The cat is out of the bag

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

The cat is out of the bag

By Nic Carter

Posted December 29, 2019

Bitcoin is everyone’s problem now

Evey: Remember, remember, the Fifth of November, the Gunpowder Treason and Plot. I know of no reason why the Gunpowder Treason should ever be forgot… But what of the man? I know his name was Guy Fawkes and I know, in 1605, he attempted to blow up the Houses of Parliament. But who was he really? What was he like? We are told to remember the idea, not the man, because a man can fail. He can be caught, he can be killed and forgotten, but 400 years later, an idea can still change the world. I’ve witnessed first hand the power of ideas, I’ve seen people kill in the name of them, and die defending them… but you cannot kiss an idea, cannot touch it, or hold it. Ideas do not bleed, they do not feel pain, they do not love… – Evey Hammond, V for Vendetta

An exorbitant privilege

Bitcoin is first and foremost a monetary phenomenon. The social climbers and false prophets who proclaimed it is a payments revolution have either come around or been repudiated by the market and washed out, embittered. Most who understood it that way are now moving on to new things. The world did not need another Paypal. The world needed a new monetary institution.

As Bitcoin went from a proof of concept, to a toy, to a joke, to a collectible, and then to a movement, a few policymakers came to realize that it posed a threat to the established system. Not because of its present form, but because what it represented: a profane insult to the carefully calibrated monetary system. All done in a mocking, insouciant fashion — a band of nerds and ne’er-do-wells insolently challenging the state’s monopoly on seigniorage. Satire is what despots fear most, and the rise of Bitcoin made our present monetary system look patently absurd.

Critic: Nothing backs Bitcoin.

Bitcoiner: What backs the dollar?

Critic: Nothing intrinsically — our ability to compel foreign nations to accept our currency as the numeraire of international trade, our ability to force citizens to pay taxes in dollars, and our military assets required to enforce both conditions.

Bitcoiner: How persuasive!

The visceral hatred elites feel about Bitcoin? Perfectly justified. How else would you react to a upstart aimed at usurping your sacred monetary privilege?

Such is the potency of Bitcoin that it compels the high priests of U.S. imperialism to reveal the unwritten rules about the role the dollar plays in power projection abroad. In May of this year, U.S. Representative Brad Sherman (D-CA) spoke out against cryptocurrency on the floor of the house. His statement laid bare the normally veiled post-Bretton Woods doctrine in which the dollar is employed not only a monetary tool but a strategic one, too.

An awful lot of our international power comes from the fact that the dollar is the standard unit of international finance […] and it is the announced purpose of the supporters of cryptocurrency to take that power away from us […]. Whether it is to disempower our foreign policy, our tax collection, or our traditional law enforcement […]. the purpose of cryptocurrency […] is solely to aid in the disempowerment of the United States and the rule of law.

Representative Sherman is practically a soothsayer. He understands precisely where the world is going.

His mistake is not in the diagnosis, but in the cure. He mistakenly believes that Bitcoin can be reckoned with. But Bitcoin is an idea, not a product. The notion of a weightless, virtual commodity was productized for good in 2009 (although the idea long predated Bitcoin), and it has been eroding the state’s monetary monopoly ever since.

It could not have been created at a better time; one wonders how Bitcoin would have fared if it had been created in the 1980s or 90s when the US economy was fairer, the monetary system was totally unquestioned, and the US was the sole dominant global superpower. Against today’s backdrop, Bitcoin insists on itself. It has urgency. In the halcyon days of Pax Americana, Bitcoin would have mattered much less. In the twilight of the American empire, however, it is more relevant than ever.

Our monetary system is disastrously redistributive

The wealth of political elites derives primarily from privileged access to the monetary spigot. This is no longer a secret. The heavenly mana of seigniorage has opened, first a trickle and now a flood. The world is grappling with inequality, and the dozens of populist revolts active in the world today are patent evidence of this. Yet the resurgent socialist parties misdiagnose the situation. The enemy is not a nebulous form of capitalism, but rather a form of socialism itself — a low-rates fueled perma-bailout to the owners of financial assets. It’s no coincidence that asset prices have steadfastly risen in the last decade, as the Fed has embarked on a ludicrously unshackled period of money creation.

Many ask: against the backdrop of monetary issuance, where did the inflation go? It went of course into financial assets. But this benefits the paltry few. Did you know that the decade-long rally in the S&P500 has been characterized by historically low participation from retail investors? The riotous gains in asset prices have sidelined mom and pop. They accrue instead to institutional investors and corporate insiders who returned capital to themselves through buybacks. In the 90s, Wharton MBAs convinced investors that the ideal mode of corporate governance was making large equity and options grants to corporate directors to create incentive alignment. Well, the grants were made, and the directors rewarded the shareholders by spending corporate earnings on buying back the stock, thus juicing earnings per share and triggering options payouts for directors. They just so happened to forgot to generate corporate value along the way. That pesky real economy… that was secondary.

Why are politicians so rich? Why do they become rich after leaving office? Why do regulators go work in industry? Why is the Secretary of the Treasury a former Goldman banker and hedge fund manager?

The Cantillon effect pictured

The Cantillon effect pictured

Why are renters historically disempowered, whereas landowners are historically privileged? Why has the cost of higher education and healthcare outpaced inflation by orders of magnitude? Why is the CPI a sad, pathetic joke? Do consumer goods account for most of your expenditures, or does rent, healthcare, and education?

What are you more exposed to? The cost of a TV, or property values?

Even if you didn’t know what the Cantillon effect was, you felt it vividly in the last decade. The hopelessness felt by many in today’s society is the consequence of this monetary misalignment; the introduction of eye-watering money into the economy, but an uneven distribution. Who benefited from historically low rates? Normal folks dealing with predatory credit card loans, or owners of financial assets who were able to put historically cheap capital to work? And no, cheap financing didn’t help the middle and lower class get a foothold in property… because property values were horrendously inflated in the first place! Property, treated as a store of value for the rich, is precisely where so many of the Fed’s newly-minted dollars settled. Reflect on those hollowed-out city centers in Vancouver, New York, and London — full of empty homes used as capital warehouses for absentee millionaires.

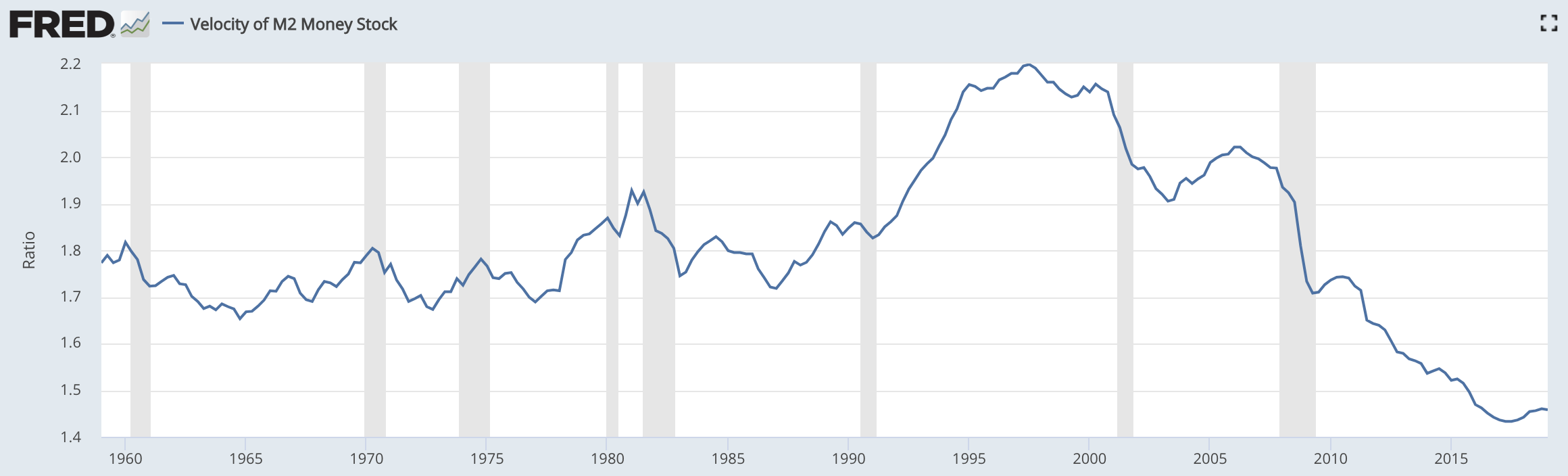

If there’s a single graph that evidences the impact of a decade of freewheeling monetary stimulus on the economy, it is the following:

Monetary velocity in the U.S. is at its lowest since modern records began. If you think about the equation of exchange (MV = PQ), a decline in V is sufficient to offset an increasing money supply (M) to keep prices (P) stable. And that’s just about what happened: the purchasing power of the dollar has remained relatively stable even as supply has expanded dramatically. “Where is the inflation?” is the common refrain, but the question should instead be “where has the new money supply gone?” It is clear that it has settled, inert and unproductive, in financial assets mostly owned by the ultra-rich, bidding them up to century highs in relative valuation terms.

This is why our perverse form of zombie capitalism is often referred to as socialism for the rich. If you can position yourself close enough to the money spigot and arrange to share in the spoils of the monetary redistribution, you can profit handsomely. If you have access to financial assets and can benefit from a low cost of capital (whether you are an investor or a corporate director with discretion over buybacks), you can make low rates and quantitative easing work for you. If you cannot, you are utterly frozen out of the system, and indeed disadvantaged, as pricier capital assets immiserate the non rentier class.

Bitcoin is a system that explicitly rejects identity

Critics often ask who, exactly, Bitcoin is for. This perhaps a misspecified question. Bitcoin does not serve a “who,” or a subset of whos. It just serves, indifferent its end users. Bitcoin, by design, does not require identity data to work. Your counterparty could be on the OFAC sanctions list, they could be a sentient toad, or a few lines of code. Bitcoin has no way of knowing, nor does it care. The only requirement to send a payment is to provide a valid signature which meets the criteria sufficient to unencumber a UTXO.

Traditional payment and credit relationships, on the other hand, enshrine identity. My credit card company is very _interested in knowing that it is me who is using the card. If I inform them that a stranger has absconded with my card, they consider all the spends post-theft _totally invalid. The call with the fraud department goes like this:

- ‘Can you vouch for the $10.51 purchase on 2/24 at Chipotle?’ Yes, that was me. Extra guac.

- ‘Can you vouch for the $463.39 purchase on 2/29 at Lululemon?’ No, I don’t habitually buy athleisure gear.

Identity data is inextricable from traditional payment networks. This is because they are many layers between payments and final settlement. An incredibly large and profitable business exists to assess the credibility of transactors and facilitate deferred-settlement transactions between them. This is because credibility and mutual trust enables massive efficiencies. You can lend your neighbor a lawnmower without demanding he provide a bond to cover its value because you trust him. Credit card networks just scale this up: they are trust underwriters, determining quantitatively how trustworthy I am, and passing along those assurances to merchants with whom I transact.

If they get it wrong, and it turns out I’m the kind of person who racks up a $10,000 credit card bill with no intention of ever paying, they swallow the cost! It was their bad. They should have done a better job assessing my trustworthiness.

The compact you implicitly agree to when you use Bitcoin is between you and the protocol, not between you and all the other users of Bitcoin. The only trust required is users trusting that the cryptographic and economic assumptions hold. So far, they have.

It has become trendy to denounce popular Bitcoiners as uncompromising, unreasonable assholes, and imply that there is something wrong with Bitcoin as a consequence, too. But Bitcoin is indifferent to this. It is a protocol for encoding and conveying value through a communications medium. Bitcoin isn’t even aware of what the price of Bitcoin is, let alone the political trends of the day. It knows very, very little about itself.

As stated above, Bitcoin is attractive and useful precisely because it rejects any identity data from the conditions required for a spend. The only thing that has to be furnished is knowledge of a private key corresponding to a public key. When you receive Bitcoin, you do not need to be aware of the identity of the sender, because Bitcoin settles probabilistically. You can simply define your own threshold for finality — say, requiring $500,000 of work to be done before you consider a transaction final. That would correspond to waiting, at current rates, for 4–5 blocks under which your transaction should be buried.

This is what allows me to accept funds from people that I mistrust, and why Bitcoin is carving out a niche in these frontier transactions. Think of a ransomware hacker and his victim. These people mutually mistrust each other. They victim has been wounded and attacked. But the hacker still trusts that the $500 sent to them for the ransom in the form of BTC is a valid, unlikely-to-be-reversed payment. You may not like this. But Bitcoin flourishes on the margins of society. These are increasingly widening, as banking becomes politicized and used as a political tool, as the U.S.-driven settlement system is coopted for strategic objectives, and as identity requirements for payments networks become ever more rapacious.

Transacting with people you have no reason to trust is precisely why Bitcoin exists. The internet allowed us to transact with people on the other side of the globe, but internet commerce is beset by fraud. The reason credit cards are expensive is because the costs of remediating fraud and chargebacks are socialized.

If you aren’t comfortable with evil people using Bitcoin, you should abandon it now

Of course, the jettisoning of counterparty trust (and risk) comes with some perceived drawbacks. Principal among them, you cannot evict someone from your network. This is very uncomfortable to people who believe that money ought to be a political tool, to be exploited to disempower political foes of the day.

There is a particular paradox in demanding that the members of a network you have inserted yourself into adhere to a certain moral code of conduct. As stated above, Bitcoin, and fast-settling hard money more generally, exists to facilitate commerce between individuals that do not have a pre-existing bond of trust. What did inter-continental traders use to transact in the 17th century? They certainly didn’t use IOUs, wampum, collectibles, or credit relationships. They knew that they might never see each other again, so they used the hardest money they had available — gold and silver. Monetary metals speak for themselves; they are no one’s liability.

In this same way, Bitcoin is a means to transfer wealth between individuals who both have an interest in final settlement. It is not a means to establish a credit relationship (although Lightning is an early move in this direction). Bitcoin is deliberately amoral, it has no requirements to entry and asks nothing of the user aside from a valid signature. It facilitates commerce between people who explicitly disagree with each other. Thus trying to impose a moral code on Bitcoin is contrary to its very nature. If everyone who used Bitcoin agreed with each other, then no one would need Bitcoin — they could all exchange IOUs backed by their mutual trust in each other. But because the world is messy, and people disagree with each other, hard money is warranted. Our chaotic world practically demands it.

So if you are the kind of person that rejects a useful transactional medium because someone you dislike is using it as well, it wasn’t suited for you in the first place. Bitcoin is edgy precisely because the world needs a payment and savings system which cannot be interfered with on moral or political grounds. To repudiate these transactional constraints is to violate the carefully poised moral setting that has seized the West. If stepping out of line isn’t for you, stick to Paypal instead.

Bitcoin is an apocalyptic death cult…

As Bitcoin hater-in-chief David Gerard so elegantly puts it, Bitcoin is in fact an apocalyptic death cult. Apocalyptic, because Bitcoiners recognize the futility of the current monetary system, and appreciate that it is likely to end in tears. Death, because States won’t give up their monetary privilege easily. Bitcoin is veiled in eschatological overtones. Cult, because you have to be somewhat deranged to take a pill this black.

Freedom is not “Free”.

Freedom is not “Free”.

So spare a thought for the Bitcoiners. They are fully awakened to the pending grief and strife that await us, Cassandras warning governments and citizens alike to the disruptive effects of truly sovereign currency (sovereign, as in free, not as in State-owned). But unable, most of the time, to convince their fellow man that the State’s monetary machinations may not be sound. Most people are content to surrender all freedom and autonomy to the Leviathan, as long as the pot they are in boils slowly.

… but it’s open to all

The exact reason that Bitcoin is despised by so many— identity, creditworthiness, and trust are irrelevant in this system, making it a fertile ground for criminals — is the exact reason why it’s so inclusive. Unlike Paypal, Venmo, or traditional payment processors, it cannot deplatform you for wrongthink, holding subversive political views, being a sex worker, or legally selling cannabis. Ours is the biggest possible tent. Don’t be distracted by the online discourse. Bitcoin is utterly indifferent to the political views of its users. Its core developers, the high priests of the protocol, can barely change it: (implementing a fairly routine upgrade, SegWit, took them _years _of cajoling and pleading). Getting it to do anything other than produce blocks, accept valid spends, resolve forks, and relentlessly march onward is virtually impossible.

Whether Bitcoin will challenge the State, or whether that task will be left up to a successor, is yet to be determined. That the State’s monetary privilege has been permanently eroded is evident though.

It died a little that day in January 2009 when the Chancellor [was] On the Brink, and it has been shrinking ever since.

By Nic Carter, Oct, 2019

The Bitcoin Times Ed 2 is the collaborative work of 8 writers & 1 designer with the intent to educate, inspire and spread ideas on bitcoin.

Each section will be released on Medium as a free long form article, and the full, compiled version of the Bitcoin Times will be available for free at the link below. In 2020, we’ll release a limited edition hard cover collectible, for purchase, which you’ll be notified of by email if you download the free pdf.

If you found value in this or any of the other essays and articles, please support each of the contributors by sharing it out & following their work.

Download the full guide at:

(Soon to be updated to: https://bitcointimes.news)

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |