| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the July 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

- 9-18-2019 Additional content has been added to this journal.

- Tweet: The Times are a changing

- Bitcoin Recapitulation

- Why Bitcoin

- Bitcoin Energy Consumption Rebuttal

- The Moral Case for Lightning

- Gradually Then Suddenly

Bitcoin’s Department of Defense: The Case For A Global Reserve Currency With No Guns

By Anthony Pompliano

Posted July 1, 2019

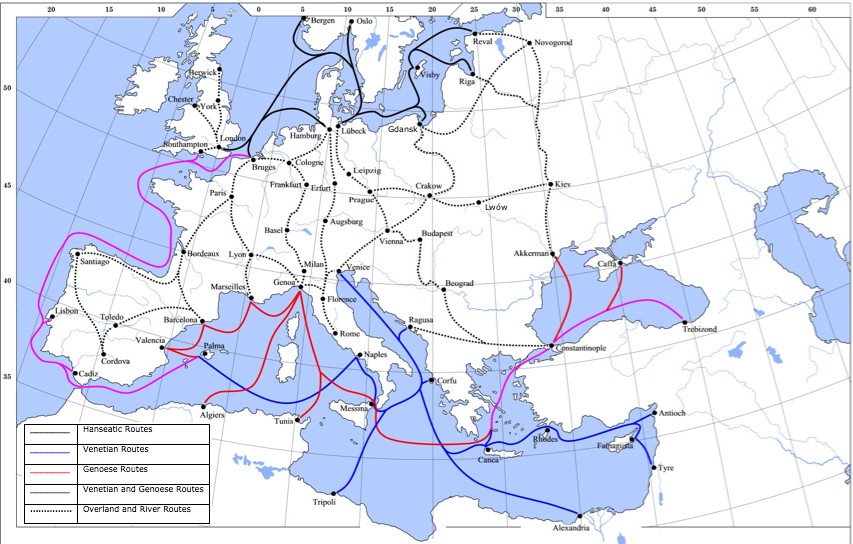

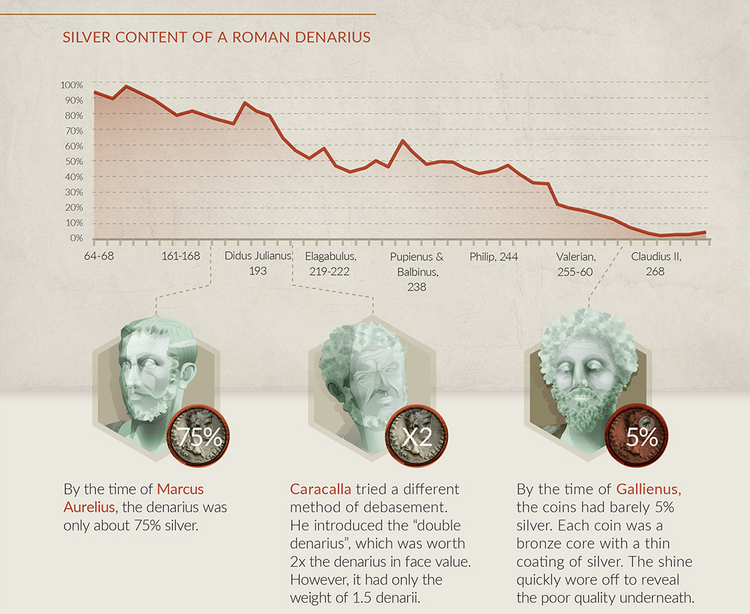

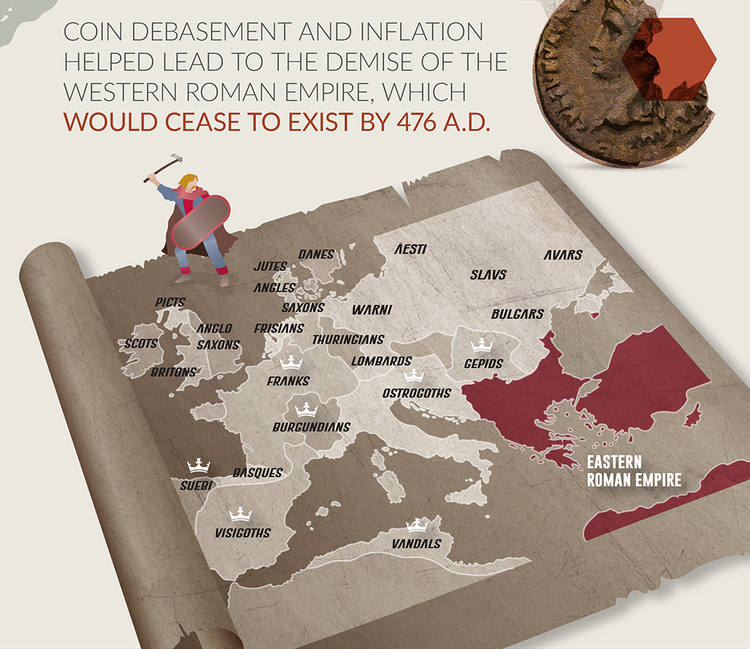

The country with the strongest military has historically implemented their national monetary system as the global reserve currency. This started with the Silver Drachma of ancient Athens during the 5th century BC. Next up was Rome when they issued the Gold Aureus (from 1st century BC to 4th century AD) and then replaced it with the Silver Denarius coin in the year 312 AD.

As the Western Roman Empire fell and the Eastern Roman Empire (Byzantine Empire) survived/thrived, the Silver Denarius was replaced by “Byzantine coins” or a “Gold Solidus” which was an evolved variation of the Western Roman Empire’s coinage. During the early 1000s AD, the Gold Solidus was gradually debased and eventually Emperor Alexios I Komnenos replaced it with the “hyperpyron,” a refined gold coin that had ~ 20% less gold.

Toward the end of the 7th century, we saw the rise of the Islamic Dinar. It wasn’t until the 13th century that the Florence Fiorino became globally dominant, which was followed in the 15th century by the Venice Ducato. Then in the 17th century, the Dutch Guilder took over as the world currency, before the 19th century ushered in the British Pound Sterling as the most important currency in the world. And the British Pound Sterling remained the global reserve currency until World War II.

It was at this time that the US dollar become the global reserve currency and it has defended that position since World War II. As I mentioned at the start of this letter, the global reserve currency was under the control of whoever was the global superpower at any given time.

This trend is about to change though.

Previously, the country with superior military firepower and tactics prevailed. It mattered who had the upper hand on land, sea, or air. But given where we are going, the bombs, bullets, tanks, ships, and fighter jets aren’t going to be nearly as important as they once were. We are moving from physical warfare to cyber warfare.

We no longer need to send troops to combat if we can attack a country’s critical infrastructure (ex: electrical grid, banking system, media publications, etc). War becomes even less necessary when we can weaponize the US dollar and cut off entire countries from the international financial system (ex: Venezuela, Iran, North Korea, etc).

There is one problem with this military, economic, and cyber strategy though — what happens if we can’t attack a country through military firepower, economic sanctions, or cyber warfare?

This may initially sound like a ridiculous question, but it isn’t. Whether we like it or not, there is a group of people (the Internet) that has created a new currency (Bitcoin) that is slowly vying for global reserve currency status. And this group of people did something counterintuitive that is currently misunderstood.

The creators of Bitcoin focused on defense, rather than offense. Instead of conceiving a plan to gain superiority by attacking other countries or currencies, Bitcoin is designed in a way to survive any known attack. You could say this strategy falls in line with the belief that “the best offense is a great defense.”

Lets look at the three main threats to a currency’s global reserve status:

- Military superiority — If you control the global reserve currency and your superpower status is revoked, you have historically lost global reserve status. No matter how hard nation states try, there are no individuals, companies, or physical locations to attack. No one person or group controls Bitcoin. If a nation state was to capture or kill an individual, nothing would change. If a nation state was to blow up all the mining facilities in their country, nothing would change. Simply, the decentralized nature of Bitcoin renders military superiority irrelevant.

- Economic sanctions — The US has done a great job defending its global reserve status by weaponizing the US dollar. Unfortunately for the world’s leading currency, there is no individual, company, or country to sanction in an effort to stop Bitcoin. No one is in control, therefore the economic sanctions are rendered irrelevant.

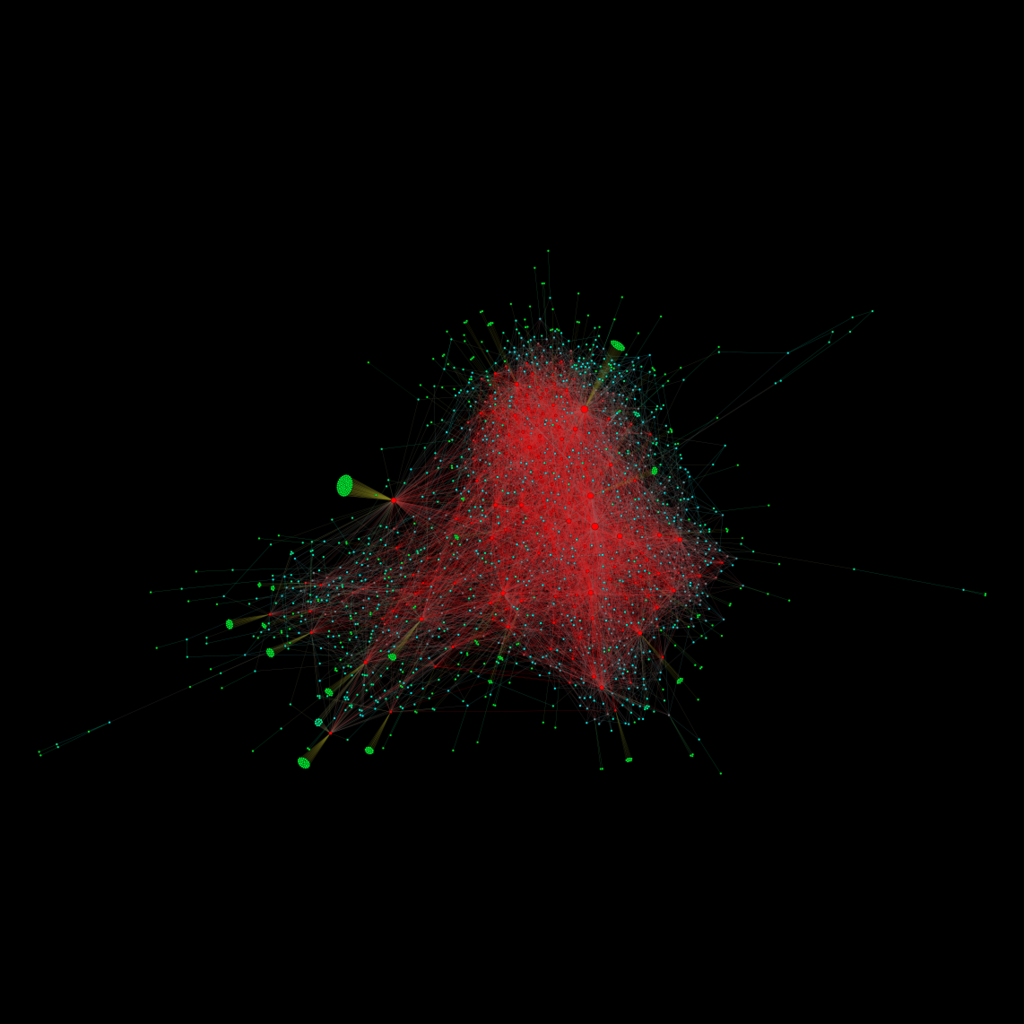

- Cyber warfare — Over the last 10 years, Bitcoin has become the most secure computing network in the world. There are hundreds of billions of dollars in incentives for someone to successfully attack the system, but no one has succeeded yet. Additionally, the network continues to get stronger every day (up 10x in hash rate over the last 2.5 years), which widens the moat of security. Because of Bitcoin’s decentralized nature, cyber warfare tactics are rendered irrelevant.

So what exactly does this mean?

Bitcoin is the first world currency that is (1) not backed by a nation-state and (2) has the ability to withstand any and all attacks by every nation-state in the world. Quite literally, the “defense first” approach to Bitcoin’s design is likely to have led us to a world where currency dominance shifts from military/economic/cyber superiority to anti-fragile superiority.

Bitcoin’s Department of Defense has no bullets, no bombs, no ships, no fighter jets, and no soldiers. It has thousands of volunteers and millions of computers around the world that are cooperating to ensure there is no single point of failure.

The world is changing quickly. Nation-states are behind the curve. And Bitcoin is the sleeping giant that is well-positioned to be the first currency to achieve global reserve status without ever having to engage in conflict.

-Pomp

Bitcoin, The Dollar And Facebook’s Cryptocurrency: Price Volatility Versus Systemic Volatility

By Caitlin Long

Posted July 1, 2019

Bitcoin has a systemic-stability mechanism built into it, but not a price-stability mechanism built into it.

Bitcoin’s price swung wildly this week, causing many to conclude bitcoin is unstable. But this conclusion misses a key nuance: Bitcoin was designed for systemic stability, not for price stability. Indeed, as a system Bitcoin is highly stable even though its price may not be. Bitcoin is the opposite of fiat currencies, which generally exhibit price-stability but are susceptible to periodic bouts of financial system instability. By extension, stablecoins that track fiat currencies, such as Facebook’s new cryptocurrency (Libra), fall into the same category as fiat currencies—they’re designed for price stability, not systemic stability, and are exposed to the same risk of periodic instability of traditional financial systems. Can a monetary system be both price-stable and systemically-stable? Probably not, and here’s why.

The real world isn’t stable. Unpredictable events happen. Consequently, demand for money is inherently unstable too, influenced by factors such as earthquakes, droughts, hurricanes, technology break-throughs, the sudden discovery of large oil/mineral reserves, tax/tariff/regulatory changes, population trends and even simple seasonality. To cajole price stability within fiat currency systems, central bankers counteract these demand fluctuations by intervening in markets—in an attempt to steer the economy to perform within a target rate of price inflation, a currency peg or interest rates.

But remember—demand for money isn’t stable. Central bankers manufacture the price stability of fiat currencies by interfering with natural market processes. Their actions can eventually lead to systemic instability. But hold that thought.

Bitcoin as a System: Designed for Systemic Stability, Not Price Stability

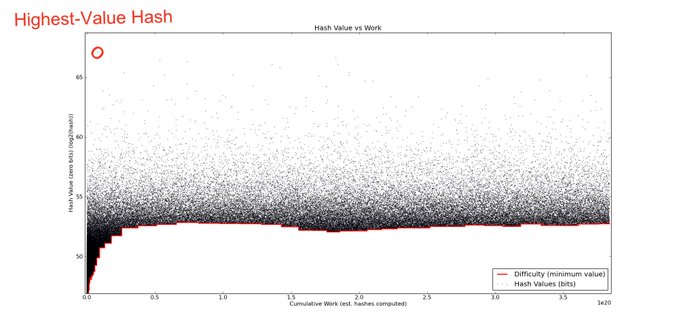

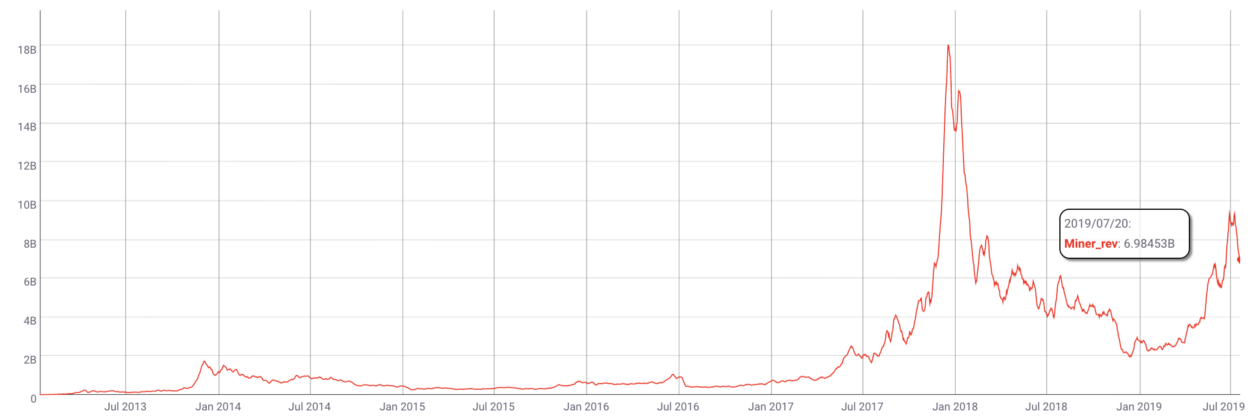

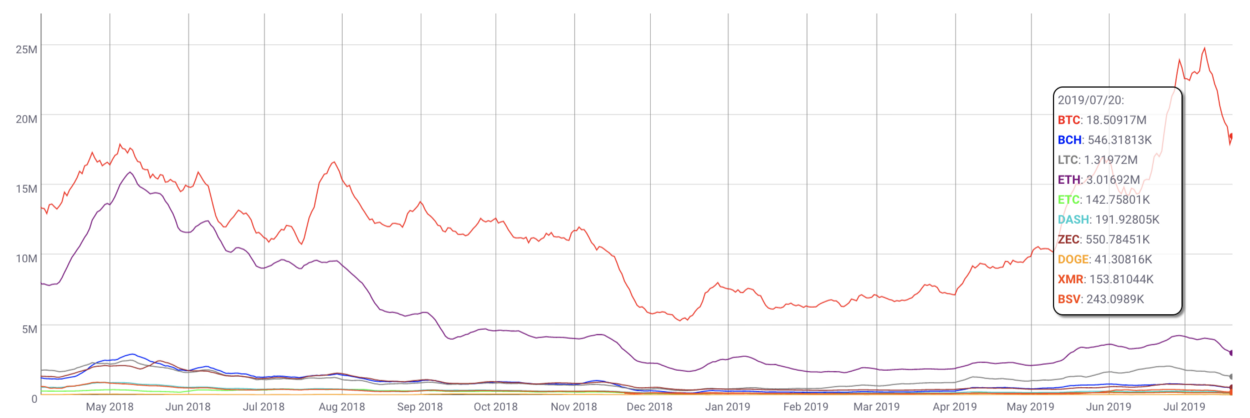

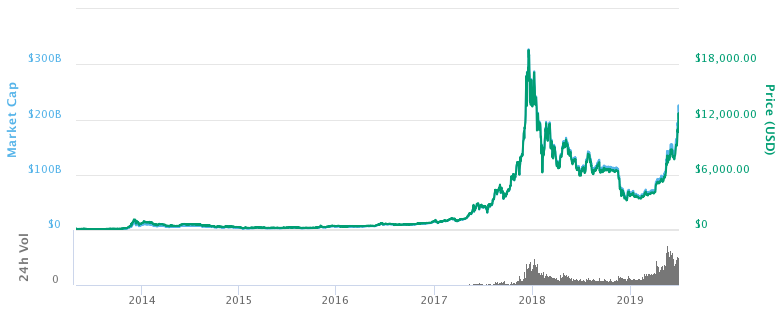

Bitcoin, by contrast, is a system that prioritizes security over price stability. Bitcoin’s systemic stability stems from the security of its network. This week, as bitcoin’s price volatility was capturing headlines, I was watching core bitcoiners get excited about something else entirely—the network’s hash power hit an all-time high, and its “difficulty” also adjusted to an all-time high.

Translation: Bitcoin’s network security hit at an all-time high.

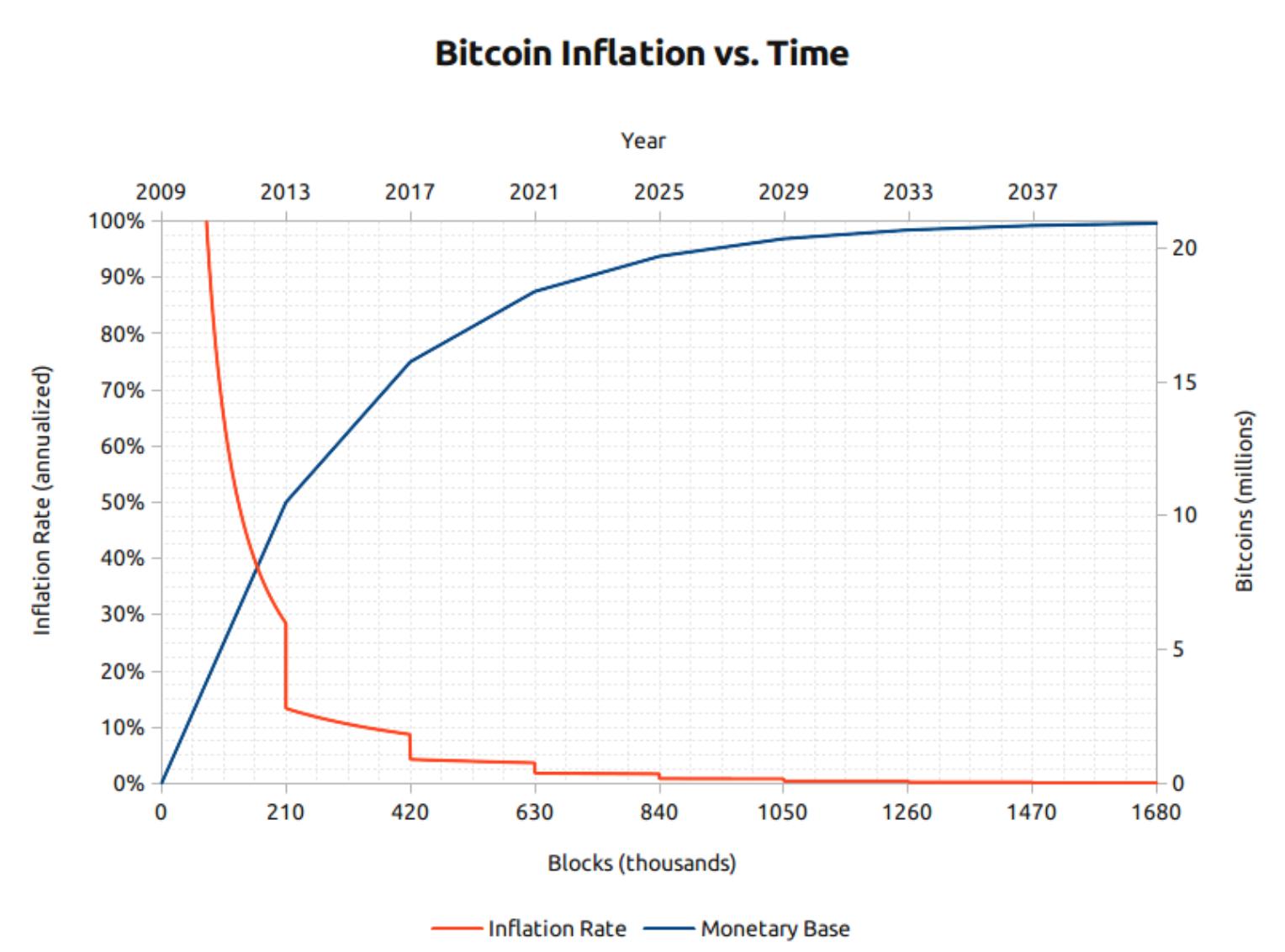

Hash power is defined as the processing power of the Bitcoin network to perform calculations necessary to confirm transactions. The higher the hash power, the more secure Bitcoin becomes—i.e., the more immune it is to attack, simply because (by design) the cost to amass enough hash power to attack the network far exceeds the gain from doing so. Bitcoin is almost certainly the most secure computer system ever created, mostly due to the staggering size of its hash power. The Bitcoin network hit a high of 66.7 quintillion hashes per second (66.7 exahashes/second) on June 22—it’s hard to convey just how powerful that is because it’s not directly comparable to supercomputers, owing to the specialized nature of chips used in the Bitcoin network, but it’s safe to conclude it still dwarfs the world’s top 500 supercomputers, combined. The size of Bitcoin’s hash power is one reason why it has survived every attack thrown at it to date, and its hash power continues to grow. What happens when additional hash power is added to the Bitcoin network? Answer: the network becomes more secure. That’s it. Adding more resources does not—cannot—create more bitcoin. Why? Because (1) bitcoin’s supply is fixed by algorithm and (2) the protocol’s “ difficulty adjustment “ automatically kicks in when more hash power enters the network, to ensure that a new block is added to the blockchain every 10 minutes, on average.

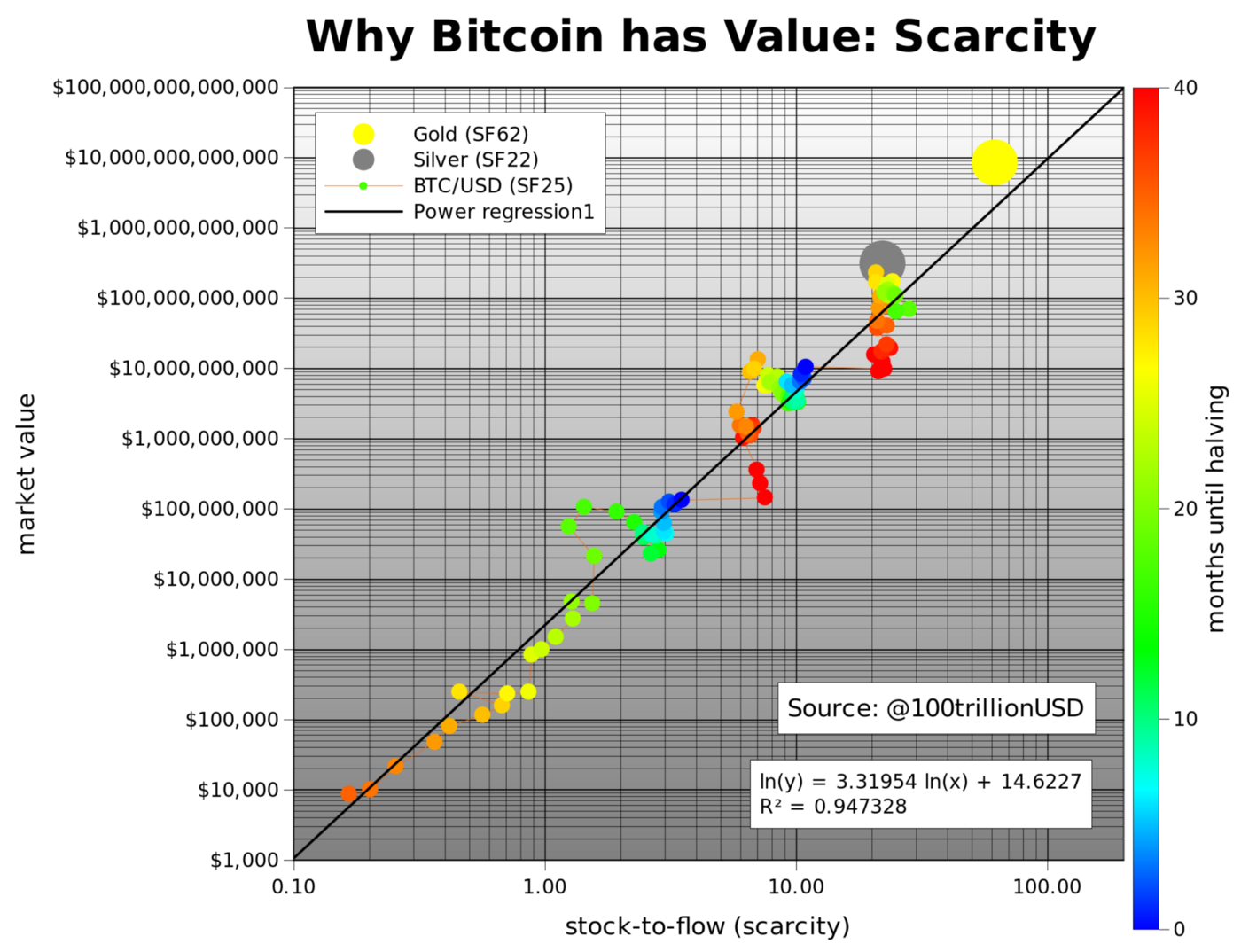

“Difficulty adjustment is the most reliable technology for making hard money and limiting the stock-to-flow ratio from rising, and it makes Bitcoin fundamentally different from every other money(emphasis added),” wrote Saifedean Ammous wrote in his book,The Bitcoin Standard.

While investing more resources in gold mining causes more supply of gold to come online, that’s not the case with Bitcoin. More computer resources simply create more security, not more supply.

So, Bitcoin has a virtuous cycle that fiat currencies don’t have. As bitcoin’s price goes up, more hash power joins the network. As more hash power joins the network, the network’s security hardens. Bitcoin becomes more immune to attack—more systemically stable. (Of course, the reverse is true as well—a vicious cycle could occur whereby Bitcoin becomes less secure as hash power exits the network. But even though the Bitcoin network lost hash power during the “crypto winter” of 2018-19, the loss of hash power negated only the prior four months of hash power growth and didn’t remotely come close to rendering Bitcoin systemically insecure. When hash power leaves the network, the difficulty adjustment adjusts downward until the cycle turns virtuous again. It’s a self-correcting system.)

To summarize, Bitcoin has a systemic-stability mechanism built into it, but not a price-stability mechanism built into it. Bitcoin’s supply is fixed, so its price will fluctuate directly as demand for it fluctuates.

Fiat Currency Systems: Designed for Price Stability, Not Systemic Stability

Fiat currency systems, by contrast, are designed to have “stability mechanisms”—they’re called central banks—which cajole short-term price stability by intervening in markets to keep a targeted metric within range. Why the quotation marks around “stability mechanisms”? Because by intervening in markets, central banks distort natural market signals (namely, interest rates) and thereby prevent accurate economic calculation by businesses—fomenting the next round of systemic instability when cash flows don’t materialize to service the debt. Indeed, as central banks became more activist in the early 1980s, traditional financial markets have ping-ponged within a crisis/stability/crisis cycle.

Nassim Nicholas Taleb provides an apt analogy for this process in his book,Antifragile: forest fires. Artificial suppression of natural volatility (by suppressing small fires) creates false stability that can last short-term, but it builds long-term risk by letting an enormous amount of tinder build up. When the fires eventually come, they’re more devastating.

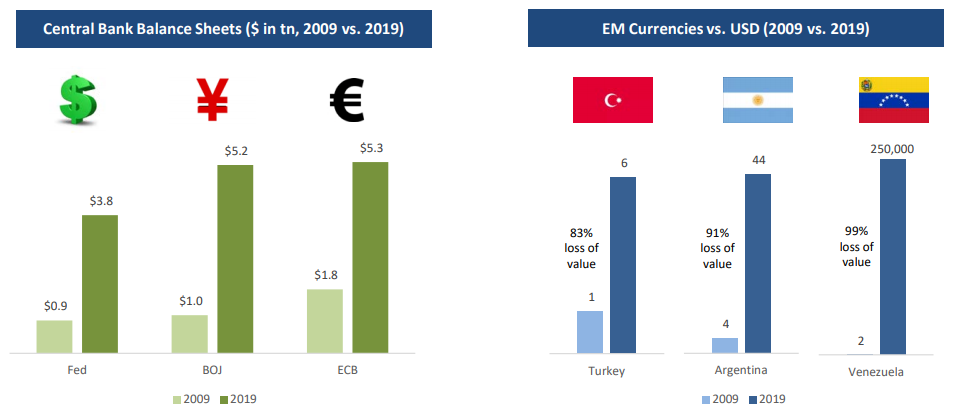

By analogy, central banks have successfully suppressed market volatility in the short-term. Yet, clear signs of underlying systemic instability are again showing up—because central bank actions not only interfere with price signals in markets, thereby causing investors to misallocate capital unintentionally, but they also gut balance sheets. We can see signs of systemic instability brewing yet again in esoteric but critical corners of money markets, which is usually where the next round of systemic instability shows up first. Jeff Snider at Alhambra Investments chronicles on a daily basis the dozens and dozens of indicators showing that the financial system is well into its fourth systemic “disturbance” since the 2008 financial crisis (e.g., the LIBOR curve just inverted for the first time since February 2008, swap spreads just turned uniformly negative in key parts of the swap curve and repo fails are growing again, among the many, many other indicators also confirming another round of systemic instability is underway). As Snider points out, this fourth episode is shaping up to be particularly nasty—maybe not as nasty as 2008, he says, but nastier than the prior three episodes. Time will tell. Despite all the warning signs, incredulously, on Thursday the Fed approved stock buyback plans submitted by 18 big banks, saying “The nation’s largest banks have strong capital levels and virtually all are now meeting supervisory expectations for capital planning.” I suspect the Fed’s decision won’t age well, but I digress…

The takeaway here is that systemic stability concerns have not been solved in traditional financial markets—and they won’t be, owing to the inherent design of fiat currency systems that favor short-term price stability at the expense of periodic episodes of systemic instability.

Summary—And What This Means for Facebook Libra

Here’s what it all means: traditional financial markets may be more price-stable than Bitcoin short-term, but will periodically face systemic crises. Bitcoin as a system is far more stable, even though its price may not be.

How does Facebook’s Libra fit into this picture? Libra is a system designed to track a basket of fiat currencies—a “stablecoin,” in the parlance. In other words, Libra is designed for price-stability but will inherit the same periodic instability faced by fiat currency systems—that is, assuming that the Libra Association keeps the basket allocated to fiat currencies. But Libra’s basket is not set in stone. Over time, the Libra Association has the opportunity to invest the basket in bitcoin and other assets that are more systemically stable than fiat currencies. It will be fascinating to watch.

The real beauty of Bitcoin is that it offers each of us a choice to own financial assets outside of the traditional fiat-currency system, if we choose to. From a system design perspective, Bitcoin and fiat currencies are fundamentally different. One way to ponder that choice is to ask yourself how much you value price stability, and whether the systemic stability of Bitcoin is valuable to you as an insurance policy. Only in retrospect will it become clear how valuable that choice turns out to be.

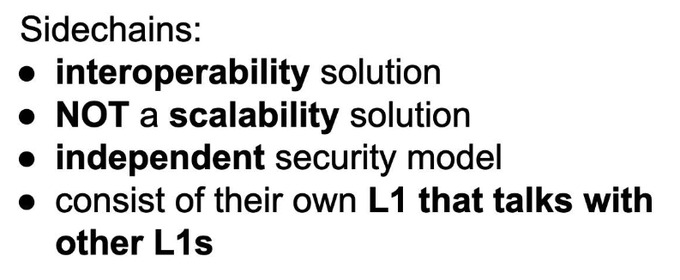

Tweetstorm:SIDECHAINS ARE NOT LAYER 2

By Georgios Konstantopoulos

Posted July 4, 2019

Let’s put a myth to bed.

Thread on the history of sidechains, their security properites, concluded by their differences to Layer 2 solutions.

(there’s a lot of resources, feel free to skip/bookmark for later!)

👇

– History of Sidechains –

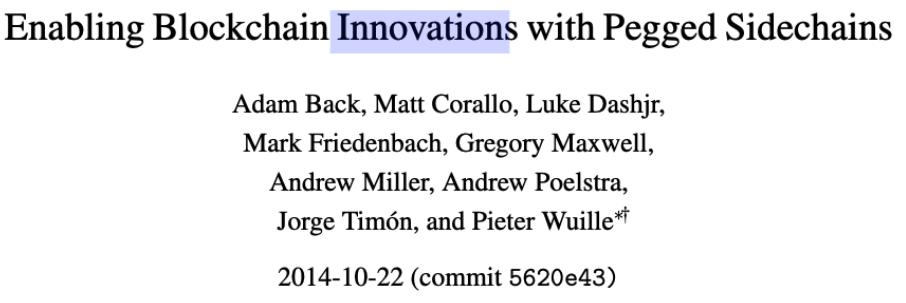

“Sidechains” is a term coined in [1] by @Blockstream, as a way to access innovative blockchain features which are too risky to try on Bitcoin.

This is done by enabling the transfer of BTC between chains w/ varying feature sets

[1] blockstream.com/sidechains.pdf They introduced the “two-way-peg” (2WP) for PoW blockchains.

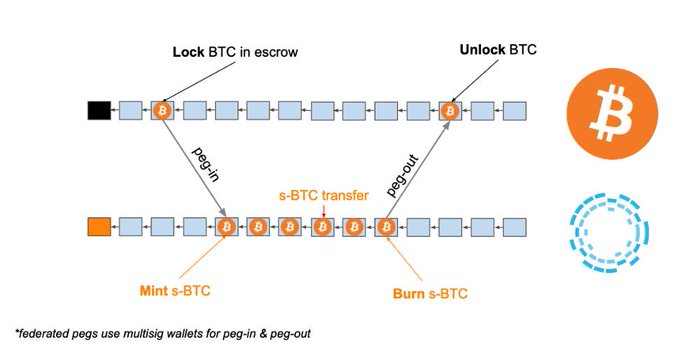

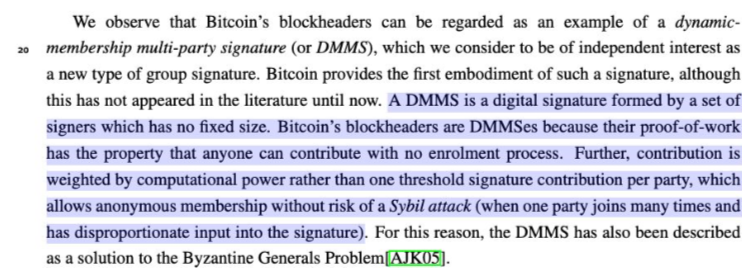

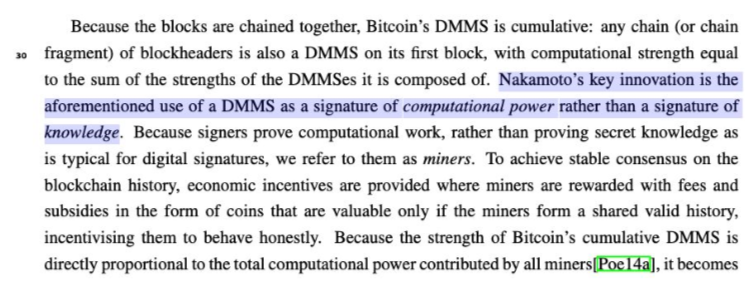

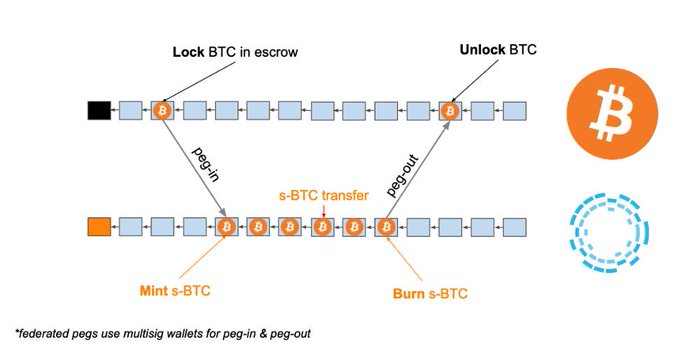

To transfer assets from the “sending chain” (SC) to the “receiving chain” (RC), you lock them on the SC, and mint an equivalent amount on RC by providing a proof of ownership on SC along with a DMMS* with enough work.

- DMMS: Dynamic Membership Multi-party Signature. In the PoW case, that’s an SPV proof. Screenshots from [1].

Note that the 2WP between PoW chains requires each chain be able to verify the other chain’s Proof of Work algo.

Blockstream’s Liquid uses a multisig federation and doesn’t need SPV proofs for peg-in/out (more on that later on PoS sidechains).

– PoW Sidechains –

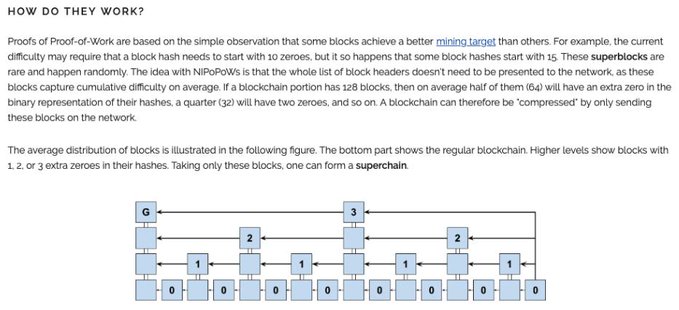

A few years later @sol3gga, @socrates1024 and @dionyziz came up with NiPoPoWs [2], a succinct SPV proof technique where the main insight is that some blocks have a better mining target than others.

[2] nipopows.com

(obviously, @socrates1024 talked about this in bitcoin talk in 2012 bitcointalk.org/index.php?topi…)

This works only for constant difficulty PoW, so is still not practical, and is vulnerable to block withholding/bribing! @gtklocker implemented a NiPoPoWs velvet fork and interlinker for Bitcoin Cash which he writes about in his thesis [3].

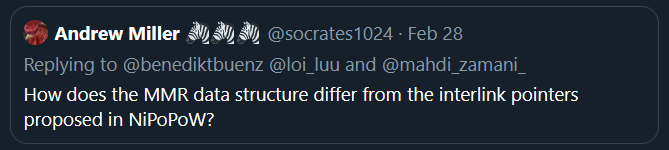

[3] arctan.gtklocker.com/thesis.pdf FlyClient [4] by @benediktbuenz utilizes @peterktodd ‘s MMRs* [5] to succinctly commit to the chain history. Combined with probabilistic sampling** has better performance than NiPoPoWs and works for varying PoW difficulty.

[4] eprint.iacr.org/2019/226 [5]proofchains/python-proofmarshal Contribute to proofchains/python-proofmarshal development by creating an account on GitHub. https://github.com/proofchains/python-proofmarshal/blob/master/proofmarshal/mmr.py

We recently wrote a ZIP with @prestwich and @therealyingtong to add MMRs in ZCash’s blockheaders. Full FlyClient ZIP soon?

**the light client repeatedly asks a full node about random parts of the chain history until they’re convinced that the chain being shown to them is correct. This is made non interactive via the Fiat Shamir Heuristic

Short discussion on FlyClient vs NiPoPoWs:

@summa_one’s stateless SPV proofs [6] can also be used for pegs, but are ‘cryptoeconomic’: the more work inside the provided headers the more confident you can be about the transaction being part of the heaviest chain

[6]

link

link

All PoW sidechain schemes assume that each chain is independently secure. That is a BIG assumption, as argued by Peter against Dionysis: .

Constructing PoW sidechains is also described in [7].

[7] eprint.iacr.org/2018/1048.pdf

TAKEAWAY:

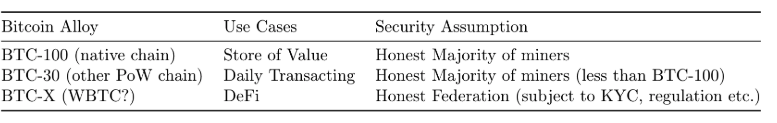

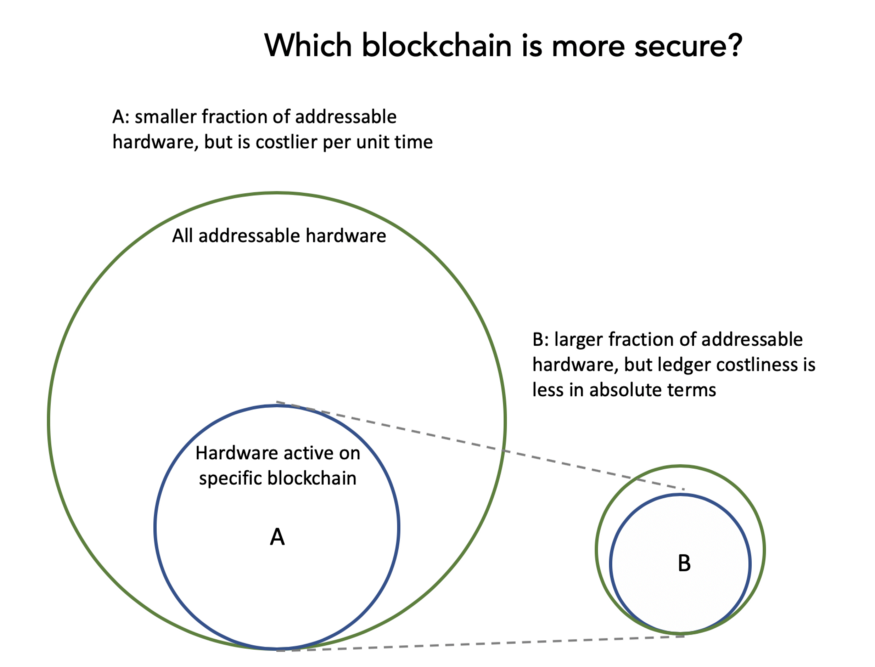

The moment your bitcoins move to an output that is spendable based on an event that happens on a chain with less hashrate than the bitcoin chain, you’re exposing yourself to counterparty risk (the miners of the other chain, or the validators if PoS) I like to think of crosschain assets as alloys.

BTC on the bitcoin chain is BTC-100. It is pure, inefficient, boring; but it is the most sovereign asset that has ever existed.

BTC-X would explore a different tradeoff space, as envisioned by the original @blockstream paper

Based on that thought, @ethereum ‘s or @binance ‘s WBTC would be BTC-X, where X is (cost of corrupting the federation) / (cost of attacking bitcoin). It’s easy to see how the fraction’s value could become 0 on regulatory pressure.

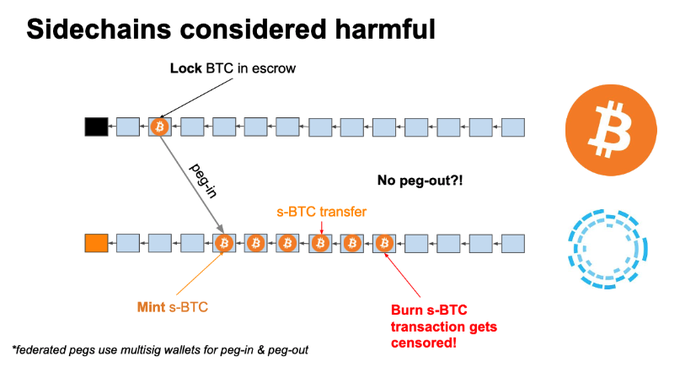

What if the receiving chain’s consensus halts (i.e., no blocks are produced)? What if the miners refuse to include your locking transaction?

WORST CASE SCENARIO: YOU LOSE ALL YOUR MONEY

What is the point of gambling your BTC with WBTC in the #DeFi casino if you cannot cash out? It’s as if as the casino shut down with all your money inside. Remember Mt. Gox?

– PoS sidechains –

In [8], Andrew Poelstra formalizes DMMS security, and argues that a properly implemented PoS with long/short-range attacks protection can be DMMS-like, but has different security from Bitcoin’s DMMS.

Maybe that’s BTC-99.99?

[8] download.wpsoftware.net/bitcoin/pos.pdf (my favorite PoS paper) Since there’s no notion of “work”, can we construct a secure DMMS that can convince us that an asset was locked on another chain?

Dionysis’ work [9], [10] covers this area extensively

[9] eprint.iacr.org/2018/1239.pdf

[10]

Proof-of-Stake Sidechains for Cardano https://docs.google.com/presentation/d/17x25AfvnMOpmXFO7wqs5q0AtW4yrYJeVPS2Lb22thyo/edit?usp=sharing

link

link

– Crosschain communication in practice (follow IBC for standardization) –

Deposit from sending PoW chain to receiving PoS chain:

- Send asset to special output on sending chain

- Validator listens for deposit with a light client and signs it

- If 2/3rds of validators weighted by stake signed, the asset gets minted on the receiving chain

Withdraw from sending PoS chain to receiving PoW chain:

- Burn on sending chain

- Make withdrawal request to validators with proof of burn

- Validators signs on the withdrawal request

- Output on receiving chain gets unlocked if signatures with 2/3rds of stake are shown

I hope that I have convinced you that there is counterparty risk in moving assets from a PoW chain to a sidechain with less hashrate, or a PoS chain.

There may be feature tradeoffs which justify that move, but the extra risk must be part of your security model.

What makes Layer 2 special?

L2 security == L1 security

A L1 smart contract acts as an escrow. Unlocking the assets relies on:

- Playing a fixed duration game where honest players are guaranteed to win, OR

- Cryptographically proving ownership with a ZKP.

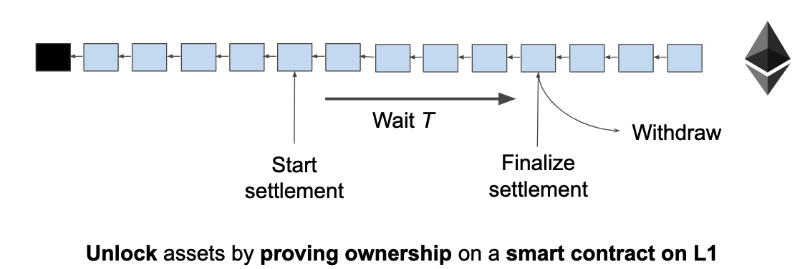

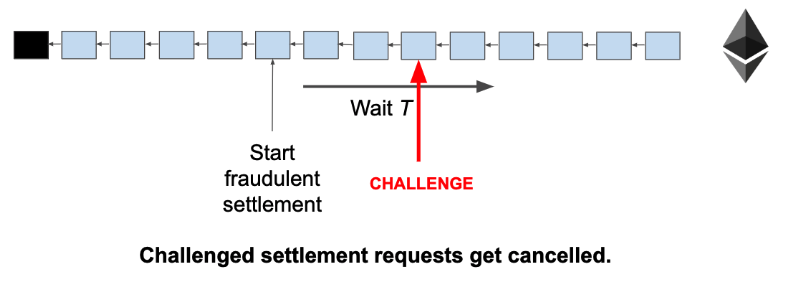

In detail: Fraud proofs:

Client side validation with an L1 smart contract as adjudicator. Withdrawal requests take time T, after which you can unlock the claimed asset. If another user comes online and submits a fraud proof, the request is cancelled. (add slashing for incentives). Assumptions: user comes online, L1 is not congested

Example: Lightning Network, Plasma, State Channels

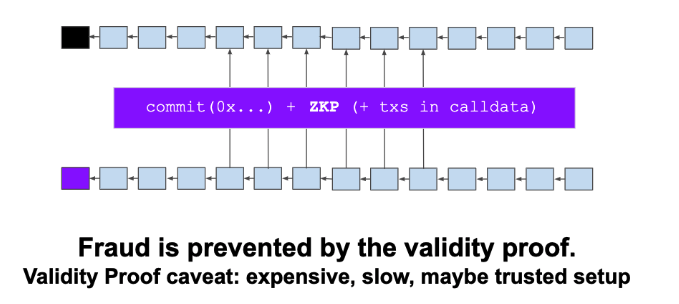

Validity Proofs:

- L1 smart contract stores hash of state.

- Aggregator gathers state updates, generates & submits ZKP.

- Update contract hash If proof is valid.

- Supports instant withdrawals

- Has no liveness assumption Assumptions: fancy crypto doesn’t break, data availability (sort of)

Examples: ZkRollup, StarkDEX, Loopring

The above was a quick summary of L2 techniques. The biggest issue with L2 that’s not state channels is the data availability problem, but that’s a separate discussion.

More about Fraud vs Validity Proofs in @StarkWareLtd ‘s blog post:

Validity Proofs vs. Fraud Proofs - StarkWare - Medium Validity Proofs and Fraud proofs are both used in different L2 scalability solutions. In this post we analyze and compare them. https://medium.com/starkware/validity-proofs-vs-fraud-proofs-4ef8b4d3d87a

Validity Proofs vs. Fraud Proofs - StarkWare - Medium Validity Proofs and Fraud proofs are both used in different L2 scalability solutions. In this post we analyze and compare them. https://medium.com/starkware/validity-proofs-vs-fraud-proofs-4ef8b4d3d87a

This was my longest thread! I hope I got my point across, and maybe you, dear reader, are now less confused.

I am considering doing “Drivechains & Statechains are not Layer 2” & “Plasma & Rollup is Layer 2” threads, let me know on your thoughts.

{fin}

Tweetstorm: The Founders and Cryptocurrency

By Jake Chervinsky

Posted July 4, 2019

0/ Happy Fourth of July!

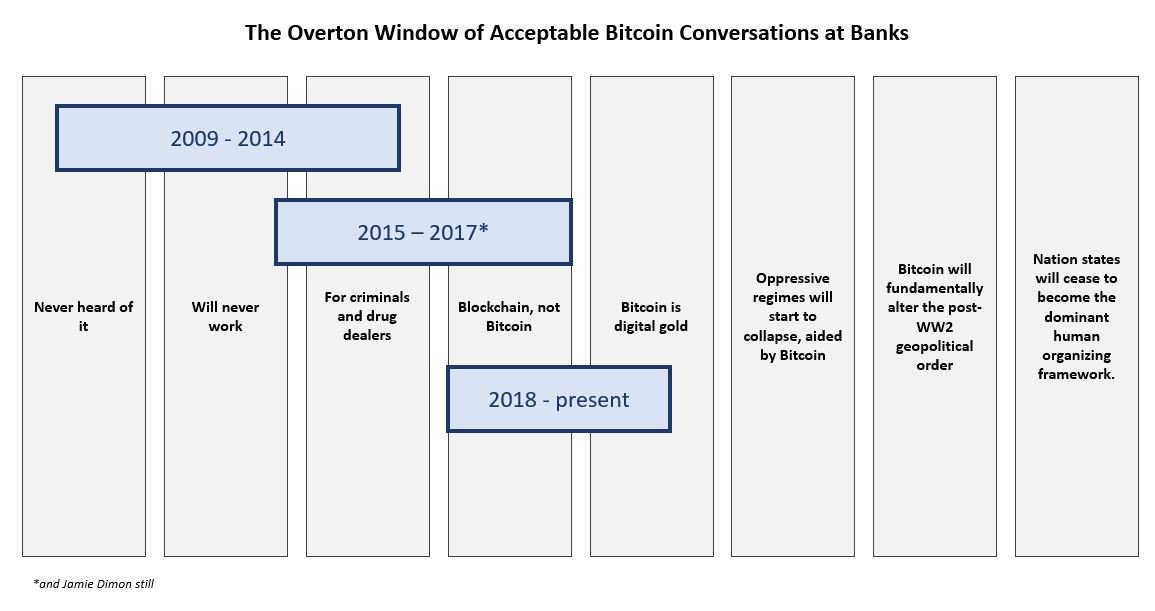

Have you ever wondered what the founders of the United States would say about cryptocurrency? Given their views on paper money, I get the sense they’d be hodling bitcoin.

Warning: 🔥 takes from the Early Republic below.

1/ First, a brief history lesson.

Before the American Revolution, the colonies used many different forms of money, including European specie (money in the form of metal coins), personal lines of credit, IOUs, and paper bills issued by banks and governments.

2/ During the war, Congress (both Continental and Confederation) and the states didn’t have enough specie to cover their rising costs.

To address the shortfall, they printed paper money backed by loans from individuals, banks, and foreign nations.

3/ But, they printed way more paper bills than the value of those loans and far outspent their actual worth. This resulted in rapid inflation and caused government debt to skyrocket.

Thus, the saying: “not worth a Continental.”

After the war, the US had to repay its debts.

4/ Problem was, Congress couldn’t force the states to contribute to the national debt, and citizens didn’t have enough cold, hard specie to pay taxes.

So, Congress and many states started experimenting even more with paper money.

Here’s what a few of the founders had to say:

5/ Alexander Hamilton, June 1783:

“To emit an unfunded paper as the sign of value ought not to continue a formal part in the Constitution, nor ever here after to be employed;…”

6/ “…being in its nature pregnant with abuses and liable to be made the engine of imposition and fraud; holding out temptations equally pernicious to the integrity of government and to the morals of the people.”

7/ George Washington, 1785:

“I never have heard, and I hope I never shall hear, any serious mention of a paper emission in this state. Yet ignorance is the tool of design and is often set to work suddenly and unexpectedly.”

8/ George Mason, 1785:

“[T]hey may pass a law to issue paper money, but twenty laws will not make the people receive it. Paper money is founded upon fraud and knavery.”

9/ James Madison, 1786:

“Paper money is unjust; to creditors, if a legal tender; to debtors, if not legal tender, by increasing the difficulty of getting specie. It is unconstitutional, for it affects the rights of property, as much as taking away equal value in land….”

10/ “…It is pernicious, destroying confidence between individuals; discouraging commerce;…reversing the end of government, and conspiring with the examples of other states to disgrace republican government in the eyes of mankind.”

11/ George Washington, January 9, 1787:

“Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.”

12/ Oliver Ellsworth, August 16, 1787:

“This is a favorable moment to shut and bar the door against paper money. The mischiefs of the various experiments…are now fresh in the public mind, and have excited the disgust of all the respectable part of America.”

13/ George Washington, February 16, 1787:

“[I]f I had a voice in your Legislature, it would have been given decidedly against a paper emission…. I contend that it is by the substance, not with the shadow of a thing, we are to be benefited….”

14/ “…The wisdom of man, in my humble opinion, cannot at this time devise a plan by which the credit of paper money would be long supported; consequently depreciation keeps pace with the quantum of the emission; and articles for which it is exchanged…”

15/ “…rise in a greater ratio than the sinking value of the money.

“I shall therefore only observe…that so many people have suffered by former emissions, that, like a burnt child who dreads the fire, no person will touch it who can possibly avoid it.”

16/ Charles Pinckney, May 1788:

“[T]hese general reasons will be found true with respect to paper money; that experience has shown that in every state where it has been practiced since the Revolution, it always carries the gold and silver out of the country and impoverishes it.”

17/ Thomas Jefferson, November 6, 1813:

“[T]he trifling economy of paper as a cheaper medium, or its convenience for transmission weigh nothing in opposition to the advantages of the precious metals; that it is liable to be abused…”

18/ “…has been, is, and forever will be abused in every country in which it is permitted. [W]e are already at 10 or 20 times the due quantity of medium, insomuch that no man knows what his property is now worth, because it is bloating while he is calculating[.]”

19/ Before anyone drags me into politics twitter (please no), it’s worth pointing out that the founders had diverse views on many issues. They’d probably end up arguing as passionately as we do today.

Still, as they intended, it often feels as if they’re talking to us directly:

20/ Thomas Jefferson, May 28, 1816:

“I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

21/ We’re still working on a problem that Jefferson identified 200 years ago. Maybe, just maybe, we finally have the technology to solve it.

I’d like to think Jefferson, an inventor, would approve.

So let’s all enjoy the holiday, and then let’s get back to work!

PS/ Thanks to @lmchervinsky, my brilliant wife and PhD-holding historian of the American Revolution and Early Republic, for helping me understand 18th century fiscal policy.

She says historians will accuse me of taking these quotes out of context, but I think I can handle it. 🚀

Tweetstorm: Inflation is Cruel

By Ben Prentice

Posted July 6, 2019

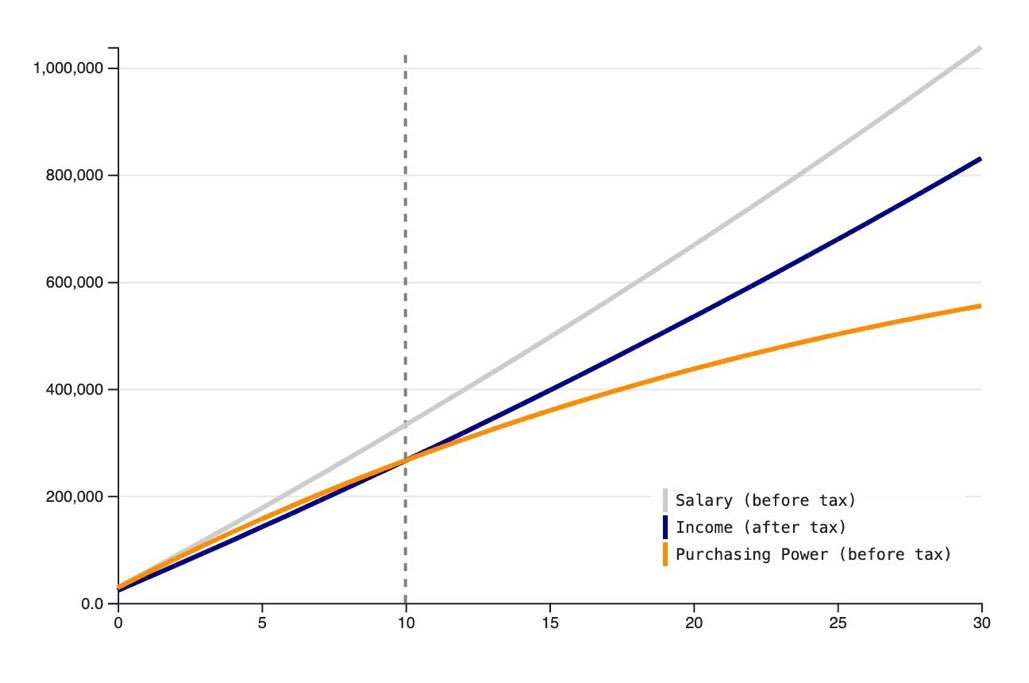

Inflation is a cruel clandestine method of stealing wealth, unlike tax which is at least knowable, inflation destroys savings, wages, and economic calculations.

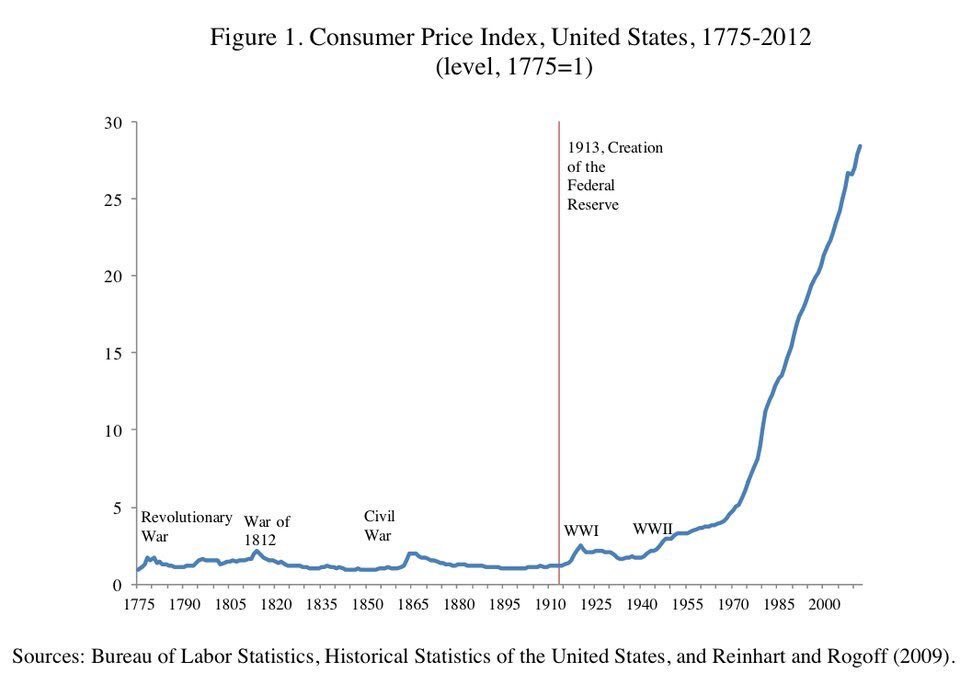

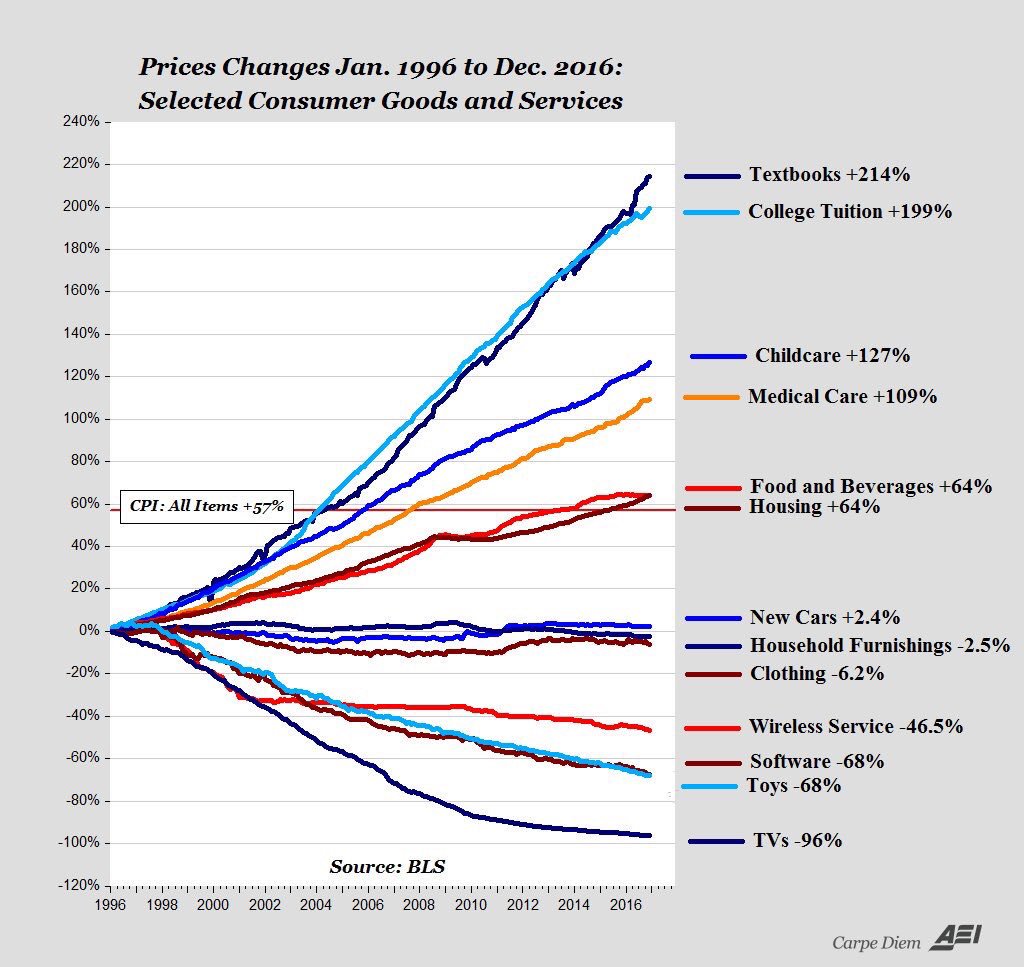

Zoom out to see what establishing the federal reserve has done to the price system, the integral component of economic coordination. When prices are distorted, our coordination with each other, our time-preference in saving/spending, and our very culture is being corrupted.

To understand the miracle of the price system, one must simply ask: “who knows how to make a pencil?”

When prices are distorted, prices that we understand are set in aggregate by the market, the signals used by savers, spenders, and producers are manipulated, and the miracle is destroyed.

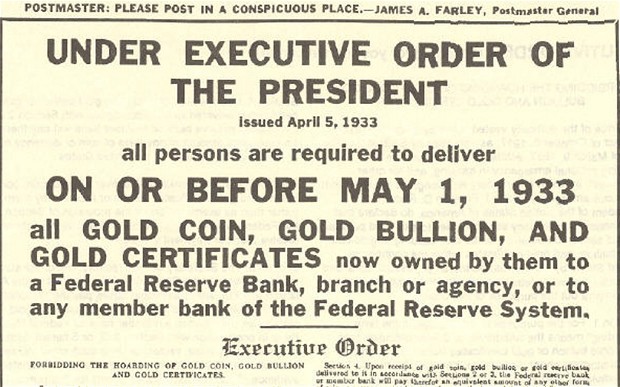

The temptation to print money is not to be underestimated. In the past, rulers were caught red-handed debasing their currencies, and at great cost of minting new coins.

The tyranny of the status quo is that we’ve all been convinced 2% inflation is necessary for growth.

i.e. “Debasing our currency is necessary for progress. If we don’t devalue your money, you might actually save some!”

No surprise, savings are at all time lows.

This lie, taught to us by the Keynesians, fed to us by the govt-funded schools, perpetuated by the Fed-endorsed banking system where money is created to enrich the banking class, and risks and losses are laid on the populace, maybe the the greatest lie ever told.

The only economic progress we have seen in the past century is due to deflation. Electronics and technology, the exponential revolution, is progressing so rapidly, only prices tied to this phenomenon are falling, in spite of inflation.

So before you point to all the “progress” we have seen in increasing standards of living, ask if it is due to inflation manipulating people into investing in stocks, or due to falling prices of technology.

What could possibly dismantle this global tyranny of lies distorting economic progress to protect big govt and enrich the rich? Could we “end the Fed” with legislation? Protest? Discourse? I have doubts.

What if we could create a new system of money, outside the control of govt, backed by raw energy and mathematics, secured by hundreds of thousands of rule-enforcers, promulgated by a social contract to preserve liberty and protect wealth?

What if the incentives were so aligned that everyone was incentivized to secure the system, to profit from its adoption, to slowly and voluntarily exit the hegemony of govt money? What if #Bitcoin is a global peaceful #revolution that secures wealth and protects individuals?

Bitcoin Is Smarter Than Politicians And Central Bankers

By Antony Pompliano

Posted July 8, 2019

Don’t look now, but the global economy is becoming unstable and uncertain. Each individual, regardless of geographic location, is increasingly being asked to trust the expertise and experience of politicians, economists, central bankers, and the leaders of legacy financial institutions.

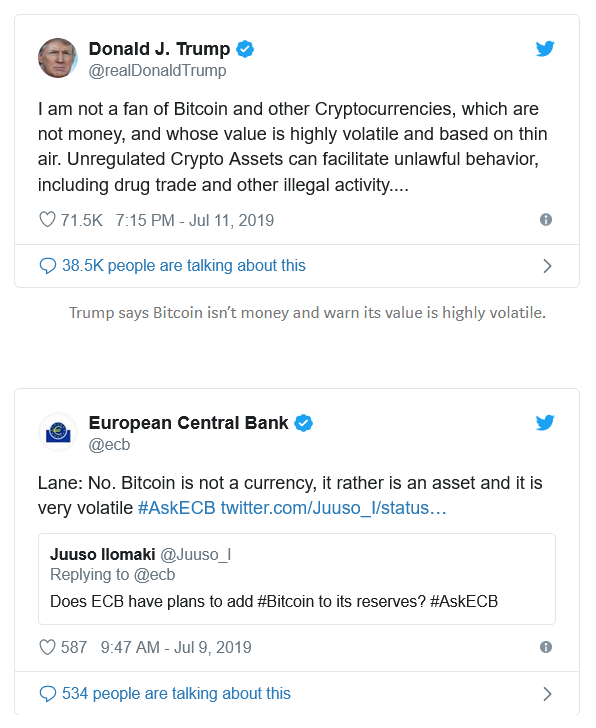

While this would historically seem like a reasonable ask, these “experts” have proven time and again that they are ill-equipped to handle the complexities of many situations that we face today. The confluence of events playing out at the moment are incredibly bullish for Bitcoin, but before I explain why, here is an overview of the current headwinds facing currencies and economies:

- Trade wars — The two largest economies in the world, the United States and China, are locked in a trade war that continues to escalate aggressively. The US has hit China with a 25% tariff on approximately $250 billion of Chinese products, while China has ratcheted up their response with increasing tariffs on billions of dollars of American products. This is all happening while the US barely avoided a trade war with Mexico and is currently threatening the EU with new tariffs that would hit $4+ billion of EU products. If the ramifications of these trade wars weren’t so serious, we would all be laughing at the fact that a material amount of this nonsense is playing out on Twitter (see here,here, and here for examples).

- Recessions are upon us — The US Treasury yield curve officially closed the second quarter of 2019 inverted. This means that for an entire quarter, investors were given higher returns on short term bonds, rather than long term bonds. As many have explained, this has been the leading indicator of an impending recession over the last 50 years (has happened 7 times) and there has not been a false positive over that time period. The US isn’t the only economy in trouble though, especially when you consider Raoul Pal’s recent argument that the EU is already in a mild recession.

- European banks are failing — Deutsche Bank is dominating headlines for their ineptitude over the last decade, which has culminated in a recent announcement of ~ 20,000 job cuts and a complete restructuring of the bank. They aren’t the only banks struggling though. Others like UBS,Credit Suisse,Société Générale,BBVA, and Barclays appear to be facing major issues that could quickly turn into a domino effect that ends in a widespread financial crisis.

- Loss of Federal Reserve Independence — According to the Federal Reserve website, “ the Federal Reserve, like many other central banks, is an independent government agency but also one that is ultimately accountable to the public and the Congress. The Congress established maximum employment and stable prices as the key macroeconomic objectives for the Federal Reserve in its conduct of monetary policy. The Congress also structured the Federal Reserve to ensure that its monetary policy decisions focus on achieving these long-run goals and do not become subject to political pressures that could lead to undesirable outcomes.” This independence is being tested as President Trump continues to publicly apply pressure to the Federal Reserve on currency manipulation, while openly critiquing the organization’s decision making.

- Low Interest Rate Environment — In the last two economic recessions, central banks were able to cut interest rates an average of 5.0% or more in an attempt to combat headwinds. Given the current 2-2.5% interest rates in the US, and negative interest rates in Japan and Europe, these institutions won’t have the same severity of aggression available to them this time around.

- High Levels of Debt — We are currently experiencing record levels of debt around the world, including US corporate debt as a percent of GDP over 70% and China holding strong around 150%. The last time this US metric was so high was during the Global Financial Crisis and China hasn’t ever seen levels this high before. To put this all in context, there is 3X+ more debt than GDP in the world today.

- Slowing Global Growth — The World Bank continues to slash global growth forecasts. They cut “ 2019 global growth forecast to 2.6% from 2.9% and cut its forecast for growth in trade to 2.6% from 3.6%. The World Bank had already forecast the US to slow to 2.5% in 2019 from 2.9% in 2018 and for China to slow to 6.2% from 6.6%.” Additionally, when World Bank President David Malpass was asked for the reasoning behind these cuts, he cited falling business confidence, the slowest pace of global trade growth since 2008 and sluggish growth in emerging and developing economies.

The outlook for the global economy is currently bleak, with numerous signals indicating an impending recession. Whether we like it or not, markets can’t go up and to the right forever.

Unfortunately, investors don’t have very many options in this scenario. They are being asked to trust the expertise and experience of politicians, economists, central bankers, and the leaders of legacy financial institutions. Not exactly something that many people are comfortable doing.

The global uncertainty, and increasing likelihood for instability, is leading investors to look for alternative options. This brings me to the argument of why Bitcoin is poised to greatly benefit from the perfect storm of events that are unfolding.

Bitcoin is a decentralized, digital asset that is built in a way that prevents any individual or organization from manipulating key components of the asset (monetary policy, security, transaction history, etc). In effect, Bitcoin as a system can not be manipulated by any government, central bank, financial institution, or politician.

And to make things even more compelling, the monetary policy decisions have already been decided for the next ~ 120 years, along with a feature where anyone in the world can publicly audit the execution of this monetary policy plan as it plays out. Think about that for a second….there is more uncertainty in the global financial system, than in the structure, operation, and governance of Bitcoin.

As we know, investors find comfort in decreased uncertainty. This is exactly why we are seeing Bitcoin become more and more attractive as global instability and uncertainty increases. Don’t believe me? Here are some interesting facts:

- During the month of May, the US was actively ratcheting up the trade war with China, along with threatening Mexico, Europe, Iran, etc with trade wars as well. Many of the issues outlined in the bullet points above were also increasing in severity during that time.

- Bitcoin’s price appreciated 55% during May, but more interestingly, the asset had a negative correlation to the S&P 500 (-0.9%) and gold (-0.8%). That means that as stocks and gold became less attractive, Bitcoin was becoming more attractive.

Obviously, one month of data is not enough to make a compelling argument with, but it is worth watching this trend as we move forward. There is a good chance that we are on the cusp of a monumental shift in global economies — a shift from trusting humans to one of trusting algorithms and machines.

This shift has already happened in other aspects of our lives, so it makes sense that it would eventually happen in economics as well. We trust algorithms over humans to give us driving directions, music recommendations, or search results, but for some reason continue to believe that humans are better than machines at synthesizing financial and economic data to produce decisions on highly complex economic issues.

Obviously, this is going to change and I’m betting that it will happen sooner rather than later. While the humans are struggling to figure out how to manipulate currencies and economies to keep the bull market raging on, Bitcoin continues to produce block after block completely unmanipulated by any outside force.

As Villeroy de Galhau, a member of the Governing Council at the European Central Bank (ECB), recently said “ the [ECB] priority is to reduce this uncertainty and here we will do our duty as central bankers, but monetary policy cannot do everything. Monetary policy has no magic wand, it cannot make miracles. And it’s up to political leaders to reduce these uncertainties, sometimes self-created. “

I, for one, don’t find it comforting to rely on the bias, greed, fear, and general emotion of politicians and central bankers. The machines are smarter, more disciplined, and better decision makers than us, so the sooner we admit that, the better off we will be.

-Pomp

The differences between Bitcoin and Libra should matter to policymakers

By Peter Van Valkenburgh

Posted July 8, 2019

The two have different design goals, work in different ways, and raise different regulatory questions.

Recently Congress has taken a strong interest in the newly announced Libra digital currency. We have been getting many questions from policymakers and the media about how Libra (as described in its white paper and accompanying materials) compares to Bitcoin and other cryptocurrencies. We thought we’d share our thinking on this here.

Our answer is that Bitcoin and Libra are very different projects that use very different technologies and, as a consequence, each project faces different regulatory and legal challenges. It’s important that policymakers understand these differences so that they may appropriately tailor any necessary policy response. If they overlook these differences, policymakers risk adopting a one-size-fits-all response that would inevitably result in unintended consequences to the detriment of the public. So, we want to make sure policymakers don’t confuse Libra with Bitcoin and similar cryptocurrencies. Let’s look at the design goals of each project, the technologies they use, and conclude with a high-level comparison of the relevant laws and regulations.

Different Design Goals and Priorities

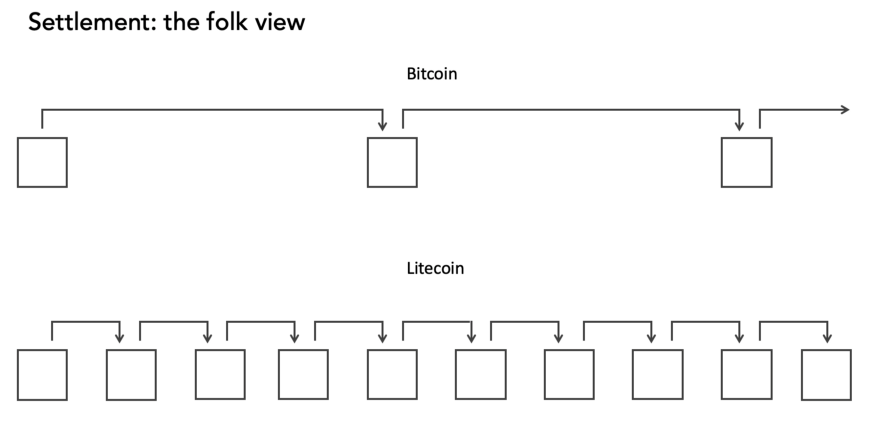

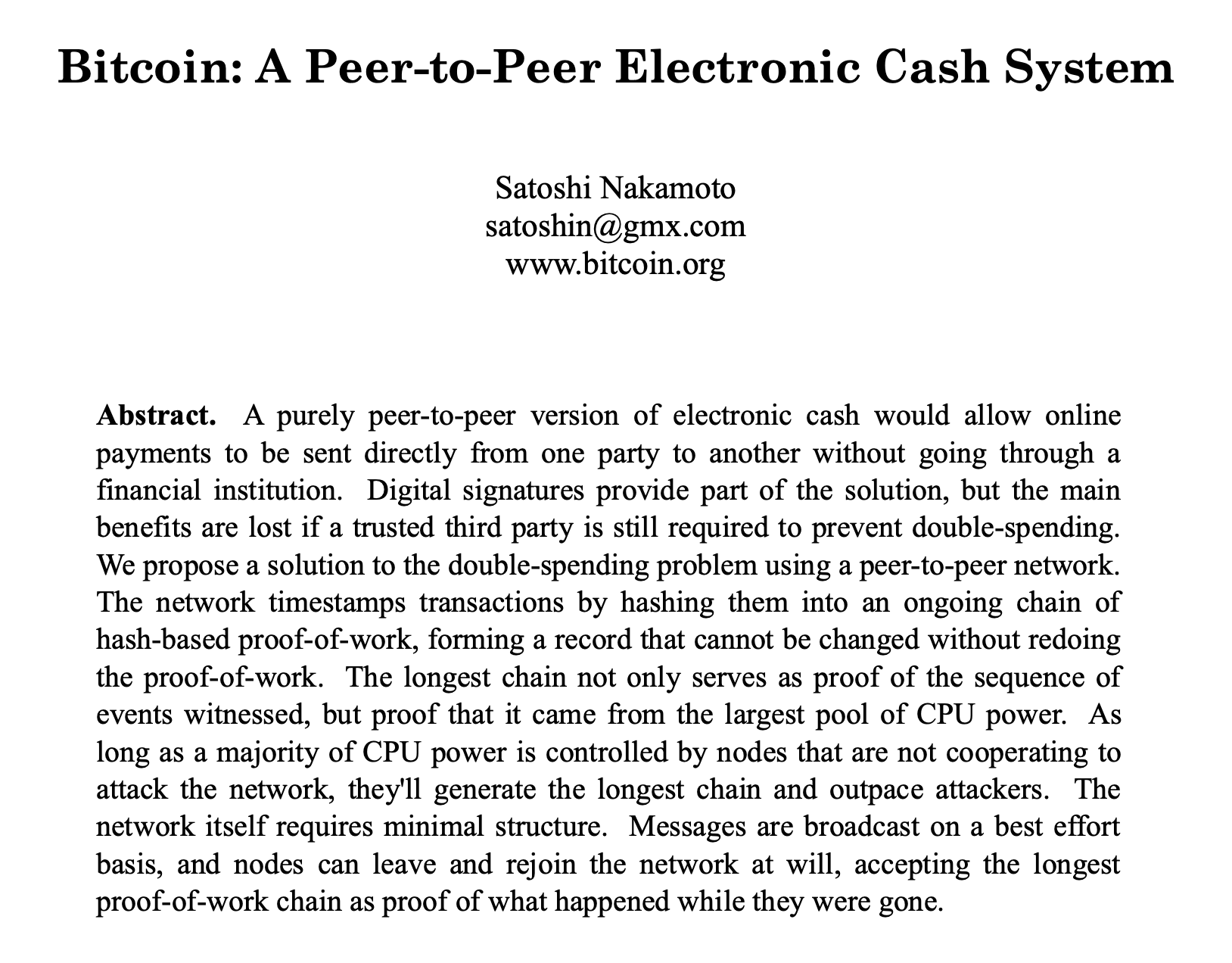

To get a sense of their respective goals and priorities, it’s instructive to compare the first sentence of each project’s white paper. Bitcoin: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Take note that the same thing is being said four different ways. The key message is “money without trusted intermediaries.” Bitcoin is peer-to-peer, cash, direct, and without institutions. The design goals of Bitcoin prioritize building a payments network without trusted intermediaries over the network’s ease of use, stability, or scalability. The Bitcoin white paper says that people should have access to an efficient and fast online payment technology, but also that it’s more important for those payments to work person-to-person without reliance on any corporation or government than it is for those payments to be easy to perform. Bitcoin is a technological response to distrust in corporations and nation states, and was designed to work for a nation’s citizens even if that nation’s government became tyrannical, and even if that nation’s businesses and corporations were untrustworthy or monopolistic.

Libra: “The goal of the Libra Blockchain is to serve as a solid foundation for financial services, including a new global currency, which could meet the daily financial needs of billions of people.”

Take note that this sentence is all about scale and access. Libra should “meet the needs of billions”; it should be a “solid foundation” for a variety of “financial services,” not just cash-like payments; and it should be “global.” The design goals of Libra prioritize scale and inclusivity over the need to avoid reliance on trusted intermediaries.

Both projects take for granted that something is wrong with the current global financial system. The problem that Bitcoin seeks to address is the consolidated power of intermediaries in that system and the danger that such power poses: corporations and governments can arbitrarily block people from participating in the economy. The problem that Libra seeks to address is the inefficiency of intermediaries in that system and their disinterest in providing services to persons who are insignificant to their bottom line.

Different Technologies Employed

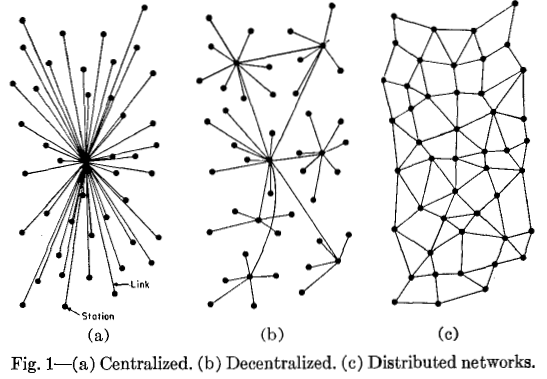

Bitcoin and Libra both use distributed ledgers (loosely called blockchains) to record payment transactions between users. In short, both projects intend to create money by sharing data over the internet. That’s generally where the similarities end.

Bitcoin is the first of a now broad class of innovations often called cryptocurrencies. It is money based on economic scarcity with transactions recorded on a censorship-resistant ledger that any anyone can both access (read data from) and append to (write data to). In other words, the Bitcoin ledger is public and permissionless. Libra is the latest of an older class of technologies often called digital currencies. It is money based on trust in an issuer with transactions recorded on a ledger that anyone can access and view, but only an authorized set of corporations can amend. In other words the ledger is public and permissioned.

Cryptocurrencies are defined by their lack of reliance on trusted intermediaries. While none of these terms are official or uncontroversial, we believe that Libra is not a cryptocurrency because of its use of a permissioned ledger and its reliance on a trusted issuer to hold and manage a fund of assets that back the currency. Libra is still part of the broader category of digital currencies along with airline miles, World of Warcraft gold, or Liberty Reserve Dollars.

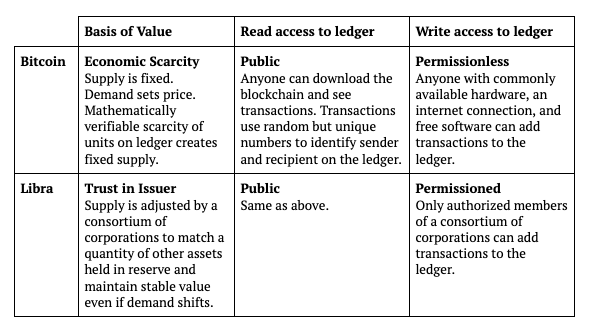

Here’s a chart reiterating these fundamental differences in architecture:

These varying architectural choices are not arbitrary. Bitcoin’s primary goal is to obviate the need for trusted intermediaries in online payments while Libra’s goal is to make online payments easier, more inclusive, and scalable. If you are willing to trust an issuer, then you can likely have a digital currency with less price volatility (because supply can be adjusted in response to shifts in demand). If you are willing to rely on a permissioned set of transaction validators, then you can likely get transactions validated faster and at a greater scale because fewer parties need to reach consensus. These are the assumptions inherent in Libra’s design. Bitcoin’s design is largely indifferent to these goals; its singular priority is to be resilient and unreliant on any such trusted intermediary. If that means that bitcoins will be more volatile in price, or that it will be more difficult to scale the Bitcoin ledger to several thousand transactions per second, so be it.

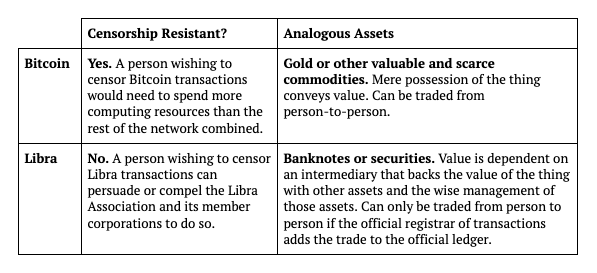

These choices also have consequences for how each project’s asset functions. Bitcoin ends up working like a bearer instrument: anyone who has the bitcoin automatically has the value. Libra ends up working like a registered instrument: the holder of a Libra really only has the value of that Libra if the official registrar, the Libra Association, says that they do and maintains the underlying reserve assets. Bitcoin, therefore, is censorship-resistant and functions like gold coins or any other valuable commodity. Libra transactions can be censored and the asset functions like a bank note or stock certificate.

Here’s another chart to illustrate how bitcoins and libras differ as assets:

Different Regulatory Consequences

Broadly speaking, financial regulations are in place to ensure that persons performing trusted roles within the financial system do not betray that trust. For example, if you are trusted with holding or managing someone’s wealth you should honor that trust and not enrich yourself at the expense of your customer. Bitcoin and similar cryptocurrencies are not designed to avoid regulation, but they are designed to minimize the number of trusted parties in an economic transaction. This is because the fewer the number of trusted parties, the fewer the number of parties that can pose a risk to users. A system without intermediaries is a system without intermediary risk, and thus no need for regulation aimed at safeguarding against the types of risk presented by intermediaries.

It stands to reason, therefore, that a true cryptocurrency will involve fewer regulated parties than a traditional financial service. Fewer but not none. Miners and software developers are not trusted custodians of people’s value, so it makes no sense to regulate them as we would regulate a bank or a money transmitter. Exchanges and custodial wallet providers, however, are indeed trusted by Bitcoin users, and therefore consumer protection and anti-money laundering regulation does apply to them.

Even miners and software developers may be subject to some regulations. While they have no more reason to know their customers than a safe manufacturer or a gold miner would have reason to know the people who store gold in safes, they may make warranties or other promises about the products they put into the world. Rather than subjecting these persons to ex-ante prudential regulations like bank chartering or licensing, regulations and laws create ex-post enforced obligations for them not to engage in fraud, breach of contract, theft, and unfair or deceptive acts and practices.

Securities laws exist to address information asymmetries between investors and persons trusted by investors to earn financial returns or manage a fund. Anti-money laundering regulations and sanctions laws exist because financial institutions establish customer relationships and can block the illicit flows of funds through their networks. While these regulations often apply to persons using Bitcoin to raise money (ICOs) or to offer exchange services (exchanges), there are obvious reasons why these regulations don’t apply to Bitcoin as a network writ large: Bitcoin doesn’t have a trusted institution minting it or a fund that backs its value. Bitcoin miners validate transactions but don’t establish customer relationships, and they don’t have the power to reliably block specific persons from sending money through the network.

Libra, on the other hand, is not designed to minimize the number of trusted parties in an economic transaction. Quite the opposite. Libra is designed to maintain a stable value and users trust the Libra Association’s management of a reserve fund to achieve that goal. Users also rely on the permissioned validators to add transactions to the ledger, and but for their participation a transaction would not go through. It’s still too early to say whether these trusted parties should or would be subject to securities or anti-money laundering law, but it might be hard to argue that they should not since with trust comes responsibility.

Pathways for DeFi on Bitcoin

By Mohamed Fouda

Posted July 10, 2019

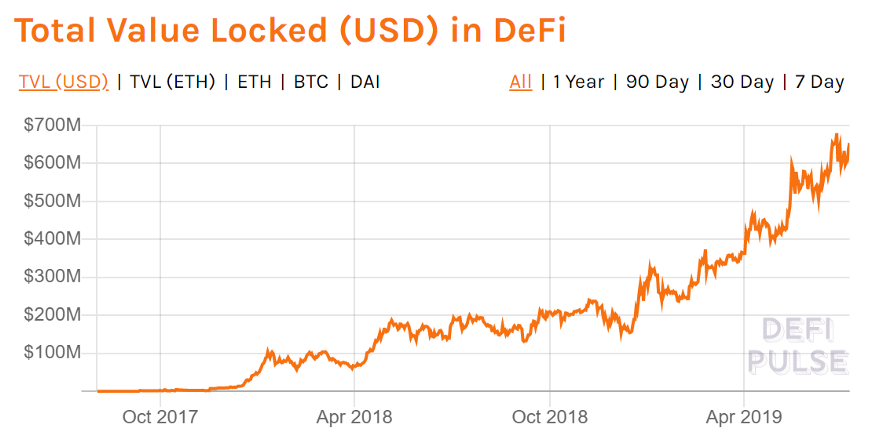

Decentralized Finance (read DeFi)has been a popular narrative for many crypto investors and enthusiasts. DeFi builds upon the promise that several critical financial services are cheaper and more efficient when the role of intermediaries is downsized or eliminated altogether. Theoretically, it also makes online financial services more inclusive since it transcends artificial barriers like different geographic boundaries or jurisdictions.

DeFi products and protocols are made possible by allowing us to code the rules (and consequences) of our financial interactions into permissionless blockchains. Consequently, it comes as no surprise that almost all current DeFi projects have been developed on Ethereum to leverage its smart contract functionality.

DeFi movement is rapidly growing

DeFi movement is rapidly growing

However, Bitcoin is still the most liquid, familiar, and decentralized cryptocurrency in the world (with dominance exceeding 60% at time of writing). This obviously positions bitcoin as a strong competitor for financial products that can benefit from trustlessness and decentralization. However, just because it is obvious does not mean it is easy.

Bitcoiners want to preserve the hardness of Bitcoin at all costs and are not willing to radically change the monetary policy for any reason, DeFi or not. There is no chance smart contract functionality would be added to the Bitcoin protocol to allow for the implementation of DeFi products, though sidechain solutions like RSK exist.

But, that does not mean Bitcoin DeFi could never happen.

Many individuals and teams are striving to use Bitcoin, with its current structure, in financial products ranging from centralized to almost completely decentralized.

In this article, I discuss how Bitcoin DeFi can be made possible. The different technological approaches are explained along with the different use cases that they target.

But First, What Do We Mean by DeFi?

Decentralized Finance or DeFi is an umbrella term for all the financial services that can be performed without a central authority or when the mechanism to control the financial product is decentralized between different entities. DeFi products include decentralized lending, decentralized exchanges, decentralized derivatives or even decentralized issuance of stable coins. Many argue that decentralized payments on their own are DeFi products.I happen to agree with this argument. In this regard, BTC is the cryptocurrency with most merchant adoption. Services like BTCPay Server even allow merchants to receive BTC directly without a third-party payment processor. Therefore, this article is mainly about how Bitcoin can expand its DeFi footprint beyond decentralized payments.

Overview of Bitcoin Centralized Financial Products

Before diving into the pathways for DeFi on Bitcoin, let’s start with some of the “centralized” financial services currently using Bitcoin. These will be prime targets for decentralization once DeFi can be efficiently executed on Bitcoin.

Bitcoin Lending

One of the most popular financial services built on Bitcoin is lending. We can categorize companies in this area into two buckets. First, are the companies that allow investors to borrow Bitcoin and other cryptocurrencies for trading or market making purposes; the most well-known company in this sector is Genesis Capital. Genesis Capital has reportedly processed $1.1B of crypto loans in 2018, ending the year with ~ 75% of these loans in BTC.

The other line of lending businesses are the companies that offer BTC-collateralized loans such as BlockFi and Unchained Capital. To protect against collateral value volatility, these companies only issue over-collateralized loans with loan-to-value ratios of 20–50%.

Margin Lending

Margin lending is a special case of collateral-based lending used for leveraged trading. In such scenarios, the borrowed funds are not allowed to leave the lending platform. Instead, if the trade loss is equal or below the collateral value, the margin position is liquidated to return the funds to the lender. Exchanges, such as BitMex, Kraken, Bitfinex, and Poloniex, are the major players in margin trading field. However, most of these products are not available for US customers because of regulatory uncertainty.

Stablecoins

Stablecoins that can be transferred easily with low fees have specifically been of interest to traders who want to benefit from volatility but keep a stable value when they are not in active positions. Tether (USDT) was one of the earliest stablecoins offered to address this issue. It was completely built on Bitcoin using the OmniLayer protocol. OmniLayer allows the creation and transfer of assets using Bitcoin transaction’s opcode space.

USDT was created as a stablecoin pegged to the dollar with the promise that the USDT tokens are only minted when corresponding USD deposits are credited to the Tether company and burnt when the USDT tokens are redeemed back to USD. Although Tether can be transacted in a decentralized way, it is centralized in the most important aspects: reserves and control. The Tether company holds and controls all the USD reserve for the issued USDT tokens in its bank account which regularly puts them in legal headwinds.

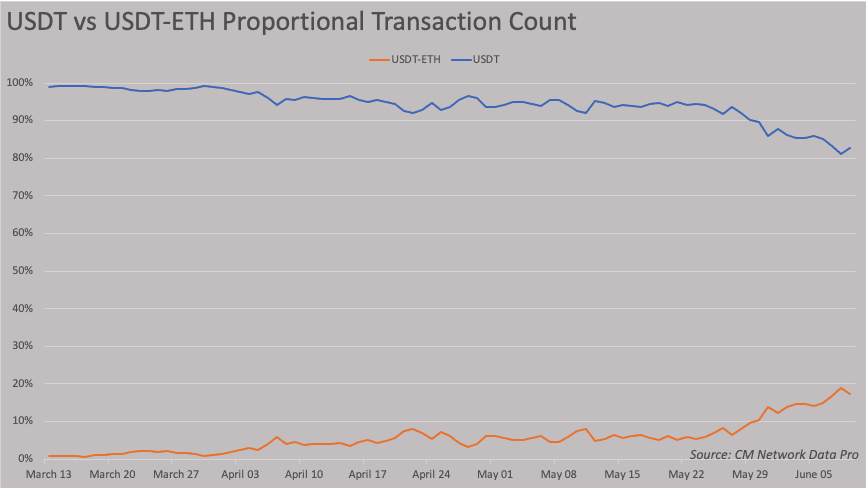

USDT usage on Ethereum is stealing activity away from USDT Omni activity. Source: CoinMetrics

USDT usage on Ethereum is stealing activity away from USDT Omni activity. Source: CoinMetrics

Recently, Tether started to reduce its dependence on the Bitcoin network by issuing USDT on other blockchains like Ethereum and EOS, which has been taking activity away from the Bitcoin blockchain.

Decentralized Finance in Bitcoin

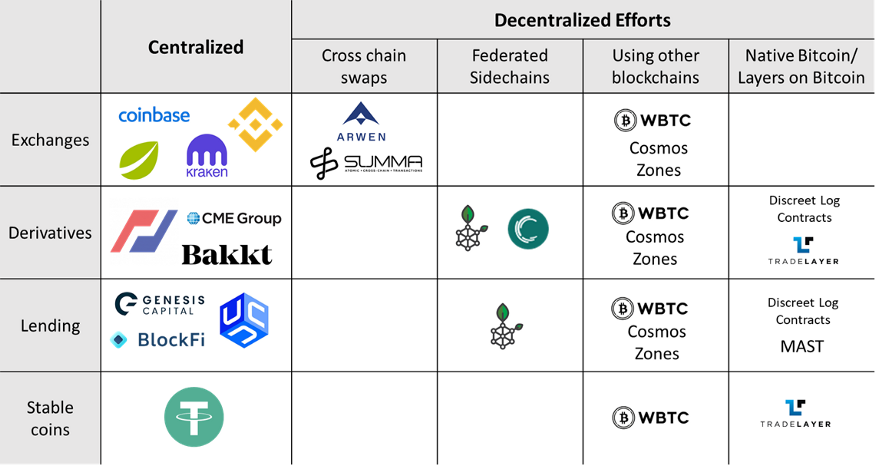

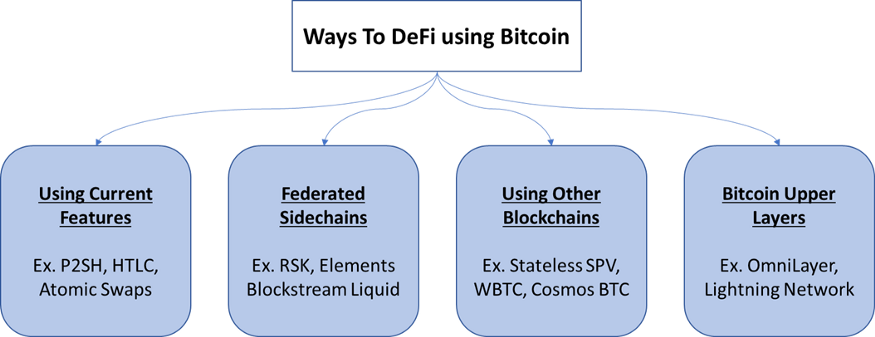

Possible technological approaches to use Bitcoin for DeFi

Possible technological approaches to use Bitcoin for DeFi

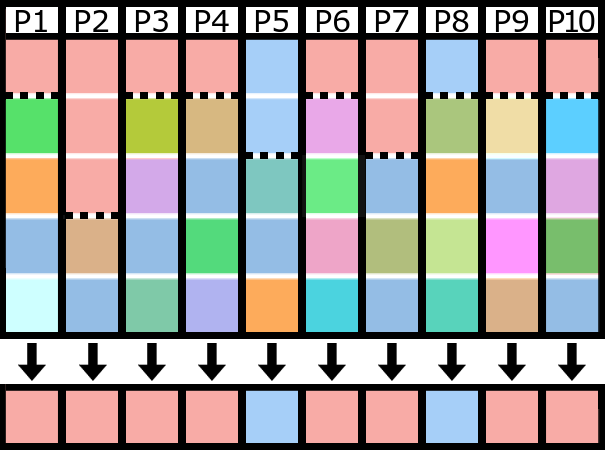

Now let’s look into how DeFi products can be used with Bitcoin and list a few use cases and projects in that area. The possible use cases include decentralized exchanges (DEXs), decentralized lending, decentralized stablecoins, and decentralized derivatives. The technological approaches to implement Bitcoin DeFi include

- Using Bitcoin current capabilities such as Hash Time Locked Contracts (HTLCs) to facilitate direct cross-chain atomic swaps to build decentralized exchanges with other cryptocurrencies.

- Federated sidechains to Bitcoin such as Blockstream’s Liquid. These sidechains use two-way pegs to the Bitcoin blockchain and allow the use of pegged BTC in various financial activities.

- Using Bitcoin within other protocols such as Ethereum or Cosmos to interact with DeFi products.

- Using layers on top of Bitcoin like OmniLayer or Lightning Network.

These technologies differ in capabilities and the range of DeFi applications they can support. In addition, most of these technologies are work in progress. In the following, we explore these technologies and the use cases they target.

Cross-chain Swaps For Decentralized Exchanges

The simple premise of DEXs is to execute trades between Bitcoin and fiat or between Bitcoin and other cryptocurrencies while keeping custody of your coins until the trade is completed. In other words, trading without the need to deposit your valuable bitcoins into a centralized exchange wallet and be subjected to the exchange security risks.

While such trades can be performed using platforms like LocalBitcoins or OpenBazaar, these platforms are only suitable for once-in-a-while slow trading and are not suitable for fast or frequent trading that allows efficient price discovery. For the latter, a centralized order book along with the ability to quickly settle trades is needed. Practically speaking, building a truly decentralized exchange is one of the hardest challenges in DeFi. As long as you have centralized servers keeping or even displaying the order book, you still have centralized components. However, our focus here is mainly around keeping custody of coins until trades are settled. In this domain, we believe a small number of companies are developing the technology needed to achieve that. The ones that we feel at the leading the pack are Arwen and Summa.

Arwenuses the concepts of trustless on-chain escrows and cross-chain atomic swaps to allow non-custodial access to centralized exchanges order books. In that sense, it is possible to trade efficiently on a centralized order book while maintaining custody of the asset until the trade is executed. Currently, the product only supports cryptocurrencies that use the same codebase as Bitcoin such as Litecoin and Bitcoin Cash. They are working on implementing cross-chain atomic swaps between Bitcoins and Ethereum and ERC-20 tokens. Arwen can currently be used (in beta) on Kucoin exchange.

Summahas invented the Stateless SPV technology to allow for trustless financial services for Bitcoin and other blockchains. Stateless SPV allows for validating Bitcoin transactions using an Ethereum smart contract making it possible to perform a wide range of financial transactions using Bitcoin. Using that technology, Summa’s team performed an auction using bitcoin bidding for Ethereum-issued tokens. The team is working on generalized cross-chain exchanges between Bitcoin and Ethereum and ERC-20 tokens.

Bitcoin DeFi Using Federated Sidechains

Bitcoin sidechain is a concept that was proposed by Blockstream in 2014 to introduce new features to Bitcoin without changing the protocol base layer. Since then the concept has developed significantly. The simple idea of sidechains is to create a separate chain with a small number of validators (called a federation) and use a token in that chain that is a pegged to BTC through a two-way peg. The benefits can include faster transaction confirmation or implementing features that may be controversial such as confidential transaction, tokenization of other assets or smart contracts. The main drawback of sidechains is the need to trust a small federation to operate the sidechain and keep it running. There is also a risk of losing money by using sidechains if, for any reason, sidechain validators decided to abandon the chain. In those situations, pegged assets would get stuck and cannot be redeemed back to BTC.

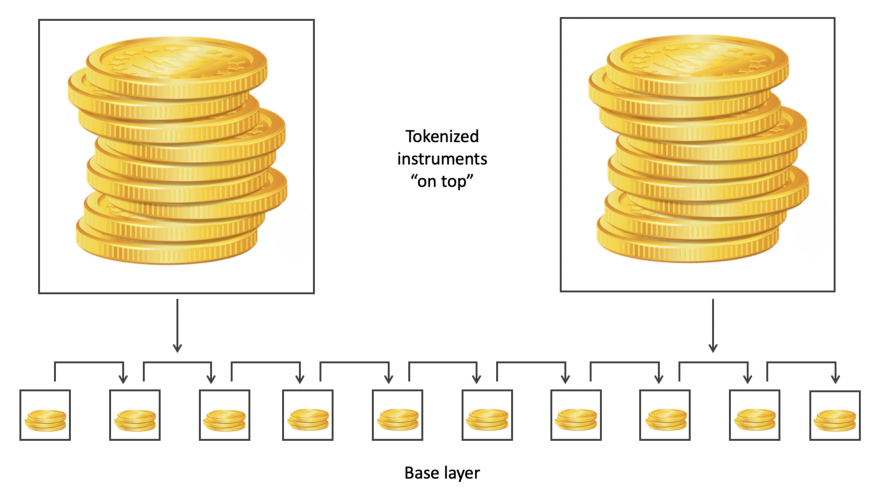

A notable sidechain working to bring smart contract functionality to Bitcoin is RSK. It supports Solidity smart contracts making it easy to migrate Ethereum DeFi protocols to RSK. In addition to RSK, Blockstream has commercially launched its Liquid sidechain product in 2018. However, Blockstream’s initial focus is around the tokenization of assets and faster transaction but the concept could be expanded later to support DeFi applications.

Decentralized Derivatives Using Bitcoin Layers

A third approach to implement Bitcoin DeFi products is to utilize intermediate layers built on top of Bitcoin such as Lightning Network or OnmiLayer. As LN is a relatively new Bitcoin development, building complex DeFi products using LN is a topic of research. The most notable effort there is Discreet Log Contracts which are discussed in some detail at the end of this article.

The other option is using OmniLayer. One of the interesting projects in this regard is Tradelayer, which is trying to implement decentralized derivative markets on Bitcoin. The project aims to extend the OmniLayer protocol with multisig channels to allow for using Bitcoin, or other tokens issued on Bitcoin, as collateral for peer-to-peer derivative trades. A possible scenario is to have traders pledging capital to multisig addresses and co-sign transactions and trade updates to settle the derivative trade. In this sense, users can take leverage natively and get fast-execution by co-signing trade transactions. Using the same methodology, another possible use case could be the issuance of stable coins using Bitcoin as collateral the same way Ether is used to collateralize DAI issuance on MakerDao.

Bitcoin DeFi With External Help

Wrapped BTC on Ethereum

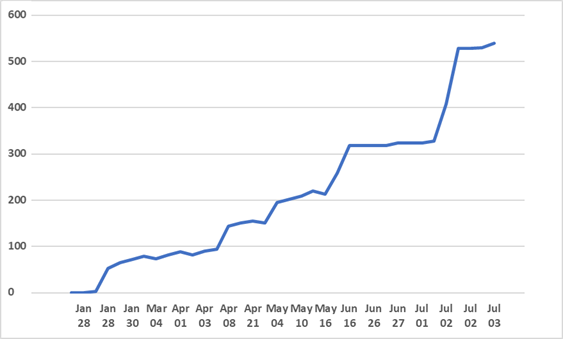

A completely different approach to allow using Bitcoin in DeFi is to leverage other networks like Ethereum or Cosmos. As most DeFi projects now work on Ethereum, it seemed logical to try to find ways to use BTC on Ethereum. The simplest idea is to issue a BTC-backed ERC20 token (WBTC) that can be traded on any Ethereum DEX or used in various Ethereum DeFi projects. The BTC used to mint WBTC are secured in mutisig wallets maintained by the project custody providers. As of early July 2019, only ~ 540 WBTC were minted is a tiny fraction of the BTC circulating supply.

Growth of the Wrapped BTC (WBTC) supply over time

Growth of the Wrapped BTC (WBTC) supply over time

While WBTC may facilitate using BTC in DeFi, it suffers a few important drawbacks. The first and most important is counterparty risk. The BTC used to collateralize WBTC is maintained by centralized parties that might be hacked. Secondly, introducing intermediate entities to custody the assets (BTC) to some extent kills the point of the DeFi movement. Finally, to use BTC/WBTC in DeFi, users have to pay fees in ETH, which is something many Bitcoin fans are not willing to do.

Cosmos Zones

Interoperability blockchain projects, such as Cosmos, opened new opportunities to bring DeFi to assets like Bitcoin. For example, Cosmos protocol defines Peg Zones where assets (issued on Cosmos) can be pegged to other blockchain assets like Bitcoin. In these zones, it is possible to add smart contract functionality to the pegged asset and benefit from faster finality. This approach has garnered the support of some hardcore Bitcoin supporters like Eric Meltzer for one specific reason: in this approach, Bitcoin will remain the native currency to pay fees and use the peg zone. Bitcoiners can stake their pegged bitcoins in the zone to process the zone transactions and claim the zone fees. In that sense, Bitcoin will benefit from the new tech without depending on a different asset. This comes in stark contrast to WBTC, which requires using ETH to pay for fees or interact with DeFi protocols.

It is worth mentioning that using Cosmos zones for Bitcoin DeFi is still work under development and there is a number of stealth projects that are building it. It is not clear yet how the two-way peg between Bitcoin and Cosmos would work. The implementation of the Cosmos Inter-Blockchain Communication (IBC) is not yet finalized. If the two-way peg requires custodial services, like WBTC, or a few validators to execute the peg, like federated sidechains, the Bitcoin zone on Cosmos will not offer much differentiation to other solutions.

In addition to the projects that are building such systems for Bitcoin, we are seeing a lot of interest in using Cosmos for bringing DeFi to other assets such as Kava Labs. If these efforts deemed successful, barriers for Bitcoin use in DeFi would significantly diminish. Success in this regard is to be able to attract sufficient liquidity to the peg zone and to maintain a reasonable level of decentralization by attracting a large enough number of validators.

Research to Expand Bitcoin DeFi Capabilities

Merkelized Abstract Syntax Trees (MAST)

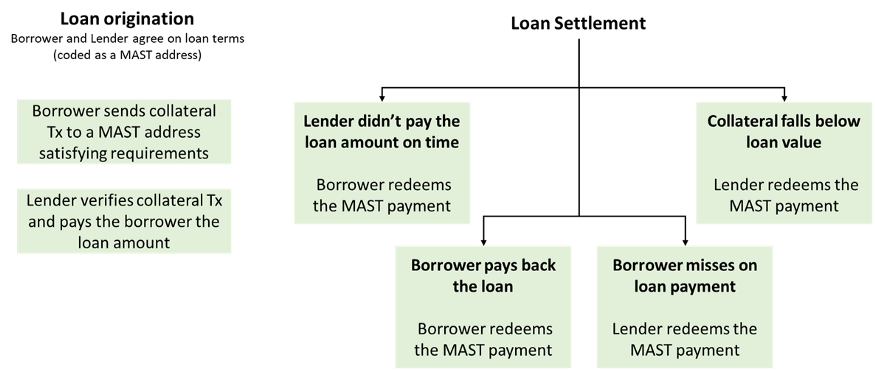

Bitcoin, in its current form, has a limited form of smart contract capabilities through the Script language. Script is not a Turing-complete language meaning it cannot be used to describe general programs. However, it still can be used to implement some smart contract functionality. This is done via Pay to Script Hash (P2SH) and SegWit addresses, in which, a transaction cannot be spent unless some conditions (defined through a Script program) are satisfied. The problem with that approach is that complex transactions with multiple conditions would be excessively large, making them too expensive to use. For those reasons, there is a proposalto implement Merkelized Abstract Syntax Trees (MAST) in Bitcoin. MAST is simply an extension to the P2SH capabilities that would make it cheaper and viable to utilize complex conditions to spend Bitcoin transactions. While the obvious benefit of MAST is improving Bitcoin scalability by saving block space, the less obvious benefit is that it could allow for some Bitcoin DeFi use cases. For example, if we assume a decentralized price-feed oracle can be implemented, MAST could allow for decentralized lending or even decentralized stable coin issuance using BTC as collateral.

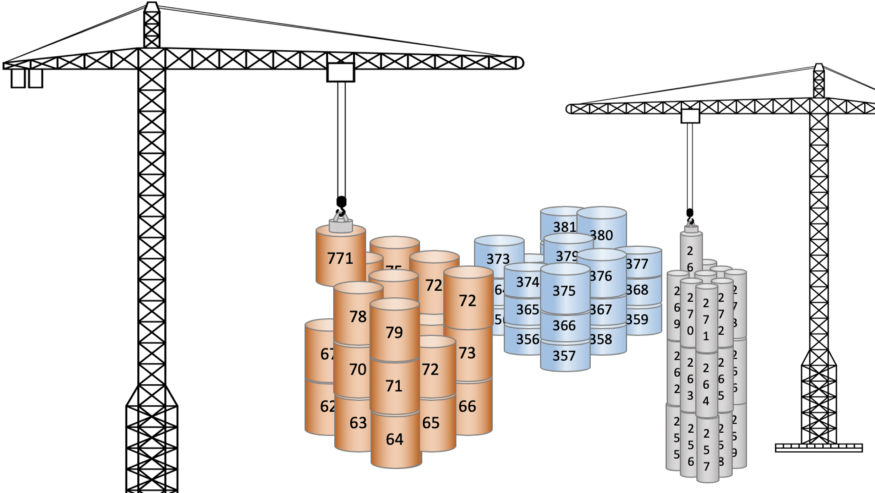

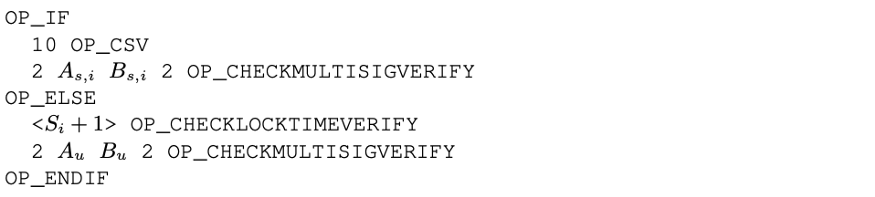

The following diagram shows a possible decision tree for a decentralized lending scenario using MAST. The various conditions for the loan settlement can be coded into a redemption script and hashed into a MAST address. The MAST address can guarantee fair execution of the loan and that the lender would get the loan collateral if the borrower didn’t pay back the loan on time or if the collateral value goes below the loan value plus interest.

Discreet Log Contracts

Another research idea that can expand Bitcoin DeFi capabilities is the Discreet Log Contracts (DLCs) suggested by Tadge Dryja of the MIT Digital Currency Initiative (DCI). A simple explanation of a DLC is that it is a way for two parties to create a Futures Contract which is simply a bet on the future price of an asset. A DLC requires both parties to select an oracle (or a number of oracles) that publicly broadcasts the asset price before they create the contract. At the time of the contract settlement, any of the two parties can use the publicly broadcasted signed messages from the oracle to settle the contract and claim their profits. DLCs utilize Schnorr signatures to hide the contract details from the oracle. This guarantees the oracle cannot game the output of the contract. As DLCs use similar technology to that of Lightning Network, it is possible to integrate DLCs with LN channels.

Conclusion

DeFi protocols have been generating a lot of buzz since early 2018. While Ethereum is recognized as the lead protocol within the DeFi movement, developers and investors have been eyeing the massive potential of Bitcoin in DeFi as the most liquid cryptocurrency. This great interest is pushing many developer teams to figure out the best ways to make it happen. While this would bring even more competition between Bitcoin and Ethereum and probably all new smart contract platforms, such competition is what is needed to encourage progress and deliver the vision of a public decentralized financial system.

I would like to thank Matt Corallo, Tony Sheng and Matthew Hammond for their feedback on this article.

BetterHash: Decentralizing Bitcoin Mining With New Hashing Protocols

An Overview Of Mining Pool Exploits That BetterHash Disables

By StopAndDecrypt

Posted July 14, 2019

Intro

BetterHash is the working name for alternative mining protocols currently in development. When it’s completed there will need to be enough miners willing to switch to a new mining pool using these protocols, or an existing pool that is willing to service both the old and new protocols while miners gradually ready themselves to switch over. In either circumstance the initial switch will need to be supported by enough miners to make doing so profitable, else profit volatility would be too high. Ultimately miners will need to understand why they should switch, and there will need to be forward thinking pool operators who don’t want the control current pools have. This can only happen if the problems and risks with the current system are properly understood and conveyed.

Disclaimer: This is not a fork, or a consensus rule change.

So what exactly is wrong with Bitcoin mining now?

Bitcoin mining has a representation problem. Bitcoin mining pools are not Bitcoin miners, yet pools unduly signal for them. Pools run the node, construct the block, select the transactions, and can choose what fork all of their miner’s hashpower is used for. This creates a handful of incentive issues and enables some pretty undesirable political leverage. BetterHash aims to address this by giving those responsibilities back to the individual miners, and stripping the mining pools of their influence for the greater good of the network. With BetterHash miners would control their own hashpower, and pools would just coordinate them and distribute the rewards.

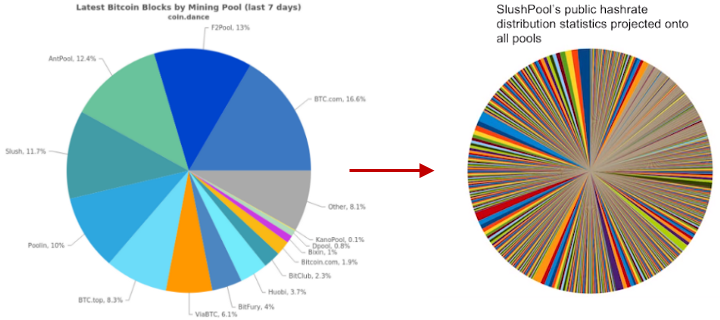

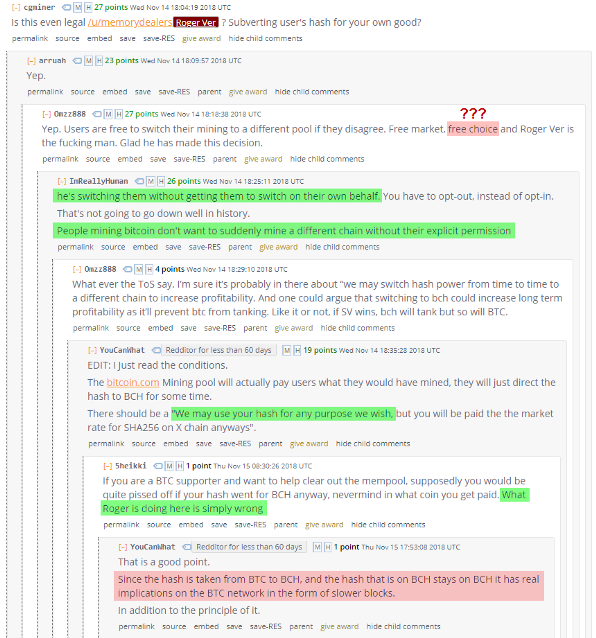

Mining pool hashpower distribution, versus Slush Pool’s miner distribution projected onto every pool.

Mining pool hashpower distribution, versus Slush Pool’s miner distribution projected onto every pool.

This article aims to highlight the kinds of exploitation pools can conduct under the current mining environment — of which would not be possible if BetterHash-like protocols were adopted — at the expense of what may be the miner’s best interests. Pools can also be hacked and then used by the attacker to engage in this behavior. Before we get to that let’s briefly go over the structural differences between what exists now and what BetterHash protocols would change about it.

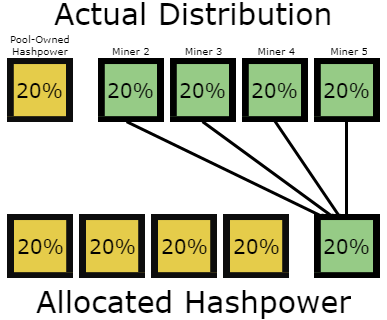

Currently, many miners don’t even run nodes and simply connect their ASICs to a mining pool using protocols like Stratum. The pool runs the node, selects the transactions, creates a block they would like mined, and then sends that block out to all of the miners using their pool and the miners begin hashing it. Once a miner successfully mines a block, it gets sent back to the pool and out to the Bitcoin network.

With BetterHash, miners will individually run their own nodes, select the transactions, create a block, and then mine it. The block would be configured to pay the pool, and just like with the Stratum protocol, those unsuccessful blocks (called “shares”) would be used by the miners to prove they’ve been mining for that pool the whole time.

By just changing who creates the block template to be mined to the individual miners, instead of the pool owner, and then building a new protocol around that concept, BetterHash circumvents all the issues we’re going to cover.

For a more technical overview on the BetterHash protocols currently in development, this presentation by Matt Corallo should suffice, but is not necessary to understand the exploits this article discusses because conceptually BetterHash is objectively better, and a fully codified implementation doesn’t need to exist in order to grasp how important this is.

It should be noted that the name “BetterHash” is not definitive, as mentioned in the video.

https://www.youtube.com/watch?v=0lGO5I74qJM

The Status Quo

To understand why switching to BetterHash is so important, let’s unpack all the problems associated with the way things are now for miners that wouldn’t exist if they were using BetterHash.

To be brief, mining on your own has returns that are most likely too volatile, which is why pools have existed since as early as 2010. Critics will point at pool distributions to claim Bitcoin mining is centralized, and while counterarguments assert miners can just switch the pool they use, it’s not always that simple. If you’re a miner your options are limited to a handful of mining pools, each with their own terms of service that you may or may not agree with. Pools are too large to provide a diverse set of options to pick from.

At the end of the day you have no choice but to choose the pool best suited to you, and if most or all of the pools decide that some practice you don’t like or agree with is going to be the norm, then you have no real alternative but to deal with that, since starting your own pool probably won’t produce a steady enough income stream. Pools that already exist are relatively large, and by having many miners under each of their umbrellas, pools have the power over their miner’s hashpower to do a number of questionable things that we’ll go over one by one.

Pools can:

- Determine what transactions do or don’t go into a block

- Be bribed to reorganize the blockchain under the right conditions

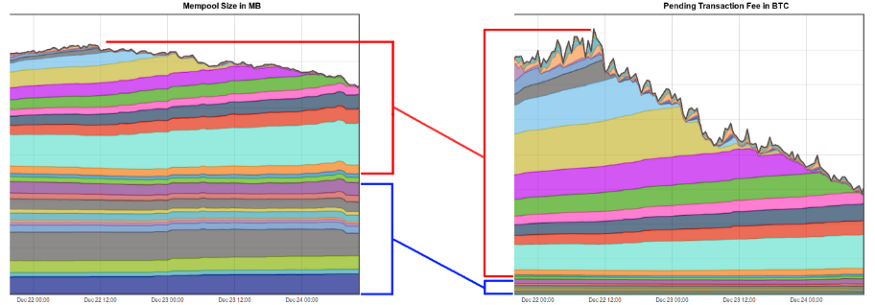

- Backlog transaction mempools to inflate the fee rate

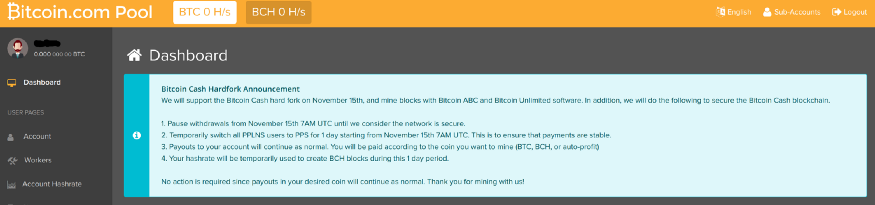

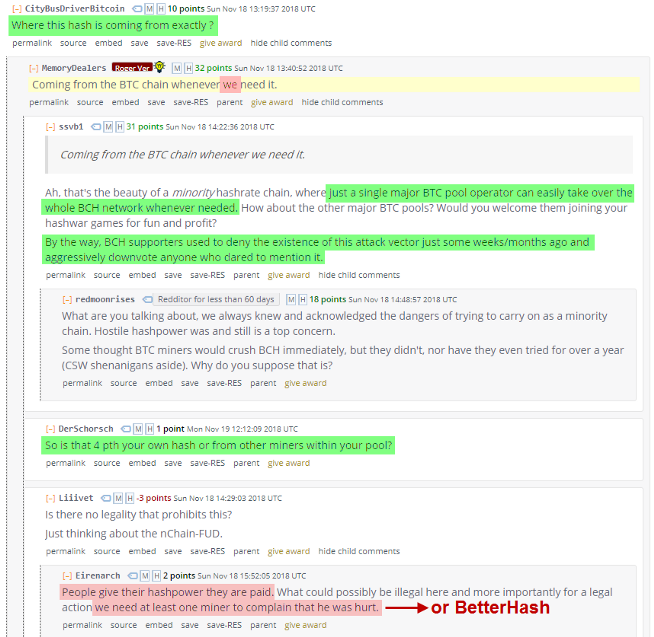

- Direct hashpower without consent & mine competitive forks

- Dishonestly mine, should they have ulterior motives for doing so

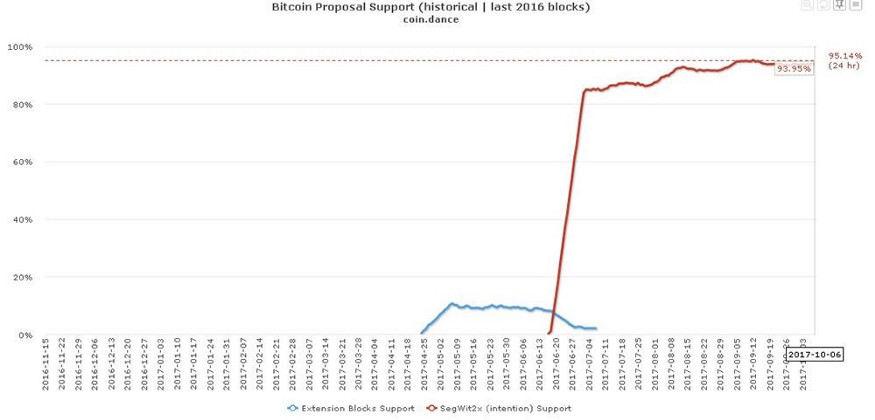

- Signal support for a proposal using a miner’s hashpower

All of these issues are essentially the direct result of pools building the Bitcoin blocks instead of the miners, as mentioned earlier. Along with pool exploitation comes third-party exploitation of the pools. Pools can be hacked and then the hackers can potentially conduct these exploits, or pools can be attacked from a network level and then miners are left scrambling to figure things out or switch to another pool. With BetterHash a pool hack wouldn’t be able to control a miner’s hashpower, and network level attacks targeting a pool wouldn’t have a direct effect on the miners using that pool.

Network level attacks are just as concerning if not more than pools exploiting their miner’s hashpower. An attacker can bring down a large chunk of the hashpower or redirect it as they please. BGP attacks are easy to do and the time & resources required to recover from them is concerning, to say the least. To convey how trivially an attacker can steal a pool’s hashrate and conduct any of the exploits written in this article, watch 3 minutes of this presentation below:

https://youtu.be/k_z-FBAil6k?t=353— Network level attacks discussed at the 5:52 mark, ends at 9:00.

There’s no doubting the benefits of a protocol that defends against these kinds of issues, but solutions to often unheard of potentialities don’t always do a great job on their own conveying their necessity. I’d like to bring to light some hypothetical scenarios as well as some that have already occurred in some fashion, so that necessity is more readily understood. So let’s take a closer look at what each of them are. (Please note that some of these are hypothetical and unlikely to actually occur, and some require very specific circumstances, while others have occurred in one form or another already.)

1: Pools determine what transactions go into a block

Often an issue raised when discussing the possibility of 51% attacks, if enough pools can be convinced to blacklist a transaction type or an address, even temporarily , then it doesn’t matter if you — a miner — personally don’t care and would have included it. The motivation for this could be coercion or just a financial incentive to do so, whether the pool’s own, or a external one paid to the pool.

Scenario #1: Censoring a service’s hot-wallet