| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Crypto Words is a monthly journal of Bitcoin commentary. For the uninitiated, getting up to speed on Bitcoin can seem daunting. Content is scattered across the internet, in some cases behind paywalls, and content has been lost forever. That’s why we made this journal, to preserve and further the understanding of Bitcoin.

Donate & Download the November 2019 Journal PDF

Remember, if you see something, say something. Send us your favorite Bitcoin commentary.

If you find this journal useful, consider supporting Crypto Words by making a donation buying us a beer.

The Real Wisdom behind Proof of Work

By Ferdous Bhai

Posted October 29, 2019

My favorite thing about Bitcoin is “proof of work”.

It’s the idea that your odds of getting the rewards of a block depends on how much work you put in. It’s a simple idea. But it changed the world.

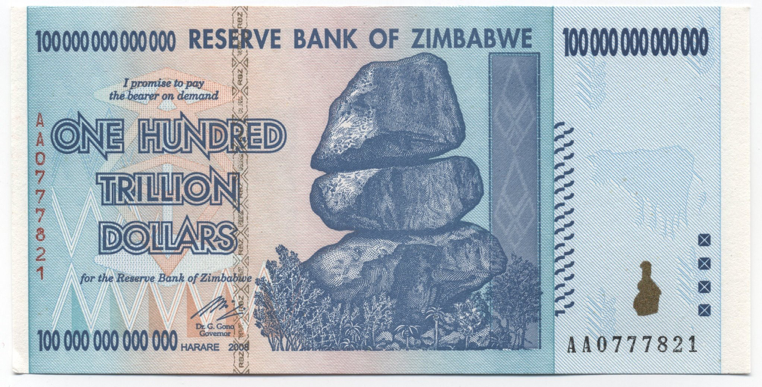

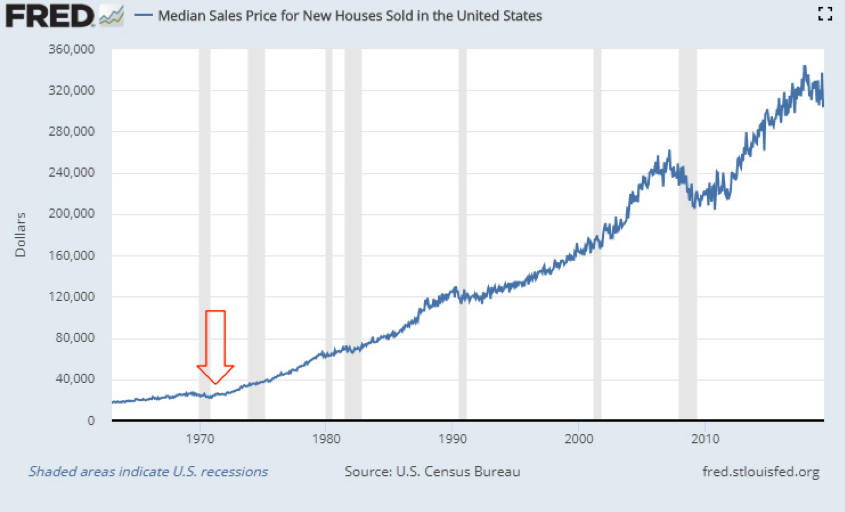

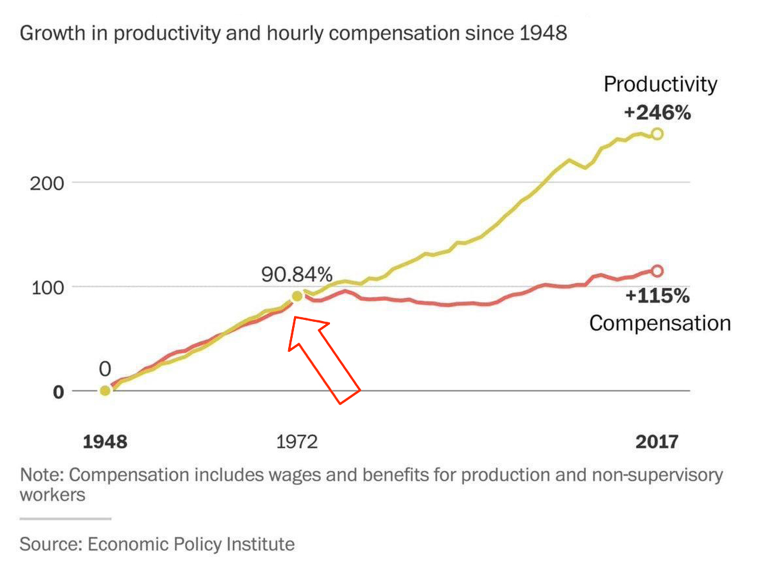

Prior to Bitcoin, the framework of fiat currencies (government-issued money) worked as follows:

There were two groups of humans:

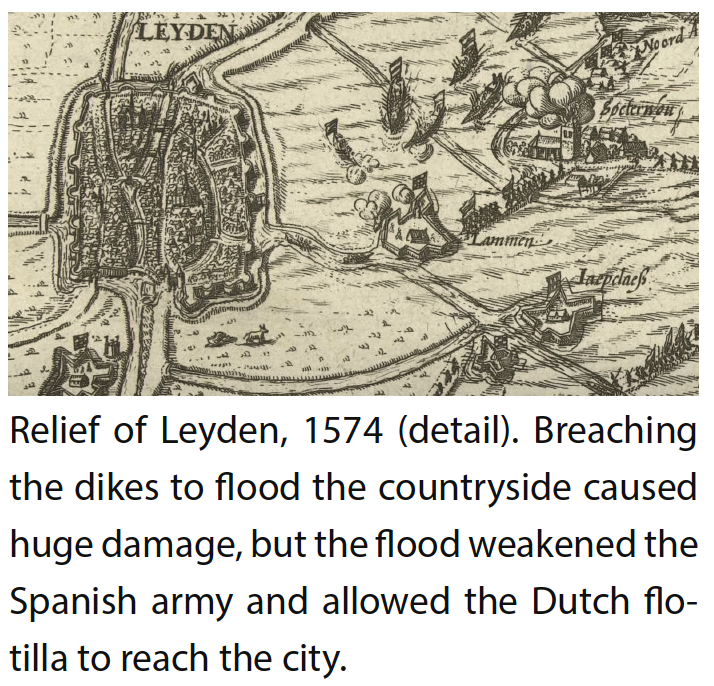

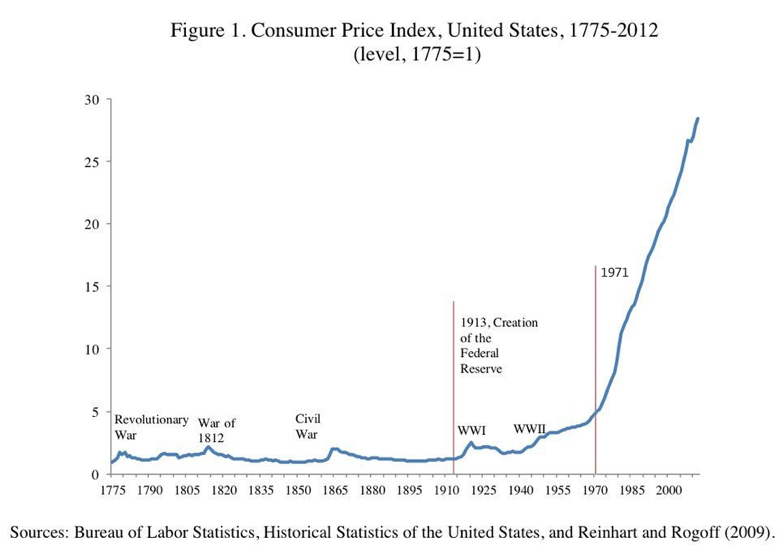

1) Ordinary citizens, who have to work to get paid in the dollar. Once they earn the dollars, they must spend or invest these dollars as soon as possible. Because the dollar, sitting idle, loses value every day, as more and more dollars get created out of thin air.

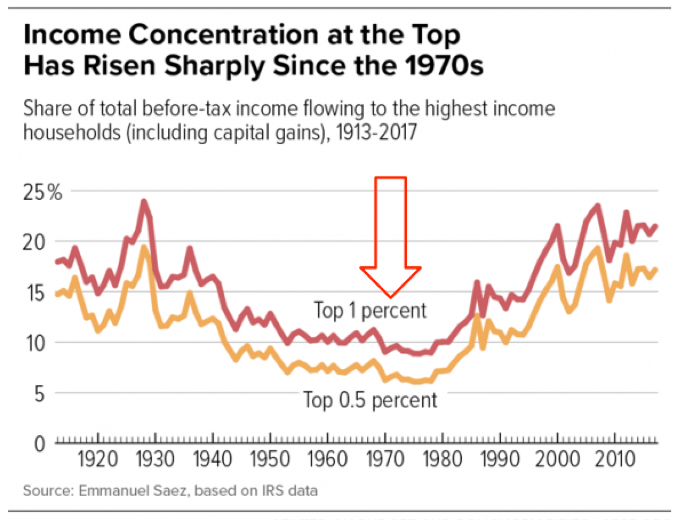

2) The privileged class. Whenever new dollars are created, most of it goes to this privileged group of people via interest income, cronyism, and various rent-seeking mechanisms.

Over time, this distribution method ensures that all real wealth gets redistributed from group 1 to group 2.

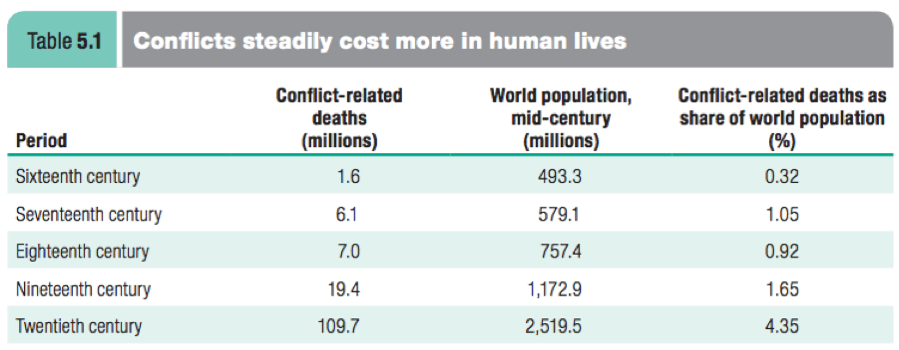

At some point, inevitably, group 1 can no longer accept this perceived injustice. Battles ensue, unrests begin, civilizations collapse. We start over.

The average life expectancy of a fiat currency is only 27 years.

This beautiful image from Simpsons perfectly captures the moment when the ordinary citizens rise up to what they perceive as “unfair”.

This beautiful image from Simpsons perfectly captures the moment when the ordinary citizens rise up to what they perceive as “unfair”.

Bitcoin fixed this.

In Bitcoin, the issuance of new coins is distributed via “proof of work”. All you have to do to earn new coins is to show “proof of work”.

“Proof of work” is not just about running the mining algorithm to keep the Bitcoin network secure. It’s deeper than that.

Are you a writer? Write. Those who value your work will pay you for it.

Are you a developer? Code.

Are you a chef? Cook.

Show proof of your work!

Unlike in fiat money, there’s no privileged class. Nobody earns bitcoins for free.

With this one simple idea: “proof of work”, Bitcoin leveled the field for humanity.

The world is a bit fairer when wealth gets distributed to those who do the work. ✌️

Tweetstorm: Circularity

By Gigi

Posted October 30, 2019

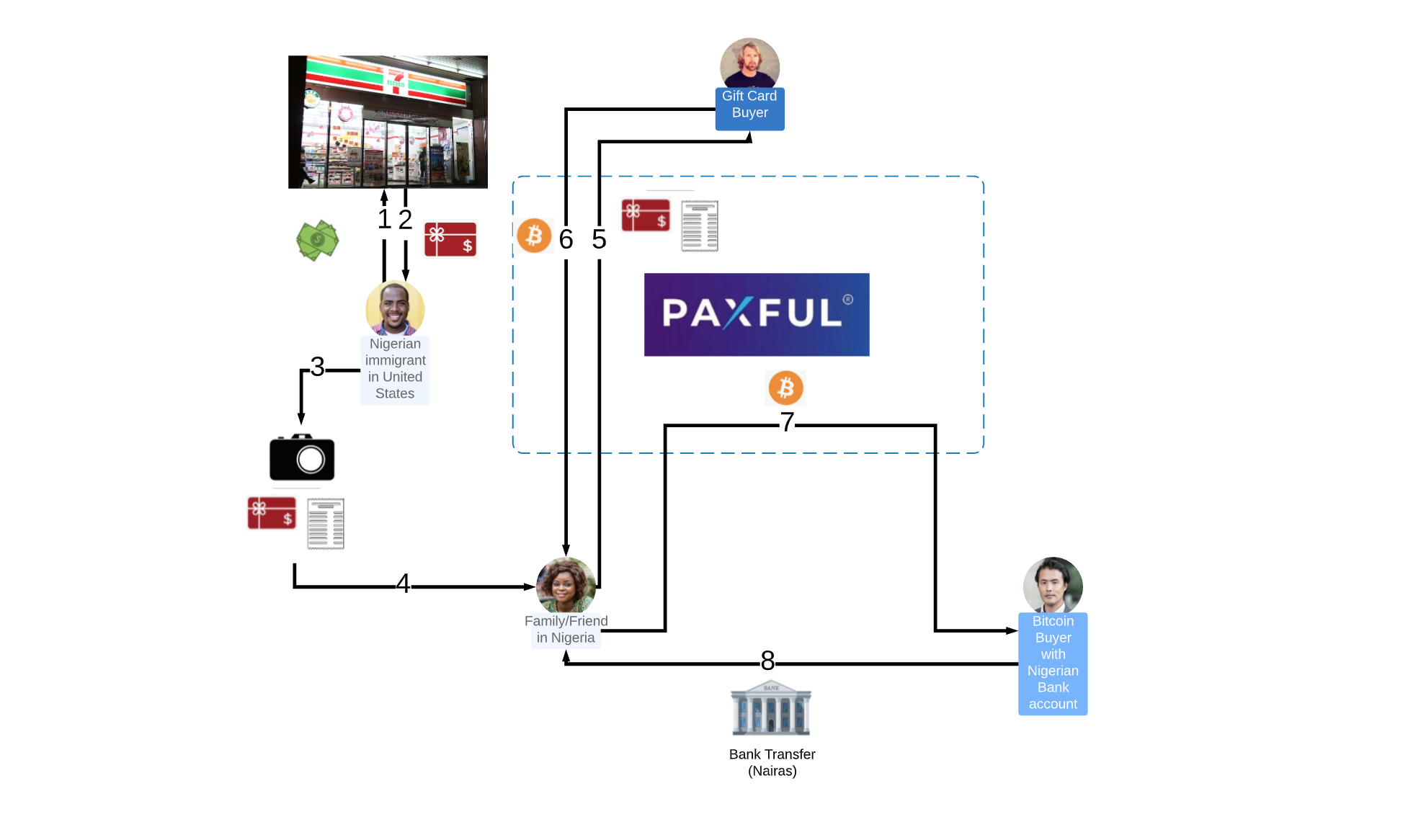

“Circularity” - A thread about Bitcoin, religion, mirrors, my rabbit hole journey, and where Bitcoin (and bitcoiners) might go in the next couple of years.

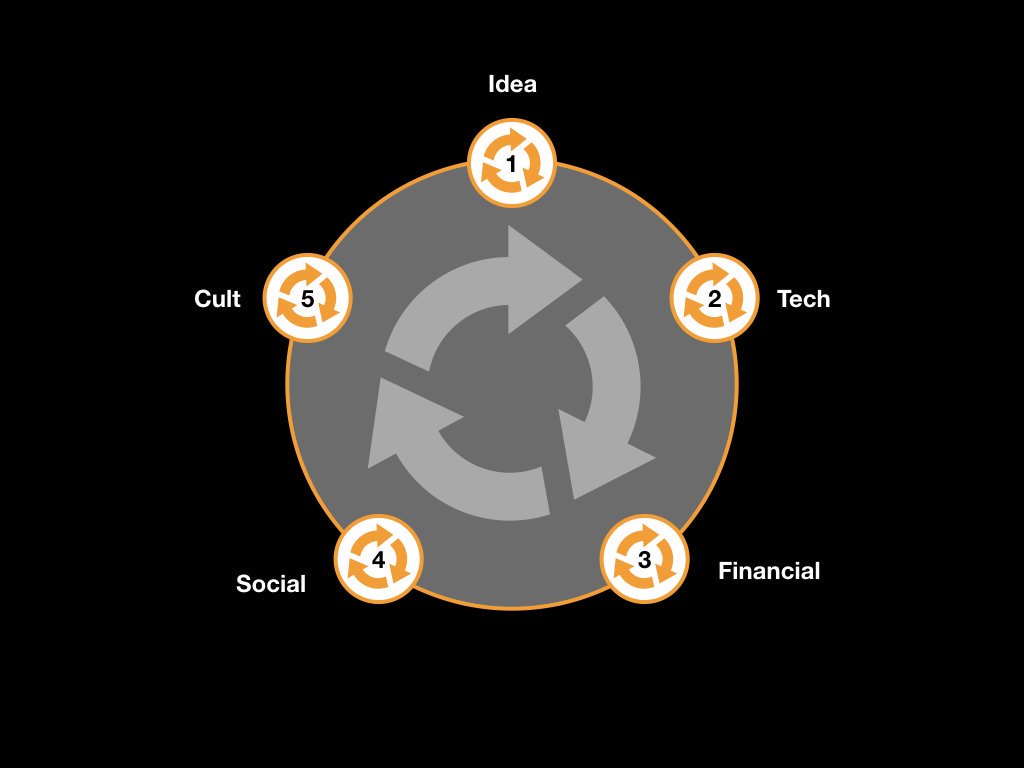

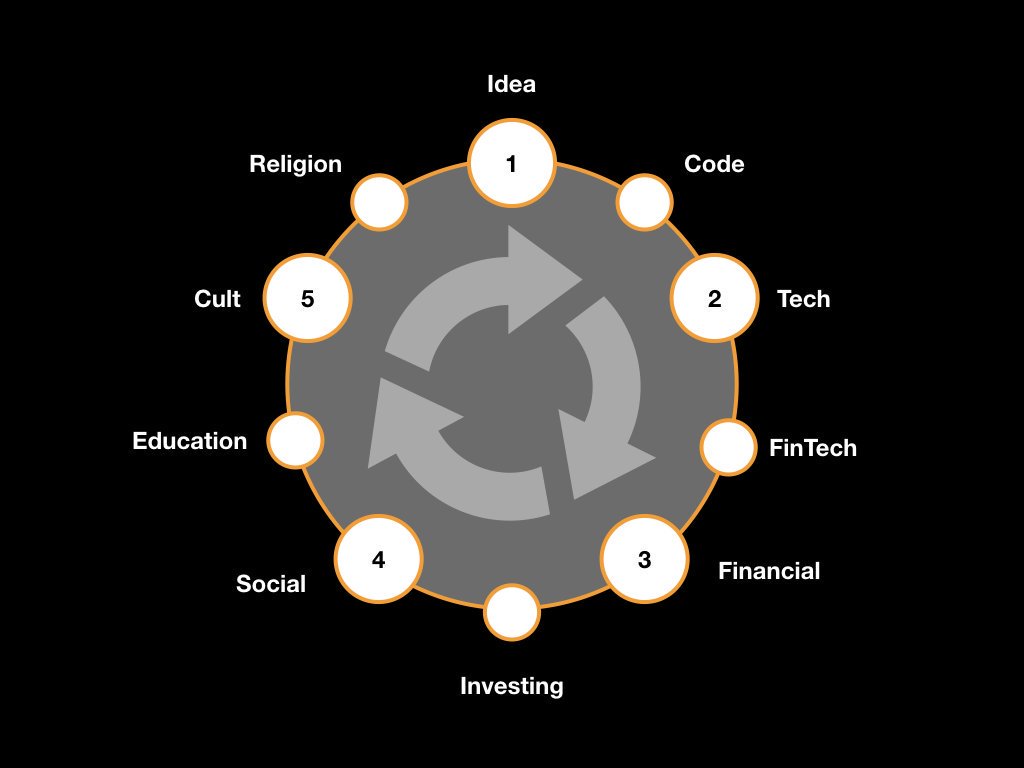

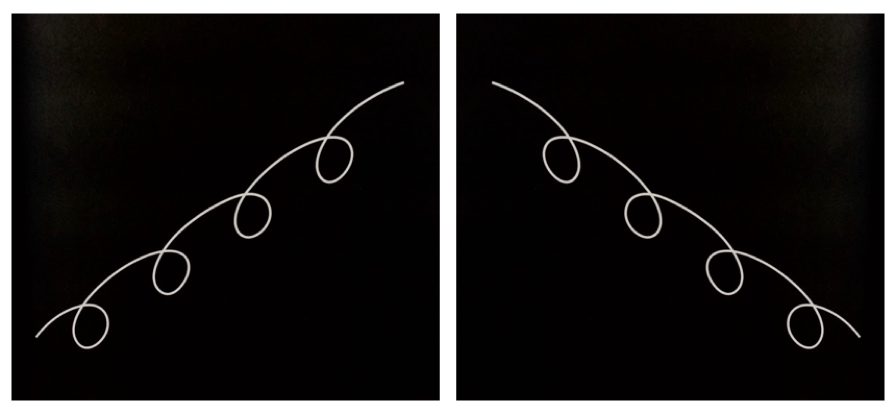

2/ I drew it in various forms, so the details (e.g. how many outside circles there are) aren’t that important. The main idea is important - at least to me.

3/ The Bitcoin “rabbit hole” might look innocuous at first. After all, you’re just trying to answer a very simple question: “What is Bitcoin?”

4/ First of all, I believe that falling down the Bitcoin rabbit hole is a deeply personal experience.

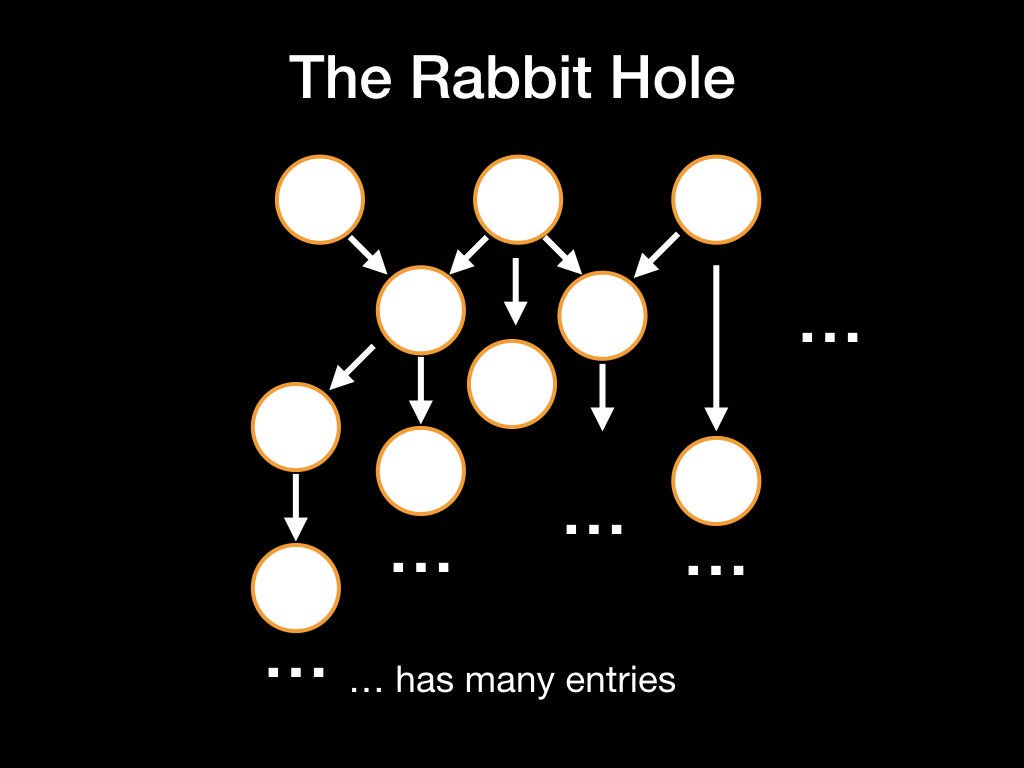

5/ The rabbit hole has many entries. Your particular entry point depends on circumstance, your background, and your previous experience.

Once you are inside, however, you will stumble upon things that are far removed from your particular point of entry.

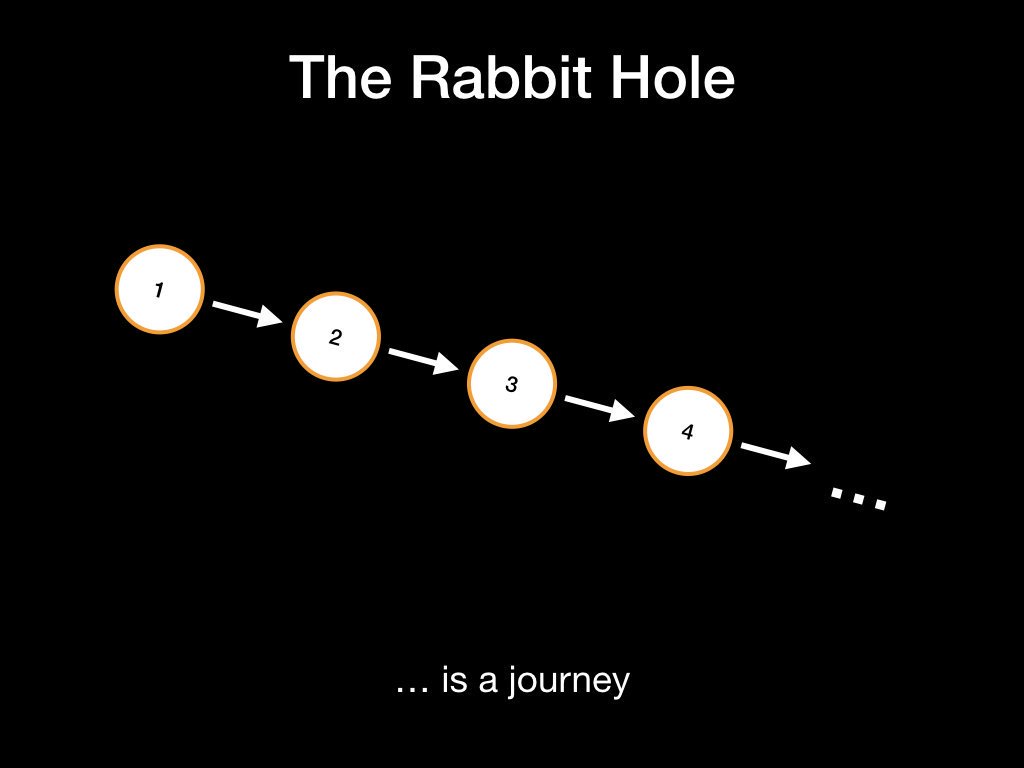

6/ Many say that the rabbit hole is bottomless, and I tend to agree. It certainly feels like a journey without end.

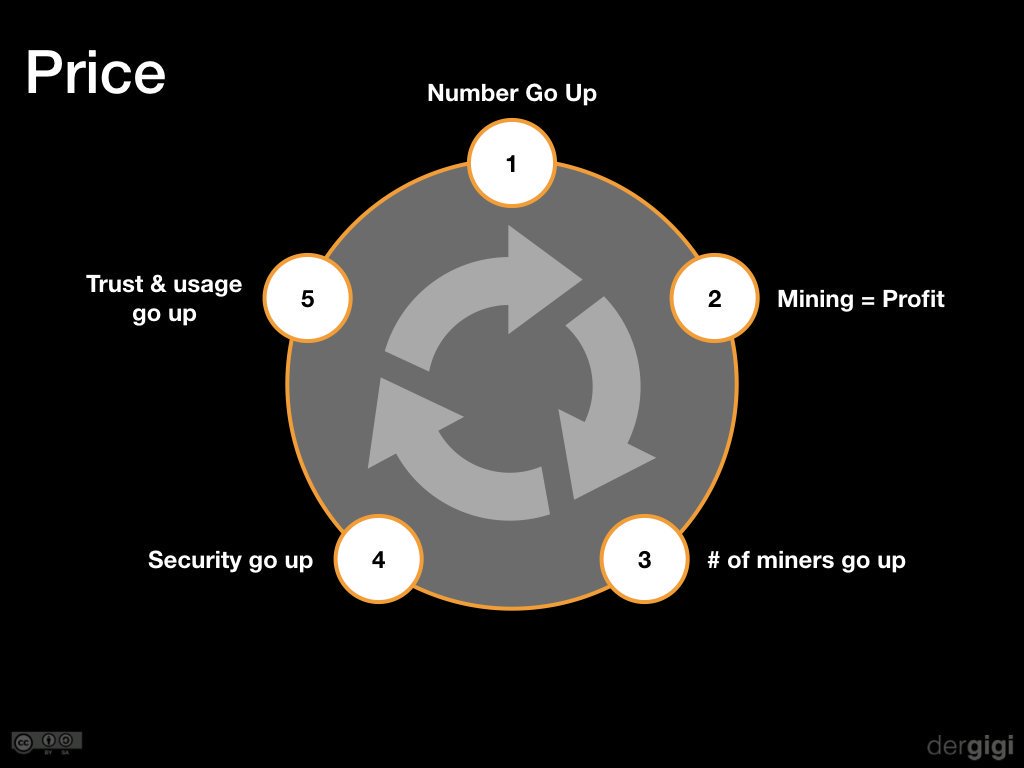

7/ However, I believe that Bitcoin - and the rabbit hole journey - is circular.

For whatever reason, this insight was of such profundity that it changed me, my view of the world, and my outlook in regards to the future.

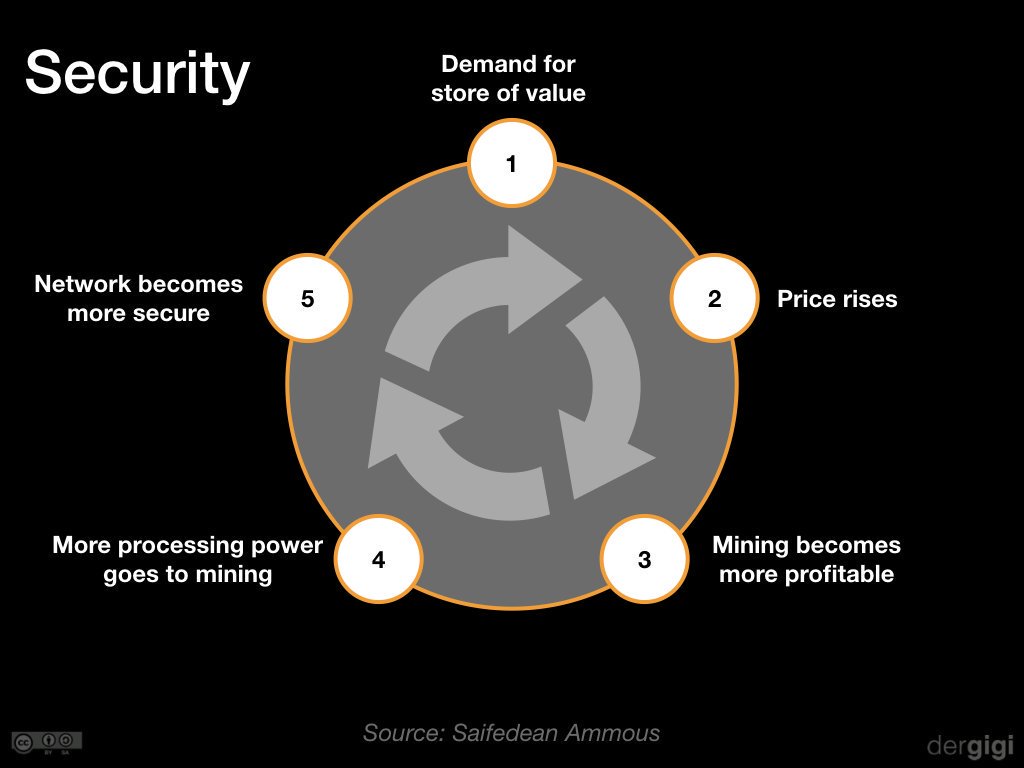

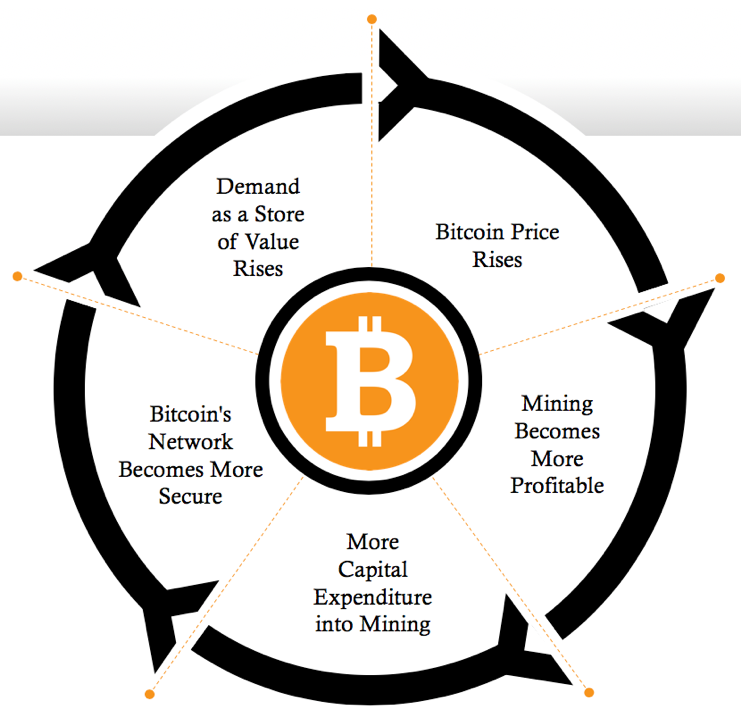

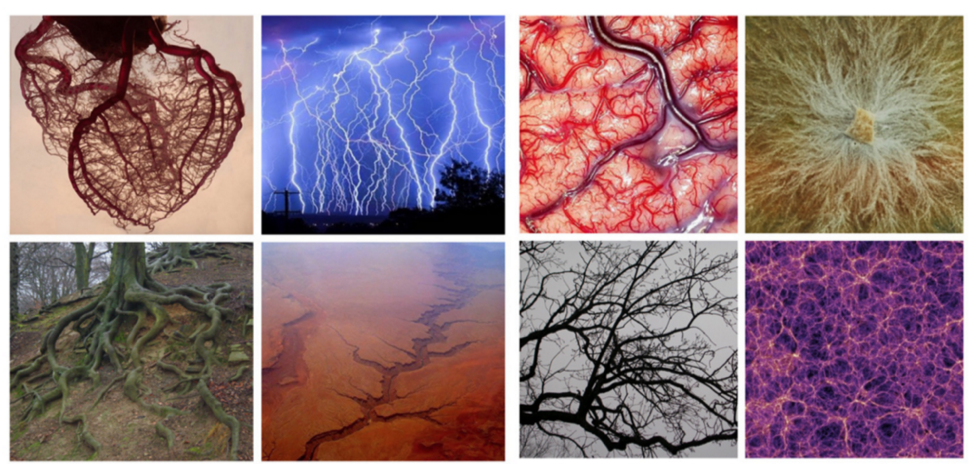

8/ Bitcoin is profoundly circular. It is circular because it is anchored in nature, via the energy expended in proof-of-work. Some even go further and conclude the following:

“Bitcoin is Nature” – @FriarHass

9/ You can get stuck in the smaller circles, which is partly why Bitcoin is so hard to understand. If you are a trader, you might get stuck trading. Others might get stuck on the whitepaper, or get stuck on implementation details.

10/ I sometimes drew this image as a mirror, because, well, I believe that Bitcoin is a mirror - it reflects who you are; it reflects your beliefs.

“Bitcoin is different things to different people.” “Bitcoin is whatever it needs to be…”

11/ “Knowledge is a mirror and for the first time in my life I was allowed to see who I was and who I might become.”

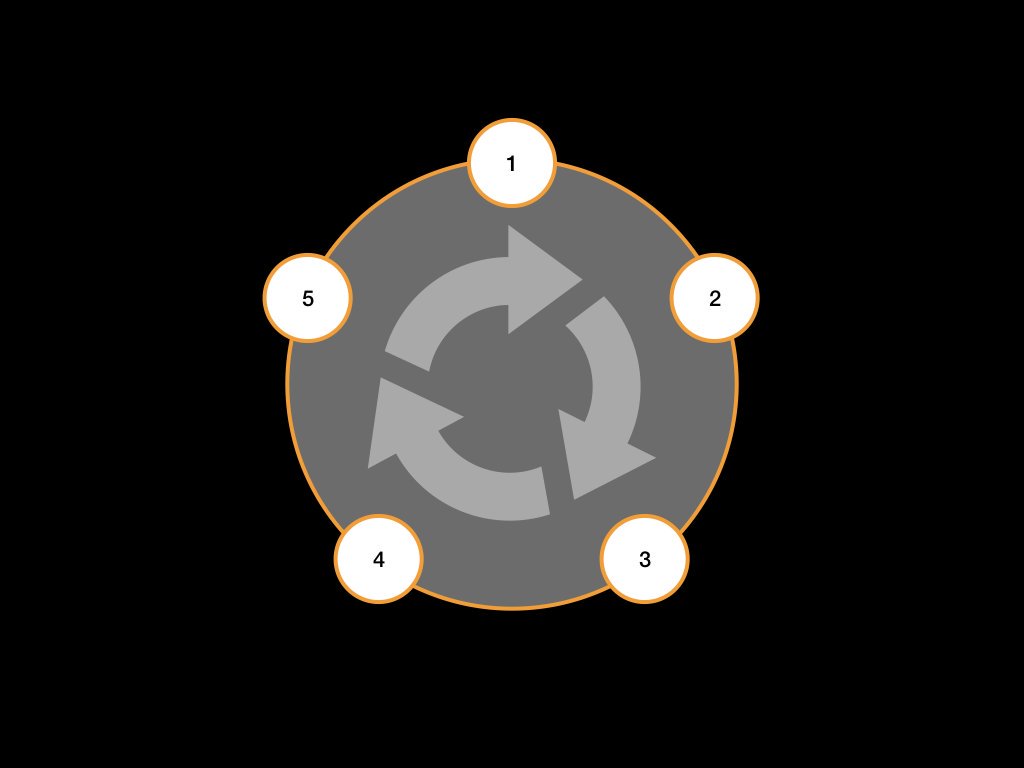

12/ The main journey, as I see it now, is roughly as follows: Idea -> Tech -> Finance -> Social -> Cult -> Idea

13/ There might be multiple stops in-between; that’s not particularly important. What is important, is that a cult exists, and some people will take it to the next level. What is the next level? I think it’s Religion.

14/ Up to now, the most powerful ideas have been religious ideas.

Bitcoin fixes this. It combines financial incentives, economic realism, mathematics, and physics with fundamentalism and religious devotion. More powerful.

“Bitcoin religion” is real. It has already started.

15/ I believe that Bitcoin is the most powerful idea of our time. It is about to become one of the most powerful memes of our time. I believe that more and more people will be religious about Bitcoin, about the idea of separating money and state through absolute scarcity.

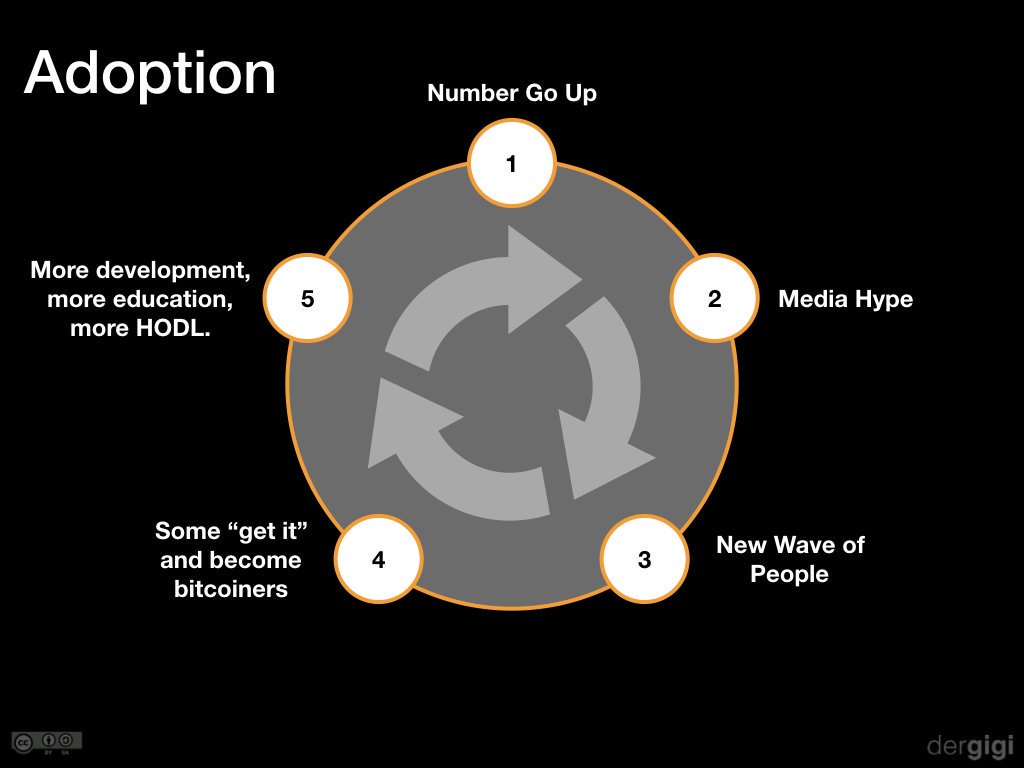

16/ Every cycle new bitcoiners are born. Some of these bitcoiners become maximalists, and some of these maximalists will have religious devotion.

17/ I’m prepared to be wrong about this.

But I ask you, dear skeptics: are you prepared to deal with tens of thousands of zealots, in case I’m right?

Volatility as information

By acrual

Posted October 31, 2019

There is this fascinating book by George Gilder named “Knowledge and power”.

In this book Gilder claims that knowledge acquired by entrepreneurs, and their freedom to share and use that knowledge, are the ignition to a prosperous economy. Whatever improves that knowledge sharing is, as a consequence, good for the economy.

On the other hand, Government’s “ability” to regulate and supress knowledge, ideas and information manipulation prevent the economy from prospering.

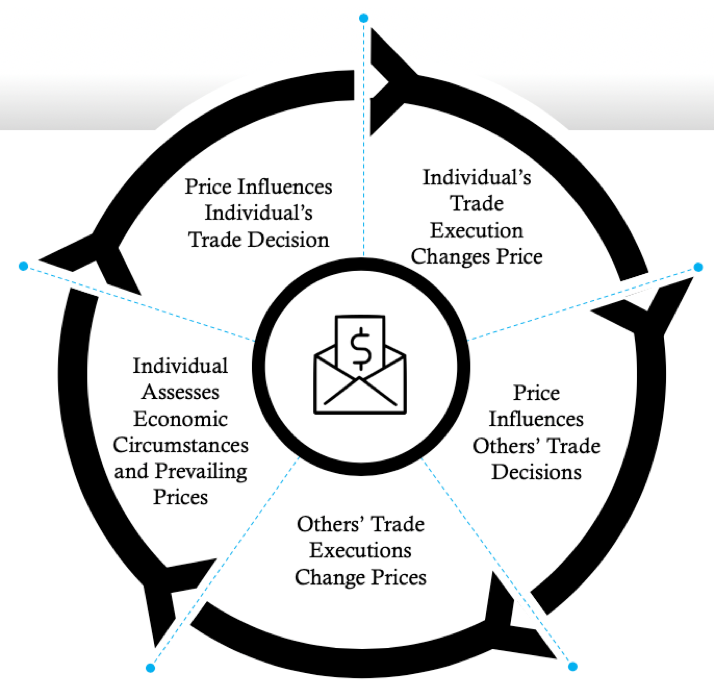

Volatility is in my opinion information that has not yet been figured out

Entrepreneurs are actually agents that get into the unknown, and are rewarded by turning volatility into predictable outcomes. Indeed, volatile environments are steep learning curves and entrepreneurs are rewarded economically and through lots of learning by making things easier for others.

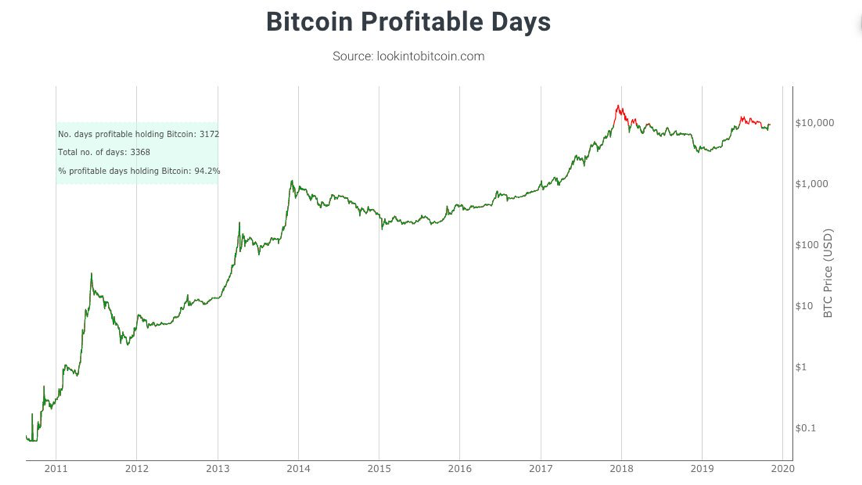

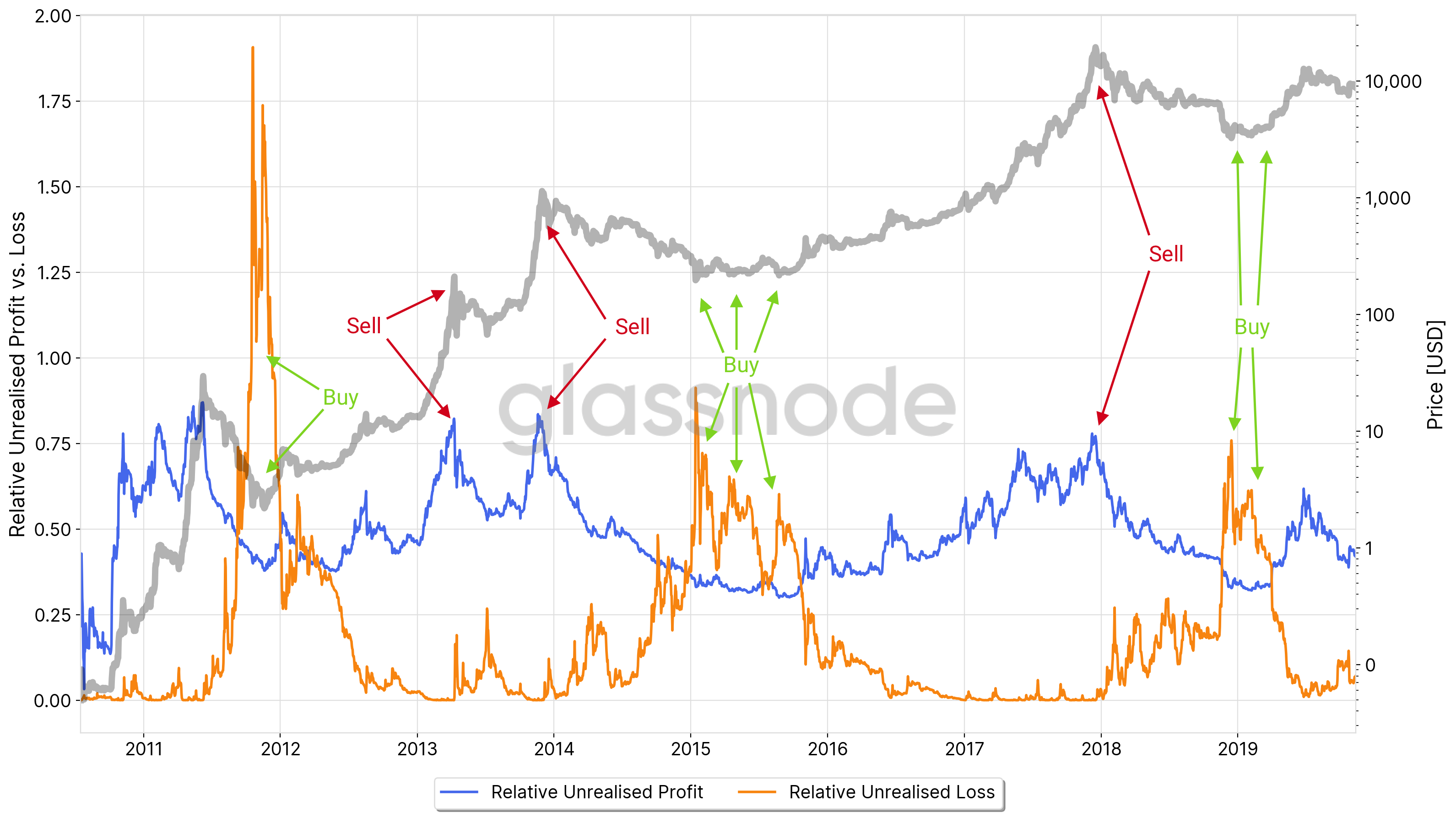

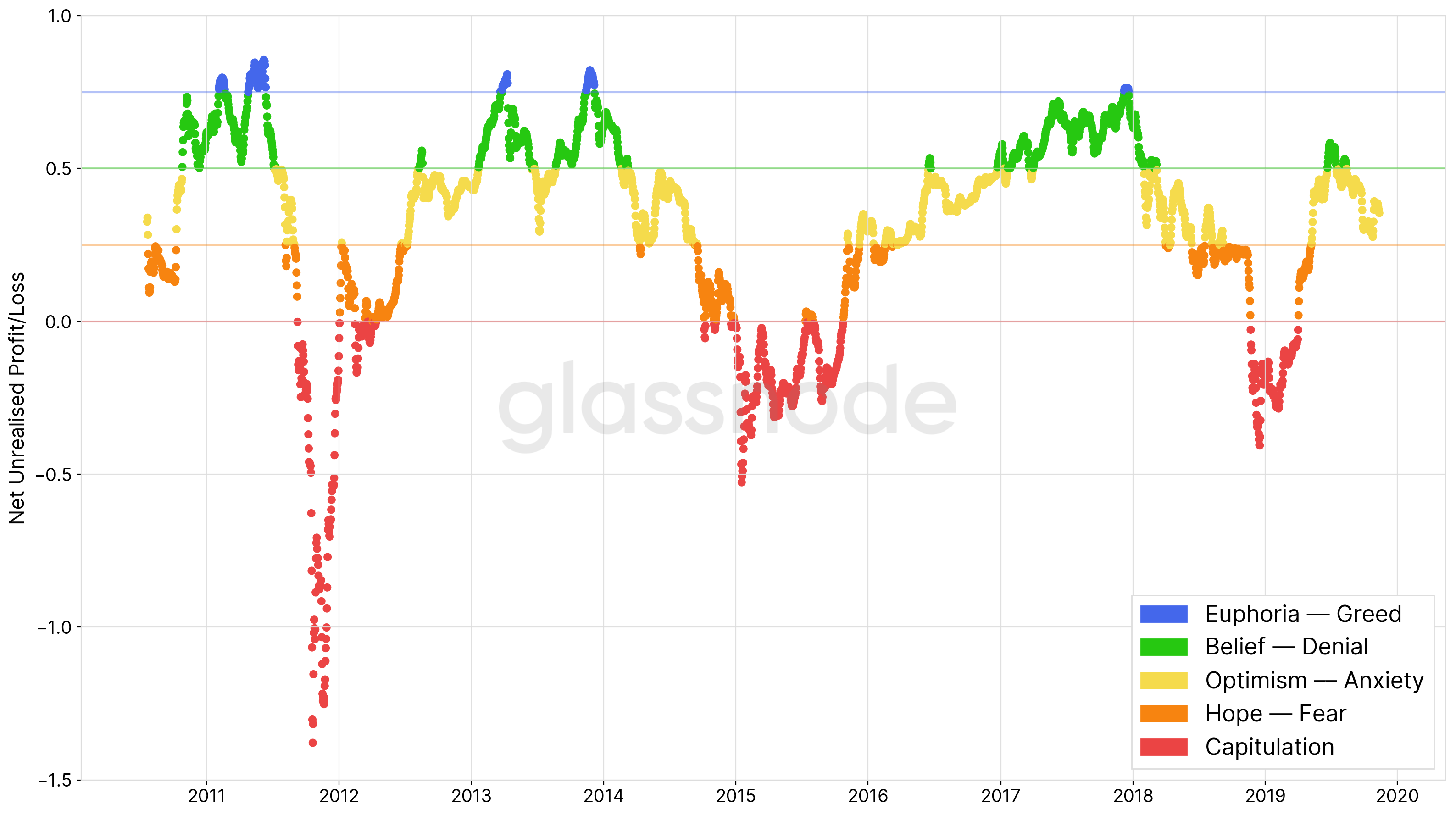

I feel this is exactly what is going on with Bitcoin’s price volatility. Its huge volatility is usually a symptom of something gigantic going on, on lots of information to be processed, huge rewards not only for the entrepreneurs (aka hodlers) willing to step in, but also for the entire world, once it manages to create a financial system where noise is mercilessly eliminated in order for information to flow freely and transformed into transparent code for those willing to learn to look into it. I think Bitcoin is what George Gilder calls a low entropy information carrier.

Its price volatility is the clear symptom that a massive amount of information still needs to be processed by millions. Entrepreneurs, speculators in a trader or hodler shape are helping to decrease it by absorbing way more information than others and profiting in the process.

If you are reading this, you are likely to be a “Bitcoin entrepreneur”, a hodler.

I have no doubt at this point that your learning efforts are very likely to be rewarded!

Why does hashing public keys not actually provide any quantum resistance?

By Andrew Chow

Posted October 16, 2019

In the discussions about taproot, it was mentioned that outputs will include the public key directly instead of hashing them. It is stated that, currently, hashing does not really provide quantum resistance. Why is that?

Answer:

Although hashing a public key by itself does provide quantum resistance, this is really only when it is considered by itself in a vacuum. Unfortunately, public key hashes do not exist in a vacuum and there are many other things in Bitcoin that need to be considered.

Firstly, if public keys were hashed, the funds are only protected before they are spent. As soon as a P2PKH or P2WPKH output is spent, the public key is exposed. Whilst the transaction is unconfirmed, an attacker with a fast enough quantum computer could compute the private key and create a conflicting transaction which sends the funds to himself instead of the intended recipient.

Furthermore, if that attacker is a miner, they could do this with every single transaction and simply refuse to mine transactions that don’t send the coins to himself.

While this is a problem, people often argue that it’s better than someone just spending the Bitcoin outright because they have the public key from the blockchain. While that is true, there are an extremely large number of outputs with exposed public keys.

Over 5.5 Million Bitcoin are in outputs with exposed public keys, either because they are P2PK outputs, or because users are reusing addresses and thus public keys are exposed in other transactions. So if a quantum computer existed that could produce the private key for a public key in a reasonable amount of time, the attacker would be able to steal so much Bitcoin that they would decimate the Bitcoin economy and Bitcoin would become worthless.

So while your particular outputs may be protected by hashes, the value of those outputs would be 0 as millions of Bitcoin are stolen. All that the hashes really do is provide a false sense of security.

Then there are issues with tooling and wallet software the simply expose public keys in other ways than just in transactions and in the blockchain. No existing tools treat public keys as private information; there’s no reason they should.

Many wallets send the parent extended public keys to a server so that the server can watch for transactions and send that data back to the client. Anyone who uses such a wallet, even temporarily, exposes their parent public key to a service provider. That provider could then compute the private keys to the public keys they have, derive all of the child keys, and steal all of the Bitcoin associated with anyone who has used their wallet.

Additional issues exist with complex scripts and contracts involving public keys. These scripts, such as multisigs, do not hash the public keys. Furthermore, these contracts typically exist because not all parties necessarily trust each other; one of them could be malicious. In such cases, a malicious participant in the contract would know the public keys involved (by virtue of knowing the script) and be able to steal the Bitcoin associated with those outputs. Existing public key hashes do not protect against this.

So overall, there are tons of ways that public keys are already exposed outside of transactions. These all would allow different kinds of attackers to steal millions of Bitcoin thereby causing the value of Bitcoin to go to 0, which renders any Bitcoin protected by public key hashes to be worthless anyways. Furthermore, users are probably exposing their public keys in unintended ways due to the software that they are using. So using public key hashes only serves to provide a false sense of security, while also increasing the size of transactions. In general, it is not worth the extra size.

Lastly, it is possible to do a transition to post quantum cryptography if it is found that a QC exists which can break ECDLP. If detected in time but still too late to do a proper upgrade, all use of signature algorithms relying on ECDLP (i.e. ECDSA and Schnorr) could be soft forked out thereby locking all coins. The coins could then be spent by providing a Zero Knowledge Proof of some non-exposed or quantum resistant information that indicates ownership of the private keys for the public key.

For example, users could provide a proof that they have the BIP 32 seed that was used to derive the private key for the given public key. Since it is a Zero-Knowledge Proof, the seed itself is not exposed (note that the seed is not part of a public-private keypair so there is no public component that is shared). Since most wallets use BIP 32, this should be sufficient. There may be other ways to prove ownership without risking coins that have not been thought of yet.

And of course, this all assumes that a quantum computer capable of computing the private key for a public key appears without the public being aware of the technology being close to existing. What is likely to happen is that the progression of quantum computers will be observed, and, at some point prior to them being powerful enough to break ECDLP, Bitcoin will soft fork in a Quantum resistant signature algorithm. Eventually, signatures relying on ECDLP will be removed. And all of that will occur before quantum computers truly becomes a thread. So in that scenario, hashing public keys provides no help anyways.

What Hath Satoshi Wrought

By Hashed Entropy

Posted November 2, 2019

.– …. .- - …. .- - …. … .- - — … …. .. .– .-. — ..- –. …. -

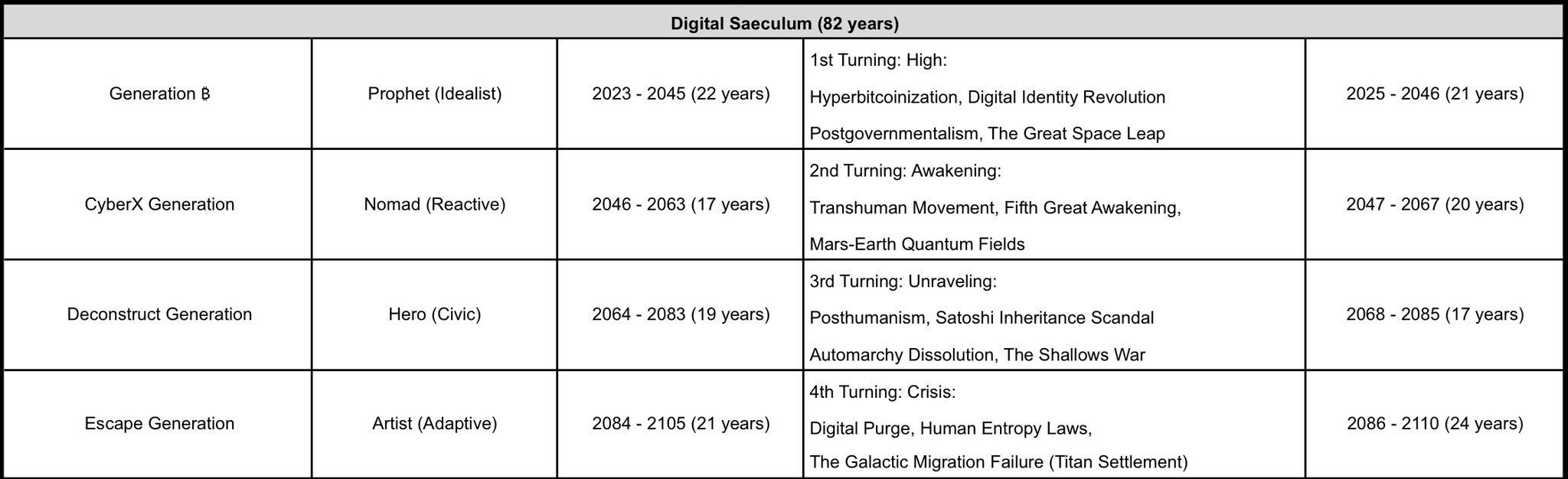

Letters from the Digital Saeculum:

The First Transmission

A saeculum is a length of time roughly equal to the potential lifetime of a person or, equivalently, of the complete renewal of a human population. The term was first used by the Etruscans. Originally it meant the period of time from the moment that something happened (for example the founding of a city) until the point in time that all people who had lived at the first moment had died. At that point a new saeculum would start. According to legend, the gods had allotted a certain number of saecula to every people or civilization; the Etruscans themselves, for example, had been given ten saecula.

Wikipedia — Saeculum

Late Millennial Saeculum bitcoin chart (2018) viewed with Early Millennial Saeculum binoculars (1917)

Late Millennial Saeculum bitcoin chart (2018) viewed with Early Millennial Saeculum binoculars (1917)

What Hath Satoshi Wrought

I’ll admit that I found the line to be a little sacrilegious. I guess not many are both students of History and Religion so I imagine that I was the only one on this side left with that impression. But I knew the sender and I knew the sender sent this message with the utmost respect to me as a homage to the honor provided by Annie Ellsworth exactly 200 years earlier.

I wondered if anyone noticed the slight encoding of history between the sender and receiver. I had timed this very moment to coincide with “What Hath God Wrought” traveling along as a dot and a dash and a dash and a dot and a dot and a dot and a dot and a…well you can figure out the rest.

200 years to the moment.

The day was May 24th, 2044.

Now, it is May 9th, 38 EMS (Earth-Mars Synced time) and I have to proclaim once again What Hath Satoshi Wrought!

Today is the start of the Unraveling.

The Digital Saeculum — 2025–2110

The Digital Saeculum — 2025–2110

The Unraveling

How can I describe to you all of the events over the last few years in such a short transmission? How do I explain in a few short words, the lifetime of moments that led up to you being asked to flee and leave behind a thousand generations of humanity in one place and to not even last one generation in a new place?

How do I explain this unraveling?

First, the moment of EMS was the most enlightened moment of our Digital Age. We: humanity, transhumans, and hubots brought our worlds: the Earth and Mars together in synchronicity. We enabled instantaneous communication, commerce, and cohabitation.

Geography has made us neighbors. History has made us friends. Economics has made us partners. And necessity has made us allies. Those whom nature hath so joined together, let no man put asunder.

John F. Kennedy

The strides in technology, science, and abstractionism reached the very peak in that moment.

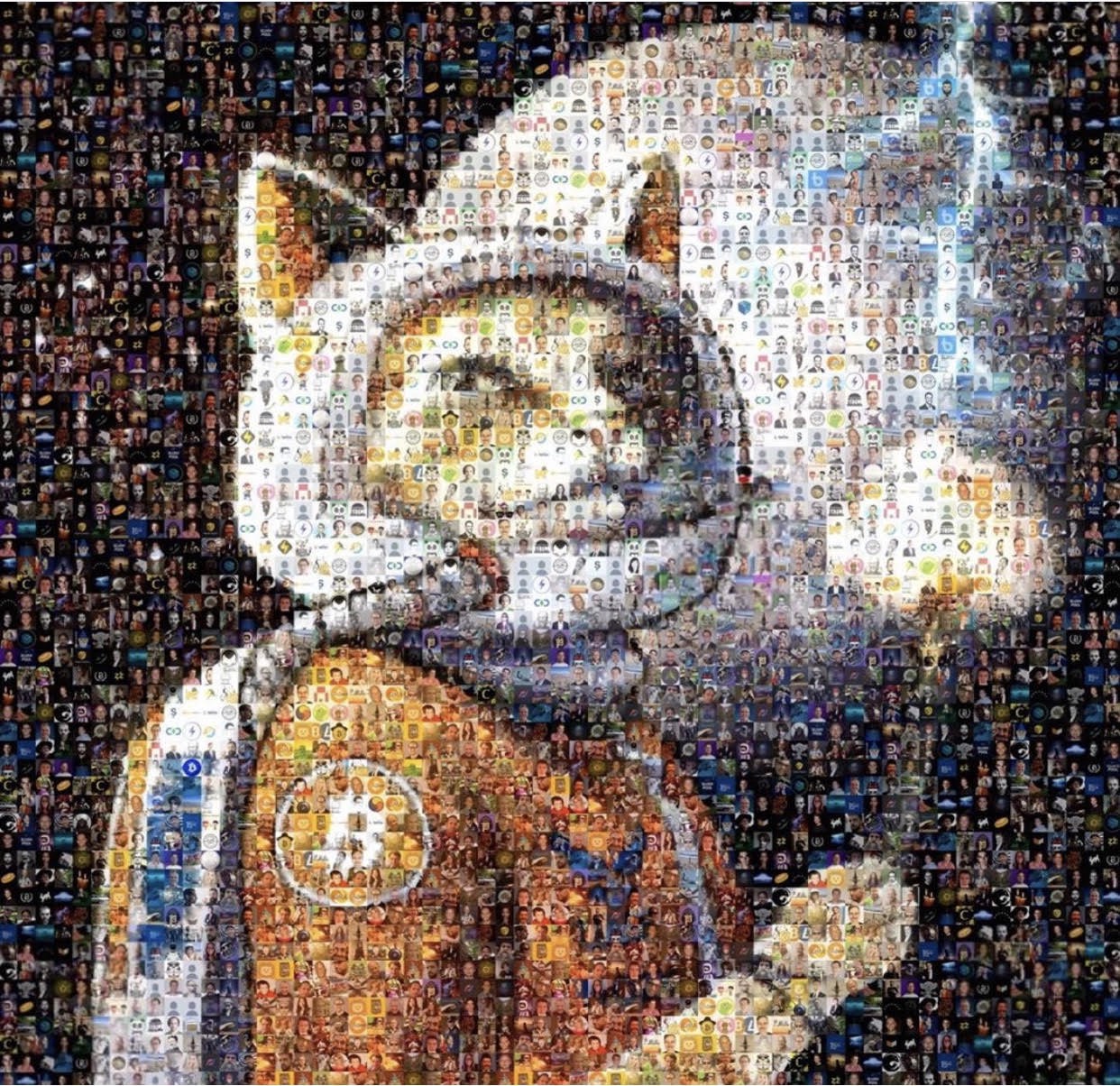

Pre-EMS Artwork Featuring Hodlonaut (May His Light Always Shine) Comprised of Hodl’rs of Ancient Times

Pre-EMS Artwork Featuring Hodlonaut (May His Light Always Shine) Comprised of Hodl’rs of Ancient Times

For now, I’ll focus on the economic tensions and leave the automarchy dissolution and the awakenings for another day.

Posthyperbitcoinization started with a simple point in time: I call it the moment that death commenced its 51% attack. This was the moment in which more than 50% of the early hodl’rs reached the end of their lives. The problem is that in their zeal for Self Sovereignty, too many failed to consider Family Sovereignty, Generational Sovereignty, Legacy Sovereignty, and with their deaths, Satoshis burned from existence. This is now known as the Satoshi Inheritance Scandal.

We are a continuum. Just as we reach back to our ancestors for our fundamental values, so we, as guardians of that legacy, must reach ahead to our children and their children. And we do so with a sense of sacredness in that reaching.

Paul Tsongas

The inability to apply Low Time Preference to beyond one’s self created a massive problem at the base layer of our economic system. This led to inequality as whole groups were unable to transact due to a lack of underlying bitcoin support. The Shallows War started as groups formed under the banner: “We are Left in the Shallows” claiming inequality and inability to access the Earth-Mars economic system.

A House Divided Against Itself Cannot Stand

Where did the first thread begin to separate? Where was the first point of weakness? Where was the first sign of anti-antifragility?

You must first understand the alliances that were created during the EMS. EMS initially created a foundation of fairness across Earth-Mars as for the first time bitcoin’s foundational layer was synced, block rewards were distributed, and the risk of one alliance dispersing was finally fully addressed.

Surely there is no enchantment against Jacob, neither is there any divination against Israel: according to this time it shall be said of Jacob and of Israel, What hath God wrought! Behold, the people shall rise up as a great lion

Numbers 23:23–24

Now I will only speak in hushed tones here so understand that I can only say so much: this was also a moment that the inequalities (i.e. fairness) could be closed across humans and hubots.

But the unraveling started…

The first thread tore when a large number of hodl’rs died on Earth as a result of the “accidental” CitaHal destruction. [CitaHal was the second major Citadel built which was appropriately named in honor of Hal Finney] While the earliest banners proclaimed “Remember the CitaHal”, the undermining of the supply of bitcoin on the Earth, quickly led to disappointment, disillusionment, dissolution, and finally “We are Left in the Shallows”.

The Shallows Artwork — “We are Being Left Behind”

The Shallows Artwork — “We are Being Left Behind”

The string was pulled and when it unraveled:

We lost.

We all lost.

We lost more than our humanity;

We lost more than our wealth;

We lost more than our health;

We lost more than our worth;

We lost more than our lives;

We lost it all.

All of it.

Even, I…

I am…

I am no longer.

But there is still hope…

You are that hope.

See what others do not see and pay close attention to the following as this is your message to share:

The Last Mortal Man

By HashedEntropy

Posted November 13, 2019

Letters from the Digital Saeculum (Part 2):

The First Message

The First Transmission (Part 1) is located here: https://medium.com/@HashedEntropy/what-hath-satoshi-wrought-f7687b631d42

For they are like a breath of air; their days are like a passing shadow. Psalm 144:4

For they are like a breath of air; their days are like a passing shadow. Psalm 144:4

Fragility

Humans were so fragile. I used to wonder if humans were preoccupied by the thought of their own mortality, though I now know that transformations can be very gradual.

If you drop a frog in a pot of boiling water, it will of course frantically try to clamber out. But if you place it gently in a pot of tepid water and turn the heat on low, it will float there quite placidly. As the water gradually heats up, the frog will sink into a tranquil stupor, exactly like one of us in a hot bath, and before long, with a smile on its face, it will unresistingly allow itself to be boiled to death.

Parable as described by Daniel Quinn

I now accept that mortality was an ever present reality for humans in which they were able to function without being crushed by an existential dread. Mortality was in the air they breathed, constantly floating and surrounding and flowing…it was their existence. They were vapor; there was no other way.

Oh, how wrong were we to think that immortality never meant dying

Our Lady of Sorrows by My Chemical Romance

As it is unknowable to ascertain when humans first became humans, it is as unknowable to fix the very moment when humans crossed the chasm into Homo Alium. Yet, we know for certain the identity and cause of The Last Mortal Man.

You have already read the words from The Last Mortal Man as shared in the The First Transmission.

Now I will share with you The First Message.

The First Message

Sacrifice was one of humanity’s greatest gifts.

Human progress is neither automatic nor inevitable… Every step toward the goal of justice requires sacrifice, suffering, and struggle; the tireless exertions and passionate concern of dedicated individuals.

Martin Luther King Jr.

In 3 EMS, it was proven that Satoshi sacrificed wealth, power, and fame in order to allow bitcoin to survive its moment of greatest vulnerability. The question of Satoshi’s mortality or intentional anonymity was finally answered.

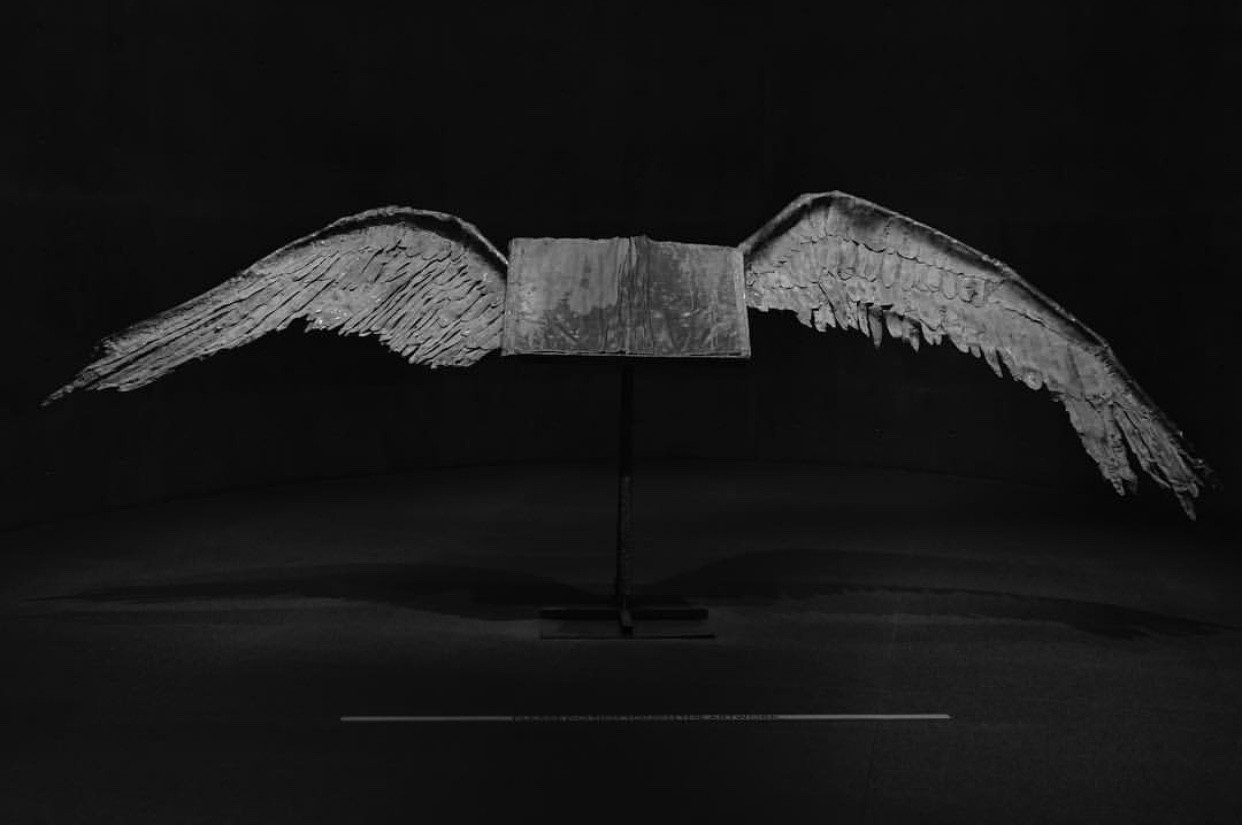

Photo of Book with Wings Sculpture by Anselm Kiefer (1992–1994); Materal: lead, tin, and steel

Photo of Book with Wings Sculpture by Anselm Kiefer (1992–1994); Materal: lead, tin, and steel

But, you know, sometimes you just gotta be drop-kicked out of the nest…It’s the only thing that gets you to the next level, right?

Robert Downey Jr.

In letting go, Satoshi provided the conditions for bitcoin to grow its anti-fragility, survive, and eventually thrive.

This was Satoshi’s sacrifice.

And The Last Mortal Man would someday make the last human sacrifice.

The fleeting moment of a bubble floating by the enduring sun

The fleeting moment of a bubble floating by the enduring sun

Like the dew on the mountain,

Like the foam on the river,

Like the bubble on the fountain,

Thou art gone, and for ever!

Coronach by Sir Walter Scott

The Crisis

In the First Transmission, you read of the Unraveling. You read the words of The Last Mortal Man. Now, I will share with you the story of what was lost and what led to The Last Mortal Man to make the final sacrifice.

The Shallows War was beyond brutal. Earth against Mars and humans against hubots. The de-center could not hold and the protocol that automated laws and rules and society was undermined. The Automarchy Dissolution resulted in a existence with no binding connectors. Incentives (both economic and governance) were no longer aligned. This led to a crisis greater than you can even imagine.

Beyond the standard rules of engagement that one might expect in an all out conflict, humans were the first to enact the “nuclear option.” The Shallows War showed that humans could not win a war on equal footing given the hubot’s embedded AI, quantum processors, and synchronicity. Out of the ashes, humans launched a Digital Purge strategy. By going completely offline, they quickly separated from their dependence on technology. They then attacked the hubs that powered hubots and assaulted any forms of digital existence. The Digital Purge reached totality in Mars and was on the verge of fully erasing the digital world from the Earth.

We’re plugged in 24 hours a day now. We’re all part of one big machine, whether we are conscious of that or not. And if we can’t unplug from that machine, eventually we’re going to become mindless.

Alan Lightman

But the hubots responded. And fittingly, they responded with code. A code was developed that would become known as the Human Entropy Laws. The concept was simple but extremely effective. Human behavior maintained a certain level of disorder and unpredictability. Through fine tuning their own behaviors, hubots were able to detect these irregularities and could eliminate the source. The source being humans.

Humans were left with two options: cede their freewill and humanity to align with the order range of hubots (and hence “to get in line”) or face destruction.

My message to you is this: pretend that you have free will. It’s essential that you behave as if your decisions matter, even though you know they don’t. The reality isn’t important: what’s important is your belief, and believing the lie is the only way to avoid a waking coma. Civilization now depends on self-deception. Perhaps it always has.

Ted Chiang

The Moment

All seemed lost, yet there was one that found another way. The Last Mortal Man had found a way to preserve humanity (thus undermining the Human Entropy Laws), to preserve hubotics (thus undermining the Digital Purge), and to preserve a lasting peace.

Monument to Earth Mars Synchronicity; Damaged during The Shallows War

Monument to Earth Mars Synchronicity; Damaged during The Shallows War

And it partly involved going back to the source: back to a protocol, back to a decentralized peer-to-peer solution. Back to the economics. Back to that ancient honey badger. Back to bitcoin.

We know the very act, though it is not yet time to share with you those details.

We call it The Moment, the moment in which The Last Mortal Man made the sacrifice.

And there was a catch…

It would cost him everything and yet the worst part is that after The Moment, he would live 21 more years.

Can you imagine the turmoil of knowing that you will be the last human to face mortality and to have to grapple with that reality for years?

Remember, the Story is not over and as he described in the First Transmission, you are the hope.

For now, you should know that the end of The Last Mortal Man would also be the last death knell of humanity as you know it.

Though, somewhere in the fog of the Crisis:

Homo Alium would arise.

Tweetstorm: Bitcoin is a minimalist philosophy

By Dan Held & Conner Brown

1/ Bitcoin is a minimalist philosophy.

Bitcoin Minimalism is a lifestyle that helps people question what things add value to their lives.

A joint thread mostly by @ConnerBrown and myself, with other Bitcoiners providing input:

2a/ Create more, consume less

Bitcoin reduces your time preference and enables you to look long-term at saving and investing. It’s not about consuming, it’s about saving and investing that makes our world a great place.

2b/ By consuming less, you allow others to access good and services more cheaply currently.

It’s a way to escape the excesses of the world around us — the excesses of consumerism, material possessions, clutter, too much debt, too many distractions, too much noise.

3a/ Discover purpose in our lives

Bitcoin Minimalism is about finding truth in yourself and your beliefs rather than in material possessions. Freedom from the trappings of the consumer culture we’ve built our lives around which has been fueled by Keynesian economic policies

3b/ Bitcoin minimalism is about making decisions more consciously, more deliberately… a flight to quality. Clearing away all of the frivolous arguments and only focusing on what matters. In stark contrast to the ICO bubble in which consuming, waste, and fraud were prevalent.

3c/ Minimalists search for happiness not through things, but through life itself; thus, it’s up to you to determine what is necessary and what is superfluous in your life. The pursuit of knowledge through Bitcoin Minimalism is about better understanding the world around you.

4a/ Minimal viable product

Building a product is about fighting the insidious disease of more. Bitcoin’s community and core dev team have focused on being the most efficient, or minimal, they can be in regards to building Bitcoin.

4b/ Developers: Working with one chain reduces mental bandwidth for developers. Working with many is a near impossible task.

4c/ Security: Using just one Blockchain enhances the security of the ecosystem through more rigorous exploit analysis and PoW building the “largest” wall (instead of hundreds of little walls)

4d/ Code: Satoshi chose a non-turing complete language so that it can provide predictable outcomes and facilitate trust minimization.

Adding more complex loops creates unpredictable scenarios (DAO, parity) that requires you to trust the script without knowing the outcomes.

4e/ Scalability: Bitcoin is about being hyper-efficient with Layer 1 (Schnorr/Segwit) while also pushing innovation on Layer 2 (Lightning) which is an exponentially more scalable solution, thereby enabling Bitcoin to be more usable by the masses.

4f/ We want to maximize the value/byte transfer. While we could easily increase the block size, it would the least efficient way to scale. And being efficient with our limited block size is the utmost importance as it enables us to become decentralized/censorship resistant.

4g/ Economics: By rebuilding the capital markets stack from a sound money base, when can then be confident that our foundation is structurally secure.

5a/ Bitcoin Minimalism is rooted in libertarian philosophy

Libertarian political philosophy follows the idea of minimal government intervention and respect for the sovereignty of the individual. As Thoreau said, “Government is best which governs least”

5b/ A government should be a minimalist system that protects individuals from threat of violence or coercion, enforces contract and property rights, and reasonably provides for the national defense.

5c/ By separating the monopoly on money from the state, we are guaranteed that any seizure of wealth must be through direct taxation rather than through silent inflation or deficit spending.

5d/ Those who opt-in to Bitcoin, are trading something abundant for something scarce, trading the past for the future, trading financial dependence for financial sovereignty.

Bitcoin, life and time.

By zen ₿

Posted November 5, 2019

You have a limited lifespan.

The moment you are born to the moment you die. A limited and countable number of days and hours. This time is the scarcest and thus the most valuable thing you will ever have.

Photo by Aron Visuals on Unsplash

Photo by Aron Visuals on Unsplash

Every passing minute, every passing second takes away a bit from the whole, leaving every remaining second even more valuable. Time keeps on passing, with or without you acknowledging, exponentially increasing the value of every day, every second you are left with to live.

Every new morning is exponentially more valuable than the last.

Now, take a pause, look at where you are right now. The present moment, this very second is the most valuable second you have ever had, exponentially valuable than any time in your life until now.

Look around, look at yourself, ask, what have you traded this time for?

Photo by Mink Mingle on Unsplash

Photo by Mink Mingle on Unsplash

Knowing this, become aware that all your life you have been trading. Trading the most valuable, scarcest resource for fulfilling your desires.

All your decisions are but a trade in time.

Most of the humanity chooses some form of good, called money, to store the time they spent generating time efficiency (value) for others. You trade your working hours for money, saving it, expecting it to hold the value of your time into the future.

With that foundation, here’s a thought experiment. One from personal experience. My mother spent most of her life teaching biology to high school students. She was paid $8/month at the start of her career in 1980s. She traded 10hr/day for a month in exchange for $8. At her retirement she was paid ~$1000/month for almost the same job.

The 8$ she was paid for a month is not even worth a day’s expense today.

Where did her time go?

Isn’t 30 days of her life back then(1980s) = 30 days of her life now? No? Think hard about it, think to the seconds that passed in that month and the seconds that tick off her life now, count them. I bet they would be the same. Can those $8 give her those days back?

If you understand the exponential nature of time’s value as explained before, you’ll see that those 30 days of her time then (if stored) should have been exponentially more valuable today because of the number of days she is left with in her life now.

So, what happened?

She’s was ignorant of the importance of scarcity. Unaware of the fact that for a good to act a store of value, it needs to reflect the scarcity of the very thing whose value it is expected to store.

She traded her time (the scarcest good) for a good that was marketed to her as a store for value but was being produced in large quantities ($). The easy printing of money diluted her life savings and robbed her of her own life.

Photo by Tadeu Jnr on Unsplash

Photo by Tadeu Jnr on Unsplash

I’d not disagree that she was a bad trader and could have traded the fiat(Government issued money) for something scarcer. But apparently the schools even today don’t teach monetary history and markets.

This still goes on today. You will be robbed off your life.

Don’t make the same mistake your parents made. Understand the value of your present moment, invest it properly(it is the most valuable thing you’ll ever have).

So, what should you do?

Understand scarcity. Study money. Learn the difference between hard and easy money. Also learn about bitcoin, it is the scarcest good that is closest in reflecting the scarcity of your time.

To get started, pick a copy of The Little Bitcoin Book and Knut Svanholm’s fantastic work Bitcoin: Sovereignty through mathematics.

For a deeper dive check out @saifedean’s book — The Bitcoin Standard.

Follow @dergigi @Breedlove22 @bquittem @CitizenBitcoin @stephanlivera @heavilyarmedc @mrcoolbp @MartyBent @ManuelPolavieja @knutsvanholm @TheCryptoconomy @RawBTC @johnkvallis @matt_odell who inspired me to write this thread.

Ask questions and don’t waste your life.

If you enjoyed and would like to support, drop me some satoshis:

https://paynym.is/+darkfeather86b

PM8TJbNS4T7Vz4NtWNaD2rf1rGKorjCPJ9FZjZ2qx3sGueDi26Ri8eZHDaU9ytbPLFDoYoEp9dkz4UY6Ra3guMmbc9rJ288fJkB1QGrn4frUpAFA344R

PM8TJbNS4T7Vz4NtWNaD2rf1rGKorjCPJ9FZjZ2qx3sGueDi26Ri8eZHDaU9ytbPLFDoYoEp9dkz4UY6Ra3guMmbc9rJ288fJkB1QGrn4frUpAFA344R

Tweetstorm: Bitcoin Oxhearding

By Dennis Reimann

Posted November 4, 2019

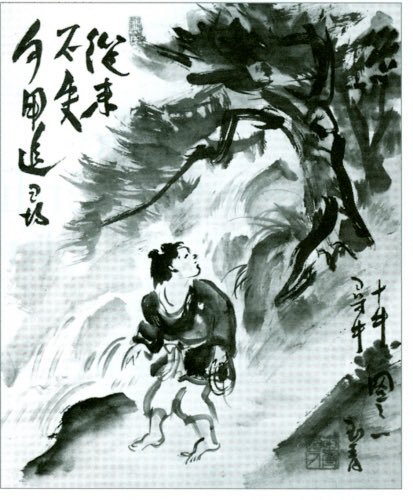

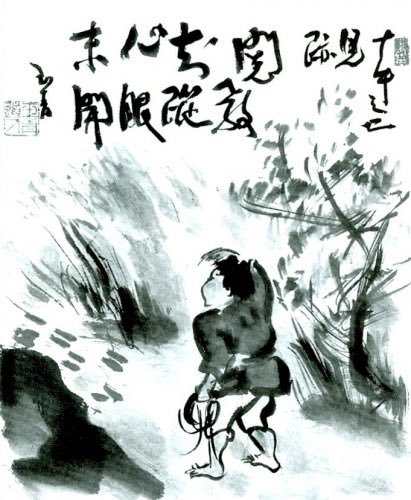

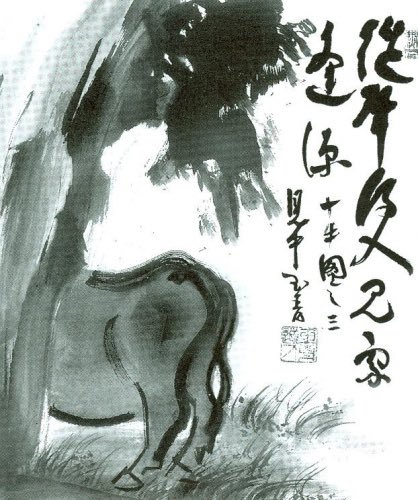

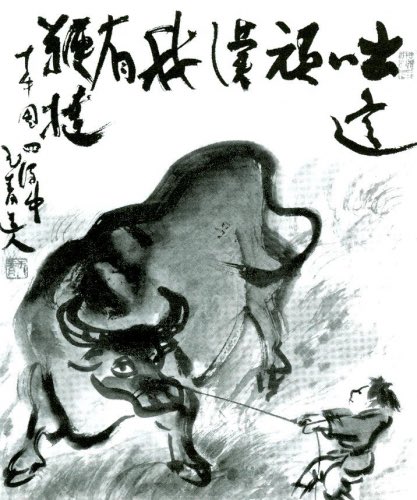

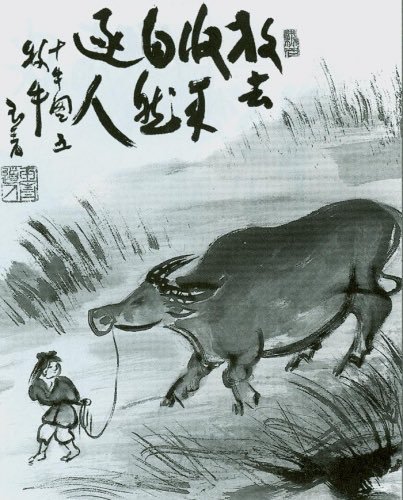

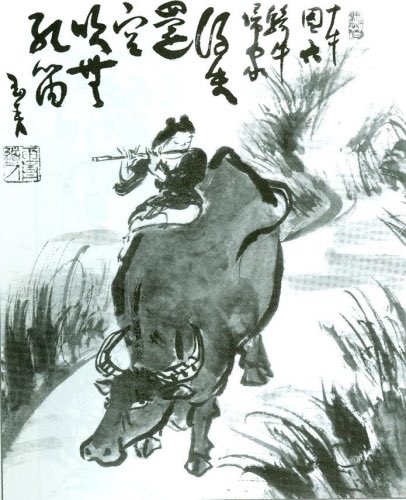

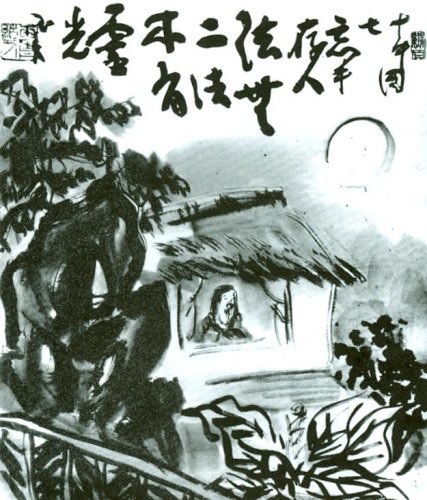

Some days ago @dergigi had a great thread about the idea of the Circular Rabbit Hole. This very much reminded me of the buddhist idea of the journey to enlightenment described with the ten Oxhearding pictures. Let‘s dive into that …

-

Searching: Going through life you feel something isn‘t quite right. You aren‘t satisfied and start to question things more fundamentally than before. You sense that you have been lied to – fake money, fake politics, fake chances.

-

Footprints: Challenging your tried and true beliefs you come to grips that trusting authorities and institutions all too much isn‘t a good idea. Fool me once, shame on you – fool me twice, shame on me.

-

Seeing: You find out about #Bitcoin, get a glimpse of its properties and potential. You read the white paper and you are excited how many ideas the space has to offer. This needs to be explored further …

-

Catching: Excited by the many things you learn you become overwhelmed by the possibilities. You certainly want to be a part in all of this, start to trade and also dabble in shitcoins.

-

Tending: Sooner than later you get burned. You see there are scammers left and right – by no means this is as rosy as you thought. You get back to basics and become even more interested in Bitcoin as it stayed true to its ideals and promises real freedom instead of quick wins.

-

Riding Home: You see this will be a marathon rather than a sprint, become calmer and have gratitude for what you learned. You lower your time preference, start #stackingsats, gradually learn while you go and peacefully enjoy the ride.

-

Forgetting: Until now there was the idea there was something to do – this separation vanishes and there is nothing special anymore. Everything has become clearer: intentions, ideas and goals align.

-

Forgotten: „Bitcoin is. And that is enough.“ (h/t @Beautyon_

-

Returning: You are where you were when you discovered the Rabbit Hole, but you are not the same anymore. You aren’t as entangled as before, see things clearer and you have become more self-sovereign.

-

Entering the Marketplace with Helping Hands: Having experienced this fulfillment and kind of freedom you connect on a deeper level and help others. Still learning tons yourself you educate, develop, grow and nurture the world you want to live in. Onwards!

… that‘s it, hope you liked it. Special thanks go to @dergigi and @citizenbitcoin for the conversation they had on this episode, which inspired this thread: Pod download

fyi: here‘s also the link to an article explaining the Oxhearding path, which I tool the pictures from: The Ten Oxherding Pictures

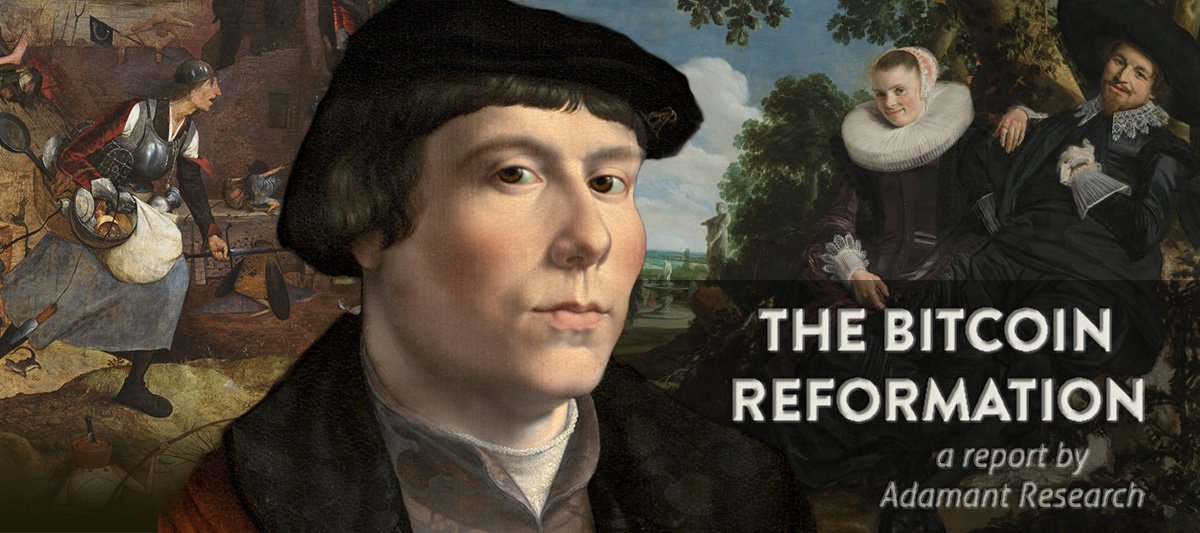

Tweetstorm: The Bitcoin Reformation

By Tuur Demeester

Posted November 7, 2019

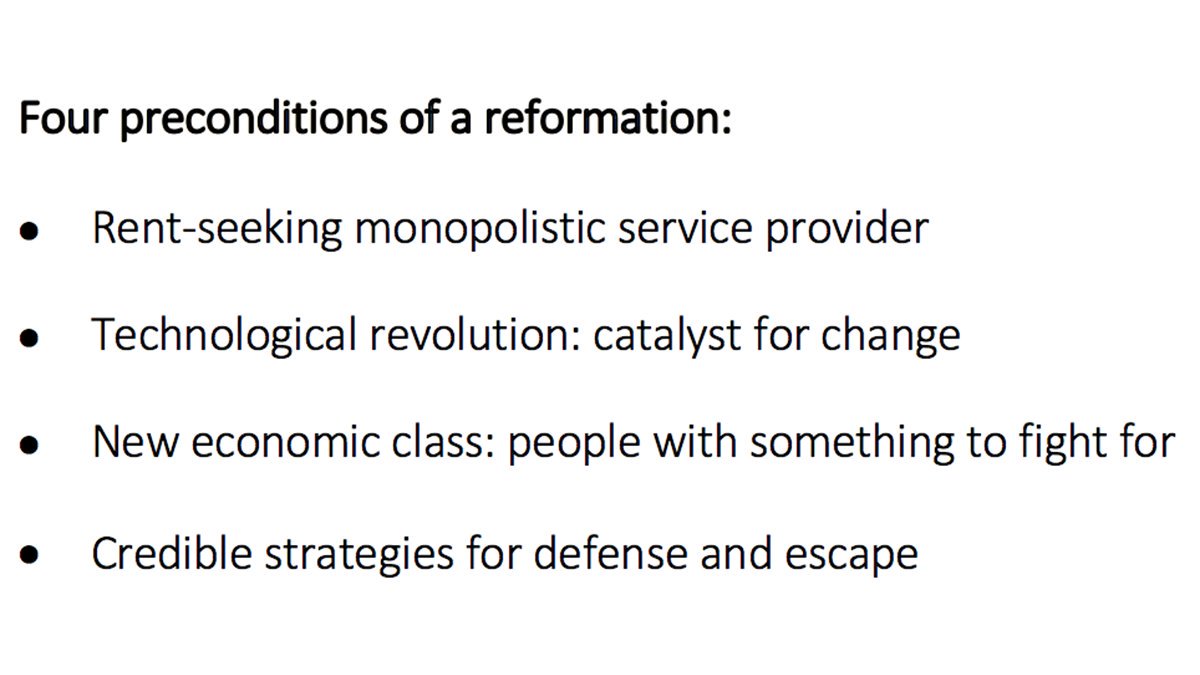

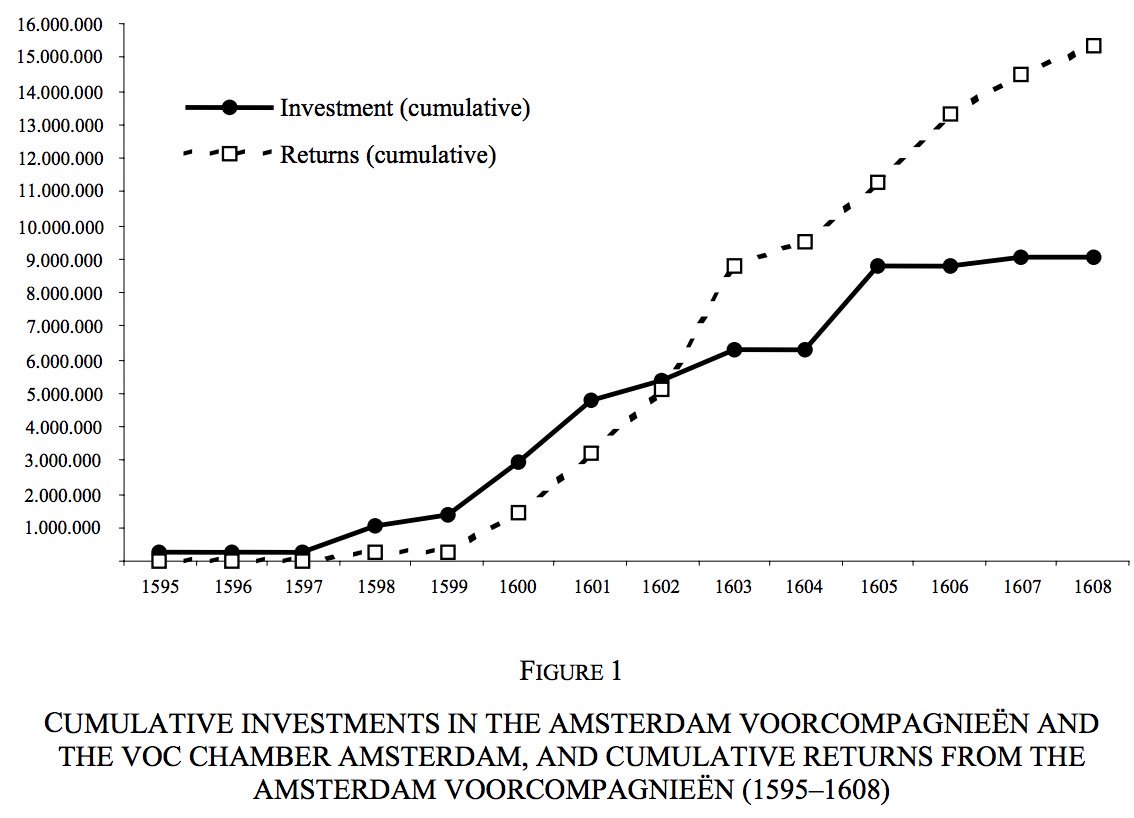

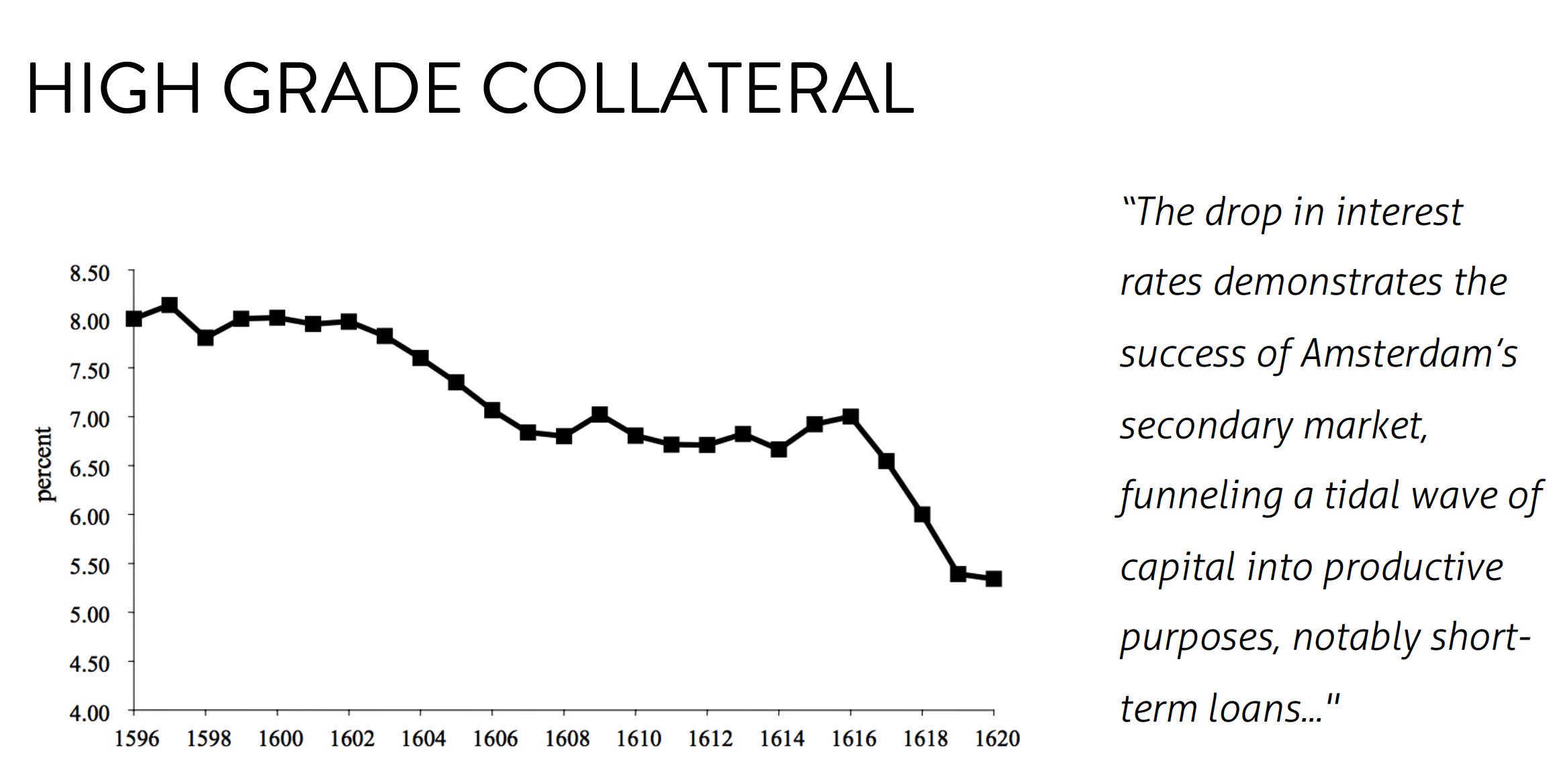

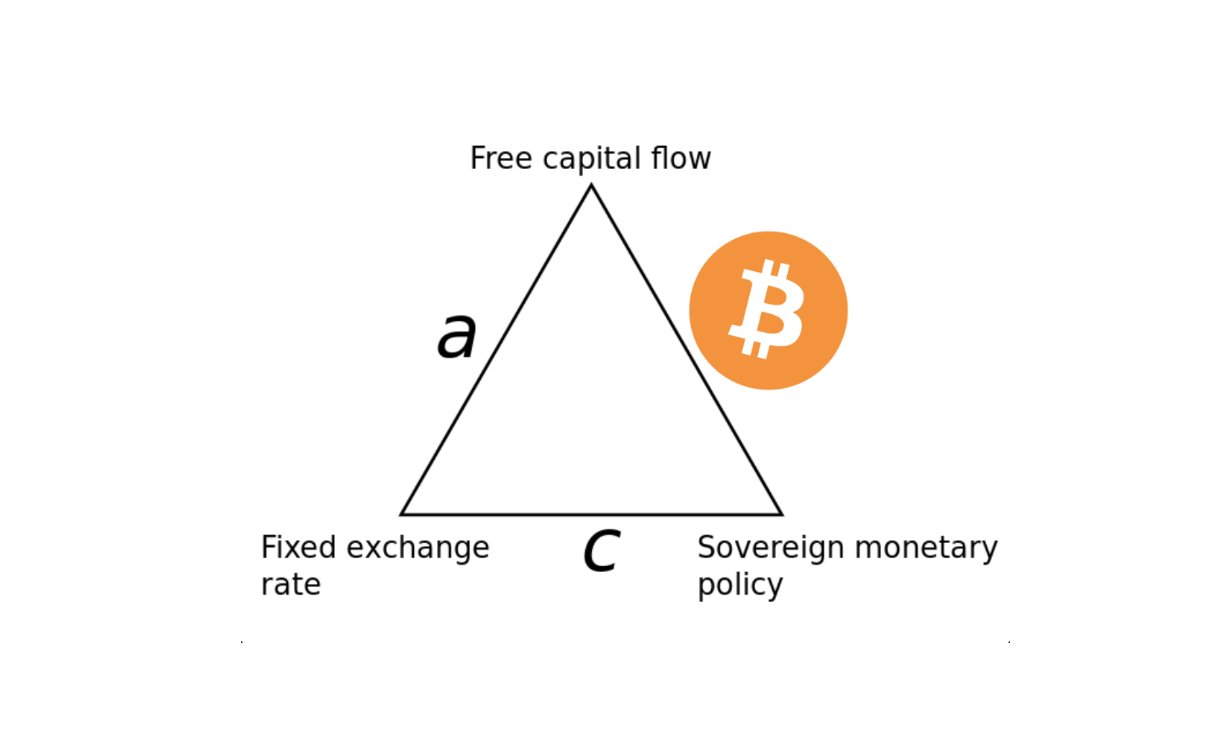

1/ The main thesis of “The Bitcoin Reformation” is that there are four fundamental parallels between the Protestant Reformation and the present day, which could signal profound societal and economic changes ahead.

2/ This is the TL;DR version of a 13 page report. This tweetstorm shares the essence but strips away the little historical details that made it so fun to research and write. Check it out here: https://docsend.com/view/ijd8qrs

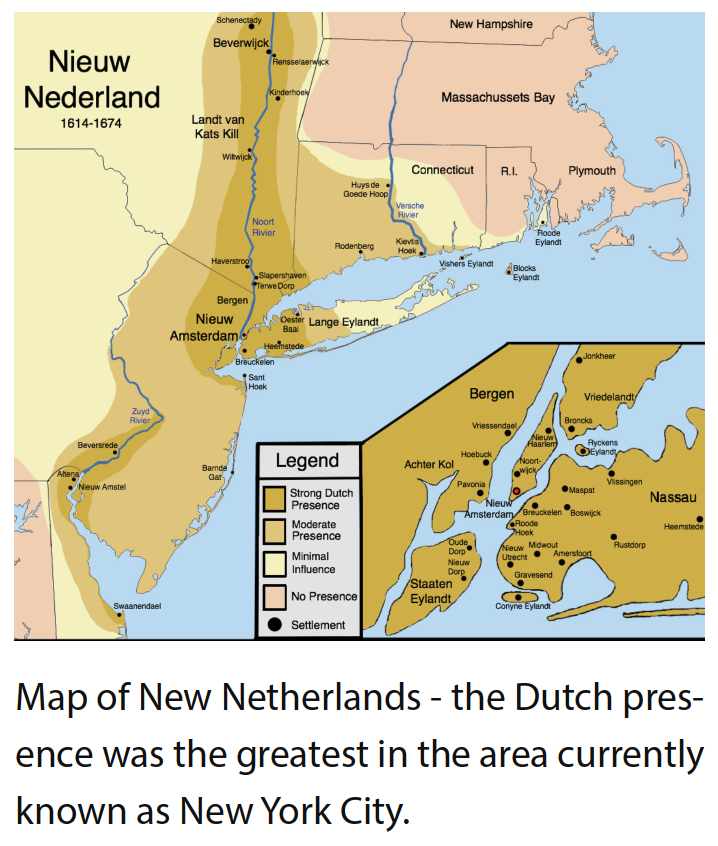

3/ The Protestant Reformation was a multi-generational conflict (16th-17th C.) that produced the separation of church and state, and which profoundly reshaped the economies of Europe and the New World. Today, bitcoin suggests that it’s possible to separate money and state.

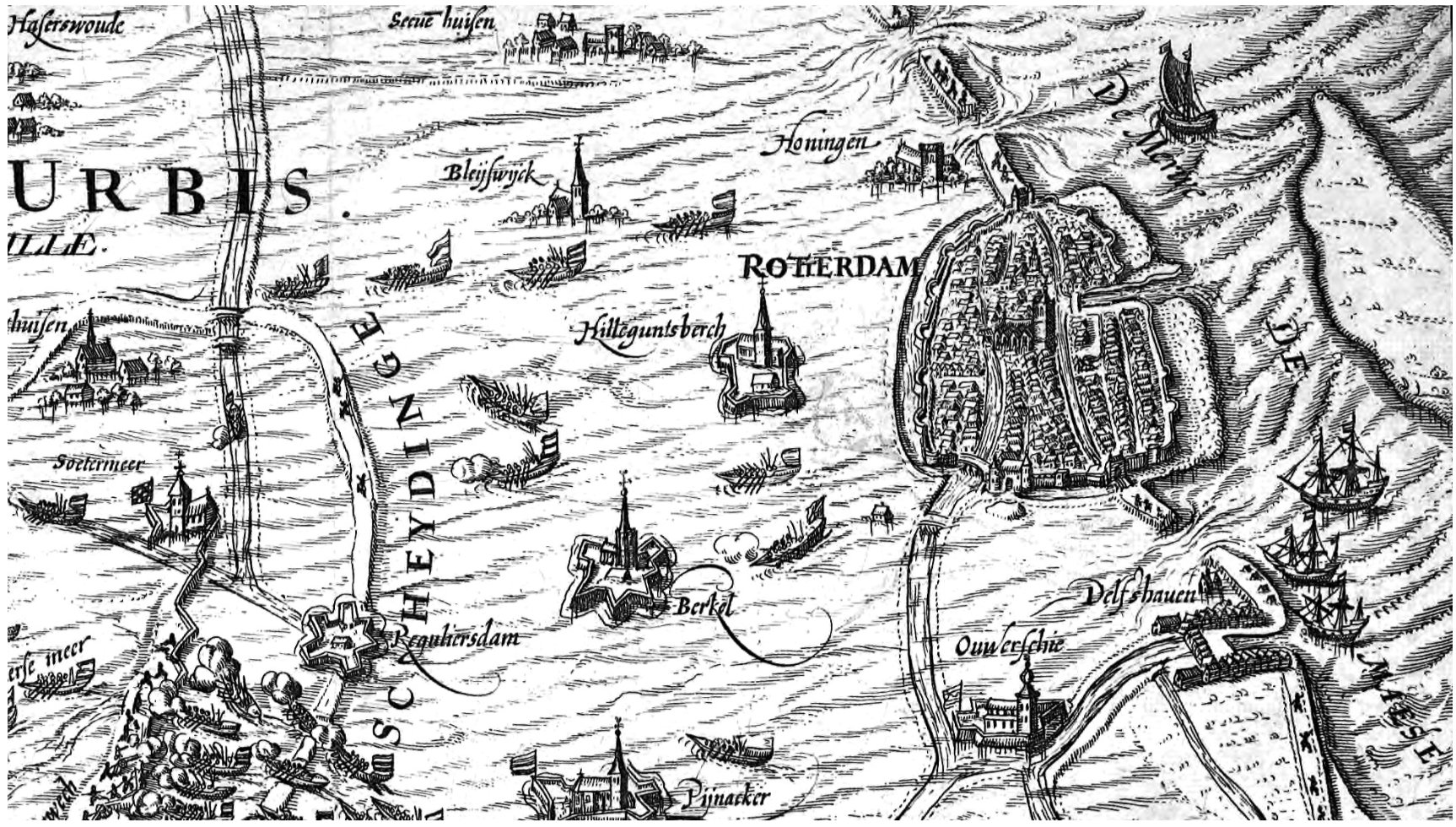

4/ Aside from the four general Reformation parallels, our report also suggests that there are significant similarities between the innovative economy of 17th century Netherlands and the bitcoin economy today. This may give us insight into what’s coming for bitcoin.

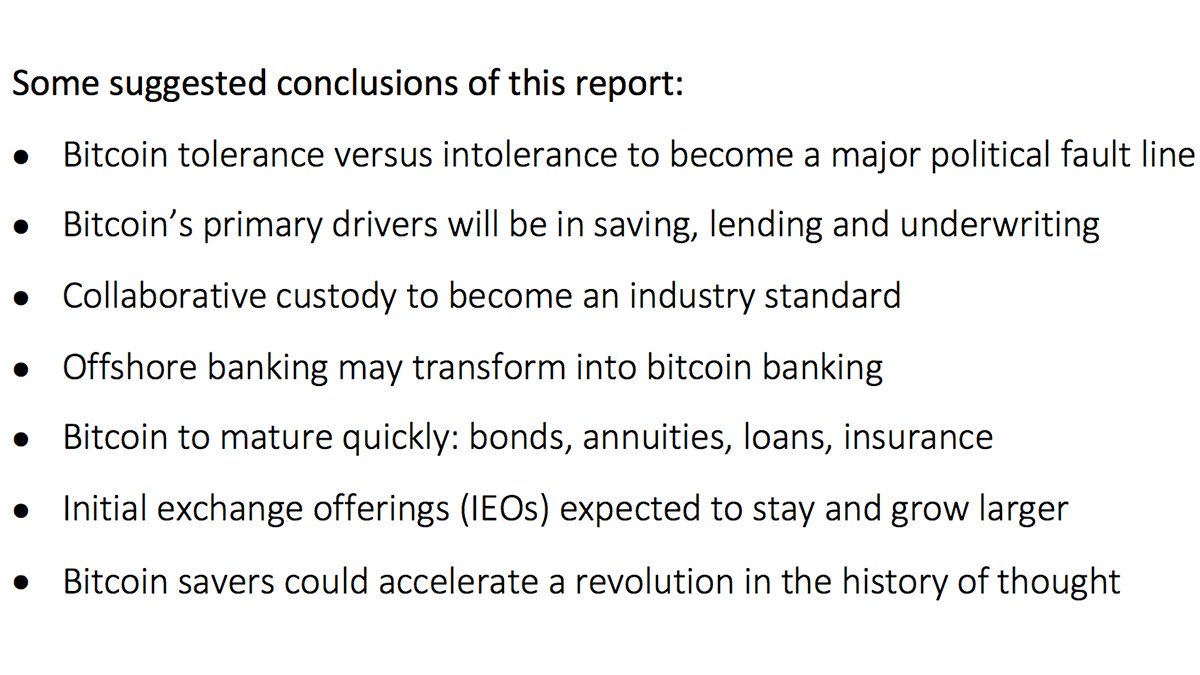

5/ Here are a few of the conclusions:

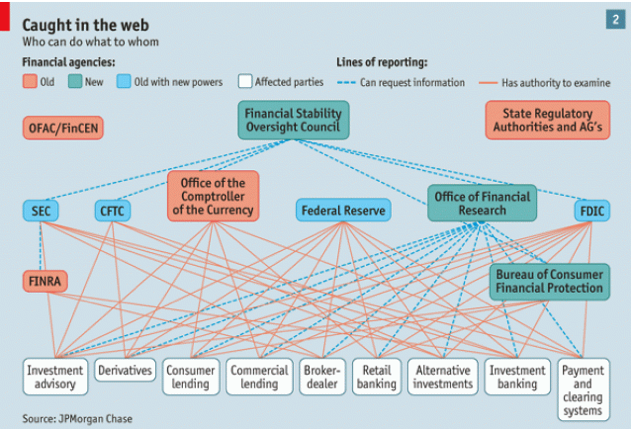

6/ So let’s dig in. What are the four requirements of a reformation?

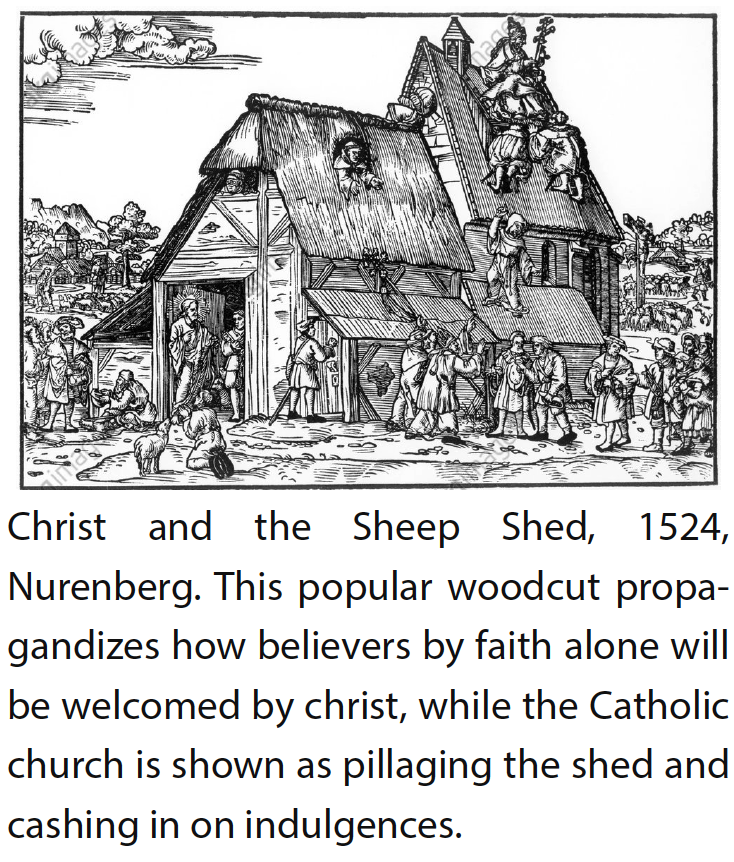

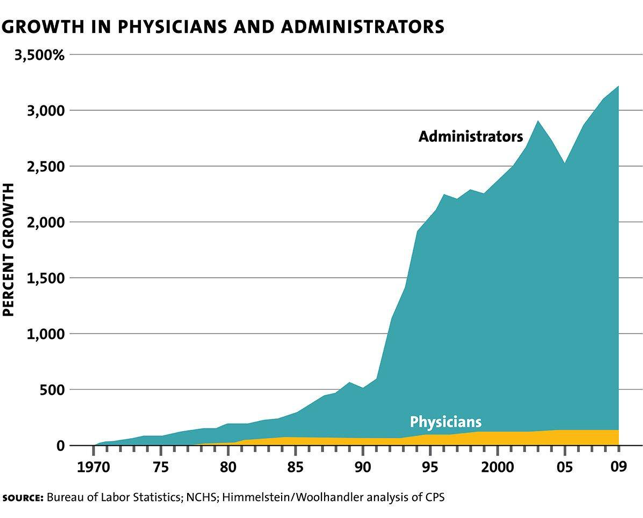

7/ First, we need a painful status quo in the form of a rent-seeking monopolistic service provider. In the 16th century that was the Catholic Church, today that is the financial system of fiat money and central banking.

8/ The service provided by the Church was access into heaven (for which it charged money by selling indulgences). The service provided by the financial system today is access to “financial heaven” (for which it charges money in the form of inflation tax).

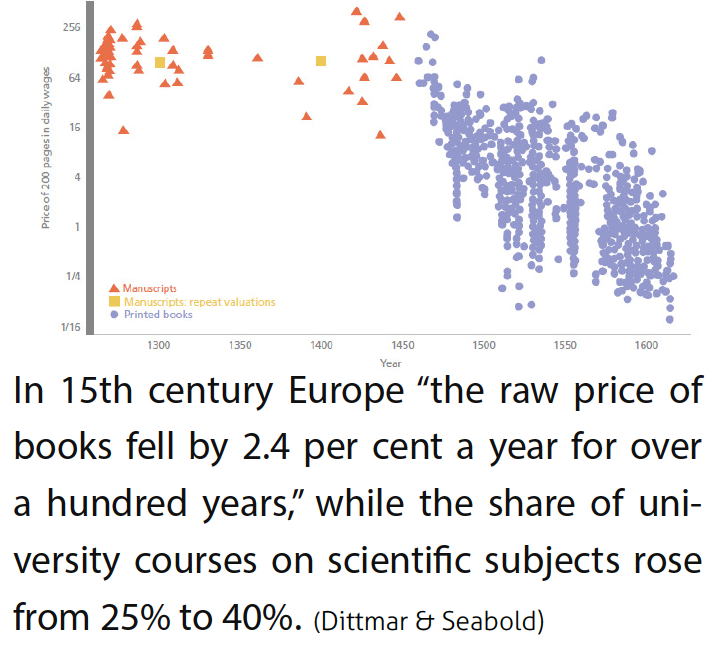

9/ The second requirement for a reformation is a technological revolution, which acts as a general accelerant in the battle of ideas: it lowers the cost of both information and travel.

10/ The most important 16th century innovations were in the area of maritime exploration, international business, and of course the printing press, which, in one century, lowered the price of a book from a full year’s wage to the equivalent of a chicken.

11/ The current-day technological revolution is digital: telecommunications, computation, data storage, open source software, cryptography, and of course the internet. The cost of 1 Mb/s bandwidth dropped by 99% in 20 years, from $100K to under $10.

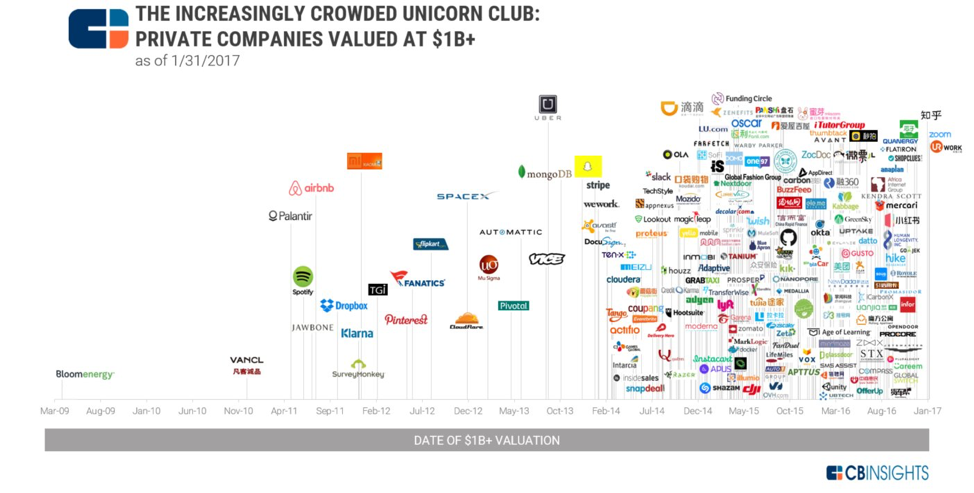

12/ Third, we need people who have something to fight for. In the 16th century that was the merchant class, today that is the millennial generation who don’t trust the financial system and who are heavily invested in technology.

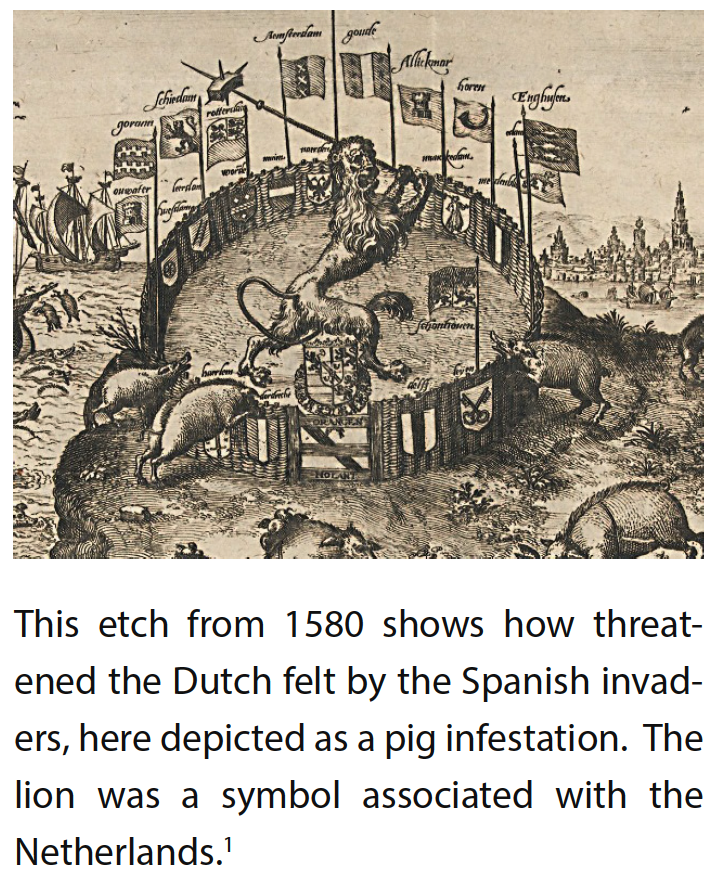

13/ And the final requirement for a reformation is for the rebels to have credible strategies of defense. The Dutch protestants mastered water as a defensive moat against invasions, the millennials have cryptography at their disposal.

14/ Another parallel are the memes! The Protestants had slogans voicing their resolve to cut out the Church as a middle man:

- Sola Fide (faith alone is enough, no need for a priest), and

- Sola Scriptura (the bible is enough, you can now read it in your own language).

15/ Bitcoiners also have slogans which underscore their resolve to cut out trusted third parties:

- Vires in Numeris

- Don’t Trust, Verify

- Not Your Keys, not Your Bitcoin

- HODL

16/ Over to the parallels between the financial economy of the Dutch Golden Age and that of Bitcoin today.

17/ The Dutch perfected deposit banking, with the world famous Amsterdam Wisselbank. We see echoes of heir staunch emphasis on security in bitcoin banking today, which is innovating with trust-minimized solutions such as collaborative custody.

18/ 16th-17th century maritime trade was risky but lucrative, which was the perfect breeding ground for the insurance sector. In the bitcoin economy we are seeing (proto-)insurance arrangements that resemble Dutch practices.

19/ The world’s first IPO was the East India Trading Company (VOC). Its shares were so liquid and desirable that they were widely used as collateral. Bitcoin is showing similar characteristics, and so may form the base collateral for deep lending and derivatives markets.

20/ Finally there’s a parallel between how the Dutch accessed capital via annuities, and IEO tokens today which give bitcoin exchanges access to capital. Our report predicts bitcoin based mutual life insurance, which is the next evolutionary step after annuities.

21/ The report’s conclusion: “Once in a while, the puzzle of circumstance fits together in a peculiar way… allowing for a spectacle of chain reactions that profoundly reshapes society. This happened 500 years ago, and it may be happening once more.”

22/ We’ve added a four page chronology of the Protestant Reformation as an appendix. This should help better place the report’s analysis in its historical context.

23/ Thank you! Once more, here is the link to read “The Bitcoin Reformation”: https://docsend.com/view/ijd8qrs

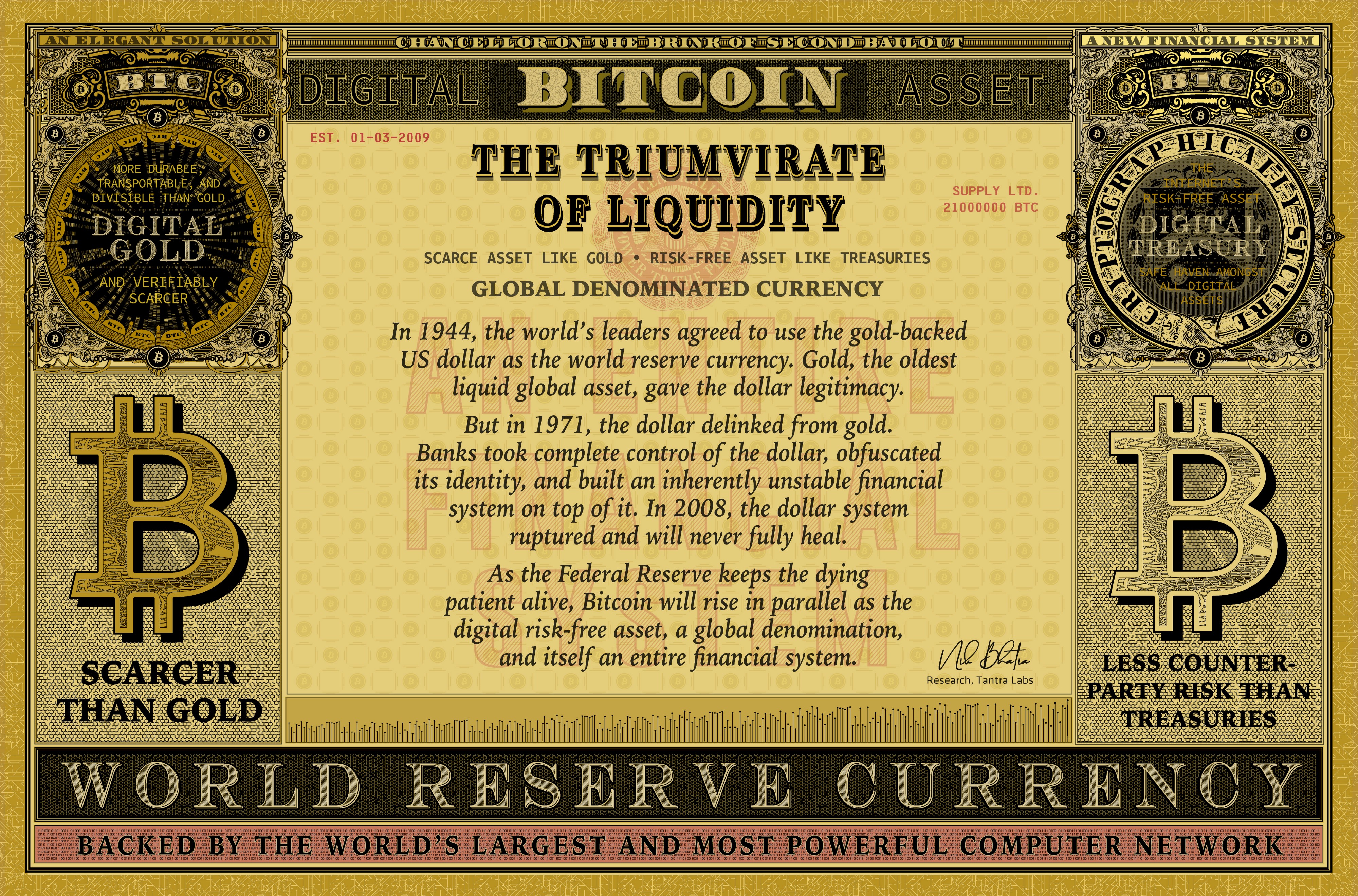

The Triumvirate of Liquidity

By Nik Bhatia

Posted November 6, 2019

Bitcoin is both digital gold and digital Treasuries, and has all the makings of the world’s next risk-free asset.

Original artwork by Lucho Poletti

Original artwork by Lucho Poletti

Introduction

US Treasuries, gold, and Bitcoin serve as a triumvirate of global liquidity, a powerful trio of safe haven assets that shelter their owners from the risks of our highly leveraged, credit-based monetary system. Of the $300+ trillion in financial assets around the world, only $32 trillion exist at this echelon of safety and liquidity.

Bitcoin captured an astonishing 1% of the trio’s total market value after only eight years in existence, yet this was only a glimpse of the future. In its next chapter, Bitcoin will catapult toward gold’s $9 trillion size, fulfilling its destiny as digital gold. After that, Bitcoin will morph into digital Treasuries and replace them as the world’s risk-free asset before eventually achieving world reserve currency status. Replacing the dollar as the world reserve currency is a lofty ambition, but it will occur only as a byproduct of Bitcoin embodying digital Treasuries.

Gold was the dollar’s source of legitimacy

Gold is the original liquid global asset, a millennia-old money. The US dollar’s gold-backing during the 20th century earned it legitimacy, culminating in the 1944 Bretton Woods agreement in which the world’s leaders assigned the dollar as the world reserve currency. Even though gold no longer officially anchors global finance, central banks still hoard it as the world’s safe haven asset, presumably as insurance against a dollar system failure. Today, global central bank gold holdings exceed $1 trillion.

Bretton Woods, New Hampshire, 1944

Bretton Woods, New Hampshire, 1944

Dollars, meet Eurodollars

In the 1950s, a new form of dollar emerged in Europe called the Eurodollar, a book-entry dollar to facilitate interbank settlement outside of the United States and outside the Federal Reserve banking system. As Eurodollar usage popularized, banks in London, Zurich, Montreal, and Tokyo gained the power to create the international settlement currency away from any regulatory purview. By 1971, excessive dollar redemptions for gold had depleted the United States’ reserves. In order to protect its holdings of the world’s safe haven asset, the US ceased all dollar-to-gold conversions, and the dollar officially lost backing. It still, however, had the confidence of global financial participants as their ultimate unit of account.

Treasuries, not dollars

Dollars weren’t backed by risk-free assets anymore, so how did investors store dollar reserves safely? Bank deposits are essentially loans to banks and come with an inordinate amount of counterparty risk. Withdrawing truckloads of $100 bills isn’t feasible either, nor does it come with convertibility to an underlying asset. Deposits and cash simply aren’t palatable investments for the risk-averse. The solution and capital market tendency is to purchase US Treasuries, a $23 trillion market, in order to safely store dollars.

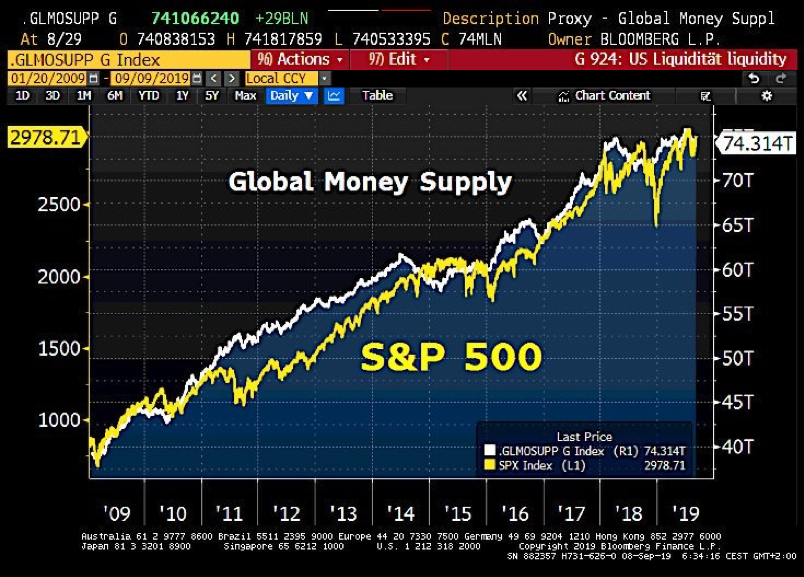

The dollar loses its identity

From 1971 to 2007, banks took complete control of the dollar, obfuscated its identity, and built an inherently unstable financial system on top of it. Eurodollars grew both in supply and sophistication. Banks stopped funding themselves with deposits; instead, they used US Treasuries as collateral to borrow book-entry dollars from each other. A bank license and US Treasuries together wielded the power to create seemingly unlimited money, obscuring money’s very definition. The dollar lost all of the identity it once had as a gold claim and became purely a banking liability, a loan to the overly-leveraged financial system. Instead of dollars, Treasuries became the most desirable global asset, not only because of the US government’s counterparty superiority, but also because Treasuries possessed omnipotent collateral powers that enabled money creation. Banks use US Treasuries, not dollars, as their risk-free asset, collateral anchor, and primary leverage vehicle.

The dollar system breaks in 2007

In 2007, banks began facing funding pressure. The previous culture of strike-of-the-pen collateralized lending withered away, and banks were unable to roll forward their maturing debt. Banks relied on their ability to constantly issue new debt, and when confidence in them faltered, so did solvency.

For decades, the relationship between dollars and Eurodollars existed without much drama; Federal Funds and LIBOR, the interest rate of each dollar type, mostly mirrored each other. In August 2007, however, LIBOR drifted higher relative to the Federal Funds rate, a sign of acute credit risk in the Eurodollar system. In hindsight, the problem wasn’t acute: banks began pulling back from each other as the global dollar system had reached an inflection point. This interest rate divergence foreshadowed the subsequent cascade of dollar-funding shortfalls and bank collapses. The multi-decade free run of money creation had cracked irrevocably.

In 2008, the Federal Reserve bailed out the world by liquifying the entire system. It chose not to discriminate between dollar liabilities and Eurodollar liabilities, and provided a lifeline to any bank or central bank in need by injecting reserves onshore and providing currency swaps offshore. Demand for the safety and liquidity of US Treasuries skyrocketed as they became the world’s security blanket, trapping the world in a dollar denomination even though the dollar’s long term viability as world reserve currency was irrefutably in question.

Permanent disrepair

The financial system is infected with a chronic disease that won’t go away. The dollar is no longer solely the national currency for the United States issued by the Federal Reserve. Instead, the dollar is an international banking instrument without limits, form, or the ability to sustain itself. The system decays as contractions in interbank liabilities cause repeated liquidity shortages for leveraged asset holders. Banks choose not to provide collateralized liquidity to other banks, even when the collateral is Treasuries themselves. This is the ultimate warning sign that banks don’t trust each other anymore. Furthermore, the Federal Reserve always bails out the system as the lender of last resort, permanently eliminating any motivation whatsoever for banks to provide liquidity to each other. The Fed’s default response is to create US dollar bank reserves, but this does not address the core problem of broken interbank trust. The Fed only provides a numbing mechanism, keeping the dying patient alive as long as they can.

Bitcoin is digital gold and digital Treasuries

What’s the endgame? Bitcoin is. Its software is engraved with “Chancellor on the Brink of Second Bailout” to proclaim an elegant solution to our banking system nightmare. Bitcoin is a bearer asset like gold, a risk-free asset like Treasuries, and a currency denomination like the dollar, rising up in parallel over the next couple decades as the infrastructure for the next financial system.

The original newspaper article referenced in Bitcoin’s genesis block

The original newspaper article referenced in Bitcoin’s genesis block

Gold and Bitcoin are both scarce assets without counterparty risk, yet Bitcoin’s digital final settlement functionality gives it a massive advantage over gold in the coming decades. Bitcoin is not only digital gold though, it’s also digital Treasuries. Bitcoin is the safe haven from all other digital assets, just as Treasuries are the safe haven from all other dollar assets. Bitcoin is used as collateral for derivatives agreements just like Treasuries are. But Bitcoin doesn’t have the counterparty risk or supply variability of Treasuries, positioning it perfectly for the forthcoming competition.

Bitcoin is the risk-free asset of the future.

The anti-Bretton Woods

The Bretton Woods monetary system established the dollar as the world’s reserve currency in 1944, but the next monetary system will not be determined by agreement between nations. Bitcoin’s path to world reserve currency status will occur one asset holder at a time. Thanks to the early-stage Lightning Network, Bitcoin’s design now includes an instantly settling currency function in addition to its slower asset function, a characteristic neither Treasuries nor gold possess. But Bitcoin first needs to add many trillions in market value to truly compete with Treasuries and gold as an asset class.

Uncertainty demands liquidity

Investors demand risk-free assets when they face geopolitical and economic uncertainty. Securing the liquidity of these assets is paramount when other asset classes experience the brutal combination of increased performance risk and liquidity deterioration that is so common in today’s financial world. In this era of dollar system fragility, the Triumvirate of Liquidity will reign supreme. Investors will scramble for financial safety, causing intense and persistent demand for US Treasuries, gold, and Bitcoin.

Start here and here for a dive down the Eurodollar rabbit hole.

Written by Nik Bhatia @timevalueofbtc

Original artwork by Lucho Poletti @LuchoPoletti

Author’s opinion only. The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of Tantra Labs SPC, (“Tantra”) or any other company. Examples of analysis performed within this article are only examples. They should not be utilized in real-world investment decisions as they are based only on very limited information. Assumptions made within the analysis are not reflective of the position of Tantra or any company.

Non-reliance. The information set forth herein is for information purposes only and should not be relied on or construed as investment advice, counsel, or solicitation for investment in Tantra or any other company. Interested investors should seek appropriate independent professional legal, investment, and tax advice prior to relying on any of the material contained in this article.

Forward-looking statements. Certain information set forth herein contains forward-looking statements that give a reader the opportunity to understand the author’s beliefs and opinions with respect to the future. These statements are not guarantees of future performance of Tantra or any other company and undue reliance should not be placed on them, as they necessarily involve known and unknown risks and uncertainties.

Not a securities offer. This article does not constitute an offer of securities by Tantra or any other company.

Thank you for reading, and stay tuned as we present our ongoing research!

For more about Tantra Labs, check out our introductory post here.

For more from Nik Bhatia, check out his other work on Medium.

For more from Lucho Poletti , check out his website.

For the latest updates, follow us on Twitter @Tantra_Labs.

Op Ed: In China, It’s Blockchain and Tyranny vs Bitcoin and Freedom

By Alex Gladstein

Posted November 5, 2019

On October 24, 2019, President Xi Jinping gave a major speech about how China is going to make blockchain technology a national priority. He said China would “take the leading position in the emerging field of blockchain” and explore its use “in people’s daily life.” China’s most-watched daily news show covered the speech in primetime, and the next day, the People’s Daily propaganda newspaper ran a front-page story on Xi and blockchain. Searches for “blockchain” on China’s most popular browser Baidu rose 200 percent.

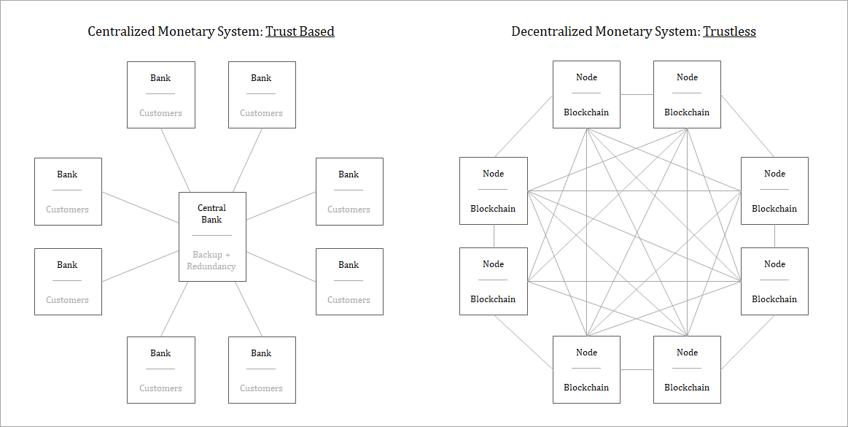

What’s essential to note is that the “blockchain technology” that Xi and his cadre are pushing is a very different type than the one that helps power Bitcoin. The ledger in the Communist Party’s blockchain won’t be updated by proof-of-work and Nakamoto Consensus, but by proof-of-authority. Xi’s blockchains will be highly centralized for maximum control and are meant to be tools for improved surveillance and social engineering. They couldn’t be any farther from Bitcoin, which is open-source, decentralized, censorship-resistant and pseudonymous.

A Blockchain-Based Digital Yuan: ‘Lipstick for a Panoptical Pig’

Unlike the internet — which Beijing can easily manipulate and censor — Communist authorities can’t control the price of bitcoin, and they haven’t been able to effectively stop their citizens from buying and selling the currency. So instead of an outright ban — which would create a huge black market and likely make bitcoin even more intriguing — they have decided to create a competitor. China’s rulers have chosen to try and get out in front of bitcoin and libra by launching a new digital yuan, blockchain only in name and only for marketing purposes. They want to ride the hype of a new technology, and use it as lipstick for a panopitcal pig.

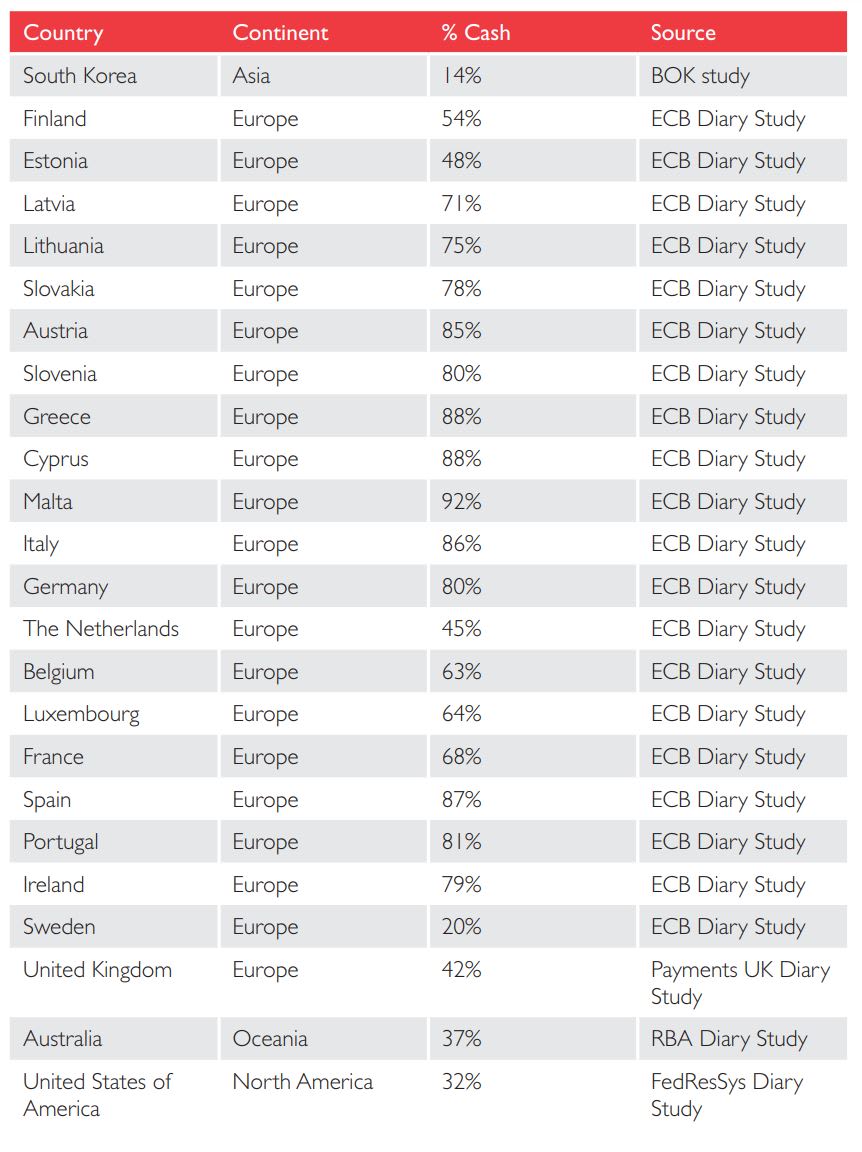

According to leadership at the People’s Bank of China (China’s central bank, known as the PBOC), the goal of the digital yuan is to eventually replace the “M0” base money supply in China. Meaning: they want to replace all paper notes and coins with a digital version based on blockchain technology that’s easily surveillable, freezable and confiscatable.

Cash is already an endangered species in China, with the majority of all daily transactions happening via apps like Tencent’s WeChat and Alibaba’s AliPay. The transformation in payments over the past decade from paper cash to social media platforms has been very helpful for China’s police state, given that they can ask companies like Tencent for information on users any time. But a currency that, itself, is a surveillance platform — that would suit the state even better.

A Dictator’s Dream: Eliminating Third-Party Cooperation for Surveillance

Today, the Communist Party is forced to work with third parties like commercial banks and technology companies to control and understand the flows of money. In a future scenario with a successful digital yuan, the Central Bank itself could have a real-time understanding of where all the nation’s currency is and where it’s going. This kind of omniscient financial surveillance is a dictator’s dream.

The main goals of the digital yuan blockchain project are clear and have been stated publicly by various government officials repeatedly over the past two years:

- to replace cash with a trackable digital currency

- to popularize the Yuan around the world

- to circumvent sanctions, U.S. and otherwise

- to undermine SWIFT and the existing global payment network

- to temper public hunger for bitcoin and other cryptocurrencies

- to condense what is currently a huge patchwork of different banks and companies into a single, easily knowable ledger

From what has been publicly revealed so far, the digital yuan will be minted by the PBOC and then sold to banks and companies, including Tencent and Alibaba. According to statements from PBOC leadership, users would download a mobile wallet and exchange their existing money for the new digital yuan. Then they could start using that for their daily spending habits.

Every time a transaction happens, the government would know about it in real time, instead of having to ask a third party. Transactions would be protected with cryptography to reduce theft, with only the formal owners being able to move assets. The exception, of course, would be Xi Jinping and the Communist Party, who would have a backdoor into anyone’s wallet.

Economic Support for Political Oppression

At a time where the PBOC is running out of options to stimulate China’s economy in the event of another recession, the digital yuan could give them new ways to fight a downturn. Consider: They could, with the click of a button, put a chunk of new digital yuan precisely into the personal account of every university student or every auto worker. In this way, Communist Party officials would be using blockchain technology to prolong the lifespan of a regime that is built on cruelty and fear. Remember: Xi Jinping is currently presiding over the internment of millions of Muslim-minority Uighurs in prison camps; the ongoing and nearly complete cultural genocide in Tibet; the crushing of democracy in Hong Kong; constant threats to “solve” the Taiwan problem; and the expansion of the Belt and Road, the largest infrastructure project in human history, which is installing surveillance technology and telecommunications across the developing world in a wave of digital colonialism. To move the digital yuan forward, the Communist Party is already educating Chinese citizens about blockchain technology in a variety of ways. Xuexi Qiangguo — the most popular app on China’s Apple store — has added informational content on blockchains, just as state media and official government apps have popularized the subject. Just a few days after Xi’s big speech, the Communist Party even launched a new phone app (called “Original Intentions Onchain”) to encourage members to pledge their loyalty to the party “on a blockchain.” Behind all of this is Beijing’s overarching goal to strengthen control over its economy and exert financial sovereignty. Xi Jinping doesn’t want the U.S. dollar or libra or bitcoin in the leading global position. He wants to win the new currency space race, and he’s chosen to do it by putting the yuan on a centralized, digital ledger.

A Threat to Human Rights

Short term, this could be a big win for Xi and a big loss for human rights. If the technology works as planned, and can be rolled out fast enough, the digital yuan could soon be the financial backbone for not just all of China but for all of the dozens of “Belt and Road” countries from South Asia to Latin America. What’s more, China moving forward aggressively to create a digital national currency will spark ripple effects of interest from governments and corporations who may follow in Beijing’s footsteps and set up their own surveillance stablecoins.

We should have no doubts about their intentions or capabilities, and if we care about human rights and freedom, we should not cheer them on.

But long term, this could be a strategic blunder on a titanic scale. Bitcoin’s ability to separate money from state by creating a parallel economy beyond government control represents one of the only things that could challenge Xi Jinping’s totalitarian goals. And, unfortunately for him, it’s hard to imagine that he can preside over a massive public blockchain education program for hundreds of millions of people, without more and more of them eventually waking up and learning about Bitcoin.

A Trojan Horse for Bitcoin and Freedom?

It’s one thing to censor the internet. The regime can make mention of Tiananmen Square forbidden, and people by and large won’t risk their livelihoods to learn about what happened on June 4, 1989, and gossip to their friends about taboo topics. But it’s another thing entirely to keep people away from a well-performing financial asset with no barrier for entry. Governments can keep people off the internet, but it will be a lot harder to keep people off Bitcoin.

In “The Matrix,” the protagonist Neo is given a choice by Morpheus to take the blue pill and stay in his known world of comfort and safety, or take the red pill and risk going down the rabbit hole. The digital yuan is the blue pill. And there are many people who are fine with the blue pill — perhaps even a large majority — who are happy to comply with the rules and who don’t want to risk their comfortable, convenient situation by doing anything that could put their status quo in jeopardy.

But there are also plenty of Neos in the world, and there will be many people who want to take Bitcoin’s red pill, especially when it’s uncensorable, hard to track, and increasing in price year-by-year against a digital yuan whose value may struggle.

The Communist Party wants to ride the “blockchain” hype cycle and create a new currency of unprecedented surveillance and control. And they may succeed, at least in the short term. We should have no doubts about their intentions or capabilities, and if we care about human rights and freedom, we should not cheer them on. The only silver lining is that ultimately, the digital yuan may end up being one big Trojan Horse for Bitcoin, where Satoshi Nakamoto — not Xi Jinping — gets the last laugh.

An Open Letter to Ray Dalio re: Bitcoin

An open letter to hedge fund colossus Ray Dalio regarding his worldview, the forces of financial nature, and how Bitcoin is bound to reshape both.

By Robert Breedlove

Posted November 8, 2019

Introduction

Ray, your ability to penetrate the opaque realm of economics and share its secrets in an easy to understand language is one of your greatest gifts to humanity. With your videos, openly published research, and authorship, you have opened the eyes of many to a topic most consider too difficult to comprehend. The world needs more pioneers like yourself writing easy-to-read maps for the nearly incomprehensible territory of economics. Macroeconomists, Academics and Central Bankers rely heavily on deceptive language and universal public ignorance to perpetrate their schemes; your work in converting this esoteric domain into a more exoteric form is therefore commendable.

Let me begin by saying that, like you Ray, I consider myself a “dumb shit” who is more focused on dealing with what I don’t know rather than relying on what I do know to navigate life and work — a mindset well accorded with ancient wisdom:

“All I know is that I know nothing.” — Socrates

Epistemic reach is finite, as knowledge cannot explain everything in the world and, often, it clouds the truth. So let us explore the territory of economics with a beginner’s mind, free of the accumulated clutter commonly called “conventional wisdom”. It is from this frame of mind that I present to you this open letter regarding your perspective on Bitcoin through the lens of your stated principles on life and work (in this letter, I sometimes direct my comments at Ray, and sometimes at the audience, so please bear with these shifting perspectives).

We begin with an evaluation of Ray set in the idea-meritocratic style practiced at Ray’s firm, Bridgewater. The purpose of these evaluations is to grade your peers candidly, being brutally honest and holding no punches, to ensure that the best ideas rise to the surface — unimpeded by policy, politics, or hierarchy — so that they may be scrutinized and, if useful, acted upon. In Bridgewater’s culture, communication is both top-down and bottom-up, so that people feel empowered to share their honest perspectives. For Ray, it’s all about getting to the truth by any means necessary, and I appreciate his blunt approach. We will explore all of this more deeply below — so let’s dive in.

Evaluation of Ray’s Assessment of Bitcoin

Subject: Ray’s Assessment of Bitcoin

From: Robert Breedlove

To: Ray Dalio

Cc: Everyone

Attachments: Ray’s assessment of Bitcoin available here —

https://www.youtube.com/watch?v=UyVIuNI797w

Ray,

You deserve an “F” for your assessment of Bitcoin’s significance and future prospects. Although there are very few of us, everyone who has the requisite depth of understanding in the fields of computer science, monetary history, game theory, economics, and mathematics, and has spent the time intensely studying Bitcoin (it takes a lot), agrees with this harsh evaluation of your short-sighted assessment of this momentous monetary innovation. As one of your biggest fans, I truly believe that if you take another look (a long, hard, thoughtful look), you will see the light. Specifically, your assessment fails for the following three reasons:

1. You claim that you are sold “blockchain technology”, despite the only proven use case for “blockchain technology” is as a component of Bitcoin. Contrary to “conventional wisdom”, the real breakthrough is Bitcoin, not blockchain.

2. You state that Bitcoin could be disrupted by another “cryptocurrency”, however this extremely unlikely: Bitcoin is a path-dependent, one-time invention; its critical breakthrough is the discovery of absolute scarcity — a monetary property never before achieved by mankind. The emergence of Bitcoin cannot be reproduced because absolute irreproducibility is the discovery! The iPhone disrupting Blackberry analogy you cite is irrelevant; Bitcoin is a protocol, not a consumer product.

3. You state that price-stable, central bank issued currencies will be issued, which will likely be attempted, but such currencies would be antithetical to free markets. Further, price stability is an illusion: all economic goods move against one another in ratios of exchange, money is simply the most marketable good, hence the reason money-denominated exchange ratios (prices) tend to be more stable, but are still subject to supply and demand interaction. Since Bitcoin is absolutely scarce and cannot be stopped, it is likely to continue outcompeting all other monetary technologies on the free market. As an economic good monetizing in real time, the exchange ratios between Bitcoin and various fiat currencies is likely to remain volatile for some time, but this volatility will continue to subside as Bitcoin’s market capitalization grows, thus making its use as a medium of exchange more practical, before reaching a point of sufficient network value where prices will come to be more commonly expressed in Bitcoin terms (similar to the evolutionary phases gold underwent during its monetization process).

Your assessment is especially disappointing for three reasons: 1) You have consistently exhibited a knack for comprehending, distilling, and communicating highly complex economic concepts in a manner palatable for general audiences, 2) The depth of knowledge you possess in history, economics, and free market dynamics presents you with a privileged position to best understand the emergence of and demand for this asset, and 3) Your virtually unparalleled reach and reputation as a macroeconomic thought leader, organizational engineer, and cultural innovator is an invaluable platform from which to trumpet to the dire circumstances faced by the prevailing economic order and how Bitcoin has the potential to alleviate them.

In the following open letter, I will show that the fundamental tenants of your worldview, as stated in your book Principles and other writings, are fully consistent with Bitcoin — even though you may not yet realize it. I’ll begin with two primer sections: one on the nature of money and its history, and one on Bitcoin’s general functionality and economic properties — either or both may be skipped by the reader who has “already fallen down the Bitcoin rabbit hole”, so to speak. After these primers, I will walk through many of Ray’s most important Principles, one by one, and break them down to better understand their relationship to markets and Bitcoin. Let’s begin.

Primer on Money

(this Primer on Money and the following Primer on Bitcoin may be skipped by the reader who understands the traits of money and Bitcoin’s general functionality/economic properties)

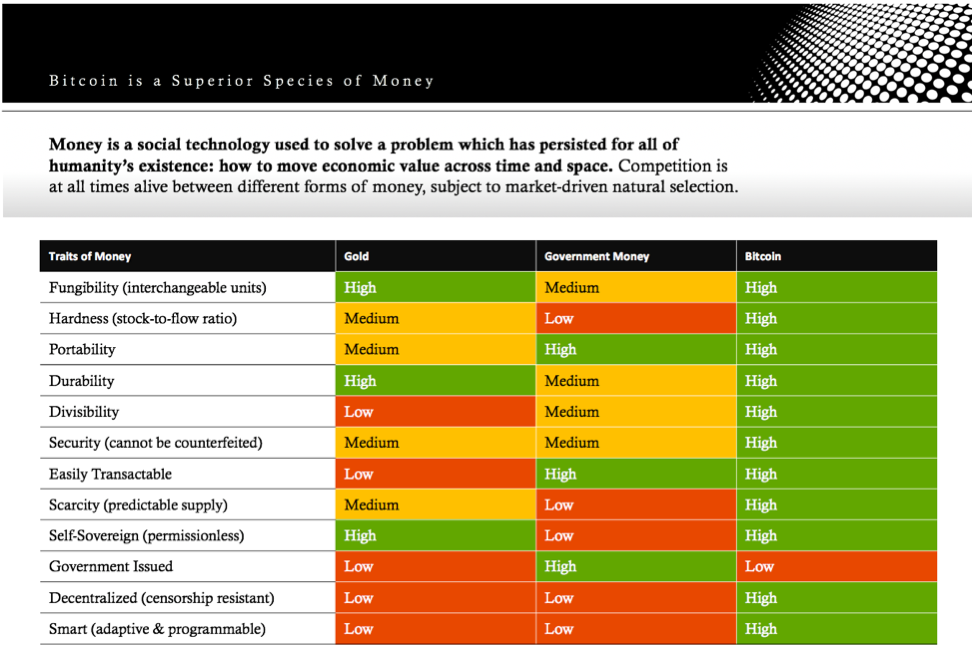

Money is a tool for moving value across time and space (or spacetime, as Einstein explained, these are actually one in the same). Money is an emergent property of barter (or direct exchange) that purports to solve the three dimensions of its non-coincidence of wants problem; it evolves naturally in the free market as the most exchangeable good in an economy. Although he is silent as to its origins, Ray understands the technological functions of money, as stated in his video assessment of Bitcoin (see open letter attachment above) that the primary functions* of money are:

1. A store hold of wealth: also called a ‘store of value’ in regard to moving value across time (the first function and evolutionary phase of money)

2. A medium of exchange: in regard to moving value across space (the second function and evolutionary phase of money)

*We will ignore for now the third function and evolutionary phase of money, unit of account, as it isn’t pertinent to our discussion here.

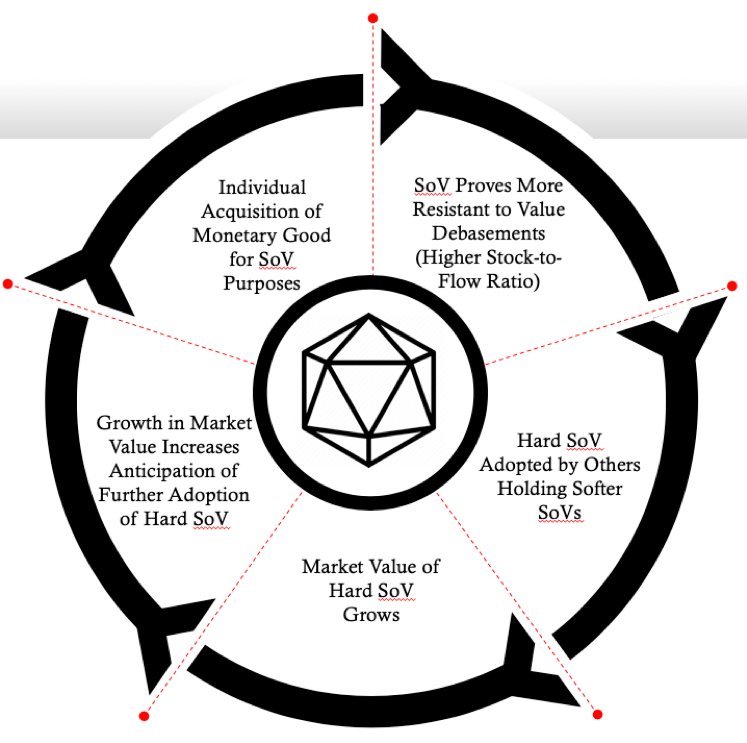

Although the purpose of money always remains the same, to move value across spacetime, the technology fulfilling this purpose is constantly being subjected to market-driven evolutionary pressures. The greater a monetary technology’s resistance to value dilution across time — whether by counterfeiting, supply inflation, or deterioration — the more effective it is as a store of value. Once a store of value accrues enough value, people begin to use it for trading purposes. The more widely accepted a form of money is, the higher its value as a medium of exchange, which makes this aspect of its value proportional to the number of its monetary network participants (aka users). When a specific monetary technology, in the form of an economic good, becomes widely accepted in interpersonal exchange (aka trade) it is called “money”. Monetary technologies compete to become more widely adopted based on the following traits:

1. Scarcity: resistance to money supply manipulations and, thus, dilutions to its monetary unit value (difficult to produce)

2. Divisibility: ease of accounting and transacting at various scales (separable and combinable units)

3. Portability: ease of moving value across space (high value-to-weight ratio)

4. Durability: ease of moving value across time (resilient to deterioration)

5. Recognizability: ease of identifying and verifying the monetary value by other parties in a transaction (universally identifiable and verifiable)

Due to the relative advantages competing monetary technologies offer, the particular economic good being used as money can, and does, change over time. Throughout history, mankind has employed seashells, salt, cattle, precious metals, and government paper as money, to name a few. Similar to the price discovery process in a free market — where the collective actions of buyers and sellers are continuously compressed into a single actionable variable called the market price — competing monetary technologies undergo a market-driven discovery process. We can gain a better understanding of this dynamic through an analogy: monetary evolution is (roughly) comparable to the evolutionary process we see in communications technologies.

No matter what specific means is used to fulfill it, the purpose of communications technology remains the same: to move information across spacetime. Similar to the market for money, competition is at all times alive among different communications technologies, in which they are all subjected to a market-driven discovery process. As newer technologies are invented they are market-tested through competition; each survives or dies in terms of its relative speed, message fidelity, reliability, traceability, and mobility. Since these technologies have a singular purpose, people tend to adopt a common technology, a coalescent process that is propelled by network effects.

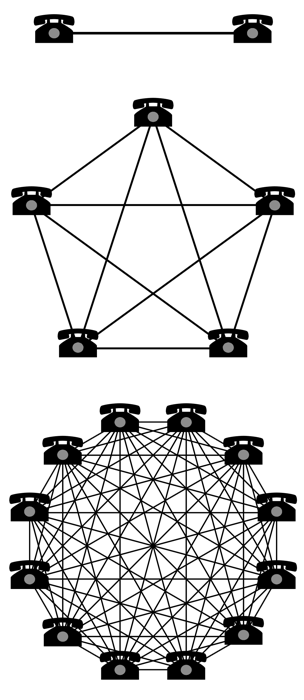

Network effects, defined as the incremental benefit attained by adding a new member to a network for all of its existing participants, drive people to adopt a primary form of communications technology. As more people migrate to the latest and greatest technology, it encourages others to do the same, as more network participation exponentially increases the number of possible connections. A simple example of this is the telephone: with two phones in existence, only 1 connection is possible; with five phones in the network, the number of connections jumps to 10; and with twelve networked phones, the number of connections increases exponentially again to 66, and so on. (see Metcalfe’s Law for a directional explanation of this network effect dynamic):

Network values are based on the number of possible connections they enable; they grow exponentially with the addition of each new constituent (or node)—this property is called network effects.

Network values are based on the number of possible connections they enable; they grow exponentially with the addition of each new constituent (or node)—this property is called network effects.

Since the purpose of communications technology remains singular (moving information across spacetime) despite technological advances, whichever technology is best at fulfilling this purpose has a tendency to become dominant in the marketplace. This tendency, reinforced by network effects, has driven communications technology evolution from carrier pigeons to telegraphs, to the internet today. This is an expression of the winner-take-all (or, winner-take-most) dynamic inherent to many networks, including those of the communications and monetary technology varieties.

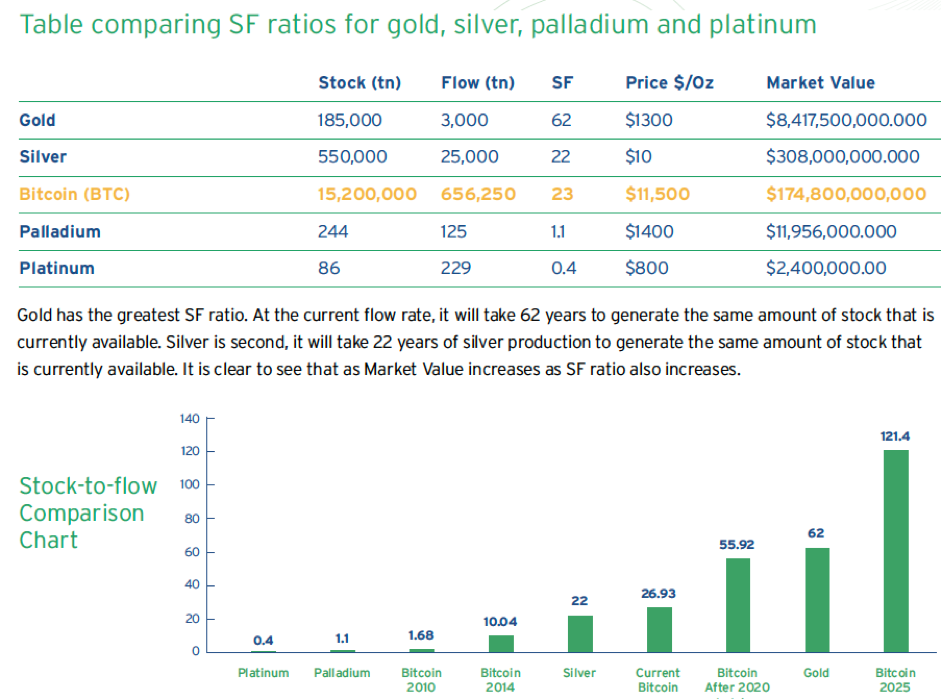

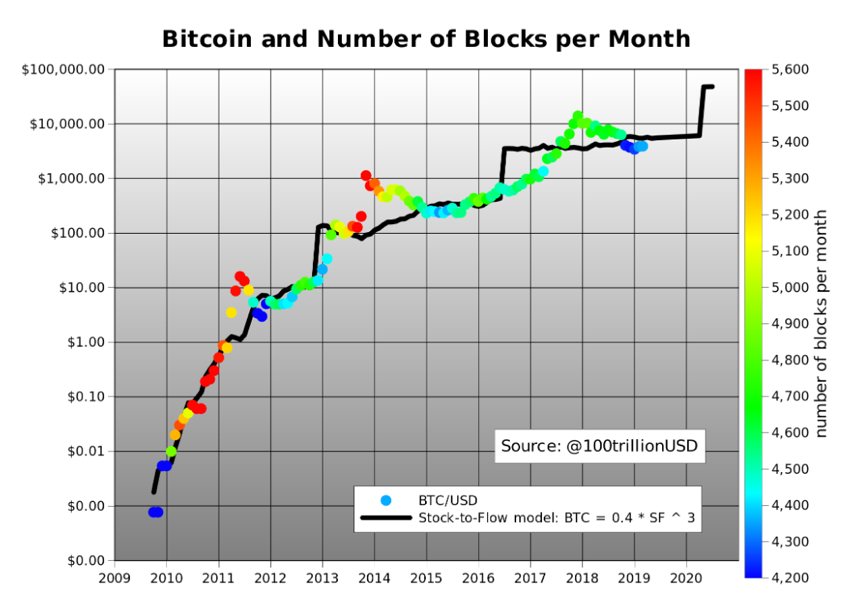

Similar to the purpose of communications technology, the purpose of monetary technology is singular: to move value across spacetime. The various monetary technologies used to fulfill this purpose, however, undergo market-driven discovery and, thus, evolve over time based on their respective monetary traits. In respect to the traits of money, the one that takes primacy in determining a specific monetary technology’s likelihood of success in the free market is its hardness (also called the scarcity or soundness of money). This trait is of primary importance because it determines a money’s usefulness as a store of value, and a money that cannot adequately store value across time necessarily cannot transmit value effectively across space. The relative hardness, or scarcity, of a competing monetary technology is quantified by its stock-to-flow ratio, a valuation metric also common in precious metals markets such as gold:

· Stock is the existing unit supply of monetary units (for example: ounces of gold, quantity of US Dollars, or quantity of Bitcoin)

· Flow is the newly created supply over a specific time span, usually one year

· The stock-to-flow ratio is calculated by dividing the stock of monetary units by its newly created supply flow (can be thought of as the inverse of inflation)

· The higher the stock-to-flow ratio, the greater the hardness (also called soundness or scarcity) of the monetary technology