An Open Letter to Ray Dalio re: Bitcoin

| Crypto Words has moved! The project has migrated to a new domain. All future development will be at WORDS. | Go to WORDS |

An Open Letter to Ray Dalio re: Bitcoin

An open letter to hedge fund colossus Ray Dalio regarding his worldview, the forces of financial nature, and how Bitcoin is bound to reshape both.

By Robert Breedlove

Posted November 8, 2019

Introduction

Ray, your ability to penetrate the opaque realm of economics and share its secrets in an easy to understand language is one of your greatest gifts to humanity. With your videos, openly published research, and authorship, you have opened the eyes of many to a topic most consider too difficult to comprehend. The world needs more pioneers like yourself writing easy-to-read maps for the nearly incomprehensible territory of economics. Macroeconomists, Academics and Central Bankers rely heavily on deceptive language and universal public ignorance to perpetrate their schemes; your work in converting this esoteric domain into a more exoteric form is therefore commendable.

Let me begin by saying that, like you Ray, I consider myself a “dumb shit” who is more focused on dealing with what I don’t know rather than relying on what I do know to navigate life and work — a mindset well accorded with ancient wisdom:

“All I know is that I know nothing.” — Socrates

Epistemic reach is finite, as knowledge cannot explain everything in the world and, often, it clouds the truth. So let us explore the territory of economics with a beginner’s mind, free of the accumulated clutter commonly called “conventional wisdom”. It is from this frame of mind that I present to you this open letter regarding your perspective on Bitcoin through the lens of your stated principles on life and work (in this letter, I sometimes direct my comments at Ray, and sometimes at the audience, so please bear with these shifting perspectives).

We begin with an evaluation of Ray set in the idea-meritocratic style practiced at Ray’s firm, Bridgewater. The purpose of these evaluations is to grade your peers candidly, being brutally honest and holding no punches, to ensure that the best ideas rise to the surface — unimpeded by policy, politics, or hierarchy — so that they may be scrutinized and, if useful, acted upon. In Bridgewater’s culture, communication is both top-down and bottom-up, so that people feel empowered to share their honest perspectives. For Ray, it’s all about getting to the truth by any means necessary, and I appreciate his blunt approach. We will explore all of this more deeply below — so let’s dive in.

Evaluation of Ray’s Assessment of Bitcoin

Subject: Ray’s Assessment of Bitcoin

From: Robert Breedlove

To: Ray Dalio

Cc: Everyone

Attachments: Ray’s assessment of Bitcoin available here —

https://www.youtube.com/watch?v=UyVIuNI797w

Ray,

You deserve an “F” for your assessment of Bitcoin’s significance and future prospects. Although there are very few of us, everyone who has the requisite depth of understanding in the fields of computer science, monetary history, game theory, economics, and mathematics, and has spent the time intensely studying Bitcoin (it takes a lot), agrees with this harsh evaluation of your short-sighted assessment of this momentous monetary innovation. As one of your biggest fans, I truly believe that if you take another look (a long, hard, thoughtful look), you will see the light. Specifically, your assessment fails for the following three reasons:

1. You claim that you are sold “blockchain technology”, despite the only proven use case for “blockchain technology” is as a component of Bitcoin. Contrary to “conventional wisdom”, the real breakthrough is Bitcoin, not blockchain.

2. You state that Bitcoin could be disrupted by another “cryptocurrency”, however this extremely unlikely: Bitcoin is a path-dependent, one-time invention; its critical breakthrough is the discovery of absolute scarcity — a monetary property never before achieved by mankind. The emergence of Bitcoin cannot be reproduced because absolute irreproducibility is the discovery! The iPhone disrupting Blackberry analogy you cite is irrelevant; Bitcoin is a protocol, not a consumer product.

3. You state that price-stable, central bank issued currencies will be issued, which will likely be attempted, but such currencies would be antithetical to free markets. Further, price stability is an illusion: all economic goods move against one another in ratios of exchange, money is simply the most marketable good, hence the reason money-denominated exchange ratios (prices) tend to be more stable, but are still subject to supply and demand interaction. Since Bitcoin is absolutely scarce and cannot be stopped, it is likely to continue outcompeting all other monetary technologies on the free market. As an economic good monetizing in real time, the exchange ratios between Bitcoin and various fiat currencies is likely to remain volatile for some time, but this volatility will continue to subside as Bitcoin’s market capitalization grows, thus making its use as a medium of exchange more practical, before reaching a point of sufficient network value where prices will come to be more commonly expressed in Bitcoin terms (similar to the evolutionary phases gold underwent during its monetization process).

Your assessment is especially disappointing for three reasons: 1) You have consistently exhibited a knack for comprehending, distilling, and communicating highly complex economic concepts in a manner palatable for general audiences, 2) The depth of knowledge you possess in history, economics, and free market dynamics presents you with a privileged position to best understand the emergence of and demand for this asset, and 3) Your virtually unparalleled reach and reputation as a macroeconomic thought leader, organizational engineer, and cultural innovator is an invaluable platform from which to trumpet to the dire circumstances faced by the prevailing economic order and how Bitcoin has the potential to alleviate them.

In the following open letter, I will show that the fundamental tenants of your worldview, as stated in your book Principles and other writings, are fully consistent with Bitcoin — even though you may not yet realize it. I’ll begin with two primer sections: one on the nature of money and its history, and one on Bitcoin’s general functionality and economic properties — either or both may be skipped by the reader who has “already fallen down the Bitcoin rabbit hole”, so to speak. After these primers, I will walk through many of Ray’s most important Principles, one by one, and break them down to better understand their relationship to markets and Bitcoin. Let’s begin.

Primer on Money

(this Primer on Money and the following Primer on Bitcoin may be skipped by the reader who understands the traits of money and Bitcoin’s general functionality/economic properties)

Money is a tool for moving value across time and space (or spacetime, as Einstein explained, these are actually one in the same). Money is an emergent property of barter (or direct exchange) that purports to solve the three dimensions of its non-coincidence of wants problem; it evolves naturally in the free market as the most exchangeable good in an economy. Although he is silent as to its origins, Ray understands the technological functions of money, as stated in his video assessment of Bitcoin (see open letter attachment above) that the primary functions* of money are:

1. A store hold of wealth: also called a ‘store of value’ in regard to moving value across time (the first function and evolutionary phase of money)

2. A medium of exchange: in regard to moving value across space (the second function and evolutionary phase of money)

*We will ignore for now the third function and evolutionary phase of money, unit of account, as it isn’t pertinent to our discussion here.

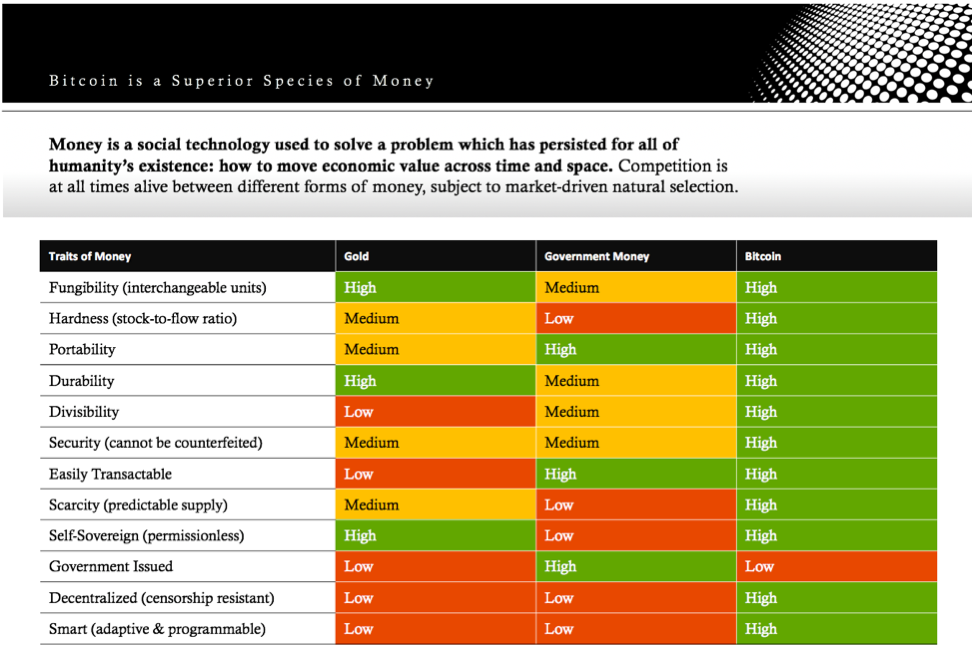

Although the purpose of money always remains the same, to move value across spacetime, the technology fulfilling this purpose is constantly being subjected to market-driven evolutionary pressures. The greater a monetary technology’s resistance to value dilution across time — whether by counterfeiting, supply inflation, or deterioration — the more effective it is as a store of value. Once a store of value accrues enough value, people begin to use it for trading purposes. The more widely accepted a form of money is, the higher its value as a medium of exchange, which makes this aspect of its value proportional to the number of its monetary network participants (aka users). When a specific monetary technology, in the form of an economic good, becomes widely accepted in interpersonal exchange (aka trade) it is called “money”. Monetary technologies compete to become more widely adopted based on the following traits:

1. Scarcity: resistance to money supply manipulations and, thus, dilutions to its monetary unit value (difficult to produce)

2. Divisibility: ease of accounting and transacting at various scales (separable and combinable units)

3. Portability: ease of moving value across space (high value-to-weight ratio)

4. Durability: ease of moving value across time (resilient to deterioration)

5. Recognizability: ease of identifying and verifying the monetary value by other parties in a transaction (universally identifiable and verifiable)

Due to the relative advantages competing monetary technologies offer, the particular economic good being used as money can, and does, change over time. Throughout history, mankind has employed seashells, salt, cattle, precious metals, and government paper as money, to name a few. Similar to the price discovery process in a free market — where the collective actions of buyers and sellers are continuously compressed into a single actionable variable called the market price — competing monetary technologies undergo a market-driven discovery process. We can gain a better understanding of this dynamic through an analogy: monetary evolution is (roughly) comparable to the evolutionary process we see in communications technologies.

No matter what specific means is used to fulfill it, the purpose of communications technology remains the same: to move information across spacetime. Similar to the market for money, competition is at all times alive among different communications technologies, in which they are all subjected to a market-driven discovery process. As newer technologies are invented they are market-tested through competition; each survives or dies in terms of its relative speed, message fidelity, reliability, traceability, and mobility. Since these technologies have a singular purpose, people tend to adopt a common technology, a coalescent process that is propelled by network effects.

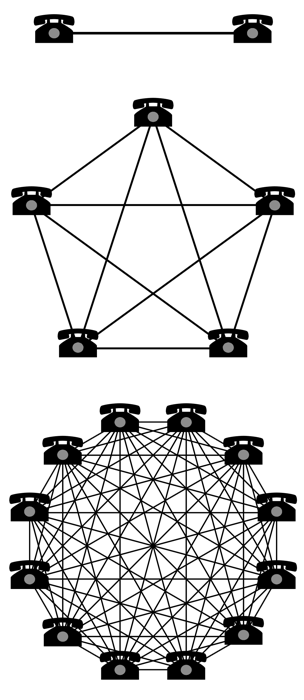

Network effects, defined as the incremental benefit attained by adding a new member to a network for all of its existing participants, drive people to adopt a primary form of communications technology. As more people migrate to the latest and greatest technology, it encourages others to do the same, as more network participation exponentially increases the number of possible connections. A simple example of this is the telephone: with two phones in existence, only 1 connection is possible; with five phones in the network, the number of connections jumps to 10; and with twelve networked phones, the number of connections increases exponentially again to 66, and so on. (see Metcalfe’s Law for a directional explanation of this network effect dynamic):

Network values are based on the number of possible connections they enable; they grow exponentially with the addition of each new constituent (or node)—this property is called network effects.

Network values are based on the number of possible connections they enable; they grow exponentially with the addition of each new constituent (or node)—this property is called network effects.

Since the purpose of communications technology remains singular (moving information across spacetime) despite technological advances, whichever technology is best at fulfilling this purpose has a tendency to become dominant in the marketplace. This tendency, reinforced by network effects, has driven communications technology evolution from carrier pigeons to telegraphs, to the internet today. This is an expression of the winner-take-all (or, winner-take-most) dynamic inherent to many networks, including those of the communications and monetary technology varieties.

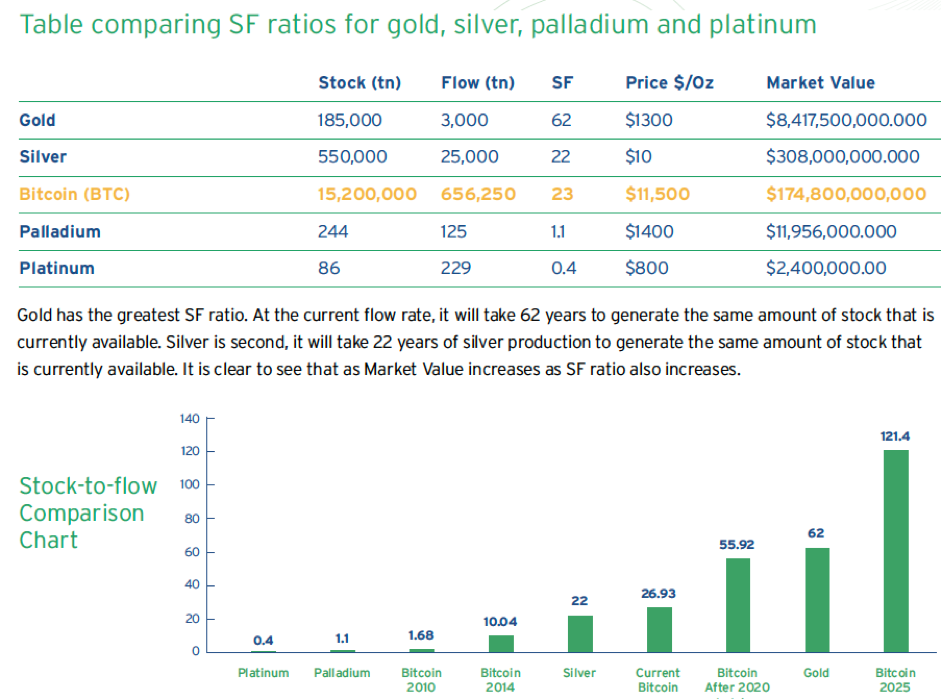

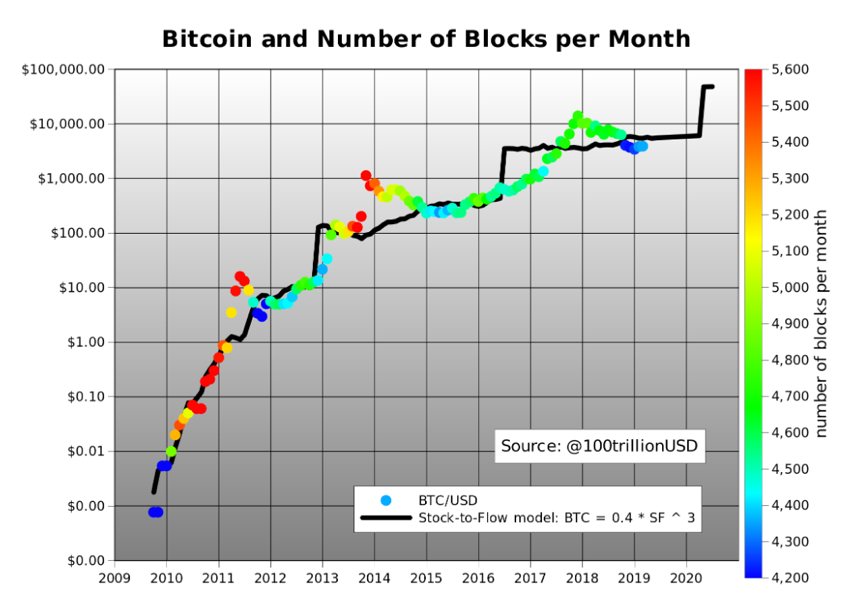

Similar to the purpose of communications technology, the purpose of monetary technology is singular: to move value across spacetime. The various monetary technologies used to fulfill this purpose, however, undergo market-driven discovery and, thus, evolve over time based on their respective monetary traits. In respect to the traits of money, the one that takes primacy in determining a specific monetary technology’s likelihood of success in the free market is its hardness (also called the scarcity or soundness of money). This trait is of primary importance because it determines a money’s usefulness as a store of value, and a money that cannot adequately store value across time necessarily cannot transmit value effectively across space. The relative hardness, or scarcity, of a competing monetary technology is quantified by its stock-to-flow ratio, a valuation metric also common in precious metals markets such as gold:

· Stock is the existing unit supply of monetary units (for example: ounces of gold, quantity of US Dollars, or quantity of Bitcoin)

· Flow is the newly created supply over a specific time span, usually one year

· The stock-to-flow ratio is calculated by dividing the stock of monetary units by its newly created supply flow (can be thought of as the inverse of inflation)

· The higher the stock-to-flow ratio, the greater the hardness (also called soundness or scarcity) of the monetary technology

We can think of monetary hardness as the difficulty (or cost) necessary to produce an incremental unit of a monetary technology. For instance, the capital and operational expenditure necessary to extract an ounce of gold from the ground is the basis of its monetary hardness. As producers of gold will always seek to extract it until their incremental cost per ounce is equal to their incremental revenue per ounce (in other words, until marginal cost equals marginal revenue), there is a perpetual financial incentive for producers to maximize new supply flows up to the point of economic breakeven. In comparison to communications technologies, money exhibits much stronger centripetal, winner-take-all network effects that drive users to adopt a single store of value. Those who fail to adopt the hardest money available to them face a debasement of their stored value by those who can produce it at an incremental profit (where MC<MR). Hard money, then, is simply the monetary technology freely selected in an unobstructed marketplace as the most sound store of value available. Historically, gold prevailed as hard money precisely because of its superior stock-to-flow ratio relative to other monetary metals:

Relative supply scarcity, as quantified by the stock-to-flow ratio, is a key driver of monetary value.

Relative supply scarcity, as quantified by the stock-to-flow ratio, is a key driver of monetary value.

On the free market, people naturally and rationally choose to store the value created by their work in the monetary technology that is hardest to produce, since producing new units dilutes the value of existing units for all holders of said money. Since gold exhibits superior monetary hardness, it has outcompeted silver and other monetary metals several times throughout history. Gold outcompetes due to the game-theoretic aspects of an evolving store of value:

Propelled by network effects and relative supply scarcities, people coalesce around a single store of value.

Propelled by network effects and relative supply scarcities, people coalesce around a single store of value.

Since gold is virtually indestructible, nearly every ounce mined throughout human history remains part of its extant supply; and since gold is relatively rare in the Earth’s crust, its new supply flows are a small percentage of its existing stock each year. Taken together, these properties give gold the highest stock-to-flow ratio of any monetary technology in the world (before Bitcoin), meaning that its supply inflates at a relatively low and predictable rate. Superior hardness is precisely why gold became the dominant monetary technology on the free market.

Game theory tells us, and market history proves, that anyone who can, for instance, profit from silver production by selling it at a higher price than it cost to produce, has a direct financial incentive (the protection of value across time) to store any profits generated in the hardest form of money available to them. As all market participants are subjected to this harsh economic reality, this persistent incentive triggers investment flows from silver (or any other softer monetary technology) to gold (or the hardest form of money available). In this way, free market competition causes people to converge on a single store of value and, therefore, perpetually promulgates hard money. This is not surprising, as free markets tend to zero in on the best possible technological solutions to problems, discarding the rest. And conceptually, in the same way that money is an emergent property of a direct exchange (barter) economy, hard money is an emergent property of an indirect exchange (monied) economy.

The physicality of gold gives it both advantages and disadvantages. Being a precious metal that achieved its monetary value on the free market, gold is a self-sovereign monetary technology, meaning that its value, trust factors, and transactional permissibility as money are not subject to any counterparty risk whatsoever. In other words, gold is equity-based money or a bearer asset. If someone flips you a gold coin and you stick it in your pocket and walk away, then you have just participated in an irreversible transaction. The value of this coin is set by the market and whosoever is in physical possession of it is assumed to be its rightful owner. No bank or payment intermediary can censor or reverse this free market transaction. You have no need trust anyone else, whether you choose to hold or spend your gold. Self-sovereignty is a quality uniquely intrinsic to bearer assets such as gold, silver, or diamonds.

Contrarily, if someone hands you a US Dollar, you assume the counterparty risk of the US Government, who can dilute its value via supply inflation (as we see with all fiat currencies throughout history) or deauthorize its value altogether (as we saw when India deauthorized its 500 rupee bank note). Further, if you received this US Dollar through a payment intermediary, like Paypal or Venmo, you are also exposed to the risk of this payment being censored, reversed, or surveilled. Even when physically hoarding fiat currency, it is still vulnerable to supply inflation as its central bank backer can simply print more, stealing the value stored therein. By transacting in anything other than a bearer asset, which is valued solely based on free market dynamics, you forfeit your personal financial sovereignty to the currency issuer and/or other financial intermediaries.

Although gold’s physicality gives it the property of self-sovereignty, it also comes with inherent disadvantages. Its primary drawback is its suboptimal divisibility. Since gold has such high value to weight, it is impractical to pay for coffee using gold coins, for instance. This drawback of gold is what gave silver some utility as a medium of exchange throughout history, as its value to weight was much lower making it more practical to use for everyday purchases (due to its higher divisibility and portability), whereas gold was typically reserved for settling large transactions.

Eventually, gold’s divisibility problem was “solved” when central banks which began issuing paper currencies which were fully redeemable for gold. This provided users with a hybrid monetary technology that exhibited the hardness of gold, while offering an ease of transactability (high divisibility and portability) even greater than that of silver. With its marginal utility disrupted by paper currencies (and later, electronic abstractions of paper currencies), silver became completely demonetized and eventually the entire world market for money evolved to a paper-currency-enabled gold standard.

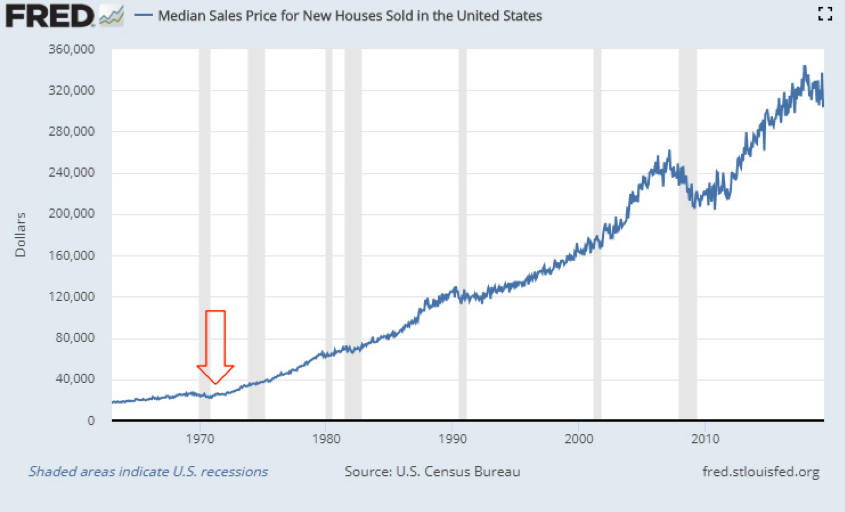

With transactions being executed in gold-backed paper currencies, the global gold standard led to the centralization of gold within bank vaults. These gold hoards became too tempting for governments and their central banks to resist expropriation of, thus catalyzing the fractional-reserve banking practices now ubiquitous in the modern world economy. As governments created more currency units than they could support with their gold reserves, they started revoking currency redeemability for gold, which culminated in the 1971 unilateral decision by US President Nixon to permanently sever the peg to gold (deceivingly, it was declared to be a temporary measure):

https://www.youtube.com/watch?v=iRzr1QU6K1o

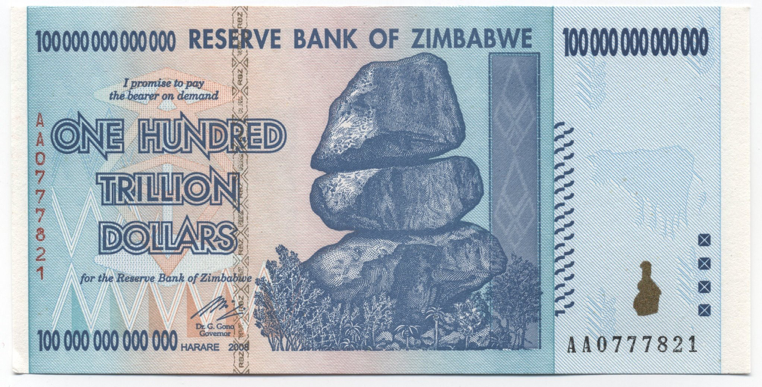

Since all other currencies in the world were pegged to the US Dollar, this final act of financial sovereignty usurpation officially abolished the gold standard worldwide. This death-stroke to monetary integrity brought us into the age of the “political debt-based money backed by the future cash flows of taxing authorities” we all are legally coerced into using today — fiat currency. With fiat currencies came the limitless inflation suffered episodically all over the world. Inflation comes to us from the Latin verb inflare meaning “to blow up”. This is an apt description since once it sets in, fiat currency inflation has only one possible outcome — dilution into worthlessness:

Central banking made many Zimbabweans the first broke-ass trillionaires, but certainly not the last.

Central banking made many Zimbabweans the first broke-ass trillionaires, but certainly not the last.

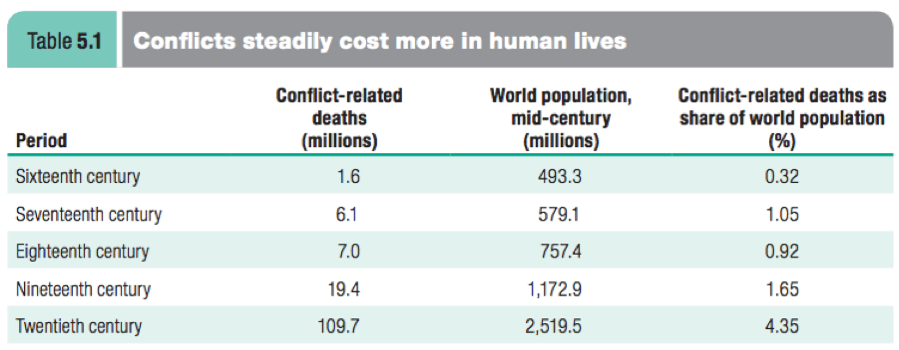

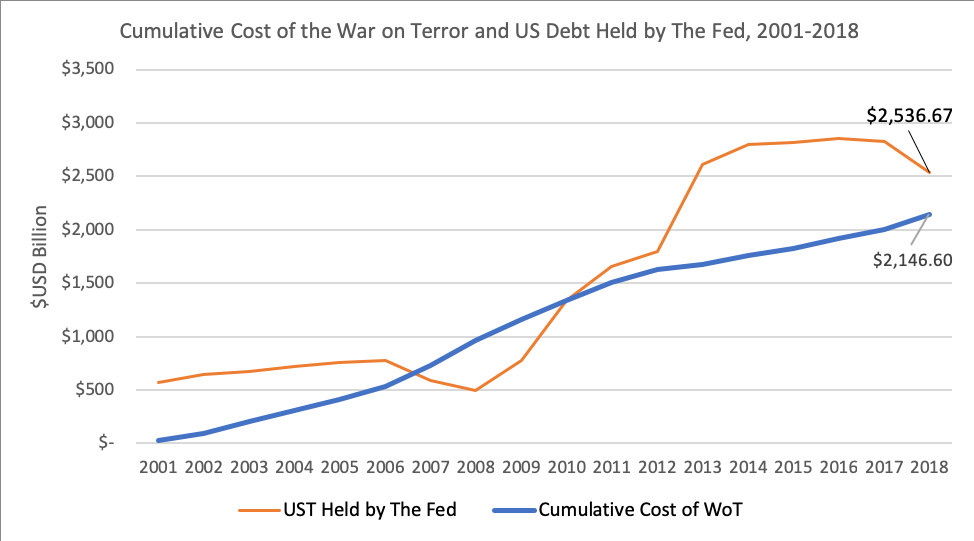

Since breaking its peg to gold, the US dollar has lost over 97% of its relative value. The fiat currency printing press has proven to be the weapon of choice for political leaders to further their agendas and enrich themselves; it has also become the primary means for funding perpetual warfare. During the past century of central banking — which cunningly imposed its dominion over a large swath of the world’s gold supply through coercion and confiscation — there has been unprecedented per capita death in warfare, an ever-widening wealth disparity, and an incessant sequence of economic boom and busts fueled by the continual marginalization of paper currencies and, ultimately, the instantiation of fiat currencies. Today, all semblance of monetary integrity and sanity has been destroyed with citizens left optionless, forced to transact in softest form of money in history.

In the wake of the latest (and arguably the greatest) fiat-currency-fueled economic bust, the 2008 Great Recession, when central banks all over the world were busy printing more fiat currencies to recapitalize their financial institutions via the shadow tax of inflation, Satoshi Nakamoto released an open-source software project into the world. He, she, or they called it Bitcoin.

Primer on Bitcoin

(again, this Primer on Bitcoin may be skipped by the reader who understands Bitcoin’s general functionality/economic properties)

Bitcoin can be thought of as the first incarnation of self-sovereign money in digital form. Its transactions are irreversible, uncensorable, and unstoppable. In other words, Bitcoin is the world’s first digital bearer asset. Possession of Bitcoin is achieved by holding its private key, which is an alphanumeric data string that can be stored in analog, computer, or even human memory. Its absolutely scarce money supply is anchored to the most fundamental commodity in the universe — energy.

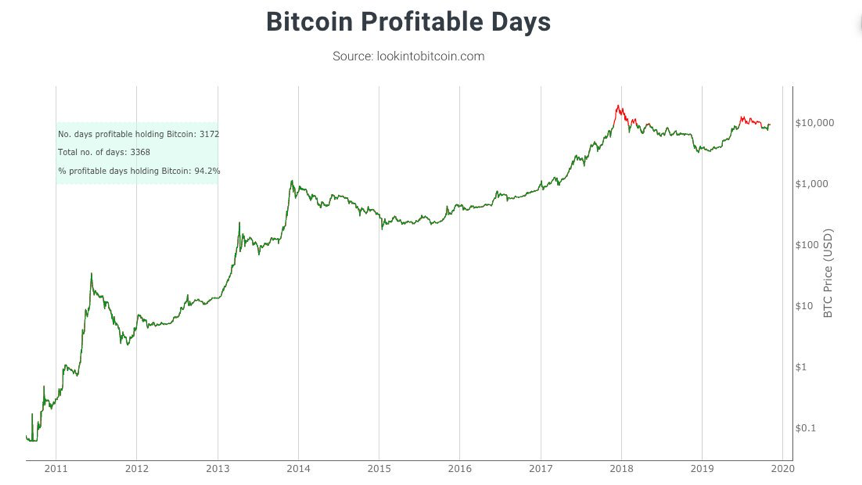

Bitcoin’s stock-to-flow ratio, the measure of its monetary hardness, increases (inevitably) every 4 years and will be about twice that of gold after its 2024 downward inflation rate adjustment (the halving); at this point, Bitcoin will definitively be the hardest form of money that has ever existed. Bitcoin’s uncompromising, apolitical monetary policy is enforced by unbreakable cryptography, hence this inevitability (as sure as 1+1=2). Its unrivaled hardness is made possible by an ever-rising production difficulty that requires expenditure of real world energy in a process called proof-of-work. This anchor to economic reality is also called mining — in an ode to the difficulty of gold production — and is the source of Bitcoin’s monetary integrity.

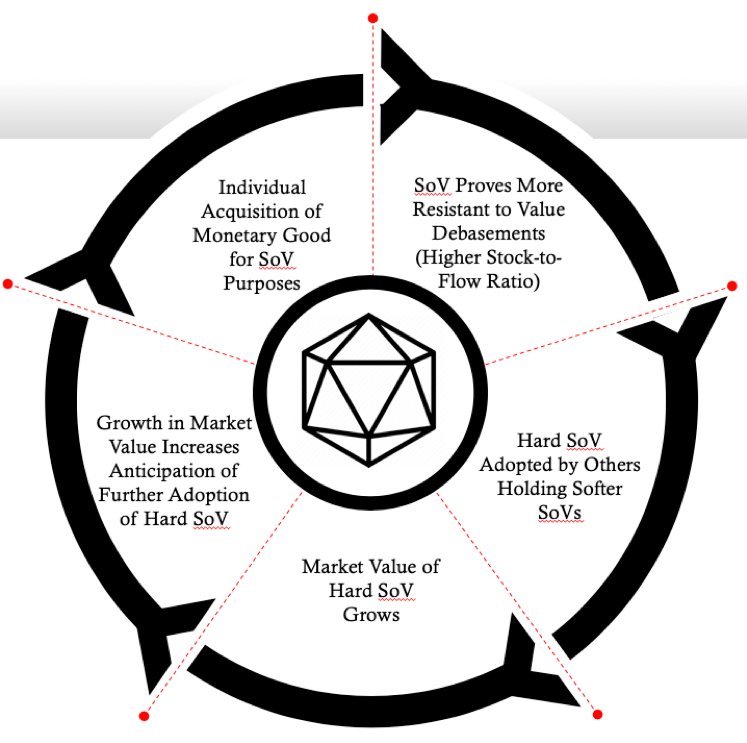

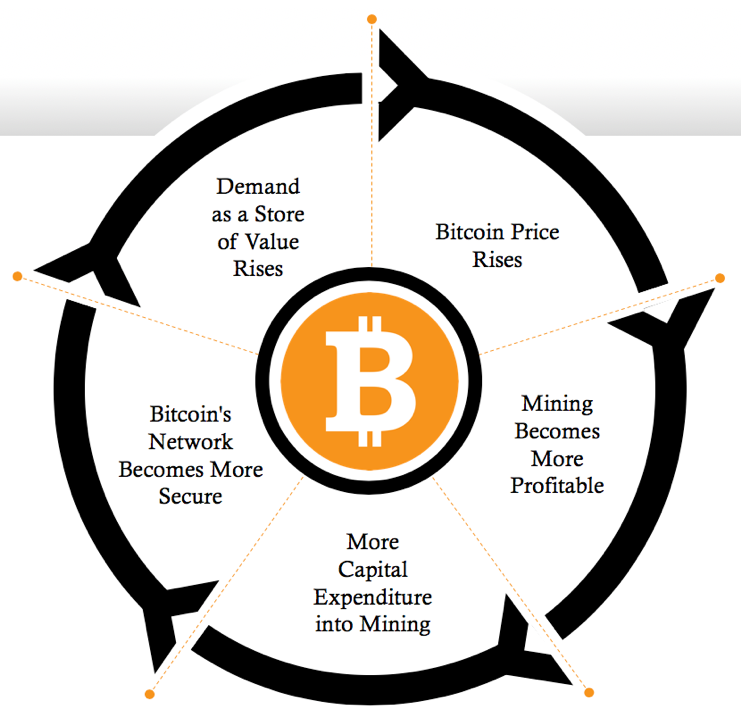

Bitcoin is also the world’s first asset with perfect supply inelasticity, as changes in its price have absolutely no impact on its supply flow. This means changes in demand for Bitcoin can only be expressed in its market price. If the price of gold increases, its new supply flow will increase as new miners enter the market and new methods of gold mining becoming economically feasible (since the gold miners can sell their product at a higher price), thereby applying downward pressure to its stock-to-flow ratio. With Bitcoin, no matter how much its price increases, it is absolutely impossible to create any new supply flow beyond its mathematically enforced and universally transparent issuance schedule. Also, a higher market price means a more secure Bitcoin network, as the resources allocated to mining are used to secure it. Like a vault with walls that thicken as more value is stored within it, Bitcoin adapts to become a more secure monetary network as its market capitalization grows. Absolute obstinance of the algorithmically enforced Bitcoin monetary policy drives a virtuous cycle that perpetuates the expansion of its network:

An ingenious composite of unbreakable cryptography and economic incentives causes Bitcoin to grow relentlessly.

An ingenious composite of unbreakable cryptography and economic incentives causes Bitcoin to grow relentlessly.

Bitcoin’s money supply is absolutely scarce, meaning its monetary policy (or money supply) is fixed — only 21M units will ever exist. Before Bitcoin, only time itself exhibited the property of absolute scarcity. This means that its stock-to-flow ratio will continue to increase and eventually become infinite when the last Bitcoin is produced sometime in the middle of the 22nd century. Bitcoin’s monetary policy is becoming the most trusted in the world as it is fully transparent and unchangeable.

Bitcoin runs countervailing to government monetary policy which is uncertain, opaque, and subject to change based on the whim of bureaucrats. Essentially, we each must decide if we are to trust the whimsical nature of self- interested bureaucrats or the inviolable nature of mathematics to manage our money supply. Shockingly, whether we decide or not, the harsh economic reality of Bitcoin’s superior hardness is likely to be imposed upon us all, as history teaches us the economic consequences of hard money cannot be ignored. As we saw earlier, the free market for money is winner-take-all. Critically, Bitcoin is open-source, like a spoken language, and it is transcendent of regulations and the legal insulations that preserve the monetary monopolies of central banks.

So we have Bitcoin, the hardest form of money in history, competing directly with government money, the softest form of money in history. So long as Bitcoin continues to exist, it will likely continue to outcompete gold and fiat currency in the free market, and its market capitalization will grow. Eventually, each and every holder of any softer form of money (whether its gold or fiat currency) will be faced with the grim reality of a gradually, then suddenly, depreciating asset relative to Bitcoin’s ever-constricting new supply flow. Imposition of this harsh economic reality will be applied persistently and each of us will be faced with the same mathematical and market-driven dynamic that has catalyzed the evolution of money throughout history.

Hard money, as selected on the free market, reigned for the first 4,900 out of 5,000 years of human commercial history and all signs indicate we are witnessing its reemergence in the rise of Bitcoin. Before government intervention, money supply was not a matter of policy, but instead was governed by game-theoretic principles, a “policy” rooted in natural law. Since governments have imposed monetary monopolies in the form of central banks, trust has steadily been eroded in their ability to prudently maintain money supplies. Said differently, Bitcoin is the most credible monetary policy in human history disrupting the most untrustworthy monetary policies in human history. A bet on Bitcoin is that the competitive dynamics inherent to the market for money will continue to play out in the same way they have throughout all of history, thus making money supply a matter to be determined once again by the free market instead of central planners.

Armed with these primers on money and Bitcoin, we will now dive deeper into the various principles that comprise Ray’s worldview. Through this exploration, we will gain a more fundamental understanding of history, markets, and Bitcoin. We begin with Ray’s most renowned cultural creation — the idea meritocracy.

Idea Meritocracy

(p.540) “Idea-meritocratic decision making is better than traditional autocratic or democratic decision making in almost all cases.”

At the pinnacle of Ray’s worldview is the cultural paradigm he originated at Bridgewater — the idea meritocracy. As a distinct organizational style, it’s intended to eliminate all barriers to the free flow of information between people — including ego, hierarchy, and personal agendas. An idea meritocracy seeks to align itself with reason and become impervious to politics. As Ray puts it, (p.306) “Power should lie in the reasoning, not the position, of the individual. The best ideas win no matter who they come from.” Essentially, an idea meritocracy is a free market for ideas — a way of filtering ideas via a (simulated) form of natural selection. Instead of charging ranked positions with the authority of decision-making, an idea meritocracy attempts to foster an environment in which the ideas compete freely based on their own merits:

The idea meritocracy: an open environment for the proliferation and combination of the most meritorious ideas, free from manmade impediments such as ego, policy, and hierarchy.

As a free market capitalist, it is unsurprising that Ray developed this approach to organizational culture, as it has proven to be the most effective system for the most people. It was (repeatedly) well established in the 20th century that free markets (capitalism) function better than centrally planned markets (socialism). At the heart of any economic system is the problem of properly adapting resource allocations to the circumstances faced by people at any particular point in spacetime. In other words, the core economic problem is how to best distribute current knowledge of relative value and scarcity. Knowledge is intrinsically superfluid: it resides within many minds and is constantly changing in accordance with the ceaseless interpersonal interactions among individuals and their assessments (and reassessments) of market realities. The challenge of an economic system is to enable quick, continuous, and effective assimilation and dissemination of this knowledge to properly guide entrepreneurial actions.

Naturally, individual entrepreneurs are always most familiar with the prevailing economic circumstances specific to their time, place, and industry. As they see, hear, and touch the productive factors and influences most pertinent to their domains on an almost daily basis, entrepreneurs gain and maintain an intimate understanding of the ever-changing conditions relevant to their chosen occupation. Said differently, knowledge has a localized dimension to it: it surfaces continuously at all points in spacetime where entrepreneurial actions (involving decisions and trade-offs) and economic realities (involving value and scarcity) interface. Therefore knowledge, by its very nature, is inherently distributed among the minds of many. And free markets, comprised of entrepreneurial actions guided by accurate price signals (more on these shortly) are the best assimilators and disseminators of these localized pools of knowledge within an economy. Simply, the free market is a nexus in which many minds effectively become one.

Capitalism is an economic system that deals with the distributed nature of knowledge in a true-to-life, bottom-up way. In a free market, each entrepreneur is unobstructed to operate in his own best interest in pursuit of profits. Contending with the ever-present realities of value and scarcity, the actions of entrepreneurs, like the actions of a pilot guiding his aircraft via his navigational instruments, are guided by the market prices relevant to his profession. This is free market capitalism: a seemingly chaotic bricolage of entrepreneurial decisions, price reconfigurations, and capital flows coming together in a unified orchestration that harmonizes individual and collective self-interests.

For instance, let’s consider the case of Larry the lemon farmer. Being a farmer, Larry is primarily conscious of the cost of fertilizer, soil, and water; and keenly aware of his total cost structure relative to the expected market value of his lemon crop, as maintaining total revenues above total costs is necessary for entrepreneurial survival. Should a drought strike and drive up the scarcity of water, Larry will become aware of this economic reality through the increased price of water which will, in turn, cause him to increase the selling price of his lemons or cut costs elsewhere to maintain his profit margin. Critically, Larry can respond effectively to this drought based purely on the increased price of water without any direct knowledge of the drought itself or its causes. As entrepreneurs choose to buy and sell the various productive factors related to their occupations, the knowledge in their minds becomes encapsulated in and distributed by the prices of these factors to everyone else in the world who interacts with them in the marketplace.

As new experiences provide feedback that change the state of knowledge, entrepreneurs must be left free to rationalize their own economic affairs, take risks in accordance with their rationalities, and operate in an environment free of coercion or violence that would otherwise disrupt their business dealings. Government in intended to be this protective force, which uses its monopoly on violence to prevent violence within society, thus preserving the rule of law and people’s rights to private property. Unhampered, free market competition among entrepreneurs ensures that only those adding value to society can survive and thrive. This principle of non-interference and mutual respect form the essence of true free market capitalism. An excerpt from the masterful essay I, Pencil poetically explains the magic of free markets:

“I, Pencil, am a complex combination of miracles: a tree, zinc, copper, graphite, and so on. But to these miracles that manifest themselves in nature an even-more-extraordinary miracle has been added: the configuration of creative human energies — millions of tiny know-hows configurating naturally and spontaneously in response to human necessity and desire and in the absence of any human masterminding! Since only God can make a tree, I insist that only God could make me. Man can no more direct these millions of know-hows to bring me into being than he can put molecules together to create a tree…The above is what I meant when writing, “If you can become aware of the miraculousness that I symbolize, you can help save the freedom mankind is so unhappily losing.” For, if one is aware that these know-hows will naturally, yes, automatically, arrange themselves into creative and productive patterns in response to human necessity and demand — that is, in the absence of governmental or any other coercive masterminding — then one will possess an absolutely essential ingredient for freedom: a faith in free people. Freedom is impossible without this faith…The lesson I have to teach is this: Leave all creative energies uninhibited. Merely organize society to act in harmony with this lesson. Let society’s legal apparatus remove all obstacles the best it can. Permit these creative know-hows freely to flow. Have faith that free men and women will respond to the Invisible Hand. This faith will be confirmed. I, Pencil, seemingly simple though I am, offer the miracle of my creation as testimony that this is a practical faith, as practical as the sun, the rain, a cedar tree, the good earth.”

Standing in stark contrast to the economic system of free market capitalism is central planning (socialism). Central planning, as the name implies, means directing an entire economy in accordance with a single unified plan in a top-down, authoritarian, and unnatural way. In a socialistic economic system, a central entity owns and operates all the productive factors (capital, land, and, ultimately, its people) within a society. As such, this centralized body (usually old, stale, and pale white guys) is arrogantly assumed to possess all the knowledge and feedback loops necessary to form a completely (and continuously) accurate representation of the ever-changing economic realities navigated by its society. Whereas the free market is a form of ideological competition (akin to the idea meritocracy) intended to guide entrepreneurial actions consistent with economic reality, central planning is more akin to the ideological totalitarianism (akin to bureaucratism) associated with a traditional organizational hierarchy, where the merits of ideas are given short shrift and underlings unquestionably carry out the orders of their “superiors”.

Being completely misaligned with reality, socialism failed because it is a poor information system: with all productive factors singularly owned and controlled, the price signals necessary for adapting to changing market realities are inhibited from developing. This inevitably leads to the shortages, mass starvation, and societal disintegration commonly associated with socialism. For an acute visualization of the differences in societal vibrancy between capitalism and socialism, take a look at this shot:

This image of North and South Korea at night vividly illuminates the stark differences between opaque central planning in the north, and vibrant free market capitalism in the south.

This image of North and South Korea at night vividly illuminates the stark differences between opaque central planning in the north, and vibrant free market capitalism in the south.

If we learned nothing else in the 20th century, it is that free markets are better than centrally planned ones in across almost every conceivable dimension. Left to function freely in their natural state, markets consistently generate innovation that increases productivity, lowers costs, and improves quality of life for everyone in society. Just consider for a moment how much innovations such as the automobile, smart phone, and internet services have increased our personal freedoms and enriched our lives. Now consider how un-innovative and un-adaptive government-run functions like the DMV, Post Office, and central banks are. So the elephant in the room, then, is why, in light of overwhelming evidence favoring a free market economic system, do we still tolerate central planning of the largest market of all — the market for money. Again, money is simply a technology for moving value across spacetime. Although it is an ancient (and somewhat, thanks largely to propagandists, enigmatic) social technology, it is hardly different than any of the other things we produce and distribute via free market mechanisms all over the world today.

Coming back to the congruence between the free market and the idea meritocracy, we arrive at two useful formulas. First, the idea meritocracy is comprised of three key elements: In Ray’s words, (p.309):

“Idea Meritocracy = Radical Truth + Radical Transparency + Believability-Weighted Decision Making”

Now, let’s translate this equation into its comparable free market format:

Free Markets = Truthful Price Signals + Transparent and Reliable Rule of Law, Private Property Rights, and Hard Money + “Skin in the Game”-Weighted Decision Making

With these equations in mind, let’s now dive into each of their elements to gain a clear understanding of Ray’s idea meritocracy and its relationship to free markets. Once we fully unpack these concepts, we will go deeper into the other principles underpinning Ray’s approach to life and work, using them as filters to more fully observe the potential impact of Bitcoin on all aspects of life.

We begin our journey from the greatest force of freedom in the universe — the truth.

Radical Truth

(p.135) “Truth — or, more precisely, an accurate understanding of reality — is the essential foundation for any good outcome.”

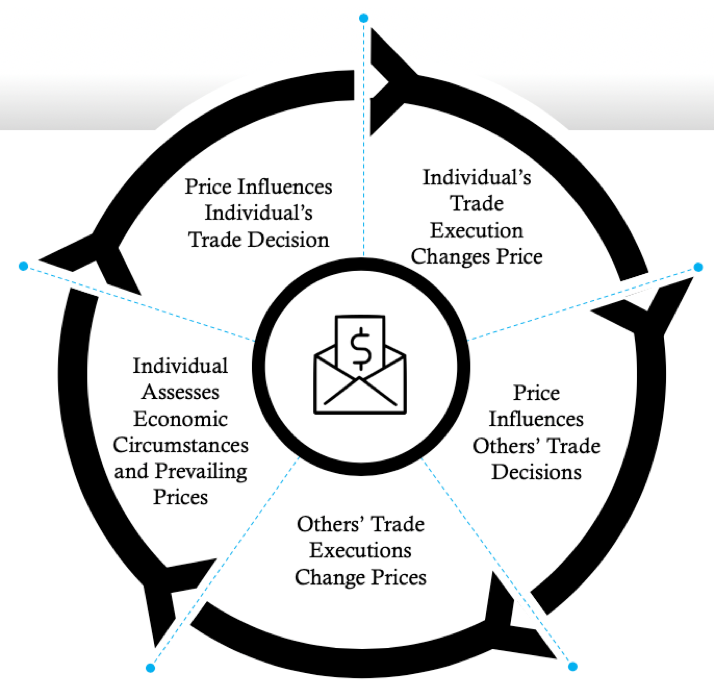

The first element of Ray’s idea meritocracy is Radical Truth, the idea that gaining a clear perception of reality is paramount to facing it head on and dealing with it. In markets, its commonly said that “price is truth”; meaning that all known market realities are expressed in, and evaluated by, any particular asset’s price at any given moment. You may remember from Economics 101 that the market price is the intersection of supply (an objective quality) and demand (an intersubjective or opinion-based quality). Put another way, prices are data packets that convey information about scarcity (which is objective) and value (which is intersubjective). Each entrepreneur’s decision to buy or sell is influenced by prevailing prices and, in turn, communicates back into the market the state of economic conditions relevant to him which, in turn, influences the same decision-making of all other entrepreneurs within his market; this is intersubjective value. These decisions are based on actual availability of time, resources, and know-how; this is objective scarcity. This feedback loop is the means by which free markets dynamically adapt to express prices that accurately portray economic realities:

Price signals are the economic nervous signals of an economy. To remain healthy and honest, they must be expressed in an uncompromisable monetary medium.

Price signals are the economic nervous signals of an economy. To remain healthy and honest, they must be expressed in an uncompromisable monetary medium.

Let’s return to Larry the lemon farmer: say a storm wipes out a large crop of lemons in California; reduced supply levels of lemons intersecting with an unchanged level of consumer demand necessarily means an increase in lemon prices. Increased prices incentivize lemon growers like Larry to produce more as they now fetch higher prices in the marketplace. On the other side of the lemon market, higher prices disincentivize consumers from buying as many of the sour yellow citrus fruit. As people respond to these ever-shifting incentives, which are a reflection of the endlessly shifting economic realities of supply and demand, free markets adapt to maximize output and minimize costs. In this way, price signals serve as a dynamic incentive system for equalizing supply and demand discrepancies in free markets. However, to maintain their truthfulness, these price signals must be freely expressed in a money that is undistorted by government interventionism.

A price signal converts countless economic complexities into simplicity; it compresses myriad market realities down into a single, actionable variable — the market price.

Accurate price signals only prevail if the market is freely competitive and not subject to government interventions such as price fixing, trade restriction, or legal monopoly insulation. In true free market capitalism, most markets are relatively unobstructed by such artifices and the price signals are, accordingly, mostly reliable conveyors of truth. Lemon prices, for instance, tend to reflect the actual underlying supply and demand (or scarcity and value) realities at any given point in time. The market for money, however, is quite different in the modern economy, and its differences have cascading effects across all other markets.

Money is economic water; in the same way water intermixes and intersperses organic chemicals throughout the circle of life, money mediates the interchange of goods, services, and knowledge within markets.

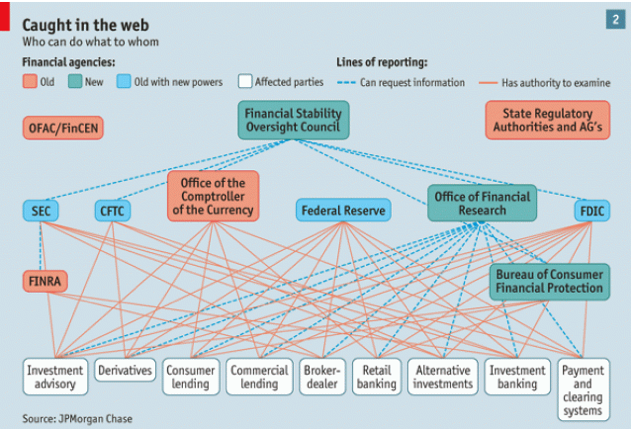

Money, as one half of virtually every economic exchange, is the largest market in the world. This market is monopolized by central banks in every major economy worldwide; meaning that all forms of money competitive to fiat currency are prohibited (see eGold). As Ray aptly points out, (p.533) “Fiefdoms are counterproductive and contrary to the values of an idea meritocracy.” Yet, for some reason, the economic fiefdoms called nation-states, which are antithetical to the free market paradigm (and, therefore, the idea-meritocratic paradigm), are commonplace. Even in the US, where we pride ourselves on being free market capitalists, we maintain this socialistic market structure for money. In this market, the following elements impact price expression of money:

· Supply — the amount of money available to be loaned out (aka loanable funds)

· Demand — the amount of loanable funds desired for borrowing

· Interest Rate — the price paid for funds borrowed

Central banks “manage” the market for money by controlling the supply of loanable funds and setting the interest rate (the price) at which these funds can be lent out. These central bank privileges are preserved by state-enforced monopoly rights, which insulate their mass-produced fiat currencies from competition and eliminate their “skin in the game”. Skin in the game, a crucial Talebian concept, is a property based on symmetry, a balance of incentives and disincentives: in addition to upside exposure, people must also be penalized if something for which they are responsible for goes wrong or hurts others. Skin in the game is a central pillar for properly functioning systems, of both the organic and inorganic variety, and is at the heart of hard money. For gold, its mining costs and risks form the disincentives which are balanced against the incentives of its market price. Central banks, through various schemes and machinations, eventually coopted the market for gold and developed an economic system that could create money without skin in the game; allowing them to privatize seigniorage profits and socialize any losses they incurred through inflation. Unless consequential decisions are made by people who are exposed to the results of their decisions, the system is vulnerable to total collapse; the frequent faltering of fiat currencies attests to the unfavorable asymmetry of this model for citizens.

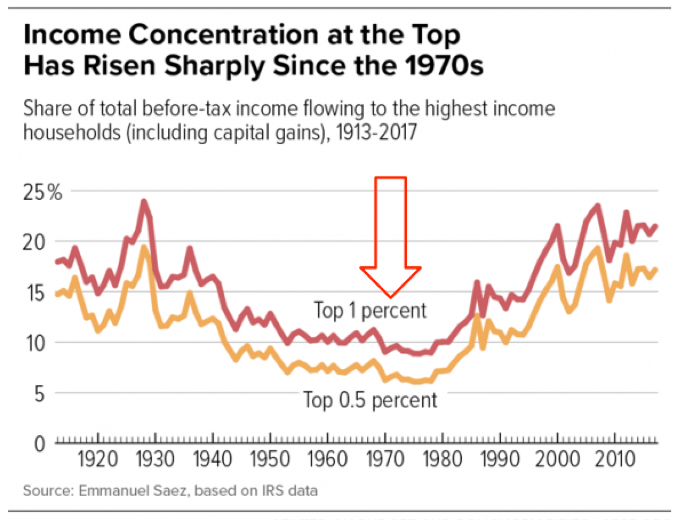

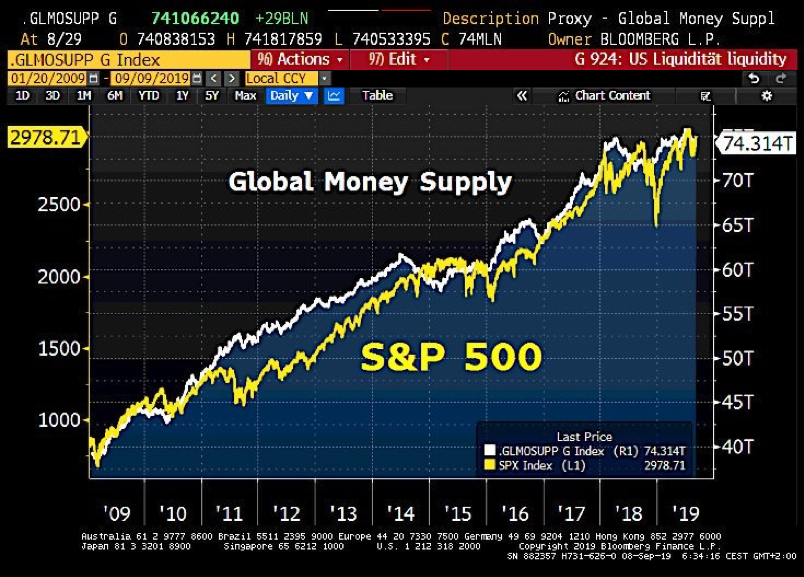

Most commonly, as they have a direct financial incentive to do so, and with no downside to consider, central banks increase the supply of loanable funds and decrease the interest rate below its natural levels, thereby inducing an expansion of the money supply. Importantly, money supply expansion does not create any new wealth, as “printing money” does not infuse an economy with any new productive factors such as tools, factories, equipment, or human time. Instead, expansionary monetary policy only redistributes claims on productive assets from their rightful owners to those who receive the newly printed money first — usually bankers, politicians, and the other politically-favored-few closest to the spigot of liquidity (due to the Cantillon Effect). As Charles Holt Carroll said:

“Inflation is the surest way to fertilize the rich man’s field with the sweat of the poor man’s brow.”

Inflation of the money supply is a violation of private property rights, as it reallocates wealth away from its original owners (the many) into the hands of those closest to the governors of the monetary system (the few). But confiscation of wealth, via the shadow tax of inflation, is not the only collateral damage inflicted by money supply expansion. Entrepreneurs operating in these soft money economies are easily misled by the distorted price signals that centrally planned fiat currency markets inevitably cause.

To understand this, let’s look at the world through the lens of Larry the lemon farmer: emboldened by the “cheap” loans proffered by his local banker, Larry decides to borrow money to expand his lemon farm. He figures that borrowing enough money at 3% will allow him to expand and increase output of his farm by 2.5X, while only increasing his cost structure (including the 3% loan interest payable to his banker each year) by 2.3X. This economy of scale (the positive 0.2X margin between revenue growth of 2.5X and cost increase of 2.3X), Larry calculates, will drop straight to his bottom-line profit. So, Larry visits his local banker to sign the loan documents and sets out to expand his operation. At first, everything seems to be going smoothly as Larry gradually begins buying the additional land, fertilizer, and equipment necessary to grow and sell more lemons. However, things get sideways when other lemon farmers, lured by similar prospects of economic gain, also borrow from their local bank to expand their farms. As more lemon producers borrow and bid for the same lemon-farming assets, inflation sets in and prices begin to rise, thus increasing the cost structure of lemon production. Shortly after investing all his loan capital into his farm expansion, Larry finds that his cost structure has actually increased 2.8X due to more dollars chasing the same amount of productive factors for lemon farming. Gradually, then suddenly, the money Larry borrowed to expand his profit margin begins to work against him, as his increased capacity has eaten up his original profits and is now generating a loss (the negative 0.3X margin between revenue growth of 2.5X and cost increase of 2.8X, net of any prior profit margin). At this point, Larry has no choice except to increase his prices, cut costs, refinance, sell the farm, or declare bankruptcy. Under the same circumstances, other projects in other industries, misled into overborrowing by artificially cheap money, begin suffering losses as well.

An economy-wide simultaneous failure of overleveraged projects like Larry’s is called a recession. The boom and bust business cycle we have all grown accustomed to in the modern economy is an inevitable consequence of this centrally planned manipulation in the market for money. It is substantively no different than the shortages that would result if the price of bread was fixed at an artificially low level (which caused the starvation of millions in Soviet Russia). Artificially low interest rates don’t provide any benefit to the real economy, rather they simply disseminate distorted price signals that encourage entrepreneurs to embark on projects that cannot be profitably executed due to the (hard to foresee) impact of inflation on their cost structures. As with all well-functioning markets, the price of money must emerge through, and constantly reorient itself against, the natural interactions of supply and demand. Attempts to centrally plan this market only distort truth (price signals) and trigger overborrowing, recessions, and cause (or, at least, exacerbate) the boom-and-bust business cycle.

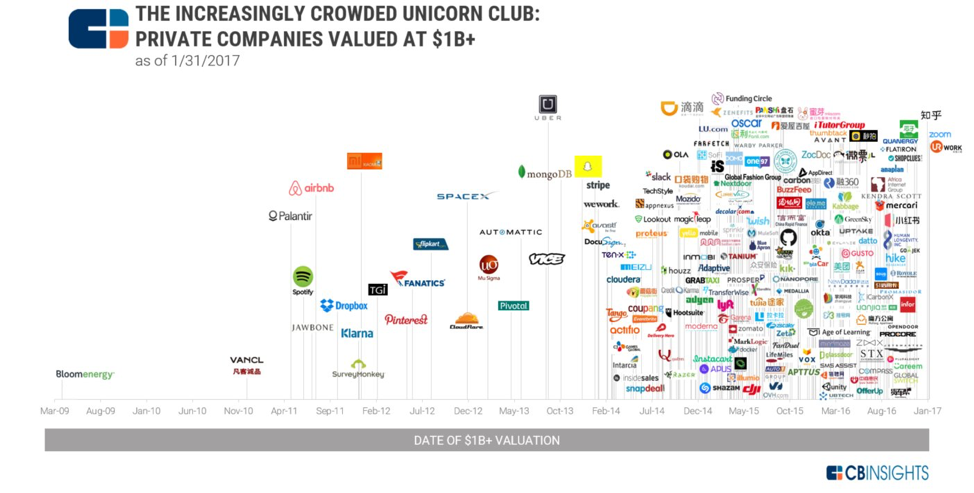

As money supplies become more opaque, so too do the critical price signals they carry back and forth between the minds of entrepreneurs.

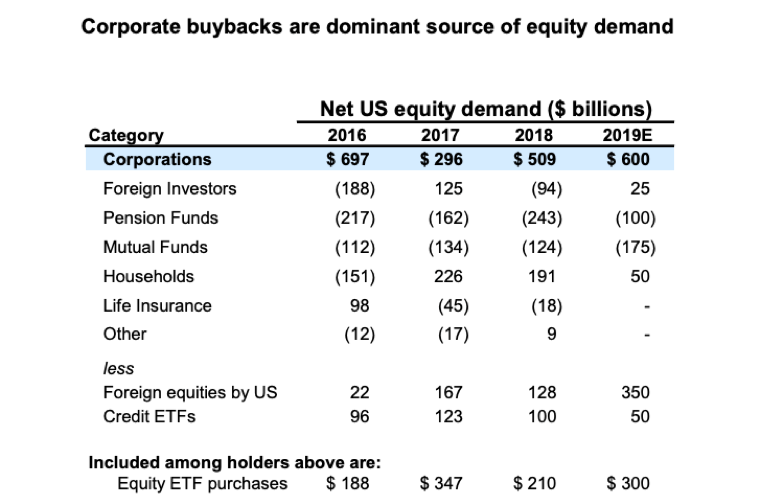

The more opaque the present and future supplies of money, the more entrepreneurs suffer from this myopia, and the more stifled the economization of human action becomes. Price signal distortions like those faced by Larry result entirely from the opacity of central bank “managed” (read: manipulated) money supplies. Central banks are only able to perpetrate this scheme due to the legal monopolies (artificial barriers against free market competition) which shield their inferior monetary technologies (fiat currencies) from facing off with superior technologies (like gold) in the marketplace. Legal monopoly protections inhibit price discovery in the market for money (the natural interest rate). There is also ample evidence that central banks actively suppress the price of gold to preserve fiat currencies (see Gata.org). Further, if monetary technologies were freely selected and priced in the marketplace, as was the case when gold ascended to dominance, then everyone could more reliably use money as a store of value instead of being forced further out along the risk curve into stocks, real estate, and other scarce assets to protect their wealth from the ravages of inflation, which further distorts prices; the increasingly crowded unicorn club reflects just how distorted prices have become:

Money that cannot reliably hold its value across time forces people to make ever-riskier investments.

Money that cannot reliably hold its value across time forces people to make ever-riskier investments.

Simply put, price is truth; distorted money supplies distort the truthfulness of price signals and throw entrepreneurial action into disarray. At the heart of the cyclic booms and busts in the economy, then, is this distortion of the fundamental signaling which, in its current distorted state, misguides entrepreneurial action. Under these conditions of monetary socialism, trying to build a business is like trying to build a house in a jurisdiction that constantly changes the spatial values of its metric system; as Taleb puts it:

According to Wittgenstein’s ruler: Unless you have confidence in the ruler’s reliability, if you use a ruler to measure a table you may also be using the table to measure the ruler. The less you trust the ruler’s reliability, the more information you are getting about the ruler and the less about the table.

With an absolutely fixed supply, Bitcoin will restore the clarity of these economic nerve signals that are so critical to proper capital allocation, risk assessment, and entrepreneurial planning. Universal units of measurement are critical in economics and industry — the seconds, meters, kilograms, and other units of measurement we use throughout the world are all immutable in value. Upon these foundations of standardized measurement, the machinery of global commerce is constructed: builders of skyscrapers, electronics, and myriad other goods rely on the constancy of these measurement units when sourcing components and materials from around the globe. Money, too, is most communicative when its supply is immutable. As a purely objective monetary medium, once it accretes enough value to incentivize its users to spend it, Bitcoin denominated price signals will carry more truth than any other money in history.

Bitcoin is a monetary channel free from the noise of unexpected supply fluctuations, which necessarily means it carries the clearest signals. In this way, Bitcoin is the perfect conveyor of the data packets on value and scarcity known as price signals.

In terms of the idea meritocracy equation, we see that fiat currency is antithetical to radical truth and, its free market corollary, truthful price signals. On the other hand, Bitcoin is the most honest money imaginable, as every component of it, including its money supply, is viewable by everyone. In a world filled with fake news, click bait, and data breaches — Bitcoin is one of the rare instances of honesty in modernity. Central banking is the reverse; it is shrouded in complexities intended to hide its truth. Bitcoin is both radically truthful and transparent.

If money is economic water, then fiat currency is inscrutably murky, and Bitcoin is crystal clear.

Bitcoin’s transparency has already shed much light on the umbral industry of central banking and its shadowy tactics by sparking a renewed interest in Austrian economics and making an entire generation ask the question: “What is Money?”. We stand to gain even more clarity around Bitcoin’s impact on the world by diving into the second element of Ray’s idea meritocracy — radical transparency.

Radical Transparency

(p.308)“By radical transparency, I mean giving most everyone the ability to see most everything.”

Originally, capitalism was founded on the cornerstones of reliably consistent rule of law, private property rights, and hard money. Respectively, these cornerstones provided people non-violent dispute resolution, confiscation resistant assets, and a sound medium of exchange. With strong and reliable rules, entrepreneurs are then free to “play the game”, accumulating capital for themselves and diffusing any innovations gleaned in the process into the whole of society. For entrepreneurs to execute effectively, they must know the rules of the game, and must be able to trust that they are not subject to change. Imagine a poker player sitting at a table where the hand-rankings changed at the whims of the casino every few hands; without sound rules on which build a strategy, no player would remain engaged for long, and would quickly exit the game. Stability in these areas is among the primary reasons why the United States is such an attractive environment for investing; for the most part, its courts function well and contract law is enforced without bias. The exception, of course, is the violation of private property rights which results from centrally manipulated money supplies — in other words, the softness of the US dollar.

According to you Ray, “The most painful lesson that was repeatedly hammered home is that you can never be sure of anything: There are always risks out there that can hurt you badly, even in the seemingly safest bets, so it’s always best to assume you’re missing something”. Considered by many to be among the safest bets in the world today is the US Dollar — it is issued by the largest economy in the world, is “backed” by the world’s most militant taxing authority, and is accepted almost everywhere as a medium of exchange. Further, by unilateral decree (and a veiled threat of force), the US Dollar exclusively denominates the lifeblood commodity of the modern industrial economy, oil. The problem with the perceived safety of the US Dollar is the opacity of the rules which govern its existence: How many are there in existence? How many will be issued in years to come? Who gets to decide? Who stands to profit from its production? Even though the US Dollar today is just an SQL database maintained by The Fed that could choose to open its records to audit, it refuses.

https://twitter.com/_justinmoon_/status/1159598647815917568?s=21

Instead, The Fed sets monetary policy in closed door meetings and (only vaguely) communicates its intentions using ambivalent speech. To counterbalance this opacity, an army of macroeconomists, analyst, and market commentators pour over every detail of the statements issued by central bankers including not only their words, but their tone, delivery, and even wardrobes.

Imagine a semi-governmental agency being put in charge of setting the price of, say, automobiles based on undisclosed criteria and decided in closed-door meetings. Ask any “free market capitalist” if this seems like a good idea and he will spew vitriol at you for even suggesting such a socialistic method of managing the production of automobiles. Then ask him whether it’s a good idea for this same agency to control the price of communications technologies like laptops and smart phones. You’ll be met with the same answer and (perhaps) a loud American battle cry in support of free market capitalism. Finally, very smoothly point out to him that The Fed sets the pricing of the US Dollar (the interest rate), which is the United States’ most valuable export market, and does so based on undisclosed criteria and closed-door discussions. Although Keynesians have done a great job convincing many of the enigmatic nature of money, it is quite simply just a tool for moving value across spacetime, and as such should be priced and technologically selected on the free market (just like everything else in a truly capitalist society).

Sunlight is the best disinfectant; when everyone can see the criteria and process behind a decision they are more likely to deem in trustworthy. With Bitcoin, the algorithm which sets its monetary policy is totally transparent, meaning people can universally agree that the system is fair and unbiased. As an open-source monetary protocol, Bitcoin is essentially the principle of radical transparency in perpetual action. Similar to some of the management tools you’ve created Ray — such as the baseball cards, Dot Collector, Pain Button, etc. — Bitcoin can be thought of as a global monetary policy management tool. As a machine componentized by open-source software and entrepreneurial self-interest, it does the work facilitated by central banks today — maintaining monetary policy, reaching consensus as to account balances, and facilitating international value flows — without relying on the whims of bureaucrats who control state-backed monopolies on money. Bitcoin is the purely transparent alternative to the opacity of central banking; it is a beacon of light outcompeting an industry purposefully shrouded in darkness. Once properly understood, Bitcoin’s superior visibility inescapably enhances its believability. And once you see it, it cannot be unseen.

Bitcoin’s monetary policy (its new supply flow schedule) is becoming the most trusted in the world as it is fully transparent and unchangeable. Bitcoin runs countervailing to government monetary policy which is uncertain, opaque, and subject to change based on bureaucratic whim.

In terms of the idea meritocracy equation, Bitcoin restores the confiscation-resistance of money, which provides its users stronger property rights when compared to fiat currency. Importantly, Bitcoin also reestablishes the sorely lacking 3rd cornerstone of capitalism in an otherwise free world — hard money. As an economic good undergoing monetization on the free market, with a supply inelasticity destined to surpass that of gold, Bitcoin is resurrecting the free market capitalist triad. As it bears repeating: Bitcoin is both radically truthful and transparent.

As you’ve said Ray: (p.327) “Having nothing to hide relieves stress and builds trust.” Transparency and reliability is the essence of Bitcoin’s monetary policy. It is truly unique in that its supply is absolutely predictable and absolutely scarce. Bitcoin is the most credible monetary policy in history outcompeting the least trustworthy monetary policies in history; it is rapidly gaining a track-record superior to central banks across all dimensions — reliability, predictability, auditability, cost-effectiveness, and resistance to censorship or manipulation — thereby further eroding the believability of central bankers, which is in shorter supply with every dollar printed.

Believability-Weighted Decision Making

(p.284) “When you’re responsible for a decision, compare the believability-weighted decision making of the crowd to what you believe.”

When it comes to money, track records matter. People’s trust tends to coalesce slowly around the most stable from an exchange ratio perspective — in other words, what best maintains or gains purchasing power across time. In this respect, gold is undoubtedly the king, as it sports a more than 5,000 year history of remaining reliably scarce and, therefore, valuable. An ounce of gold has roughly equaled the price of a fine man’s suit for the past century, whereas the same suit’s price in dollars has skyrocketed. The best performing central bank fiat currency in history in the British pound, which has only lost 99.5% of its value in its 317 year existence. When it comes to value storage, gold has a believable track record, whereas fiat currencies could only barely be less believable. The hardness or soundness of money, as one of the three cornerstones of free market capitalism, has been almost completely compromised as a result of state-enforced monopolization.

For free markets to function optimally, its three cornerstones — rule of law, private property rights, and hard money — must be consistently applied across all market participants. While the rule of law and property rights are (mostly) sound in western society, centrally planned money supplies are quite the opposite. Without any reliable insight into the primary governance aspects of money (see Radical Transparency above), entrepreneurs are forced to rely on other means of protecting their wealth from theft or debasement. Simply, the implementation of fiat currency offers limited to no assurances to its users that their wealth will be protected from confiscation, censorship, inflation, or counterfeit.

Fiat currencies, when stored in banks, are subject to confiscation or payment censorship by authorities. When stored physically (say, under your mattress), fiat currencies are still subject to value dilution via inflation (the legalized version of counterfeiting). Although fiat currencies offer some physical security measures against counterfeiting (the criminalized version of inflation), this has proven to be a cat and mouse game in which counterfeiters and authorities are constantly trying to outsmart one another in the domain of currency verification technologies.

Bitcoin, on the other hand, is a purely sound money and offers robust assurances to its users. It is resistant to confiscation, as only the possessor of a private key (an alphanumeric string of data) can produce the digital signature necessary to spend it. Bitcoin transactions cannot be censored due to the peer-to-peer and open-source nature of its software architecture. Complete immunity to unforeseen changes in its money supply is guaranteed by unbreakable cryptography and the economic self-interest of miners which secure its network. Finally, since the rules which govern Bitcoin can be verified by anyone, anywhere, and at any time — it is completely counterfeit resistant. Indeed, it is its radically transparent nature that makes Bitcoin the most believable monetary technology in history. Monetary opacity always leads to moral hazard on the part of policymakers.

With decades of experience seeing these hazards explode up close, Ray has said, (p.107) “The job of a policymaker is challenging under the best of circumstances, and it’s almost impossible during a crisis. The politics are horrendous and distortions and outright misinformation from the media make things worse.” So this begs the question: why should we permit policymakers to dictate monetary policy? As “free market capitalists”, we make no such concessions in any other market in the world. We don’t trust a board of governors to tell us how many automobiles to manufacture or at what price to sell laptops each year, so why should we trust central banks to set price and production targets the largest market in the world? As with all production decisions, the free market — representing the collective interests, intelligence, and wisdom of all economic actors — is always the best generator of (low) believable prices, new innovations, and consumer satisfaction.

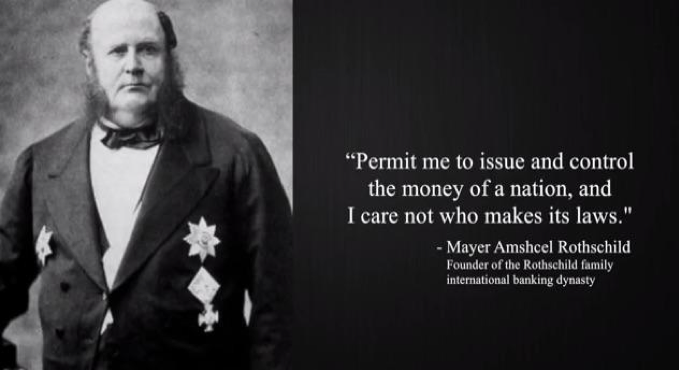

Controlling monetary policy is like being crowned king of the world. As a fat-cat banker once said:

Money is an instrument of freedom; controlling its supply grants control over its users.

Money is an instrument of freedom; controlling its supply grants control over its users.

For this reason, most of the world’s wars have been waged in an attempt gain control over this contentious crown. And to control monetary policy, it is necessary to dominate the original monetary sovereignty layer of planet Earth — gold. For instance, during World War II, North America became a geographically-strategic safe haven for European gold hoards to protect them from Nazi plundering. At the conclusion of World War II, into which the United States ultimately intervened to destroy its war-wearied opponents and declare itself victorious, the Brettonwoods Conference was convened in which the rules of the global economic were rewritten by the newly self-proclaimed king — the United States. This conference cemented The Fed as the effective central bank of the world and the US dollar as the world reserve currency.

Even if you are a believer in monetary socialism, you would be hard pressed to defend the believability of central bankers. As you said Ray, “Think about people’s believability, which is a function of their capabilities and their willingness to say what they think. Keep their track records in mind.” In terms of capabilities, central banks have arrogated themselves virtually unlimited latitude to manipulate the supply and price of fiat currency. However, they have exercised these privileges based on (largely) undisclosed criteria and are notorious for their veiled communication styles. In other words, central bankers seem quite unwilling to say what they think (which violates the first thing necessary for an idea meritocracy) and their decision-making criteria is shrouded in falsehood. As Michel de Montaigne once wrote:

“If falsehood had, like truth, but one face only, we should be upon better terms; for we should then take for certain the contrary to what the liar says: but the reverse of truth has a hundred thousand forms, and a field indefinite, without bound or limit.”

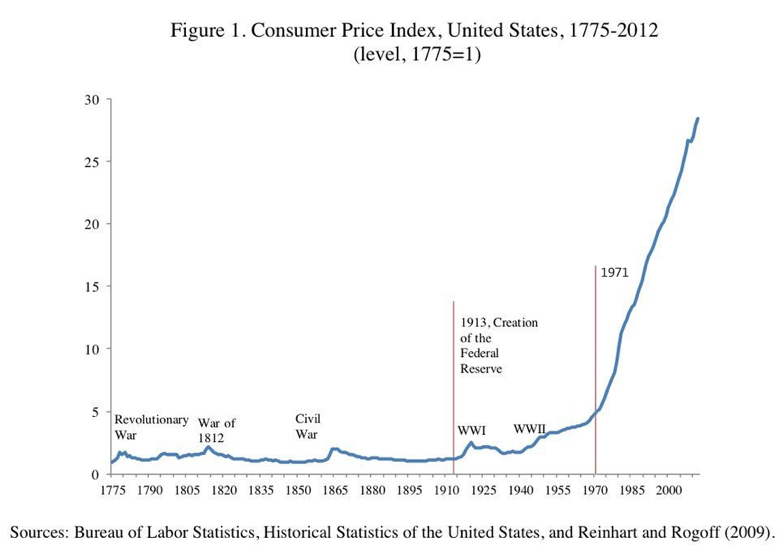

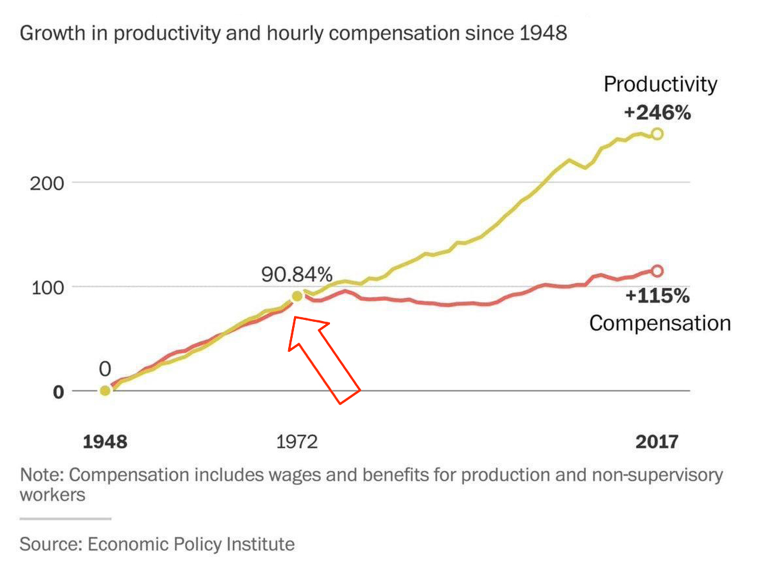

In regards to track records, central bankers likely hold the world record for the most abysmal performance history. Since reputation cannot be printed, and must be earned through a lifetime of honesty, it is unsurprising that central banks have struggled in this respect. Historically, every fiat currency has trended towards worthlessness, which has only dragged the believability of this monetary model ever-downward. Mandated with price stabilization and employment maximization, The Fed has failed miserably at both, especially since severing the peg to gold in 1971; here, we show the US dollar’s loss of purchasing power since 1775:

The softer money becomes, the more it trends towards absolute worthlessness.

The softer money becomes, the more it trends towards absolute worthlessness.

Central banker opinion-driven money supplies are proportionately reliable to the value storage functionalities of the ever-softening fiat currencies they mass produce. Bitcoin’s fact-driven money supply is as reliable as the mathematics and thermodynamics which sanctify its inviolable ledger. Opinions are like soft money, in that they can easily be diluted and distorted. Facts are like hard money, in that they are rooted in scientific realities. Said simply: do we believe the largest market in the world is best governed by opinion or fact? Buying Bitcoin is buying a put option on central banker malfeasance. As Travis Kling says:

https://twitter.com/Travis_Kling/status/1181647574861832193

More fundamentally: how can we possibly believe that central bankers will perform well when they completely lack skin in the game? As Taleb puts it:

“Systems don’t learn because people learn individually –that’s the myth of modernity. Systems learn at the collective level by the mechanism of selection: by eliminating those elements that reduce the fitness of the whole, provided these have skin in the game. Food in New York improves from bankruptcy to bankruptcy, rather than the chefs individual learning curves –compare the food quality in mortal restaurants to that in an immortal governmental cafeteria. And in the absence of the filtering of skin in the game, the mechanisms of evolution fail: if someone else dies in your stead, the build up of asymmetric risks and misfitness will cause the system to eventually blow-up.”

Totally disconnected from the consequences of their policy actions, which are instead born by citizens, central bankers are incentivized to maintain the status quo to preserve their jobs and “prestige”. Money, the largest and most critical market in the world, simply cannot evolve without practitioners who are subjected to real world consequences and tradeoffs, in real time. Simply, if you lack skin in the game then you lack believability. This explains why ancient Roman architects were required by law to stand beneath their monolithic arches when the scaffolding was removed. This (deadly) disincentive to malperformance worked wonders, as some of the oldest arches constructed in this way are still standing at over 2,000 years of age. If only central bankers were subjected to the devastation they inflict on centrally planned economies should their decision-making not work out, then perhaps the world would still be on a gold standard and the dire need for Bitcoin would be lessened.

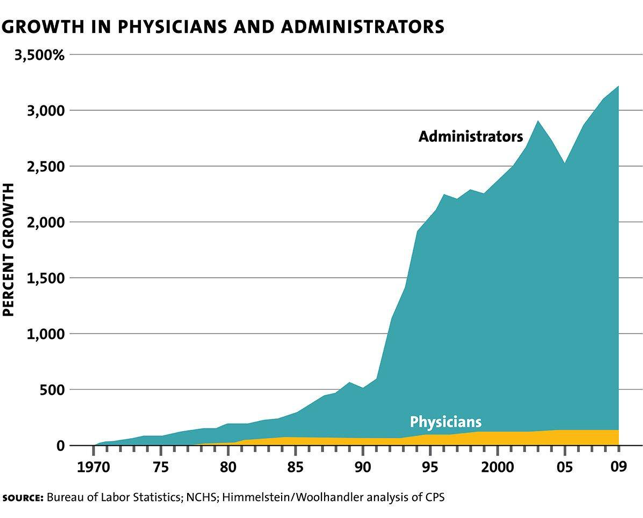

Parading themselves as the healers of economic crises, central bankers are actually the creators of these calamities. QE, TARP, NIRP, and other interventions inflict a heavy iatrogenic cost on society; and the harm done is further compounded by the agency problem (central bankers have no skin in the game, and therefore have conflicted interests when it comes to managing money supplies).

So, in terms of the idea meritocracy formula, it is clear that central banking fails to satisfy its third element of Believability-Weighted Decision Making, instead, the prevailing economic order seems to promote the least believable people into the driver’s seat of the world economy. Translated into the free market formula terms, this is an expectant result as these policymakers suffer from the agency problem and are rendered impotent without “Skin in the Game”-Weighted Decision Making. In this sense, Bitcoin is the reverse; its node operators and miners govern the system, all of whom have skin in the game and, therefore, possess more believable decision-making capabilities — just like the ancient architects who stood beneath their newly un-scaffolded arches.

To put it all together in terms of our original equations; we began with:

“Idea Meritocracy = Radical Truth + Radical Transparency + Believability-Weighted Decision Making”

Which translates to this free market format:

Free Markets = Truthful Price Signals + Transparent and Reliable Rule of Law, Private Property Rights, and Hard Money + ‘Skin in the Game’-Weighted Decision Making

Based on what we’ve learned so far, we can translate these equations once again into central banking and Bitcoin versions:

Central Banking = Untruthful Price Signals + Transparent and Reliable Rule of Law, Marginalized Private Property Rights (due to violations via inflation), and Soft Money + “Agency Problem”-Weighted Decision Making

Bitcoin = (Absolutely) Truthful Price Signals + Transparent and Reliable Rule of Law, Private Property Rights, and (Absolutely) Hard Money + “Skin in the Game”-Weighted Decision Making

Clearly, only Bitcoin is 100% consistent with the equation for free markets; whereas fiat currency is almost entirely inconsistent. Since this free market equation is equivalent to the idea-meritocratic equation, we may deduce: Bitcoin is completely consistent with Ray’s formulation of the idea meritocracy, and fiat currency is not.

Therefore, because math, Bitcoin is both a free market and an idea meritocracy.

So, Ray, assuming your Principles are stated forthrightly, how can you possibly be a non-believer in Bitcoin? As you said Ray, (p.379) “When someone says ‘I believe X,’ ask them: What data are you looking at? What reasoning are you using to draw your conclusion?” So let me ask you Ray: after Bitcoin’s impeccable performance for over a decade (over 99.98% uptime, never been hacked, evolution into the most secure computing network in the world, roughly $200B in market capitalization, and over $1T of transactions cleared in total), what data and reasoning are you using to draw your conclusion about Bitcoin?

My guess is that like many smart people, you may have disregarded Bitcoin at the outset. In accordance with one of your favorite principles, I implore you to keep an open mind about Bitcoin and, perhaps, you will come to see it as an embodiment of open-mindedness itself. In that spirit, let’s dive deeper.

Open-Mindedness

(p. 187) “If you can recognize that you have blind spots and open-mindedly consider the possibility that others might see something better than you — and that the threats and opportunities they are trying to point out really exist — you are more likely to make good decisions.”

Open-mindedness is a key aspect of both an idea meritocracy and evolution. It is a concept closely related with filtering and optionality: a form of non-cognitive intelligence intrinsic to natural systems in which exposure to multiple potentialities is employed, allowing the system to “learn” by adopting what works and discarding what doesn’t. An interesting paradox is discovered in that this openness is the source of Mother Nature’s opaque logic — as Taleb puts it:

“Evolution proceeds by undirected, convex bricolage or tinkering, inherently robust, i.e., with the achievement of potential stochastic gains thanks to continuous, repetitive, small, localized mistakes. What men have done with top-down, command-and-control science has been exactly the reverse: interventions with negative convexity effects, i.e., the achievement of small certain gains through exposure to massive potential mistakes…Simply, humans should not be given explosive toys (like atomic bombs, financial derivatives, or tools to create life)”

Close-mindedness, on the other hand, represents a rigid fixity on an existing knowledge framework that excludes the possibility of learning, innovation, and evolution. Without a culture of open-mindedness, organizations fail to learn and adapt well, and begin to suffer losses at the hands of more fit competitors. Sheltered from market discipline by their legally fortified monopoly positions, central bankers become feeble minded while, at the same time, their monetary technologies become brittle and maladapted to shifts in user demand.

Open-mindedness is an ever-present state of mind, a keen awareness of optionality and the freedom to filter; to change one’s mental or organizational model, to reform one’s prior assessment of conditions based on new information or a new vantage on old information (Bayesian inference).