On Schelling points, network effects and Lindy: Inherent properties of communication

On Schelling points, network effects and Lindy: Inherent properties of communication

Willem Van Den Bergh

June 29, 2018

The above mentioned phenomena are widely known among Maximalists and although they seem to apply to Bitcoin on an intuitive level, I wanted to define these principles on a higher resolution. Only after establishing this framework in detail can we better understand why these effects make Bitcoin such an all-consuming force to contend with. Furthermore, it will become evident why “successful” alternative blockchains like Ethereum cannot compete with Bitcoin. (Disclaimer: this article presumes a basic understanding of the above mentioned effects).

What really got me puzzled at first was the insight of Giacomo Zucco during episode 0.14.0 of the Noded podcast (hosted by Pierre Rochard and Michael Goldstein). There he elaborated on his insightful observation that although capitalism is an immensely powerful tool for the advancement of society, there are some anomalies that do not abide by these traditional properties of free market capitalism.

Unlike all other products, protocols do not benefit from the perpetual struggle of competing markets as one would assume to be the case in a healthy capitalist environment. Rather the opposite is true; protocols tend to converge to one sole victor over time who subsequently becomes the dominant monopoly player within its respective market. But what do we mean exactly by protocols? Is it constrained to computer protocols like HTML, HTTP and TCP/IP? All proven to be monopoly king within their respective markets. Or, just as Zucco suggested by referring to the English language as a protocol we all concede to in this globalized world, is there a bigger picture? Let us investigate a good example of a market that has benefited from this tendency towards monopoly to illustrate the point.

Video tape format war:

In the early seventies the time and technology was getting ripe for the conquest of the home cinema market. For the first time in history it would be possible for millions of households to enjoy the full scope of movies from the comfort of their own houses while at the same time also making it possible to record public TV broadcasts. The battle for the consumer was commencing and what ensued was a 10 year death struggle between the 2 predominant market leaders; JVC’s VHS cassette (video home system) and Sony’s Betamax. Both products hit the market in 1975 with very similar features. Though most people only remember the two mentioned above, the late seventies offered a wide variety of alternatives (for example Avco’s cartrivision). All of whom were destined for a quick demise.

The advantages of both competitors became clear, once the market started to develop. VHS had a slightly lower retail price and offered a recording time of 120 minutes, while Betamax was putting emphasis on video quality but only allowed for 60 minutes of recording. The battle for the US consumer was gathering steam but over the coming years it proved to be easier for JVC to enhance the product quality while Sony was struggling to increase its recording time. The Americans started to favour VHS and by the end of the 1970’s JVC controlled 70% of the US market. In 1980 Europe started to warm up to this new medium and families all over the continent started to buy into the video recorder. Though by this point both availability and a better optimized economy of scale led a lot of households to adopt VHS over Betamax. VHS was the emerging Schelling point in the space of home cinema. Betamax kept competing during the early 80’s but its success continued to dwindle and by 1986 its global market share had dropped to only 7.5%. Shortly after Sony threw in the towel and VHS became the monopoly brand in the sector. Any competition thereafter proved futile as VHS now enjoyed the fully fledged benefits of the Lindy Effect.

Other examples, all with equally fascinating origin stories, that enjoy the network monopoly effect include: Facebook, Amazon, PostgreSQL, the English language, the dollar, google, USB ports, CD, HTML, Windows, bit torrent, YouTube, the metric system, TCP/IP, HTTP, Binary code, Wikipedia.

There is one binding factor that this broad collection of networks all share in common: They all belong to the sphere of communication. Whether it’s VHS recorders that provide an analogue interface model to communicate movies from tape to screen, TCP/IP that makes it possible for all email clients to send content to each other or USB ports that allow multimedia devices to have a direct line of information exchange. Communication is their core function. In any other sphere you can name, whether it be entertainment, sports, consumable or durable good, services, arts etc, there is no inherent tendency towards monoculture. Rather, the opposite is true: when one of these spheres tends towards monopoly, the product quality becomes increasingly stale and the market starts to collapse due to falling revenue and lack of diversity. People only buy out of pure necessity or lack of alternatives. These markets cannot function without the essential stimulus of competition. Communication truly seems to be the only sphere that successfully escapes the beneficial dance of perpetual competing capitalist markets. It’s even worse than that, if there is choice within a certain communication protocol market, it seems to diminish cooperation and efficiency rather than enhancing it. To be clear, in the early stages, fierce competition is more than welcome; it’s the only way to arrive at a broad consensus among all market participants. The statement above just highlights the outcome, not the initial selection process. Note that for this thesis hardware communication is defined as equipment that interacts in a physical manner, mainly this interaction happens between a media carrier (for example a DVD) and a media decoder (DVD player). This definition allows us to make a clear distinction between communication hardware that evolves towards a monopoly (CD, DVD etc.) and communication hardware that does not evolve towards a monopoly (Personal Computer, Smartphone etc.)

The case for monopoly:

So we’ve established that communication protocols in general tend towards monopoly. This definitely doesn’t need to be a bad thing, quite the opposite. There are three main reasons why I think communication is antithetical to market competition in the long run.

-

A new form of communication requires a considerable adaptation period; it needs to be learned in the case of humans, developed in the case of software or designed in the case of hardware. These adaptations represent the sunken cost on behalf of all participants in that specific communication network. This considerable sunken cost entrenches the user of that network and makes them unwilling to change to a different protocol on the basis of some arbitrary additions or improvements. This is what you might call protocol loyalty. It signifies the inefficiency of repeatedly switching between different communication networks.

-

Furthermore, the division of the market between several competing protocols represents a problem of compatibility. Choosing one communication model over the other immediately connects you to all individuals within that group but at the same time prevents you from having any communication to people who prefer another model. The different protocols become isolated from each other and all networks start to form closed-off parallel communities. This unavoidably leads to the fragmentation of knowledge and information, which in turn results in less optimal use of time and resources. Division of labor cannot express itself to its fullest in a fragmented society. This compatibility problem only occurs in the sphere of communication. All the other spheres do not suffer from a diminished potential of collaboration as a result of having several competing products. We don’t all need the same brand of car in order to get along in traffic, we don’t all need to wear the same brand of clothes in order to fulfill the socially acceptable standard of appearance, we don’t all need to watch the same sport in order to have entertaining high level competition etc.

-

Finally I would add that protocols are not static but organic of nature. They can adapt to new circumstances or implement solutions when confronted with previously unknown flaws. Without this ability to adapt or evolve, communication networks would not be able to persist long enough to amortize sunken costs.

Money as communication

Money is one of the most effective forms of communication known to mankind. As Nick Szabo defines it in “Shelling out”: “Money converts the division of labor problem from a prisoner’s dilemma into a simple swap”. It is the communication tool that allowed us to scale up from barter based tribes no larger than the Dunbar number into thriving societies and civilizations with millions of people cooperating in peace. Money is the language in which we communicate value to one another. Since humans are social beings and we have a proclivity to create value systems as a tool to make sense out of our environment and the world, despite what some utopians might claim, there will always be a need for money, no matter how advanced or altruistic the society. Because money is a form of communication we can therefor assume that it will act as any other communication protocol; it will converge to a single protocol (in Austrian economics this market chosen protocol is called the most saleable commodity). This is also proven by history, which again and again converges to gold.

It is through this reference frame that we can understand precisely how the following three effects synergistically feed into all forms of communication (money being one of the most important):

Network effect:

This is the driving force behind any emerging form of communication. As famous network effect pioneer W. Brian Arthur puts it “Modern, complex technologies often display increasing returns to adoption in that the more they are adopted, the more experience is gained with them, and the more they are improved” (from his famous paper “Competing technologies, increasing returns, and lock-in by historical events”). This of course implies there is to some degree a randomness effect at play because early on small events can sway the adopters in one direction or the other creating a feedback loop which can lead to the lesser protocol becoming the monopoly (VHS was considered inferior to Betamax in the seventies). Although the best protocol doesn’t necessarily win, it’s important to point out that there is only room for very little variation between competing candidates. There is an infinite amount of possible formats that can exist as a protocol within a specific communication domain, but there is only a very tiny amount of viable formats that can pass the test of the free market within that domain. Despite the fact that viable contenders always try to promote themselves by accentuating how different they are from one another, in essence they only diverge in the details. From a broader perspective, VHS and Betamax are almost identical. The whole video cassette competition took place within a very narrow set of logistical and technological boundaries. It was the details and minor price differences that proved pivotal. As a comparison; the differences between Ethereum and Bitcoin are more substantial than those of VHS and Betamax ever were. Claiming that Ethereum competes with Bitcoin is absolutely preposterous. It’s like saying Atari Pong was competing with VHS, a straight out idiotic proposition (more on this later).

|

|

|---|---|

| Betamax and VHS (left) | Atari Pong (right) |

Hardware communication networks also have another factor at work, the economy of scale. Creating another layer of feedback loops for the protocol in the lead. This is less of an aspect in software technologies, though open source projects have incremental advantages with growing adoption as a consequence of Linus’s Law; “given enough eyeballs, all bugs are shallow”.

And then there is the most important factor of the network effect, Metcalfe’s law. This is a well documented and well known aspect of networks. So without going into too much details: Metcalfe’s law states that a network becomes proportionally more valuable the more users it has. The relationship between the network value and amount of users is n². Where n is the amount of users and n² is the value of the network. This makes sense at an intuitive level as the larger the group of users gets the more unique possible connections can be formed which in turn increases the functionality of the network. But the theory also holds up in practice when examining the vast amount of data we now have available since the mainstream adoption of the internet (see “Empirical validation of Metcalfe’s law: How Internet usage patterns have changed over time” by António Madureira).

Both the Schelling point and the Lindy effect can be considered a subcategory of the network effect.

Schelling point:

“A Schelling point is a solution that people will tend to use in the absence of communication, because it seems natural, special, or relevant to them”. The classic definition of the term Schelling point does not directly indicate it has special relevance to emerging communication technologies, but in my honest opinion, it does. The description bellow is a generalization of the mechanism that takes place when the market is sorting out who will become the monopoly.

During the first years of a new emerging technology, people mainly show interest in it due to its novelty. People didn’t really care if that new gray box underneath their TV was compatible with VHS or Betamax, they just wanted that home cinema experience. It’s hard enough already to figure out how this new technology can even possibly record live broadcasts! Even more problematic, they had no reference point or experience to properly asses the quality of the products being offered. The Schelling point had not revealed itself yet. But as the market matures, stakes rose and the consumer got smarter and more informed, people wanted their specific choice of movies and they wanted one universal recorder to play them all. So they were forced to make strategic decisions, they wanted to be on the side of the winner! Will my local store offer mainly VHS or Betamax? And in 5 years, will I still be able to use my recorder? So to the best of their incomplete information, they tried to pick the network which would survive in the long run. They actively attempted to select the Schelling point product. A maturing market can stay in this period of flux for quite some time, but once a Schelling point starts to gather steam, things can move quickly and a lock-in is imminent. Again bear in mind that the Schelling point can only shift between different protocols that are almost identical, the free market is very intolerant of protocols that stray too far from the narrow viable format formula.

Lindy effect:

The Lindy effect is the concept that the future life expectancy of a technology is in proportion to its current age. It is the final stage of a communication technology and comes into full effect once lock-in is established. Let me use the metaphor of W. Brian Arthur to explain: Imagine an infinitely long bowling lane. When you make a near perfect throw, the bowling ball can stay in the middle for an extensive amount of time, but at some point a divergence has to take place towards the gutter one way or the other. From that moment on the direction is virtually irreversible and the Schelling point has revealed itself, once the ball hits the gutter it is locked-in and the Lindy effect reaches maximum enforcement. In this case the emerging communication market is the bowling ball and the gutters resemble competing protocols. This is also what happened in the VHS-Betamax feud. For some years it could have gone either way, predicting the outcome at this point was pure speculation. But then VHS started to take the upper hand in Europe and all of a sudden the lock-inhappened, sealing the fate of Betamax. I believe the main power of the Lindy effect lies in the irreversibility of acquired monopolies through lock-in. It transforms the sunken costs of all participants in aggregate into an intolerant and permanent status quo established by free market consensus making. Especially good examples of protocols that benefitted from the Lindy effect are TCP/IP, HTML and HTTP.

Next generation technology: Lindy cycles

All the above sounds really nice, but if the story ends here then we would have no way to break through any Lindy effect ever, including that of the dollar. Monopolies would stay monopolies and that’s that. So let us once again revisit our video recorder example. No story truly lasts forever, and VHS had a long and dominant run. But times change, and technologies change even faster. When the DVD came along, a major transformation had taken place in society. Computers slowly but surely started to compete with the classical TV set in our living rooms. The world was moving from an analogue society to a digital one. And with a digital world came digital media. The Lindy Cycle of analogue video recording had come to an end.

It’s not that the VHS Lindy effect became obsolete for some random reason. But the DVD was a totally different and improved experience altogether. DVD is the next generation technology in the video communication market. Where VHS was the undisputed king in the realm of analogue video, the DVD represented an improvement of several orders of magnitude because of its digital nature. Vastly better video quality, longer play times, easy scene selection (no more rewinding), great interface possibilities, multiple audio tracks, deleted scenes… It is this kind of innovation that breaks open the Lindy effect. Only a paradigm shift justifies the time and energy expenditure needed to make the long and burdensome transition from one protocol to another. During this transition period a lot of logistical, cognitive and financial sacrifices have to be made on behalf of the network users. The DVD passed this test with flying colours, it justified the abandonment of sunken costs that VHS represented. It is also worth mentioning that you can be the holder of the Lindy effect of a next generation technology even before you have broken up the previous generation Lindy effect. Lindy Cycle’s of succeeding technologies can temporarily overlap during the adoption phase of the next generation technology. For example: VCD was defeated by DVD in the US markets well before VHS dominance in the video space had ended.

The case for Bitcoin

I believe Bitcoin is the seminal improvement in the money technology language that will lead to the breakup of the current Lindy effect enjoyed by our current money protocol monopoly aka the dollar. I understand that there is a huge amount of alternative currencies but since the dollar is the world reserve currency it effectively functions as the global monopoly of money. I am not going to lay out the full history of money and its many transitions from protocol to protocol through time, but please do check out Nick Szabo’s “Shelling out” and “Collecting metal” as they make a great summary of our early monetary history. The period that is relevant to this discussion is the last ~ 150 years.

The gold standard:

Though a lot of empires and tribes have used gold in one way or another as a monetary standard throughout history (and consequently met their demise after abandoning it), the most recent and globally implemented example of this is La Belle Époque, spanning from 1871 to 1913.

Considered by many as the pinnacle of human endeavour and prosperity, the latter half of the nineteenth century up until World War 1 was an era of unprecedented sound money. During this economic and technological boom the US and all the prominent European countries worked together under this standard. A further improvement was made on top of this communication protocol by issuing 100% redeemable bank notes. These were a lot easier to carry around and allowed for smaller purchases, thus greatly improving the portability and divisibility of gold. They started out as a great second layer solution to the limitations of gold but little did we know how much these bank notes were going to be abused and exploited by nation states in the coming century, ultimately leading to the demise of the gold standard. The more these notes were adopted by the general public, the less need there was to hold physical gold. As a consequence gold became more and more centralized at the banks due to the logistical benefits this entailed (less and less settlement costs). Over time this process put the responsibility of maintaining the gold protocol in the hands of less and less actors, who subsequently gained increasing amounts of power. Generation after generation the general populace became more disenfranchised from the superior proposition that sound money can offer society, it was a slow collective amnesia event. Money became easy, and debasement became the norm. Over time, gold always consolidates under the control of the few, be it emperors or central banks. This is the quintessential flaw of gold and it has been exploited many times in the course of history. A famous example is the debasement of the Aureus golden coin issued by Julius Caesar. Over the centuries it got continuously debased (same is true for the silver Denarius) until finally leading to the collapse of the Western Roman empire. For this reason I do not consider the dollar as a separate Lindy effect holder as compared to the gold standard Lindy effect. It doesn’t matter that the dollar is completely fiat and without gold backing, it is rooted in the gold standard and could never have existed without this prehistory. The dollar is simply the contemporary representative of a gold standard in its final stage of decay. There have been many of these gold standard iterations before, and if Bitcoin fails for whatever reason, there will surely be many iterations of the gold standard in the future. Without ever achieving a different final resolution.

The next generation of the money protocol: Breaking open Lindy

This limitation of the current money Lindy Cycle is exactly the problem that Bitcoin is trying to address. Due to the invention of the blockchain technology, it is now possible to effectively isolate monetary policy from any human interference while at the same time avoiding the centralization mechanisms inherent to gold. It allows us to create a non-sovereign money in the digital space, a truly groundbreaking achievement (to understand how Bitcoin accomplishes this, read Bitcoin: A Peer-to-Peer Electronic Cash System by Satoshi Nakomoto). This quality is so unique and mind boggling that there isn’t anything yet that comes close. Furthermore, Bitcoin has an even scarcer supply then gold. It is what Saifedean Ammous likes to call absolute scarcity(for more information read The Bitcoin Standard: The Decentralized Alternative to Central Banking). For these reasons I believe that Bitcoin is the next generation technology for money, it has what it takes to break open the prevailing Lindy effect!

This rational also completely demolishes the “blockchain not Bitcoin” mantra as the Schelling point is purely based on bitcoin the money, not blockchain the technology. Blockchain is just a tool, a very sophisticated but narrow tool, specifically designed to allow Bitcoin to have monetary properties that were unthinkable before. A blockchain without similar monetary properties than Bitcoin is like a computer in the middle of the jungle without any access to electricity, a useless piece of junk.

Bitcoin the Schelling point, Bitcoin the Lindy effect holder

The transition towards the next generation money protocol has been going on for well over 9 years now and there are undoubtedly a lot more years of adaptation to come. But by this point it’s becoming increasingly clear that Bitcoin is the undisputed Schelling point.

The main reason being that for all this time Bitcoin really hasn’t gotten any decent competition. Very few altcoins seem to focus on an immutable monetary policy, and the ones that act as if they do (for example BCash, Litecoin) completely neglect the centralization problem that got us into this financial mess in the first place! So for whatever reason, 99.9% of all altcoins totally abandon BOTH preconditions to be able to compete with Bitcoin as a next generation technology of money. Of course competitors being so naive and horrendously awful at design and game theory doesn’t go unpunished. Fact is that by this time Bitcoin has been able to build up such a considerable lead (Hash rate, developer community, decentralization, code quality, reputation of extreme security, liquidity, amount of users and nodes, ossification of its core principles…) that is seems virtually impossible to break its Lindy effect. If the bowling ball isn’t in the gutter already, it’s so close that you would need a damn miracle to prevent it from locking in!

As discussed earlier in this article it is not necessarily the best protocol that wins. But the margins that competitors inevitably have to compete within, in order to qualify as a viable format, are extremely narrow. I believe that in order to take over the Schelling point of Bitcoin (as unlikely as it is at this point) there are some indisputable principles an altcoin has to adhere to.

1. Proof of work:

POW is the key to unlock the solution to the double-spending conundrum. It is a vital cornerstone to build a secure and trustless money protocol. Despite what some altcoin hucksters might claim, it is the only consensus algorithm that actually works. The best analogy comes from Tuur Demeester; alternative consensus algorithms are the modern day alchemy, they try to create something of value out of thin air. A delusion that will probably be propagated for many years to come. Furthermore, whether you like it or not, ASICs are an inevitability in this business. Nothing is ASIC resistant; the best you can hope for is ASIC tolerance that lasts a year or maybe two. If someone wants to compete with Bitcoin they better embrace ASICs, the alternative is constant danger of 51% attacks.

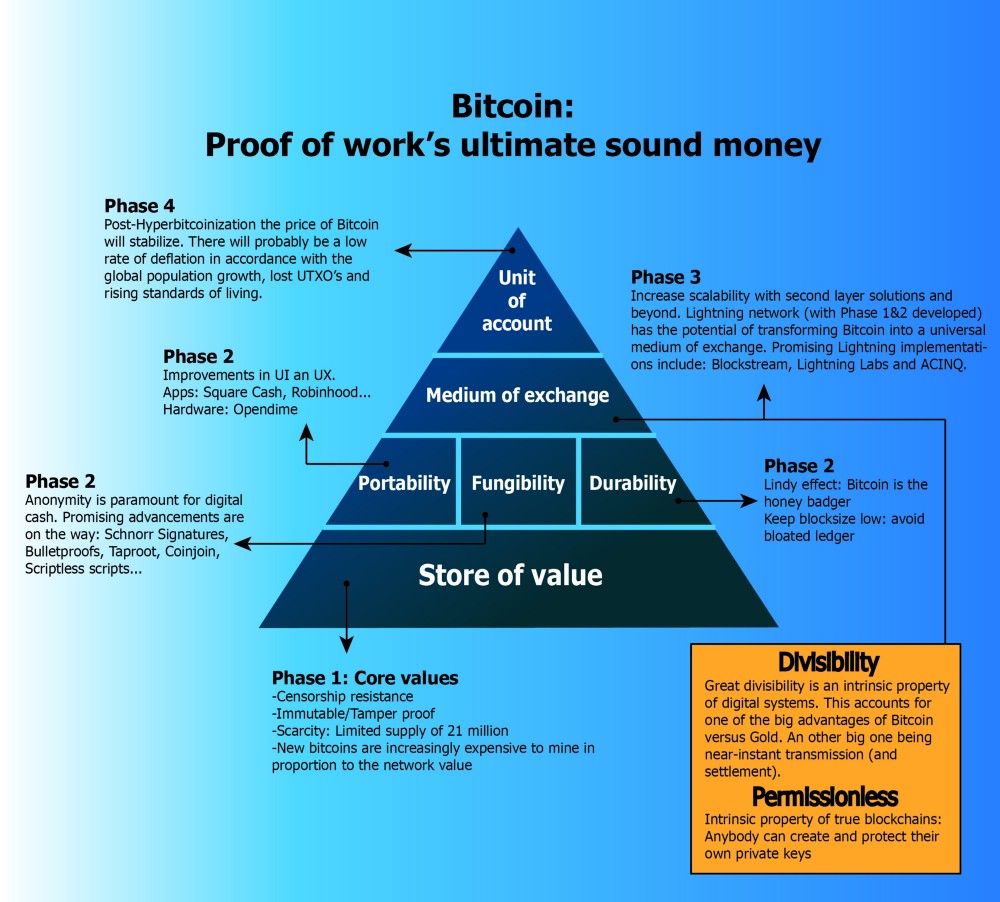

2. Heavy emphasis on store of value:

As Nick Szabo illustrates in Shelling Out, proto-money emerges as a store of value and a medium of wealth transfer. These proto-moneys are selected on the basis of their unforgeable costliness. Bitcoin is strictly scarce, making it the hardest money in existence. For another blockchain to compete, the same strictness or more will have to be applied.

The Bitcoin utility stack, everything has to be built on top of the store of value bedrock

The Bitcoin utility stack, everything has to be built on top of the store of value bedrock

SoV can function as a basis and other utilities can then be built on top of this bedrock. It absolutely does not mean that medium of exchange is not a vital part of money. But the reality is that creating a medium of exchange is fairly simple, creating of store of value on the other hand is something never attempted before in the digital space and probably needs decades to mature and cultivate.

3. Heavy emphasis on decentralization:

This is by far the hardest concept and it can express itself in many different forms. Centralization is a constant threat. It can manifest itself in governance for example. The only way to limit this flaw is by keeping the governance strictly off-chain as Bitcoin does. On-chain governance will inevitably lead to the loss of sovereignty of its users. The UASF of 2017 was a great example and the undisputed proof that off-chain governance is the only way to preserve decentralization of decision making, once and for all debunking the myth that miners have all the power. Another centralization threat is node deficiency, a danger that Bcashers cannot grasp for some reason. Fewer nodes greatly reduces the ability of users to exert influence on governance and selection of the valid chain. Centralization can also manifest itself in miner cartels, probably the biggest threat to Bitcoin right now but improvement might be on the horizon (Matt Corallo’s BetterHash, Sony entering the ASIC market). Many other forms of centralization exist, but they go beyond the scope of this article.

I could easily write another 20 minute long article just to discuss these 3 fundamentals of Bitcoin in more detail. But the bottom line is that from an objective perspective, there is not one single altcoin that comes even close to the high standards of Bitcoin concerning these 3 principles. This framework makes it abundantly clear that Ethereum cannot be compared to Bitcoin as it does not even compete it the same communication market. Ethereum doesn’t want to be a money, it wants to be a decentralized application platform (and a very bad one at that).

Top down Schelling points, false lock-ins and open source

There is one last important topic we need to address in order to understand Bitcoin; the relevance of its open source nature. Through history many communication protocols emerged and vanished. And beside money itself, it is only in recent times that companies or third parties were able to monetize them. Before analogue and digital media, our societies only had access to a small number of communication markets, for example language itself. You could posit that the English language was and still is an open source project created by society at large. In our modern age we have grown used to companies being the patent holders of communication protocols (Facebook, YouTube, Blu-ray etc.). This is an unnatural state of affairs because communication networks spontaneously evolve towards monopoly, and putting a small group of people or a company in control of the whole market is the equivalent of central planning. There are two big problems with communication markets that are not open source:

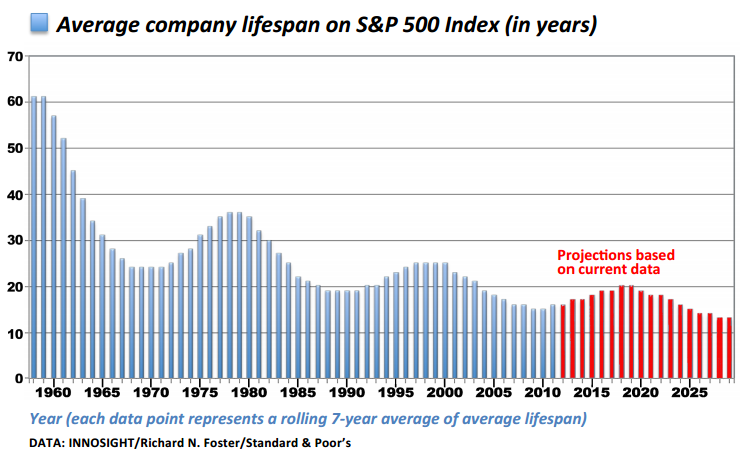

Firstly, all companies grow and behave in a predictable manner (To learn more about this read “Scale: The Universal Laws of Growth” by Santa Fe Institute professor Geoffrey West, or watch his TED talk). Geoffrey West makes the point that growing bureaucracy and administration in big firms contribute to its unavoidable demise. Humans make the architecture of a corporation increasingly vulnerable over time. The vertical hierarchy that defines firms lends itself to all sorts of rent-seeking, abuse and miscommunication. The result is that companies all follow the same life trajectory. They grow up (hockey stick), they bend over (plateau), and then they all die. All companies have a limited life expectancy and Microsoft, YouTube or Facebook are in no way an exception to this rule. An average S&P 500 company today has a life expectancy of just under 20 years. This inherent instability poses a big problem because they limit the degree to which company protocols can enjoy the Lindy effect. Open source does not have this vertical hierarchy problem, as it is a permissionless meritocracy. The administrative and managerial costs are stripped to the bone due to the horizontal and open approach. Anybody can work on any problem at any given time, and the most interesting improvements will be picked up and integrated into the source code.

As our economy deteriorates under Keynesian impulses, the average company lifespan decreases

Secondly, communication protocol companies do not wish to share the burden of maintaining and improving their product with the general public because that means they would have to share the profits. You can sustain this creative input asymmetry for a reasonable amount of time but in the long run open source always wins out on closed source. It is a mathematical certainty, proven over and over again, that the joint efforts of passionate volunteers out-compete the highly paid corporate methodology. In the nineties for example, intranets jumped out of the ground like mushrooms. Firms were not convinced of the internet as a whole and thought they would be better off using their own closed off intranet infrastructure. Over time it has become evident that intranets become stale rather quickly. Despite still being used today they are a fascinating illustration of how the quality of open source and closed source projects diverge over time. The evolution of a communication protocol is an organic process that can only be improved on by trial and error of society as a whole. Assuming that a small group of people in a corporation can perfectly predict the needs of an entire market is naive, a communication protocol cannot function properly under central planning. A single company that controls a communication protocol is the exact antithesis of capitalism, it completely undermines the competition of ideas. Open source on the other hand thrives on the competition of ideas due to its uncompromising meritocratic nature. Open source is the perfect solution to this communication monopoly conundrum as it transfers the free market of ideas from the inter-protocol domain to the intra-protocol domain. In the long run I think it is inevitable that all forms of communication migrate to open source. The days of companies like Facebook, Amazon and Google are numbered.

Thankfully Bitcoin is completely open source, probably the only one in the whole crypto space. Altcoins simply cannot compete with Bitcoin because fundamentally they are companies, not protocols.

Conclusion:

The Network effect, Lindy effect and Schelling point are facets of one overarching phenomenon i.e. the adoption of one monopoly communication protocol through free market competition over time. The communication monopoly effect, if you will. With the emergence of Bitcoin it is becoming increasingly clear that the Lindy Cycle of the dollar is coming to an end. We must be thankful for the timing of this event because I believe it is still possible to transition to Bitcoin before the complete collapse of the current late stage gold standard iteration. Bitcoin is the pinnacle of what human endeavour and technological progress is capable of, as it brings together a large variety of fields including cryptography, politics, distributed systems, economics, game theory etc. It took us thousands of years to come up with a worthy successor of gold as our money protocol and therefore I think it is reasonable to assume that the Lindy cycle of Bitcoin will rule for at least hundreds of years to come.

- Many thanks to Dirk vandekerkhove for the comments and feedback