Ignorance about Bitcoin Disguised as Caution

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Ignorance about Bitcoin Disguised as Caution

By Rollo McFloogle

Posted December 7, 2019

Bitcoin has done a lot in its 11 years of existence. Perhaps one surprising role of Bitcoin has been exposing economic ignorance—namely the economics of money—of many people. I humbly include myself in that category of people (fortunately, it can also be an invaluable tool for helping you to learn the subject as well). Bitcoin is a nebulous and mysterious amalgam of technical computer science and economics to the newcomer. Very few people, even experts in one field or the other, can instantly grasp all that is Bitcoin. It takes even the best of minds some time to sort through and figure out.

We all can identify money. We use it a lot and think about it even more. It is absolutely instrumental in our ability to perform economic calculation, which is what we do when we use the information that prices provide to help us best direct resources to their most efficient uses. But while we can talk about any number of things about money, few people are actually able to explain what money truly is and how any given thing that is used as money came about.

This confusion is one of the things that pulls people into many incorrect conclusions about Bitcoin, including plenty of well-respected people. This includes, Jeffrey Tucker, who recently penned a piece on the American Institute of Economic Research (AIER) called “A Cautious Retrospective on Bitcoin.”

Tucker was an early enthusiastic proponent of Bitcoin, then got sucked into the Bitcoin Cash and altcoin hype, and now I’m not exactly sure how to categorize him.

In his AIER piece, Tucker lays out five reasons why he’s feeling a little bit more on the bearish side of Bitcoin and by doing so shows that he has some key misunderstandings of Bitcoin.

Let’s dive into his piece.

Before his list of five cautions, Tucker starts by showing two charts, one of transactions per day and the other of the USD exchange trade volume. He points out that transactions are at 2016 levels and exchange volumes are at 2017 levels. He then shows a third chart of wallet usage, which is steadily rising at an increasing rate, but that metric “belies the hope of a disintermediated money.”

Has Bitcoin taken a step backwards and is it on the decline? It’s ironic that Tucker, a man who like the rest of us scoffs at all the announcements that “Bitcoin is dead” during a bear market, would get so easily rattled in the latest lull following the by far biggest bull run to date. To be fair, he hasn’t bought the casket yet, but it is surprising that Tucker apparently believes that trading activity during a surge to almost $20,000 per bitcoin would sustain itself after the price correction. We all saw what was going on in late 2017. Everyone and their mother were trying to buy and sell Bitcoin. Once the price fell back down, did anyone really expect the people trying to get rich quickly to stay in the market?

Regardless of whether or not 2016 and 2017 were cherrypicked to compare metrics, Tucker’s problems are predicated from his idea that the health of Bitcoin’s adoption is based on how much it is transacted with. Since money’s primary use is as a medium of exchange, Tucker and many other critics of Bitcoin make the mistake of believing that money is only useful for spending in the present. They ignore that the delay of exchange, also known as saving, is also a perfectly valid—and not to mention absolutely critical—use of money. After all, what is money but a tool that transports current value across time and space for future uncertainty?

This describes money’s ability to function as a store of value, which as Michael Goldstein put it is “a metaphor for using a medium of exchange for exchange in the long term.” Bitcoin is still in its very early stages and those of us who see it as a way to shore up the attack surfaces that destroyed the gold standard believe that it will have a much greater value in the future as it monetizes around the world in the winner-take-all game of money. Meanwhile, fiat bolstered by legal tender laws is continuously inflated by central banks, pillaging the purchasing power of money. And we’ve seen the results of this: when money is expected to be worth less tomorrow than it is today, there is a strong incentive to get all the stuff you can exchange it for in the present. Everyone thinks about gratification today without regard for tomorrow. Prices are corrupted and economies have to absorb huge amounts of waste.

Thank goodness for sound money, the only medicine for this disease. When someone has both Bitcoin and fiat, he expects the value of the former to appreciate while he expects the latter to lose its value over time. Any rational economic actor will choose to spend his fiat while holding his Bitcoin whenever he can. This is Thiers’ law. He will also begin to demand payment in Bitcoin while charging a premium if someone must pay him in fiat. Eventually, everyone dumps their fiat on the greatest fools and it becomes so valueless that no one will accept it as payment even at great premiums. Since Bitcoin is now the only acceptable means of payment, it has become the common medium of exchange.

But since Tucker brought up numbers and charts as metrics for his proof that Bitcoin’s adoption is waning, let’s consider some of our own. It’s tough to point to a metric to show that people are using Bitcoin as a savings vehicle, but there certainly are things we can look at to check its health.

The first one is price in USD. Putting the y-axis on a logarithmic scale helps show the value appreciation of Bitcoin much more clearly.

Source: https://bitcoincharts.com/charts/bitstampUSD#tgMzm1g10zm2g25zl

Source: https://bitcoincharts.com/charts/bitstampUSD#tgMzm1g10zm2g25zl

What cannot be ignored is that while new bitcoins are being added to the supply through the mining process, if demand remained the same throughout this process, then the price would drop. Despite the local peaks and valleys, the overall trend of Bitcoin is a rising price, so demand must be increasing. Even if it’s only the current people in Bitcoin contributing to that demand, increases in price is a powerful signal to others that they should probably get in.

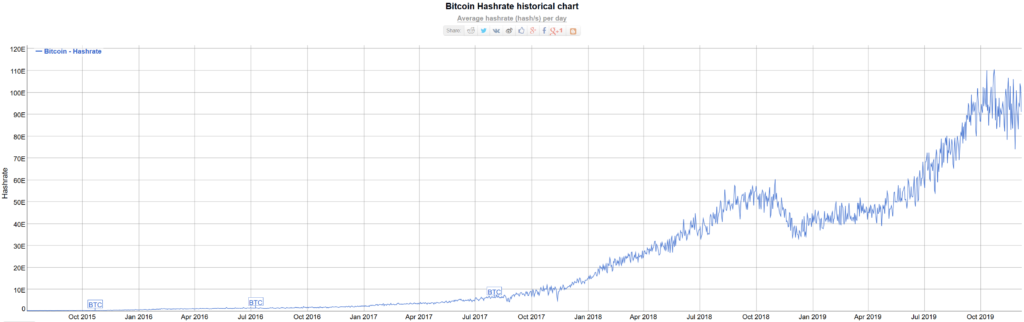

The other interesting metric to observe is Bitcoin’s hash rate, which is the number of hashes (guesses to solve a block) per second that the aggregate of miners makes across the network. In order to contribute hashes to the network, a miner must run software on specialized hardware. This hardware requires electricity, so mining Bitcoin with any chance of solving a block requires a significant commitment of expenditures for electricity. Miners want the block reward and transaction fees when they are the first to solve a block, so they’re careful not to break any rules (i.e. create an invalid block) that would cause all the validating nodes in the network to reject their block. If they submitted an invalid block, it would mean all the money they spent to solve it would be wasted, so miners tend to remain honest. This arrangement is what is referred to as “proof of work.” Using proof of work also means that any miner who wants to reverse transactions and rewrite history would have to spend enormous amounts of time and electricity to resolve previous blocks to submit a chain with the most proof of work to the network.

Miners add hash rate to increase their chances of solving a block and receiving the reward. More hash rate for the network means more proof of work, making it more expensive to attack, but it also makes it more difficult to solve blocks. Miners, being rational economic actors just like anyone else, are not interested in losing money on their operations.

*Source: https://bitinfocharts.com/comparison/bitcoin-hashrate.html

*Source: https://bitinfocharts.com/comparison/bitcoin-hashrate.html

The chart above shows that the hash rate is the highest it has ever been. If the overall value of Bitcoin were diminishing, then why would miners be spending so many resources on it? Certainly it could mean that miners are finding cheaper sources of electricity (they are), but that search for cheap electricity is a good signal that participation is in high demand since they must seek an advantage to stay competitive.

All of this shows that Tucker doesn’t have a good approach in either the economic or technical basics for viewing Bitcoin. This will help inform us to understand his perception of Bitcoin as we address each of his five considerations.

- Underpriced market assets are grounded in information asymmetries. Profits come from possessing valuable insight that others do not share, and acting on that insight. These asymmetries can be large or small. They were very large in Bitcoin from 2009 to 2015 or so. Some of us were convinced while vast numbers of even highly sophisticated people were sure that it could not, and the results were impressive for those who took the risk.

We are now eleven years into this, and the skeptics are now in a small minority. That blockchain technology is awesome is a given. If there were vast asymmetries in knowledge in the past, those have dissipated over time. The process of price discovery might have settled into a confident equilibrium: this stuff is cool, and useful for some purposes, but it cannot be a money for the world. It’s a given that there is no “true price” for Bitcoin but it is also true that the days of astonishment that it worked at all are now settling into the widespread awareness of why it works today.

With the full hindsight at our disposal, imagine being 11 or so years into the start of the internet and saying, “You know what, we’ve had the internet for awhile and plenty of people know about it, but it hasn’t been all that world changing, so I’m not sure this is really going to work out.” (We’re looking at you, Paul Krugman.) The success of the internet doesn’t guarantee the success of Bitcoin, but it does give us some insight on how global protocols take time to be fully implemented.

While much of the world’s population has had enough exposure to Bitcoin to at least know what it is, that doesn’t mean that knowledge about Bitcoin has settled equally among all these people. Knowing of and knowing about are two very different things. How many people simply aware of Bitcoin understand how it works or what its value proposition is? How many people even understand the economics of money well enough to act on the information they get about Bitcoin? How many people are aware of second layer solutions like the Lightning Network and sidechains that can massively scale Bitcoin?

These questions matter because money is for everyone. Everyone doesn’t need to know why or how it works (look at the internet again), but their ignorance about its usefulness explains why they’re not using it. And in fairness to these people, even if they weren’t too happy with the inflationary fiat system but didn’t worry much about censorship, they wouldn’t necessarily be drawn to use Bitcoin because the on-chain layer is not a superior substitute to the services they use for their day to day transactions in terms of cost and speed. Those who understand that the on-chain layer provides the security for the soundest money in the history of the world will compete for the bitcoins that are available for sale as they speculate that future layers built on top of this first layer will be the infrastructure that makes transitioning to Bitcoin the only play for even the ignorant.

- At the same time Bitcoin was launched, so too were released some other impressive payment technologies designed to reduce the price of transactions and make accepting credit cards vastly easier. Back in the day, small merchants had a very hard time accepting credit cards. Thanks to technologies like Square, even a lemonade stand can accept them using a smartphone, which was also launched around the same time. The near-universal use case for Bitcoin was once obvious; apart from specific demographics and interests, the case for broad public adoption is no longer clear. To be sure, there remain vast and important uses for crypto for permissionless remittances and for allowing the unbanked to move money (one of the booming facets of the crypto-asset sector are ATMs), but that will remain true regardless of market valuations.

It is truly a shame that Jeffrey Tucker puts censorship-resistant digital scarcity as a secondary value proposition for Bitcoin. Governments coopted central banks to use seigniorage to fund their massive expansions in size and scope, which has allowed them to wage endless warfare since. They removed the gold standard and constantly inflate the money supply, which further inflate bubbles of malinvestment. These bubbles, as part of the business cycle, have destroyed massive amounts of wealth and have prevented people from directing resources to their most efficient uses. Humanity is years behind in production and overall quality of life because governments can censor and create money on a whim. Bitcoin gives anyone with a computer and an internet connection the ability to remove the need for a trusted third party to send and receive money and to validate that the money they’re receiving isn’t counterfeit. This final settlement that once took large amounts of time and money now takes minutes and maybe a few dollars.

Bitcoin strikes at the root of the ability of governments to hold power. This innovation is world-changing. It is the zero-to-one event that can lead to a flourishing that humanity has never seen before. That was the hard part. Compared to that, it will be easy to build services for making fast and cheap payments on top of that.

- The old pitch for Bitcoin – that it made payments fast, cheap, and permissionless – had been dramatically changed as adoption increased and the portals couldn’t keep up. Permissionlessness still survives but that is not true of fast and cheap. By 2017 it became very obvious to the world that though Bitcoin is wonderful, it is not very practical for payments as compared with legacy systems that had vastly improved. Forks emerged to fix that problem but because the crypto sector is so vast, none could develop the network that Bitcoin obtained as the first mover in the space. Among those crypto innovations have been stable coins that operate as settlement banks. Those in the market for stability will find these more useful than old-fashioned crypto. And let us not forget the greatest lesson of monetary history: it’s the use value of a currency that is its value (there is no such thing as “storing” value).

Tucker, and many like him, first entered the Bitcoin space when some people were selling it as a fast and cheap payments processor. The reality, however, is that Bitcoin allows anyone to run a fast and cheap money validator. Consider what the last sound money system, the gold standard, involved. We tend to take for granted all the trust and centralization that had to occur simply for someone to use stamped gold coins. Imagine the cost—no wonder that work got entrusted for someone else to do. It is totally impractical for an individual accepting gold payments to test that the gold he is receiving is the gold that he is expecting for every single payment.

Bitcoin fixes this. Running a full node allows the user to trace any bitcoins that he is receiving all the way back to when they were first mined. This happens nearly instantly. Once the transaction is signed with a modest transaction fee, final settlement (the transfer of custody over the bitcoins) occurs in minutes (although your time depends on how many confirmations you want before you’re comfortable).

Bitcoin was the first mover in the space, but that’s not the reason it dominates its industry. It is by far the most secure in its ability to provide final settlement and maintain its monetary properties. Altcoin competitors are often centralized and at best only offer a small fraction of the security provided by Bitcoin’s network of nodes and proof of work. It is the most liquid out of all the cryptocurrencies and will continue to gain in liquidity and market share as its competitors of all kinds approach values of zero. So-called stablecoins pegged to the dollar don’t solve any of the problems that Bitcoin sets out to and will be absorbed by Bitcoin’s dominance just like all the others.

- Bitcoin came into a banking world that was dilapidated and anachronistic. But banks and processors felt the heat and adapted in an unusually quick period of time. Now we have peer-to-peer payment systems working within the regular banking systems. We have Venmo, Zelle, Apple, and Google, and many other systems, and, for all their limitations, they are getting better by the day. For that matter, the Fed itself has announced its own plans for a blockchain-like P2P payment system. Competition works. Bitcoin made a major contribution to lighting a fire under the mainstream industry. But that innovation necessarily affects Bitcoin’s prospects.

Services like Venmo, Zelle, etc. may be nice because they add a layer for transferring money that is fast and cheap, but they are still controlled by gatekeepers who are at the mercy of the governments that operate where they are located. They offer no censorship resistance and do nothing to harden the money they’re built on top of.

Let the Fed make their own “blockchain-like P2P” payment system. I am astonished that Tucker found it at all interesting to mention them as competition against Bitcoin.

- Let’s just say – as many industry experts say to me in private – that the days of endless price increases of Bitcoin are over, and that it settles into a stable price and even gradually falls to 2014 or 2013 levels. That is not beyond the realm of possibility. Nothing about markets are perfectly predictable, and there is nothing baked into the nature of Bitcoin that guarantees any particular future. A major problem hits the essence of money itself: the use case is everything and adoption is the path toward making any money mainstream. The trends here do not look brilliant for Bitcoin.

Ah, the “experts” are saying that Bitcoin won’t see increases in price against the dollar. And while Tucker correctly points out that markets are not perfectly predictable, economics tell us that the hardest money wins. Can events happen in the future that prevent Bitcoin from fully monetizing? Of course, they can, but nothing Tucker has said in his article has convinced me to step back from my bullishness.

Tucker ends the piece by taking an agnostic stance on the future of money although he seems fairly confident that Bitcoin will flourish in the immediate future “to service a special type of need.” He leaves the possibility for anything to happen, from Bitcoin going “to the moon” to “something else entirely—an Amazon coin, for example.” He just wants people to have some humility in the process.

Humility is a good trait to have, but let’s not mistake a bearish outlook on Bitcoin because of ignorance as humility. Tucker’s suggestion of a completely centralized “Amazon coin” demonstrates his failure to understand the ultimate purpose of Bitcoin. The sun may not rise tomorrow. Am I being humble for not being so sure that it will? Obviously, the future of Bitcoin is harder to predict than the rising and setting of the sun, but you should see the point of my hyperbole. Bitcoin is on its path and it doesn’t care what either Jeffrey Tucker or I say about it. But Bitcoin is not cold and vengeful. It’s chugging along, happy to welcome anyone, no matter who they are, to its network. I look forward to the day when Jeffrey Tucker welcomes Bitcoin back.

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |