Tweetstorm: How to Outperform Bitcoin

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Tweetstorm: How to Outperform Bitcoin

By Michiel Lescrauwaet

Posted September 19, 2019

1/ “How to outperform Bitcoin” - a thread based on my recent presentation at #bh2019

2/ We see 3 reasons why BTC should be the benchmark in crypto:

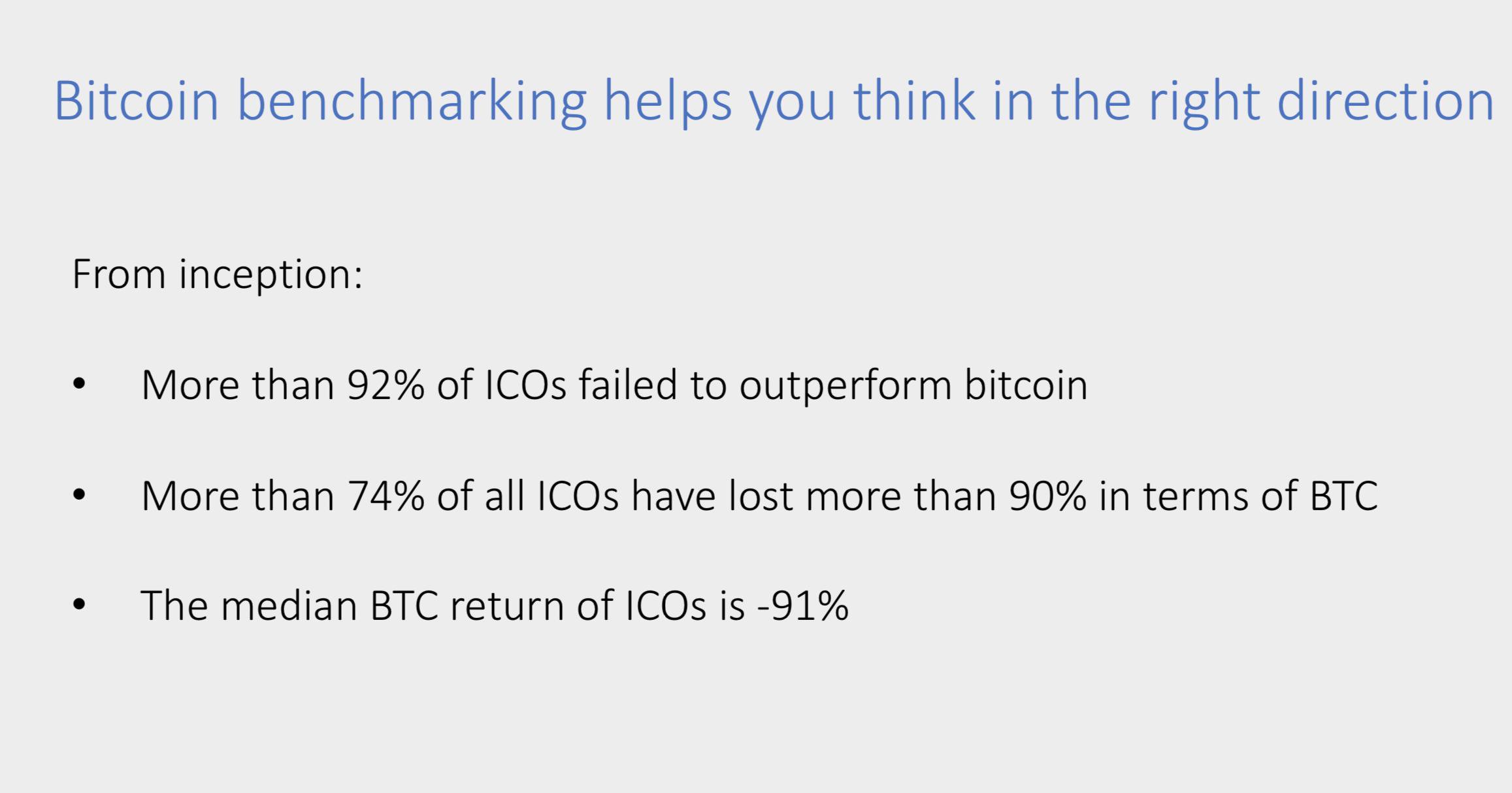

- a) Current portfolio indices are flawed and won’t stand the test of time

- b) BTC is way ahead of its competition to become a monetary standard

- c) It helps investors think in the right direction

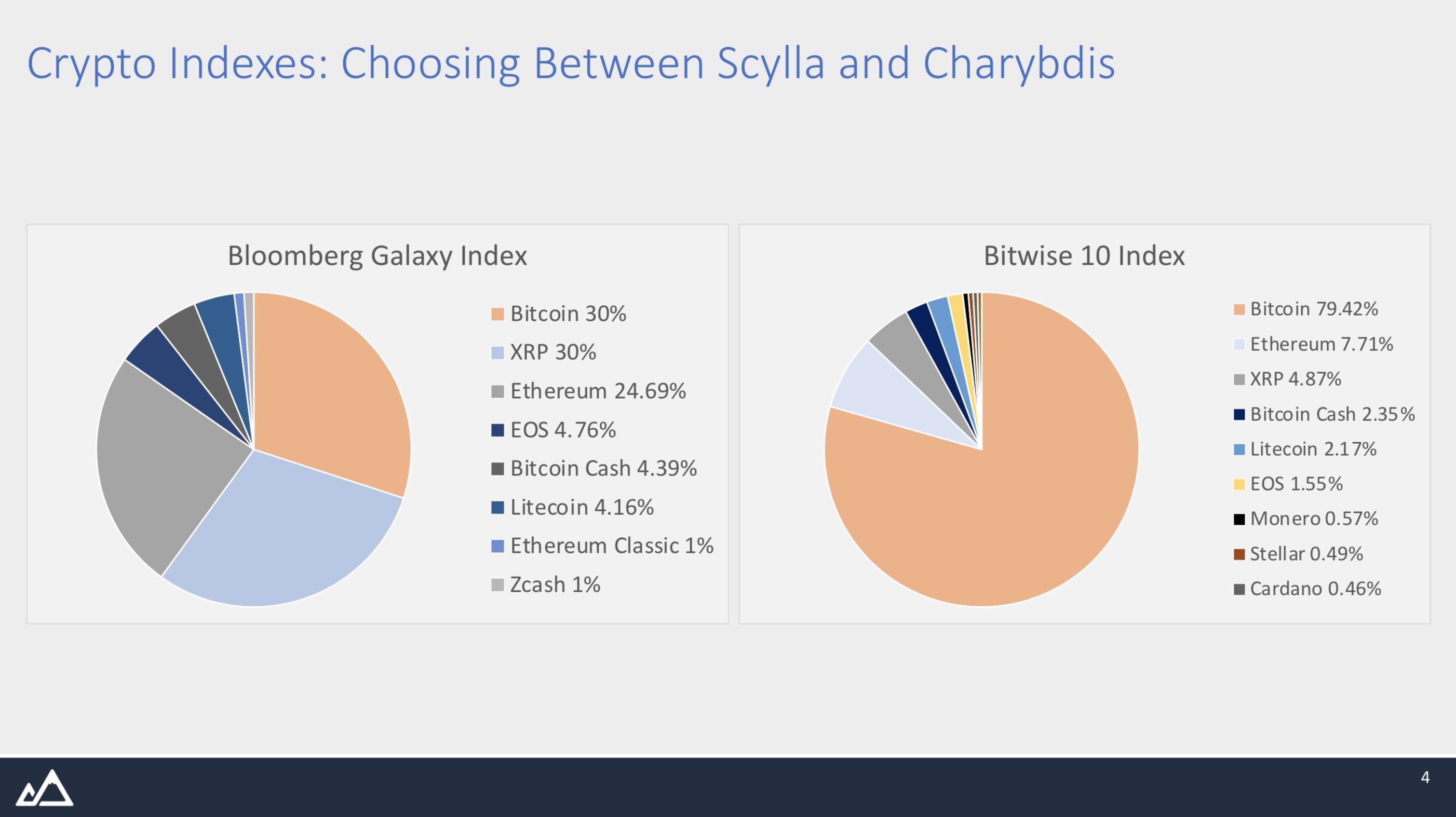

3/ Imo crypto indices are DOA:

The Bloomberg Galaxy Index is a subjective mix of heterogeneous assets: no rational justification for the weightings.

For Bitwise 10 the question becomes: why include Bitcoin at all? Analogous to adding 80% AMZN to a junior index.

4/ We think Bitcoin stands on its own as digital gold and should not be mixed with experimental altcoins:

“Diversification is a security against ignorance. It makes little sense if you know what you’re doing” - Warren Buffett

5/ When we look at proxies for moneyness, Bitcoin performs at least 10X better than the next 4 projects.

6/ Institutions are coming - and they’re coming to Bitcoin first.

This shouldn’t be a surprise: they have a long-term mindset and a reputation to uphold.

7/ The opportunity cost of selling BTC is huge & long-term it’s hard for an asset to outperform BTC.

Not thinking in terms of Bitcoin can cost you a lot of bitcoins.

8/ If we accept that Bitcoin is the benchmark, the question that follows is: How to outperform Bitcoin?

Here are a few frameworks that helped us think about Bitcoin alpha.

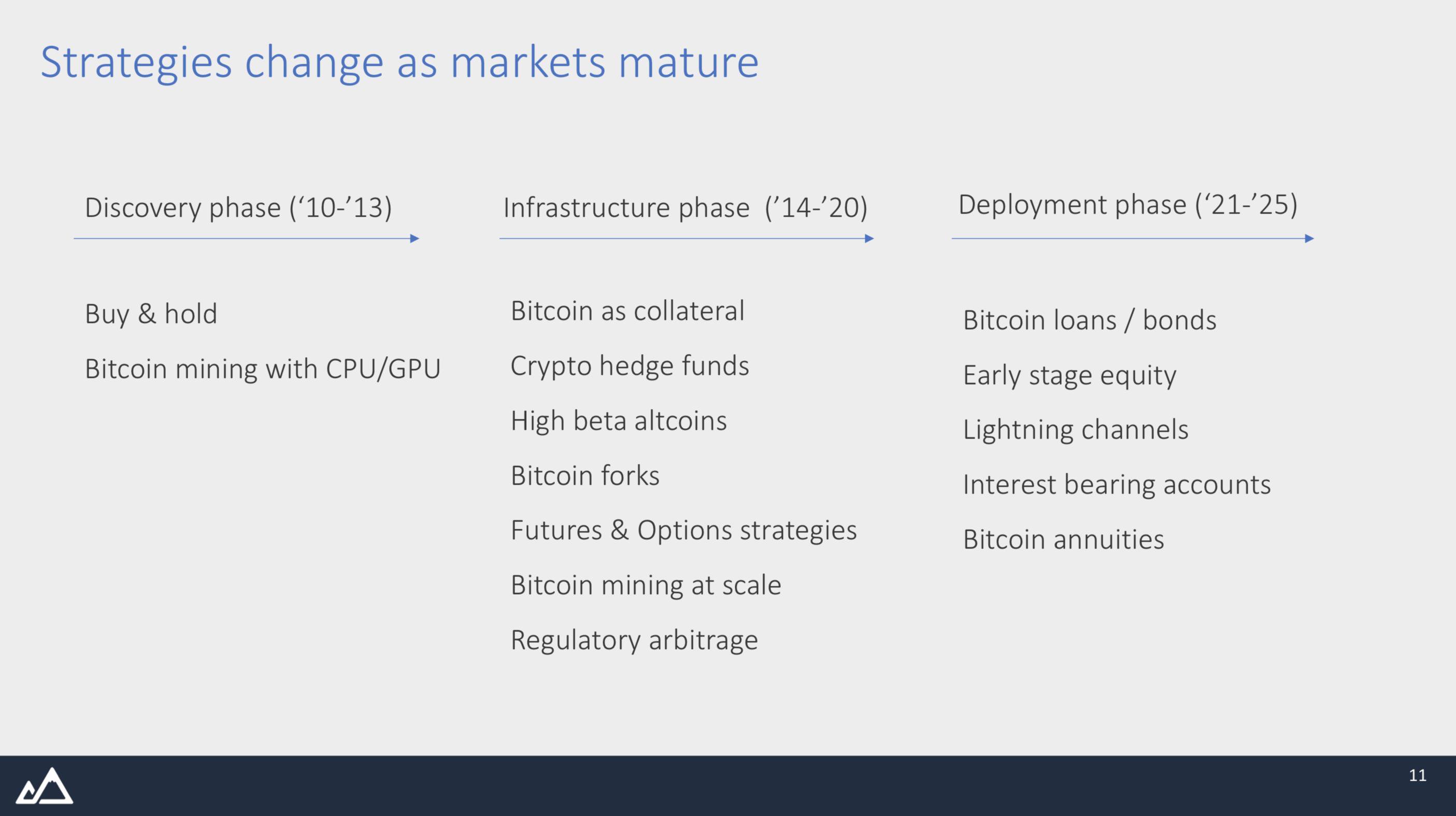

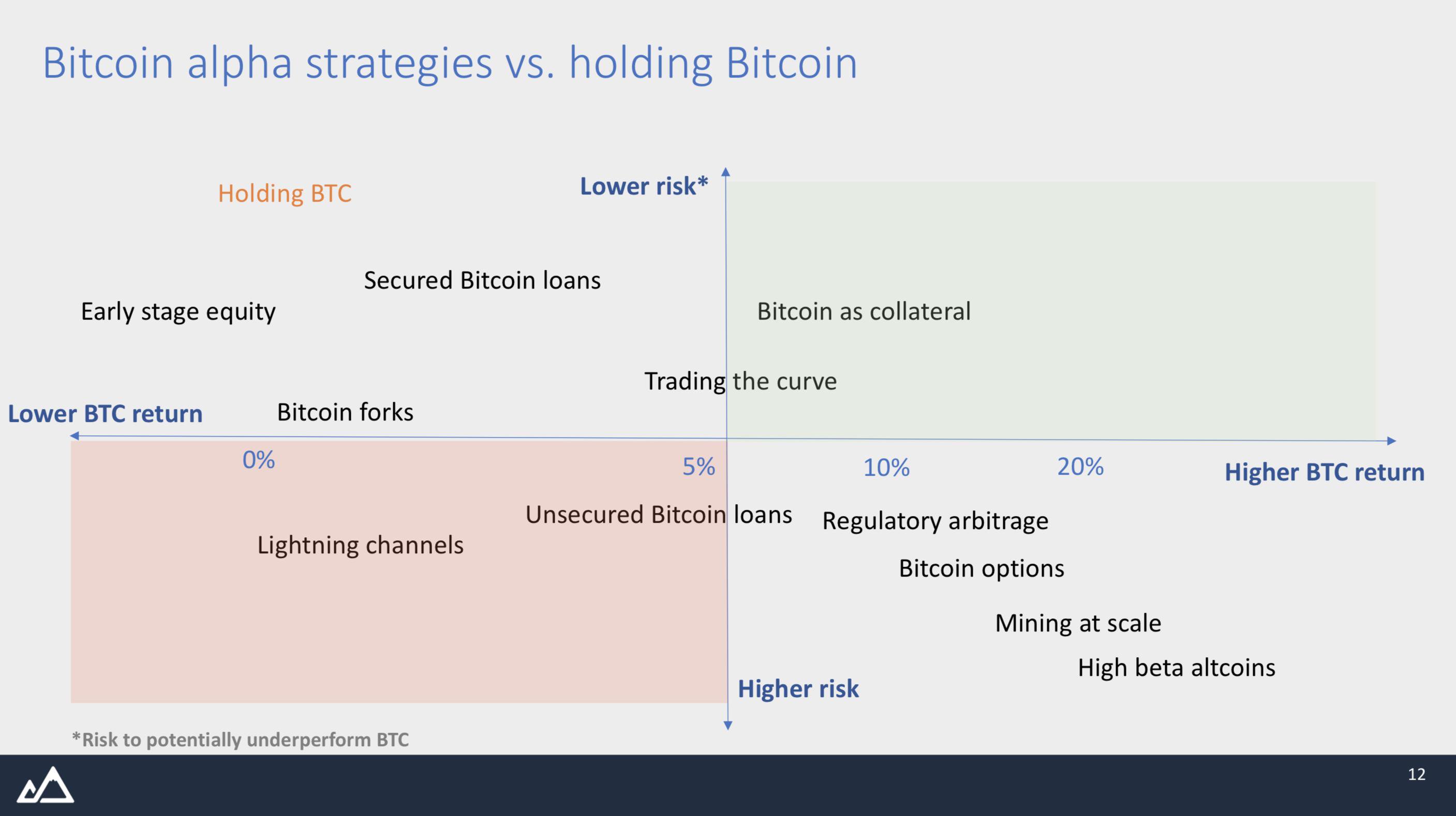

9/ The risk/reward of each strategy depends on the maturity of the BTC ecosystem.

You could’ve gone levered long BTC on Bitcoinica in ‘11, but then lost everything in the bankruptcy.

At the same time, today it’s too early to lock up you BTC in Lightning channels.

10/ Here is a suggested look at the risk/reward profile for every strategy (note that the positions depend to some extent on the skillset).

The take-away is that you want to identify a strategy that offers a relatively high return for a relatively low risk.

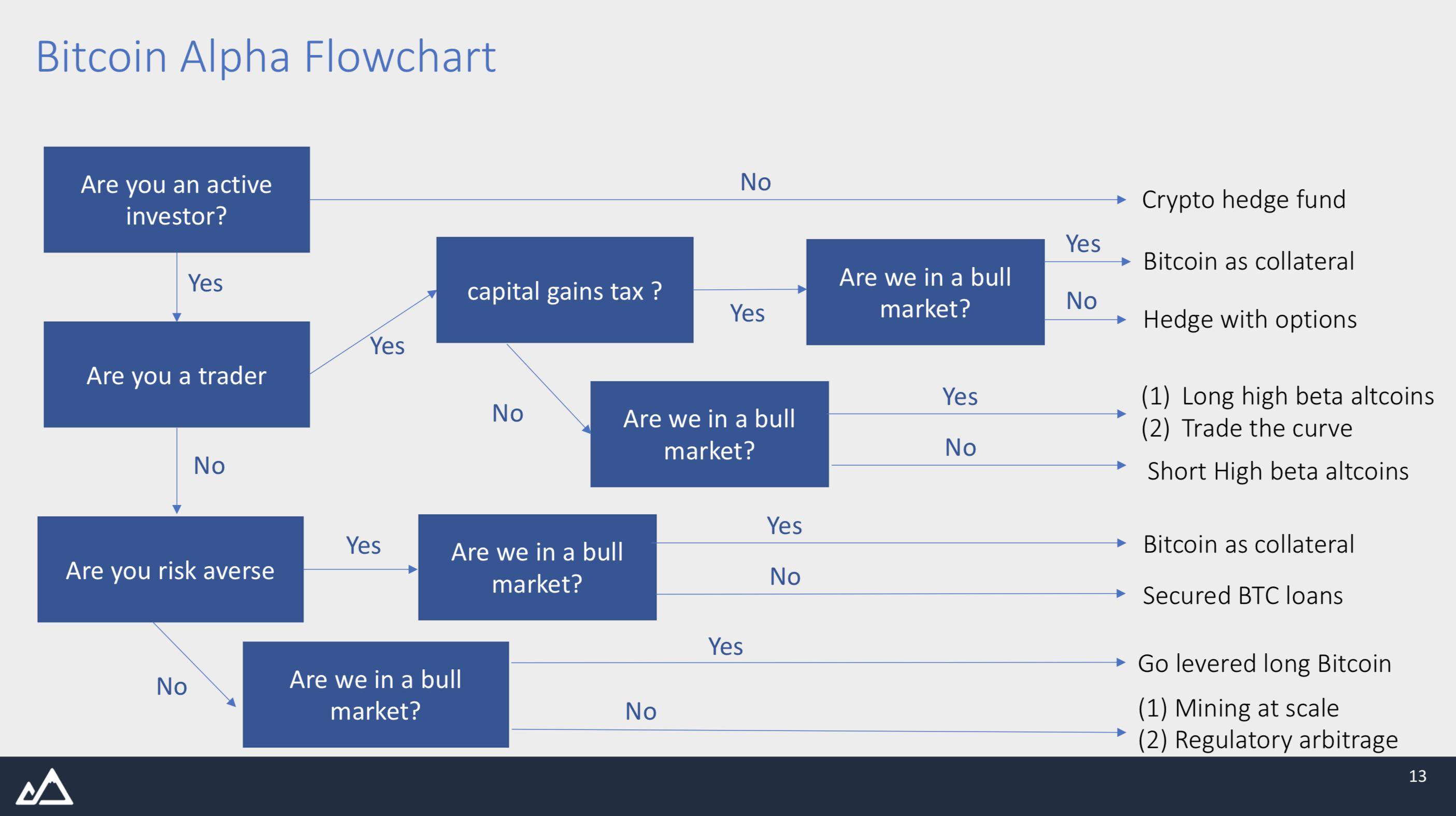

11/ Finally, context matters. It’s important to ask the right questions, in the right order.

12/ Let’s now look at a few strategies in more detail.

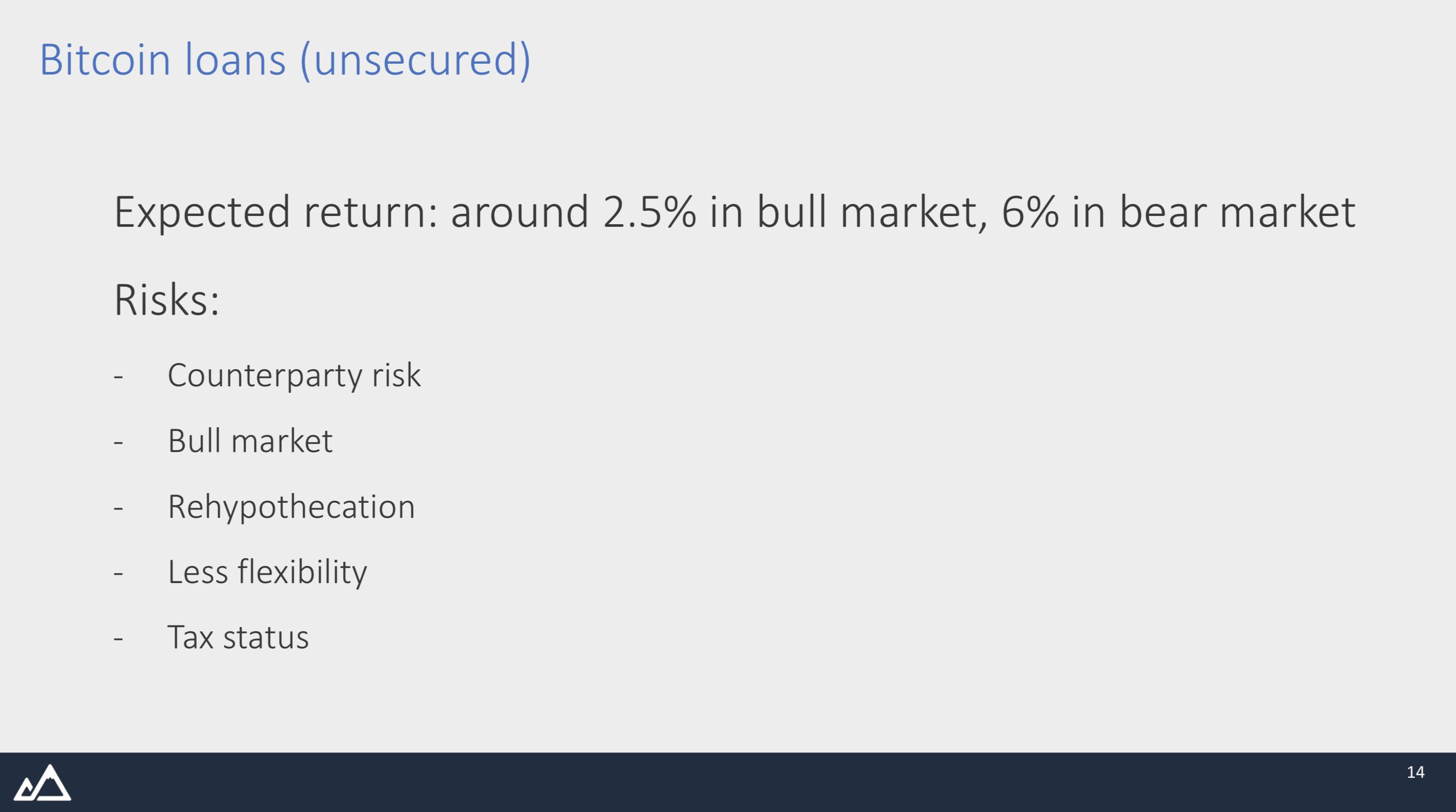

13/ If you’re lending out your bitcoins, you will earn around 2.5% APR - the reason is that there’s less demand for BTC borrowing in a bull market as shorting / hedging is less of a concern.

Keep in mind that counterparty risk is still material, esp. in a bull market.

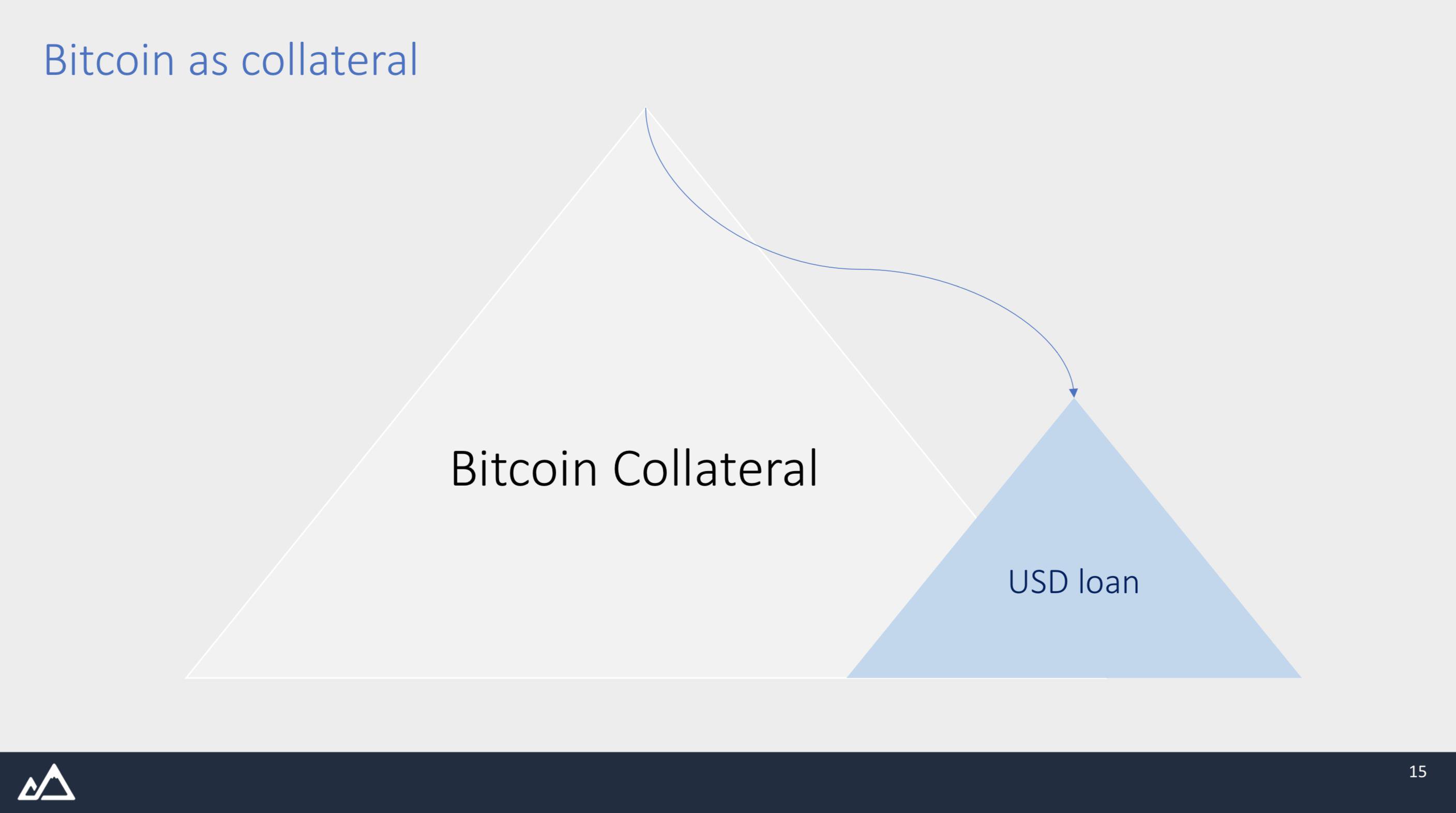

14/ An alternative strategy is using Bitcoin as collateral to borrow extra USD, which is reinvested (leverage):

- Flexibility to manage risk

- Bitcoin is excellent collateral

- Possibility for tax-efficiency.

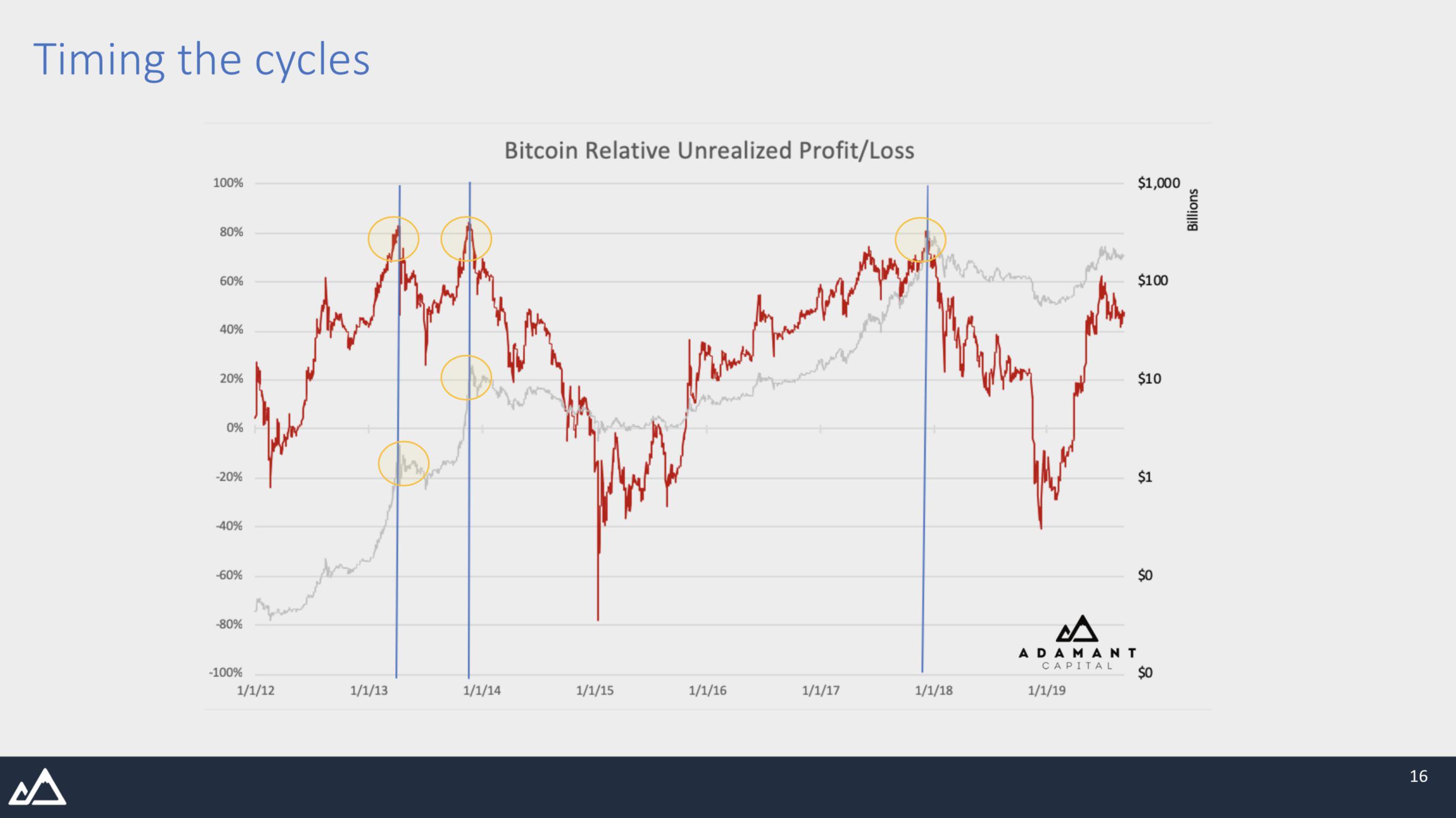

15/ When levering up/down it’s important to be able to time the cycles.

An indicator that we like is the Relative Unrealized P&L. It’s a proxy for paper profits/losses.

We’re at 40% now. Historically, 80% was an important level for a reversal in trend.

16/ When investing in crypto (hedge) funds, it’s critical to ask the right questions:

- What is the performance benchmark?

- How much is committed by the GP?

- Does the strategy align with my outlook?

- What was the performance?

- How are the fees structured?

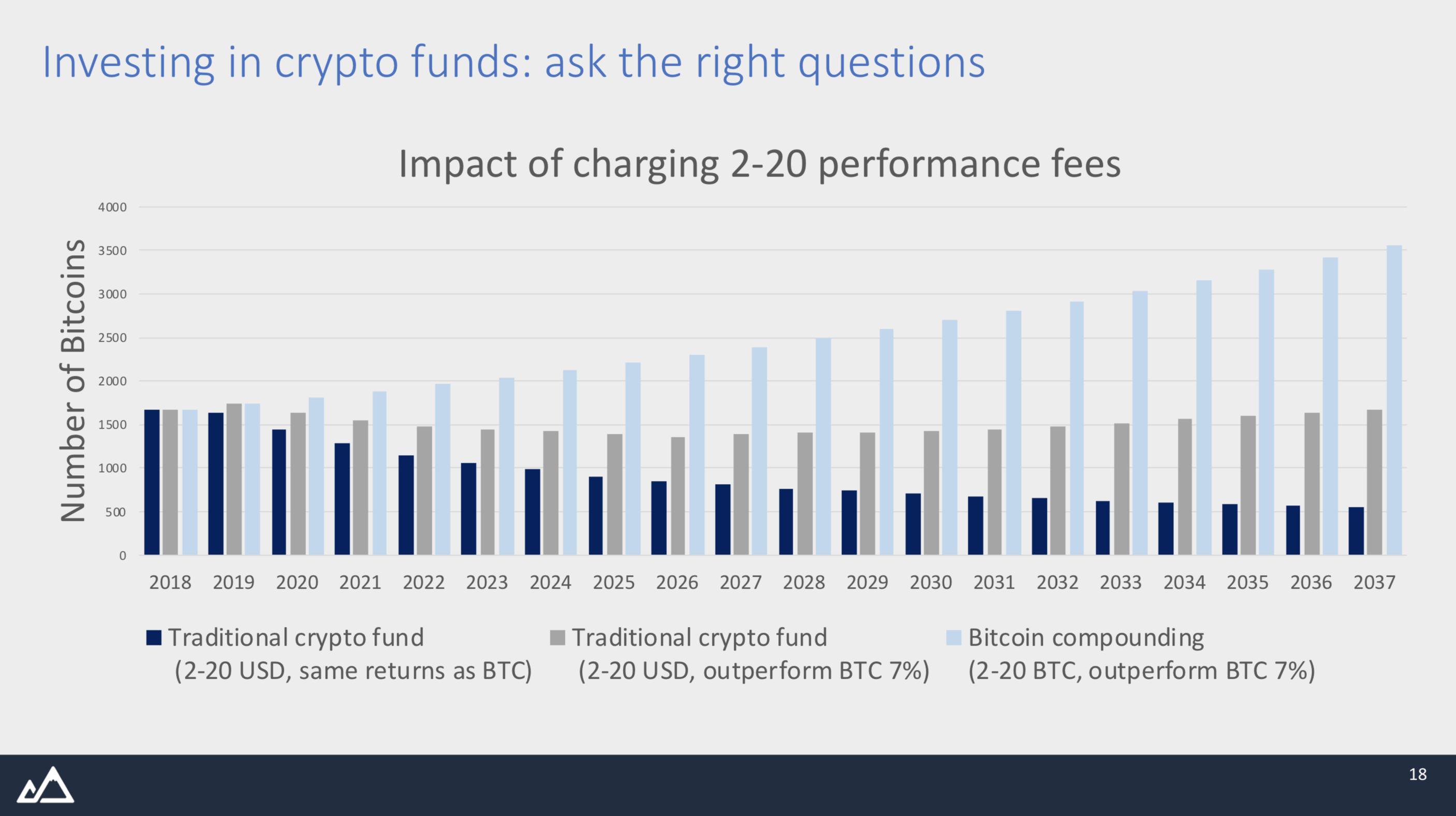

17/ The fee structure is important because BTC tends to move up violently

Let’s say you invest 100k (or 10 BTC), BTC does a 5x and the fund’s return = BTC return. The fund charges 80k (20%), and you now have 420k instead of 500k when holding BTC.

Charging fees in BTC fixes this

/18 In conclusion, we believe that:

- BTC as a benchmark is the future of crypto asset mgmt and those who adopt it early will benefit.

- When pursuing BTC alpha, it’s crucial to know how mature the market is, to know your skillset & ask the right questions.