold standard — and people who had the hardness of their money compromised suffered enormous consequences — such as the Yap Islanders, West Africans using glass beads and the Chinese under a silver standard in the 19th century. Moving a society away from a hard money system has been a harbinger of economic crisis and societal decay, an outcome that can be explained as a social contract rescission.

Bitcoin’s Social Contract [10]

Social contract theory starts with an assumed hypothetical state of nature full of violence that is unbearable for people to live in. Driven by a desire to improve their circumstances, people come together and collectively agree to sacrifice some of their freedoms to establish a social contract and empower an institution to protect them. Government is the result of a social contract: people sacrifice some of their freedoms to give the state control over the monetary system and armed forces. The state, in turn, uses that power to manage the economy, redistribute wealth and fight crime. In the United States, our current social contract grants the government monopoly control of money (via the Federal Reserve) and violence (via the Police and Military).

Similarly, money itself can be thought of as a social contract. If enough people are unhappy with a barter economy, they can collectively agree to use money instead. This social contract entails sacrificing certainty (requiring trust that dollars will maintain their value over time) in exchange for convenience (using dollars as a medium of exchange). The social contract for money, as we have seen, emerges and evolves spontaneously based on market-driven natural selection. Each person continuously decides which outcomes they prefer and how best to achieve them. If enough people seek the same outcome, we call the result a social contract.

Throughout history, almost every government (a form of social contract) put in charge of the monetary system (another, often interrelated, form of social contract) has abused its power by forcibly confiscating assets, censoring private transactions and printing money to steal wealth via inflation. Using the virtually unlimited financial means provided by control over money supplies, these governmental social contracts grew in successive bureaucratic layers. The larger and more valuable these social contracts became; the more freedoms were forfeited and the more others sought control over them. This led to many instances of conflict (warfare or social revolution) in which old social contracts (dictatorships or tyrannical regimes) were rescinded in favor of new ones (new laws, treaties or governments). The principal point here is that people can agree they are in a terrible situation and come together to change it, but the resultant social contract is only as strong as its credibility and enforceability.

The invention of Bitcoin can be regarded as a new implementation of the social contract for money. Nakamoto settled on the following rules for this new implementation:

- Only the owner of a Bitcoin can produce the digital signature to spend it (confiscation resistance)

- Anyone can transact and store value in Bitcoins without permission (censorship resistance)

- There will only be 21 million Bitcoins, issued on a predictable schedule (inflation resistance)

- Anyone will always be able to verify all the rules of Bitcoin (counterfeit resistance)

Historically, social contracts intended to protect people, such as governments and their central banks, eventually became controlling and ultimately turned abusive. When a social contract loses sufficient trust of the people, it falls apart or is overthrown, by ballot or by bullet. This dynamic has resulted in a continuous cycle of rising and falling social contracts throughout history. Bitcoin is intended to break this cycle in two ways:

- Instead of seeking security from a powerful central entity (like a government or central bank) that can be corrupted or overthrown, Bitcoin creates a hypercompetitive market for its own protection. It turns security into a commodity and the security providers (miners) into harmless commodity producers.

- By requiring its security market participants (miners) to incur real world costs to generate their economic reward (skin in the game), Bitcoin incentivizes the market to reach consensus over who owns what at any given point in time.

In this sense, the Bitcoin social contract is composed of two distinct, self-reinforcing layers: the social layer and the protocol layer. The social layer is the social consensus itself, which determines the rules of Bitcoin and establishes its value. The protocol layer simply automates the enforcement of the rules set by the social layer:

In this sense, Bitcoin is more than just a technology. Indeed, it is a new institutional form. Viewing it in this way, we are better able to answer some of the more existential questions about Bitcoin:

Who Can Change the Rules of Bitcoin?

Since the rules of the Bitcoin social contract are decided at its social layer and enforced at its protocol layer, who can actually change its rules? Bitcoin, as computer network, comes into existence when people run implementations that follow the same ruleset (think of these rulesets as speaking the same language). You remain in the network by following the same rules as everyone else. If you decided to change the ruleset on your local computer, you would simply be evicted from the network (you no longer speak the same language as everyone else). Your unilateral decision to change the rules would not impact the actual Bitcoin network in any way whatsoever.

The only way to change the rules of the Bitcoin social contract is to convince people to voluntarily accept your proposed rule changes at the social layer. As each network member is self-interested, they will only adopt rules that benefit them. Seeing as its current rules are already optimal for Bitcoin holders (resistance to confiscation, censorship, inflation and counterfeit) it would be extremely difficult to convince a majority of the approximately 30 million network participants to change rulesets. This asymmetrical governance dynamic virtually rules out any contentious changes from succeeding, as they would never get broad social consensus. Therefore, the Bitcoin network can be upgraded in ways that align with the collective best interests of its members and is at the same time highly resilient to changes that contradict these interests.

Can a Software Bug Kill Bitcoin?

In September 2018, a software bug arose in the main implementation of Bitcoin that opened up two potential attack vectors which theoretically could have been exploited to circumvent its counterfeit and inflation resistance properties. Bitcoin developers quickly fixed the bug before either vector was exploited, however this event left many people wondering what would have happened had the vulnerabilities not been discovered in time.

Any time the social layer and protocol layer diverge in the Bitcoin social contract, the protocol layer is always wrong. Again, all rules are set at the social layer whereas the protocol layer is only responsible for automating their enforcement. Had the software bug not been discovered in time, Bitcoin’s blockchain would have undergone a fork — meaning its protocol layer would have been split it into two networks, one with the bug and one without it. Every Bitcoin holder would then have an equal number of coins in each network, but the value of these coins would be determined solely by the free market. This is true for all forms of money, as social consensus determines the value of money. At the social layer, each Bitcoin owner would then choose either the implementation with or without the bug. To protect the value of their Bitcoin, holders would rationally choose to migrate to the mended network and its blockchain would continue without interruption.

When the Bitcoin protocol layer successfully automates the enforcement of the rules determined at its social layer, the two layers are in sync. If they diverge for any reason, the social layer supersedes, and the protocol layer is mended to reflect the economic reality of the social consensus surrounding Bitcoin. Software bugs are inevitable, and Bitcoin’s 2-layer social contract construction ensures that it can withstand them.

Can Forks Compromise the Immutability of Bitcoin’s Rules?

Since Bitcoin is open-source software, anyone in the world can copy its code, change it and launch their own version. This is also a chain fork which, as established earlier, affects only the protocol layer of the Bitcoin social contract. Without changing the rules at the social layer first, a protocol layer fork only evicts you from the true Bitcoin network. To successfully change the rules of Bitcoin, you must successfully fork its social layer first. To accomplish this, you would need to convince as many people as possible that your proposed ruleset is meaningfully better for them, so that they take the risk of adopting your proposed software changes. Forks like these are difficult to pull off in reality because they require buy-in from thousands of people to be successful. This asymmetry between the cost of campaigning for ruleset changes and their potential benefit to network participants makes the Bitcoin network exhibit an extremely strong status quo bias when it comes to governance.

The key to understanding this is that the value of any form of money is purely a social construct or, in other words, is derived from social consensus. Individual Bitcoins, like US dollars or any other currency, receive their value exclusively from the shared belief of their users. Forking Bitcoin’s protocol layer is worthless without forking the social layer from which it derives its value. In the rare cases that the social layer itself splits, as was the case with the Bitcoin Cash fork, the result is two weaker social contracts, each agreed upon by fewer people than before. The complete failure of the Bitcoin Cash fork (its price has declined from 0.21 to 0.04 Bitcoin over the past year) is yet another battle scar for Bitcoin that pays testament to its governance model and exemplifies the winner take all dynamics inherent to monetary competition.

So long as Bitcoin network participants continue to act in accordance with their own individual self-interest, the rules of Bitcoin (resistance to confiscation, censorship, inflation and counterfeit) are immutable and, therefore, as reliable as the laws of mathematics. It’s clear from this perspective that Bitcoin is more than just a technological innovation. Although Bitcoin as a network and monetary technology is groundbreaking in many respects, its social contract implementation is revolutionary. Bitcoin is the first technology that incorporates human nature as one of its core moving parts.

In essence, by believing that mathematics and individual self-interest will persist, we can reliably believe in Bitcoin’s value proposition and its ongoing successful operation.

Over the past 10 years, by inventively aligning human self-interest with its own self-interest, the Bitcoin network has managed to grow organically from $0 to $80B in value.

A New Form of Life [1]

Although Bitcoin is intended to be a monetary technology, it is a totally unique compared to other forms of money. Ralph Merkle, famous cryptographer and inventor of the Merkle tree data structure, has a remarkable way of describing Bitcoin:

“Bitcoin is the first example of a new form of life. It lives and breathes on the internet. It lives because it can pay people to keep it alive. It lives because it performs a useful service that people will pay it to perform. It lives because anyone, anywhere, can run a copy of its code. It lives because all the running copies are constantly talking to each other. It lives because if any one copy is corrupted it is discarded, quickly and without any fuss or muss. It lives because it is radically transparent: anyone can see its code and see exactly what it does. It can’t be changed. It can’t be argued with. It can’t be tampered with. It can’t be corrupted. It can’t be stopped. It can’t even be interrupted. If nuclear war destroyed half of our planet, it would continue to live, uncorrupted. It would continue to offer its services. It would continue to pay people to keep it alive. The only way to shut it down is to kill every server that hosts it. Which is hard, because a lot of servers host it, in a lot of countries, and a lot of people want to use it. Realistically, the only way to kill it is to make the service it offers so useless and obsolete that no one wants to use it. So obsolete that no one wants to pay for it, no one wants to host it. Then it will have no money to pay anyone. Then it will starve to death. But as long as there are people who want to use it, it’s very hard to kill, or corrupt, or stop, or interrupt.”

Bitcoin is a technology, like the hammer or the wheel, that survives for the same reason any other technology survives: it provides benefits to those who use it. It can be understood as a spontaneously emergent protocol that serves as a new form of uninflatable money and an unstoppable payments channel. Structurally, the Bitcoin network reflects a quintessential manifestation commonly found in nature.

The Decentralized Network Archetype [7]

The Bitcoin network mirrors one of the most successful evolutionary structures found in nature, the decentralized network archetype:

Clockwise from the top left: the human heart, lightning, the human brain, a fungal mycelium network, roots from a tree, an aerial view of the Grand Canyon, branches from a tree and a cosmic web of galactic superclusters in the deep Universe (which is the largest observable structure in the known Universe at over 1 billion lightyears across).

Clockwise from the top left: the human heart, lightning, the human brain, a fungal mycelium network, roots from a tree, an aerial view of the Grand Canyon, branches from a tree and a cosmic web of galactic superclusters in the deep Universe (which is the largest observable structure in the known Universe at over 1 billion lightyears across).

The decentralized network archetype is prevalent in nature because it is one of the most energy efficient structures possible. Energy is the fundamental commodity of the universe and nature always optimizes for its utilization. Atoms, bubbles and stars (in a state of equilibrium) always form spherical shapes, which is the most energy efficient form for minimizing surface area, precisely because they are energy conservation structures. Minimal surface area output per unit of energy input ensures that these structures optimally expend the finite energy of which they are composed. Spheres are figures of equilibrium with equal distribution their own inherent energy.

Conversely, decentralized networks always form in these tendrilled, circuitous and redundant shapes, which is the most energy efficient form of maximizing surface area, precisely because they are energy exchange structures. Maximal surface area output per unit of energy input ensures that these structures achieve the highest degree of spatial exposure to optimize the likelihood of successful exchange — whether their purpose is pumping blood, imbibing groundwater or seeking sunlight. Spheres and decentralized networks are antithetical in purpose and archetype. Decentralized networks are figures of disequilibrium which both disperse and gather energy within their environments. A decentralized form in organic systems confers advantages such as distributed intelligence, invulnerability to singular attack vectors and accelerated adaptivity.

The decentralized network archetype found in nature is the antecedent to paradigm shifting innovations throughout history such as the railroad system, the telegraph, the telephone, the power distribution grid, the internet, social media and now Bitcoin.

To illustrate the power of this natural archetype, let’s consider the story behind the design of the Tokyo subway system. Scientists conducted an experiment where an ancient fungus, the slime mold, was incentivized to recreate the Tokyo subway system. Each subway stop (node) was marked with oat flakes, the favorite food of the slime mold. In a single day, the slime mold grew to connect all the subway stops in a more energetically efficient design than that proposed by the central planning committee of engineers who spent many months at great expense to the Japanese government in the design process:

Japanese subway design

Japanese subway design

As the Scientists later reported:

“Transport networks are ubiquitous in both social and biological systems. Robust network performance involves a complex trade-off involving cost, transport efficiency, and fault tolerance. Biological networks have been honed by many cycles of evolutionary selection pressure and are likely to yield reasonable solutions to such combinatorial optimization problems. Furthermore, they develop without centralized control and may represent a readily scalable solution for growing networks in general. We show that the slime mold Physarum polycephalum forms networks with comparable efficiency, fault tolerance, and cost to those of real-world infrastructure networks — in this case, the Tokyo rail system. The core mechanisms needed for adaptive network formation can be captured in a biologically inspired mathematical model that may be useful to guide network construction in other domains.”

In a similar vein, Bitcoin and its network participants receive signals from the market to create features that satisfy unmet demands or improve the functionality of its network. When block space demand exceeds capacity, as it did it late 2017, transaction fees spike and encouraged the development of a second layer protocol to increase transaction throughout (the Lightning network discussed earlier). As rent-seeking businesses, like Western Union, continue charging exorbitant fees for international remittances, market demand shifts to Bitcoin’s much more cost effective and permissionless payment channel. When governments crack down on Bitcoin exchanges, trading volume on peer-to-peer exchanges like LocalBitcoins.com flourishes. To enhance Bitcoin network accessibility, Blockstream launches satellites that provide global coverage for node synchronization. The Bitcoin network is constantly adapting to optimize for its own expansion and the interconnectedness of its participants. Perhaps Bitcoin is less so digital gold, and more so digital slime mold (just kidding, or am I?).

In most forms of life, genes are only passed from parent to offspring in a process called vertical gene transfer . Certain fungal networks, which are modeled after the decentralized network archetype, are able to steal competitive advantages directly from physical contact with other similar organisms in a process called horizontal gene transfer . These fungal networks can grow to gargantuan sizes — indeed, the largest organism on Earth, at nearly 4 kilometers across, is a honey fungus in Oregon that is slowly consuming an entire forest. Fungal networks live in constant competition as they fight off predators, pests and pollutants. This environmental stress causes them to naturally synthesize a variety of enzymatic and chemical countermeasures and, when one of these measures is successful, it is stored in the distributed mind of the entire fungal network. The next time it encounters a menace for which it has even once synthesized an effective countermeasure, the fungal network will use it to neutralize the threat, no matter where the latest encounter occurs. Amazingly, these fungal networks are capable of absorbing countermeasures created by competitors in the same ecosystem purely from physical contact. Such organisms exhibit distributed intelligence, meaning they learn at the edges and distribute the lessons throughout their vast networks.

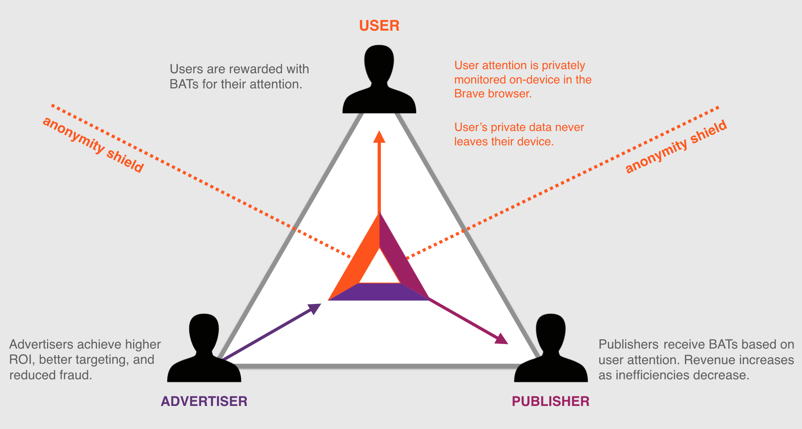

There is a common misconception that an alternative cryptoasset could develop a superior feature that will eventually outcompete Bitcoin. Similar to certain fungal networks, Bitcoin is able to subsume features that have been proven in the marketplace from cryptoasset competitors. For example, an alternative cryptoasset called Basic Attention Token (BAT) is designed to power an internet browser called Brave that allows users to shield themselves from advertisements:

BAT is a cryptoasset designed to allow web browser users to monetize their own attention. Using a set of open-source software extensions, today you can perform browser-based microtransactions similar to BAT but using Bitcoin instead. This effectively eliminates the need for a cryptoasset like BAT. The capacity of Bitcoin to subsume market-proven features from competitive cryptoassets fortifies it from disruption.

BAT is a cryptoasset designed to allow web browser users to monetize their own attention. Using a set of open-source software extensions, today you can perform browser-based microtransactions similar to BAT but using Bitcoin instead. This effectively eliminates the need for a cryptoasset like BAT. The capacity of Bitcoin to subsume market-proven features from competitive cryptoassets fortifies it from disruption.

Brave users are then given the option to open their browsing sessions up to advertisements and are paid in BAT for their attention. This blockchain-based digital advertising solution is intended to allow users to monetize their own attention, whereas in most browsers advertising revenues are allocated mostly to the content publishers. Given Bitcoin’s open-source nature, it is able to absorb competitive features like this in a process similar to horizontal gene transfer. Today, by using the Lightning Joule browser extension and running a full Bitcoin node, you can perform browser-based microtransactions similar to BAT but using Bitcoin instead. This effectively eliminates the need for a cryptoasset like BAT. Further, the technologies combined to make Bitcoin all came from previous attempts at digital cash, reiterating the point that open-source software is amenable to feature absorption. This ability accelerates the adaptivity of the Bitcoin network and insulates it from competitive disruption which further reinforces its position as the market leader.

Antifragility [1,11]

Seeing the ubiquity of the decentralized network archetype throughout nature in this way makes the invention of decentralized digital money seem less novel and more inevitable. An open and decentralized nature also enables Bitcoin to benefit from adversity. In light of its track record, Bitcoin is an excellent incarnation of Nassim Taleb’s concept of Antifragility:

“Wind extinguishes a candle and energizes fire… Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder and stressors and love adventure, risk and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. This property is behind everything that has changed with time: evolution, culture, ideas, revolutions, political systems, technological innovation, cultural and economic success, corporate survival, good recipes, the rise of cities, legal systems, equatorial forests, bacterial resistance… even our own existence as a species on this planet.”

Fragility can be defined as sensitivity to disorder, whereas robustness is insensitivity to disorder. Antifragility is a property of anything that benefits from disorder, stress or adversity. The many failed attempts at killing Bitcoin thus far have only made it stronger by drawing attention to attack vectors or vulnerabilities that its global team of self-interested, volunteer programmers can then fix. These improvements have only increased the network’s operational efficiency. Also, each time it withstands an external attack or a chain fork (as we are witnessing with the abject failure of Bitcoin Cash), its reputation for network security and immutability is strengthened. The resiliency of Bitcoin is hardened by hostility.

As Bitcoin has fluctuated wildly in price over the years, each new crash has triggered widespread declarations of its demise. Over 330 prominent articles declaring the death of Bitcoin, known as Bitcoin obituaries, have been written over the past 10 years. These publicity attacks on Bitcoin brought it to the attention of ever-wider audiences. As obituaries intensified, Bitcoin’s network processing power, transaction volume and market capitalization all continued to ascend relentlessly — a confirmatory example of the saying ‘all publicity is good publicity’.

When China took a heavy-handed approach to regulation by shutting down Bitcoin exchanges in 2017, we witnessed several informal exchanges and OTC markets appear following the demise of each centralized exchange. Although the liquidity for Bitcoin was negatively impacted initially, soon transactions started happening off exchange in China, with volume on websites like localbitcoins.com exploding. The regulatory attack also encouraged people to hold Bitcoin for longer periods, as evidenced by a steep decline in sell volumes, which only reduced the amount of Bitcoin being traded and put upward pressure on its price. Also, these regulatory actions backfired by triggering the Streisand Effect, which is a phenomenon whereby an attempt to hide, remove or censor information has the unintended consequence of publicizing the information more widely, usually facilitated by the internet. As the world watched the situation in China unfold, both the Bitcoin price and global internet searches for the term Bitcoin reached new all-time highs.

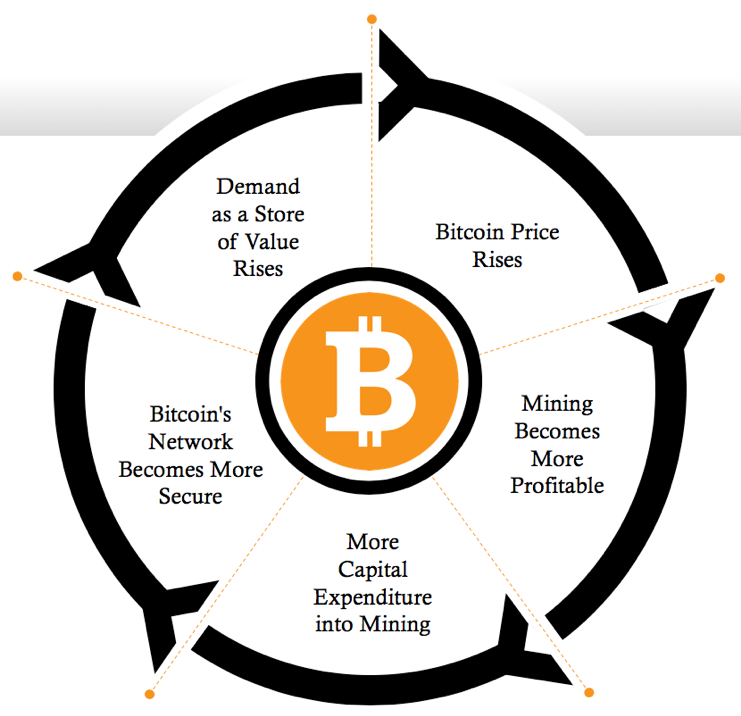

Bitcoin’s Positive Feedback Loop [1,4]

All of the adversity Bitcoin has faced so far has only fed its growth. Absent any top-down authority, Bitcoin is organic in the sense that it has grown from the bottom-up based solely on its own merits as money. Bitcoin perpetuates the expansion of its network and maintains truthful records by relying on asymmetric economic incentives that make fraud far costlier than its potential rewards. Network participants are all rewarded economically for their interactions with Bitcoin, which creates a flywheel effect on its price and network security:

Bitcoin autonomously proliferates its network by economically rewarding everyone who interacts with it.

Bitcoin autonomously proliferates its network by economically rewarding everyone who interacts with it.

As the Bitcoin network adapts to better meet the demands of its constituents, it in turn recruits more network participants. This positive feedback loop promotes the sustained growth of its network and fuels powerful, multi-sided network effects.

Bitcoin’s Network Effects [1,4,5]

Bitcoin’s meteoric growth has been both supported and protected by its unique multi-sided network effects. The basic example of a powerful 1-sided network effect is a social network (or a telephone network, as outlined earlier). The more people on a social network, the more valuable it is for others to be on it, as there are exponentially more possible connections. It can, however, be disrupted by a competitor that provides a more valuable service to its single customer cohort, the users, who might then transition to the new service (as happened when Facebook disrupted MySpace).

Successful 2-sided markets (like eBay or Craigslist) are significantly more difficult to disrupt. Consumers want to be there because merchants are there, and merchants want to be there because consumers are there. To disrupt a 2-sided network, you have to simultaneously introduce a superior value proposition for both parties, otherwise nobody moves. That is why Craigslist, despite its limited innovation over the years, has been able to leverage its early 2-sided lead and is still a dominant website today.

Bitcoin has a unique 4-sided network effect that insulates it from disruption and supports its growth. These are the four constituencies that participate in expanding the value of Bitcoin as a result of their own self-interested interaction with its network:

- Consumers who pay with Bitcoin

- Merchants who accept Bitcoin

- Nodes that maintain the distributed ledger

- Developers and entrepreneurs who are building onto and on top of Bitcoin

This 4-sided network effect makes Bitcoin’s first mover advantage seemingly indomitable. As an adaptive monetary technology, its network effects encompass the liquidity of its market, the number of network participants, the community of software developers who support it and Bitcoin’s brand awareness. Large investors will always seek the most liquid market for ease of entry and exit. Consumers, merchants and developers tend to join the largest of each of their respective Bitcoin communities, which only reinforces their social interconnectivity and cohesion. Brand awareness is innately self-reinforcing, as any cryptoasset competitor will inevitably be mentioned in comparison to Bitcoin.

An aside on Bitcoin’s brand awareness: As we have learned, the value of any money is derived from its social consensus, or the mutual beliefs of its users. The notion of a “believer” has religious connotations, as the notion of one having an epiphany once the “truth” is revealed. Such religious undertones are prevalent in most forms of money (In God We Trust on the US Dollar) and they are also part of Bitcoin’s aura (The Genesis Block, Bitcoin Evangelists). The most important of these quasi-religious ideas is the mythological bedrock Nakamoto laid with his enigmatic appearance in 2008 and then with his mysterious disappearance 3 years later. Whoever he/she/they were, Nakamoto gave Bitcoin its creation myth . As market strategist Nicolas Colas said:

“In business, creation stories reinforce the role of the individual as a societal agent of change and speak to a core audience of customers. They are the bedrock for what marketers call a brand and the source waters for Wall Street’s shareholder value.”

Assuming Nakamoto was a lone wolf, it is arguable that his disappearance transformed him from a person into a mythological figure. This mystery fuels the brand awareness of Bitcoin and reinforces its quality of decentralization, as there is no single individual to vilify, denigrate or otherwise target in an attempt tarnish Bitcoin’s symbolism. Like a super hero with a secret identity, all we have is the icon of Nakamoto as a cryptic genius — the godhead of Bitcoin.

As we have learned, the value of a network is a reflection of the total number of possible connections it allows. Therefore, each new Bitcoin owner increases the value of the Bitcoin network, which benefits all existing owners. This new owner is then incentivized to evangelize the benefits of Bitcoin to others, creating the next wave of new owners, and the cycle continues. As the price increases, so too do the incentives to secure the network which draws in more capital expenditure from miners, making Bitcoin’s network effects even stronger and self-reinforcing as price appreciation reflexively energizes Bitcoin’s positive feedback loop outlined earlier.

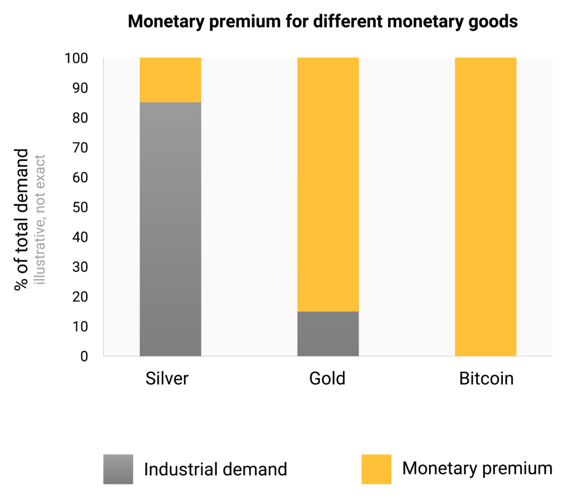

Since money is a social network, the price of a monetary good is a reflection of how widely adopted it has become or is expected to become. The price of a monetary good in excess of its industrial demand is its monetary premium . This is the only rational basis for the common criticism that Bitcoin is a bubble, as it is purely a monetary technology and has no industrial demand whatsoever. However, this premium is the defining characteristic of all forms of money, as all monetary value is based on the optionality it gives its user for exchange across scales, space and time.

Actual bubbles occur when price exceeds fair value, such as the market distortions created by central bank monetary manipulation. However, some mistake monetary premia for bubbles since they cause prices of monetary goods to exceed their underlying industrial values. If monetary premia are bubbles, then money is the bubble that never pops. Paradoxically, in this sense a monetary technology can presently be both a bubble and significantly undervalued if it later achieves widespread adoption:

As a pure bred monetary technology, Bitcoin derives none of its value from alternative uses.

As a pure bred monetary technology, Bitcoin derives none of its value from alternative uses.

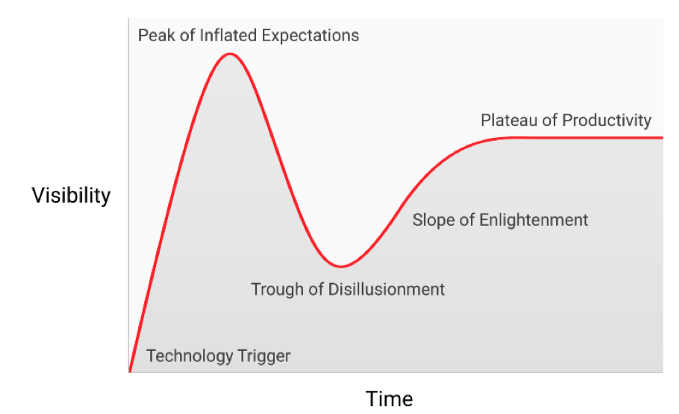

Although there is no established price pattern for a digital good that is becoming monetized, Bitcoin’s price appears to follow a fractal (a recursive, self-similar shape) wave pattern of increasing magnitude commensurate with its level of user adoption. The volatility of this price pattern is exacerbated by Bitcoin’s perfect price inelasticity of supply (as discussed earlier). Each iteration of the fractal wave pattern appears to match the standard shape of the Gartner hype cycle, which provides a graphical and conceptual representation of emerging technologies undergoing five phases of maturation:

Figure 1 Bitcoin’s price appears to follow a fractal wave pattern based on the archetypal Gartner hype cycle.

Figure 1 Bitcoin’s price appears to follow a fractal wave pattern based on the archetypal Gartner hype cycle.

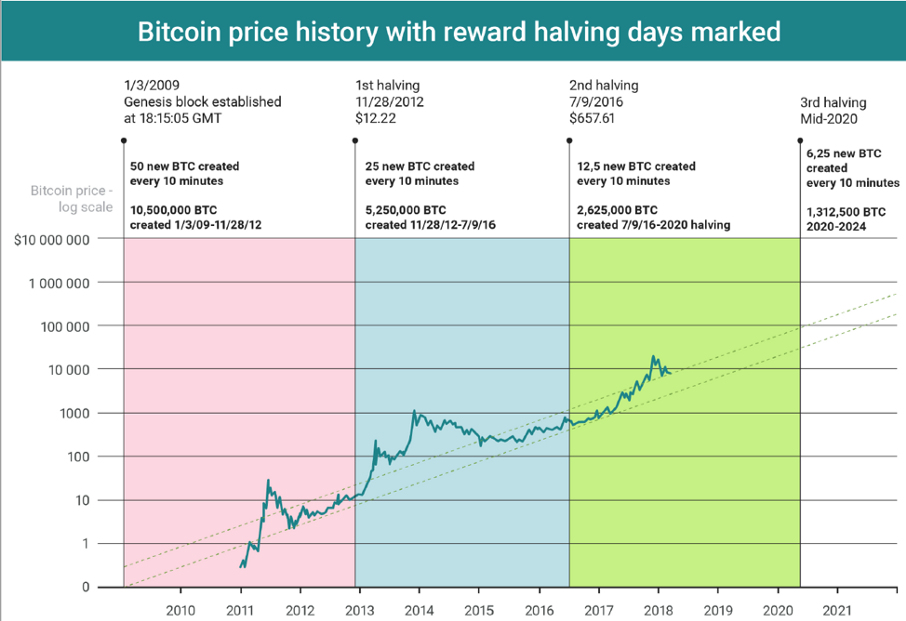

Bitcoin’s growth, in terms of price and transactions, has been dramatic to say the least. Indeed, it is the fastest growing asset in history. Its price has gone from $0.000994 on October 5, 2009, in its first recorded transaction, to about $4,000 today — a total increase of over 400,000,000% in 10 years. By its 10th birthday, Bitcoin had processed about $1.38T USD worth of transactions, with USD value calculated at the time of each transaction. Here we show Bitcoin’s entire price history, from a logarithmic perspective, with the Gartner hype cycle fractal wave pattern iterations located inside boxes:

Bitcoin is the fastest growing and most volatile asset in history, although both are leveling off as it grows.

Bitcoin is the fastest growing and most volatile asset in history, although both are leveling off as it grows.

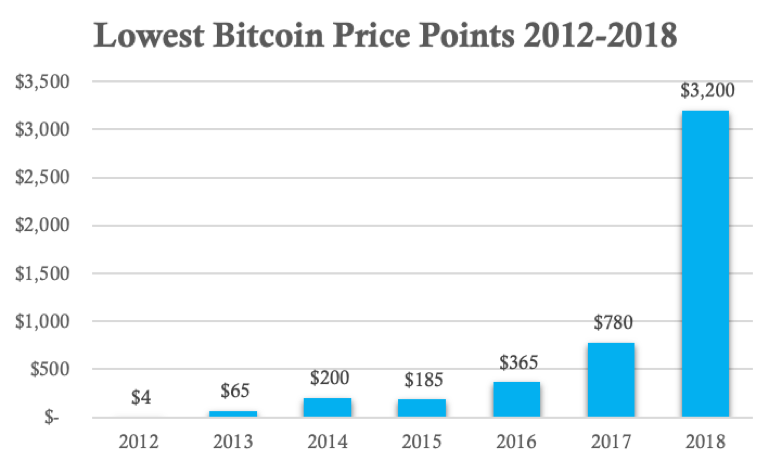

These extreme price cycles draw in new Bitcoin owners as each fractal wave crests. Some of these new owners buy in near the peak, only to be crushed in the trough. Most will capitulate, but those who remain because of their long-term conviction in Bitcoin (typically the most studious of history and monetary evolution among them) become the newest hodlers of last resort . Hodl, which began as a chat room typo in the early days of Bitcoin, has morphed into a memetic phrase that denotes “hodling” Bitcoin long term without regard to its price volatility. Layers of these stubborn hodlers have been added throughout each of Bitcoin’s four major price cycles. A good proxy for the depth of these layers is the lowest price Bitcoin hits each year, which indicates the rising collective obstinacy of these hodlers:

The annual low prices of Bitcoin provide an effective proxy for the collective intransigence of its hodlers.

The annual low prices of Bitcoin provide an effective proxy for the collective intransigence of its hodlers.

These layers form the base for the next iteration of each fractal wave pattern. As more observers recognize the survivability of Bitcoin following each price crash, they realize that investing in it may not be as risky as they once thought. This larger base of believers sets the stage for the next iteration of the fractal wave pattern which will support a much larger set of newcomers at a far greater magnitude of peak price. Few people are able to accurately predict how high prices will go in each fractal wave cycle, and they usually reach levels that would seem absurd to most investors at the earliest stages of the cycle. The best proxy for the timing of these fractal wave patterns has been the quadrennial Bitcoin inflation rate adjustment, when the amount of new Bitcoin rewarded at the close of each block is reduced by half, an event commonly known as the halving. Historically, Bitcoin achieves a new all-time high price within 18 months of its last halving. The next halving will occur in May 2020:

Every four years, the Bitcoin supply growth rate is cut in half. Each halving also cuts the Bitcoin sell pressure from miners in half and creates upward pressure on its price. Historically, this quadrennial event is the best proxy for the timing of Bitcoin price fractal wave patterns.

Every four years, the Bitcoin supply growth rate is cut in half. Each halving also cuts the Bitcoin sell pressure from miners in half and creates upward pressure on its price. Historically, this quadrennial event is the best proxy for the timing of Bitcoin price fractal wave patterns.

The fractal wave patterns inevitably crescendo and begin to crash, usually attributed to myriad factors by mainstream media. However, the Gartner Hype cycle is an archetypal market pricing pattern that is driven entirely by human psychology, game theory and the ultimate exhaustion of market participants reachable in each iteration. The magnitude of each cycle is exacerbated by Bitcoin’s absolutely fixed supply schedule, as increases in demand are expressed exclusively through its price, which historically leads to market frenzies at each peak. The long game for Bitcoin, and its final fractal wave pattern, will begin when and if central banks begin accumulating it as a reserve asset (more on this later). In this way, the bedrock of the Bitcoin network’s expansion is the intransigency of its hodlers of last resort. Although they constitute a small minority of the whole, these stubborn hodlers will contribute to ongoing Bitcoin adoption in a meaningful way.

Minority Rule [3]

When it comes to group preferences, certain types of minorities — those who stubbornly insist on a particular preference — that constitute even a small level of the total population (often less than 4%) can cause the majority to submit to their preferences. Another clever concept from Nassim Taleb, called the minority rule, is the result of complex system dynamics, like those inherent to human interaction.

The nature of complex systems (society) is that the collective behaves in a way not predicted by its individual constituents (people). The interactions between its constituents matter more than their individual natures. Studying individual ants will never give us an idea on how the ant colony operates. For that, one needs to understand an ant colony as an ant colony, not just a collection of ants. This is called an emergent property of the whole. In other words, the whole is more than the sum of its parts because what matters is the interactions between the parts. These interactions, while complex, can obey simple rules, like the minority rule (or the rule that barter economies settle on a medium of exchange or that the hardest form of money always outcompetes). Many domains are impacted by the minority rule such as:

- Markets — Market prices are not the consensus of market participants, but instead reflect the activities of the most motivated buyers and sellers. In 2008, a single $50B order, less than 0.2% of the stock market’s total value of about $30T, caused the market to drop by almost 10%, causing losses of around $3T. The order was activated by the Parisian Bank Société Générale who discovered a hidden trade by a rogue trader and wanted to reverse the purchase. The market reacted disproportionately because there was only a desire to sell and no way to change the stubborn seller’s mind.

- Science — Similar to markets, science is not the consensus of scientists, it is the minority body of knowledge remaining after removing disproven hypotheses.

- Law — A law abiding citizen will never commit criminal acts but a criminal will readily engage in legal acts, and criminal behavior has been shown to be contagious within certain social groups.

- Imports — In the United Kingdom, where the (practicing) Muslim population is only around 4%, a very high proportion of the meat we find is halal (or Kosher). Close to 70% of lamb imports from New Zealand are halal. The same population and import proportions hold true in South Africa (the case of imports is closely related to the example below).

Today, in the United States and Europe, companies are selling more and more non-GMO food precisely because of the minority rule. Given the possibility of food containing GMOs, food not bearing the label “non-GMO” may be assumed by some to contain GMOs which, according to the minority, contain unknown risks. People who eat GMO food will readily eat non-GMO food, but not the reverse. Assuming the price and distribution costs differences between GMO and non-GMO are sufficiently small and the intransigent minority is distributed somewhat evenly throughout the population, this will have the effect of disproportionately increasing the demand for non-GMO food in the long run. This dynamic of scale can be explained quantitatively. In mathematical physics, renormalization groups are an apparatus that allow us to see how things scale up or down.

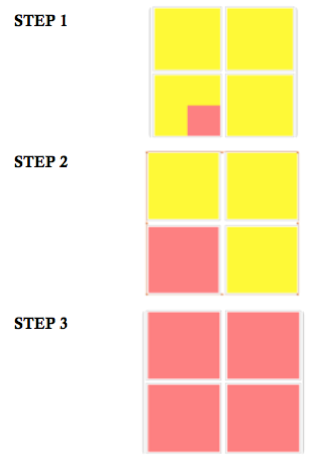

Here we show how the minority rule can renormalize the preferences of the majority.

Our graphic depicts:

- Three vertically-stacked large boxes, each representing one sequential step in the minority rule renormalization process

- Four medium boxes in each step, each representing a family of four

- Four smaller boxes contained within each medium box, each representing an individual member within each family of four

Assume that in Step 1, the daughter in the family of four is the intransigent minority (the small pink box) who eats only non-GMO food. As we move to Step 2, the group renormalizes as the stubborn daughter manages to impose her rule on her three family members (who are now all pink) as they are flexible on the matter and consistency simplifies their grocery shopping and administrative process. In Step 3, the family of four goes to a backyard barbecue attended by three other families. As their family is known for their strict eating habits, the host will only serve non-GMO food as the other families are flexible and consistency simplifies the food preparation process, thereby making all four families (which are now all pink) adopt the minority rule originally set by the intransigent daughter in Step 1.

This minority rule will continue imposing and proliferating itself as these families attend other social events, which gradually shifts customer preferences in the neighborhood and eventually causes the local grocery store to switch to non-GMO foods to simplify its procurement processes, which impacts the local wholesaler, and so on up the supply chain. The real world result of this dynamic is the preferences of 4% of a population (practicing Muslims) driving the market preferences of 70% of their respective populations (in the UK, New Zealand and South Africa). As we can see, the minority rule spreads by interaction and renormalizes the entire group to conform with its preferences. Its proliferation is accelerated if there are incentives to switch, low switching costs or anticipated future benefits from switching (as superiorly hard digital cash money, Bitcoin offers all three). In this example, a minority constituting 6.3% of the total population imposed its rules on the majority using pure intransigence. In reality, the minority rule often takes effect when minorities become 4% or less of the total population.

Languages also often adhere to the minority rule. For instance, French was originally intended to be the language of diplomacy as civil servants from aristocratic backgrounds used it, while English was reserved for those engaged in commerce. In the rivalry between the two languages, which are still considered two of the international languages (a third, Spanish, was added later because of its widespread use), English won as commerce came to dominate modern life. This gives us some intuition as to how the emergence of Lingua Franca languages, those commonly spoken across cultures, can come from minority rules. As Taleb puts it:

“Aramaic is a Semitic language which succeeded Canaanite (that is, Phoenician-Hebrew) in the Levant and resembles Arabic; it was the language Jesus Christ spoke. The reason it came to dominate the Levant and Egypt isn’t because of any particular imperial Semitic power or the fact that they have interesting noses. It was the Persians –who speak an Indo-European language –who spread Aramaic, the language of Assyria, Syria, and Babylon. Persians taught Egyptians a language that was not their own. Simply, when the Persians invaded Babylon they found an administration with scribes who could only use Aramaic and didn’t know Persian, so Aramaic became the state language. If your secretary can only take dictation in Aramaic, Aramaic is what you will use. This led to the oddity of Aramaic being used in Mongolia, as records were maintained in the Syriac alphabet (Syriac is the Eastern dialect of Aramaic). And centuries later, the story would repeat itself in reverse, with the Arabs using Greek in their early administration in the seventh and eighth’s centuries. For during the Hellenistic era, Greek replaced Aramaic as the lingua franca in the Levant, and the scribes of Damascus maintained their records in Greek. But it was not the Greeks who spread Greek around the Mediterranean — Alexander (himself not Greek but Macedonian and spoke a different dialect of Greek) did not lead to an immediate deep cultural Hellenization. It was the Romans who accelerated the spreading of Greek, as they used it in their administration across the Eastern empire.”

There is an asymmetry that those who do not have English as their first language usually know basic English, but native English speakers knowing other languages is less likely. If a meeting is taking place in an international office in say, Istanbul, among twenty executives from a sufficiently international corporation and one of the attendees does not speak Turkish, then the entire meeting will be run in English (the commercial Lingua Franca). This is the minority rule in action.

Money is an emergent property, as it is an expected result of complex human interactions within a barter economy. Similar to language, it is a means of expression, only it is used to express value instead of information or emotion. The US Dollar is the Lingua Franca of money today, as it belongs to one of the world’s largest economies (an economy which also happens to effectively control the global banking system).

As the digital age matures and the world becomes increasingly interconnected, ever-more commerce and administration will be conducted over the internet. Also, fully interconnected trade networks will level the terrain of commerce and increase free market competition among different forms of money. Considering the significant market lead already enjoyed by Bitcoin, its superior hardness, its multi-sided network effects, the impotency of capital controls on digital cash and the winner take all dynamic inherent to monetary competition; it’s likely that Bitcoin will continue to outcompete and its adoption rate will increase. By considering the application of the minority rule to adoption of Bitcoin in the digital age, we can reasonably expect the following:

- Once a sufficient minority of the world’s population, say 4% or less, have realized the advantages of hard money and digital cash money, their intransigent hoarding of Bitcoin will drive its price upward (Gresham’s Law) and begin imposing itself economically on all other holders of money in the world. This will put downward price pressure on government fiat money, further accelerate Bitcoin’s adoption rate and drastically improve Bitcoin’s chances for global acceptance over the long run.

- As the first natively digital form of cash money, Bitcoin will become the Lingua Franca of digital commerce and the dominant value exchange protocol, thereby capturing nearly all the value transacted online (e-commerce alone is estimated to be nearly $5T annually by the year 2021) over the long run.

- Bitcoin may also become the base layer for other tools of cryptographic certainty in commerce, such as smart contracts and TrustNet applications (more on these later).

The minority rule is based on a fundamental asymmetry between the intransigence of the minority and the flexibility of the majority. The minority rule shows us that a small number of unyielding people with skin or soul in the game can change the shape of the majority. Bitcoin already has the advantage of being the hardest form of money ever invented, and its rules are immutable, which is the highest form of intransigency possible. It also has unrivaled brand awareness, fed by the mystery of its creation myth, and the support of free market fanatics all over the world. Once its obstinate minority reaches a certain size, the unbreakable rules of Bitcoin will begin to stubbornly impose themselves on the established economic order. In the words of Margaret Mead:

“Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.”

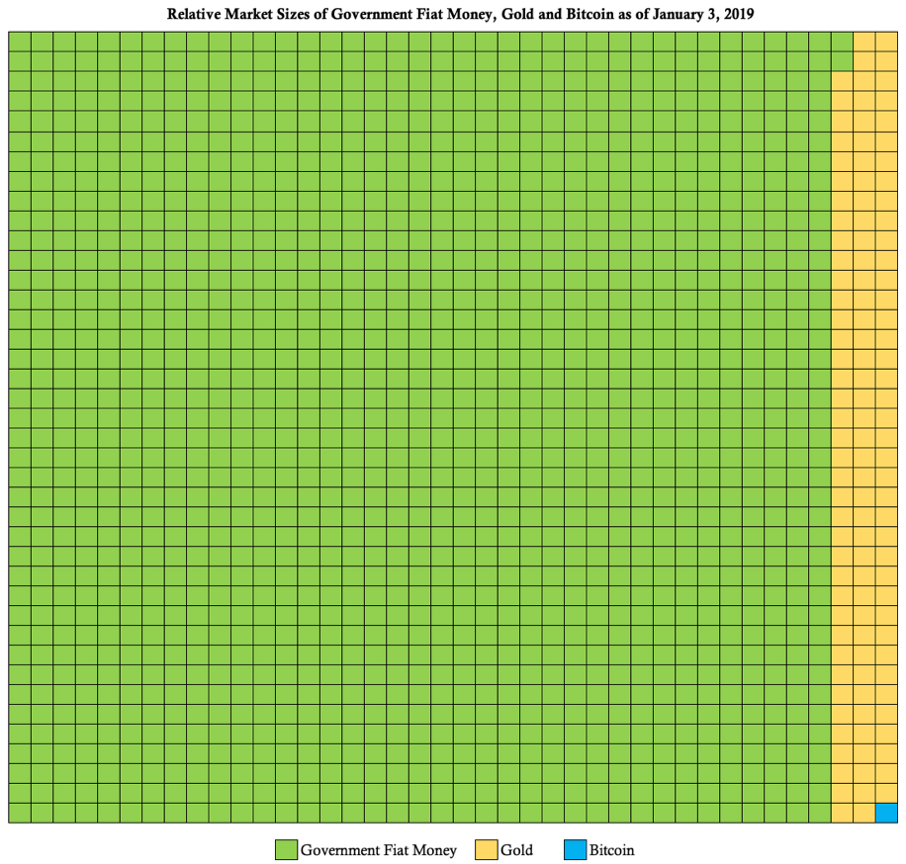

A Superior Species of Money [1,4,12]

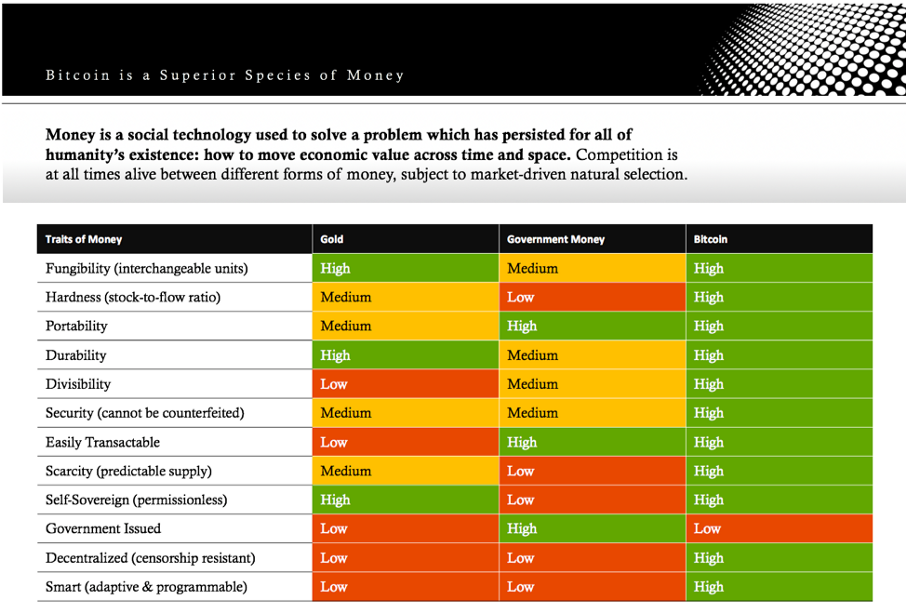

Bitcoin also introduces three new traits of money never before seen — censorship resistance, adaptivity and programmability. Censorship resistance means that no group or individual in the world can stop payments made on its network. Bitcoin gains censorship resistance by virtue of its decentralized architecture. Adaptivity refers to the ability for Bitcoin’s network to become more secure as it stores more value, its open-source nature which aligns the incentives of its global team of volunteer programmers with its own to ensure it is always up to date with state-of-the-art software enhancements and its ability to subsume features from competitors that have been proven in the marketplace. Programmability refers to the digital nature of Bitcoin and its ability to interface with smart contracts and other decentralized applications. As we have learned, the free market for money is a competitive environment that is shaped by continuous market-driven natural selection; as a competitor in this domain Bitcoin is a superior species:

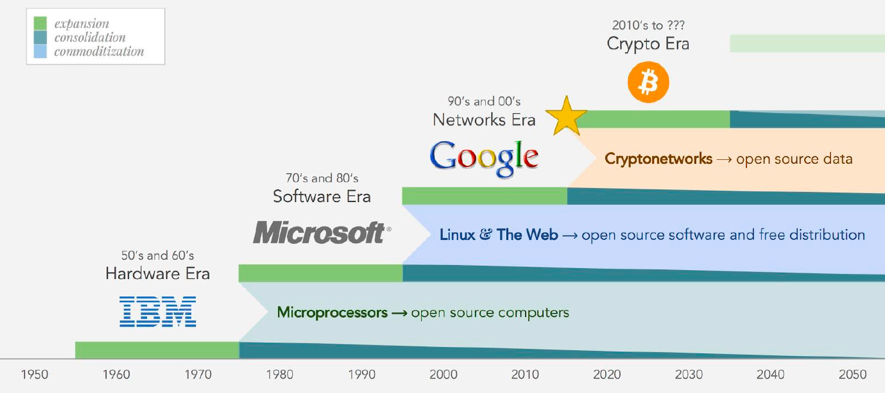

The technology that is enabling Bitcoin to compete effectively in the market for money is also being applied to create new markets or disintermediate other existing markets. In technical parlance, the Bitcoin network is the world’s first decentralized application. A decentralized application is a service that no single entity owns or operates. It is a new form of software and human organization that eliminates single points of failure, resists external attacks and reduces the need for intermediaries. Decentralized applications are enabled by cryptoassets. In the same way corporate equities serve companies and government bonds serve nations, cryptoassets serve decentralized applications. Owning a cryptoasset (like Bitcoin) is the only way to own a piece of a decentralized application (like the Bitcoin network). Technically, a cryptoasset is a cryptographically protected digital token representing rights within an economic network. A cryptoasset is to a decentralized application what oil is to an engine; it provides functionality and liquidity for the network and its constituents. A defining feature of cryptoassets and decentralized applications, and arguably their most alluring, is their organic nature; they are not centrally owned, governed or developed — making them highly resistant against censorship and manipulation.