Bitcoin Is Smarter Than Politicians And Central Bankers

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Bitcoin Is Smarter Than Politicians And Central Bankers

By Antony Pompliano

Posted July 8, 2019

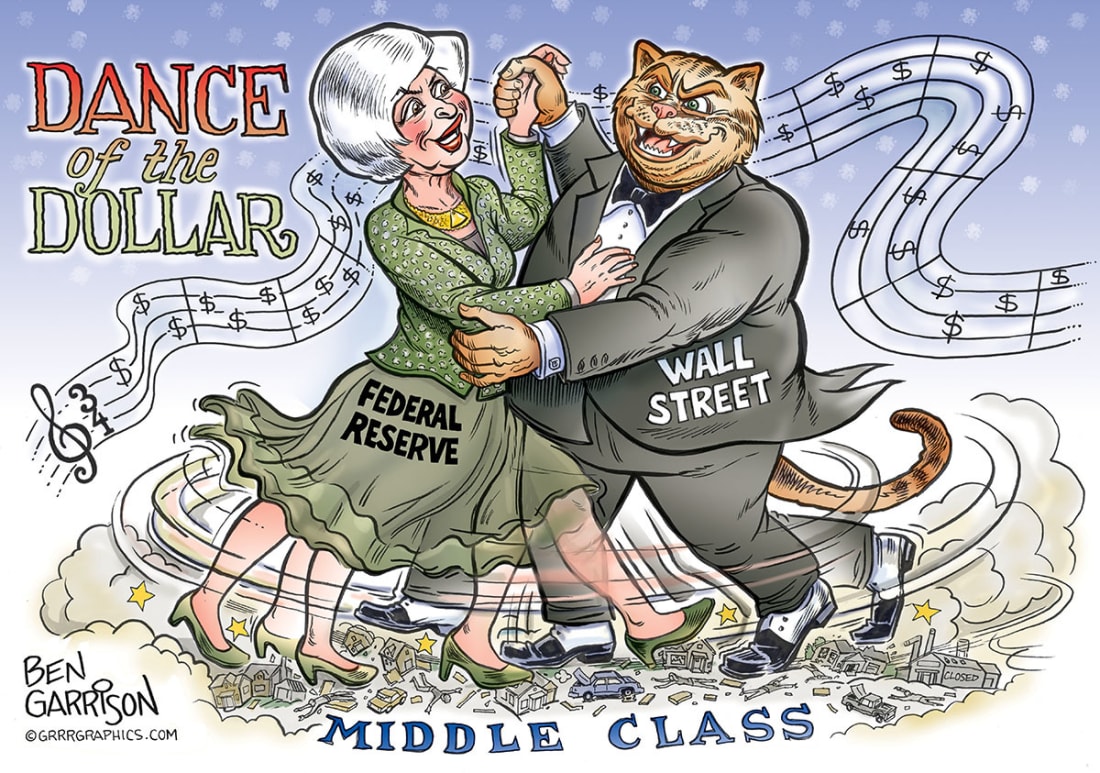

Don’t look now, but the global economy is becoming unstable and uncertain. Each individual, regardless of geographic location, is increasingly being asked to trust the expertise and experience of politicians, economists, central bankers, and the leaders of legacy financial institutions.

While this would historically seem like a reasonable ask, these “experts” have proven time and again that they are ill-equipped to handle the complexities of many situations that we face today. The confluence of events playing out at the moment are incredibly bullish for Bitcoin, but before I explain why, here is an overview of the current headwinds facing currencies and economies:

- Trade wars — The two largest economies in the world, the United States and China, are locked in a trade war that continues to escalate aggressively. The US has hit China with a 25% tariff on approximately $250 billion of Chinese products, while China has ratcheted up their response with increasing tariffs on billions of dollars of American products. This is all happening while the US barely avoided a trade war with Mexico and is currently threatening the EU with new tariffs that would hit $4+ billion of EU products. If the ramifications of these trade wars weren’t so serious, we would all be laughing at the fact that a material amount of this nonsense is playing out on Twitter (see here,here, and here for examples).

- Recessions are upon us — The US Treasury yield curve officially closed the second quarter of 2019 inverted. This means that for an entire quarter, investors were given higher returns on short term bonds, rather than long term bonds. As many have explained, this has been the leading indicator of an impending recession over the last 50 years (has happened 7 times) and there has not been a false positive over that time period. The US isn’t the only economy in trouble though, especially when you consider Raoul Pal’s recent argument that the EU is already in a mild recession.

- European banks are failing — Deutsche Bank is dominating headlines for their ineptitude over the last decade, which has culminated in a recent announcement of ~ 20,000 job cuts and a complete restructuring of the bank. They aren’t the only banks struggling though. Others like UBS,Credit Suisse,Société Générale,BBVA, and Barclays appear to be facing major issues that could quickly turn into a domino effect that ends in a widespread financial crisis.

- Loss of Federal Reserve Independence — According to the Federal Reserve website, “ the Federal Reserve, like many other central banks, is an independent government agency but also one that is ultimately accountable to the public and the Congress. The Congress established maximum employment and stable prices as the key macroeconomic objectives for the Federal Reserve in its conduct of monetary policy. The Congress also structured the Federal Reserve to ensure that its monetary policy decisions focus on achieving these long-run goals and do not become subject to political pressures that could lead to undesirable outcomes.” This independence is being tested as President Trump continues to publicly apply pressure to the Federal Reserve on currency manipulation, while openly critiquing the organization’s decision making.

- Low Interest Rate Environment — In the last two economic recessions, central banks were able to cut interest rates an average of 5.0% or more in an attempt to combat headwinds. Given the current 2-2.5% interest rates in the US, and negative interest rates in Japan and Europe, these institutions won’t have the same severity of aggression available to them this time around.

- High Levels of Debt — We are currently experiencing record levels of debt around the world, including US corporate debt as a percent of GDP over 70% and China holding strong around 150%. The last time this US metric was so high was during the Global Financial Crisis and China hasn’t ever seen levels this high before. To put this all in context, there is 3X+ more debt than GDP in the world today.

- Slowing Global Growth — The World Bank continues to slash global growth forecasts. They cut “ 2019 global growth forecast to 2.6% from 2.9% and cut its forecast for growth in trade to 2.6% from 3.6%. The World Bank had already forecast the US to slow to 2.5% in 2019 from 2.9% in 2018 and for China to slow to 6.2% from 6.6%.” Additionally, when World Bank President David Malpass was asked for the reasoning behind these cuts, he cited falling business confidence, the slowest pace of global trade growth since 2008 and sluggish growth in emerging and developing economies.

The outlook for the global economy is currently bleak, with numerous signals indicating an impending recession. Whether we like it or not, markets can’t go up and to the right forever.

Unfortunately, investors don’t have very many options in this scenario. They are being asked to trust the expertise and experience of politicians, economists, central bankers, and the leaders of legacy financial institutions. Not exactly something that many people are comfortable doing.

The global uncertainty, and increasing likelihood for instability, is leading investors to look for alternative options. This brings me to the argument of why Bitcoin is poised to greatly benefit from the perfect storm of events that are unfolding.

Bitcoin is a decentralized, digital asset that is built in a way that prevents any individual or organization from manipulating key components of the asset (monetary policy, security, transaction history, etc). In effect, Bitcoin as a system can not be manipulated by any government, central bank, financial institution, or politician.

And to make things even more compelling, the monetary policy decisions have already been decided for the next ~ 120 years, along with a feature where anyone in the world can publicly audit the execution of this monetary policy plan as it plays out. Think about that for a second….there is more uncertainty in the global financial system, than in the structure, operation, and governance of Bitcoin.

As we know, investors find comfort in decreased uncertainty. This is exactly why we are seeing Bitcoin become more and more attractive as global instability and uncertainty increases. Don’t believe me? Here are some interesting facts:

- During the month of May, the US was actively ratcheting up the trade war with China, along with threatening Mexico, Europe, Iran, etc with trade wars as well. Many of the issues outlined in the bullet points above were also increasing in severity during that time.

- Bitcoin’s price appreciated 55% during May, but more interestingly, the asset had a negative correlation to the S&P 500 (-0.9%) and gold (-0.8%). That means that as stocks and gold became less attractive, Bitcoin was becoming more attractive.

Obviously, one month of data is not enough to make a compelling argument with, but it is worth watching this trend as we move forward. There is a good chance that we are on the cusp of a monumental shift in global economies — a shift from trusting humans to one of trusting algorithms and machines.

This shift has already happened in other aspects of our lives, so it makes sense that it would eventually happen in economics as well. We trust algorithms over humans to give us driving directions, music recommendations, or search results, but for some reason continue to believe that humans are better than machines at synthesizing financial and economic data to produce decisions on highly complex economic issues.

Obviously, this is going to change and I’m betting that it will happen sooner rather than later. While the humans are struggling to figure out how to manipulate currencies and economies to keep the bull market raging on, Bitcoin continues to produce block after block completely unmanipulated by any outside force.

As Villeroy de Galhau, a member of the Governing Council at the European Central Bank (ECB), recently said “ the [ECB] priority is to reduce this uncertainty and here we will do our duty as central bankers, but monetary policy cannot do everything. Monetary policy has no magic wand, it cannot make miracles. And it’s up to political leaders to reduce these uncertainties, sometimes self-created. “

I, for one, don’t find it comforting to rely on the bias, greed, fear, and general emotion of politicians and central bankers. The machines are smarter, more disciplined, and better decision makers than us, so the sooner we admit that, the better off we will be.

-Pomp