| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

About The Bitcoin Financial Journal

This special journal is a collection of Bitcoin valuation models and indicators. Special thanks to Adam Taché for your epic tweetstorms collecting these models.

This special journal is a collection of Bitcoin valuation models and indicators. Special thanks to Adam Taché for your epic tweetstorms collecting these models.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate + Download the Bitcoin Financial Journal

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

On-Chain Valuation Models

Introducing Realized Capitalization

By the Coinmetrics Team

Posted December 14, 2018

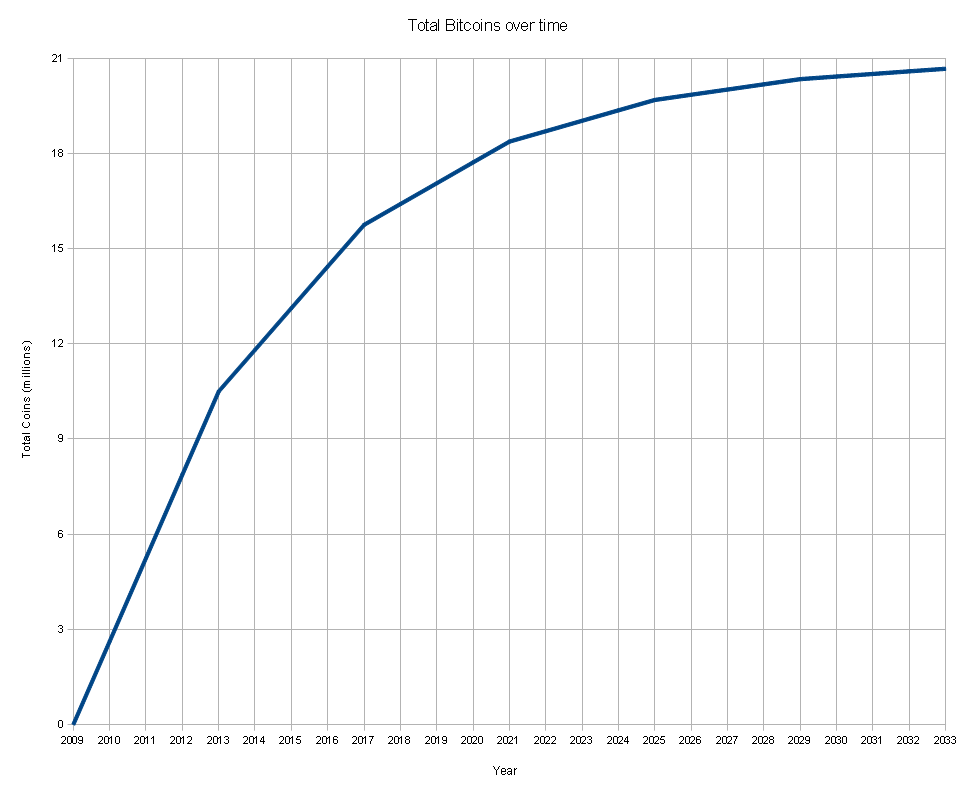

The motivation for the creation of Realized Cap was the realization that “Market Capitalization” is often an empty metric when applied to cryptocurrencies. Market Capitalization, borrowed from the world of equities, is calculated for cryptocurrencies as

circulating supply * latest market price

However, unlike with equities, large fractions of cryptocurrencies tend to get lost, go unclaimed, or become otherwise inert through bugs. By design, there is no Depository Trust and Clearing Corporation which keeps track of everyone’s stock certificates. So when tokens or virtual coins get lost, they stay lost. In Bitcoin, this means that roughly 15% of supply is assumed to be permanently lost and out of circulation. Market Cap does not consider these nuances, instead aggregating the value of all coins ever mined and assessing them at the last market price.

We wanted to create a measure that reflected this, at least for UTXO chains. Our design goals were as follows:

- De-emphasize lost coins

- Where possible, maximize generalizability (so reduce reliance on idiosyncratic adjustments)

- Do not deviate from Market Cap by more than a single order of magnitude

The eureka moment came when Pierre Rochard asked for data on a historically-weighted UTXO market cap for Bitcoin. This was mentioned to Coinmetrics engineer Antoine Le Calvez, who figured out an appropriate methodology and also dubbed it “Realized Capitalization.” (It was previously called “Effective Cap”.) Realized Cap seemed to fit the bill:

- It reduces the contemporary impact of long-lost coins

- It is trivially generalizable to UTXO chains, and, with some effort, generalizable to account chains

- It doesn’t deviate from Market Cap by too much

- It is automated: it doesn’t require (much) human oversight or intervention

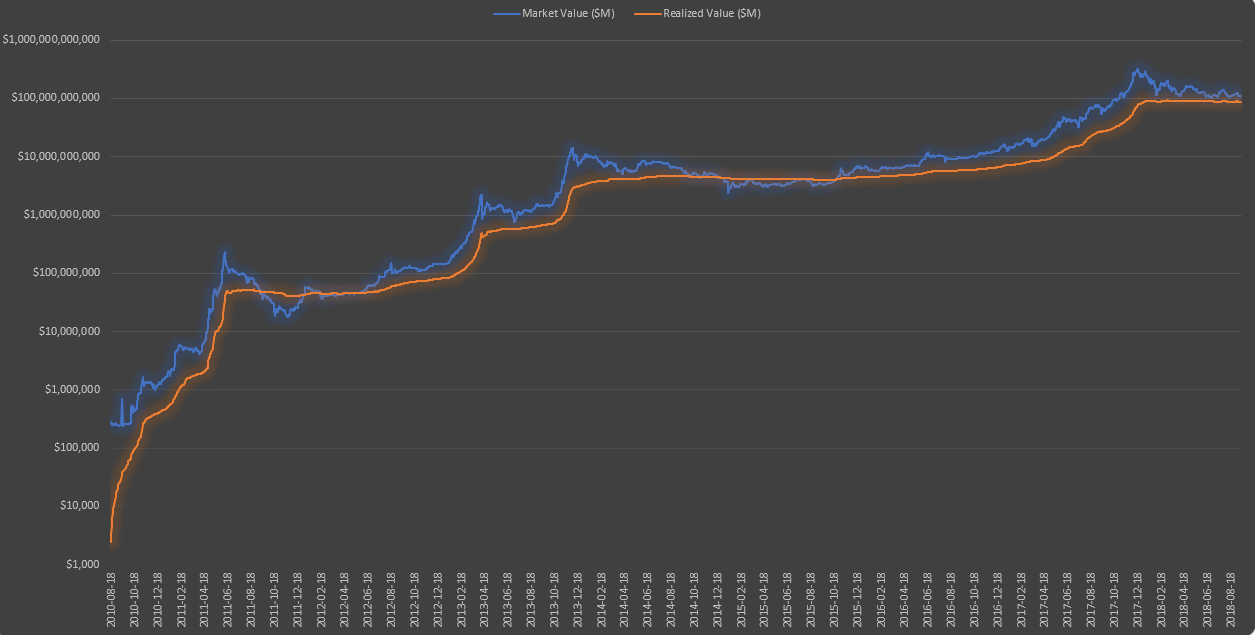

When we first worked out the numbers in September, Bitcoin’s Market Cap was $115 billion and its Realized Cap $88 billion. That seemed to make sense. Deriving new metrics from scratch is always tricky, so they need to pass the smell test too. Realized Cap seemed to do just what it said on the tin: weight coins according to their actual presence in the Bitcoin economy. It is one of a new generation of economic measures which hybridizes market and on-chain data.

Of course, exotic new measures are not without risks. There are a few challenges here: dealing with deep-cold-storage coins, interpreting Realized Cap for coins with little turnover, and generalizing it to account based coins.

First, imagine Satoshi’s ~ 700k-1m coins really were just in deep storage, and our dear leader was planning on spending them all on Bitcoin’s 10th birthday – Jan. 03 2019. In that case, Realized Cap would be seriously underweighting the economic weight of Bitcoins in circulation, since it prices those long-lost coins at 2009 values… of $0 per BTC. Realized Cap has a hard time differentiating between truly lost/abandoned coins and coins that are merely in yearslong deep cold storage. However, even the coldest of storage schemes do require periodic awakenings – to renew a multisig scheme, to take advantage of a fork, or to cash out a portion. So many of these accounts will have some amount of churn anyway.

Another issue is Realized Cap on smaller chains. Outside of the industry “blue chips,” there are many chains with relatively little turnover. This poses a challenge for Realized Cap, as it is the sending of new coins that triggers the upwards (or downwards) revaluation at a new price. One common phenomenon we observed was price spikes, with many coins getting sent back and forth to exchanges, and an increase in Realized Cap, followed by a slow, low-velocity grind down where Realized Cap hardly moves. In this case the high Realized Cap was more of an artifact of the low turnover rather than a fair reflection of the network’s pricing.

So how is Realized Cap calculated?

The realized cap attempts to improve on the market cap by trying to discount coins that might be lost. Its crux is to value different part of the supplies at different prices, instead of using the daily close as market cap does.

For UXTO coins, this consists in valuing outputs at the price at the time of their creation. For example, for a UTXO currency of supply 10 and market price of $10, its market cap would be $100. But if the UTXO set is as follows:

| Value | Time of creation | Price at time of creation | USD Value at time of creation |

|---|---|---|---|

| 8.3 | 2009-02-01 | $0.00 | $0.00 |

| 1.2 | 2011-03-17 | $1.00 | $1.20 |

| 0.5 | 2018-11-15 | $10.00 | $5.00 |

Its realized cap would be $0.00 + $1.20 + $5.00 = $6.20 or 6.2% of its market cap as 83% of the supply hasn’t moved for years.

Extension to account based chains

Extending this metric to account based coins is a bit more complex. Instead of a list of unspent coins, the state in this case is represented as a list of accounts:

| Account | Balance |

|---|---|

| 0xabc | 8.3 |

| 0xdef | 1.2 |

| 0xfad | 0.5 |

Compared to the UTXO model, it is not possible to always assign a time of creation to a balance which makes assigning it a price, and thereby a value, hard.

Let’s take an example transaction history for an account and see what methods can be used to accurately value its balance. We’ll assume the current time is 2018-11-01 and the market price is $150.00

| Time | Change in balance | Price at time | Balance |

|---|---|---|---|

| 2015-08-01 | +1,000.00 | $0.01 | 1000.00 |

| 2016-02-01 | +100.00 | $10.00 | 1100.00 |

| 2017-05-01 | -50.00 | $50.00 | 1050.00 |

| 2017-12-17 | -100.00 | $1200.00 | 950.00 |

| 2018-04-01 | +20.00 | $200.00 | 970.00 |

From this data, several approaches can be used to value the balance:

Last movement price

We use the price at the last movement on the account: here $200.00, this gives a realized balance of $194,000.

This values accounts when they are active at all on the network. However, if someone sends dust to a lost account, its whole balance is re-valued at the current market price.

Last outgoing movement price

To avoid lost accounts being re-valued when someone sends money to them, we can use the price of the last time it had an outgoing movement (defaulting to the creation of the account if no outgoing payment).

In our case, this price is $1200.00, the realized balance would be $1,164,000.

Virtual UTXO

One downside of using the last movement price is that an account which has a very high balance and sends a tiny amount out would trigger a re-valuation of the whole balance at market price.

While it’s the desired effect (after all, we just want to discount lost coins), it is unfair to UTXO based chains where the whole balance of an address is not taken into account for the realized cap, but just the coins used.

To reduce this undesirable effect, we can simulate a UTXO set for account based systems:

- each incoming payment creates a new coin attached to the account, the coin is valued at the price of the movement

- each outgoing payment triggers a coin selection on the coins attached to the account, the change is valued at the current market price

Let’s replay the example account’s history while maintaining this virtual UTXO, the coin selection we’ll use is largest coins first:

| Time | Change in balance | Price at time | Balance | Virtual coins | Realized balance |

|---|---|---|---|---|---|

| 2015-08-01 | +1,000.00 | $0.01 | 1000.00 | (1000.0 at $0.01) | $10.00 |

| 2016-02-01 | +100.00 | $10.00 | 1100.00 | (1000.0 at $0.01), (100.00 at $10.00) | $1,010.00 |

| 2017-05-01 | -50.00 | $50.00 | 1050.00 | (100.00 at $10.00), (950.00 at $50.00) | $48,500.00 |

| 2017-12-17 | -100.00 | $1200.00 | 950.00 | (100.00 at $10.00), (850.00 at $1200.00) | $1,021,000.00 |

| 2018-04-01 | +20.00 | $200.00 | 970.00 | (100.00 at $10.00), (850.00 at $1200.00), (20.00 at $200.00) | $1,025,000.00 |

This gives this account a realized balance of $1,025,000.

Using Realized Cap on Coinmetrics

Right now, Realized Cap is only available for UTXO chains – we are still refining it for account-based chains.

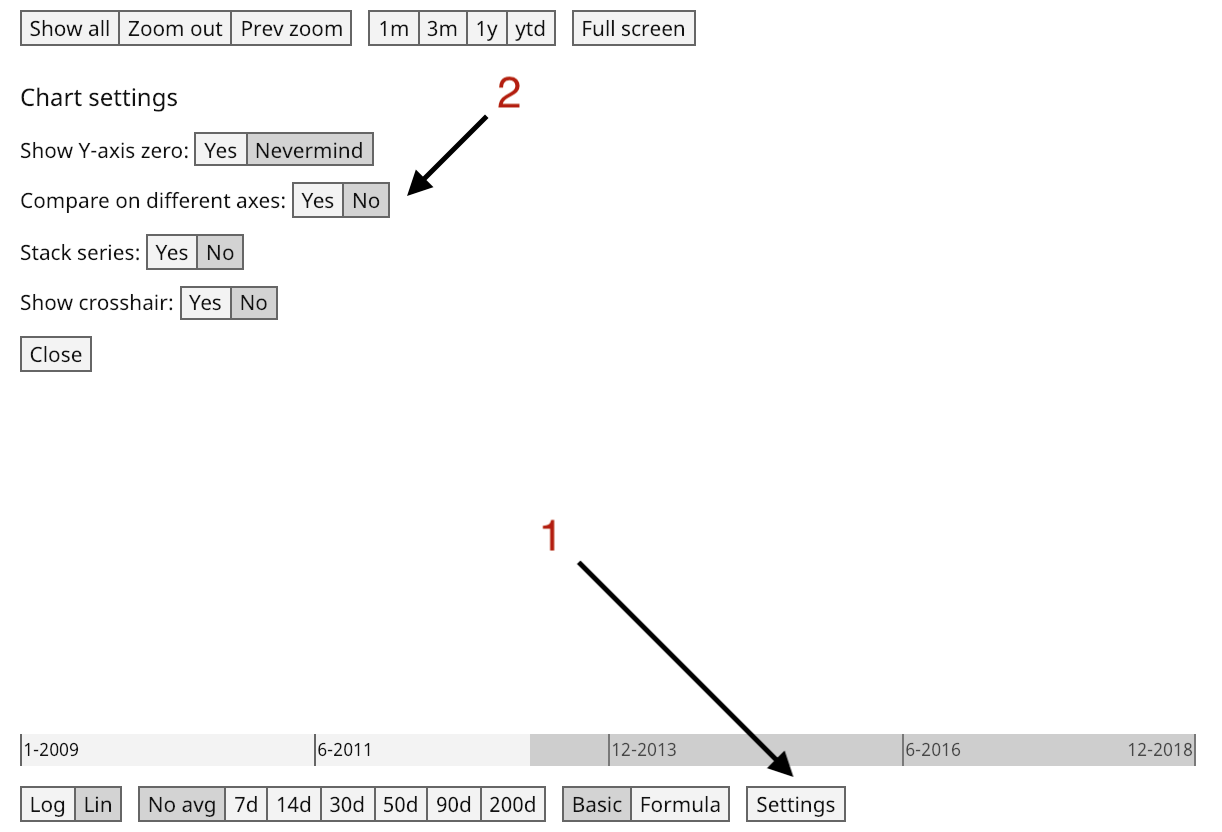

For charting, you can find it on the chart as Realized Network Value (in keeping with our naming convention of using “Network Value” rather than Market Cap). If comparing Realized Cap to Market cap, we recommend hitting settings and selecting no on Compare on different axes.

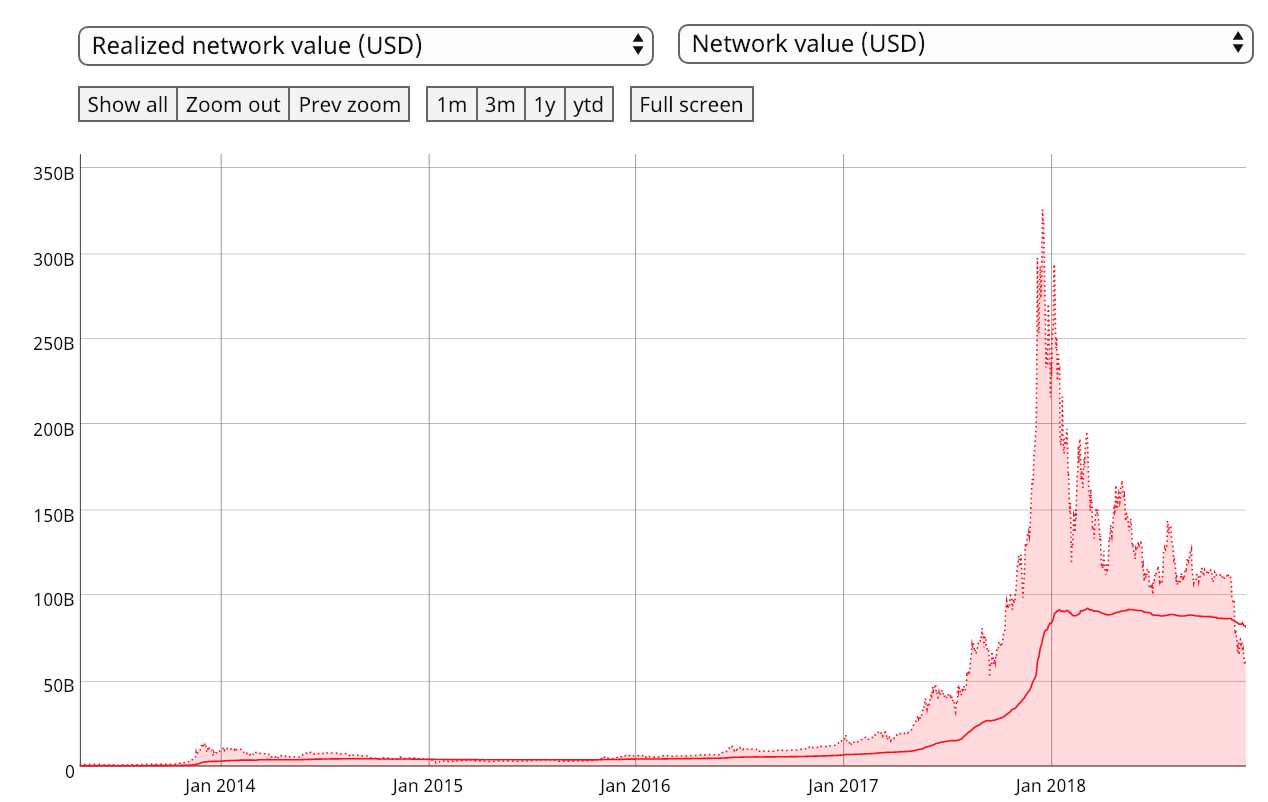

This lets you create nice comparisons like this:

Bitcoin realized network value (solid red line) and network value (shaded area). Link here Keep in mind that on our charts builder page, the command for realized cap is

Ticker.realizedCapUsd

You can also create a ratio of the two.

Market cap to realized cap ratio The reasoning behind the ratio has been explored by Murad Mahmudov and David Puell here.

Market cap to realized cap ratio The reasoning behind the ratio has been explored by Murad Mahmudov and David Puell here.

Coin Days Destroyed

By Joaquin Roibal

Posted July 1, 2018

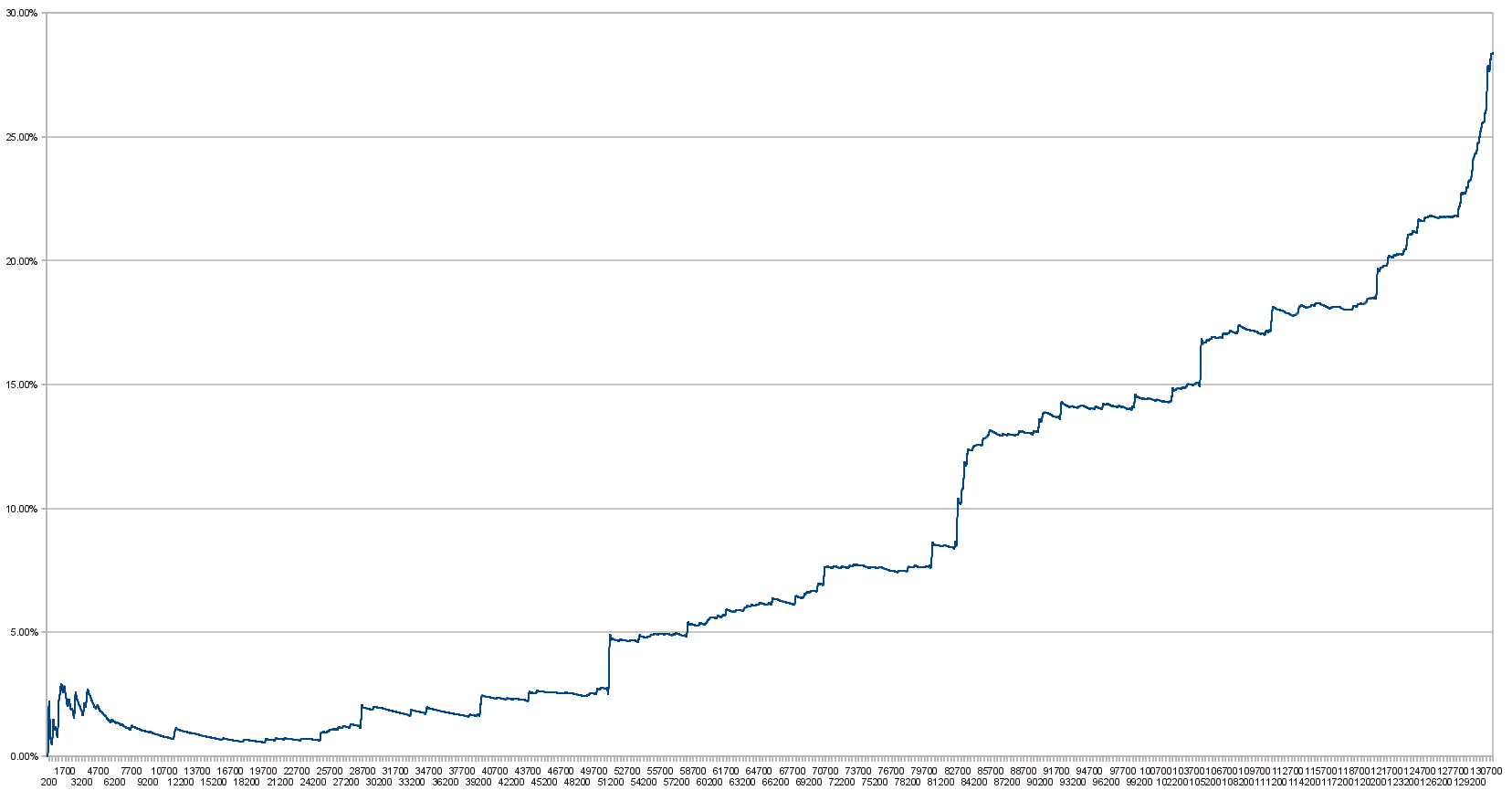

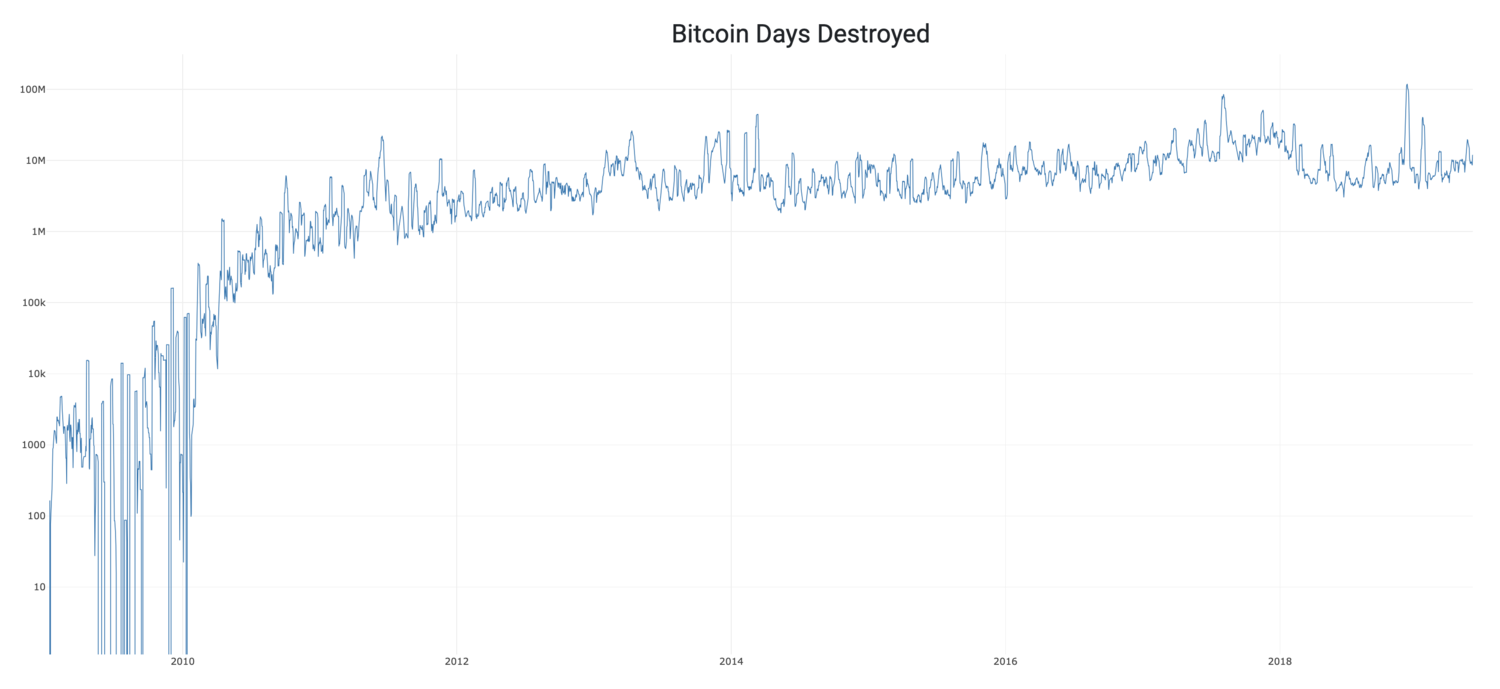

The idea of “bitcoin days destroyed” came about because it was realised that total transaction volume per day might be an inappropriate measure of the level of economic activity in Bitcoin. After all, someone could be sending the same money back and forth between their own addresses repeatedly. If you sent the same 50 btc back and forth 20 times, it would look like 1000 btc worth of activity, while in fact it represents almost nothing in terms of real transaction volume.

With “bitcoin days destroyed”, the idea is instead to give more weight to coins which haven’t been spent in a while. To do this, you multiply the amount of each transaction by the number of days since those coins were last spent. So, 1 bitcoin that hasn’t been spent in 100 days (1 bitcoin * 100 days) counts as much as 100 bitcoins that were just spent yesterday (100 bitcoins * 1 day). Because you can think of these “bitcoin days” as building up over time until a transaction actually occurs, the actual measure is called “bitcoin days destroyed”. This is believed to give a better indication of how much real economic activity is occurring on the bitcoin network.

So how well does it work? Well, it’s still not perfect, because the other day I moved some coins out of a wallet they’ve been in for several months without spending them or giving them away. And some genuine businesses have very rapid turnover in bitcoins, so they’re not being measured well by this method. But it does do a good job of filtering out the “noise” of bitcoins that are just “bouncing around” without really going anywhere. The graph of overall bitcoin days destroyed is believed to show that the genuine level of activity in the Bitcoin economy is continually increasing–it’s not just one person experimenting by rapidly sending the same coins back and forth, flooding the network with meaningless chatter. Looks pretty good, hey?

Image from the Bitcoin wiki. The above graph is in percentage of bitcoin days destroyed and a little out of date–for a regularly updated version in bitcoin days destroyed check out Bitcoin Days Destroyed - Active Chart instead!

Experiments on Cumulative Destruction

Two Approaches to Bring Bitcoindays Destroyed Into the Price Domain

By David Puell and Willy Woo

Posted April 9, 2019

Disclaimer: Nothing here should be considered investment or trading advice.

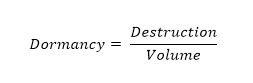

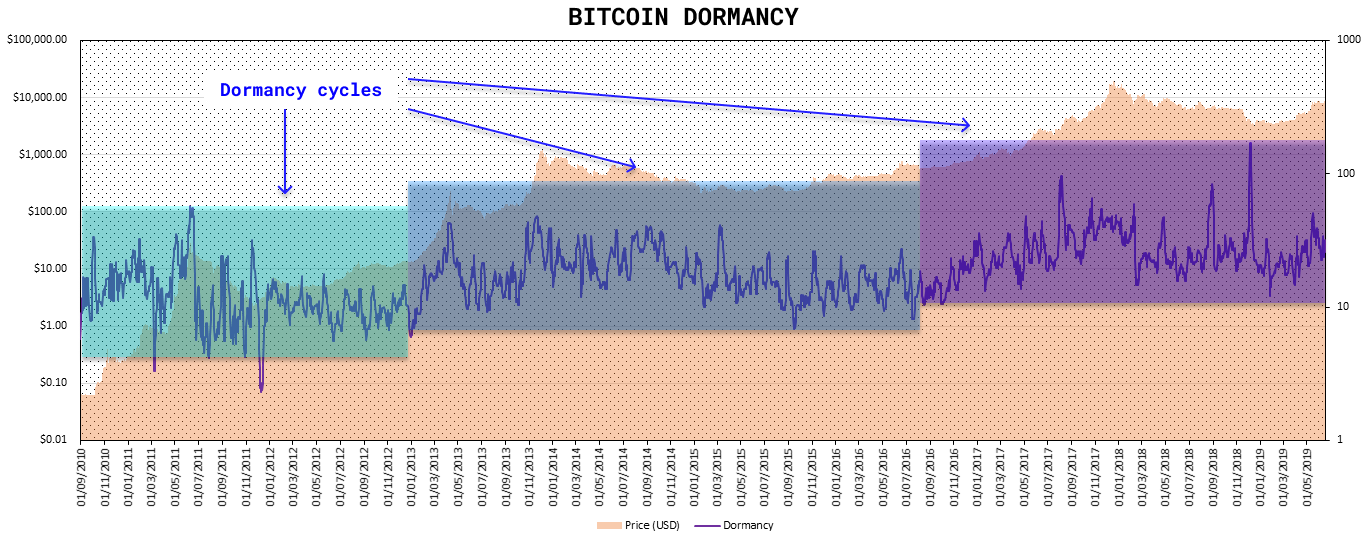

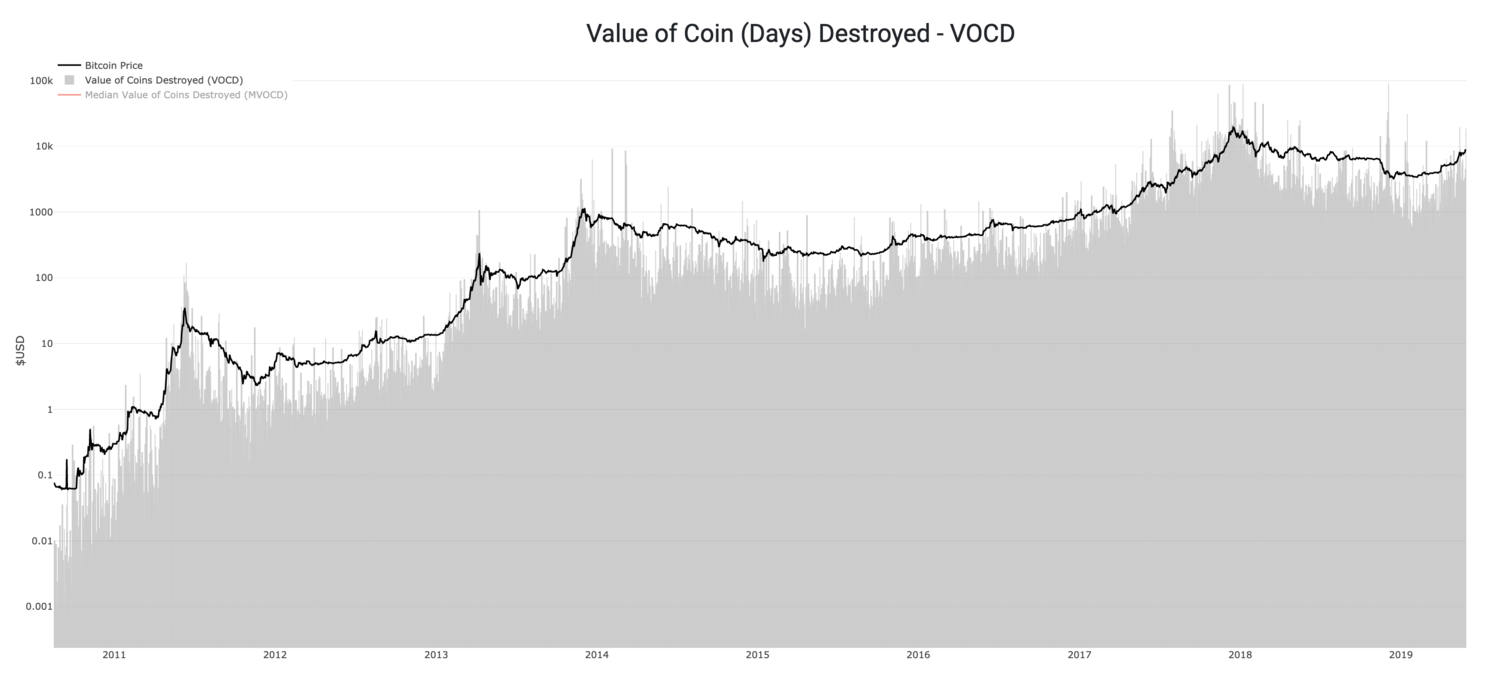

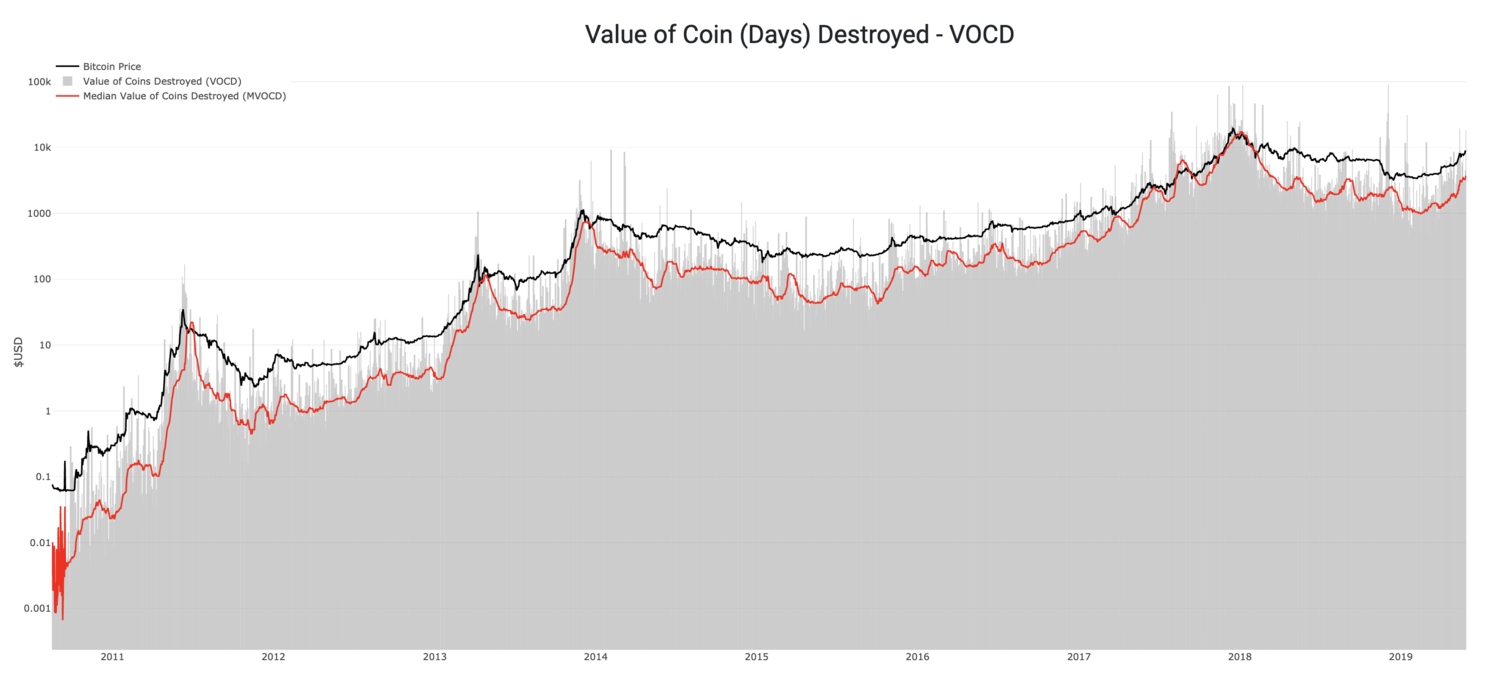

Okay, so this article is now well overdue given the recent price action. BTC never rests! The last few months have been very productive in terms of discovering new valuation metrics based on on-chain analytics. The recent proposals using coindays destroyed by Tamas Blummer and the team at Adamant Capital have put this essential metric once again on the map. We thought we’d give it a go at coming up with a way to best translate the concept of destruction into a precise price level for market analysis.

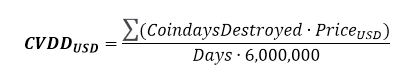

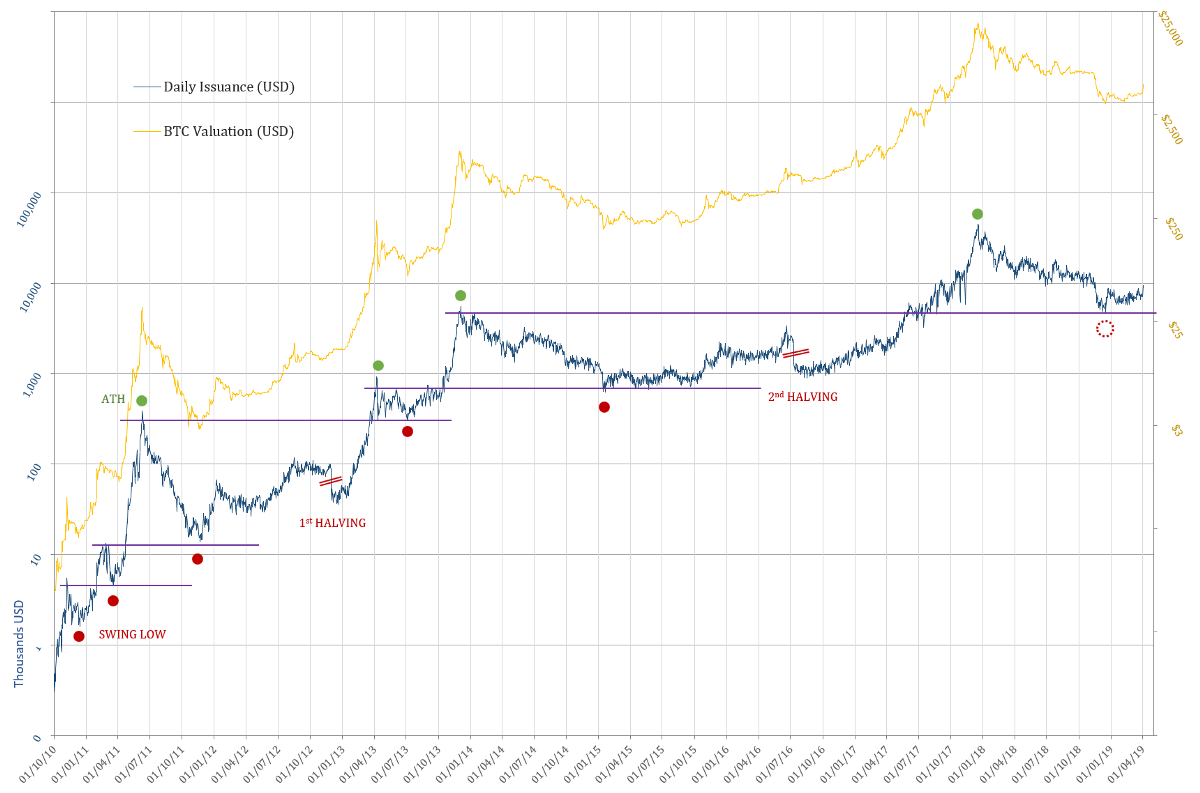

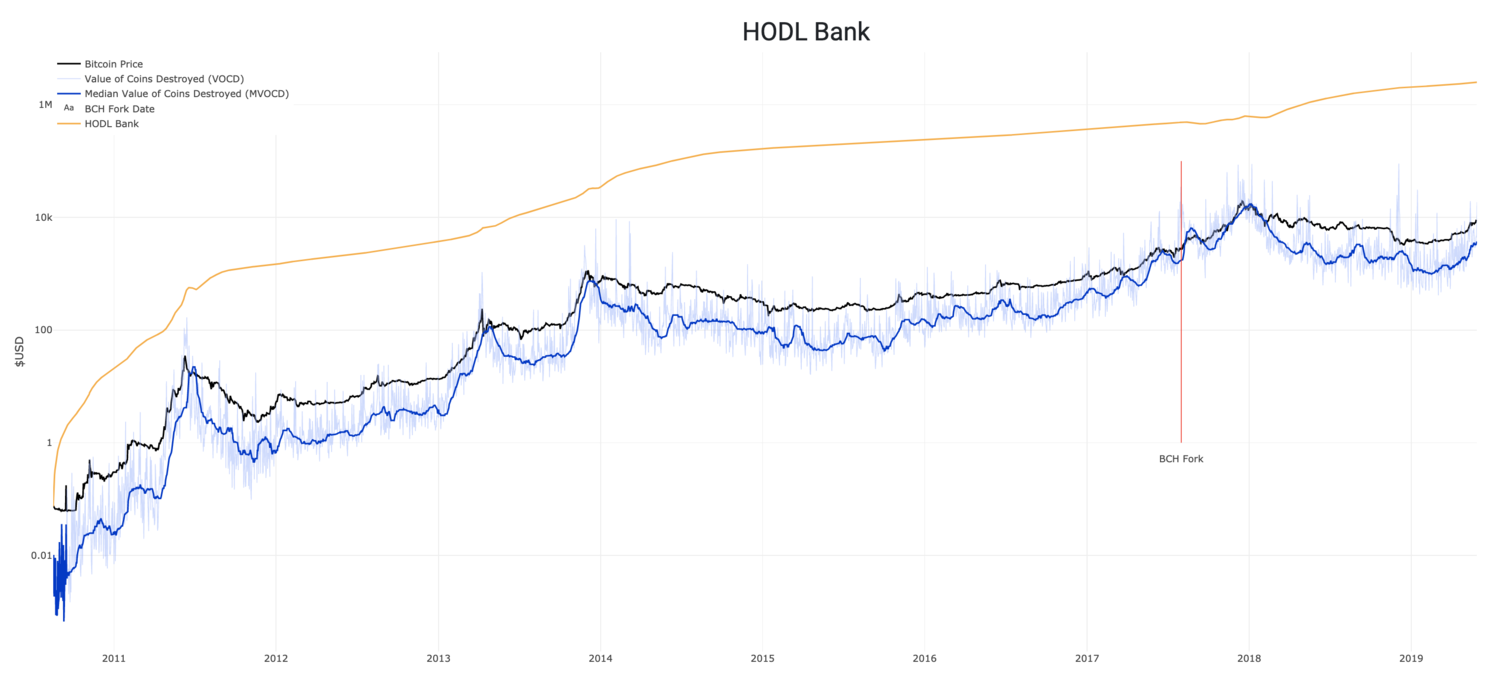

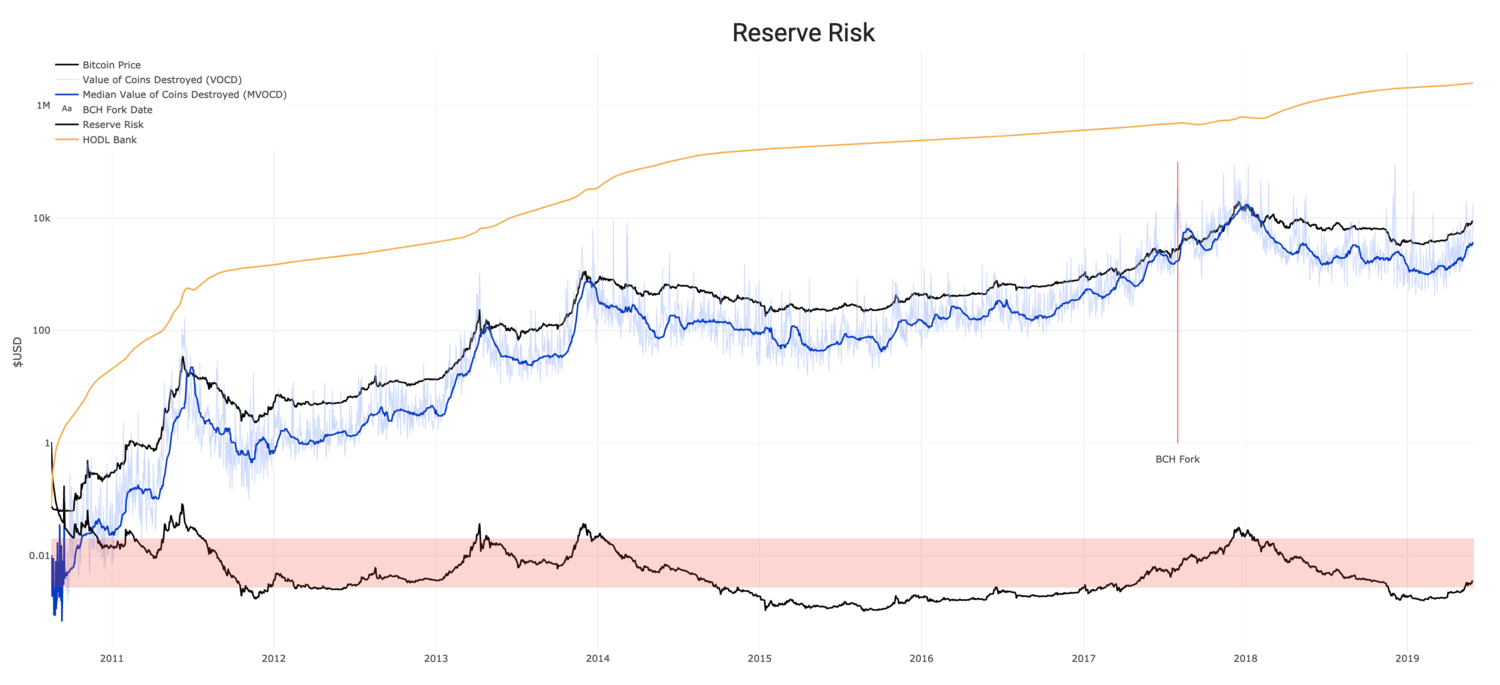

Experiment A: Cumulative Value-Days Destroyed (CVDD) by Willy Woo

When coins move from one investor to another, the transaction carries both a USD value and also destroys a time value relating to how long the original investor held their coins. CVDD tracks the cumulative sum of this value-time destruction as coins move from old hands into new hands as a ratio to the market age. It is calculated with the following formula:

Note that 6 million is used for calibrating the chart. This number is arbitrary and would be different had we used hours or blocks as unit for the age of the market.

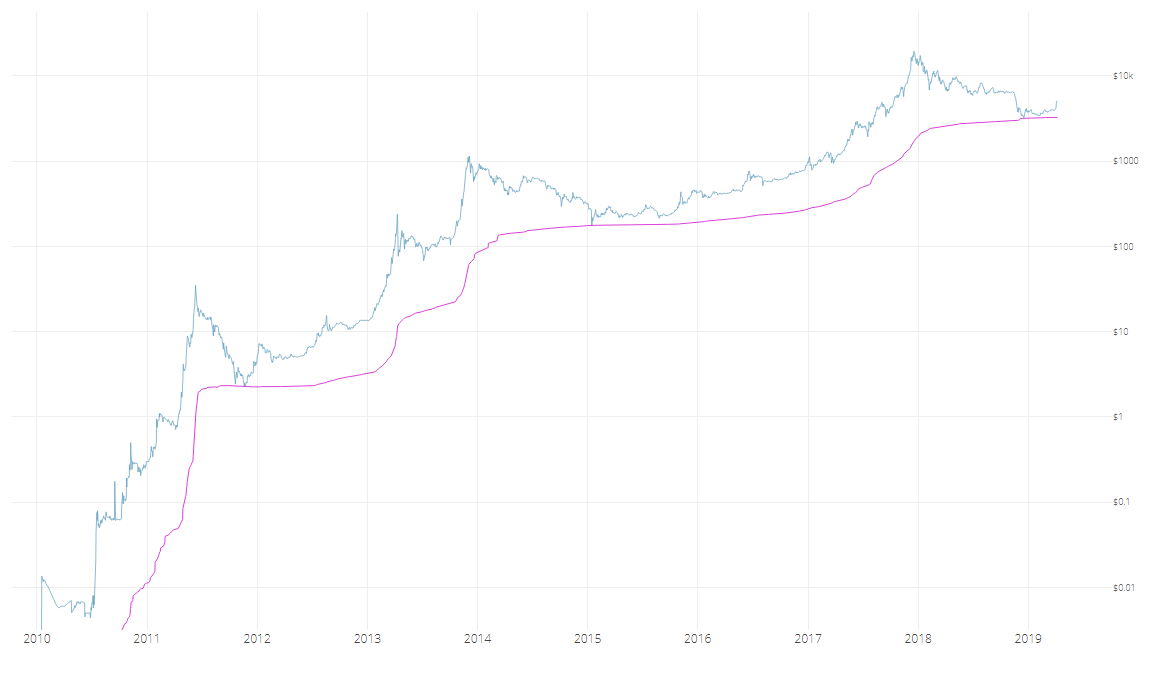

CVDD has hit the historical Bitcoin price bottoms with remarkable accuracy.

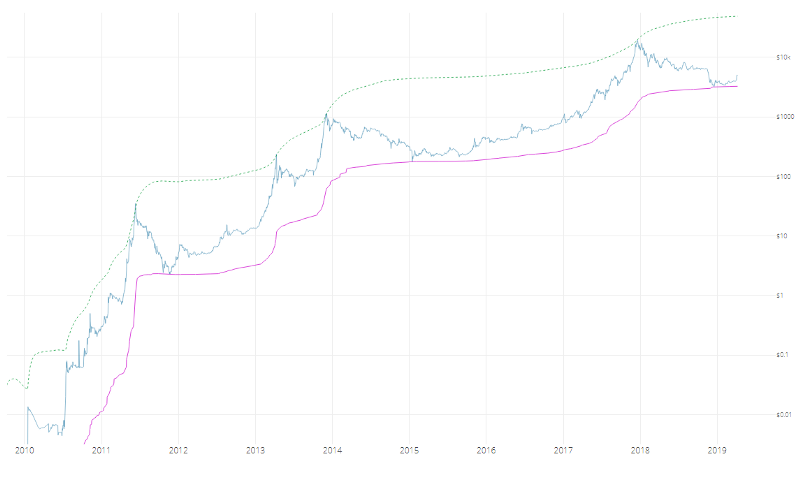

CVDD

CVDD

Unlike delta cap, CVDD tends to consistently climb in value — this becomes useful to frame an increasing lower bound for a market bottom during bear seasons when the market price is falling.

When used in conjunction with the top price model, CVDD and top price provide upper and lower bands for price action.

CVDD and top price

CVDD and top price

When used in conjunction with Coinmetric’s realized price, CVDD can help the visualization of Bitcoin’s accumulation bottoms.

CVDD and realized price

CVDD and realized price

Both CVDD and realized price have remarkable resemblances in shape, so it is no coincidence that they both use HODL time by the investor in their calculation. It is important to note that both CVDD and top price are interesting curiosities, and are not guaranteed to work in future cycles.

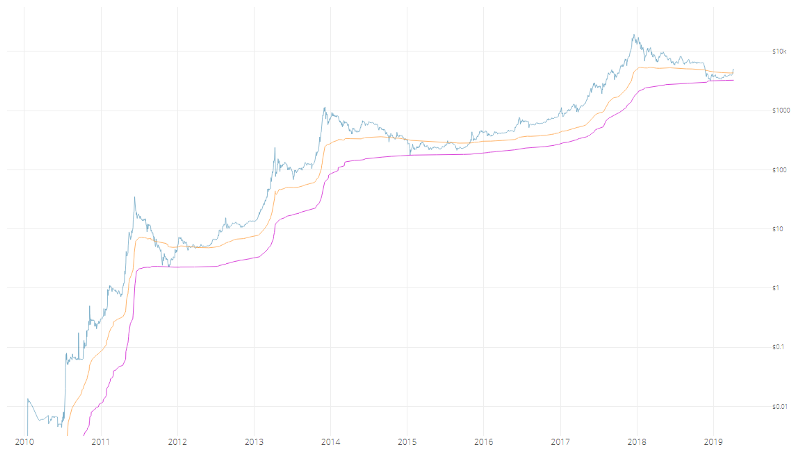

Experiment B: Transferred Price and Balanced Price by David Puell

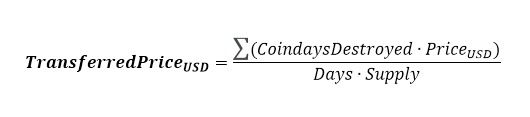

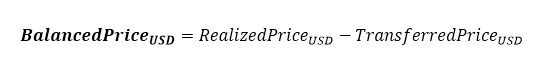

Instead of using a 6-million figure, transferred price uses supply to bring destruction into the price domain:

Looking at this as a life-to-date moving average of spending behavior (again, old hands selling into new hands), it can be assumed that when subtracted from realized price (the average paid for all coins in the market), a “fair” valuation measure emerges. Balanced price denotes the level at which, during bear markets, a full detox has been achieved — market price matching what was paid minus what was spent.

Balanced price

Balanced price

It goes without saying that this evokes delta price in both calculation and visualization. We believe that delta serves as a technical analysis proxy of balanced price. The former seems to be agile enough to catch exact bottoms — the “wicks” — while the latter catches the full accumulation level prior to the bull run, also defining the brief moment when price remains below it as “capitulation.”

More iterations on coindays destroyed to follow. Stay tuned…

Sources

- Woobull.com : Charts and early price data archeology.

- Coinmetrics.io : Realized price data.

- Blochchair.com: Coindays destroyed data. Authors

- Willy Woo, on-chain analytics pioneer @Woobull.com.

- David Puell, Head of Research @ Adaptive Capital.

Bitcoin Delta Capitalization

A New View of BTC Long-Term Valuation

By David Puell

Posted February 14, 2019

Disclaimer: Nothing contained in this article should be considered as investment or trading advice.

As a follow-up to Willy Woo’s recently-introduced Bitcoin Valuations live chart, this article aims to present delta cap with the goal of answering two of the most pressing questions in speculators’ minds at the present moment:

- Where is the bottom?

- When is the next bull run coming along?

Something’s Amiss

Two sets of items originated the search for what later became delta cap:

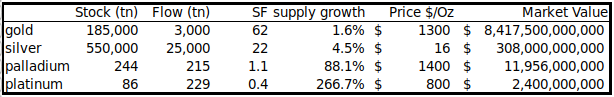

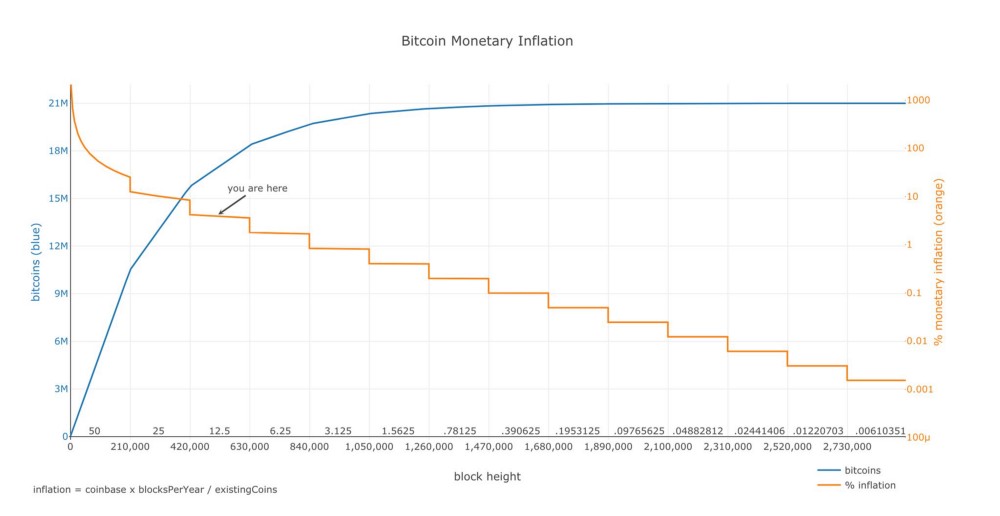

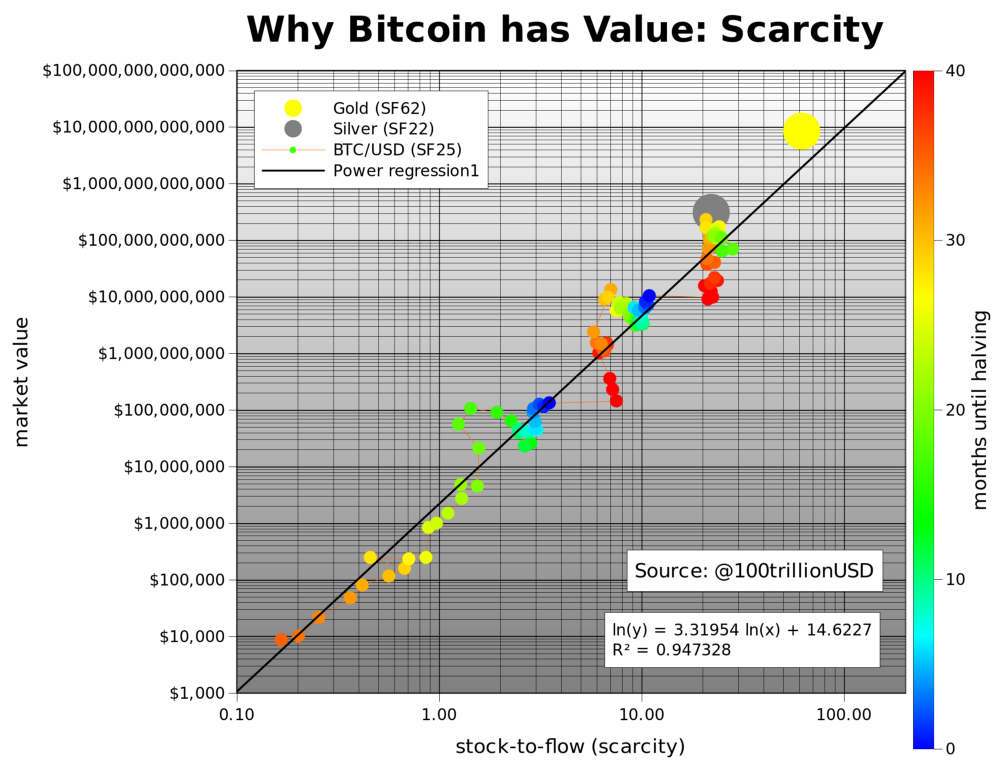

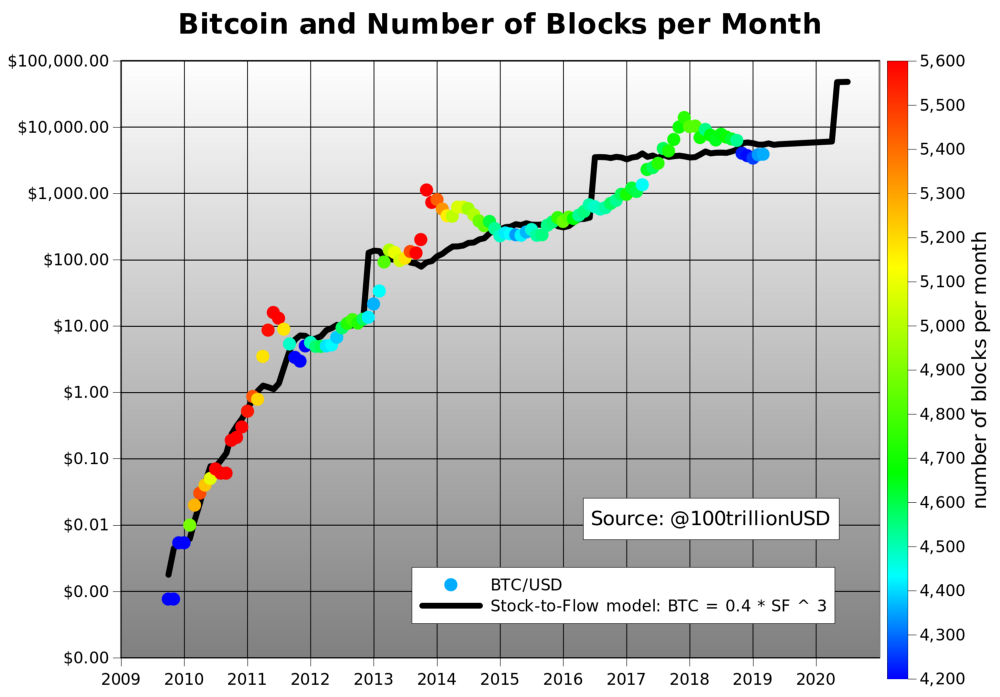

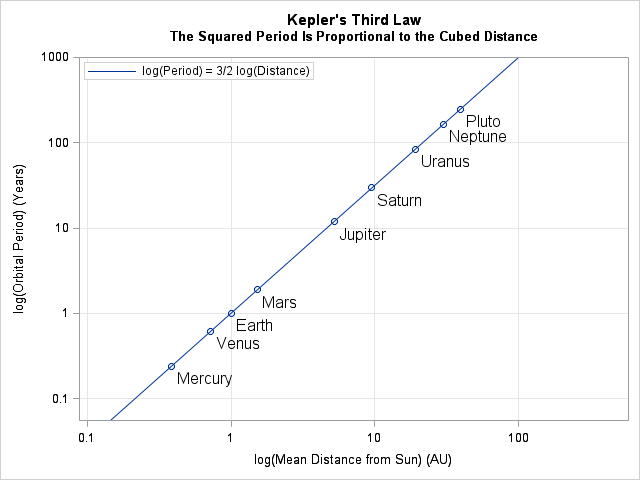

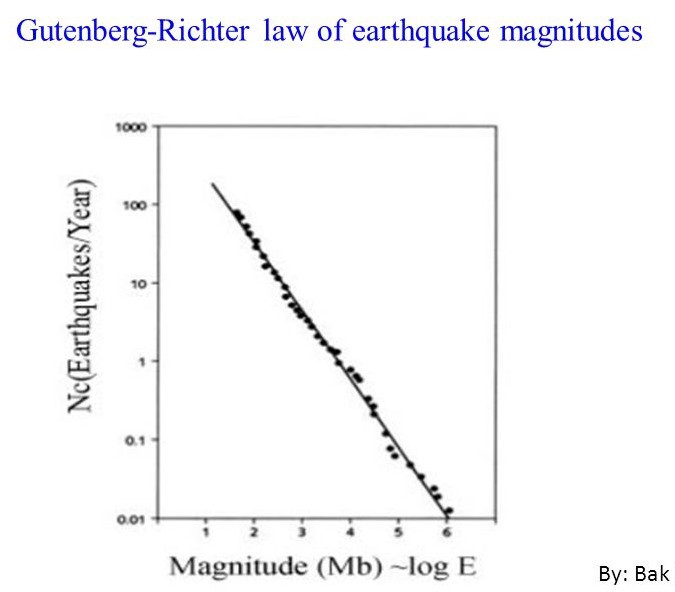

- Awe and Wonder’s studies on Bitcoin’s logarithmic regression and Plan B’s studies on Bitcoin’s power regression (R² of 0.93 and 0.95 respectively), which seem to suggest that the BTC trend is increasing at a decreasing rate.

- Murad Mahmudov’s exploration of historical moving averages, expressing a dissatisfaction with any particular SMA or EMA as definitive enough to “catch the bottom” in every bear cycle.

This initiated the search for a metric that both adapted to Bitcoin’s rapid, high-velocity parabolic moves and accounted for its overall trend decay over time. Two other valuation models seemed to provide a tentative answer: realized cap for the former and average cap for the latter.

Delta Capitalization

Delta cap is, as seen next, a hybrid of sorts — half “fundamental,” half “technical.” It is calculated through the following formula, measuring the difference between two long-term Bitcoin moving averages:

For the purposes of this piece, let’s review these definitions:

Realized capitalization

Invented and presented by the brilliant team at Coinmetrics, instead of counting all of the mined coins at current price, the coins are counted at the price when they last moved through the blockchain. This approximates the USD value paid for all the bitcoins in circulation. Best put by its co-creator Nic Carter, it can be described as an on-chain volume-weighted average price (VWAP) of BTC.

Average capitalization

Instead of setting a fixed period for calculating a moving average (e.g., a 200-day MA), this is a life-to-date, cumulative simple moving average that serves as the true mean of the whole history of market cap. Due to its “laggy” nature, it is the perfect mechanism to help decay the upward speed of delta cap over time. Shoutout to Renato Shirakashi for first pointing out this average.

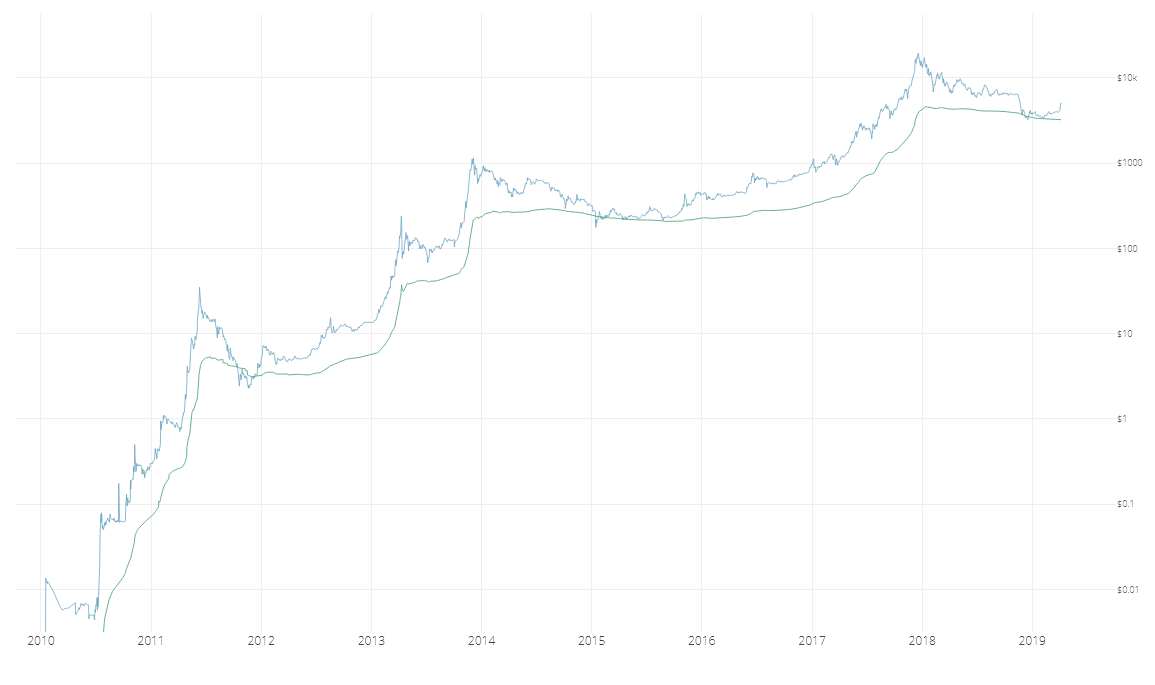

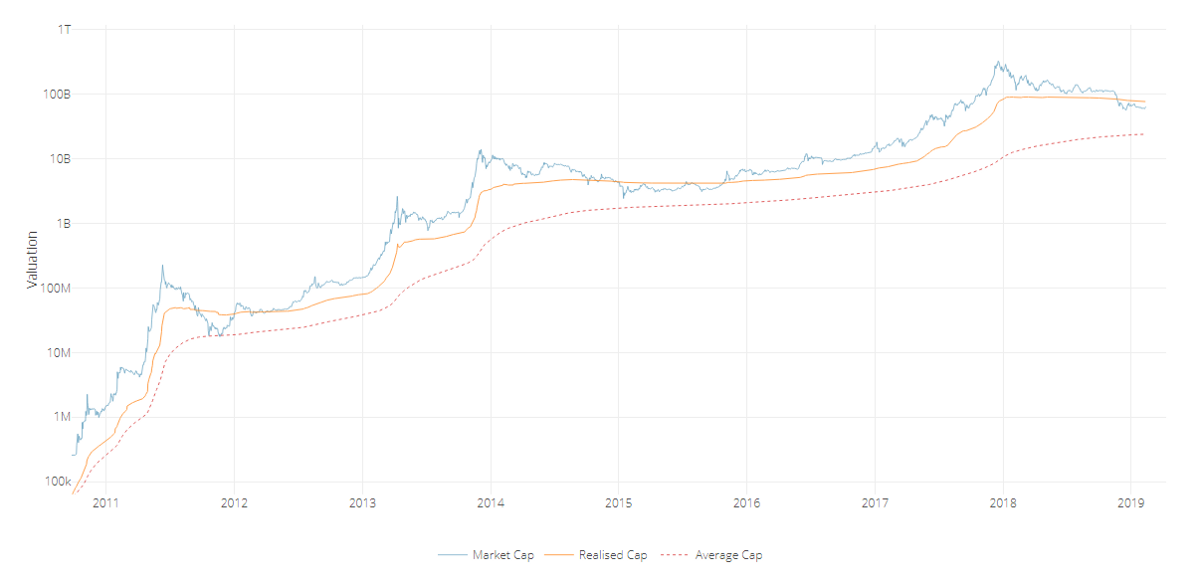

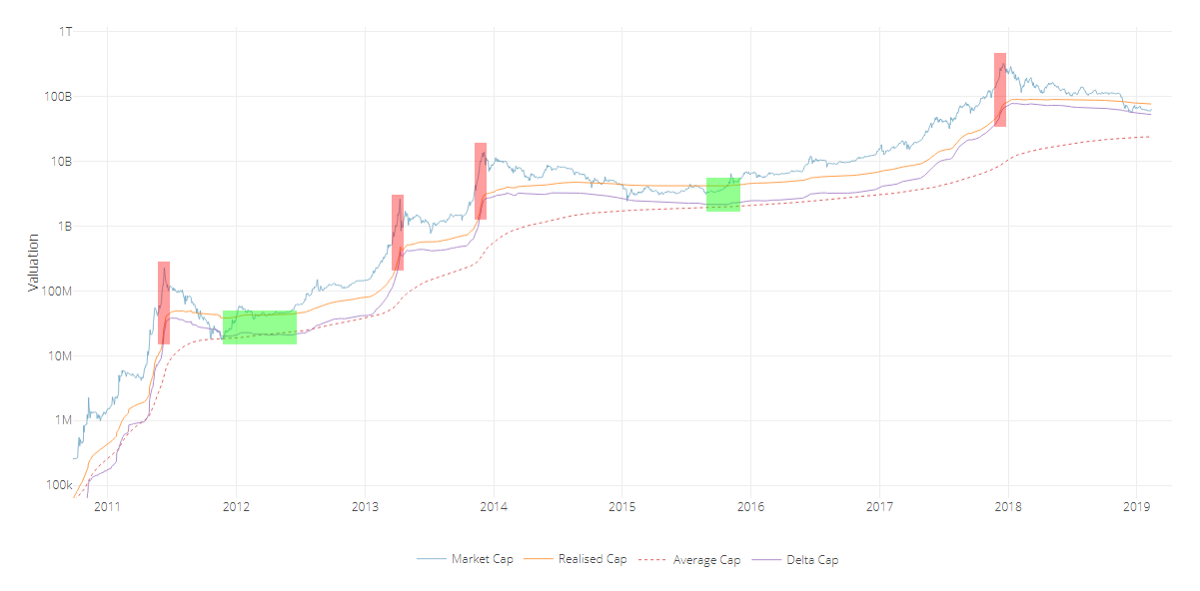

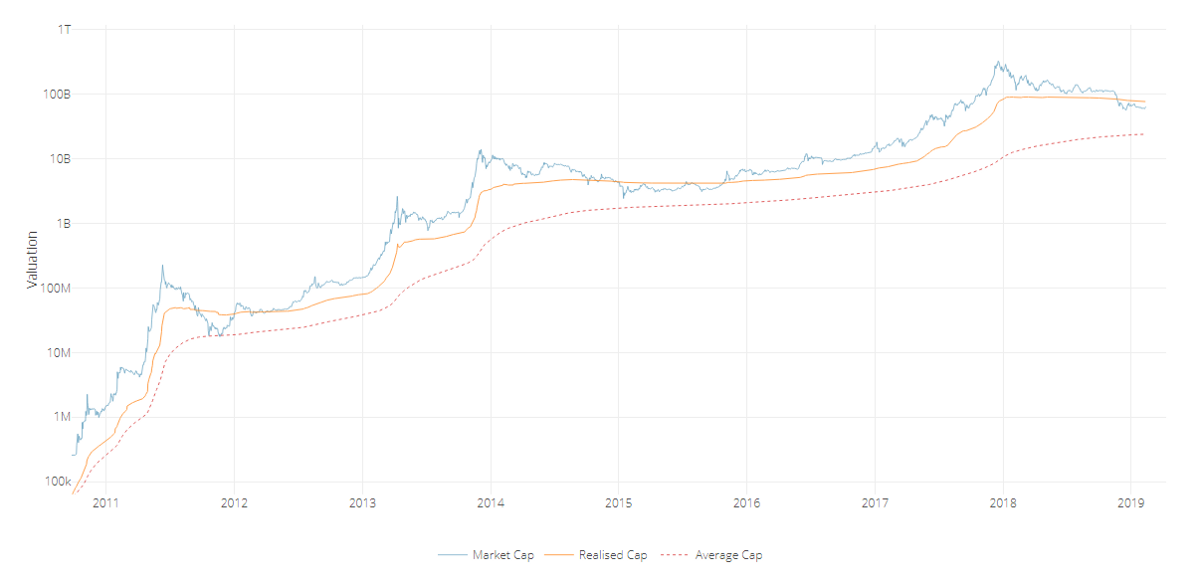

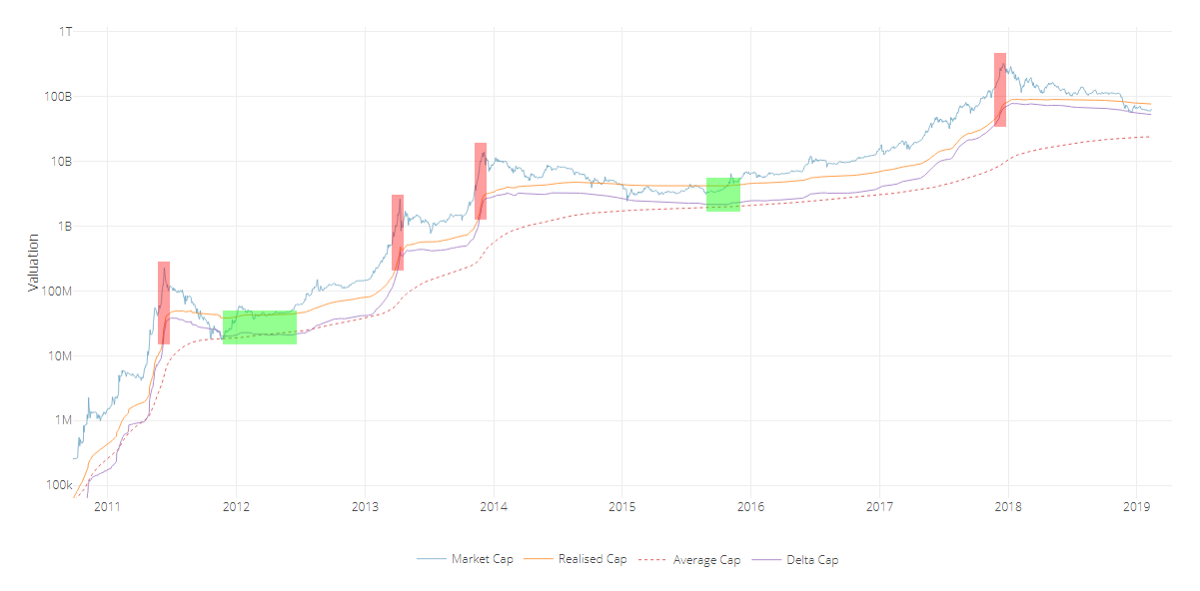

Below, a view of both lines, courtesy of Willy Woo:

The aforementioned substraction of the two in turn provides the following delta cap line, both reactive locally and decaying globally:

As seen at first glance, delta cap provides an excellent framework for catching global bottoms — or at the very least bottoms near the floor of the bear cycle. Please see the caveats of this indicator below to have a more nuanced view of the current state of affairs, since having just touched delta cap does not guarantee that we have bottomed.

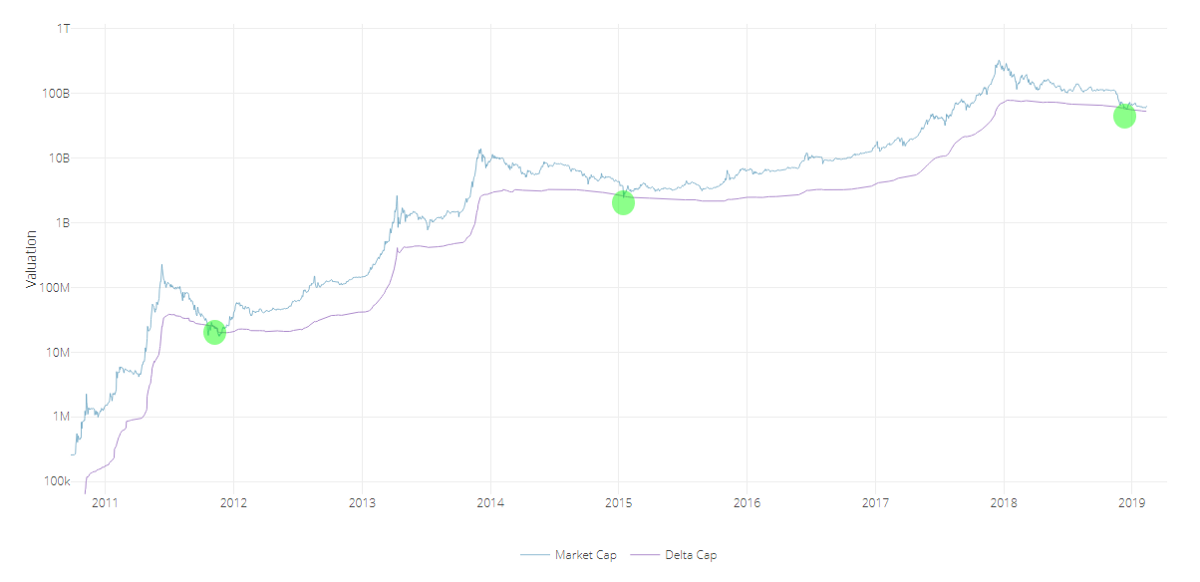

Time Analysis

Another interesting (and still experimental) exploration of delta cap emerges when comparing it to its parent inputs through a logarithmic view, as follows:

We can easily gauge periods were delta approaches realized cap during the bubble tops, and then evermore slowly descends to almost touching the average cap during the phases of breakout price behavior, signaling the inauguration of the new bull run.

The good news? If this pattern continues, people will have lots of time to buy up. The bad news? This bear-to-sideways market may last for an unprecedented while, going as far as projecting a post-accumulation breakout as late as Q2, 2020 — the moment when it could be expected for delta cap to get nearest to average cap if the extension of these lines continues as-is. Bear in mind that this is all pending on the overall rate of drop of realized cap and the rate of rise of average cap — local price action, velocity, and dormancy are all in play. Time domain here is still a broad estimate.

It goes without saying that we lack enough bottom samples to claim this as a certainty, but long-term investors must stay mentally prepared for this possible delay. It is further evidence that suggests Bitcoin’s cycles are elongating.

Yes, Another Ratio: MVDV

Since most will be curious about how the Market-Value-to-Delta-Value (MVDV) Ratio looks like, here it goes:

A few notes on it:

- Just as seen on MVRV Ratio and the Mayer Multiple, MVDV seems to indicate that each of Bitcoin’s blow-off tops is losing momentum. This is not necessarily bearish, as I believe it merely implies that each bubble is becoming less exuberant and getting closer to the mean.

- Major bearish divergences seem to announce global tops (red circles) while differentiating them from previous local tops of the same cycle.

- The bottoms seem to maintain a steadier horizontal longitudinal threshold at 1 (green line). If market cap were to revisit delta cap today at a lower low, the oscillator would present this event as a double bottom.

Caveats

- _Having touched delta cap recently does not imply a global bottom:_One must remember that delta cap is currently sloping down — and it will continue to do so for several months — so the likelihood of market cap revisiting it is not out of the question. Add to that the fact that the NVT tools are still just slowly trending into normal historical conditions and velocity remains weak. Touching delta cap on a lower low in the following months is still a likely possibility. Every penetration of market cap into delta cap should be best used as one componet of an averaging-in strategy over a prolonged period of time.

- Despite timeboxed halving days, the Bitcoin cycle seems to be elongating: This makes perfect sense, since larger bull runs require larger liquidity. The experiment here is to continue evaluating delta cap as a mean that keeps adjusting to Bitcoin’s curved trend. That being said, the time analysis section of this article remains highly speculative, especially for signaling the breakout events, so let’s take it one day at a time.

- _The market currently holds a major dissonance:_That of delta cap providing a good “baseline” for a relatively optimistic market floor, versus the current state of velocity as seen on NVT Ratio,Network Momentum, and NVT Caps— on life support relative to price.

- Delta cap remains experimental: Just as with most technical and on-chain tools, these indicators should be used with prudence and in the company of other trading mechanisms and a sound risk management strategy. Past events don’t reflect future outcomes.

Acknowledgements

Many thanks to the following individuals:

- Willy Woo, for the beautiful charts and valuable feedback.

- Murad Mahmudov,Phil Bonello,Hans Hauge,PositiveCrypto, and Plan B, whose comments helped perfect this article.

Sources

- Woobull.com : Charts and early market cap data archeology.

- Coinmetrics.io : Realized cap data.

- Blockchain.com : Market cap data.

On & Off-Chain Valuation Indicators

Bitcoin Mayer Multiple

By Trace Mayer

Unsure on original post date

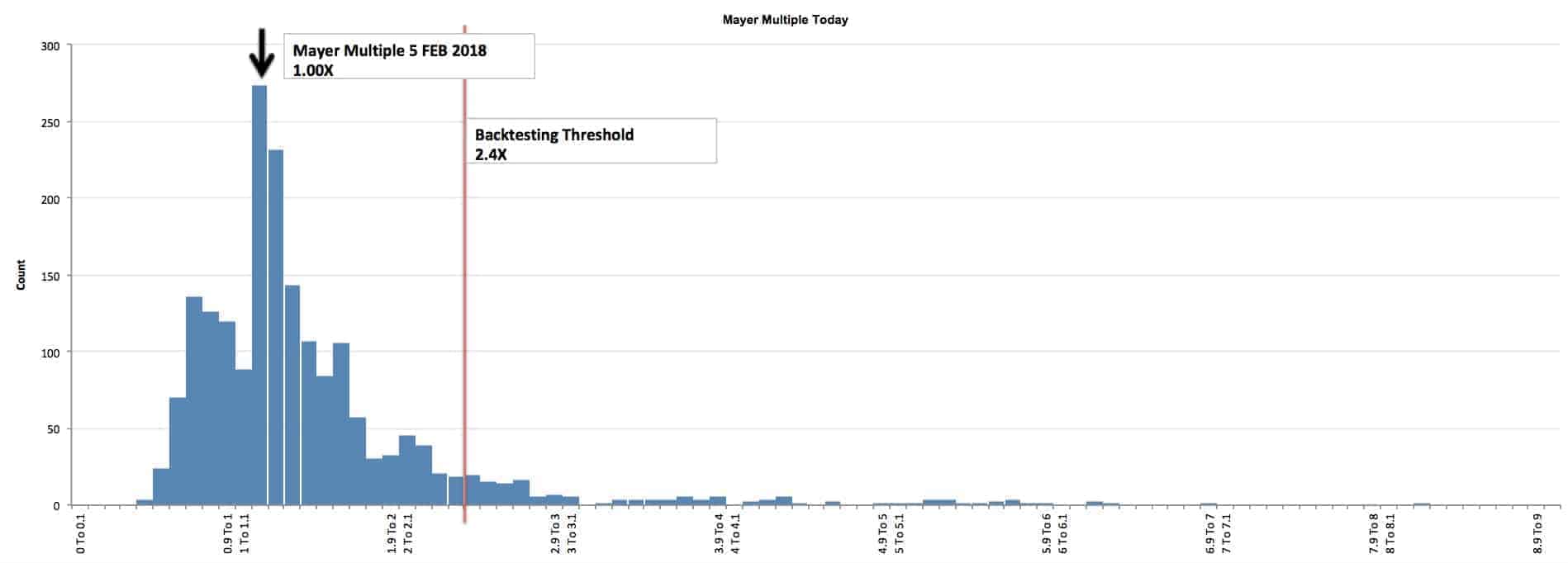

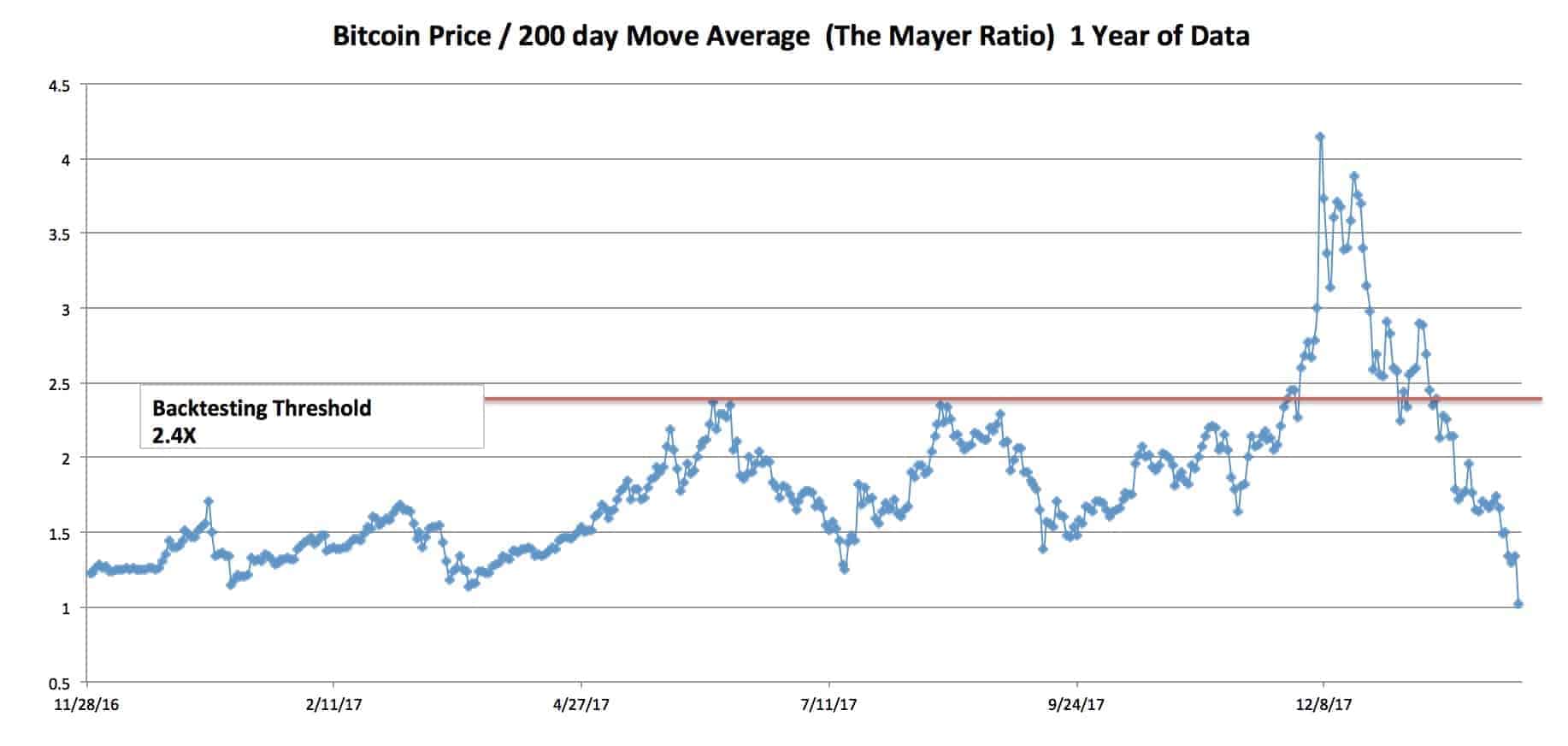

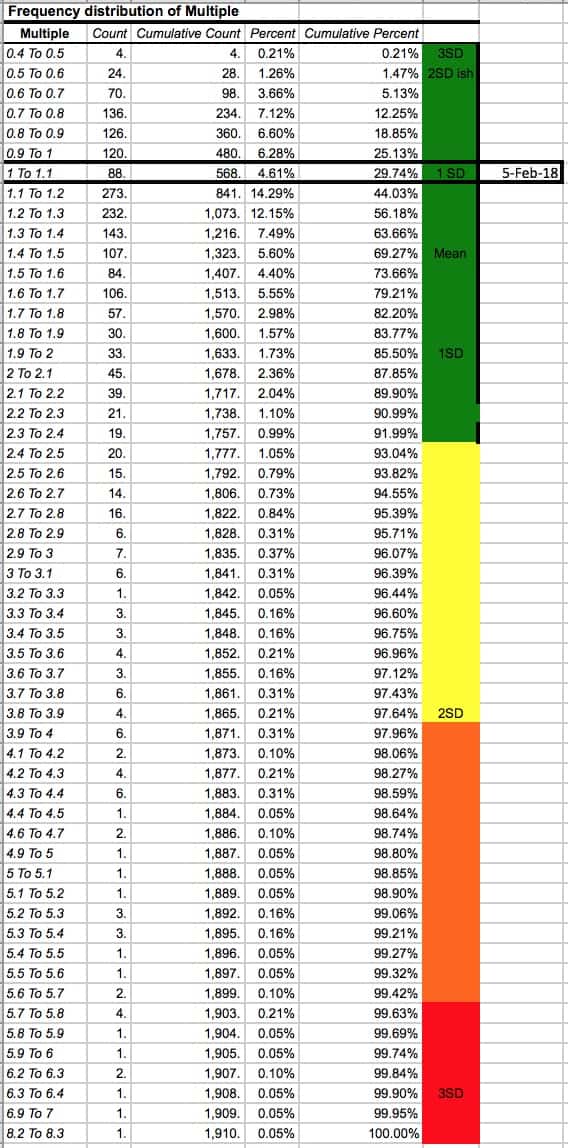

Below is a distribution chart of the multiple of the bitcoin price over the 200-day moving average. If a person decides to allocate a small portion of their portfolio to Bitcoin, this tool is intended to help people understand their emotions and corresponding probabilities of various price multiples (from a historical context). The charts and following information is not telling you to buy or sell Bitcoin. Bitcoin is insanely volatile. The charts do not suggest future results will be the same as the past. Please note, some suggest the long-term value of Bitcoin is high (in excess of $100,000 per Bitcoin), but there are also others that say Bitcoin is a mania and will be deeply regulated by the government if it is allowed to get too large. Either way, this page is simply a study to understand the probabilities of price multiples and what is normal and abnormal levels (from a historical context).

HOW THE MAYER MULTIPLE WORKS

The following explanation is how the to interpret the Mayer Multiple using 5 February 2018 at 4.00 PM EST as an example. Remember to check this page or follow us on Twitter, to get updates daily.

The 200 Day Moving Average is: $6858

The average Mayer Multiple is 1.47 for the history of Bitcoin.

The multiple on 5 February 2018 is 1.00X. A higher multiple has historically happened 75% of the time. A price less than $16461 would put the Mayer Multiple below 2.4X on 5 February 2018. A price of $10145 would put the price on the average multiple of 1.47X. The BTC price when this calculation was last conducted was $7000 USD.

THE MAYER MULTIPLE SINCE THE INCEPTION OF BITCOIN

Please note: Bitcoin is not normally distributed. As a result, a typical Standard Deviation model is not accurate when talking about probabilities. With that said, this is the only model we can use to try and characterize normal and abnormal behavior. If you don’t like the use of this model, contact your college statistics teacher and he can help you invest in only absolute scenarios. Regardless of our distaste for academia, this model does have limitations and might not be the best way to represent the bitcoin price!

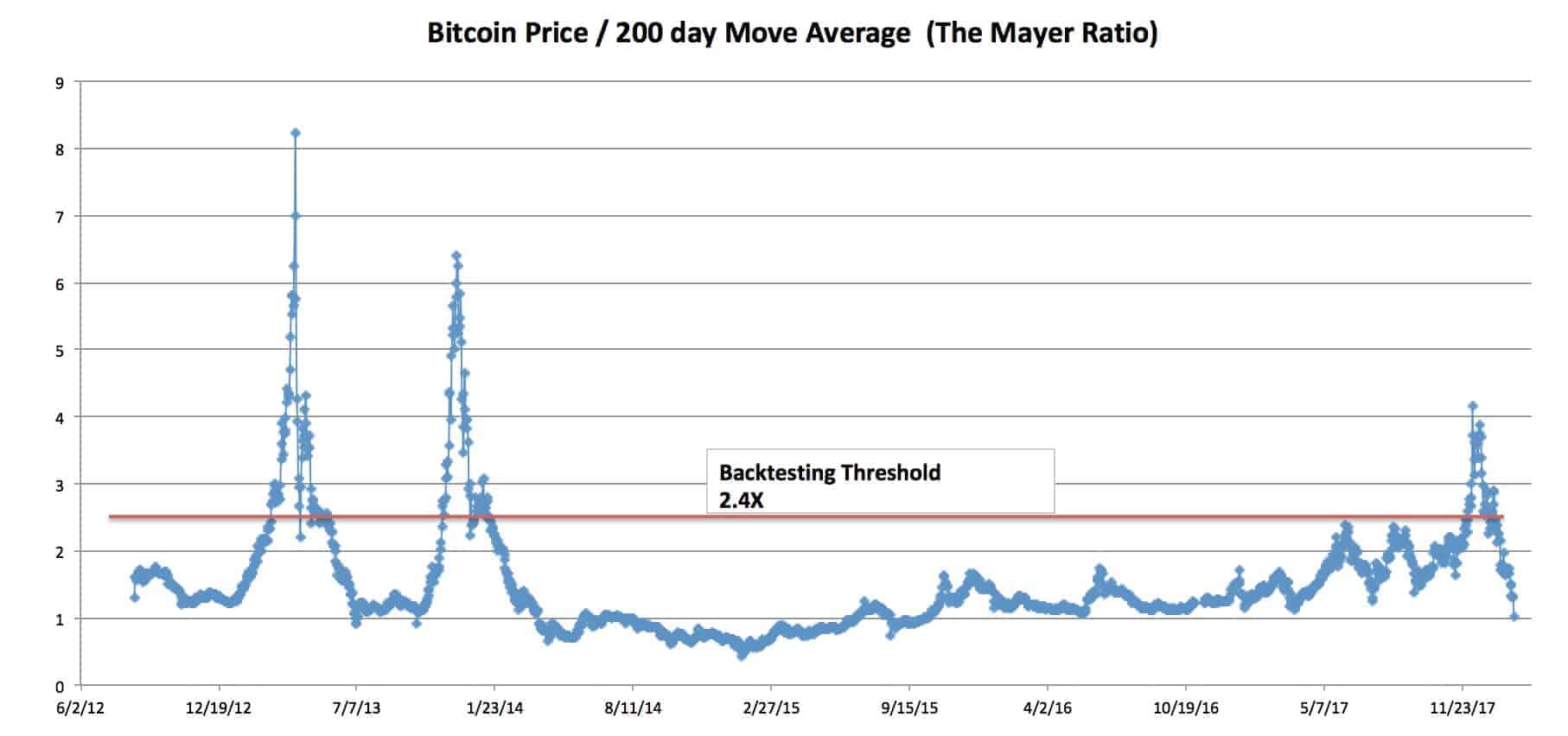

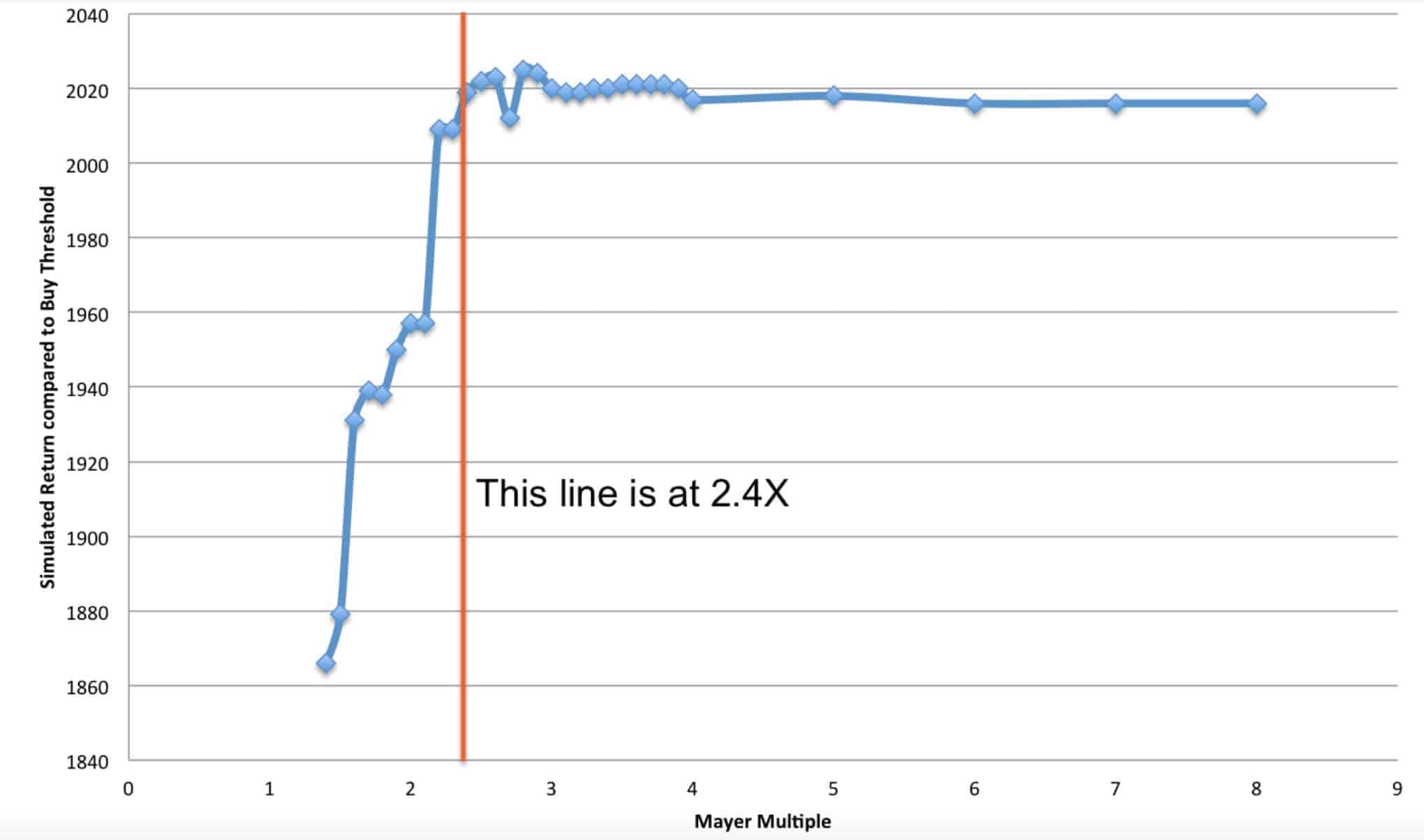

The chart below was determined by a simulation. The simulation assumed a person had $100 to invest in Bitcoin everyday since inception. There was only 1 control variable – the Mayer Multiple. If the price was < x Mayer Multiple, then the individual would buy $100 worth of BTC. If the price was >= x Mayer Multiple, the person would accumulate fiat until the price dropped back below x. The various x multiples that were tested are listed on the x axis below. When the simulation was run for various Mayer Multiples, it produced various returns (displayed in BTC on the y axis of the chart below). The chart demonstrates that anything over a Mayer Multiple of 2.4X failed to produce better results. When a multiple was selected below 2.4X, the BTC buyer got dramatically worse results. But, it’s very important to note that a new entrant buying below a 2.4X threshold would have an easier time emotionally during the first few quarters of ownership. Please note, every time the Mayer Multiple has gone above the 2.4X line, it has returned below 1.5X. In our simulation, we did not hold cash until reaching 1.5X (instead, the model simply purchased more BTC once below the 2.4X threshold). If the simulation would have waited for repurchase below 1.5X (after movement above 2.4X was achieved), the results would have likely been better than depicted below. This, however, may or many not be indicative of how the market might perform in the future, so those enhanced results were not displayed.

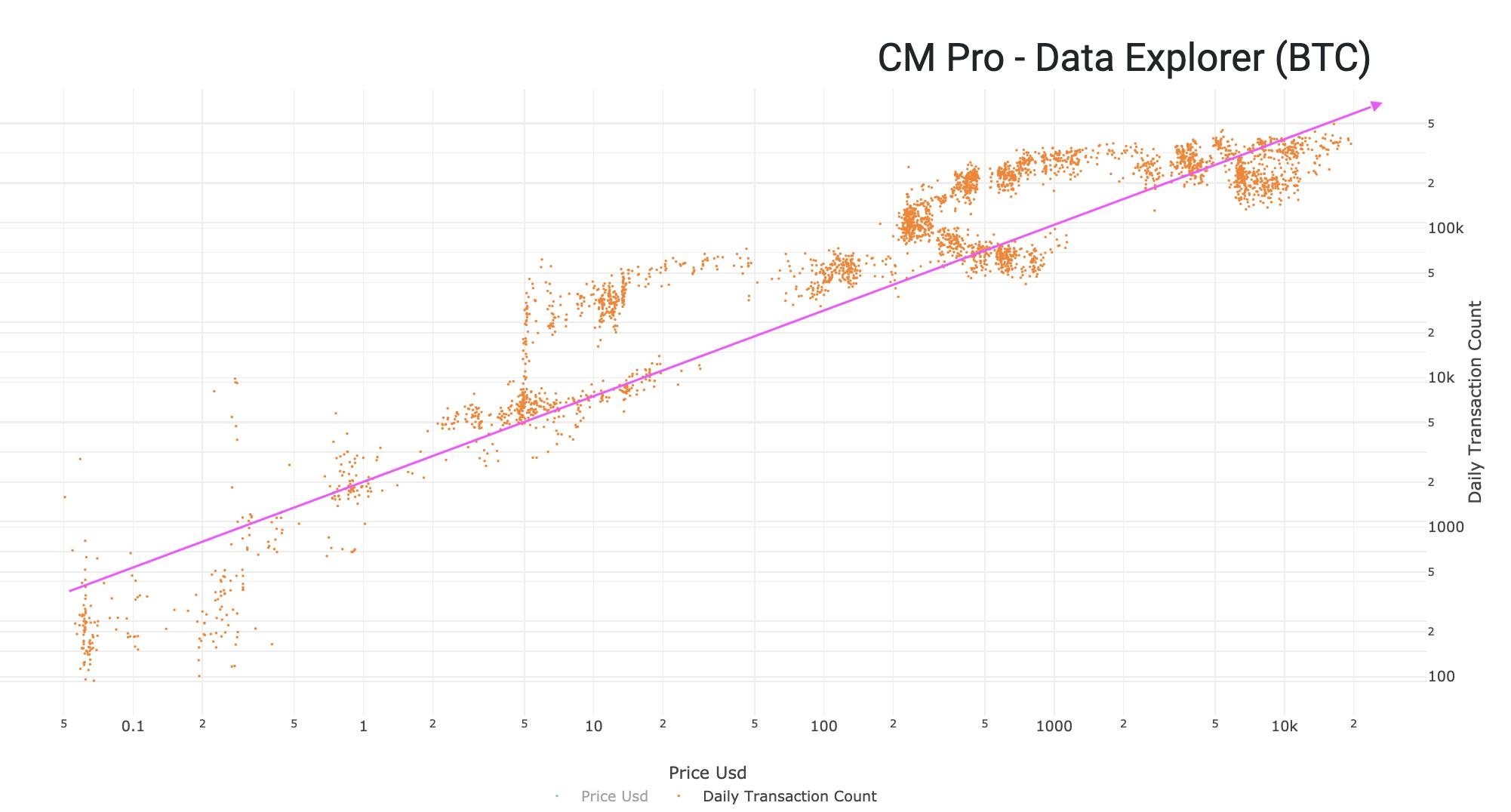

THE INTRINSIC VALUE AND NETWORKING EFFECT

The graph below shows how the value of Bitcoin might increase exponentially. The graph is derived from Metcalfe’s law that states that the value of a telecommunications network (fax machines, telephones, etc.) is proportional to the square of the number of connected users of the system. Companies like Facebook and Tencent showed that Metcalfe’s law, originally presented in 1980, held for both.

94% of the price movements from 2013-2017 has been explained by this law.

Questions? Please contact Preston Pysh or Trace Mayer .

Bitcoin’s Inflation Adjusted NVT Ratio - An UpToDate Assessment

By cryptopoiesis

Posted September 18, 2018

Noon. Herd in the steppe by Arkhip Kuindzhi c. 1895

Noon. Herd in the steppe by Arkhip Kuindzhi c. 1895

This analysis aims to take a closer look at the NVT Signal/Ratio adjusted for Bitcoin’s inflation in circulating supply, in the light of recent price developments and comparing it to the original NVT Ratio/Signal developed by Willy Woo and Dimitri Kalichkin. The data of these ratios, provides a good insight regarding the current market cycle, as well as a better understanding of the wider perspective in regard to the relevance & applicability of these metrics going forward.

” Bitcoin’s NVT Ratio Normalised for Inflation in the Circulating Supply” will be referred to as: Wookalich Ratio for short and as credit to the developers of the original NVT Ratio & Signal. Whether that will be welcomed or disapproved off, remains to be seen.

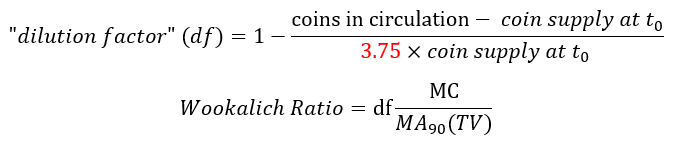

The rationale for adjusting the ratio was put forward in the article Bitcoin’s NVT Ratio Normalised for Inflation in the Circulating Supply .The Wookalich Ratio charted in this article differs slightly in methodology by further “normalising” / flattening the trend line: a denominator factor of 3.75 replacing the 4 in the equation bellow:

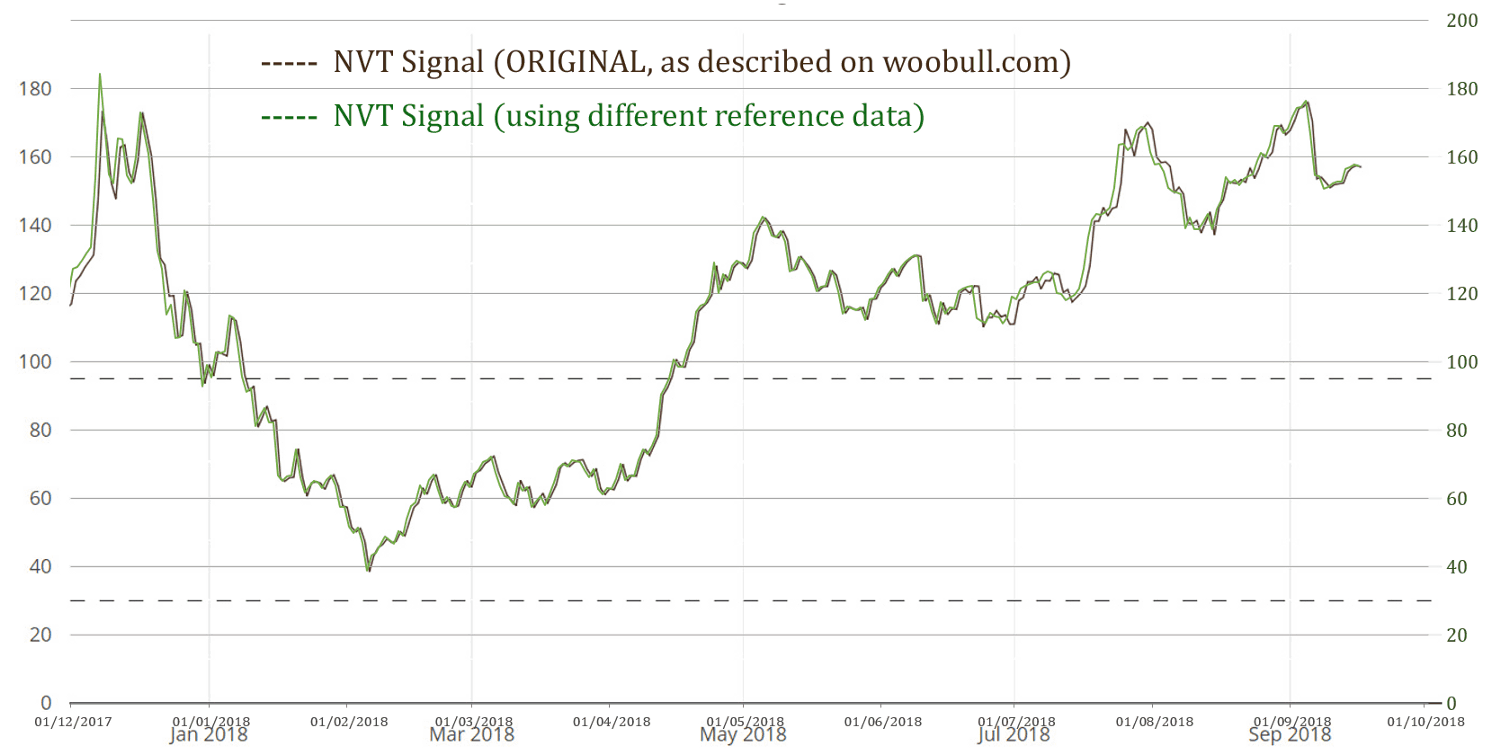

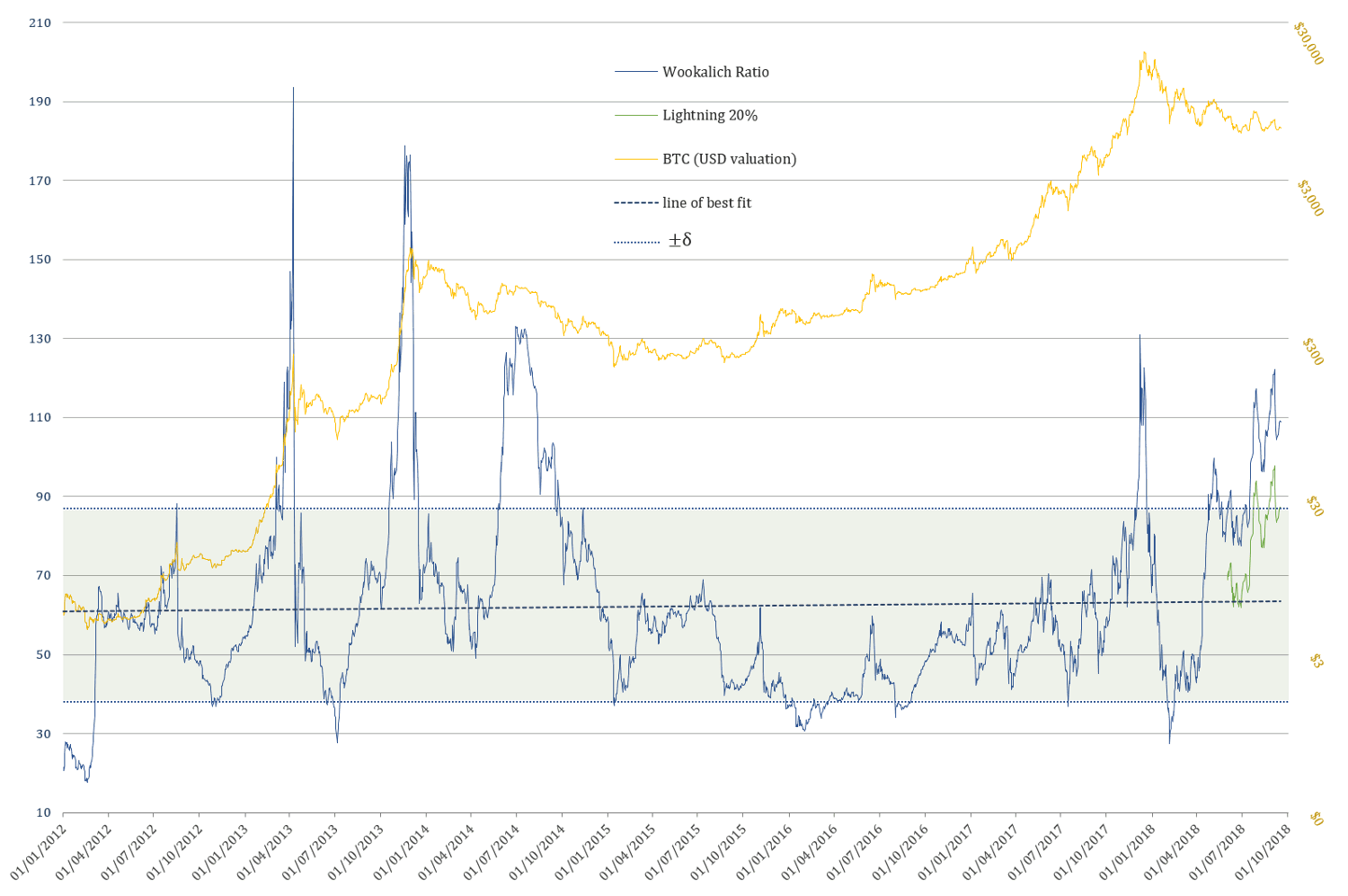

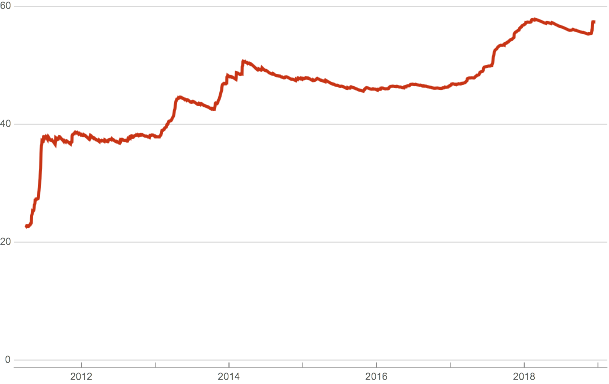

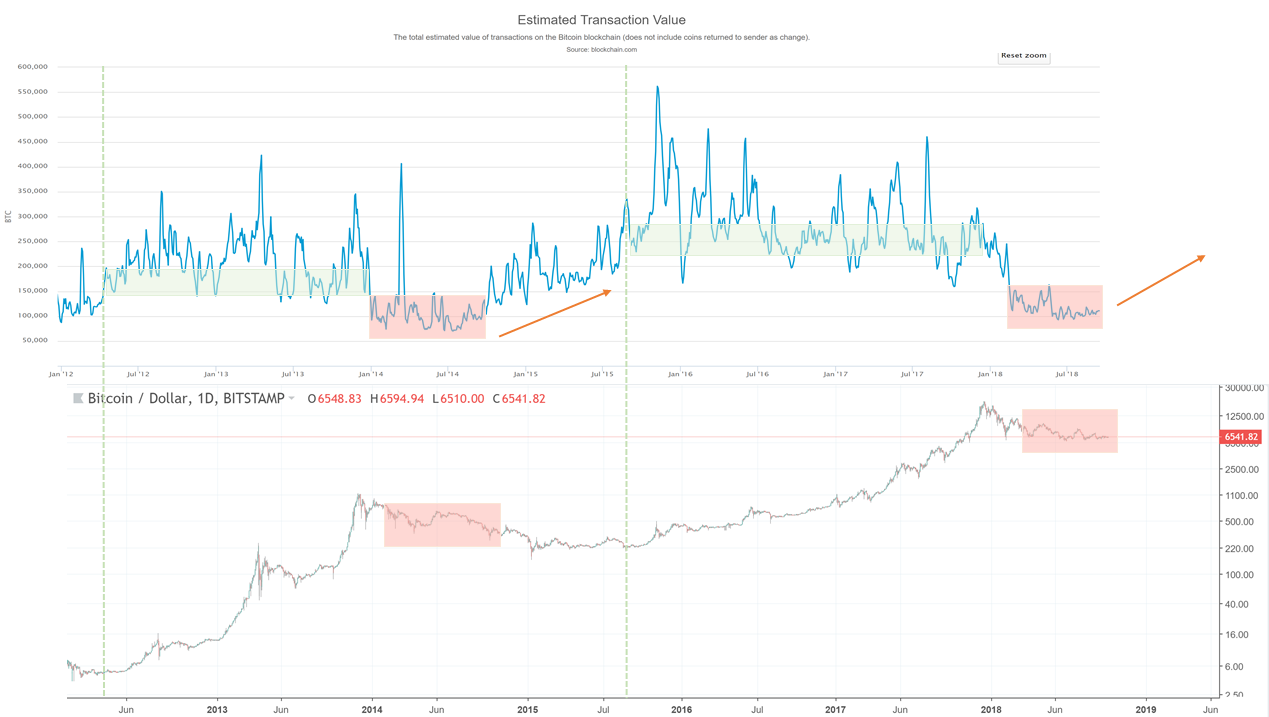

Furthermore, the Wookalich Ratio had been charted in this article using a different set of price, coin supply and market cap data. The graph below assesses the reliability of this data in comparison to that used to calculating NVT Signal on woobull.com :

From the above chart, it can be concluded that the data is compatible, giving a virtually identical NVT Signal. The one subtle, nevertheless constant, difference is the slightly (1 day) leading “bias” generated by this data. The rationale and the methodology used for this reference data are succinctly described in the article: What is the Price of Bitcoin, or its Market Cap…. exactly?

NVT Signal & Wookalich Ratio Overview

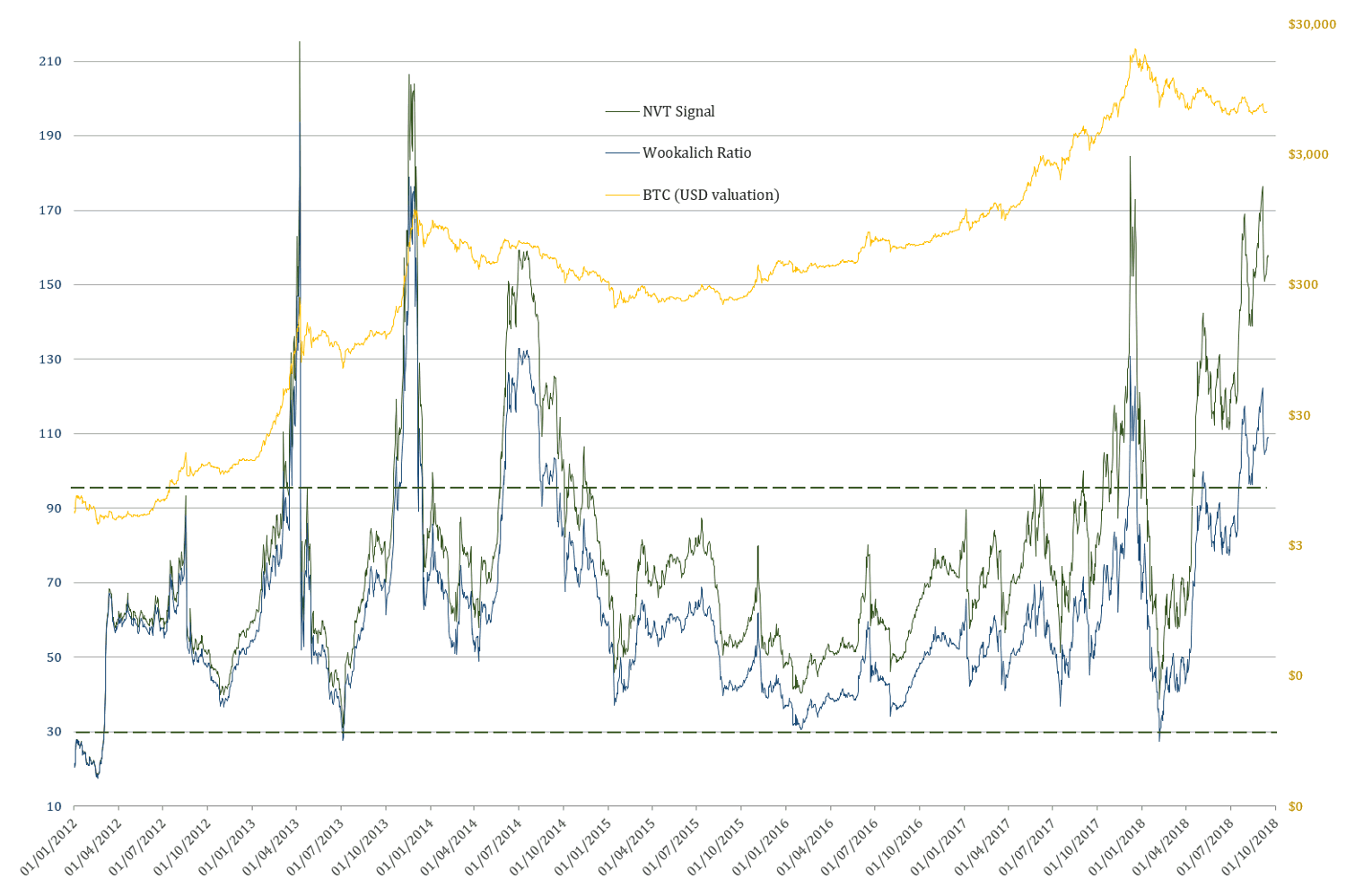

The Wookalich & NVT Ratios in all charts have been plotted against BTC dollar valuation instead of those of the Market Cap for the purpose of being more “user friendly”.

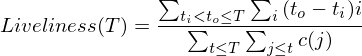

The Wookalich Ratio

2012 — Present

2012 — Present

Wookalich Ratio properties:

- Average value (since 2012): 62.24

- Standard deviation from the mean (±δ): 24.48

- Upper bound (+δ): 86.72 & Lower bound (-δ): 37.77

Taking into consideration the levels at which the line of best fit is currently at the following approximate key levels can be determined:

- Wookalich Ratio average: 63

- Upper “overbought” bound: 88

- Lower “oversold” bound: 39

Discussion

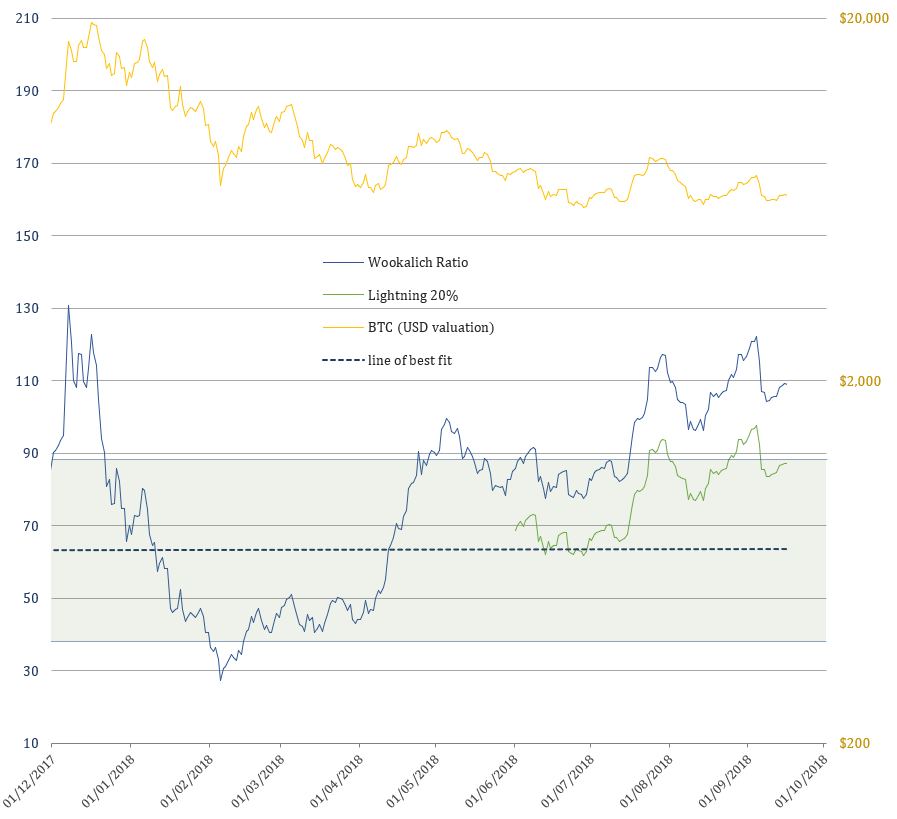

If one is to expect an oversold condition, close to an NVT Signal level of 30, similar to the 2015 capitulation, the price would have to drop to c. $1239, tomorrow, as would be the case in the coming few weeks.

However, if an oversold condition is expected to mirror the NVT Signal levels of 40, as was the case in the first 2017 “capitulation”, the price would “only” have to drop to c. $1653.

As for the denominator side of equation, the value transferred over the network has been steadily declining for a while. Furthermore, the fact that a 90 day moving average is used in calculating the NVT Signal & Wookalich Ratio ensures that this trend is not bound to change in the near future.

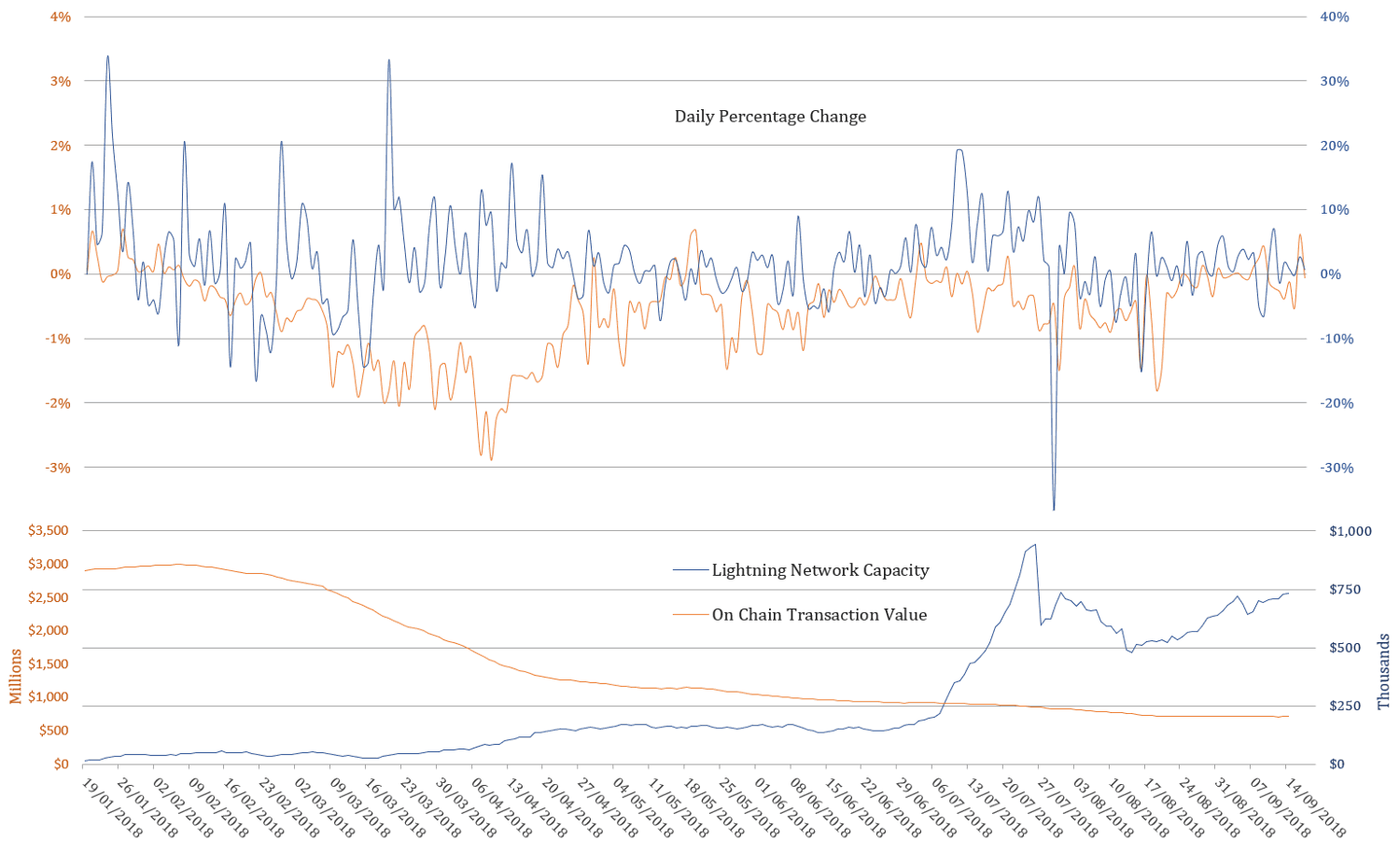

Another reason that no considerable uptick is to be expected in the on-chain TV is the increasingly adoption of Lighting Network, which, so far, remains an unknown quantity in terms of its measurable effect on the overall TV.

If the large values are transferred by rich investors, speculators and exchanges, which until very recently would have had to be solely settled on-chain, now they have the option and every incentive to make use of the Lightning Network. The “smart money” can afford being smart, thus be managed with competency on the technical part as well.

Note: On Chain Transaction Value and it’s percentage change refer to the smoothed 90d MA (as the one used in the ratios)

Note: On Chain Transaction Value and it’s percentage change refer to the smoothed 90d MA (as the one used in the ratios)

As highlighted in Brief Observations and Questions on the Lightning Network’s Effect on Bitcoin’s NVT Ratio, the Lightning Network Capacity is continuing to grow and does correlate with the on-chain TV (using percentage change). This can only be seen as proof that it is very much alive and kicking, mimicking the “on-chain behaviour”. Hence it has the potential to serve as proxy in estimating a more inclusive / overall transaction volume.

The Wookalich Ratio despite being “fudged” / normalised, it does not, however, offer any significantly less of a dire / bearish outlook. If one is expecting the metric to go into “oversold” territory (e.g. 1 standard deviation below the mean), tomorrow or in the coming weeks, the price would require taking a deep dive toc. $1615. If we are to assume that Lightning Network capacity handles 20% of the overall value transfer, the same “oversold” threshold would be reached at c. $2918.

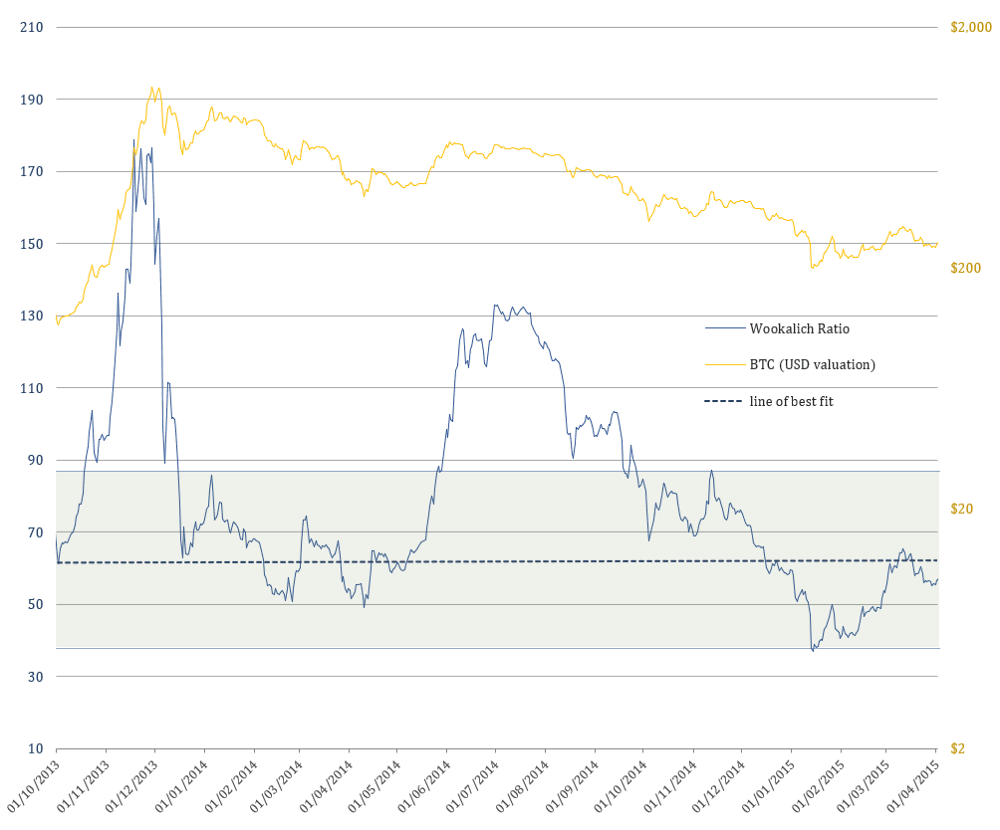

Looking back for clues into a more volatile past

2014 Bear Market

2014 Bear Market

The Wookalich Ratio could, however, signal an “oversold” level in the coming weeks, without a dramatic free fall in price, only if we are to assume the possibility that the lightning network takes care of approx. half of the overall value transfer. In this scenario an oversold level would be reached by dropping to a value of c. $4671 as of today.

Looking down a cliff or across the plains in the middle of nowhere?

2018 Bear Market

2018 Bear Market

Conclusion

If the Wookalich or NVT Signal /Ratio are to serve any purpose in the future, a method of quantifying and incorporating the transaction value over the Lightning Network would be essential.

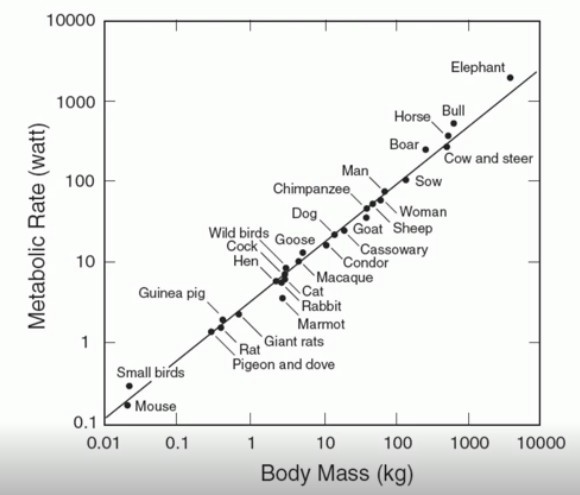

Settling just for the on-chain transaction will increasingly make this metric less relevant, much like trying to assess combustion engines in terms of horsepower and continuing to attempt to match it against that of an actual horse.

The Lightning Network Capacity could serve as a proxy metric in estimating a more inclusive TV. To what extent however, remains to be answered.

Acknowledgements

- Willy Woo

- Dmitry Kalichkin & Cryptolab Capital

Disclaimer

The content is only to be take as my personal observations and opinions for the purpose to be further considered, answered or discarded, hence this article is far from exhaustive and IS NOT and CANNOT serve as basis for any financial / investment / trading advice.

Rethinking Network Value to Transactions (NVT) Ratio

Dmitry Kalichkin

Posted February 3, 2018

This is the first post in our series on cryptoasset valuation. Second one is “ Rethinking Metcalfe’s Law applications to cryptoasset valuation “.

Cryptoasset prices have been quite turbulent in the past few weeks. At times like this it’s especially important to look at the fundamental foundations of cryptoasset prices, and quantitative metrics. Today I will share with you one of the main metrics we use in our investing decisions at Cryptolab Capital.

Emerging field of cryptoeconomic ratio analysis

In traditional finance, ratio analysis is one of the most widely used valuation methods. Lacking the detail of other valuation approaches, such as DCF analysis, ratio-based valuation is much faster and is still a good proxy of fair value. It also allows one to easily track asset price dynamic over long periods of time as well as compare different assets to each other.

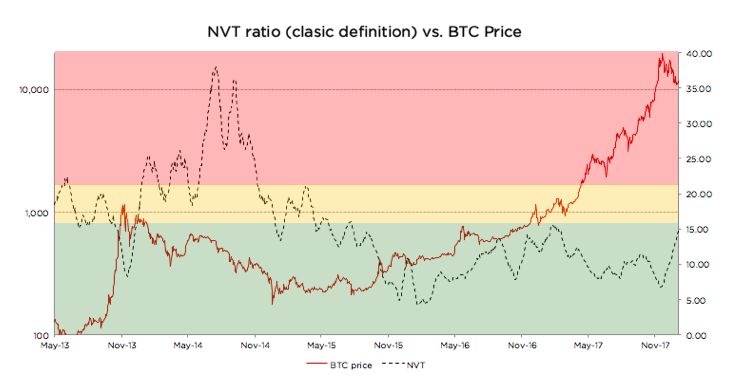

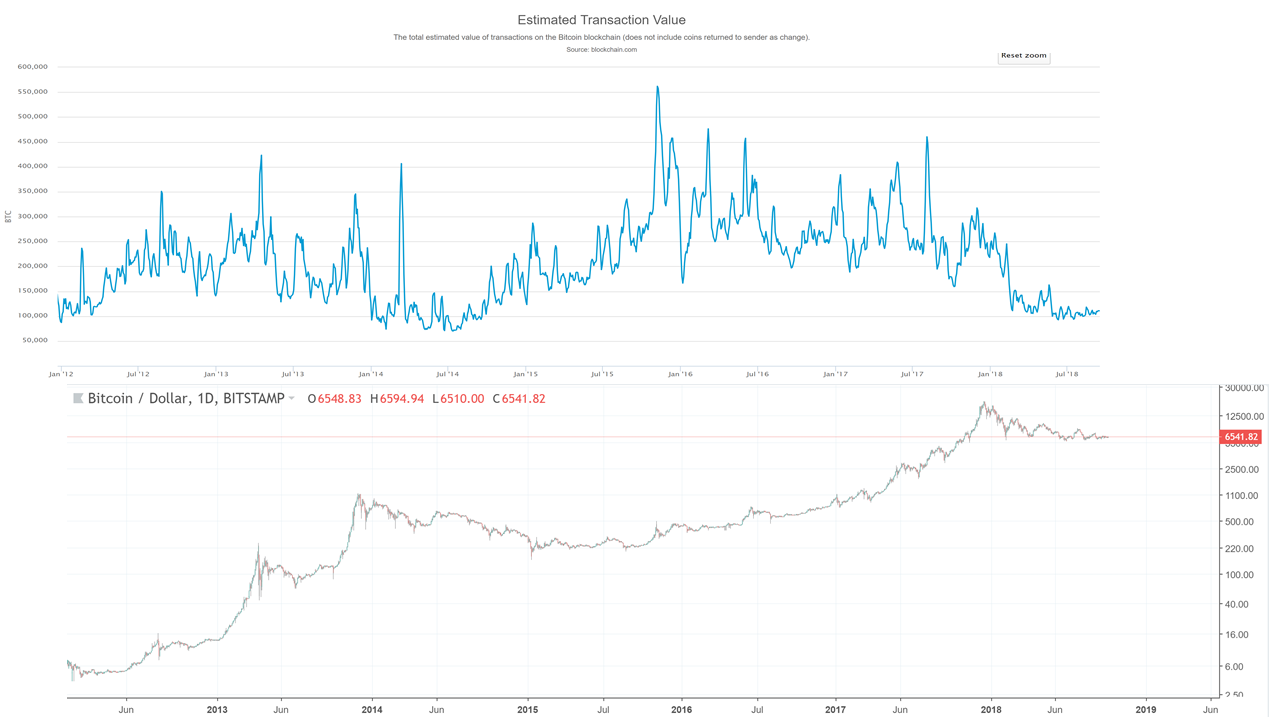

Over the course of the last year, a new study of cryptoeconomic ratio analysis emerged. The main idea behind this new field is to study the relationship between price of a cryptoasset and its fundamentals. One of the most widely known ratios is Network Value to Transactions, or NVT. Introduced and popularized by Chris Burniske, Willy Woo, and the team behind Coinmetrics, NVT is often called “crypto PE ratio.” Here’s the definition of the ratio:

In a traditional PE ratio, the earnings metric in the denominator is used as a proxy for the underlying utility of the company created for the shareholders. While cryptoassets don’t have earnings, one can argue that the total value of transactions flowing through the network is a proxy for how much utility users derive from the chain. It is worth highlighting that Daily Transaction Volume in NVT takes into account only on-chain transactions. All the trading activity that happens on exchanges and is, for the most part, speculative is not included in this volume.

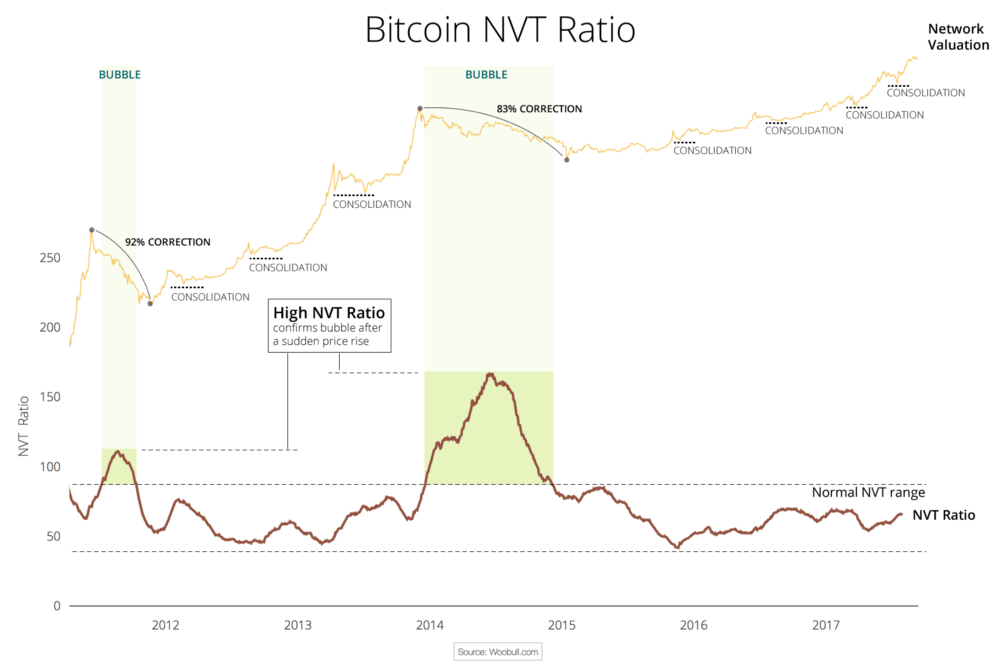

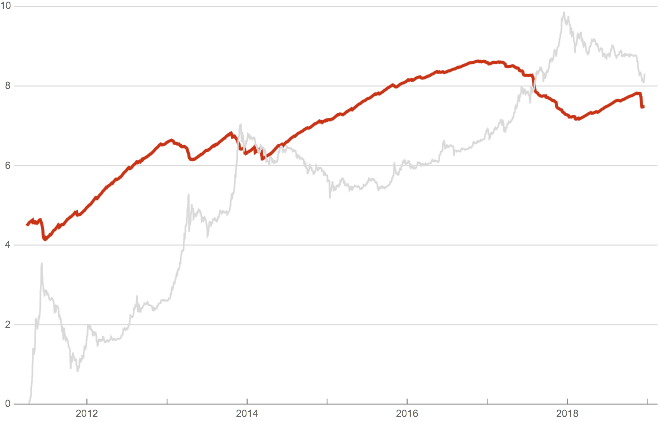

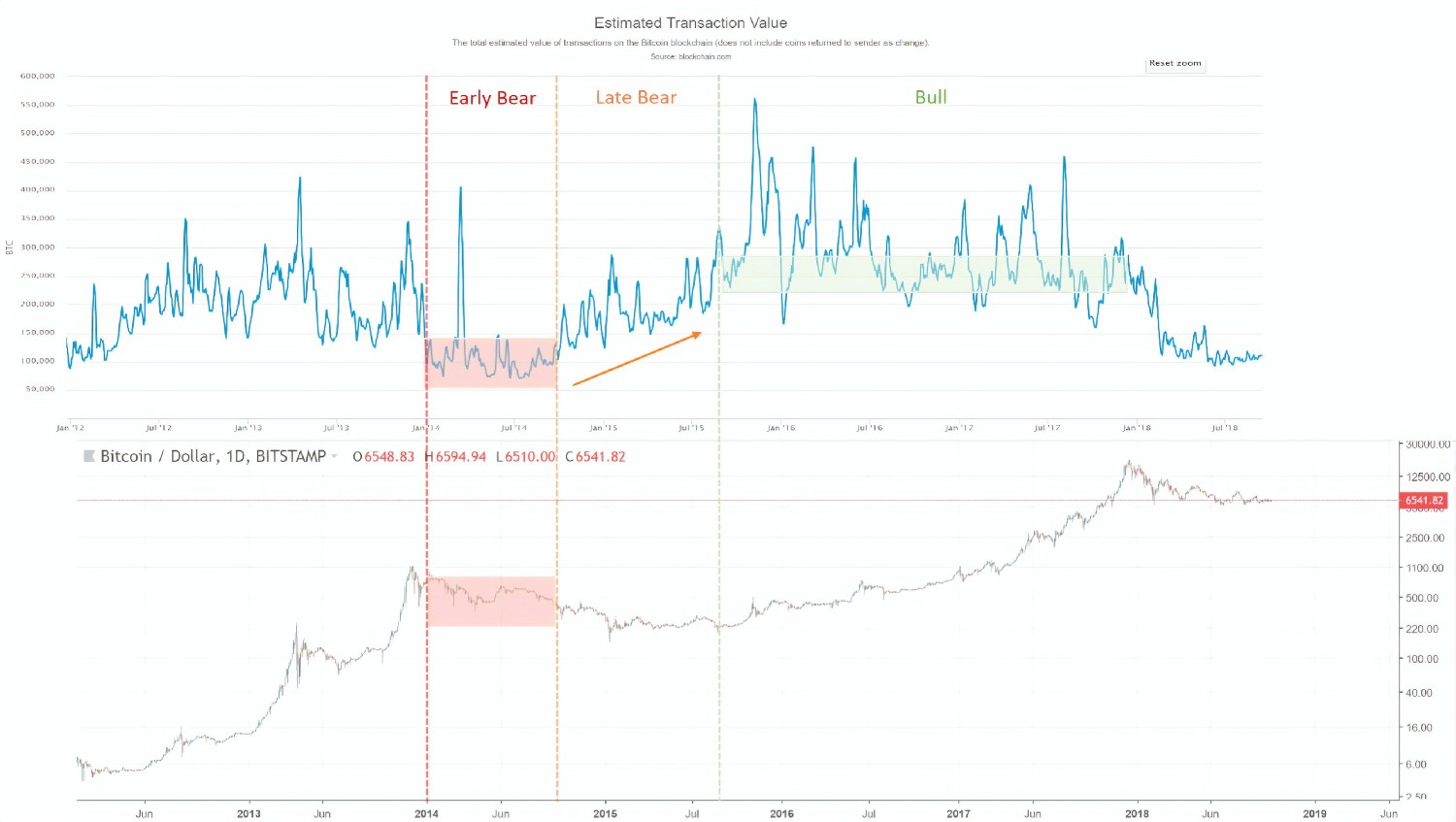

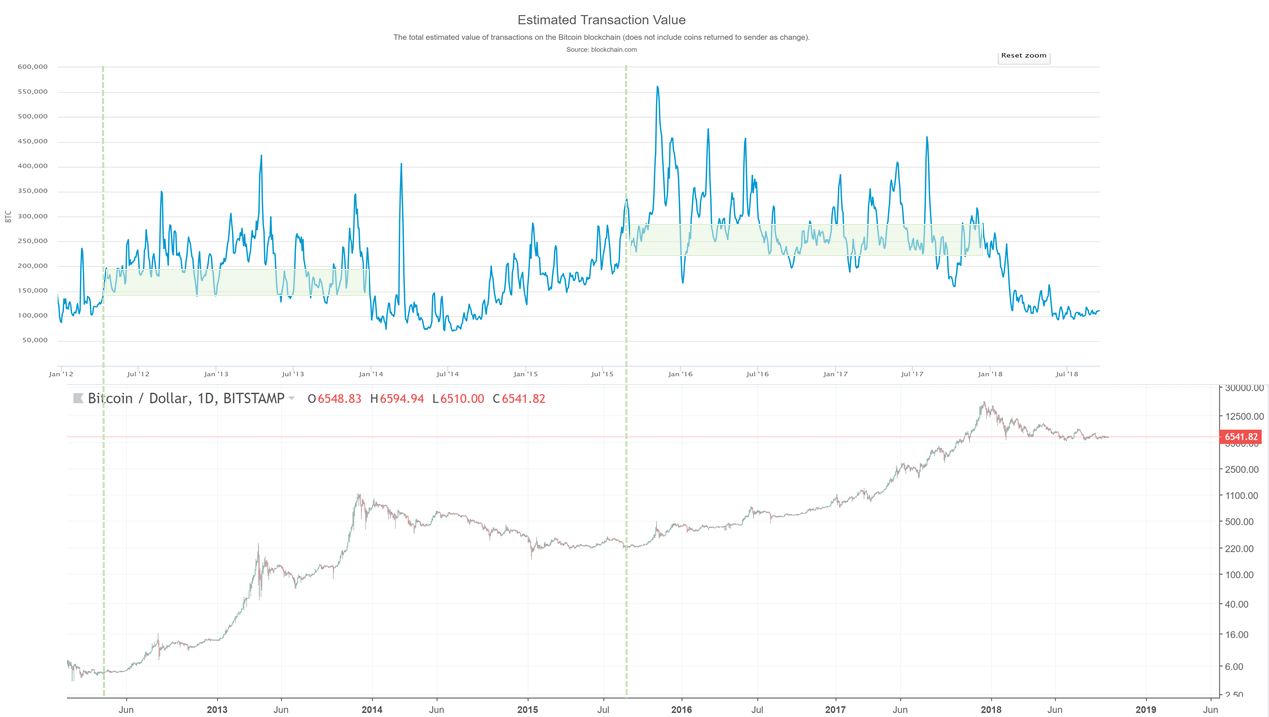

This Forbes article argues that NVT can be successfully used to detect bitcoin price bubbles when valuation is not supported by fundamentals and differentiate them from consolidations. The chart below concisely illustrates this argument.

This chart also greatly illustrates what we at Cryptolab Capital don’t like about NVT in its current form. The spike in NVT follows the bubble with a considerable lag of a few months.Peak NVT coincides with the middle of a correction period. NVT is neither predictive (doesn’t precede the overvaluation), nor descriptive (doesn’t coincide with it). You can only detect the bubble a few months after it bursts.

Rethinking NVT ratio

Trying to dissect this issue and improve this ratio, we started by looking at the ratio definition:

“Ratio has been smoothed using moving averages, 14 day forward and 14 day backward facing…“

Mathematically speaking, this means the following:

Hereinafter:

- NVT_Classic stands for “Classic definition of NVT”

- 28 MA_is “ _28-day Moving Average”

- NV is “ Network Value in USD”

- TV is “ Transaction Volume in USD”

Let’s pause here and look back at the conceptual meaning of NVT. In this ratio, Transaction Volume is used as a proxy for fundamental network utility value. When you look at Transaction Volume on a daily basis, there is a lot of noise, so I completely agree with the decision to smooth it by using a 28-day Moving Average. But we asked ourselves a few questions:

- Why 28 days, and not 10, 30, 90, or 180? A 28-day average might be not enough for a truly fundamental metric.

- Why 14 days forward and backward? If we are trying to develop a predictive, or at least descriptive, indicator we shouldn’t rely on future data.

- Do we need to smooth both parameters — ratio as a whole — or just the denominator?

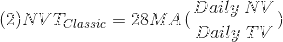

We then experimented with different Moving Average periods, and came to an empiric conclusion that the optimal solution is to divide daily Network Value by 90 days Moving Average of Transaction Volume. So here’s a definition of our new NVT ratio:

Comparing old and new NVT for bitcoin

Source: author’s calculations

Source: author’s calculations

As can be seen from the chart above, when we move from a 28-day Moving Average to a 90-day Moving Average NVT definition, we get rid of the time lag issue described above. We can also see that every time NVT went to the Yellow or Red zone (autumn 2013, spring 2014, December 2017), a price correction followed.

We claim that this refined NVT ratio is a better descriptive metric of bitcoin bubbles. Conceptually, this makes sense. Given that Transaction Volume in NVT is a proxy for fundamental utility value of the network, a 90-day Moving Average is a better proxy for long-term fundamental value than a 28-day Moving Average.

Let’s now look at the recent bitcoin price performance using the refined NVT ratio in more detail. From January until mid-December 2017, bitcoin has appreciated almost 20x. For the most part of this rally, though, NVT ratio has stayed in the Green Zone. However, in December when price reached almost $20,000, NVT went into the Yellow for a few days. This rapid appreciation was shortly followed by a 30% price correction, and another even steeper price correction in the last weeks. After the correction, NVT has returned to the Green zone. This is another empiric evidence in support of 90 MA NVT.

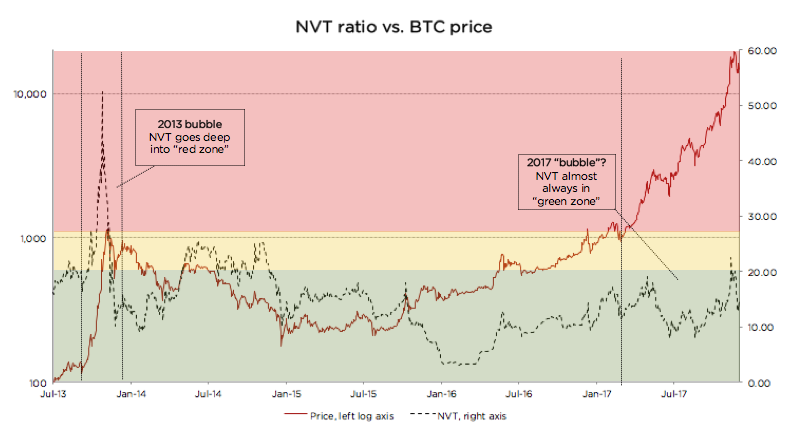

Looking at the chart below, it is much harder (if at all possible) to foresee the December 2017 correction. Quite the opposite, during late 2017 price rally, NVT went down! How can it be?

Source: author’s calculations

Source: author’s calculations

There is a non-static non-linear relationship between the numerator and denominator of NVT. Every time there’s a sharp increase in price, there’s growth in trading activity (off-chain transactions) that is shortly followed by on-chain transaction volume growth as investors liquidate their positions. Exchanges and wallets trade with each other to provide liquidity to their users. All this activity increases on-chain transaction volume, even though it is fully speculative.

In other words, the cryptoassets exhibit reflexivity. In the short run, the price changes the fundamentals. In this case, transaction volume follows price. I don’t want to go into much detail on this, but I can refer you to an excellent article on the topic by the Coinmetrics team: “ Mean-reversion and reflexivity: a Litecoin case study “.

So why does a longer period average result in a better indicator? Intuitively it makes sense. By definition, the role of Transaction Volume in the NVT denominator is to be a proxy for fundamental utility that users get from using the network. A longer smoothing period helps to get rid of the reflexivity effects described above — spikes in transaction volume that follow sharp price increase. These irregularities are speculation-driven and are bad descriptors of fundamental intrinsic utility of the network. When we remove these irregularities, we end up with a better proxy for fundamental value in NVT denominator, and, as a result, the new NVT ratio becomes a better descriptor of price level.

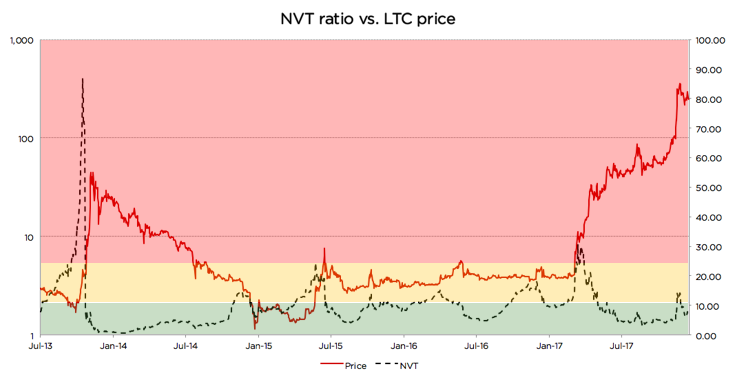

Analyzing Litecoin using the refined NVT

Source: author’s calculations

Source: author’s calculations

Looking at the chart, we can see that there were at least 3 cases since 2013 when the same logic applied: price spikes coincided with, or in some cases were even preceded by, spikes in 90-day NVT

- Autumn 2013

- Summer 2015

- Autumn 2015

- Late 2017

However, in a few cases it didn’t work as well. Those cases are usually explained by a strong trend or some big external news:

- In late 2014, an NVT spike happened during a one-year-long price correction, and the price just kept going down. A similar dynamic can be seen on the BTC graph above during the correction of the second half of 2014. NVT spiked a couple of times while BTC price was steadily declining.

- Most interestingly, in April 2017 NVT spiked really high, but price actually went up! Here there were a couple of strong external factors: (1) SegWit adoption speculation, and more importantly, (2) listing on Coinbase in May that propelled asset price to a whole new level and moved LTC to another league. The price did increase significantly, but the fundamentals shortly followed.

Despite these exceptions, the descriptive power of the refined NVT for detection of overvaluation is still quite strong. It is definitely stronger than that of the currently used NVT.

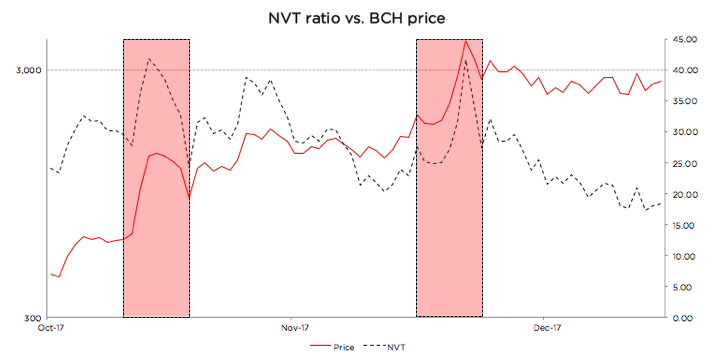

Using new NVT for BCash

Source: author’s calculations

Source: author’s calculations

BCash is quite new, and its history has been full of breaking news, hostile attacks on bitcoin, and other exogenous events. Given this, it is hard for us to define the limits of the Green, Yellow, and Red zones for this currency. If we were forced to state Cryptolab Capital’s opinion, we would likely say it is rather overvalued at the moment, the NVT might still be in the Red zone, and the fundamentals have to catch up for the price to make sense.

But one thing that can be seen from the chart above is the sharp NVT spikes coincide perfectly with local price maxima. Yet another win for redefined NVT.

Summary

For every investor it is of crucial importance to understand what is going on in the market right now. As a result of Cryptolab Capital research, we have designed a metric that describes price bubbles well and without a time lag across different time periods and assets.

There is, however, another more fundamental weakness of NVT. It only takes into account total value of on-chain transactions, but it doesn’t factor in the number of transactions or the number of addresses (wallets) participating in these transactions. Let’s call this metric Daily Active Addresses (DAA).

For internet companies, especially marketplaces, social networks, and other businesses with strong network effects, the analogous Daily Active Users (DAU) indicator is one of the most important performance and valuation metrics. This and other metrics that now make up the language of valuing internet companies didn’t exist in the 1990s. It has been developed by technology investors over the last 20+ years. Similar valuation framework for cryptoassets is yet to be developed and is only starting to form.

In our next post, we will try to contribute to this framework and propose a way to use Daily Active Addresses (DAA) in cryptoasset network valuation.

Acknowledgements

I wanted to thank a few people who contributed to my understanding of cryptoasset investing, and gave valuable feedback in the process of this research:

- Professor Susan Athey from Stanford

- Professor Christian Catalini at MIT

- Chris Burniske from Placeholder.vc

- Willy Woo

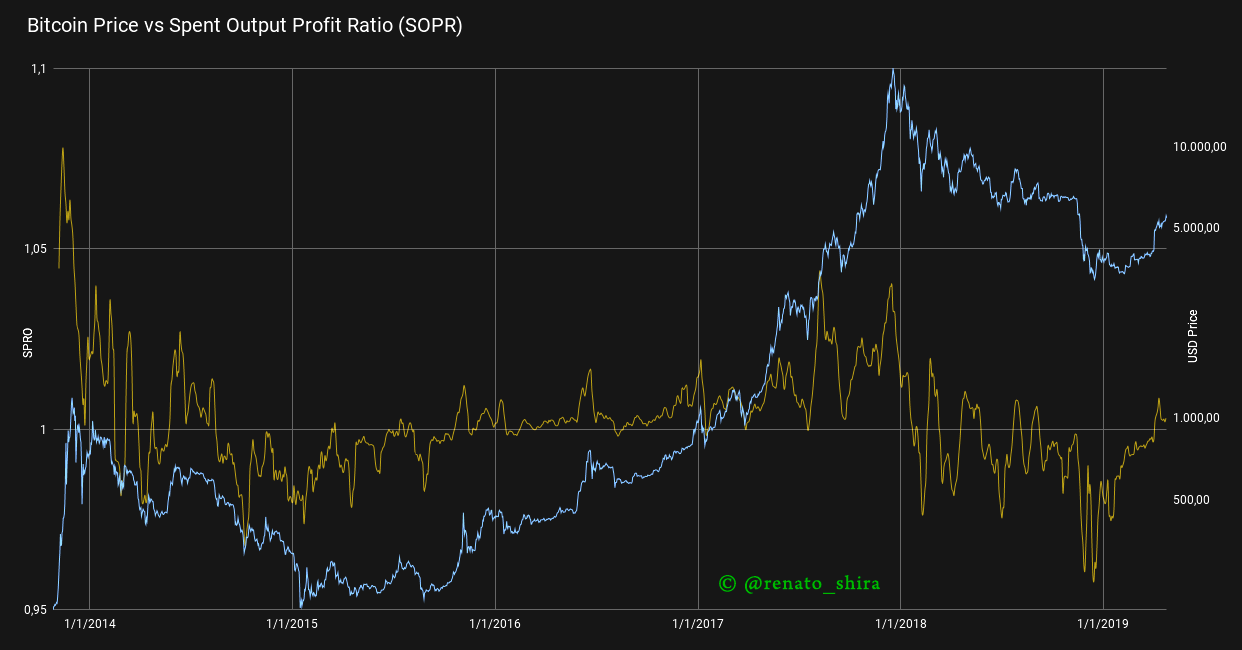

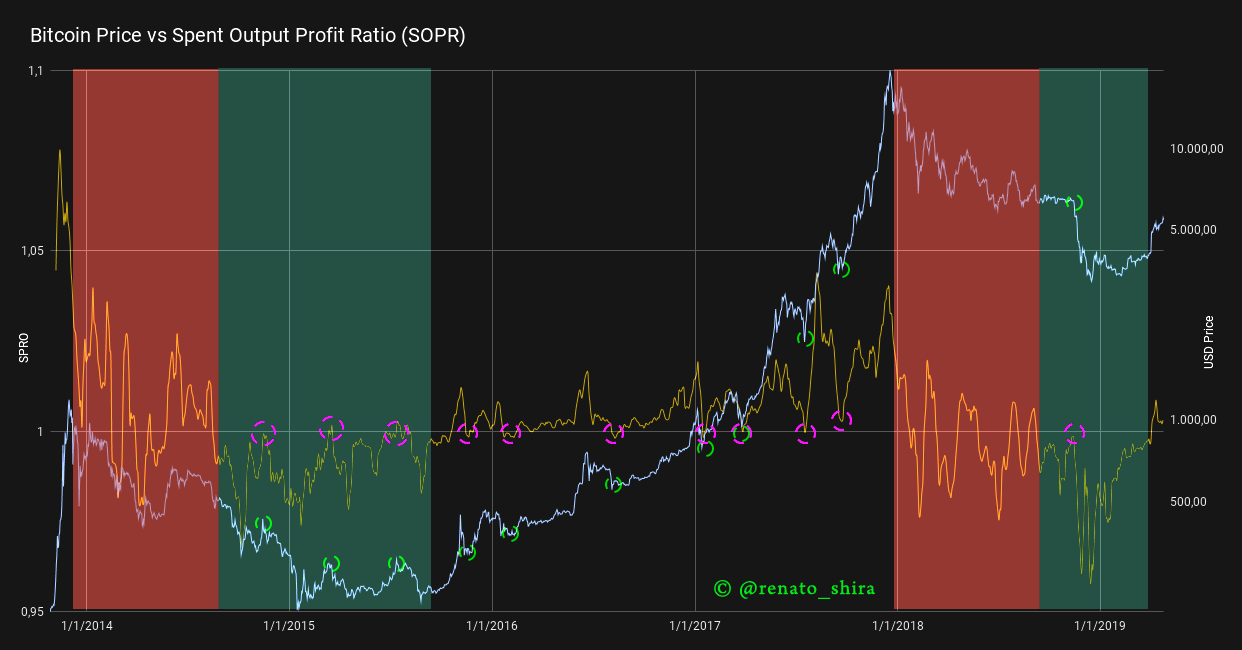

Introducing SOPR: spent outputs to predict bitcoin lows and tops

PostedRenato Shirakashi

By April 25, 2019

One of the best things about Bitcoin is how the data is available for analysis. The blockchain itself can provide a lot of information on the money flow, and from these we can infer a lot on people’s sentiment and behavior.

In this analysis two important psychological turning points that significantly change the supply of bitcoin are going to be described by introducing a new oscillating indicator that signals when these major supply changes occur, using blockchain data.

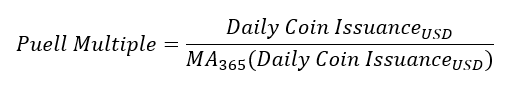

Introducing the Spent Output Profit Ratio (SOPR)

The SOPR a very simple indicator. It’s calculated from spent outputs. It’s the realized value (USD) divided by the value at creation (USD) of the output. Or simply: price sold / price paid.

When SOPR > 1, it means that the owners of the spent outputs are in profit at the time of the transaction; otherwise, they are at a loss

By plotting the SOPR of all spent outputs combined, aggregated by the day in which they were spent (using blockchain date), the graph can be produced

SOPR (sma 10) vs Price

SOPR (sma 10) vs Price

There are several interesting observation that can be made from the chart above. First of all, SOPR appears to oscillate around the number 1. Secondly, during a bull market values of SOPR below 1 are rejected, while during a bear market values of SOPR above 1 are rejected. Therefore, the SOPR oscillator could serves as a reliable marker for identifying local tops & bottoms. This feature is highlighted in the graph below

SOPR (sma 10) vs Price — Highlighted

SOPR (sma 10) vs Price — Highlighted

Ignoring the areas in red, in which the SOPR is unstable (at the beginning of a bear market), it seems to work like a charm! But why?

People, in general, are much more comfortable selling when they are in profit(you can read more about this Daniel Kahneman’s work, Nobel prize 2002). In a bull market, when SOPR falls below 1, people would sell at a loss, and thus be reluctant to do so. This pushes the supply down significantly, which in turn puts an upward pressure on the price, which increases.

Bull market example

Bull market example

In a bear market, everyone is selling or waiting for the break-even point to sell. When SOPR is close/greater than 1, people start to sell even more, as they reach break-even. With a higher supply, the price plunges.

Bear market example

Bear market example

Due to the fundamental nature of underlying metrics on which the SOPR relies on, it would be fair to speculate that the Spent Output Profit Ratio is influencing price changes. This can be of considerable significance, since most current indicators are lagging indicators.

Next steps will be to further explore SOPR using different time-frames for the spent output as well as value sizes.

Interesting things to notice:

- SOPR suggests the bull run is starting

- SOPR also suggests the capitulation in 2018 was, technically speaking, pretty nasty ; and yes, there was pain,even when compared to 2015.

This is a preliminary work, if you want to have updates on this and future work, please follow me on twitter: @renato_shira

Revision by: @cryptopoiesis

Bitcoin Market-Value-to-Realized-Value (MVRV) Ratio

Introducing realized cap to BTC market cycle analysis

By Murad Mahmudov and David Puell

Posted October 1, 2018

Disclaimer: Nothing contained in this article should be considered as investment or trading advice.

Nic Carter from Castle Island Ventures (in a co-effort with Antoine Le Calvez from Blockchain.info) has recently presented his newly-termed concept of realized cap at Riga Baltic Honeybadger 2018 conference, inspired by some previous ideas of Pierre Rochard. Nic was kind enough to share some of his findings and data with us after the conference, and we wanted to delve into some analysis of the information available to us. For the purposes of this article, let’s define a couple of terms:

Market value

Otherwise known as total market capitalization, it applies to Bitcoin if you were to multiply the latest available BTCUSD trading price on exchanges by the number of bitcoins mined thus far (currently standing at 17,299,787 BTC as of Oct. 1, 2018).

Realized value

Instead of counting all of the mined coins at equal, current price, the UTXOs are aggregated and assigned a price based on the BTCUSD market price at the time when said UTXOs last moved.

The Logic Behind Realized Value

Realized cap’s effectiveness intuitively seems to adjust for two aspects of BTC’s nature: (1) lost coins, and (2) coins used for hodling, establishing the collective psychological sum of entries when users began seeing Bitcoin’s value and long-term potential. Realized cap seems to suggest the final layer of people’s cumulative cost basis and, in recent history, the ultimate line of “center of mass” where 2017 strong buyers remain unrattled by short-term uncertainty.

One way of looking at realized value is that it helps us eliminate some of the lost, unused, unclaimed coins from our total value calculations. Another way is seeing it as an indicator of the sum of levels where groups of long-term, legit, buyer-hodlers entered into their Bitcoin positions, with local and immediate emotions and manias stripped out.

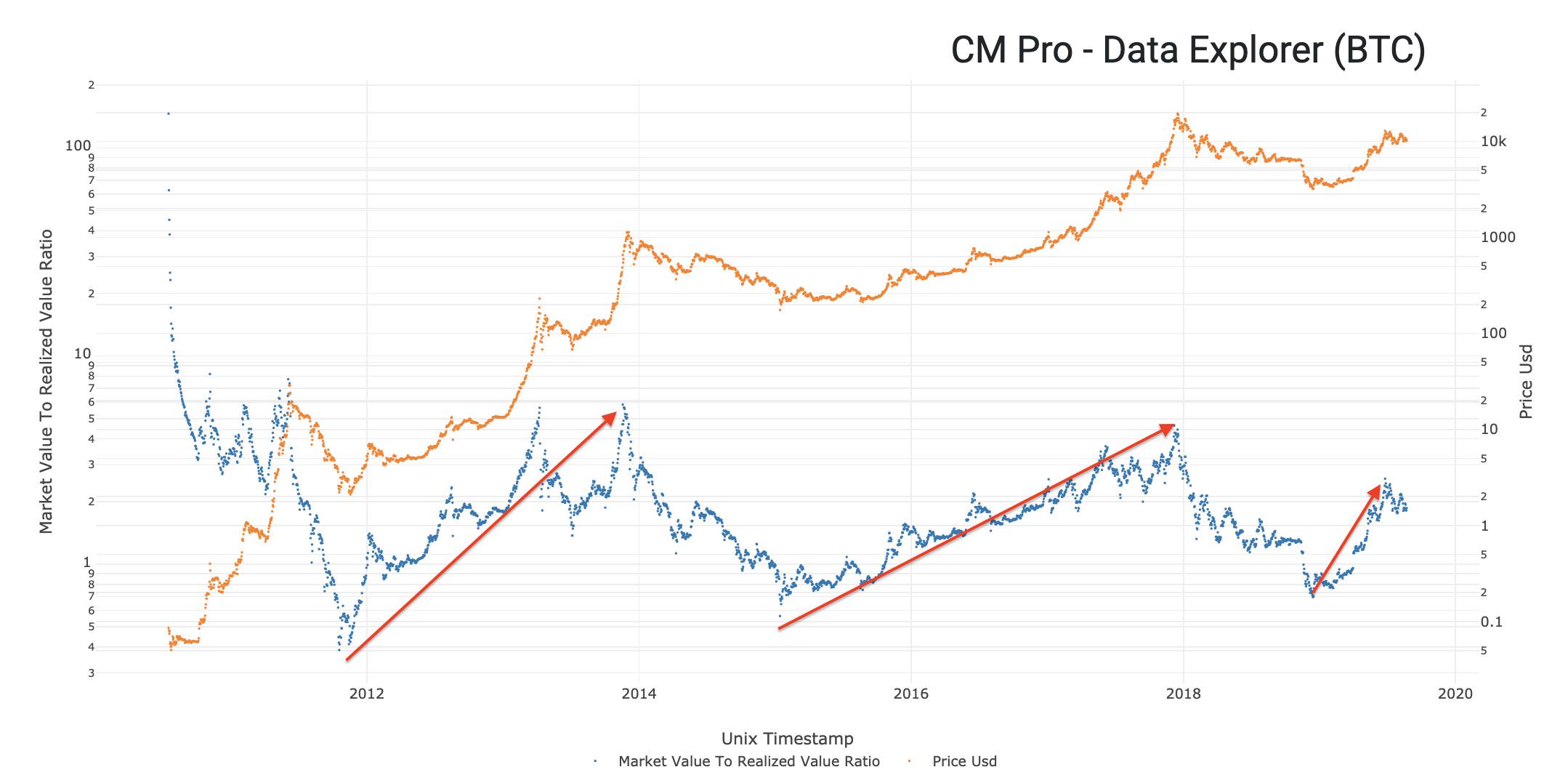

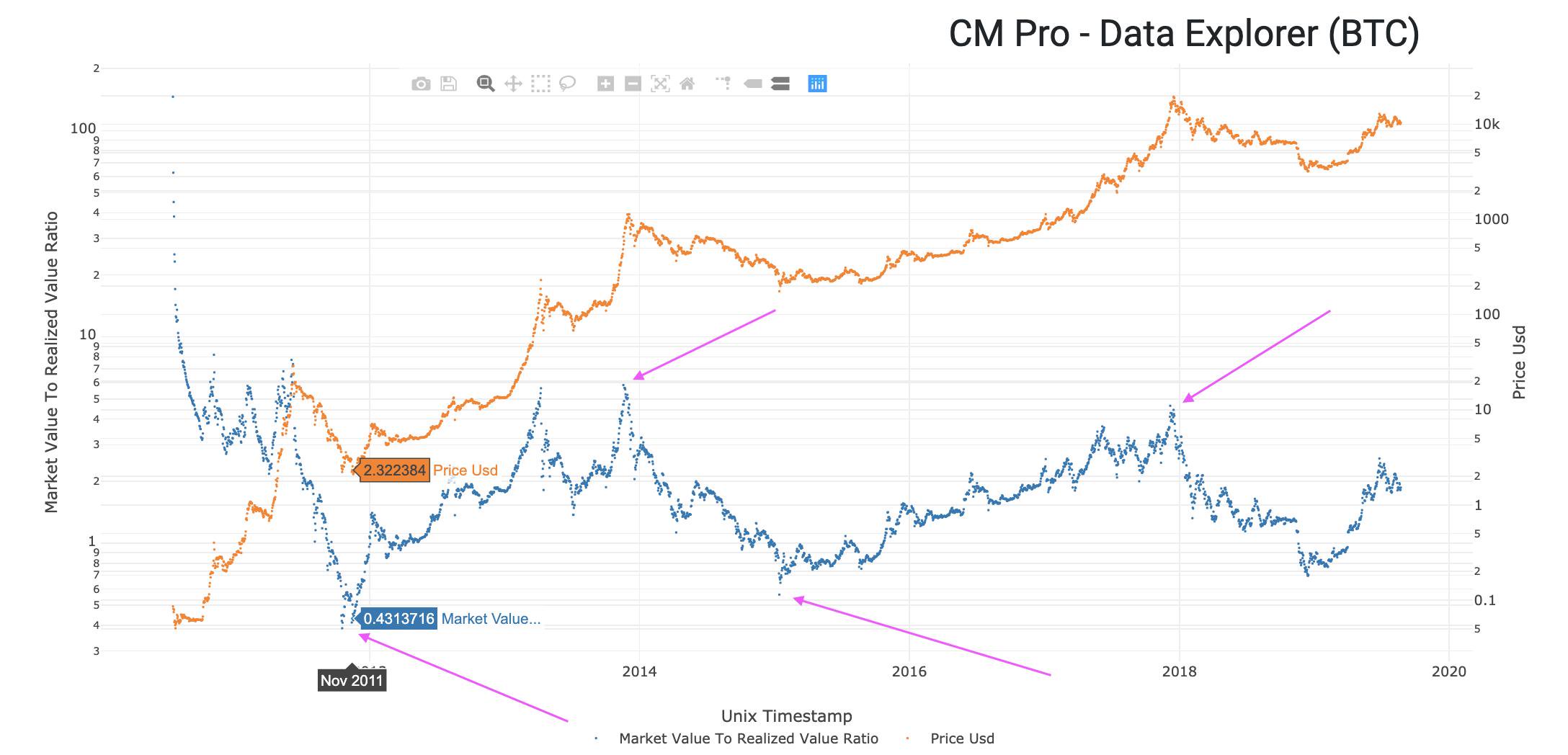

MVRV Ratio

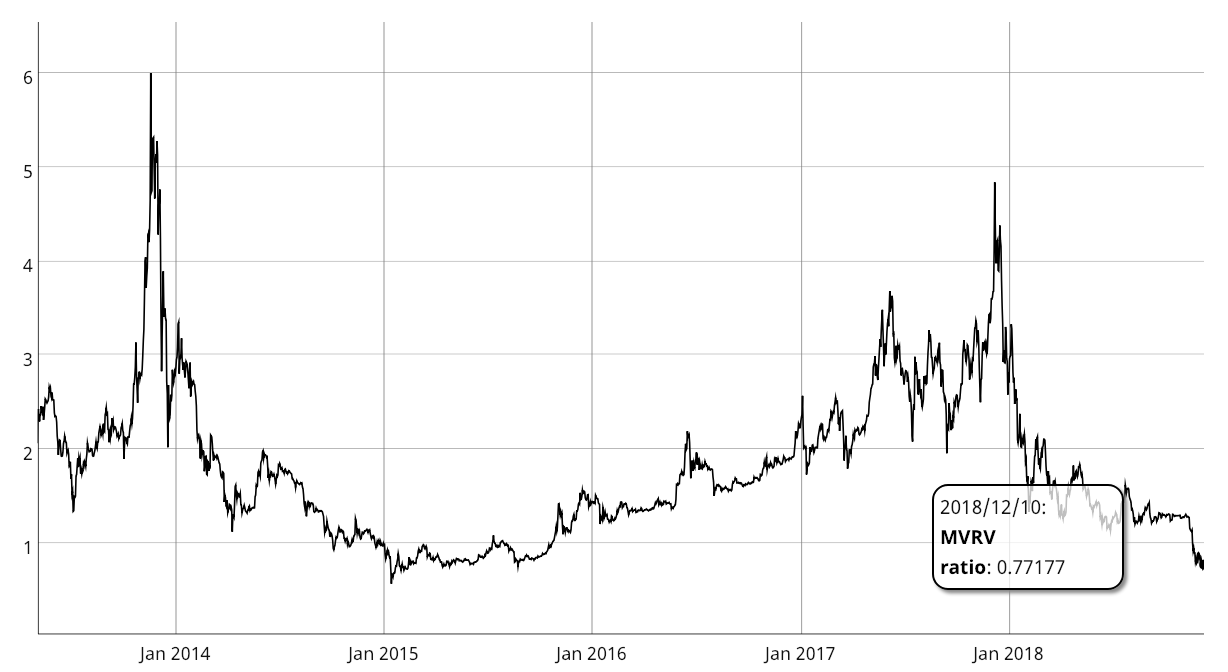

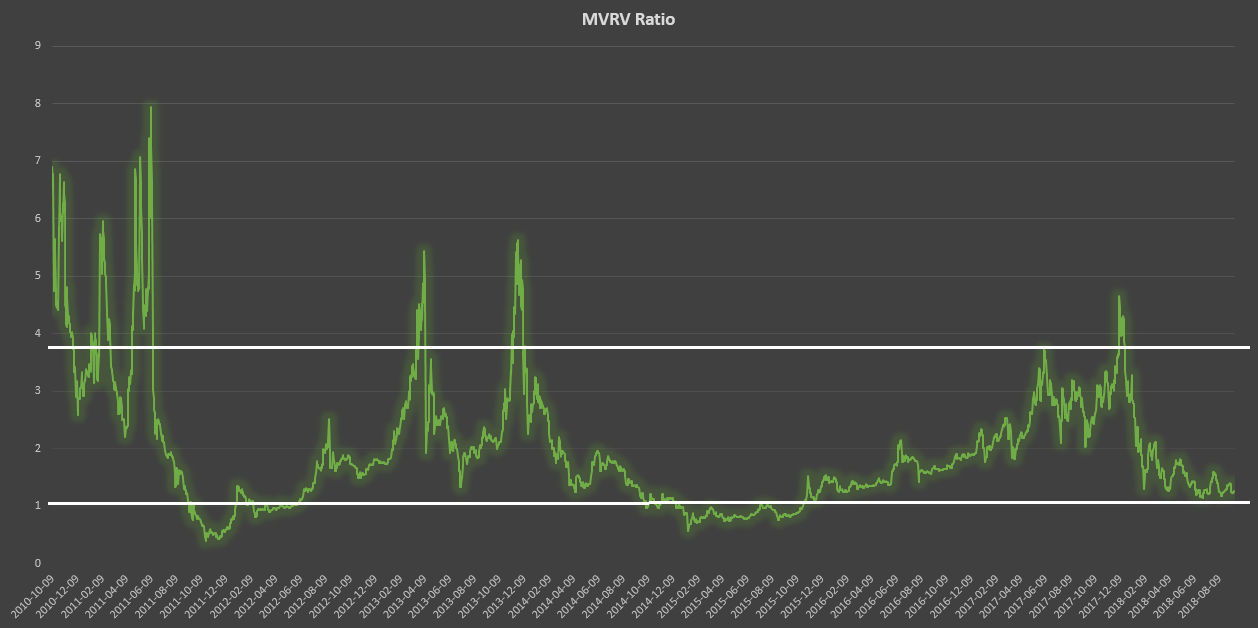

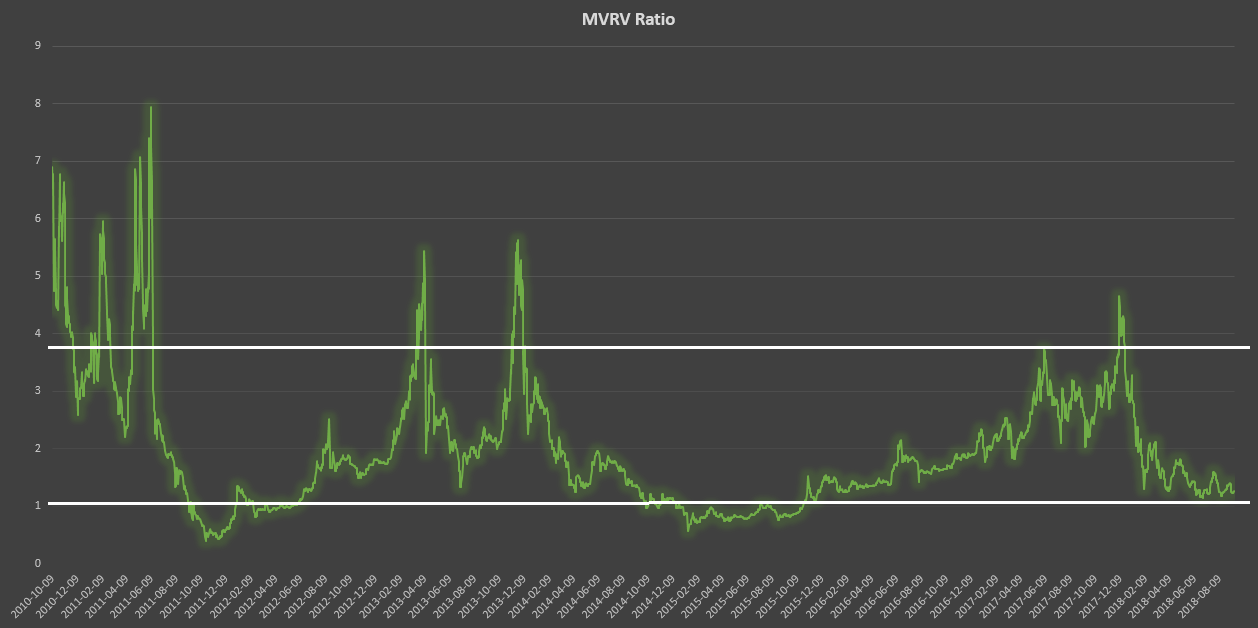

MVRV is calculated by simply dividing market value by realized value on a daily basis (in this case from Oct. 9, 2010 to Sept. 14, 2018). This formula provides the following oscillator:

From this calculation, two historical thresholds emerge: 3.7, which denotes overvaluation, and 1, which denotes undervaluation. It is also interesting to see how MVRV evokes both the Mayer Multiple and Dmitry Kalichkin’s NVT signal without the need for a moving average.

Market Dichotomy?

A theoretical framework for this ratio would echo a dichotomy that can be best expressed in the following:

- Speculators vs. hodlers.

- High time preference vs. low time preference (as argued by Saifedean Ammous in chapter 5 of The Bitcoin Standard).

- Irrational exuberance vs. uncertainty acclimation (as argued by Jimmy Song in “The Antifragility of Bitcoin” presentation).

We believe that both market concepts and participants are crucial for Bitcoin’s game theory and price action, since the booms seem to expand the network via an exuberant viral gossip mechanism that broadcasts the existence of Bitcoin to the world population; while the busts, in the long-run, seem to reward individuals who chose to delay short-term financial gratification in the search for sound money. This very dichotomy, in our opinion, also explains the relevance and effectiveness of MVRV ratio. Network value, to go back to Willy Woo’s terminology, is to us both market value and realized value.

Similar to Woo’s NVT principle, MVRV appears to track the interaction between the market actors that best describe the aforementioned dichotomy. It suggests the at times major divergence between price discovery at exchanges and the “sounder,” more steady rise of unmoved coins — either lost or used for hodling.

It is of particular interest whenever market value goes below a 1:1 ratio to realized value. We suggest that these periods account for both undervaluation and the capitulation-despondency stages of market psychology. Just as the upper levels of MVRV suggest the climax of euphoria, overshooting it’s “fair” value at the peaks, price action as discovered at exchanges tends to undershoot beyond BTC’s “real” value at the bottoms. Looking back at the past two Bitcoin bear cycles, we can say without a doubt that both occasions proved to be the most opportune periods to accumulate bitcoins.

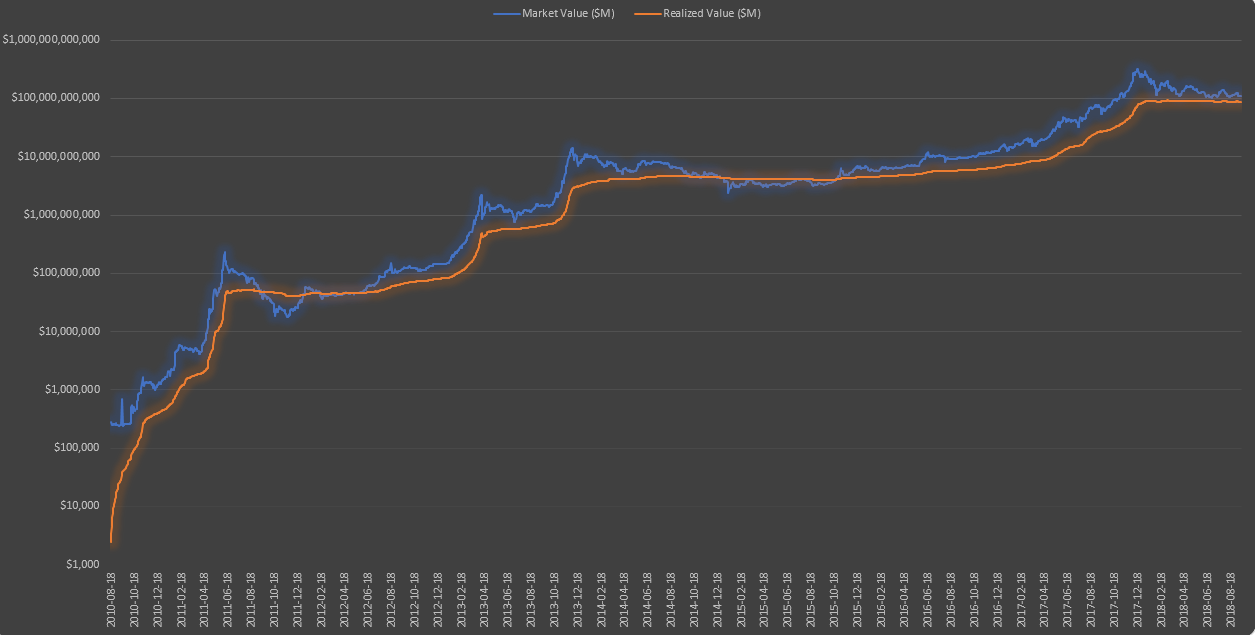

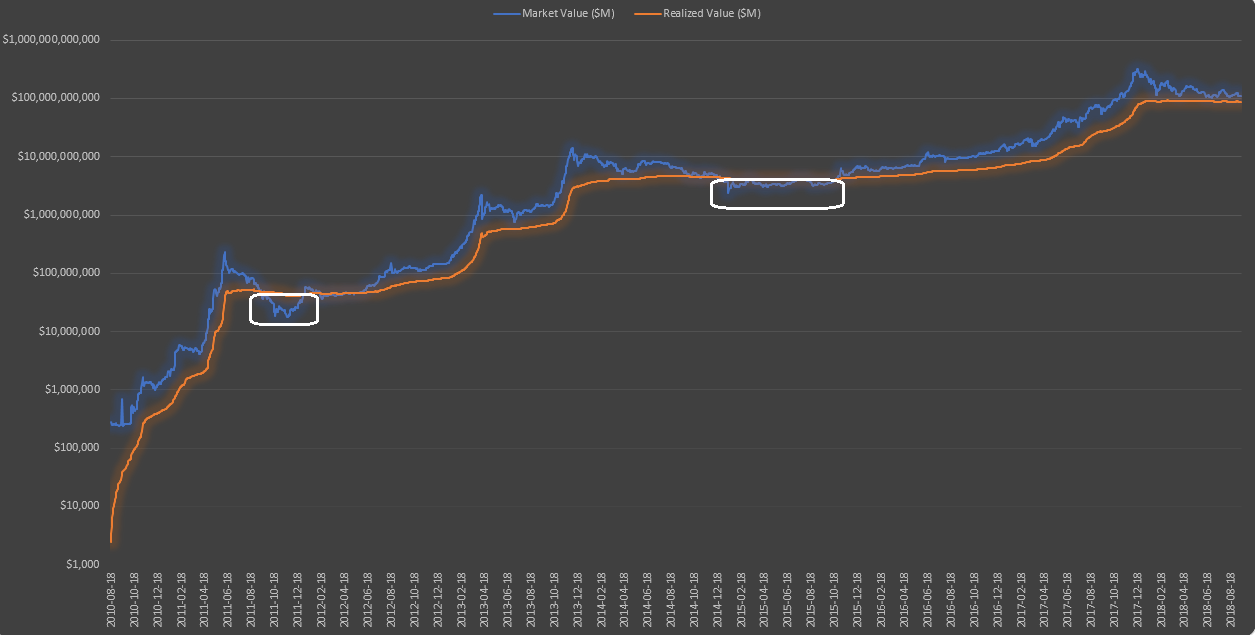

When plotted over the long run on a log chart, the realized value line of Bitcoin (orange above) is more similar to a stepwise function, with near-vertical moves upwards during peak months of bull market, then a prolonged period of horizontal flatness. That being said, each flatness level could be roughly interpreted as Bitcoin’s newfound stable fair value threshold. The traditional market cap, however, is more sharply pronounced by the emotion of the crowds, namely excessive euphoria when market value sharply diverges upwards away from realized value, and, conversely, excessive fear when market value drops below realized value for a multi-month period.

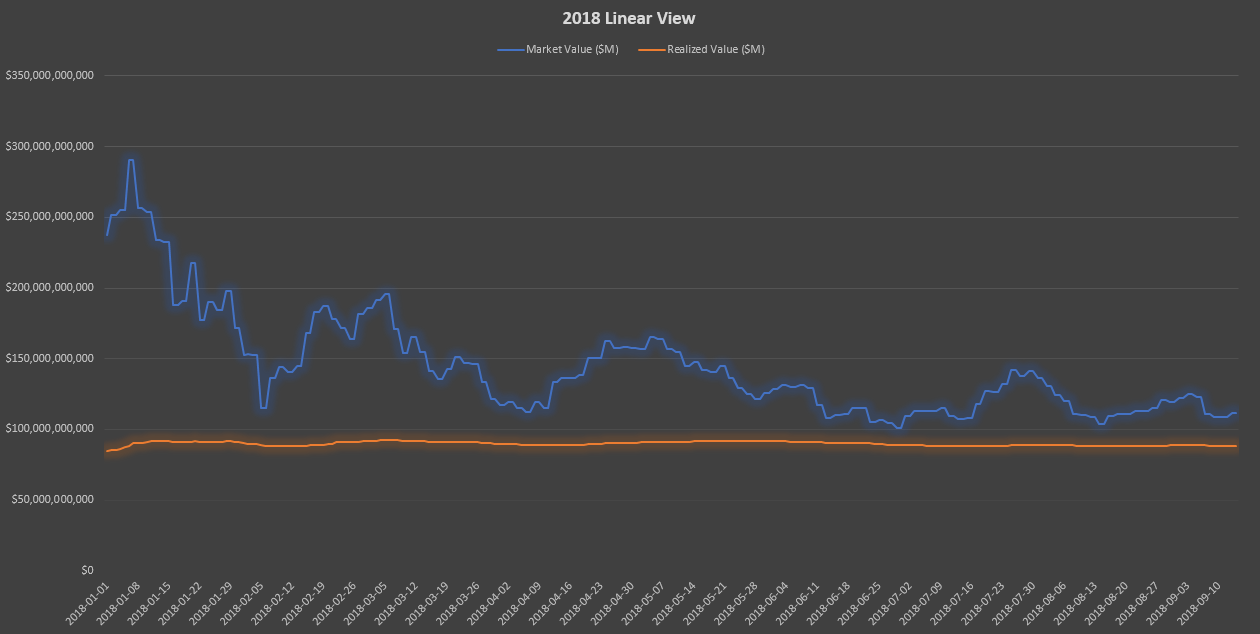

Current Environment

Simply put, we expect market value to descend below realized value on a mid-term basis, which in turn would establish a structural gap between them, to be filled after an accumulation period of potentially as long as several months. The following chart displays the historical periods when accumulation in Bitcoin took place (which would be represented by MVRV ratio’s descent below 1).

A zoomed-in linear version of the current environment gives us a clearer view of how market value remains overextended above realized value.

Some Caveats

As with any fundamental or technical indicator, we recommend using this particular tool with prudence. Some observations:

- Thresholds: Going forward, as market cap decreases in volatility, we believe that the upper threshold of MVRV might not prove as reliable — as market cap overextends less and less above realized cap as time progresses. However, we expect the lower threshold to remain useful to detect Bitcoin’s undervaluation in multi-month periods ripe for accumulation. This is to say that the saving power and the speculative power of Bitcoin will become, increasingly more and more, very closely intertwined.

- Precision: MVRV ratio only provides a long-term perspective of BTC market cycles — specifically, to apply Wyckoffian terminology, distribution and accumulation phases.

- _Technical methodology:_The use of MVRV as a momentum oscillator where the breakage of a trendline implies capitulation (similar to NVT signal or the Mayer Multiple) still comes into question. Thus, more conservatively, we provide two recommendations: (a) to analyze this indicator as a companion to other fundamental and technical tools; and (b) mostly use its thresholds for multi-yearly analysis; a diagnostics tool of Bitcoin’s “hodling” health.

- Realized cap: It is important as well to remember that realized cap may drop given a black-swan shock event where strong hands lose confidence in BTC. For this reason we recommend assessing market value and realized value both as a ratio and separately.

Acknowledgements

We would like to thank the following people, whose work and help was essential for this analysis:

- Nic Carter and Antoine Le Calvez, for inventing the realized cap and providing us with invaluable data.

- Pierre Rochard, whose initial idea was the starting point for the invention of realized cap.

- Willy Woo and Dmitry Kalichkin, whose work on NVT and NVM has been deeply influential.

- Saifedean Ammous and Jimmy Song, for providing crucial ideas in developing a theoretical framework for MVRV.

Sources and Data

- Daily market value and realized value data provided by Nic Carter (Castle Island Ventures) and Antoine Le Calvez (Blockchain.info).

- Ammous, Saifedean. The Bitcoin Standard. Hoboken: Wiley, 2018.

- Song, Jimmy. “The Antifragility of Bitcoin.” Off-Chain with Jimmy Song YouTubeChannel:https://www.youtube.com/watch?v=LYjUOFc0OMo

Introducing … The Bitcoin “MVRV Z” Metric That Predicts Market Tops with 90%+ Accuracy

By Awe & Wonder

Posted October 9, 2018

Disclaimer: Not investment advice. Past performance is not indicative of future results.

Background:

The MVRV ratio was created by Murad Mahmudov & David Puell following Nic Carter’s (in a co-effort with Antoine Le Calvez) striking presentation at Honeybadger 2018. Building from Nic’s and Antoine’s conceptualization of realized value, the MVRV ratio was born.

In essence, realized value is closer to Bitcoin’s “fair value” as it adjusts for lost coins and coins used for hodling. The purpose of this article is to demonstrate the modified MVRV ratio’s usefulness with respect to market timing.

For a more extensive overview of realized value, please visit David’s & Murad’s original article describing this concept in detail. Bitcoin Market-Value-to-Realized-Value (MVRV) Ratio Introducing realized cap to BTC market cycle analysis blog.goodaudience.com

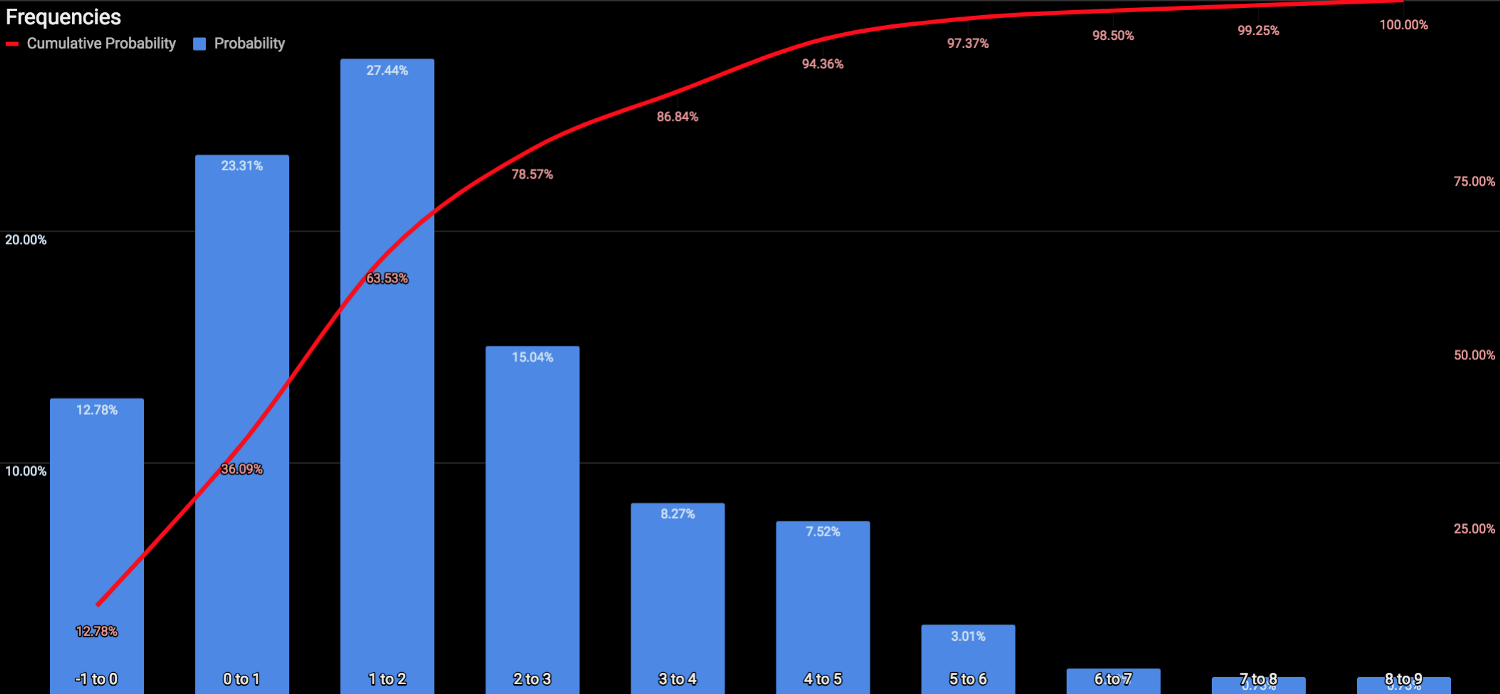

The original MVRV ratio described above is calculated by dividing market value by realized value on a daily basis. This provides the following oscillator:

The original MVRV ratio described above is calculated by dividing market value by realized value on a daily basis. This provides the following oscillator:

As David stated, this metric clearly displays the peaks and busts of the price cycle, emphasizing the oscillation between fear and greed. The brilliance of realized value is that it subdues “the emotions of the crowds” by a significant degree. In other words, it is reasonable to consider realized value as a more accurate descriptor of Bitcoin’s stable, long-term value. Interestingly, it’s not too far-fetched to consider this area as the trend’s “psychological mean”; the zone where long-term holders see true value.

Realized Value as a proxy for the trend’s mean.

Realized Value as a proxy for the trend’s mean.

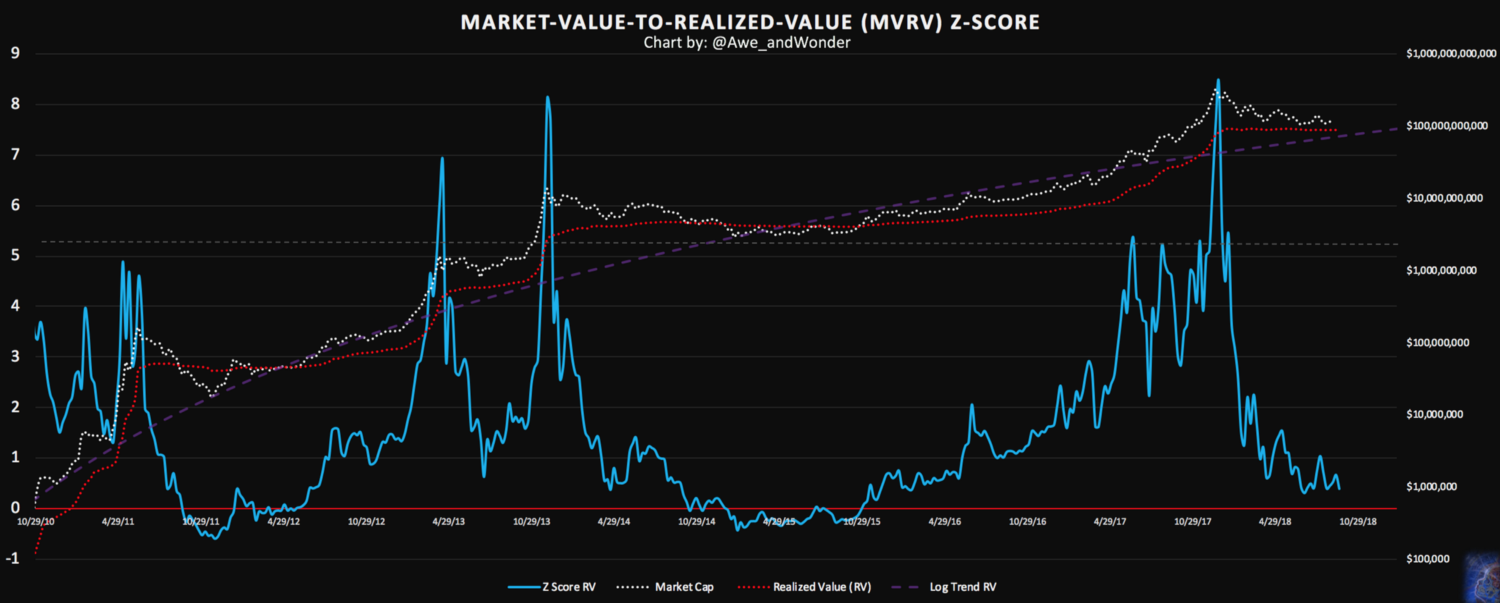

Market-Value-to-Realized-Value (MVRV) Z-Score

This new metric aims to measure the deviation between realized value and market value.

The modified MVRV ratio is just the z-score distance from the realized value.

Simply put, a z-score is the number of standard deviations above or below the mean. In this case, the realized value is used as a proxy for the true population mean. Therefore, this z-score transformation simply serves as a standardization technique and the standard deviations are not interpreted as one would in a normal distribution. This provides the following:

z-score distance from realized value as of 9/9/18

z-score distance from realized value as of 9/9/18

As you can see, the parabolic spikes triggered alarm one, two, and three weeks in advance, respectively. Coupling this metric with other buying climax patterns like say, daily returns exceeding two standard deviations from the mean makes for a killer combination.

Successful trading is all about finding and capitalizing on market imbalances. Markets that are in balance cannot be exploited.

Momentum (where strong moves beget stronger moves) eventually create market imbalances. The mean reversion effect, on the other hand, is a market’s response to excess momentum as it seeks to counteract this force. In a perfect random walk market, these forces eventually balance each other out. However, certain trigger events can tilt the scale in favor of one force winning over the other. This creates an environment where big moves can be reasonably expected to at-least partially reverse.

Weekly closes above z-score value of 5 occurred 5.64% of the time. Loosely speaking, a 94.36% chance of reversal can be attached to any observation above this value. Similarly, weekly closes below realized value occurred 12.78% of the time. Or from a historical perspective, expected to be above this zone 87.22% of the time. As we all know, history doesn’t repeat but it often rhymes. For example, in the next overvaluation cycle, the top may not exhibit a parabolic spike like in the past. This emphasizes the need to combine multiple sources of evidence to come to a sound conclusion and not rely on this metric alone. With that said, these observations add more confidence to the 4400–5000 region.

Furthermore, observing the log trend line in respect to realized value, one can see that price coincidentally bottomed at this zone twice. Currently, the trend line sits at 74B and is expected to rise to 88B by 1/6/19. This amounts to a rate of growth about 5.88% per month (compared to 10% four years ago). Since this trend line is increasing in value at a decreasing rate, its reasonable to expect that the market cycles may start to elongate to some degree. But thats a topic for another day.

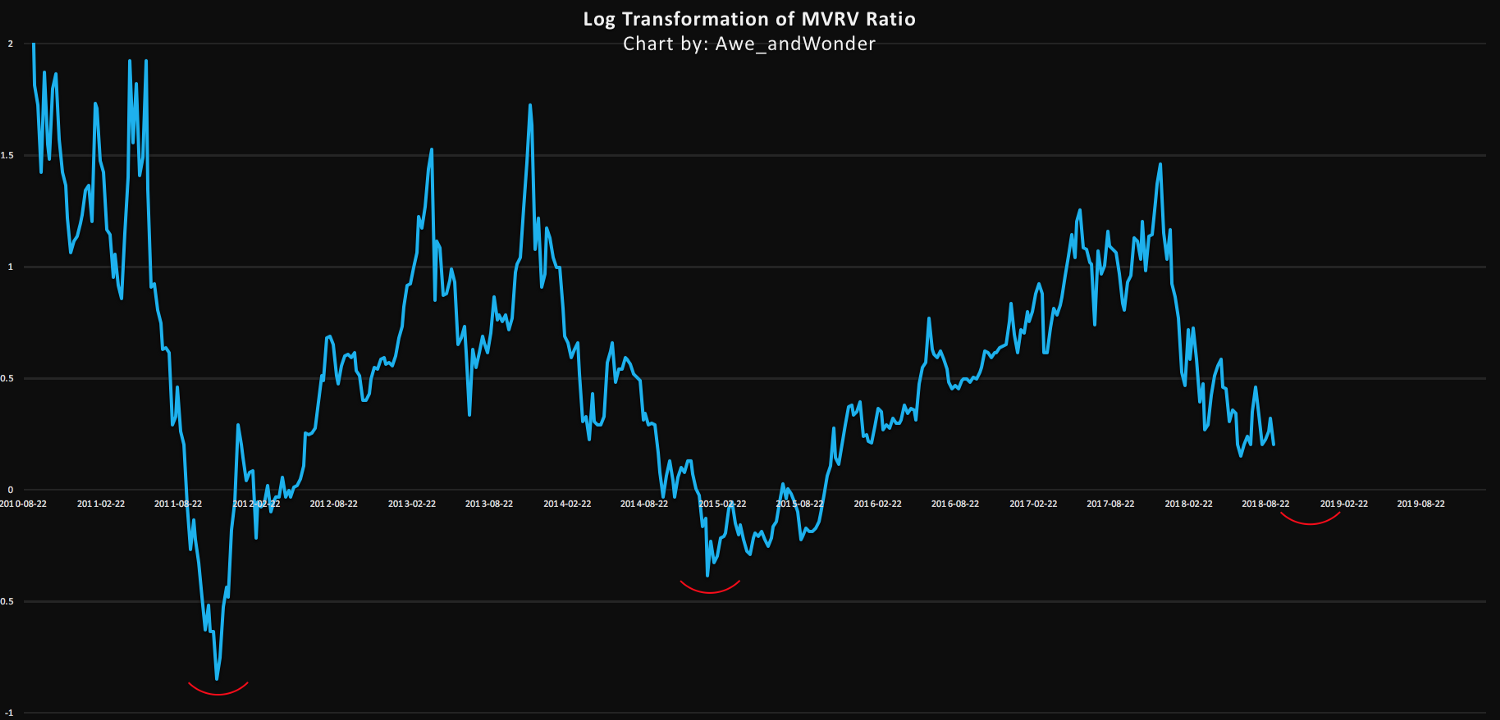

MVRV ratio emphasizing percentage change

MVRV ratio emphasizing percentage change

The chart above represents the original MVRV ratio but with an applied log transformation to amplify visual clarity.

Note that the January 2015 bottom was 32% higher than 2011. Applying this same haircut, the estimated z-score deviation below realized value is 0 to -0.25.

This is perfectly reasonable. Markets stabilize though price and time. Considering the outsized returns of the 2017 bull market plus the parabolic blow off top that followed, it should be of no surprise that this market may need more time to stabilize and level off before the next bull run.

In conclusion, its important to remember that these type of models are only as good as the simplifications and assumptions they make, and that no metric should be used in isolation. The MVRV Z-Score metric from a historical perspective has worked incredibly well. I’d imagine combining this metric with exponential and logarithmic regression confidence intervals, to name a few, would make for a killer combination…

PS.

Thanks to Nic Carter and Antoine Le Calvez for providing the data.

Please follow if you’d like further analysis.

Bitcoin Delta Capitalization

A New View of BTC Long-Term Valuation

By David Puell

Posted February 14, 2019

Disclaimer: Nothing contained in this article should be considered as investment or trading advice.

As a follow-up to Willy Woo’s recently-introduced Bitcoin Valuations live chart, this article aims to present delta cap with the goal of answering two of the most pressing questions in speculators’ minds at the present moment:

- Where is the bottom?

- When is the next bull run coming along?

Something’s Amiss

Two sets of items originated the search for what later became delta cap:

- Awe and Wonder’s studies on Bitcoin’s logarithmic regression and Plan B’s studies on Bitcoin’s power regression (R² of 0.93 and 0.95 respectively), which seem to suggest that the BTC trend is increasing at a decreasing rate.

- Murad Mahmudov’s exploration of historical moving averages, expressing a dissatisfaction with any particular SMA or EMA as definitive enough to “catch the bottom” in every bear cycle.

This initiated the search for a metric that both adapted to Bitcoin’s rapid, high-velocity parabolic moves and accounted for its overall trend decay over time. Two other valuation models seemed to provide a tentative answer: realized cap for the former and average cap for the latter.

Delta Capitalization

Delta cap is, as seen next, a hybrid of sorts — half “fundamental,” half “technical.” It is calculated through the following formula, measuring the difference between two long-term Bitcoin moving averages:

For the purposes of this piece, let’s review these definitions:

Realized capitalization

Invented and presented by the brilliant team at Coinmetrics, instead of counting all of the mined coins at current price, the coins are counted at the price when they last moved through the blockchain. This approximates the USD value paid for all the bitcoins in circulation. Best put by its co-creator Nic Carter, it can be described as an on-chain volume-weighted average price (VWAP) of BTC.

Average capitalization

Instead of setting a fixed period for calculating a moving average (e.g., a 200-day MA), this is a life-to-date, cumulative simple moving average that serves as the true mean of the whole history of market cap. Due to its “laggy” nature, it is the perfect mechanism to help decay the upward speed of delta cap over time. Shoutout to Renato Shirakashi for first pointing out this average.

Below, a view of both lines, courtesy of Willy Woo:

The aforementioned substraction of the two in turn provides the following delta cap line, both reactive locally and decaying globally:

As seen at first glance, delta cap provides an excellent framework for catching global bottoms — or at the very least bottoms near the floor of the bear cycle. Please see the caveats of this indicator below to have a more nuanced view of the current state of affairs, since having just touched delta cap does not guarantee that we have bottomed.

Time Analysis

Another interesting (and still experimental) exploration of delta cap emerges when comparing it to its parent inputs through a logarithmic view, as follows:

We can easily gauge periods were delta approaches realized cap during the bubble tops, and then evermore slowly descends to almost touching the average cap during the phases of breakout price behavior, signaling the inauguration of the new bull run.

The good news? If this pattern continues, people will have lots of time to buy up. The bad news? This bear-to-sideways market may last for an unprecedented while, going as far as projecting a post-accumulation breakout as late as Q2, 2020 — the moment when it could be expected for delta cap to get nearest to average cap if the extension of these lines continues as-is. Bear in mind that this is all pending on the overall rate of drop of realized cap and the rate of rise of average cap — local price action, velocity, and dormancy are all in play. Time domain here is still a broad estimate.

It goes without saying that we lack enough bottom samples to claim this as a certainty, but long-term investors must stay mentally prepared for this possible delay. It is further evidence that suggests Bitcoin’s cycles are elongating.

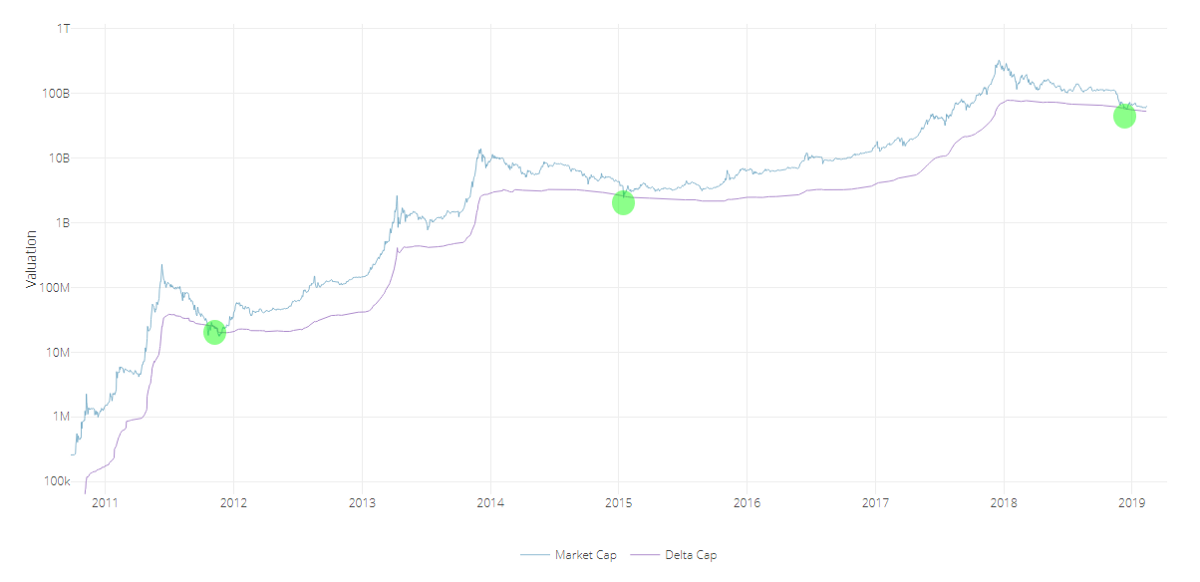

Yes, Another Ratio: MVDV

Since most will be curious about how the Market-Value-to-Delta-Value (MVDV) Ratio looks like, here it goes:

A few notes on it:

- Just as seen on MVRV Ratio and the Mayer Multiple, MVDV seems to indicate that each of Bitcoin’s blow-off tops is losing momentum. This is not necessarily bearish, as I believe it merely implies that each bubble is becoming less exuberant and getting closer to the mean.

- Major bearish divergences seem to announce global tops (red circles) while differentiating them from previous local tops of the same cycle.

- The bottoms seem to maintain a steadier horizontal longitudinal threshold at 1 (green line). If market cap were to revisit delta cap today at a lower low, the oscillator would present this event as a double bottom.

Caveats

- _Having touched delta cap recently does not imply a global bottom:_One must remember that delta cap is currently sloping down — and it will continue to do so for several months — so the likelihood of market cap revisiting it is not out of the question. Add to that the fact that the NVT tools are still just slowly trending into normal historical conditions and velocity remains weak. Touching delta cap on a lower low in the following months is still a likely possibility. Every penetration of market cap into delta cap should be best used as one componet of an averaging-in strategy over a prolonged period of time.

- Despite timeboxed halving days, the Bitcoin cycle seems to be elongating: This makes perfect sense, since larger bull runs require larger liquidity. The experiment here is to continue evaluating delta cap as a mean that keeps adjusting to Bitcoin’s curved trend. That being said, the time analysis section of this article remains highly speculative, especially for signaling the breakout events, so let’s take it one day at a time.

- _The market currently holds a major dissonance:_That of delta cap providing a good “baseline” for a relatively optimistic market floor, versus the current state of velocity as seen on NVT Ratio,Network Momentum, and NVT Caps— on life support relative to price.

- Delta cap remains experimental: Just as with most technical and on-chain tools, these indicators should be used with prudence and in the company of other trading mechanisms and a sound risk management strategy. Past events don’t reflect future outcomes.

Acknowledgements

Many thanks to the following individuals:

- Willy Woo, for the beautiful charts and valuable feedback.

- Murad Mahmudov,Phil Bonello,Hans Hauge,PositiveCrypto, and Plan B, whose comments helped perfect this article.

Sources

- Woobull.com : Charts and early market cap data archeology.

- Coinmetrics.io : Realized cap data.

- Blockchain.com : Market cap data.

Author

David Puell, Head of Research @ Adaptive Capital

Bitcoin Data Science (Pt. 1): HODL Waves

By Dhruv Bansal

Posted April 17, 2018

This is part 1 of a series

- Bitcoin Data Science (Pt. 1): HODL Waves

- Bitcoin Data Science (Pt. 2): The Geology of Lost Coins

- Bitcoin Data Science (Pt. 3): Dust & Thermodynamics

Bitcoin uses a curious accounting structure called a UTXO — an Unspent Transaction Output. All UTXOs are timestamped by the transaction/block in which they were created. Since all bitcoin in existence is contained in some UTXO, this means that all bitcoins have an age: not the age/time when that bitcoin was first mined, but when it was last used in a transaction.

Since Bitcoin stores its full transaction history in the blockchain, it is possible to look backwards and analyze the age distribution of UTXOs over time. Unchained Capital first analyzed Bitcoin’s UTXO history a few years ago and what we learned encouraged us to start our crypto-lending product. We are now sharing our analyses publicly because we think they are fascinating and informative. Let us know if you agree.

On to the data science!

The Bitcoin UTXO Age Distribution

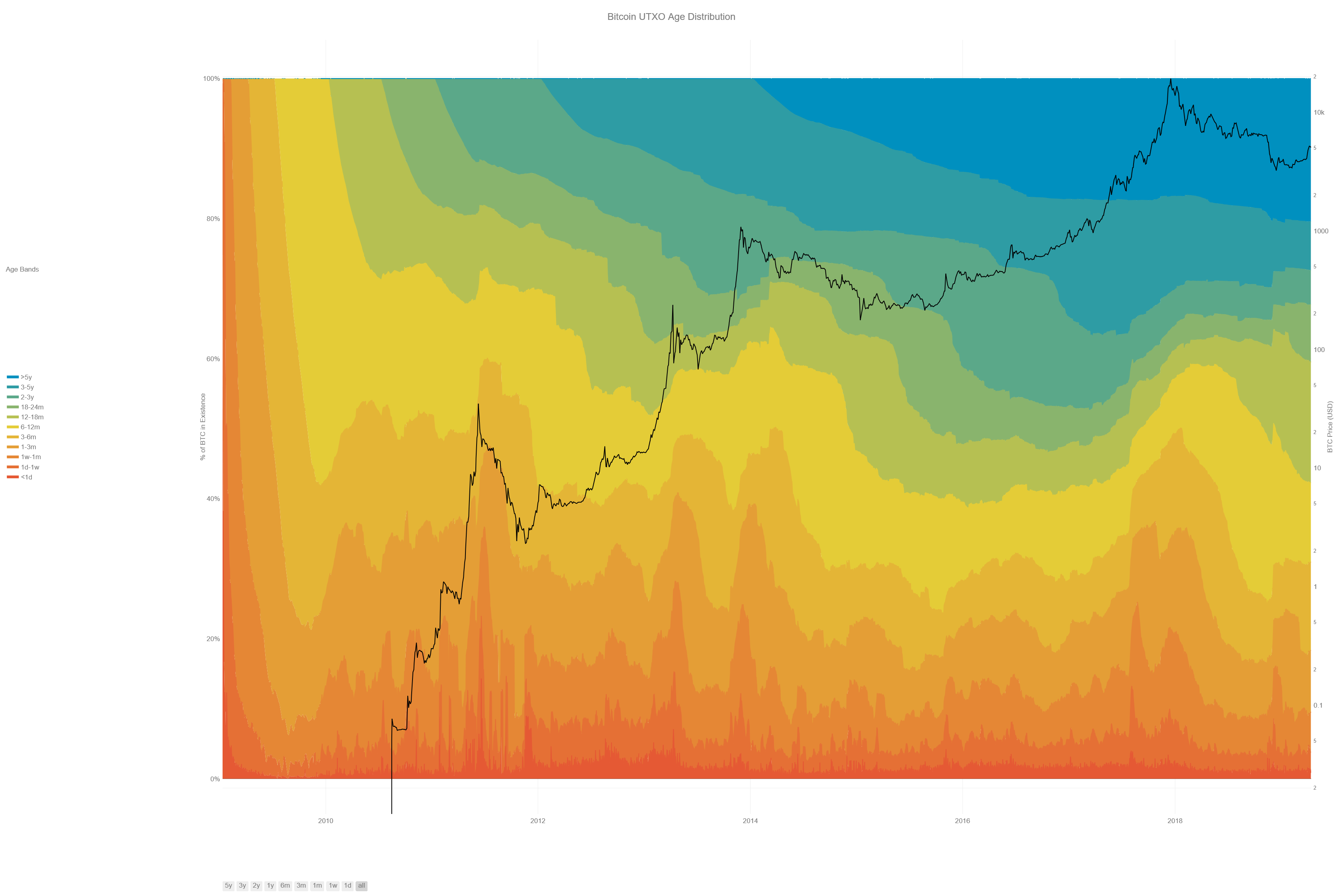

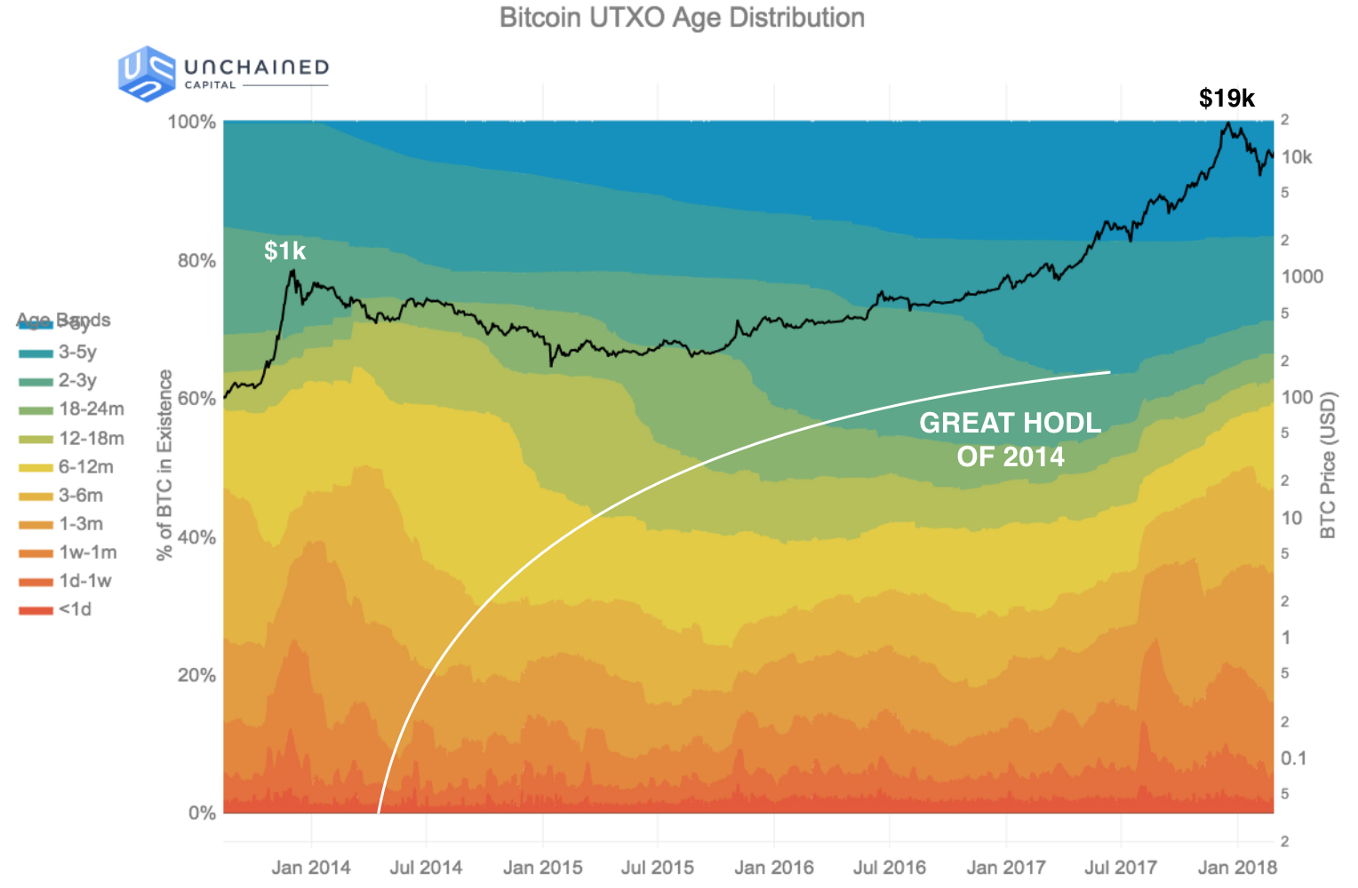

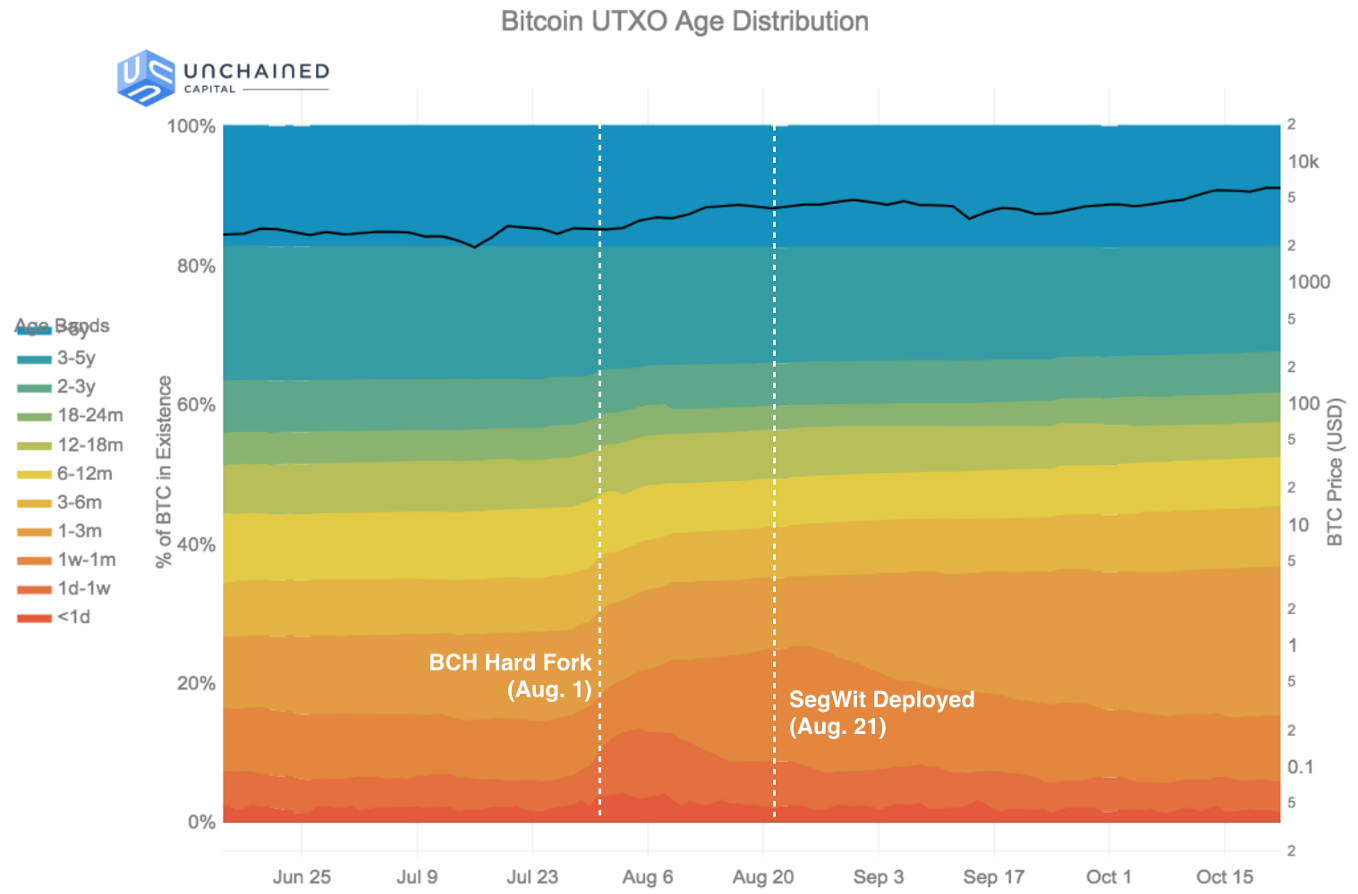

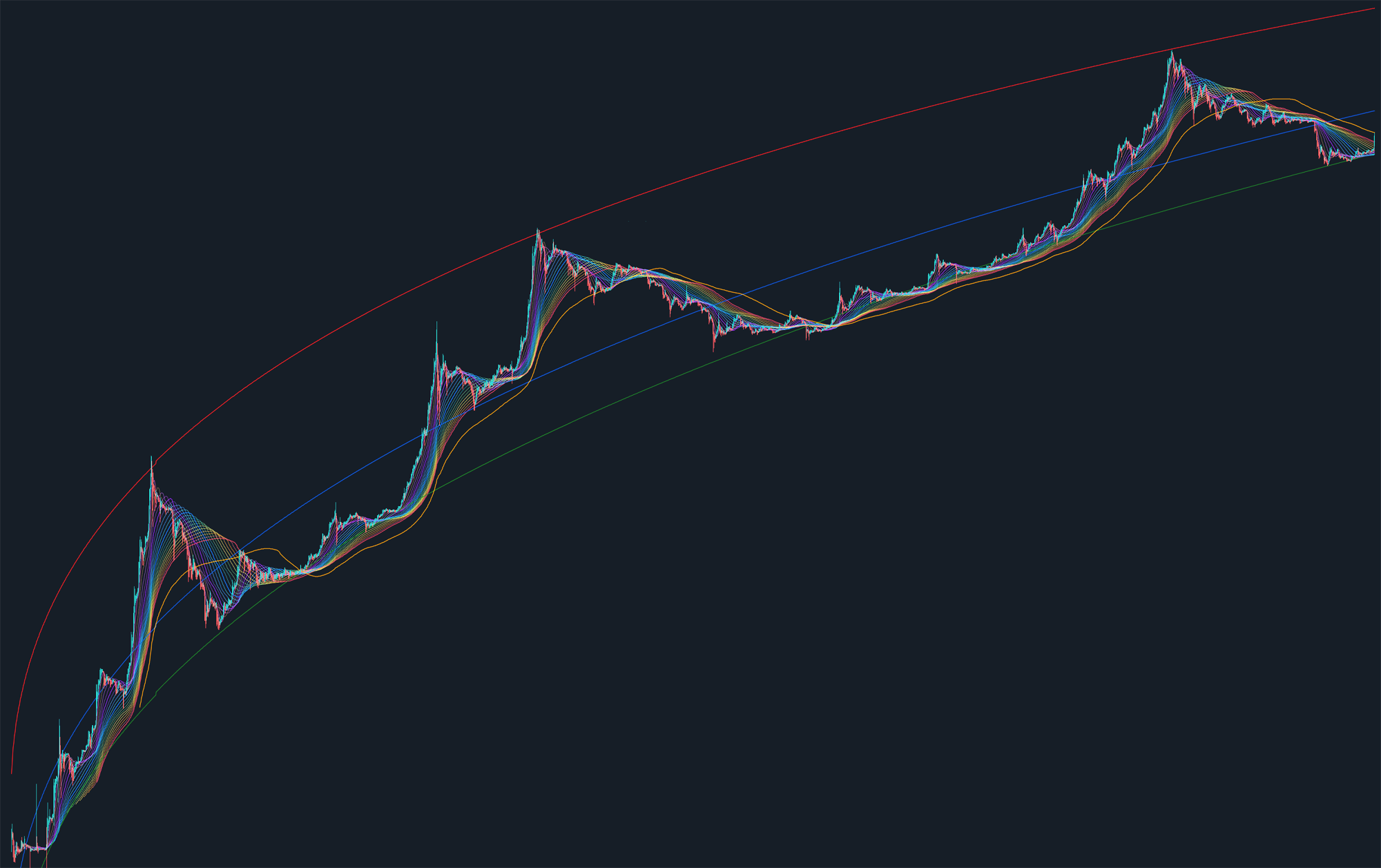

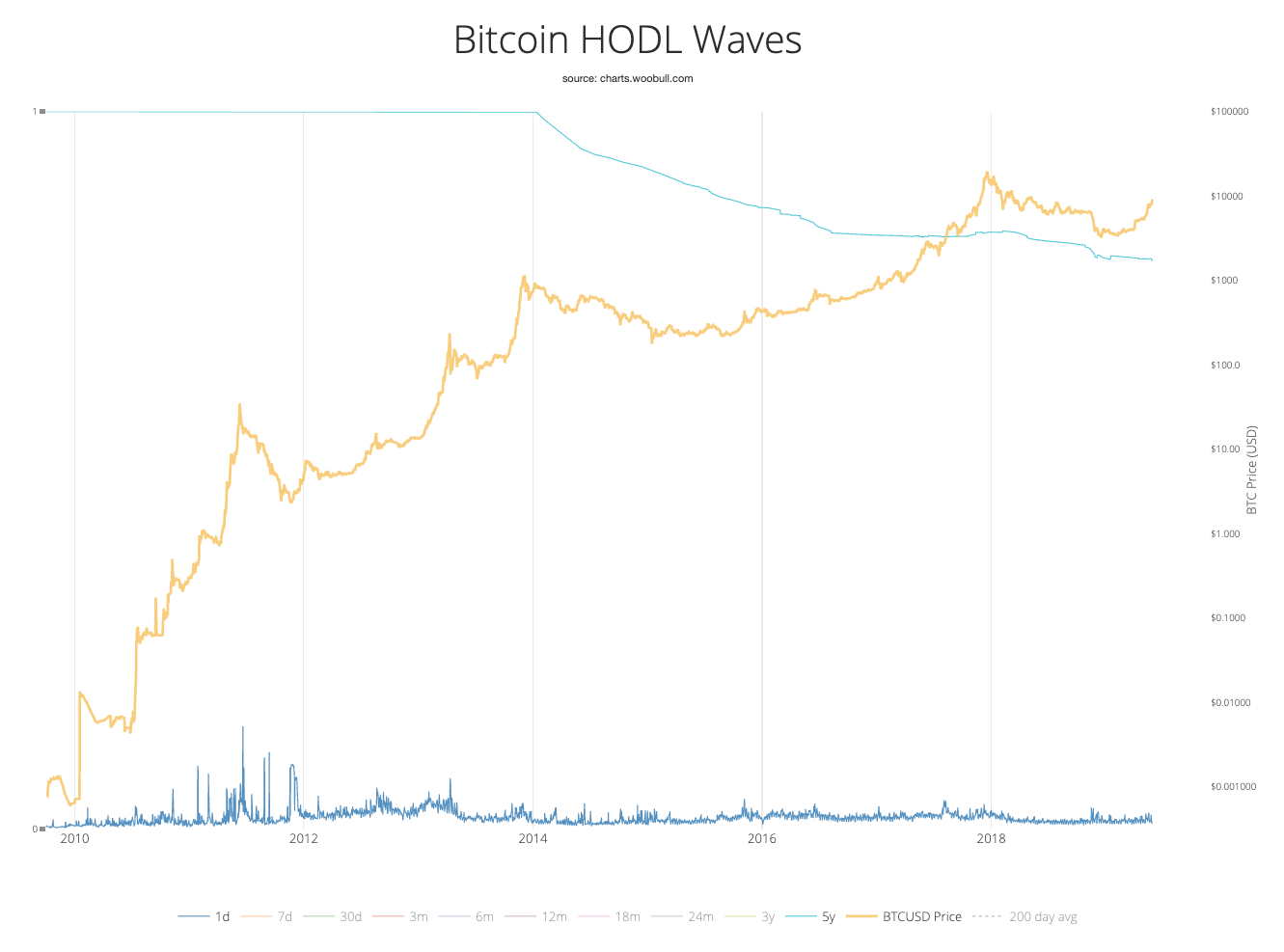

The following chart displays the age distribution of Bitcoin’s UTXO set historically back to the genesis block (Note: this chart does not display correctly on mobile devices.)

The colored bands show the relative fraction of Bitcoin in existence that was last transacted within the time window indicated in the legend. The bottom, warmer colors (reds, oranges) represent Bitcoin transacting very recently while the top, cooler colors (greens, blues) represent Bitcoin that hasn’t transacted in a long time. Bitcoin’s money supply grew from 50 BTC to ~ 17M BTC over this time period, so the chart has been normalized by the BTC in existence at each date (left y-axis). The black line shows the USD/BTC price (logarithmically, right y-axis). Chart lovingly made by Nelson Morrow based on prior work by @jratcliff [Direct Link]

The colored bands show the relative fraction of Bitcoin in existence that was last transacted within the time window indicated in the legend. The bottom, warmer colors (reds, oranges) represent Bitcoin transacting very recently while the top, cooler colors (greens, blues) represent Bitcoin that hasn’t transacted in a long time. Bitcoin’s money supply grew from 50 BTC to ~ 17M BTC over this time period, so the chart has been normalized by the BTC in existence at each date (left y-axis). The black line shows the USD/BTC price (logarithmically, right y-axis). Chart lovingly made by Nelson Morrow based on prior work by @jratcliff [Direct Link]

This chart is fascinating because it displays the macroscopic shifts that have occurred in Bitcoin’s ownership through history. Spikes in the bottom, warmer-colored age bands (<1 day, 1 day — 1 week, 1 week — 1 month) indicate large amounts of bitcoin suddenly transacting. The steady growth of the top, coolor-colored age bands (2–3 years, 3–5 years, >5 years) shows bitcoin that’s not being transacted with, idling between rallies. The interaction between these two patterns illustrates the behavior of Bitcoin’s investors during market cycles.

It is not possible to make charts such as the one above for traditional asset classes. It’s only Bitcoin and other public blockchains that meticulously track these data throughout their whole histories. This enables post-hoc analyses of large-scale market behavior.

Introducing: The HODL Wave

A common pattern after every rally in Bitcoin’s price is what we have named a “HODL wave.” A HODL wave is created when a large amount of Bitcoin transacts on the way up to and through a local price high, becoming recent BTC (1 day — 1 week old), and then slowly ages into each later band as its new owners HODL.

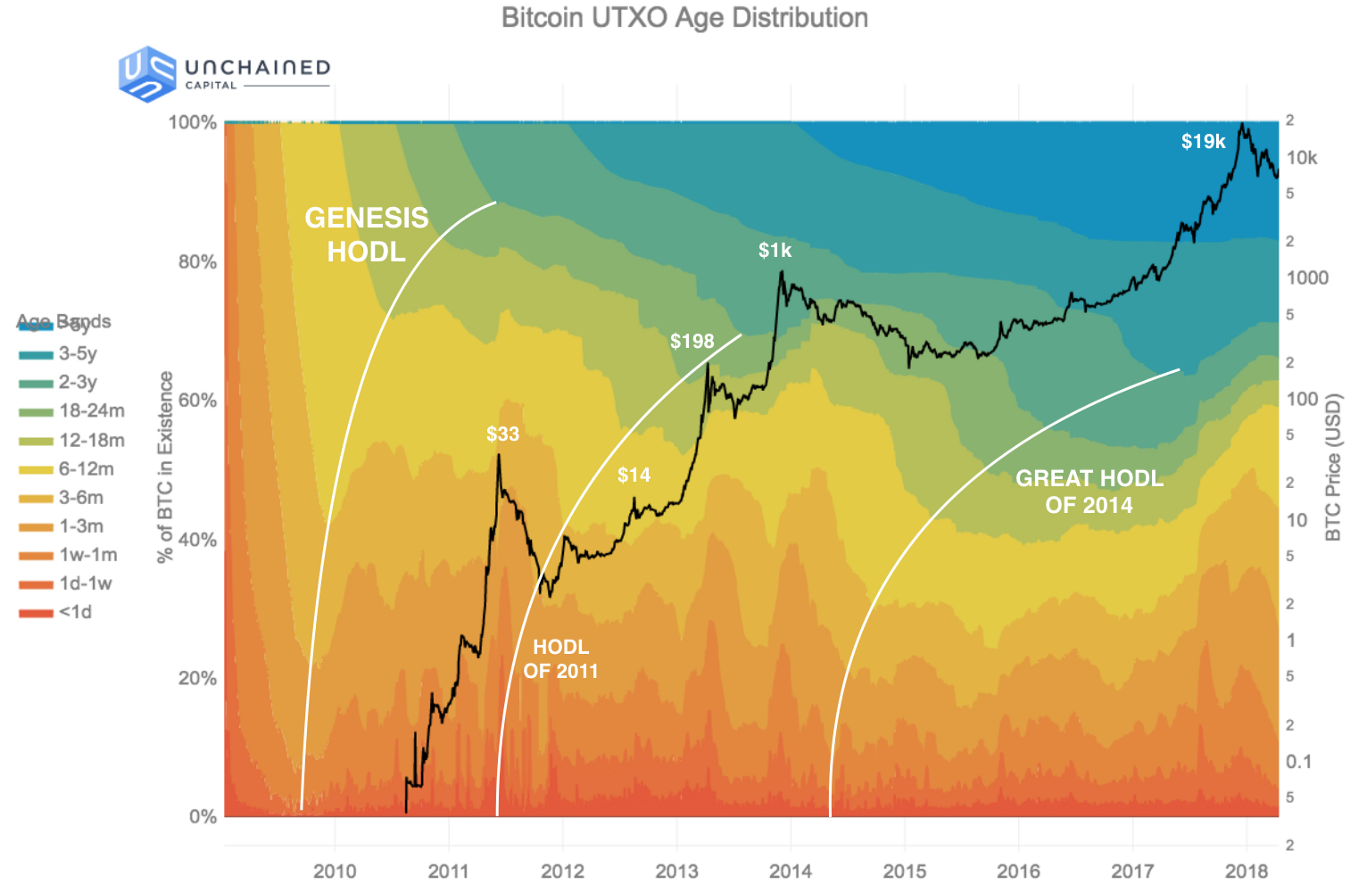

A HODL wave manifests visually on the chart as a pattern of nested curves caused by each age band becoming suddenly much fatter (taller) at progressively later times from the rally. The image below traces a few of the largest HODL waves.

An annotated image of the UTXO age distribution. Local price peaks are labeled. The solid white lines trace “HODL waves” — a pattern of newly recent Bitcoin aging into each subsequent band, indicating that its new owners are HODLing. Only the three largest HODL waves are traced — many smaller HODL waves are also present.

An annotated image of the UTXO age distribution. Local price peaks are labeled. The solid white lines trace “HODL waves” — a pattern of newly recent Bitcoin aging into each subsequent band, indicating that its new owners are HODLing. Only the three largest HODL waves are traced — many smaller HODL waves are also present.

A Short History of HODL Waves

The Genesis HODL: January 2009 — June 2011 ($0 — $33)

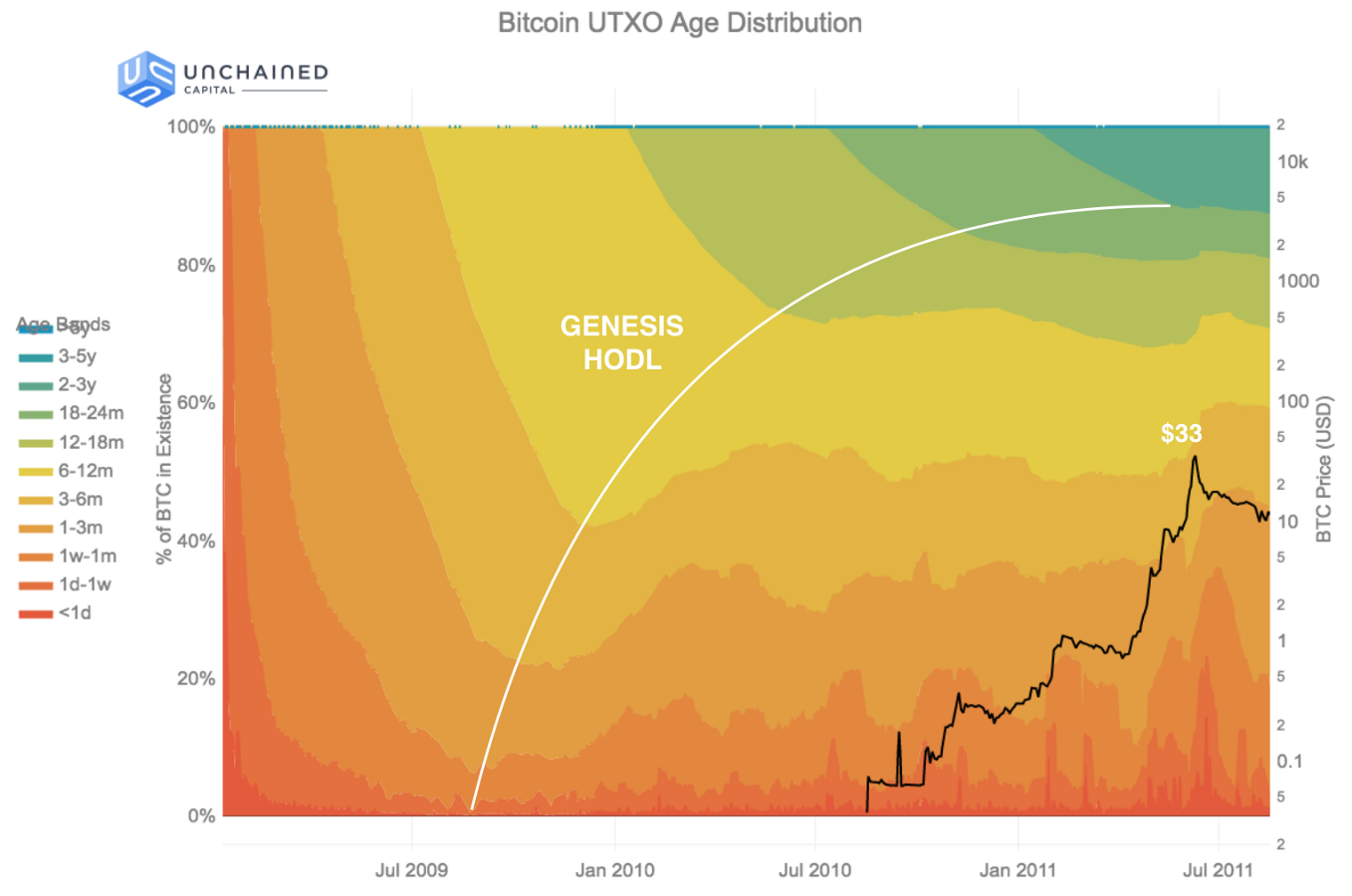

The Bitcoin UTXO age distribution zoomed in to a timespan covering the “Genesis HODL” — the first HODL wave in Bitcoin’s history.

The Bitcoin UTXO age distribution zoomed in to a timespan covering the “Genesis HODL” — the first HODL wave in Bitcoin’s history.

The first HODL wave — the “Genesis HODL” — was not caused by a price rally because Bitcoin had no price at that time. Instead, it was caused by the initial acquisition of Bitcoin by Satoshi and the other first miners.

During the first year of Bitcoin’s history the community was extremely small, transaction volume was low, and there were no exchanges to establish a USD/BTC price. The coins being mined during 2009 weren’t included in transactions very often for these reasons. They sat around and progressively accumulated into later age bands.

Consequently, each of the colored age bands appears suddenly in the diagram once sufficient time has passed since the genesis block (e.g. — the green 12–18 month age band appears exactly 12 months after the genesis block). The age band grows for a time, but then begins shrinking as all the existing Bitcoin ages into the next band.

Because there was nowhere to sell Bitcoin at the time, the Genesis HODL is one of the clearest HODL waves on the chart: early miners had no choice but to hold their Bitcoin and surf the wave. Later HODL waves are much frothier as holders could exit into fiat whenever they wanted.

The first time this pattern shifted was in mid-2010, going into 2011. The first Bitcoin exchanges, including Mt. Gox, launched in 2010. Bitstamp, Kraken, Coinbase all launched in 2011. The fraction of coins older than 12 months stopped growing in June 2010 for the first time. This is the first era where holders could trade Bitcoin online. Bitcoin’s price wouldn’t reach even $1 till February, 2011, but early miners likely had many thousands of BTC. Why not make a little cash?

By April 23rd, 2011, Satoshi had left Bitcoin, right as Bitcoin reached $1. Satoshi is estimated to hold ~ 1M BTC, so he/she/they/it was already a millionaire at this point. Maybe that was enough?

I’ve moved on to other things. — Satoshi Nakamoto, April 23rd, 2011 (1 BTC = $1).

What a casual bastard. :)

The HODL of 2011: June 2011 — December 2013 ($33 — $1k)

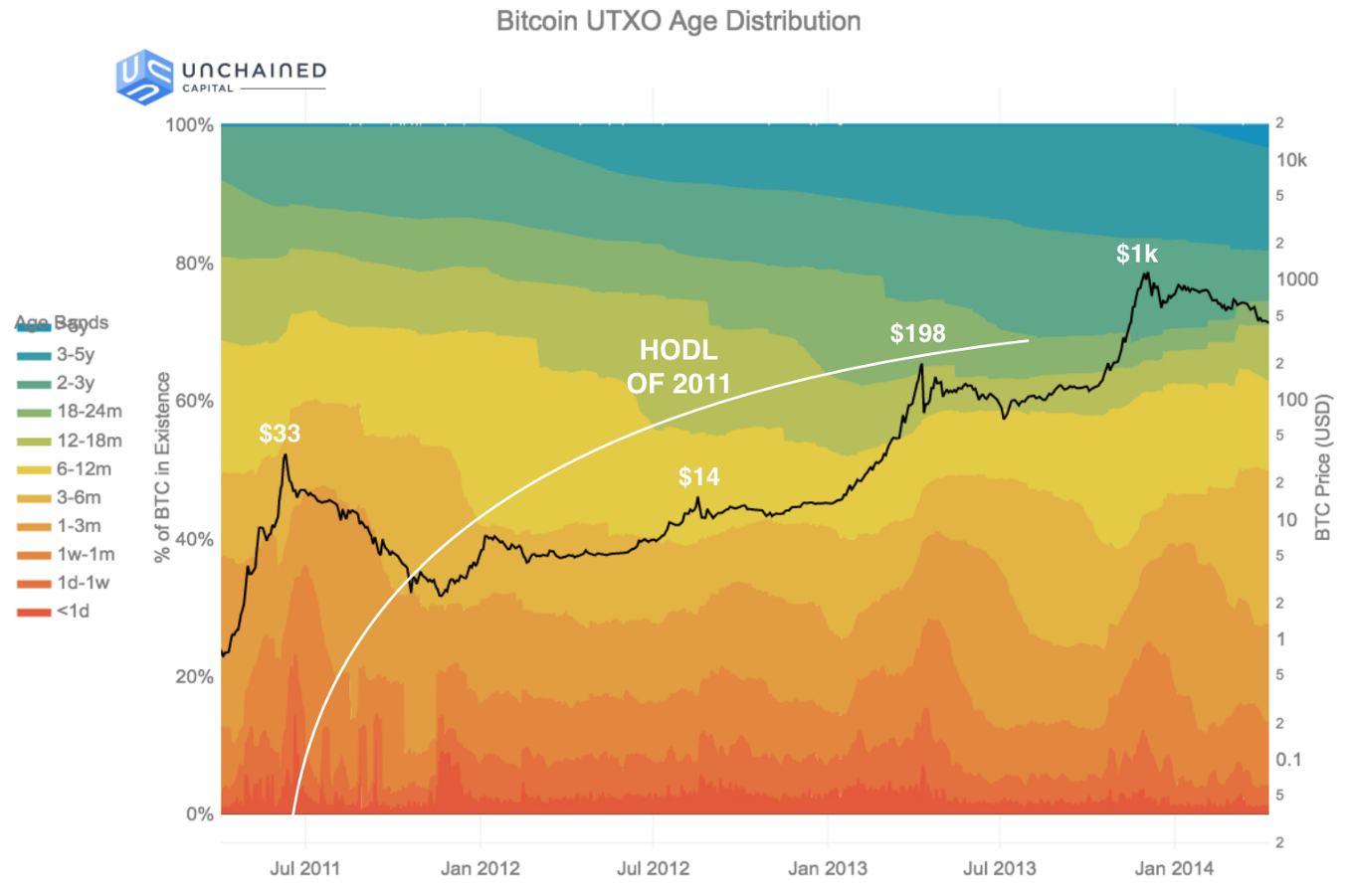

The Bitcoin UTXO age distribution zoomed in to a timespan covering the “HODL of 2011” — the second major HODL wave in Bitcoin’s history.

The Bitcoin UTXO age distribution zoomed in to a timespan covering the “HODL of 2011” — the second major HODL wave in Bitcoin’s history.

Starting in June 2011, Bitcoin’s price suffered its first major collapse, from $33 all the way down to $2–3 by November 2011. It took almost two years to recover when it rallied to $198 in April, 2013.

During the rally up to $33 in June 2011, all the holders who sold were early miners by definition. No one else could really have acquired BTC to sell.

But the rally up to $198 was different. The age bands which shrunk the most leading up to the rally were between 12 months to 24 months. These were likely the first wave of investors — not miners — selling to realize gains. These investors would have acquired their BTC leading into the prior $33 price rally and afterwards.

Bitcoin collapsed again from $198 in April, 2013, down to $69 in July, 2013 only to soar past $1k by December, 2013. There wasn’t much time for panic-selling before a new surge of euphoria.

This was the first major rally that was covered in the news. Many major exchanges such as Bitstamp, Kraken, & Coinbase — not to mention Mt. Gox — had been around for a few years and were mature enough to service a large wave of demand for the first time.

Right after the rally to $1k, more than 60% of BTC had been spent within the last 12 months. This was the most “recent” moment for BTC’s money supply in history — the moment at which the average last time of use of a Bitcoin was lowest. Who sold? Once more, it was the investors who purchased in the prior 2–3 years, through the $33 peak and the $198 peak.

The Great HODL: December 2013 — December 2017 ($1k — $19k)

The Bitcoin UTXO age distribution zoomed in to a timespan covering the “Great HODL of 2014” — the third major HODL wave in Bitcoin’s history.