| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the February 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

Updated 12-18-2019 Added “A Human Rights Activist’s Response to Bitcoin Critics” & “Cryptosovereignty”.

Why Monetary Maximalism could fall short of expectations

By Su Zhu and Hasu

Posted February 2, 2019

Monetary maximalism is the idea that in a free market for money one big winner will emerge and that the “soundest” money is in the best position to do so.

In a previous post I wrote that “every token competes in one massive power law distribution for the title of dominant non-sovereign monetary store of value. If it does not win this rat race (or comes to a close second or third place), its market share will, effectively, be zero.”

The most popular argument for why that should be the case is that it already happened once – with gold.

There are two big assumptions baked into the grand narrative of monetary maximalism today. First, that the world will gravitate towards the soundest monetary-policy coin. And second, that gold-analogies are apt in describing Bitcoin.

We would argue that this is reasoning by analogy, and that the analogy is not self-evident even for many people inside crypto, let alone outside. We should steer clear of suggesting that we can use logic to determine how this will all play out.

Instead, we should realize that for Bitcoin to become what most of the community wishes it to be, there are multiple challenges to overcome that work as counterforces to the consolidation into one money. These counterforces are:

Misalignment of incentives with crypto companies

Crypto companies are funded with the goal to capture value – especially value that can weather both bull and bear markets. The result is a value capture layer on top of Bitcoin with actors that over time evolve their own opinions that ultimately become social attacks on Bitcoin.

Many of these companies would lose if bitcoin was to become a mature store-of-value tomorrow and since they respond to their shareholders and not the Bitcoin community, it’s in their best interest to prevent that.

The biggest “attack” on Bitcoin is the existence of altcoins. Investors and VCs are incentivized to push for a multicoin future because they can be paid for finding the next Bitcoin. Monetary maximalism ascending necessarily implies that this paradigm of crypto-as-tech would come to an end.

Exchanges like Coinbase are also incentivized to push for a multicoin future, as they benefit from people trading back and forth between different assets. Consolidation into one money would mean a massive decline in cross-currency trading. As an exchange, they love drama and volatility in the markets to attract traders. Their support for past contentious Bitcoin forks as an attempt to shape the protocol to suit the needs of their business and later pushing for a world where Bitcoin is just one of many assets have been entirely rational.

Miners can also decide to attack Bitcoin, with Bitmain as a prominent example. When they disliked the direction protocol development was going, possibly because they were afraid that a layered scaling approach would hurt their bottom line, they launched a social attack in the form of Bitcoin Cash. Even though the attack ultimately failed, the fork diluted Bitcoin’s supply in the eyes of the public as well as its brand value.

If we look at who is actually incentivized to help Bitcoin become a mature SoV, in terms of crypto businesses there are shockingly few. A mature Bitcoin would force many of them out of business. And yet we find that Bitcoiners are constantly surprised by the so-called impure behavior of companies in this space.

Culture clash between different currencies

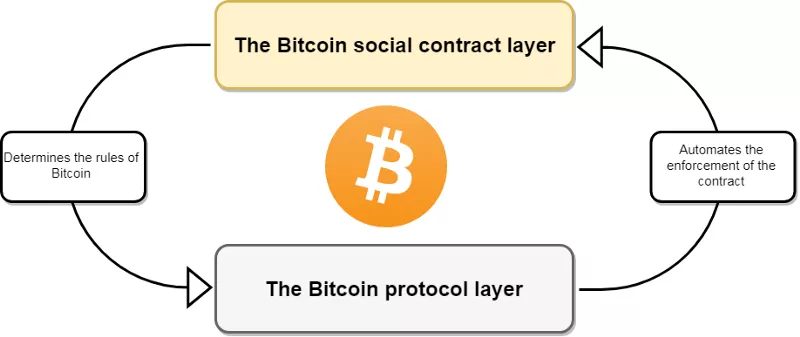

Because of crypto’s unique nature of a social layer and technical implementation reinforcing each other, all networks are highly cultural in nature.

All coins get their properties from the shared beliefs of their holders. A strong culture has to be enforced so they can retain these properties against change.

Image Source: Unpacking Bitcoin’s Social Contract

Image Source: Unpacking Bitcoin’s Social Contract

Arjun Balaji and Yassine Elmandrja have recently laid out how almost all fundamental disagreements in crypto are not about details of implementation, but about the fundamental values that each project enshrines in their social layer.

The result is competing frameworks like “Vision of the Constrained vs Unconstrained”, “Money crypto vs tech crypto” or “Autonomous vs Governed”, proving that there is a lot to disagree about when it comes to culture.

Just as the world is unlikely to converge to a single culture, whether we are talking about politics, art, music, language or food, so too can crypto exist for a long time as a pluralistic collection of different cultures.

If we assume there are irreconcilable disagreements on the social layer between projects and that the value of each token is agreed upon at the social layer, then the logical conclusion is that people with different cultures will prefer – and hence monetize – different coins.

We claim Bitcoin is apolitical maximalist money, but in practice the political philosophy views of bitcoiners are homogenous, especially with regards to libertarianism, and distinct from other crypto communities (which your authors have previously argued is a dangerous mismatch).

Bitcoiners tend to be objectivists – they believe there is such a thing as objective moral truths. But let us not mistake strongly held opinions for provable truths. We can neither prove that global money will evolve through soft forks rather than hard forks, nor can we prove that a premine is worse than no premine.

We can only show that the tradeoffs are such that we believe certain approaches are more promising than others. But if people disagree with us and these projects don’t actually implode as we predict, then this market can well stay fragmented forever.

Appealing to human biases

Beyond basic preferences that are the result of a different culture, there are some biases inherent to our thinking that can draw people away from Bitcoin’s monetary maximalism and towards other forms of money.

The most familiar example is probably the unit bias. When faced with a selection of coins most people intuitively compare the price of one unit, without regard for the number of total units outstanding. As a result, they falsely assume the cheapest unit is underpriced relative to the others and buy it.

Then there are people who have a bias in favor of innovation and tend to promote the new over the old without really looking at its limitations or weaknesses. Pro-innovation bias could play a big role in Bitcoin’s future as the incentives of this market (see earlier) are aligned in such a way that crypto companies and investors collectively benefit from a steady flow of new competitors.

The most important bias working against Bitcoin, however, might be the “anti-waste” or “anti-PoW” bias. Already today there are many who categorically refuse to use any currency that uses proof-of-work for security, claiming that it is extremely wasteful and hence dangerous to our environment.

You can expect Bitcoin competitors like Ethereum to lean even more on this bias once they have completed their switch to proof-of-stake.

It’s hard to imagine that people with a strong ideological dislike for proof-of-work can be convinced by economic arguments to turn around and embrace it. We find it more likely that this particular bias will continue to appeal to many people in the same way that easy answers to hard questions have always appealed to humans throughout history.

Conclusion

While we don’t fundamentally disagree with the idea that a big winner could emerge from the battle of monies in the ultra-long run, there are also significant counterforces at work to prevent Bitcoin from being that winner.

The counterforces presented today all assume that the market structure itself is uncompromised, i.e. a free market for money exists. In practice, this assumption is hopelessly optimistic. Governments will continue to shape our economic realities as people in the Liberal West will not risk their lives to use one money over another for ideological reasons.

Most Bitcoiners are gleefully unaware of how few companies in this space actually have an incentive to help Bitcoin succeed, especially those who own the customer relationship and onboard all the new people into this space.

Bitcoiners should stop expecting companies, miners, etc. to virtue signal to them and instead start taking ownership of the means of production by building their own exchanges, nodes, wallets, custody, and education.

All cryptos are highly cultural. They need to be because they derive their properties from the shared beliefs of all users. This is a major differentiation from gold. The idea of Bitcoin monetary maximalism would require Bitcoin to transcend culture itself if it wants to appeal to people versus other cryptocurrencies.

Many people are questioning the “top-down” analogies used by bitcoiners today. Even many Austrian economists are not buying into Bitcoin as sound money .

So instead of mapping the history of gold over the future of bitcoin, we should look where we are today, where we want to be tomorrow, and how we can get there.

Demystifying Blockchain Not Bitcoin

By David Nage

February 9, 2019

This is a conversation that needs to happen now. As many know, I have been part of the family office community for the last decade and have been working to educate my peers on crypto for the last two years. This article comes on the heels of two private luncheons this week, where we discussed crypto amongst other investment themes. The poplar, but incorrect catch phrase, “blockchain, not bitcoin” came up several times and I attempt to identify several drivers of this narrative.

Some of you will read that catch phrase and be filled with 3 emotions: rage and disgust followed by annoyance. Others will think this is a logical separation, and…more importantly, will be more inclined to put their chips down on the Blockchain island.

Non-crypto focused investors hear about IBM and their work with Hyperledger; they hear about JP Morgan and Quorum. These are brand names no different than Nike, Pepsi and Ford; they’ve been comfortable with them for a long time — but in essence they don’t understand the fundamental differences in what IBM and other corporate entities are building (a permissioned DLT) versus what Bitcoin, Ethereum and other protocols are building.

Why does this divide exist? How did we get here?

As Garrick Hileman writes:

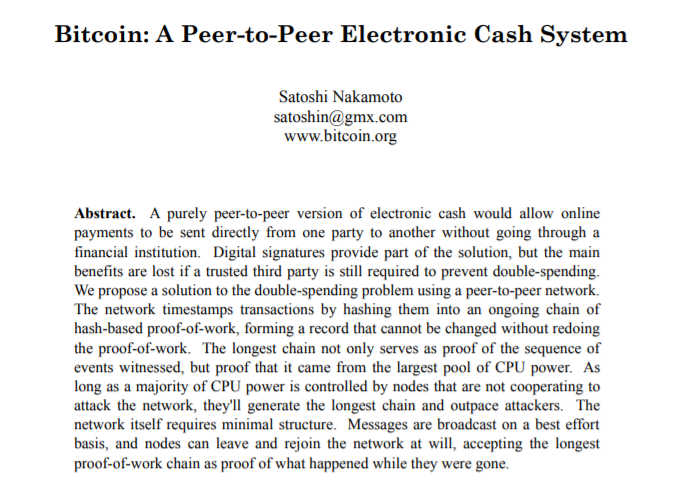

“The 2008 financial crisis reached its nadir with the collapse of Lehman Brothers on September 15, just six weeks before Satoshi Nakamoto published the bitcoin paper”

This is what was given to the world after the financial crisis — a purely peer-to-peer version of electronic cash allowing online payments to be sent directly from one party to another without going through a financial institution.

Innovation and adaptation has occurred during the last decade, as observed with every other technology society has bore witness to. In addition to Bitcoin we’ve seen other protocols leveraging the proof-of-work consensus algorithms and we’ve seen other consensus algorithms be created, such as proof-of-stake.

This discussion is NOT going to delve into which is the best and why, etc. However, at the very core, there is a fundamental lack of understanding from the perspective of the Institutional Investor on several main tenets which need to be illuminated:

- Difference in Distributed, Centralized and Decentralized Systems;

- Why we (as a society) need them;

- Contributor (node) and Incentive models and;

- Why it can’t be in the form of fiat/USD.

Distributed Systems

Distributed Systems

The work done by Stanislav Kozlovski: “A Thorough Introduction to Distributed Systems” provides color on this; as stated:

A distributed system in its most simplest definition is a group of computers working together as to appear as a single computer to the end-user.

These machines have a shared state, operate concurrently and can fail independently without affecting the whole system’s uptime.

Distributed But Centralized

As Julia Poenitzschwrites:

A distributed, but centralized system may sound contradictory but consider a cloud service provider offering a data storage service. Physically, your data could be shared and replicated on different machines according to resource availability and resiliency(distributed). However, wherever the machines and data storage facilities happen to be, the cloud service provider still controls them all (centralized).

Distributed systems and ledgers can be either decentralized, granting equal rights within the protocol to all participants or centralized, designating certain users particular rights.

Decentralized Systems

Decentralized and distributed systems, such as Bitcoin, cannot be altered by any one entity. It also runs as a peer-to-peer network of independent computers spread across the globe.

In conversations with Institutional Investors they understand concepts associated with Distributed Systems but this shift from centrally controlled distributed systems to a P2P network of “ independent” computers/nodes is where the confusion comes in.

Why We Need Them

Decentralized, distributed systems offer advantages to their legacy centralized systems. Two of the more pronounced arguments in favor of these new systems that may resonate with traditional, non-crypto investors are:

-

Fault Tolerance: Because they rely on many separate components, decentralized systems are less likely to fail accidentally. The recent Wells Fargo outage serves as evidence of legacy systems failing.

-

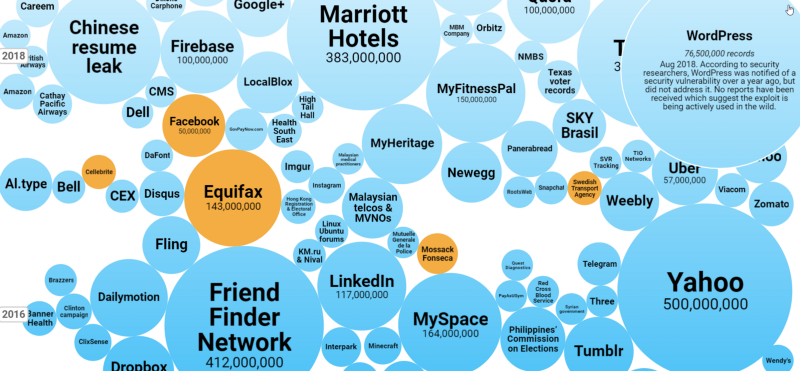

Attack resistance: Due to the presence of a lot of players, decentralized systems lack central points of failure; there’s no one point of attack that would disarm the entire system. This makes it more expensive and less viable to destroy these systems. This infographicis very useful to explain the significant amounts of data hacks we as a society have fallen victim to over the last decade and a half.

Incentive Models

Cathy Barrera discusses how incentive models help crypto: “Blockchain Incentive Structures: What they are and why they matter”

As Cathy notes:

An incentive is any design element of a system that influences the behavior of system participants by changing the relative costs and benefits of choices those participants may make.

Incentives include pay-for-performance reward systems that compensate individuals with money and they also include systems that incorporate no financial rewards at all.

Economics of Bitcoin

As Bitcoin.org states:

Bitcoins have value because they are useful as a form of money. Bitcoin has the characteristics of money (durability, portability, fungibility, scarcity, divisibility, and recognizability) based on the properties of mathematics rather than relying on physical properties (like gold and silver) or trust in central authorities (like fiat currencies). In short, Bitcoin is backed by mathematics. With these attributes, all that is required for a form of money to hold value is trust and adoption. In the case of Bitcoin, this can be measured by its growing base of users, merchants, and startups. As with all currency, bitcoin’s value comes only and directly from people willing to accept them as payment.

This is a fundamentally misunderstood concept; more and more I hear “why can’t a bitcoin/blockchain miner be paid in USD/fiat”. This sounds ridiculous to people who’ve been in the ecosystem for years, but this phrase comes from multiple conversations with HNW/Family Office investors. Investors need more education on this topic because it is essential that they understand it.

Conclusion

Bitcoin, blockchain and the phrase “crypto” are part of the conversation among Institutional Investors these days; education from crypto investors, researchers and builders has significantly improved over the last year but there continues to be significant deficits in understanding the fundamental roots of the technology. Conversations with investors should focus on the four areas highlighted in this article; especially during the elongated “crypto winter” so they better understand the massive tectonic shift that is underway.

Bitcoin Delta Capitalization

A New View of BTC Long-Term Valuation

By David Puell

Posted February 14, 2019

Disclaimer: Nothing contained in this article should be considered as investment or trading advice.

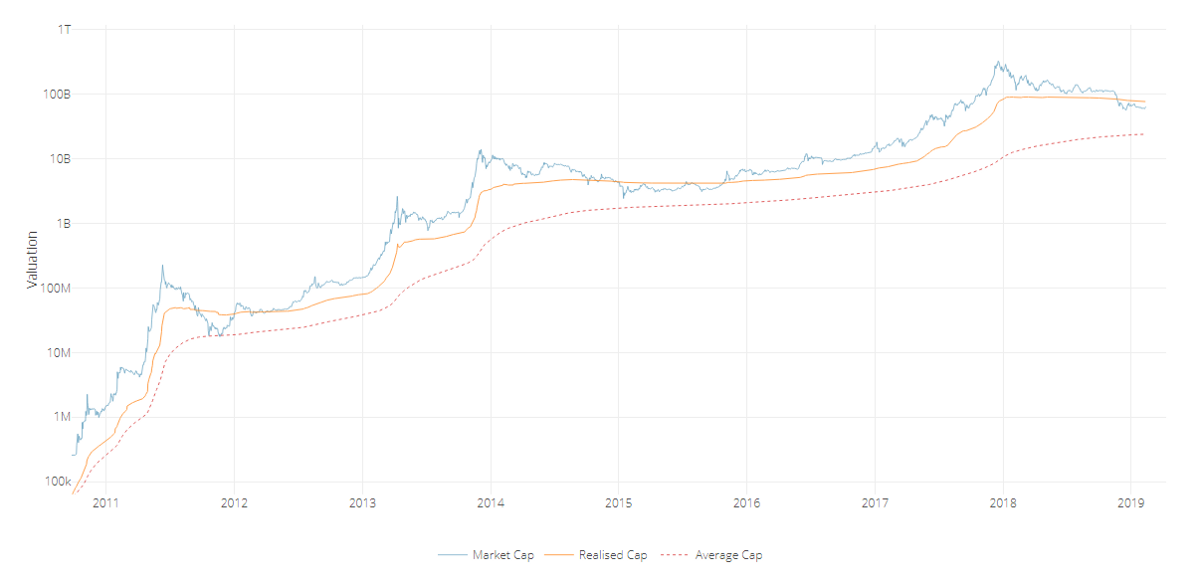

As a follow-up to Willy Woo’s recently-introduced Bitcoin Valuations live chart, this article aims to present delta cap with the goal of answering two of the most pressing questions in speculators’ minds at the present moment:

- Where is the bottom?

- When is the next bull run coming along?

Something’s Amiss

Two sets of items originated the search for what later became delta cap:

- Awe and Wonder’s studies on Bitcoin’s logarithmic regression and Plan B’s studies on Bitcoin’s power regression (R² of 0.93 and 0.95 respectively), which seem to suggest that the BTC trend is increasing at a decreasing rate.

- Murad Mahmudov’s exploration of historical moving averages, expressing a dissatisfaction with any particular SMA or EMA as definitive enough to “catch the bottom” in every bear cycle.

This initiated the search for a metric that both adapted to Bitcoin’s rapid, high-velocity parabolic moves and accounted for its overall trend decay over time. Two other valuation models seemed to provide a tentative answer: realized cap for the former and average cap for the latter.

Delta Capitalization

Delta cap is, as seen next, a hybrid of sorts — half “fundamental,” half “technical.” It is calculated through the following formula, measuring the difference between two long-term Bitcoin moving averages:

For the purposes of this piece, let’s review these definitions:

Realized capitalization

Invented and presented by the brilliant team at Coinmetrics, instead of counting all of the mined coins at current price, the coins are counted at the price when they last moved through the blockchain. This approximates the USD value paid for all the bitcoins in circulation. Best put by its co-creator Nic Carter, it can be described as an on-chain volume-weighted average price (VWAP) of BTC.

Average capitalization

Instead of setting a fixed period for calculating a moving average (e.g., a 200-day MA), this is a life-to-date, cumulative simple moving average that serves as the true mean of the whole history of market cap. Due to its “laggy” nature, it is the perfect mechanism to help decay the upward speed of delta cap over time. Shoutout to Renato Shirakashi for first pointing out this average.

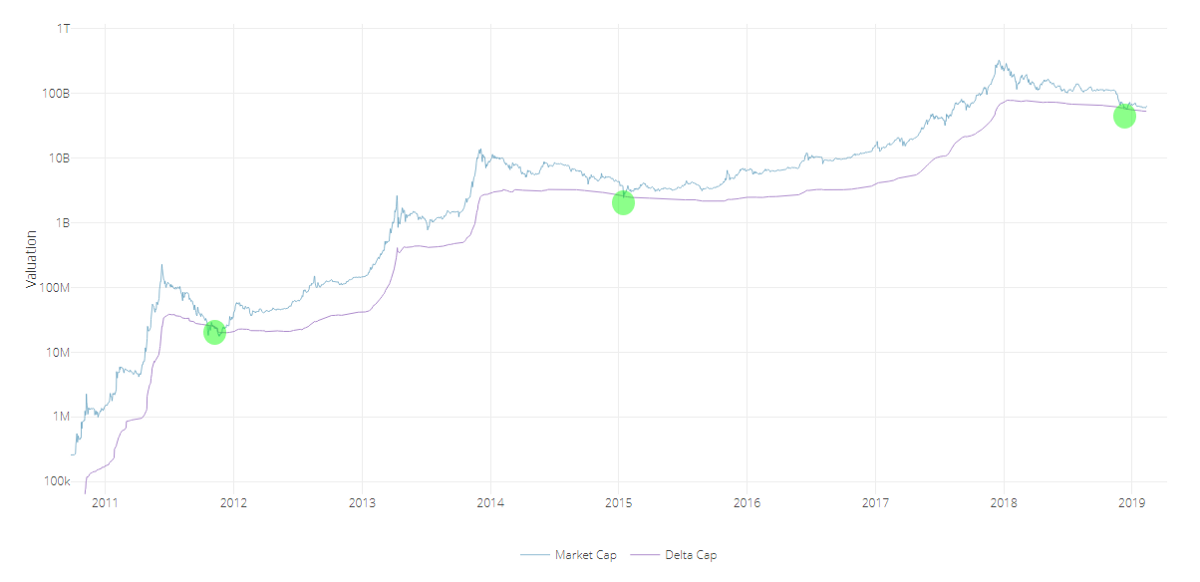

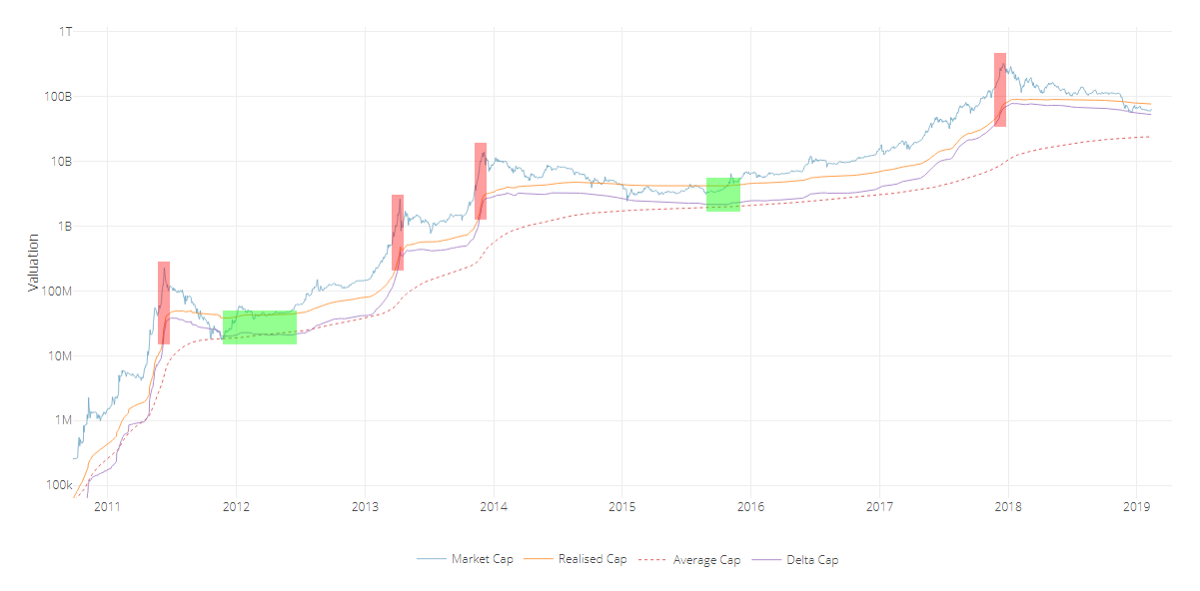

Below, a view of both lines, courtesy of Willy Woo:

The aforementioned substraction of the two in turn provides the following delta cap line, both reactive locally and decaying globally:

As seen at first glance, delta cap provides an excellent framework for catching global bottoms — or at the very least bottoms near the floor of the bear cycle. Please see the caveats of this indicator below to have a more nuanced view of the current state of affairs, since having just touched delta cap does not guarantee that we have bottomed.

Time Analysis

Another interesting (and still experimental) exploration of delta cap emerges when comparing it to its parent inputs through a logarithmic view, as follows:

We can easily gauge periods were delta approaches realized cap during the bubble tops, and then evermore slowly descends to almost touching the average cap during the phases of breakout price behavior, signaling the inauguration of the new bull run.

The good news? If this pattern continues, people will have lots of time to buy up. The bad news? This bear-to-sideways market may last for an unprecedented while, going as far as projecting a post-accumulation breakout as late as Q2, 2020 — the moment when it could be expected for delta cap to get nearest to average cap if the extension of these lines continues as-is. Bear in mind that this is all pending on the overall rate of drop of realized cap and the rate of rise of average cap — local price action, velocity, and dormancy are all in play. Time domain here is still a broad estimate.

It goes without saying that we lack enough bottom samples to claim this as a certainty, but long-term investors must stay mentally prepared for this possible delay. It is further evidence that suggests Bitcoin’s cycles are elongating.

Yes, Another Ratio: MVDV

Since most will be curious about how the Market-Value-to-Delta-Value (MVDV) Ratio looks like, here it goes:

A few notes on it:

- Just as seen on MVRV Ratio and the Mayer Multiple, MVDV seems to indicate that each of Bitcoin’s blow-off tops is losing momentum. This is not necessarily bearish, as I believe it merely implies that each bubble is becoming less exuberant and getting closer to the mean.

- Major bearish divergences seem to announce global tops (red circles) while differentiating them from previous local tops of the same cycle.

- The bottoms seem to maintain a steadier horizontal longitudinal threshold at 1 (green line). If market cap were to revisit delta cap today at a lower low, the oscillator would present this event as a double bottom.

Caveats

- _Having touched delta cap recently does not imply a global bottom:_One must remember that delta cap is currently sloping down — and it will continue to do so for several months — so the likelihood of market cap revisiting it is not out of the question. Add to that the fact that the NVT tools are still just slowly trending into normal historical conditions and velocity remains weak. Touching delta cap on a lower low in the following months is still a likely possibility. Every penetration of market cap into delta cap should be best used as one componet of an averaging-in strategy over a prolonged period of time.

- Despite timeboxed halving days, the Bitcoin cycle seems to be elongating: This makes perfect sense, since larger bull runs require larger liquidity. The experiment here is to continue evaluating delta cap as a mean that keeps adjusting to Bitcoin’s curved trend. That being said, the time analysis section of this article remains highly speculative, especially for signaling the breakout events, so let’s take it one day at a time.

- _The market currently holds a major dissonance:_That of delta cap providing a good “baseline” for a relatively optimistic market floor, versus the current state of velocity as seen on NVT Ratio,Network Momentum, and NVT Caps— on life support relative to price.

- Delta cap remains experimental: Just as with most technical and on-chain tools, these indicators should be used with prudence and in the company of other trading mechanisms and a sound risk management strategy. Past events don’t reflect future outcomes.

Acknowledgements

Many thanks to the following individuals:

- Willy Woo, for the beautiful charts and valuable feedback.

- Murad Mahmudov,Phil Bonello,Hans Hauge,PositiveCrypto, and Plan B, whose comments helped perfect this article.

Sources

- Woobull.com : Charts and early market cap data archeology.

- Coinmetrics.io : Realized cap data.

- Blockchain.com : Market cap data.

Author

David Puell, Head of Research @ Adaptive Capital

Bitcoin is a hedge against the cashless society

When cash is gone, where will you turn to transact with a basic level of privacy? What money do you hold when negative interest rates start eating away at your bank account?

By Su Zhu and Hasu

Posted February 12, 2019

The rise of digital payments and the move towards a cashless society are often seen as the same, but there is an important difference between them.

Digital payments like Paypal, Venmo, domestic-, and international bank transfers are convenient for people and businesses to transact with. They represent fintech innovation to consumers by the market. Faster, cheaper, and more efficient forms of digital payments are uncontroversial and largely an engineering and marketing challenge.

They don’t, however, remove every need for cash. Cash has unique properties that digital payments have not. As physical coins and notes, it can be exchanged peer-to-peer without a middleman. Its ownership is transferred simply by handing it over. The absence of an intermediary ensures that transfers are permissionless, censorship-resistant and, most importantly, private.

Digital payments solutions do not utilize physical cash but also do not prevent anyone from continuing to use cash if they want. It is an alternative payment method to cash but is not antithetical to it. Indeed, in almost all modern societies, there coexists both a large digital economy and a large cash economy.

We will argue that the elimination of cash, even if most payments are already digital, will make society more vulnerable to surveillance, financial control, and authoritarianism.

Why do countries go cashless?

In a cashless society, the government seeks to discourage or even criminalize the holding and using of cash itself. In Sweden, it happened largely without coercion. In India, the government demonetized the 500 and 1,000 Rupee denominations of notes.

Different countries can have different incentives to push for a cashless society. In China, digital payments are primarily a tool of social control and serve as a backbone for China’s social credit system. And they are making progress on it: 96% of cash payments in 2012 have turned into only 15% in 2019.

Over in Europe, central bankers are enthralled by the idea of negative interest rates. A recent IMF report states that:

“Severe recessions have historically required 3–6 percentage points cut in policy rates. If another crisis happens, few countries would have that kind of room for monetary policy to respond.”

Negative interest rates were traditionally hard to implement because cash served as a lower bound. In a cashless society, this lower bound would disappear. In a severe recession, the CB could drop the policy rate to, say, -4% to make consumption and investment more attractive relative to saving.

Recently, central banks have started to brush everyone who prefers cash with the label of a criminal. They do that by separating the uses of cash into legitimate and illegitimate. People “abroad” can hold cash “legitimately” to replace an unstable or inflationary currency. Now domestically, the only beneficiaries of an anonymity-providing currency are

“those engaged in tax evasion, money laundering and the financing of terrorism, and those wishing to store the proceeds from crime and the means to commit further crimes.”

Indeed, the use of cash in larger denominations has become so stigmatized in the US and Europe that withdrawing or carrying above a certain amount requires explicit government permission.

Problems of the cashless society

A society without cash has no ability to transact value without the omnipresence of government actors. By going cashless, societies double down on the properties of digital payments but lose all access to the unique properties of cash.

If every payment is intermediated, it becomes impossible to pay someone for anything without there being a record somewhere. It eliminates privacy and places the government as the third party in every financial event.

Governments claim that a cashless society enables them to protect citizens from criminals. The specters of terrorism and organized crime are often cited at this point. But this makes the naive assumption that governments itself can never become evil.

Because all transactions require the consent of an intermediary, they can easily be censored and funds confiscated. It might not be happening right now, but a good monetary system should be robust to changes in political moods. A cashless monetary system is less resistant to both the tyranny of the majority and shifts towards authoritarianism.

Cash may not be the right tool for the majority of transactions, but the elimination of it removes an important choice, and safeguard against government abuse, for the people.

Bitcoin as a hedge against the cashless society

When cash is gone, where will you turn to transact with a basic level of privacy? What money do you hold when negative interest rates start eating away at your bank account?

Traditionally, it has been impossible for the private market to come up with solutions for these basic human demands. The state doesn’t like competition to their own fiat currency and made sure to quickly shut down all attempts of other monies to enter the market.

Bitcoin could change that. Decentralized and digital in nature, it no longer has the central point of failure that made previous “private monies” vulnerable. And it is modeled to marry the two forms of money — physical cash and digital payments — into an entirely new breed: digital cash. It can be transacted peer-to-peer, is permissionless, does not censor people or transactions, and has a reasonable level of privacy (if one knows how to use it).

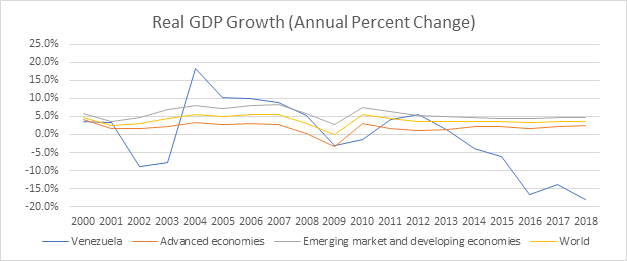

We are still early into the Bitcoin-experiment, but with the cashless society looming on the horizon, we more than ever need it to succeed. Its fixed monetary policy already makes it a hedge against high inflation (that is increasingly used in places with collapsing fiat currencies like Venezuela). But, equally importantly, Bitcoin is a hedge against the demonetization of cash and the rise of the cashless society.

Rehypothecation: BTC’s path to becoming king of collateral

By Patrick Dugan

Posted February 15, 2019

Quick Take

- Concerns about rehypothecation in layer 2 protocols for Bitcoin are overblown, we just need to accurately price its risk premiums

- In the default model of the Lightning Network, lots of BTC is needed in a fully-collateralized fashion to facilitate payments, earning a low yield from routing fees of generally under 1% per annum

- There’s a strong argument to be made that historically, when people were allowed to create currency, e.g. credit instruments, to facilitate trade, prosperity rose

- Power money that is more scarce in supply becomes useful as a market referent and collateral base when it has the lowest perceived counterparty risk on the planet

- The path to BTC becoming king of collateral will require forms of rehypothecation

Concerns about rehypothecation in layer 2 protocols for Bitcoin are overblown. We don’t need to fear rehypothecation, we just need to accurately price its risk premiums. There’s inflationary and deflationary forms of derivative open interest. The deflationary version comes in the form of fully-backed synthetic cash positions, which fuels Bitcoin Dollarization and gives a sensible valuation-growth model for Bitcoin. To understand these nuances, we have to understand bank credit.

If your collateral is so good, why not use it like any other collateral?

What is fiat? Fiat is a b-side currency note, a form of immediate-term debt, it’s an asset, but only because of its legal connection to the amortization of debts. It is an anti-liability, but mathematically, by the transitive property – that’s an asset!

To restore some sanity, we call these “financial assets”, derivatives are also financial assets, that’s why you can be short them. For every $1 in someone’s pocket, which they are “long”, the Central Bank or Commercial Banks are short $1.

A real asset would be, for example, some Caterpillar machinery purchased with a secured loan. To buy real assets, people accept shorting units of fiat that they borrow, then spend. You get this phenomenon of “fiat” – let it be – the “creation” of new money in the form of credit. The difference between a licensed bank, and a pool of investors funding loans on LendingClub with full capital paid, or a bond investor, is that the bank has essentially a portfolio margin license from the government. You don’t have to fund loans with cash, you can fund them with credit. Your bank’s credit. Also, the checking account deposits everyone depends on to survive are a junior, most-subordinated liability of the bank — thanks for looking out for us.

In essence, a lender is making a hypothesis that the borrower will pay them back. In the hypothetical scenario of a default, XYZ can be triggered (e.g. going and taking assets to settle the loan). So to hypothecate something, you just have to lend it.

To rehypothecate something then, you just… lend it again! Currency units issued by a bank as consideration for a new debt note, which may cycle back to that same bank and generally these days the value stays in the banking system, and around and around it goes. One man’s leveraged capex is another man’s revenue is another bank account’s deposit. You get the money multiplier effect.

People who are Pro-Bitcoin generally hate the Federal Reserve, inflation, and fractional reserve banking. This is because many of us came of age at a time where all of these institutions were called into question, amidst great cataclysm unleashed through corruption of the highest halls of capitalism, and also we saw this movie called Zeitgeist and watched Ron Paul run for president. We read Baby Boomers’ rants about gold manipulation on ZeroHedge, and then we found BTC. Murray Rothbard, Hayek, and the general school of Austrian economics figured in, but people who consider themselves a priori, categorically, it’s gotta be Austrian, Austrians, are not necessarily representative of the majority of Pro-Bitcoin people.

Rehypothecation can fuel Lightning

In the default model of the Lightning Network, lots of BTC is needed in a fully-collateralized fashion to facilitate payments, earning a low yield from routing fees of generally under 1 percent per annum (what Nik Bhatia calls the “Lightning Network Reference Rate”). The presumption here, was that LN is necessarily going to be used in that way, that BTC would necessarily dominate liquidity in an environment of cross-chain asset swaps, and that nobody would use BTC/LN in a way that would contravene these Austrian economics tenants of strictly deflationary currency – which by the way, aren’t strictly speaking representative of pre-Bitcoin Austrian economics, perhaps better described as Quebecois Economics, after its two most prolific proponents, Francis Pouliot and Pierre Rochard. Much respect.

However, one of the greatest things about Bitcoin is that nobody can censor usage of it. The only thing you can do to discourage certain kinds of usage is, either get mass consensus for a soft fork, changing around parameters that make it more difficult to relay “spam”, or have it be generally uneconomical. But if it’s economical, enough clients will relay it, and a single block-winning miner will include it, it can get in. Lightning Network is also a client-agnostic network in the sense that is has no global consensus state or specific blockchain. So it reasons, LN clients that run a bit differently could be pretty amazing for getting yield on BTC. For those who know what they are doing, there’s nothing that can be done to stop that, and it will have some degree of synthetic dilutive effect on BTC in the Lightning Network.

Rehypothecation of BTC across Lightning Nodes, creating some sort of money multiplier, is possible if channels are constructed that operate based on un-collateralized trades. Finance has given us solid math describing the adequate pricing, as least to the extent that major bank trading desks are able to stay in business, for trades both involving collateral and without. For those without, they price a sort of Credit-Default-Swap-like option premium, called a Counterparty Value Adjustment, in order to compensate the optionality of having some time window to deliver on a trade.

In the context of Lightning Network HTLC-like trades with a time-based escrow, someone can underwrite those failures to deliver as an income business, in a manner similar to a bail bondsman; think of it as collating the default risk of all those option-writes into a big secured loan that aggregates however many writes a party wishes to make. Those writes come with risk of default, but if there are recoverability mechanisms with a high efficacy rate, the business can end up looking like covered writes rather than risky, uncovered writes, and the premiums can get pretty cheap. Instead of stacking lots of BTC for a low yield, smaller sums of BTC can underwrite throughput for a higher yield and slightly higher risk, making loose trading more cost effective. Cheaper premiums allow people to trade up a storm, which creates derivatives of open interest (basically rehypothecated BTC). Time horizon is a major limiter to how much this sort of synthetic inflation can actually scale.

Bakkt to the future

With Baakt, they start with a 1 Day contract, the community doesn’t cry fowl, they bridge the old money to the new, fees akimbo, great. That open interest is unlikely to become substantially larger than their daily volume, more likely the open interest will be a fraction of daily volume. They then position themselves to the retail public as anti-rehypothecation, but most likely with success on the 1 Day they’ll consider quarterlies and monthlies, and we’d quickly see open interest expansion. However, there are many spread positions in derivatives. Calendar spreads are an example, people trying to milk out a living at the edge of market efficiency, that expansion of open interest is inflationary to some extent and is rehypothecation-like, but it’s still healthy for market liquidity. What we’d like to see is the equivalent of the CME’s Commitment of Traders report for bitcoin derivatives, breaking down hedgers vs. speculators, and ideally, to separate the inflationary OI from the deflationary.

A loan default is deflationary. The money goes out of existence, it’s balanced, and it’s why the Fed has done okay manipulating interest rates for the last 40 years. Derivatives portfolios are similarly limited. For swaps and futures open interest, scarcity in the cash-collateral is needed to capture the “risk-free” return of swap payments or futures premium; this creates demand in spot markets, soaks up supply, and puts BTC to work as collateral on higher time horizons.

But if Baakt, or even enterprising traders, are willing to adapt the horizon of Wall St. derivatives practice to loosening the margin requirements of Lightning-type DEX environments, we could end up with a situation where 1 BTC in margin can be used to portfolio-margin a lot of spreads in CVA options vs. BTC settled options that reference some price. We could then have those under-writers hedge by using graph default swaps, the equivalent of Credit Default Swaps but for sets of networked counterparties. These GDS price the risk of different sets of channels operating by different margin rules, and perhaps also with detectable capitalization levels that indicate greater risk, it will be possible to trade these GDS instruments effective in dynamic, data-informed strategies.

Imagine a CDS on BitMex’s contracts: the CDS pays you whatever percent of open interest is experienced as a shortfall on BitMex due to margin calls that are unfilled by a fast-moving market. BitMex has an insurance fund and a lot of revenue to replenish it, but let’s say it didn’t, such a CDS might be relevant to some traders, and provide a seemingly “free money” yield to those willing to take the other side. Now imagine the same for a decentralized BitMex based on LN. The nuanced degree of how much a contract shortfall can amount to makes these GDS potentially much more efficient to trade than traditional CDS, which deal in tail risks, usually involving extreme binary events. Sometimes corporates go bankrupt and semi-senior notes recover at some rate, or sovereigns default and try to force a restructure, but the percentages involved are usually greater than 50 percent of face value, rather than the 2-25 percent range that a volatility-stricken decentralized contract might suffer margin short-falls.

There are two strong attractors: the higher time-value based return of deploying BTC in the LN to channels operating along CVA-type margining, and the demand for leverage which keeps those premiums enticing. It’s a bilateral way of doing leverage in the Lightning Network between chains, in the form of options, which could complement more “traditional” perpetual swaps (less than three years old, BitMex launched XBTUSD perpetual swap in April 2016) that settle on LN just in BTC or LTC. All these forms of leverage create, temporarily, and against risk, some inflation in the trade-able supply of these coins. That’s just a fact of life.

Gold as an analog only goes so far

If we look at what happened to the gold market, prior to China’s buy-out plans, the lending of gold allowed banks to lend more gold on-paper than they had sitting in a vault. Gold banking, in other words. Before anyone turned in their tallysticks to buy shares in the Bank of England, gold receipt issuance was a source of fiat inflation. In the London/New York gold market structure, both spot and derivatives markets were saturated with multipliers. These were not transparent systems, LN counterparties are probably much more auditable. It’s arguable that 200x open interest to warehouse inventory ratios, or having less detectable dilution of supply through rehypothecation of gold was bad for the gold market, and made some ideological investors pretty upset. But let me ask you: if your collateral is so good, why should it not be utilized like any other collateral? The main issuing is one of auditing transparency so that extreme financial practices don’t create moral hazards, systemic risks and information asymmetry. There’s a strong argument to be made that historically, when people were allowed to create currency, e.g. credit instruments, to facilitate trade, prosperity rose. See the late Stephen Belgin and Bernard Lietaer’s book New Money For A New World for more color on that. It’s probably not so simple as, fixed supply good, expanding supply bad. Elastic supply that is intelligently allocated, not by a single intelligent planner but by many people lending, trading, working, building and so forth in the economy, based on value production, not political graft, that is what seems to make a currency most dynamic and valuable. See also Niall Ferguson’s chapters in The Ascent of Money regarding the fortunes of the gold-hungry Spanish vs. the debt-happy Italians, it’s like night and day.

Power money that is more scarce in supply becomes useful as a market referent and collateral base that has the lowest perceived counterparty risk on the planet, which then evolves a complementary market mechanism. As with interest rates, a balance is achieved through price discovery, between inflation and deflation.

Bitcoin is valuable because it serves a purpose in that market mechanism, but with the added hyperfungibility of information; it’s globally transversable, melting capital controls like the invisible, imaginary boundaries they are. So it’s got an uptrend. It’s got time value as collateral. It’s got other derivative time-value returns that can be obtained at times, by using it to hedge, shorting those derivatives. These things have so far reinforced each other, with other key metrics like the thickness of Bitcoin’s mining moat being positively correlated.

King of collateral

This is how BTC becomes king collateral for the world:

- Lightning Network Swap Dex’s

- Inter-chain Counterparty Value Adjustment Options Exchanges

- Reinsurance-like market for Graph Default Swaps that create side-bets, mostly for hedging purposes we assume, on the credit risk of different galaxies of the LN.

- Now with the ability to have yielding synthetic cash, leveraged bets, options markets, the works, and leading the way in new derivatives frontiers that attract the brightest quantitative traders to seek fortunes in a new wild west of risk hedging, we finally show the legacy financial system what a parallel, independent, systemic risk-quantified financial system can look like.

Whereas banks currently employ quants crunching simulations of graph triangle-counters to try and process nettings of various derivatives counterparties (we’re talking about hundreds of thousands of big to medium sized bank counterparties), we can do this on the scale of hundreds of thousands of LN nodes. The utility in UXTO money is increased significantly.

In conclusion, I think the fear of rehypothecation may be overstated, but it’s indeed possible, and BTC scalability will depend on the influence of fiat-liquidity into the system, seeking a USD-benchmarked return, which will to some extent dilute supply through leverage. But on the other hand, safe-returns-seeking capital will tend to do the opposite, put on a 1:1 fully collateralized position, and ride it for the USD interest rate, which is very bullish for the supply and demand dynamics of any commodity money that becomes a popular synthetic-USD base.

I think most likely, the most extreme leverage, with the most survivability, will be with the most professional risk managers who can crunch the math on these derivatives and start making markets. Maybe not the 90 percent quoting-time market makers, but those who take smart views to trade mis-priced hedges, who take a market view, who lean into LN constellations with the best margin rules, or who exploit convexity between different instruments.

And that means most of the leverage dilution in imminent supply will be a boon to liquidity, and the sort of leverage that gets people rekt will remain a modest component of overall supply and demand. This will make Lightning many times more capital efficient, maybe not 10x like the typical fractional reserve banking money multiplier, but enough to create convex liquidity aggregation benefits in the LN in general.

Nik Bhatia’s counterparty risk spectrum fits into this. He cited cold storage as near-zero counterparty risk (there’s still operational risk of physical attack vectors and the credit risk of the underlying blockchain, small though it may be) and the average optimized return for routing fees a bit further up that scale, because you have to be in a live hot wallet perpetually to operate for that revenue. Then, off-chain lending was this example of a riskier thing yet, which veers into the realm of counterparty risk. But HTLCs used for margining general derivative contracts with BTC also come with counterparty risk that must be priced to make HTLC’s incentive-aligned enough that those trading mechanisms actually work. We’re probably going to need to evaluate Schnorr-based discrete log contracts or some modification on the HTLC-based cross-chain atomic swap model, such that one party clearly holds the option, and the other party is short it. Having either side be equally able to jerk out of the trade is too problematic to be priced and functional.

It’s not just about 2:2 locked channels, hashed timelocks, or 2:3 watchtowers. There’s also 2:3 of M multisigs, where M is the number of signers, being used as a state channel for Byzantine Fault Tolerant staked sidechains. These create more decentralized watchtowers, allow for instant-finality of signed transactions, and facilitate state references to co-ordinate LN DEx contract settlements, especially once the migration to stealthy transactions with Schnorr/Taproot/unicast begins.

BFT Sidechains are going to figure into solving some of the technical weak spots in the Lightning Network settlement model. It bears considering, when I use portfolio margin on Deribit, ultimately Deribit is assuming underlying clearing risk for me blowing up my account. Perish the thought, but let’s say I was a sloppy options trader and I sold 10x the number of naked calls as my equity, Deribit would end up on the hook after that sudden $500 snap rally that you know can happen any day. Who takes the role of Deribit to enable more sophisticated margining? It would have to be the sidechain, with collateralized validators checking up on state, taking small fees, another layer of income and risk removed.

Turns out this risk spectrum goes in deep if you zoom in on the middle. It’s probably the next big thing in derivatives, fueled perhaps by hyper-bitcoin-dollarization, a process of mainstream finance replacing the Eurodollar model with a bitcoin-backed dollars model. If you look into how much time and money is spent on Wall Street trying to deal with collateralization and counterparty risks, you could see how with just the right amount of momentum, just the right amount of debt supercycle unwinding, macro tail-winds, pricing in every inch of a vast semi-decentralized network of dealers, could become quite interesting for Wall Street. They need this financial system, it will eventually save them so much money vs. the old, not because “blockchain technology reduces overhead on back-office auditing and compliance tasks – for the enterprise.” But rather because the collateral discounting rates will precipitously favor it. Time value of money is the crux of the whole banking business and they will follow the value in time.

Thanks to Nik Bhatia for providing good feedback on how to reposition the key themes of the essay front and center. Also to Dan Goldman for technical feedback.

Patrick Dugan is a writer, trader, and designer. He founded TradeLayer, a protocol to introduce a native derivatives layer on top of Bitcoin and Litecoin. In previous adventures, Patrick worked in game design, temporarily administered the Omni Layer foundation and ran a sustainable farming-oriented ecommerce website._

Security Budget in the Long Run

By Paul Sztorc

Posted February 14, 2019

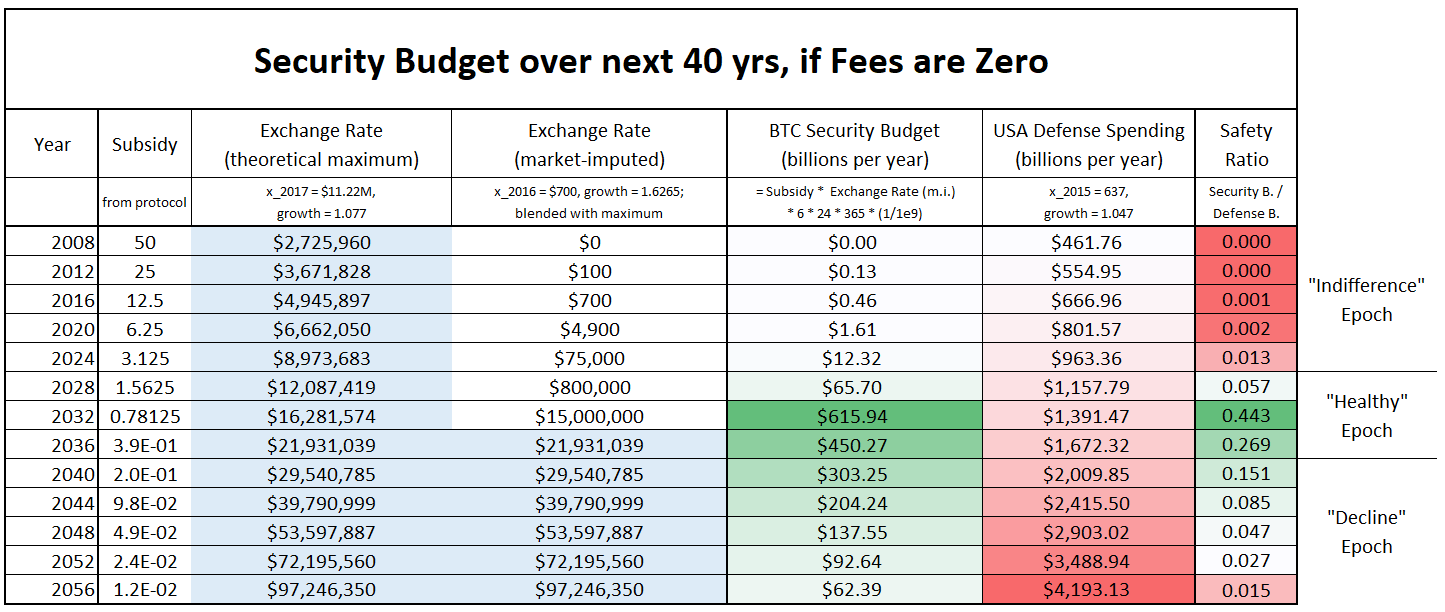

A discussion of Bitcoin’s ability to resist 51% attacks (ie, its “security budget”). Competition makes it difficult for one network to collect enough fees – instead, we should try to collect fees from all networks. This post is a somewhat more-empirical sequel to “Two Types of Blockspace Demand”. And to my Building-on-Bitcoin talk.

1. The “Security Budget”

Bitcoin’s “security budget” is the total amount of money we pay to miners (or, if you prefer, the total amount spent on mining – they are the same thing). When this value is low, 51% attacks are cheap. In 2018, BTC’s security budget was about $7 million per day. So, the suppression of BTC (via a never-ending campaign of 51% attacks) would cost –at most– $2.6 billion per year.

$2.6 B is pretty low – by comparison, the 2017 annual US Military Budget was $590 billion, and the FED’s annual operating expenses totaled $5.7 billion.

2. The Block Subsidy

Fortunately, we can expect the block subsidy to give us more security in the future. Even though it “halves” once every four years (effectively falling by a factor of 0.84 per year), it hits for full force no matter how high the BTC exchange rate climbs. As long as annual appreciation 19%+, it fully compensates for the PP lost to the halvening. Historically, the rate has been much higher than 19% (more like 70%+), and so the security budget has increased substantially over time, and will continue to do so for a while.

Of course, eventually the exchange rate must stop appreciating. Even if Bitcoin is outrageously successful, it will apparently reach a point where it simply cannot grow faster than 1.077 per year1, as this is apparently the growth in the nominal value of all the world’s money.

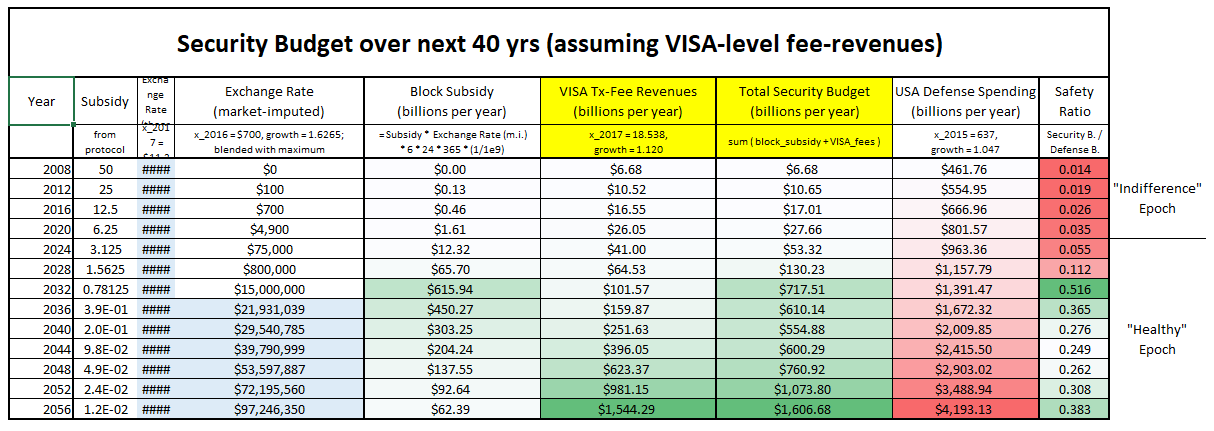

Here I show the growth, and ultimate decline of the security budget:

Above: Bitcoin’s security budget over time.

Above: Bitcoin’s security budget over time.

Each row refers to a different year. Theoretical max exchange rate from the Game and Watch paper. Imputed exchange rate is historical rates and growth factors, with some manual “blending in” so as to more rapidly approach the theoretical maximum. Defense budget extrapolated from wikipedia data. “Safety Ratio” is the percentage of military budget that would be needed to disable Bitcoin. All numbers are in nominal dollars.

The “indifference” epoch is one where Bitcoin is vulnerable, but few adversaries squander their opportunity to attack because they are not paying attention. The “healthy” epoch is one where BTC should be able to deter 51% attacks even from ultra-wealthy motivated adversaries. But the “decline” epoch shows us a bleak future, in which 51% attacks on Bitcoin are easy again.

3. Transaction Fees

i. The Desired “Fee Pressure”

As is commonly known, transaction fees are expected to come to the rescue. As Greg Maxwell remarked:

fee pressure is an intentional part of the system

design and to the best of the current understanding

essential for the system's long term survival

Personally, I'm pulling out the champaign that market

behaviour is indeed producing activity levels that can

pay for security without inflation.

This view, (of a needed “fee pressure”), is common. Roger Ver has compiled similar quotes from other Bitcoin intelligentsia. Roger did this in order to discredit them politically, but the quotes are nonetheless accurate.

ii. The Dual Nature

The dual nature of Bitcoin (as both a money-unit, and a payment-rail) has confused people since Bitcoin was first invented.

In general, monetary theorists and economics ignored the payment-rail (and dismissed Bitcoin as supposedly having “no intrinsic value”). Businessmen and bankers ignored the money-unit (and regarded purchases of BTC as hopelessly naive), and instead tried hopelessly to rip-off the “blockchain technology”.

The confusion persists today in the “scaling debate”, in the form of a discussion over whether or not the “medium of exchange” use-cases are more valuable than the “store of value” use-cases.

And I think it persists in long-run security budget analysis, as well. Consider the following table:

| Revenue Source | Block Subsidy (12.5 BTC) | Transaction Fees |

|---|---|---|

| Market’s Units | …of BTC | …of block space |

| Price Units | … $ (PPP) per BTC | $ (PPP) per byte |

| If BTC price = moon… | …SB Goes Up | …SB Unaffected |

| Meme | Store of Value | Medium of Exchange |

| Slogan | “Digital Gold” | “P2P Electronic Cash” |

While the two are mixed into the same “security budget”, the block subsidy and txn-fees are utterly and completely different. They are as different from each other, as “VISA’s total profits in 2017” are from the “total increase in M2 in 2017”.

VISA’s profits are a function of how cost-effectively VISA provides value to its customers, relative to its competitors (MasterCard, ACH, WesternUnion, etc). Changes in M2 are a function of other things entirely, such as: election outcomes, public opinion, business cycles, and FED decisions. There is some sense in which M2 “competes” with the Japanese Yen, but there are really no senses in which it competes with MasterCard.

iii. Are fees truly paid “in BTC”?

Transaction fees are explicitly priced in BTC. But, unlike the block reward, they do react to changes in the exchange rate. As the exchange rate rises, a given satoshi/byte fee rate becomes more onerous, and people shy away from paying it.

And so tx-fees are not really “priced in BTC”, despite the protocol’s attempt to mislead us into thinking that they are. They are actually priced in purchasing power, which –these days (pre-hyper-bitcoinization)– is best expressed in US Dollars.

So, it is entirely appropriate to say, for example, that “in Dec 2017, BTC had tx-fees as high as twenty-eight dollars “. And it would be inappropriate to say that the tx-fees were “as high as .0015,0000 BTC”. For if the BTC price had been 10x higher2, the tx-fees would have only reached .0001,5000 BTC.

iv. Stimulating Production

Whenever prices rise, entrepreneurs are induced to produce. (Owners are also induced to sell, but we are not interested in that right now.)

The supply of BTC is famously capped at 21 million. The produced supply (aka the “new” supply) is currently capped at 12.5 BTC per block, until the next halving.

The supply of a completely different good, “btc-block-bytes”, is also capped. It was first (in)famously capped at 1 MB per block, and now is capped at something-like 2.3 MB per block.

As was just said: whenever blocks become more valuable, entrepreneurs search for ways to produce more of them.

One way is to reactivate older, marginally unprofitable mining hardware. Production then hastens…temporarily. Of course, after the next difficulty adjustment, block-production will return to its equilibrium rate (of 1 block per 10 minutes).

Alternatively, entrepreneurs can create, and mine, Altcoins.

v. Altcoins as Substitute Goods

Alt-“coins” are very poor substitutes for Bit-“coins”. Each form of money, is necessarily in competition with all other forms: money has strong network effects; the recognizability property has super-linear returns to scale; exchange rates are transaction frictions that are inconvenient; etc. What people wanted was a BTC. They wanted to get rid of all their other forms of money!

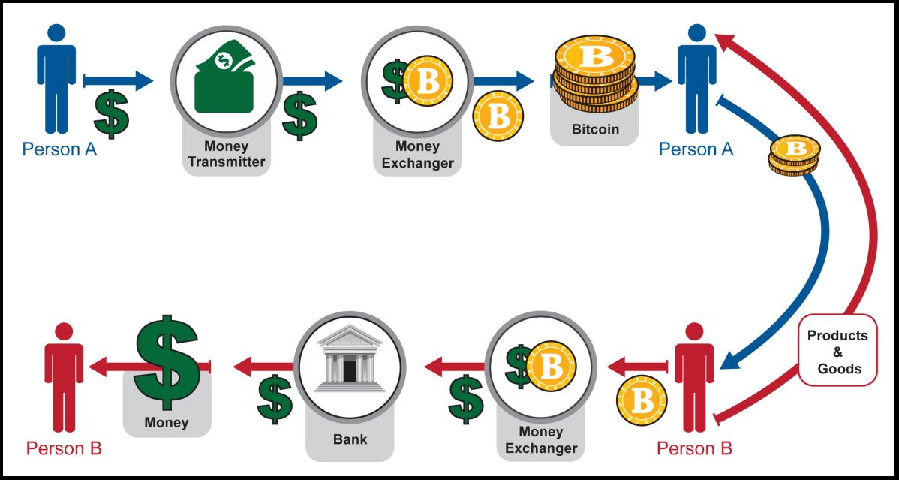

But it is the reverse when we consider transaction fees and “btc-block-bytes”: Altcoin-blockspace is a pretty good substitute for Bitcoin-blockspace. Remember that this type of demand has nothing to do with obtaining BTC. Users merely wish to buy something using the Bitcoin payment-rail. This image from 2013 FINCEN Congressional testimony hopefully makes it clear:

insert caption here

insert caption here

Since the amount of coin sent in a blockchain payment is always configurable, it will always be possible to send someone “twenty dollars” worth of LTC; or “one BTC” worth of DOGE; or “one sandwich” worth of EOS. All of this is made much easier by the “exchangers” (ie: Coinbase, ShapeShift, SideShift, BitPay, LocalBitcoins, multi-currency wallets, CC ATMs, etc) which now take numerous forms and are easy to use.

Furthermore, this (true) premise –that Altcoin-payments are indeed substitutes for Bitcoin-payments– is occasionally explicitly admitted3, even by hardcore maximalists. Especially during the last fee run-up in late 2017:

vi. Competitive Demand for the Payment Rail

The supposedly-essential “fee pressure” has, for the moment, deserted us.

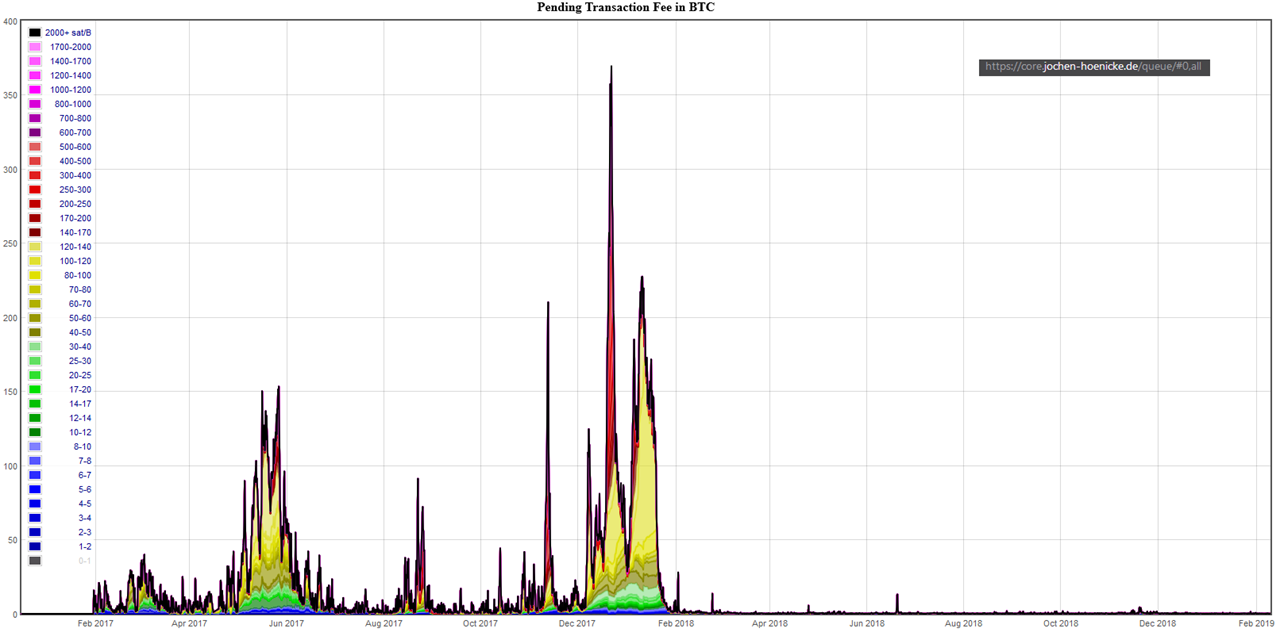

See this graph (from this page) for BTC-priced fees:

insert caption here

insert caption here

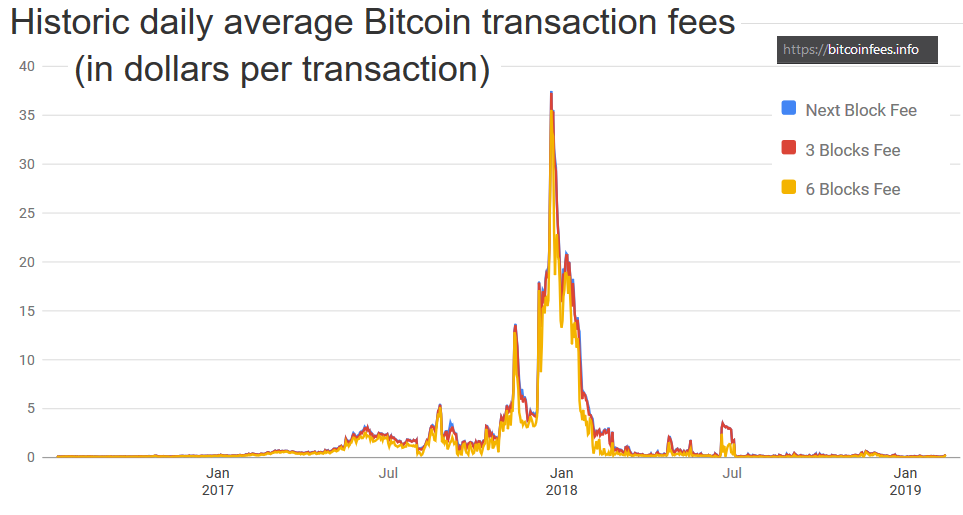

And this graph (from this page) for USD-priced fees:

We see that fee pressure has crumbled. Today, a typical transaction will cost 30-40 cents – much cheaper than a VISA txn.

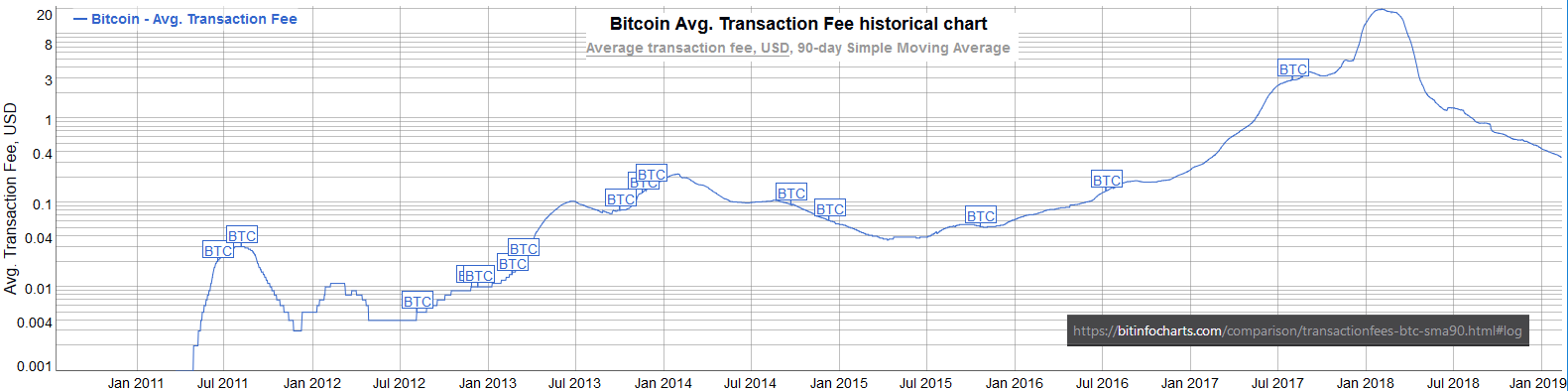

Compare the historical data, given in 90-day moving-average …

…to the two graphs below:

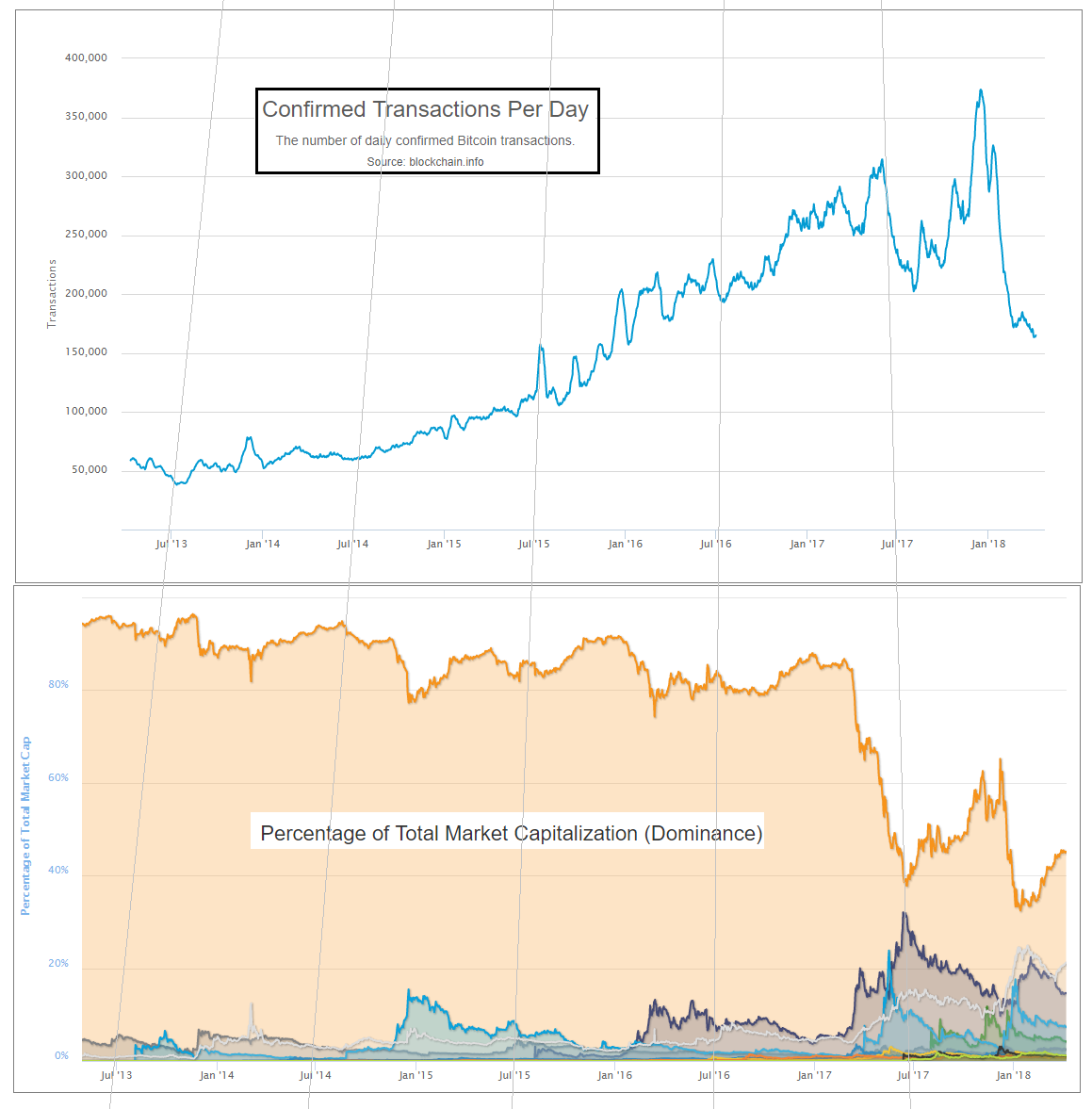

We see that BTC’s crossing of the “1 USD per transaction line”, in May of 2017, coincides with the rise of Altcoins. We also see that the “pressure” of late 2017 quickly canceled itself out, and then some. Finally, we see that this release-of-pressure coincided with a sudden (and unprecedented) decline in BTC-transactions.

To me, this data refutes the theory that users will pay high BTC fees willingly. In fact, they seem to have only ever paid high fees unwillingly– during a brief “bubble” time (of relative panic and FOMO).

If that theory is indeed false, then total fees will not be any higher –in USD terms– than they are today.

According to blockchain.info, fees in the last 12 months totaled $70 million. (In the 12 months before that, they were $770 million).

Revisit the chart above, and you will see that this barely registers. After all, when $70 M is priced in the units of the chart (billions), it is just $0.07.

If the consumer is cost-conscious, and will only pay the lowest tx-fees, then how can we get those numbers up?

vii. Alternative Fee-Sources

a. Lightning Network

The Lightning Network (if successful) will allow very many “real-life transactions” to be fit into just two on-chain txns.

The immediate effect of this, is to lower on-chain transaction fees; but the ultimate effect is increase them. LN boosts on-chain fees by increasing the utility of each on-chain txn (by allowing each to do the work of many txns), and by therefore making high on-chain fees more tolerable to the end user.

Exactly how much will LN boost fees?

At this point – it is anyone’s guess. But my guess is that they cannot realistically increase by more than two orders of magnitude.

First, on-chain txns are needed to create, and periodically maintain, the LN. So LN-users will still be paying on-chain fees; and will still prefer to minimize these costs. Meanwhile, Altcoins will have their own Lightning Network (they will copy LN, just as they’ve copied everything else). All of these LNs will compete with each other, the same way that different blockchains compete with each other.

Keep in mind, that the fees paid to LN-hubs4 will, by definition, not be paid to miners. So, there is no sense in which LN-fees “accumulate” into one big on-chain txn-fee (in contrast to how the economic effect of each LN-txn does accumulate into a single net on-chain txn).

Second, the LN user-experience will probably always be worse than the on-chain user-experience. LN is interactive, meaning that users must be online, and do something [sign a transaction] in order to receive money. It also means that your LN-counterparties can inconvenience you (for example if they stop replying, or if their computers catch fire) or outright harass you. LN also comes with new risks – the LN-design is very clever at minimizing these risks, but they are still there and will still be annoying to users. Users will prefer not to put up with them. So they will tend to prefer an Altcoin on-chain-txn over a mainchain-LN-txn.

b. Merged Mining Sidechains

Merged-Mined Sidechains do whatever Altcoins can do, but without the need to purchase a new token. So they have infinitely lower exchange rate risk, and are more convenient for users.

On top of that, MM SCs send all txn-fees they collect to Bitcoin miners. Under Blind Merged Mining, they do this without requiring any users or miners to run the sidechain node software.

A set of largeblock sidechains could process very many transactions. In the next section, I will assume that the total Sidechain Network replaces VISA, (and VISA alone), and captures all of its transaction fee revenues. VISA is only a small percentage of the total payments market (which includes checks, WesternUnion, ApplePay, etc), but it is a good first look.

viii. VISA’s Transaction Fee Revenues

Contrary to what I believed just moments before looking this up, VISA does not earn any money off of the interest that it charges its customers.

Observe page 40 of their most recent annual report:

Our operating revenues are primarily generated from

payments volume on Visa products for purchased goods

and services, as well as the number of transactions

processed on our network. We do not earn revenues

from, or bear credit risk with respect to, interest

or fees paid by account holders on Visa products.

Instead VISA’s revenue comes from transaction fees. This perfectly facilitates our comparison.

Total revenues were 18,538 $M in 2017, up from 11,778 $M in 2013. This corresponds to quite an annual growth rate – 12% per year.

If we assume that current trends holds, we get the following:

Above: The ‘security budget table’ from earlier in this post, plus a new column: VISA transaction fees. These fees are added to the base block subsidy amounts, to get a new total security budget.

This security budget does seem to be much safer in the long run, and safer in general.

Conclusion

To deter 51% attacks, Bitcoin needs a high “security budget”. Today’s tx-fee revenues are not high enough; we must ensure that they are “boosted” in the future.

Higher prices (ie, higher satoshi/byte fee-rates) are one way of boosting revenue. Unfortunately, competition from rival chains acts to suppress the market-clearing fee-rate.

A better way, is to attempt to devour the entire payments market, and claim all of its fee revenues. This can be done using Merge Mined Sidechains, without any decentralization loss.

Footnotes

- The math is that 1.077 = (25.94/5.85)^(1/20). And note that 1.077 is below the required “stasis rate” of 1.19. ↩

- I mean that if the USD/BTC price had been 10x higher, throughout the “bubble” of late-2017. In other words, if Bitcoin had started Jan 2017 at around 9,000 USD/BTC and then risen to 190,000 USD/BTC. ↩

- I do remember there being much more of this, but I could only find a few examples (before giving up). Please message me if you can find/remember any other examples. I guess I will eventually remove this paragraph if I never find any more. ↩

- By “fees paid to LN-hubs”, I mean the fees that you would pay, (off chain), to any Lightning Node that your LN-payment routes through. ↩

Tweetstorm: Power and Money

By Saifedean Ammous

Posted February 17, 2019

Fiat money allows wars with no real cost to governments, which makes detestable bloodthirsty chickenhawk scum like @MaxBoot & @BillKristol, who’ve never faced costs for their warmongering, the perfect “foreign policy experts”.

In 2003 Wolfowitz told Congress the Iraq war would be practically costless. It turned out to cost more than $2Trillion. With hard money Wolfowitz would have had to raise the $2T BEFORE war. With easy money, he can get his carnage on & leave taxpayers footing the bill for decades

Wolfowitz was not alone. Richard Perle, Lawrence Lindsay, Kenneth Pollack, Glenn Hubbard, Ari Fleischer, Donald Rumsfeld, & Mitchell Daniels all lied about the expected cost of war. They all got paid handsomely for it; never had to pay back a dime.

Modern “intellectuals”, who are government propaganda parrots, think this is just how war works. I urge you to read Hoppe’s Democracy The God That Failed for an explanation of how war functioned under governments forced to be responsible by hard money: riosmauricio.com/wp-content/upl…

Under hard money, governments had to finance their operations from their citizens, which made wars possible when necessary but bankrupted governments that engaged in unnecessary war. War was limited & contained to expensive armies kings were careful to not decimate needlessly.

Under hard money, governments fought till they ran out of their own money. Under easy money, governments can fight until they completely consume the value of all the money held by their people. This is why the century of central banking was the century of total war.

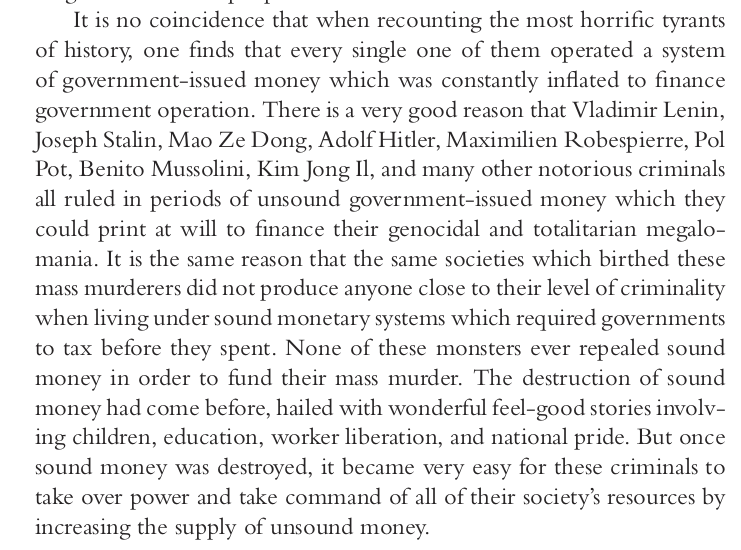

Whatever you think of the retarded Keynesian economics used to justify government control of money, you need to come to terms with the fact that the most horrific criminals of history have all operated with easy government-controlled money, as discussed in The Bitcoin Standard:

This is why bitcoin matters, and this is of course the point that critics of bitcoin miss. What better technology do you have for castrating scum like Kristol & Wolfowitz & preventing their sociopathic minds from capturing government money & causing millions of deaths?

Bitcoin’s real cost is in hardware & electricity needed to run the network. Fiat’s real cost is the hundreds of millions of deaths financed by government made omnipotent by inflation. Which do you find more expensive? Which would you rather pay in the twenty-first century?

Bitcoin might end up consuming half the world’s electricity, but if it prevents one war, that would be the best bargain humanity ever got. Bitcoin might be the most important application of electricity. Can you think of a better use for electricity than neutering mass murderers?

A Primer on Bitcoin Investor Sentiment and Changes in Saving Behavior

By Tuur Demeester , Tamás Blummer , and Michiel Lescrauwaet

Posted February 20, 2019

In our conversations with institutional investors, we often get asked the question “What is your model to value Bitcoin?”. Investors want to know what the fundamental drivers are behind BTC price gyrations, and whether at a given time Bitcoin is overvalued, undervalued, or at fair value. The new measures we suggest here are tools to help with that judgement. We build on work that goes back to 2011, and use the Bitcoin blockchain to extract market information not generally available for traditional commodities.

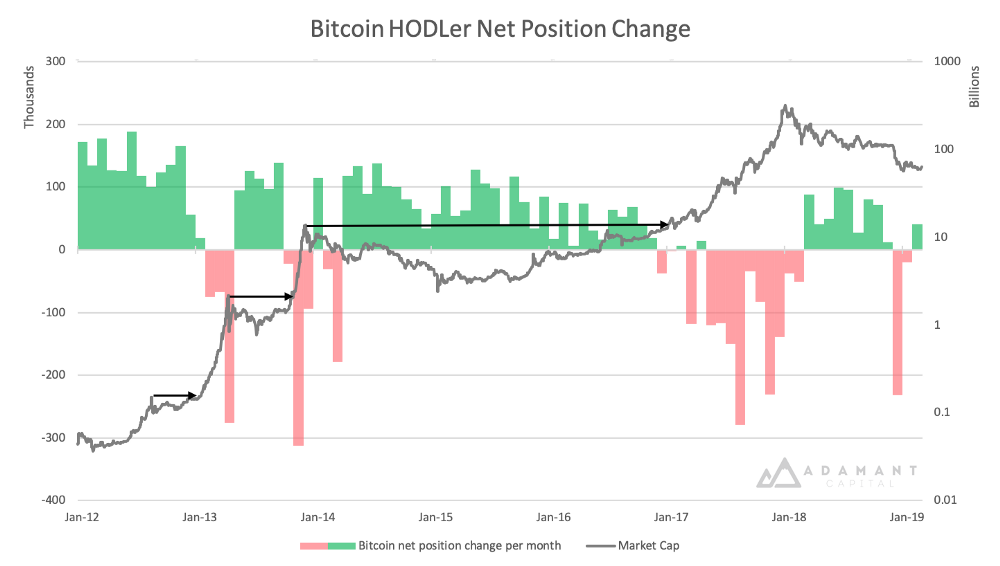

We suggest two new ways to measure changes in Bitcoin saving behavior:

- Relative Unrealized Profit/Loss Ratio(≈investor sentiment)

- HODLer Position Change(≈insider buying/selling)

Also introduced is the Liveliness measure, which reflects the extent to which a cryptocurrency is meaningfully used by savers.

A History of Bitcoin Valuation Research

Here’s an overview of the quantitative approaches we’ve seen Bitcoin investors take to help them decide what its fair value is at any given time.

- In 2010, Bitcoin users tried calculating the “value” of one Bitcoin by estimating the electricity cost of mining it. However, the usefulness of this was quickly dismissed, as the cost of mining goes up when investors bid up the price of Bitcoin.

- In 2011, early investors came up with the idea of calculating Bitcoin’s market cap as a valuation tool, and with the concept of ‘Bitcoin Days Destroyed’. The latter was dubbed an “indicator of market health and participation “ and it was the first valuation metric that considered the age of addresses. There was also discussion about a “Price over Difficulty” ratio, to determine whether it was better to mine than to buy BTC, and forum threads emerged about how many lost coins there might be.

- In 2012, Trace Mayer suggested the 200 Daily Moving Average of Bitcoin’s market capitalization as a value indicator, because it filters out the long-term secular uptrend .

- In 2013,various authors explored the idea that Bitcoin’s price is in a long-term parabolic uptrend, and that deviation from that trend line is indicative of over- and under valuation.

- On January 1st, 2014, user gbianchi proposed “Network Value” as the ratio of Bitcoin’s address growth and its market capitalization — similar analyses followed later that year.

- In November 2014, developer Jon Ratcliff published his analysis of the blockchain, showing the distribution of bitcoins based on age of last use, and commented “This graph shows … how many bitcoins are actively moving at any one time over time.”

- In September 2017,Willy Woo and Chris Burniske published research around the NVT ratio, which was called a “PE Ratio for Bitcoin” as it focused on comparing Bitcoin’s on-chain volume with its market cap.

- In March 2018, Dmitry Kalichkin suggested a variation on NVT which he dubbed the 90-day NVT ratio. Two months later he introduced the Network Value to Metcalfe ratio (NVM) which was based on Daily Active Addresses.

- In April 2018, Dhruv Bansal updated Ratcliff’s work on UTXO age distribution, and suggested the concept of HODL waves. He commented: “It is not possible to make charts such as the one above for traditional asset classes. It’s only Bitcoin and other public blockchains that meticulously track these data throughout their whole histories. This enables post-hoc analyses of large-scale market behavior.”

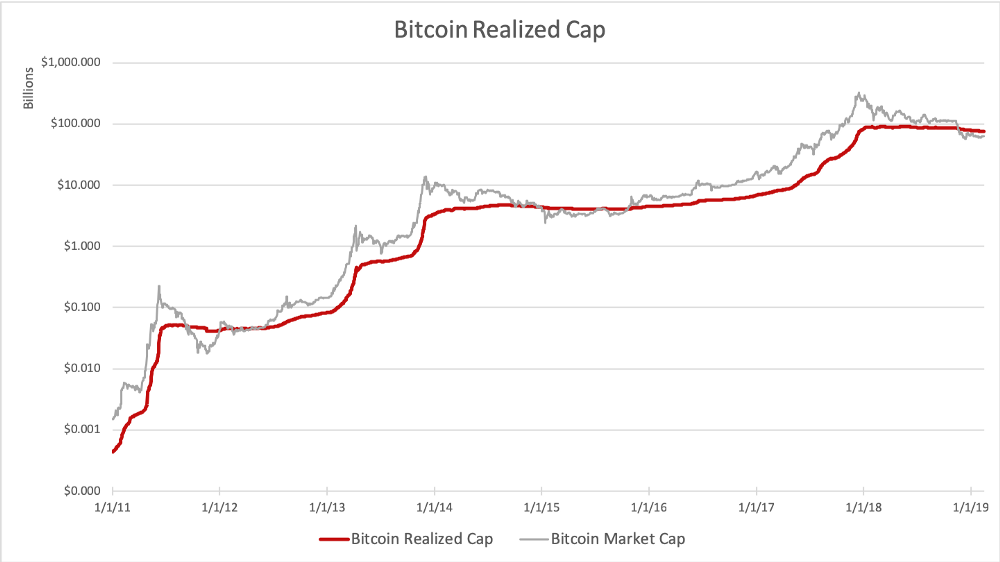

- In October 2018, inspired by Pierre Rochard, Nic Carter and Antoine Le Calvez created the Bitcoin “realized cap” which is the aggregate value of the UTXOs priced by their value when they last moved. Soon after, Bitcoin “thermocap” or “accumulated security spend” was suggested, which is the aggregated miner revenues over the entire history of Bitcoin.

- That same month, Murad Mahmudov and David Puell published work on the Bitcoin Market-Value-to-Realized-Value (MVRV).

- In December 2018, Tamás Blummer introduced the concept of Liveliness, which reflects how much a given blockchain is used for meaningful transaction settlement.

Goal: Measure Changes in Saving Behavior

Given that we view Bitcoin’s primary use case as censorship resistant store of value (digital gold), and its utility as a payment mechanism as only secondary, our main goal in identifying the components of our valuation toolbox is to find data that specifically reflects changes in saving behavior.

Limitations and challenges of existing valuation methodologies

The Bitcoin blockchain records a lot of data, but not all data. It is blind to how many bitcoins are lost. It doesn’t know whether a transaction represents a transition from one owner to another (sale), or whether it’s simply the same owner moving coins to another address in his control. It also doesn’t reflect off-chain transactions — for example it won’t show balance transfers from one Bitfinex user to another, or Liquid Sidechain transactions, or Lightning Network transactions.

The limitations of blockchain-recorded information, as well as the commodity nature of cryptocurrencies themselves, have consequences for valuation methodologies:

- With cryptocurrencies, information about real circulating supply is opaque, exchange listing requirements are often extremely loose, and dilution schemes can be stretched to extremes. Assigning a “market cap” to a cryptocurrency (mined coins × token price) doesn’t at all create an objective comparison tool — a coin’s “market cap” doesn’t teach us anything about the commitment of coin holders. To illustrate: a centralized coin with a premined supply of 1 billion tokens and a single recorded sale of one token for $10 would yield a $10 billion market cap, identical to a decentralized coin with a large community of long-term savers. This “market cap” measure is also blind to lost coins, which stretches the comparison with the securities world where the assets are held by transfer agents, making loss a very rare phenomenon.

- The challenge with using the number of active addresses or transaction volumes (e.g. NVT, NVM) is that these data sources don’t allow us to separate behavior that is long-term oriented from behavior that is short term oriented. These measures don’t directly differentiate speculators from value investors, and can conceivably be gamed or inflated by moving a large amount of coins back and forth, or by creating a flurry of small on-chain transactions.

Solution

Our solution is to collect data that places each circulating quantity of Bitcoin in its historical context, in the tradition of previous work such as HODL Waves, Realized Cap, and MVRV. We focus on the data provided by the Bitcoin blockchain, as this is the ultimate (most secure and final) settlement layer for all its important transactions. By taking the Output Quantities of a block, and combining it with the Recorded Time of that block, we learn more about the behavior of Bitcoin savers.

Relative Unrealized P&L (≈investor sentiment)

Every time a bitcoin moves on the blockchain, its market value is realized. The owner was aware of its value and affirmed his control over it at the point of the move. It doesn’t matter if the transaction represents the owner sending the coins to somebody else (a sale or gift), or if it is an act of self-dealing.

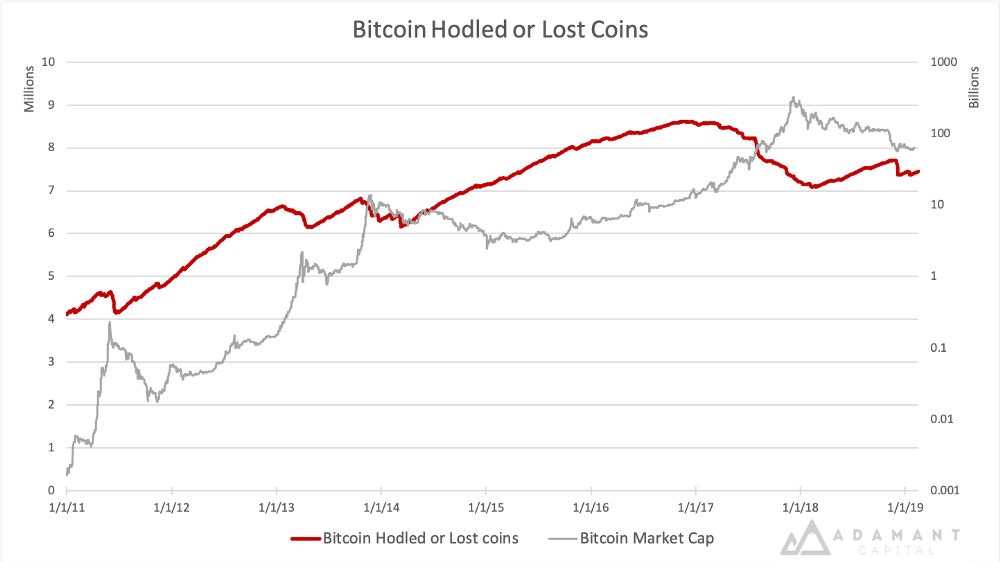

If we value every coin at the time it last moved and aggregate these values, we arrive at the “Realized Capitalization .”

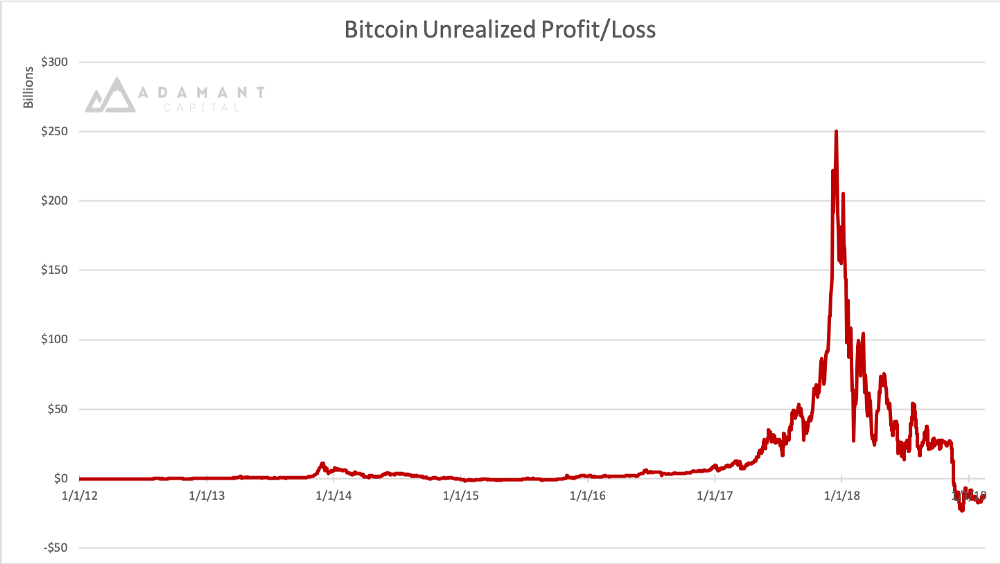

By subtracting the Realized Cap from the Market Cap, we calculate Unrealized Profit/Loss (P&L):

We see that Bitcoin investors in aggregate currently face a significant unrealized loss, which is quite a change if compared with the 2017 huge unrealized profits.

The measure of Unrealized Profit also contains the unrealizable profit of Lost Coins. Some coins are certainly lost as they were associated with a provably un-spendable output script, but the majority of lost coins can only be guessed by setting a threshold of inactivity after we consider them Lost.

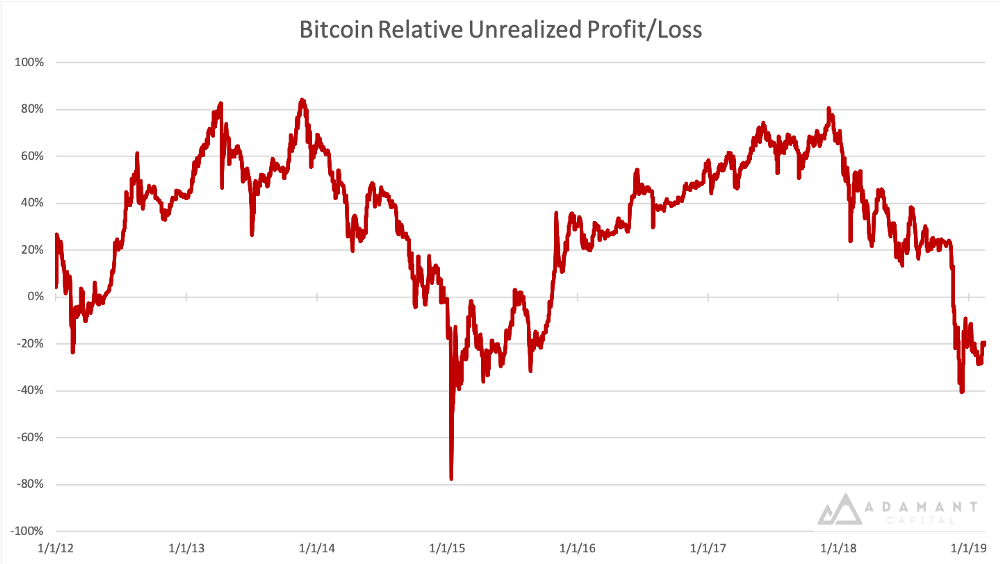

The measure of Unrealized P&L estimates the total dollar amount of paper profits/losses in Bitcoin, but it does not clearly filter out the relative change that accompanies it. By dividing Unrealized P&L by the Market Cap, we arrive at the Relative Unrealized P&L, which can be interpreted as an indicator of investor sentiment:

When a high percentage of Bitcoin’s market cap consists of unrealized profits, it can be interpreted that investors are greedy. The ratio drops as prices decline and investors likely become more fearful. When the unrealized gains turn into unrealized losses, we enter the phase of capitulation and apathy. Here’s a suggested illustration:

So why does the percentage of Relative Unrealized P&L go up in a bull market? What this indicates is that on average, investors are realizing profits at a slower rate than the growth in the market cap. For the time being, 20% of the market cap consists of ‘underwater’ holdings — coins that would generate losses if they were sold today.

Before we move on to a new suggested valuation tool, HODLer Net Position Change, we first need to explain the measure of Bitcoin Liveliness.

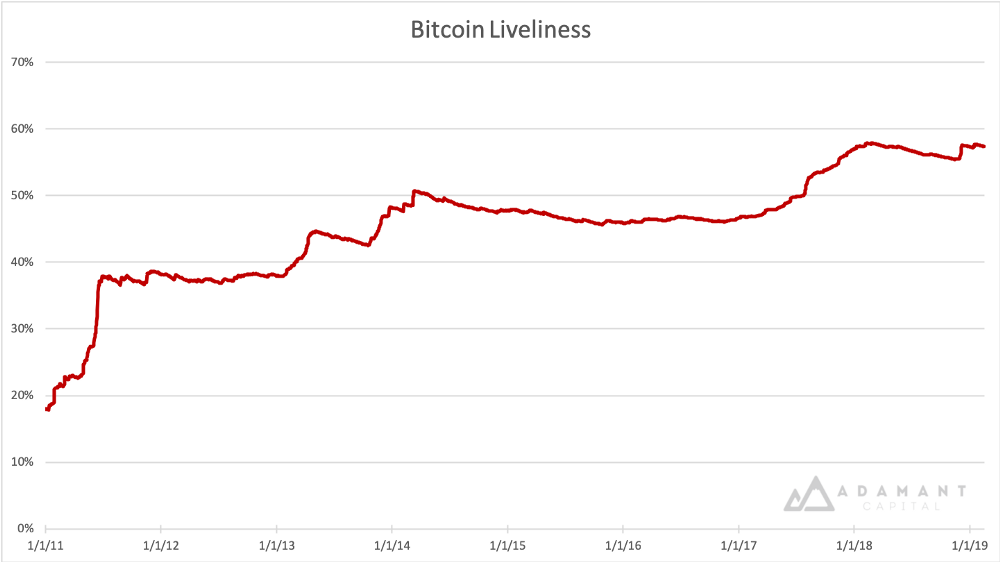

Liveliness