Why Bitcoin?

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Why Bitcoin?

By Wiz

Posted July 16, 2019

Brief introduction to the security, privacy, and freedom of your money.

Exchange rates of fiat currencies compared: (100,000 Venezuelan Bolivar for 1 USD) and (20,000 USD for 1 Bitcoin)

Exchange rates of fiat currencies compared: (100,000 Venezuelan Bolivar for 1 USD) and (20,000 USD for 1 Bitcoin)

What is financial self-sovereignty?

Imagine you have a gold coin in your hand, one of the simplest and purest forms of financial self-sovereignty. To hold that coin, you don’t need to agree to any Terms of Service or Privacy Policy, comply with any KYC or AML regulations, or show your ID or give your name or social security number. You just hold it in your hand, and you can use it to pay for anything by giving that coin to someone else to hold in their hand. It’s pure freedom.

In addition to the freedom of what you buy with your coin, nobody can magically know who you pay or what goods/services you buy with that gold coin, because your privacy isn’t being compromised with gold. And since you have your privacy, nobody can know about your transactions, and so nobody can decide to restrict or control what you use that gold coin to pay for.

For thousands of years, gold was the global standard of money. Everyone maintained their financial self-sovereignty, and the privacy and freedom of everyone’s money was respected. It was really that simple.

Why did we stop using the gold standard?

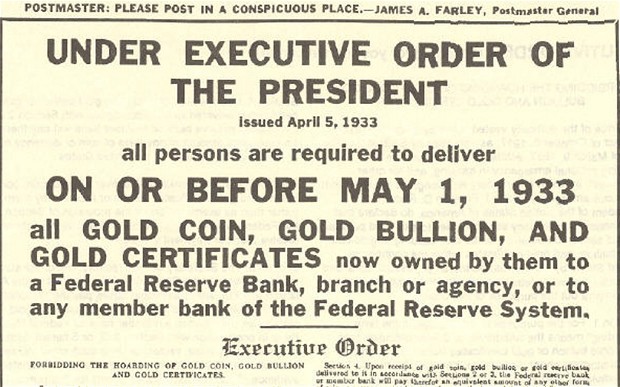

The current global banking and fiat currency system was implemented very slowly by bankers over the past 100+ years. They partnered with the world’s governments who confiscated everyone’s gold under threat of violence. For example, after the Federal Reserve Bank was established in USA in 1913, the USA government violently confiscated everyone’s gold coins in 1933, forcing everyone to use the new Federal Reserve central banks and bank note system.

“Deliver all your gold to our vaults in exchange for worthless paper, or we will use violence against you.”

“Deliver all your gold to our vaults in exchange for worthless paper, or we will use violence against you.”

Banks initially replaced the gold standard with paper receipts called gold certificates, but after enough time passed, the banks basically just stopped redeeming them for gold. The bank’s gold receipts (bank notes, or “cash”) were just worthless paper at that point, but because of the government’s threat of violence, everyone was forced to keep using Federal Reserve notes.

More recently, the banks now use a digital database, where they can literally create money out of nothing, without even having to print it on paper. They have solidified their full power to manipulate and inflate the global money supply, monitor everyone’s financial transactions, and control the flow of all fiat currency in their banking system. Banks control everything now.

Once the central bankers had successfully taken over control of the world’s money supply, together with everyone’s ability to freely transact and trade, the world collectively lost the security, freedom, and privacy of its money.

What’s wrong with fiat currency and central banks?

After the implementation of the current global banking and fiat currency system, the world was left with no other choice than to trust bankers and politicians to run the global financial system in a fair way.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” — Satoshi Nakamoto

The history of the abuse of fiat currencies can be grouped into 3 categories:

- Security. Bad people stealing your money or your money’s value, sometimes in obvious ways, sometimes in sneaky ways.

- Privacy. Bad people monitoring all your private financial transactions, and using your personal financial data against you.

- Freedom. Bad people controlling how you can spend your own money, who you can transact with, how much you can spend, etc.

How can people steal my money if it’s in a bank?

Here are a few examples:

- Theft by Inflation: This is the primary way banks steal your money, and one of the most sneaky. When central banks issue new money, either by printing it on worthless paper, or just adding an accounting entry in a database they control, they inflate the global money supply. Inflation steals buying power from everyone who holds some of that currency, simply because there is now more of that currency in circulation. Gold cannot be created, so bankers invented a paper money system instead.

Banks can issue an infinite amount of fiat currency, either by printing or using a digital database.

Banks can issue an infinite amount of fiat currency, either by printing or using a digital database.

- Theft by Seizure: This is one way governments can steal your money. Ever heard of Civil Forfeiture? If a police officer suspects your property was used in a crime, they can seize it, and you have to fight to try and get your stolen property back. Or, another example: Try entering a country with more than $10,000 USD in your pocket, not declaring it, and see what happens. It’s all the same: theft by other people with guns.

Governments absolutely can and will steal your fiat currency

Governments absolutely can and will steal your fiat currency

- Theft by Taxation: This is another way governments steal your money. I’m not arguing if taxation is ethical or not, I’m merely stating the fact that your government has the ability to force your bank to give them your money, and this is a security vulnerability. For money to be secure it must be unconfiscatable, and governments can confiscate your bank accounts.

How do people use my financial data against me?

If you physically pass fiat currency to another person, in the form of paper money or coins, it’s relatively easy to protect the privacy of your transaction, just like using a gold coin would be.

However, if you’re using credit cards, debit cards, wire transfers, PayPal, Venmo, LINE Pay, WeChat Pay, or any other centrally controlled payment network, you’re actively consenting to waive the privacy of all of your private financial transaction data, and giving it all to a trusted third party.

When all the data and metadata of your financial transactions is logged in a central database, whoever has access to that database can use your data against you. Here are some basic examples:

- If you purchased high-risk lifestyle goods like cigarettes, your bank can tell your insurance company to raise your rates.

- If you purchased something that is illegal, like recreational drugs, your bank can tell your government to prosecute you.

But in the case of some oppressive governments, they’ve taken this to the extreme. They centrally collect all financial transactions, and other data of all its citizens, and have created a totalitarian Social Credit Score system:

George Orwell’s writings have already become a reality in China because of the central bank fiat currency system, and the payment networks that were built on top of it. If you think this won’t happen in your country, think again. It happens very slowly, but eventually all world governments will implement a Social Credit Score system, China was just the first to do it.

How do people control who I transact with?

In the first example with the gold coin, when you pass it to someone else as payment for goods or services, there is no centralized records of your payment transaction, and you have perfect privacy.

However, in the central banking system, since the bank has both the knowledge of your transaction data and the power to control your funds, they can evaluate against a set of rules to decide if they want to allow your transaction or deny it, as well as enforce that decision by controlling your funds. This is how governments have weaponized fiat currency and the central banking system as a System of Control upon its citizens.

To summarize: Because you have given up the security and privacy of your money, you have also lost your financial freedom.

” Privacy isn’t about something to hide. Privacy is about something to protect.” — Edward Snowden

How do we get back our financial self-sovereignty?

The Cypherpunk movement was started by individuals who understood the importance of protecting individual user’s privacy and freedom on the Internet. The Cypherpunks commonly believed that the problems described above could only be solved with a completely new money system, which respected and protected individual’s security, privacy, and freedom.

Many of the Cypherpunks attempted to build new ethical e-cash systems which could replace fiat currencies and central banking. There were many difficult computer science problems to overcome in creating such a truly decentralized system, and while some of them came very close, they all failed.

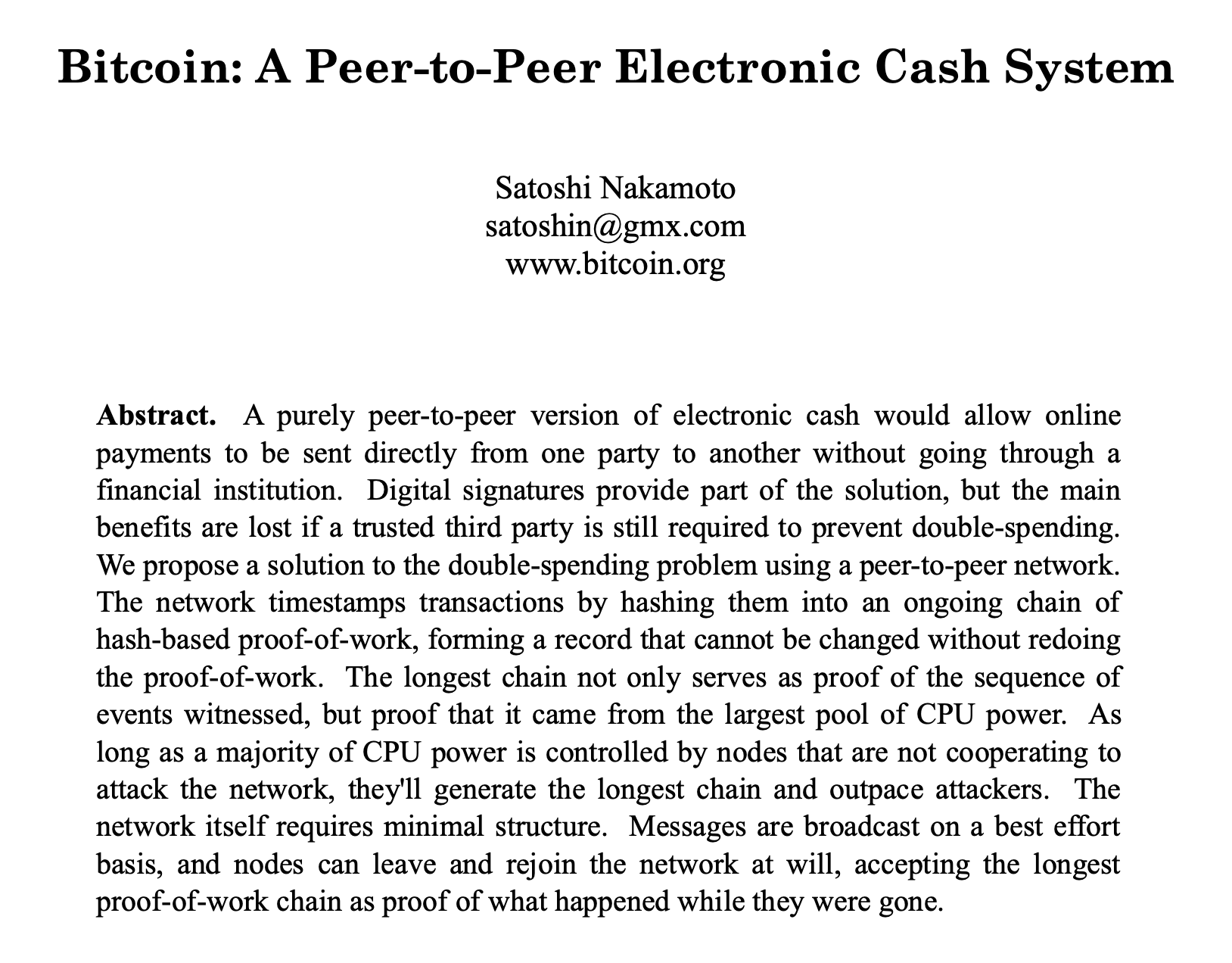

That is, until one pseudonymous Cypherpunk finally figured it out in 2008:

Combining digital signatures, a distributed ledger, and a peer-to-peer network, Bitcoin was born.

Combining digital signatures, a distributed ledger, and a peer-to-peer network, Bitcoin was born.

How does Bitcoin work?

Just like how you don’t need to know how the Internet works to look at cat pictures on the Internet, understanding the technical complexities of how Bitcoin works under the hood is not necessary to use it and achieve your own financial self-sovereignty.

The important thing I want you to take away from this article is that while any new technology has a poor user-experience at first, Bitcoin is consciously and very intentionally not sacrificing any of its underlying philosophical principals to onboard new users faster, or to improve the user experience. The smartest Cypherpunks are working to improve the user experience. The technology will improve over time, just like it did for the Internet.

So then, Why Bitcoin?

I’ll tell you why:

Because Bitcoin respects individuals’ security , privacy , and freedom .

How is Bitcoin better than the fiat currency system?

For starters, Bitcoin has No Terms of Service, No Privacy Policy, and No KYC/AML compliance regulations. Bitcoin is a successful implementation of crypto-anarchy where the only rules are cryptography, math, and a hard set of consensus rules. It is a distributed and trustless system, based on financial incentives, and no single person or centralized entity can control Bitcoin.

But most importantly, Bitcoin enables you to opt-out of the fiat currency and fractional reserve central banking system, by solving the core trust problems:

- ✅ Security against inflation by using a fixed supply

- ✅ Security against seizure by using keys to control funds

- ✅ Privacy of payments by using pseudonymous identities

- ✅ Freedom against censorship by using a peer to peer network

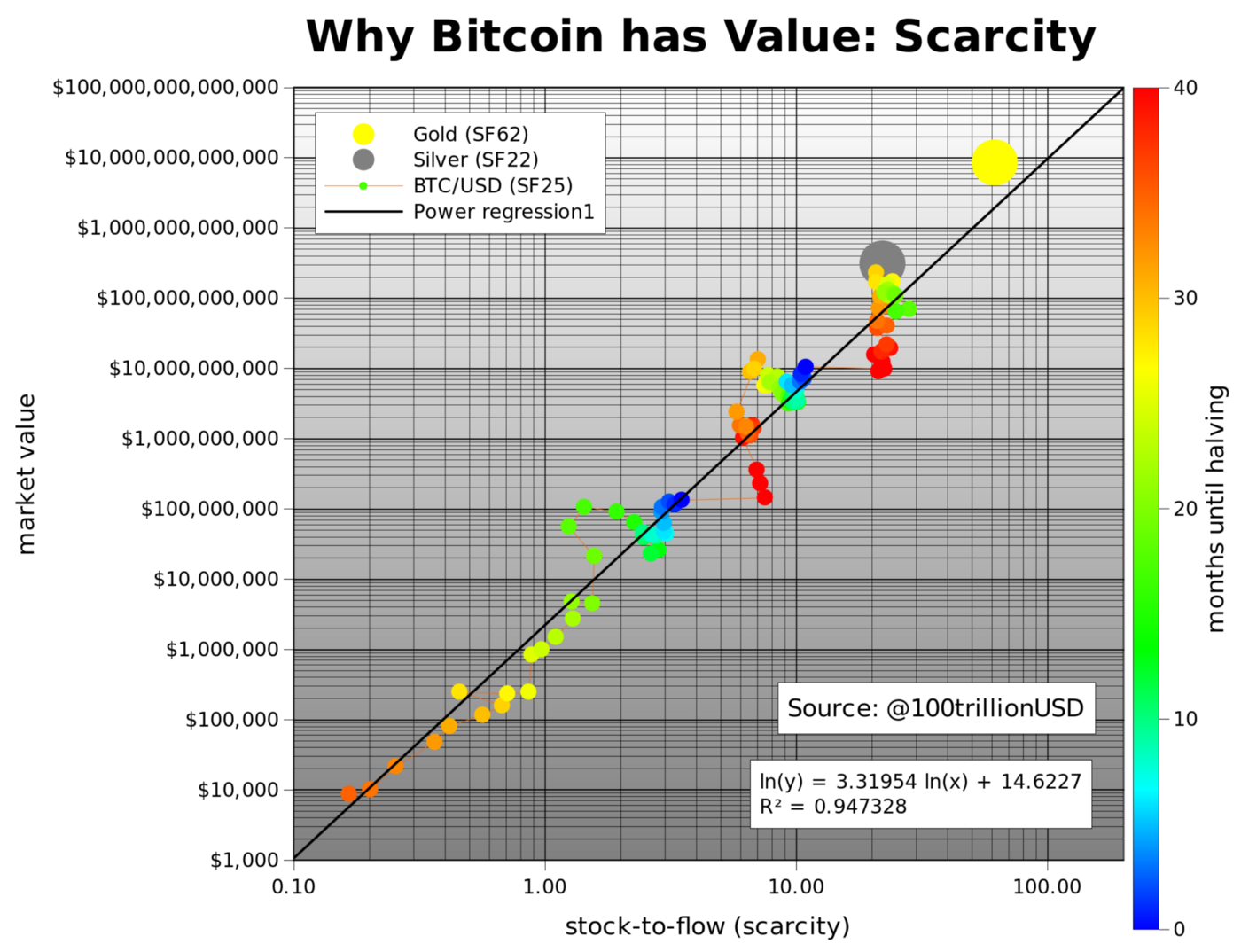

How does Bitcoin protect against Inflation?

One of the most critical consensus rules of Bitcoin is that there will only ever be a maximum of 21,000,000 Bitcoin ever created. After all the Bitcoin is issued, there can never be any new Bitcoin created. Therefore, Bitcoin is a deflationary currency, which prevents people from stealing your money or its value by inflating the money supply.

How does Bitcoin protect against Seizure?

Bitcoin can only be transferred by using the cryptographic private key which controls the funds. No government or bank or court order can seize funds. There is simply no way to enforce such a decree or order from any “authority”, as Bitcoin does not acknowledge any “authority” within its system. Bitcoin is a fully self-sovereign system, and because of its distributed nature, cannot be shut down. It exists on its own merits, purely because people believe in it.

How does Bitcoin protect Privacy?

Bitcoin doesn’t ask for your name or other personally identifiable details. Your identity is cryptographic, not real-world name based. So your identity looks like 1wizSAYSbuyXbt9d8JV8ytm5acqq2TorC and not like “John Smith”.

Additionally, nobody knows who controls the funds in a given Bitcoin address, and new technology is constantly being developed to improve Bitcoin Privacy.

How does Bitcoin protect against Censorship?

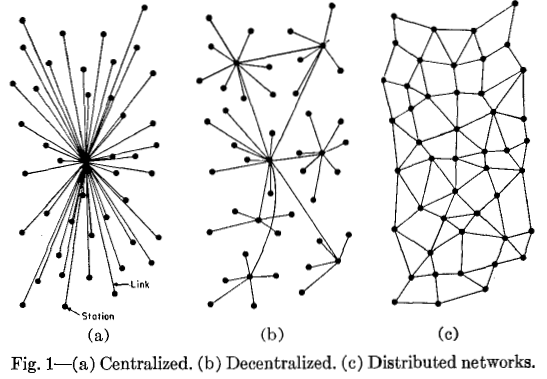

The peer-to-peer Bitcoin network is fully distributed. This means if one node attempts to censor your transaction, they will not succeed unless every node censors your transaction.

Centralization bad. Decentralization good. Distributed peer-to-peer best.

Centralization bad. Decentralization good. Distributed peer-to-peer best.

What will government and banks do about Bitcoin?

Some countries have tried to regulate it, control it, shut it down, etc. but none of them have succeeded. They mostly just seem to want to use the existing central bank system to control how people trade fiat currencies for Bitcoin, and of course they want to tax Bitcoin in whatever way possible.

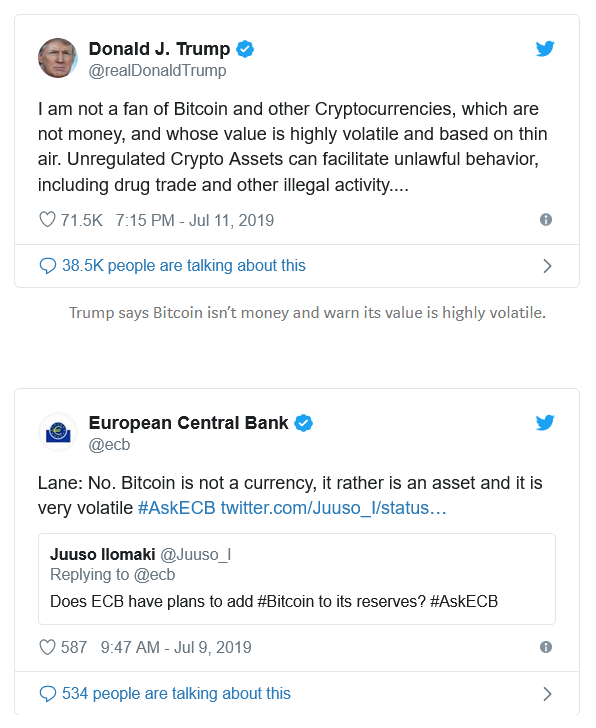

Here are some common claims about Bitcoin by government and banks:

Trump says Bitcoin isn’t money and warn its value is highly volatile. European Central Bank says Bitcoin is not a currency and warns it is very volatile.

Trump says Bitcoin isn’t money and warn its value is highly volatile. European Central Bank says Bitcoin is not a currency and warns it is very volatile.

Is the value of Bitcoin volatile?

If you zoom out the price chart, you will see that Bitcoin has been steadily going up in value since it was created, trading at less than $0.01 and slowly climbing to over $20,000 USD at its most recent peak at the end of 2017.

This is because its supply is fixed and people value its scarcity. With more demand and a fixed supply, prices go up over time. As the years go on, its value will continue to increase as new users start holding Bitcoin.

Is Bitcoin Money?

To answer the question of if Bitcoin is or is not money, you must first define the term “money”. Unfortunately we use the word “money” to describe several very different complicated concepts, which are all completely separate.

The term “money” actually refers to:

- Store of Value

- Medium of Exchange

- Unit of Account

- *System of Control

Bitcoin as a Store of Value

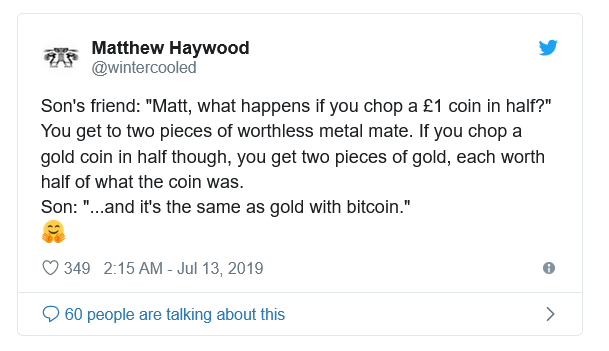

This tweet explains it perfectly:

Bitcoin is completely fungible and works as an excellent Store of Value, just like gold has for thousands of years.

Bitcoin as a Medium of Exchange

Bitcoin has worked well as a Medium of Exchange for its early adopters. But scaling Bitcoin to a global level that could serve all humans is a big challenge, as the underlying “blockchain” technology does not scale to a global level.

To solve this scaling issue, Satoshi invented the concept of payment channels, and combined with some help from other brilliant computer scientist Cypherpunks who have improved the concept over the past 10 years, we now have the Lightning network, which enables Bitcoin to be used as an excellent Medium of Exchange that can eventually scale to a global level.

Bitcoin as a Unit of Account

Bitcoin’s smallest Unit of Account is named after its creator, the Satoshi. One Bitcoin is equal to 100,000,000 Satoshi. Eventually as more goods and serviced are exchanged for Bitcoin, more people will use Bitcoin or “Sats” as a Unit of Account.

Bitcoin as a System of Control

Since Bitcoin was designed to respect and protect individual human rights, specifically the security, privacy, and freedom of money; it would not make a very good System of Control, and cannot be used to oppress people like the fiat currency and central banking system is currently doing very well.

What about “The Next Bitcoin” ?

Just like there can only be one global Internet, there can only be one global money, and the new Bitcoin Standard has arrived. Everything else is either an outright scam or a waste of time.

If someone wanted to sell you “The Next Gold”, would you buy it?

In closing

I hope this article helped you understand why Bitcoin was created and how it can help the world to break free of the fiat currency and central banking system that has been very deeply integrated into our current society.

Here are some thoughts to take away:

- Bitcoin wasn’t invented for profits, it was invented to change the world.

- Bitcoin will do that by respecting user’s security, privacy, and freedom.

- Bitcoin is already used as money, in several ways that money can be used.

- Bitcoin is not volatile, its value actually rises slowly over time (zoom out).

- Bitcoin has many copycats and scammers who will try to sell you their copy of Bitcoin. Don’t be fooled by Fool’s Bitcoin just like you wouldn’t be fooled by Fool’s Gold.

- Bitcoin is going to become the biggest transfer of wealth in our lifetime, so you might want to pickup some sooner rather than later.

- Stay humble and stack sats.

How do I get started using Bitcoin?

To be continued in Part 2.