| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the May 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

- 9-25-2019 Additional content has been added to this journal.

- Understanding (and Mitigating) Re-Orgs

- Decentralizing Bitcoin’s Last Mile With Mobile Mesh Networks

Bitcoin’s Gravity

How idea-value feedback loops are pulling people in

By Gigi

Posted May 1, 2019

Bitcoin is different things to different people. Whatever it might be to you, it is undoubtedly an opinionated and polarizing phenomenon. There are certain ideas embedded in the essence of Bitcoin, and you might be intrigued by some or all of them.

The invention of Bitcoin, and its underlying blockchain, which is so widely misunderstood, spawned many projects, networks, and communities. Some of these networks are in direct competition, which has resulted in endless conflicts and lots of debate. The root of these conflicts is ideological in nature: disagreement about how the world is and how it should be — a disagreement about ideas.

The following is an attempt to explain some of the reasons behind this polarization, explore the underlying dynamics in more detail, and illustrate why an increasing number of people seem to be gravitating towards Bitcoin.

“There are some oddities in the perspective with which we see the world. The fact that we live at the bottom of a deep gravity well, on the surface of a gas covered planet going around a nuclear fireball 90 million miles away and think this to be normal is obviously some indication of how skewed our perspective tends to be, but we have done various things over intellectual history to slowly correct some of our misapprehensions.”Douglas Adams

Agreeing on a Set of Ideas

The goal of the Bitcoin network is to reach consensus, a general agreement on the state of the system. Bitcoin’s breakthrough innovation was utilizing unforgeable costliness to reach global consensus without relying on a central authority.

Bitcoin can be understood as a game that anyone can join. Like all games, it can only be played if it has rules, certain ideas which are internally consistent. Otherwise, it wouldn’t be a game; it would be chaos.

“Before any game can be played, the rules have to be established; before the game can be altered, the rules have to be made manifest. […] All those who know the rules, and accept them, can play the game — without fighting over the rules of the game. This makes for peace, stability, and potential prosperity — a good game. The good, however, is the enemy of the better; a more compelling game might always exist.”Maps of Meaning Bitcoin’s consensus rules are just that: a set of ideas, codified into validation rules, acted out by nodes on the network. Changing this core set of ideas is akin to changing what Bitcoin is, and the decentralized nature of the network makes changing them extremely difficult. There is no central authority to dictate changes, making unanimous adoption of a new set of ideas virtually impossible. Anyone who changes the rules, even if he thinks such a change is for the better, will start to play a different game, with only those who join him.

As Bitcoin’s creator famously said: the nature of Bitcoin is such that once the first version was released, the core design was set in stone for the rest of its lifetime.

Undoubtedly, Satoshi had certain ideas in mind when he created Bitcoin. Many of these ideas are articulated in his writing, and even in the genesis block. Most importantly, however, his core ideas are codified in Bitcoin’s consensus rules:

- fixed supply

- no central point of failure

- no possibility of confiscation or censorship

- everything can be validated by everyone at all times

This set of ideas is embedded in the rules of the network, and you have to adopt them to participate. In essence, a network like Bitcoin encodes a social contract in its software: ideas which are shared by everyone on the network.

Spreading ideas

All great things start small, and Bitcoin was no exception. In the beginning, it was one node, one piece of software, one person, one set of ideas. On 31 October 2008, the Bitcoin whitepaper was published. Two months later, on 3 January 2009, the genesis block was mined.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”Bitcoin’s Genesis Block It took only two days until a second person was intrigued enough to join the network. Hal Finney ran the software, connected to Satoshi’s node, and the Bitcoin network was born. Soon, other people picked up on the idea, ran the software, and set up their nodes to join the network. The rest, as they say, is history.

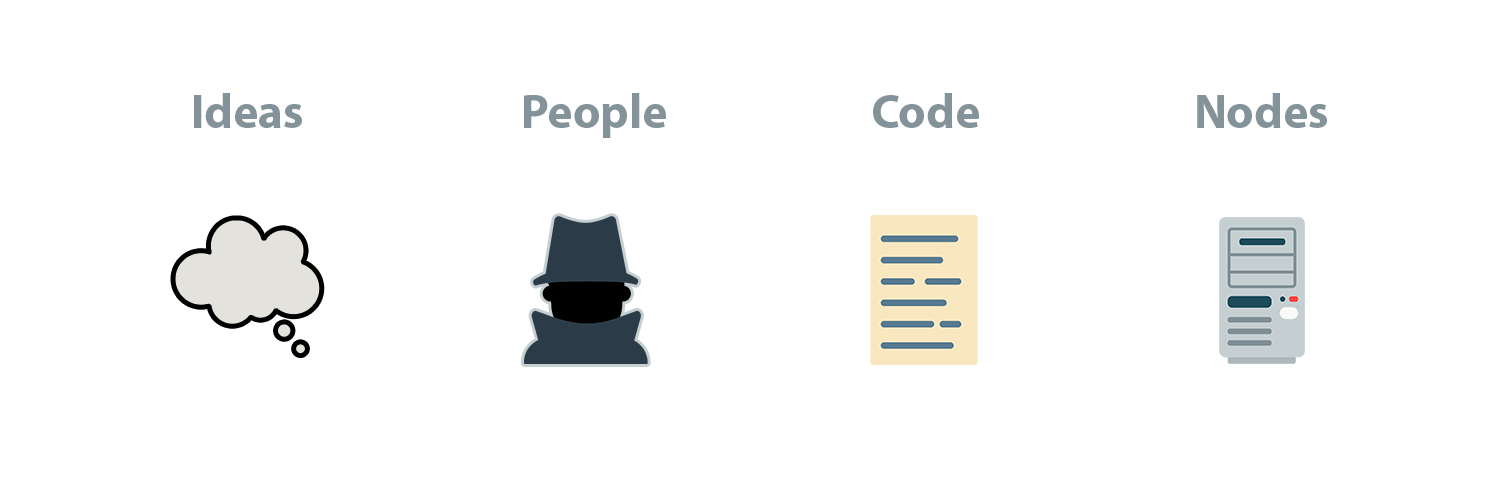

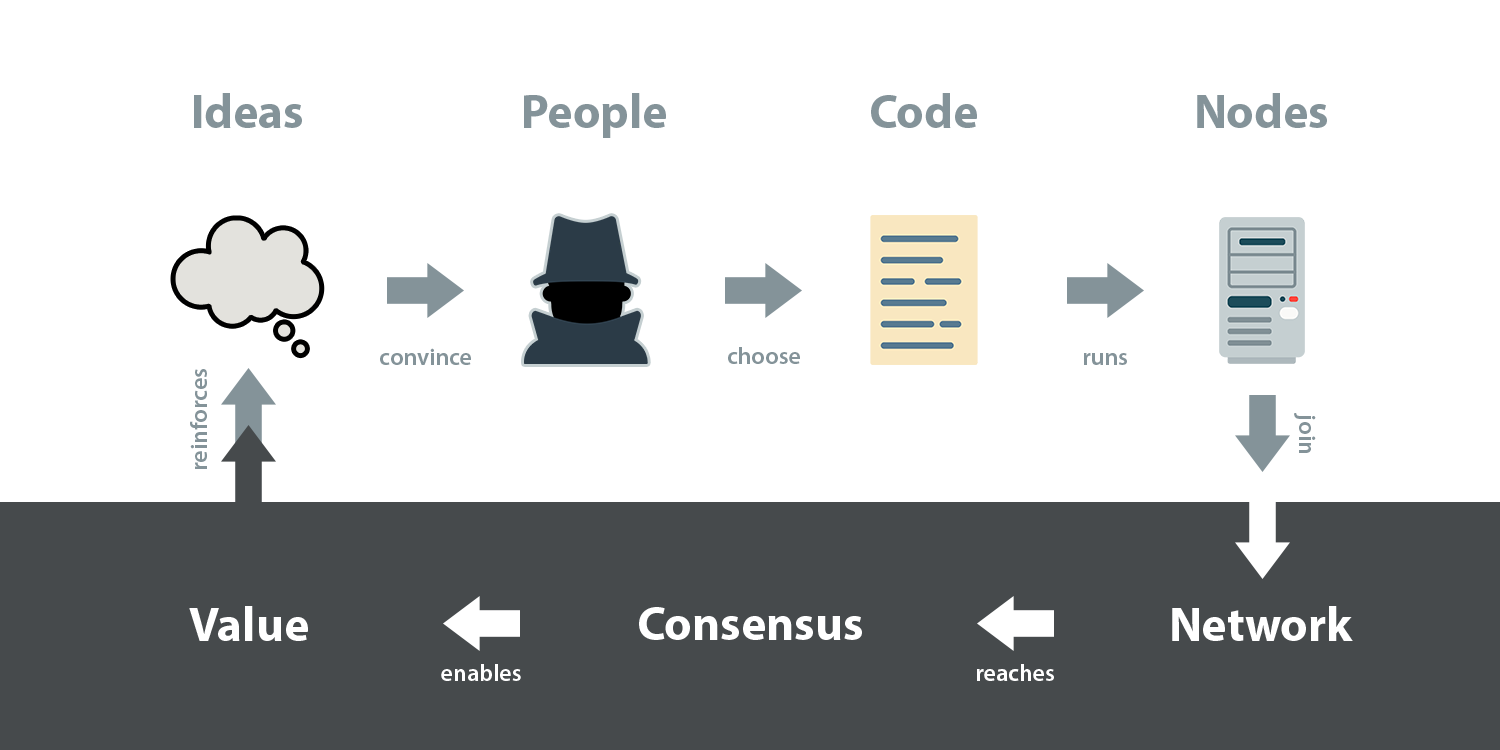

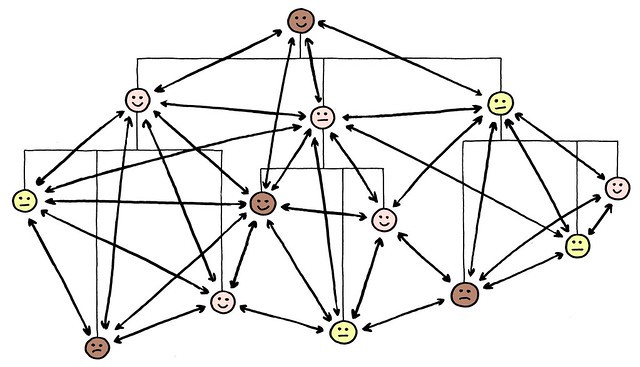

The Bitcoin network is a complex piece of machinery. The constituents of the network — part technology, part biology — make it inherently difficult to describe and understand. While the following doesn’t claim to be a complete description of the system by any means, I think it’s helpful to focus on some constituents in more detail. In particular, I want to focus on the following four: ideas, people, code, and nodes.

Bitcoin’s ingredients: two parts software, two parts hardware.

Bitcoin’s ingredients: two parts software, two parts hardware.

On the physical layer, the network is made up of interconnecting nodes. Bitcoin’s consensus rules are embodied in its software, i.e. the code which is running on its nodes. Ultimately, people are choosing which software to run, a decision which is shaped by the set of ideas they hold.

The possibility of running self-sovereign nodes is part of the reason why Bitcoin’s consensus rules are so hard to change. As mentioned above, there is no central authority, no entity to trust. Changes have to be adopted voluntarily by everyone. People are free to run any version of the software, be it out of conviction, laziness, or contempt.

Bitcoin is a system “based on cryptographic proof instead of trust,” to quote the whitepaper. The implication is that you are the authority and you have to verify everything for yourself from scratch. Out of this, consensus emerges.

“Freedom brings men rudely and directly face to face with their own personal responsibility for their own free actions.”Frank Meyer, In Defense of Freedom As soon as consensus is reached on the network, value comes into play. That bitcoins — or any monies, for that matter — have value, is in itself an idea that people need to be convinced of.

For Bitcoin, this process took almost 500 days. When the network was in its infancy, bitcoins weren’t worth anything. They were mined and sent back and forth between curious cypherpunks. However, the moment Laszlo exchanged 10,000 BTC for two pizzas, Bitcoin went from zero to one. In an instant, the network became valuable in a tangible way.

Ever since this moment, the following idea-value feedback loop is at play:

- Bitcoin’s set of ideas— its value proposition — is attracting people.

- Those people freely choose which code to run.

- The selected code runs on individual nodes, dictating their behavior.

- Nodes join the network, connecting to peers who share their ideas.

- The network reaches consensus, enabling agreement on who owns what.

- The value, in turn, is based on the set of ideas enforced by consensus rules: the embodiment of its value proposition.

Idea-value feedback loop.

Idea-value feedback loop.

This idea-value feedback loop, the re-enforcement of ideas through value creation, is the mechanism behind Bitcoin’s gravity. Everything in this cycle influences everything else — whether it is software, hardware, or wetware. This loop is what ultimately captures people, and since Bitcoin’s core set of ideas is virtually fixed, it has some surprising effects on the sets of ideas held by people.

Bitcoin’s Gravity Well

As we have seen above, Bitcoin is an opinionated piece of software, creating an opinionated network. The result of an opinionated network is that it attracts opinionated people.

Arguably, most early adopters of Bitcoin shared its core set of ideas. As Dan Held points out in Planting Bitcoin, Satoshi carefully chose the initial group of people: cryptographers and cypherpunks, who understood the technical components Bitcoin is made of.

There are many paths which might bring you close to Bitcoin’s gravitational pull: you might have an interest in cryptography, information security, or financial technologies. You may hold certain political or economic beliefs. You might be a gold bug, free speech advocate, or a speculator. You may need to use Bitcoin out of necessity. Whatever the reasons for your initial contact with Bitcoin, there is a certain probability that you are pulled in. Satoshi alluded to this multi-dimensional attractiveness in one of his emails to the cryptography mailing list.

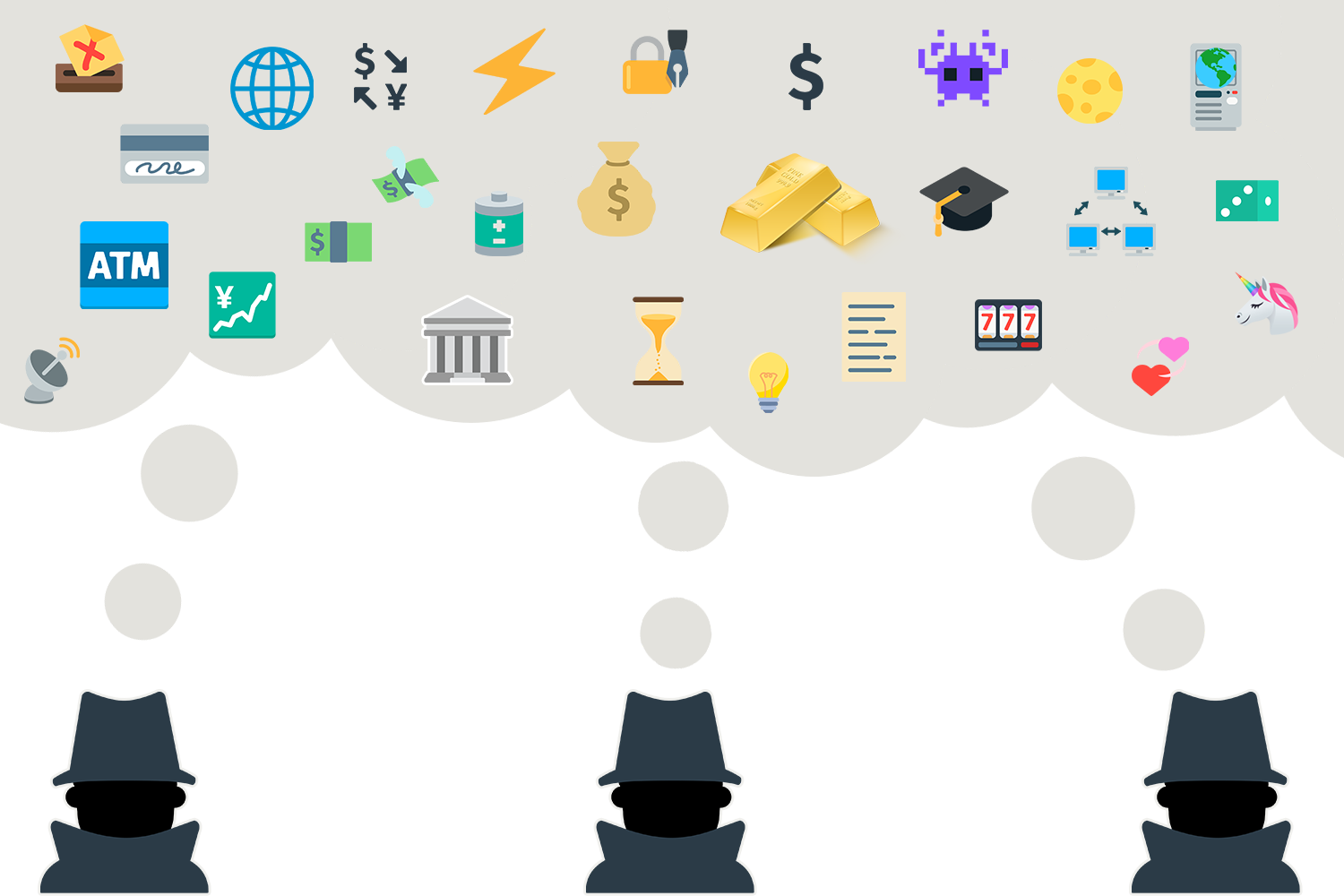

“It’s very attractive to the libertarian viewpoint if we can explain it properly. I’m better with code than with words though.”Satoshi Nakamoto One way to illustrate this is by visualizing a landscape of ideas. Since the number of all possible ideas is basically infinite, we will have to focus on a small subset. And since we are talking about Bitcoin, we will focus on the small universe of ideas spawned by asking the question of what Bitcoin is.

What is Bitcoin?

What is Bitcoin?

Ask three strangers what Bitcoin is, and you will probably get three very different answers. Any answer is necessarily shaped by past experience, political and economic beliefs, and an individual understanding of the world. Your personal set of ideas, your world view, defines where you are on the landscape of ideas.

The landscape has sets of ideas which clump together: narratives, which help to explain what Bitcoin is. One person might think of Bitcoin primarily as digital gold, focusing on the store of value aspect of Bitcoin. Another person might think of Bitcoin as a payment system, focusing on the medium of exchange aspect of Bitcoin. Yet another person might think of Bitcoin as a way to automate more complex social constructs, focusing on automation of contracts and similar ideas.

“Nobody can know everything. The complexity of society is irreducible. We cling to mental models that satisfy our thirst for understanding a given phenomenon, and stick to groups who identify with similar narratives.” Dan Held These narratives, these sets of ideas, describe both what Bitcoin actually is — at least in part — and what people think it is. These narratives will necessarily evolve over time as our understanding of the system and the system itself evolves. Neither ideas, nor people, nor Bitcoin, nor the world at large are static things. Our visions of Bitcoin have changed, and will continue to do so in the future.

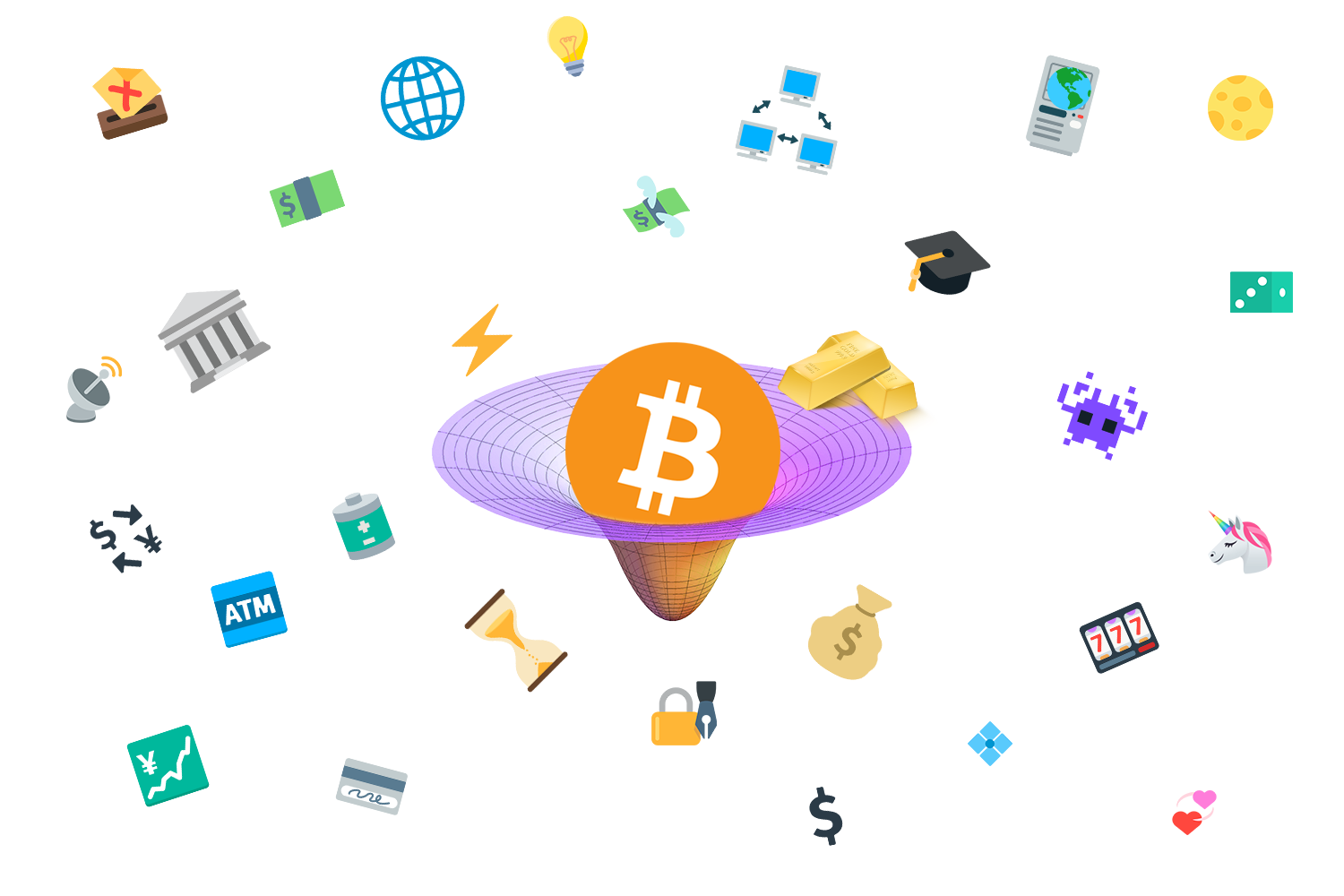

Whatever Bitcoin is, it acts as a gravity well in this universe of ideas. If your set of ideas overlaps with those embodied by Bitcoin, you are close to its gravity well and captured easily. If your set of ideas is opposed to Bitcoin’s, you are far away from its gravitational pull and remain unattracted.

What is Bitcoin?

What is Bitcoin?

Consequently, Bitcoin is attracting opinionated people who share certain ideas and ideals. “Birds of a feather flock together,” as the saying goes. In this case, many nerd-birds and cypherpunks flocked around Bitcoin early. Not particularly surprising.

What is surprising, however, is the side-effect of an opinionated network: it influences people. Since the set of ideas embodied by Bitcoin is fixed, it is the set of ideas held by people which has to align — not vice-versa. The last ten years have shown that Bitcoin is very effective in changing minds. So far, no single mind was particularly effective in changing it.

“So the universe is not quite as you thought it was. You’d better rearrange your beliefs, then. Because you certainly can’t rearrange the universe.” —Isaac Asimov To repeat an old TFTC trope: Bitcoin will change us more than we will change it, as I have learned myself.

Attraction and Repulsion

But what if your set of ideas does not overlap with Bitcoin’s? What if you wish to change Bitcoin’s set of ideas, not convinced of the futility of this endeavor? What if you are downright repulsed by some of its ideas?

“The miracle of physics that I’m talking about here is something that was actually known since the time of Einstein’s general relativity; that gravity is not always attractive. Gravity can act repulsively.”Alan Guth If you are truly repulsed by Bitcoin’s ideas, you might end up drifting away into space, joining the interstellar void where nocoiners float around.

If you want to change Bitcoin’s ideas in a fundamental way, you might end up creating another gravity well. This is easily possible because of Bitcoin’s openness. Its open source code, permissionless network structure, and lack of formal organization of any kind allows anyone to copy, modify, and run the code without asking for permission.

As outlined above, changing the core rules of Bitcoin results in a new game — different from the game everyone else is playing. To not play alone, you would have to convince other people to play with you. If you want to have the same number of people to play with, you will have to convince everyone on the network that your set of ideas is better than the one held by everyone else. And since this is mostly a financial game, strong network effects are very beneficial; it is in your best interest to convince everyone.

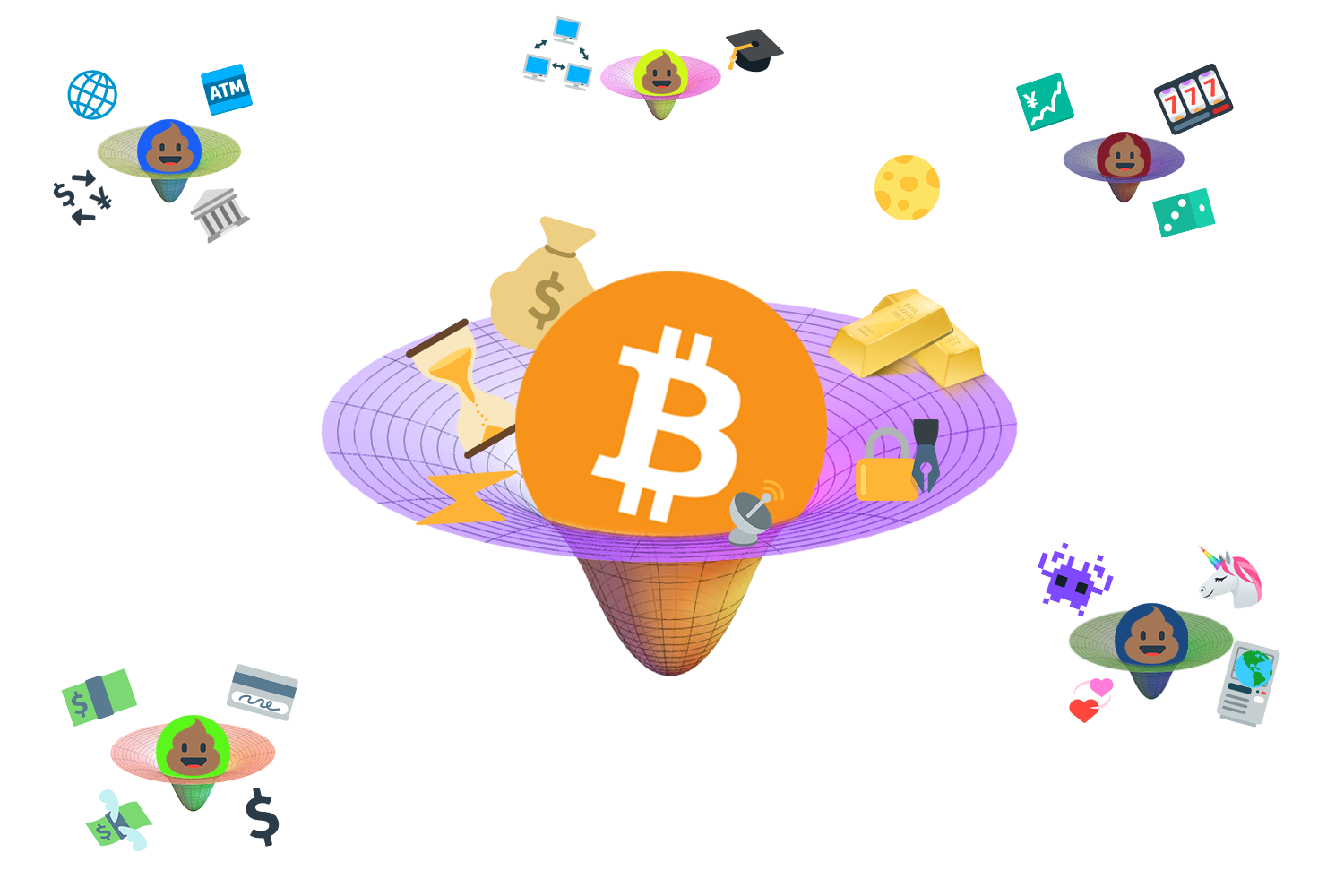

Failing to do so will create a competing system; either by creating a new network or by splitting off from the existing Bitcoin network. Since all new projects are inspired by Bitcoin, the set of ideas necessarily overlaps; sometimes almost exactly.

“Tracking narratives is a good way to help people understand that there are, in fact, a menu of beliefs competing for their affiliation; […] Trying to identify where one narrative ends and another begins is a challenging task, as ideas tend to have permeable borders.”Nathaniel Whittemore Since creating new gravity wells is (a) possible and (b) relatively easy to do (copy Bitcoin’s code, change a few parameters, launch the new network with a couple of friends) there was an explosion of alternative coins in the last few years. While most of these altcoins are outright scams, some try to find a niche, attracting people who share its new or modified set of ideas.

Different ideas are captured by different gravity wells.

Different ideas are captured by different gravity wells.

Being sucked into one of these gravity wells — and thus into an idea-value feedback loop — is the reason for much of the toxicity we see in Bitcoin and elsewhere. The direct link between holding beliefs (ideas) and holding assets (value) is a multiplying factor which can result in ever deeper entrenchment.

“Everyone knows nowadays that people “have complexes.” What is not so well known, though far more important theoretically, is that complexes can have us.”Carl Jung One could argue, as Carl Jung did in relationship to complexes, that blockchains have people. At the root of every gravity well is a set of ideas and a group of people which are had by them.

Once captured, a difference in technicalities can easily become a difference in ideologies — and vice versa. Giving up on ideas is difficult in any case, but if your net worth is intractably linked these ideas it becomes ever more difficult.

Orbits and Collisions

The formation of any gravity well isn’t exactly a smooth ride. Just like stellar and planetary formation is violent at times — suns swallowing planets, planets bumping into each other, and moons being smashed to pieces — the formation of Bitcoin’s gravity well had some violent events too.

I plan to explore some of these events in the future, but for now, let’s just acknowledge that there are other projects orbiting Bitcoin and that there have been collisions in the past.

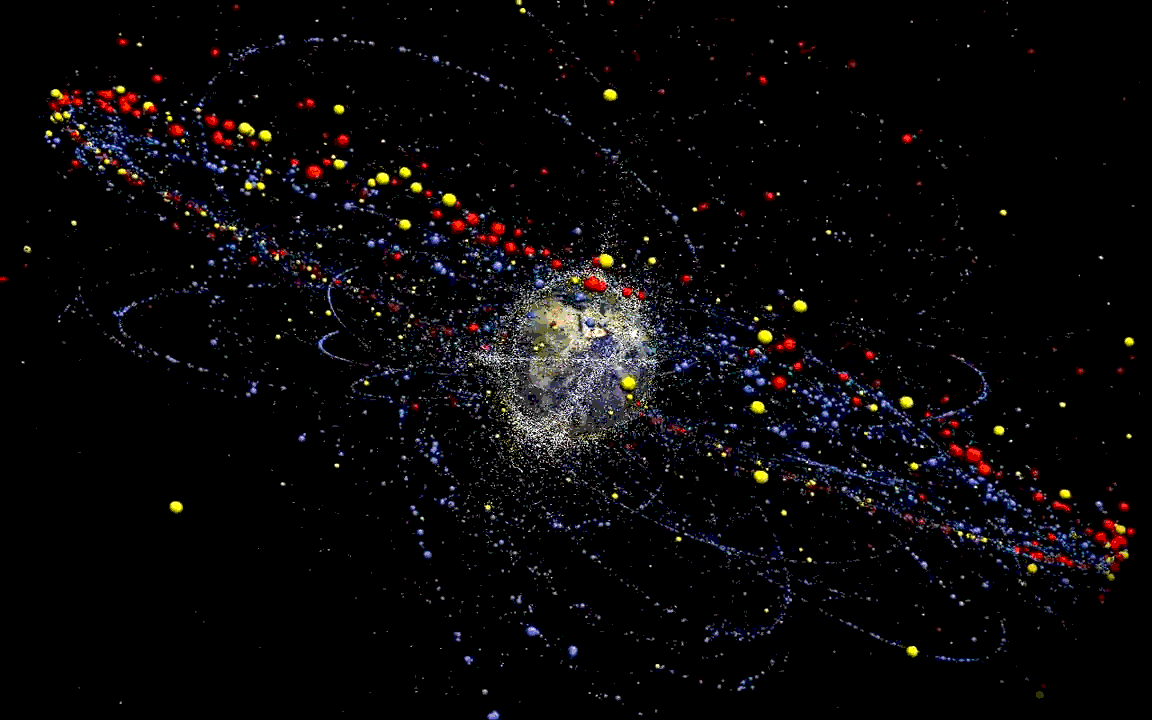

An artist’s impression of Bitcoin and its satellites. Source: KQED Science

An artist’s impression of Bitcoin and its satellites. Source: KQED Science

Whether all other projects will be swallowed by Bitcoin or die on their own, or whether some will find stable orbits, is yet to be seen. What can be observed today, however, is that most networks are competitive. To quote Eric Hoffer: “the gain of one in adherents is the loss of all the others.”

What can also be observed, since it has happened multiple times over the last couple of years, is that projects which fail to deliver on their value proposition are quickly losing most of their adherents and also their value — the former due to disillusion, the latter due to market forces. Value, and speculation on future value, is an integral part of the idea-value feedback loop. If ideas don’t materialize or fail, real (and speculative) value is lost, which is effectively killing those ideas and the networks which embody them.

However, as long as people hold different sets of ideas, and as long as a project in Bitcoin’s orbit embodies this set of ideas, people will flock to it. Whether those ideas have merit will be decided by time, the open market, and ultimately, reality. Horrible ideas don’t work at all, bad ideas not for long, and solutions which aren’t substantially better than the status quo won’t thrive in a free market.

The best ideas, however, might be discovered by the biggest networks and will be assimilated, if assimilation is possible. If Bitcoin can eat it, it will eat it.

Feeding on Ideas

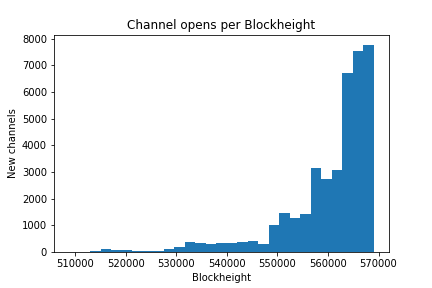

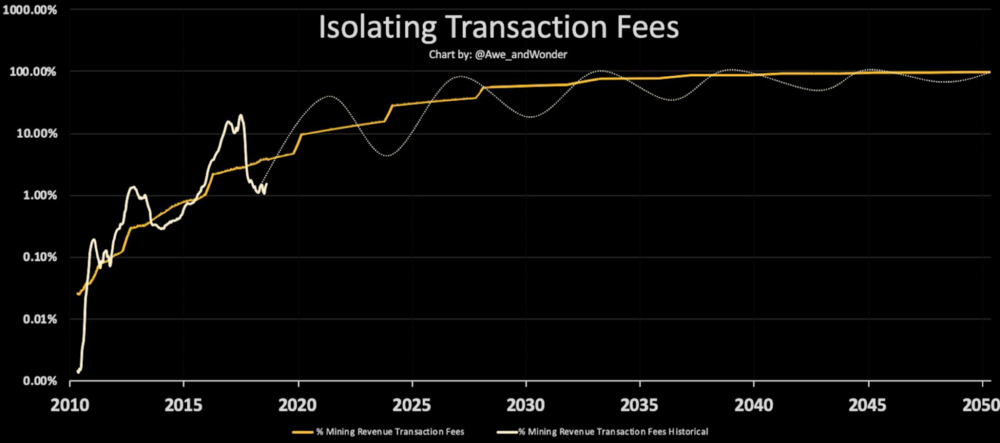

As mentioned above, Bitcoin’s core set of ideas is fixed from day one. However, this doesn’t imply that Bitcoin can’t be improved. It can and should be improved, but it has to be improved in ways that don’t destroy the essence of Bitcoin. Such improvements are happening all the time, which is why we can send payments to script hashes, have segregated witness, and can pay small amounts quickly and cheaply on the lightning network.

The technicalities of improving Bitcoin — and the important difference between a soft and a hard fork — are well worth exploring, but are beyond the scope of this article. Without going into more details in regards to the nature of these improvements, Bitcoin undoubtedly is improving, and thus its feature set is changing and expanding.

In terms of gravitational pull, this means that Bitcoin is gaining mass. The set of ideas which describes Bitcoin is expanding along with its feature set, potentially capturing more people and swallowing competing projects and ideas in the process.

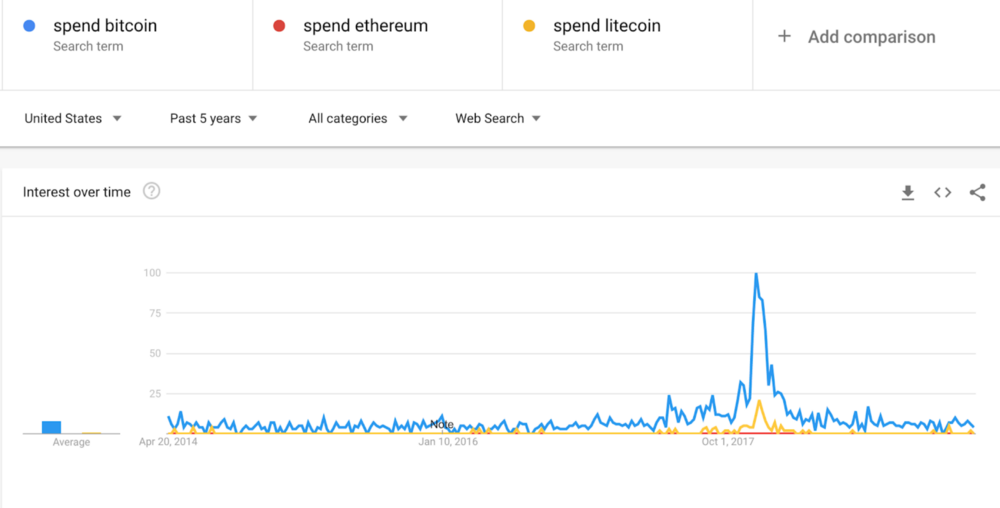

The idea of cheap payments, for example, has re-emerged thanks to payment channels on the lightning network. While still in its early stages, other projects built on this idea will lose their merit if the lightning network is successful on a large scale.

Privacy is another idea which is at the root of several competing projects. If future privacy enhancements in Bitcoin prove to be successful (Schnorr signatures, lightning, whirlpool, wallets supporting CoinJoins), these projects might be swallowed by Bitcoin as well.

“And the earth opened her mouth, and swallowed them up, and their houses, and all the men that appertained unto Korah, and all their goods. They, and all that appertained to them, went down alive into the pit, and the earth closed upon them: and they perished from among the congregation.”Book of Numbers I’m not saying that all other projects will perish, necessarily. But networks thrive because of network effects: the winner takes most, if not all.

The Value of Conviction

Whenever people are debating ideas, tribalism is the norm, not the exception. Whether it is politics, sports, iPhone vs Android, or pineapple on pizza, people identify with the camp that is closest to their ideas and ideals.

While the validity of ideas are sometimes hard to measure, either because their consequences are very indirect (politics) or subjective and not truly consequential in the grand scheme of things (pineapple on pizza), networks like Bitcoin come with a direct measurement: value.

While this value can be distorted by both manipulation and speculation, it is a reliable and (almost) direct indicator of both conviction and validity of ideas. If more people are convinced by a network’s set of ideas, more people will hold its native token as an asset. And the more those ideas align with reality, the more real-world value is generated by the network, convincing more people and deepening the convictions of those already convinced.

Bitcoin has the largest gravity for a reason: it works since day one, solves real problems for real people, generating real value. It works because its set of ideas aligns most closely with reality. It is valuable because people believe in its value proposition, and with good reason: Bitcoin is the largest, most secure, most robust network for permissionless and digital value transfer to date. And it is growing.

Whether you are already convinced by Bitcoin’s ideas or are diametrically opposed to them, Bitcoin will continue to not care. Its gravitational pull will continue to increase, swallowing ideas, people, code, and nodes in the process.

Conclusion

We have seen that Bitcoin embodies a certain set of ideas in its consensus rules and overall architecture. Changing Bitcoin’s core set of ideas is virtually impossible, which is why its core design is “set in stone” since day one.

The idea-value feedback loop is what creates Bitcoin’s gravity. People coming close to this feedback loop have a certain probability of being captured, which forces them to align their own set of ideas with Bitcoin’s or “fork off.”

Understanding that any unchanging system will change its participants is helpful in understanding both attraction to and repulsion by Bitcoin. Since changing the core set of ideas is not an option, new projects embodying new sets of ideas are launched, creating new gravity wells in the process.

A different idea-value feedback loop is the basis for each gravity well. Tribalism and loss-aversion help to explain some of the toxicity between competing projects and communities, since falling into any feedback loop will taint the world view of anyone captured by it.

“For one can fall victim to possession if one does not understand betimes why one is possessed. One should ask oneself for once: Why has this idea taken possession of me? What does that mean in regard to myself?”Carl Jung Both the world and Bitcoin are dynamic things, making any set of ideas we currently hold insufficient for a permanent, complete view of either. Bitcoin can and does change, even if its essence is virtually unchangeable. No matter our individual beliefs, we must not get too attached to any narrative, or to any set of ideas.

Bitcoin’s dominance is no accident. Its set of ideas managed to convince the largest group of people, generating the most value in turn. However, exploring other ideas can be a good and healthy thing, if pursued genuinely. Time and the free market will decide which ideas align with reality. Bad ideas will vanish, and good ideas will be absorbed.

In a world where people hold a combination of ideas and valuable assets, a feedback loop which links and reinforces both is a powerful force of attraction. Whether you just started to feel Bitcoin’s gentle pull or you’ve been a hodlonaut in close orbit, Bitcoin’s gravity will continue to increase. I am convinced of that idea, and I hope to have planted a seed of conviction in you as well.

Further Reading

- Unpacking Bitcoin’s Social Contract by Hasu

- We can’t all be friends: crypto and the psychology of mass movements by Tony Sheng

- Visions of Bitcoin - How major Bitcoin narratives changed over time by Hasu and Nic Carter

- The Many Faces of Bitcoin by Murad Mahmudov and Adam Taché

- Bitcoin: Past and Future by Murad Mahmudov and Adam Taché

- Crypto-incrementalism vs Crypto-anarchy by Tony Sheng

- Bitcoin Culture Wars by Brandon Quittem

- Schrödinger’s Securities by Nathaniel Whittemore

- Market Narratives Are Marketing by Nathaniel Whittemore

- Quantum Narratives by Dan Held

Acknowledgments

- Thanks to Hasu, whose incredible feedback helped to shape large parts of this article. His writing on Unpacking Bitcoin’s Social Contract was my inspiration for writing about Bitcoin’s gravity.

- Thanks to Nathaniel Whittemore for his writings on narratives and feedback on earlier drafts of this article.

- Thanks to Ben Prentice for proofreading the final draft.

- Graphics based on the fxemoji set cc-by Sabrina Smelko

- Dedicated to the bravest space cat of them all (* April 2017, † April 2019).

Translations

Bitcoin - The Unseizable Asset

By Rayne Steinberg May 2, 2019

Posted May 2, 2019

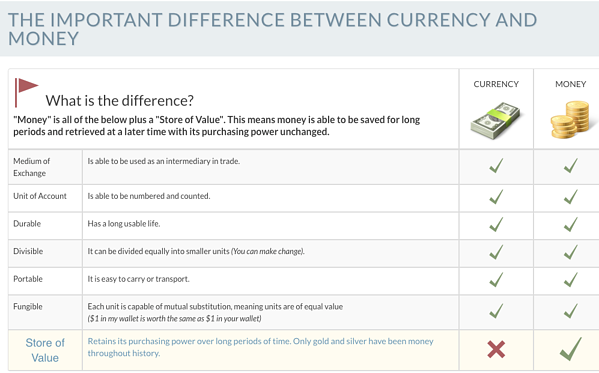

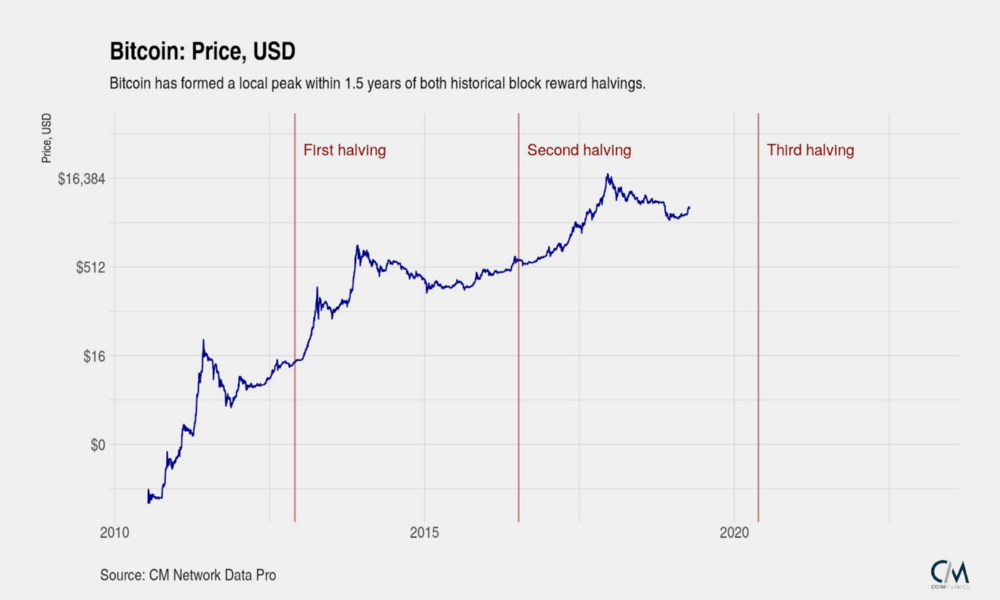

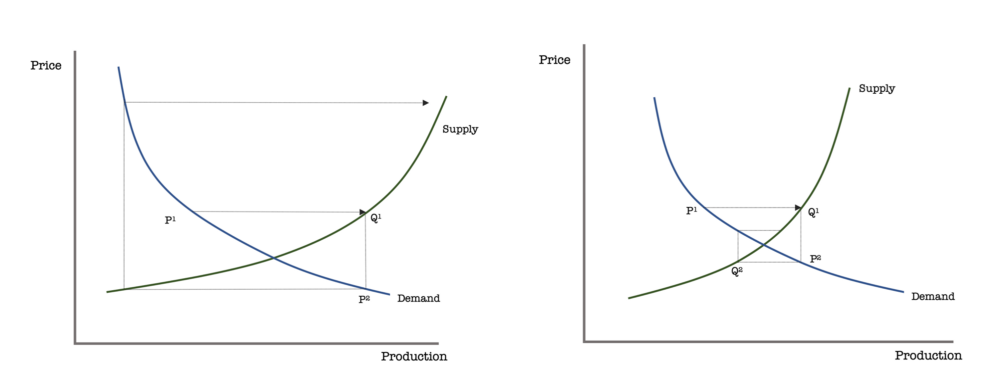

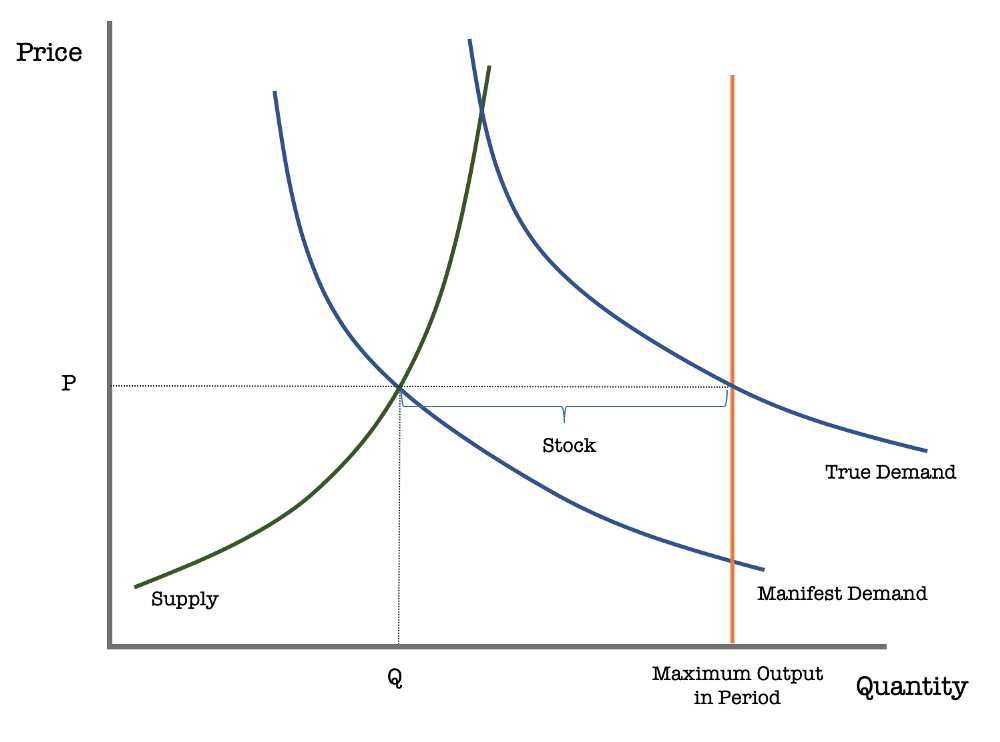

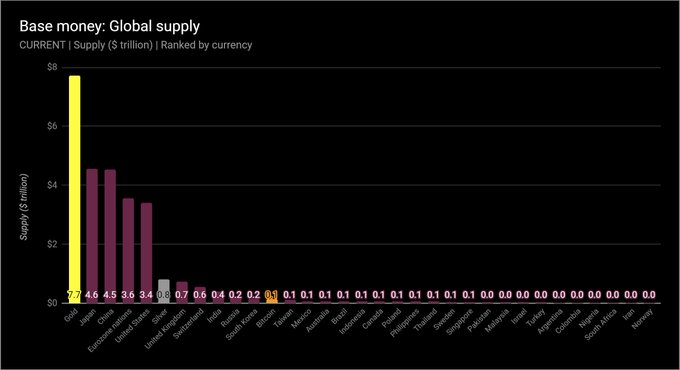

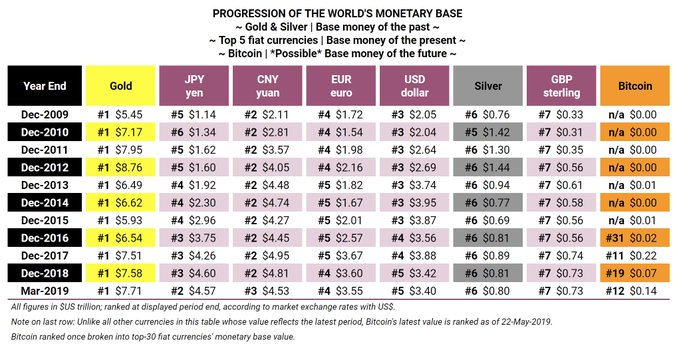

You often hear that Bitcoin specifically, and crypto generally, is digital gold…but what does that mean? When most people talk about gold and its value, they are talking about how it is a superior form of money when compared to fiat currency (I have previously examined the relationship between Bitcoin and Gold prices here). The chart below summarizes the difference between currency and money:

Everything lines up, except for the store of value argument, which gold proponents have always asserted is the yellow metal’s killer feature. The store of value argument usually focuses on inflation - notably, issuing governments have inflated and eventually debased every fiat currency throughout history. This focuses on the “theft of inflation,” but we often overlook a much more direct form of value destruction - outright theft or confiscation of property by the government. Bitcoin, unlike gold, may offer unique attributes that remedy the ever present possibility of asset seizure by force.

Property Rights throughout History

When we talk about property, it is important to understand what we mean. There are broadly three types of property regimes: common, centralized and private. When we think about property, we are generally thinking about it in the private sense:

The recognition and enforcement of private property rights are the founding pillars of a free-market economy. Private property means that individuals have absolute, exclusive and permanent rights on what they legally own: they can do whatever they like with their property, nobody can interfere with their decisions, and there is nobody to whom these rights must be returned after a given time period. Thus, under this regime each individual engages in unfettered voluntary exchange, subject to his/her compliance with the freedom-from-coercion principle (no violence and no cheating are allowed), and insofar as he/she respects the private property of the other individuals. Put differently, the legitimacy of private property and the freedom-from-coercion principle specify the moral foundations of a free-market economy. By contrast, the illegitimacy of private property and the limits to private property define the features of the centralised economies, regardless of the political format –dictatorship or social democracy. This idea that “individuals have absolute, exclusive and permanent rights on what they legally own” is the essence of Bitcoin and crypto. If you secure your Bitcoin correctly, it cannot be seized or stolen or confiscated. If you do not understand private keys or the statement “not your keys, not your Bitcoin,” take a minute and watch Andreas Antonopoulos explain. Can the same be said about gold?

Property Rights in the Land of the Powerful Centralized Governments

When it comes down to it, the first thing we have to look at is how powerful centralized governments have behaved when it comes to property rights in general. If we just look at the 20th century, it is rife with examples of governments seizing what they want, when they want it. In 1938, the Nazi party forced Jews to register their property before they seized it. This activity is not limited to the distant past or easily recognizable totalitarian regimes. The US has an increasingly flexible relationship between what the government can and cannot do when it comes to asset seizure. Time after time, the US government has further encroached on the rights of private citizens, taking their private property in more and more blatant manners. From the 1970’s evolution of the Racketeering Influence and Corrupt Organizations (RICO) Act, to the Comprehensive Forfeiture Act (Introduced by 2020 Democratic presidential frontrunner, Joe Biden). This trajectory of property rights erosion has continued to the present day. But, how does all of this relate to gold?

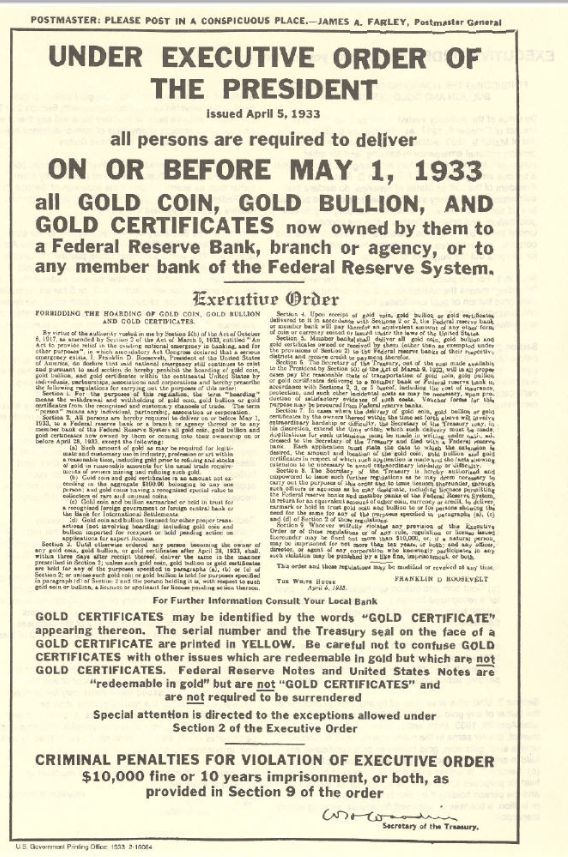

Executive Order 6102

We do not have to speculate about the generic degradation of property rights as it refers to gold ownership in the US; we have a concrete and chilling example. On April 5, 1933, President Franklin D. Roosevelt signed Executive Order 6102, “forbidding the hoarding of gold coin, gold bullion, and gold certificates.”

The order required all persons to deliver all but a small amount of gold to the Federal Reserve in exchange for $20.67 an ounce. Private ownership of gold was restricted one way or another, until the full repeal of these laws by President Gerald Ford, in 1974. The reasons given for these laws? “Hard times had caused ‘hoarding’ of gold, stalling economic growth and making the depression worse.” Does any of this sound familiar? Is it that unreasonable to think our government would use extraordinary measures to carry out desired policy regarding the economy? Bottom line: gold was made illegal to possess in one of the freest countries in the world for over 40 years. How is that for your store of value?

Die Hard Bearer Bonds and Bitcoin

In the 1988 classic Die Hard, John McClane (Bruce Willis) defends Nakatomi Plaza from Hans Gruber (Alan Rickman).

Source

What people may or may not remember (I feel like I’m dating myself with intimate Die Hard knowledge…sigh), is that the target of Hans Gruber and Co., was the hoard of $640 million in bearer bonds housed in the Nakatomi vault. Bearer bonds are securities whose ownership is determined by the “bearer” or possessor of the security. The instrument was employed to allow a feasible plan where the gang could get away with stealing that much money and spending it “realistically,” without authorities catching them (there are whole areas of the internet debating the merits, feasibility and accuracy of such a plan). While spiriting away nearly a billion in value in 1988 required the suspension of disbelief, that reality is here now, in the form of Bitcoin.

Bitcoin and other cryptocurrencies allow one to hold a theoretically infinite amount in their heads with no physical indication of its existence at all. While central authorities argue that the only reason to do this is to avoid legitimate government oversight, the myriad examples above demonstrate many instances of governments’ abusing their monopolies of force to extract private property from citizens. No property has been immune to this seizure, including gold. Here, Hans is trying to evade law enforcement for theft. But does one’s desire to have their assets be unseizable mean your goal is necessarily illegitimate? If history is any guide, an inability to seize or discover property is the true killer feature of crypto and the Achilles heel of gold and physical assets.

Source

What people may or may not remember (I feel like I’m dating myself with intimate Die Hard knowledge…sigh), is that the target of Hans Gruber and Co., was the hoard of $640 million in bearer bonds housed in the Nakatomi vault. Bearer bonds are securities whose ownership is determined by the “bearer” or possessor of the security. The instrument was employed to allow a feasible plan where the gang could get away with stealing that much money and spending it “realistically,” without authorities catching them (there are whole areas of the internet debating the merits, feasibility and accuracy of such a plan). While spiriting away nearly a billion in value in 1988 required the suspension of disbelief, that reality is here now, in the form of Bitcoin.

Bitcoin and other cryptocurrencies allow one to hold a theoretically infinite amount in their heads with no physical indication of its existence at all. While central authorities argue that the only reason to do this is to avoid legitimate government oversight, the myriad examples above demonstrate many instances of governments’ abusing their monopolies of force to extract private property from citizens. No property has been immune to this seizure, including gold. Here, Hans is trying to evade law enforcement for theft. But does one’s desire to have their assets be unseizable mean your goal is necessarily illegitimate? If history is any guide, an inability to seize or discover property is the true killer feature of crypto and the Achilles heel of gold and physical assets.

Why Blockchain is Not the Answer

By Jimmy Song

Posted May 7, 2019

There’s a persistent myth that blockchain tech is brand new and that if only given enough time, somebody will make something that’s useful for something other than money. This is what I call the “blockchain, not Bitcoin” syndrome and in this article, I’m going to dispel the myth that uses for blockchain are just around the corner, that they’re going to add decentralization to all the things, and that it’s some revolutionary new tech.

The concept is about as bankrupt as the company whose logo which this imitates.

The concept is about as bankrupt as the company whose logo which this imitates.

Blockchain not Bitcoin is 5 years old already

Corporate obsession with blockchain started in 2014, shortly after Bitcoin got on their radar. Instead of paying attention to the revolutionary, innovative, decentralized and digitally-scarce money that is Bitcoin, they instead took a concepts from the software and called it “blockchain”.

Multiple industry groups were found at this time, like Hyperledger and R3 as well as companies like Digital Asset Holdings that tried to create a market around this tech.

What they had in common was the use of the word blockchain as a panacea for a bunch of problems in all sorts of industries. In typical corporate fashion, they took the word “blockchain” and bastardized it to mean whatever they wanted it to mean.

Ignorance meets hype

The life that the word “blockchain” took on around 2015 was incredible. Tons of people, especially people that weren’t technical, often with only a vague sense of how Bitcoin worked, were saying things like “I believe in the technology, but I don’t believe in Bitcoin”. This was apparently the “consensus” response for business-types that wanted to seem like they were current on the technology.

You can understand why for two reasons. First, Bitcoin’s reputation from 2011 to 2015 or so, and to some degree today, was unsavory. Bitcoin was associated with activities like buying drugs, paying for an ad on backpage or even being an anarcho-capitalist/libertarian/Ron Paul crazy. Second, by praising the technology, an executive could appear to be on the leading edge of something that’s too technical for others to question effectively.

In other words, endorsing “blockchain” and not Bitcoin gave many business-types the appearance of expertise and knowledge about the topic without all the unsavory connotations associated with Bitcoin at the time. What’s clear from the subsequent actions is that they had no idea what blockchain was and seeded the consequences of their own ignorance.

Their ignorance led to mediocre engineers with very little understanding of incentive systems, game theory or even public key cryptography to masquerade as blockchain experts. These “experts” bamboozled business-types into believing that the solution to the biggest problem for a particular industry could be built with a blockchain, some developers and some money. But we’re getting ahead of ourselves. Before the full fledged “blockchain, not Bitcoin” syndrome caught fire, plenty of fuel in the form of hype preceded it.

Blockchain: the Panacea for All Ills

This pretense of knowledge led to books like The Blockchain Revolution, which promised fixes to pretty much every sector in the economy while giving just enough tantalizing technical concepts in vague enough terms that many executives felt the adolescent fear of missing out on the new technical trend of “blockchain technology”.

To be fair, many were taken in by promises of solutions to real problems for their industry. For health care, “blockchain” would somehow make patient history available to care providers at exactly the right time without violating patient privacy. For law, “blockchain” would somehow create perfectly fair contracts without the need for expensive lawyers. For supply chains, “blockchain” would somehow prove whose fault it was that some parts were substandard or that not enough parts were delivered. For art, music and TV, “blockchain” would somehow reward the creators what they were due while combating piracy and taking out the middle men. For online ads, “blockchain” would somehow make tracking accurate, reduce fraud and take out the many different middle men that collectively take a large portion of the profit. We could go on and on and on about the impossibly difficult problems that “blockchain” supposedly would solve.

It’s not a coincidence that these promises correspond to giant problems in each industry. Blockchain became a blank canvas onto which any problem could be painted as being solvable. Literally hundreds of startups and industry consortiums, many using ICOs, promised to solve the biggest inefficiencies in every industry using “blockchain”.

Many of these startups were created by veterans of a given industry who thought that the only missing piece was developers to write the blockchain system that would solve everything. They reasoned that they had the expertise to know what the problems were and that getting a few blockchain experts would be all that would be needed to make their industry so much better and create tremendous profit for themselves.

The Reality of Blockchain

This would work if only these developers could deliver on what the industry veterans wanted! How hard could it be to make a flawless, auditable, decentralized, encrypted database that execute terabytes of smart contracts quickly and efficiently using oracles that check each other using zero-knowledge proofs? Surely a few lines of code in Solidity could create a scalable, provably correct, maintainable system that would solve the biggest pain points of industry X, right? Well, no.

No, because no such explanations exist

No, because no such explanations exist

Blockchain became a meaningless buzzword that meant “solving the biggest challenge in industry X” using fancy jargon to convince people that the challenge could be met. The reality was far different. What most of these startups discovered is that blockchain is not a panacea. They ran head first into problems that we’ve known for a long time like the oracle problem, or the consensus problem, or the analyzability of Turing-complete contracts, or the free rider problem. It turns out blockchain, far from being a panacea is actually a hindrance to creating these solutions because of the requirement, at least nominally, of decentralization.

To make matters worse, the developers tasked with creating these systems were often completely ignorant about user and node incentives and possible exploits in an adversarial environment.

The Utter Failure

The results of such shenanigans are sadly predictable. When you promise more than you can deliver with mediocre talent in a technology that few people understand, you’re not going to be able to deliver much. Most of these efforts have accomplished nothing. The few that created proof-of-concepts have not progressed to full-fledged products. The few products that have launched have very little traction (less than 2000 users per day is considered a complete failure for an app or website).

Despite all this, ICOs touting decentralized blockchains for industry X, enterprise blockchain efforts to optimize Y and even public blockchains for some service Z continue to be touted as the future. Several different arguments generally come up when this discrepancy between promises and results are pointed out.

How can you be sure nothing will come out of blockchain technology other than Bitcoin?

It’s true, it only takes one counterexample to disprove my thesis that blockchain is really only useful for sound money. However, without bastardizing the word blockchain, the essence of what blockchains provide is decentralized, authoritative, expensive to alter data. This is not a surprise as these properties are exactly what you want for sound money like Bitcoin.

Unfortunately, what non-monetary projects generally need, given that it’s software for an industry that’s regulated, changing and growing, is a centralized, upgradeable and scalable system. Each need is made greatly more difficult when combining with a blockchain. In other words, blockchain is the wrong tool for the job.

Even if by some miracle a popular app is created on a blockchain, a centralized equivalent without the extraneous blockchain will be cheaper, faster, more reliable, more maintainable while having the exact same single points of failure as the “decentralized” blockchain-y version. Or put another way, any popular dApp is destined to lose against a centralized competitor on cost, speed, features and scale.

So many people are working on this! Something has to come out of it.

Lots of people working on something doesn’t mean desires magically turn into reality (see: alchemy, cold fusion, flying cars, etc).

That’s even overstating the point. Flying cars are at least possible. What most of these projects are working on are square circles or perpetual motion machines: decentralized services that have centralized control, that is, logical impossibilities.

I can hear my critics now, “Jimmy is against experimentation, entrepreneurship and trying new things!” This is a classic bait and switch tactic. Experimentation is fine to start. Pouring more money into failed experiments is just putting good money after bad. These “blockchain” experiments have a history of being futile and have little basis in reality. They are wastes of capital and human effort and don’t lead to any useful goods or services. All they do is allow charlatans to rent-seek.

Lots of money has gone into it! Someone is going to come up with something!

Certain engineering challenges are simply not a matter of funding, they are a matter of innovation. What’s worse, when a company is handcuffed by being required to use a particularly cumbersome technology like blockchain, there’s even less chance of anything coming out of it. This is the classic error of a solution looking for a problem. And no, more money won’t magically find you a profitable market problem for which a blockchain happens to be the most optimal solution.

Conclusion

“Blockchain, not Bitcoin” is not a new idea. The past five years have produced nothing with this so-called “blockchain” technology and we’re unlikely to see anything in the next five. The only thing that blockchain seems to be good at is promising to fix the biggest problems while delivering very little and consuming tremendous capital.

Blockchain is a solution looking for a problem. Too many people have been taken in by “blockchain” and pretend to see clothes on a naked emperor. The imaginary clothes may seem like perfect solutions to the biggest problems of their industry. Unfortunately, wishful thinking is not reality.

Sorry to be the bearer of bad news, but the emperor has no clothes. Blockchain without Bitcoin is a big nothing burger.

Thanks to Neil Woodfine, chandra duggirala, Vijay Boyapati, Michael Flaxman, Ben Kaufman, and DOC.

BTC Long/Short MVRV difference indicates an end of the bear cycle

By valentin

Posted May 7, 2019

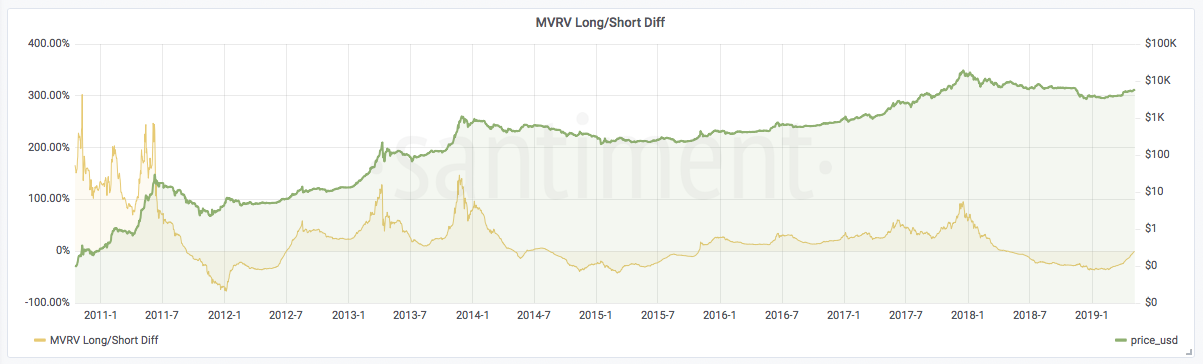

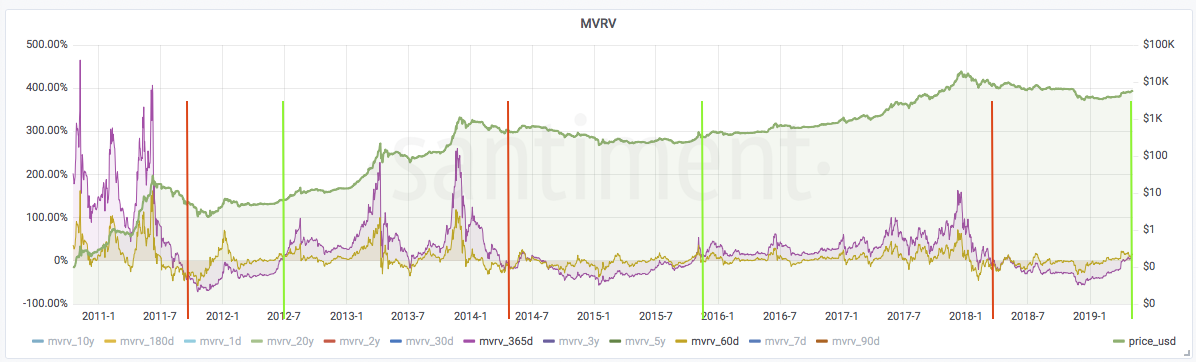

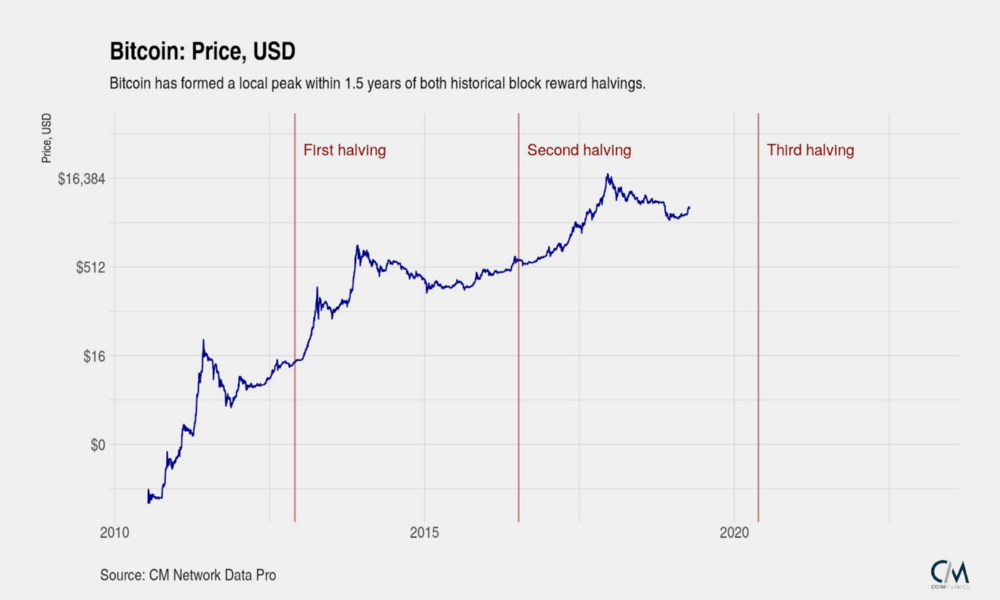

The BTC Long/Short MVRV difference is almost at 0% at the moment, which historically has proven to indicate an end of a bear cycle.

What does that mean and what exactly is the BTC Long/Short MVRV difference?

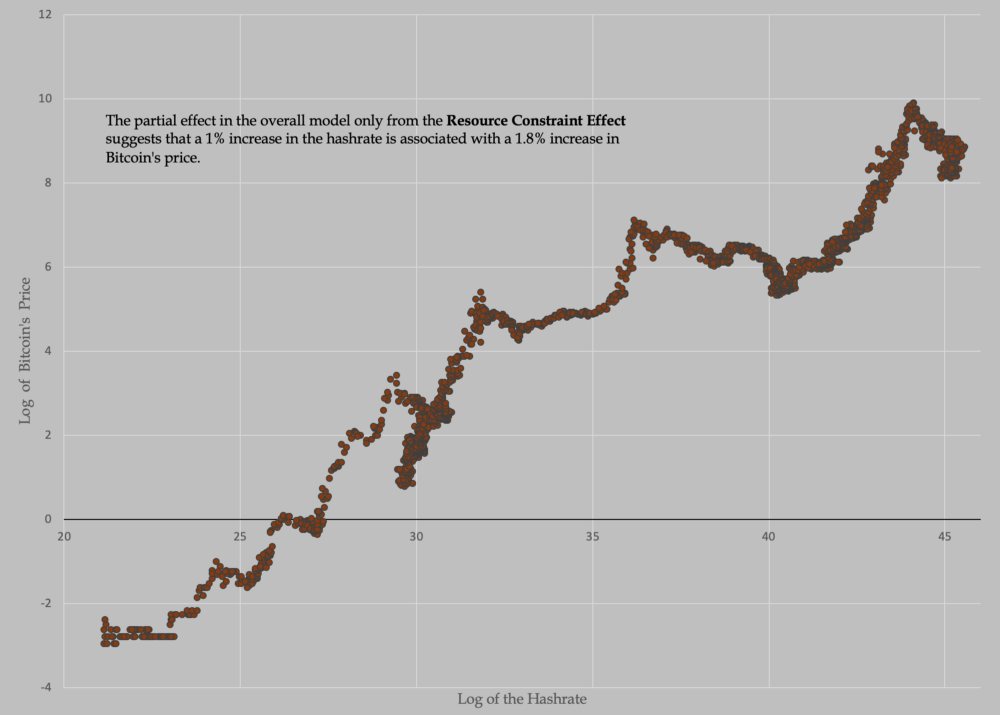

The MVRV Long/Short difference for the last 8 years. Green is BTC price on log scale.

The MVRV Long/Short difference for the last 8 years. Green is BTC price on log scale.

May be you are familiar with the MVRV ratio, which was first developed by Murad Mahmudov and David Puell at the end of 2018: https://blog.goodaudience.com/bitcoin-market-value-to-realized-value-mvrv-ratio-3ebc914dbaee

The idea is to measure how much each BTC holder paid for his coins and compare it to the current price of BTC. If the ratio is above 1.0, then on average all BTC holders will get profit if they sell their coins now. If it is below 1.0, on average everyone will realize a loss if they sell. The bigger the ratio, the more sell pressure there will be on the BTC price.

At Santiment we extended this metric to a “Time-bound MVRV”, which is the same as MVRV, but takes into account only coins that moved in the last X days. For example we have 365day MVRV and 60day MVRV. These ratios will measure the average profit/loss of all coins that moved within the last 365 days and 60 days respectively. When we computed these 2 metrics we observed something very interesting: during a bull market the 356day MVRV is bigger than 60day MVRV and during a bear market it is the opposite. The explanation could be that the short term traders are usually profiting when the market goes down and sideways, while during a bull run the long term holders are the ones that will have the final call - ultimately when the long term holders start to sell, that will be the end of the bull run. Another nice thing about the time-bound MVRV is that it automatically filters out lost coins.

365day (purple) vs 60day (yellow) MVRV. Lines on the inflection points. Red is bear cycle. Green is bull cycle.

365day (purple) vs 60day (yellow) MVRV. Lines on the inflection points. Red is bear cycle. Green is bull cycle.

Having all the above in mind we developed a single indicator that we call MVRV Long/Short MVRV difference, which captures this phenomena. The indicator will bottom at the bottom of the bear market and will top at the top of the bull run. As you can see from the first image above, when the indicator crosses 0, the price of BTC grows steadily. The tricky point is to identify the top of the ratio.

We are still researching this indicator and so far we’ve been able to beat a buy’n hold strategy using it as it gives us a good indication when we should sell. If you want to get access to this metric go to https://santiment.net/dashboards/ and requests access.

Why learn to program with Bitcoin’s Lightning network?

By Pierre Rochard

Posted May 7, 2019

Send and receive payments

Enabling payments in your software is often a business necessity

Common consumer web application use cases include:

- Receiving SaaS revenue

- Payments between marketplace participants, including escrow

- In-app purchases for premium features

Until now, the only choice for developers has been integrating proprietary, trusted, centralized, third-party digital credit systems like PayPal or Stripe.

Bitcoin’s Lightning network offers developers an open source, trustless, decentralized, self-hosted digital cash system.

What is Bitcoin’s Lightning network?

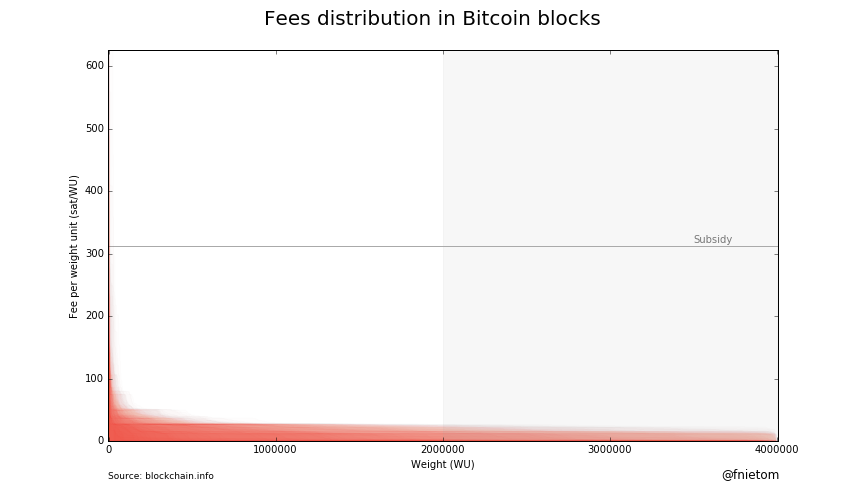

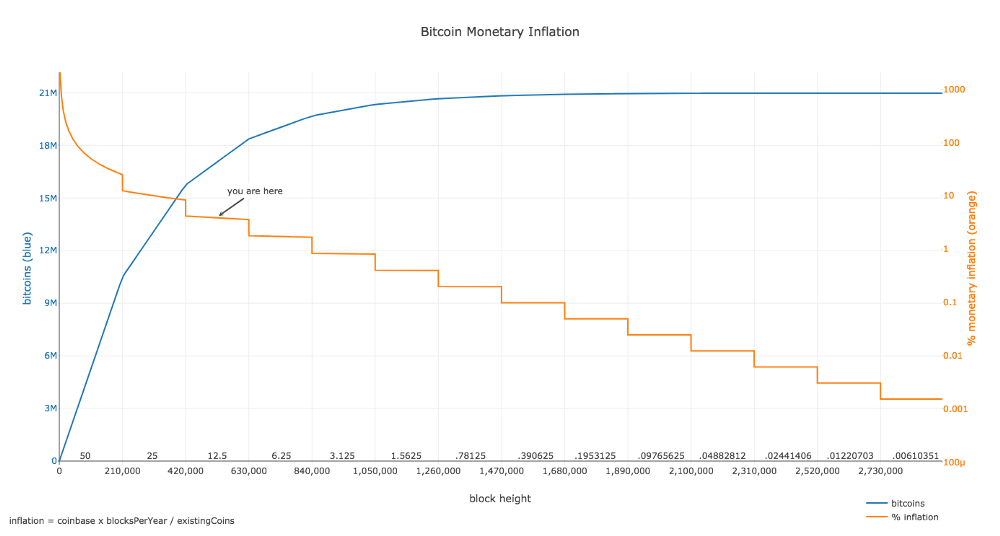

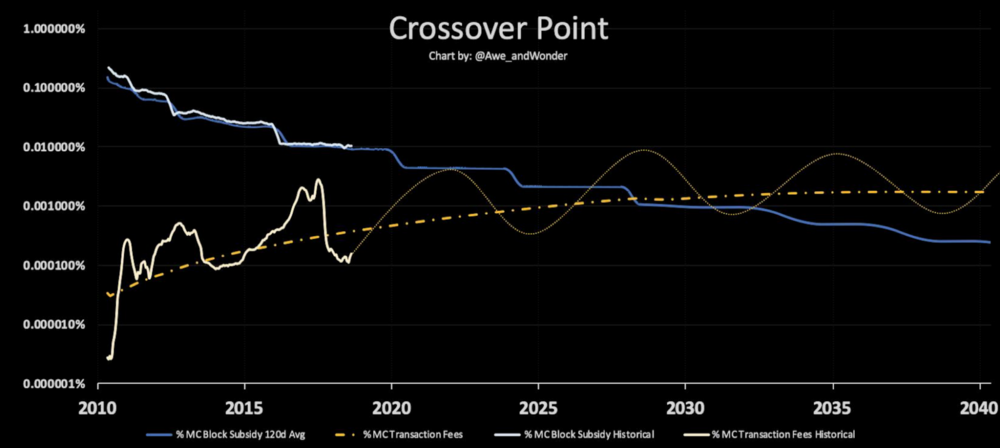

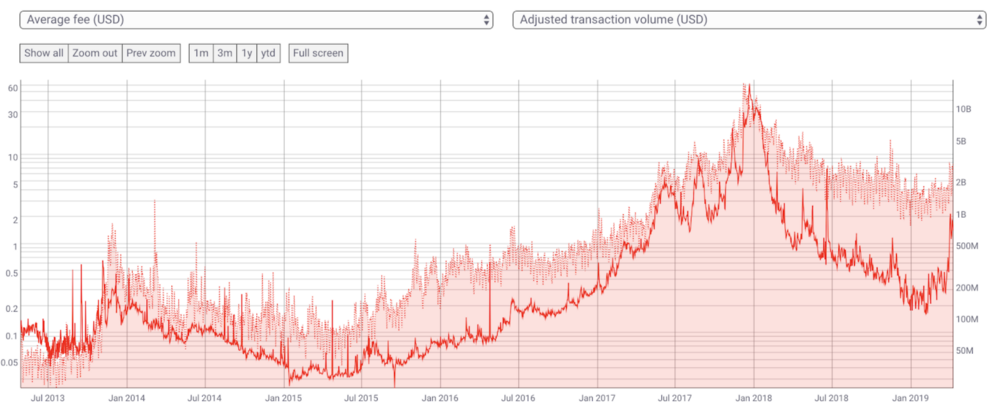

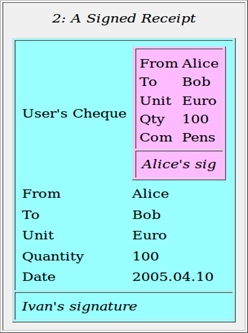

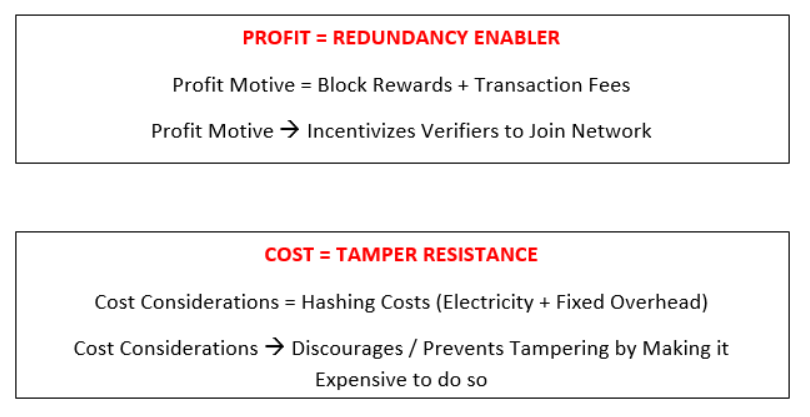

The Bitcoin digital cash system uses proof-of-work over time to provide transaction finality. This proof-of-work function is currently paid for by new cash emission and transaction fees. Full verification of every transaction is necessary for users to trustlessly determine that the expected cash emission schedule to 21 million bitcoins is correctly being followed. To keep the cost of full verification reasonable, the system’s consensus rules have a number of resource-usage limits.

Bitcoin’s scaling challenge is to maximize the efficient use of its limited resources. One approach is to transfer cash by privately updating one transaction many times “off-chain” before publicly broadcasting the last version of the transaction for final settlement “on-chain”.

Off-chain updates to transactions instantly transfer cash, and the cost of on-chain transactions are amortized over many off-chain updates. Lightning is an off-chain scaling protocol, often called “layer 2” or “state channels”. Peers on the Lightning network send cash payments to each other by updating Bitcoin transactions.

Lightning uses smart contracts (spending conditions) embedded in Bitcoin transactions to prevent cheating by a malicious peer broadcasting a superseded version of a Bitcoin transaction.

Payments are instant and inexpensive, with a few manageable trade-offs:

- Your server should have high uptime. For almost all web applications, this was already the case.

- You must secure a hot wallet. For services that already send cash with on-chain transactions, this is not a new requirement. To minimize risk, cash can be regularly transferred from the hot wallet to a cold wallet.

- You must continuously backup Lightning data. This is a new requirement as on-chain wallets only need to be backed up once, but it is easy to implement. Almost all applications already have data which needs to be continuously backed up.

With these conditions met, Lightning is a subset of the Bitcoin digital cash system and thus shares its trustlessness and sound monetary properties.

For most software developers, using off-chain Lightning payments to enable sending and receiving cash in their application is a strict improvement over using on-chain transactions for the same purpose.

Digital Cash

Legacy solutions are trusted, centralized credit systems

Lightning is a trustless, decentralized cash system

- No counter-party credit risk

- No personally identifiable information is required

- No need to securely store other people’s credit card numbers

- No charge-backs

Open Access

Lightning is self-hosted

- No need to “apply” for an account

- No unexpected account closures

- No bank holidays

- No geographical limitations

You don’t need to ask for permission to use the Lightning network

Open Source Bazaar

The Lightning protocol and implementations are open source and being developed in public. Any developer is welcome to contribute to the lightning-rfc GitHub repository, which is home to the protocol spec:

Discussion of changes is open to the public, you are free to participate as much or as little as you want.

There are no executives or salespeople forcing their decisions on developers, but a business perspective is very helpful for developers working on a cash payments system.

Bitcoin Has No Intrinsic Value — and That’s Great.

By Conner Brown

Posted May 8, 2019

Intrinsic Value. Bitcoin skeptics love to talk about it. Their argument is typically as follows: “Bitcoin cannot be used as a money because it does not have any intrinsic value as a commodity. For something to be a viable money, it must first be accepted and used for some other commodity purpose intrinsic to the item then slowly become a money over time. For example: because gold can be used in jewelry and electronics, people naturally stockpile it to store value.”

Previously, Bitcoiners have made several compelling arguments against this on the grounds that 1) intrinsic value is subjective and 2) Bitcoin does have intrinsic value as a good for censorship resistant payments. Here I will argue that Bitcoin skeptics are right. Bitcoin has no “intrinsic value” as a commodity, but that’s a great thing for Bitcoin (and the rest of the world).

Inside the Mind of a Skeptic

Intrinsic value is an old idea. Even Aristotle wrote about the importance of money being “intrinsically useful and easily applicable to the purposes of life, for example, iron, silver, and the like.” It’s no wonder that this idea has persisted — commodity value has been essential to humankind for thousands of years and is directly evident to the layman.

Despite its ancient origins, intrinsic value is not directly linked to monetary functions. A good money needs to be many things — portable and easy to trade, scarce and durable to store value, fungible and divisible as a unit of account — but an alternative commodity use is not one of them. So why do many critics claim money needs intrinsic commodity value?

There appear to be two main reasons.

Appeals to History

Many skeptics denounce Bitcoin’s lack of intrinsic value simply because they are accustomed to stores of value doubling as commodities. Put simply — they are living in the past. Many have made this argument about previous technological improvements by wrongly assuming that previous trends would hold true.

The fact that all previous forms of value had a physical form does not mean a new store of value must also be physical. People were making similar arguments about physical shopping during the rise of the internet. Here is a hilariously bad takefrom a Newsweek contributor in the 90’s, arguing that because we’ve always had physical sales in the past, physical sales will not be replaced by the internet. Bitcoin skeptics claiming money needs to be a useful physical commodity will seem equally ridiculous a decade from now.

In fact history shows that commodity value is far from a requirement for a money. Nick Szabo explains in the beginning of his classic piece“Shelling out: The Origins of Money” that societies have used otherwise “useless items” for storing and communicating value. These glass beads had many strong monetary properties and were used for trading throughout Africa and parts of North America, but they had little use as a commodity. The Rai stones used by the Yap people are another example of a store of value without commodity use.

Figure One: Glass Beads formerly used as money among tribes in Oklahoma.

Figure One: Glass Beads formerly used as money among tribes in Oklahoma.

Appeals to Authority

Today, many who voice concerns about intrinsic commodity value trace their arguments to Austrian economists such as Menger, Mises, and Rothbard. These writers strongly emphasize the importance of money and its impacts on society. For them, commodity value and money have been inseparable since their earliest writings. One of Menger’s seminal works, On the Origins of Money, begins by describing money as “the fact of certain commodities becoming universally acceptable media of exchange” (p. 1). Mises later built upon this understanding. In The Theory of Money and Credit, Mises writes, “we may give the name commodity money to that sort of money that is at the same time a commercial commodity; and the name fiat money to money that comprises things with a special legal qualification” (p. 61).

Following in the mental footsteps of previous Austrian economists, many critics apply these outdated frameworks to attack Bitcoin. Niels van der Liden, one of the first Bitcoin skeptics (when a bitcoin was 77 cents!), rejected Bitcoin for this very reason. He claimed it would not work because “nobody could do anything with them but trade them.” Therefore, he concluded they had no use as commodities and would not work as money.

While commodity and fiat monies were the only two possibilities for early Austrian economists (outside of credit instruments), times have changed. In our digital age, the distinction between commodity and fiat money has lost its value. It should be immediately apparent that Bitcoin does not fit neatly into this dichotomy — it has no use as a physical commodity but also does not exist through any legal decree. We can now hold and trade digital money wholly independent of the simple force of law. Instead, Bitcoin’s monetary properties are guaranteed with rules and logic embedded into its coded DNA. Through this purely digital existence, Bitcoin lives as a money free from the restraints of the physical world.

Solving the hard money paradox

In fact, if the skeptics had done their homework, they would realize that Mises was a Bitcoiner at heart as well. He recognized the problems inherent in commodity money but saw gold as the best of bad choices. In The Theory of Money and Credit, Mises laments that even a monetary system based on gold is still subject to “considerable disadvantages” regarding “not only the fluctuations in the supply of money and the demand for it, but also fluctuations in the conditions of production of the medal and variations in the industrial demand for it” (p. 238).

Mises correctly points out that commodity uses of money create price distortions as fluctuating industrial demands push and pull on the shared supply.Hard money has always been associated with unique physical attributes — good for money, but also other industries. In this regard, gold’s incredible versatility across many different industries magnifies this harmful effect.

The physical world also brings other monetary restraints. Something found in nature cannot be routinely distributed over time. Here, Bitcoin’s predictable, periodic emission allows for supply calculations decades into the future that are not possible outside the digital world. A physical item’s supply also cannot be audited. At any moment someone could find previously unknown amounts of gold and radically dilute ownership without current holders knowing about the sudden changes in supply — similar to how cowry shells were secretly inflated by European tradersto the detriment of African tribes. With Bitcoin’s digital nature, anyone can audit the entire supply and know the exact amount created at any time.

With these advances, it’s silly to cling to the Austrian economists giving advice for their unique historical moment. Those writers were not laying down universal constants. Even they realized their limits and hoped for better forms of money than precious metals. New circumstances require new theoretical foundations — and Bitcoin gives us just that.

Bitcoin as the key to unlocking captured utility

In our present day, it just so happens that the best stores of value are also those that have some element of utility as a commodity. The key distinction here is that gold, real estate, or any form of commodity money is not a store of value becauseof its utility as a commodity, but despitethat utility!

When someone decides to hold gold or any other asset for a monetary purpose, they make a clear and conscious choice to use it for its wealth storage properties instead of as a useful commodity. Rather than creating electronics parts or jewelry, holding a gold bar puts gold’s monetary properties to work. While this decision may appear innocuous, this can bring harmful economic consequences. Large numbers of people storing their value in a specific commodity with hopes of wealth storage often leads to extreme waste and speculative bubbles.

Real-estate is a particularly egregious example of this effect. Today, speculators chase “golden concrete” to protect their wealth. Developer Michael Stern explains “the global elite is basically looking for a safe-deposit box” and many have decided to invest in Manhattan properties to store their funds. By doing this, they are using their luxury apartments for saving instead of for living. As a result, journalists noted “according to the Census Bureau, throughout a sweeping stretch of midtown — from Forty-ninth to Seventieth streets, between Fifth Avenue and Park — nearly one in three apartments is completely empty at least ten months a year.” Similar trends are spreading through large cities worldwide. As The Guardian reports, “[t]he trend for the world’s super-rich to invest in prime London property as a way to safeguard their wealth, without the need to secure a rental income, has meant the number of empty homes in Kensington and Chelsea rose 22.7% over the same period and 8.5% since 2015.” As the elite continue to pour wealth into these commodities, bubbles begin to rise to the top. A recent report by UBS shows just how risky this has become.

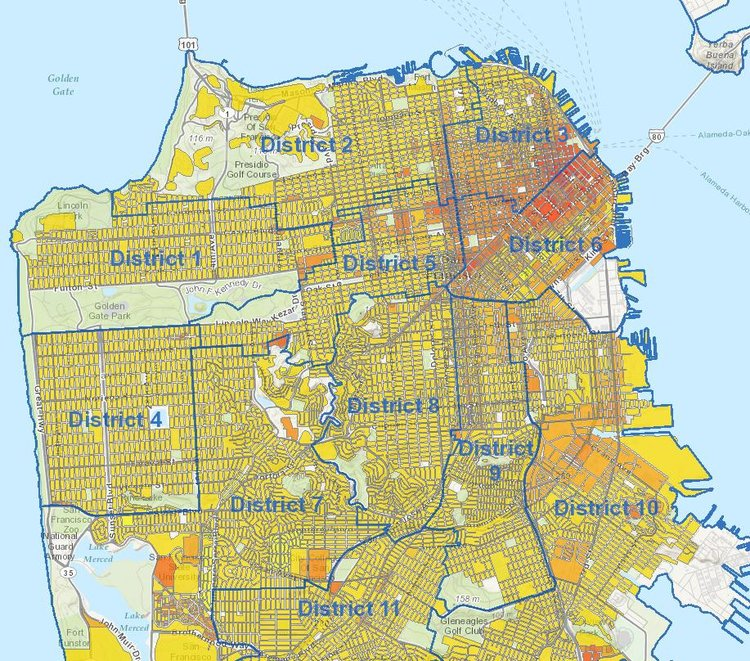

Not only are properties sitting empty, using homes as a significant store of wealth destroys healthy market incentives for new housing development. San Francisco and the rest of the California housing market are obvious examples of this phenomena. Below is a map illustrating San Francisco’s zoning regulations. All areas shaded yellow are limited to a building height of 40 feet.

Figure Two: A map of San Francisco’s local zoning laws.

Figure Two: A map of San Francisco’s local zoning laws.

These regulations are a clear impediment to building new affordable housing to meet demand. Given the repercussions on the average residents and rent prices, why do they exist? One large cause stems from existing homeowners lobbying for artificial restrictions on supply to preserve their wealth. A recent report by the Legislative Analyst’s Office for Californianoted that “residents may see new housing as a threat to their financial wellbeing. For many homeowners, their home is their most significant financial investment. Existing homeowners, therefore, may be inclined to limit new housing because they fear it will reduce the values of the homes.” Because the average buyer does not have a reliable store of value in their money, homes are considered by many to be the best place to safeguard one’s wealth. This naturally causes homeowners to then lobby to constrict home supply so their precarious wealth is not diluted. In this sense, the real-estate markets only have store of value properties through artificially generating scarcity.

Bitcoin would not solve this problem entirely, but it gives potential homebuyers an alternative way to securely store wealth over time. Allowing people to rethink their financial decisions may ease the pressure against building new homes. With new affordable development, cities would be able to increase their density and improve the quality of life for all residents. For example, research modeling suggests that if San Francisco were able to increase its housing density, this could significantly reduce the city’s carbon footprint, increase the city’s walkability, and improve the quality of community life — all while preserving the signature sunny California environment.

Even securing the network would be cheaper, with higher quality ASICs!

Even securing the network would be cheaper, with higher quality ASICs!

Gold is another great example. As individuals sell their gold to buy bitcoins, gold that was previously held for its wealth storage properties can be put to work in electronics, medical devices, and aerospace pursuits. It can even be eaten! Gold stored around the world can be used to benefit society through cheaper and higher quality products — and make previously impossible endeavors much more affordable. With Bitcoin we can actually afford to go to the moon. So when you hear goldbugs extol its amazing societal uses — they are right — but they are really making a case for digital gold. By acting as a global store of value, Bitcoin unlocks that stored commodity utility that we’ve had to set aside because our world has always lacked a pure money.

Final Thoughts

Instead of locking up useful resources to store wealth, Bitcoin gives humans the ability to store wealth free from the opportunity cost inherent in storing commodities. This global, permanent, and accessible store of wealth is forming a solid bedrock for future economies around the world. As funds move from other asset classes towards Bitcoin, this newfound supply will create better access for affordable housing, rejuvenated urban environments, higher quality consumer goods, and more.

Yes, Bitcoin has no intrinsic value and for that we should be thankful.

A special thanks to Karina Kauffman, Dan Held, and the Bitcoin Observer for their incredible help.

How to bribe miners to re-org?

By Tamas Blummer

Posted May 8, 2019

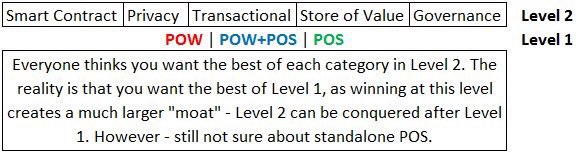

Organizing a re-org to revert a Bitcoin transaction was recently considered but not attempted Binance. They could have done it, would they had better understanding the technology and POW economics. I describe how to bribe miners so they unite for a re-org.

A bitcoin transaction economically matters only if it is recorded in the chain of blocks with most work.

There are already 111 blocks built on top of the block containing the Binance hacker’s transaction by the time of this writing. It is safe to say now, that Binance lost 7000 Bitcoins.

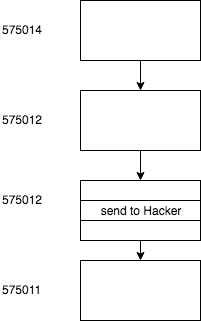

Block 575011 contains the hacker’s transaction and further blocks were mined as usual on top of it.

Block 575011 contains the hacker’s transaction and further blocks were mined as usual on top of it.

Bitcoins lost to the hacker could be re-claimed if miner would build an alternate continuation of the chain that roots before the block that contains the hacker’s transaction. That alternate continuation would not contain the hacker’s transaction and would have to grow faster than the current one, so at some point it exhibits more work and all Bitcoin clients re-org to it. After the re-org the hacker’s transaction would ceases to exist in the memory of the network.

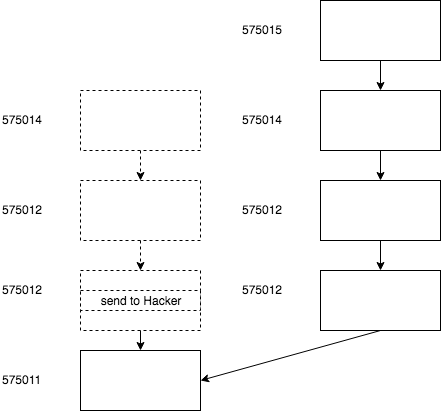

The earlier versions of blocks 575012 and higher would then cease to exist in the memory of the network.

The earlier versions of blocks 575012 and higher would then cease to exist in the memory of the network.

Re-orgs to an alternate chain with higher work are nothing special for the network, but its regular method of resolving the race between independently working miner. Re-orgs that replace the most recent block are quite frequent.

A re-org is costly for the miner who mined on the side that ceases to exist, since the miner loses the Bitcoins mined in those blocks. This is the main reason why miner are keen to extend the chain and avoid creating alternatives.

Binance CEO considered to offer the stolen funds to miner who build an alternate chain of blocks. He can offer those funds in the alternate chain since they would remain in his control there. He rejected the plan as he thought it was impractical. It is impractical if considered within the bounds of collusion between his friends and network, but would have been possible if he was prepared, knowledgeable and quick.

How to bribe the miners

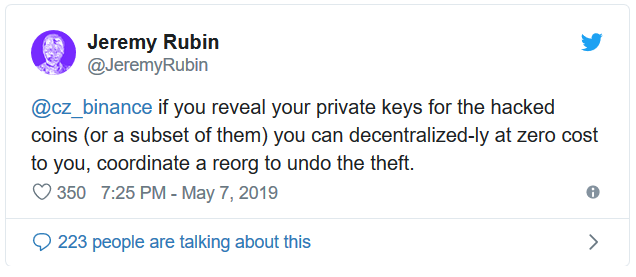

Besides calling friends Binance CEO could have done the following as soon as the breach is noticed:

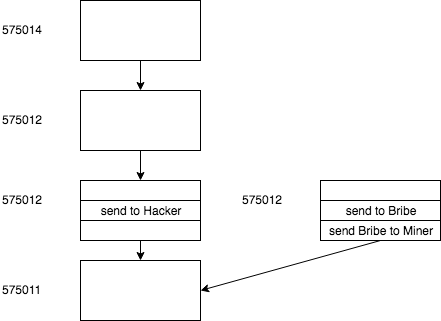

- Create a transaction that spends a big chunk of the stolen funds from their last controlled address to a bribe address and publish the transaction on their web site.

- Publish the private key of the bribe address on their website.

The transaction is worthless in the current reality since the funds are at the Hacker’s address, but is perfectly valid in an alternate reality that starts with an alternate block 575012.

A miner who builds an alternate 575012 can include the transaction published on the website and also another transaction that moves the bribe to his own address, since he also knows the private key for the bribe address.

It is rational for a miner to mine that alternate reality if the bribe is higher than the amount of Bitcoins he mined since Block 575011 and there is a sufficient chance that the alternate reality will attract more work than the current chain.

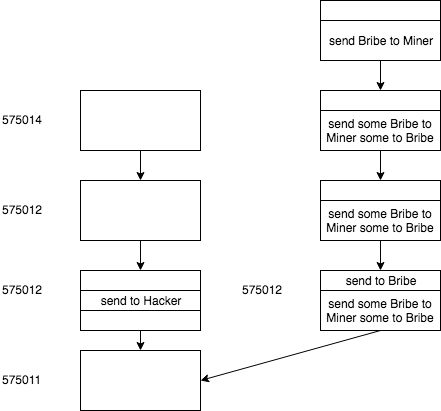

Note that the miner can significantly increase the chances of the alternate reality taking over by not taking the entire bribe but leaving sufficient amount for the next miner.

A sufficiently hight bribe and not too greedy split of it can build a coalition for the alternate reality quickly and more efficiently than calling friends as any miner is invited and could be attracted to join.

Eventually the chain of miner splitting the bribe could overtake the current chain and in the new reality after the re-org Binance would own the rest of the stolen funds and miner who participated in the rescue would have earned much more than usual.

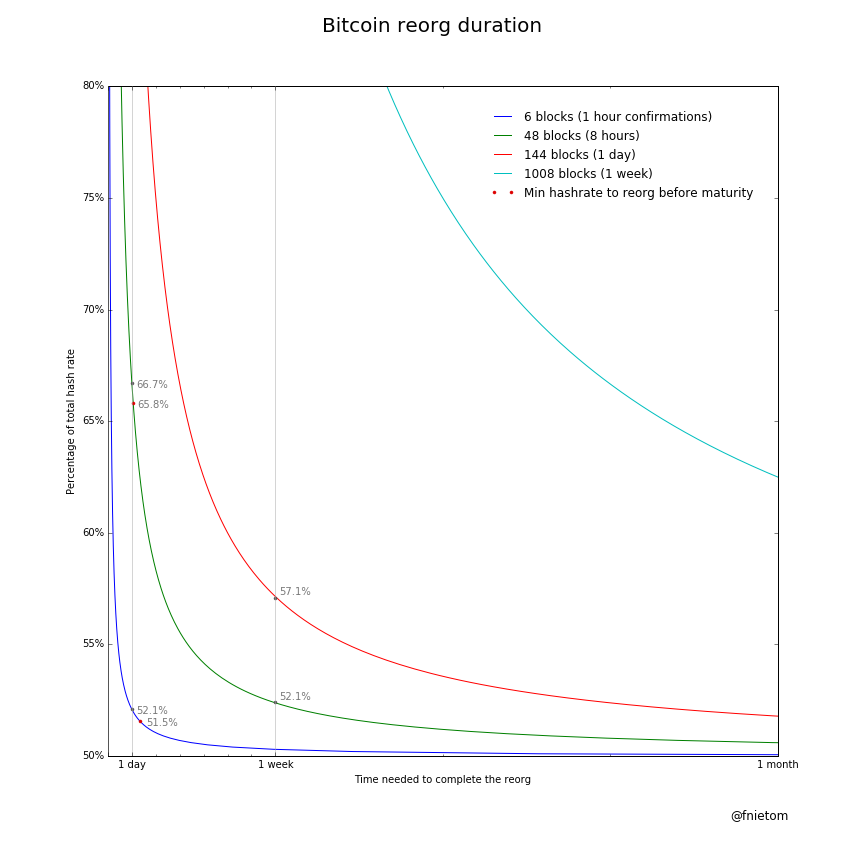

I know that above rescue is technically feasible. It would work if those who can lose funds are prepared to offer a bribe and miner are prepared to act on it and make rational choices. Chances of success still diminish exponentially with time.

Exchanges could commit in advance to use this procedure in the unlikely event of losing funds, so miner are also prepared to act swiftly on the offers.

Consequences?

Consequences of miners acting on a bribe could be severe as the re-org can disrupt regular transaction processing and diminish trust into the block chains immutability.

Damages would be proportional to the length of the re-org. I think damage would be negligible if the rescue maneuver is executed within hours as a re-org of a few blocks is not an event in the technical sense and would not noticeably delay regular transaction processing.

Addendum

After publishing above, I participated in a few public discussions and the most prominent objection against the described procedure was that the hacker could counter the bribe on the original chain. While this is technically correct, it neglects that miner who would take that offer would become complicit and target of lawsuits. Even anonymous miner were vary of taking those coins as they could not be sold in short term to cover their electricity cost, also being associated with coins in high interest could dox them.

Tweetstorm: Ari Paul on the reorg and it’s feasibility

By Ari Paul

Posted May 7, 2019

- There’s a bit of superficial discussion happening (mostly dismissal) of CZ of binance’s exploration of reorganizing the blockchain to reverse binance’s recent hack. Here’s why such a rollback is plausible in a future case (whether we want it to be plausible or not.)

- 2/first, I’m not commenting at all on what I want to happen or what’s good for bitcoin. I’m going to argue reorgs in these scenarios may be a natural result of the game theory for bitcoin that Satoshi created.

- 3/this hack was relatively small, but consider Bitfinex’s previous hack of 117k+ BTC, which was 30+ days of block rewards. If Bitfinex could create a smart contract to programmatically incentivize miners to re-org 3 days of the blockchain, the simple economic incentives work.

- 4/ then the question is coordination. A reorganization requires 50%+ of hashpower, but doesn’t require conscious coordination. If no one miner had more than 1% hashpower, and all were truly anonymous, might raw incentives serve to coordinate a reorganization?

- 5/ I’m not aware of how you could structure such incentives entirely within the bitcoin network itself. The logic of the smart contract would, I think, have to refer to whether a re-org has occurred. The incentives might have to be provided on another layer or network.

- 6/ but I’m probably missing some simple clever in-network incentive structures. Regardless, there’s a pie of BTC value that could be programmatically cut to incentivize the reorg for any and every miner, considering only mining economics.

- 7/ if the exchange is incentivized to attempt this, and all rational miners are incentivized to take the deal, why wouldn’t the re-org happen? Only one answer I believe - we have to hope the miners act uneconomically in the short-term due to altruism, or non-mining incentives.

- 8/ many miners are incentivized by things other than mining math. They have other economic incentives like the value of their ASICs or BTC on balance sheet. It would come down to miner incentives in the reorg payoff vs devaluation of their ASICS or BTC.

- 9/ for any one small miner, they could sell their BTC at market, so more decentralization is actually worse in this regard since it makes miner BTC holdings more liquid (smaller relative to market liquidity.) same might apply for secondary ASIC market.

- 10/ in a world where miners don’t have to own their ASICS and don’t generally hold a bunch of BTC, there would be really clear economic incentives for the re-org to happen. But what about the real world where miners do own ASICs?

- 11/ here it might be a prisoner’s dilemma, I’m not clear on the right game theory model. Collectively miners might be hurt by the re-org devaluing their hardware, but every individual miner is incentivized to re-org. Re-org is binary though, different from typical prisoner’s.

- 12/if the exchange could think of a way to reward every miner that supports the re-org more than those who oppose it, that might be enough to cause the reorg by turning this into a classic prisoner’s dilemma.

- 13/is this a bad thing for Bitcoin? Maybe. One way to think about all of this is just as a cypherpunk free market rising organically from Satoshi’s competitive mining game theory solution for BFT. It’s just economic actors playing the game.

- 14/what result might this have? For average users, probably none. Average transactions would almost certainly be included in the re-organized chain. So this would probably only be relevant to giant, “fast” transactions separated from the legal system. exchange withdrawals.

- 15/does our twitter conversation on this topic matter or is this just shouting into the wind and it’s all up to miner incentives? Twitter actually matters a little here, since we’re effectively increasing the cost of the reorg to miners.

- 16/by strengthening the social consensus around immutability, we imply a large devaluation in BTC price should such a reorg occur, which incentivizes miners who own ASICS or BTC not to reorg in marginal cases.

- 17/as part of that social consensus building, I expect the self-appointed social media bitcoin priests to attack this thread. It’s kind of their job to vigorously support the immutability social consensus. Have at it you self-appointed social consensus guardians 😀

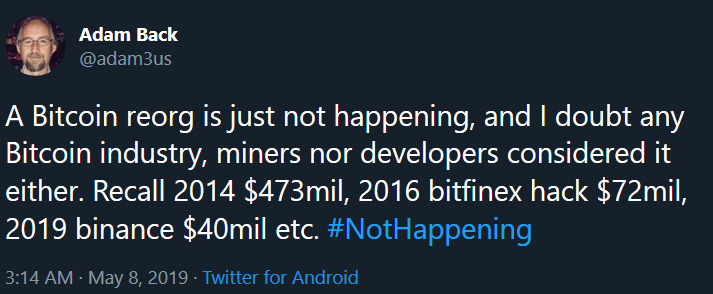

- 18/a final thought inspired by the brilliant Adam Back (but disagreeing with him.). Past data is useless here. Incentivizing a reorg is a hard coordination problem that fairly simple new tech may solve.

- 19/another final thought again inspired by Adam. Most of the logic in this thread could be changed if node operators ran software that didn’t blindly follow the longest chain. Such software may be provided eventually, some Core devs have worked on it.

Tweetstorm: Jimmy on the reorg

By Jimmy Song

Posted May 8, 2019

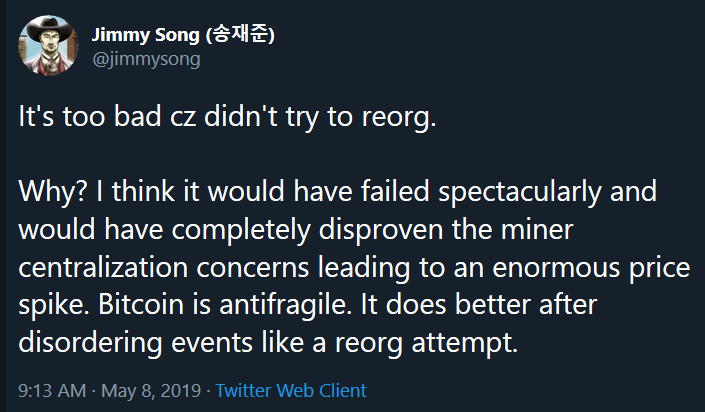

It’s too bad cz didn’t try to reorg.

Why? I think it would have failed spectacularly and would have completely disproven the miner centralization concerns leading to an enormous price spike. Bitcoin is antifragile. It does better after disordering events like a reorg attempt.

No, You Can’t Just ‘Rollback Bitcoin’

Yet Another False Narrative

By Eric Olszewski

Posted May 9, 2019

A few days ago, Binance, one of the largest cryptocurrency exchanges, faced a hack in excess of 7000 Bitcoin (~ $42M at the time of this writing). Details on the hack, here.

With so much value stored in these exchanges, it’s unsurprising that they are getting regularly hacked. And it’s somewhat hysterical to hear about someone losing their Bitcoins to an exchange hack given that one of the main values of Bitcoin is the ability to be in complete control of your own wealth. And as far as the majority of the Bitcoin community is concerned, these people knew the risk that they were taking.

Lucky for the individuals who were affected by the hack, Binance stepped up and used a contingency fund to refund all affected users. Regardless, this was small potatoes compared to things like the Bitfinex hack of 2016 where 120,000 BTC were stolen or the infamous Mt. Gox hack of 2014 where over 850,000 BTC were stolen.

And yet, someone in the community thought that miners could be incentivized with a percentage of the stolen funds to re-mine from the point of the hack, omitting the transactions which stole the funds.

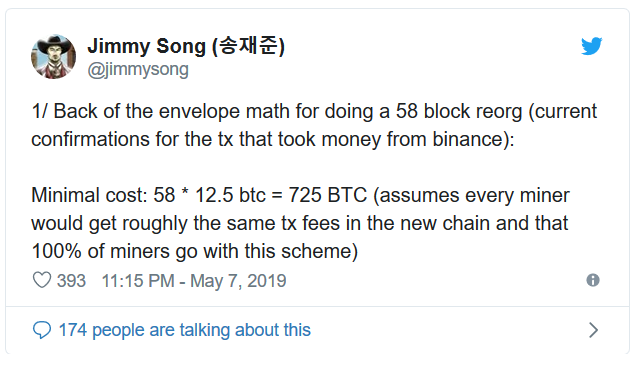

With the justification for this sort of reasoning being that each Bitcoin block takes 10 minutes to mine and pays out 12.5 Bitcoin, so, Binance could just pay miners more than what they made mining the previous blocks to re-mine them, and omit the hacker’s transactions. And while such measures may be lucrative to miners, these are only in the short term — Jimmy Song gives a good overview on how this becomes less and less so as time progresses.

Not to mention that if this were to occur, that it would undermine Bitcoin’s censorship-resistance and damage the network’s value. This would likely tank the price of of Bitcoin, as well, and subsequently hurt the miners who performed the reorg to begin with.

While something like this could certainly happen, the fact that it was asserted as something which could easily be pulled off with short-term incentives for miners shows how many people are completely oblivious to Bitcoin’s history.

While a reorg which removes past transactions is not against the initial Bitcoin design, its ramifications on the value of Bitcoin would likely be cataclysmic. And I highly advise everyone new (and old) in the space to look back at Bitcoin’s history before asserting it’s future.

Note: As much as I hate exchanges, Binance did an incredible job of handling things and being transparent throughout the process. Major kudos to them and CZ for admitting their faults and communicating updates as they surfaced.

A modest proposal regarding Bitcoin mining

Nic Carter

May 9, 2019

From the editor… This is satire, just want to be clear.

Join us, or pay the price.

Join us, or pay the price.