The Road to $1m per Bitcoin

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

The Road to $1m per Bitcoin

By Genesis Node on ALTCOIN MAGAZINE

Posted April 17, 2019

Since the peak of the Bitcoin price at around $20,000 in late 2017 and the subsequent move down to a $3,100 to $4,000 range by March 2019 much has been written and discussed about the volatility of the most established cryptocurrency. Media outlets and Nobel prize winning economists have enjoyed producing ill-informed clickbait suggesting that ‘The Bitcoin Ponzi is over’ or that ‘The Bitcoin bubble has burst’. Over time the world will start to understand money and Bitcoin in more detail but for now, reporting and analysis by the mainstream media remains self-interested and rather sensationalist.

<Cue open-minded, altruistic sensationalism>

At Genesis Node, we believe Bitcoin will eventually be used as a global reserve currencyand that it has the potential to either replace government-issued fiat currencies entirely or be the base money used all over the world that governments issue their own currency on top of — in other words, we see a situation where all money will be backed by Bitcoin and that Bitcoin will also replace monetary metals including gold as a key store of value and all pricing and mental calculations will be undertaken in ‘Satoshis’ rather than native currencies.

In our view, Bitcoin represents a fundamental global paradigm shift and to give it some form of analogy to bring this narrative to life a little it can be thought of as a monetary glacier….a gigantic force that is slowly moving through the global economic terrain, flattening and accumulating all other forms of global money and wealth storage as it goes. Bitcoin could very well culminate as a single, stable, unstoppable form of value transfer that we as a human race need to harness so we can rebuild a better economic and financial system upon which to continue our development and societal progress.

Photo by Alto Crew on Unsplash

Photo by Alto Crew on Unsplash

Now that the awkward glacier analogy is out of the way, let’s explore some sensationalist click bait of our own and analyze how Bitcoin could possibly reach a $1m per Bitcoin price or in other terms $0.01 per Satoshi. The following article assumes that the reader has a rudimentary understanding of sound money and the challenges with the current global economic and central banking systems. If not then please take some time to read our previous article, the work of Austrian economists and the Mises Institute publications regarding sound money and the issues with government controlled money and central banking.

The following article groups the rationale for a situation where Bitcoin reaches $1m per coin as follows:

- Bitcoin technical enhancements and global infrastructure

- Forthcoming global economic collapse

- Separation of state and money

- Bitcoin mass adoption

- Investor speculation and return on investment shift

A return to sound monetary measures and a separation of state-controlled money in favor of a free market approach is likely to redress the imbalances of a system that has gone horribly wrong over the last 100 years.

Quick maths (TLDR)

Photo by Helloquence on Unsplash

Photo by Helloquence on Unsplash

Let’s apply some simple maths to the Bitcoin realm.

A $20 Trillion market cap against a Bitcoin supply of 18m coins gives a price of over $1m per Bitcoin. The current market cap of Bitcoin as of the end of March 2019 is circa $80 Billion with around 17.5 million circulating coins and the price is around the $4,500 — $5,000 mark (as of April 2019). Let that sink in for a moment.

As Vijay Boyapati stated in his article ‘The bullish case for Bitcoin’

“This case was made even more trenchantly by the brilliant cryptographer Hal Finney, the recipient of the first bitcoins sent by Nakamoto, shortly after the announcement of the first working Bitcoin software:” [I]magine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. With 20 million coins, that gives each coin a value of about $10 million.

At this point, we need to explore how the roadmap from $80 Billion to $20 Trillion and beyond might pan out and why.

1. Bitcoin technical enhancements and global infrastructure

Bitcoin is an emergent form of global money and is most easily thought of as digital gold. However its potential is far greater than that limited analogy and once certain challenges and limitations in the cryptocurrency market as a whole such as regulation, currency on/off ramps and user interface and experience (UI/UX) are overcome, the road to a $20 Trillion market cap will really begin to open up.

Photo by Bernard Hermant on Unsplash

Photo by Bernard Hermant on Unsplash

First, the Bitcoin protocol and surrounding cryptocurrency ecosystem need to address some current limitations which will most certainly happen over the coming years. The points below explore these in more detail:

a) User interface and user experience:

The current user interface and overall user experience regarding Bitcoin are somewhat complex and to achieve full global adoption and usability this needs to improve. The current experience is akin to using dial-up internet and email for the first time in the early 1990s but as the entire industry continues to advance the end to end usability will become as simple and seamless as one-click payment solutions are today. When the experience doesn’t include having to explain the importance of private keys and using cryptocurrency is as simple as connecting to free WiFi is today then we will reach the mass adoption tipping point.

b) On and off ramps:

It is getting easier to convert fiat currency into Bitcoin and vice versa and it will continue to improve as more exchanges come online and the growth of Bitcoin as a payment mechanism seeps into the mainstream. A more favorable regulatory environment will help here as will a clearer government stance on retail and institutional investing in Bitcoin and digital assets alongside a well-defined tax framework.

c) Payment use cases:

Some governments and US states have started to accept Bitcoin as a means of paying taxes already and for large scale, non-time critical purchases the use case for Bitcoin payments already exists — remember Nic Carter’s analogy of Bitcoin as a ship transporting goods across oceans rather than the final mile postman delivering letter and parcels.

d) Transaction speed via Lightning network:

Micropayments will be enabled through the proliferation of the lightning network and further layer 2 and 3 solutions that help Bitcoin move up the monetary ladder from being a means of a final settlement to an effective network for transferring small, instantaneous payments from one party to another…globally.

e) BTC halving and supply model:

As the 2020 halving approaches there will be a realization that Bitcoin holds the same scarcity level (stock to flow ratio) as gold and by 2024 will be more scarce than gold. Scarcity is a key part of the Bitcoin proposition and as 1 Bitcoin can be divided into 100 million Satoshis and then grouped as required for any value of transaction it can, therefore, operate effectively as a means of exchange and unit of account….however before that can happen the price needs to stabilize so it can pass the ‘store of value’ function of money.

f) Global telecommunications infrastructure:

As 5G technology starts to roll out and we see companies such as Blockstream enable Bitcoin payments via satellite it is not difficult to imagine a world where there is wireless communication capability covering every square inch of the planet. If you are able to make this mental leap and assume it happens in the next 10 years then the possibility of Bitcoin becoming a global payment system for micro-purchases with near real-time final settlement becomes a reality.

2) Forthcoming global economic collapse

Photo by Ehud Neuhaus on Unsplash

Photo by Ehud Neuhaus on Unsplash

Next, we need to consider the real possibility of a forthcoming economic crash that could make 2007/2008 look nothing more than a short term set of ‘bad economic data’. At present, fiat currencies fulfill the store of value, medium of exchange and unit of account functions of money however when the government and central banks operate ineffectively, fraudulently or under the illusion that printing money through quantitative easing, undertake massive bond purchases “to increase liquidity” or other expansionary means then their currency no longer operates as it was intended — see Argentina, Zimbabwe, Venezuela, Weimar Republic and even the Roman Empire for cautionary tales and evidence on the destructive effects of currency debasement.

In essence, we believe that the world is in uncharted territory regarding debt and the burden is growing too heavy — at some point the last 100 years of Keynesian and expansionary monetary policies may fail completely and could cause one or more of the IMF SDR (Special Drawing Rights) reserve currencies such as GBP, USD, EUR, Yen or Yuan to go into a high or hyperinflationary spiral and eventually collapse. The Modern Monetary Theory view that a sovereign nation can always pay debts denominated in its own currency because it can simply print more money to do so is a catastrophically flawed argument as Economist Daniel Lacalle outlines in an enlightening interview on his website.

We are also on the precipice of banks implementing centralized digital currencies and when that happens there will be no escape for citizens to safely store their savings in the legacy retail banking system and negative interest rates are likely to be imposed, the ethics of personal privacy will be challenged significantly if not completely eroded and the opportunity to implement greater state control over citizen actions will be in place — see China right now for an example of social credit scoring initiatives that could easily be implemented in other nations;

“If an individual has a lower social credit score, they might find their ability to purchase what they want such as high-quality goods or a new home to be restricted. They might also be prohibited from buying airline and train tickets or renting an apartment. Some people with low social credit scores can expect to be blocked from dating sites and not be able to enroll their children in a school of their choice.” Forbes, 21 January 2019

With state-issued digital currencies, there is also the increased risk of one-off taxes such as that experienced by Cyprus residents in 2013 to fund bailouts or any kind of national initiative against the will of the citizens without them being able to do a single thing about it.

“Under an emergency deal reached early Saturday in Brussels, a one-time tax of 9.9 percent is to be levied on Cypriot bank deposits of more than 100,000 euros effective Tuesday, hitting wealthy depositors — mostly Russians who have put vast sums into Cyprus’s banks in recent years. But even deposits under that amount are to be taxed at 6.75 percent, meaning that Cyprus’s creditors will be confiscating money directly from pensioners, workers and regular depositors to pay off the bailout tab.” NY Times, 16 March 2013

This series of factors is probably the most important in the likely rise of Bitcoin as a globally accepted, sound money. As discussed in our previous article, there are significant shortcomings with the Euro currency and it is not inconceivable to think that these could well see a further fragmented and divided Europe for economic reasons. As the abstract from the paper below covering the little known ‘Target2’ system outlines, the debt owed by other Eurozone member states to Germany is so vast (approx €1 Trillion) that they are unlikely ever to be repaid and as such there is a real risk of significant political repercussions and a possible breakup of the Eurozone;

“Target2 is the Eurozone’s cross-border payment system and is mandatory for the settlement of euro transactions involving Eurozone central banks. It is being used to save the Eurozone from imploding. A key underlying problem is that the Eurozone does not satisfy the economic conditions for being an Optimal Currency Area, a geographical area over which a single currency and monetary policy can operate on a sustainable long-term basis. The different business cycles in the Eurozone, combined with poor labour and capital market flexibility, mean that systematic trade surpluses and deficits will build up — because interregional exchange rates can no longer be changed. Surplus regions need to recycle the surpluses back to deficit regions via transfers to keep the Eurozone economies in balance. But the largest surplus country — Germany — refuses formally to accept that the European Union is a ‘transfer union’. However, deficit countries including the largest of these — Italy — is using Target2 for this purpose. Further, the size of the deficits being built up is causing citizens in deficit countries to lose confidence in their banking systems and they are transferring funds to banks in surplus countries. Target2 is also being used to facilitate this capital flight. However, these are not viable long-term solutions to systemic Eurozone trade imbalances and weakening national banking systems. There are only two realistic outcomes. The first is full fiscal and political union — which has long been the objective of Europe’s political establishment. The second is that the Eurozone breaks up.” Blake, D. (2018). Target2: The silent bailout system that keeps the Euro afloat. London: City, University of London.

In a situation where we see global stocks and bond markets starting to stall and major issues with reserve currencies such as the Euro, we may see a significant flight of capital from retail and institutions into traditional safe havens such as Gold. At this point, it will be interesting to see whether Bitcoin has done enough to demonstrate its store of value function to carve out a portion of the ‘safe haven’ market.

a) Government debt levels:

Global government debt levels are now at a level that cannot be repaid. The US alone has $22 Trillion in govt debt. Keynesians and MMT advocates often argue that a sovereign nation can just print money to pay off its debts but this is simply not true for the levels of debt governments now find themselves in and would cause a massive devaluation in the currency.

b) Expansionary monetary policies:

Since 2008 the Federal Reserve has injected $4.5 Trillion into the US economy through QE. In Europe, the ECB bought $3 Trillion of government bonds between 2015 and 2019 and in Japan the experiment with ‘Abenomics’ left Japan with a struggling economy and a government debt to GDP ratio of 220%. Despite all of these ineffective measures, China has now started playing the same game as the rest and in January 2019 it injected $83 Billion directly into the banking system in one day. If monetary history has taught us anything it is that printing money and debasing the value of the currency does not lead to sustained growth, it leads to the collapse of a state or even an empire.

c) Eurozone and Target2:

Target2 has become the bailout system that keeps the Euro afloat. The German Central bank (Bundesbank) is owed almost €1 Trillion and Luxembourg is owed c€200 Bn by Eurozone member states as a result of the Target2 system. Italy, Spain, Greece & Portugal owe the most and it is not clear whether these figures can be repaid. It is possible that a default by these countries to the European Central Bank could take place and they would, in turn, struggle to meet obligations to creditor nations such as Germany. Trillions of debt contracts would be called into question. There are two possible options: (1) A full political European Union with common fiscal and monetary policy is implemented; (2) The Euro currency failings drive political divisions and an eventual break up of the Eurozone

d) Household debt:

At the end of 2018 US household debt stood at over $13 Trillion with around $4 Trillion of that figure relating to non-mortgage related debt. Warning signs are creeping into the economic forecasts through record levels of automobile loan defaults. Whilst unemployment is at record lows, wages are stagnant and exposure to debt is increasing, the horizon is not looking good.

e) Negative interest rates and central bank stock purchases:

Central banks are running out of tools and options to stimulate growth in flagging economies worldwide and many Economists argue that the next step should be to print more money to purchase stocks and shares directly — a false underpinning of a broken system. With proposals to implement negative interest rates being considered to encourage savers to take their money out of banks and spend or invest it or risk it being eroded away there appears now to be little room on the runway.

3) Separation of state and money

Photo by mahdis mousavi on Unsplash

Photo by mahdis mousavi on Unsplash

It was only during the early part of the 20th Century that there was a real unification of state and monetary control. It is true that the ruling classes of old taxed their citizens to raise funds for the crown and subsequently wage wars and build infrastructure. However, alongside this direct taxation, money operated in a free market environment which allowed the commodity with the most attractive qualities fulfilling the store of value, medium of exchange and unit of account functions to be selected for use by the market.

Often, there were many localized markets and thus, localized, free market selections of ‘commodity money’ such as Yap stones on an island the Pacific Ocean, glass beads and seashells in West Africa and many societies often used salt as a means of payment. So the modern concept of a centrally managed economic system with control of the currency linked directly to the whims of government and central banking authorities is a relatively new phenomenon that has led us to the edge of another global economic crisis (see section 2).

The time is now right for a separation of state controlled money and a return to a free market economic system that allows governments to tax their citizens but not to control the output and quantity of currency available in the economy — a return to sound money.

It is not obvious where the incentive is for a government to support a return to sound money as they have a much greater sphere of influence and control over the citizens living within their borders if they retain a state influenced money through a central banking entity. Some nations may start to stockpile gold and Bitcoin as a hedge against a failing global system but this is different to supporting a full move to a 1–1 link between the hard currency (Gold/Bitcoin) and a state-owned fiat currency that they can print and devalue at will at the expense of the citizens.

As Economist Daniel Lacalle states in his book ‘Escape from the Central Bank trap’,“The search for ways to preserve wealth in a society which owns most of it in deposits makes citizens seek any way to avoid the assault on their savings from the massive printing of money through increase of money supply. For this reason, the search for a currency whose control is not in the hands of States has been a constant in preserving capital for many years now”

4) Bitcoin mass adoption

Photo by Tom Grimbert (@tomgrimbert) on Unsplash

Photo by Tom Grimbert (@tomgrimbert) on Unsplash

At present Bitcoin is complex to understand, difficult to use for everyday purchases and puts the security of wealth storage entirely in the hands of the user without legal recourse or insurance protection (NB: Some custodian services do exist that offer a level of insurance against loss or theft). As the technical enhancements are deployed and the benefit of a sovereign, uncensorable, uninflatable currency start to become more evident then we will see a gradual rise in the number of people who store their wealth and choose to transact in Bitcoin. For people in countries where their currency becomes an ineffective means of wealth storage due to high or hyperinflation, it is likely that we will see a greater rate of adoption and day to day use — see the current situation in Venezuela. In addition, countries facing sanctions and embargoes by other nations may choose to adopt Bitcoin as a store of value alongside gold or encourage their citizens to transact and pay their taxes in Bitcoin. Ultimately a bottom-up (people led) adoption of Bitcoin is more likely to occur than a top-down (government-led) approach but once one central bank and government announces that they recognize Bitcoin as money and a legitimate currency then this is likely to cause a significant global institutional race to acquire Bitcoin and use it in a mix of sound money with central bank gold reserves.

A recent essay by Wences Casares, CEO of Xapo covers a detailed overview of Bitcoin and his belief that in 7–10 years Bitcoin could be worth $1m per Bitcoin.

“In a world in which Bitcoin succeeds all currencies may be quoted in satoshis (the smallest fraction of a Bitcoin). When your granddaughter asks what is the price of the New Zealand dollar she may receive an answer in satoshis: the New Zealand dollar is 72 satoshis today. And the price of the Turkish Lira? 21 satoshis today. The US dollar? 107 satoshis today. A barrel of oil? 5,600 satoshis today. Global GDP? 97,356,765 bitcoins. The GDP of Indonesia? 1,417,007 bitcoins. The reserves of the South African Reserve Bank? 53,230 bitcoins. You get the idea. Then all of these values would be easily comparable across time and across geographies.”

5) Investor speculation and return on investment shift

All the above could well lead to a reduced role for the government from a fiscal policy and planning perspective as less central co-ordination would be needed and citizens would be able to save their wealth in an uncensorable currency that does not have its value eroded through inflation or unsanctioned government taxation. Furthermore, all kinds of speculative investment sectors start to lose their shine as there is no longer the need to risk capital in the stock market, real estate or other markets and instead, global citizens can store their earnings in their private wallet and watch it retain its value or even appreciate in value over time. This could, in turn, lead to an exodus of investment and a global rebalance of real estate values to a more normalized market-driven level reflecting the cost of production, quality, scarcity, location, and desirability instead of artificially inflated markets due to speculation-driven price rises. Speculation will remain prevalent, however, it is simply the volume of speculation that could reduce as investors chase and are able to achieve a higher and safer return by storing their wealth in Bitcoin rather than real estate.

Photo by Benjamín Gremler on Unsplash

Photo by Benjamín Gremler on Unsplash

Underlying number assumptions

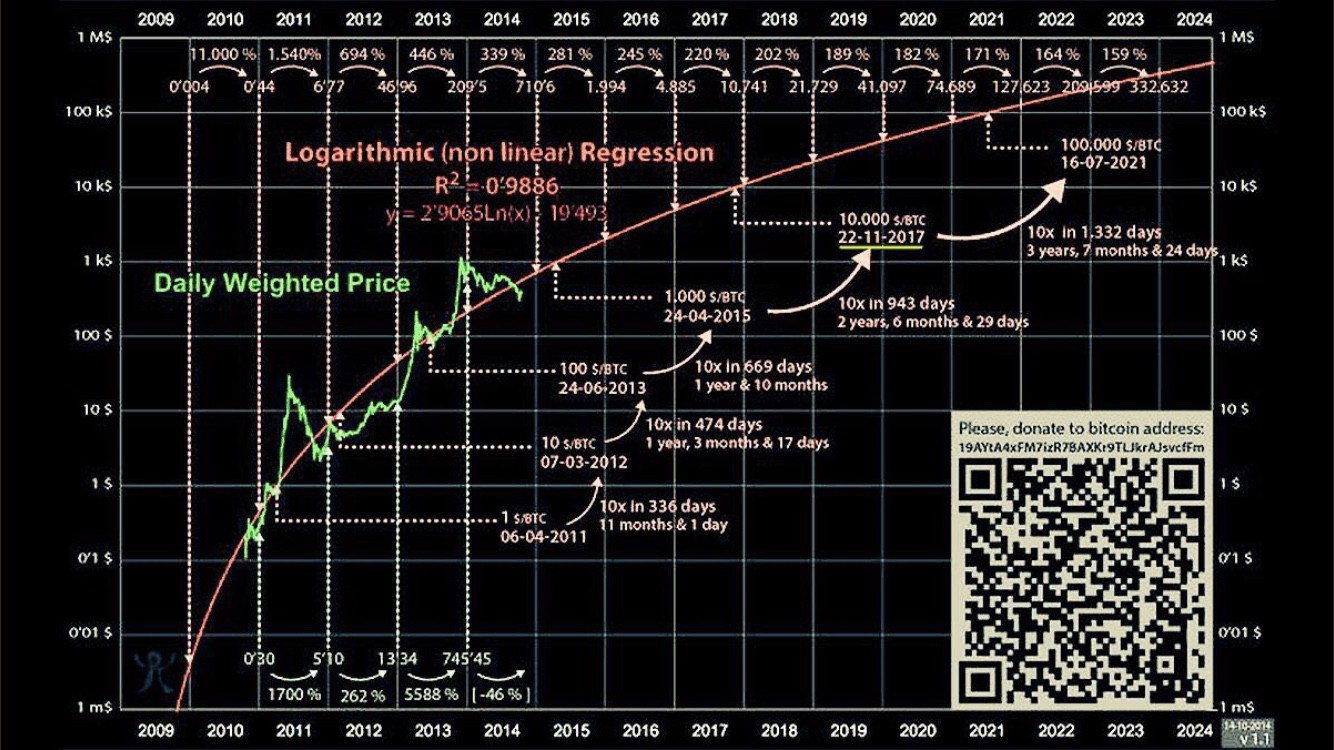

The chart below is from 2014 (unknown creator) and outlines a simple path to almost $1m per Bitcoin, the scary part is that it accurately forecast a $10k price in November 2017. As of March 2019, the forecast is behind this view however it will be interesting to see if price catches up to this projected trend line over the coming months and years — one to keep an eye on.

Unknown creator — please advise and we will credit them

Unknown creator — please advise and we will credit them

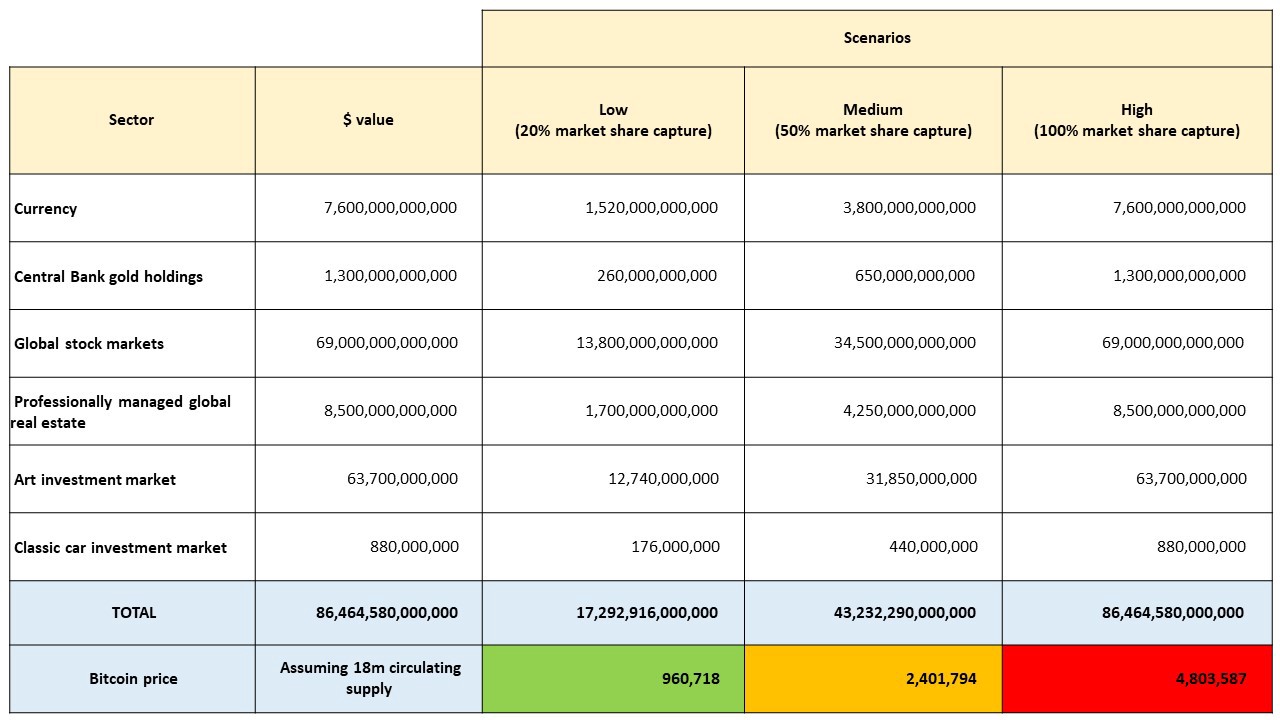

If we look at some potential scenarios we can see different implied market capitalization values and subsequent Bitcoin prices. The low scenario models Bitcoin capturing a 20% market share of each of the sectors on the left, Medium a 50% market share and High a 100% market share.

Copyright Genesis Node 2019

Copyright Genesis Node 2019

The low figure is in our view a possible scenario that could occur. This would see Bitcoin absorbing 20% of global coinage and currency (paper and digital), 20% of the existing gold reserves held by Central banks or instead of buying more gold year on year central banks could switch strategy to start accumulating a position in Bitcoin on top of their current gold holdings. Stock market values reflect the value of all the public listed companies in the world — whilst in reality, this figure will not reduce completely as companies will always retain value based on assets, financial performance and returns to shareholders and investors. We could, however, see an exodus of speculatorsas previously mentioned who could keep their savings in a lower risk commodity such as Bitcoin (not yet but in time as the volatility decreases) which over a longer timeframe is likely to outperform the stock market — we therefore feel a 20% shift of capital out of stocks and into Bitcoin is achievable, after all, Bitcoin is the single best-performing asset in the last 10 years. It is inaccurate to include the full $69 Trillion market cap of global stock markets though so let’s rule out the high column of $4.8m per Bitcoin in this analysis.

The $960k figure in the low scenario would increase to $1.2m per Bitcoin if it was to absorb the full $7.6 Trillion in circulating currency and all goods and services worldwide were priced in Bitcoin or Bitcoin were used to back fiat currencies.

Whilst this is incredibly high-level analysis/numberwang it outlines the monumental steps and hurdles that Bitcoin needs to take to meet targets such as $1m per Bitcoin and beyond. That said, the fact that Bitcoin has survived 10 years already, is now next to impossible to hack, has suffered nation states banning their people from using it and poorly claimed links to money laundering and criminal activity there is a very high chance it will survive indefinitely.

Whilst that seems challenging at present, to believe that Bitcoin can reach $1m it may onlytake the collapse of the Euro, a devaluation and rapid global sell-off of the USD and other currency capitulations in light of the massive economic risks and global debt bubble for Bitcoin to acquire 20%-50% of the global value of circulating currency which would propel it well on the way to a $1m per Bitcoin valuation. These things do not have to happen all at once or even over a short timeframe, but history and current economic policies worldwide suggest that there is a chance that they will happen and if they do we will gradually see Bitcoin acquire more and more value for the long term. It would be wrong to double count the allocations of institutional investors into the calculations above but if you assume that at present they do not yet have an average position of 10% (most are likely to be at 0–1%) of capital under management due to a lack of understanding and the challenges of approving investment decisions through boards and trustees into an asset class that is not well understood and highly volatile then the subsequent price rise that will come when institutions start to buy in via small positions will be enormous. An ETF approval by the SEC in the US is likely to start this wave of investment and whilst no firm date is confirmed it is likely that by the end of 2020 an institutional grade ETF investment vehicle will be in place.

Using different metrics and rationale the Xapo CEO, Wences Casares outlines his views on the future potential for Bitcoin in his essay ‘The case for a small allocation to Bitcoin’;

“How much a Bitcoin may be worth if Bitcoin succeeds is pure speculation. Today Bitcoin is worth a total of ~ $70 billion (~ 17.5 million bitcoins in circulation x ~ $4,000 per Bitcoin). If Bitcoin ever becomes the world’s standard of value and settlement it may have to be worth more than gold and less than the world’s narrow supply of money. All the gold that was ever been mined is worth ~ $7 trillion the world’s narrow supply of money is ~ $40 trillion. If Bitcoin is ever worth as much as gold each Bitcoin would be worth ~ $300,000, and if Bitcoin is ever worth as much as the world’s narrow supply of money it would be worth ~ $2 million.”

The table above and comments from the CEO of Xapo is nowhere near exact science however, they are simply an illustration of the steps that need to be taken for Bitcoin to reach certain price levels. On one hand, the current $4,500 — $5,000 price per Bitcoin looks like a snowball when compared to the slow moving but non-stop all-consuming glacier that is Bitcoin but on the other hand, it can be argued that the price of Bitcoin is the least interesting aspect about it.

Copyright Genesis Node 2019

Copyright Genesis Node 2019

References

- Blake, D. (2018). Target2: The silent bailout system that keeps the Euro afloat. London: City, University of London

- Escape from the central bank trap — Daniel Lacalle

- The bullish case for Bitcoin — Vijay Boyapati

- The case for a small allocation to Bitcoin — Wences Casares

Chinese Social Credit Score: Utopian Big Data Bliss Or Black Mirror On Steroids? By 2020, the Chinese social credit score system will be fully operational and have searchable records and a social… www.forbes.com Facing Bailout Tax, Cypriots Try to Get Cash Out of Banks For an updated version of this article, click here . ATHENS - In a move that could set off new fears of contagion… www.nytimes.com

Sources for the Bitcoin price table:

Home - The Money Project _ All of the World’s Money and Markets in One Visualization_money.visualcapitalist.com Global real estate investment market increases to $8.5t in 2017 | News | Institutional Real Estate… The size of the professionally managed global real estate investment market increased from $7.4 trillion in 2016 to… irei.com Art Market Grew to $63.7 Billion in 2017, and Other Key Takeaways from Art Basel Report Some of the more intriguing findings are mined from the data on Artfacts.net, which has tracked openings and closings… www.artsy.net Classic cars top alternative investment asset classes, with 192pc growth in 10 years Classic cars continue to power ahead as one of the top-ranking alternative investment assets, with growth of 192pc over… www.telegraph.co.uk