| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the August 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

Introducing the Difficulty Ribbon, signaling the best times to buy Bitcoin

By Willy Woo

Posted August 1, 2019

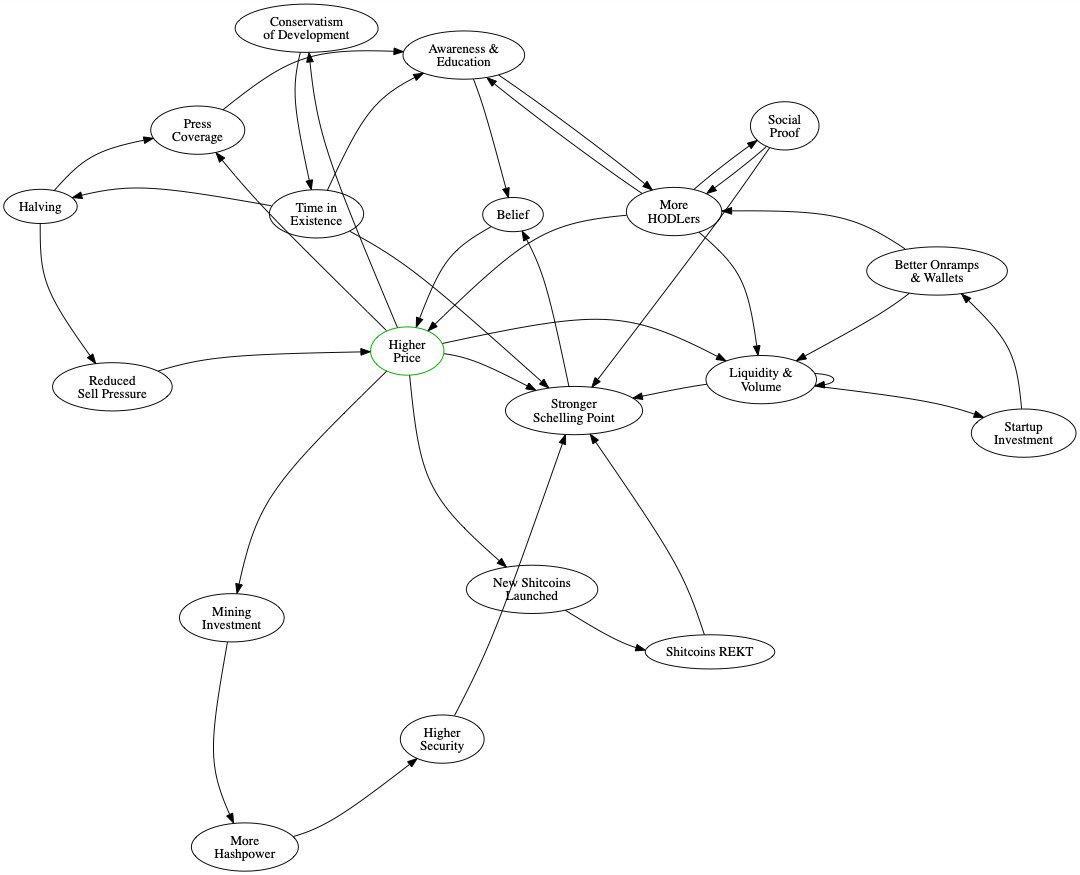

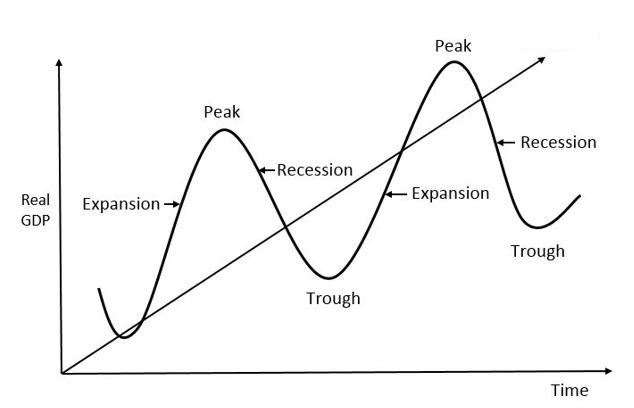

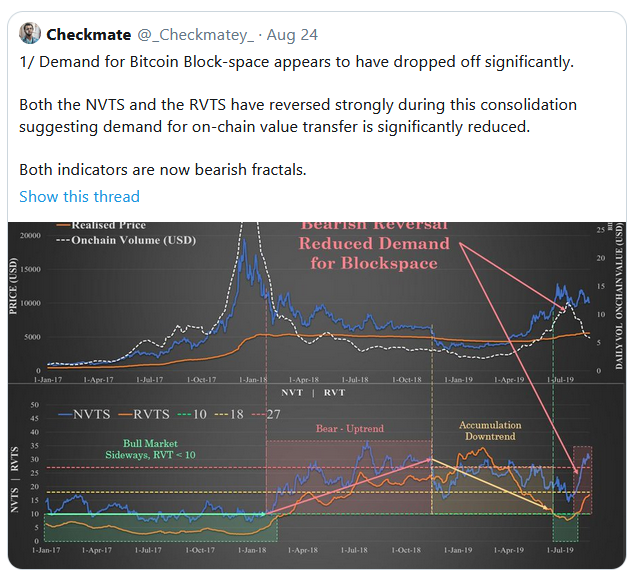

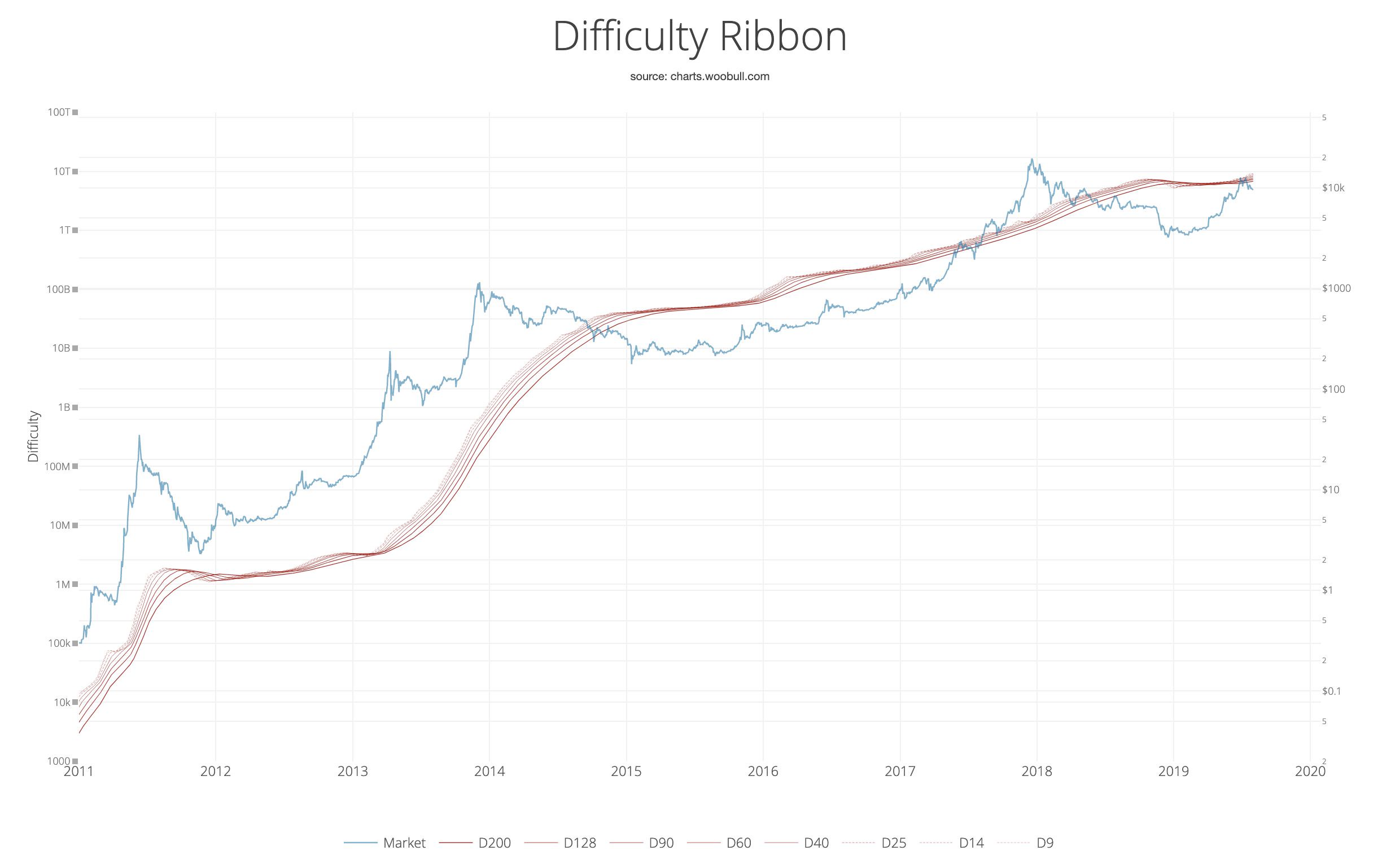

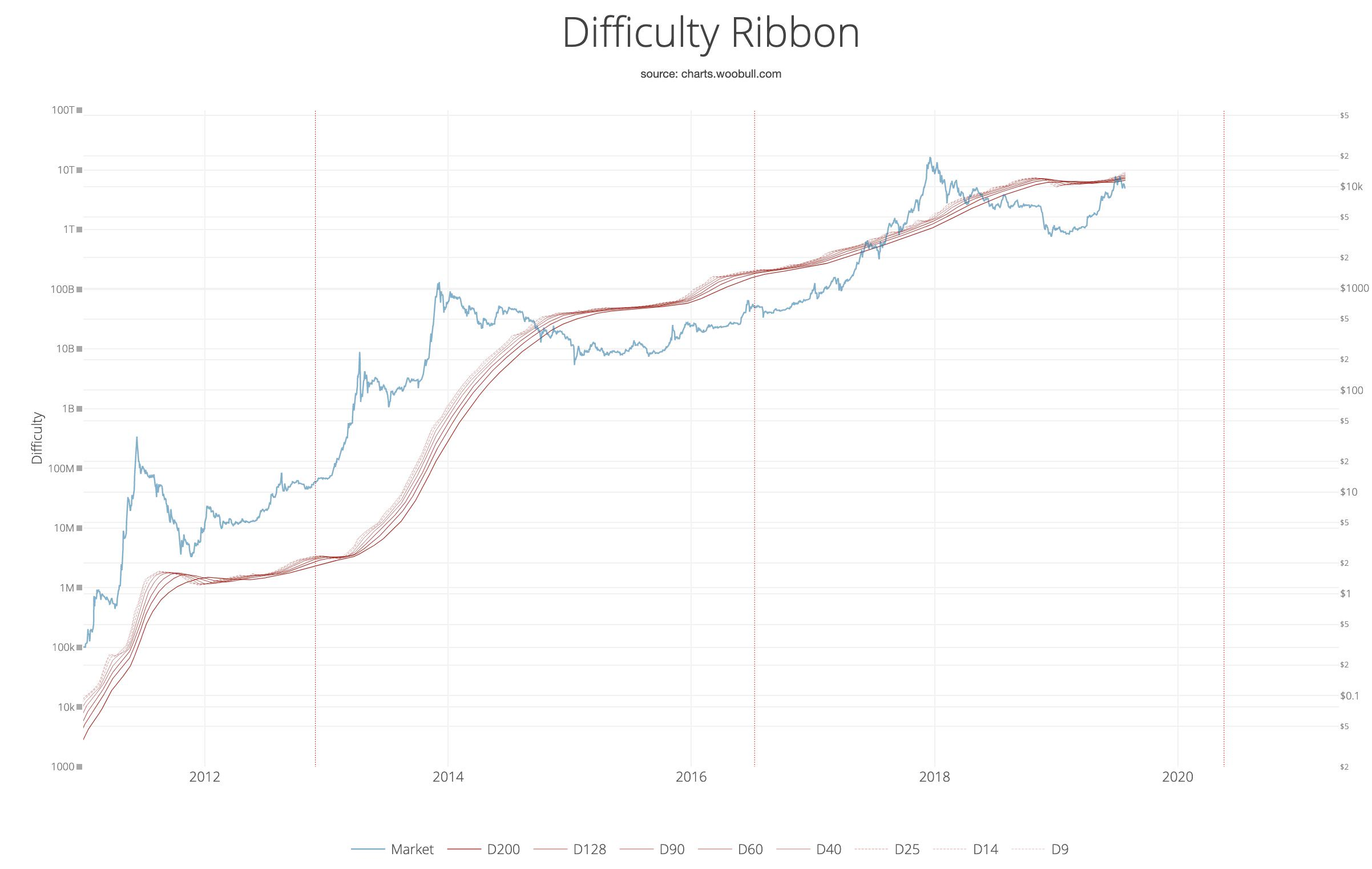

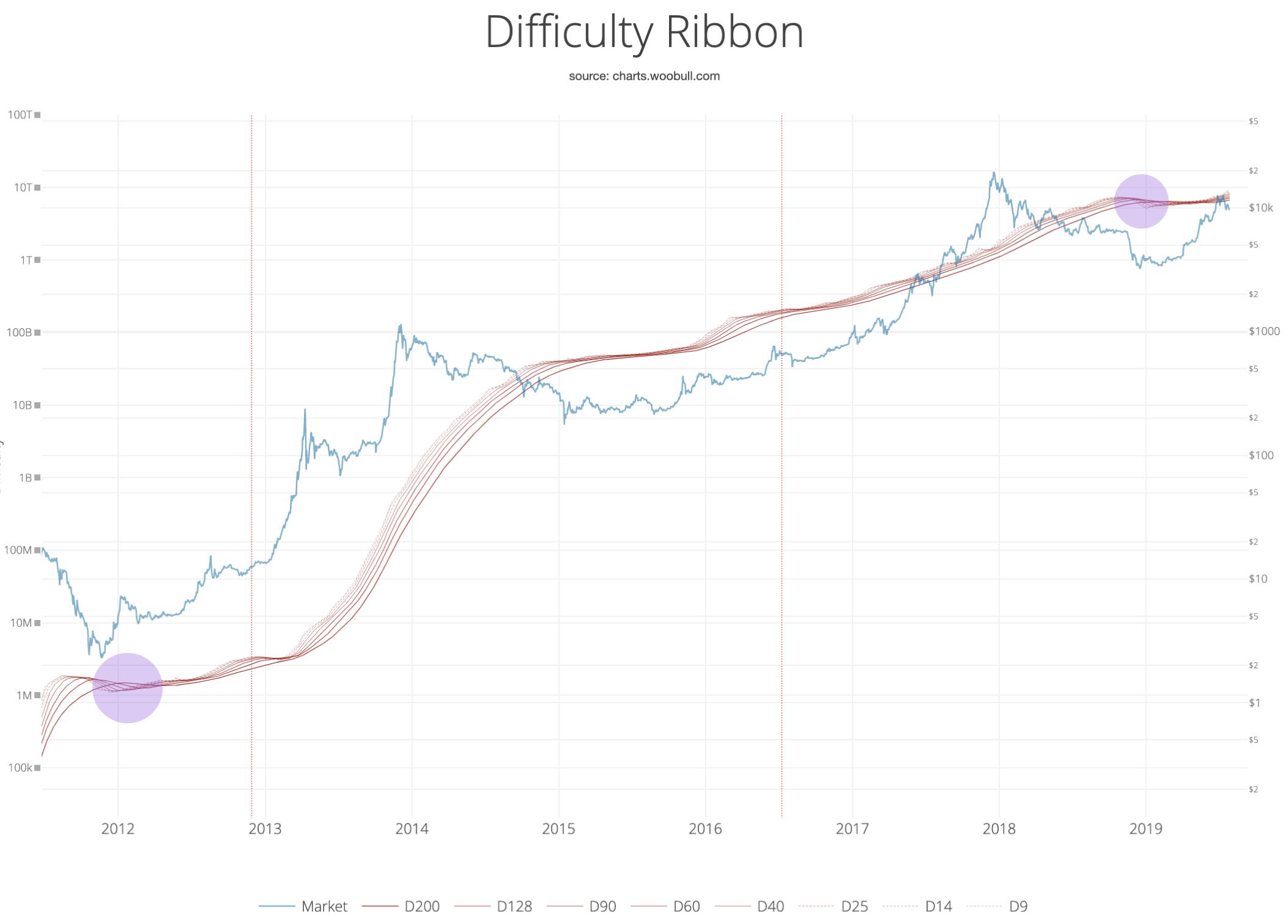

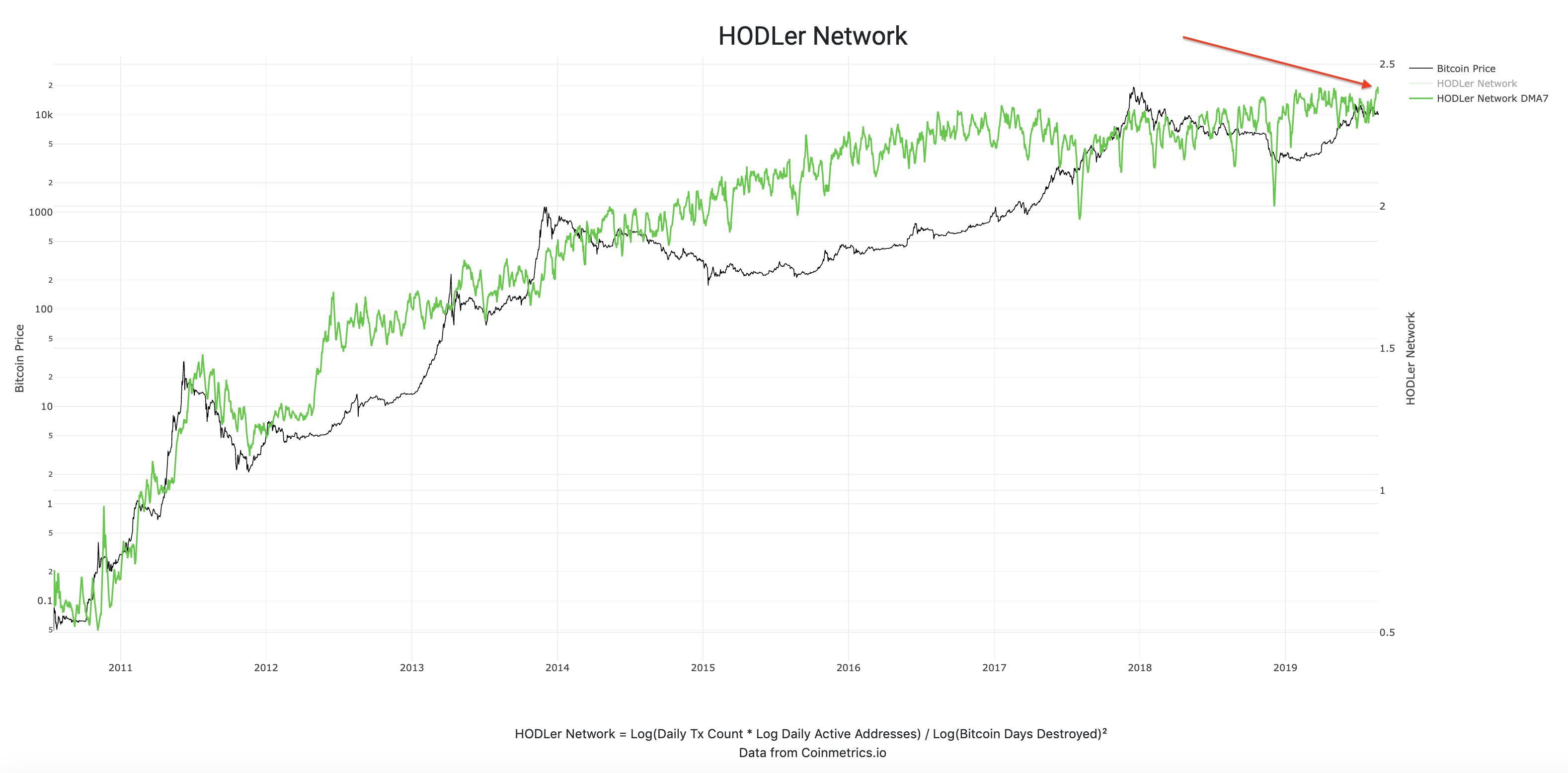

Introducing the Bitcoin Difficulty Ribbon. When the ribbon compresses, or flips negative, these are the best times to buy Bitcoin. The ribbon consists of simple moving averages on mining difficulty so we can easily see the rate of change in difficulty.

How it the Difficulty Ribbon works

This visualisation of network mining difficulty speaks to the impact of mining on Bitcoin’s price. As new coins are mined into existence, miners sell some of their mined coins to pay for production costs. This produces bearish price pressure.

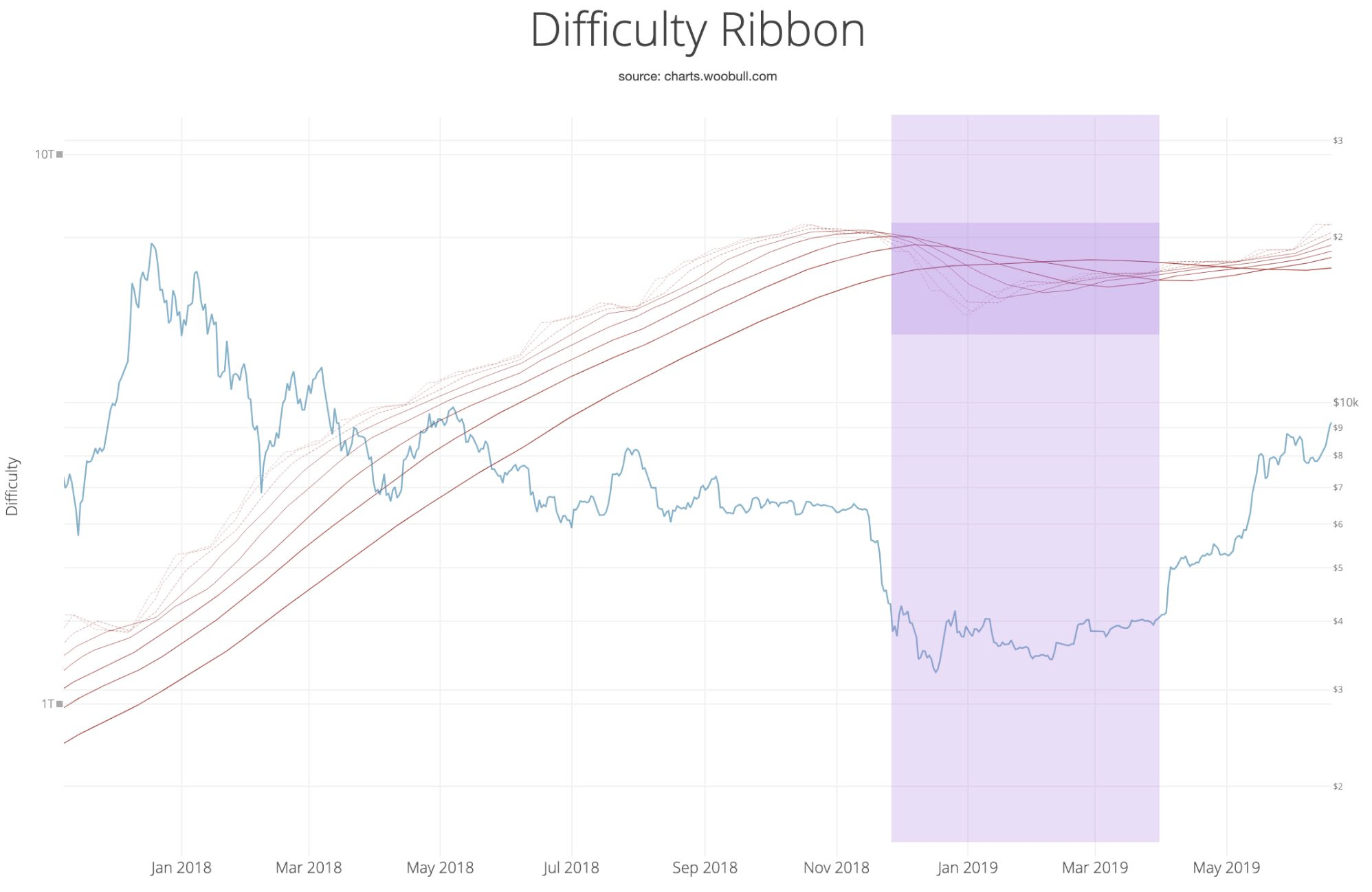

The weakest miners sell more of their coins to remain operational. When it becomes unsustainable, they capitulate, hashing power and network difficulty reduces (ribbon compression), leaving only the strong, who sell less leaving more room for more bullish price action.

Typically we see this at the end of bear cycles, after miners capitulate, the lack of miner selling pressure allows the price to stabilise and then climb; the classic accumulation bottom.

Credit goes to Vinny Lingham who was the first as far as I know to spot this dynamic in his April 2014 article on how Bitcoin finds its price equilibrium . We now have 5 more years of data to back it up.

Miners capitulate in bears, but also during block reward halvening events when suddenly only half the coins are mined for the same costs and the market price has yet to catch up to pay for it. We can easily see the compression after each halvening (marked as vertical lines) as miners die off.

As a final note, notice how the 2019 the 2012 bull market have the same structure, we saw severe mining capitulation (i.e. the ribbon flipped negative), the resulting vacuum in selling pressure lead to a shorter accumulation band before price breakout. Thus this bull market has resembles 2012 more than 2016 structurally.

Tweet: Bitcoin’s Power Balance

By Nic Carter

Posted August 1, 2019

Happy UASF day*

*nothing actually happened on this day in 2017 but it was decreed as Segwit lock in day so we’re going to celebrate it anyway

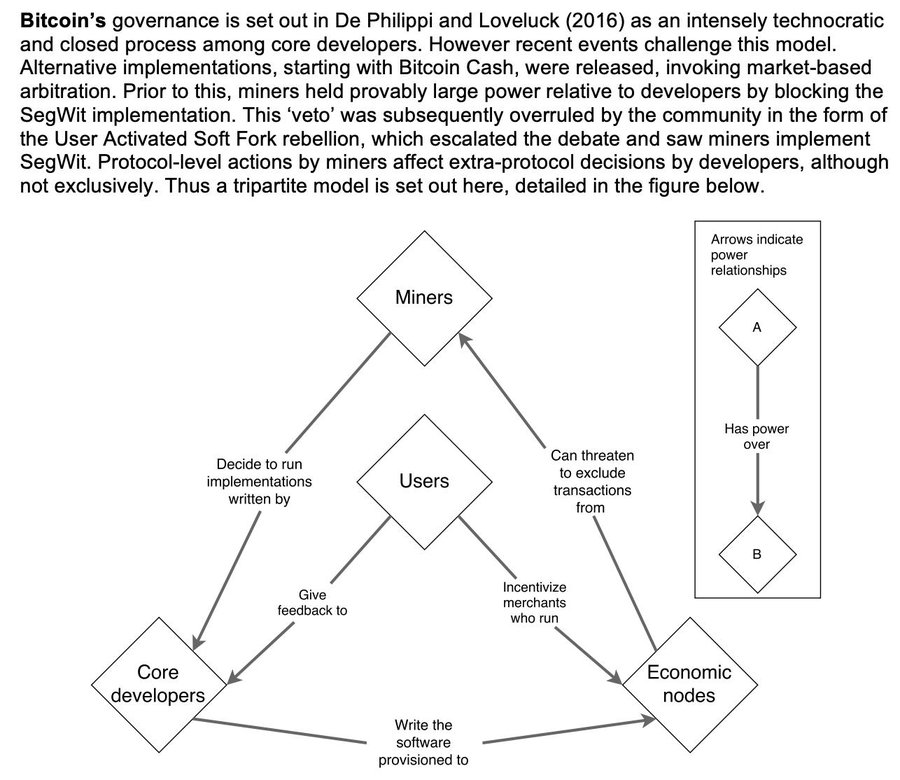

UASF is the most important event in bitcoin’s history (in my opinion) and it is absolutely critical to understand bitcoins “governance” (call it what you will)

I modeled bitcoin’s power balance like this after the event, I’m fairly pleased at how it has held up.

Tweet: Proof of Work Equivalent Days

By Nic Carter

Posted August 1, 2019

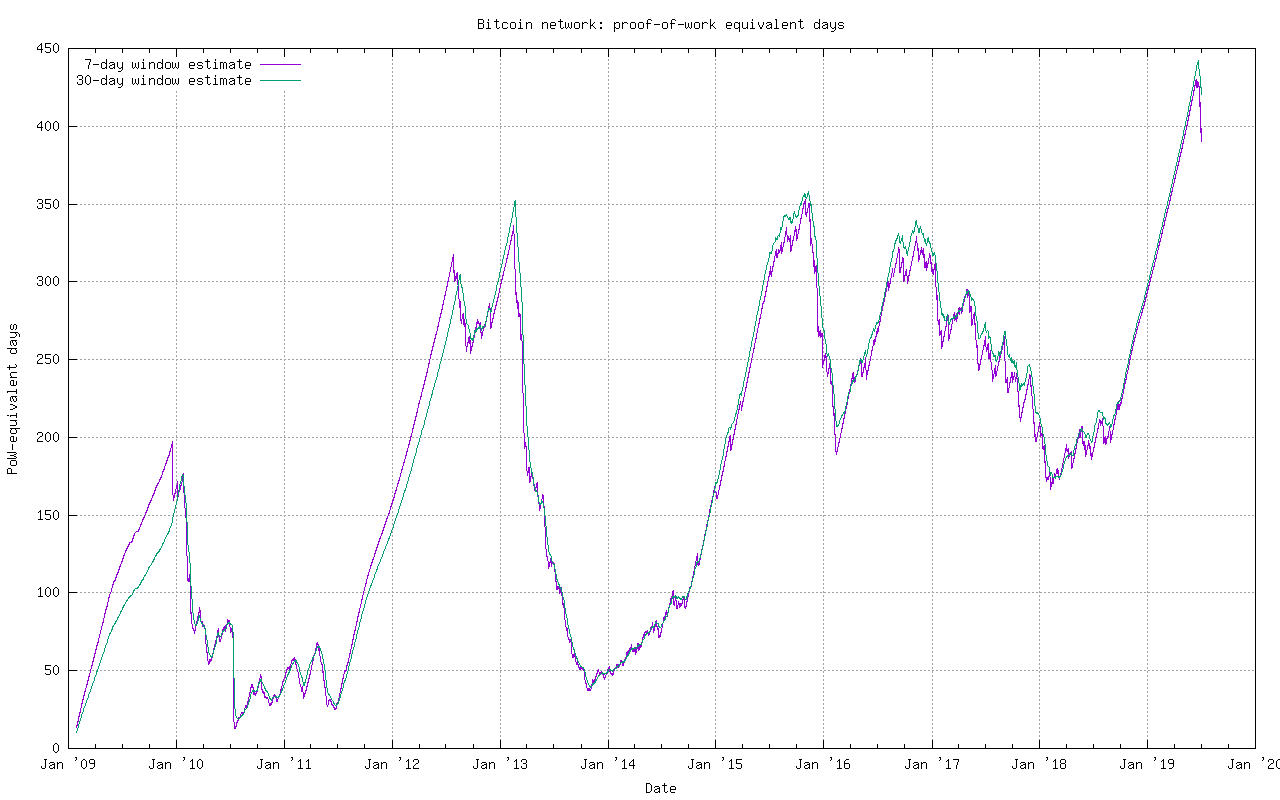

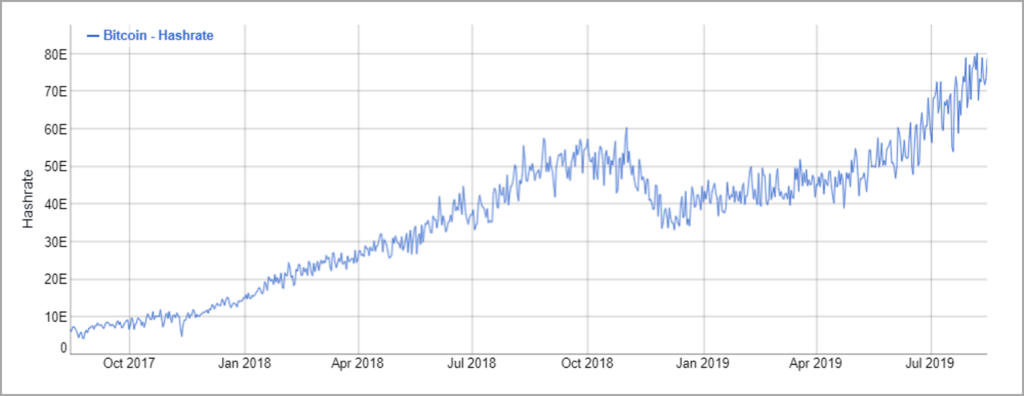

So Bitcoin just peaked at an ATH of ~430 “proof of work equivalent days”. That refers to the time required to rewrite Bitcoin’s entire history if you had 100% of hashpower.

Chart here: http://bitcoin.sipa.be

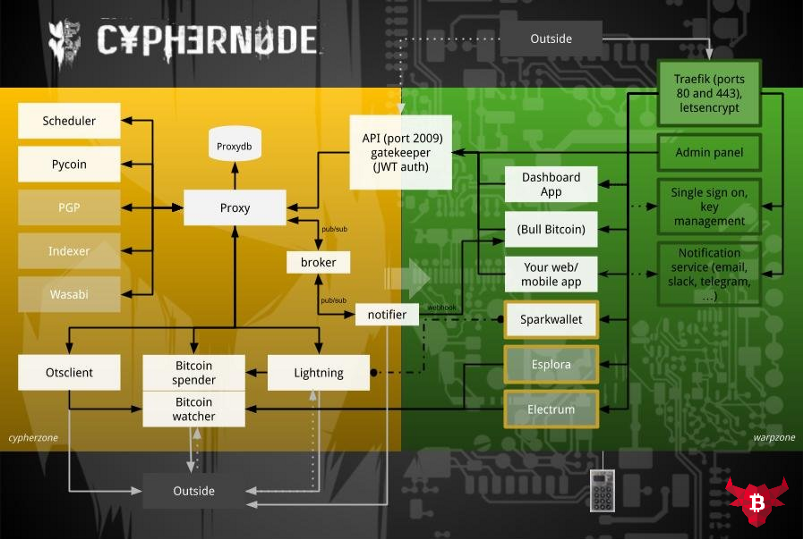

We need Bitcoin full nodes. Economic ones.

By Stadicus

Posted August 1, 2019

Why is it important to run your own Bitcoin full node to have a say regarding Bitcoin consensus and verify your own transactions?

Bitcoin is about financial sovereignty. It’s about holding a scarce bearer asset that cannot be counterfeited, seized or frozen. It’ s about being part of a peer-to-peer network that does not employ middlemen to facilitate financial transactions. It is free speech money.

As a bearer asset that you truly own, private keys need to be in your possession, managed by a modern Bitcoin wallet application. It’s hard to store digital secrets securely on potentially malware-riddled computers, so hardware wallets are a good way to keep your private keys out of the hands of hackers.

But who guarantees that my bitcoin are really there?

A hardware wallet stores your private keys, but not your actual bitcoin. The wallet usually comes with a software companion app that allows you to manage your funds. But this software wallet is not downloading and verifying blocks from the Bitcoin network, so how can it know what your Bitcoin balance is?

Can it guarantee that your hard-earned bitcoin are really there? That an incoming transaction really confirmed on the blockchain?

The answer is that by default you are putting all your trust in a single party: your wallet provider. Lightweight software wallets are mostly nice interfaces to some Bitcoin application backend. Whoever runs this backend controls what you see in your wallet. Your provider tells you how much bitcoin you own. Your provider broadcasts all of your transactions and suggests what fees you have to pay. Your provider runs your access gateway to Bitcoin, assures you that this one big incoming transaction really happened and decides whether it is valid or not. Your provider enforces consensus rules for you and all other customers.

A pretty good vantage point

Your access gateway to the Bitcoin network potentially knows everything. For example, it could easily correlate all your transactions, addresses and balances. As your network address is known, so is your approximate geographical location. Connecting many pseudonymous address clusters through their peer-to-peer transactions, connecting them to well known addresses of exchanges and merchants could give a very detailed account of the whole Bitcoin ecosystem.

As a wallet provider ourselves, we haven’t chosen to run these backend systems, it’s simply necessary to provide a good user experience. Most providers probably don’t even want to take this role and the power this gives us. Of course, we and other providers promise not to misuse this power. We don’t analyze transactions, nor keep logs on our Bitcoin servers. There’s nothing to gain by betraying the trust of our customers.

But what about legal coercion through a court order? A rogue employee bribed by a malicious actor? Or a hacker gaining access to the backend applications, altering them just so slightly?

In the not so distant future, when big business and central banks realise that Bitcoin is challenging their financial monopolies, the fight will be on. Once we leave the honeymoon phase, Bitcoin cannot afford such centralized choke points.

It is dangerous for Bitcoin users to outsource their direct network participation to a centralized node. There are a few really big nodes in the network, processing a lot of economic activity. They are actively validating blocks, processing transactions and updating balances. They verify how many bitcoin belong to which address and can judge whether miners behave according to the desired consensus rules. Some lightweight Bitcoin wallets (like our own BitBox App) independently check at least proof-of-work requirements and verify if a transaction has been mined using Merkle branch proofs, but these checks cannot provide definitve proof.

The good news is that it’s not that hard to run a Bitcoin full node yourself. After all, that’s what the Bitcoin Core application is all about. Run it on your regular computer, an old laptop or as an always-on network appliance like a Raspberry Pi. Run a node and support the network! But unless you are using your node to verify your transactions, just running an idle full node is not really achieving anything.

A harsh truth: only economic nodes matter

Propagating transactions and serving blocks to other peers is nice, but the network doesn’t really need additional nodes to do that. In an ad-hoc network like Bitcoin, more nodes do not make it faster or more efficient. What the Bitcoin network really needs are more nodes that enforce the Nakamoto consensus: rules each node follows and applies to decide whether a block or a transaction is valid.

Enforcing consensus: but against whom? Well, anyone that likes to profit just that little bit more. So pretty much everyone. Miners might give themselves a bigger block reward, regular users spend the same bitcoin twice or a business tries to spend a multi-signature contract unilaterally. Why not cheat on the Lightning Network and create a transaction that ignores a timelock?

But ultimately, it comes down to the miners. While I can create and broadcast as many fake transactions as I’d like for free, a miner that includes it in a block will lose the whole block reward while bearing the full operational costs of producing that invalid block.

Dystopia: let’s think it through

Imagine a worst-case scenario, where there are only two big economic nodes, some miners and a hundred idle nodes. What happens if there is business- or miner-driven desire to change the consensus rules, for example to allow bigger blocks? Let’s take a look:

- Some big miners decide that it’s time for bigger blocks, because more transactions mean more fees in total.

- The two big economic nodes think that this is a good idea, as cheap transactions are good for business.

- The idle nodes don’t like that and threaten to not accept bigger blocks.

- But the miners don’t care. All they want is to sell their newly minted bitcoins, which will be accepted by the economic nodes. So they start producing bigger blocks.

- The economic nodes accept these blocks, bringing them into the Bitcoin ecosystem and giving them value.

- The hundred idle nodes reject these blocks and the Bitcoin network silently undergoes a hardfork. Unfortunately for the idle nodes, their side of the fork does not have any economic activity, so nobody even notices.

- As the owners of the idle nodes also use the two economic nodes to send and receive Bitcoin, they are forced to accept the new consensus rules.

That was quick!

Of course it’s not as clear cut. For example, customers of the big economic nodes would complain. But without running their own economic nodes, they don’t really have a say. This extreme example demonstrates that idle nodes don’t really count. Now the good news: in aggregate, many small nodes with just a little economic activity have a huge say when it comes to consensus rules. In the end, it’s about threatening to reject transactions which you cannot do if your incoming transactions are processed by someone else.

Relationship status: it’s complicated

It’s important that we learn to be direct participants in the Bitcoin network. There are different ways to do that, but unfortunately Bitcoin Core is not yet sufficiently in love with hardware wallets.

Run Bitcoin Core as your wallet.The Bitcoin reference client is the most popular implementation of the Bitcoin protocol: a full node that validates the whole blockchain on your regular computer and is best used with it’s own included software wallet. It’s not made with hardware wallets in mind, and while support for them is coming, it’s not yet ready for non-techies.

Run an Electrum server.As Bitcoin Core is not made to serve other wallets, the traditional way is to run Bitcoin Core plus an Electrum server. This way, you can use the Electrum desktop application that works seamlessly with most hardware wallets. Our BitBox Applets you specify your own Electrum server, so you can easily use the BitBox hardware wallet in private.

There are several server implementations: electrs, ElectrumX or Electrum Personal Server.

Buy a Full Node appliance (or build it yourself) The most convenient way to run a full node is to buy a ready-made Bitcoin and Lightning Network appliance, or you can build your own (that’s how we started). But hardware wallet integration is not quite as seamless as it could be which is why are working on our BitBox Base appliance. The BitBox Base integrates directly into the BitBox App so you are truly sovereign. You can use other wallets too as this is about providing the appropriate privacy for all of us.

If you want to learn and grow, then my RaspiBolt guide as well as the more feature-rich RaspiBlitz project are well worth your time investment.

Mass adoption? Only with better solutions.

While the Lightning Network gave a boost to the number of Bitcoin full nodes, many are not used to verify economic transactions and secure the Bitcoin network. In my experience, many users are not aware that this is an absolute necessity. I believe that better solutions need to be built, especially for usage with hardware wallets. This is the main reason why I’m dedicating all of my time to the BitBox Base.

Bitcoin Can’t Be Copied

By Parker Lewis

Posted August 2, 2019

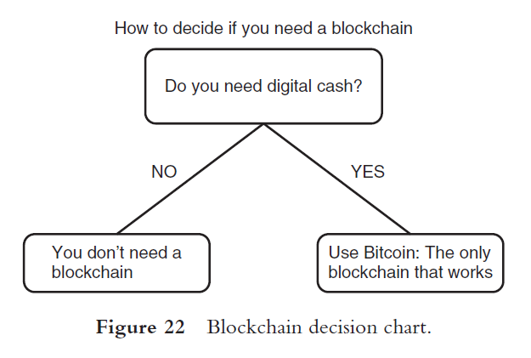

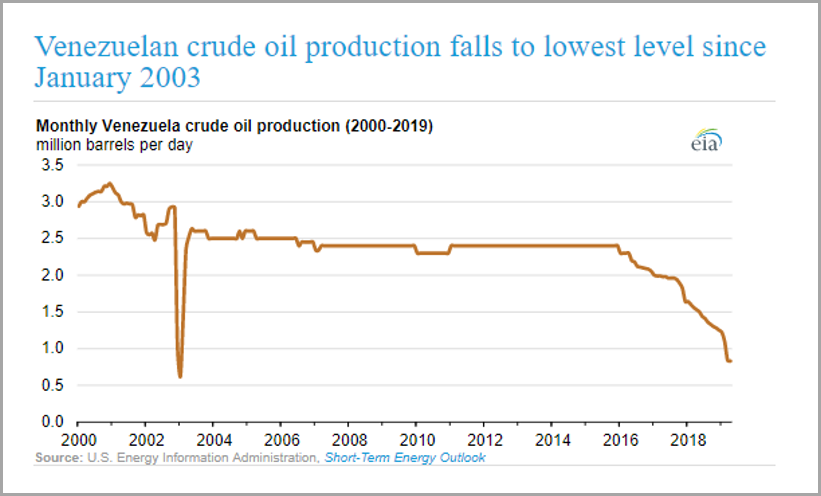

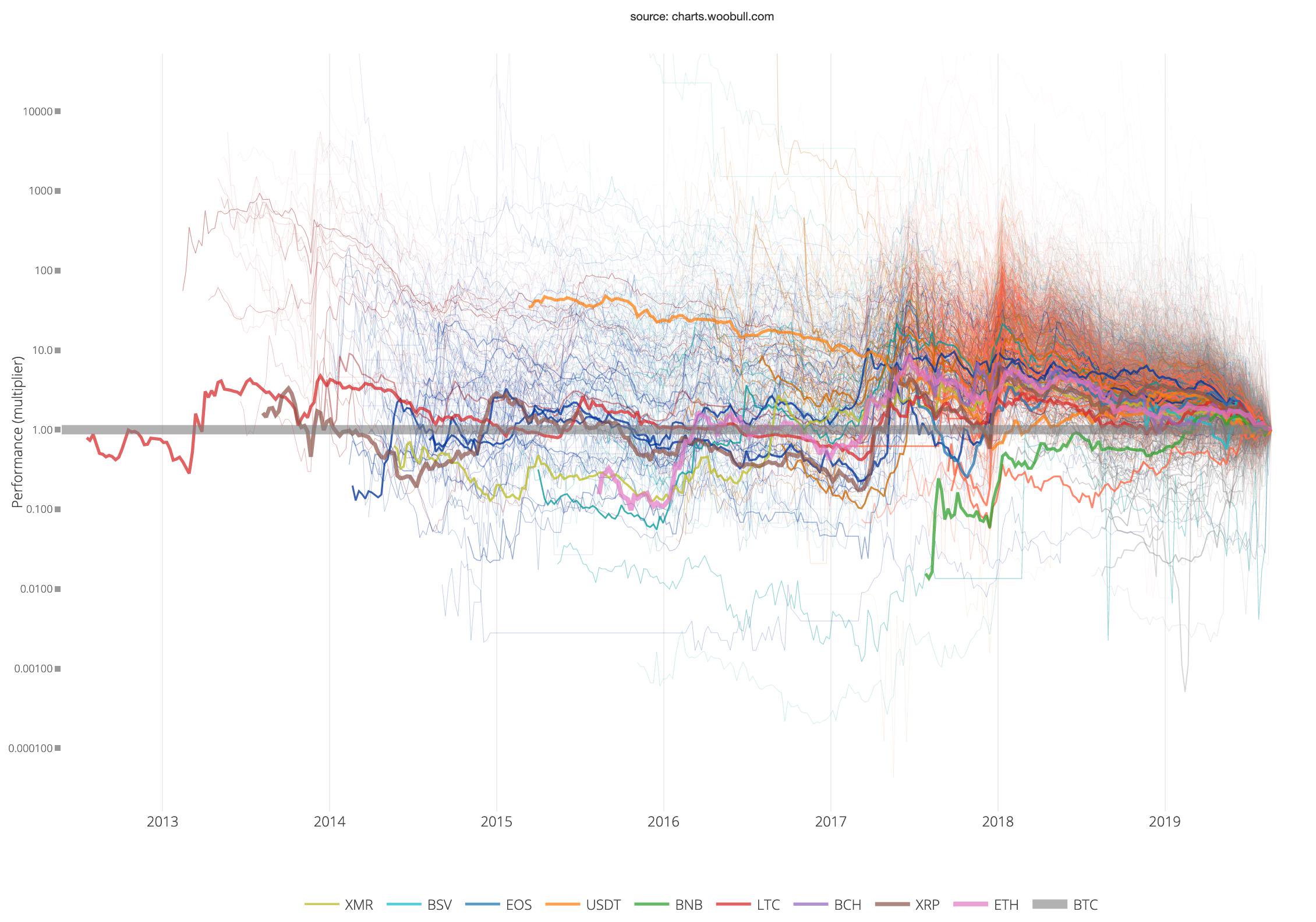

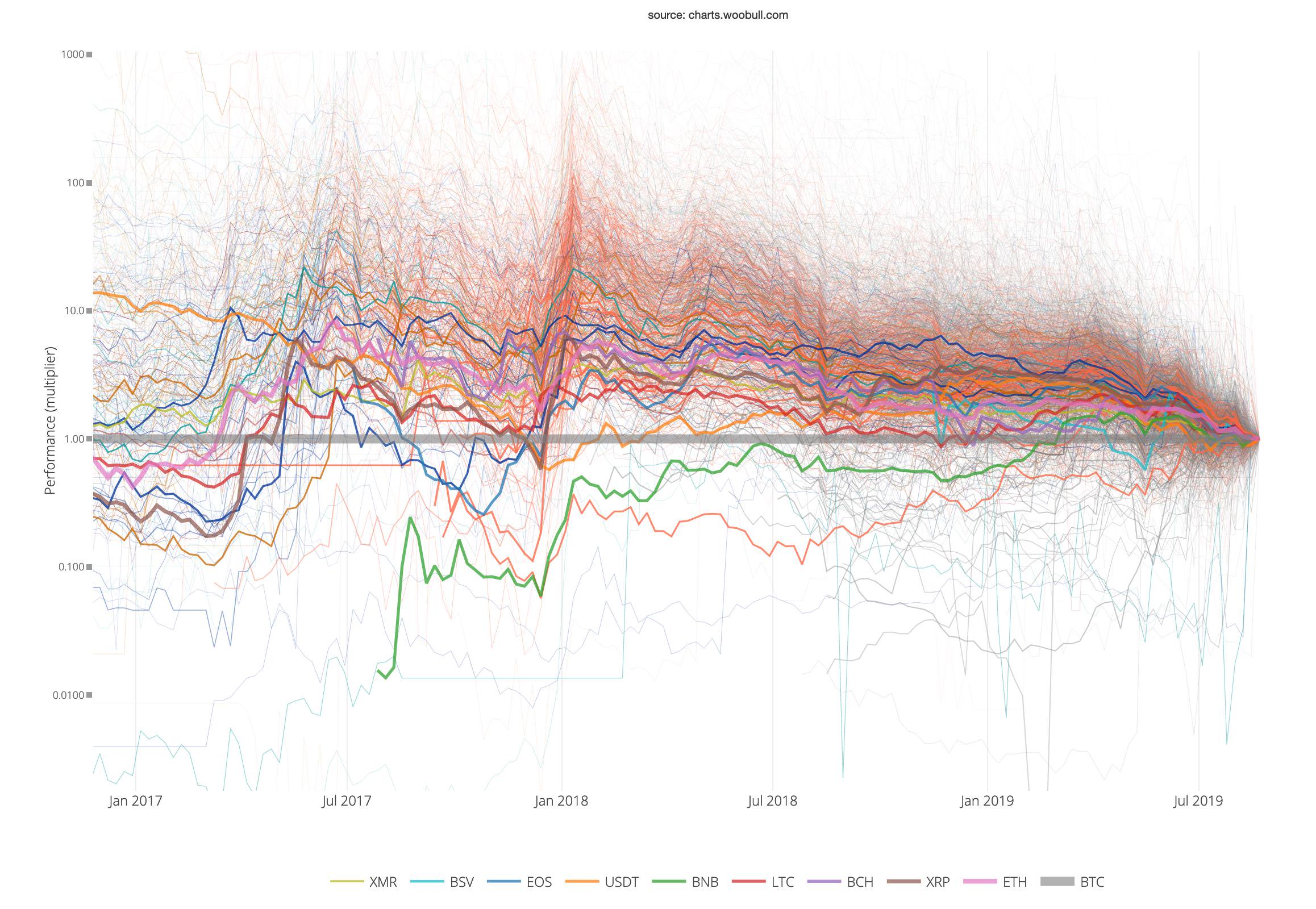

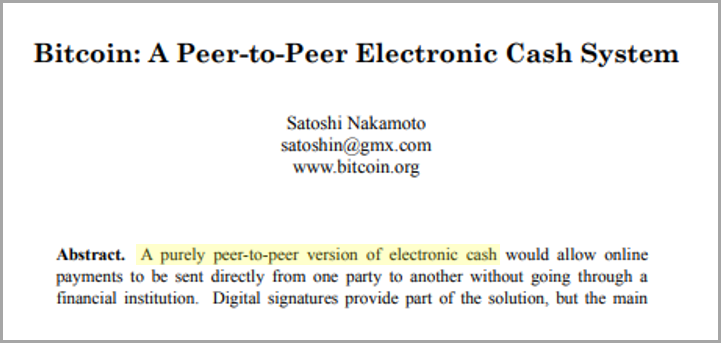

As kids, we all learn that money doesn’t grow on trees. As a society on the other hand, we have become conditioned to believe that it’s not only possible but that it’s a normal, necessary and productive function of our economy. Before bitcoin, this privilege was reserved to global central banks (see here for example). Post bitcoin, every Tom, Dick & Harry seems to think that they can create money too. At a root level, this is the audacity of everyone that attempts to create a copy of bitcoin. Whether by hard-forking out of consensus (bitcoin cash), cloning bitcoin (litecoin) or creating a new protocol with “better” features (ethereum), each is an attempt to create a new form of money. If bitcoin could do it, why can’t we?

We sit here, in 2019, witnessing the monetization event of an economic good (bitcoin) on the free market for the first time in thousands of years (h/t gold). Rather than stopping to contemplate the weight of that reality or to understand how or why that is possible, many people skip right past it to focus on some derivative or some way to improve upon a problem they didn’t see in the first place. Everyone wants to get rich quick, and so long as there is money, there will also be alchemists. Those that attempt to copy bitcoin are our modern day alchemists.

“Everyone wants to get rich quick, and so long as there is money, there will also be alchemists.”

They tell us that bitcoin is too slow so they create a copy that is “faster”. Or they tell us that bitcoin does not have the capacity to handle the number of transactions required by the global economy so they create a copy that has “greater” scale. Then they tell us that bitcoin is too volatile to be a currency so they create a “more stable” version. It goes on and on. Next its that bitcoin is too rigid and that it needs to be more programmable so they create a copy that is “more flexible”. They often even tell us that their creation is not money but instead, it’s a vehicle for “payments” or a “utility” or maybe a “global computer fueled by gas”. They also try to convince us of a world that has hundreds, if not thousands, of currencies. But make no mistake, in each case, it is their own attempt to create money.

Bitcoin’s Value Function

If an asset’s primary (if not sole) utility is the exchange for other goods and services and if it does not have a claim on the income stream of a productive asset (such as a stock or bond), it must compete as a form of money and will only store value if it possesses credible monetary properties. With each “feature” change, those that attempt to copy bitcoin signal a failure to understand the properties that make bitcoin valuable or viable as money. When bitcoin’s software code was released, it wasn’t money. To this day, bitcoin’s software code is not money. You can copy the code tomorrow or create your own variant with a new feature and no one that has adopted bitcoin as money will treat it as such. Bitcoin has become money over time only as the bitcoin network developed emergent properties that did not exist at inception and which are next to impossible to replicate now that bitcoin exists.

“Those that attempt to copy bitcoin signal a failure to understand the properties that make bitcoin valuable or viable as money.”

These properties emerged organically and spontaneously as individual economic actors all over the world evaluated bitcoin and determined to store a portion of their wealth in it. As bitcoin’s value increased, it became decentralized and as it became decentralized, it also became increasingly difficult to alter the network’s consensus rules or to invalidate, or prevent, otherwise valid transactions (often referred to as censorship-resistance). There remains reasonable debate as to whether bitcoin is sufficiently decentralized or sufficiently censorship-resistant, but while this may be the case, there are other considerations less subject to debate:

- Bitcoin represents, by far, the most decentralized and most censorship-resistant monetary system in the world today, whether compared to traditional currencies, other digital currencies or commodity monies like gold.

- Bitcoin derives its value because it is decentralized and because it is censorship-resistant; it is these properties which secure and reinforce the credibility of bitcoin’s fixed 21 million supply (i.e. why it is an effective store of value).

- Bitcoin becomes increasingly decentralized and increasingly censorship-resistant as its value increases and as it scales at all levels of the network.

- Repeat.

Monetary Systems Tend to One

Every other fiat currency, commodity money or cryptocurrency is competing for the exact same use case as bitcoin whether it is understood or not and monetary systems tend to a single medium because their utility is liquidity rather than consumption or production. When evaluating monetary networks, it would be irrational to store value in a smaller, less liquid and less secure network if a larger, more liquid and more secure network existed as an attainable option.

Apply a common sense test. If you worked for two weeks and your employer offered to pay you in a form of currency accepted by 1 billion people all over the world or a currency accepted by 1 million people, which would you take? Would you request 99.9% of one and 0.1% of the other, or would you take your chances with your billion friends? If you are a U.S. resident but travel to Europe one week a year, do you request your employer pay you 1/52nd in euros each week or do you take your chances with dollars? The practical reality is that almost all individuals store value in a single monetary asset, not because others do not exist but rather because it is the most liquid asset within their market economy.

Anyone with Venezuelan bolivars or Argentine pesos would opt into the dollar system if they could. And similarly, anyone choosing to speculate in a copy of bitcoin is making the irrational decision to voluntarily opt-in to a less liquid, less secure monetary network. While certain monetary networks are larger and more liquid than bitcoin today (e.g. the dollar, euro, yen), individuals choosing to store a percentage of their wealth in bitcoin are doing so, on average, because of the belief that it is more secure (decentralized → censorship-resistant → fixed supply → store of value). And, because of the expectation that others (e.g. a billion soon-to-be friends) will also opt-in, increasing liquidity and trading partners.

“Anyone choosing to speculate in a copy of bitcoin is making the irrational decision to voluntarily opt-in to a less liquid, less secure monetary network.”

Why Bitcoin Can’t Be Copied

Many individuals creating digital currencies neither accept or admit that what they are creating has to be money to succeed; others that are speculating in these assets fail to understand that monetary systems tend to one medium or naively believe that their currency can out-compete bitcoin. None of them can explain how their digital currency of choice becomes more decentralized, more censorship-resistant or develops more liquidity than bitcoin. To take that further, no other digital currency will likely ever achieve the minimum level of decentralization or censorship-resistance required to have a credibly enforced monetary policy. And to literally steal a page from The Bitcoin Standard:

Bitcoin is valuable, not because of a particular feature, but instead, because it achieved finite, digital scarcity, through which it derives its store of value property. The credibility of bitcoin’s scarcity (and monetary policy) only exists because it is decentralized and censorship-resistant, which in itself has very little to do with software. In aggregate, this drives incremental adoption and liquidity which reinforces and strengthens the value of the bitcoin network. As part of this process, individuals are, at the same time, opting out of inferior monetary networks. This is fundamentally why the emergent properties in bitcoin are next to impossible to replicate and why bitcoin cannot be copied or out-competed: because bitcoin already exists as an option and its monetary properties become stronger over time (and with greater scale), while also at the direct expense of inferior monetary networks.

One would likely never come to this conclusion without first developing their own understanding of the following: i) that bitcoin is finitely scarce (how/why); ii) that bitcoin is valuable because it is scarce; and iii) that monetary networks tend to one medium. You may come to different conclusions, but this is the appropriate framework to consider when contemplating whether it is possible to copy (or out-compete) bitcoin rather than a framework based on any particular feature set. It’s also important to recognize that any individual’s conclusions, including your own or my own, has very little bearing in the equation. Instead, what matters is what the market consensus believes and what it converges on as the most credible long-term store of value.

The empirical evidence (price mechanism & value) demonstrates that the market continues to determine why bitcoin is different, despite a significant amount of noise. Before speculating, try to understand why bitcoin works and why it’s unique. When someone inevitably tells you about a better bitcoin or some differentiating feature, remember that the market, which has come to this same crossroad over the last decade before you, has considered those trade-offs and chosen bitcoin over the field for very rational reasons.

The Minority Rule

Nassim Taleb writes about how a very small intransigent minority can force its preference on the majority, referring to it as the minority rule and explaining why The Most Intolerant Wins. Bitcoin (and monetary systems) are a perfect example of this phenomenon. If a very small minority converges on the belief that bitcoin has superior monetary properties and will not accept your form of digital (or traditional) currency as money, while less convicted market participants accept both bitcoin and other currencies, the intolerant minority wins. This is exactly what is happening in the global competition for digital currency supremacy. A small minority of market participants has determined that only bitcoin is viable, rejecting the monetary properties of all other digital currencies, while the majority is willing to accept bitcoin along with the field. Because of its intransigence, the minority is slowly forcing its preference on the majority. In the world of digital currencies, diversifying by picking the field is the equivalent of letting the crowd (or the intolerant minority) choose what your future money will be, while resigning yourself to only a fraction of what you otherwise would have saved. Evaluate the trade-offs and consider the minority rule before trading in your hard-earned value for a flyer. Money doesn’t grow on trees.

“Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value.” – Eric Schmidt (Former Google CEO).

Proof of Life

Why Bitcoin is a Living Organism

By Gigi

Posted August 7, 2019

The definition of life has been a challenge for scientists and philosophers alike. While many definitions have been put forward, what precisely differentiates the living from the non-living remains elusive. Are viruses alive? DNA molecules? Computer viruses? Biologically produced minerals?

Ralph Merkle, inventor of cryptographic hashing and namesake of the Merkle tree, made the argument that Bitcoin is the first example of a new form of life. In this article series, I intend to take this claim seriously, explore it further, and see what can be gleaned from viewing Bitcoin as a living organism.

The first part will establish that Bitcoin is indeed a living organism. The second part will take a closer look at Bitcoin’s various habitats, and how changes in these habitats might affect the organism. In the third part we will dissect the Bitcoin organism, trying to understand some of its parts in more detail. Finally, we will perform the thought experiment of trying to kill Bitcoin, to illustrate the remarkable resilience of this strange, decentralized organism.

What is Life?

The question of whether something is alive or not obviously hinges on one’s definition of life. Life is endlessly complex, so it is no surprise that answering the question “What is Life?” leads to a multitude of answers. New-age speculations aside, it seems that life is a process, not a substance.

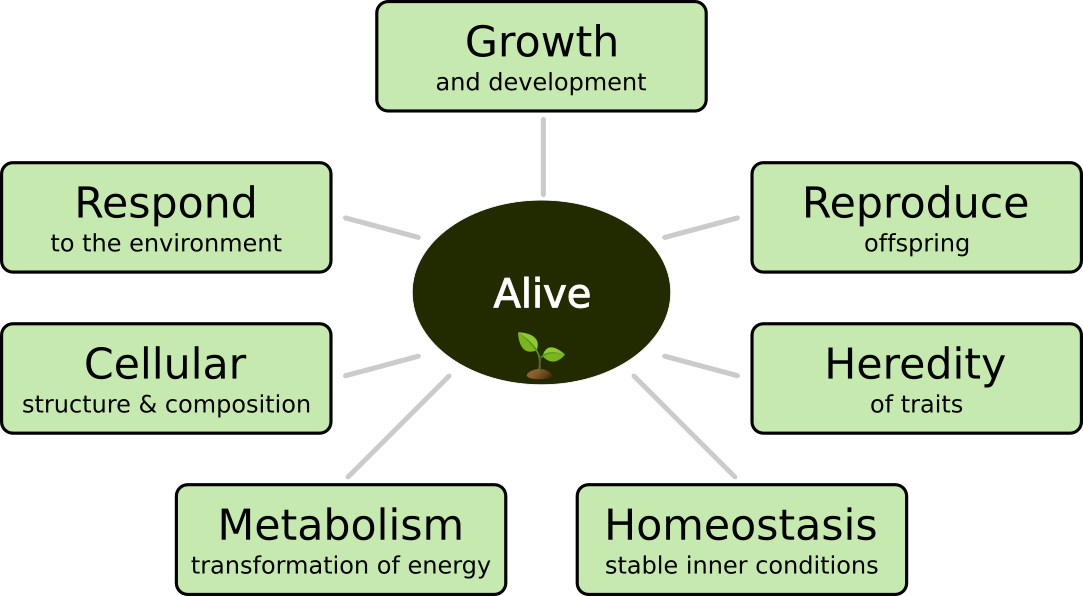

We can try to describe this process by looking at things which are alive, and looking at what they do: they tend to grow, reproduce, and respond. They inherit traits, are made up of smaller units (cells), and use energy to maintain their internal structure in the face of entropy.

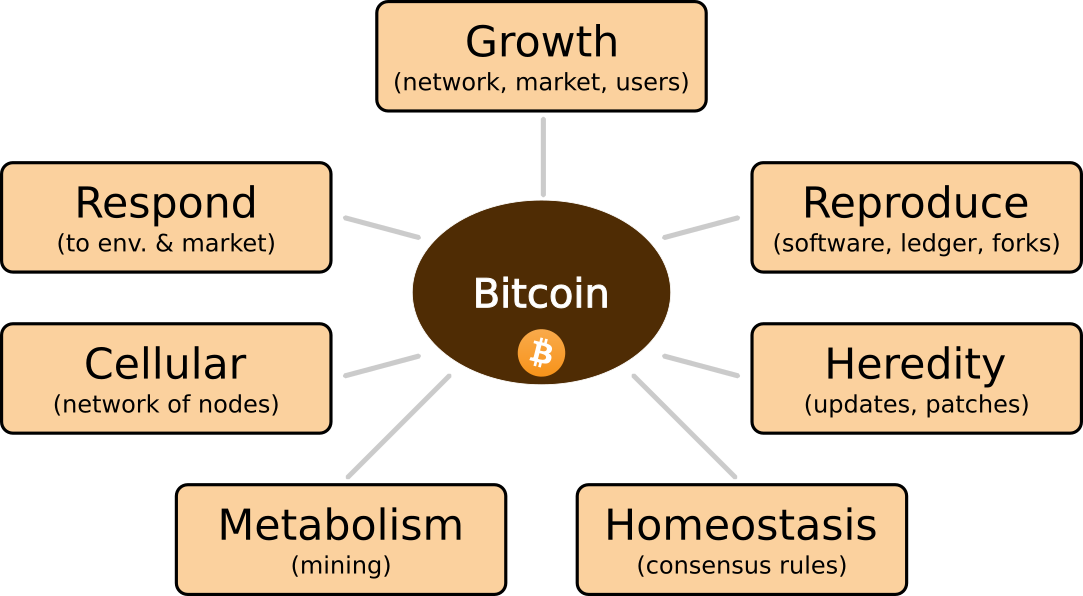

Based on Chris Packard’s Characteristics of Life, cc-by-sa 4.0

Based on Chris Packard’s Characteristics of Life, cc-by-sa 4.0

From a physics perspective, living things are thermodynamic systems: they utilize the energy-differences in their surroundings to maintain a specific molecular organization and create copies of themselves. Thermodynamically speaking, living systems are able to decrease their internal entropy at the expense of “free” energy taken in from the environment. In short, living things create order out of chaos.

Bitcoin is doing exactly that: it takes energy from the environment and puts things in order, i.e. it decreases its internal entropy. It does so by appending blocks to a well-ordered structure. Some call this structure the blockchain, others call it a distributed ledger. I will refrain from using either name, since the name of this particular structure isn’t important, and doesn’t help to convey a deeper truth: that this structure is just one part of a large and complex system, just like the backbone in vertebrates. It is important, no doubt. But distributed or not, a ledger on its own is as useful and as alive as a bag of bones.

To understand why Bitcoin behaves animatedly we will have to look beyond the buzzwords and ask ourselves what Bitcoin actually is, what it is made of, and what its boundaries are.

What is Bitcoin?

Compared to biological life, Bitcoin is quite simple. Nevertheless, finding a succinct answer to “What is Bitcoin?” is not.

Depending on your background it might be a computer network, a financial revolution, a way to protect your wealth, a payment system, a global settlement layer, an alternative to central banking, sound money, a parallel economy, an exercise in free speech, a bubble, a pyramid scheme, a messaging system, a communications protocol, an inefficient database, internet money, or all of the above. In short, Bitcoin is different things to different people.

Whatever Bitcoin might be, it undoubtedly is a force to be reckoned with. It has a life of its own, and thus arguably, it is best described as a living thing.

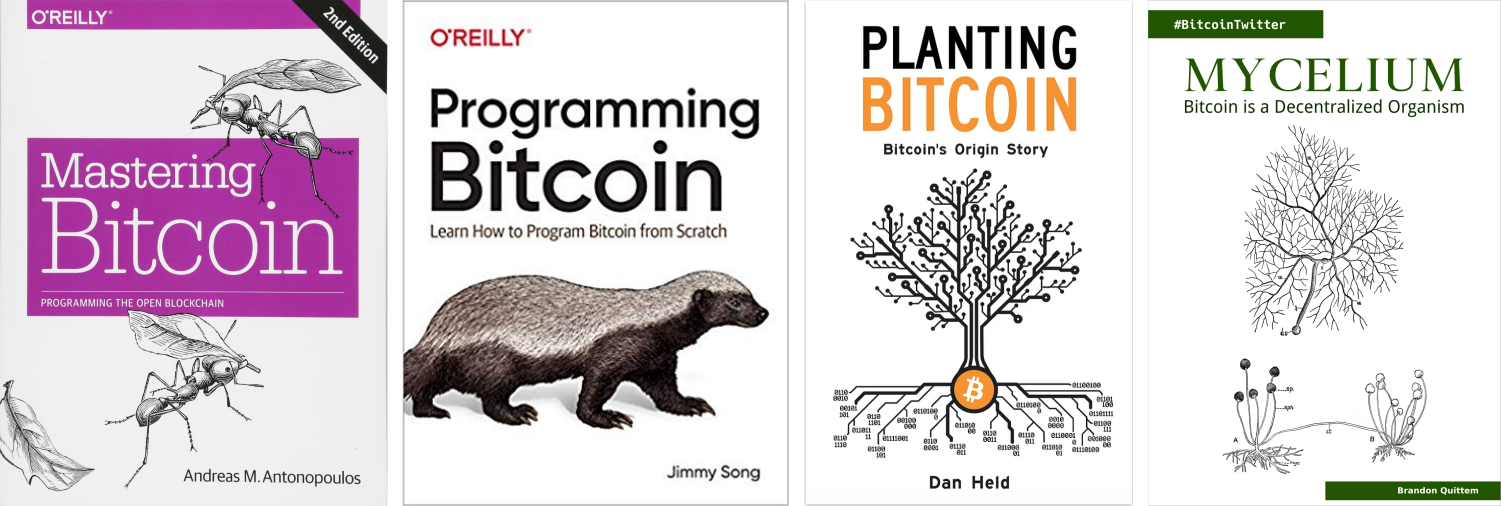

Many people seem to have come to this conclusion independently. Bitcoin is described as an army of leaf-cutter ants in Andreas M. Antonopoulos’ Mastering Bitcoin — a biological system which is working in concert without a central coordinator. The honey badger, an animal which is commonly used to refer to Bitcoin (since it doesn’t care and isn’t afraid of anything) is on the cover of Jimmy Song’s Programming Bitcoin. Dan Held compared the invention of Bitcoin to planting a tree, examining the species (code), season (timing), soil (distribution), and gardening (community) that were essential to its success. Brandon Quittem postulates that Bitcoin is most similar to mycelium, the underground network which powers the fungi kingdom, and can thus be best understood as a decentralized organism.

The snake of regulation and central banking is biting you while you are eating it alive? Honey badger don’t care! And just like an army of ants doesn’t care if half of the workers are washed away by a flood, the Bitcoin network doesn’t care if half of the nodes are offline tomorrow.

“Honey badger don’t care, honey badger don’t give a fuck.” — Randall

Memes like these, especially if they survive and continue to be popular over a long period of time, tend to be right, conceptually. What people seem to be saying when they refer to Bitcoin as the honey badger is that, in essence, Bitcoin behaves like an animal which can’t be controlled, can’t be tamed, and doesn’t care too much about externalities.

Which particular organism Bitcoin resembles most closely will be left as an exercise for the reader. The above examples should merely illustrate that multiple authors made the intellectual leap of classifying Bitcoin as a living organism - a leap which I believe to be fascinating, useful, and ultimately, correct.

Bitcoin is a living organism, and we should try to understand it as such if we want to live in harmony with it.

The Bitcoin Organism

As mentioned above, Ralph Merkle was the first to point out that Bitcoin can be seen as a living entity. He remarked that Bitcoin has spawned an incredible amount of excitement in the technical community, and tried to translate this excitement into something which can be understood by everybody: a new form of life.

“Briefly, and non-technically, Bitcoin is the first example of a new form of life. It lives and breathes on the internet. It lives because it can pay people to keep it alive. It lives because it performs a useful service that people will pay it to perform. It lives because anyone, anywhere, can run a copy of its code. It lives because all the running copies are constantly talking to each other. It lives because if any one copy is corrupted it is discarded, quickly and without any fuss or muss. It lives because it is radically transparent: anyone can see its code and see exactly what it does.” — Ralph Merkle

While Bitcoin is indeed radically transparent, it is not perfectly obvious where Bitcoin begins and where it ends. Like all living things, Bitcoin isn’t just a uniform blob of matter. It is a dynamic, living thing, consisting of many different parts, all of which communicate with and influence each other, as well as other living things and the environment as a whole.

The Bitcoin organism is made up of many interlocking parts which work together to ensure the survival of the whole. As with biological organisms, as soon as one crucial part is missing, the whole organism is bound to die.

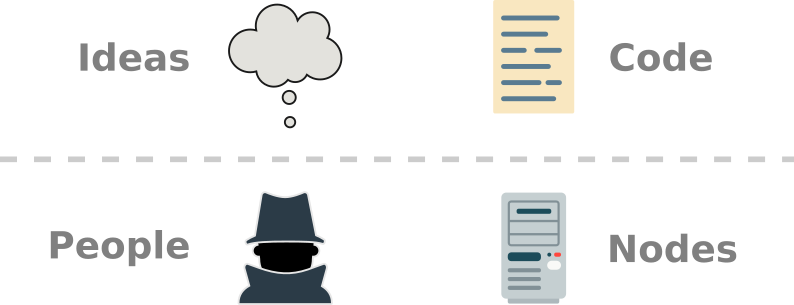

Bitcoin, however, is a strange beast. It lives across domains, with one foot in the purely informational realm (ideas and code) and one foot in the physical realm (people and nodes).

The Bitcoin organism manifests itself through the interplay of ideas, code, people, and nodes. All four of these conceptual pieces react to and influence each other in a value-generating feedback loop which keeps Bitcoin alive.

Whether people are part of the Bitcoin organism, or merely living in symbiosis with it, depends on your point of view. For now, let’s take an all-encompassing view of the Bitcoin organism, including people as one part of the whole. After all, just like we can’t live without a multitude of bacteria, fungi, viruses and other creepy-crawlies which make up the human microbiome, Bitcoin can’t live without us: the tiny beings in meatspace which keep it alive.

In any case, nodes and their operators are tangible things which are manifest in the physical world. Like the cells in your body, all physical components of the Bitcoin organism can and will be replaced over time. Node operators come and go, node and mining hardware is replaced periodically, and even whole mining farms go offline and are replaced by more cost-efficient facilities.

Ideas and code are more ethereal. They can’t be grasped or pointed to in the same fashion. However, Bitcoin has an essence, the soul of the organism, if you like. Note that this essence could, in theory, breathe life into a new host if the current incarnation of the organism dies. The ghost of Bitcoin is independent of its physical body, to borrow a metaphor from Shirow’s Ghost in the Shell.

As long as something is compatible with this essence, it will be treated as part of the whole. If something is incompatible, however, it will be rejected — just like biological organisms reject foreign objects inside their bodies.

Part of this essence is made explicit by Bitcoin’s consensus rules, other parts are repeated as mantras: “ not your keys, not your bitcoin” and “ run your own node” are gentle reminders of lessons learned, as well as shortcuts to a deeper understanding of what Bitcoin is and should be.

With a basic idea of the constituents and the extent of the Bitcoin organism in mind, let’s return to the descriptive definition of life above and see how Bitcoin maps onto each trait.

- Growth: Bitcoin grows in multiple ways. The network grows, the value of each bitcoin grows, the market grows, its user base grows, and the ecosystem as a whole grows as well.

- Reproduction: Paradoxically, Bitcoin uses replication to create absolute scarcity. It reproduces itself in multiple ways, and on multiple levels: the source code is replicated across repositories, the software is copying itself upon installation, the ledger reproduces itself on every node, blocks propagate across the network by replication, and even UTXOs can be understood as reproductive entities, dividing and merging during the transaction process. Mutations exist on every level as well: invalid transactions, invalid blocks, hundreds of forks, and thousands of imperfect copies have been spawned by Bitcoin in the last couple of years.

- Heredity: Bitcoin inherits several traits from its predecessors: public-key cryptography, digital signatures, peer-to-peer networking, digital timestamping, and unforgeable costliness — just to name a few. Further, Bitcoin’s open nature enables both vertical and horizontal gene transfer: some traits develop by gradual mutations of previous versions, others find their way into the codebase by incorporating ideas from other projects.

- Homeostasis: Above all else, Bitcoin’s consensus rules are responsible for its stable inner conditions. If blocks do not adhere to the current consensus rules, they will be rejected mercilessly and quickly. The Bitcoin network will rid itself of these blocks just like we shed the dead cells of our skin.

- Metabolism: Mining rigs around the world keep the organism alive, erecting virtually impenetrable walls in the process. Energy is transformed into digital amber, ensuring that the shield around past transactions is growing and Bitcoin’s heart keeps beating.

- Cellular: Multiple parts of Bitcoin are cellular: the Bitcoin network consists of nodes, each of which a self-sustaining, functional entity. The ledger itself is cellular since blocks (and transactions) are basically cells in a large, append-only spreadsheet.

- Responsive: Bitcoin is a highly responsive organism. It responds to changes in price, political changes, economic changes, environmental changes (e.g. if parts of the internet are cut off), technological changes (e.g. breakthroughs in chip manufacturing), and changes in our scientific understanding (e.g. breakthroughs in computer science, mathematics, or cryptography). It reacts on its own, without any person, company, or nation-state in charge.

As mentioned above, life is a process, not a substance. A delicate dance of innumerable parts, all signaling and communicating in an intricate way to self-sustain each organism, and the phenomenon which we call life as a whole.

“Life is like fire, not water; it is a process, not a pure substance. […] The simplest, but not the only, proof of life is to find something that is alive.” — Christopher McKay

In the words of astrobiologist Chris McKay, the simplest proof of life is to find something that is alive. I have found Bitcoin, and as far as I can tell, it is alive — for all the reasons outlined above.

Conclusion

Bitcoin checks all the boxes when it comes to the characteristics of living things: it grows, reproduces, inherits and passes on traits, uses energy to maintain a stable inner structure, is cellular in nature, and responds to the various environments it lives in.

In the next part of this series we will take a closer look at these environments, and how Bitcoin responds to changes in them. Bitcoin lives and breathes on the internet, as Ralph Merkle beautifully said. But arguably, the internet isn’t the only environment it is living in.

For now, I hope to have convinced you that Bitcoin can be seen as a living organism — alien as it may be.

Further Reading

- Bitcoin is a Decentralized Organism by Brandon Quittem

- Planting Bitcoin by Dan Held

- DAOs, Democracy and Governance by Ralph C. Merkle

- Bitcoin’s Gravity by Gigi

Acknowledgements

Thanks to Dan Held,Brandon Quittem, and Raph for their feedback on earlier drafts of this article.

I hope you have enjoyed this excursion into the world of the Bitcoin organism. If you like to accelerate the growth of both Bitcoin and this article series feel free to drop me a line, some applause on medium, or even some sats via the beast which is Bitcoin. Thanks for all the encouragement, and thank you for reading.

Thanks to Brandon Quittem and Dan Held.

Bitcoin Layers

By Joe Rodgers

Posted August 8, 2019

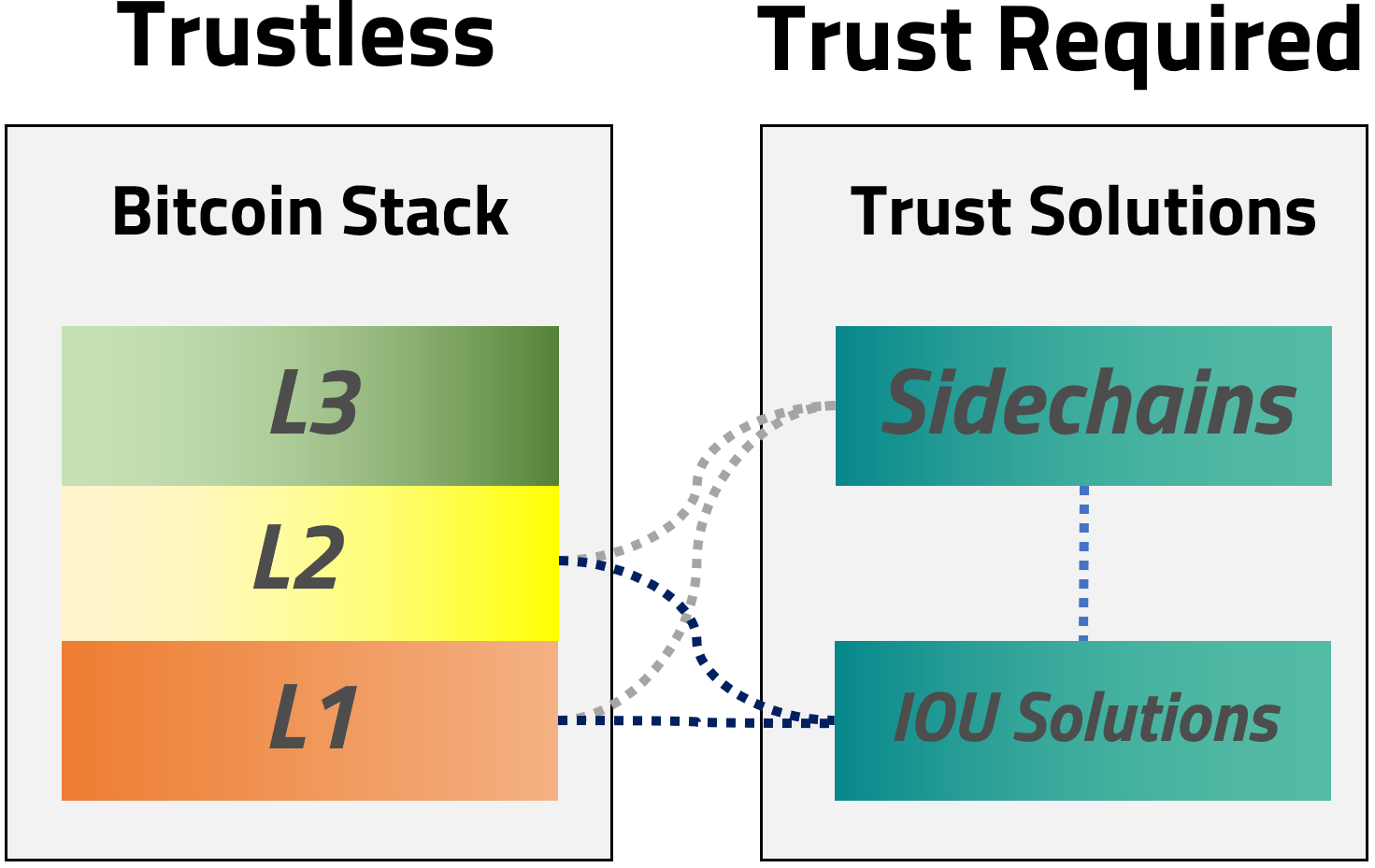

The past few weeks there have been several good threads about Bitcoin’s scaling layers. Two camps have emerged as they try to define the stack. While this has no real implications and the market will ultimately decide on the best way to define layers, I wanted to put a post together to show the two camps.

Any Tech Stack

Any technology that allows you to move Bitcoin around without making a Bitcoin L1 transaction, and settles directly on L1.

This is consistent with our friends at Blockstream, they have put out a simple graphic with their view on things.

As you can see in this image, the “Any Tech Stack” approach shows Lightning Network and Liquid as Layer 2 solutions. With the recent update to Liquid where you can bring Lightning on top of Liquid, they are socializing the idea that Liquid is closer to Bitcoin L1 than Lightning, calling Liquid Layer 1.5.

Bitcoin Stack

On the other side of the spectrum is the camp of folks who believe Bitcoin scaling layers are trustless. These trustless scaling layers allow the transfer and control of Bitcoin. Products and services can be built upon these layers where no permission or trust is required.

Lightning Network is a Bitcoin L2 solution because it is trustless, that is you can retrieve your funds at any time and no one holds them for you.

- Bitcoin L1 (Layer 1) - The Bitcoin chain, upon which additional layers and trust solutions are built.

- Bitcoin L2 (Layer 2) - Allows you to move Bitcoin without making a L1 transaction.

- Bitcoin L3 (Layer 3) - Allows you to move Bitcoin without making a L1 or L2 transaction. Settles on L2.

- Sidechains – trusted solutions where users exchange Bitcoin for a product or service. These solutions have a cryptographic link to Bitcoin layers, which adds additional security. These products and services will help Bitcoin scale, however there are certain tradeoffs such as required trust. Examples: Liquid

- IOU Solutions – trusted solutions where entities hold Bitcoin for you. These solutions offer scalability to Bitcoin; however trust is required as they hold the Bitcoin for you. Examples: Exchanges, Custodial Wallets

The Bitcoin Stack is one piece of the Bitcoin scaling solution and can work with fantastic emerging Trust Solutions such as Sidechains and IOU Solutions.

Conclusion

I believe trust is a fundamental part of defining Bitcoin scaling technology. It’s my belief that it’s only Bitcoin L2 if the technology retains Bitcoin’s trustless nature. For this reason, I believe Sidechains and IOU Solutions should be defined as trust solutions in the trust stack for Bitcoin, rather than L2 scaling technology.

There is no doubt that Sidechains and IOU Solutions will play a vital role in the scalability of Bitcoin, but let’s not call them L2.

Markets clear.

Thanks to 6102 for helping me think through this.

Bitcoin Is Not Too Volatile

By Parker Lewis

Posted August 9, 2019

Has anyone you respect ever told you that bitcoin doesn’t make any sense? Maybe you’ve seen the price of bitcoin rise exponentially and then seen it crash. You write it off, believe your friend was right, don’t hear about it for a while and think bitcoin must have died. But then you wake up a few years later, bitcoin hasn’t died and somehow its value is a lot higher again. And you start thinking maybe your skeptical friend wasn’t right?

The list of bitcoin skeptics is long and distinguished (see here), but the noise contributes directly to the antifragile nature of bitcoin. People that store wealth in bitcoin are forced to think through first principles in order to understand characteristics of bitcoin which otherwise seem, on the surface, to contradict an establishment view of money, which ultimately hardens convictions. Bitcoin volatility is one of these oft-criticized characteristics. A common refrain among skeptics, including central bankers, is that bitcoin is too volatile to be a store of value, medium of exchange or unit of account. Given its volatility, why would anyone hold bitcoin as a savings mechanism? And, how could bitcoin be effective as a transactional currency for payments if its value could reasonably drop tomorrow?

The principal use case for bitcoin today is not as a payments rail but instead as a store of value, and the time horizon for those that store wealth in bitcoin is not a day, week, quarter or even a year. Bitcoin is a long-term savings mechanism and stability in the value of bitcoin will only be realized over time as mass adoption occurs. In the interim, volatility is the natural function of price discovery as bitcoin advances down the path of its monetization event and toward full adoption. Separately, bitcoin does not exist in a vacuum; most individuals or businesses are not singularly exposed to bitcoin and exposure to multiple assets, like any portfolio, mutes volatility of any single asset.

Not Volatile ≠ Store of Value

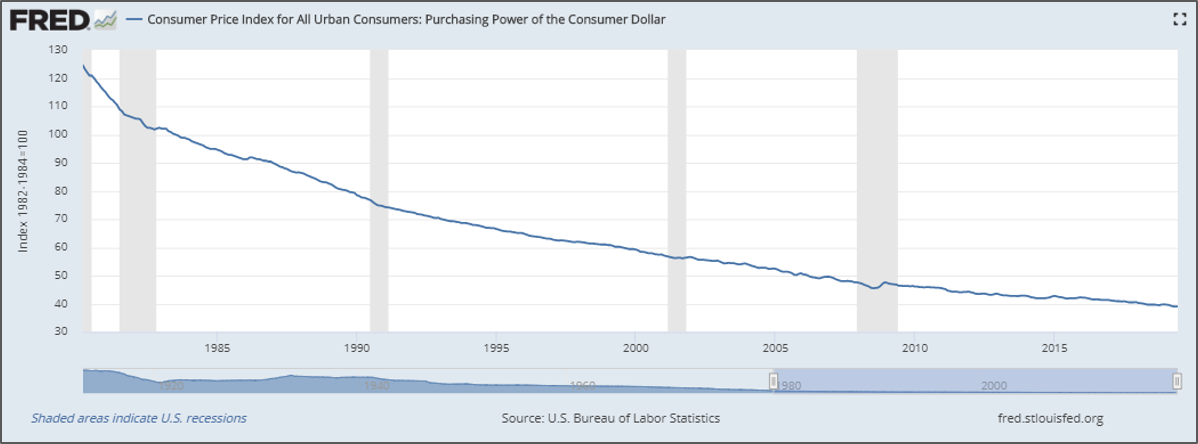

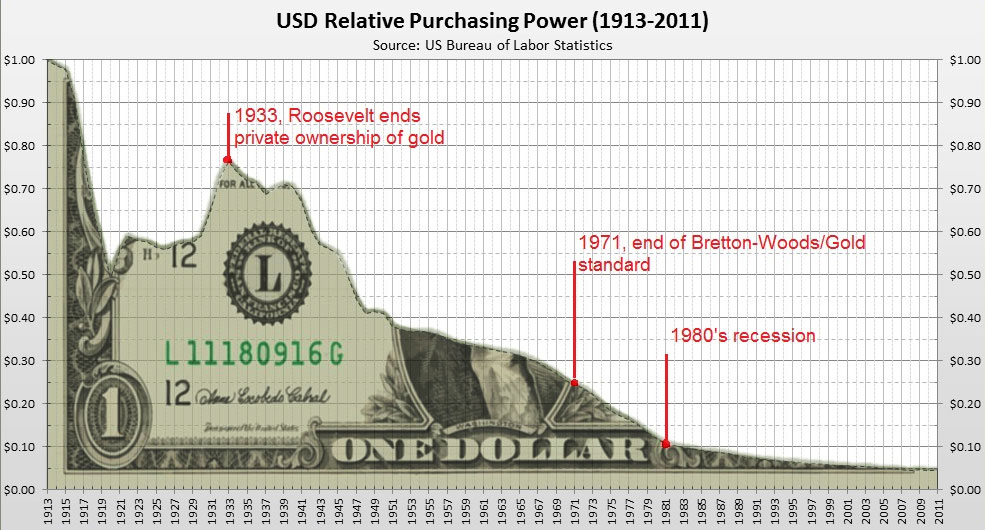

It is fair to say that volatility and store of value are often confused as mutually exclusive. However, they most certainly are not. If an asset is volatile, it does not mean that asset will be an ineffective store of value. The opposite is also true; if an asset is not volatile, it will not necessarily be an effective store of value. The dollar is a prime example: not volatile (today at least), bad store of value.

“Volatile things are not necessarily risky, and the reverse is also true.” Nassim Taleb ( Skin in the Game)

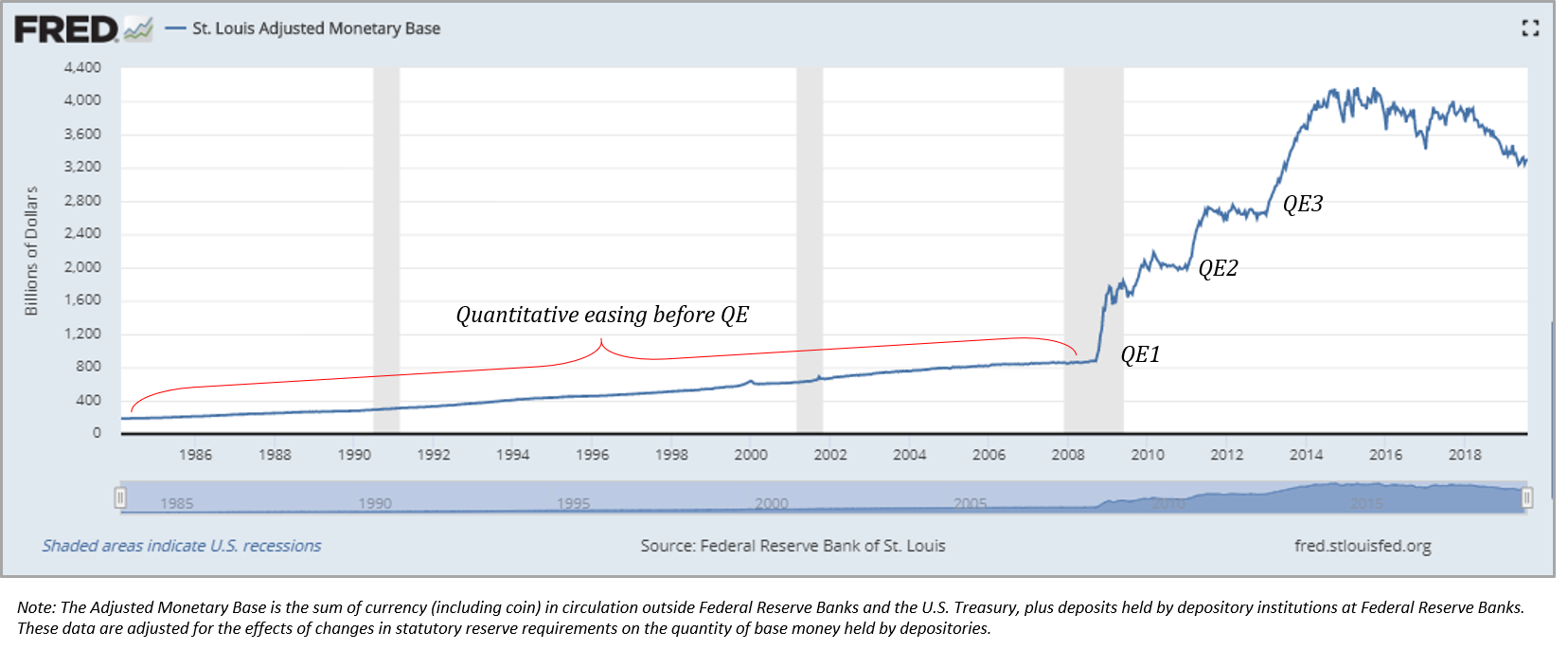

The Fed has been highly effective in very slowly devaluing the dollar, but always remember, gradually, then suddenly. And, not volatile ≠ store of value. This is a critical mental block that many people experience when thinking about bitcoin as a currency, and it is largely a function of time horizon. While central bankers all over the world point to bitcoin as a poor store of value and not functional as a currency because of volatility, they think in days, weeks, months and quarters while the rest of us plan for the long-term: years, decades and generations.

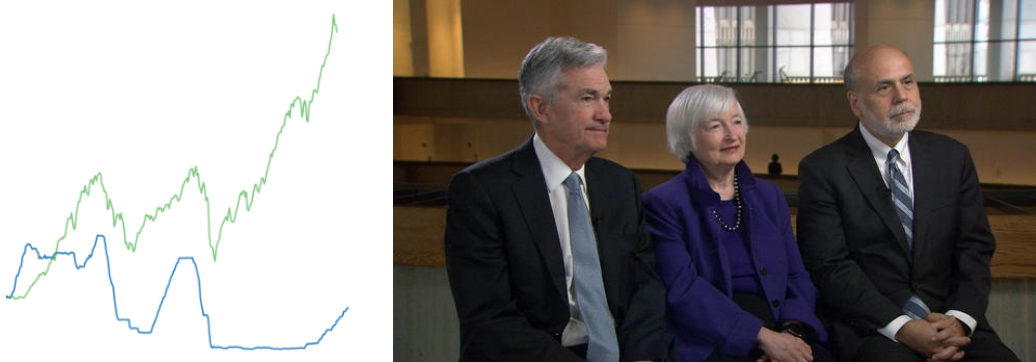

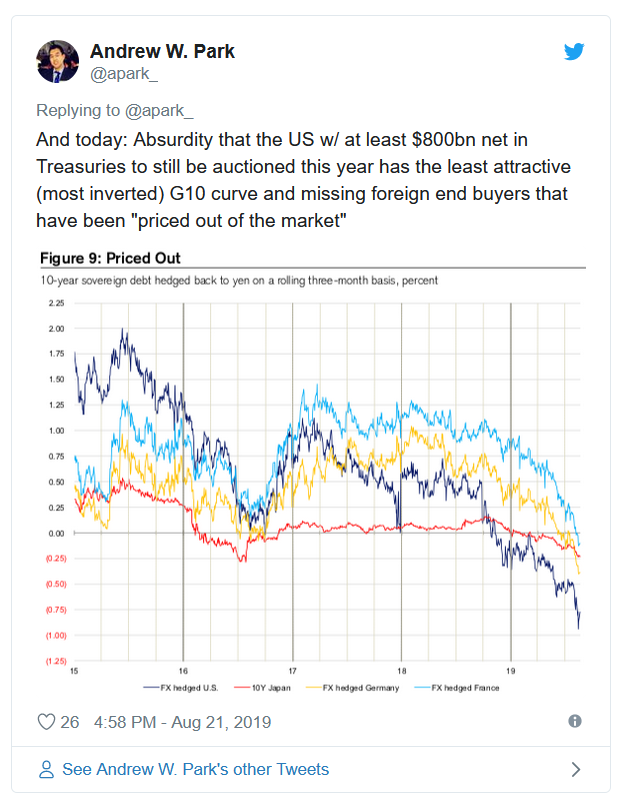

Despite the logical explanations, volatility is one area that particularly confounds the experts. Bank of England Governor, Mark Carney recently commented that bitcoin “has pretty much failed thus far on […] the traditional aspects of money. It is not a store of value because it is all over the map. Nobody uses it as a medium of exchange,” (see here). The European Central Bank (ECB) has also mused on Twitter that bitcoin is “not a currency”, noting that it is “very volatile” while at the same time reassuring everyone that it can “create” money to buy assets, the very function by which its currency actually loses value and why it’s a poor store of value.

The lack of self-awareness is not lost on anyone here but Mark Carney and the ECB are not alone. From former Fed Chairs, Bernanke and Yellen, to current Treasury Secretary Mnuchin to the President himself. All have, at times, trumpeted the idea that bitcoin is flawed as a currency (or as a store of value) because of its volatility. None seem to fully appreciate, or at least admit, that bitcoin is a direct response to the systemic problem of governments creating money via central banks or that bitcoin volatility is a necessary and healthy function of price discovery.

But luckily for all of us, bitcoin is not too volatile to be a currency and often the experts are not experts at all. Setting logic aside, the empirical evidence shows that bitcoin has proven to be an exceptional store of value over any extended time horizon despite its volatility. So how could an asset such as bitcoin be both highly volatile and an effective store of value?

Bitcoin Value Function Revisited

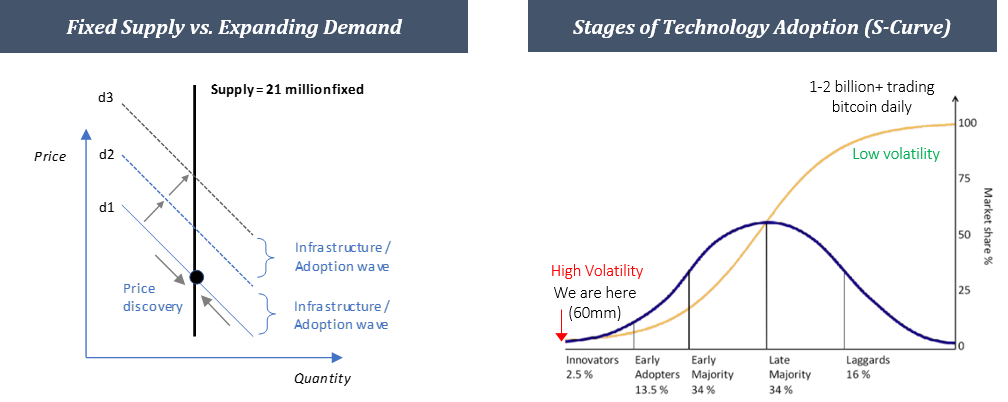

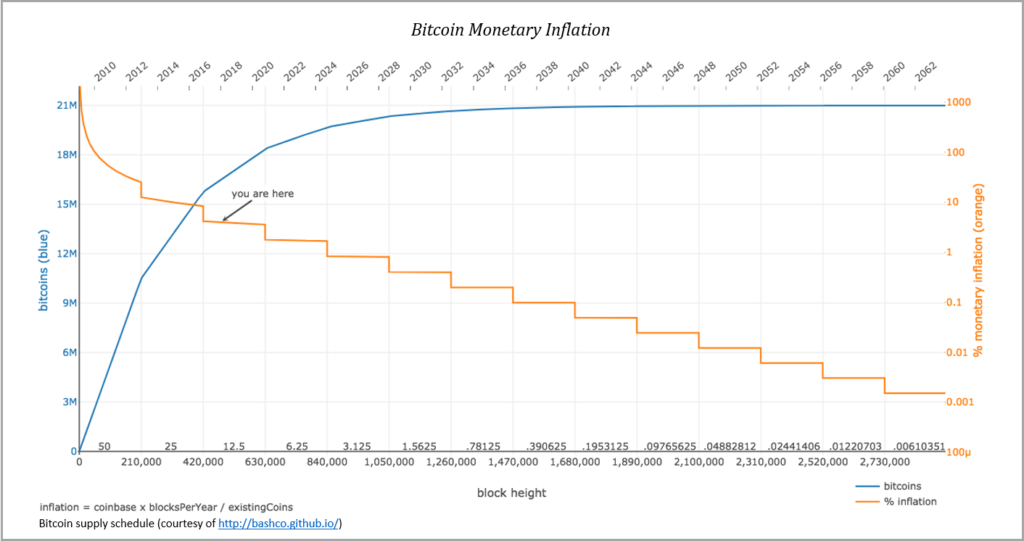

Consider why there is fundamental demand for bitcoin and why bitcoin is naturally volatile. Bitcoin is valuable because it has a fixed supply and it is also volatile for the same reason. The fundamental demand driver for bitcoin is in its scarcity. To revisit bitcoin’s value function from a previous edition, decentralization and censorship-resistance reinforce the credibility of bitcoin’s scarcity (and fixed supply schedule) which is the basis of bitcoin’s store of value property:

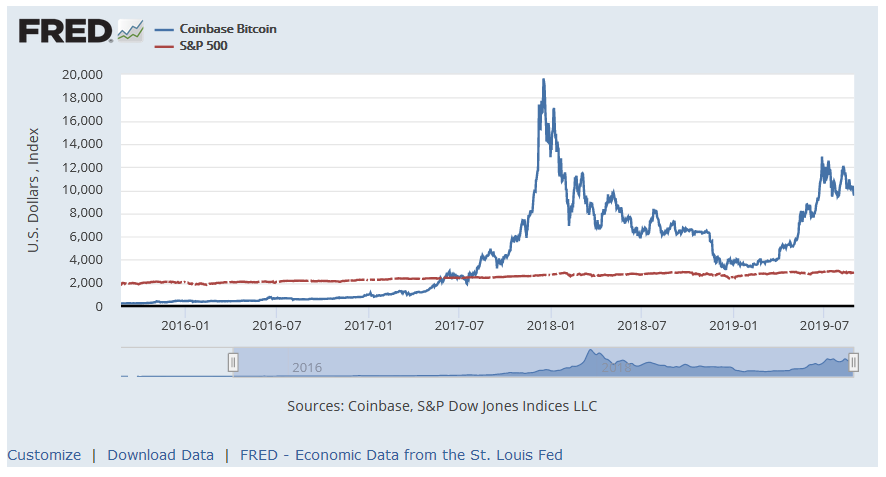

While demand is increasing by orders of magnitude, there is no supply response because bitcoin’s supply schedule is fixed. The disparity in the rate of increase in demand (variable) vs. supply (fixed) combined with imperfect knowledge amongst market participants causes volatility as a function of price discovery. As Nassim Taleb writes in The Black Swan of Cairo: “Variation is information. When there is no variation, there is no information.” As bitcoin’s value increases, it communicates information despite the volatility; the variation is the information. Higher value (dependent on variation) causes bitcoin to become relevant to new pools of capital and new entrants which then stokes an adoption wave.

Adoption Waves & Volatility

Knowledge distribution and infrastructure fuel adoption waves and vice versa. It is a virtuous feedback loop and a function of both time and value. As value rises, bitcoin captures the attention and mindshare of a much wider audience of potential adopters, which then begin to learn about the fundamentals of bitcoin. Similarly, an appreciating asset base attracts additional capital not only as a store of wealth but also to build incremental infrastructure (e.g. more on-ramps & off-ramps, custody solutions, payments layers, hardware, mining, etc.). Developing an understanding of bitcoin is a slow process, as is building infrastructure, but both fuel adoption which then further distributes knowledge and justifies additional infrastructure. Knowledge → Infrastructure → Adoption → Value → Knowledge → Infrastructure

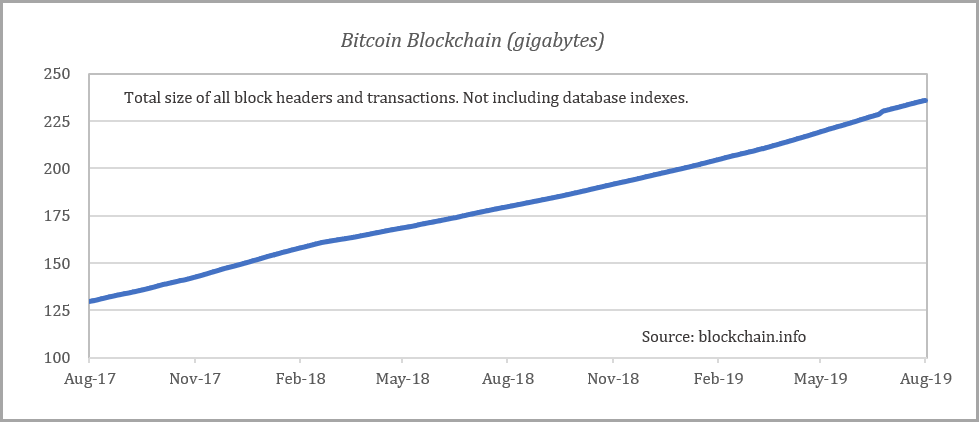

Today, bitcoin is still nascent and current adoption likely represents <1% of terminal adoption. As a billion people adopt bitcoin, new adoption will represent orders of magnitude for any foreseeable future period which will continue to drive significant volatility; however, with each new adoption wave, the value of bitcoin will also reset higher because of higher base demand. Bitcoin volatility will only decline as the holder base reaches maturity and as the rate of new adoption stabilizes. Said another way, for a billion people to be using bitcoin, adoption will have had to increase by ~20x, but the subsequent 100 million adopters will only represent an additional 10% of the base. All while the supply of bitcoin remains on a fixed schedule. So long as adoption represents orders of magnitude, volatility is unavoidable, but on that path, volatility will naturally and gradually decline.

As Vijay Boyapati explained on Stephan Livera’s podcast, “establishment economists deride the fact that bitcoin is volatile, as if you can go from something that didn’t exist to a stable form of money overnight; it’s completely ludicrous.” What happens between adoption waves is the natural function of price discovery as the market converges on a new equilibrium, which is never static. In bitcoin hype cycles, the rise, fall, stabilization and rise again is almost rhythmic. It is also naturally explained by speculative fear, followed by accumulation of fundamental knowledge and the addition of incremental infrastructure. Rome wasn’t built in a day; in bitcoin, volatility and price discovery are core to the process.

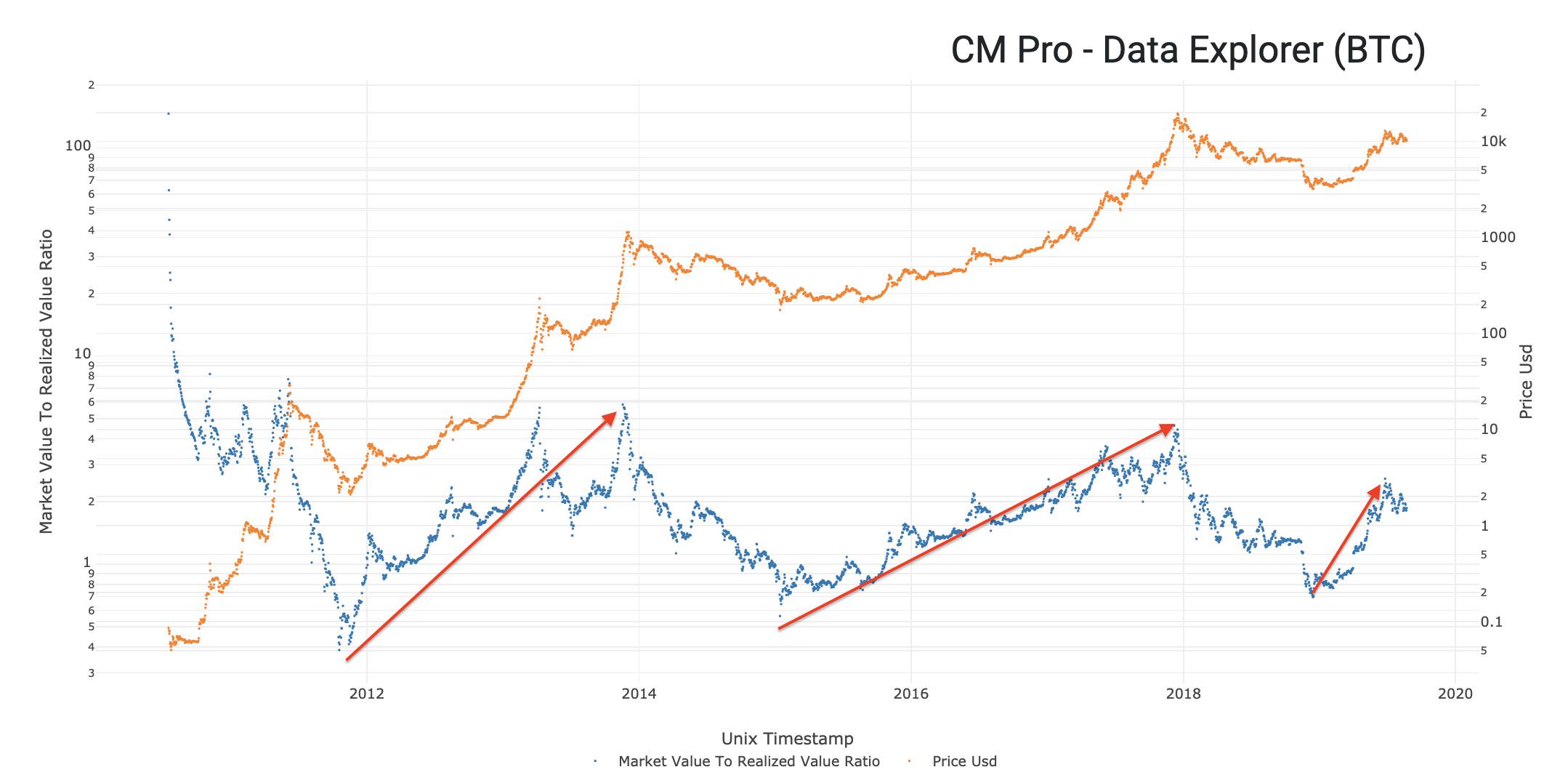

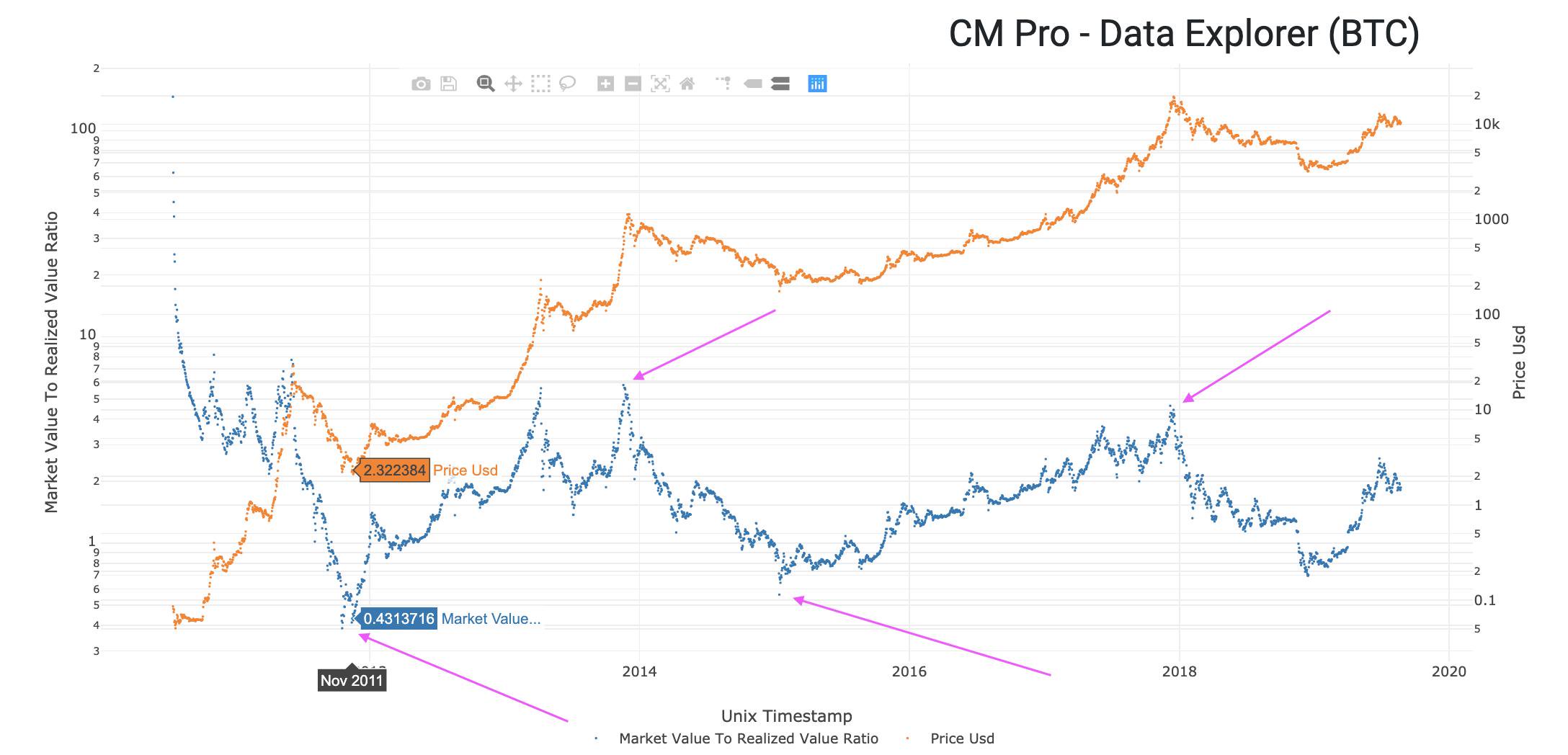

Historical Adoption Wave

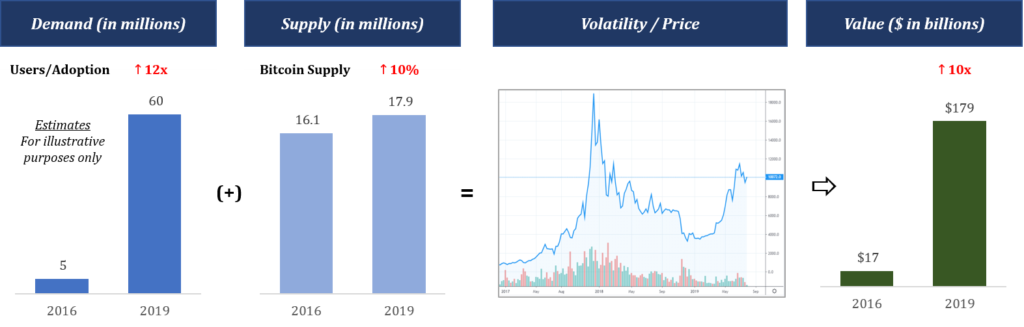

For a more tangible explanation of the relationship between volatility and value, it is helpful to think about the most recent adoption wave from the end of 2016 to present (2019).

While adoption can never really be quantified, a rough but fair estimate would be that bitcoin adoption increased from ~5 million people to ~60 million (an increase in demand of ~12 times) from 2016 to present, yet the supply of bitcoin only increased by approximately 10% over the same period. And naturally, the information and capital possessed by market participants varies significantly. As a massive adoption wave occurred, it was met by bitcoin’s fixed supply schedule. What would one expect to happen when demand increases by an order of magnitude but supply only increases by 10%? And what would happen if the knowledge and capital of the new entrants naturally varies greatly?

The very logical end result is higher volatility and a higher terminal value, if even a small percentage of new entrants convert to long-term holders (which is exactly what happened). New adopters who initially purchased bitcoin in its astronomical rise, slowly accumulate knowledge and convert to long-term holders, stabilizing base demand at a far higher terminal value compared to the prior adoption cycle.

Because bitcoin is nascent, the aggregate wealth stored in bitcoin on a relative basis is still very small (~$200 billion) which allows for the rate of change between marginal buyers and sellers (price discovery) to represent a significant percentage of the base demand (volatility). As base demand increases, the rate of change will begin to represent a smaller and smaller percentage of the base, reducing volatility over time and only after several more adoption cycles.

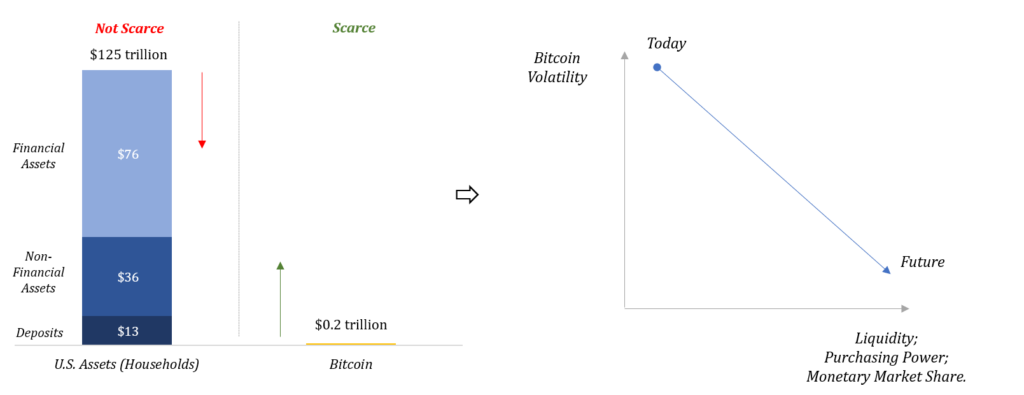

Managing Volatility

If we can accept that bitcoin volatility is both natural and healthy, why doesn’t current volatility prevent the adoption required to transition bitcoin to a stable form of money? Very simply: diversification, portfolio allocation theory and time horizon. There exists a global network (bitcoin) through which you can transfer value over a communication channel to anyone in the world, and it is currently valued, in total, at less than $200 billion. Facebook alone, on the other hand, is worth in excess of $500 billion. For further frame of reference, U.S. household assets are estimated to be valued at $125 trillion (see here, page 138).

In a theoretical world, bitcoin volatility would be an issue if it existed in a vacuum. In the real world, it doesn’t. Diversification comes in the form of real productive assets as well as other monetary and financial assets, which mutes the impact of bitcoin’s present volatility. Separately, information asymmetry exists and those that understand bitcoin also understand that, in time, the cavalry is coming. These concepts are obvious to those that have exposure to bitcoin and actively account for its volatility in short and long-term planning, but it’s apparently less obvious to the skeptics, who struggle to grasp that bitcoin adoption is not an all or nothing proposition.

While bitcoin will continue to steal share in the global competition for store of value because of its superior monetary properties, the function of an economy is to accumulate capital that actually makes our lives better, not money. Money is merely the economic good that allows for coordination to accumulate that capital. Because bitcoin is a fundamentally better form of money, it will gain purchasing power relative to inferior monetary assets (and monetary substitutes) and increasingly take market share in the economic coordination function, despite being less functional as a transactional currency today.

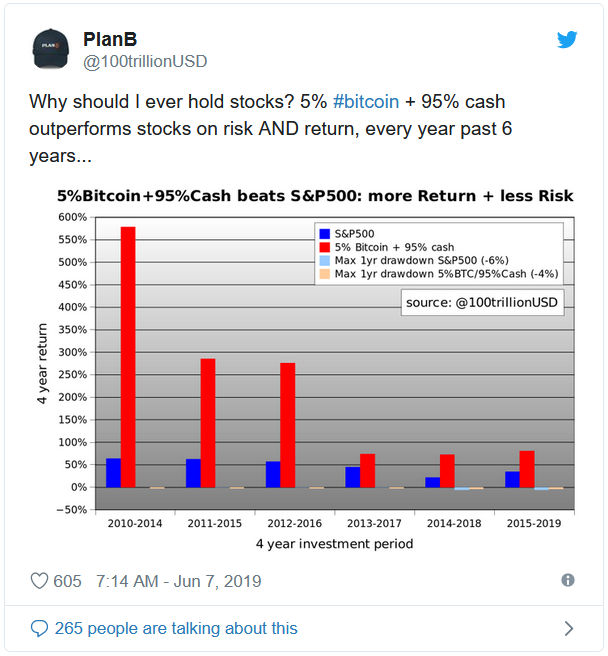

Bitcoin will also likely induce the de-financialization of the global economy, but it will neither eliminate financial assets nor real assets. During its monetization, these assets will continue to represent the diversification which will mute the impact of bitcoin’s day-to-day volatility. See example here which highlights the risk/return of a 1% bitcoin + 99% dollar portfolio compared to gold, U.S. treasuries and the S&P 500 (@100trillionUSD). Also see The Case for a Small Allocation to Bitcoin by Xapo CEO Wences Casares. Both provide a look through into how volatility and risk can be managed should bitcoin experience a significant drawdown or even fail (which is still a possibility).

While failure is a possibility and significant drawdowns are an inevitability, each day that bitcoin doesn’t fail, its survival becomes more and more likely (Lindy Effect). And over time, as bitcoin’s value and liquidity increase due to its fundamental strengths, its purchasing power will also increase in terms of real goods, but as its purchasing power represents a larger and larger share of the economy, its volatility relative to other assets will proportionally decrease.

The End Game

Bitcoin will become a transactional currency over time but in the interim, it would be far more logical to spend a depreciating asset (dollars, euro, yen, gold) and save an appreciating asset (bitcoin). Establishment economists and central bankers really struggle with this one; but I digress. On bitcoin’s path to full monetization, store of value must come as a logical first order and bitcoin has proven to be an incredible store of value despite its volatility. As adoption matures, volatility will naturally fall, and bitcoin will increasingly become a medium of direct exchange.

Consider the person or business that would demand bitcoin in direct exchange for goods and services. This person or business collectively represent those that have first determined that bitcoin will hold its value over a particular time horizon. If one did not believe in the fundamental demand case for bitcoin as a store of value, why would they trade real-world goods and services in return? Bitcoin will transition to a transactional currency only as its liquidity gradually shifts from other monetary asset to goods and services which will occur along the path to mass adoption. It will not be a flash cut or a binary process. On a more standard path, adoption fuels infrastructure and infrastructure fuels adoption. Transactional infrastructure is already being built but more material investment will only be prioritized as a sufficient number of individuals first adopt bitcoin as a store of wealth.

Ultimately, bitcoin’s lack of a price stability mandate and fixed supply will continue to result in near-term volatility but will drive long-term price stability. It is the literal opposite model pursued by Mark Carney of the BOE, the ECB (and its twitter account), the Federal Reserve and the Bank of Japan. And, it is why bitcoin is antifragile; there are no bailouts and it’s a market devoid of moral hazard, which drives maximum accountability and long-term efficiency. Central banks manage currencies to mute short-term volatility, which creates the instability that leads to long-term volatility. Volatility in bitcoin is the natural function of monetary adoption and this volatility ultimately strengthens the resilience of the bitcoin network, driving long-term stability. Variation is information.

Nassim Taleb & Mark Blyth (Black Swan of Cairo)

“Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks.” “This is one of life’s packages: there is no freedom without noise—and no stability without volatility.”

Ben Bernanke, Chairman of the Federal Reserve (during the Great Financial Crisis)

“The Federal Reserve is not currently forecasting a recession.” – January 10, 2008 “The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.” – June 9, 2008

Projection and Throwness

By The Bitcoin Observer

Posted August 11, 2019

Part III — Bitcoin’s 10x Advantage Over Gold Might Not Lie Where You Think

TLDR: This is a multi-part series about the many ways in which Bitcoin is such a unique, inter-disciplinary, and inter-temporal technology. The third part touches on an overlooked advantage of Bitcoin over other traditional forms of commodity money, including gold.

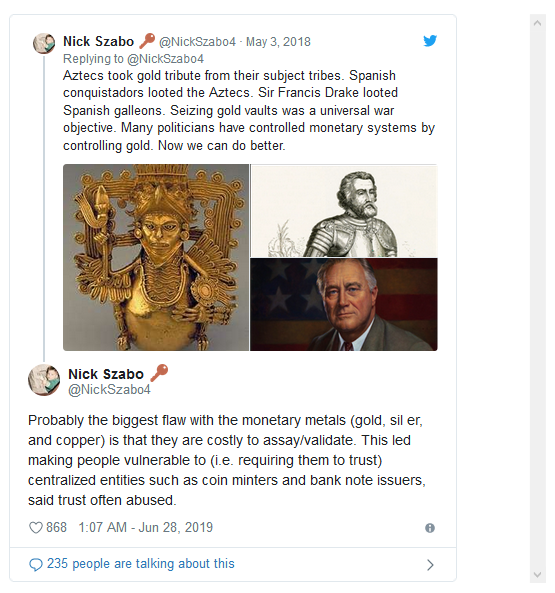

I have been thinking for a while about why sound money survived for thousands of years but was quickly killed in the age of nation-states. When I bumped into this insightful tweet from Nick Szabo the reasons became clear to me. As we will see below, the points he makes are extremely important to understand Bitcoin’s advantages over gold. They might go beyond Bitcoin’s more rigid monetary policy and also have to do with the limitations of metallic money in regards to the expansion of commerce and trade.

Click here if you would like to read this series from the first text.

Click here if you would like to read this series from the first text.

The Long and Winding Road From Metallic Coins to Paper Banknotes

Contrary to what some think, fiat money was not implemented suddenly in 1971 when Nixon closed the gold window or in 1974 when the IMF changed the SDR composition from gold to a basket of fiat currencies. Jim Rickards showed in his book The Road to Ruin that the classical gold standard was actually killed in stages starting with the Austro-Hungarian ultimatum to Serbia and the outbreak of World War I in 1914. The next five paragraphs summarize his argument.

Right after the start of WWI, nations were aware that gold reserves were a determinant factor of victory and suspended redemptions in specie. The two exceptions, for different reasons, were the US and the UK. However, that’s exactly when gold coin circulations were replaced by 400-oz bars, the gold delivery standard until today, in London, which was the undisputed global financial center at the time. This change gradually disincentivized people to hold and transact money in-specie (a 400-oz gold bar today is worth about $500,000) and use banknotes instead.

With the end of WWI in 1918, the new habit of holding banknotes instead of gold coins was ingrained not only in the UK but throughout Europe and increasingly in the US. Gold could still be privately owned, but it was buried out of sight and out of mind. Another major boost to monetary base centralization was FDR’s famous 1934 order 6102 that required US citizens to surrender private gold to the government. Fort Knox was built three years later.

In stages between 1914 and 1934, U.S. gold went from private hands, to bank hands, to central banks, to the Treasury. This paralleled the process that took place in the United Kingdom and other developed economies. Governments made gold disappear.

At the outbreak of World War II, gold convertibility, to the extent that remained, was again suspended. The only major gold dealer at that point was the Bank of International Settlements (BIS). The BIS acted as a broker of Nazi gold, including gold taken from Jews and other Holocaust victims. By the end of WWII, gold did not circulate as currency anymore. The Bretton Woods Agreement of 1944 introduced the gold exchange standard, meaning it applied to nation-states but not to its citizens.

It should be clear by now that it was only a matter of time until the implementation of a full fiat monetary system, which came in 1971 when Nixon closed the gold window. The growing influence of Milton Friedman and his idea of “elastic money” as a remedy that could have avoided the Great Depression provided the intellectual justification politicians needed for the implementation of the monetary system we have until today.

Demonetization Of Silver Revisited

Jörg Guido Hülsmann, probably the greatest monetary economist alive, went a step further and also analyzed the process of demonetization of silver under the perspective of monetary base centralization in his monumental The Ethics of Money Production.

Many Bitcoiners believe that gold won the battle against silver due to its higher stock-to-flow ratio. According to Hülsmann, this view is misguided. There is plenty of evidence that the demonetization of silver was not a free market process, but one heavily engineered by governments. Mises seems to be more or less in accord with this view when he discusses this matter in Theory of Money and Credit:

And while some thus regarded gold as nothing less than the embodiment of the very principle of evil, all the more enthusiastically did other exalt the glistering yellow metal which aline was worthy to be the money of right and mighty nations. It did not seem as if men were disputing about the distribution of economic goods; rather it was as if the precious metals were contending among themselves and against Paper for the lordship of the market. All the same, it would be difficult to claim that these Olympic struggles were engendered by anything but the question of altering the purchasing power of money.

Here I’ll summarize Hülsmann’s argument. Until the 1860s, only the US and some major parts of the UK empire had been on what we today call the classical gold standard. Things changed with the German victory in the Franco-Prussian war of 1870–71. Germany obtained an indemnity in gold and used that to institute a monetary model similar to Britain’s. The Prussian Central Bank, later rebranded the Reichsbank in a marketing coup, was instituted four years later.

Why did the Germans institute a gold standard and not a silver standard or the bi-metallic systems that were floating around? One factor is that gold had better externalities — Britain, the world’s financial center — was on gold and the major silver countries (Austria and Russia) had suspended silver payments at the time of German victory. Gold at that time provided more advantages from an international division of labor standpoint. But Hülsmann points to another reason as well:

Moreover, one should not neglect that silver, the only serious competitor for gold among the commodity monies, has one grave disadvantage from the point of view of a government bent on inflationary finance. Because of its bulkiness, the use of silver entails higher transportation costs, which makes it less suitable than gold for fractional reserve banks trying to quash systematic bank runs through cooperation.

Virtually all western countries followed suit. By the early 1880s, all countries of the West and their colonies had adopted the British monetary model. The silver lining of the classical gold standard was that it demonstrated how a world monetary system can emerge without central coordination. There was no conference, no treaty. The countries adopted it independently of each other.

However, this was done at the discretion of national governments, not at its citizens’. The classical gold standard was brought by the coercive elimination of the alternative monies and it paved the way for government interventions in the monetary system. It ignited the age of national central banks and private fractional-reserve banks taking control of the monetary system. This does not look like a bulwark for the liberty movement.

We have to stress these facts because many advocates of the free market believe the classical gold standard was something like the paradise of monetary systems. This reputation is underserved. The classical gold standard differed only in degree, not in essence, from its successors, all of which have been widely and deservedly criticized in the literature on our subject.

In sum, Hülsman states that the lethal hit that World War I brought to the classical gold standard only anticipated its death from its own cancer. This is not a silver bug argument, but an argument against coercive centralization of the monetary base. Earlier in this same book Hülsmann defines what fiat money is: one that artificially circulates more than the unhampered market would set. This definition also applies to gold in the classical gold standard.

Bitcoin’s 10x Improvement Over Gold Might Not Lie Where You Think it Does

So now we understand that the institution of the fiat system was just the culmination of a process that was going on for about one hundred years before Nixon’s order in 1971. Citizens were coerced to trade silver coins for gold coins, then gold coins for gold bars stored in private banks and finally to gold bars stored with the government. Without this fiat money would be a lot harder, or maybe even impossible, to implement.

How was this process so swiftly accepted by the population? In my opinion, this centralization of the monetary base that led people to trade in IOUs instead of in specie actually brought some advantages to commerce and trade. As Nick Szabo points out, metallic money is hard to assay/validate and is also relatively hard to transport.

As economic activity expands with respect to number of transactions and to geographical footprint, dealing with physical money becomes impracticable. IOUs were a boon to commerce and trade from this standpoint, despite all the additional trust it required and all the monetary base centralization it entailed. Metallic money does not scale well in response to more commerce and trade activity, fiat money actually beats gold there. Bitcoin fixes this.

Mercury is the Roman god of financial gain, commerce, thieves, among other things. Peter Paul Rubens, a true Bitcoin OG, portrayed in 1635 Mercury rescuing a no-coiner after realizing how Bitcoin makes his job a lot easier. “Bitcoin is sound money, free money, and darknet money”, Mercury purportedly said.

Mercury is the Roman god of financial gain, commerce, thieves, among other things. Peter Paul Rubens, a true Bitcoin OG, portrayed in 1635 Mercury rescuing a no-coiner after realizing how Bitcoin makes his job a lot easier. “Bitcoin is sound money, free money, and darknet money”, Mercury purportedly said.

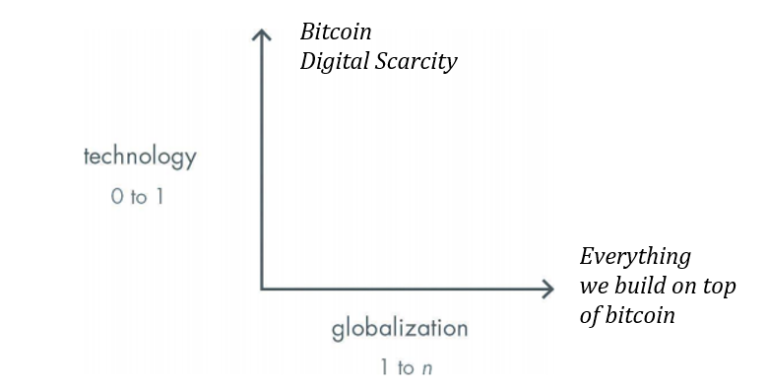

Bitcoin makes the cost of transportation and validation negligible without adding any counterparty risk to the system. This monetary evolution can not be overstated. At this point, I also hope that the importance of these properties for a sustainable sound money in the internet age is clear. Metallic money did not survive the age of globalization and nation-states because it did not scale well. Bitcoin optimizes for that while still sustaining the highest stock-to-flow ratio of any monetary asset. That’s its 10x improvement right there!

Bitcoin’s harder monetary policy compared to gold is usually cited as the main factor that will make it succeed. This is certainly an advantage and a pre-condition for it to be sound money in the first place. However, the question of whether this improvement is enough for Bitcoin to leapfrog gold’s massive Lindy effect is a valid one that has been bothering me for a while. Answering this with the possibility of gold mining in space might be a bit far-fetched at this point. The catalyst for Bitcoin’s extremely high stock-to-flow ratio to shine is how well it scales with commerce and trade activity.

References

- The Road to Ruin by James Rickards. I certainly do not agree with Ricards’ views about Bitcoin. However, I appreciate much of his view about money and enjoy his prose. This is a good read for bitcoiners!

- The Ethics of Money Production by Jörg Guido Hülsmann. This is required reading for anyone who wants to understand why sound money matters.

- Theory of Money and Credit by Ludwig Von Mises. The best book on money written by the best economist of all time. By now it should be clear why this is required reading.

Tweet: Opinion on Wealth Concentration

By Nic Carter

Posted August 14, 2019

My view on wealth concentration

- bitcoin is an emerging monetary system, it started with a GINI of 1 and decreases over time

- ‘fairdrops’ don’t work; see the voucher programs in the USSR

- the best thing you can hope for is equality of opp. and no seignorage (bitcoin has both)

- long term holders sell out as their wealth increases. this is empirically observable in Bitcoin (@unchainedcap ‘s Hodl waves analysis makes this point)

- this is a natural and organic force which disperses supply

- wealth concentration is something to worry about if wealth can be transformed into political power, because you kick off a feedback loop of wealth -> power -> discretion over system features -> more wealth

- luckily, bitcoin manifestly does NOT care if you are wealthy

- in this context, the concentration of wealth in bitcoin is not something that worries me, even a little bit. Bitcoin ‘governance’ is nicely poised between nodes, devs, miners

- if wealth meant power in Bitcoin, S2X would have prevailed. it didn’t. compare that with other chains

- given that wealth does NOT equal power in Bitcoin, worrying about the concentration carries sinister undertones

- it insinuates that the outcomes in Bitcoin are ‘wrong’ and may need to be remediated

- if you believe in free market money, you believe in free market outcomes

- thanks to a decade of PoW and an unrepeatable launch where coins where freely traded for years without a $ value, Bitcoin has an enviable distribution

- the chosen metric (% of addresses owning % of supply) is comically bad

- every other coin is empirically more concentrated

- this is a great case study in how data can be both trivially correct and very misleading

- the default thing people do with data is misrepresent things

- this is a difficult subject which requires nuance & a patterned analysis, not just a single metric

- if you think that ‘bitcoin is unevenly distributed’ will inhibit adoption, you are in for a surprise

- Bitcoin has long succeeded in spite of political unacceptability and bad optics. this probably won’t stop it

- fin

Bitcoin Does Not Waste Energy

By Parker Lewis

Posted August 16, 2019

How many times have you heard the safety instructions before a standard commercial flight? You probably know them by heart, but every time, prior to takeoff, flight attendants instruct passengers traveling with children to put their oxygen mask on first and then tend to the children. Instinctively, it’s counterintuitive. Logically, it makes all the sense in the world. Make sure you can breathe, so that the child dependent on you can breathe too. The same principle applies to the coordination function of money in an economy and the resources required to protect that function. In a more philosophical safety warning, the flight attendant may say, “please make sure the money supply is secure so that we can continue to coordinate the activity of millions of people to build these hyper complex planes that afford you the opportunity to even contemplate the problem I’m about to explain.”

We will come back to this, but you will never hope to understand the justification for the amount of energy bitcoin consumes without first developing an appreciation for the fundamental role money plays in coordinating economic activity and all the things we collectively take for granted. What is money? How does it work? How should it work? What is its function in society? If you haven’t stopped to ask these questions, you can’t begin to grasp the weight of the problem bitcoin intends to solve. And without an appreciation for the problem, the cost to secure the solution will never seem justified.

Any number of concerned onlookers raise the red flag about the amount of energy consumed by the bitcoin network. This concern stems from the idea that the energy consumed by the bitcoin network could otherwise be utilized for more productive functions, or that it is just plain bad for the environment. Both ignore the fundamental magnitude of how critical bitcoin’s energy consumption actually is. In the long-game, there may be no greater, more important use of energy than that which is deployed to secure the integrity of a monetary network and constructively, in this case, the bitcoin network. But, that doesn’t stop those that do not understand the problem statement from raising concerns.

“The fundamentally wasteful nature of bitcoin mining means there’s no easy technological solution coming.” –the Guardian “In the context of climate change, raging wildfires, and record-breaking hurricanes, it’s worth asking ourselves hard questions about Bitcoin’s environmental impact.” –Vice Media

Bitcoin Energy Consumption

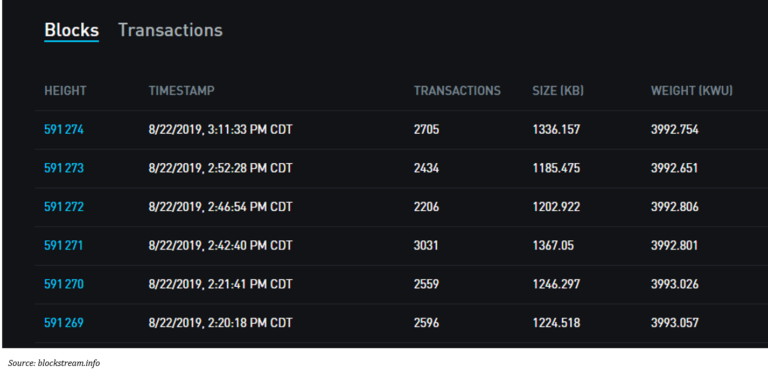

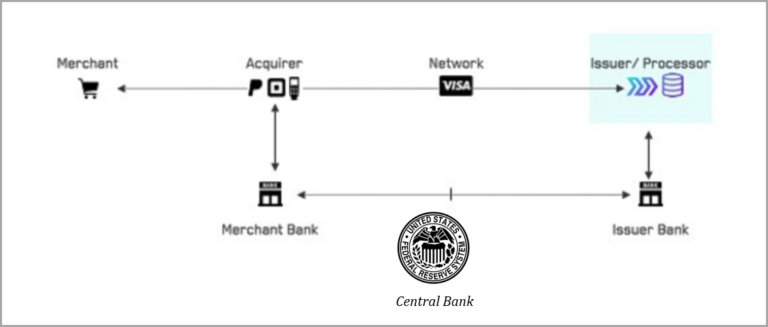

For background, bitcoin is secured by a decentralized network of nodes (computers running the bitcoin protocol). Economic nodes within the network generate, validate and relay transactions as well as validate and relay bitcoin blocks (time sequenced groups of transactions). Mining nodes perform similar functions but also perform bitcoin’s proof of work function to generate, solve and transmit blocks to the rest of the network. By performing this work, miners validate history and provide a “clearing” function for current transactions, which all other nodes then check for validity. Think the clearing function of the New York Fed but on a completely decentralized basis every ten minutes (on average).

The work performed requires massive amounts of processing power contributed by miners all over the world, running 24 hours a day, 7 days a week. This processing power requires energy. For context, at 75 exahashes per second, the bitcoin network currently consumes approximately 7-8 gigawatts of power, which translates to ~$9 million per day (or ~$3.3 billion per year) of energy at a marginal cost of 5 cents per kWh (rough estimates). Based on national averages in the U.S., the bitcoin network consumes as much power as approximately 6 million homes. Yeah, it is definitely a lot of power, but it is also what secures and backs the bitcoin network.

How could this much energy be justified? And what will bitcoin consume when a billion people are using it? The dollar works just fine, right? Well that’s just the thing, it doesn’t. These resources are being devoted to fix a problem most don’t understand exists, which makes justifying a derivative cost challenging. To help ease the pain of environmentalists and social justice warriors, we often point out a number of countervailing narratives to make it seem more palatable:

- A significant portion of bitcoin’s energy consumption is generated from renewable resources.

- Bitcoin will spur innovation in the development of renewable energy technology & resources.

- Bitcoin consumes energy that is otherwise wasted, if not,flared into the atmosphere.

- Bitcoin consumes only the energy that the free market will bear at a free market rate.

- Bitcoin consumes energy resources that would otherwise not be economic to develop.

- The nature of bitcoin energy demand will improve the efficiency of energy grids.

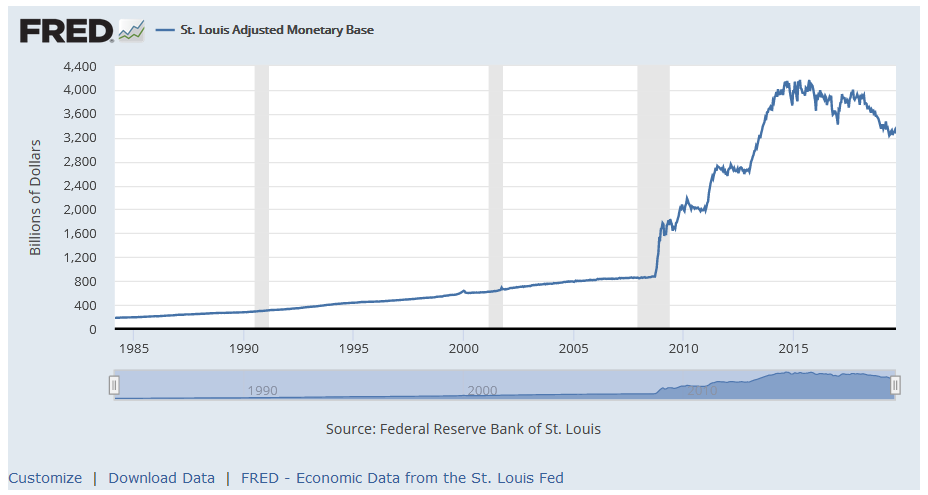

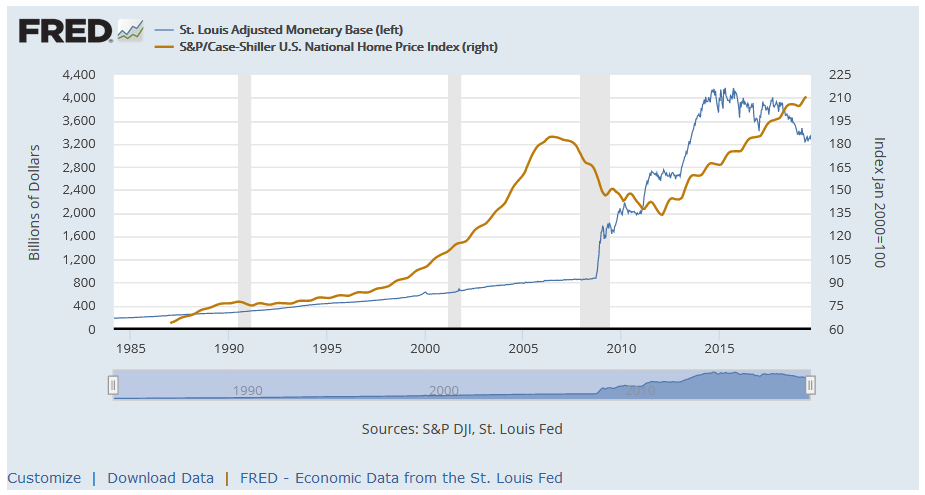

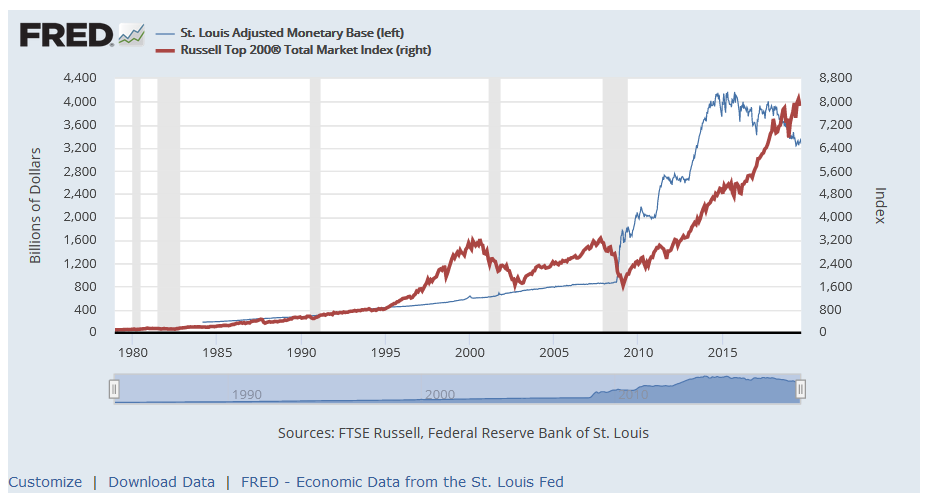

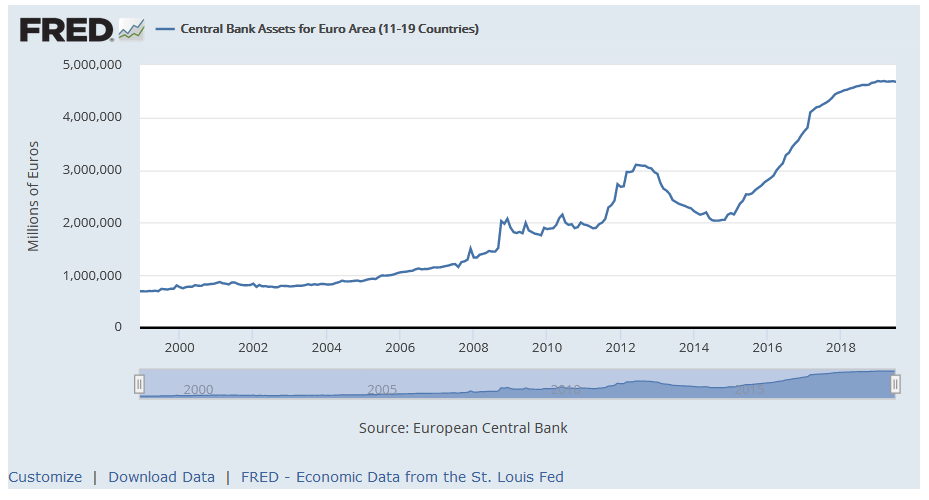

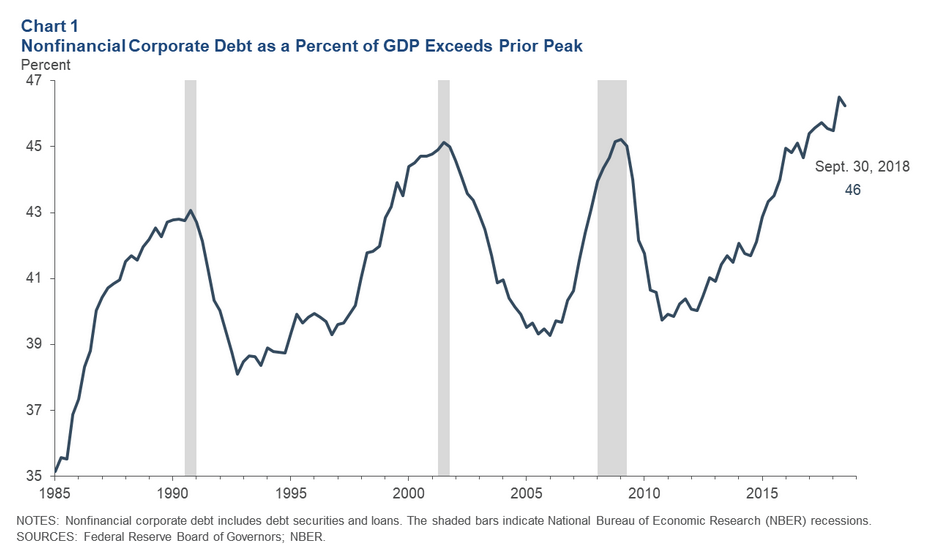

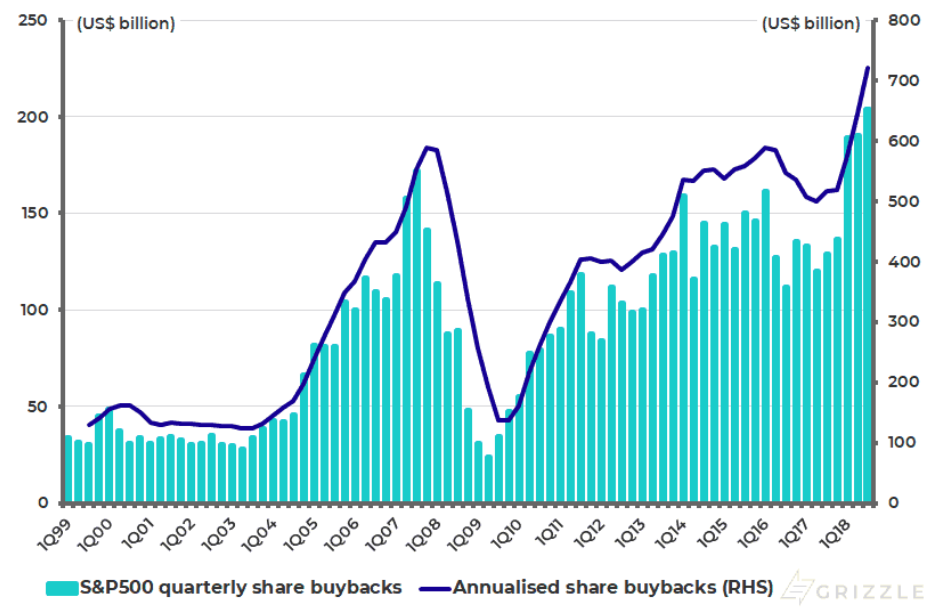

These considerations help enumerate why a simple view that bitcoin’s energy consumption is necessarily wasteful or necessarily bad for the environment fails the proverbial test. However, without an appreciation for the enormity of the monetary problem bitcoin intends to solve, the marginal cost could never be justified. Bitcoin represents a solution to the systemic issues that exist within our legacy monetary framework and it relies on energy consumption to function. Economic stability depends on the function of money and bitcoin provides a more sound monetary framework which is why there is no more important long-term use of energy than securing the bitcoin network. So rather than expand on the many individual counterpoints to the mainstream narrative, there is no better place to focus than the first principle problem itself: the money problem or the global QE (quantitative easing) problem, see here.

The Function of Money

The problem of money is enormous, though most people do not recognize it. Most can feel it in their daily lives but cannot identify the root cause. Working harder, longer hours, going into debt and still barely getting by. There has to be a better way, but in order to identify a solution, one has to first see and understand the problem. The problem that exists is with our money and the impact it has on society is pervasive.

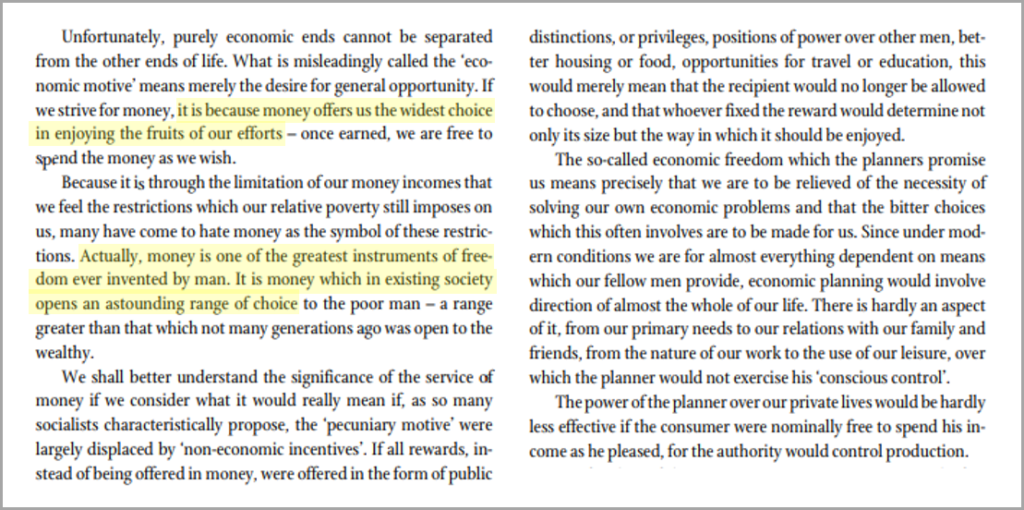

Without getting into the details of what money is (read the Bitcoin Standard or Nick Szabo’s Shelling Out), we can more easily describe its function in society. Money is the good that facilitates economic coordination between parties that otherwise would not have a basis to cooperate. Put simply, it is the good that allows society to function, and it allows us to accumulate the capital that makes our lives better, which takes different forms for different people. There is a saying that money is the root of all evil, but as Hayek more appropriately describes it in the Road to Serfdom, money is an agent of freedom.