Every Investment is Speculation - Move on

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Every Investment is Speculation - Move on!

By Jeff Dorman

Posted July 29, 2019

U.S. stocks hit all time highs again, amidst better than expected GDP data, progress in trade and budget talks, and hopes for looser monetary policy ahead of this week’s FOMC decision. Not to mention, Congress lifted the debt ceiling again (which at this point appears to be more like a limbo bar than a ceiling). Meanwhile, the crypto markets continue to go the other direction, declining roughly 10% week-over-week. Crypto prices are now down 40% from recent highs, and are making lower highs and lower lows during this period of heightened volatility.

Bitcoin seems caught in a full fledged tug-o-war between long-term positives and short-term negatives. On the positive side, supply/demand is in Bitcoin’s favor (in August 2020, mining rewards will be cut in half), so if demand remains the same, prices will rise. Additionally, a deteriorating macro backdrop propped up by unprecedented and continuous inflationary monetary policy almost explicitly screams “Buy Bitcoin”. On the negative side, Bitcoin is still small and largely irrelevant as a global store of value, it has massive swings in value based on leverage and speculation, and can be considered overvalued based on current usage metrics.

However, the far more common view is that Bitcoin can’t be owned at all - a view that we think is completely uninformed.

In a recent story, Edward Jones investment strategist, Kate Warne, claims that people investing in cryptocurrencies are setting themselves up for a disaster. She opines:

“We don’t like the specifics of bitcoin, and we really think the price is moving around on speculation, rather than something else. When you think about bitcoin, you’re looking to buy something that you hope to sell for more to somebody else who’s more excited than you are. That’s the essence of speculation. We would not advise investing in them or speculating in them. If it goes up, sell it. If it goes down, sell it. But get out quick.”

Giorgio Carlino, a managing director and CIO of the global multi-asset team at Allianz Global Investors, New York, also went on record stating that Bitcoin is not investable:

“As an institutional investor, you should not, you could not actually, explain a position in bitcoin … or any other crypto in your portfolio as an asset allocation. The valuation of the cryptocurrency is not possible as of today. They have no income, there’s no intrinsic value, there’s no guarantee by a state or a central bank. It is an interesting concept and I’m fascinated, but it’s not an investment.”

Carlino’s colleague, Andreas Utermann, AllianzGI CEO and global CIO, went further stating:

“The value of a cryptocurrency is in the eye of the beholder. This makes cryptocurrencies entirely unsuitable for investing in.”

Let’s break this down starting with the term “intrinsic value”. This is an entirely made up term for investing, based on a philosophical concept, wherein the worth of an object or endeavor is derived in and of itself—or, in layman’s terms, independent of other extraneous factors.

The representatives of Edward Jones and Allianz above don’t really say anything controversial. They simply say that Bitcoin doesn’t have value by itself, and therefore it is just speculation based on what someone else will pay for it. But here’s the problem with this simple and completely naive narrative.

EVERYTHING IN INVESTING IS SPECULATION!

While it is true that equities have a price floor based on the difference between assets and liabilities, and bonds have a price floor based on asset coverage, and even commodities have a price floor based on production value, the current price of ALL of these asset classes is many, many, many multiples above this floor. If these asset classes traded at “intrinsic value”, the entire investable universe would plummet.

Think about this for a moment. When you buy a stock, you are speculating that the company will increase cash flows, or that multiples will expand. Further, when a stock trades at a 15x P/E ratio, or at 2x Price/Sales, or at 8x EV/EBITDA, these values are WAY above intrinsic value. These values are based on what the market perceives someone else will pay for it (either another investor or a strategic buyer). When you buy a corporate bond, especially a BBB-rated or high yield bond, there is ZERO chance that this company can pay off maturing debt using free cash. Instead, you are buying these bonds based on speculation that other investors will help refinance these bonds when they mature with the purchase of new speculative bonds or stock to pay off the old debt. When you invest in commodities, you’re speculating that there will be increased or continuous usage. Even when you invest in early stage technology companies via private stock, you are speculating that mass adoption will occur with no data to support it. Finally, I wonder if anyone at AG Edwards or Allianz has ever owned a call option or a put option? If you bought a $3500 December 2019 SPX call option right now, the intrinsic value of that option is ZERO. But it has value due to time, volatility and other factors in the Black-Scholes model.

To say that you should not invest in Bitcoin because it is speculation is ill-informed. For naysayers that don’t believe the speculation is justified, that’s fine – this would be a logical conclusion and everyone is entitled to their opinion. But the word “speculation” is flat out lazy. To quote Howards Marks: “I’d much rather be an intelligent speculator than a conventional investor.”

On the flip side, for those that understand risk/reward and understand how to value speculation, Bill Miller just taught a course on how to incorporate risky assets like Bitcoin into a broader portfolio- his fund rose 46% in the 2nd quarter led by his Bitcoin long position. Yes, this Bill Miller:

Miller, 69, has found success by following the same playbook he used during his three-decade run at Legg Mason:picking beaten-down securities that trade at a large discount to their intrinsic value.

Once we agree that everything is speculation, it’s much easier to see why speculating on digital assets makes sense as a complement to other investments, and perhaps eventually, as an outright replacement. Arca’s own David Nage continues to spell out the bull case each and every day to those who will listen, and he is starting to attract others who want to tell their digital asset stories as well (we highly recommend his recent interview and webinar with Cambridge Associates’ Marco Veremis).

Stop Looking Just at Bitcoin - an Entire Asset Class Sits Below

We’re not done with Allianz. Not only can we easily debunk their anti-Bitcoin stance, but we can also debunk their anti-Digital Assets stance. For anyone who is seriously considering this asset class as an investment, or who feels confident enough to deride its existence, it would make sense to move beyond just Bitcoin and cryptocurrencies and explore the other investable digital assets that make up the rest of this asset class. A crypto investor wouldn’t make a statement that healthcare stocks don’t exist simply because the media focuses on FANG stocks. That would be foolish and uninformed right? In the same fashion, Allianz and many others undoubtedly have no idea these other digital assets exist. A majority of the investable token landscape does not fall into the “cryptocurrency” sub-category.

We are in the midst of an evolution where tokens now take on a variety of unique investment characteristics. Some are essentially equity-linked notes of cash-flow producing companies, others are more akin to “airline miles”. A few tokens thrive on community engagement and growth mechanisms, while others represent asset transfers in forms that were previously unheard of (i.e. transferring computer file storage).

Let’s focus on one of the easiest digital asset sub-categories to understand. Many crypto exchanges that allow investors to buy and sell digital assets have issued “tokens” that serve as part utility / part security. In its basic form, if you own an “exchange token”, you are typically entitled to discounted trading fees on their site (utility), and a percentage of the company’s revenue/profit (security) in the form of a token buyback. Many of these companies have net profit margins that would put US and International publicly traded companies to shame.

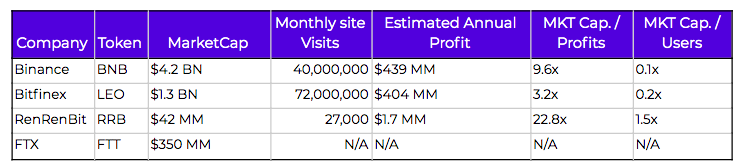

These exchange tokens can also be valued, both on an absolute basis and a relative value basis. While the actual valuation techniques we use at Arca are above the scope of this market recap, let’s look at a very simple example. While “market cap” is not necessarily the best indicator of value, we can use it as a proxy. Here are 4 exchange tokens currently on the market:

- Binance is the largest and most well known

- Bitfinex is the oldest, and the largest by Bitcoin volume

- RenRenBit is a little over a year old, and just completed a small token raise last week to grow its business further

- FTX is a brand new,interesting but completely unproven exchange, and is about to launch a token this week at an incredibly lofty valuation

Source: Arca Proprietary Data and Company Estimates, similarweb

Source: Arca Proprietary Data and Company Estimates, similarweb

These tokens are clearly not “Currencies” and, instead, give investors and users of their platforms a chance to participate in the company’s growth. All of these companies are real companies, with real equity values that are distinct and separate from their token values. Further, they are similar enough that relative value matters. For example, it’s pretty clear that successful, proven leaders like Binance and Bitfinex can capture tremendous value in the form of user growth and revenue. Meanwhile, newcomers like RenRenBit that are realistic about their company’s value can give “venture-like” returns to investors and users who want to bet on their growth, while others like FTX may be trying to take advantage of unsophisticated investors with absurdly high initial valuations. Eventually, as we continue to move away from just protocols and “decentralized everything”, you end up with interesting tokens like these that derive value based on their users. And user growth can be measured. And measurements can be compared.

So a word to the prognosticators out there making public statements. Educate yourself before becoming a meme.