Money Crypto vs. Tech Crypto

Money Crypto vs. Tech Crypto

By Erik Torenberg

Posted in October, 2018

Crypto has a bit of a narrative problem.

When talking about Why Crypto Matters and where The Big Opportunity is, people often begin from different assumptions and starting points, and, more importantly, have a different end game in mind, which leads to confusion: investors are unclear what thesis they’re applying to the market, newcomers struggle to follow along, and maximalists spend endless energy trying to convince one group to think like the other, without fully appreciating where they differ (or align!) on first principles.

Let me try to simplify by painting a (very broad) picture of the two main belief systems in the space:

One belief system maintains that the point of cryptocurrency is to redefine how money works by (re-)introducing Sound Money. Let’s call this narrative “Money Crypto”.

Another belief system holds that the real point is to redefine how the internet works by introducing Web 3.0. Let’s call this narrative “Tech Crypto”.

Others call these respective narratives “Bitcoin Maximalism” and “Ethereum Maximalism”, but it’s broader and more expansive than that.

While there’s overlap between these belief systems, to be sure, they have different aims, different approaches, and different philosophical underpinnings – which leads to some of the confusion.

Money Crypto

Money Crypto believes that the goal of all this is the introduction of Sound Money – money with an iron-clad monetary policy that cannot be changed by governments, central-banks, or other entities.

With Sound Money, governments will be forced to behave responsibly because they are no longer able to borrow from tomorrow (via debt/inflation) to finance wars or fund short term political objectives at the expense of long term wealth.

Money Crypto believes that censorship resistant store of wealth is paramount. This may seem strange to us living in the U.S., where we trust our banks and governments (for now!), but much of the world doesn’t have that luxury: People suffer from corrupt governments, currency controls preventing people from covering capital, and currency inflation due to government instability.

Money Crypto believes, naturally, that Bitcoin is superior because it is an un-inflatable, disinflationary, censorship-resistant, fixed-supply asset that can’t be shut down by any government and operates without any trusted-third parties.

The Bitcoin/Bitcoin Cash almost-civil-war over block size doesn’t scare Money Crypto. On the contrary, it gives them more confidence: If it was so hard to change something as small as the block size, it will be nearly impossible to imagine changing something as monumental as money supply

Money Crypto believes that, of all currently existing cryptocurrencies, Bitcoin has the best chance of being sound money. It has the “immaculate conception” effect: an anonymous, uninvolved founder and no central entity; It’s got the first-mover advantage; It has the greatest lindy effect; It has the highest market cap; Most liquidity; Most credible monetary policy and scarcity; Best censorship resistance; Best brand; Best durability; Best network effects, etc, etc, etc.

Money Crypto believes that we should treat cryptocurrencies as money – and not as the next app store or the next software platform that captures all of the VC dollars.

Money Crypto believes that the internet is a faulty analogy for studying the nature of money, and that we can instead learn more about the future of cryptocurrency from studying economic history and how monies have emerged over time.

What can we learn exactly? That whenever people control money, they create more of it — insidiously diluting existing money holders in the process.

Money Crypto believes that Ethereum is novel and interesting, but the value it creates (let alone captures!) will be orders of magnitudes smaller than the next money (Bitcoin). All the apps / dApps being built on top of Ethereum will create some value — but it won’t make ETH, the token, a better money. Yes, Ethereum has many more developers, but Money Crypto believes 1 protocol developer is worth 10,000 app developers.

Money Crypto explicitly rejects the Utility Hypothesis, maintaining that digital money will be SOV first, not MOE first.

Value capture is insanely hard in decentralized realm, the logic goes. Indeed: If decentralized applications succeed at removing middlemen and rent seeking behavior — they won’t create revenues, they will destroy them.

Money Crypto is specifically “Bitcoin, not blockchain”. Nearly all Blockchain use cases are not merely unnecessary — they also make the application slower and more expensive.

Indeed: Satoshi used blockchain structure in an extremely specific and deliberate sacrifice of a massive amount of speed & cost in order for us to achieve sovereign level censorship resistance, trustlessness, and greater social scalability.

To summarize: Money Crypto believes The Future of Crypto isn’t software — it’s money.

Crypto isn’t equity. It’s not a website. It’s not a company. And It’s not social media network.

It’s money.

Tech Crypto

Tech Crypto, on the other hand, believes we should study the history of the internet – rather than the history of money – to help us understand how cryptocurrencies will evolve, and how they will usher in the next epoch of the internet, web3.

The narrative goes something like this: Although the internet started as a decentralized and open system, it quickly became centralized and concentrated among 5 players — Google, Amazon, Apple, Facebook, and Microsoft — addicted users, controlled their attention, monetized through advertising, acquired those that compete, and shamelessly copied those who somehow survived.

Far from fulfilling its original vision of decentralizing control, web 2.0 has in fact created power centers that are orders of magnitude larger than anything that preceded the internet. Although the marginal cost of moving packets around on the internet is 0 – and despite the amazing economic gains and consumer surplus that web 2.0 has produced – the social costs have been significant: grotesque inequality, end of privacy, fake news, monopolies, filter bubbles, a threat to democracy, and more.

Tech Crypto believes that the internet will only have increasingly more of a say in how power and wealth is distributed, and fixing the incentives (via cryptonetworks) is one of the most important things we can do, along with enabling consumers to own and control their own data.

Had the token model for network development existed during web 2.0, things could have played out differently:

Tokens provide a way not only to define a protocol, but to bootstrap the operating expenses required to host it as a service.

Tokens power the economic incentives to enable distributed computation – compute, storage, bandwidth – at scale in a decentralized way.

Tech Crypto views tokens as the most salient innovation in human-coordination mechanisms since the invention joint stock corporation centuries ago. Before the joint stock company corporation, businesses had natural limitations. People owned the businesses in their entirety and passed them down to their offspring. There was no liquidity in equity, and therefore businesses could not raise capital.

The advent of joint stock corporations, and more recently publicly traded corporations, has produced incredible businesses that wouldn’t have been possible otherwise. We’ve seen, however, the faults of those same systems:

The joint-stock equity industry model is inefficient at accounting for actual value creation behind online networks, as in, it only rewards employees – not users, contractors, or developers. Value of a share of stock is a function of profits. And profits reflect companies’ ability to monetize data — not the actual worth of the service. When a company reaches a certain size their incentives become misaligned with their users and developers building on top of them.

Tokens also do something else which may enable the disruption of hitherto unbeatable network-effect businesses: they – in theory – incentivize orders of magnitude more people to contribute to the network. This includes all stakeholders — users, developers, contractors, speculators — not just employees. Instead of accruing value by ownership, like equity, network participants accrue value by improving underlying protocol, either by mining, validating, building on top of, or by using the service.

How do you create the next Facebook? Give millions of people upside in its success, the theory goes, instead of just a few hundred.

And it’s not just tokens. Every aspect of blockchain infrastructure becomes a building block for the next developer looking to build something on top of it. This leads to compounding innovation, since every application leads to more possible applications. Just look at standards like ERC721 or 0x turning into memes, leading to more companies starting, which then become building blocks for creating more innovations on top of them.

In contrast, Web 2.0 naturally led to silos and consolidation. Tokens are the fuel that both incentivizes protocol maintenance and development, as well as guarantees enforcement of trust and openness.

Tech Crypto says the blockchain, using the crypto networks described above, will disintermediate all middlemen: Not just all of payments ($500B) but all banks, all social networks, marketplace operators, etc.

Tech Crypto, as you probably guessed, is more bullish on Ethereum. They see BTC as digital gold and Ethereum (or some other smart contract platforms) as the world’s computer, and are eager to build millions of dApps on it.

Tech Crypto says In order for money to be money it needs to be used as money.

Tech Crypto compares blockchain to the early web - people said the web wouldn’t scale either. That it was unnecessary. That it was a toy.

Tech Crypto says that software tends to rewrite the rutles of things it runs into – “software is eating the world” – and crypto is no different.

Tech Crypto says don’t bet against developers.

Which Narrative is Right?

Tech Crypto and Money Crypto in some ways couldn’t be more different – from their beliefs to their vibes. To quote Murad Mahmudov: “Tech Crypto is more gentle, touchy feely social justice-y positive vibe-y hippies. Money crypto is more carnivorous borderline annoying intense uncompromising right wing meat eaters.”

And yet. It’s too early to tell whether either or both of them are right - nor are they mutually exclusive. It’s possible that both are right about the eventual of outcome but merely disagree about the order of operations. There are a lot of people in Tech Crypto who are sympathetic to the Money Crypto narrative: They believe that working to swing the pendulum back towards decentralization is vital, and that tokenization is a powerful mechanism to do so, but also that it’s entirely possible that we haven’t figured out token design yet and that it could be a money token like BTC that we all eventually use (or that there is some much more invisible token swapping thing or that it will be securitized equity style tokens that do it or something else.)

There are also factions that just wildly disagree. Some of Money Crypto believes that Tech Crypto applications will not accrue value, and that the near religious belief in tokens will dissipate when the ICO bubble pops. Some of Tech Crypto believes that the money problems are overstated (Quoting “Why Decentralization Matters “: “For example, it is sometimes said that the reason cryptonetwork advocates favor decentralization is to resist government censorship, or because of libertarian political views. These are not the main reasons decentralization is important”.)

Ultimately, Money Crypto approaches this tech from a largely Austrian economics perspective, looking at at how monetary media have evolved over history and then trying to replicate those same characteristics in digital form (Saifedean Ammous’ The Bitcoin Standard is the manifesto here). Tech crypto, on the other hand, thinks that those historical examples only go so far, because having money wrapped in software creates entirely new paradigms, opens up the design space, and potentially even means that this time around, money will take a much different path than it has historically.

Some of these factions not only disagree, but also think the other as detrimental. Parts of Money Crypto believe that tech crypto is detrimental as it obfuscates the “real value” of crypto – Sound Money – and that ICOs distract developers from working on Bitcoin. There are parts of Tech Crypto that believe that the Money Crypto narrative – and the often aggressive and hostile nature – is turning people away from using or building on top of cryptocurrencies. 1 It’s sort of like the great Slate Star Codex post about group infighting. Take Vegans and Paleo fans, for example. Rationally, you would want both the vegan and paleo people to work on getting people off, say, McDonald’s because either diet is clearly an improvement.

But, in practice, the human dynamics are such that they will not stop fighting with each other precisely because their viewpoints are so similar.

Sound familiar?

Similarly, I’d argue, any animosity between Money Crypto & Tech Crypto is better directed towards their common enemies (central banks, corrupt governments, tech monopolies, etc). I’d go further and say that both belief systems can benefit from each other’s rise.

Without Money Crypto people helping make crypto a good form of currency, Tech Crypto can’t accomplish its goal of letting people get paid for hosting/mining/participating because they need their currencies to be worth something for them to be compelling incentives.

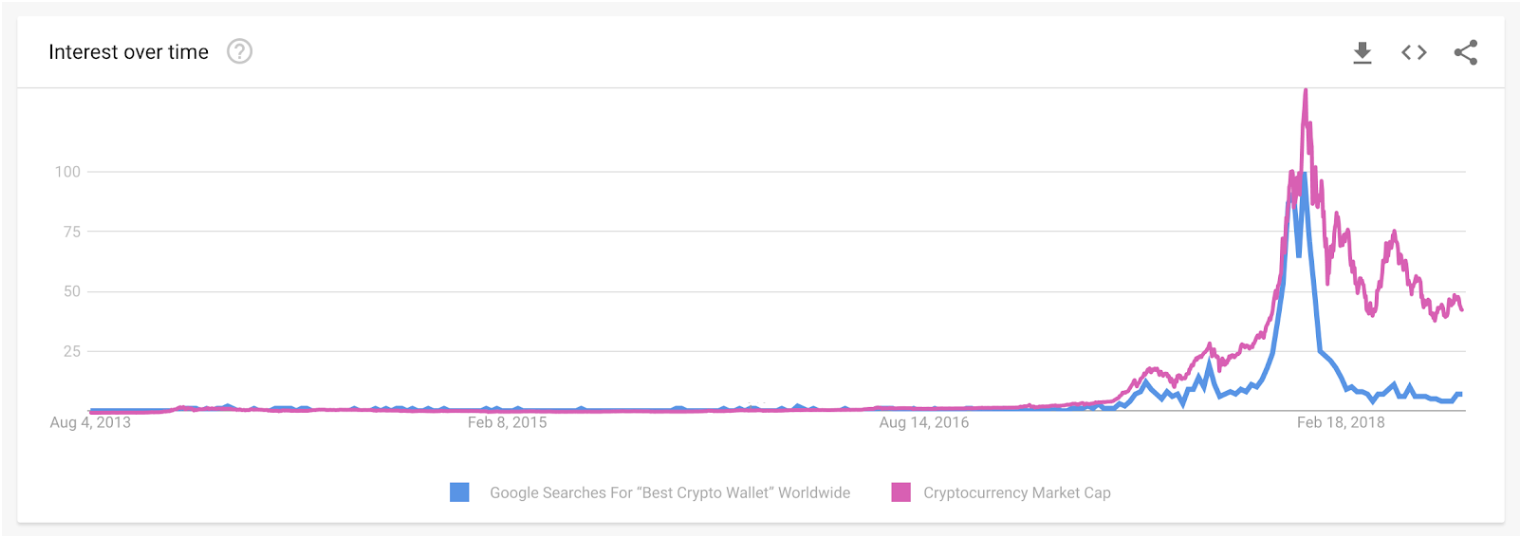

And without Tech Crypto builders, Money Crypto people are climbing up a hill because having a new ecosystem around digital currencies will give them credibility and value. (See the graph below - when crypto value gets higher, more people get wallets. More people having wallets means more people can use dApps).

To be sure, these concepts – Money Crypto & Tech Crypto – could be classified any number of ways, but for the sake of clarity, we’ve excluded other, more granular factions. For example, there are many people who want to redefine how money works but via some mechanism other than Bitcoin – privacy coins, stable coins, etc. Similarly, there are many people who, beyond the internet, want to “decentralize all the things” from supply chains to automotive, from media to data – in both tech and governance. An upgraded web is part of this, but not the only part.

What’s important to realize here is that not only can these narratives both exist, we may find that they ultimately leverage and further the other’s chance of success.

Thanks to Mike Maples, Kyle Samani, Tony Sheng, Trent McConaghy, Nathaniel Whittemore, Taylor Pearlson, Dani Grant, Kevin Pan, Myles Snyder, Denis Nazarov, Arjun Balaji, Soona Amhaz, and Murad Mahmudov for their meaningful contributions to this piece.