This is a curated collection of posts and essays from Gigi. Read these words.

Tweetstorm: Circularity

By Gigi

Posted October 30, 2019

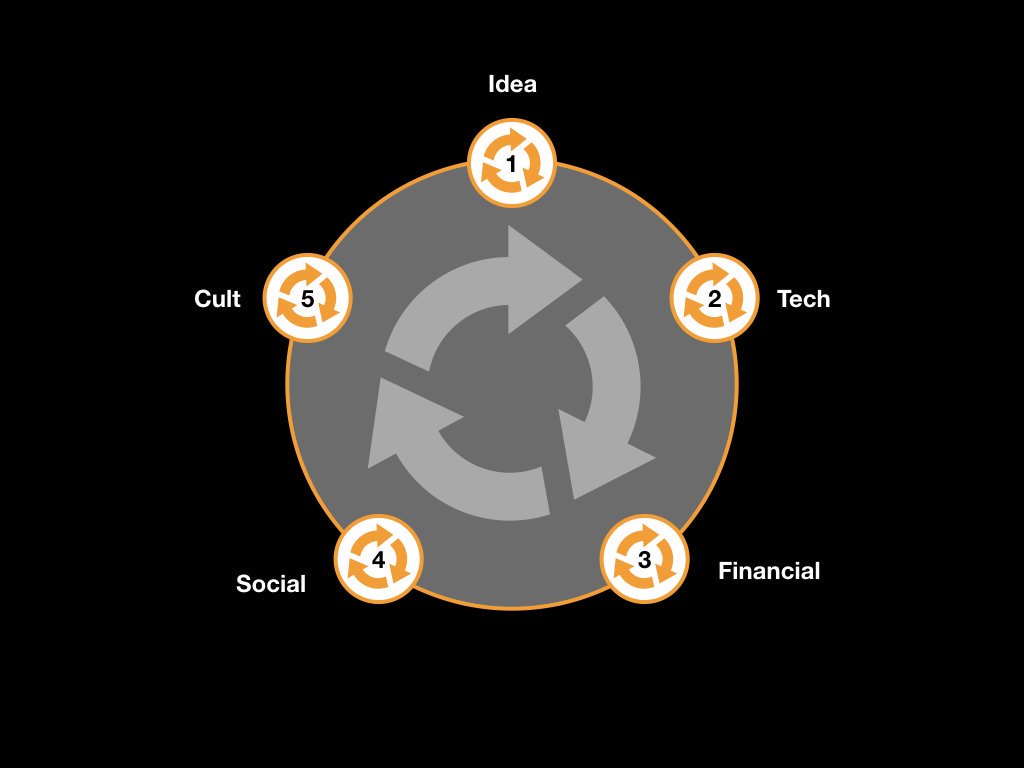

“Circularity” - A thread about Bitcoin, religion, mirrors, my rabbit hole journey, and where Bitcoin (and bitcoiners) might go in the next couple of years.

2/ I drew it in various forms, so the details (e.g. how many outside circles there are) aren’t that important. The main idea is important - at least to me.

3/ The Bitcoin “rabbit hole” might look innocuous at first. After all, you’re just trying to answer a very simple question: “What is Bitcoin?”

4/ First of all, I believe that falling down the Bitcoin rabbit hole is a deeply personal experience.

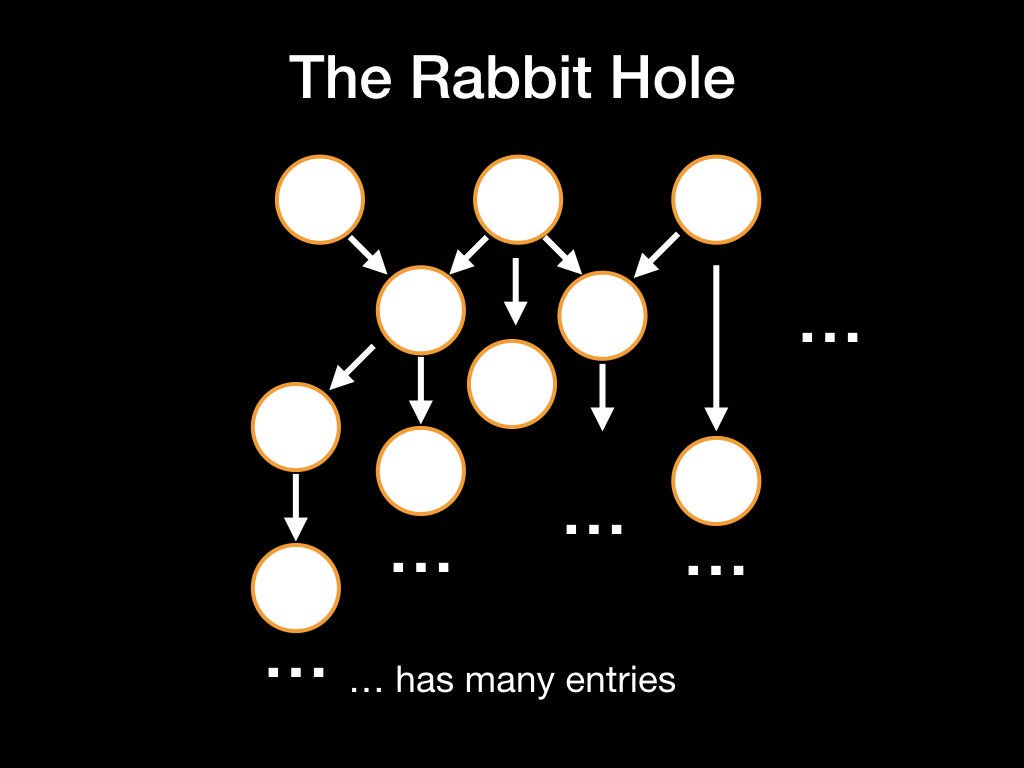

5/ The rabbit hole has many entries. Your particular entry point depends on circumstance, your background, and your previous experience.

Once you are inside, however, you will stumble upon things that are far removed from your particular point of entry.

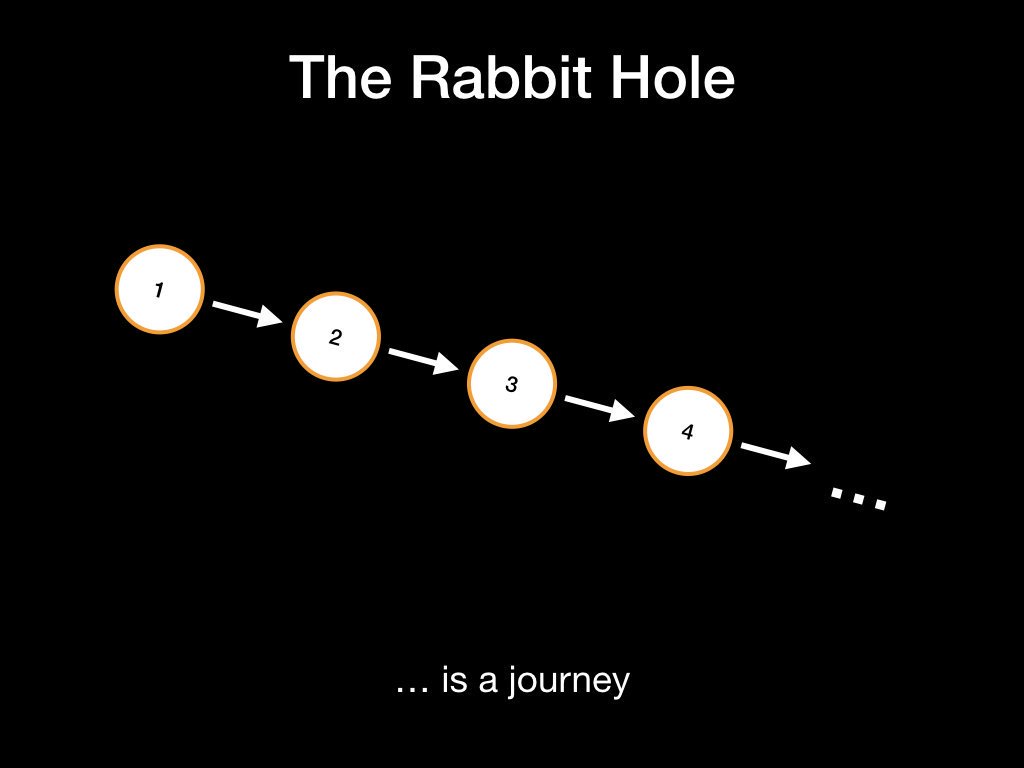

6/ Many say that the rabbit hole is bottomless, and I tend to agree. It certainly feels like a journey without end.

7/ However, I believe that Bitcoin - and the rabbit hole journey - is circular.

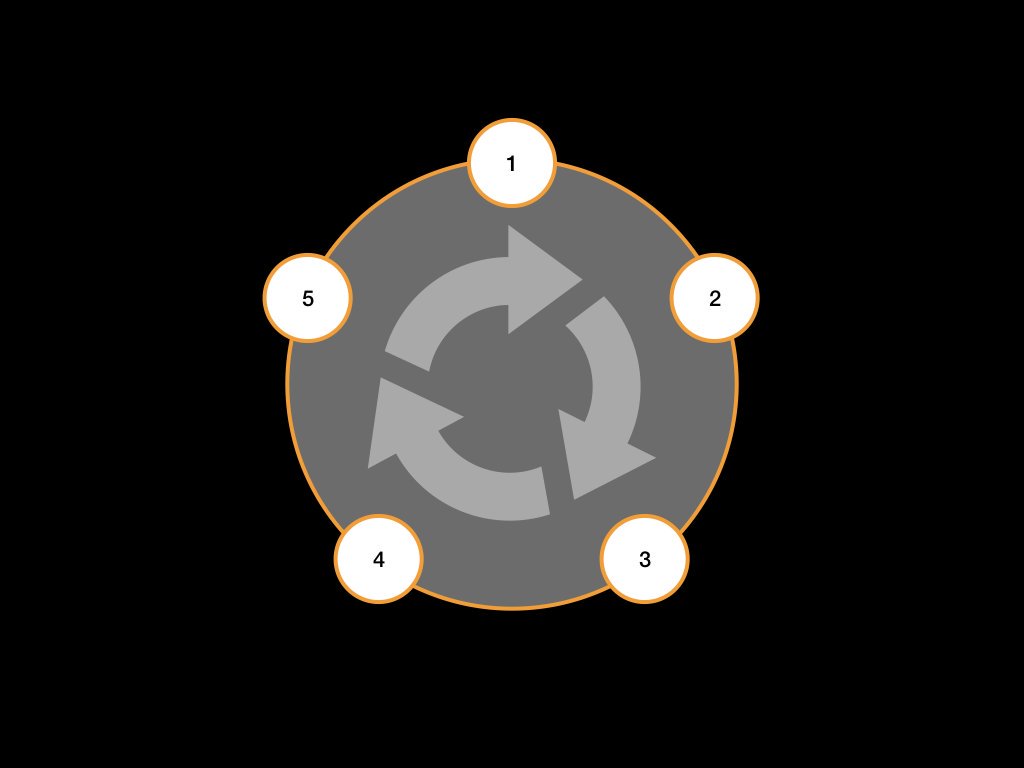

For whatever reason, this insight was of such profundity that it changed me, my view of the world, and my outlook in regards to the future.

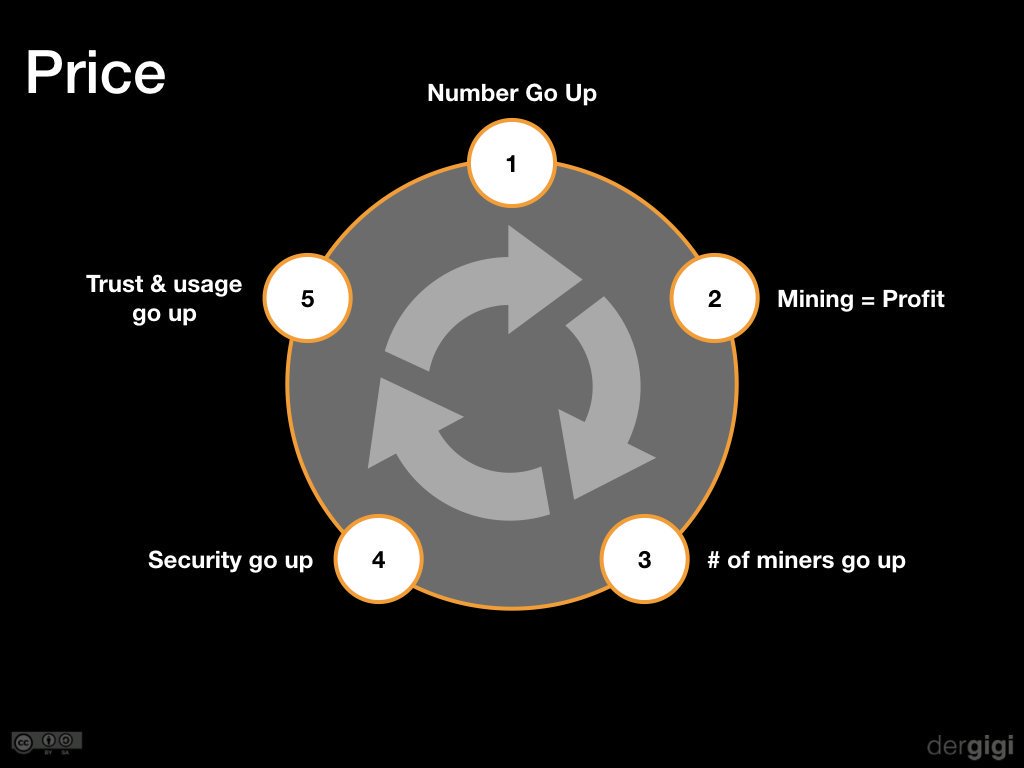

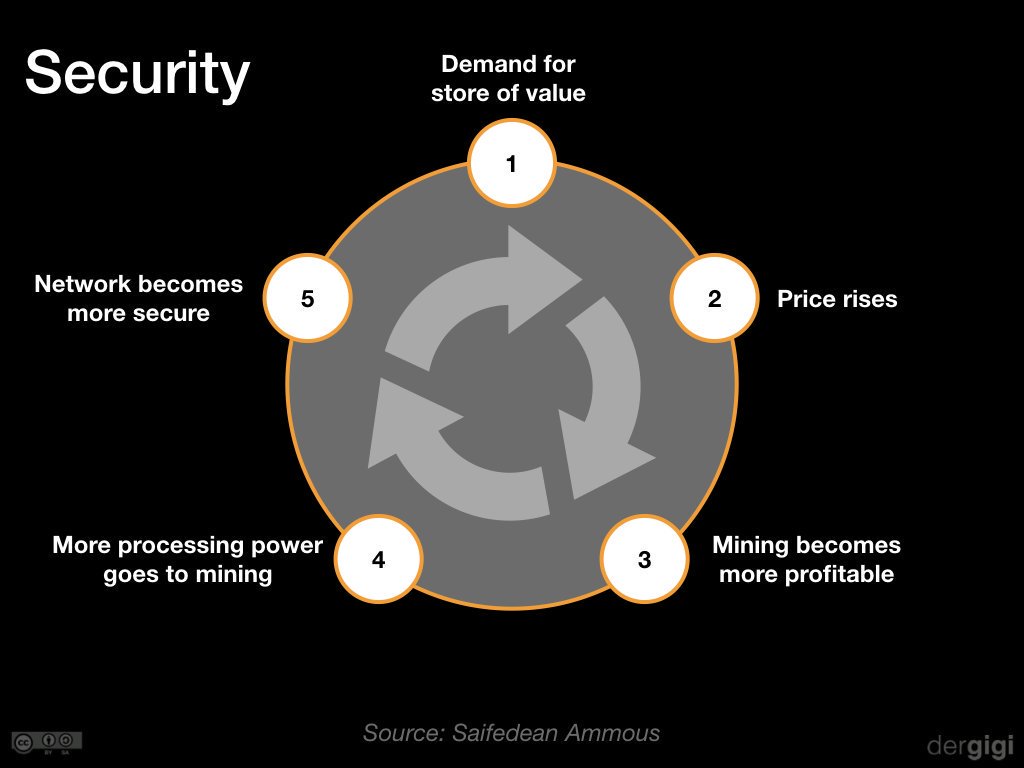

8/ Bitcoin is profoundly circular. It is circular because it is anchored in nature, via the energy expended in proof-of-work. Some even go further and conclude the following:

“Bitcoin is Nature” – @FriarHass

9/ You can get stuck in the smaller circles, which is partly why Bitcoin is so hard to understand. If you are a trader, you might get stuck trading. Others might get stuck on the whitepaper, or get stuck on implementation details.

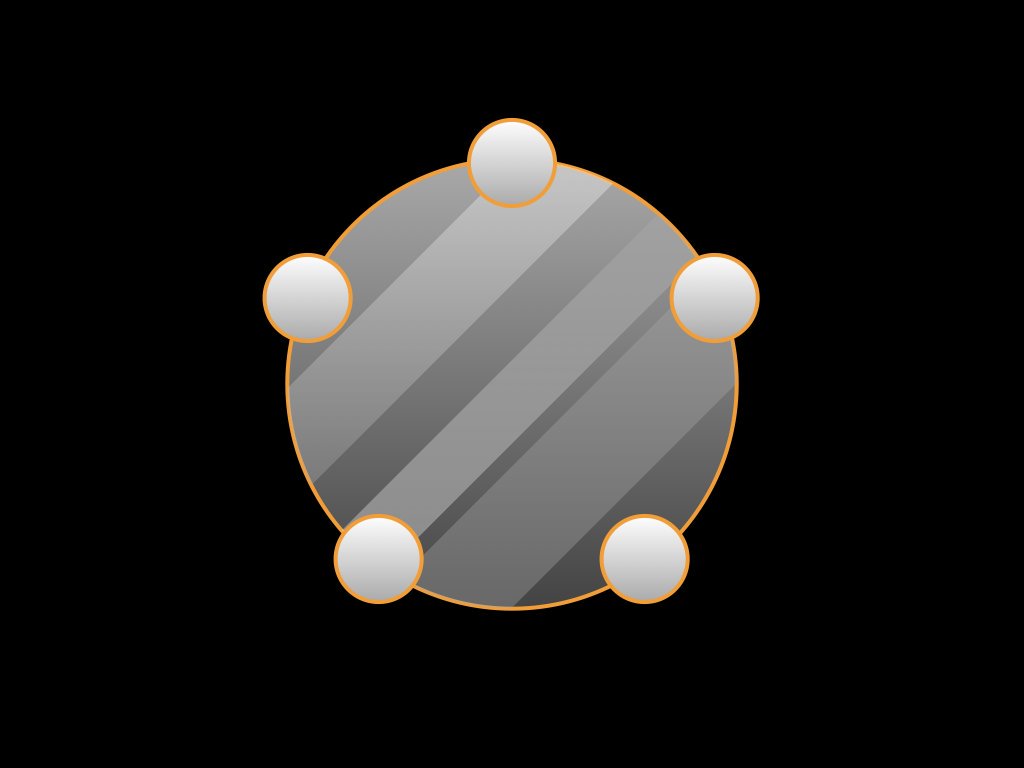

10/ I sometimes drew this image as a mirror, because, well, I believe that Bitcoin is a mirror - it reflects who you are; it reflects your beliefs.

“Bitcoin is different things to different people.” “Bitcoin is whatever it needs to be…”

11/ “Knowledge is a mirror and for the first time in my life I was allowed to see who I was and who I might become.”

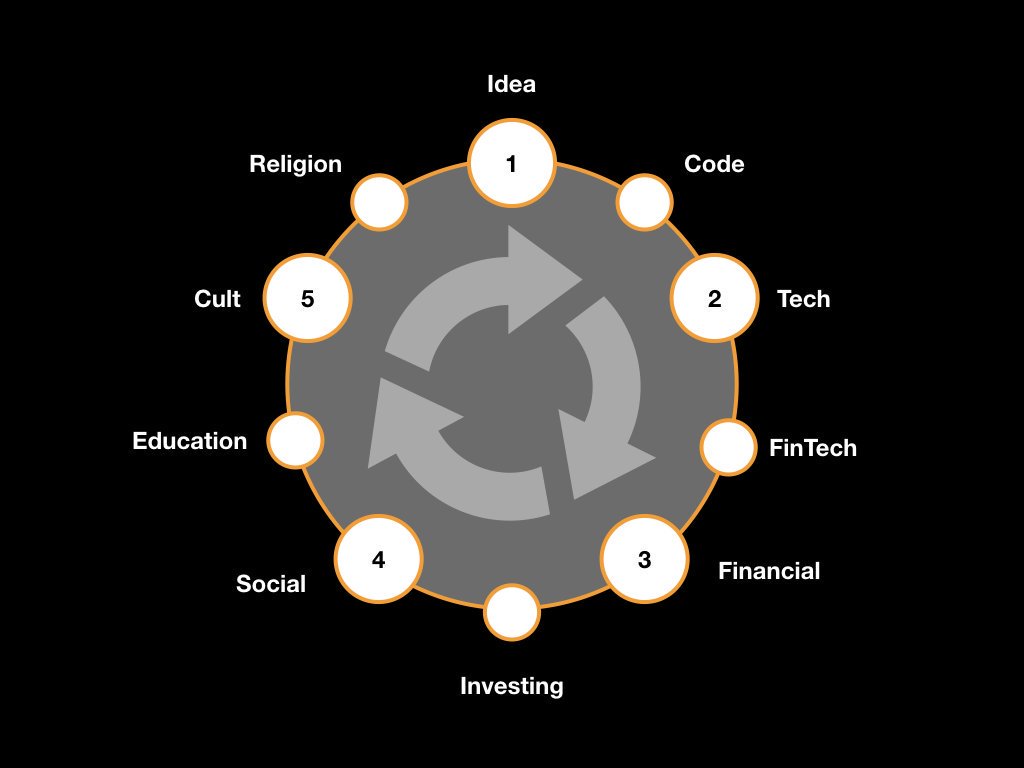

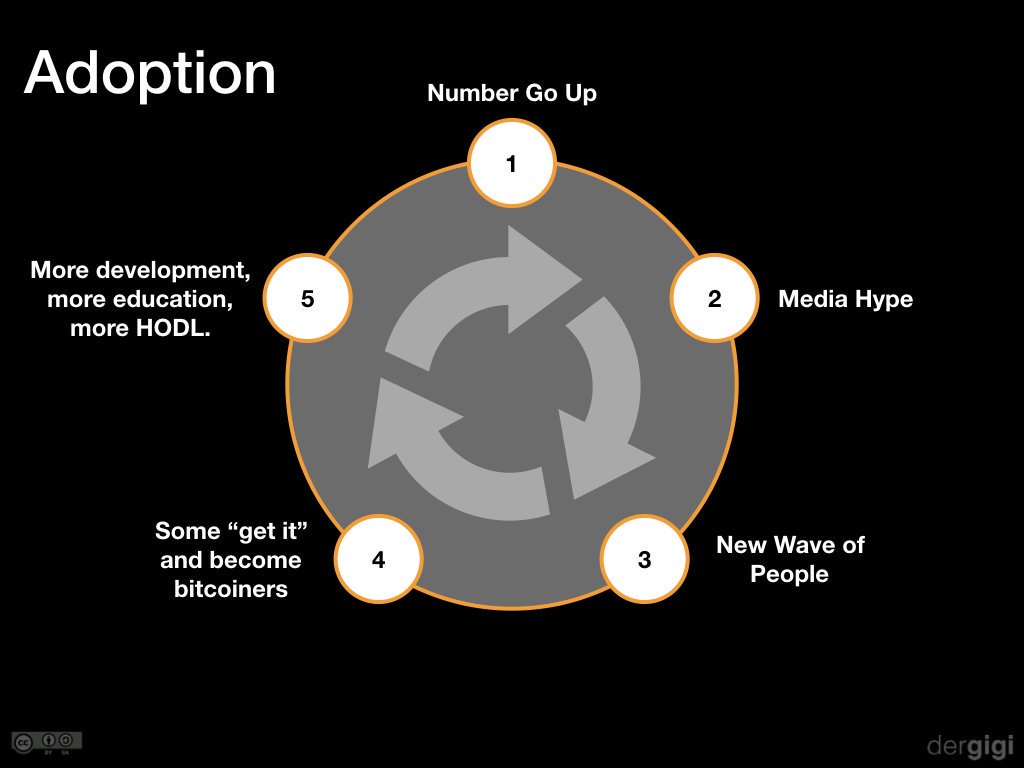

12/ The main journey, as I see it now, is roughly as follows: Idea -> Tech -> Finance -> Social -> Cult -> Idea

13/ There might be multiple stops in-between; that’s not particularly important. What is important, is that a cult exists, and some people will take it to the next level. What is the next level? I think it’s Religion.

14/ Up to now, the most powerful ideas have been religious ideas.

Bitcoin fixes this. It combines financial incentives, economic realism, mathematics, and physics with fundamentalism and religious devotion. More powerful.

“Bitcoin religion” is real. It has already started.

15/ I believe that Bitcoin is the most powerful idea of our time. It is about to become one of the most powerful memes of our time. I believe that more and more people will be religious about Bitcoin, about the idea of separating money and state through absolute scarcity.

16/ Every cycle new bitcoiners are born. Some of these bitcoiners become maximalists, and some of these maximalists will have religious devotion.

17/ I’m prepared to be wrong about this.

But I ask you, dear skeptics: are you prepared to deal with tens of thousands of zealots, in case I’m right?

The Rise of the Sovereign Individual

How power is re-aligning itself in an internet-native world

By Gigi

Posted August 22, 2019

Photo cc-by Studio Incendo

Photo cc-by Studio Incendo

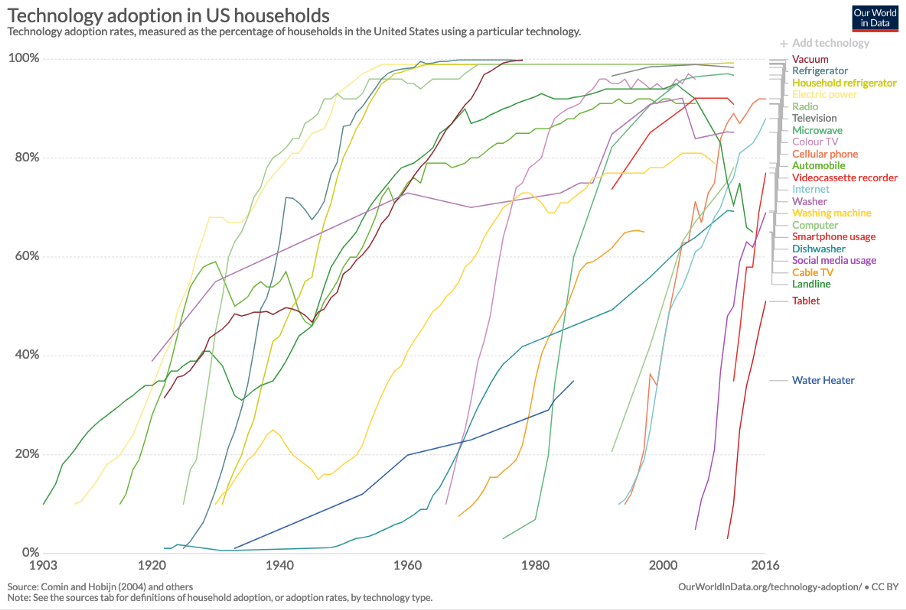

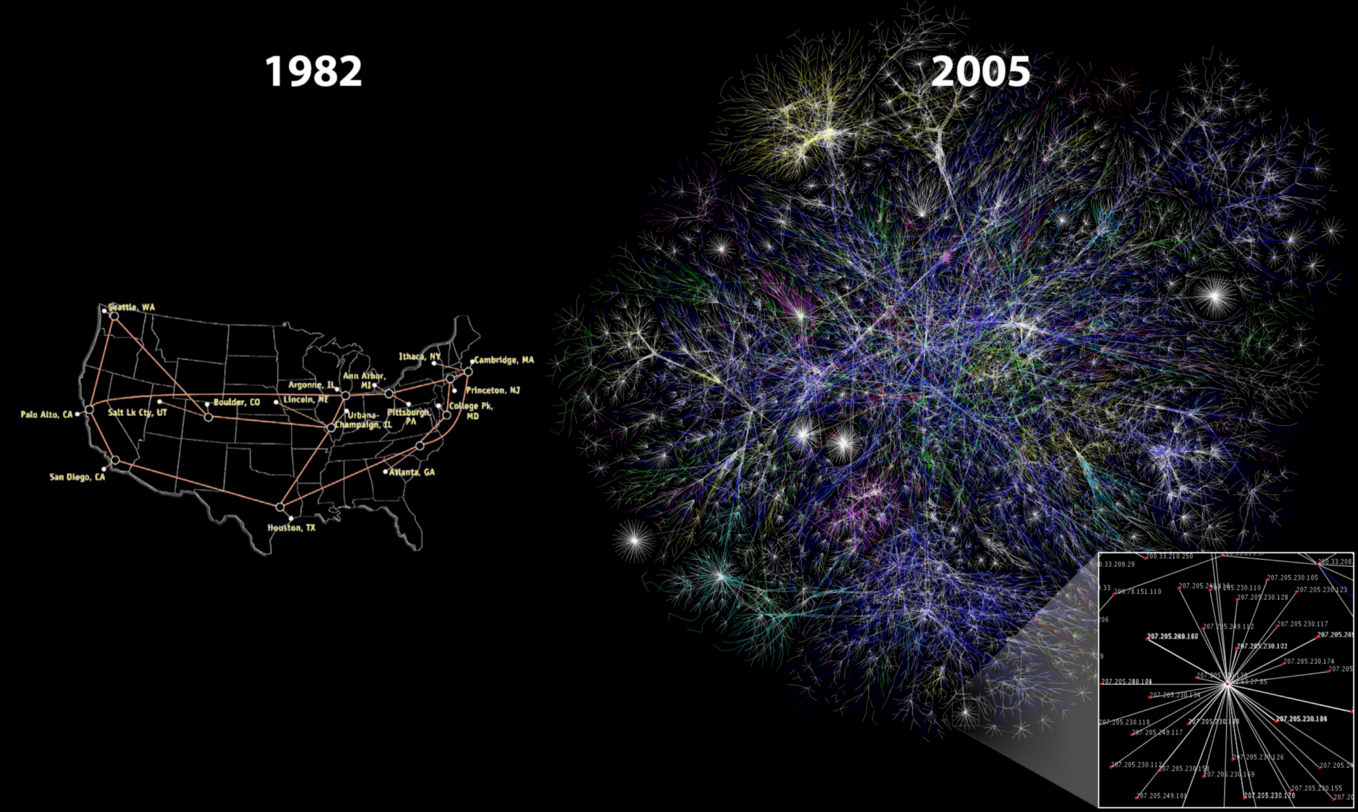

Not too long ago, the internet was a fringe phenomenon. Very few people saw the benefits of a global communications network. Even fewer people had the vision and the foresight to see what it might enable. Today, most people take the internet for granted. It is simply expected to be there, like running water in your home.

Even before the internet became ubiquitous, technologists and visionaries realized the potential of this transformative technology. They realized that an undiscriminating network combined with the magical power of public-key cryptography tips the power-balance in the individual’s favor.

Eavesdropping-resistant communication which can’t be stopped is poison to authoritarian regimes, which, after all, are in the business of suppressing and controlling the flow of information. If people are still able to communicate and assemble, they can rise up and speak truth to power. We saw the liberating potential of communications technology during the Arab Spring, and we continue to see individuals rise up and fight authoritarian rule today.

What the cypherpunks understood 30 years ago is starting to play out right before our eyes: the tools of our information age have the potential to empower individuals like never before.

The Freedom to Transact

As I am writing these lines, hundreds of thousands of people are marching in the streets of Hong Kong, protesting against an extradition bill proposed by the government. As always, protests like these shine a light on the current power balance between individuals and the powers that be.

Unfortunately, the current system of surveillance, automated facial recognition, and cashless transfers enables not only a single point of failure, but also a single point of control in times of unrest. If the government doesn’t like your opinion or the fact that you were part of a (peaceful) protest, a simple truth becomes apparent: your freedom of assembly was an illusion, as was your freedom to transact freely.

In a free society, these freedoms should be guaranteed. How? Well, as we have seen in the past, information technology and strong cryptography — if used carefully — guarantee the right to speak freely. After all, no amount of violence will ever solve a math problem. In the same vein, an information technology exists today which guarantees the right to transact freely: Bitcoin.

It is easy to forget that “permissionless” and “censorship-resistant” are more than mere buzzwords. Under difficult circumstances, these words become a matter of life and death. The Hong Kong protests make evident once again what privacy advocates have been preaching for years, even decades: if censorship and surveillance are built into the system, it will be used and abused by those who are in charge. And if you don’t have the option to detach from your identity, free speech, free thought, and free action are impossible.

What is true for WeChat, Facebook, and Google, is also true for our current payment rails and the financial institutions of this world. No matter how noble the motivation of building central controls into communication or financial systems — power corrupts, and absolute power corrupts absolutely, as the saying goes.

“Decentralized and private payments are a necessary innovation for a digital future where we retain our civil liberties and personal freedoms.” —Alex Gladstein

Strong cryptography allows us to reclaim our right to private conversations in the digital age, thanks to end-to-end encryption. The same cryptography allows us to reclaim our right to transact freely in a digital world, thanks to digital signatures, cryptographic hashes, and the global machine of truth and freedom which is Bitcoin.

The Freedom to Remain Private

In today’s digital world — as Hong Kong protesters know — finding out who went to which protest is as easy as retrieving data from a database. Whether it is from people’s bank accounts, WeChat, Alipay, or other virtual profiles, the convenience of the status quo inevitably leads to a system of total surveillance, and thus total control.

The solution to this conundrum is enabling privacy by default, which has been the default setting for thousands of years. Neither the internet nor Bitcoin is perfect in this regards, which is why constant vigilance and the development of privacy-enhancing technology are a necessity.

In the last couple of years, efforts to encrypt all internet traffic by default have been made. In the next couple of years, we hope to see continued efforts being made to make every bitcoin transaction even more private than they are now (which is one of the reasons why Bull Bitcoin uses Wasabi’s CoinJoin by default).

As is evidenced by the long lines at Hong Kong’s train ticketing machines, surveillance renders all other freedoms useless.

Source: Mary Hui

Source: Mary Hui

The current situation in Hong Kong paints a vivid picture of the disastrous side-effects of a cashless society. Without a way to transact privately and anonymously, people are enslaved to the masters of finance. And no amount of going digitally dark will allow you to avoid this slavery.

Arguably, things are bound to go from bad to worse. The financial elite which controls the most important good of our society — money itself — is playing god with our shared macroeconomic reality. In the last couple of decades, a concerted effort was made to attack another financial freedom: the freedom to save.

The Freedom to Save

Even without people marching in the streets, it is apparent to most that these are chaotic times. Currencies are not holding their value. A recession is looming. The most powerful men in the world are openly fighting currency wars and are bragging about it on twitter. All while the endless printing of money continues and politicians/bankers are spewing propaganda to normalize negative interest rates.

People talk about Quantitative Easing (QE) and Negative Interest Rate Policies (NIRPs) as if they were anything other than pure insanity. The first is simply printing massive amounts of money, the second is paying borrowers and stealing from savers.

Gone are the days where you would get interest from your money in the bank. In the world of NIRPs, you have to pay the bank to hold your money. In the same vein, gone are the days where you have to pay back your loan plus a little extra to reimburse your lender for taking on the risk. In the world of NIRPs, you are getting paid to take out a loan. Need some money? No worries! We are giving you the money and are paying you a little extra, for enjoying the privilege of giving you a loan!

As should be apparent for every child which is offered the choice between two marshmallows today, or one marshmallow tomorrow: the current financial world is defying common sense. I repeat: pure insanity.

More and more people realize that this insanity has to stop and decide to exit a system in which a global negative-yielding debt of $15 trillion is the new normal. The broken financial system, with its negative interest rates and “modern” monetary policies, are, in part, responsible for the rise of sovereign individuals all over the world.

Source: Rachel Cheung

Source: Rachel Cheung

People begin to realize the stupidity of this game. Putting pressure on this broken system by making a run on banks is one form of peaceful protest. Storing your value in an asset which can not be inflated, can not be confiscated, and can not be subject to the whim of politicians and bankers is another one.

“Sats are my safe haven.” —Matt Odell

Bitcoin is quickly becoming a safe haven asset, especially for people who don’t have easy access to more “stable” currencies than their own. On a long enough time scale, bitcoin offers stability in a world of global instability. It _guarantees_the right to save: nobody will be able to take away your sats — you must give them away willingly.

Building towards a Sovereign Future

People are fed up with the tyranny of the banks, the tyranny of the state, the tyranny of Facebook, WeChat, Sina Weibo, and everything else which is “too big to fail.”

It is our collective responsibility to build a better future. A future where the freedom to transact, the freedom to remain private, and the freedom to save your wealth over time are guaranteed. In the words of the United Nations: the same rights and freedoms people have offline must also be protected online.

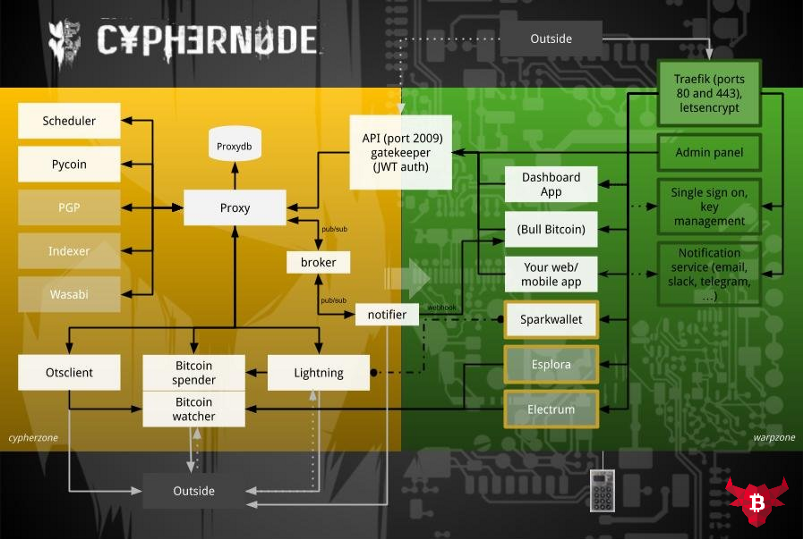

We want to help build a world which enables sovereign individuals to strive. A world where every individual — and every company, for that matter — can use freedom-enabling technologies, as they see fit, without asking anyone for permission. This is one of the reasons why we have released cyphernode, a suite of software and utilities to operate enterprise-grade Bitcoin services, as free software.

Cyphernode— free as in freedom.

Cyphernode— free as in freedom.

While it is debatable whether Bitcoin can literally solve every problem of the world, it is undoubtedly a big piece of the puzzle. Technologies which empower the individual are more important than ever before. Technologies which enable you to remain private, speak and transact freely, or tip the balance of power towards the individual in another way will be invaluable for the world we are heading towards.

China is giving us a taste of what living in a dystopian surveillance state is like: you cross the street at the wrong place or the wrong time, and thanks to facial recognition, a fine is automatically deducted from your bank account while an algorithm adjusts your social credit score downwards. You pay for a bus ticket to take part in a peaceful protest, and you are at risk of being erased from the central registry, effectively erasing your ability to live a normal life as a citizen. It might happen today, it might happen tomorrow, or at any point in the future. The surveillance state does not forget.

The tools to guarantee freedom for all exist today, they are just not evenly distributed, not well understood, and not widely deployed. However, with every passing day, more and more people are realizing what kind of power is in their hands.

We encourage you to stay strong. We encourage you to keep on building. We encourage you to not give in to tyranny. We, and many people like us, will do our best to build towards a better future. Stay safe out there, and don’t forget to buy bitcoin.

Proof of Life

Why Bitcoin is a Living Organism

By Gigi

Posted August 7, 2019

The definition of life has been a challenge for scientists and philosophers alike. While many definitions have been put forward, what precisely differentiates the living from the non-living remains elusive. Are viruses alive? DNA molecules? Computer viruses? Biologically produced minerals?

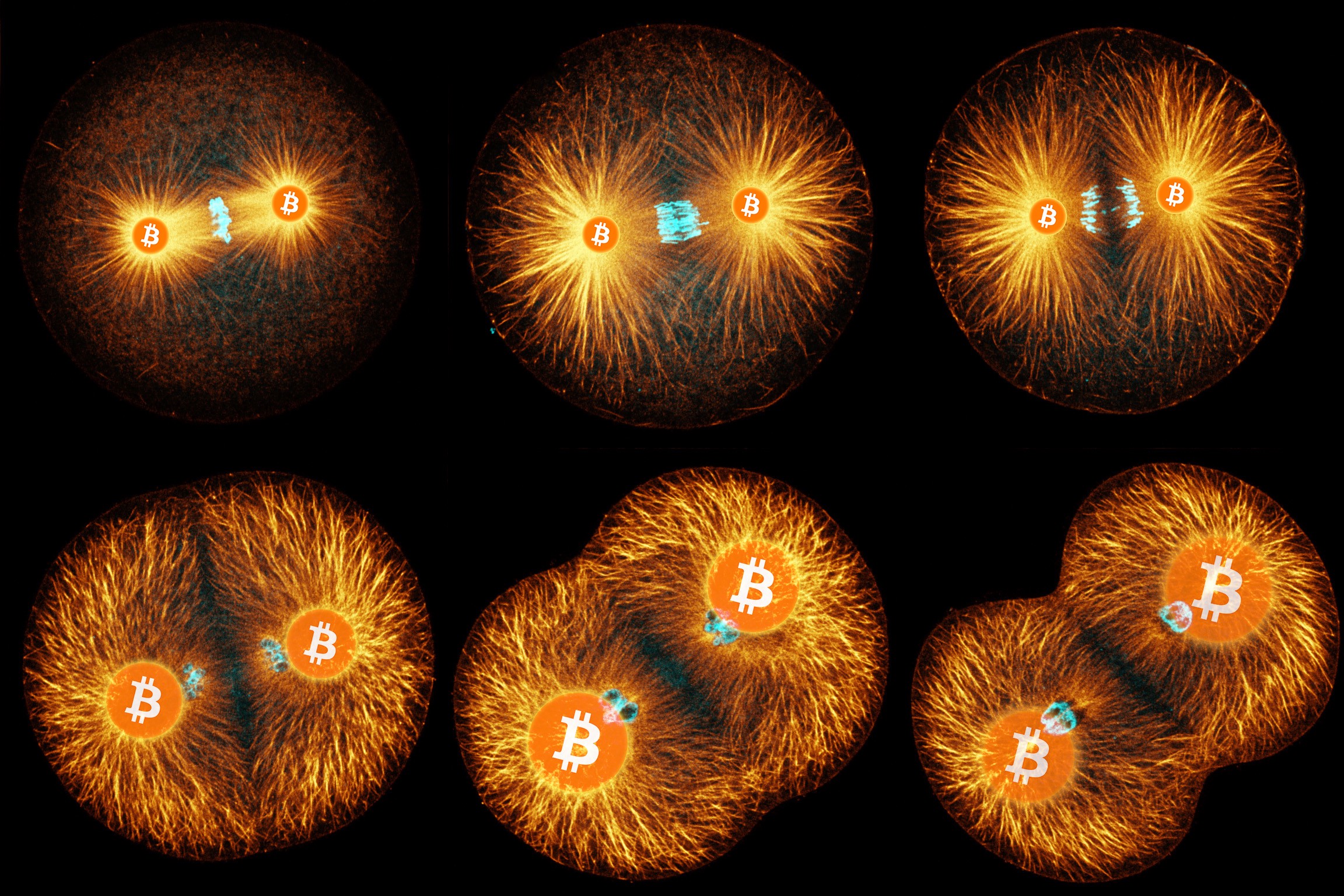

Ralph Merkle, inventor of cryptographic hashing and namesake of the Merkle tree, made the argument that Bitcoin is the first example of a new form of life. In this article series, I intend to take this claim seriously, explore it further, and see what can be gleaned from viewing Bitcoin as a living organism.

The first part will establish that Bitcoin is indeed a living organism. The second part will take a closer look at Bitcoin’s various habitats, and how changes in these habitats might affect the organism. In the third part we will dissect the Bitcoin organism, trying to understand some of its parts in more detail. Finally, we will perform the thought experiment of trying to kill Bitcoin, to illustrate the remarkable resilience of this strange, decentralized organism.

What is Life?

The question of whether something is alive or not obviously hinges on one’s definition of life. Life is endlessly complex, so it is no surprise that answering the question “What is Life?” leads to a multitude of answers. New-age speculations aside, it seems that life is a process, not a substance.

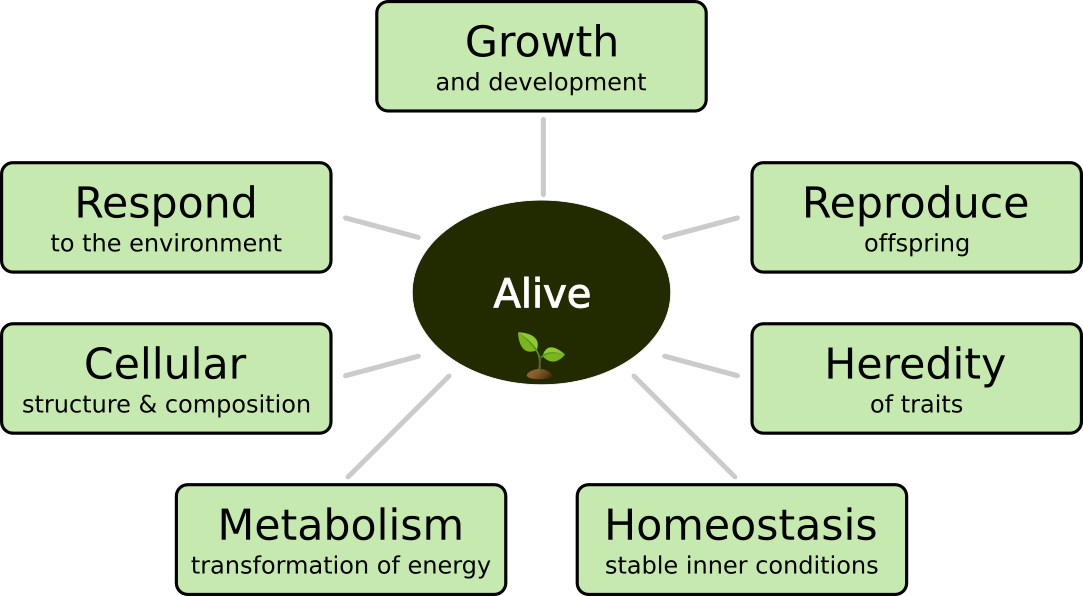

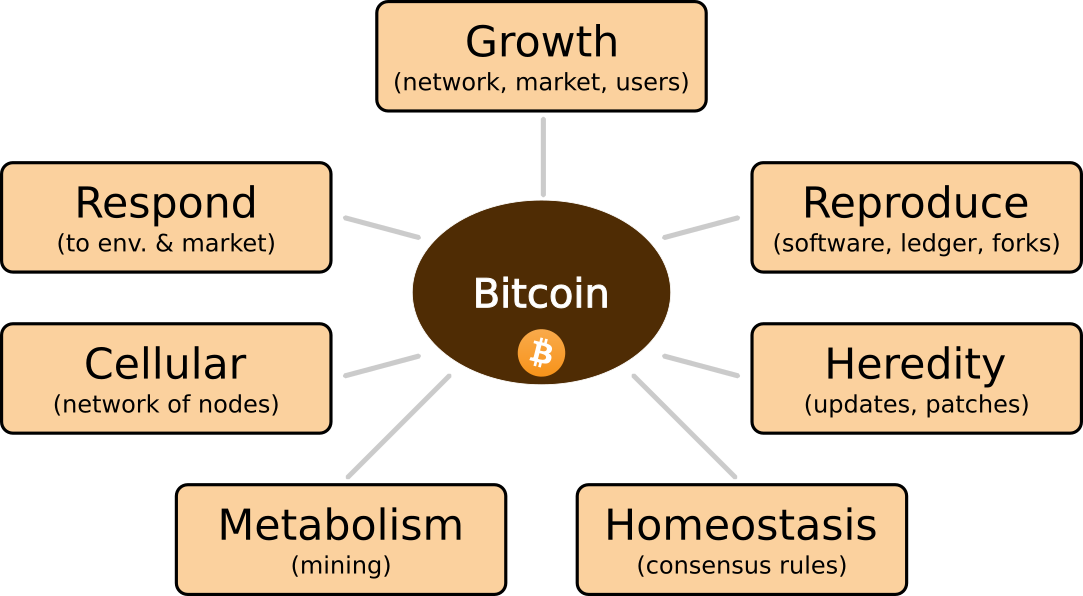

We can try to describe this process by looking at things which are alive, and looking at what they do: they tend to grow, reproduce, and respond. They inherit traits, are made up of smaller units (cells), and use energy to maintain their internal structure in the face of entropy.

Based on Chris Packard’s Characteristics of Life, cc-by-sa 4.0

Based on Chris Packard’s Characteristics of Life, cc-by-sa 4.0

From a physics perspective, living things are thermodynamic systems: they utilize the energy-differences in their surroundings to maintain a specific molecular organization and create copies of themselves. Thermodynamically speaking, living systems are able to decrease their internal entropy at the expense of “free” energy taken in from the environment. In short, living things create order out of chaos.

Bitcoin is doing exactly that: it takes energy from the environment and puts things in order, i.e. it decreases its internal entropy. It does so by appending blocks to a well-ordered structure. Some call this structure the blockchain, others call it a distributed ledger. I will refrain from using either name, since the name of this particular structure isn’t important, and doesn’t help to convey a deeper truth: that this structure is just one part of a large and complex system, just like the backbone in vertebrates. It is important, no doubt. But distributed or not, a ledger on its own is as useful and as alive as a bag of bones.

To understand why Bitcoin behaves animatedly we will have to look beyond the buzzwords and ask ourselves what Bitcoin actually is, what it is made of, and what its boundaries are.

What is Bitcoin?

Compared to biological life, Bitcoin is quite simple. Nevertheless, finding a succinct answer to “What is Bitcoin?” is not.

Depending on your background it might be a computer network, a financial revolution, a way to protect your wealth, a payment system, a global settlement layer, an alternative to central banking, sound money, a parallel economy, an exercise in free speech, a bubble, a pyramid scheme, a messaging system, a communications protocol, an inefficient database, internet money, or all of the above. In short, Bitcoin is different things to different people.

Whatever Bitcoin might be, it undoubtedly is a force to be reckoned with. It has a life of its own, and thus arguably, it is best described as a living thing.

Many people seem to have come to this conclusion independently. Bitcoin is described as an army of leaf-cutter ants in Andreas M. Antonopoulos’ Mastering Bitcoin — a biological system which is working in concert without a central coordinator. The honey badger, an animal which is commonly used to refer to Bitcoin (since it doesn’t care and isn’t afraid of anything) is on the cover of Jimmy Song’s Programming Bitcoin. Dan Held compared the invention of Bitcoin to planting a tree, examining the species (code), season (timing), soil (distribution), and gardening (community) that were essential to its success. Brandon Quittem postulates that Bitcoin is most similar to mycelium, the underground network which powers the fungi kingdom, and can thus be best understood as a decentralized organism.

The snake of regulation and central banking is biting you while you are eating it alive? Honey badger don’t care! And just like an army of ants doesn’t care if half of the workers are washed away by a flood, the Bitcoin network doesn’t care if half of the nodes are offline tomorrow.

“Honey badger don’t care, honey badger don’t give a fuck.” — Randall

Memes like these, especially if they survive and continue to be popular over a long period of time, tend to be right, conceptually. What people seem to be saying when they refer to Bitcoin as the honey badger is that, in essence, Bitcoin behaves like an animal which can’t be controlled, can’t be tamed, and doesn’t care too much about externalities.

Which particular organism Bitcoin resembles most closely will be left as an exercise for the reader. The above examples should merely illustrate that multiple authors made the intellectual leap of classifying Bitcoin as a living organism - a leap which I believe to be fascinating, useful, and ultimately, correct.

Bitcoin is a living organism, and we should try to understand it as such if we want to live in harmony with it.

The Bitcoin Organism

As mentioned above, Ralph Merkle was the first to point out that Bitcoin can be seen as a living entity. He remarked that Bitcoin has spawned an incredible amount of excitement in the technical community, and tried to translate this excitement into something which can be understood by everybody: a new form of life.

“Briefly, and non-technically, Bitcoin is the first example of a new form of life. It lives and breathes on the internet. It lives because it can pay people to keep it alive. It lives because it performs a useful service that people will pay it to perform. It lives because anyone, anywhere, can run a copy of its code. It lives because all the running copies are constantly talking to each other. It lives because if any one copy is corrupted it is discarded, quickly and without any fuss or muss. It lives because it is radically transparent: anyone can see its code and see exactly what it does.” — Ralph Merkle

While Bitcoin is indeed radically transparent, it is not perfectly obvious where Bitcoin begins and where it ends. Like all living things, Bitcoin isn’t just a uniform blob of matter. It is a dynamic, living thing, consisting of many different parts, all of which communicate with and influence each other, as well as other living things and the environment as a whole.

The Bitcoin organism is made up of many interlocking parts which work together to ensure the survival of the whole. As with biological organisms, as soon as one crucial part is missing, the whole organism is bound to die.

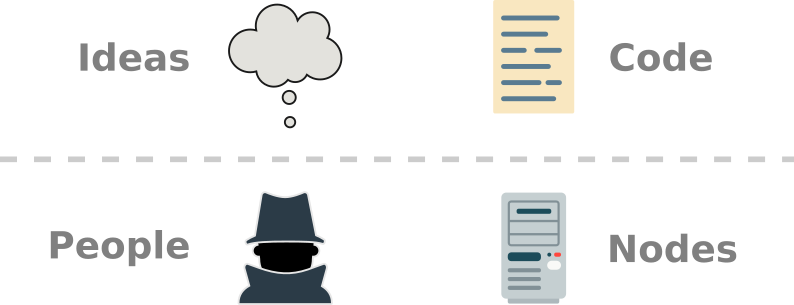

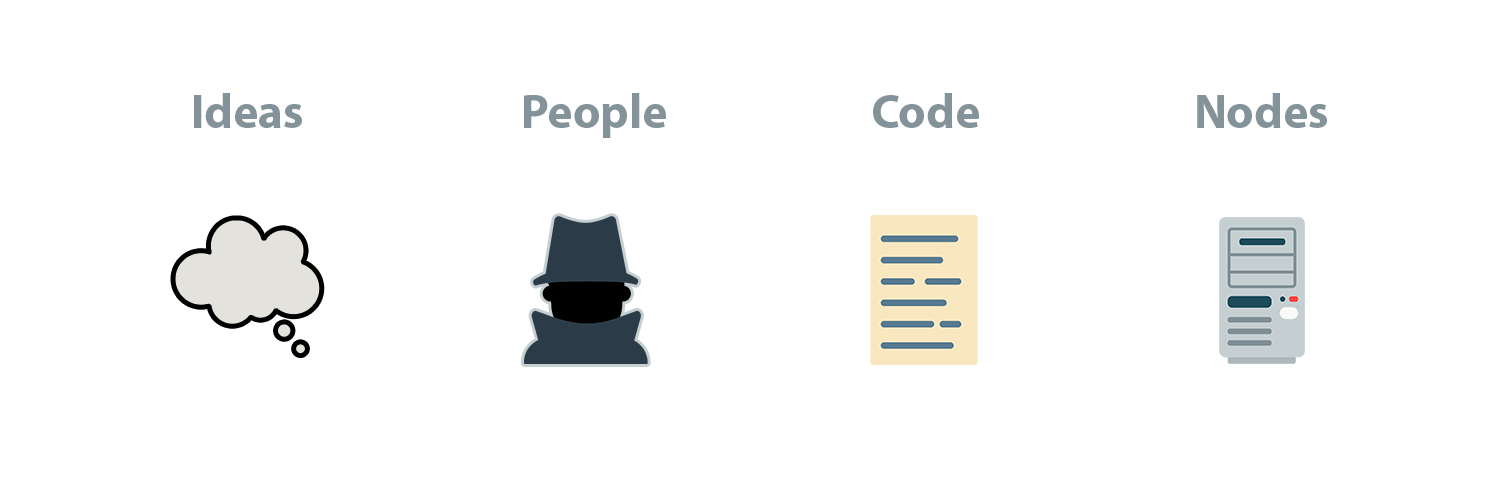

Bitcoin, however, is a strange beast. It lives across domains, with one foot in the purely informational realm (ideas and code) and one foot in the physical realm (people and nodes).

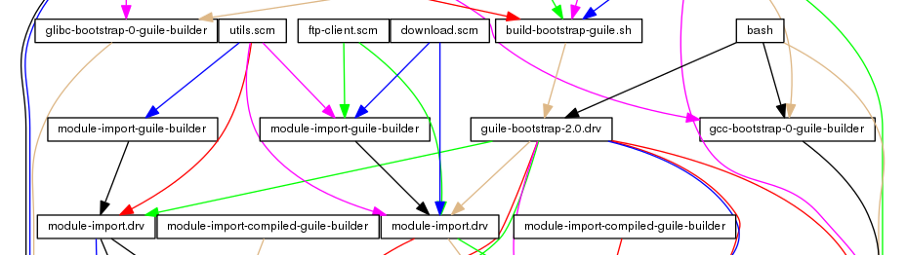

The Bitcoin organism manifests itself through the interplay of ideas, code, people, and nodes. All four of these conceptual pieces react to and influence each other in a value-generating feedback loop which keeps Bitcoin alive.

Whether people are part of the Bitcoin organism, or merely living in symbiosis with it, depends on your point of view. For now, let’s take an all-encompassing view of the Bitcoin organism, including people as one part of the whole. After all, just like we can’t live without a multitude of bacteria, fungi, viruses and other creepy-crawlies which make up the human microbiome, Bitcoin can’t live without us: the tiny beings in meatspace which keep it alive.

In any case, nodes and their operators are tangible things which are manifest in the physical world. Like the cells in your body, all physical components of the Bitcoin organism can and will be replaced over time. Node operators come and go, node and mining hardware is replaced periodically, and even whole mining farms go offline and are replaced by more cost-efficient facilities.

Ideas and code are more ethereal. They can’t be grasped or pointed to in the same fashion. However, Bitcoin has an essence, the soul of the organism, if you like. Note that this essence could, in theory, breathe life into a new host if the current incarnation of the organism dies. The ghost of Bitcoin is independent of its physical body, to borrow a metaphor from Shirow’s Ghost in the Shell.

As long as something is compatible with this essence, it will be treated as part of the whole. If something is incompatible, however, it will be rejected — just like biological organisms reject foreign objects inside their bodies.

Part of this essence is made explicit by Bitcoin’s consensus rules, other parts are repeated as mantras: “ not your keys, not your bitcoin” and “ run your own node” are gentle reminders of lessons learned, as well as shortcuts to a deeper understanding of what Bitcoin is and should be.

With a basic idea of the constituents and the extent of the Bitcoin organism in mind, let’s return to the descriptive definition of life above and see how Bitcoin maps onto each trait.

- Growth: Bitcoin grows in multiple ways. The network grows, the value of each bitcoin grows, the market grows, its user base grows, and the ecosystem as a whole grows as well.

- Reproduction: Paradoxically, Bitcoin uses replication to create absolute scarcity. It reproduces itself in multiple ways, and on multiple levels: the source code is replicated across repositories, the software is copying itself upon installation, the ledger reproduces itself on every node, blocks propagate across the network by replication, and even UTXOs can be understood as reproductive entities, dividing and merging during the transaction process. Mutations exist on every level as well: invalid transactions, invalid blocks, hundreds of forks, and thousands of imperfect copies have been spawned by Bitcoin in the last couple of years.

- Heredity: Bitcoin inherits several traits from its predecessors: public-key cryptography, digital signatures, peer-to-peer networking, digital timestamping, and unforgeable costliness — just to name a few. Further, Bitcoin’s open nature enables both vertical and horizontal gene transfer: some traits develop by gradual mutations of previous versions, others find their way into the codebase by incorporating ideas from other projects.

- Homeostasis: Above all else, Bitcoin’s consensus rules are responsible for its stable inner conditions. If blocks do not adhere to the current consensus rules, they will be rejected mercilessly and quickly. The Bitcoin network will rid itself of these blocks just like we shed the dead cells of our skin.

- Metabolism: Mining rigs around the world keep the organism alive, erecting virtually impenetrable walls in the process. Energy is transformed into digital amber, ensuring that the shield around past transactions is growing and Bitcoin’s heart keeps beating.

- Cellular: Multiple parts of Bitcoin are cellular: the Bitcoin network consists of nodes, each of which a self-sustaining, functional entity. The ledger itself is cellular since blocks (and transactions) are basically cells in a large, append-only spreadsheet.

- Responsive: Bitcoin is a highly responsive organism. It responds to changes in price, political changes, economic changes, environmental changes (e.g. if parts of the internet are cut off), technological changes (e.g. breakthroughs in chip manufacturing), and changes in our scientific understanding (e.g. breakthroughs in computer science, mathematics, or cryptography). It reacts on its own, without any person, company, or nation-state in charge.

As mentioned above, life is a process, not a substance. A delicate dance of innumerable parts, all signaling and communicating in an intricate way to self-sustain each organism, and the phenomenon which we call life as a whole.

“Life is like fire, not water; it is a process, not a pure substance. […] The simplest, but not the only, proof of life is to find something that is alive.” — Christopher McKay

In the words of astrobiologist Chris McKay, the simplest proof of life is to find something that is alive. I have found Bitcoin, and as far as I can tell, it is alive — for all the reasons outlined above.

Conclusion

Bitcoin checks all the boxes when it comes to the characteristics of living things: it grows, reproduces, inherits and passes on traits, uses energy to maintain a stable inner structure, is cellular in nature, and responds to the various environments it lives in.

In the next part of this series we will take a closer look at these environments, and how Bitcoin responds to changes in them. Bitcoin lives and breathes on the internet, as Ralph Merkle beautifully said. But arguably, the internet isn’t the only environment it is living in.

For now, I hope to have convinced you that Bitcoin can be seen as a living organism — alien as it may be.

Further Reading

- Bitcoin is a Decentralized Organism by Brandon Quittem

- Planting Bitcoin by Dan Held

- DAOs, Democracy and Governance by Ralph C. Merkle

- Bitcoin’s Gravity by Gigi

Acknowledgements

Thanks to Dan Held,Brandon Quittem, and Raph for their feedback on earlier drafts of this article.

I hope you have enjoyed this excursion into the world of the Bitcoin organism. If you like to accelerate the growth of both Bitcoin and this article series feel free to drop me a line, some applause on medium, or even some sats via the beast which is Bitcoin. Thanks for all the encouragement, and thank you for reading.

Thanks to Brandon Quittem and Dan Held.

Bitcoin’s Gravity

How idea-value feedback loops are pulling people in

By Gigi

Posted May 1, 2019

Bitcoin is different things to different people. Whatever it might be to you, it is undoubtedly an opinionated and polarizing phenomenon. There are certain ideas embedded in the essence of Bitcoin, and you might be intrigued by some or all of them.

The invention of Bitcoin, and its underlying blockchain, which is so widely misunderstood, spawned many projects, networks, and communities. Some of these networks are in direct competition, which has resulted in endless conflicts and lots of debate. The root of these conflicts is ideological in nature: disagreement about how the world is and how it should be — a disagreement about ideas.

The following is an attempt to explain some of the reasons behind this polarization, explore the underlying dynamics in more detail, and illustrate why an increasing number of people seem to be gravitating towards Bitcoin.

“There are some oddities in the perspective with which we see the world. The fact that we live at the bottom of a deep gravity well, on the surface of a gas covered planet going around a nuclear fireball 90 million miles away and think this to be normal is obviously some indication of how skewed our perspective tends to be, but we have done various things over intellectual history to slowly correct some of our misapprehensions.”Douglas Adams

Agreeing on a Set of Ideas

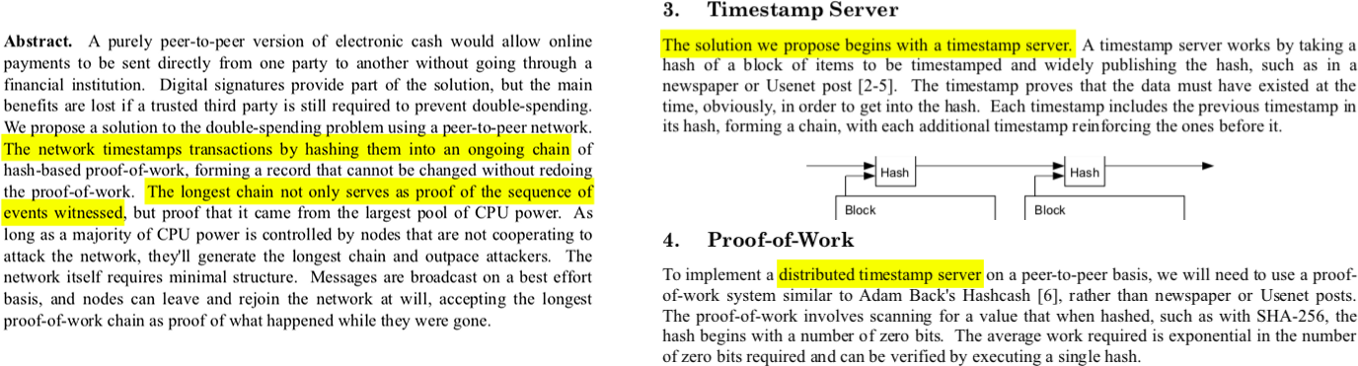

The goal of the Bitcoin network is to reach consensus, a general agreement on the state of the system. Bitcoin’s breakthrough innovation was utilizing unforgeable costliness to reach global consensus without relying on a central authority.

Bitcoin can be understood as a game that anyone can join. Like all games, it can only be played if it has rules, certain ideas which are internally consistent. Otherwise, it wouldn’t be a game; it would be chaos.

“Before any game can be played, the rules have to be established; before the game can be altered, the rules have to be made manifest. […] All those who know the rules, and accept them, can play the game — without fighting over the rules of the game. This makes for peace, stability, and potential prosperity — a good game. The good, however, is the enemy of the better; a more compelling game might always exist.”Maps of Meaning Bitcoin’s consensus rules are just that: a set of ideas, codified into validation rules, acted out by nodes on the network. Changing this core set of ideas is akin to changing what Bitcoin is, and the decentralized nature of the network makes changing them extremely difficult. There is no central authority to dictate changes, making unanimous adoption of a new set of ideas virtually impossible. Anyone who changes the rules, even if he thinks such a change is for the better, will start to play a different game, with only those who join him.

As Bitcoin’s creator famously said: the nature of Bitcoin is such that once the first version was released, the core design was set in stone for the rest of its lifetime.

Undoubtedly, Satoshi had certain ideas in mind when he created Bitcoin. Many of these ideas are articulated in his writing, and even in the genesis block. Most importantly, however, his core ideas are codified in Bitcoin’s consensus rules:

- fixed supply

- no central point of failure

- no possibility of confiscation or censorship

- everything can be validated by everyone at all times

This set of ideas is embedded in the rules of the network, and you have to adopt them to participate. In essence, a network like Bitcoin encodes a social contract in its software: ideas which are shared by everyone on the network.

Spreading ideas

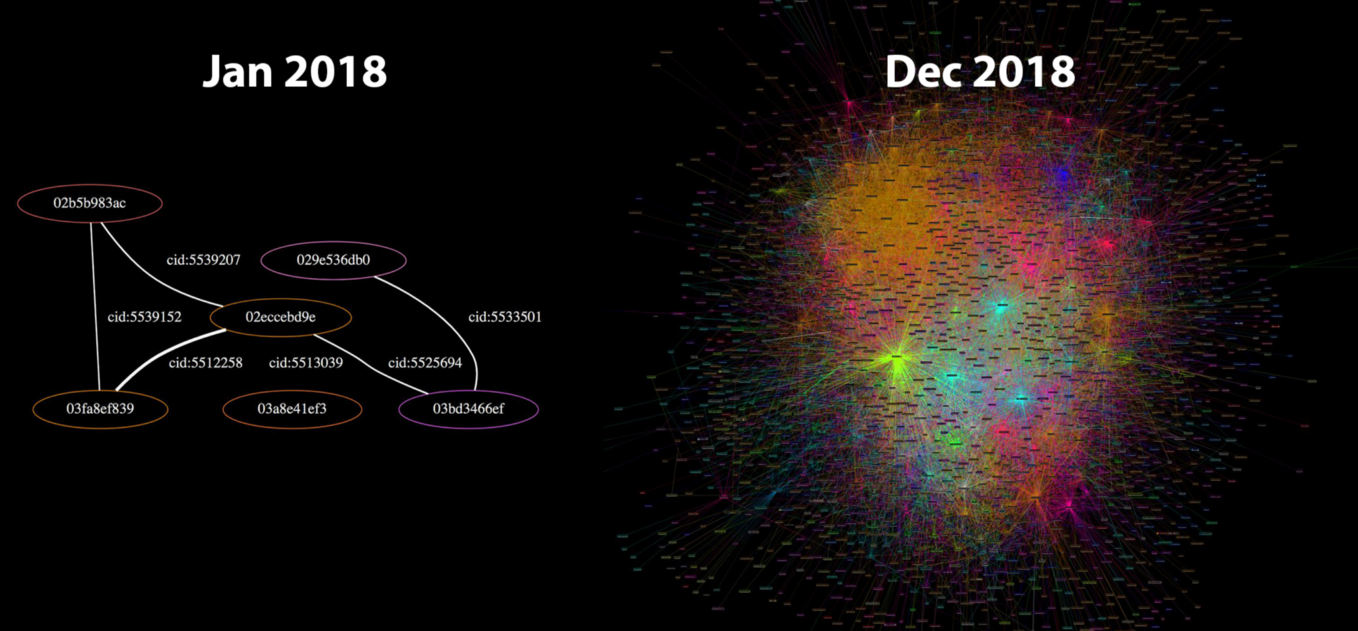

All great things start small, and Bitcoin was no exception. In the beginning, it was one node, one piece of software, one person, one set of ideas. On 31 October 2008, the Bitcoin whitepaper was published. Two months later, on 3 January 2009, the genesis block was mined.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”Bitcoin’s Genesis Block It took only two days until a second person was intrigued enough to join the network. Hal Finney ran the software, connected to Satoshi’s node, and the Bitcoin network was born. Soon, other people picked up on the idea, ran the software, and set up their nodes to join the network. The rest, as they say, is history.

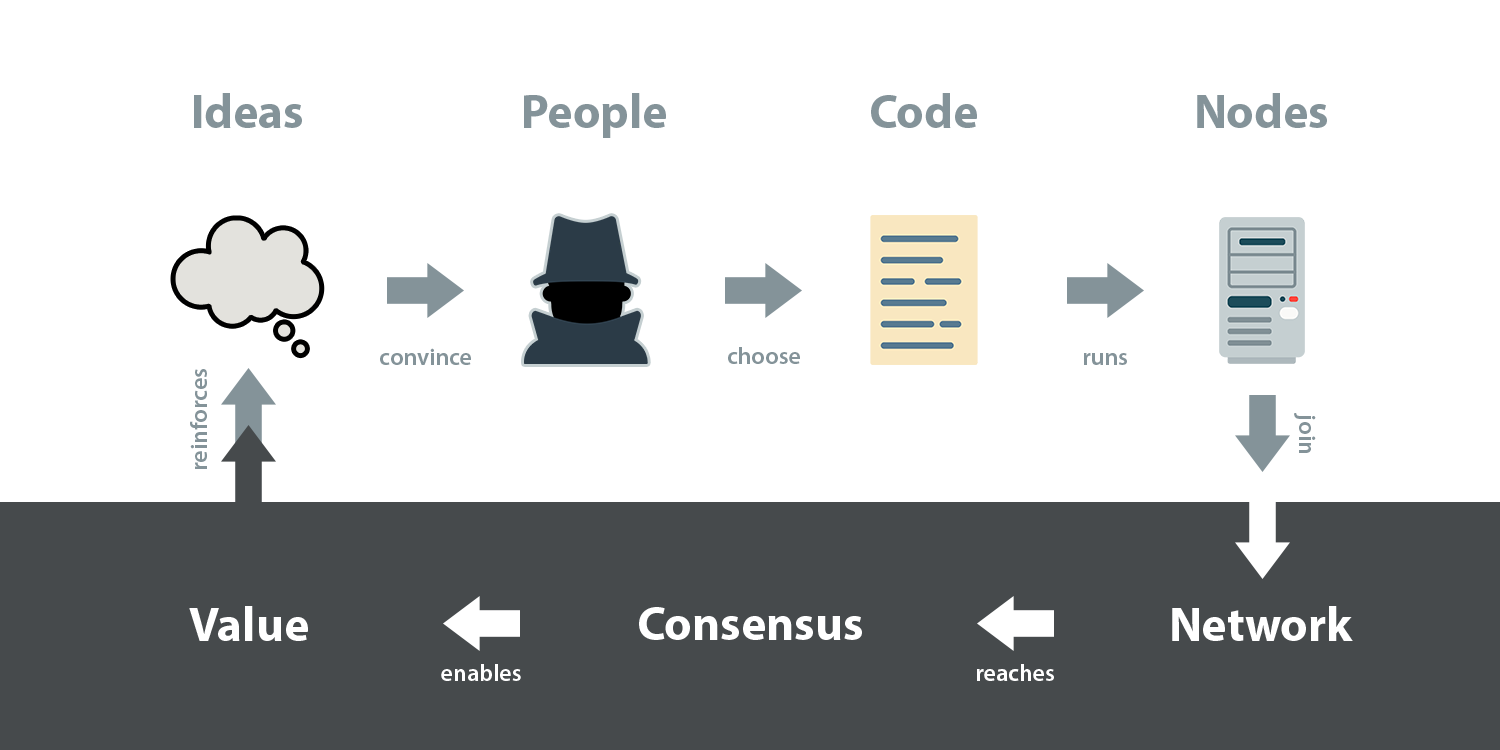

The Bitcoin network is a complex piece of machinery. The constituents of the network — part technology, part biology — make it inherently difficult to describe and understand. While the following doesn’t claim to be a complete description of the system by any means, I think it’s helpful to focus on some constituents in more detail. In particular, I want to focus on the following four: ideas, people, code, and nodes.

Bitcoin’s ingredients: two parts software, two parts hardware.

Bitcoin’s ingredients: two parts software, two parts hardware.

On the physical layer, the network is made up of interconnecting nodes. Bitcoin’s consensus rules are embodied in its software, i.e. the code which is running on its nodes. Ultimately, people are choosing which software to run, a decision which is shaped by the set of ideas they hold.

The possibility of running self-sovereign nodes is part of the reason why Bitcoin’s consensus rules are so hard to change. As mentioned above, there is no central authority, no entity to trust. Changes have to be adopted voluntarily by everyone. People are free to run any version of the software, be it out of conviction, laziness, or contempt.

Bitcoin is a system “based on cryptographic proof instead of trust,” to quote the whitepaper. The implication is that you are the authority and you have to verify everything for yourself from scratch. Out of this, consensus emerges.

“Freedom brings men rudely and directly face to face with their own personal responsibility for their own free actions.”Frank Meyer, In Defense of Freedom As soon as consensus is reached on the network, value comes into play. That bitcoins — or any monies, for that matter — have value, is in itself an idea that people need to be convinced of.

For Bitcoin, this process took almost 500 days. When the network was in its infancy, bitcoins weren’t worth anything. They were mined and sent back and forth between curious cypherpunks. However, the moment Laszlo exchanged 10,000 BTC for two pizzas, Bitcoin went from zero to one. In an instant, the network became valuable in a tangible way.

Ever since this moment, the following idea-value feedback loop is at play:

- Bitcoin’s set of ideas— its value proposition — is attracting people.

- Those people freely choose which code to run.

- The selected code runs on individual nodes, dictating their behavior.

- Nodes join the network, connecting to peers who share their ideas.

- The network reaches consensus, enabling agreement on who owns what.

- The value, in turn, is based on the set of ideas enforced by consensus rules: the embodiment of its value proposition.

Idea-value feedback loop.

Idea-value feedback loop.

This idea-value feedback loop, the re-enforcement of ideas through value creation, is the mechanism behind Bitcoin’s gravity. Everything in this cycle influences everything else — whether it is software, hardware, or wetware. This loop is what ultimately captures people, and since Bitcoin’s core set of ideas is virtually fixed, it has some surprising effects on the sets of ideas held by people.

Bitcoin’s Gravity Well

As we have seen above, Bitcoin is an opinionated piece of software, creating an opinionated network. The result of an opinionated network is that it attracts opinionated people.

Arguably, most early adopters of Bitcoin shared its core set of ideas. As Dan Held points out in Planting Bitcoin, Satoshi carefully chose the initial group of people: cryptographers and cypherpunks, who understood the technical components Bitcoin is made of.

There are many paths which might bring you close to Bitcoin’s gravitational pull: you might have an interest in cryptography, information security, or financial technologies. You may hold certain political or economic beliefs. You might be a gold bug, free speech advocate, or a speculator. You may need to use Bitcoin out of necessity. Whatever the reasons for your initial contact with Bitcoin, there is a certain probability that you are pulled in. Satoshi alluded to this multi-dimensional attractiveness in one of his emails to the cryptography mailing list.

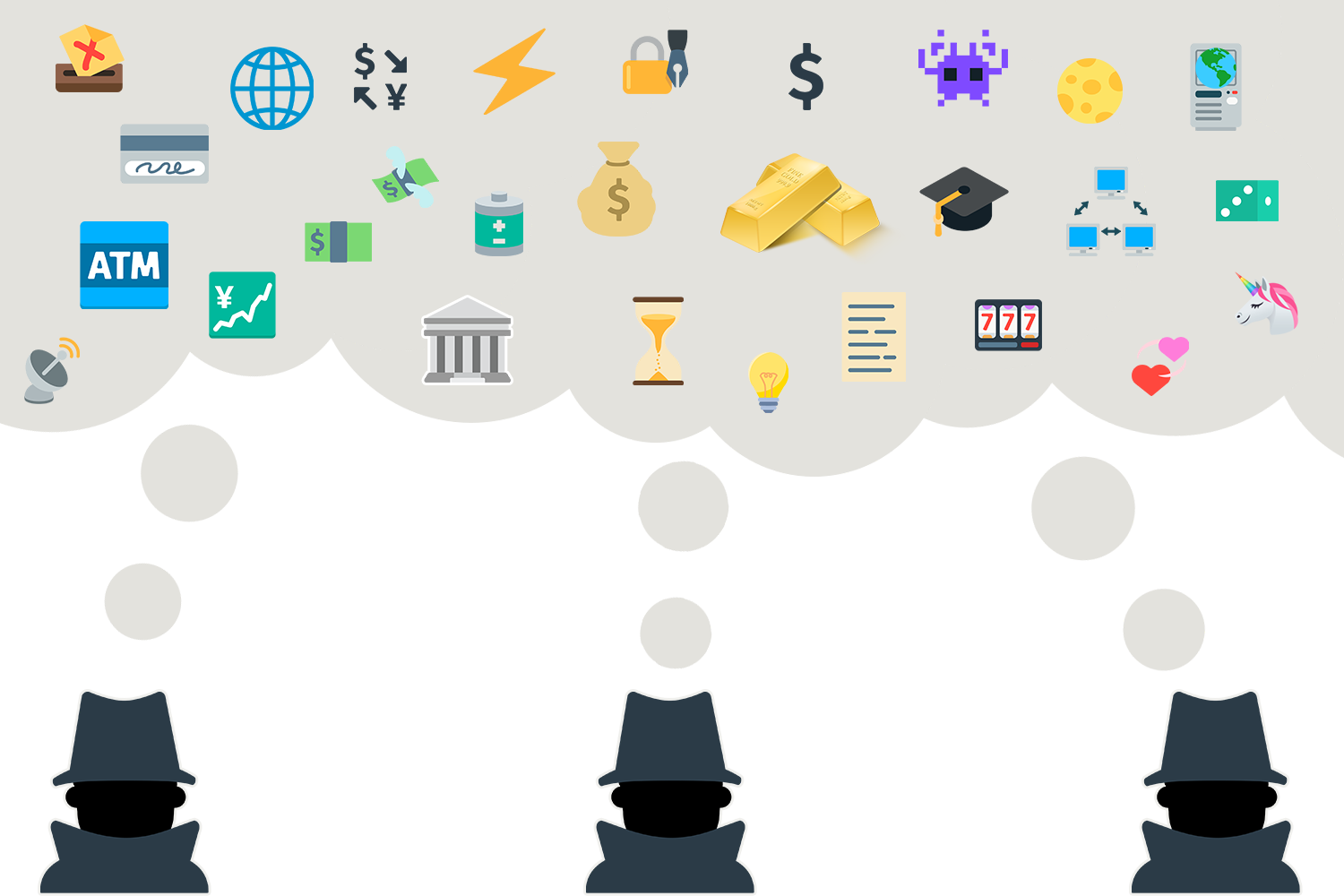

“It’s very attractive to the libertarian viewpoint if we can explain it properly. I’m better with code than with words though.”Satoshi Nakamoto One way to illustrate this is by visualizing a landscape of ideas. Since the number of all possible ideas is basically infinite, we will have to focus on a small subset. And since we are talking about Bitcoin, we will focus on the small universe of ideas spawned by asking the question of what Bitcoin is.

What is Bitcoin?

What is Bitcoin?

Ask three strangers what Bitcoin is, and you will probably get three very different answers. Any answer is necessarily shaped by past experience, political and economic beliefs, and an individual understanding of the world. Your personal set of ideas, your world view, defines where you are on the landscape of ideas.

The landscape has sets of ideas which clump together: narratives, which help to explain what Bitcoin is. One person might think of Bitcoin primarily as digital gold, focusing on the store of value aspect of Bitcoin. Another person might think of Bitcoin as a payment system, focusing on the medium of exchange aspect of Bitcoin. Yet another person might think of Bitcoin as a way to automate more complex social constructs, focusing on automation of contracts and similar ideas.

“Nobody can know everything. The complexity of society is irreducible. We cling to mental models that satisfy our thirst for understanding a given phenomenon, and stick to groups who identify with similar narratives.” Dan Held These narratives, these sets of ideas, describe both what Bitcoin actually is — at least in part — and what people think it is. These narratives will necessarily evolve over time as our understanding of the system and the system itself evolves. Neither ideas, nor people, nor Bitcoin, nor the world at large are static things. Our visions of Bitcoin have changed, and will continue to do so in the future.

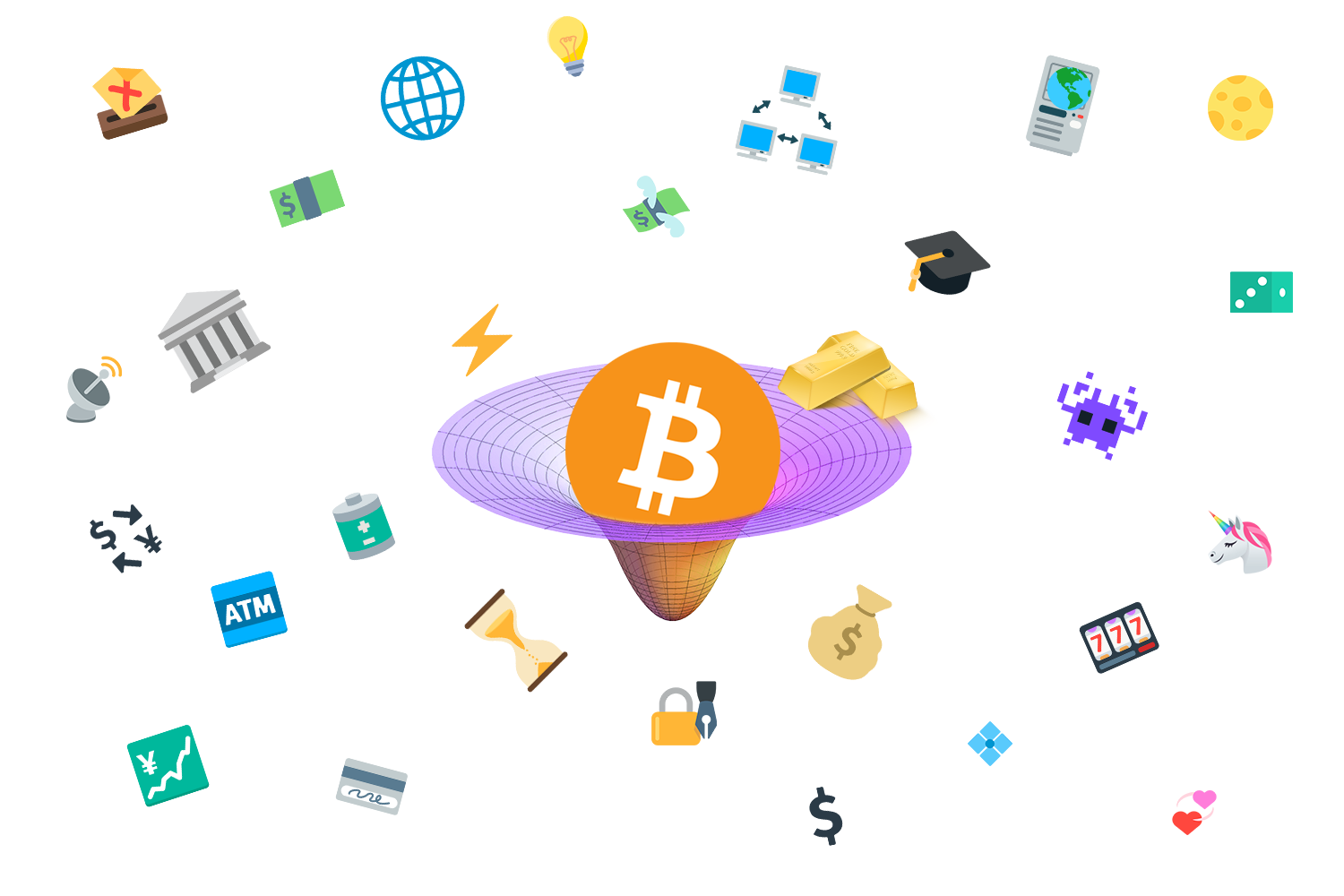

Whatever Bitcoin is, it acts as a gravity well in this universe of ideas. If your set of ideas overlaps with those embodied by Bitcoin, you are close to its gravity well and captured easily. If your set of ideas is opposed to Bitcoin’s, you are far away from its gravitational pull and remain unattracted.

What is Bitcoin?

What is Bitcoin?

Consequently, Bitcoin is attracting opinionated people who share certain ideas and ideals. “Birds of a feather flock together,” as the saying goes. In this case, many nerd-birds and cypherpunks flocked around Bitcoin early. Not particularly surprising.

What is surprising, however, is the side-effect of an opinionated network: it influences people. Since the set of ideas embodied by Bitcoin is fixed, it is the set of ideas held by people which has to align — not vice-versa. The last ten years have shown that Bitcoin is very effective in changing minds. So far, no single mind was particularly effective in changing it.

“So the universe is not quite as you thought it was. You’d better rearrange your beliefs, then. Because you certainly can’t rearrange the universe.” —Isaac Asimov To repeat an old TFTC trope: Bitcoin will change us more than we will change it, as I have learned myself.

Attraction and Repulsion

But what if your set of ideas does not overlap with Bitcoin’s? What if you wish to change Bitcoin’s set of ideas, not convinced of the futility of this endeavor? What if you are downright repulsed by some of its ideas?

“The miracle of physics that I’m talking about here is something that was actually known since the time of Einstein’s general relativity; that gravity is not always attractive. Gravity can act repulsively.”Alan Guth If you are truly repulsed by Bitcoin’s ideas, you might end up drifting away into space, joining the interstellar void where nocoiners float around.

If you want to change Bitcoin’s ideas in a fundamental way, you might end up creating another gravity well. This is easily possible because of Bitcoin’s openness. Its open source code, permissionless network structure, and lack of formal organization of any kind allows anyone to copy, modify, and run the code without asking for permission.

As outlined above, changing the core rules of Bitcoin results in a new game — different from the game everyone else is playing. To not play alone, you would have to convince other people to play with you. If you want to have the same number of people to play with, you will have to convince everyone on the network that your set of ideas is better than the one held by everyone else. And since this is mostly a financial game, strong network effects are very beneficial; it is in your best interest to convince everyone.

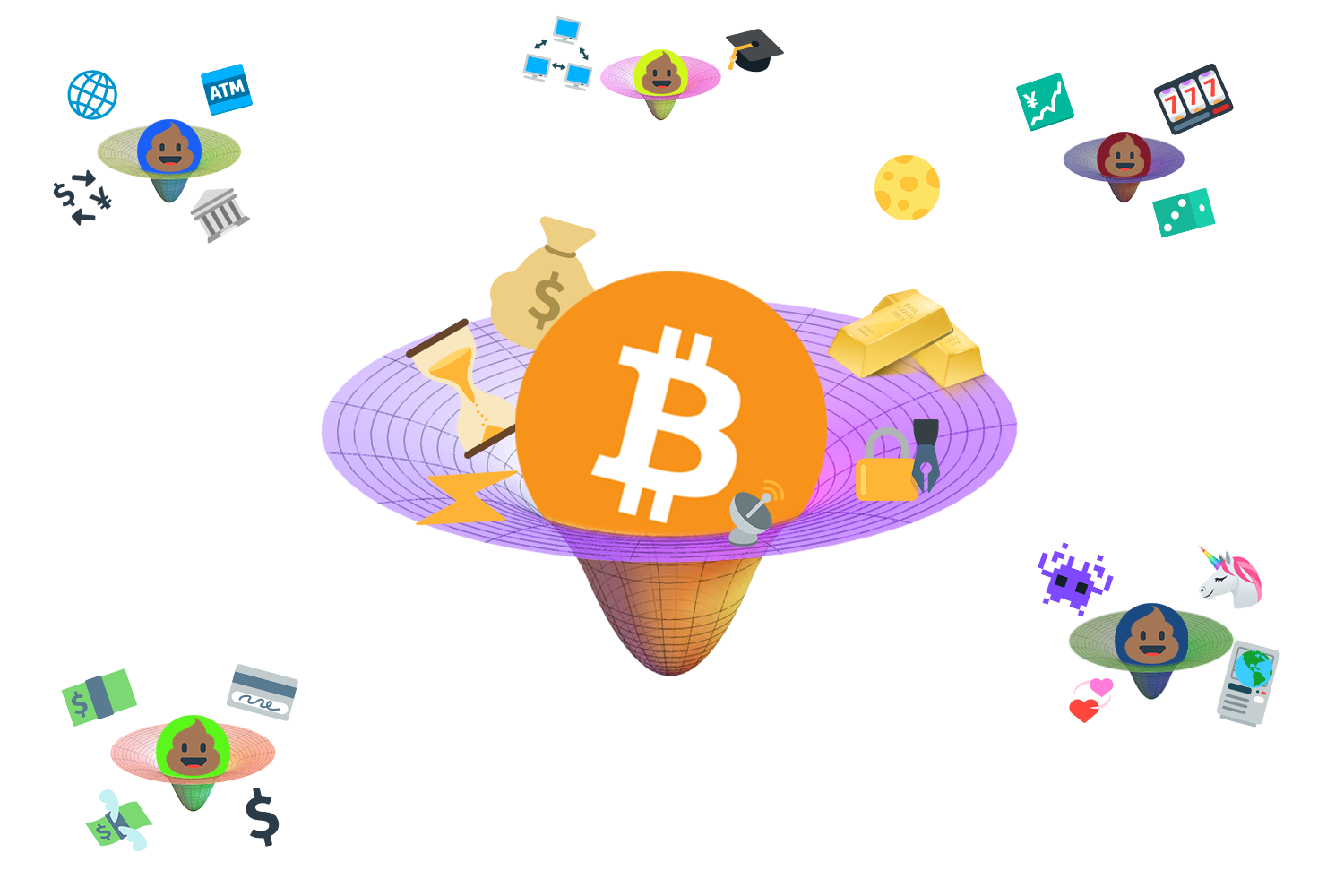

Failing to do so will create a competing system; either by creating a new network or by splitting off from the existing Bitcoin network. Since all new projects are inspired by Bitcoin, the set of ideas necessarily overlaps; sometimes almost exactly.

“Tracking narratives is a good way to help people understand that there are, in fact, a menu of beliefs competing for their affiliation; […] Trying to identify where one narrative ends and another begins is a challenging task, as ideas tend to have permeable borders.”Nathaniel Whittemore Since creating new gravity wells is (a) possible and (b) relatively easy to do (copy Bitcoin’s code, change a few parameters, launch the new network with a couple of friends) there was an explosion of alternative coins in the last few years. While most of these altcoins are outright scams, some try to find a niche, attracting people who share its new or modified set of ideas.

Different ideas are captured by different gravity wells.

Different ideas are captured by different gravity wells.

Being sucked into one of these gravity wells — and thus into an idea-value feedback loop — is the reason for much of the toxicity we see in Bitcoin and elsewhere. The direct link between holding beliefs (ideas) and holding assets (value) is a multiplying factor which can result in ever deeper entrenchment.

“Everyone knows nowadays that people “have complexes.” What is not so well known, though far more important theoretically, is that complexes can have us.”Carl Jung One could argue, as Carl Jung did in relationship to complexes, that blockchains have people. At the root of every gravity well is a set of ideas and a group of people which are had by them.

Once captured, a difference in technicalities can easily become a difference in ideologies — and vice versa. Giving up on ideas is difficult in any case, but if your net worth is intractably linked these ideas it becomes ever more difficult.

Orbits and Collisions

The formation of any gravity well isn’t exactly a smooth ride. Just like stellar and planetary formation is violent at times — suns swallowing planets, planets bumping into each other, and moons being smashed to pieces — the formation of Bitcoin’s gravity well had some violent events too.

I plan to explore some of these events in the future, but for now, let’s just acknowledge that there are other projects orbiting Bitcoin and that there have been collisions in the past.

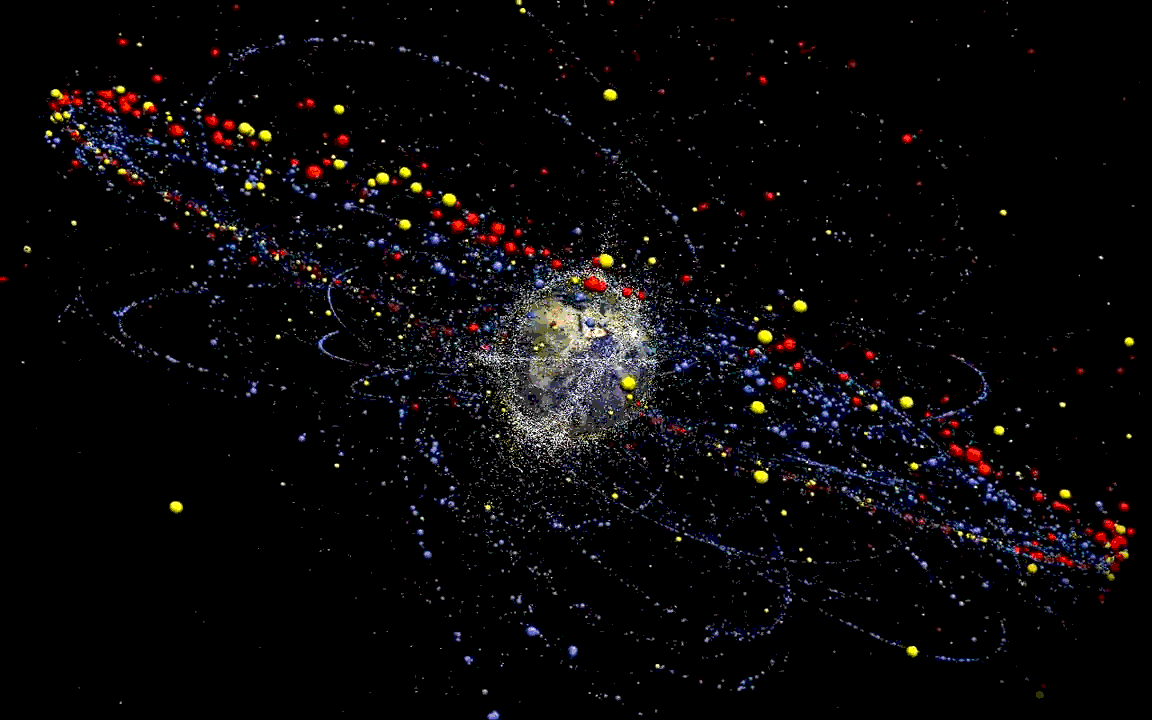

An artist’s impression of Bitcoin and its satellites. Source: KQED Science

An artist’s impression of Bitcoin and its satellites. Source: KQED Science

Whether all other projects will be swallowed by Bitcoin or die on their own, or whether some will find stable orbits, is yet to be seen. What can be observed today, however, is that most networks are competitive. To quote Eric Hoffer: “the gain of one in adherents is the loss of all the others.”

What can also be observed, since it has happened multiple times over the last couple of years, is that projects which fail to deliver on their value proposition are quickly losing most of their adherents and also their value — the former due to disillusion, the latter due to market forces. Value, and speculation on future value, is an integral part of the idea-value feedback loop. If ideas don’t materialize or fail, real (and speculative) value is lost, which is effectively killing those ideas and the networks which embody them.

However, as long as people hold different sets of ideas, and as long as a project in Bitcoin’s orbit embodies this set of ideas, people will flock to it. Whether those ideas have merit will be decided by time, the open market, and ultimately, reality. Horrible ideas don’t work at all, bad ideas not for long, and solutions which aren’t substantially better than the status quo won’t thrive in a free market.

The best ideas, however, might be discovered by the biggest networks and will be assimilated, if assimilation is possible. If Bitcoin can eat it, it will eat it.

Feeding on Ideas

As mentioned above, Bitcoin’s core set of ideas is fixed from day one. However, this doesn’t imply that Bitcoin can’t be improved. It can and should be improved, but it has to be improved in ways that don’t destroy the essence of Bitcoin. Such improvements are happening all the time, which is why we can send payments to script hashes, have segregated witness, and can pay small amounts quickly and cheaply on the lightning network.

The technicalities of improving Bitcoin — and the important difference between a soft and a hard fork — are well worth exploring, but are beyond the scope of this article. Without going into more details in regards to the nature of these improvements, Bitcoin undoubtedly is improving, and thus its feature set is changing and expanding.

In terms of gravitational pull, this means that Bitcoin is gaining mass. The set of ideas which describes Bitcoin is expanding along with its feature set, potentially capturing more people and swallowing competing projects and ideas in the process.

The idea of cheap payments, for example, has re-emerged thanks to payment channels on the lightning network. While still in its early stages, other projects built on this idea will lose their merit if the lightning network is successful on a large scale.

Privacy is another idea which is at the root of several competing projects. If future privacy enhancements in Bitcoin prove to be successful (Schnorr signatures, lightning, whirlpool, wallets supporting CoinJoins), these projects might be swallowed by Bitcoin as well.

“And the earth opened her mouth, and swallowed them up, and their houses, and all the men that appertained unto Korah, and all their goods. They, and all that appertained to them, went down alive into the pit, and the earth closed upon them: and they perished from among the congregation.”Book of Numbers I’m not saying that all other projects will perish, necessarily. But networks thrive because of network effects: the winner takes most, if not all.

The Value of Conviction

Whenever people are debating ideas, tribalism is the norm, not the exception. Whether it is politics, sports, iPhone vs Android, or pineapple on pizza, people identify with the camp that is closest to their ideas and ideals.

While the validity of ideas are sometimes hard to measure, either because their consequences are very indirect (politics) or subjective and not truly consequential in the grand scheme of things (pineapple on pizza), networks like Bitcoin come with a direct measurement: value.

While this value can be distorted by both manipulation and speculation, it is a reliable and (almost) direct indicator of both conviction and validity of ideas. If more people are convinced by a network’s set of ideas, more people will hold its native token as an asset. And the more those ideas align with reality, the more real-world value is generated by the network, convincing more people and deepening the convictions of those already convinced.

Bitcoin has the largest gravity for a reason: it works since day one, solves real problems for real people, generating real value. It works because its set of ideas aligns most closely with reality. It is valuable because people believe in its value proposition, and with good reason: Bitcoin is the largest, most secure, most robust network for permissionless and digital value transfer to date. And it is growing.

Whether you are already convinced by Bitcoin’s ideas or are diametrically opposed to them, Bitcoin will continue to not care. Its gravitational pull will continue to increase, swallowing ideas, people, code, and nodes in the process.

Conclusion

We have seen that Bitcoin embodies a certain set of ideas in its consensus rules and overall architecture. Changing Bitcoin’s core set of ideas is virtually impossible, which is why its core design is “set in stone” since day one.

The idea-value feedback loop is what creates Bitcoin’s gravity. People coming close to this feedback loop have a certain probability of being captured, which forces them to align their own set of ideas with Bitcoin’s or “fork off.”

Understanding that any unchanging system will change its participants is helpful in understanding both attraction to and repulsion by Bitcoin. Since changing the core set of ideas is not an option, new projects embodying new sets of ideas are launched, creating new gravity wells in the process.

A different idea-value feedback loop is the basis for each gravity well. Tribalism and loss-aversion help to explain some of the toxicity between competing projects and communities, since falling into any feedback loop will taint the world view of anyone captured by it.

“For one can fall victim to possession if one does not understand betimes why one is possessed. One should ask oneself for once: Why has this idea taken possession of me? What does that mean in regard to myself?”Carl Jung Both the world and Bitcoin are dynamic things, making any set of ideas we currently hold insufficient for a permanent, complete view of either. Bitcoin can and does change, even if its essence is virtually unchangeable. No matter our individual beliefs, we must not get too attached to any narrative, or to any set of ideas.

Bitcoin’s dominance is no accident. Its set of ideas managed to convince the largest group of people, generating the most value in turn. However, exploring other ideas can be a good and healthy thing, if pursued genuinely. Time and the free market will decide which ideas align with reality. Bad ideas will vanish, and good ideas will be absorbed.

In a world where people hold a combination of ideas and valuable assets, a feedback loop which links and reinforces both is a powerful force of attraction. Whether you just started to feel Bitcoin’s gentle pull or you’ve been a hodlonaut in close orbit, Bitcoin’s gravity will continue to increase. I am convinced of that idea, and I hope to have planted a seed of conviction in you as well.

Further Reading

- Unpacking Bitcoin’s Social Contract by Hasu

- We can’t all be friends: crypto and the psychology of mass movements by Tony Sheng

- Visions of Bitcoin - How major Bitcoin narratives changed over time by Hasu and Nic Carter

- The Many Faces of Bitcoin by Murad Mahmudov and Adam Taché

- Bitcoin: Past and Future by Murad Mahmudov and Adam Taché

- Crypto-incrementalism vs Crypto-anarchy by Tony Sheng

- Bitcoin Culture Wars by Brandon Quittem

- Schrödinger’s Securities by Nathaniel Whittemore

- Market Narratives Are Marketing by Nathaniel Whittemore

- Quantum Narratives by Dan Held

Acknowledgments

- Thanks to Hasu, whose incredible feedback helped to shape large parts of this article. His writing on Unpacking Bitcoin’s Social Contract was my inspiration for writing about Bitcoin’s gravity.

- Thanks to Nathaniel Whittemore for his writings on narratives and feedback on earlier drafts of this article.

- Thanks to Ben Prentice for proofreading the final draft.

- Graphics based on the fxemoji set cc-by Sabrina Smelko

- Dedicated to the bravest space cat of them all (* April 2017, † April 2019).

Translations

Philosophical Teachings of Bitcoin

What I’ve Learned From Bitcoin: Part I

By Gigi

Posted December 21, 2018

This is part 1 of a 3 part series

- Part 1 Philosophical Teachings of Bitcoin

- Part 2 Economic Teachings of Bitcoin

- Part 3 Technological Teachings of Bitcoin

Some questions have easy answers. “What have you learned from Bitcoin?” isn’t one of them. After trying to answer this question in a short tweet, and failing miserably, I realized that the amount of things I’ve learned is far too numerous to answer quickly, if at all. I also realized that any set of answers to this question will be different for everyone — a reflection of the very personal journey through the wonderful world of crypto. Hence, the subtitle of this series is What I’ve Learned From Bitcoin, with which I want to acknowledge the inherent personal bias of answering a question like this.

I tried to group the teachings of Bitcoin by topics, resulting in three parts:

- I: Philosophical Teachings of Bitcoin

- II:Economic Teachings of Bitcoin

- III:Technological Teachings of Bitcoin

As hinted above, attempting to answer this question fully is a fool’s errand, thus my answers will always be incomplete. I would like to lessen this shortcoming by inviting you, dear reader, to share your own answers to this question:

Bitcoin is indeed a game disguised. It is akin to a trapdoor, a gateway to a different world. A world much stranger than I would have ever imagined it to be. A world which takes your assumptions and shatters them into a thousand tiny pieces, again and again. Stick around for long enough, and Bitcoin will completely change your worldview.

“After this, there is no turning back. You take the blue pill — the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill — you stay in Wonderland, and I show you how deep the rabbit hole goes.”

— Morpheus

***

Lesson 1: Immutability and change

Bitcoin is inherently hard to describe. It is a new thing, and any attempt to draw a comparison to previous concepts — be it by calling it digital gold or the internet of money — is bound to fall short of the whole. Whatever your favorite analogy might be, two aspects of Bitcoin are absolutely essential: decentralization and immutability.

One way to think about Bitcoin is as an automated social contract. The software is just one piece of the puzzle, and hoping to change Bitcoin by changing the software is an exercise in futility. One would have to convince the rest of the network to adopt the changes, which is more a psychological effort than a software engineering one.

The following might sound absurd at first, like so many other things in this space, but I believe that it is profoundly true nonetheless: You won’t change Bitcoin, but Bitcoin will change you.

“Bitcoin will change us more than we will change it.” —Marty Bent

It took me a long time to realize the profundity of this. Since Bitcoin is just software and all of it is open-source, you can simply change things at will, right? Wrong. Very wrong. Unsurprisingly, Bitcoin’s creator knew this all too well.

The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime. — Satoshi Nakamoto

Many people have attempted to change Bitcoin’s nature. So far all of them have failed. While there is an endless sea of forks and altcoins, the Bitcoin network still does its thing, just as it did when the first node went online. The altcoins won’t matter in the long run. The forks will eventually starve to death. Bitcoin is what matters. As long as our fundamental understanding of mathematics and/or physics doesn’t change, the Bitcoin honeybadger will continue to not care.

“Bitcoin is the first example of a new form of life. It lives and breathes on the internet. It lives because it can pay people to keep it alive. […] It can’t be changed. It can’t be argued with. It can’t be tampered with. It can’t be corrupted. It can’t be stopped. […] If nuclear war destroyed half of our planet, it would continue to live, uncorrupted. “ —Ralph Merkle

The heartbeat of the Bitcoin network will outlast all of ours.

Realizing the above changed me way more than the past blocks of the Bitcoin blockchain ever will. It changed my time preference, my understanding of economics, my political views, and so much more. Hell, it is even changing people’s diets. If all of this sounds crazy to you, you’re in good company. All of this is crazy, and yet it is happening.

Bitcoin taught me that it won’t change. I will.

Lesson 2: The scarcity of scarcity

In general, the advance of technology seems to make things more abundant. More and more people are able to enjoy what previously have been luxurious goods. Soon, we will all live like kings. Most of us already do. As Peter Diamandis wrote in Abundance: “Technology is a resource-liberating mechanism. It can make the once scarce the now abundant.”

Bitcoin, an advanced technology in itself, breaks this trend and creates a new commodity which is truly scarce. Some even argue that it is one of the scarcest things in the universe. The supply can’t be inflated, no matter how much effort one chooses to expend towards creating more.

“Only two things are genuinely scarce: time and bitcoin.” —Saifedean Ammous

Paradoxically, it does so by a mechanism of copying. Transactions are broadcast, blocks are propagated, the distributed ledger is — well, you guessed it — distributed. All of these are just fancy words for copying. Heck, Bitcoin even copies itself onto as many computers as it can, by incentivizing individual people to run full nodes and mine new blocks.

All of this duplication wonderfully works together in a concerted effort to produce scarcity.

In a time of abundance, Bitcoin taught me what real scarcity is.

Lesson 3: An immaculate conception

Everyone loves a good origin story. The origin story of Bitcoin is a fascinating one, and the details of it are more important than one might think at first. Who is Satoshi Nakamoto? Was he one person or a group of people? Was he a she? Time-traveling alien, or advanced AI? Outlandish theories aside, we will probably never know. And this is important.

Satoshi chose to be anonymous. He planted the seed of Bitcoin. He stuck around for long enough to make sure the network won’t die in its infancy. And then he vanished.

What might look like a weird anonymity stunt is actually crucial for a truly decentralized system. No centralized control. No centralized authority. No inventor. No-one to prosecute, torture, blackmail, or extort. An immaculate conception of technology.

“One of the greatest things that Satoshi did was disappear.” —Jimmy Song

Since the birth of Bitcoin, thousands of other cryptocurrencies were created. None of these clones share its origin story. If you want to supersede Bitcoin, you will have to transcend its origin story. In a war of ideas, narratives dictate survival.

“Gold was first fashioned into jewelry and used for barter over 7,000 years ago. Gold’s captivating gleam led to it being considered a gift from the gods.” —Gold: The Extraordinary Metal

Like gold in ancient times, Bitcoin might be considered a gift from the gods. Unlike gold, Bitcoins origins are all too human. And this time, we know who the gods of development and maintenance are: people all over the world, anonymous or not.

Bitcoin taught me that narratives are important.

Lesson 4: The problem of identity

Nic Carter, in an homage to Thomas Nagel’s treatment of the same question in regards to a bat, wrote an excellent piece which discusses the following question: What is it like to be a bitcoin? He brilliantly shows that open, public blockchains in general, and Bitcoin in particular, suffer from the same conundrum as the Ship of Theseus: which Bitcoin is the real Bitcoin?

“Consider just how little persistence Bitcoin’s components have. The entire codebase has been reworked, altered, and expanded such that it barely resembles its original version. […] The registry of who owns what, the ledger itself, is virtually the only persistent trait of the network […] To be considered truly leaderless, you must surrender the easy solution of having an entity that can designate one chain as the legitimate one.” —Nic Carter

It seems like the advancement of technology keeps forcing us to take these philosophical questions seriously. Sooner or later, self-driving cars will be faced with real-world versions of the trolley problem, forcing them to make ethical decisions about whose lives do matter and whose do not.

Cryptocurrencies, especially since the first contentious hard-fork, force us to think about and agree upon the metaphysics of identity. Interestingly, the two biggest examples we have so far have lead to two different answers. On August 1, 2017, Bitcoin split into two camps. The market decided that the unaltered chain is the original Bitcoin. One year earlier, on October 25, 2016, Ethereum split into two camps. The market decided that the altered chain is the original Ethereum.

If properly decentralized, the questions posed by the Ship of Theseus will have to be answered in perpetuity for as long as these networks of value-transfer exist.

Bitcoin taught me that decentralization contradicts identity.

Lesson 5: Replication and locality

Quantum mechanics aside, locality is a non-issue in the physical world. The question “Where is X?” can be answered in a meaningful way, no matter if X is a person or an object. In the digital world, the question of where is already a tricky one, but not impossible to answer. Where are your emails, really? A bad answer would be “the cloud”, which is just someone else’s computer. Still, if you wanted to track down every storage device which has your emails on it you could, in theory, locate them.

With bitcoin, the question of “where” is really tricky. Where, exactly, are your bitcoins?

“I opened my eyes, looked around, and asked the inevitable, the traditional, the lamentably hackneyed postoperative question: ‘Where am l?’” —Daniel Dennett

The problem is twofold: First, the distributed ledger is distributed by full replication, meaning the ledger is everywhere. Second, there are no bitcoins. Not only physically, but technically.

Bitcoin keeps track of a set of unspent transaction outputs, without ever having to refer to an entity which represents a bitcoin. The existence of a bitcoin is inferred by looking at the set of unspent transaction outputs and calling every entry with a 100 million base units a bitcoin.

“Where is it, at this moment, in transit? […] First, there are no bitcoins. There just aren’t. They don’t exist. There are ledger entries in a ledger that’s shared […] They don’t exist in any physical location. The ledger exists in every physical location, essentially. Geography doesn’t make sense here — it is not going to help you figuring out your policy here.” —Peter Van Valkenburgh

So, what do you actually own when you say “I have a bitcoin” if there are no bitcoins? Well, remember all these strange words which you were forced to write down by the wallet you used? Turns out these magic words are what you own: a magic spell which can be used to add some entries to the public ledger — the keys to “move” some bitcoins. This is why, for all intents and purposes, your private keys are your bitcoins. If you think I’m making all of this up feel free to send me your private keys.

Bitcoin taught me that locality is a tricky business.

Lesson 6: The power of free speech

Bitcoin is an idea. An idea which, in its current form, is the manifestation of a machinery purely powered by text. Every aspect of Bitcoin is text: The whitepaper is text. The software which is run by its nodes is text. The ledger is text. Transactions are text. Public and private keys are text. Every aspect of Bitcoin is text, and thus equivalent to speech.

“Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.” — First Amendment to the United States Constitution

Although the final battle of the Crypto Wars has not been fought yet, it will be very difficult to criminalize an idea, let alone an idea which is based on the exchange of text messages. Every time a government tries to outlaw text or speech, we slip down a path of absurdity which inevitably leads to abominations like illegal numbers and illegal primes.

As long as there is a part of the world where speech is free as in freedom, Bitcoin is unstoppable.

“There is no point in any Bitcoin transaction that Bitcoin ceases to be text._It is _all text, all the time. […] Bitcoin is text.Bitcoin is speech.It cannot be regulated in a free country like the USA with guaranteed inalienable rights and a First Amendment that explicitly excludes the act of publishing from government oversight.” —Beautyon

Bitcoin taught me that in a free society, free speech and free software are unstoppable.

Lesson 7: The limits of knowledge

Getting into Bitcoin is a humbling experience. I thought that I knew things. I thought that I was educated. I thought that I knew my computer science, at the very least. I studied it for years, so I have to know everything about digital signatures, hashes, encryption, operational security, and networks, right?

Wrong.

Learning all the fundamentals which make Bitcoin work is hard. Understanding all of them deeply is borderline impossible.

“No one has found the bottom of the Bitcoin rabbit hole.” —Jameson Lopp

My list of books to read keeps expanding way quicker than I could possibly read them. The list of papers and articles to read is virtually endless. There are more podcasts on all of these topics than I could ever listen to. It truly is humbling. Further, Bitcoin is evolving and it’s almost impossible to stay up-to-date with the accelerating rate of innovation. The dust of the first layer hasn’t even settled yet, and people have already built the second layer and are working on the third.

Bitcoin taught me that I know very little about almost anything. It taught me that this rabbit hole is bottomless.

Conclusion

Bitcoin is a child of the internet. Even though it requires computers to function efficiently, computer science is not sufficient to understand it. The implications of this new technology are far-reaching. Bitcoin is not only borderless but also boundaryless in respect to academic disciplines.

In this first part of the Teachings of Bitcoin I tried to outline some of the philosophical implications of this fascinating machinery. In part two I will try to discuss what Bitcoin taught me about economics. Part three will conclude this series to show what I, a technologist, have learned from the tech perspective by stumbling into Bitcoin.

As mentioned above, I think that any answer to the question “What have you learned from Bitcoin?” will always be incomplete. The systems are too dynamic, the space moving too fast, and the topics too numerous. Politics, game theory, monetary history, network theory, finance, cryptography, information theory, censorship, law and regulation, human organization, psychology — all these and more are areas of expertise which might help to grasp what Bitcoin is.

What have you learned from Bitcoin?

Further Reading

- The Bitcoin Standard: The Decentralized Alternative to Central Banking by Saifedean Ammous

- Abundance: The Future Is Better Than You Think by Peter Diamandis

- The Mind’s I by Daniel Dennett and Douglas Hofstadter

- Money, blockchains, and social scalability by Nick Szabo

- Bitcoin’s Existential Crisis, originally published as What is it like to be a Bitcoin? by Nic Carter

- Unpacking Bitcoin’s Social Contract: A framework for skeptics by Hasu

- Why America Can’t Regulate Bitcoin by Beautyon

- Why Bitcoin is different by Jimmy Song

- Peter Van Valkenburg on Preserving the Freedom to Innovate with Public Blockchains hosted by Peter McCormack

Acknowledgments

- Thanks to Arjun Balaji for the tweet which motivated me to write this.

- Thanks to Marty Bent for providing endless food for thought and entertainment. If you are not subscribed to Marty’s Ƀent and Tales From The Crypt, you are missing out.

- Thanks to Michael Goldstein and Pierre Rochard for curating and providing the greatest Bitcoin literature via the Nakamoto Institute and the Noded Podcast which influenced my philosophical views on Bitcoin substantially.

- Thanks to Peter McCormack for his honest tweets and the What Bitcoin Did podcast, which keeps providing great insights from many areas of the space.

- Thanks to Jannik for providing feedback to early drafts of this article.

- And finally, thanks to all the bitcoin maximalists, shitcoin minimalists, shills, bots, and shitposters which reside in the beautiful garden that is crypto twitter.

Translations

Economic Teachings of Bitcoin

What I’ve Learned From Bitcoin: Part II

Gigi

Posted January 11, 2019

This is part 2 of a 3 part series

- Part 1 Philosophical Teachings of Bitcoin

- Part 2 Economic Teachings of Bitcoin

- Part 3 Technological Teachings of Bitcoin

Money doesn’t grow on trees. To believe that it does is foolish, and our parents make sure that we know about that by repeating this saying like a mantra. We are encouraged to use money wisely, to not spend it frivolously, and to save it in good times to help us through the bad. Money, after all, does not grow on trees.

Bitcoin taught me more about money than I ever thought I would need to know. Through it, I was forced to explore the history of money, banking, various schools of economic thought, and many other things. The quest to understand Bitcoin lead me down a plethora of paths, some of which I try to explore in this series. This is the second of three parts:

- I:Philosophical Teachings of Bitcoin

- II: Economic Teachings of Bitcoin

- III:Technological Teachings of Bitcoin

In Part I of this series, some of the philosophical questions Bitcoin touches on were discussed. Part II will take a closer look at money and economics. Again, I will only be able to scratch the surface. Bitcoin is not only ambitious, but also broad and deep in scope, making it impossible to cover all relevant topics in a single essay, article, or book. I am starting to doubt if it is even possible at all.

Bitcoin is a child of many disciplines. Being a new form of money, learning about economics is paramount in understanding it. Dealing with the nature of human action and the interactions of economic agents, economics is probably one of the largest and fuzziest pieces of the Bitcoin puzzle.

Blind monks examining Bitcoin

Blind monks examining Bitcoin

Like the first part, this essay is an exploration of the various things I have learned from Bitcoin. And just like the first part, it is a personal reflection of my journey down the rabbit hole. Having no background in economics, I am definitely out of my comfort zone and aware that any understanding I might have is incomplete. Like blind monks examining an elephant, everyone who approaches this novel technology does so from a different angle and will come to different conclusions. Blindfolded as I am, I will try to outline what I have learned, even at the risk of making a fool out of myself. After all, I am still trying to answer the question:

“What have you learned from Bitcoin?”

After seven lessons examined through the lens of philosophy, let’s use the lens of economics to look at seven more. I hope that you will find the world of Bitcoin as educational, fascinating and entertaining as I did and still do. In any case, hop on and enjoy the ride. Economy class is all I can offer this time. Final destination: sound money.

Find lessons 1-7 here.

Lesson 8: Financial Ignorance

One of the most surprising things, to me, was the amount of finance, economics, and psychology required to get a grasp of what at first glance seems to be a purely technical system — a computer network. To paraphrase a little guy with hairy feet: “It’s a dangerous business, Frodo, stepping into Bitcoin. You read the whitepaper, and if you don’t keep your feet, there’s no knowing where you might be swept off to.”

To understand a new monetary system, you have to get acquainted with the old one. I began to realize very soon that the amount of financial education I enjoyed in the educational system was essentially zero.

Like a five-year-old, I began to ask myself a lot of questions: How does the banking system work? How does the stock market work? What is fiat money? What is regular money? Why is there so much debt? How much money is actually printed, and who decides that?

After a mild panic about the sheer scope of my ignorance, I found reassurance in realizing that I was in good company.

“Isn’t it ironic that Bitcoin has taught me more about money than all these years I’ve spent working for financial institutions? …including starting my career at a central bank” —aarontaycc “I’ve learned more about finance, economics, technology, cryptography, human psychology, politics, game theory, legislation, and myself in the last three months of crypto than the last three and a half years of college” —bitcoindunny

These are just two of the many confessions all over twitter. Bitcoin, as was explored in part one, is a living thing. Mises argued that economics also is a living thing. And as we all know from personal experience, living things are inherently difficult to understand.

“A scientific system is but one station in an endlessly progressing search for knowledge. It is necessarily affected by the insufficiency inherent in every human effort. But to acknowledge these facts does not mean that present-day economics is backward. It merely means that economics is a living thing — and to live implies both imperfection and change.” —Ludwig von Mises

We all read about various financial crises in the news, wonder about how these big bailouts work and are puzzled over the fact that no one ever seems to be held accountable for damages which are in the trillions. I am still puzzled, but at least I am starting to get a glimpse of what is going on in the world of finance.

Some people even go as far as to attribute the general ignorance on these topics to systemic, willful ignorance. While history, physics, biology, math, and languages are all part of our education, the world of money and finance surprisingly is only explored superficially, if at all. I wonder if people would still be willing to accrue as much debt as they currently do if everyone would be educated in personal finance and the workings of money and debt. Then I wonder how many layers of aluminum make an effective tinfoil hat. Probably three.

“Those crashes, these bailouts, are not accidents. And neither is it an accident that there is no financial education in school. […] It’s premeditated. Just as prior to the Civil War it was illegal to educate a slave, we are not allowed to learn about money in school.” —Robert Kiyosaki

Like in The Wizard of Oz, we are told to pay no attention to the man behind the curtain. Unlike in The Wizard of Oz, we now have real wizardry: a censorship-resistant, open, borderless network of value-transfer. There is no curtain, and the magic is visible to anyone.

Bitcoin taught me to look behind the curtain and face my financial ignorance.

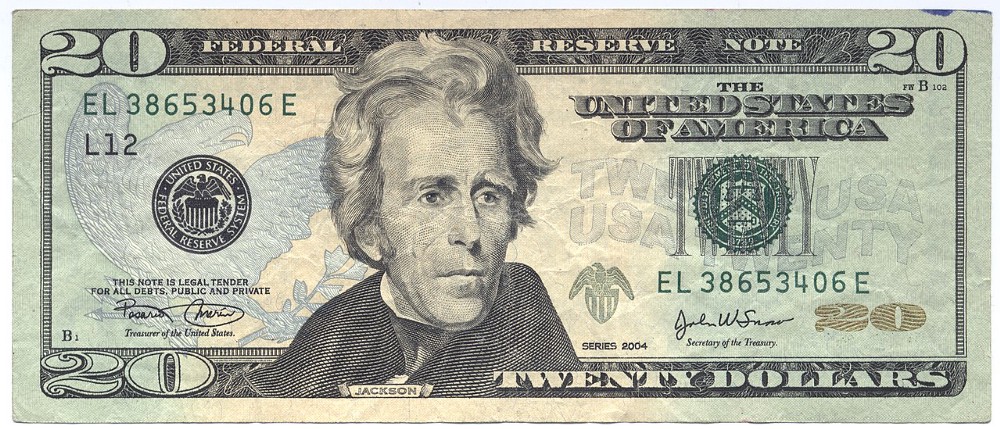

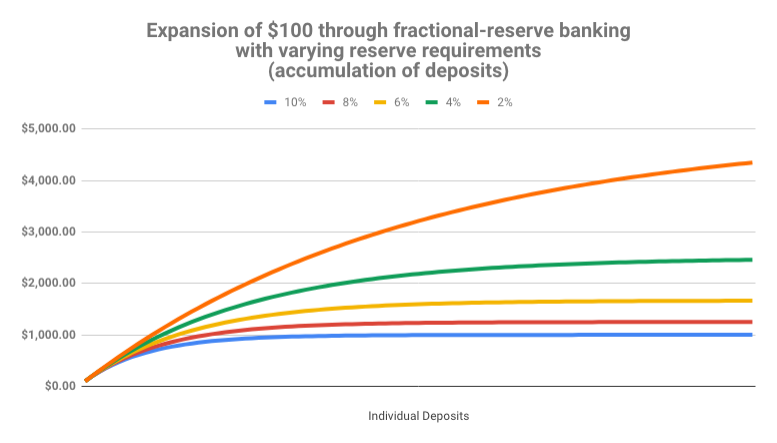

Lesson 9: Inflation

Trying to understand monetary inflation, and how a non-inflationary system like Bitcoin might change how we do things, was the starting point of my venture into economics. I knew that inflation was the rate at which new money was created, but I didn’t know too much beyond that.

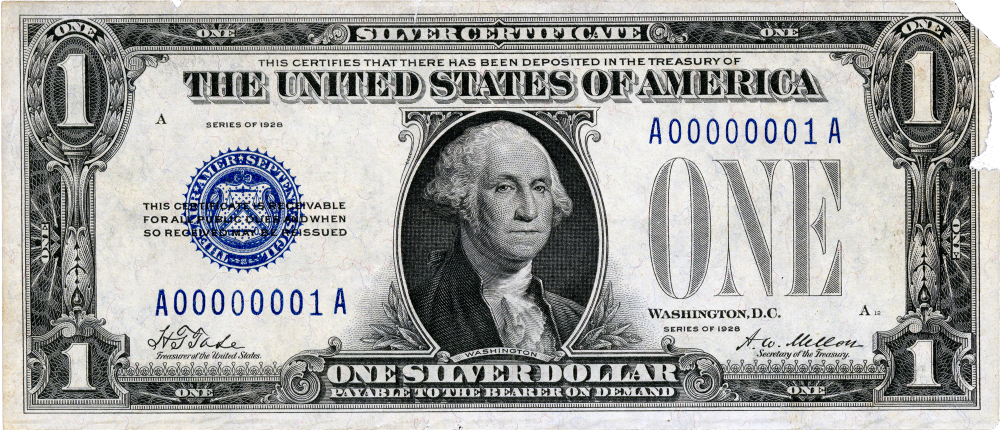

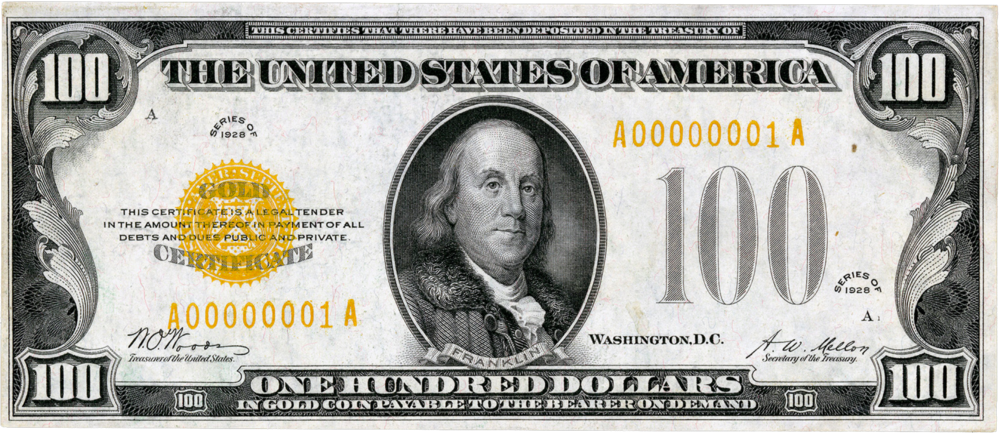

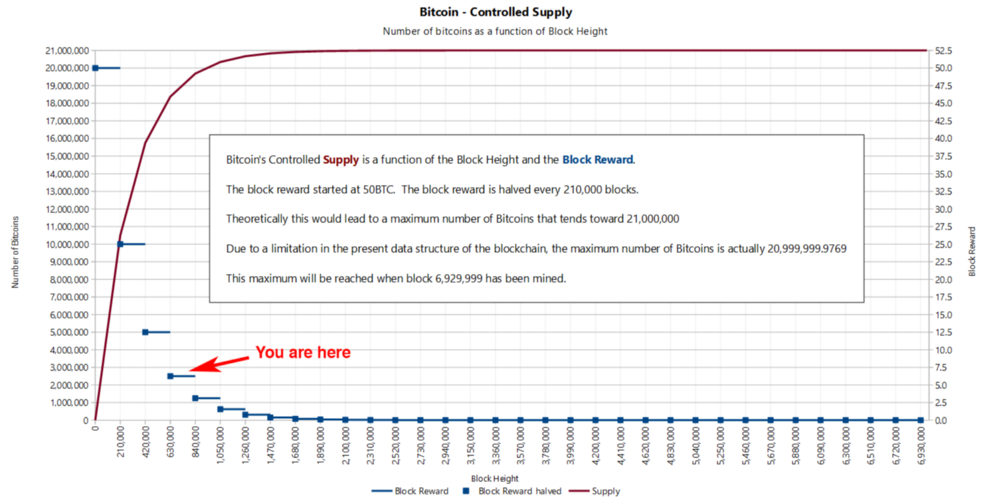

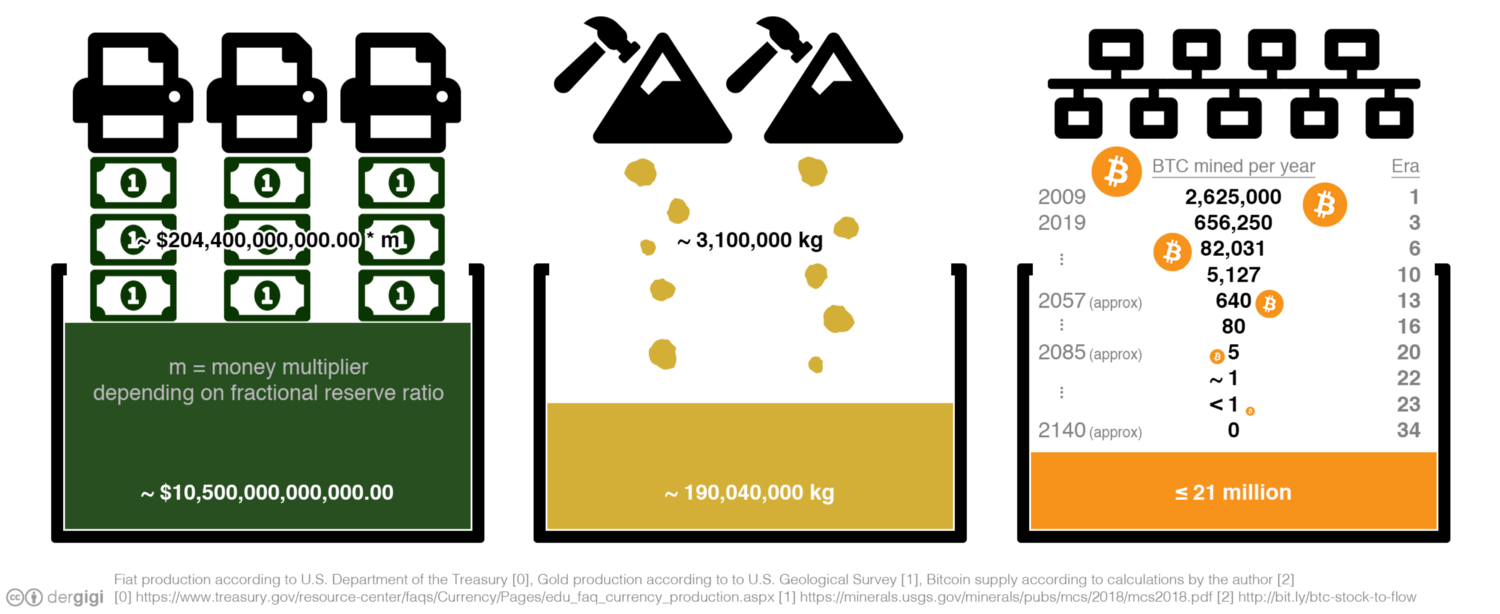

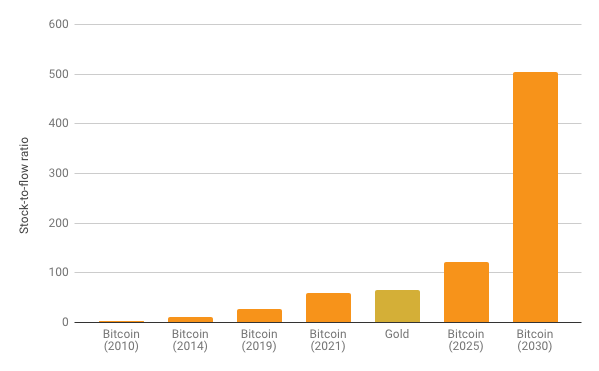

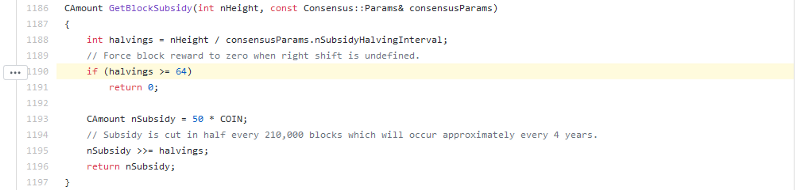

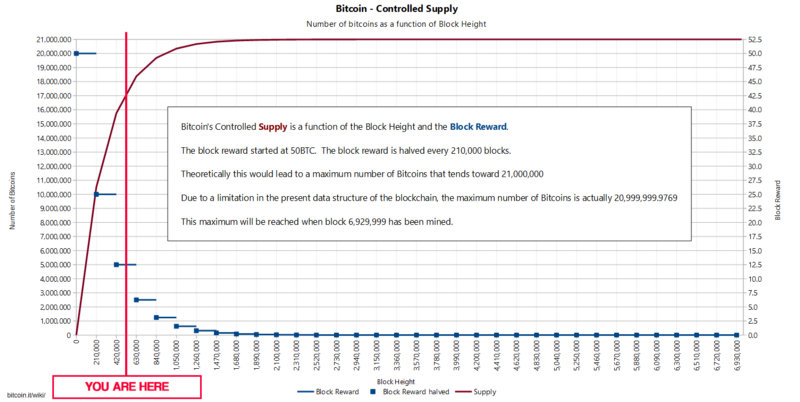

While some economists argue that inflation is a good thing, others argue that “hard” money which can’t be inflated easily —as we had in the days of the gold standard — is essential for a healthy economy. Bitcoin, having a fixed supply of 21 million, agrees with the latter camp.

Usually, the effects of inflation are not immediately obvious. Depending on the inflation rate (as well as other factors) the time between cause and effect can be several years. Not only that, but inflation affects different groups of people more than others. As Henry Hazlitt points out in Economics in One Lesson: “The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.”

One of my personal lightbulb moments was the realization that issuing new currency — printing more money — is a completely different economic activity than all the other economic activities. While real goods and real services produce real value for real people, printing money effectively does the opposite: it takes away value from everyone who holds the currency which is being inflated.

“Mere inflation — that is, the mere issuance of more money, with the consequence of higher wages and prices — may look like the creation of more demand. But in terms of the actual production and exchange of real things it is not.” —Henry Hazlitt

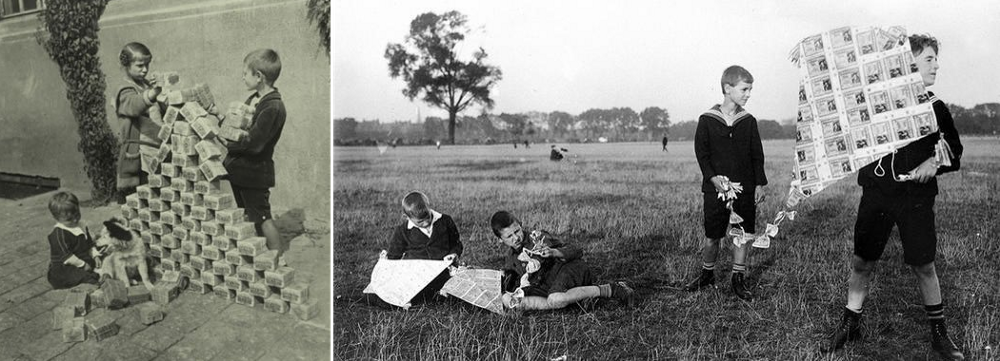

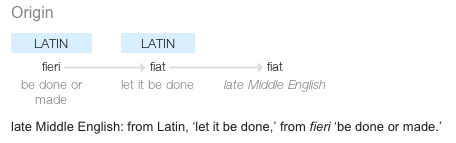

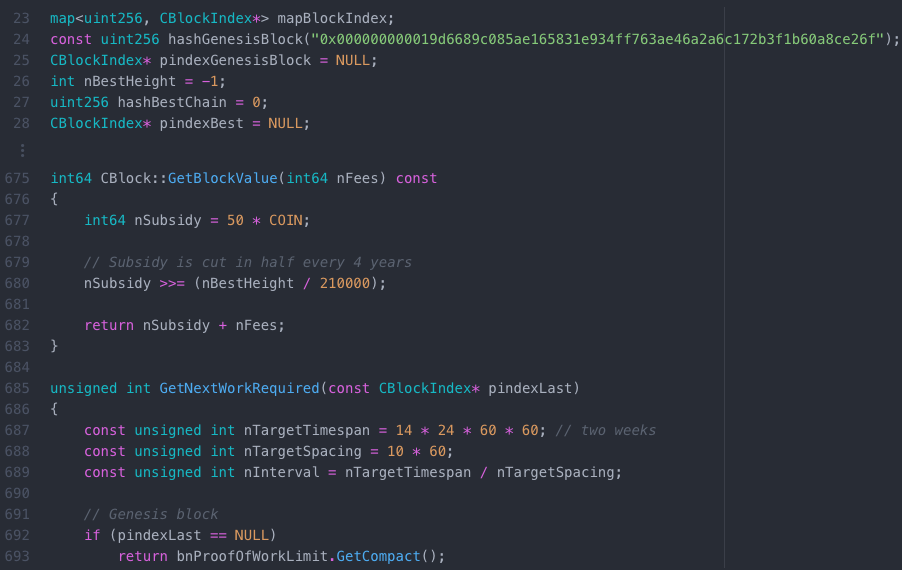

The destructive force of inflation becomes obvious as soon as a little inflation turns into a lot. If money hyperinflates, things get ugly real quick. As the inflating currency falls apart, it will fail to store value over time and people will rush to get their hands on any goods which might do.