| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the September 2018 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

The Yin and Yang of Bitcoin

By LaurentMT

Posted September 3, 2018

This is post 2 of 3 in a series

“Countless words count less than the silent balance between yin and yang” - Laotzi

Hodling & Mining, the two dragons of Bitcoin (photo: Panels of Dragons Yin Yang)

Hodling & Mining, the two dragons of Bitcoin (photo: Panels of Dragons Yin Yang)

In the second part of this series, we’re going to define a new metrics called the Price-Performance Ratio of Bitcoin’s PoW (PPR). Our goal will be to analyze the evolution of the actual efficiency of the system and to identify the factors driving its dynamics.

After having defined this new metrics, we will first witness its “surprising” correlation with the bitcoin’s market price. Going a bit further in our analysis, we’ll study the role played by hodling and mining. We’ll then focus on a “strange” pattern displayed by the metrics (resistance levels) before concluding with an observation about the existence of PPR cycles.

Prologue: Price-Performance Ratio of a product

The Price-Performance Ratio (PPR) is a metrics used in economics and defined as the ratio of the price of a product to its performance (expressed in any unit making sense for expressing this performance).

The PPR is often used to illustrate the difference between “classic” and “new technology” products. Indeed, it can often be observed that “classic” products display a constant or increasing PPR while each new iteration of “new technology” products come with a lower PPR.

This phenomenon can be explained by the fact that production of “new technologies” usually begins at an inefficient level but each iteration benefits from works and investments done for previous versions (R&D, etc). It’s this cumulative effect which allows to decrease the PPR.

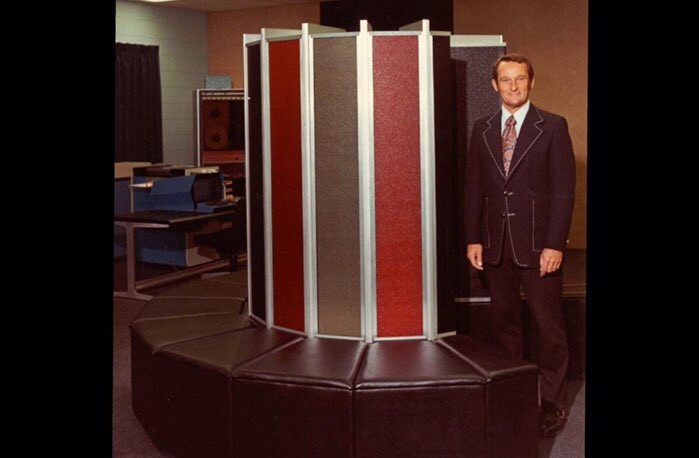

Moore’s law is a famous example of this phenomenon. When I was a kid (i.e. before I learnt that Moore’s law was a thing), the Cray 1 was in my imagination a kind of mythical beast which would forever remain out of my reach. The first commercial version of the Cray 1A was sold in 1977 for the equivalent of $37M (in today value). Guess what… This beast was less powerful than your smartphone…

“Hello… Hello?” — Happy owner of a crappy smartphone

“Hello… Hello?” — Happy owner of a crappy smartphone

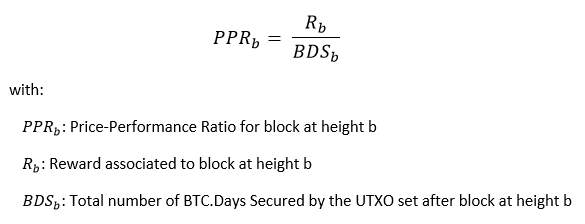

Price-Performance Ratio of Bitcoin’s PoW

Ok. Let’s define our new metrics. For this, we’re going to consider the UTXO set after each new block as a new iteration of a “product”. Its performance will be measured by the total number of bitcoins.days secured it has accumulated. At last, we’ll approximate the price of this “product” by the reward associated to the block.

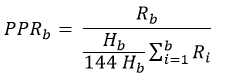

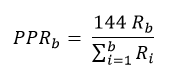

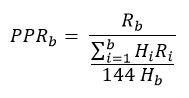

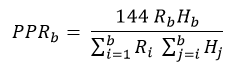

The equation for the PPR is

which can be rewritten as

which is equivalent to

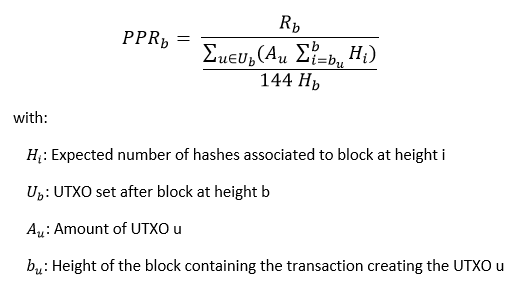

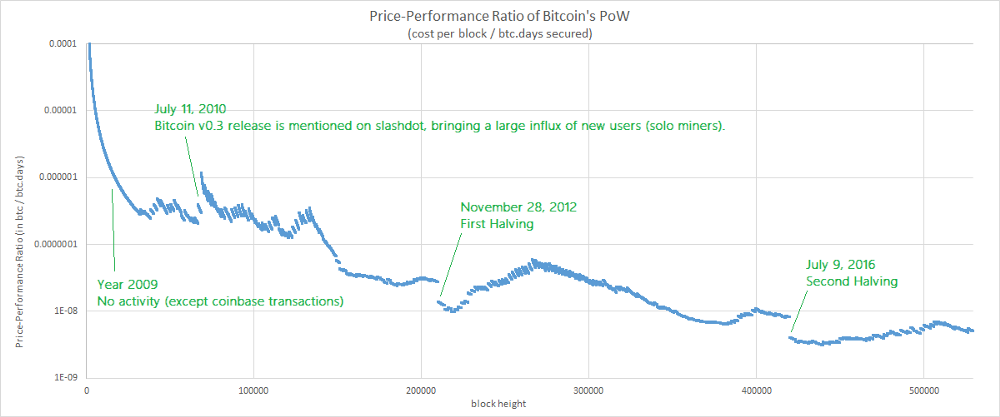

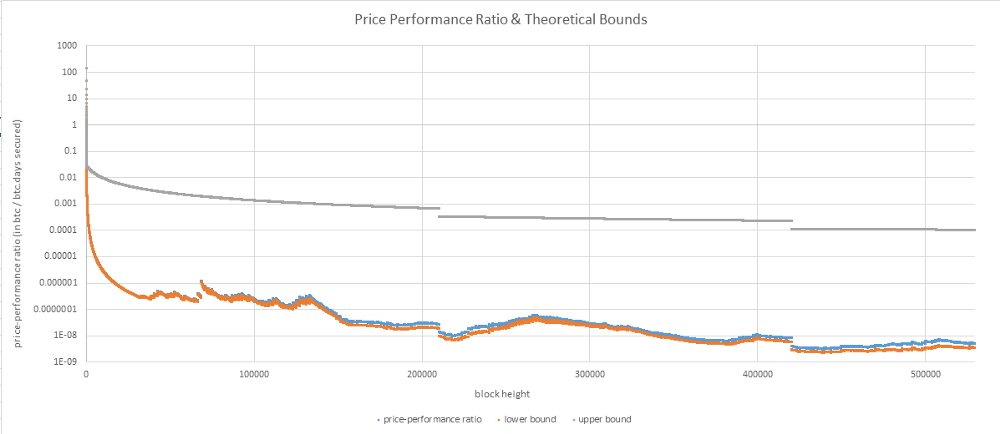

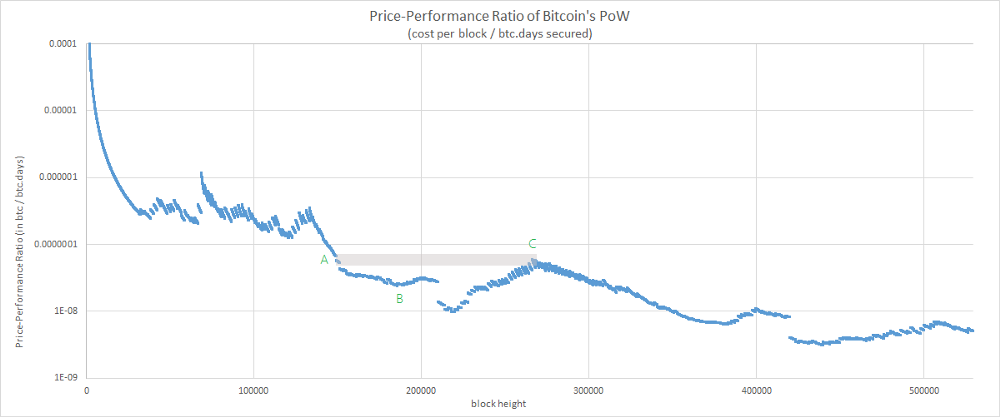

That gives us the following chart

The chart displays a decreasing trend (i.e. an improving price-performance ratio) which is consistent with what we might expect from a system having a cumulative effect. And once again, the metrics suggests that the efficiency of the system has improved over time.

That being said, this curve is far less smooth than those obtained for our two previous metrics. It seems that the journey has been a bit rock & roll. Let’s try to understand what is happening here.

Singularities

Let’s begin with an easy task and let’s try to identify the causes of a few singularities observed on the chart.

Bulls and Bears

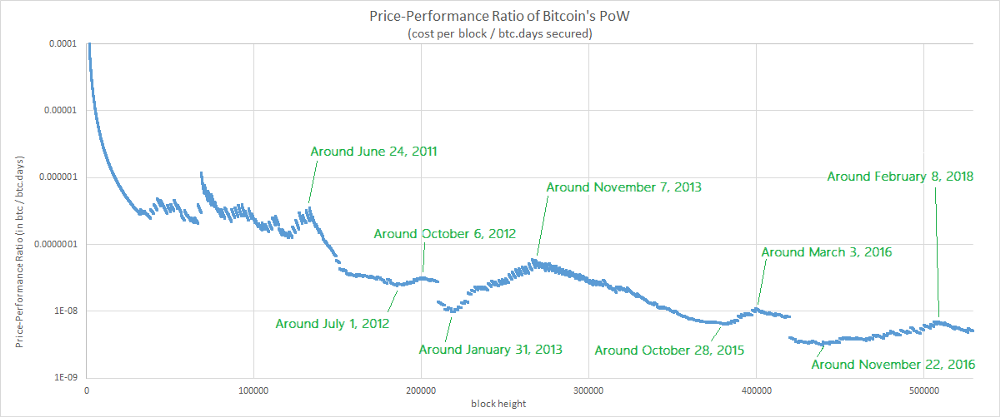

All right. Now, let’s focus on the multiple oscillations of the curve and let’s add the dates associated to a few top and bottom values.

If you follow (even negligently) the multiple movements of the bitcoin’s market price, these dates may remind you something…

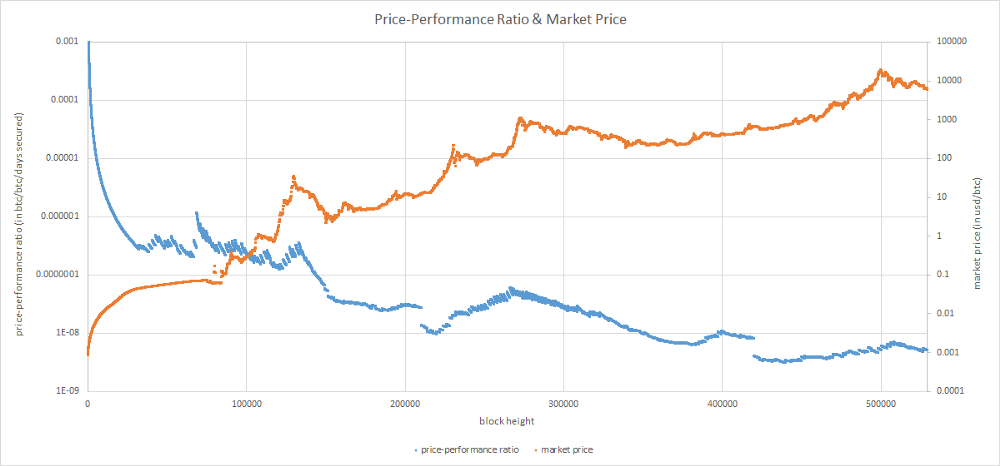

Price-Performance Ratio & Market Price (market price data from bitcoincharts and blockchain.com with a linear interpolation used for missing data points)

The chart suggests an interrelation between the PPR and the market price. At first, this might seem surprising since the market price isn’t a factor used in the definition of the PPR but it certainly makes more sense if we remind ourselves of multiple observations made in the past about the bitcoin’s market price driving changes in hodling & mining behaviors, two components of the PPR.

Let’s try to confirm this intuition with a deeper analysis of the relation existing between holding, mining and the PPR.

Yin (Hodling)

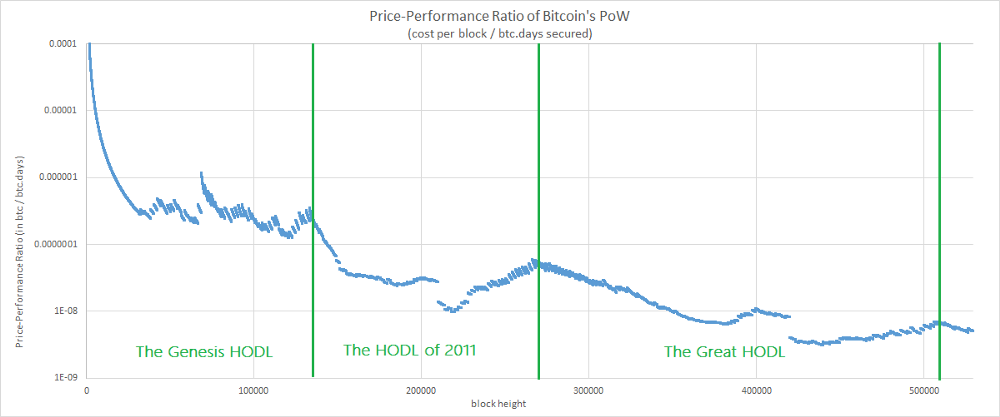

A few months ago, Unchained Capital published an excellent work about a phenomenon called the “Hodl Waves”. The main finding of this study was a repeated pattern of increasing hodling after each rally in bitcoin’s price. Considering that hodling is an integral part of the PPR, a convergence with the Hodl Waves model doesn’t seem absurd. Let’s check this hypothesis by plotting the dates associated to the three Hodl Waves.

The intuition seems good. We can already associate 3 “tops” with the Hodl Waves. Moreover, the chart suggests that the first phase of a new Hodl Wave (i.e. a period of increasing hodling) is correlated with an improvement of the PPR. It’s then followed by a degradation of the PPR which is correlated to the new rally in bitcoin’s price concluding the Hodl Wave.

Ok. Let’s try to get a better picture of the influence of hodling by determining its lower and upper bounds (i.e. when hodling is maximized and minimized). For this, we’re going to use a thought experiment and imagine two hypothetical versions of Bitcoin…

Upper bound: Bitcoin Steroïds

In the parallel universe of Bitcoin Steroïd, users seem gripped with a spending frenzy and they can’t help but spend their coins as soon as they receive them. An UTXO never “accumulates” more hashes than the ones added by the block including the transaction creating the UTXO (notwithstanding that freshly created coins must wait for a 100 blocks period before becoming spendable).

The PPR for Bitcoin Steroïd can be defined by the following equation (for the sake of simplicity, we omit the constraint over the maturity of coinbase transactions)

which can be rewritten as

Lower bound: Bitcoin Arctic

In the parallel universe of Bitcoin Arctic, store of value is all the rage. Basically, all users are miners trying to create new bitcoins that they’ll never transfer. Their goal is just to transfer their wealth into this digital store of value and keep it there forever.

Thus, the PPR for Bitcoin Arctic can be defined by the following equation

which can be rewritten as

Now, let’s plot our chart of the PPR with the two bounds defined by Bitcoin Arctic & Bitcoin Steroïd.

There are several observations to be made here.

First, it appears that since its inception, Bitcoin has operated in a mode very close to the lower bound defined by Bitcoin Arcticand their oscillations are quite similar.

On its side, the upper bound defined by Bitcoin Steroïd has a very different profile. Oscillations have disappeared. All we have is a smooth monotonically decreasing curve. This observation makes sense considering that in Bitcoin Steroïd, UTXOs don’t accumulate hashes for longer than a single block. Here, the main drivers are the increasing number of coins and the decreasing rewards. But there’s an expensive price to pay for this regularity; the PPR of Bitcoin Steroïd is several order of magnitudes higher than the PPR of Bitcoin or Bitcoin Arctic.

As a first conclusion, we can state that hodling has played an active role in the evolution of the efficiency of the system during the past 9 years.

Yang (Mining)

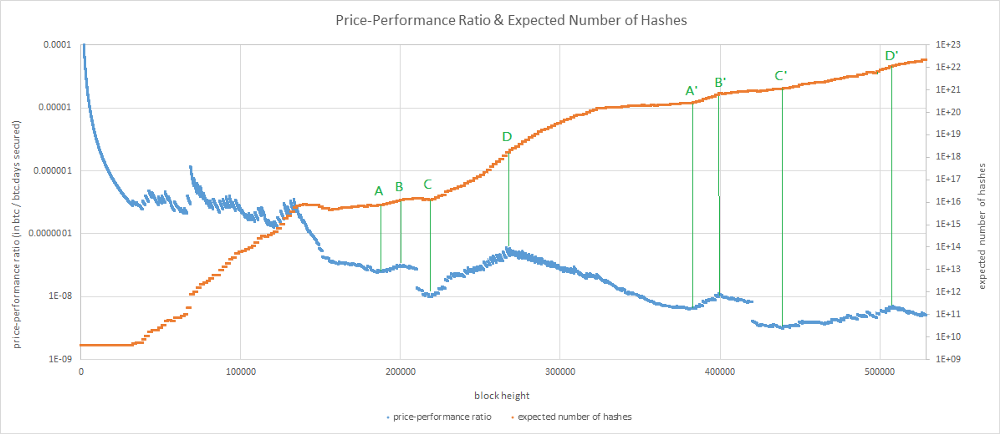

Let’s now focus on the influence of mining. For this, we’re going to plot a chart displaying the PPR and the expected number of hashes associated to the PoWs of past blocks.

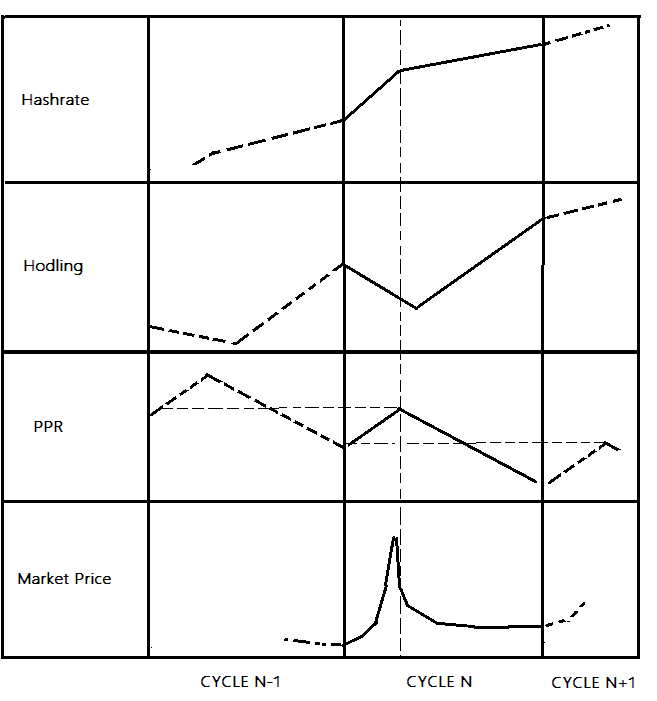

The chart displays a series of cyclic patterns composed of four phases:

- A=>B / A’=>B’ (a few months before a halving): Hashrate growth and PPR start to increase.

- B=>C / B’=>C’ (around the halving): Hashrate growth and PPR decrease.

- C=>D / C’=>D’ : Market price starts to increase. Hashrate growth and PPR increase again.

- D=>A / D’=>… : A “bubble” pops. Hashrate growth and PPR decrease again… until a new cycle begins.

Once again, these observations aren’t really surprising. They’re consistent with past observations made about the dynamics of bitcoin’s hashrate (anticipation of halvings, bull markets).

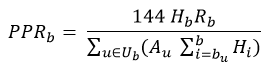

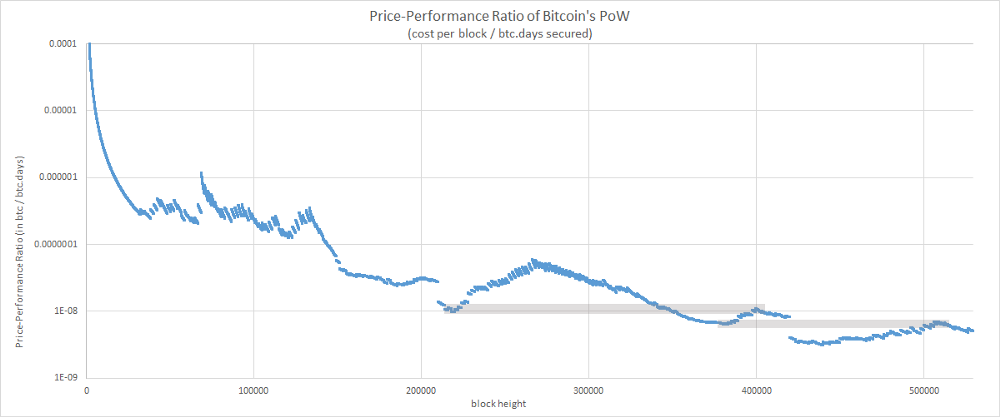

“Technical analysis”

While looking at the PPR chart, you may have noticed something else which seems a bit “weird”.

PPR “Resistance” levels

PPR “Resistance” levels

Yep. That’s it. Some bottoms seem to act as a “resistance” for the top coming later. This observation puzzled me for a while. To better understand what is happening here, let’s play with a simplified model simulating the system.

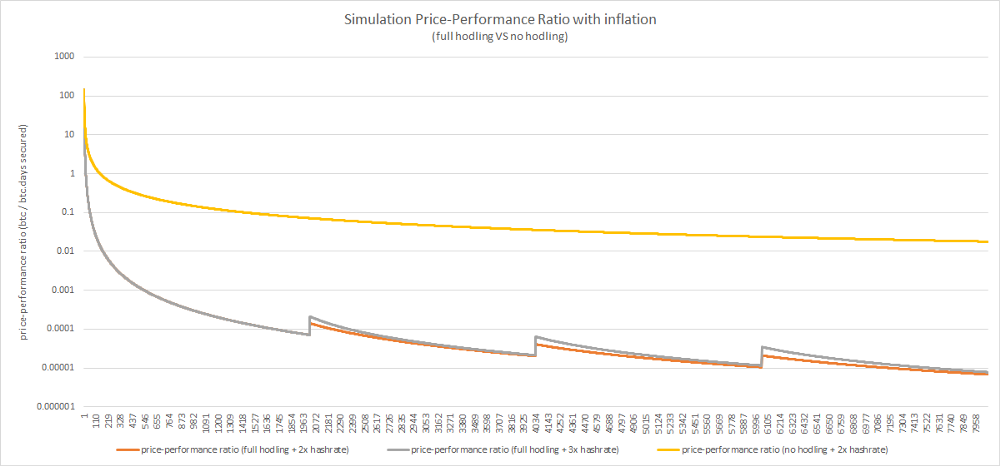

First, we’re going to remove the halvings and difficulty adjustments. Then, we’re going to state that each block is rewarded by a single coin and that the first mined blocks require a single hash. Every N blocks, we’re going to simulate an increased market price instantaneously driving up the hashrate by a given factor (x2 or x3 for our simulation). That gives us the following result:

As you can see, this very simplified model is enough to reproduce the main characteristics of the PPR observed in the wild. It confirms that the occurrence of oscillations is correlated with a hodling behavior and it also suggests that resistance levels are influenced by the multiplying factor (the lower the factor the more the previous bottom “acts” as a resistance).

Let’s break some assumptions

There’s a last observation to be made about this phenomenon. You may have noticed that this “resistance” effect doesn’t seem to apply to all the tops.

Indeed, according to our previous observation, we might expect that blocks around C find a “resistance” at the level of B instead of A. The interesting part of this observation is that A marks the beginning of a very unique period in the history of Bitcoin. For the first time, the hashrate strongly decreased and remained at this “low” level for an extended period which ended… around B.

It seems that what we’re witnessing here is the rare occurrence of a period breaking one of our assumptions (A5: “… the average amount of computing power dedicated to Bitcoin mining monotonically increases”). At this point, one of my hypotheses is that these top and bottom values might be associated to an equilibrium existing between hashrate, hodling behavior, mining rewards and market price. Anyway, the subject remains to be investigated further.

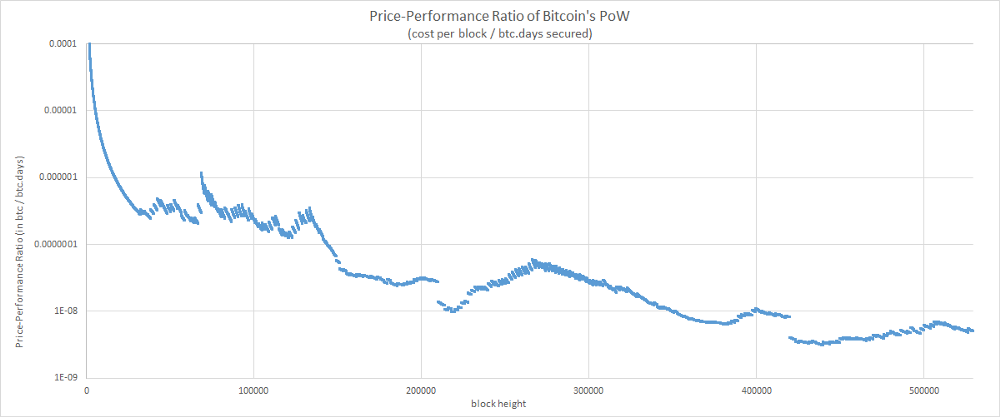

The PPR Cycles

The last observation that we can infer from all the previous points is that the PPR follows a series of cycles which can be associated to bitcoin’s market cycles (anticipation of a halving or bull+bear cycle).

PPR Cycles

PPR Cycles

For each cycle, it can be observed that after a temporary period of degraded efficiency, the system has become more efficient. Specifically, each PPR cycle is composed of two phases:

- Phase 1: Market Price increases — Hodling decreases / Hashrate growth increases => PPR increases (the system becomes temporarily less efficient).

- Phase 2: Market price decreases / bubble pops — Hodling increases / Hashrate growth decreases => PPR decreases to a new low.

At last, it’s worth noting that the PPR cycles are slightly more fine-grained than the Hodl Waves. My hypothesis is that it can be explained by the fact that PPR cycles associated to bitcoin halvings primarily result from the influence of mining, a factor excluded from the scope of the Hold Waves model.

Conclusion

We have defined a new metrics taking into account the effects of mining and hodling over the actual efficiency of Bitcoin’s PoW.

Once again, the metrics suggests that the system has become more efficient over timebut the most interesting insights gathered from this metrics are certainly related to the analysis of its multiple oscillations. To my surprise, it remarkably synthetizes multiple past observations made about the interrelation between the market price and hodling & mining behaviors. It also highlights the influence of the market price over the efficiency of the system through its influence over hodling and mining.

At last, we have witnessed the existence of PPR cycles associated to market cycles (anticipation of halvings, bull+bear cycles) and we have observed that under our assumptions, the PPR value at the top of each cycle seems to reach a “resistance” around the initial PPR value of the previous cycle.

( Next part )

Acknowledgements

I wish to thank @Beetcoin, Pierre P. and Stephane for their precious feedback and their patience :)

A great thank you to @SamouraiWallet and TDevD for their feedback and their support of OXT.

At last, I wish to thank the team at Unchained Capital for their wonderful work on the Hodl Waves.

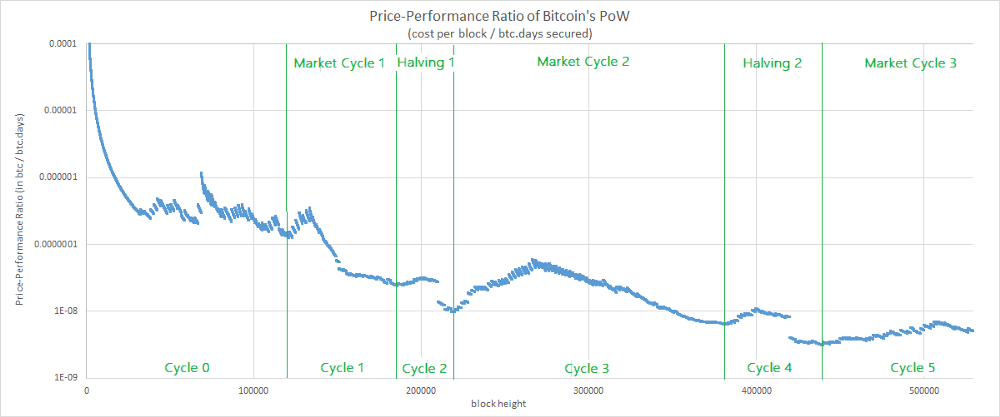

Annex A : Simplified schema of trends observed during a PPR Cycle

Cliffhangers

By LaurentMT

Posted September 10, 2018

This is post 3 of 3 in a series

“Be like the cliff against which the waves continually break; but it stands firm and tames the fury of the water around it.” — Marcus ‘Rocky’ Aurelius, Meditations of a Bitcoin miner

In the previous parts of this series, we’ve started to investigate the efficiency of Bitcoin’s PoW. In this third part, we’re going to focus on a slightly different question: “Is the system running at its optimum ?”.

For this, we’ll first underline some points related to the effects of an increasing hashrate and we’ll introduce the Satoshi’s cliff, a 3D visualization illustrating the diminishing marginal security provided by older blocks. Then, we’ll define what could be considered as the theoretical optimum of the system and we’ll wonder how far is the system from this optimum. At last, we’ll conclude with a few thoughts about the diverging paths followed by Bitcoin and Bitcoin Cash.

Prologue: Bitcoin Steroïd and Bitcoin Arctic

We’ve previously discussed the influence of hodling over the efficiency of Bitcoin’s PoW by imagining two hypothetical versions of Bitcoin. While caricatural, these two examples were useful for understanding the consequences of different trade offs. Bitcoin Steroïd sacrifices its efficiency for a maximized activity while Bitcoin Arctic sacrifices its activity for a maximized efficiency. Obviously, none of these solutions is very satisfying. Can we do better ?

Satoshi’s Cliff

When I began to study the Bitcoin protocol, I was first amazed by the idea of new PoWs piling on top of old ones and providing an ever increasing security. But as often with Bitcoin, things aren’t as simple as they seem. The truth is that with an increasing efficiency and availability of mining hardware, the security provided by old individual PoWs tends to decrease.

This phenomenon can be illustrated with a statistics provided by P.Wuille on this page. The chart displays the number of days which would be required for recomputing all PoWs since day 1 with 100% of the actual hashrate.

proof-of-work equivalent days (source: bitcoin.sipa.be)

In order to better visualize the evolution of the two phenomena (i.e. the cumulative effect of PoW and the effect of an increasing hashrate on old blocks) we’re going to compute a 3D visualization generalizing the chart provided by P.Wuille. This visualization is going to display how many days (z axis) would be required to rewrite the history back to a past block (y axis) with 100% of the expected hashrate used to mine a more recent block (x axis).

I’ll call this chart the “Satoshi’s Cliff”

Satoshi’s Cliff (simplified version, x and y axes are expressed in time periods between 2 adjustments of the difficulty)

Let’s choose any value on the x axis and starting from the bottom, let’s climb the cliff. As you can see, rewriting more blocks requires more and more time (and is more expensive). But at some point, we reach a plateau. Being older doesn’t provide a significant additional security to an UTXO. This highlights why the approach followed by Bitcoin Arctic (i.e. a “naive” maximization of accumulated PoWs) isn’t optimal. Once the plateau has been reached, activity is sacrificed for almost no additional security.

On the edge of the cliff

Based on this observation, we’re going to define the “edge of the cliff” as a theoretical optimum for the system. Indeed, beyond a certain point it doesn’t seem very wise to sacrifice activity for the diminishing marginal security provided by older PoWs.

It’s important to note that the concept of an optimal age doesn’t really make sense for an individual UTXO. Indeed, as the “owner” of an UTXO you don’t have a fine-grained control over its age. Either you hodl the UTXO and at some point it will reach the plateau or you spend it and it instantly goes back to the bottom of the cliff.

In my opinion, this concept of optimal age is primarily useful when we consider the UTXO set as a whole.It can be considered as a reference point for the distribution of existing bitcoins per age. The more existing bitcoins are concentrated around the optimal age, the closer the system is from its optimum.

Ok. Let’s try to determine the evolution of this optimal age. For this, we’re going to iterate over all the values on the x axis and plot a 2D chart for each value (a kind of transverse slice of the cliff).

A slice of the cliff

Then, we’re going to use a very simple method based on vector arithmetic (see Annex A) in order to approximate the optimal age for the slice. We just have to repeat the same operation for each slice and that gives us the following chart.

Let’s note that very different criteria might be used to determine what is the optimum at a given date. Which one is best remains an open question.

A lemming effect ?

SELLL !

You may remember some observations made about the Hodl Waves which suggest a “lemmings” effect occurring during rallies in the bitcoin’s price, with many old UTXOs “jumping” from the cliff. As it was shown earlier, one of the consequences of this phenomenon (coupled with the increasing hashrate) is a temporary degradation of the efficiency of the system. Does it mean that the system is significantly moving away from our theoretical optimum during these events ?

As a first benchmark, we can try to use a few data points provided by the Hodl Waves analysis and plot the distribution of UTXO amounts per age. The selected data points will be the last 4 four top and bottom values identified for the PPR. We’ll then plot an interval identifying the position of the optimal age on top of these distributions.

Distribution of existing bitcoins per age (selected data points are the last 4 top and bottom values of the PPR)

We can observe that for most of these data points, a majority of the existing bitcoins (50–70%) are hanging on the cliff (i.e. below the optimum). But an indicator more important than the median is the concentration of existing bitcoins around the optimum. I must admit that I’ve been a bit surprised here. I was expecting a clear differentiation between the bottoms (07/07/2012, 31/01/2013, etc) and the tops (21/09/2012, 16/11/2013, etc) but it doesn’t seem to be the case.

To be honest I don’t think that we can infer anything definitive from so few data points. Unfortunately, I lacked time for computing an exhaustive fine-grained comparison and it remains a task to be done. [Yep. It’s a really brutal cliffhanger]

Bitcoin and Bitcoin Cash

As a last thought on this subject, I’ll say that it should be interesting to observe how Bitcoin and Bitcoin Cash evolve in the future. As you certainly noticed, the trade offs described for Bitcoin Arctic and Bitcoin Steroïd have some resemblances with the divergent visions followed by the two chains.

Concerning Bitcoin, it should be particularly interesting to observe how the Lightning Network impacts the efficiency of the system. Indeed, the idea of long lived channels (i.e. several months or years) may help to “naturally” aggregate more UTXOs around the optimum (which is currently oscillating between 18 and 24 months).

Concerning Bitcoin Cash, it should be interesting to observe if the effect of an ever increasing number of on-chain payments can be counterbalanced by hodlers and if it’s enough to stay close from an optimal use of the security provided by its PoWs.

Conclusion

In this third part, we’ve discussed the idea of an optimal age of the UTXOs allowing to measure how far the system is running from its optimum. It’s clear that this post has barely scratched the surface of the question. My hope is that this first foray into the subject will encourage more people to investigate it.

( Next part )

Acknowledgements

I wish to thank @Beetcoin, Pierre P. and Stephane for theirs precious feedback and their patience :)

A great thank you to @SamouraiWallet and TDevD for theirs feedback and their support of OXT.

Annex A — Approximation of the optimal age of an UTXO

We’re going to use a method inspired from the Needle algorithm. For any value on the x axis of the 3d chart, we can define a 2d chart (a slice of the cliff) and compute a vector Vi (see chart below).

We can then iterate over each value of the x axis of this 2d chart and compute the vector Vo. From these two vectors, we can compute the vector Vd and its norm (dot product + vectors addition). We consider the point O maximizing the norm of the vector Vd as our optimum.

An interpretation of this method is that the segment IA is what we would observe if the hashrate was constant. Thus, O is the point maximizing the effect of an increasing hashrate (compared to a constant hashrate) while making a trade off between a maximized security and a maximized activity.

Expensive Privacy is Useless Privacy

By Paul Sztorc

Posted September 11, 2018

Privacy is impersonation. To be useful, a privacy tech must be [1] cheaper, or at least [2] have costs which are themselves private.

1. Something to Hide

Sometimes, we need to keep a Truly Important Secret.

And I mean “important”. Not a triviality or some piece of gossip – something that we really don’t want anyone else to know.

Above: Adam and Eve hide from God. Taken from this website.

Above: Adam and Eve hide from God. Taken from this website.

A. Resembling The Innocent

In such circumstances, we start to take Secret-Keeping seriously. We need the secret information to remain hidden. We simulate, in our minds, exactly what we think other people are like, and how [we think] that they learn things. We obsess over their ability to conduct which-kinds of research (and at-what-expense). We find ourselves absorbed by their interests and their distractions, over how they spend their “down time” (at parties, or at the dinner table), their expectations for engagement in conversation; which pretexts they will find believable.

For example: an early romance at around age 15.

Eg, the hackneyed “teenage crush”. For example, Teenager 1 will “like” Teenager 2, but will keep this information dreadfully secret! Throughout modern history, many a popular children’s television program has a main character or two burdened with this dire tribulation.

In this situation, we are equipped with this skin-in-the-game, and become much smarter than normal. We intuitively grasp something, that would otherwise pass for complex and arcane Baysian reasoning. It is an essential precept of both privacy and freedom.

It is that keeping the secret also involve keeping a meta-secret.

In other words, you are not only keeping something hidden. You are also pretending that you have nothing to hide. Teenager 1 has to pretend that ‘talking about crushes’ is exactly as boring or interesting as it was before.

B. The Meta-Secret

Once, my mother told me that she had “exciting news” to reveal (in other words, the news had henceforth been secret). But before she said another word, I had deduced immediately that my step-sister-in-law was pregnant – and I was right: this was, indeed, the secret.

I actually would never have just guessed it out of the blue, or assigned it to be likely (if, for example, I were presented with some sort of list of possible events, and asked to estimate their likelihood). But of the possible secrets that my mother could be keeping from me (and would then reveal), it ranked very highly.

If my father revealed that he had “exciting news” to announce, I would then know that he was about to explain that he intends to retire, sell his house in Connecticut, and move to Florida. I do not currently expect him to do this anytime soon. If my brother announced, I would know that he was about to say that he was getting engaged to his girlfriend. Again, I have no current expectations of either. I am not extrapolating from a set of “likely” events – it is only the “learning that a secret exists”, which makes me assume that they are imminent.

Similarly, if I had learned that “a secret exists between my brother and the CIA (or the KGB)”, I would –without knowing what the secret is, exactly– be forced to revise my opinion of him substantially. As I would if I learned that some secret were between him and a ballet school (or an alchohol rehab program, or an HIV clinic).

This concept I call the “meta-secret”. I make no pretense to have discovered it – it is ancient wisdom to all secret-keepers.

"..the most important part of any secret

is the knowledge that a secret exists..."

-HPMOR, Chapter 48

C. Publicly Hiding Something

Imagine that Adolf Hitler shows up at your house, and asks you if you are hiding any Jews in your attic. He wants to send all of the Jews and the Jew-lovers into the furnace and burn them all alive, basically for no real reason.

And imagine that you are indeed sheltering some Jewish people in your attic. How should you respond?

But before you respond, ask yourself: what did my neighbors say, when asked this question?

You estimate that they said the following:

The Head of Household A says “No, I hate the Jews. I hope you find lots of them and burn them all.”

HoH B says the same thing.

But HoH C actually is hiding some Jews in his attic. Nonetheless, he imitates HoH A. (And so he and his Jewish guests live to fight another day.)

HoH D, being very naive, believes that “lying is wrong” (whatever that means). So he says “I admit there may be some Jews here. But all people have an equal right to share in th–” but before he can finish his poetic thought he and his entire family (and the Jews living in his attic) are arrested and killed.

Finally, consider HoH E: He says, “This question is objectionable. I have the right to use my house any way that I damn well please. None of your business!” and he slams the door. Of course, the Gestapo raid it that night, find the Jews in the attic, and kill everyone.

You see, if you are going to really keep a secret, you have to commit to it completely. You need an entire second identity. You are resembling an “innocent” person.

"...to keep a secret ...I must give no

sign that differs from the reaction of

someone truly ignorant."

-HPMOR, Chapter 70

Imagine that Modern Hitler comes next for the gays. He asks German Men, via survey, whom they feel most attracted to. The survey options are: [1] women, [2] men, and [3] decline to answer.

Option three is, really, not a serious option. All of the straight German men will be proudly checking option one, en masse. And anything other than what they do will look suspicious. Admitting that you have something to hide is already a total defeat. The only thing that you could hide, in this context, is a “shameful” thing. So hiding is not an option.

D. Block Explorers

Imagine that Hitler knows, using data from other countries, that around 3% of the male population is homosexual.

He then decides to use public surveillance, instead of a survey. He discovers that 98% of German 18-24 yr old males use public roadways to hit up the clubs, on Friday/Saturday, to get laid with women. But 2% are “staying home to read” or are “working on their careers”. And he further discovers that, on Facebook/Twitter, 95% of good-looking bachelors freely talk to their friends/family about girls, but 5% instead become “irritated” and change the subject. Some percentage of the population is aberrant.

I don’t know, it just seems obvious to me – if you really need to keep the secret [from someone], then you have to go all the way. You have to do what they expect a truly unsecretive person would do – go to bars with your friends, get married and have kids and all of that. You’re either keeping the secret [again – from someone] or you aren’t.

E. The Pretext

One of mankind’s most powerful technological innovations is the pretext– a justification for doing something that is fake, but irrefutable. Pretexts act as a kind of “social shield” or “social encryption” that one can hide behind. Specifically, you can hide your motivations. Your secret motivations.

For example, imagine that Teenager 1 (“Alice”) wants to spend more time with Teenager 2 (“Bob”). So Alice decides to join a drama club that Bob is in. While doing so, Alice will misdirect the audience’s attention, to the non-Bob attributes of the club. In other words, she is sure to remark loudly that she loves acting (etc). And Alice may fool a few people with this ruse. But, much more importantly, Alice’s claim [of interest in drama, vs an interest in Bob] cannot be easily [dis]proven by anyone. And therefore most people will be disinterested in the claim’s truth or falsehood. Mission accomplished!

In fact, even those who are nearly certain that it is a lie (for example: Alice’s rivals, or long-time members of the drama club), cannot prove their knowledge to anyone else, without appearing to be suspicious or dark-minded themselves. And so even the suspicious people are forced to self-censor their suspicion. The fact that Alice is up to something, goes un-discussed. (At least, not openly.)

F. Dis-Entanglement

The pretext works because some people really do enjoy drama club, and really are interested in joining it for the first time. Since “interaction with Bob” is entangled with “participation in drama club”, we can’t know for sure which event Alice is after.

But, like Hanson’s Clothes, the pretext starts to break down as it becomes more expensive. Drama Club is one thing, but what if it met on Sunday mornings? Or two hours away from the school? (Or what if it were just objectively not fun at all, a terrible experience.)

A sufficiently Bob-motivated Alice would still join drama club, and invent the appropriate pretext. And it will still be impossible to prove her state of mind, or to talk about it without seeming nosy or obsessive.

But, alas, things for Alice are about to go horribly wrong! Say that the school has two drama clubs, identical in all ways except two: Bob is in Club 1 [but not Club 2], and Club 1 costs $5 to join [but Club 2 costs nothing]. Choosing Club 2 is effectively “buying Bob” for $5.

Since the clubs are identical in every other way except Bob, there are now no pretexts available for Alice to use. Even if Alice is super-super-wealthy, it makes no difference. There is only one reason for Alice to pay that five dollars: to be with Bob.

Above: “Market for lemons” title slide image, from this presentation.

Above: “Market for lemons” title slide image, from this presentation.

Alice can try some new pretext, ie that Bob and Alice are “friends” and want to hang out together. But only if they are already friends. If Alice is trying to make a new friend it will not work[^n] – it will be obvious, and possibly desperate.

Aside: this may shed some light on the puzzling but incontrovertible claim that “making friends” requires there to be “unplanned interactions” among potential-friends.

2. Bitcoin Privacy Technologies (ie “Fungibility”)

Now…

…with all that you’ve just learned…

…I would like you to tell me, what the key difference is, across the following Bitcoin Technologies:

| Column 1 | Column 2 | Column 3 |

|---|---|---|

| Reusable (“stealth”) addresses, The lightning network, Non-interactive CoinJoin w/ Schnorr signature aggregation, TumbleBit, Dandelion, Taproot | Sending your own BTC to yourself N times. | Ring Signatures, zk-SNARKs, Confidential Transactions, Confidential Assets, Interactive CoinJoin |

Column 1 contains technologies that are more private, and also cheaper or more convenient for the user. Reusable addresses are much more user-friendly than our current process [of awkward interaction, over an endlessly mutating list of gibberish]1. LN and Schnorr-CoinJoin are literally cheaper to use – they consume fewer on-chain bytes. And developers [we can assume] will eventually make TumbleBit, Dandelion, and TapRoot the standard or default behavior2 for clients/LN-hubs/MASTs, at which point doing anything else will be inconvenient (and suspicious).

Column 2 contains one item: “sending your own BTC to yourself”. This is certainly not “free”, because each txn costs one tx-fee. However, the costs are themselves 100% private3– no one knows, for sure, that you are going out of your way to pay-for-privacy. So the cost-differential is itself private, making it unobservable.

This is, incidentally, why it does not matter that TumbleBit and Dandelion are “more expensive” in that they require more CPU cycles (relative to “basic” LN-hubs or node-txn-rely). No one observes CPU cycles directly, and even if they could, observers couldn’t prove their observations to third parties. The CPU cycles, just like self-sending cycles, are done in private.

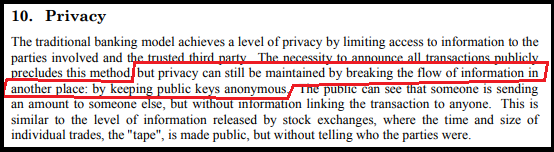

In fact, any fake txns that you broadcast will not only mix your coins, but they will also make the chain as a whole more incomprehensible. It is even (speaking very roughly) the privacy model advocated by Satoshi himself:

Column 3 contains privacy technologies that are more expensive to use. Thus, they will tend to be exclusively used by “the guilty”, as any innocent person has no reason to pay up4.

I am sorry to trod on other people’s hard work, but I don’t see any hope for the members of Column 3. While those techs certainly have academic value, and while they could certainly be stepping stones to greater technological improvement, they are unserious and should be discarded. Any talk of their use or implementation is perplexing at best. They are in the situation I outlined above, of Alice paying $5 to join the Bob-drama-club. These techs make no attempt to achieve the goal of privacy: to allow the Guilty to resemble The Innocent.

3. Applied to Bitcoin Itself

This critique –that expensive privacy unravels, Market-for-lemons style– can be easily applied to Bitcoin itself.

In fact, it’s so easy that a sitting US Congressman has already done so, on camera no less!

I give you the comments from Congressman Sherman on July 18, 2018, emphasis added:

“[Bitcoin] seems to be a solution looking for a problem. What can an honest citizen not do… I can be in the smallest hamlet in rural India, and use my VISA card. I’ve never had a problem paying somebody. …we have pretty efficient, mostly digital, transfers of dollars every day… So what’s the problem [that Bitcoin is] trying to solve? …unless I’m a tax evader or narco-terrorist. … I’m trying to illustrate that it [Bitcoin] is a solution, only to the problems of tax evaders, criminals, and terrorists. … the currency whose sole value is helping the before-mentioned ne’er do wells.”

As you can see, he lays out exactly the argument that I have been making. That Bitcoin will tend to be used “sole”ly by “ne’er do wells”, because it is marginally useful to them and marginally inconvenient5 for innocent people. And therefore that Bitcoin should be completely suppressed.

If we are interested in defending against this argument, then Bitcoin must do something else for ‘the Innocent’.

The obvious choice is for Bitcoin txns to be cheaper, because everyone prefers having more money to having less money. Unfortunately, this choice has become needlessly controversial with the rise of the Great Scaling Dispute.

Another choice would be to emphasize Bitcoin’s use in anything hitherto-impossible, such as “smart contracts”. Unfortunately, any “smart contract” could be turned into a more-straightforward dumb contract, using the formula “smart_contract = dumb_contract + ( brand_name OR judicial_system ). And so these transactions would not truly be “hitherto-impossible”, and so Sherman’s critique [that Bitcoin is useless for Innocent people] would still apply.

Footnotes

- Especially after they are merged with blockchain identity technology. ↩

- In my upcoming Introduction to Game Theory, I will describe the surprisingly extreme power of the “status quo” or “defaults”. ↩

- Assuming, of course, that you take appropriate internet privacy precautions when physically broadcasting the transactions. For example: broadcasting these transactions while connected to a VPN, or to TOR, or while behind several proxies, or at the public library, etc. (I say “physically” because electromagnetism is physics.) ↩

- Other than idealism. In other words, these privacy techs may be used by a few almsgiver privacy-advocates. But this simply cannot scale. Oover time, regular users will defect to the cheapest and easiest-to-use technologies (as they should), and so the use of awkwardly-expensive technologies will look more and more suspicious. ↩

- We can see that Innocents today place a high premium on convenience, as many use the Venmo app and maintain its default “everything public” privacy settings. ↩

PoW is Efficient

By Dan Held

Posted September 14, 2019

Foreword

Most people think #Bitcoin’s PoW is “wasteful.” In this article, I explore how everything is energy, money is energy, energy usage is subjective, and PoW’s energy costs relative to existing governance systems. This article is a collection of direct thoughts from many individuals in the space — my value-add was in the aggregation, distillation, and combination of narratives.

Work is Energy

The idea of “work” being energy started when the French Mathematician Gaspard-Gustave de Coriolis introduced the idea of energy being “work done.” A long time ago, the work done in the economy was entirely human. That work was powered by food.

About a million years ago, humans stumbled across fire. As a result, the energy available to us increased because now we could keep warm not just from what we ate but also from burning. So this added energy usage improved our standard of living.

Some thousands of years ago, our energy usage increased still further when we domesticated animals. Animals could labor in our place. Those new laborers also had to be fed. Large amounts of food were required to meet the energy demand, and our prosperity increased alongside.

In the last few hundred years, we built great machines. Those mechanized machines produced work, first from sources like water & wind, and then the cheaper sources like coal and gas, and now from nuclear sources (fission/fusion). Both machines and nature produce work through the utilization of energy. We have an economy based not on money, but on work and energy.

All things in our lives are closely linked to the price of energy. Purifying water requires energy. Transporting products requires energy. Manufacturing products requires energy. Cooking requires energy. Refrigerators and freezers require energy. In a free market, the cost of any good largely reflects the energy used in producing that good. Because free markets encourage the lowest priced goods, the energy used in producing any good is minimized. Money, which is the representation of the work required to generate goods and services, can also be viewed as stored energy.

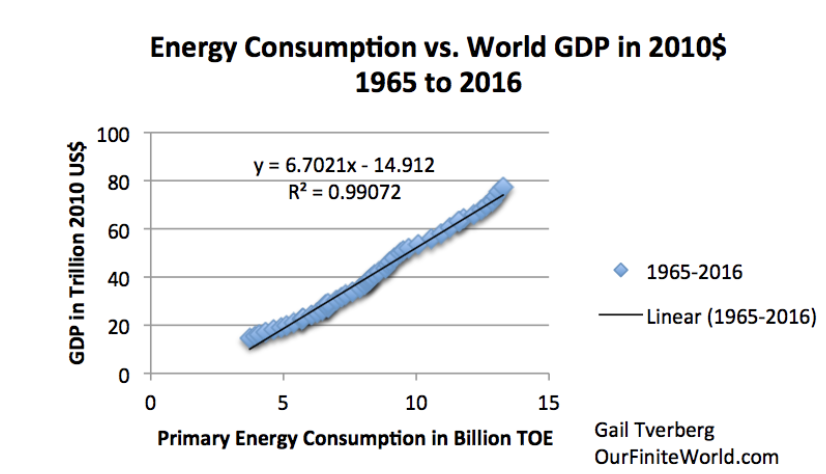

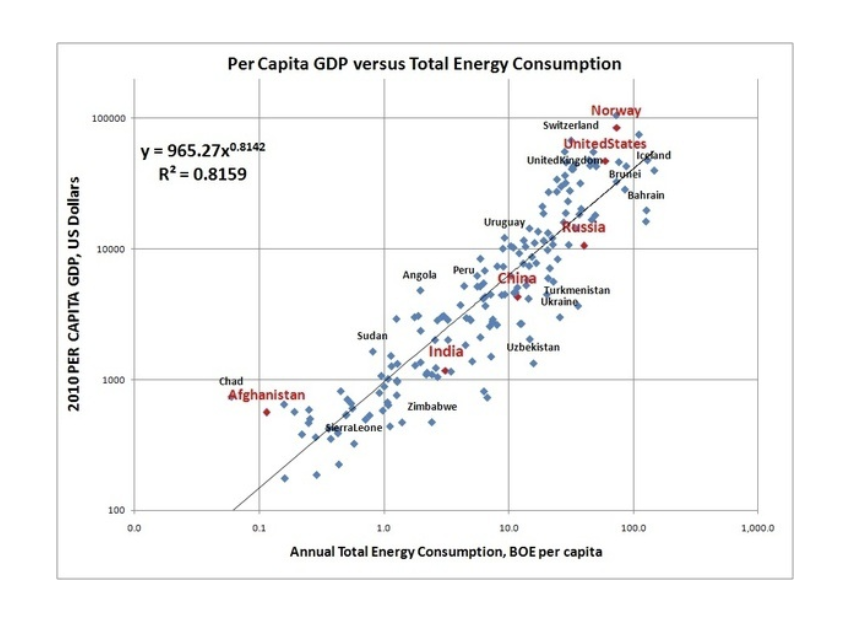

World GDP in 2010$ compared (from USDA) compared to World Consumption of Energy (from BP Statistical Review of World Energy 2014).

World GDP in 2010$ compared (from USDA) compared to World Consumption of Energy (from BP Statistical Review of World Energy 2014).

In the early 20th century, industry leaders like Henry Ford and Thomas Edison were interested in replacing gold or the dollar with “the energy dollar” or “units of energy” (commodity/energy currency). The concept was popular due to its sound money characteristics, including: a well-defined unit of account, easy measurement/not easily counterfeited, divisibility into smaller units, and fungibility (that these units would be equivalent to any other unit). However, energy money was flawed — it could not be transmitted or stored easily.

“that in order to make a man/woman covet a thing, it is only necessary to make the thing difficult to attain.” — Mark Twain

Fast forward to October 31, 2008 — Satoshi publishes the Bitcoin whitepaper. Bitcoin’s Proof of Work (PoW) was originally invented as a measure against email spam. Only later did Satoshi adapt it to be used in digital cash. What PoW mining does under the hood, is use dedicated machines (ASICs) to convert electricity into Bitcoins (via block reward). The machine repeatedly performs hash operations (guesses/votes) until it solves a cryptographic puzzle and receives Bitcoins (block reward). The solution to the puzzle proves that the miner spent energy in the form of ASICs and electricity, a proof that a miner put in work. Bitcoin has a capitalistic voting mechanism, “money risked, votes gained” through the energy/ASICs used to generate hashes (votes). — Hugo Nguyen

When Satoshi designed PoW, he was fundamentally changing how consensus between humans is formed from political votes to apolitical votes (hashes) via the conversion of energy. PoW is proof of burn, or the validation that energy was burnt. Why is that important? It’s the most simplistic and fair way for the physical world to validate something in the digital world. PoW is about physics, not code. Bitcoin is a super commodity, minted from energy, the fundamental commodity of the universe. PoW transmutes electricity into digital gold.

The Bitcoin ledger can only be immutable if and only if it is costly to produce. The fact that Proof of Work (PoW) is “costly” is a feature, not a bug. Until very recently, securing something meant building a thick physical wall around whatever is deemed valuable. The new world of cryptocurrency is unintuitive and weird — there are no physical walls to protect our money, no doors to access our vaults. Bitcoin’s public ledger is secured by its collective hashing power: the sum of all energy expended to build the wall. And through its transparent costly design, it would take an equivalent amount of energy to tear it down (unforgeable costliness).

Energy Consumption

The cryptopocalypse is coming — Bitcoin’s (PoW) is so bad that it’s going to destroy the world in 2020! You may have noticed that most of the “doomsday” articles were based on the results of an analysis provided by Alex De Vries, a “financial economist and blockchain specialist” working for PWC Netherlands and author of the site Digiconomist. His estimation has already received a fair share of criticism due to its poor energy consumption calculation. But the KPI of his choosing was intentionally misleading: “the electricity consumption per transaction” for several reasons:

- The energy spent is per block, which can have a varying number of transactions. More transactions does not mean more energy

- The economic density of a Bitcoin transaction is always increasing (Batching, Segwit, Lightning, etc). As bitcoin becomes more of a settlement network, each unit of energy is securing exponentially more and more economic value.

- The average cost per transaction isn’t an adequate metric for measuring the efficiency of Bitcoin’s PoW, it should be defined in terms of the security of an economic history. The energy spend secures the stock of bitcoin, and that percentage is going down over time as inflation decreases. A Bitcoin “accumulates” the energy associated with all the blocks mined since its creation. LaurentMT, a researcher, has found empirically that Bitcoin’s PoW is indeed becoming more efficient over time: increasing cost is counterbalanced by the even greater increasing total value secured by the system.

Now that we know what the right KPI is for ROI on energy consumption, let’s take a look at how energy costs are trending for Bitcoin’s PoW.

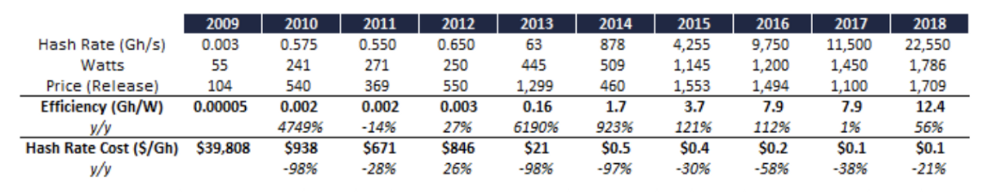

The rate of ASIC efficiency improvement is slowing. As efficiency gains slow we can expect an increase in manufacturer competition as margins narrow.

https://cseweb.ucsd.edu/~mbtaylor/papers/Taylor_Bitcoin_IEEE_Computer_2017.pdf_

https://cseweb.ucsd.edu/~mbtaylor/papers/Taylor_Bitcoin_IEEE_Computer_2017.pdf_

https://research.bloomberg.com/pub/res/d3bgbon7nESTWTzC1U9PNCxDVfQ

https://research.bloomberg.com/pub/res/d3bgbon7nESTWTzC1U9PNCxDVfQ

All-in mining cost will shift from the upfront accessibility cost of ASIC hardware (capex) to the ongoing energy costs to operate (opex). Since the physical location of mining centers is not important to the Bitcoin network (they are movable), miners flock to areas generating surplus electricity for the lowest marginal costs. In the long-run, this has the potential to produce more efficient worldwide energy markets with Bitcoin miners performing an arbitrage of electricity between global centers. The cost of Bitcoin mining becomes the lowest (excess) value of electricity. This may solve a problem with renewable energy sources that have predictable capacity that is otherwise wasted, like hydro and flared methane. In the future, Bitcoin mining could help with renewable energy sources that have variable output — energy producers can plug in miners, and store the excess power as bitcoin.

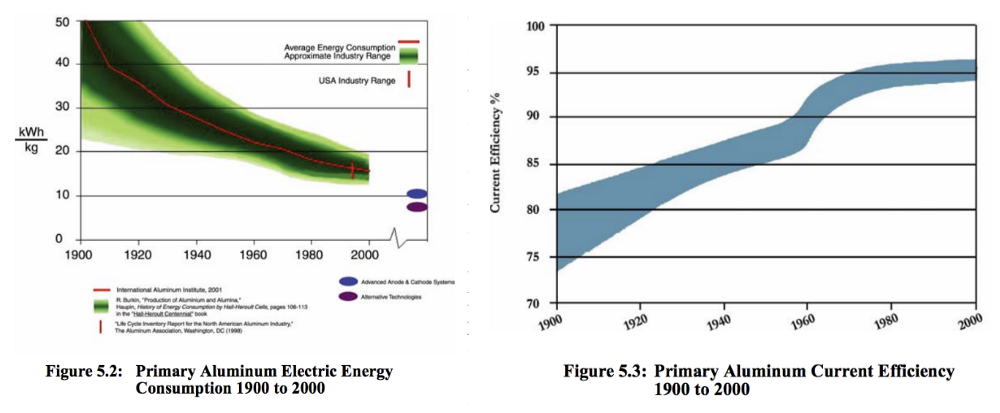

Aluminum was a popular means of “exporting” electricity from a country with abundant renewable energy resources that are stranded (ex: Iceland). Smelting bauxite (aka aluminum ore) has huge energy requirements, and converting that into aluminum is a one way function (just like a hash). The same concerns around “unfair” energy consumption existed for aluminum nearly 40 years ago — 1979 (including concerns of centralization). All of these companies constantly scoured the planet for cheap power and other concessions. As aluminum manufacturing matured over the decades, the kWh per Kg of aluminum produced became more efficient.

https://www1.eere.energy.gov/manufacturing/resources/aluminum/pdfs/al_theoretical.pdf

https://www1.eere.energy.gov/manufacturing/resources/aluminum/pdfs/al_theoretical.pdf

“This global energy net liberates stranded assets and makes new ones viable. Imagine a 3D topographic map of the world with cheap energy hotspots being lower and expensive energy being higher. I imagine Bitcoin mining being akin to a glass of water poured over the surface, settling in the nooks and crannies, and smoothing it out.” —Nic Carter

Bitcoin’s PoW is the buyer of last resort for all electricity, creating a floor that incentivizes the building of new energy producing plants around disparate energy sources that would have otherwise been left untapped.

“When will the energy used for PoW stop growing? Precisely when enough energy producers have started doing PoW directly that the marginal return from burning a kWh of energy through PoW = the marginal return from selling that kWh to the grid — when the “premium” on PoW is reduced to zero. I call this equilibrium the “Nakamoto point.” I suspect PoW will use between 1–10% of the world’s energy when this equilibrium is reached.” —Dhruv Bansal

Some complain that Bitcoin mining doesn’t accomplish “anything useful” like finding prime numbers. While introducing a secondary reward for doing the work might seem like a virtuous idea, it actually introduces a security risk. Splitting the reward can lead to a situation where “it’s more worthwhile to do the secondary function than it is to do the primary function.” Even if the secondary function was innocuous (a heater), instead of an expected $100 per x hashes, we’d move to $100 + $5 of heat per x hashes. The “Mining Heater” is just another increase in hardware-efficiency, resulting in a higher difficulty and an increase in (energy used/block). Luckily, Bitcoin will never have this problem as its security is guaranteed by the purity of its proof-of-work algorithm.

Note: Bitcoin is already doing something immensely useful for society (mining wouldn’t be profitable if it wasn’t), and it isn’t rational to ask miners to perform a function that is altruistic without incentives.

Relative Costs

Everything requires energy (first law of thermodynamics). Claiming that one usage of energy is more or less wasteful than another is completely subjective since all users have paid market rate to utilize that electricity.

“If people find that electricity worth paying for, the electricity has not been wasted. Those who expend this electricity are rewarded with the bitcoin currency.” —Saifedean Ammous

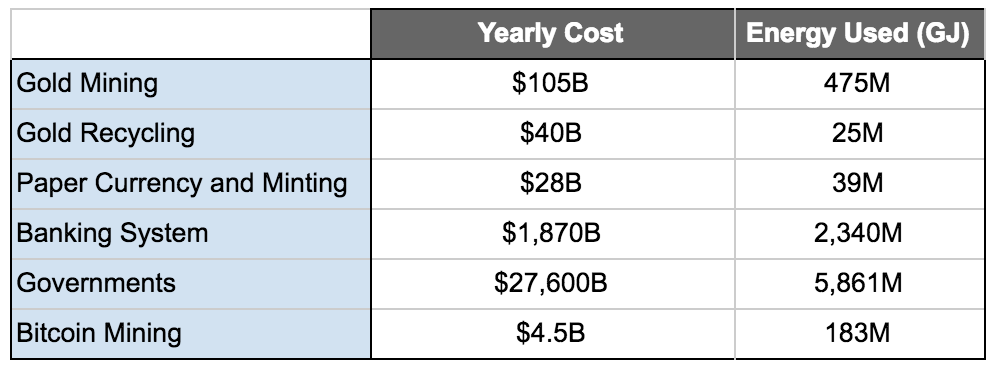

In thermodynamics, the universe is the ultimate closed system. Bitcoin’s utilization of the excess electrical capacity consumes magnitudes less electricity than existing fiat systems which not only have power requirements banking infrastructure, but the military and political machina. The energy tradeoff for the utilization of that electricity to secure the financial system backbone is a “net positive” outcome. Below I make a rough comparison to the existing financial, military, and political systems (notes are at the bottom of the article)

Type I Civilization

In the hunt for cheap energy sources, we will unlock greater economic abundance in the real world. Bitcoin, through the harnessing of these new or disparate energy sources, not only moves us forward to a Kardeshev Type I economy but may bring us closer to a Kardeshev Type I energy civilization (We’re ~ 0.72 on the Kardashev Scale). With Bitcoin mining as an incentive, it may shrink the time we get to T1 from 200 years to less than a few decades. After reaching Type I status, there is less of a need to restrict the growth of energy consumption, which increases the standard of living for everyone.

The pressure to find cheap electricity sources will accelerate the effort to build fusion reactors. Nature is showing the way, powering the whole universe with nuclear fusion (stars). Humans are in the process of emulating nature by building fusion reactors. It is estimated that it will take ~ $80B in research over decades to finally unlock nuclear fusion. The fuel for fusion (primarily deuterium) exists abundantly in the Earth’s ocean which could potentially supply the world’s energy needs for millions of years. Fusion power has many of the benefits of renewable energy sources, such as being a long-term energy supply and emitting no greenhouse gases or air pollution. Fusion could provide very high power-generation density and uninterrupted power delivery. Another aspect of fusion energy is that the cost of production does not suffer from diseconomies of scale. The cost of water and wind energy, for example, goes up as the optimal locations are developed first, while further generators must be sited in less ideal conditions. With fusion energy, the production cost will not increase much even if large numbers of stations are built, because the raw resource (seawater) is abundant and widespread.

“Water, water, everywhere, Nor any drop to drink.” — Samuel Taylor Coleridge

Fusion power and other cheaper energy sources will solve major problems for humanity like fresh water shortages. We are surrounded by seawater, but desalination stations, which remove salt from the seawater, require large amounts of energy. Costs of desalinating seawater are currently higher than freshwater, groundwater, water recycling, and water conservation.

Humankind’s will to explore, up the mountains, down to the sea floors, to the heart of the atom, to the very fabric of space-time; to grow, not be stifled by a limit to energy. We will reach for the stars.

Is the trustless settlement of $1.34T between counterparties annually with the added benefit of cheaper energy for all, worth the $4.5B in current mining costs? I think the answer is a resounding yes.

If you enjoyed reading this please:

1/ Follow me on Twitter.

2/ Sign up for my weekly newsletter which contains my distilled thoughts of the week

3/ Check out my other articles 👇

- Planting Bitcoin Sound Money (sanum pecuniam) medium.com

- Bitcoin’s Distribution Was Fair _ Debunking FUD_ blog.picks.co

- Hodlers are the revolutionaries My reflections on the important role hodlers play in developing Bitcoin’s network (and other cryptocurrency networks). tokeneconomy.co

Notes:

- All costs are in USD

- “Governments” are the total annual expenditures including military spending

- In 2006, the DoD used almost 30,000 gigawatt hours (GWH) of electricity, at a cost of almost $2.2 billion

- Global military spending annually is ~ $1.7T

- Initial research this analysis was based on

- Gold mining, banking system, gold recycling costs are all estimates from 2014

- Banking system and government estimates are a combination of annual expenses which includes electrical cost

- US energy usage as % of world

- US federal government energy expenditures

- Bitcoin Mining Costs

- $63.8B a year is spent on electricity alone for the banking system

- Bitcoin has had 0 recorded worker deaths, whereas gold has had 50,000 recorded deaths over the last 100 years

- Inflation for fiat currency has been approximately 2–3% annually which is a stealth tax that erodes savings. The costs are enormous to calculate and are not included

- Bitcoin isn’t issued by a government, there is little to no corruption involved in distribution

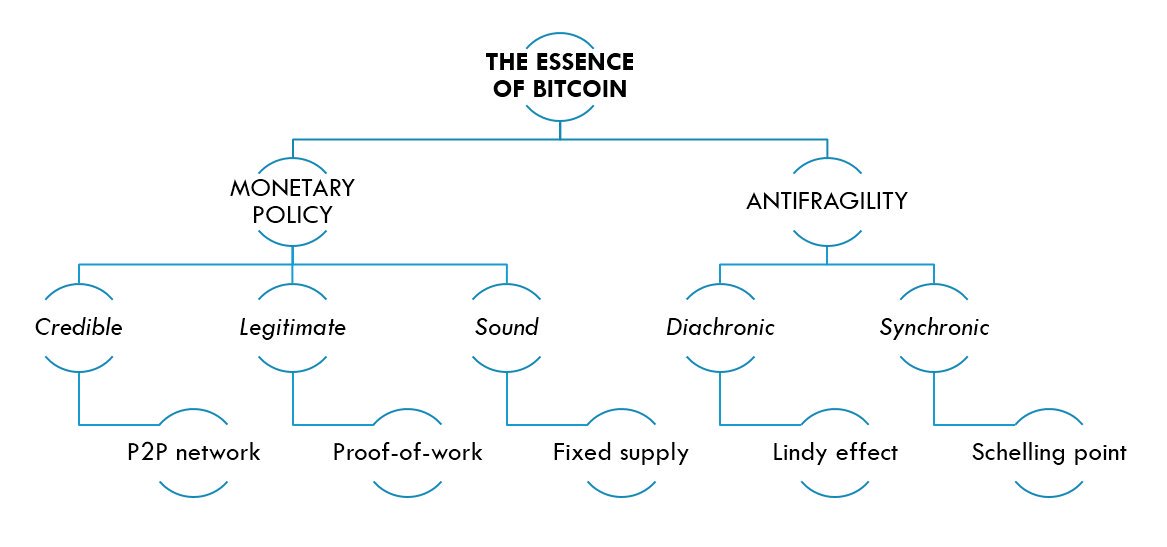

The Essence of Bitcoin

By David Puell

Posted September 14, 2018

For the newbs or the shitcoiners, the essence of Bitcoin in a simple graph.

(Based on @pierre_rochard.)

Bitcoin as a store of energy

By JP Thor [ ₿ ⚡️]

Posted September 15, 2018

Bitcoin is a fascinating new asset class that we are only just barely beginning to understand. This article is one of a multi-part series that I want to explore about how the world can transition to the Bitcoin Standard; where BTC is used as the liquidity of the global economy instead of the current status quo (USD).

I’ll discuss Bitcoin as a Store of Value and how that relates to energy. I’ll then outline global energy production trends and problems. I’ll then do an analysis on how Bitcoin can be used to compliment and augment energy production as a means to transmit energy from low cost regions to high cost regions, and what it may look like for Australia’s energy grid.

We are beginning to see how Bitcoin can be used as a store of value (SoV). For almost a year now BTC has maintained a value higher than $5000 a unit, and 18 months for higher than $1000 a unit. Going deeper we can see that Bitcoin is actually a store of energy, as it consumes electricity in the most efficient manner possible via the actions of self-interested profit-seeking mining operators. As Bitcoin is created from coinbase rewards that can only be performed by miners, the value of that Bitcoin is invariably related to the amount of work that was performed in creating the Bitcoin, which requires energy expenditure. The combination of mathematically defined supply and proof-of-work is the strongest case of Bitcoin’s SoV argument.

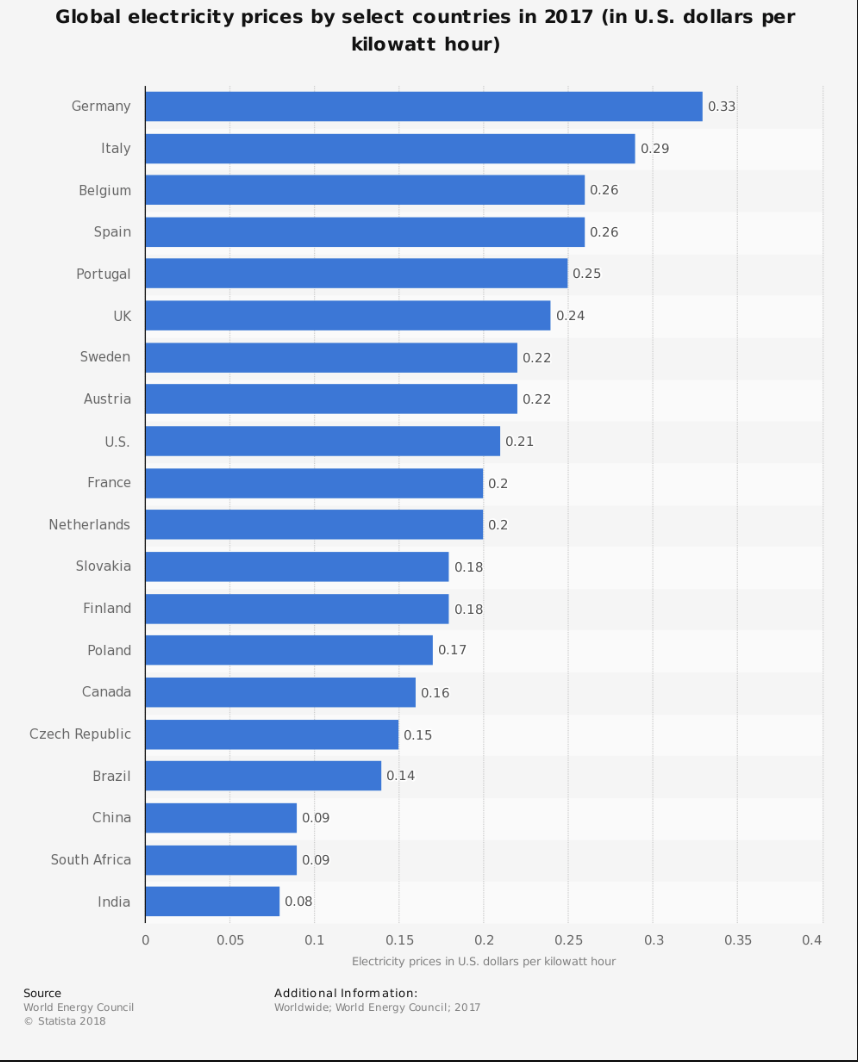

Global Electricity Prices

There is a massive disparity in global electricity prices, ranging from less than 10c kwh in some countries, to over 40c kwh in others. This can all be attributed to the differences in regional electricity production costs, exacerbated by the cost of transmission.

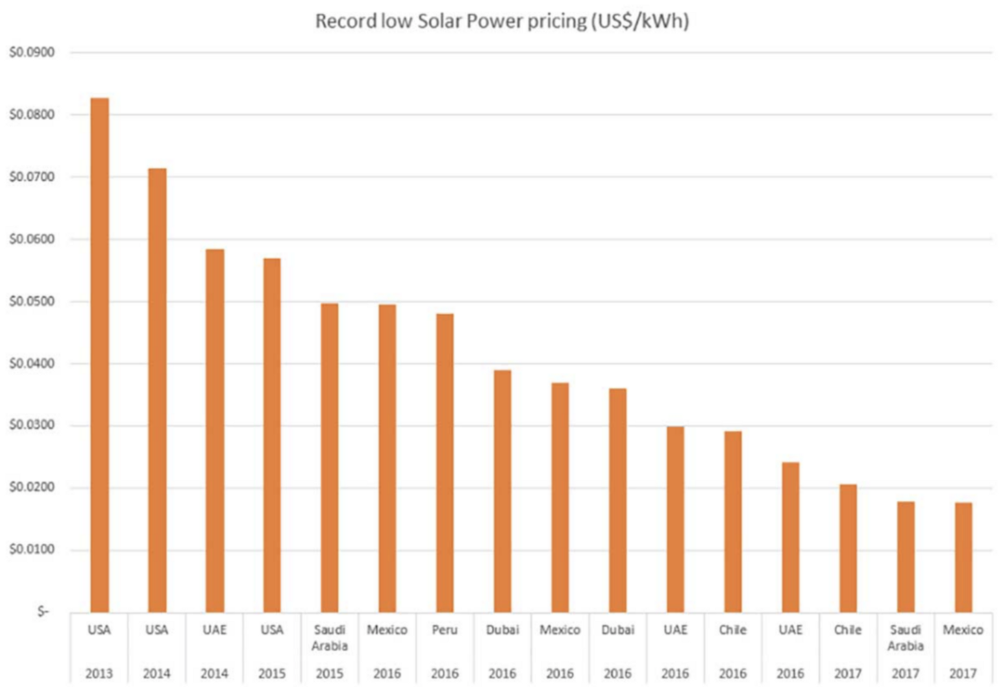

However, these prices are far higher than what can be achieved through renewable sources, in particular Solar PV:

In 2018 ACWA Power won a bid to deliver a 300MW Solar plant at a cost of $300m with energy production pegged to 2.34c kwh. A bid by Enel for a similar sized plant in Mexico was at a pegged price of 1.77c kwh.

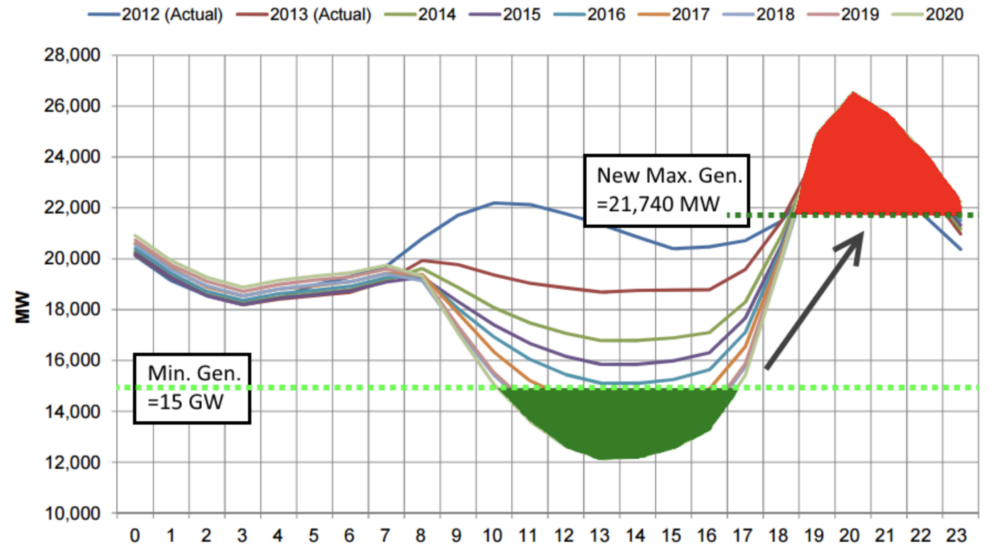

Energy Production and the Duck Curve

Energy production follows the “duck curve”, where the variable generation of energy across a day does not match the variable demand. Without some way to store, energy production must be adjusted to match demand, resulting in very expensive infrastructure such as peaker plants to compliment peaks of demand and load banks to shed energy when demand is below baseload. The baseload is the minimal amount of energy a grid must generate “at idle” to prevent infrastructure being turned off, which is expensive and damaging.

A Stanford study into Californian Energy Generation and Demand cycles

A Stanford study into Californian Energy Generation and Demand cycles

It is clear that energy can easily be produced in very large quantities for very cheap prices in the right regions. However, the issue is in transmitting this energy to the regions where it is needed. Enter Bitcoin.

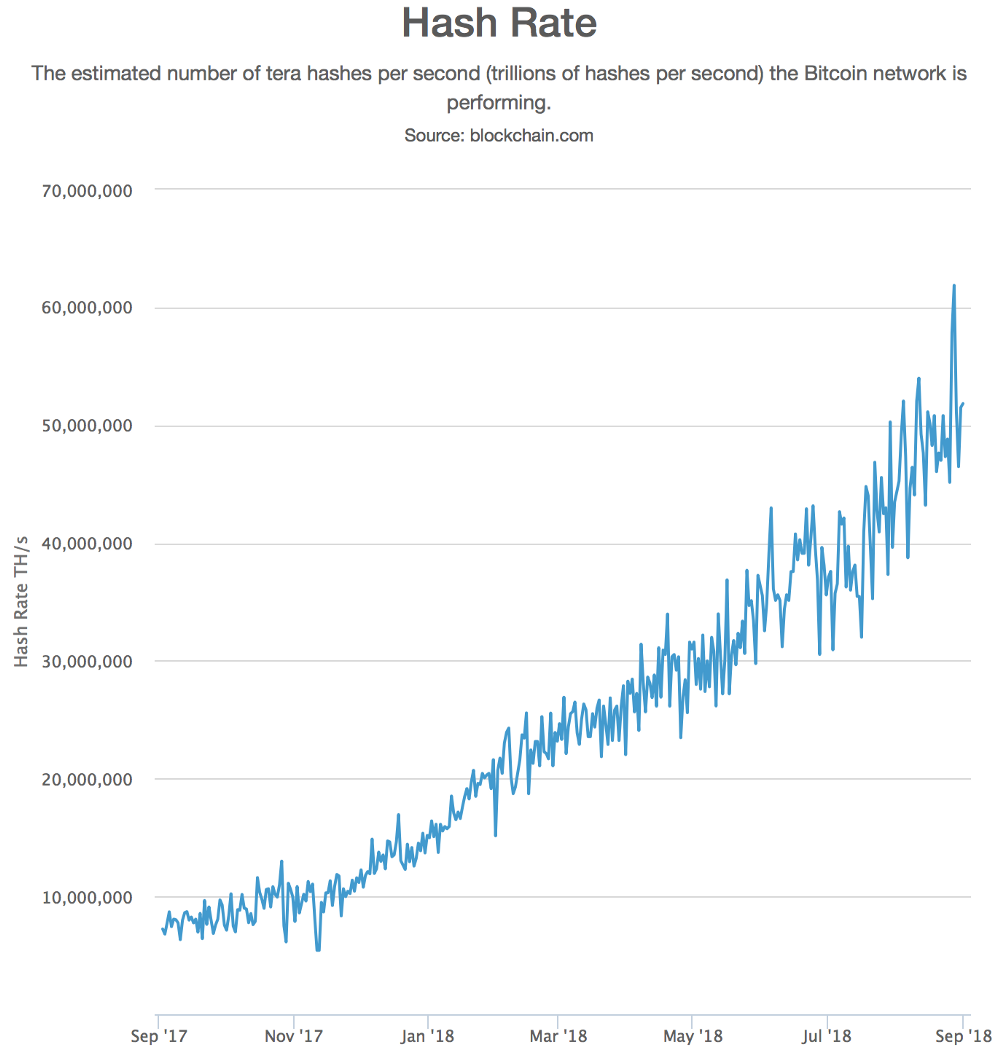

Bitcoin Hash Rates

There is a continual increase in Bitcoin hash rate; which is an indirect metric of how much infrastructure is invested into and maintains the network at any given moment. Over the last year, despite any price volatility, the hash rate has increased 6 times, from 10 exa-hash to 60 exa-hash.

For every day that it is more profitable to mine a single Bitcoin and sell it than the amortized cost of infrastructure and the cost of electricity that goes into mining it, hash rate will be added. It is a very simple equation.

Analysis

The question is whether Bitcoin can be used to effectively absorb energy in one location and transmit it to another region to release that energy. We will do an analysis around a $300m energy contract with two scenarios:

- Spend $300m on a Gas Power Plant in Australia.

- Spend $100m on a Bitcoin mining farm in a low cost solar plant and $200m on an initial solar plant with storage, then using Bitcoin energy revenue to continue augmenting the growth of the plant.

Using existing data, the following are real-world numbers:

$300m Gas Power Plant yields 210Mw of peak power.

$150m on Solar yields 100Mw of power, with $50m in storage to store 60MW.

For this analysis we will use the following assumptions around the Antminer S9 with a realistic wholesale cost of $1000/unit (Bitmain are currently selling them off in a firesale less than $400):

- Bitcoin: $7000 USD

- Average cost of Antminer S9:$1000

- Output of Antminer: 14.5Th/s

- Daily Energy Consumption: 32kwh

- Daily Bitcoin produced: 0.000542

We will also use the following assumptions around a mining farm that would be built to consume energy from a low cost solar plant:

- Total farm cost: $100m

- Mining Equipment: $90m

- Fixed infrastructure: $10m

- Years of operation: 3 years

- Daily amortized infrastructure cost: $90k

- Total Antminers: 100,000

- Total Bitcoin produced a day: 50 BTC

- Total Daily Revenue: $170k

- Total mining reinvestment: 50% Profit

- Total Daily profit realised: $80k

- Total Daily electricity consumption : 2,948,400 kwh

- Total Daily Hash Rate: 2% of total hash rate

- Farm Size: 122 MW

- Electricity Cost Break-even: 5c kwh

Over 3 years, half of the daily profit from the farm is used to reinvest back into more mining infrastructure to prevent dilution against increasing hash rate. This leaves $80k of daily profit to be immediately transmitted back to Australia. This profit can then be used to either reinvest in the growth of the Australian solar plant, or by reducing the retail cost of electricity by over half.

- Reinvesting into growth of solar plant

If reinvested, a total of $100m more is collected over 3 years (assuming no further increase in Bitcoin value). This would allow the solar capacity of the plant to be doubled.

- Reducing cost of electricity

Assuming that solar energy can be retailed at 10c kwh in Australia, a profit-generating farm would allow the retail cost of electricity to be reduced by more than half by subsidising the cost of retail electricity.

Summary

These are significant figures in a world of marginal improvements. It was shown that energy cost can be arbitraged between two different regions by simply using Bitcoin mining to consume it in one area, and produce it in another via liquidation to local currencies and investment into infrastructure.

Currently Bitcoin mining consumes around 40,000,000 MWh, which is roughly 0.2% of the world’s energy production. In the future it may consume around 10–20% of the world’s energy production, at least a 100x multiple from here, at the same time as supporting the world’s $80tn global economy, which is also a order of magnitude of 100 from where we are today.

In the next part I will discuss how the Lightning Network can be used by a self-sovereign country to completely power their economy and still collect consumption-based taxes fairly to run essential services. It will also be a look at how an economy can work in a low-inflation environment.

Electric Money

By LaurentMT

Posted September 17, 2018

“Do states dream of electric money ?” — Philip K. Dick (Reloaded)

So Electricity. Many Efficiency. (Blade Runner)

So Electricity. Many Efficiency. (Blade Runner)

No equation, no chart in this fourth part. Just a short discussion about the total cost of Bitcoin’s PoW. It will offer us the opportunity to introduce another fundamental property of PoW which makes it truly unique.

Is it really worth it ?

While our previous posts suggest that the efficiency of Bitcoin’s PoW has improved over time, they don’t address another source of concerns which is the total cost of the system.

Indeed, it seems legit to ask ourselves if this cost is really worth it. After all, we already know that alternate models (centralized systems, federations, etc) can be used for implementing monetary and/or payment systems and it’s often said that these models come with a lower environmental cost. If it’s really the case, why should we bother with a such expensive system ?

Centralized and federated systems

Let’s first focus on alternate models relying on centralized or federated parties acting as block builders. The details will depend on the exact model but it’s easy to understand that in these systems, the centralized party or a large enough fraction of the federation is always able to prevent a new actor from joining the system. By design, these systems allow incumbents to indefinitely maintain their dominant position and to enforce arbitrary decisions.

Proof of Stake

Since they are often touted as serious challengers of Proof of Work, let’s now consider alternate models based on Proof of Stake, Delegated Proof of Stake, etc.

At first sight, they seem better than the centralized or federated versions. Indeed, participation to the consensus is pseudonymous and it only requires that you have a stake in the currency. But here lies the issue with these models. With PoS and DPoS systems, a majority of incumbents is still able to prevent a new actor from becoming a leading player.

It means that in PoS and DPoS systems, a majority of incumbents still has the ability to indefinitely maintain its dominant position.

Proof of Work

With Proof of Work, the game is different. A lot has been written about the shortcomings of Proof of Work (cost, concentration of mining, suspicions of incumbents “playing dirty”, etc) but a fact remains:

PoW is intrinsically an open system.

It means that no coalition of incumbents can prevent a new actor from entering the game or even from becoming a leading player. Not even a coalition of 100% of the participants. Your position in this “competition” is always dynamic and it primarily depends on the energetic, financial and technological resources invested.

Because of this truly unique property, Bitcoin’s Proof of Work creates on the long term an open and dynamic playing field far more immune to unilateral political decisions (blockades, lock-out, etc) than any other existing digital system.

After 50 years of “hegemony” of the US dollar, if the ideas of digital gold and of a truly global currency must become a reality, it’s not unlikely that the ability to provide an open and dynamic playing field will increasingly be considered as a fundamental property for a globally acceptable system. I don’t expect that this conclusion will be natural for most governments and it’s likely that their first instinct will be to create national cryptocurrencies relying on a “Proof of Authority”. But as always, it’s hard to predict the future. Time will tell.

A last word about “efficiency”

Since the term efficiency is often used to explain how “X is more efficient than PoW”, it’s seems important to remind a few things about it.

Efficiency isn’t an absolute metrics. It isn’t something that you can define without a context. When we state that “X is more efficient than Y”, it’s implied that both X and Y produce the same expected results/properties but X wastes less resources. But it doesn’t make sense to state that “X is more efficient than Y” if it requires that X sacrifices important properties of Y.

And it’s precisely my issue with the trending assertions that “PoS (DPoS or whatever) is more efficient than PoW”. These statements conceal that this efficiency “gain” is the result of a trade-off sacrificing the intrinsically open nature of PoW.

On my side, I consider this property as a fundamental aspect of Bitcoin (if not the most important) and removing it from the system would clearly change the value proposition of the cryptocurrency. It doesn’t mean that there’s no room for alternative consensus and anti-sybil systems in the context of different specific use cases but these alternatives should clearly state the trade-offs being made.

I guess that the conclusion will be somewhat shocking for some people but the fact is that to date Bitcoin’s PoW is the most efficient solution in its category because it’s the only existing digital solution providing this property. It’s simple as that. Pending a breakthrough in Computer Sciences, our best roadmap for building a truly open and dynamic playing field is to continuously work on improving the utility of Bitcoin’s PoW, to encourage the use of renewable energies and to make sure that the positive feedback loop at the heart of the system is counterbalanced by negative feedback loops avoiding a runaway which might have very negative consequences.

Conclusion

This fourth part marks the end of this series dedicated to the properties and the efficiency of Bitcoin’s Proof of Work.

These articles have barely scratched the surface of the subject. To be honest, they’re mostly the result of an intellectual curiosity mixed with a high propensity to choose weird hobbies. I have little doubt that it should be easy to improve and generalize the model proposed in the first parts (just remove a few assumptions) or to come up with a better model.

My only wish is that this series has convinced you that many aspects of Bitcoin’s Proof of Work are still greatly misunderstood, be it by ignorance or on purpose. This subject is a greenfield remaining to be explored. Don’t be scared to go down the rabbit hole.

Acknowledgements

I wish to thank Yorick de Mombynes , @Beetcoin, Pierre P. and Stephane for theirs precious feedback and their patience :)

A great thank you to @SamouraiWallet and TDevD for theirs feedback and their support of OXT.

Bitcoin’s Inflation Adjusted NVT Ratio - An UpToDate Assessment

By cryptopoiesis

Posted September 18, 2018

Noon. Herd in the steppe by Arkhip Kuindzhi c. 1895

Noon. Herd in the steppe by Arkhip Kuindzhi c. 1895

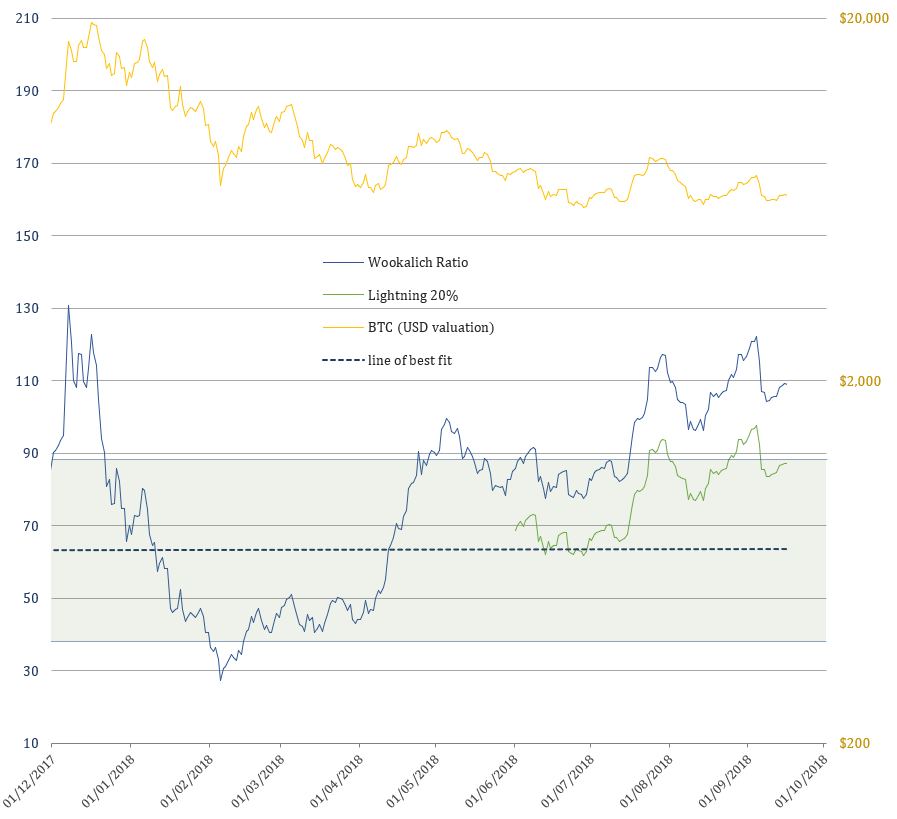

This analysis aims to take a closer look at the NVT Signal/Ratio adjusted for Bitcoin’s inflation in circulating supply, in the light of recent price developments and comparing it to the original NVT Ratio/Signal developed by Willy Woo and Dimitri Kalichkin. The data of these ratios, provides a good insight regarding the current market cycle, as well as a better understanding of the wider perspective in regard to the relevance & applicability of these metrics going forward.

” Bitcoin’s NVT Ratio Normalised for Inflation in the Circulating Supply” will be referred to as: Wookalich Ratio for short and as credit to the developers of the original NVT Ratio & Signal. Whether that will be welcomed or disapproved off, remains to be seen.

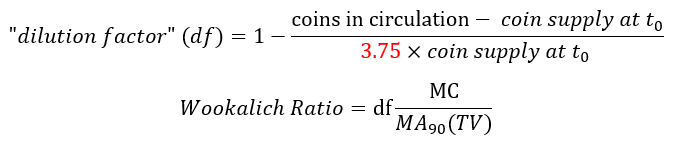

The rationale for adjusting the ratio was put forward in the article Bitcoin’s NVT Ratio Normalised for Inflation in the Circulating Supply .The Wookalich Ratio charted in this article differs slightly in methodology by further “normalising” / flattening the trend line: a denominator factor of 3.75 replacing the 4 in the equation bellow:

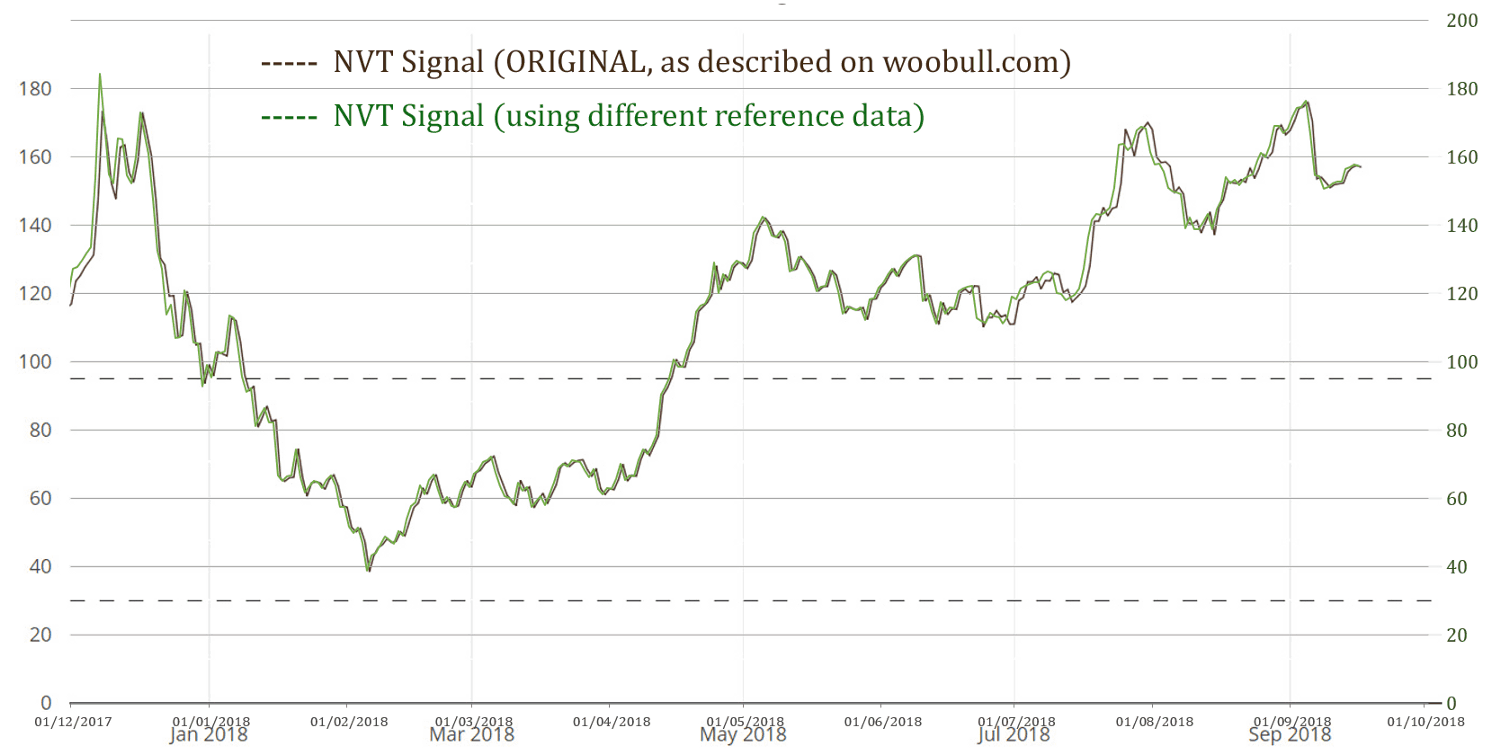

Furthermore, the Wookalich Ratio had been charted in this article using a different set of price, coin supply and market cap data. The graph below assesses the reliability of this data in comparison to that used to calculating NVT Signal on woobull.com :

From the above chart, it can be concluded that the data is compatible, giving a virtually identical NVT Signal. The one subtle, nevertheless constant, difference is the slightly (1 day) leading “bias” generated by this data. The rationale and the methodology used for this reference data are succinctly described in the article: What is the Price of Bitcoin, or its Market Cap…. exactly?

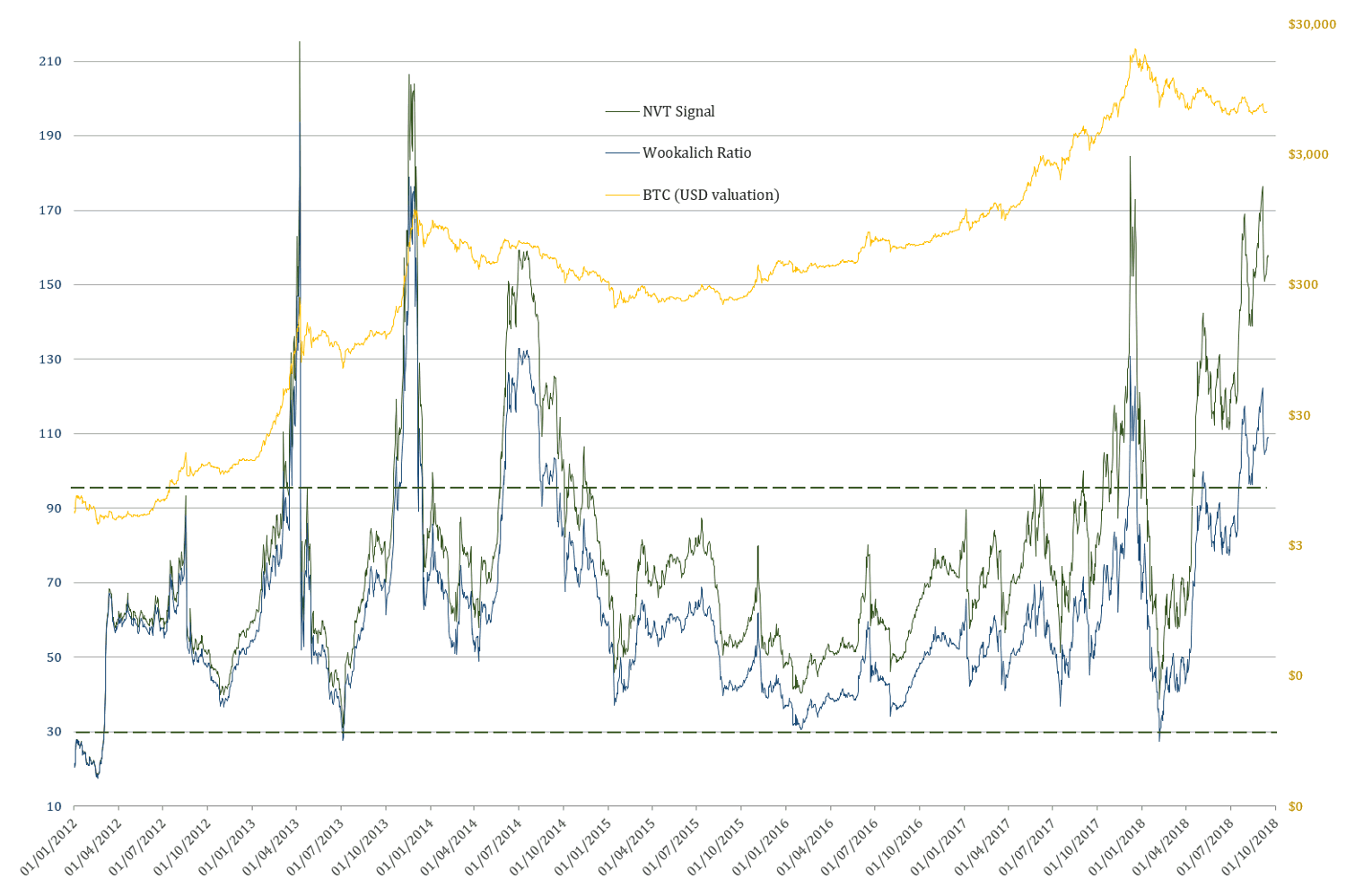

NVT Signal & Wookalich Ratio Overview

The Wookalich & NVT Ratios in all charts have been plotted against BTC dollar valuation instead of those of the Market Cap for the purpose of being more “user friendly”.

The Wookalich Ratio

2012 — Present

2012 — Present

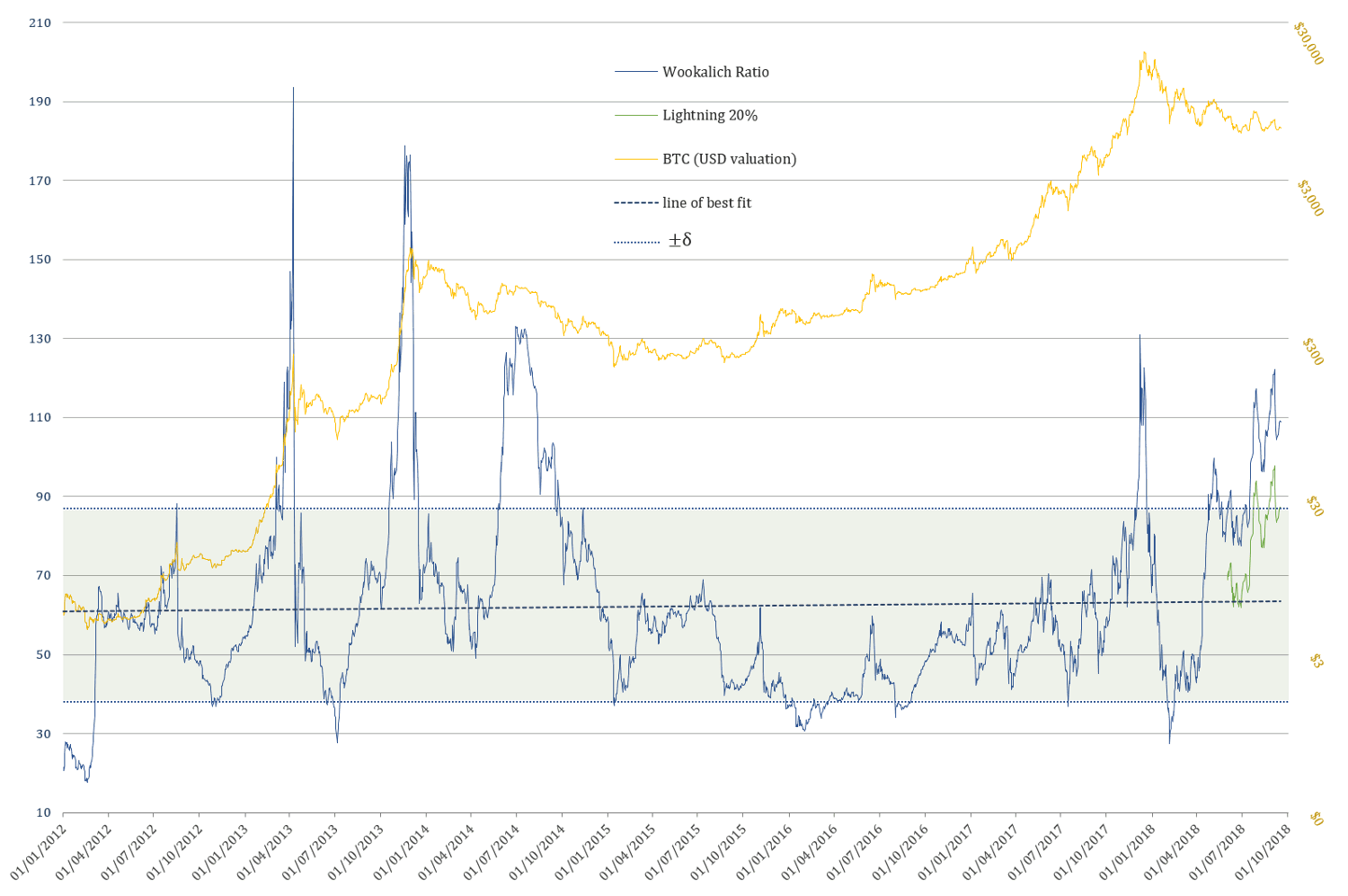

Wookalich Ratio properties:

- Average value (since 2012): 62.24

- Standard deviation from the mean (±δ): 24.48

- Upper bound (+δ): 86.72 & Lower bound (-δ): 37.77

Taking into consideration the levels at which the line of best fit is currently at the following approximate key levels can be determined:

- Wookalich Ratio average: 63

- Upper “overbought” bound: 88

- Lower “oversold” bound: 39

Discussion

If one is to expect an oversold condition, close to an NVT Signal level of 30, similar to the 2015 capitulation, the price would have to drop to c. $1239, tomorrow, as would be the case in the coming few weeks.

However, if an oversold condition is expected to mirror the NVT Signal levels of 40, as was the case in the first 2017 “capitulation”, the price would “only” have to drop to c. $1653.

As for the denominator side of equation, the value transferred over the network has been steadily declining for a while. Furthermore, the fact that a 90 day moving average is used in calculating the NVT Signal & Wookalich Ratio ensures that this trend is not bound to change in the near future.

Another reason that no considerable uptick is to be expected in the on-chain TV is the increasingly adoption of Lighting Network, which, so far, remains an unknown quantity in terms of its measurable effect on the overall TV.

If the large values are transferred by rich investors, speculators and exchanges, which until very recently would have had to be solely settled on-chain, now they have the option and every incentive to make use of the Lightning Network. The “smart money” can afford being smart, thus be managed with competency on the technical part as well.

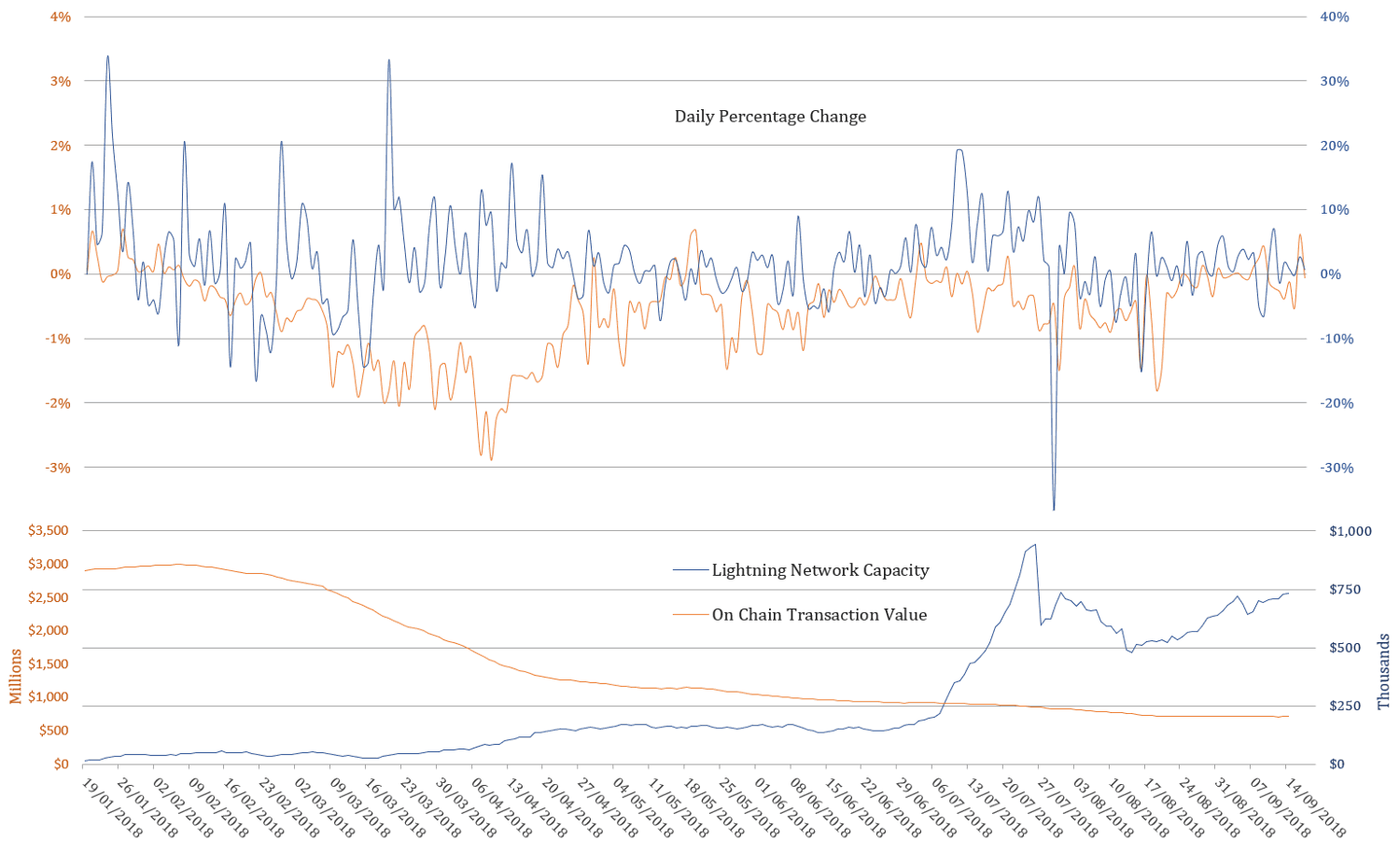

Note: On Chain Transaction Value and it’s percentage change refer to the smoothed 90d MA (as the one used in the ratios)

Note: On Chain Transaction Value and it’s percentage change refer to the smoothed 90d MA (as the one used in the ratios)

As highlighted in Brief Observations and Questions on the Lightning Network’s Effect on Bitcoin’s NVT Ratio, the Lightning Network Capacity is continuing to grow and does correlate with the on-chain TV (using percentage change). This can only be seen as proof that it is very much alive and kicking, mimicking the “on-chain behaviour”. Hence it has the potential to serve as proxy in estimating a more inclusive / overall transaction volume.

The Wookalich Ratio despite being “fudged” / normalised, it does not, however, offer any significantly less of a dire / bearish outlook. If one is expecting the metric to go into “oversold” territory (e.g. 1 standard deviation below the mean), tomorrow or in the coming weeks, the price would require taking a deep dive toc. $1615. If we are to assume that Lightning Network capacity handles 20% of the overall value transfer, the same “oversold” threshold would be reached at c. $2918.

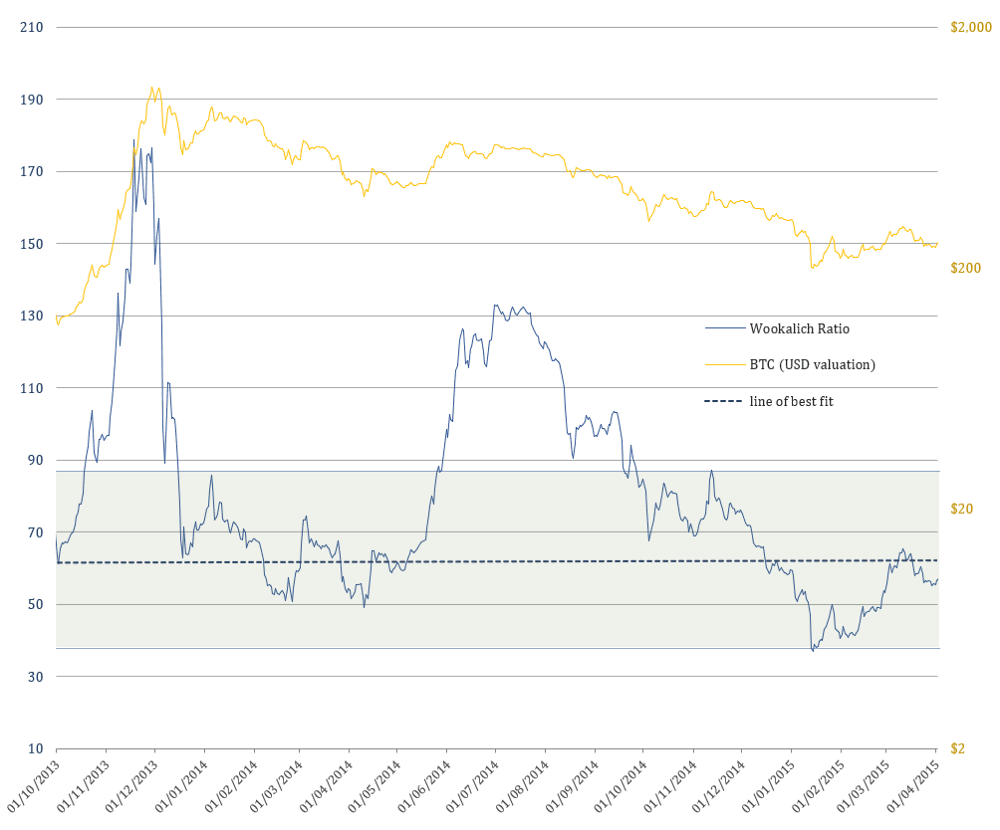

Looking back for clues into a more volatile past

2014 Bear Market

2014 Bear Market

The Wookalich Ratio could, however, signal an “oversold” level in the coming weeks, without a dramatic free fall in price, only if we are to assume the possibility that the lightning network takes care of approx. half of the overall value transfer. In this scenario an oversold level would be reached by dropping to a value of c. $4671 as of today.

Looking down a cliff or across the plains in the middle of nowhere?

2018 Bear Market

2018 Bear Market

Conclusion

If the Wookalich or NVT Signal /Ratio are to serve any purpose in the future, a method of quantifying and incorporating the transaction value over the Lightning Network would be essential.

Settling just for the on-chain transaction will increasingly make this metric less relevant, much like trying to assess combustion engines in terms of horsepower and continuing to attempt to match it against that of an actual horse.

The Lightning Network Capacity could serve as a proxy metric in estimating a more inclusive TV. To what extent however, remains to be answered.

Acknowledgements

- Willy Woo

- Dmitry Kalichkin & Cryptolab Capital

Disclaimer

The content is only to be take as my personal observations and opinions for the purpose to be further considered, answered or discarded, hence this article is far from exhaustive and IS NOT and CANNOT serve as basis for any financial / investment / trading advice.

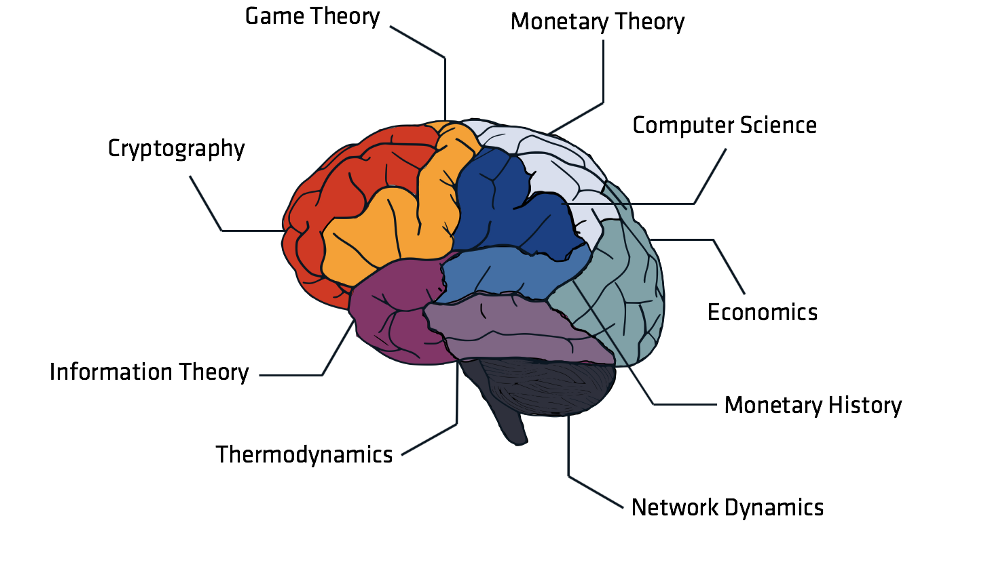

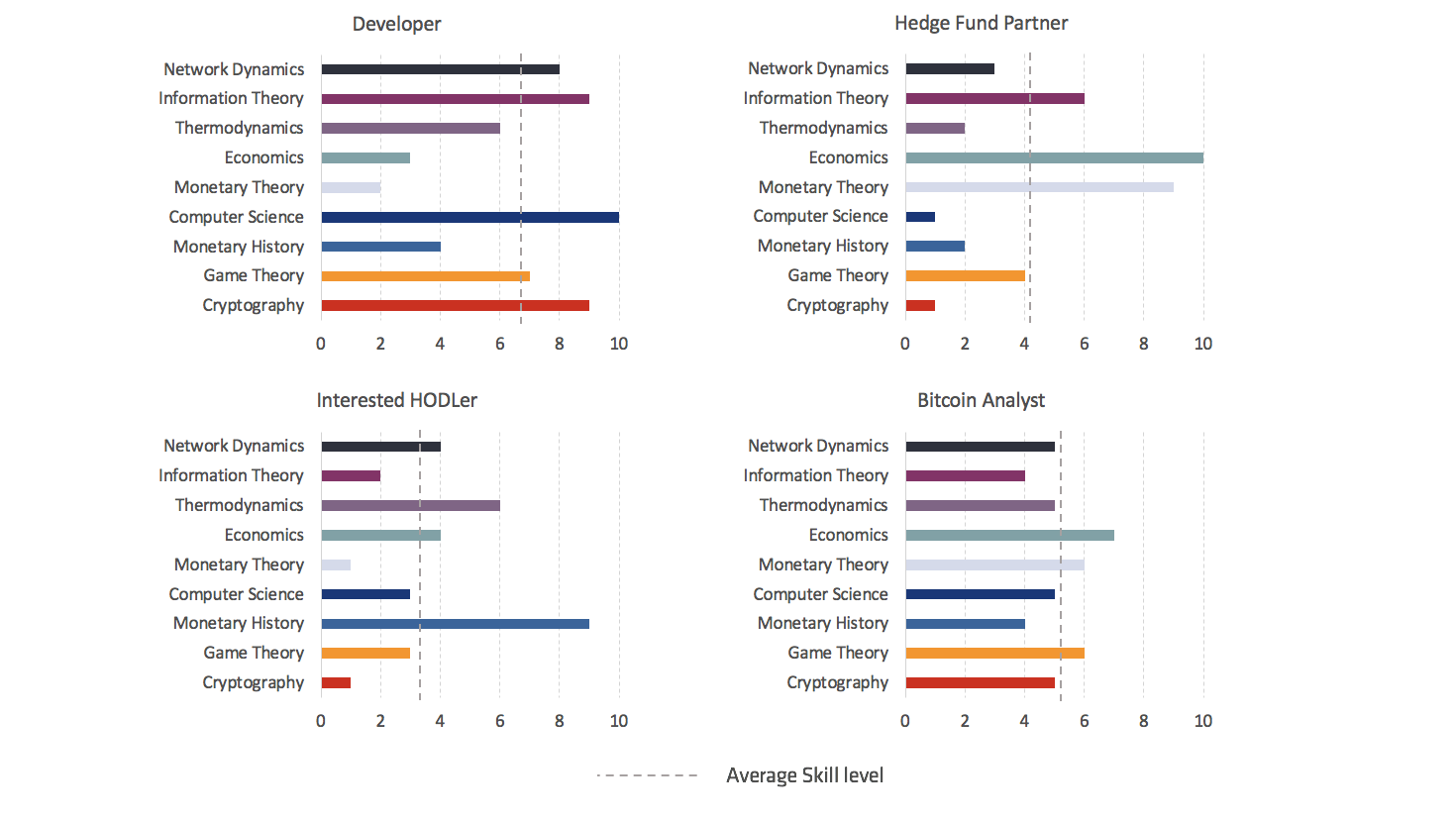

The Bitcoin Analyst Brain: A Primer

By Christopher Bendiksen

Posted September 19, 2018

The industry is in building mode and I love it. It almost even smells like a giant construction site. I kinda want a Bitcoin hard hat.

Institutions are building too, but they are huge, slow-moving beasts whose motions can seem imperceptible against the fury of the Bitcoin anthill. Don’t be fooled though, there is activity happening and their (not to mention their clients’) thirst for information is ever growing. Which brings us to the very topic of this post.

One of the next developments we foresee is the initiation and increased frequency of Bitcoin coverage by financial research desks. This will in turn necessitate the hiring or re-training of a new wave of Bitcoin analysts to fill these new requirements of skills and knowledge.

That is why we are creating a Bitcoin Analyst series geared at training interested readers and the next wave of budding Bitcoin analysts. Our intention is to help readers “level up” in all the areas that are critical to understanding this emerging digital asset class and the technology on which it is built.

Perhaps you will become one of these new analysts. Or maybe you’re just really interested in going deep into Bitcoin so you can humble that insufferable blockchain guy at your next dinner party. In any case, finding this article means you’re already on the right track. It’s a levelling up of sorts in its own right.

But before you get too excited, I feel obliged to let you know that Bitcoin is one of those games where no one can ever truly complete or “beat” it._It’s almost like Chess in that the more you learn, the more there is _to_learn. And if you ever hear anyone claiming to be a Bitcoin (or worse, _blockchain) expert, turn your scam sensors to eleven. The real experts never claim to be such, because as soon as you actually start getting deep into Bitcoin, it immediately dawns on you just how little you actually know.

Over the next few months, I will do my best to guide readers towards the appropriate skills, knowledge and resources needed to succeed in our business through a series of articles. The goal is not to teach you everything, I wouldn’t know how, but to point you in the right directions for applying your own efforts without wasting too much time on the way. I will also be hosting interactive events in London and Stockholm (and NYC if the demand is there) where we’ll cover selected Bitcoin topics in more detail. But I digress..

The Bitcoin Analyst Brain

This is a brain. I used to work with them but they weren’t complicated enough so I got into Bitcoin instead.

Behold the Bitcoin Analyst brain in all its phrenological glory. It precisely maps nine important (but non-exhaustive) fields of Bitcoin knowledge to their exact corresponding neurological structures in a colourful and approachable manner while simultaneously illustrating the diverse domains of knowledge required to understand and analyse Bitcoin.