Bitcoin is Not a Pyramid Scheme

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

Bitcoin is Not a Pyramid Scheme

By Parker Lewis

Posted October 18, 2019

A few years ago, I received an email from a friend asking for my opinion about an investment opportunity that a mutual contact of ours was considering. After a quick search on the internet and after having watched a few videos, I explained that it looked like a pyramid scheme. This was my shorthand for “avoid at all cost.” The information was forwarded along to our mutual contact and the reply back was not what I was expecting: “Are all pyramid schemes bad?” Some pyramid schemes are harder to identify than others, but even those that are easy to identify find prey in unassuming victims. A good rule of thumb is to run, not walk, away from anything that even hints of being a pyramid scheme. Thankfully, bitcoin is not one of them. While it may seem obvious, not everyone understands what a pyramid scheme actually is, what the warning signs may be, or why such schemes always fail.

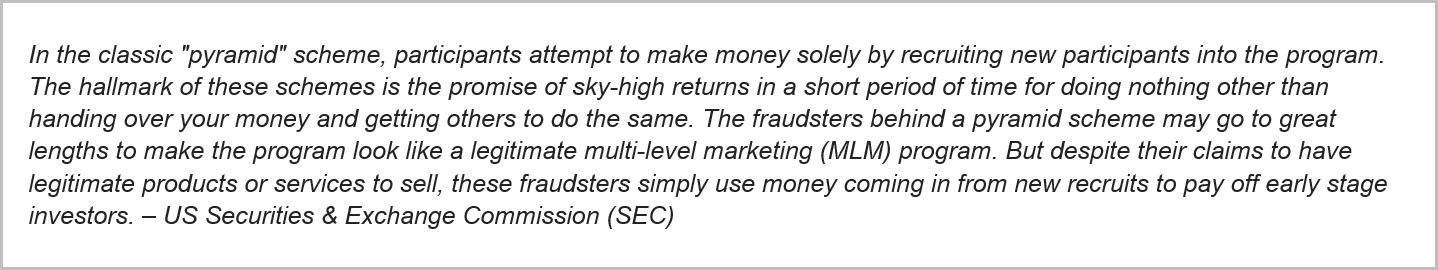

Definition of a Pyramid Scheme – Securities & Exchange Commission

Warning Signs of a Pyramid Scheme – Federal Trade Commission

Not all multi-level marketing programs are pyramid schemes, but all pyramid schemes are in some fashion a multi-level marketing program. With pyramid schemes, there is always some company and it is selling a product for which the end demand falls far short of the available supply. The company recruits participants to purchase inventory and to recruit new participants. The participants are all sales people, and compensation is tied mostly to recruiting, rather than selling the actual product. Often the sale of product is purposefully woven into the recruitment process.

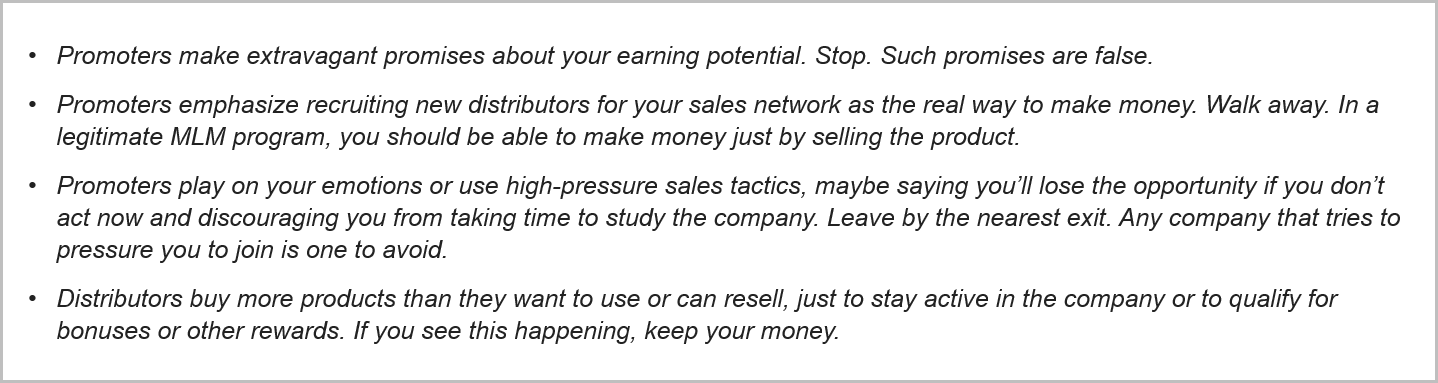

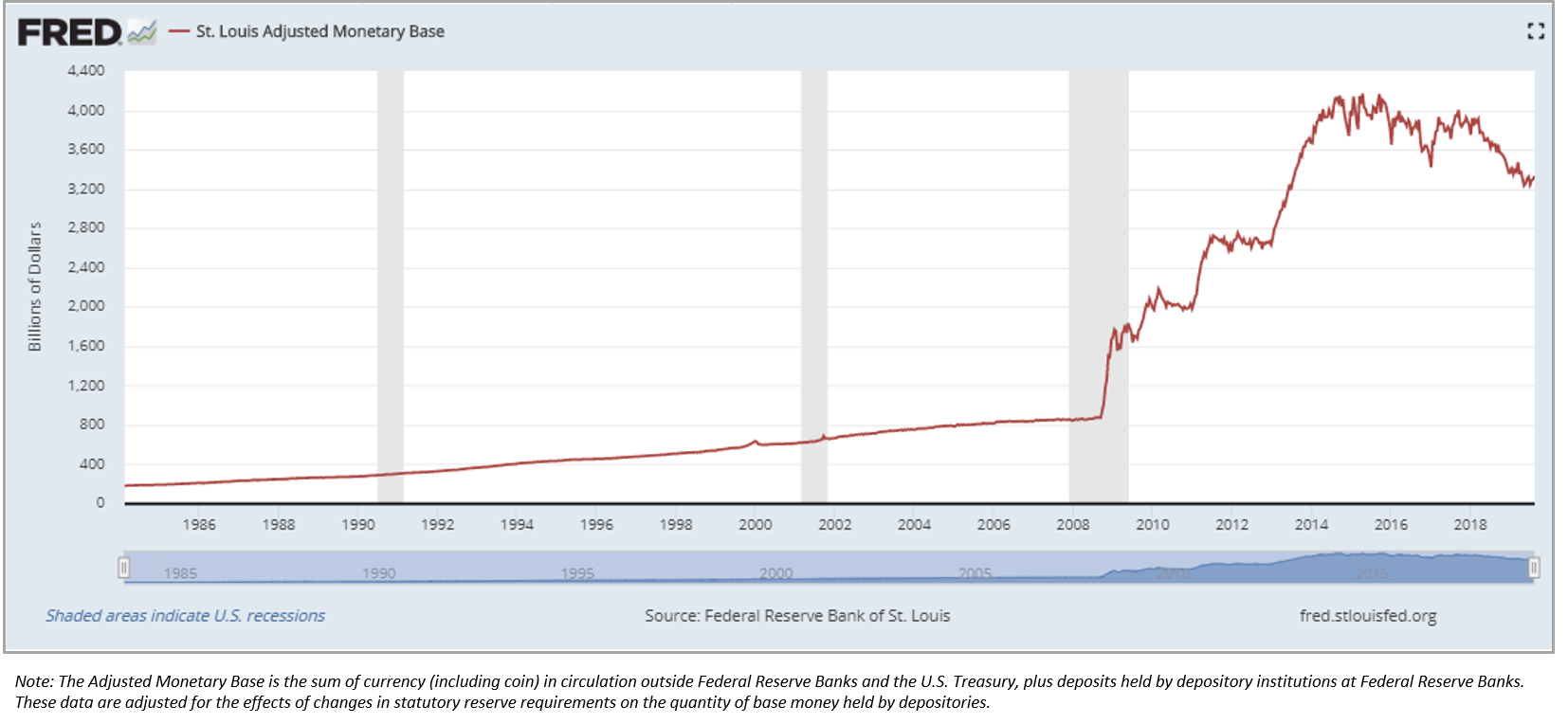

In a normal sales-driven business, the company takes on the inventory risk and pays commissions based on sales to end users. In a pyramid scheme, the sales people take on the inventory risk, rather than the company, and compensation is paid for recruiting more sales people and selling product through to new participants. It all falls apart because sufficient end demand for the product does not actually exist. Everyone up the chain can make money at the expense of the new recruits at the end of the line. This is a pyramid scheme. Bitcoin is not. Bitcoin is not a company. It has no employees and its supply is finitely scarce. No matter how many people adopt it, there will only ever be 21 million bitcoin.

The distinctions should be glaringly obvious, but because bitcoin is complex and the very idea of money is not well understood, it can easily be confused. Bitcoin will only become a global reserve currency if hundreds of millions (if not billions) more adopt it. And seemingly everyone that goes down the bitcoin rabbit hole ends up on the other side explaining it to their family and friends, pitching it as a better form of money. Sounds kind of like a pyramid scheme, right? Wrong. When Dell started selling PCs on its website in 1996 and everyone told their friends to get a Dell, was it a pyramid scheme? When Apple released the first iPhone in 2007 and everyone told their friends to drop the Blackberry for its superior successor, was it a pyramid scheme?

Technological shifts often happen fast. Ten and twenty years later, smartphones and PCs are ubiquitous. It is all about the quality of the product and the incentive structure. If someone owned Apple stock or Dell stock, did it change the fact that the product itself provided a real value proposition? Was there a direct benefit for telling people about a new technological innovation? The value proposition of an innovation trumps all else. It does not matter how you learn about it; all that matters is whether the innovation provides utility. If it does, people will want to use it; if it doesn’t, they won’t. That is what makes a market.

The Utility & Innovation of Bitcoin

Bitcoin’s utility is as money. It has a market because it solves a problem inherent in modern money. Not only is bitcoin not a pyramid scheme; it is fundamentally distinct from the class of innovation that could be offered by any individual company. Bitcoin is not Dell and it is not Apple. It is not a tech stock. There is no company that exists behind bitcoin. Bitcoin is not a company selling a product and there is no income stream to pay future dividends. Bitcoin is not about making money; instead, bitcoin is money, or at least it has become money to those choosing to store a portion of their wealth in it. And it’s not a get-rich-quick scheme; it is fundamentally about storing the value you have already created. Bitcoin is a bearer asset; however, unlike a bearer bond, there is no income stream.

Bitcoin’s innovation is that it represents a superior form of money, but there are no future promises beyond being in possession of a digital bearer instrument. The only utility of bitcoin is in holding it as a currency and transacting with it in the future, whether that be in exchange for legacy currencies or other goods and services. Bitcoin is only useful as a form of money, and it will only maintain value if others demand it in the future. But this is true of any form of money (not just bitcoin). Money is not a collective hallucination or merely a belief system; monetary goods have distinct properties which make them more or less effective in facilitating exchange. However, monetary properties are not absolute; the relative strength of monetary properties is the fundamental basis of demand. When the market evaluates bitcoin, it does so relative to other monetary mediums (the dollar, euro, yen, gold, etc.).

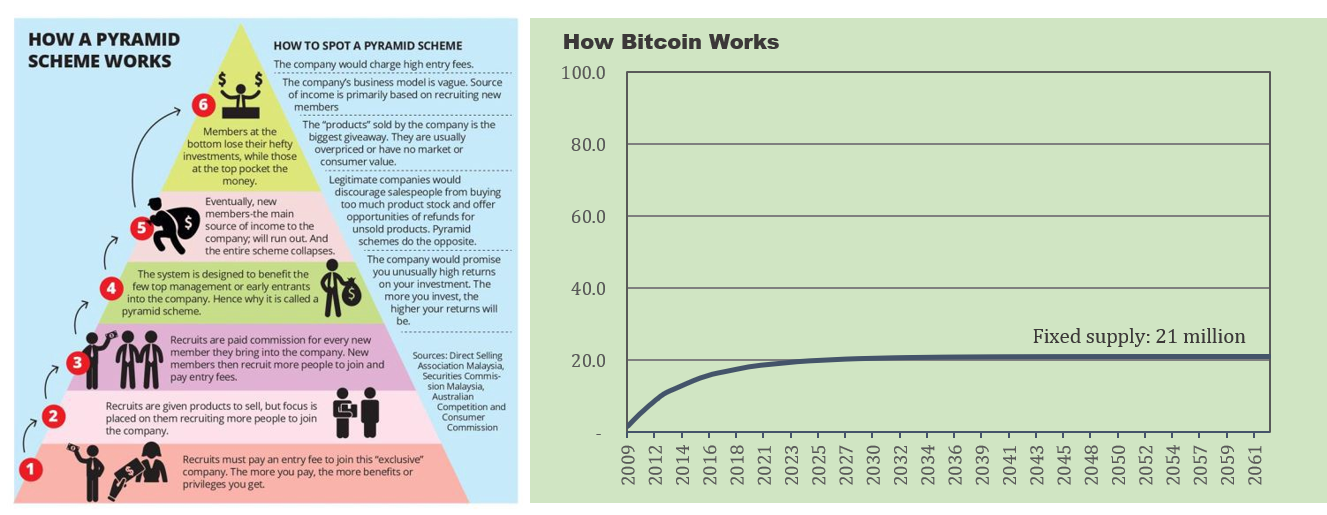

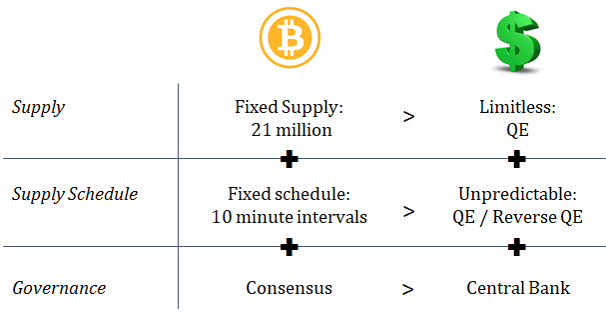

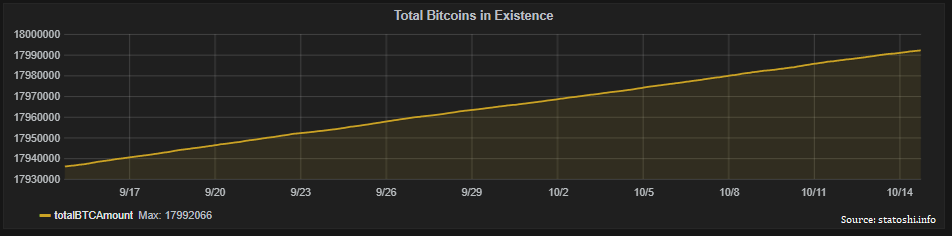

The supply of bitcoin, and its rigid supply constraint, is the foundation of bitcoin’s utility and fundamental demand; it is also why bitcoin is not a pyramid scheme. There will only ever be 21 million bitcoin. That is bitcoin’s schelling point. Everyone knows it; everyone remembers it. Everyone can also verify it at any point in time. For discussion of how and why bitcoin has a credibly fixed supply, see Bitcoin, Not Blockchain and Bitcoin is Not Backed by Nothing. But for now, just work on the assumption that the supply of bitcoin is capped at 21 million. In contrast, no one knows the supply of dollars. The Fed estimates the current supply of dollars, but no one knows how many dollars will exist in the future. There is no constraint on the supply of the dollar, other than the Federal Reserve, and all we know for sure is that many more dollars will exist in the future; it is a limitless function. In the end, there is fundamental demand for bitcoin because its monetary policy is i) optimally engineered and ii) credibly enforced. Relative to its competition, bitcoin is a vastly superior monetary medium.

Exhibit A – Dollar Historical Supply

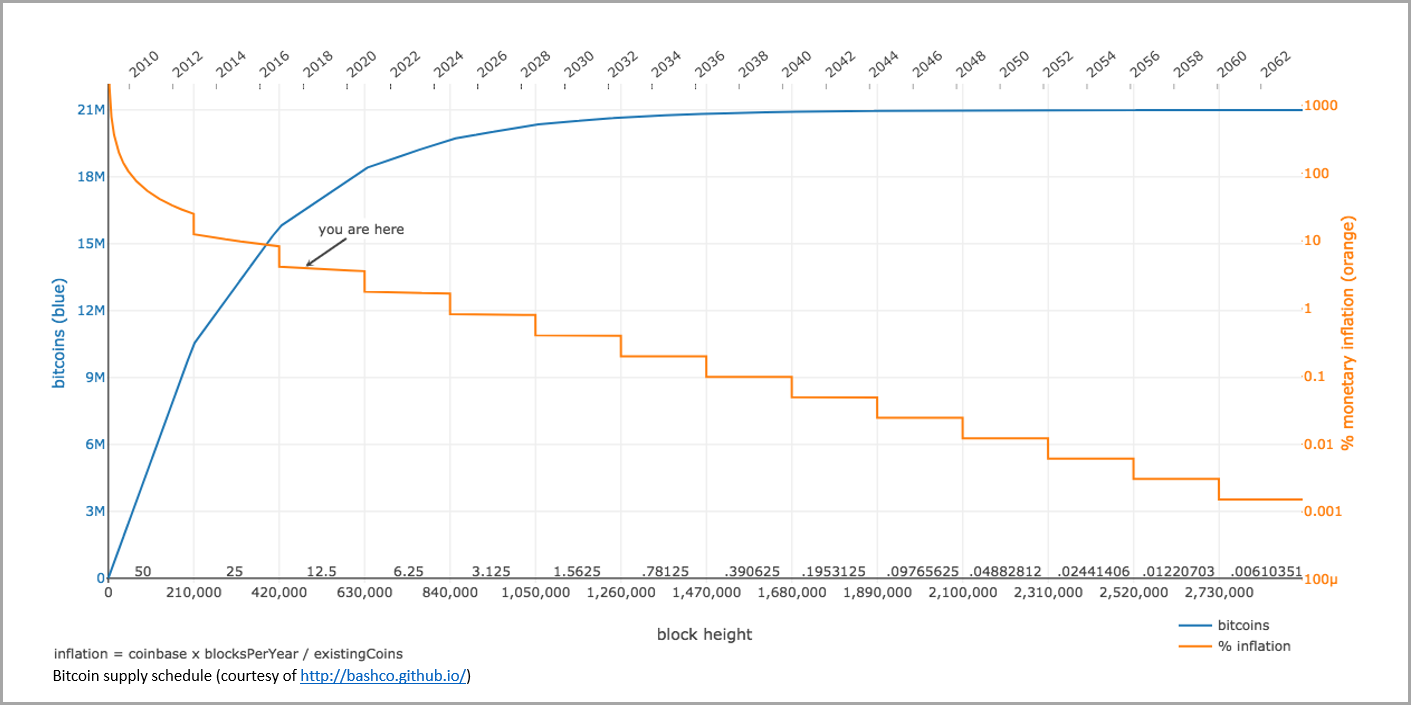

Exhibit B – Bitcoin Supply Schedule

The monetary base in fiat systems changes unpredictably whereas the monetary base in bitcoin is governed by a well-defined supply schedule. Think about the monetary base as setting the foundation of a global economic system. The unpredictable changes in the supply of dollars is not merely akin to shifting the proverbial goal posts. Instead, it is more similar to building the field on a 1980s-style water bed, and then shifting the goal posts. The whole game is distorted, not just the end points. Bitcoin, on the other hand, is a bedrock as a function of its fixed supply, and over time, the foundation becomes stronger and stronger. The credibility of its supply schedule is reinforced with each passing bitcoin block. As it becomes more evident that bitcoin’s supply schedule is credibly enforced, more people adopt bitcoin as a form of money, and those that already have increasingly use it as a store of wealth. Fixed supply + increasing adoption = increased value. As adoption increases and as value rises, bitcoin becomes further decentralized. And as bitcoin decentralizes over time, it becomes harder to change, reinforcing the credibility of its foundation: its fixed supply.

You are the Scammer

In a pyramid scheme, the people selling the scheme are the scammers. These scammers are selling the promise of future monetary gains through high-pressure sales tactics and by recruiting new members to the scheme as the primary compensation mechanism. In bitcoin, the people buying bitcoin are the scammers, as described in Michael Goldstein’s timeless piece, Everyone’s a Scammer. If this is you, you are the scammer. In most cases today, whenever someone buys bitcoin, they are directly trading a fractionally reserved form of currency (with the promise of future debasement) in return for a bearer asset with a finite supply and a vastly superior monetary policy. The person on the other end of the line is getting the raw deal. It is not to say that literally everyone that sells a bitcoin does so without good reason. It is money after all, and its utility is in exchange; by definition, market participants have a wide variety of present needs for liquidity and real value is transferred every time a bitcoin is transacted, whether for dollars or for goods and services. However, on average and over the longer-term, it is information asymmetry in full effect. Bitcoin’s monetary policy is optimally engineered and credibly enforced, though few understand it, which is why it represents the greatest asymmetry in the world today.

Monetary First Principles

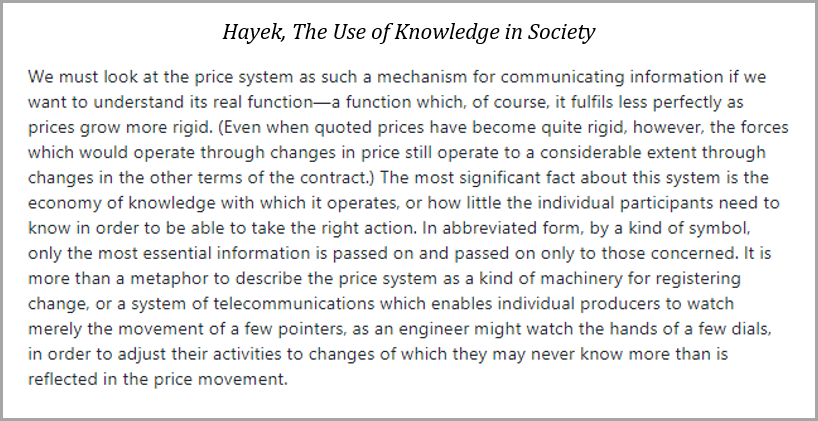

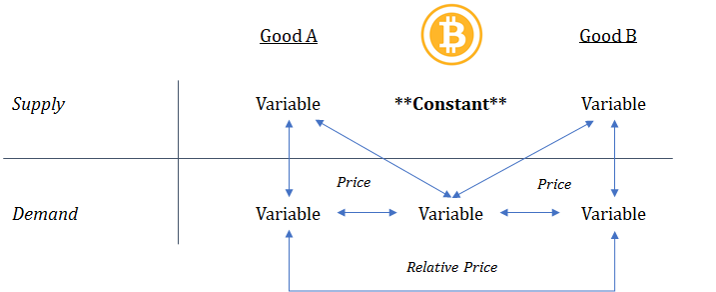

A monetary medium with the lowest rate of change is most effective in communicating economic signals, and a fixed supply (zero rate of change) is the optimal monetary policy end game. While the monoculture that is modern mainstream academia disagrees with this view, a fixed supply currency is superior to a currency that increases in supply over time (and at unpredictable rates). In any economy, supply and demand for goods and services relative to the supply and demand of money dictates prices. Price is what ultimately coordinates economic activity, and money is the foundation of the pricing mechanism within an economy. A currency with a fixed supply would remove the noise created by changes to the money supply in the price system, thus creating more reliable market signals. Because a monetary good facilitates the exchange between goods used for the purpose of either consumption or production, the form of money with the lowest rate of change will most accurately reflect changes in supply and demand of all other goods. Essentially, money is used to communicate the relative value of other goods and services, and changes in the money supply distort the communication of this information by introducing an extraneous variable to the equation.

For example, an iPhone costs approximately $1,000, whereas a barrel of oil costs approximately $50. The information communicated through a monetary medium is that an iPhone costs approximately 20 times more than a barrel of oil. Money communicates opportunity cost (economic trade-offs) through its price system, and the more constant the quantity of money (lower rate of change), the more reliable the communication of information and economic trade-offs. If the money supply increased by 10% and prices adjusted equally, an iPhone would cost $1,100 and a barrel oil would cost $55. An iPhone would still cost 20 times more than a barrel of oil, and that is the relevant information which all market participants rely upon. In the real world, the problem is that prices do not adjust equally as the money supply changes. Instead, price signals become distorted. In a world with a constant money supply, changes in price would more accurately reflect changes in supply and demand in underlying markets for goods and services rather than also reflecting the unequal impact of a changing money supply. Changes in the money supply create noise extraneous to the underlying economic activity. Price coordinates economic trade-offs, and the reliability of a pricing system is dependent on the stability of the form of money used to communicate information.

In that regard, monetary goods are differentiated (at least those that emerge on the free market); it is why money is an effective communication tool. The market structure for money is different than that of all other goods. A consumption good is consumed and a production good is ultimately consumed in the production of other consumption goods. Whereas, the utility of money is in exchange; it is functional in the coordination of trade by and between consumption and production goods, rather than being consumed itself. Because the utility of money is in exchange, scarcity is more important than the nominal amount of money in an economy. As demand for money increases and as its price rises, there is not a commensurate supply response because of natural supply constraints. The same is not true for any individual good or service. The relative supply constraint of money is what allows it to communicate relative value between other goods and services. Consumption goods and production goods can be substituted for each other, but money facilitates virtually all exchange between all other goods. The value of a money may fluctuate relative to goods and services but relative scarcity of a money supply allows price to be communicated in terms of the money itself.

Prior to bitcoin, no form of money was finitely scarce. Bitcoin has a fixed supply, capped at 21 million. Finite scarcity creates a constant where none existed previously. Imagine the supply of one good being perfectly constant while the supply of all other goods fluctuates. Demand for all goods changes, but only one constant exists: the supply of bitcoin. In this world, everything would be measured against the constant. The purchasing power of money would communicate far more perfect information through this pricing mechanism than if the supply of the money itself were changing. By creating one constant, everything else can be more reliably measured. And the desired information is not the absolute value of any one good. All value is subjective. Instead, the critical information communicated through a pricing mechanism is the relative value (or relative price) of many goods to each other. While price levels are ever changing due to constantly shifting supply and demand, the stability of the pricing mechanism itself allows for economic coordination via the communication of opportunity cost (i.e. how we know, or learn, that an iPhone costs approximately 20 times more than a barrel of oil).

Distortion of the Price System

In our current system, the supply of money changes unpredictably and increases over time. This is core to the central banking monetary model, and it derives from monetarist economic theory which argues that an active management of the money supply stimulates aggregate demand and ultimately promotes full employment. What it technically does is manipulate interest rates downward by increasing the supply of money. Lower interest rates increase the willingness and incentive to borrow; however, all else being equal, a lower interest would otherwise decrease the willingness to lend. Essentially, by inflating the money supply, the central bank artificially manipulates the function of credit, creating a sustained imbalance between the incentive to borrow and the willingness to lend. The more pervasive consequence is the distortion of the pricing mechanism that coordinates economic activity. By manipulating the supply of money and the supply of credit, central banks distort all prices throughout the market. False signals (and bad information) are distributed to all market participants.

The entire supply and demand structure of the economy becomes distorted as hundreds of millions of people respond to manipulated price signals and when resources within the economy are re-allocated based on those signals. When the money supply is increased, new money (and credit) enters the system through various channels and at unpredictable times. The quantity and rate of change is unknown to most market participants. Instead, market participants react to price signals; that is how information is communicated. A price signal may be the cost of a good at the supermarket or it may be a salary an employer is willing to pay for a certain job. The change in the money supply creates a distortion of prices such that market participants cannot effectively understand whether changes in price are driven by changes in underlying supply and demand structures, or to what extent changes in price are merely a function of more or less money in the system. Regardless, everyone reacts to distorted signals.

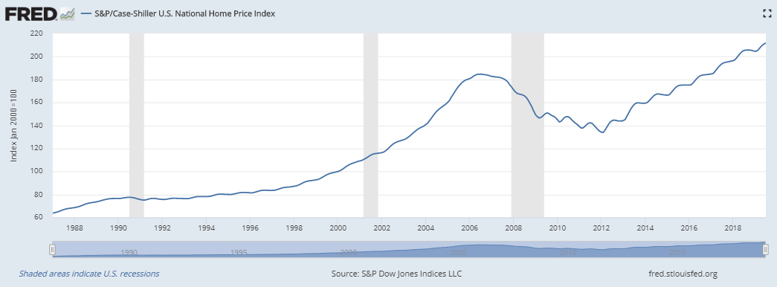

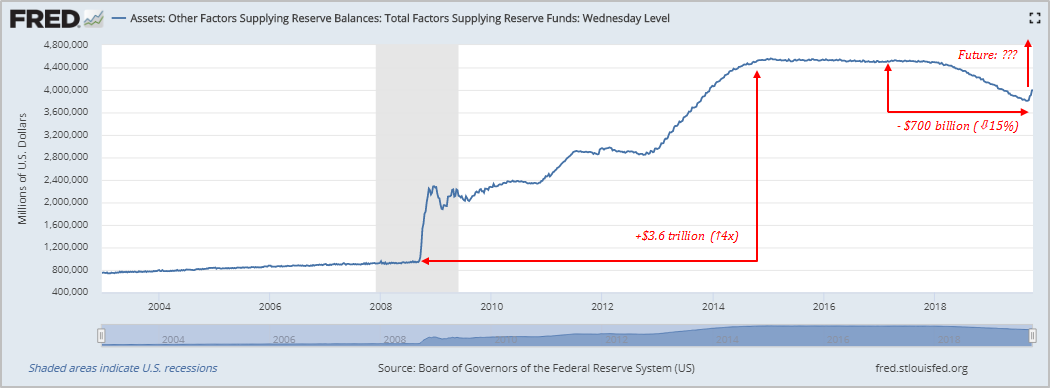

For a more tangible example, the Fed purchased $1.7 trillion of mortgage-backed securities (~17% of all mortgages) following the financial crisis as part of its quantitative easing program, which ultimately increased the base money supply by $3.6 trillion. Most people recall that prior to the financial crisis there was a housing bubble. By directly purchasing mortgages and by inflating the money supply, the Fed manipulated interest rates lower. Housing relies heavily on the supply of credit and ultimately on the cost of interest. With lower interest rates and more money available to lend, housing prices were manipulated higher. As a result, distorted price signals were sent to both buyers and sellers. Developers of housing respond by building more homes (increasing supply) and buyers of homes believe they can take on more debt at lower rates to purchase homes. More resources in the economy are devoted to the function of housing because of higher price levels. However, any increase in demand can only be sustained so long as the cost of credit is continually manipulated downward as a function of an increasing money supply.

Despite wide recognition of the unsustainable housing bubble in 2007, the national home price index is now 15% higher than it was at the prior peak. This is the manipulation of price levels on full display, and it happens as an intended function of central bank monetary policy. The Fed increases the money supply, lowers interest rates, and inflates asset prices such that the amount of existing debt in the credit system can be sustained. Credit expansion is the Fed’s objective in stimulating growth, and net new credit cannot be created unless existing debt levels can be sustained, which is why the Fed must inflate asset prices to achieve its objectives. Asset prices support existing debt levels. When everyone figures out the price signals are unsustainable and unreliable, it causes a shock to the system. This is what happened in 2007 and it is likely to happen again as the market signals have become even further distorted. But it is not some evil scheme; the Fed is not a purposively malicious actor. The Fed ultimately intends to promote “full employment” through its policies, but what it actually does is manipulate relative price signals which creates imbalances in the underlying supply and demand structures of the economy, creating sudden and more chronic unemployment.

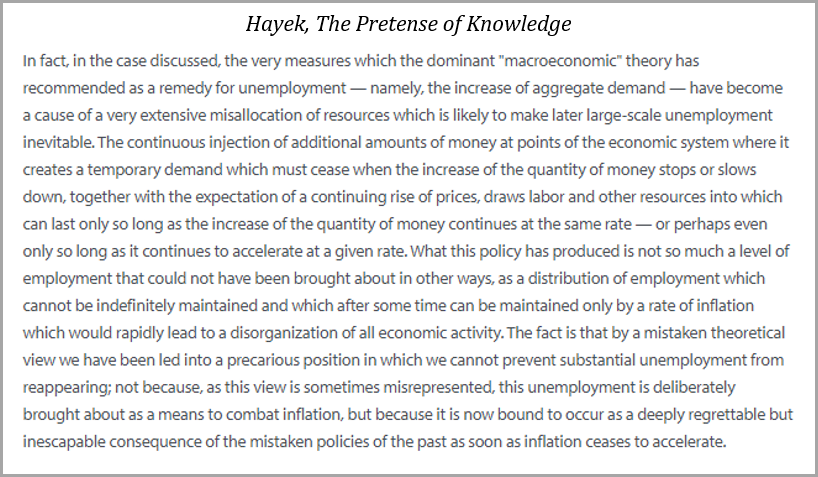

Hayek spoke on this subject in his 1974 Nobel Prize winning speech, the Pretense of Knowledge. As a function of manipulated prices, more resources are devoted to a segment of the economy than could otherwise be sustained naturally; when the central bank changes the course of its monetary policy, prices begin to respond and the market corrects. Because price levels have been manipulated on a sustained basis, a demand shock becomes inevitable and everyone figures out imbalances exist. In the case of the housing example, supply (both of goods and labor) significantly exceeds sustainable demand at current price levels. More broadly, imbalances are everywhere. It becomes apparent that supply and demand are significantly out of balance and unemployment increases rapidly. The market cannot find an equilibrium because all markets have been manipulated on a sustained basis for extended periods of time.

This is what occurred during, and in the aftermath of, the financial crisis. It was the boiling over point after the Fed had manipulated the supply of money and the supply of credit for decades. As portrayed in the Big Short, the financial crisis often gets blamed on the subprime crisis, but the not-often-discussed 800-pound gorilla in the room is central bank monetary policy. Following the crisis, the Fed responded by pursuing the same policy action it had pursued for decades but on a much greater scale; it massively increased the money supply, further manipulating price signals. When the money supply is manipulated, recognize that not all price levels respond ratably. Money enters the system through different channels and the expansion of credit impacts certain segment of the economy more than others. All prices are manipulated, but not equally. It is fundamentally the distortion of relative prices which disrupt the underlying supply and demand function of a market. Price communicates information. It is how market participants communicate what they value on a relative basis. And, it is how all market participants then respond to those preferences on the supply side: what skills people train themselves with, what businesses people choose to build, what employment opportunities people seek. The Fed may not intend to do harm by manipulating the money supply, but ultimately, it is the unavoidable consequence of distorting the price mechanism within an economy.

Predictability of the Money Supply

Bitcoin is the white knight. Or at least, it has the potential to be. By creating a fixed supply, bitcoin has the potential to be the greatest pricing mechanism the world has ever known. Once bitcoin reaches its maximum supply of 21 million, changes to the money supply will be removed entirely from the equation of price signals. It should be axiomatic that the creation of money does nothing to generate real economic activity. It doesn’t matter whether the change in the money supply is predictably small or whether the money supply increases significantly and unpredictably. Printing money does nothing to generate economic activity; it only serves to distort supply and demand. The utility of money is in exchange. Whether present exchange or future exchange, that is all. Money is not consumed; it is used to coordinate the economic activity that allows for capital to be accumulated. Whether it be physical capital required to produce real goods or human capital which advances arts, science, mathematics etc. That capital is the true savings of a society and it is fundamental to the function of an economy.

Most people think of savings in monetary terms because money is a unit of account, but real savings is represented by the accumulated capital that enriches the lives of individuals, families, and communities. In a world with a fixed money supply, monetary savings would be constant. Money would transfer from individual to individual, family to family, or business to business. But, in total, the money supply would neither increase or decrease. Economic activity would be coordinated as a function of money and with an undistorted pricing mechanism. The aggregate preferences of all markets would be more accurately communicated without the distortion of a changing money supply. Imbalances in supply and demand would be naturally corrected and not sustained over long periods of time; as a consequence, imbalances would also be smaller and not systemic to the economy as a whole. It does not mean all prices would always be perfect or that other variables, such as government spending or taxes, could not influence or distort economic activity. However, it would eliminate the primary mechanism that distorts price signals and market structures.

Bitcoin’s fixed supply is the foundation of its more reliable pricing system but it is also issued at a predictable rate. In the future state, when bitcoin reaches its maximum supply, the rate of change thereafter will be zero. But on its way to that future state, bitcoin imbeds a stable and predictable supply schedule, which is a distinct and equally important part of the equation. Bitcoin are issued through a mining process that helps to secure the network and the network adjusts to ensure that bitcoin are issued on average every ten minutes. If more mining resources are added to the network, the network adjusts to prevent bitcoin from being issued at a faster rate. More mining results in greater levels of network security, rather than increasing the rate of issuance or increasing the total amount of bitcoin that will ultimately be issued. This allows the entire economic system to plan for the future. It allows miners building security infrastructure to forecast future compensation, but it also allows all market participants to predictably know the rate of change of the currency at any point in time.

Rather than allowing bitcoin to be issued rapidly or at an unpredictable rate, the network ensures that bitcoin will be issued steadily over time and as a consequence, on a more distributed basis. Most importantly, it constantly reinforces the credibility of the overall issuance structure. Every ten minutes (on average), a certain number of bitcoin are issued. Approximately every four years that number is cut in half until ultimately no incremental bitcoin will be issued. On the path to 21 million, the enforcement of the fixed supply every ten minutes builds credibility in the future state supply over time. All market participants come to understand that the fixed supply will be enforced not because of a magical point in time when the maximum is actually reached, but instead because the network enforces its monetary policy every 10 minutes. By creating a predictable supply schedule, the rate of change predictably decreases, and all market participants can observe for themselves that the system is functioning as intended.

Monetary Policy by Consensus vs. Central Bank

This process which constantly reinforces the credibility of bitcoin’s monetary system is occurring in parallel to the dysfunction of legacy monetary systems. Central banks everywhere are increasing the money supply of their respective economies at unpredictable rates. As discussed previously, the Fed increased the money supply in the U.S. by $3.6 trillion following the financial crisis, from 2008 to 2014. Despite the Fed forecasting its plans, no one knew what the total would ultimately be. Everyone was guessing. The Fed didn’t even know. And, after increasing the money supply by several multiples, the Fed then began removing $50 billion dollars from the economy each month, a process which began in October 2017. Again, no one knew exactly how much money would actually be removed from the system, in total or for how long. In aggregate, approximately $700 billion in base money was removed over the course of approximately two years. And now, as of October 2019, the Fed has once again shifted course and has begun to add more money back into the system. Just recently, the Fed signaled plans to add $60 billion dollars to the financial system each month (planned for the next six months). But once again, no one really knows for how long this will go on or whether the amounts will change. Realistically, the Fed does not know because it is impossible to know.

All we practically know is that from this point forward the money supply will increase (and by a lot). But recognize, most market participants have no idea any of this has occurred or is occurring. All market participants really know is what is communicated to them via prices and employment opportunities. Those that have an understanding of the Fed’s actions may be in a better position to forecast or predict the directional consequences, but economic systems are complex. We all react to the pricing mechanisms around us and no one has anywhere close to perfect knowledge; this is the pretense of knowledge. The aggregate knowledge of millions of people is communicated through price which is ultimately a function of ever-changing preferences of the individuals that make up an economy.

Individuals are inherently limited in the knowledge they possess. And this is certainly true of central banks. In the central banking monetary model, twelve individuals (or thereabout) determine how and when to create billions, if not trillions, of dollars despite possessing inherently limited knowledge. No matter how well-intentioned or how much knowledge possessed, the net consequence is the distortion of the fundamental mechanism (i.e. the pricing mechanism) which aggregates knowledge possessed by the market as a whole. For everyone relying upon the dollar as a unit of account and as a mechanism to communicate economic trade-offs, the very foundation changes unpredictably, unbeknownst to most of its participants. Distorted price signals are communicated gradually through millions of markets impacting the decisions made by hundreds of millions and the centralized mechanism that dictates monetary policy is a root cause of the distortion.

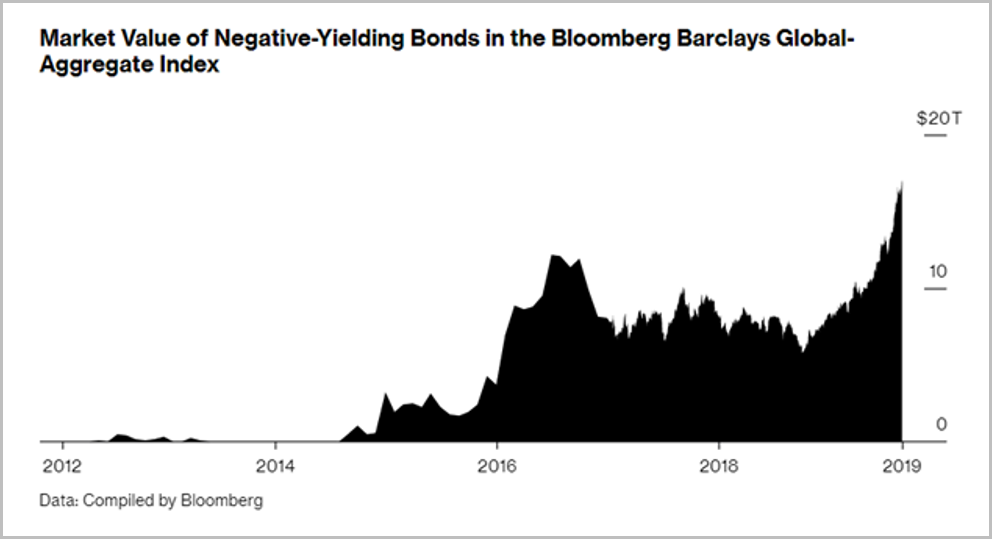

And even if a reasonable person believed active money supply management to be a net benefit, bitcoin is now operating alongside the legacy economic system: a decentralized system vs. a centralized system. Monetary policy by consensus vs. monetary policy by central bank. While the money supply of the legacy system is unpredictably changing, the bitcoin network is operating flawlessly with a known supply and with a predictable rate of change. Rather than it being a philosophical or economic debate, there are now two competing systems, and the market will have the last say. While bitcoin may be complicated and the very subject of money may not be well understood, the flaws in the existing system are independent of bitcoin. The $17 trillion of negative yielding debt should be evidence enough and it only exists as a direct consequence of central bank monetary policy. Ultimately, the currencies that support the legacy system will be the release valve because central banks will be forced to increase the money supply in order to sustain what is an otherwise unsustainable credit system.

With the legacy system coordinated by central banks, all one can rely on is that the money supply will change and at unpredictable rates. With bitcoin, everyone can verify the supply and the predictable rate of change. By running a bitcoin full node, anyone can verify the number of valid bitcoin that exist in circulation and the amount of new bitcoin issued in each block. Anyone and everyone can verify this information without trusting anyone else. This is how bitcoin works. Each node not only verifies information; it also validates information independently. Bitcoin’s monetary policy is enforced on a decentralized basis by all nodes within the network. With precision, everyone can calculate when future blocks will be solved and when the rate of issuance will change. The fact that everyone can verify and validate the money supply, regardless of the nominal amount, reinforces the credibility of the monetary system. This reinforcement occurs every 10 minutes, 6 times an hour, 144 times a day, 4,320 times a month, 52,560 times a year, with each passing bitcoin block. The monetary system hardens as market participants validate that the monetary policy is enforced, over and over again, every ten minutes.

Supply & rate of issuance verified on four year-old Apple laptop (supply: 17,988,755; block subsidy = 12.5 bitcoin or 1,250,000,000 satoshis)

Supply & rate of issuance verified on four year-old Apple laptop (supply: 17,988,755; block subsidy = 12.5 bitcoin or 1,250,000,000 satoshis)

A fixed supply is of little meaning without the credibility of its enforcement. Anyone can copy bitcoin’s architecture and code base. But what cannot be replicated is the credibility of its monetary properties. The consensus mechanism which governs bitcoin is the foundation of its credibility and what ultimately sets bitcoin apart from its competition. Even if an individual remained unconvinced that a currency with a fixed supply would communicate better information through its pricing mechanism, it does not matter what any individual believes. Bitcoin entrusts its monetary policy to a consensus mechanism. While the maximum supply of bitcoin is practically capped at 21 million, the supply is ultimately governed by a consensus of those that hold bitcoin as a currency.

If the market, which unquestionably possesses more information than any individual, collectively determined that it would be better to change the supply schedule rather than implementing a fixed cap, it is theoretically possible. However, the market would have to come to an overwhelming consensus to effect that change, and practically speaking, a decentralized network of rational economic actors would not form an overwhelming consensus to debase its own currency. Bitcoin’s monetary policy is flexible enough to change but it is impossible to do so without an overwhelming consensus. Bitcoin ultimately represents the contrast between monetary policy by consensus and monetary policy by central bank. The information possessed by a market consensus mechanism will always exceed that of a small number of individuals, which is why bitcoin out-competes the legacy system at every step.

Bitcoin is Not a Pyramid Scheme

So no, bitcoin is not a pyramid scheme. It is not organized by a sketchy company, pushing high pressure sales tactics. It is not peddling some inferior consumer good, with abundant supply, where compensation is directly tied to recruiting new members to the scheme. Bitcoin is money and its supply is finitely scarce. It does not matter how many people adopt bitcoin; as adoption increases, the same pie is distributed across more and more people, and on average, more people control a smaller and smaller share of the network. Its value increases as a function adoption, and adoption is increasing because its monetary properties are superior to the competition. Bitcoin has a fixed supply, its supply schedule is predictable, and its monetary policy is governed and enforced by consensus. Bitcoin’s pricing mechanism is unmanipulable and cannot be distorted because of its fixed supply. Everything changes around bitcoin but bitcoin’s fixed supply is the constant. Because bitcoin’s supply is fixed and cannot be manipulated, it will eventually become the most reliable pricing mechanism in the world, and consequently, the greatest distribution system of knowledge.

That is the promise which bitcoin provides, and it will only proliferate if it creates utility for those that adopt it. Today and into future, that utility will continue to be the ability to reliably store wealth in a monetary medium that cannot be debased. When people make the claim that bitcoin could be “bigger-than-the-internet,” it is generally not a linear application, but instead rooted in the idea that a sovereign, unmanipulable form of money has the potential to be one of the greatest instruments of freedom ever invented. The success of bitcoin is not a given, but if successful in delivering on its promise, it will facilitate more effective and more peaceable coordination by and amongst people throughout the world. At the end of the day, bitcoin is a communication tool. That is the function of money. Bitcoin simply provides an alternative system, operating on a decentralized basis which no one controls. It is the lack of control and the lack of conscious direction which will allow bitcoin to accumulate and communicate knowledge more effectively than any pre-existing monetary medium. Current volatility is nothing more than the logical path of price discovery, as adoption increases exponentially over time and as we advance toward that future state of full adoption.

“Many of the greatest things man has achieved are the result not of consciously directed thought, and still less the product of a deliberately coordinated effort of many individuals, but of a process in which the individual plays a part which he can never fully understand. They are greater than any individual because they result from the combination of knowledge more extensive than a single mind can master.” – Hayek, The Counter-Revolution of Science

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |